EX-2.1

Exhibit 2.1

AGREEMENT AND PLAN OF MERGER

by and between

REGENCY CENTERS

CORPORATION

and

EQUITY ONE,

INC.

Dated as of November 14, 2016

TABLE OF CONTENTS

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

| ARTICLE I MERGER |

|

|

2 |

|

|

|

|

| Section 1.1 |

|

Merger |

|

|

2 |

|

| Section 1.2 |

|

Closing |

|

|

2 |

|

| Section 1.3 |

|

Articles and Bylaws of the Surviving Corporation |

|

|

2 |

|

| Section 1.4 |

|

Directors and Officers of the Surviving Corporation |

|

|

2 |

|

| Section 1.5 |

|

Tax Consequences |

|

|

2 |

|

|

|

| ARTICLE II TREATMENT OF SECURITIES |

|

|

3 |

|

|

|

|

| Section 2.1 |

|

Treatment of Securities |

|

|

3 |

|

| Section 2.2 |

|

Exchange of Certificates |

|

|

3 |

|

| Section 2.3 |

|

Further Assurances |

|

|

7 |

|

| Section 2.4 |

|

Treatment of Eagle Equity Awards |

|

|

7 |

|

| Section 2.5 |

|

Employee Stock Purchase Plan |

|

|

8 |

|

| Section 2.6 |

|

Adjustments to Prevent Dilution |

|

|

9 |

|

| Section 2.7 |

|

Lost Certificates |

|

|

9 |

|

|

|

| ARTICLE III REPRESENTATIONS AND WARRANTIES |

|

|

9 |

|

|

|

|

| Section 3.1 |

|

Representations and Warranties of Eagle |

|

|

9 |

|

| Section 3.2 |

|

Representations and Warranties of Raven |

|

|

26 |

|

|

|

| ARTICLE IV COVENANTS RELATING TO CONDUCT OF BUSINESS |

|

|

43 |

|

|

|

|

| Section 4.1 |

|

Covenants of Eagle |

|

|

43 |

|

| Section 4.2 |

|

Covenants of Raven |

|

|

49 |

|

|

|

| ARTICLE V ADDITIONAL AGREEMENTS |

|

|

53 |

|

|

|

|

| Section 5.1 |

|

Preparation of Joint Proxy Statement; Stockholders Meetings |

|

|

53 |

|

| Section 5.2 |

|

Access to Information |

|

|

56 |

|

| Section 5.3 |

|

Efforts; Notice of Certain Events |

|

|

56 |

|

| Section 5.4 |

|

Non-Solicitation; Change in Recommendation |

|

|

58 |

|

| Section 5.5 |

|

NYSE Listing |

|

|

61 |

|

| Section 5.6 |

|

Employee Matters |

|

|

61 |

|

| Section 5.7 |

|

Fees and Expenses |

|

|

63 |

|

| Section 5.8 |

|

Governance |

|

|

63 |

|

| Section 5.9 |

|

Indemnification and D&O Insurance |

|

|

64 |

|

| Section 5.10 |

|

Dividends |

|

|

65 |

|

| Section 5.11 |

|

Public Announcements |

|

|

66 |

|

| Section 5.12 |

|

Tax Matters |

|

|

66 |

|

| Section 5.13 |

|

Financing Cooperation |

|

|

67 |

|

| Section 5.14 |

|

Transaction Litigation |

|

|

69 |

|

| Section 5.15 |

|

Director Resignations |

|

|

69 |

|

| Section 5.16 |

|

Delisting |

|

|

69 |

|

| Section 5.17 |

|

Rule 16b-3 Matters |

|

|

69 |

|

| Section 5.18 |

|

Termination of Affiliate Agreements |

|

|

69 |

|

-ii-

|

|

|

|

|

|

|

|

|

| ARTICLE VI CONDITIONS PRECEDENT |

|

|

69 |

|

|

|

|

| Section 6.1 |

|

Conditions to Each Party’s Obligation |

|

|

69 |

|

| Section 6.2 |

|

Conditions to Obligations of Eagle |

|

|

70 |

|

| Section 6.3 |

|

Conditions to Obligations of Raven |

|

|

71 |

|

|

|

| ARTICLE VII TERMINATION |

|

|

72 |

|

|

|

|

| Section 7.1 |

|

Termination |

|

|

72 |

|

| Section 7.2 |

|

Effect of Termination |

|

|

74 |

|

|

|

| ARTICLE VIII GENERAL PROVISIONS |

|

|

78 |

|

|

|

|

| Section 8.1 |

|

Survival |

|

|

78 |

|

| Section 8.2 |

|

Amendment; Waiver |

|

|

78 |

|

| Section 8.3 |

|

Notices |

|

|

79 |

|

| Section 8.4 |

|

Interpretation |

|

|

80 |

|

| Section 8.5 |

|

Counterparts |

|

|

80 |

|

| Section 8.6 |

|

Entire Agreement; No Third-Party Beneficiaries |

|

|

80 |

|

| Section 8.7 |

|

Governing Law |

|

|

80 |

|

| Section 8.8 |

|

Severability |

|

|

81 |

|

| Section 8.9 |

|

Assignment |

|

|

81 |

|

| Section 8.10 |

|

Submission to Jurisdiction |

|

|

81 |

|

| Section 8.11 |

|

Enforcement |

|

|

81 |

|

| Section 8.12 |

|

WAIVER OF JURY TRIAL |

|

|

81 |

|

|

|

| ARTICLE IX DEFINITIONS |

|

|

82 |

|

|

|

|

| Section 9.1 |

|

Certain Definitions |

|

|

82 |

|

| Section 9.2 |

|

Terms Defined Elsewhere |

|

|

91 |

|

|

|

|

| Exhibit A |

|

Amendment to Articles of Incorporation of Regency Centers Corporation |

-iii-

AGREEMENT AND PLAN OF MERGER

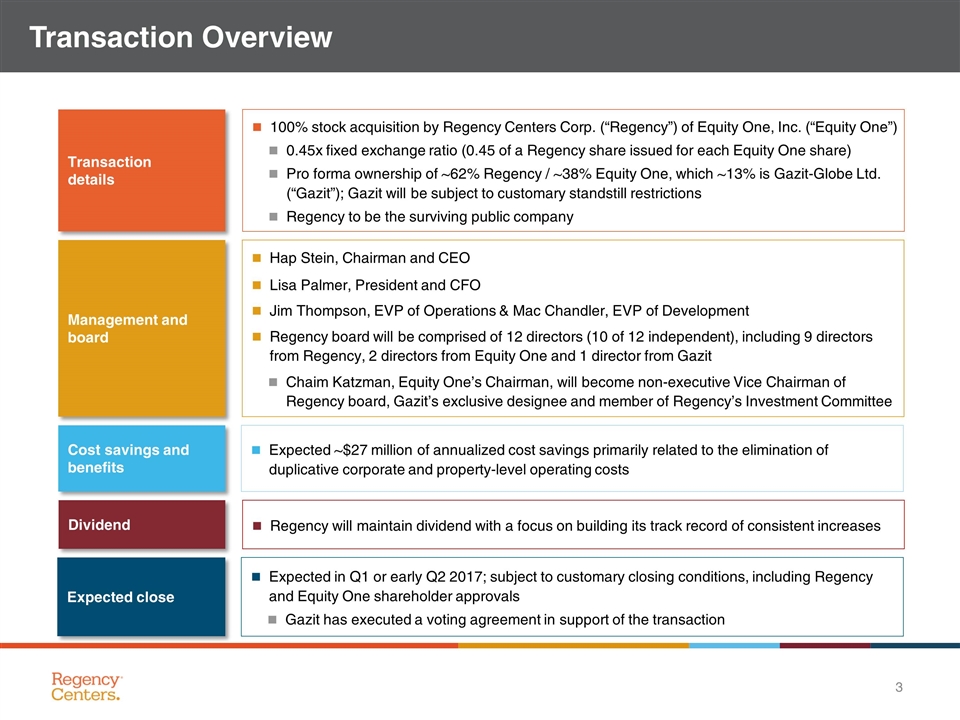

This AGREEMENT AND PLAN OF MERGER, dated as of November 14, 2016 (this “Agreement”), is by and between Regency Centers

Corporation, a Florida corporation (“Raven”), and Equity One, Inc., a Maryland corporation (“Eagle”). Raven and Eagle are each sometimes referred to herein as a “Party” and collectively as the

“Parties”.

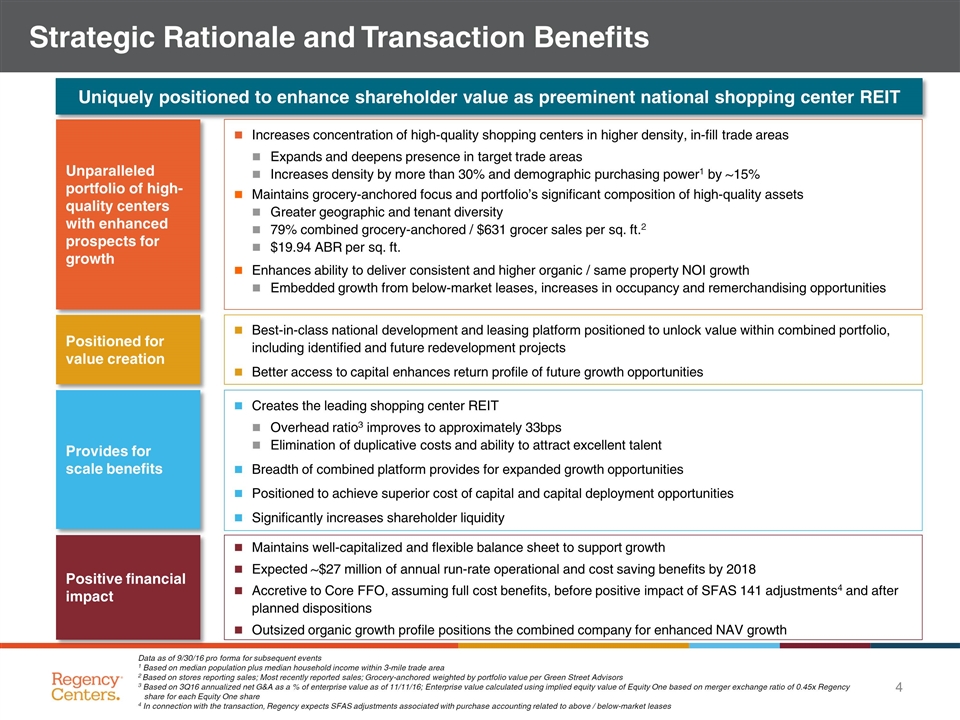

WHEREAS, the Parties wish to effect a business combination through the Merger of Eagle with and into Raven,

with Raven being the surviving corporation of the Merger, and in which Merger each outstanding share of Eagle Common Stock, other than Excluded Shares, shall be converted into the right to receive 0.45 (the “Exchange Ratio”) of a

newly issued share of Raven Common Stock (the “Merger Consideration”), as more fully described in this Agreement and on the terms and subject to the conditions set forth in this Agreement;

WHEREAS, each of the respective boards of directors of Raven and Eagle has approved this Agreement and declared this Agreement and the

transactions contemplated hereby, including the Merger, to be advisable and in the best interests of Raven and Eagle, respectively, and their respective stockholders, on the terms and subject to the conditions set forth in this Agreement;

WHEREAS, concurrently with the execution and delivery of this Agreement, Gazit-Globe Ltd., MGN America, LLC, Silver Maple (2001) Inc.,

Ficus, Inc., MGN (USA) Inc., MGN America 2016 LLC, Gazit First Generation LLC and MGN USA 2016, LLC (collectively, the “Gazelle Stockholders”) and Raven have entered into (a) a governance agreement (the “Governance

Agreement”), which provides, among other things, for certain post-Closing governance matters and (b) a voting agreement (the “Voting Agreement”), which provides, among other things, that the Gazelle Stockholders will

vote all of their respective shares of Eagle Common Stock in favor of the transactions contemplated by this Agreement; and

WHEREAS, for

U.S. federal income tax purposes, (a) it is intended that the Merger will qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), and

(b) this Agreement is intended to be and hereby is adopted as a “plan of reorganization” within the meaning of Section 354 and Section 361 of the Code.

NOW, THEREFORE, in consideration of the foregoing and the respective representations, warranties, covenants and agreements set forth in this

Agreement, and for other good and valuable consideration, the receipt and adequacy of which is hereby acknowledged, and intending to be legally bound, the Parties hereby agree as follows:

ARTICLE I

MERGER

Section 1.1

Merger.

(a) Merger. Upon the terms and subject to satisfaction or waiver (subject to applicable Law) of the conditions set

forth in this Agreement, and in accordance with the Maryland General Corporation Law (the “MGCL”) and the Florida Business Corporation Act (the “FBCA”), at the Effective Time, Eagle shall be merged with and into

Raven (the “Merger”). As a result of the Merger, the separate existence of Eagle shall cease, and Raven shall continue as the surviving corporation of the Merger (the “Surviving Corporation”). The Merger will have

the effects provided in this Agreement and as specified in the MGCL and the FBCA, as applicable.

(b) Effective Time. The Parties

shall cause the Merger to be consummated by filing as soon as practicable on the Closing Date articles of merger for the Merger with the State Department of Assessment and Taxation of the State of Maryland (the “SDAT”) and the

articles of merger for the Merger with the Department of State of the State of Florida (the “DOS”) (as applicable, the “Articles of Merger”), in such form as required by, and executed in accordance with, the

relevant provisions of the MGCL and the FBCA, respectively. The Merger shall become effective at the time when the Articles of Merger have been accepted for record by the SDAT and the DOS or at such later time as may be agreed by the Parties in

writing and specified in the Articles of Merger (not to exceed 30 days from filing) (the date and time the Merger becomes effective being the “Effective Time”).

Section 1.2 Closing. The closing of the Merger (the “Closing”) will take place at the offices of Wachtell,

Lipton, Rosen & Katz, 51 West 52nd Street, New York, New York 10019, at 8:30 a.m., New York time, on the second Business Day after the satisfaction or waiver (subject to applicable Law) of the conditions set forth in Article VI

(other than the conditions that by their nature are to be satisfied at the Closing, but subject to the satisfaction or waiver of those conditions at the Closing), unless another date, time or place is agreed to in writing by the Parties (the date on

which the Closing occurs, the “Closing Date”).

Section 1.3 Articles and Bylaws of the Surviving Corporation.

At the Effective Time, the restated articles of incorporation of Raven as in effect immediately prior to the Effective Time shall be amended in the Merger (such amendment to be in the form attached hereto as Exhibit A, the “Articles

Amendment”), and as so amended, shall be the articles of incorporation of the Surviving Corporation until thereafter amended as provided therein or by applicable Law. At the Effective Time, the bylaws of Raven as in effect immediately prior

to the Effective Time shall be the bylaws of the Surviving Corporation until thereafter amended as provided therein or by applicable Law.

Section 1.4 Directors and Officers of the Surviving Corporation. Subject to Section 5.8, from and after the Effective

Time, the directors and officers of Raven immediately prior to the Effective Time shall be the directors and officers of the Surviving Corporation. Prior to the Closing, the Board of Directors of Eagle shall duly adopt resolutions to give effect to

this Section 1.4, including the matters set forth in Section 1.4 of the Eagle Disclosure Letter.

Section 1.5 Tax

Consequences. It is intended that, for U.S. federal income tax purposes, the Merger will qualify as a “reorganization” within the meaning of Section 368(a) of the Code, and that this Agreement is intended to be, and is adopted as,

a “plan of reorganization” for purposes of Sections 354 and 361 of the Code.

-2-

ARTICLE II

TREATMENT OF SECURITIES

Section 2.1 Treatment of Securities.

(a) Treatment of Eagle Common Stock. At the Effective Time, as a result of the Merger and without any action on the part of the Parties

or any holder of any shares of capital stock of Raven or Eagle, each share of common stock, par value $0.01, of Eagle (the “Eagle Common Stock”) issued and outstanding immediately prior to the Effective Time, other than shares of

Eagle Common Stock owned directly by Raven or Eagle and in each case not held on behalf of third parties (such excluded shares, the “Excluded Shares” and such eligible shares, the “Eligible Shares”), shall be

automatically converted into the right to receive the Merger Consideration.

(b) Conversion of Eagle Common Stock. As a result of

the Merger and without any action on the part of the Parties or any holder of any shares of capital stock of Raven or Eagle, as of the Effective Time, all of the Eligible Shares shall no longer be outstanding and shall be automatically cancelled and

retired and shall cease to exist, and each evidence of shares in book-entry form previously evidencing any of the Eligible Shares immediately prior to the Effective Time (the “Eagle Book-Entry Shares”) and each certificate

previously representing any Eligible Shares immediately prior to the Effective Time (the “Eagle Certificates”) shall thereafter represent only the right to receive the Merger Consideration and the right, if any, to receive pursuant

to Section 2.2(e) cash in lieu of fractional shares into which such Eligible Shares have been converted pursuant to Section 2.1(a) and any dividends or other distributions pursuant to Section 2.2(c) or

Section 5.10(c).

(c) Cancellation of Excluded Shares. At the Effective Time, as a result of the Merger and without any

action on the part of the Parties or any holder of any shares of capital stock of Raven or Eagle, each Excluded Share issued and outstanding immediately prior to the Effective Time shall cease to be outstanding, be cancelled without payment of any

consideration therefor and shall cease to exist.

(d) Raven Capital Stock. At the Effective Time, each share of capital stock of

Raven issued and outstanding immediately prior to the Effective Time shall remain outstanding as a share of capital stock of the Surviving Corporation and shall not be affected by the Merger.

Section 2.2 Exchange of Certificates.

(a) Exchange Agent. At or prior to Effective Time, Raven shall deposit or shall cause to be deposited with a nationally recognized

financial institution or trust company selected by Raven and reasonably acceptable to Eagle to serve as the exchange agent (the “Exchange Agent”), for the benefit of the holders of Eligible Shares, (i) an aggregate number of

shares of Raven Common Stock to be issued in uncertificated or book-entry form comprising the number of shares of Raven Common Stock required to be issued pursuant to Section 2.1(a), and (ii) an aggregate amount of cash comprising

approximately the amount required to be delivered pursuant to Section 2.2(e). In addition, Raven shall deposit or cause to be deposited with the Exchange Agent, as necessary from time to time after the Effective Time, any dividends or

other

-3-

distributions, if any, to which the holders of Eligible Shares may be entitled pursuant to Section 2.2(c) with both a record and payment date after the Effective Time and prior to the

surrender of such Eligible Shares or pursuant to Section 5.10(c). Such shares of Raven Common Stock, cash in lieu of any fractional shares payable pursuant to Section 2.2(e) and the amount of any dividends or other

distributions deposited with the Exchange Agent pursuant to this Section 2.2(a) are referred to collectively in this Agreement as the “Exchange Fund.” The Exchange Fund shall not be used for any purpose other than for

the purpose provided for in this Agreement.

(b) Exchange Procedures.

(i) Promptly after the Effective Time (and in any event within five Business Days thereafter), the Surviving Corporation shall

cause the Exchange Agent to mail to each holder of record of Eligible Shares notice advising such holders of the effectiveness of the Merger, including (A) appropriate transmittal materials specifying that delivery shall be effected, and risk

of loss and title to the Eagle Certificates or Eagle Book-Entry Shares shall pass, only upon delivery of the Eagle Certificates (or affidavits of loss in lieu of the Eagle Certificates, as provided in Section 2.7) or transfer of the

Eagle Book-Entry Shares to the Exchange Agent (including customary provisions with respect to delivery of an “agent’s message” with respect to Eagle Book-Entry Shares) (the “Letter of Transmittal”), and

(B) instructions for surrendering the Eagle Certificates (or affidavits of loss in lieu of the Eagle Certificates, as provided in Section 2.7) or transferring the Eagle Book-Entry Shares to the Exchange Agent in exchange for the

Merger Consideration, cash in lieu of fractional shares of Raven Common Stock, if any, to be issued or paid in consideration therefor, and any dividends or distributions, in each case, to which such holders are entitled pursuant to the terms of this

Agreement. With respect to holders of Eagle Book-Entry Shares, the Parties shall cooperate to establish procedures with the Exchange Agent to allow the Exchange Agent to promptly transmit, following the Effective Time, to such holders or their

nominees, upon surrender of Eligible Shares, the Merger Consideration, cash in lieu of fractional shares of Raven Common Stock, if any, to be issued or paid in consideration therefor, and any dividends or distributions, in each case, to which such

holders are entitled pursuant to the terms of this Agreement.

(ii) Upon surrender to the Exchange Agent of Eligible Shares

that are represented by Eagle Certificates, by physical surrender of such Eagle Certificate (or affidavit of loss in lieu of an Eagle Certificate, as provided in Section 2.7) or that are Eagle Book-Entry Shares, by book-receipt of an

“agent’s message” by the Exchange Agent in connection with the transfer of Eagle Book-Entry Shares, in accordance with the terms of the Letter of Transmittal and accompanying instructions or, with respect to Eagle Book-Entry Shares,

in accordance with customary procedures and such other procedures as agreed by the Surviving Corporation and the Exchange Agent, the holder of such Eagle Certificate or Eagle Book-Entry Share shall be entitled to receive in exchange therefor

(A) that number of whole shares of Raven Common Stock that such holder is entitled to receive pursuant to Section 2.1(a) and (B) an amount (if any) in immediately available funds (or, if no wire transfer instructions are

provided, a check, and in each case, after giving effect to any required Tax withholdings as provided in

-4-

Section 2.2(h)) of (1) any cash in lieu of fractional shares payable pursuant to Section 2.7 plus (2) any unpaid non-stock dividends and any other

dividends or other distributions that such holder has the right to receive pursuant to Section 2.2(c) or Section 5.10(c).

(iii) No interest will be paid or accrued on any amount payable upon due surrender of Eligible Shares, and any Eagle

Certificate or ledger entry relating to Eagle Book-Entry Shares formerly representing shares of Eagle Common Stock that have been so surrendered shall be cancelled by the Exchange Agent.

(iv) In the event of a transfer of ownership of certificated Eligible Shares that is not registered in the transfer records of

Eagle, the proper number of shares of Raven Common Stock, together with an amount (if any) in immediately available funds (or, if no wire transfer instructions are provided, a check, and in each case, after giving effect to any required Tax

withholdings as provided in Section 2.2(h)) of cash to be paid upon due surrender of the Eagle Certificate and any dividends or distributions in respect thereof, may be issued or paid to such a transferee if the Eagle Certificate

formerly representing such Eligible Shares is presented to the Exchange Agent, accompanied by all documents required to evidence and effect such transfer and to evidence that any applicable stock transfer Taxes have been paid or are not applicable,

in each case, in form and substance, reasonably satisfactory to the Exchange Agent and the Surviving Corporation. Payment of the Merger Consideration with respect to Eagle Book-Entry Shares shall only be made to the Person in whose name such Eagle

Book-Entry Shares are registered in the stock transfer books of Eagle. Until surrendered as contemplated by this Section 2.2(b), each Eagle Certificate and Eagle Book-Entry Share shall be deemed at any time at or after the Effective Time

to represent only the right to receive the Merger Consideration in accordance with this Article II, including any amount payable in lieu of fractional shares in accordance with Section 2.2(e), and any dividends or other

distributions in accordance with Section 2.2(c) or Section 5.10(c), in each case without interest.

(c)

Distributions with Respect to Unexchanged Shares. All shares of Raven Common Stock to be issued in connection with the Merger shall be deemed issued and outstanding as of the Effective Time and whenever a dividend or other distribution is

declared by Raven in respect of Raven Common Stock, the record date for which is after the Effective Time, that declaration shall include dividends or other distributions in respect of all shares issuable pursuant to this Agreement. No dividends or

other distributions in respect of Raven Common Stock shall be paid to any holder of any unsurrendered Eligible Share until the Eagle Certificate (or affidavit of loss in lieu of the Eagle Certificate as provided in Section 2.7) or Eagle

Book-Entry Share is surrendered for exchange in accordance with this Article II. Subject to applicable Laws, following such surrender, there shall be issued or paid to the holder of record of the whole shares of Raven Common Stock issued

in exchange for Eligible Shares in accordance with this Article II, without interest, (i) at the time of such surrender, the dividends or other distributions with a record date after the Effective Time theretofore payable with

respect to such whole shares of Raven Common Stock and not paid and (ii) at the appropriate payment date, the dividends or other distributions payable with respect to such whole shares of Raven Common Stock with a record date after the

Effective Time but with a payment date subsequent to surrender.

-5-

(d) Transfers. From and after the Effective Time, there shall be no transfers on the stock

transfer books of Eagle of the shares of Eagle Common Stock that were outstanding immediately prior to the Effective Time. From and after the Effective Time, the holders of Eagle Certificates or Eagle Book-Entry Shares outstanding immediately prior

to the Effective Time shall cease to have any rights with respect to such shares of Eagle Common Stock, except as otherwise provided in this Agreement or by applicable Law. If, after the Effective Time, Eagle Certificates or Eagle Book-Entry Shares

are presented to the Surviving Corporation for any reason, they shall be cancelled and exchanged as provided in this Agreement.

(e) No

Fractional Shares. Notwithstanding any other provision of this Agreement to the contrary, no fractional shares of Raven Common Stock shall be issued upon the conversion of Eligible Shares pursuant to this Agreement. Any holder of Eligible Shares

otherwise entitled to receive a fractional share of Raven Common Stock but for this Section 2.2(e) shall be entitled to receive, upon surrender of the applicable Eligible Shares, a cash payment, without interest, in lieu of any

fractional share, equal to the product obtained by multiplying (i) the fractional share interest to which such holder (after taking into account all shares of Eagle Common Stock held at the Effective Time by such holder) would otherwise be

entitled by (ii) the closing price on the New York Stock Exchange (the “NYSE”), as reported on the consolidated tape at the close of the NYSE regular session of trading, for a share of Raven Common Stock on the last trading day

immediately preceding the Closing Date. No holder of Eligible Shares shall be entitled by virtue of the right to receive cash in lieu of fractional shares of Raven Common Stock described in this Section 2.2(e) to any dividends, voting

rights or any other rights in respect of any fractional share of Raven Common Stock. The payment of cash in lieu of fractional shares of Raven Common Stock is not a separately bargained-for consideration and solely represents a mechanical

rounding-off of the fractions in the exchange.

(f) Termination of Exchange Fund. Any portion of the Exchange Fund that remains

undistributed to holders of Eligible Shares for nine months after the Effective Time shall be delivered to the Surviving Corporation, upon demand, and any former stockholders of Eagle who have not theretofore complied with this

Article II shall thereafter look only to the Surviving Corporation for delivery of any shares of Raven Common Stock and any payment of cash and any dividends and other distributions in respect thereof payable or issuable pursuant to

Section 2.1(a), Section 2.2(c), Section 2.2(e) and Section 5.10(c), in each case, without any interest thereon.

(g) No Liability. Notwithstanding anything in this Agreement to the contrary, none of the Surviving Corporation, the Exchange Agent or

any other Person shall be liable to any former holder of shares of Eagle Common Stock for any amount properly delivered to a public official pursuant to applicable abandoned property, escheat or similar Laws. Any portion of the Exchange Fund that

remains undistributed to the holders of Eligible Shares immediately prior to the time at which the Exchange Fund would otherwise escheat to, or become property of, any Governmental Entity, shall, to the extent permitted by Law, become the property

of the Surviving Corporation, free and clear of all claims or interest of any Person previously entitled thereto.

-6-

(h) Withholding. Each of Raven, Eagle, the Exchange Agent and the Surviving Corporation

shall be entitled to deduct and withhold from the consideration otherwise payable pursuant to this Agreement such amounts as it is required to deduct and withhold with respect to the making of such payment under the Code or any other applicable Tax

Law. To the extent that amounts are so deducted or withheld by Raven, Eagle, the Exchange Agent or the Surviving Corporation, such withheld amounts shall be treated for all purposes of this Agreement as having been paid to the Person in respect of

which such deduction and withholding was made.

Section 2.3 Further Assurances. If at any time following the Effective Time

the Surviving Corporation shall consider or be advised that any deeds, bills of sale, assignments or assurances or any other acts or things are necessary, desirable or proper (a) to vest, perfect or confirm, of record or otherwise, in the

Surviving Corporation its right, title or interest in, to or under any of the rights, privileges, powers, franchises, properties or assets of any Party, or (b) otherwise to carry out the purposes of this Agreement, the Surviving Corporation and

its proper officers and directors or their designees shall be authorized to execute and deliver, in the name and on behalf of any Party, all such deeds, bills of sale, assignments and assurances and to do, in the name and on behalf of any such

Person, all such other acts and things as may be necessary, desirable or proper to vest, perfect or confirm the Surviving Corporation’s right, title or interest in, to or under any of the rights, privileges, powers, franchises, properties or

assets of such Party and otherwise to carry out the purposes of this Agreement.

Section 2.4 Treatment of Eagle Equity Awards.

(a) Eagle Stock Options. As of the Effective Time, by virtue of the Merger and without any action on the part of the Parties or any

holders thereof, each option to purchase shares of Eagle Common Stock granted under the Eagle Equity Plan (each, an “Eagle Stock Option”), whether vested or unvested, that is outstanding and unexercised as of immediately prior to

the Effective Time shall vest in full, not be assumed by Raven and shall be converted into, and entitle the holder thereof to receive, within seven days following the Effective Time, an amount in cash equal to the product of (i) the number of

shares of Eagle Common Stock subject to such Eagle Stock Option as of immediately prior to the Effective Time, and (ii) the excess of (A) the Merger Consideration Cashout Value over (B) the exercise price per share of Eagle Common

Stock subject to such Eagle Stock Option. For purposes of this Agreement, “Merger Consideration Cashout Value” shall be equal to the product of (i) the Exchange Ratio and (ii) the closing price per share of Raven Common

Stock on the NYSE on the last complete trading day prior to the date on which the Effective Time occurs.

(b) Eagle Restricted Stock

Awards. As of the Effective Time, by virtue of the Merger and without any action on the part of the Parties or any holders thereof, each award of restricted shares of Eagle Common Stock granted under the Eagle Equity Plan (each, an

“Eagle Restricted Stock Award”) that is outstanding as of immediately prior to the Effective Time shall be assumed by Raven and shall be converted into an award of restricted shares of Raven Common Stock (a “Raven Restricted

Stock Award”) with respect to a number of whole shares of Raven Common Stock (rounded to the nearest whole share) equal to the product obtained by multiplying (i) the number of shares of Eagle Common Stock subject to such Eagle

Restricted Stock Award as of immediately prior to the Effective Time by (ii) the Exchange Ratio. Except as otherwise provided in this Section 2.4(b), each Eagle Restricted Stock Award assumed and converted into a Raven Restricted

Stock Award pursuant to this Section 2.4(b) shall continue to have, and shall be subject to, the same terms and conditions as applied to the corresponding

-7-

Eagle Restricted Stock Award as of immediately prior to the Effective Time (including, for the avoidance of doubt, the right to have shares of Raven Common Stock withheld to satisfy any tax

liabilities associated with the vesting of such Raven Restricted Stock Award); provided, however, that (i) all Raven Restricted Stock Awards held by Covered Individuals (as defined in Section 5.6(c) of the Eagle Disclosure

Letter) and members of the Eagle Board of Directors will vest in full as of the Effective Time, and (ii) if the employment with Raven and its Affiliates of a holder of a Raven Restricted Stock Award is terminated without Cause, by the holder

for Good Reason (each, as defined in Section 5.6(a) of the Eagle Disclosure Letter) or due to the holder’s death or disability, such Raven Restricted Stock Award will vest in full as of the date of such termination.

(c) Eagle LTIP Awards. As of the Effective Time, by virtue of the Merger and without any action on the part of the Parties or any

holders thereof, each award of restricted stock units corresponding to shares of Eagle Common Stock granted under the Eagle Equity Plan or otherwise that vests based on the achievement of performance targets (each, an “Eagle LTIP

Award”) that is outstanding as of immediately prior to the Effective Time shall vest in full and be converted into a number of fully vested shares of Raven Common Stock equal to the product obtained by multiplying (i) the number of

shares of Eagle Common Stock subject to such Eagle LTIP Award as of immediately prior to the Effective Time by (ii) the Exchange Ratio. For purposes of the immediately preceding sentence, the number of shares of Eagle Common Stock in

clause (i) shall be determined based on the actual achievement of all applicable performance goals through the Effective Time, and without proration.

(d) Eagle Actions. Prior to the Effective Time, Eagle shall take such actions as are necessary to provide for the treatment of the Eagle

Equity Awards as contemplated by this Section 2.4.

(e) Plans and Awards Assumed by Raven; Raven Actions. At the

Effective Time, Raven shall assume all obligations in respect of the Eagle Equity Plan, including each outstanding Eagle Equity Award. Raven shall take all corporate action necessary to reserve for issuance a number of authorized but unissued shares

of Raven Common Stock for delivery upon settlement or vesting of the Raven Restricted Stock Awards and Eagle LTIP Awards in accordance with this Section 2.4. If registration of any plan interests in the Eagle Equity Plan or the shares of

Raven Common Stock issuable thereunder is required under the U.S. Securities Act of 1933, as amended (the “Securities Act”), on the Closing Date, Raven shall promptly file a registration statement on Form S-8 (or any successor or

other appropriate form) with respect to the shares of Raven Common Stock subject to such awards.

Section 2.5 Employee Stock

Purchase Plan. Eagle shall take all necessary action to ensure that (a) no new offering periods under the Eagle 2004 Employee Stock Purchase Plan (“Eagle ESPP”) will commence during the period from the date of this

Agreement through the Effective Time, (b) there will be no increase in the amount of payroll deductions permitted to be made by the participants under the Eagle ESPP during the current offering periods, except those made in accordance with

payroll deduction elections that are in effect as of the date of this Agreement, and (c) no individuals shall commence participation in the Eagle ESPP during the period from the date of this Agreement through the Effective Time. The accumulated

contributions of the participants in the current offering periods shall be used to purchase shares of Eagle Common Stock as of no later than 10 Business Days prior to the Closing Date and the participants’ purchase rights under such offerings

shall terminate immediately after such purchase. As of no later than the Business Day immediately prior to the Closing Date, Eagle shall terminate the Eagle ESPP.

-8-

Section 2.6 Adjustments to Prevent Dilution. If, at any time during the period

between the date of this Agreement and the Effective Time, there is a change in the number of issued and outstanding shares of Eagle Common Stock or shares of Raven Common Stock, or securities convertible or exchangeable into shares of Eagle Common

Stock or shares of Raven Common Stock, in each case, as a result of a reclassification, stock split (including reverse stock split), stock dividend or stock distribution, recapitalization, merger, subdivision or other similar transaction, the

Exchange Ratio shall be equitably adjusted to provide the holders of Eligible Shares and Raven with the same economic effect as contemplated by this Agreement prior to such event.

Section 2.7 Lost Certificates. If any Eagle Certificate shall have been lost, stolen or destroyed, upon the making of an affidavit

of that fact by the Person claiming such Eagle Certificate to be lost, stolen or destroyed and, if requested by Raven, the posting by such Person of a bond, in such reasonable amount as Raven may direct, as indemnity against any claim that may be

made against it with respect to such Eagle Certificate, the Exchange Agent (or, if subsequent to the termination of the Exchange Fund and subject to Section 2.2(f), the Surviving Corporation) shall deliver, in exchange for such lost,

stolen or destroyed Eagle Certificate, the shares of Raven Common Stock into which the shares of Eagle Common Stock represented by such Eagle Certificate were converted pursuant to Section 2.1(a), any cash in lieu of fractional shares

and any dividends and distributions deliverable in respect thereof pursuant to this Agreement.

ARTICLE III

REPRESENTATIONS AND WARRANTIES

Section 3.1 Representations and Warranties of Eagle. Except (x) as set forth in the applicable section or subsection of the

disclosure letter delivered to Raven by Eagle immediately prior to the execution of this Agreement (the “Eagle Disclosure Letter”) (it being understood that any matter disclosed pursuant to any section or subsection of the Eagle

Disclosure Letter shall be deemed to be disclosed for all purposes of this Article III as long as the relevance of such disclosure to the other Sections or sub-Sections of this Article III is reasonably apparent on the face

of such disclosure) or (y) as disclosed in the Eagle SEC Documents filed with the SEC since December 31, 2014 and publicly available prior to the date hereof (other than disclosures in any “risk factors” or “forward looking

statements” sections of such reports or any other disclosures in such reports to the extent they are predictive or forward-looking in nature), Eagle hereby represents and warrants to Raven as follows:

-9-

(a) Organization, Standing and Power.

(i) Eagle is duly organized, validly existing and in good standing under the laws of the State of Maryland and has requisite

corporate power and authority to own, lease and operate its properties and assets and to carry on its business as presently conducted. Each Subsidiary of Eagle is duly organized, validly existing and in good standing under the laws of the

jurisdiction of its organization and has requisite corporate, partnership or limited liability company (as the case may be) power and authority to own, lease and operate its properties and assets and to carry on its business as presently conducted,

except where the failure to be so organized, validly existing or in good standing, or to have such power or authority, has not had and would not reasonably be expected to have, individually or in the aggregate, an Eagle Material Adverse Effect.

Eagle and each of its Subsidiaries is duly qualified as a foreign corporation or other entity to do business and is in good standing in each jurisdiction where the ownership, leasing or operation of its properties or assets or the nature of its

activities makes such qualification necessary, except for such failures to be so qualified as has not had and would not reasonably be expected to have, individually or in the aggregate, an Eagle Material Adverse Effect. Eagle has previously made

available to Raven true and complete copies of the articles of incorporation, certificates of formation, bylaws, limited liability company agreements, certificates of partnership, bylaws, partnership agreement or other organizational documents

(“Organizational Documents”), as applicable, of Eagle and its Significant Subsidiaries, in each case as in effect as of the date hereof. Eagle’s Organizational Documents are in full force and effect and Eagle is not in

violation of any of its Organizational Documents.

(ii) Section 3.1(a)(ii) of the Eagle Disclosure Letter

sets forth a true and complete list of each Subsidiary of Eagle, together with the jurisdiction of organization or incorporation, as the case may be, of each such Subsidiary. The Organizational Documents of Eagle’s Subsidiaries are in full

force and effect and Eagle’s Significant Subsidiaries are not in violation of any of their respective Organizational Documents.

(iii) Section 3.1(a)(iii) of the Eagle Disclosure Letter sets forth a true and complete list of each

Subsidiary of Eagle that is a REIT, a “qualified REIT subsidiary” within in the meaning of Section 856(i)(2) of the Code or a “taxable REIT subsidiary” within the meaning of Section 856(l) of the Code.

(iv) All issued and outstanding shares of capital stock of, or other equity interests in, each Subsidiary of Eagle (except for

directors’ qualifying shares) are wholly owned, directly or indirectly, by Eagle free and clear of all Liens.

(b) Capital

Structure.

(i) As of the date hereof, the authorized capital stock of Eagle consists of 250,000,000 shares of Eagle

Common Stock and 10,000,000 shares of preferred stock, par value $0.01 per share (“Eagle Preferred Stock”). As of the close of business on November 8, 2016 (the “Eagle Capitalization Date”),

(A) 145,142,192 shares of Eagle Common Stock were issued and outstanding (including 375,408 shares underlying Eagle Restricted Stock Awards), (B) no shares of Eagle Preferred Stock were issued and outstanding, (C) 7,013,959 shares of

Eagle Common Stock were reserved for issuance under the Eagle Equity Plan and the Eagle ESPP, (D) Eagle LTIP Awards relating to 452,728 shares of Eagle Common Stock were outstanding (assuming the

-10-

achievement of maximum performance), (E) Eagle Stock Options to purchase 200,000 shares of Eagle Common Stock were outstanding with a weighted average strike price of $22.89 and (F) no

shares of Eagle capital stock were held by any Subsidiaries of Eagle. All the outstanding shares of Eagle Common Stock are, and all shares of Eagle Common Stock that may be issued prior to the Effective Time shall be, when issued in accordance with

the respective terms thereof, duly authorized, validly issued, fully paid and non-assessable and free of pre-emptive rights.

(ii) Section 3.1(b)(ii) of the Eagle Disclosure Letter sets forth a true and complete list, as of the Eagle

Capitalization Date, of (A) each Eagle Equity Award, (B) the name of each Eagle Equity Award holder, (C) the number of shares of Eagle Common Stock underlying each Eagle Equity Award, (D) the date on which each Eagle Equity Award

was granted, (E) the exercise price of each Eagle Equity Award, if applicable, (F) the expiration date of each Eagle Equity Award, if applicable and (G) the vesting schedule applicable to each Eagle Equity Award.

(iii) Except as set forth in Section 3.1(b)(i) and Section 3.1(b)(ii), as of the date hereof:

(A) Eagle does not have any shares of capital stock or other equity interests issued or outstanding other than shares of Eagle Common Stock that have become outstanding after the Eagle Capitalization Date as a result of the exercise of Eagle

Stock Options as set forth in Section 3.1(b)(ii) or the issuance of Eagle Common Stock pursuant to the Eagle ESPP in the ordinary course of business consistent with past practice, and (B) other than issuances in connection with

Eagle’s ESPP in the ordinary course of business consistent with past practice, there are no outstanding subscriptions, options, warrants, puts, calls, exchangeable or convertible securities or other similar rights, agreements or commitments

relating to the issuance of capital stock or other equity interests to which Eagle or any of its Subsidiaries is a party or otherwise bound obligating Eagle or any of its Subsidiaries to (1) issue, transfer or sell any shares of capital stock

or other equity interests of Eagle or any of its Subsidiaries or securities convertible into or exchangeable for such shares or equity interests (in each case other than to Eagle or a wholly owned Subsidiary of Eagle); (2) grant, extend or

enter into any such subscription, option, warrant, put, call, exchangeable or convertible securities or other similar right, agreement or commitment; (3) redeem or otherwise acquire any such shares of capital stock or other equity interests; or

(4) provide a material amount of funds to, or make any material investment (in the form of a loan, capital contribution or otherwise) in, any Subsidiary of Eagle that is not wholly owned.

(iv) No bonds, debentures, notes or other Indebtedness having the right to vote (or which are convertible into or exercisable

for securities having the right to vote) on any matters on which stockholders may vote (“Voting Debt”) of Eagle or any of its Subsidiaries are issued or outstanding.

(v) There are no voting trusts or other agreements or understandings to which Eagle or any of its Subsidiaries is a party with

respect to the voting of the capital stock or other equity interest of Eagle or any of its Subsidiaries, or restricting the transfer of, or providing registration rights with respect to, such capital stock or equity interest.

-11-

(c) Authority; No Violation.

(i) Eagle has all requisite corporate power and authority to execute, deliver and perform its obligations under this Agreement

and, subject to the receipt of the Eagle Required Vote, to consummate the transactions contemplated hereby. The execution and delivery of this Agreement by Eagle and the performance by Eagle of its obligations hereunder and the consummation of the

transactions contemplated hereby have been duly authorized by the Board of Directors of Eagle and all other necessary corporate action on the part of Eagle, other than the receipt of the Eagle Required Vote and the filing of the Articles of Merger

with each of the SDAT and the DOS, and no other corporate proceedings on the part of Eagle are necessary to authorize this Agreement or the transactions contemplated hereby. This Agreement has been duly and validly executed and delivered by Eagle

and constitutes, subject to the execution and delivery by Raven, a valid and binding obligation of Eagle, enforceable against Eagle in accordance with its terms, except as may be limited by applicable bankruptcy, insolvency, reorganization,

moratorium and other similar laws affecting or relating to creditors’ rights generally and subject to general principles of equity (the “Bankruptcy and Equitable Exceptions”).

(ii) The execution and delivery by Eagle of this Agreement does not, and, except as described in

Section 3.1(c)(iii), the consummation of the transactions contemplated by this Agreement and compliance with the provisions of this Agreement by Eagle will not (A) conflict with or result in any violation or breach of, or default

(with or without notice or lapse of time, or both) under, or give rise to a right of, or result in, termination, modification, cancellation or acceleration of any obligation or to the loss of a benefit under any Contract, permit, concession,

franchise or right binding upon Eagle or any Subsidiary of Eagle or result in the creation of any Lien upon any of the properties or assets of Eagle or any Subsidiary of Eagle, other than Permitted Liens, (B) conflict with or result in any

violation of any provision of the Organizational Documents of Eagle or any Subsidiary of Eagle or (C) conflict with or result in any violation of any Laws applicable to Eagle or any Subsidiary of Eagle or any of their respective properties or

assets, other than in the case of clauses (A), (B) (with respect to Subsidiaries of Eagle that are not Significant Subsidiaries) and (C), as has not had and would not reasonably be expected to have, individually or in the aggregate, an Eagle

Material Adverse Effect.

(iii) Except for (A) the applicable requirements, if any, of state securities or “blue

sky” laws (“Blue Sky Laws”), (B) required filings or approvals under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the Securities Act, (C) any filings or approvals

required under the rules and regulations of the NYSE and (D) the filing of the Articles of Merger with, and the acceptance for record of the Articles of Merger by, the SDAT pursuant to the MGCL and the DOS pursuant to the FBCA, no consent,

approval, order or authorization of, or registration, declaration or filing with, any court, administrative agency or commission or other governmental authority or instrumentality, domestic or foreign, or industry self-regulatory organization (a

“Governmental Entity”) is required by or with respect to Eagle or any of its Subsidiaries in connection with the execution and delivery of this

-12-

Agreement by Eagle or the consummation by Eagle of the transactions contemplated hereby, except for such consents, approvals, orders, authorizations, registrations, declarations or filings that,

if not obtained or made, would not reasonably be expected to have, individually or in the aggregate, an Eagle Material Adverse Effect.

(d)

SEC Documents; Financial Statements; No Undisclosed Liabilities.

(i) Eagle has timely filed or furnished to the SEC

all reports, schedules, statements and other documents required to be filed or furnished by it under the Securities Act or the Exchange Act since December 31, 2014, together with all certifications required pursuant to the Sarbanes-Oxley Act of

2002, as amended (the “Sarbanes-Oxley Act”) (such documents, as supplemented or amended since the time of filing, and together with all information incorporated by reference therein and schedules and exhibits thereto, the

“Eagle SEC Documents”). As of their respective dates, the Eagle SEC Documents at the time filed (or, if amended or superseded by a filing prior to the date of this Agreement, as of the date of such filing) complied in all material

respects with the applicable requirements of the Securities Act, the Exchange Act and the Sarbanes-Oxley Act, and the rules and regulations of the SEC promulgated thereunder applicable to such Eagle SEC Documents, and none of the Eagle SEC Documents

when filed contained any untrue statement of a material fact or omitted to state a material fact required to be stated therein or necessary to make the statements therein, in light of the circumstances under which they were made, not misleading. To

the knowledge of Eagle, none of the Eagle SEC Documents is as of the date of this Agreement the subject of ongoing SEC review and as of the date hereof, Eagle has not received any comments from the SEC with respect to any of the Eagle SEC Documents

which remain unresolved, nor has it received any inquiry or information request from the SEC as of the date of this Agreement as to any matters affecting Eagle that have not been adequately addressed.

(ii) The financial statements of Eagle included in the Eagle SEC Documents complied as to form, as of their respective dates of

filing with the SEC, in all material respects with all applicable accounting requirements and with the published rules and regulations of the SEC with respect thereto (except, in the case of unaudited statements, as permitted by Form 10-Q of the

SEC), have been prepared in accordance with GAAP applied on a consistent basis during the periods involved (except as may be disclosed in the notes thereto, or, in the case of unaudited statements, as permitted by Rule 10-01 of Regulation S-X under

the Exchange Act) and fairly present in all material respects the consolidated financial position of Eagle and its consolidated Subsidiaries and the consolidated results of operations, changes in stockholders’ equity and cash flows of such

companies as of the dates and for the periods shown.

(iii) Eagle has established and maintains a system of internal

control over financial reporting (as defined in Rules 13a–15(f) and 15d–15(f) of the Exchange Act) sufficient to provide reasonable assurances regarding the reliability of financial reporting. Eagle (A) has designed and maintains

disclosure controls and procedures (as defined in Rules 13a–15(e) and 15d–15(e) of the Exchange Act) to provide reasonable assurance that all information required to be disclosed by Eagle in the reports that it files

-13-

or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms and is accumulated and communicated to

Eagle’s management as appropriate to allow timely decisions regarding required disclosure, and (B) has disclosed, based on its most recent evaluation of internal control over financial reporting, to Raven, Eagle’s outside auditors and

the audit committee of the Board of Directors of Eagle (1) all significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect Eagle’s

ability to record, process, summarize and report financial information and (2) any fraud, whether or not material, that involves management or other employees who have a significant role in Eagle’s internal control over financial

reporting. Since December 31, 2014, any material change in internal control over financial reporting required to be disclosed in any Eagle SEC Document has been so disclosed.

(iv) Since December 31, 2014, neither Eagle nor any of its Subsidiaries nor, to the knowledge of Eagle, any Representative

of Eagle or any of its Subsidiaries has received or otherwise obtained knowledge of any material complaint, allegation, assertion or claim, whether written or oral, regarding the accounting or auditing practices, procedures, methodologies or methods

of Eagle or any of its Subsidiaries or their respective internal accounting controls relating to periods after December 31, 2014, including any material complaint, allegation, assertion or claim that Eagle or any of its Subsidiaries has engaged

in questionable accounting or auditing practices.

(v) There are no liabilities or obligations of Eagle or any of its

Subsidiaries of any kind whatsoever, whether accrued, contingent, absolute, determined, determinable or otherwise, other than: (A) liabilities or obligations reflected or reserved against in Eagle’s most recent balance sheet or in the

notes thereto contained in the Eagle SEC Documents filed with the SEC prior to the date of this Agreement; (B) liabilities or obligations incurred in the ordinary course of business consistent with past practices since the date of such balance

sheet; (C) liabilities or obligations arising out of this Agreement or the transactions contemplated hereby; and (D) liabilities or obligations that have not and would not reasonably be expected to have, individually or in the aggregate,

an Eagle Material Adverse Effect.

(vi) Neither Eagle nor any Subsidiary of Eagle is a party to, or has any commitment to

become a party to, any joint venture, off-balance sheet partnership or any similar contract or arrangement, including any contract relating to any transaction or relationship between Eagle or any Subsidiary of Eagle, on the one hand, and any

unconsolidated Affiliate of Eagle or any Subsidiary of Eagle, including any structured finance, special purpose or limited purpose entity or Person, on the other hand, or any “off balance sheet arrangements” (as defined in Item 303(a)

of Regulation S-K of the SEC), where the result, purpose or effect of such contract is to avoid disclosure of any material transaction involving, or material liabilities of, Eagle or any Subsidiary of Eagle or any of their financial statements.

-14-

(e) Information Supplied. None of the information supplied or to be supplied by Eagle for

inclusion or incorporation by reference in (i) the Form S-4 will, at the time the Form S-4 is filed with the SEC and at the time it becomes effective under the Securities Act, contain any untrue statement

of a material fact or omit to state any material fact required to be stated therein or necessary to make the statements therein not misleading, or (ii) the Joint Proxy Statement/Prospectus will, at the date of mailing to stockholders and at the

times of the meetings of stockholders to be held in connection with the Merger, contain any untrue statement of a material fact or omit to state any material fact required to be stated therein or necessary in order to make the statements therein, in

light of the circumstances under which they were made, not misleading. The Form S-4 and the Joint Proxy Statement/Prospectus will comply as to form in all material respects with the requirements of the Securities Act, the Exchange Act and the rules

and regulations of the SEC promulgated thereunder, except that no representation or warranty is made by Eagle with respect to statements made or incorporated by reference therein based on information supplied by Raven for inclusion or incorporation

by reference in the Form S-4 or the Joint Proxy Statement/Prospectus, as applicable.

(f) Compliance with Laws. Eagle and each of

its Subsidiaries are in compliance with all Laws applicable to any of them or their respective operations, except to the extent that failure to comply has not had and would not reasonably be expected to have, individually or in the aggregate, an

Eagle Material Adverse Effect. Neither Eagle nor any of its Subsidiaries has received any written notice since January 1, 2014 asserting a failure, or possible failure, to comply with any such Law, the subject of which written notice has not

been resolved, except for such failures as have not had and would not reasonably be expected to have, individually or in the aggregate, an Eagle Material Adverse Effect.

(g) Legal Proceedings. There is no suit, action, investigation or proceeding (whether judicial, arbitral, administrative or other)

pending or, to the knowledge of Eagle, threatened, against or affecting Eagle or any of its Subsidiaries or any of their respective properties or assets which have had or would reasonably be expected to have, individually or in the aggregate, an

Eagle Material Adverse Effect. There is no judgment, decree, injunction or order of any Governmental Entity or arbitrator outstanding against Eagle or any of its Subsidiaries or any of their respective properties or assets which have had or would

reasonably be expected to have, individually or in the aggregate, an Eagle Material Adverse Effect.

(h) Taxes. Except as has not

had and would not reasonably be expected to have, individually or in the aggregate, an Eagle Material Adverse Effect:

(i)

Eagle and each of its Subsidiaries have (A) duly and timely filed (or caused to be filed on their behalf) with the appropriate taxing authority all Tax Returns required to be filed by them (after giving effect to any extensions), and such Tax

Returns are true, correct and complete, (B) duly and timely paid in full (or caused to be paid in full on their behalf), or made adequate provision for, all Taxes required to be paid by them, and (C) complied with all applicable Laws

relating to the payment and withholding of Taxes (including withholding of Taxes pursuant to Sections 1441, 1442, 1445, 1446, 3102 and 3402 of the Code or similar provisions under any state and foreign Laws) and have duly and timely withheld and, in

each case, have paid over to the appropriate governmental authorities any and all amounts required to be so withheld and paid over on or prior to the due date thereof under all applicable Laws;

-15-

(ii) in the past five years, neither Eagle nor any of its Subsidiaries has

received a written claim, or to the knowledge of Eagle, an unwritten claim, by any authority in a jurisdiction where any of them does not file Tax Returns that it is or may be subject to taxation by that jurisdiction;

(iii) there are no disputes, audits, examinations, investigations or proceedings pending (or threatened in writing), or claims

asserted, for and/or in respect of any Taxes or Tax Returns of Eagle or any of its Subsidiaries, and neither Eagle nor any of its Subsidiaries is a party to any litigation or administrative proceeding relating to Taxes;

(iv) no deficiency for Taxes of Eagle or any of its Subsidiaries has been claimed, proposed or assessed in writing or, to

Eagle’s knowledge, threatened, by any governmental authority, which deficiency has not yet been settled;

(v) neither

Eagle nor any of its Subsidiaries has requested, has received or is subject to any written ruling of a taxing authority or has entered into any written agreement with a taxing authority with respect to any Taxes;

(vi) neither Eagle nor any of its Subsidiaries has extended or waived (nor granted any extension or waiver of) the limitation

period for the assessment or collection of any Tax that remains in effect;

(vii) neither Eagle nor any of its Subsidiaries

currently is the beneficiary of any extension of time within which to file any Tax Return that remains unfiled;

(viii)

neither Eagle nor any of its Subsidiaries has entered into any “closing agreement” as described in Section 7121 of the Code (or any corresponding or similar provision of state, local or foreign income Tax Law);

(ix) since Eagle’s formation, (A) neither Eagle nor any of its Subsidiaries have incurred any liability for Taxes

under Sections 857(b), 857(f), 860(c) or 4981 of the Code; and (B) neither Eagle nor any of its Subsidiaries have incurred any material liability for any other Taxes other than (x) in the ordinary course of business or consistent with past

practice, or (y) transfer or similar Taxes arising in connection with acquisitions or dispositions of property. No event has occurred, and no condition or circumstance exists, which presents a risk that any amount of Tax described in the

previous sentence will be imposed upon Eagle or any of its Subsidiaries;

(x) there are no Tax allocation or sharing

agreements or similar arrangements with respect to or involving Eagle or any of its Subsidiaries, and after the Closing Date neither Eagle nor any of its Subsidiaries shall be bound by any such Tax allocation agreements or similar arrangements or

have any liability thereunder for amounts due in respect of periods prior to the Closing Date, in each case, other than customary provisions of commercial or credit agreements and Tax protection agreements;

-16-

(xi) neither Eagle nor any of its Subsidiaries (A) has been a member of an

affiliated group filing a consolidated U.S. federal income Tax Return (other than a group the common parent of which was Eagle or a Subsidiary of Eagle) or (B) has any liability for the Taxes of any Person (other than Eagle or any of its

Subsidiaries) under Treasury Regulations Section 1.1502-6 (or any similar provision of state, local, or foreign law), as a transferee or successor, by contract, or otherwise;

(xii) Eagle (A) for all taxable years commencing with its taxable year ended December 31, 1995 through and including

its taxable year ended December 31 immediately prior to the Effective Time, has elected and has been subject to federal taxation as a REIT and has satisfied all requirements to qualify as a REIT, and has so qualified, for U.S. federal Tax

purposes for such taxable years, (B) at all times since such date, has operated in such a manner so as to qualify as a REIT for U.S. federal Tax purposes and will continue to operate (including with regard to the REIT distribution requirements

in the taxable year that includes and/or ends on the Closing Date) through the Effective Time in such a manner so as to so qualify for the taxable year that will end with the consummation of the Merger) and (C) has not taken or omitted to take

any action that could reasonably be expected to result in a challenge by the IRS or any other taxing authority to its status as a REIT, and no such challenge is pending or, to the knowledge of Eagle, threatened;

(xiii) each Subsidiary of Eagle has been since the later of its acquisition or formation and continues to be treated for

federal and state income Tax purposes as (A) a partnership (or a disregarded entity) and not as a corporation or an association or publicly traded partnership taxable as a corporation, (B) a “qualified REIT subsidiary” within the

meaning of Section 856(i) of the Code, (C) a “taxable REIT subsidiary” within the meaning of Section 856(l) of the Code or (D) a REIT.

(xiv) neither Eagle nor any of its Subsidiaries holds, directly or indirectly, any asset the disposition of which would be

subject to (or to rules similar to) Section 1374 of the Code;

(xv) neither Eagle nor any of its Subsidiaries has

participated in any “listed transaction” within the meaning of Treasury Regulations Section 1.6011-4(b)(2);

(xvi) neither Eagle nor any of its Subsidiaries (other than taxable REIT Subsidiaries) has or has had any earnings and profits

attributable to such entity or any other corporation in any non-REIT year within the meaning of Section 857 of the Code;

(xvii) there is no Tax protection agreement to which Eagle or any of its Subsidiaries is a party;

(xviii) there are no Tax Liens upon any property or assets of Eagle or any of its Subsidiaries except Liens for Taxes not yet

due and payable or that are being contested in good faith by appropriate proceedings and for which adequate reserves have been established in accordance with GAAP;

-17-

(xix) Eagle is not aware of any fact or circumstance that could reasonably be

expected to prevent the Merger from qualifying as a “reorganization” within the meaning of Section 368(a) of the Code; and

(xx) neither Eagle nor any of its Subsidiaries has constituted either a “distributing corporation” or a

“controlled corporation” (within the meaning of Section 355(a)(1)(A) of the Code) in a distribution of stock qualifying for tax-free treatment under Section 355 of the Code in the two years prior to the date of this Agreement.

(i) Material Contracts. (i) Section 3.1(i) of the Eagle Disclosure Letter sets forth a true, complete and correct

list of all Eagle Material Contracts as of the date of this Agreement and (ii) a true, complete and correct copy of each Eagle Material Contract, as of the date of this Agreement, has been made available by Eagle to Raven prior to the date of

this Agreement; provided, that, for purposes of the foregoing clauses (i) and (ii), only any Eagle Property with a fair market value of greater than $50,000,000 shall be deemed material for purposes of clause (h)(ii) of the “Eagle

Material Contract” definition. Except as has not had and would not reasonably be expected to have, individually or in the aggregate, an Eagle Material Adverse Effect, each of the Eagle Material Contracts is a valid and binding obligation of

Eagle or the Subsidiary of Eagle that is a party thereto, and, to the knowledge of Eagle, the other parties thereto, enforceable against Eagle and its Subsidiaries and, to the knowledge of Eagle, the other parties thereto in accordance with its

terms (subject to the applicable Bankruptcy and Equitable Exceptions). None of Eagle or any of its Subsidiaries is, and to the knowledge of Eagle no other party is, in breach, default or violation (and no event has occurred or not occurred through

Eagle’s or any Subsidiary of Eagle’s action or inaction or, to the knowledge of Eagle, through the action or inaction of any third party, that with notice or the lapse of time or both would constitute a breach, default or violation) of any

term, condition or provision of any Eagle Material Contract to which Eagle or any Subsidiary of Eagle is a party, or by which any of them or their respective properties or assets may be bound, except for such breaches, defaults or violations as have

not had and would not reasonably be expected to have, individually or in the aggregate, an Eagle Material Adverse Effect.

-18-

(j) Benefit Plans.

(i) Section 3.1(j)(i) of the Eagle Disclosure Letter contains a true, complete and correct list of each material

Benefit Plan sponsored, maintained or contributed by Eagle or any of its Subsidiaries, or which Eagle or any of its Subsidiaries is obligated to sponsor, maintain or contribute to, other than any plan or program maintained by a Governmental Entity

to which Eagle or its Subsidiaries is required to contribute to pursuant to applicable Law (the “Eagle Benefit Plans”). No Eagle Benefit Plan is established or maintained outside of the United States or for the benefit of current or

former employees of Eagle or any of its Subsidiaries residing outside of the United States.

(ii) Eagle has made available

to Raven prior to the date of this Agreement a true, correct and complete copy of each Eagle Benefit Plan currently in effect and, with respect thereto, if applicable, (A) all amendments, the current trust (or other funding vehicle) agreements,

and the most recent summary plan descriptions, (B) the most recent annual report (Form 5500 series including, where applicable, all schedules and actuarial and accountants’ reports) filed with the Department of Labor and the most recent

actuarial report or other financial statement relating to such Eagle Benefit Plan, (C) the most recent determination letter from the IRS (if applicable) for such Eagle Benefit Plan and (D) any material correspondence with a Governmental

Entity regarding any Eagle Benefit Plan.

(iii) Except as has not had and would not reasonably be expected to have,

individually or in the aggregate, an Eagle Material Adverse Effect, (A) each Eagle Benefit Plan has been maintained and administered in compliance with its terms and with applicable Law, including, but not limited to, ERISA and the Code and in

each case the regulations thereunder, (B) each Eagle Benefit Plan intended to be qualified under Section 401(a) of the Code has received a favorable determination letter or is the subject of a favorable opinion letter from the IRS as to

its qualification, and, to the knowledge of Eagle, there are no existing circumstances or any events that have occurred that would reasonably be expected to adversely affect the qualified status of any such plan, (C) neither Eagle nor any of

its Subsidiaries has engaged in a transaction that has resulted in, or would reasonably be expected to result in, the assessment of a civil penalty upon Eagle or any of its Subsidiaries pursuant to Section 409 or 502(i) of ERISA or a tax

imposed pursuant to Section 4975 of the Code, (D) there does not now exist, nor, to the knowledge of Eagle, do any circumstances exist that would reasonably be expected to result in, any Controlled Group Liability that would be a liability

of Eagle, any of its Subsidiaries or any of their respective ERISA Affiliates, (E) all payments required to be made by or with respect to each Eagle Benefit Plan (including all contributions, insurance premiums or intercompany charges) with

respect to all prior periods have been timely made or paid by Eagle or its Subsidiaries in accordance with the provisions of each of the Eagle Benefit Plans and applicable Law or, to the extent not required to be made or paid on or before the date

hereof, have been reflected on the books and records of Eagle in accordance with GAAP and (F) there are no pending or, to the knowledge of Eagle, threatened claims by or on behalf of any Eagle Benefit Plan, by any employee or beneficiary

covered under any Eagle Benefit Plan or otherwise involving any Eagle Benefit Plan or any trusts related thereto (other than routine claims for benefits).

-19-

(iv) None of Eagle, any of its Subsidiaries or any of their respective ERISA

Affiliates, maintains, contributes to, or participates in, or has any obligation or liability in connection with: (A) a plan subject to Title IV or Section 302 of ERISA or Section 412 or 430 of the Code, (B) a “multiple

employer welfare arrangement” (as defined in Section 3(40) of ERISA), a “multiple employer plan” (as defined in Section 413(c) of the Code) or a “multiemployer plan” (as defined in Section 3(37) of ERISA), or

(C) any plan or arrangement which provides for post-employment or post-retirement medical or welfare benefits for retired or former employees or beneficiaries or dependents thereof, except pursuant to Section 4980B of the Code or other

applicable Law.

(v) Neither the execution and delivery of this Agreement nor the consummation of the transactions

contemplated hereby (either alone or in conjunction with any other event) will (A) result in any payment (including severance, “excess parachute payment” (within the meaning of Section 280G of the Code), forgiveness of

Indebtedness or otherwise) becoming due to any current or former director, employee or other service provider of Eagle or any of its Subsidiaries under any Eagle Benefit Plan, (B) increase any benefits otherwise payable or trigger any other

obligation under any Eagle Benefit Plan, or (C) result in any acceleration of the time of payment, funding or vesting of any such benefits.

(vi) No Eagle Benefit Plan provides for the gross-up or reimbursement of Taxes under Section 409A or 4999 of the Code or

otherwise.

(k) Employment and Labor Matters.

(i) Neither Eagle nor any of its Subsidiaries is a party to or bound by any material collective bargaining or similar agreement

or work rules or practices with any labor union, works council, labor organization or employee association applicable to employees of Eagle or any of its Subsidiaries.

(ii) Except as has not had and would not reasonably be expected to have, individually or in the aggregate, an Eagle Material

Adverse Effect, (A) there are no pending, or, to the knowledge of Eagle, threatened strikes or lockouts with respect to any employees of Eagle or any of its Subsidiaries (“Eagle Employees”), (B) there is no union

organizing effort pending or, to the knowledge of Eagle, threatened against Eagle or any of its Subsidiaries, (C) there is no unfair labor practice, labor dispute (other than routine individual grievances) or labor arbitration proceeding

pending or, to the knowledge of Eagle, threatened with respect to Eagle Employees, and (D) there is no slowdown or work stoppage in effect or, to the knowledge of Eagle, threatened with respect to Eagle Employees, nor has Eagle or any of its

Subsidiaries experienced any events described in clauses (A), (B), (C) or (D) within the past three years.

-20-

(iii) Except for such matters as have not had and would not reasonably be

expected to have, individually or in the aggregate, an Eagle Material Adverse Effect, Eagle and its Subsidiaries are, and have been since December 31, 2013, in compliance with all applicable Laws relating to employment or labor, including all

applicable Laws relating to wages, hours, collective bargaining, employment discrimination, civil rights, classification of service providers as employees and/or independent contractors, safety and health, workers’ compensation, immigration,

pay equity and the collection and payment of withholding or social security.

(l) Absence of Certain Changes.

(i) From December 31, 2015 through the date of this Agreement, Eagle and its Subsidiaries have conducted their respective

businesses in the ordinary course in all material respects.

(ii) Since December 31, 2015, no Effects have occurred,

which have had or would reasonably be expected to have, individually or in the aggregate, an Eagle Material Adverse Effect.

(m) Board

Approval. The Board of Directors of Eagle, by resolutions duly adopted by unanimous vote, has (i) approved this Agreement and declared this Agreement and the transactions contemplated hereby, including the Merger, to be advisable and in the

best interests of Eagle and its stockholders, (ii) subject to Section 5.4, resolved to recommend that the stockholders of Eagle approve the Merger and directed that such matter be submitted for consideration by Eagle stockholders at

the Eagle Stockholders Meeting and (iii) taken all appropriate and necessary actions to render any and all limitations on mergers, business combinations and ownership of shares of Eagle Common Stock as set forth in Eagle’s Organizational

Documents or in any state takeover statute to be inapplicable to the transactions contemplated by this Agreement.

(n) Vote

Required. The affirmative vote of the holders of shares entitled to cast a majority of all of the votes entitled to be cast on the Merger (the “Eagle Required Vote”) is the only vote of the holders of any class or series of

capital stock of Eagle necessary to approve this Agreement and the transactions contemplated hereby (including the Merger).

(o)

Properties.

(i) Section 3.1(o)(i) of the Eagle Disclosure Letter sets forth a true, correct and

complete list of the address of each real property owned or leased by Eagle or any of its Subsidiaries, name of the entity owning or leasing, whether such property is owned, leased, ground leased or subleased (all such real property interests,

together with all right, title and interest of Eagle and any of its Subsidiaries in and to (A) all buildings, structures and other improvements and fixtures located on or under such real property and (B) all easements, rights and other

appurtenances to such real property, and subject to any easements, impairments, rights and other appurtenances affecting such real property, are individually referred to herein as an “Eagle Property” and collectively referred to

herein as the “Eagle Properties”). Section 3.1(o)(i) of the Eagle Disclosure

-21-