UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For fiscal year ended December 31, 2017

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ______

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report:

Commission file number: 000-22216

Canadian

Zinc Corporation

(Exact Name of Registrant as Specified in its Charter)

| British Columbia, Canada | 1400 | N/A |

| (Province or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code) |

(I.R.S. Employer Identification No.) |

650 West Georgia

Street, Suite 1710

Vancouver, British Columbia, Canada V6B 4N9

(604) 688-2001

(Address and Telephone Number of Registrant’s Principal Executive Offices)

CT Corporation System, 111 Eighth Avenue, New York, NY, 10011, (212) 590-9070

(Name, address (including zip code) and telephone number (including area code) of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act: None

Securities registered or to be registered pursuant to Section 12(g) of the Act: Common Shares, no par value

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of December 31, 2017: 266,111,543 common shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

If this is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of "large accelerated filer", “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer x | Emerging growth company x |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ¨

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ¨ | International Financial Reporting Standards as issued | Other ¨ |

| by the International Accounting Standards Board x |

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow:

¨ Item 17 x Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No x

CONTENTS

| 2 |

| 3 |

This Annual Report (“Annual Report”) contains forward-looking statements that are made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and under Canadian securities laws that involve a number of risks and uncertainties. Such statements are based on the Company’s current expectations, estimates and projections about the industry, management’s beliefs and certain assumptions made by it. We use words such as “expect,” “anticipate,” “project,” “believe,” “plan,” “intend,” “seek,” “should,” “estimate,” “future” and other similar expressions to identify forward-looking statements. The Company’s actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors.

Statements about the Company’s planned/proposed Prairie Creek Mine operations, which includes future mine grades and recoveries; the Company’s plans for further exploration at the Prairie Creek Mine and other exploration properties; the timing for the completion of the definitive feasibility study; future cost estimates pertaining to further development of the Prairie Creek Mine and items such as long-term environmental reclamation obligations; financings and the expected use of proceeds thereof; the completion of financings and other transactions; the outlook for future prices of zinc, lead and silver; the impact to the Company of future accounting standards and discussion of risks and uncertainties around the Company’s business are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Therefore, the Company's actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors. You should not place undue reliance on these forward-looking statements.

Information relating to the magnitude or quality of mineral deposits is deemed to be forward-looking information. The reliability of such information is affected by, among other things, uncertainty involving geology of mineral deposits; uncertainty of estimates of their size or composition; uncertainty of projections relating to costs of production or estimates of market prices for the mineral; the possibility of delays in mining activities; changes in plans with respect to exploration, development projects or capital expenditures; and various other risks including those relating to health, safety and environmental matters.

The Company cautions that the list of factors set forth above is not exhaustive. Some of the risks, uncertainties and other factors which negatively affect the reliability of forward-looking information are discussed in the Company's public filings with the Canadian securities regulatory authorities, including its most recent Annual Report, quarterly reports, material change reports and press releases, and with the United States Securities and Exchange Commission (the “SEC”). In particular, your attention is directed to the risks detailed herein concerning some of the important risk factors that may affect its business, results of operations and financial conditions. You should carefully consider those risks, in addition to the other information in this Annual Report and in the Company's other filings and the various public disclosures before making any business or investment decisions involving the Company and its securities.

The Company undertakes no obligation to revise or update any forward-looking statement, or any other information contained or referenced in this Annual Report to reflect future events and circumstances for any reason, except as required by law. In addition, any forecasts or guidance provided by the Company are based on the beliefs, estimates and opinions of the Company’s management as at the date of this Annual Report and, accordingly, they involve a number of risks and uncertainties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Except as required by law, the Company undertakes no obligation to update such projections if management’s beliefs, estimates or opinions, or other factors should change.

Resource and Reserve Estimates

This Annual Report on Form 20-F includes resource and reserve information that has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with Canadian National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. These definitions differ from the definitions in SEC Industry Guide 7 under the United States Securities Act of 1933, as amended (the “Securities Act”). Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

| 4 |

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” or “contained metal” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures.

U.S. Investors should note that Canadian Zinc Corporation DOES NOT currently disclose any SEC Industry Guide 7 mineral reserves with regard to its mineral deposits at the Prairie Creek Mine site.

| 5 |

Measurement Conversion Information

In this Annual Report, metric measures are used with respect to mineral properties described herein. For ease of reference, the following conversion factors are provided:

1 mile = 1.6093 kilometres

1 metric ton (tonne) = 2,205 pounds

1 foot = 0.305 metres

1 troy ounce = 31.103 grams

1 acre = 0.4047 hectare

1 imperial gallon = 4.546 litres

1 long ton = 2,240 pounds

1 imperial gallon = 1.2010 U.S. gallons

“BQ” – Referring to diamond drill core with a diameter of 36.5 mm or 1.438 inches.

“Deposit” — A mineralized body which has been physically delineated by sufficient drilling, trenching, and/or underground work, and found to contain a sufficient average grade of a commodity, metal or metals to warrant further exploration and/or development expenditures. Such a deposit does not qualify as a commercially mineable ore body or as containing reserves of ore, unless final legal, technical, and economic factors are resolved.

“NQ” – Referring to diamond drill core with a diameter of 47.6 mm or 1.835 inches.

“Ore” — A natural aggregate of one or more minerals which, at a specified time and place, may be mined and sold at a profit or from which some part may be profitably separated.

“Reclamation” — The restoration of land and the surrounding environment of a mining site after the metal is extracted.

“Ton” — Short ton (2,000 lbs.). 1 Ton equals 0.907185 Metric Tons.

“Tonne (t)” — Metric ton (1,000 kilograms). 1 Tonne equals 1.10231 Tons.

| 6 |

National Instrument 43-101 Definitions

National Instrument 43-101 requires mining companies to disclose reserves and resources using the subcategories of proven reserves, probable reserves, measured resources, indicated resources and inferred resources. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

A “mineral reserve” is the economically mineable part of a measured or indicated resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allows for losses that may occur when the material is mined. A “proven mineral reserve” is the economically mineable part of a measured resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. A “probable mineral reserve” is the economically mineable part of an indicated mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit.

A “mineral resource” is a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. A “measured mineral resource” is that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. An “indicated mineral resource” is that part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. Mineral resources that are not mineral reserves do not have demonstrated economic viability. An “inferred mineral resource” is that part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

A “feasibility study” is a comprehensive study of a mineral deposit in which all geological, engineering, legal, operating, economic, social, environmental and other relevant factors are considered in sufficient detail that it could reasonably serve as the basis for a final decision by a financial institution to finance the development of the deposit for mineral production. A “preliminary feasibility study” or “pre-feasibility study” is a comprehensive study of the viability of a mineral project that has advanced to a stage where the mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, has been established, and which, if an effective method of mineral processing has been determined, includes a financial analysis based on reasonable assumptions of technical, engineering, operating, economic factors and the evaluation of other relevant factors which are sufficient for a qualified person, acting reasonably, to determine if all or part of the mineral resource may be classified as a mineral reserve. “Cut-off grade” means (a) in respect of mineral resources, the lowest grade below which the mineralized rock currently cannot reasonably be expected to be economically extracted, and (b) in respect of mineral reserves, the lowest grade below which the mineralized rock currently cannot be economically extracted as demonstrated by either a preliminary feasibility study or a feasibility study. Cut-off grades vary between deposits depending upon the amenability of ore to mineral extraction and upon costs of production and metal prices.

| 7 |

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

The following table sets forth selected financial data of the Company. This selected financial data is derived from the Company’s audited financial statements and notes thereto, as at December 31, 2017, 2016, 2015, 2014 and 2013. The Company’s financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board, which differs in certain respects from U.S. GAAP. The selected financial data provided below is not necessarily indicative of the future results of operations or financial performance of the Company. The Company has not paid any dividends on its common shares and it does not expect to pay dividends in the foreseeable future. The selected financial data set forth below should be read in conjunction with “Item 5 – Operating and Financial Review and Prospects”, and the financial statements and the notes thereto and other financial information which appear elsewhere in this Annual Report.

Selected Financial Data

(CDN$ in thousands, except share and per share data)

| Year ended December 31, | ||||||||||||||||||||

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

| Amounts in accordance with IFRS: | ||||||||||||||||||||

| Net loss | $ | (11,074 | ) | $ | (5,077 | ) | $ | (8,262 | ) | $ | (12,434 | ) | $ | (6,911 | ) | |||||

| Basic and diluted loss per share | (0.04 | ) | (0.02 | ) | (0.04 | ) | (0.06 | ) | (0.04 | ) | ||||||||||

| Total assets | 21,565 | 18,497 | 11,183 | 21,899 | 19,272 | |||||||||||||||

| Net assets | 5,667 | 15,899 | 8,907 | 17,045 | 15,685 | |||||||||||||||

| Share capital | 114,618 | 114,618 | 104,028 | 104,028 | 91,823 | |||||||||||||||

| Reserves | 16,715 | 15,873 | 14,394 | 14,270 | 12,681 | |||||||||||||||

| Dividends declared (per share) | $ | 0.00 | $ | 0.00 | $ | 0.00 | $ | 0.00 | $ | 0.00 | ||||||||||

| Weighted average number of common shares outstanding – basic and diluted | 266,111,543 | 238,480,985 | 218,047,709 | 192,465,968 | 166,539,368 | |||||||||||||||

| Number of common shares outstanding | 266,111,543 | 266,111,543 | 218,047,709 | 218,047,709 | 172,828,575 | |||||||||||||||

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in Canadian dollars (“CDN”).

Since June 1, 1970, the Government of Canada has permitted a floating exchange rate to determine the value of the Canadian dollar against the U.S. dollar. The high and low exchange rates, the average rates (average of the exchange rates on the last day of each month during the period), and the end of the period rates for Canadian dollars, expressed in U.S. dollars, from January 1, 2013 to December 31, 2017 were as follows:

| U.S. DOLLARS PER $1.00 (CDN) | ||||||||||||||||||||

| Years ended December 31 | ||||||||||||||||||||

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

| High | 0.8245 | 0.7972 | 0.8527 | 0.9422 | 1.0164 | |||||||||||||||

| Low | 0.7276 | 0.6854 | 0.7148 | 0.8589 | 0.9348 | |||||||||||||||

| Average | 0.7708 | 0.7548 | 0.7820 | 0.9027 | 0.9670 | |||||||||||||||

| End of Period | 0.7971 | 0.7448 | 0.7225 | 0.8620 | 0.9402 | |||||||||||||||

| 8 |

The high and low exchange rates for Canadian dollars, expressed in U.S. dollars for each of the most recent six months were as follows:

| U.S. DOLLARS PER $1.00 (CDN) | ||||||||||||||||||||||||

| Monthly | ||||||||||||||||||||||||

| September ‘17 | October ‘17 | November ‘17 | December ‘17 | January ‘18 | February ‘18 | |||||||||||||||||||

| High | 0.8245 | 0.8018 | 0.7885 | 0.7971 | 0.8135 | 0.8138 | ||||||||||||||||||

| Low | 0.8013 | 0.7756 | 0.7759 | 0.7760 | 0.7978 | 0.7807 | ||||||||||||||||||

The exchange rate on March 27, 2018 was 0.7771.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

The following is a discussion of those distinctive or special characteristics of the Company’s operations and industry which may have a material impact on, or constitute risk factors in respect of, the Company’s future financial performance. Though the following are major risk factors identified by management, they do not comprise a definitive list of all risk factors related to the Company’s business, financial condition and/or operating results.

Financing and Going Concern

At December 31, 2017, the Company had a positive working capital balance of $11,791,000 including cash and cash equivalents of $12,979,000 and short-term investments of $31,000.

On December 22, 2017, the Company entered into a financing agreement (“Project Bridge Loan”) with Resource Capital Fund VI L.P. (“RCF VI”) pursuant to which RCF VI provided an interim non-convertible project loan in the amount of US$10 million. The Project Bridge Loan will mature on January 31, 2019. The Project Bridge Loan is secured by a charge on the Company’s assets and contains customary affirmative and negative covenants and events of default.

Canadian Zinc has a history of losses with no operating revenue other than minor interest income. The Company has not achieved profitable operations, has an accumulated deficit since inception and expects to incur further losses in the development of its business.

Canadian Zinc does not currently generate any cash flow from its operationsand will need to generate additional financial resources to fund its corporate administration costs and working capital, to refinance or renew the loan payable when it becomes due in January 2019, and to continue the development of the Prairie Creek Project and to put the Prairie Creek Mine into production.

The development of the Prairie Creek Mine will require substantial additional financing. The 2017 Feasibility Study estimated that the additional capital required to install the planned new facilities and to bring the Prairie Creek Mine into production will aggregate $253 million, plus a contingency of $26 million for a total of $279 million. Working capital required upon commencement of production is estimated to be $36 million.

| 9 |

Supported by the results of the 2017 Feasibility Study, Canadian Zinc will continue to evaluate all alternatives and possibilities for raising the senior financing necessary to complete the development and construction and put the Prairie Creek Mine into production. The Company is currently evaluating various opportunities and seeking additional sources of financing. The Investor Agreement with RCF VI contains various rights granted to RCF VI, including among other things: a period of exclusivity to work with the Company to define the terms of RCF VI’s future participation in the project financing of the Prairie Creek Mine, on terms and conditions to be agreed by the Company and RCF VI remain in discussions regarding RCF VI’s further participation in future project financings. However, the ability to raise financing may be impacted by conditions beyond the control of the Company, including future projections of commodity prices, uncertainty in the capital markets and the lack of investor interest in the resource sector.

The ability of the Company to continue as a going concern and to carry out its planned business objectives, including the successful development of the Company’s Prairie Creek property will depend upon the Company’s ability to obtain financing through private placement financing, public financing, the joint venturing of projects, bank financing or other means. There is no assurance that the Company will continue to be able to obtain additional financial resources or that such additional financing will be available to the Company on a timely basis or on acceptable terms. There are no assurances that the Company will be successful in obtaining the required financing and/or achieve positive cash flows or profitability. These conditions indicate the existence of material uncertainties which cast significant doubt about the Company’s ability to continue as a going concern.

Securities of junior and small-cap companies have experienced substantial volatility in the past, often based on factors unrelated to the financial performance or prospects of the companies involved. These factors include macroeconomic developments in North America and global and market perceptions of the attractiveness of particular industries. The share price of Canadian Zinc is likely to be significantly affected by short-term changes in metal prices. Other factors unrelated to Canadian Zinc’s performance that may have an effect on the price of its shares include the following: the extent of analytical coverage available to investors concerning Canadian Zinc’s business may be limited if investment banks with research capabilities do not follow the Company’s securities; lessening in trading volume and general market interest in the Company’s securities may affect an investor’s ability to trade significant numbers of common shares; the size of Company’s public float may limit the ability of some institutions to invest in the Company’s securities; and a substantial decline in the price of the common shares that persists for a significant period of time could cause the Company’s securities to be delisted from an exchange, further reducing market liquidity.

As a result of any of these factors, the market price of the Company’s shares at any given point in time may not accurately reflect Canadian Zinc’s long-term value. Securities class action litigation often has been brought against companies following periods of volatility in the market price of their securities. Canadian Zinc may in the future be the target of similar litigation. Securities litigation could result in substantial costs and damages and divert management’s attention and resources.

Permitting, Environmental and Other Regulatory Requirements

The Company’s operations are subject to permitting, environmental and other regulatory requirements which the Company may not be able to comply with.

The operations of Canadian Zinc require licences and permits from various governmental and regulatory authorities. Canadian Zinc holds all necessary licences and permits under applicable laws and regulations for the operation of the Prairie Creek Mine. Canadian Zinc believes that it is presently complying in all material respects with the terms of its current licences and permits. However, such licences and permits are subject to change in various circumstances. There can be no guarantee Canadian Zinc will be able to maintain all necessary licences and permits as are required to explore and develop its properties, including the Prairie Creek Property, commence construction or operation of mining facilities or properties under exploration or development.

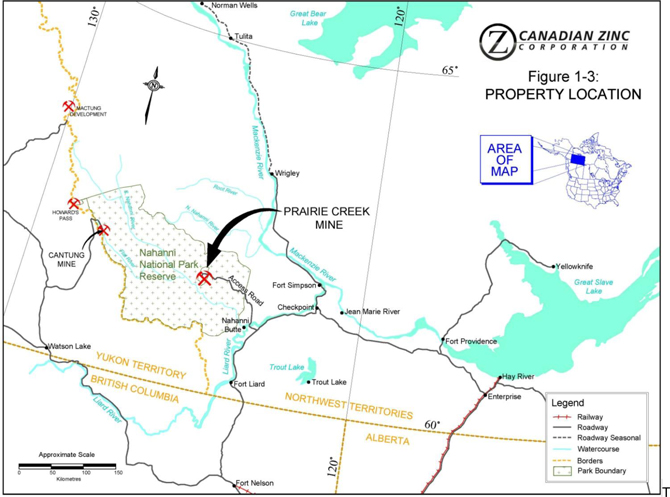

The Prairie Creek Project is located in an environmentally sensitive and remote area in the Mackenzie Mountains of the Northwest Territories, within the watershed of the South Nahanni River. The South Nahanni River is considered to be of global significance, is highly valued as a wilderness recreation river and is a designated World Heritage Site. The South Nahanni River flows through the Nahanni National Park Reserve.

| 10 |

The Prairie Creek Property is encircled by the Nahanni National Park Reserve; however, an area of approximately 300 square kilometres immediately surrounding the Prairie Creek Mine is specifically excluded from the Park. In 2009 new legislation entitled “An Act to Amend the Canada National Parks Act to enlarge Nahanni National Park Reserve of Canada” was enacted, which also authorized the Minister of Environment to enter into leases, licences of occupation or easements over Nahanni Park lands for the purposes of a mining access road leading to the Prairie Creek Mine area, including the sites of storage and other facilities connected with that road. The Company has obtained permits from the Parks Canada Agency for the purposes of accessing the Prairie Creek Mine area. There can be no guarantee Canadian Zinc will be able to maintain all necessary permits on acceptable terms.

Canadian Zinc’s activities are subject to extensive federal, provincial, territorial and local laws and regulations governing environmental protection and employee health and safety. Canadian Zinc is required to obtain governmental permits and provide bonding requirements under federal and territorial water and mine regulations. All phases of Canadian Zinc’s operations are subject to environmental regulation. These regulations mandate, among other things, the maintenance of water and air quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner, which will require stricter standards and enforcement, increased fines and penalties for non-compliance, and more stringent environmental assessments of proposed projects. United Nations proposals for a global treaty on mercury, intended to result in reduced global emissions of mercury, may place restrictions on the production, use and international movement of mercury and mercury-containing wastes which may, if adopted, result in restrictions on shipment of concentrates or other mineral products containing by-product or trace mercury. There is no assurance that future changes in environmental laws or regulations, if any, will not adversely affect Canadian Zinc’s operations.

Environmental laws and regulations are complex and have tended to become more stringent over time. These laws are continuously evolving. Any changes in such laws, or in the environmental conditions at the Prairie Creek Property, could have a material adverse effect on Canadian Zinc’s financial condition, liquidity or results of operations. Canadian Zinc is not able to determine the impact of any future changes in environmental laws and regulations on its future financial position due to the uncertainty surrounding the ultimate form such changes may take. The Company does not currently consider that its expenditures required to maintain ongoing environmental monitoring obligations at the Prairie Creek Property are material to the results and financial condition of the Company. However, these costs could become material in the future and would be reported in the Company’s public filings at that time.

Although Canadian Zinc makes provision for reclamation costs, it cannot be assured that such provision is adequate to discharge its obligations for these costs. As environmental protection laws and administrative policies change, Canadian Zinc will revise the estimate of its total obligations and may be obliged to make further provisions or provide further security for mine reclamation costs. The ultimate amount of reclamation to be incurred for existing and past mining interests is uncertain.

Existing and possible future environmental legislation, regulations and actions could cause additional expense, capital expenditures, restrictions and delays in the activities of the Company, the extent of which cannot be predicted. The Company must obtain various regulatory approvals, permits and licences relating to the Prairie Creek Property and there is no assurance that such approvals will be obtained. No assurance can be given that new rules and regulations will not be enacted or made, or that existing rules and regulations will not be applied, in a manner which could limit or curtail production or development.

Regulatory approvals and permits are currently, and will in the future be, required in connection with Canadian Zinc’s operations. To the extent such approvals are required and not obtained; Canadian Zinc may be curtailed or prohibited from proceeding with planned exploration or development of its mineral properties or from continuing its mining operations.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. The Company may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

| 11 |

Failure to comply with applicable environmental and health and safety laws can result in injunctions, damages, suspension or revocation of permits and imposition of penalties. There can be no assurance that Canadian Zinc has been or will be at all times in complete compliance with all such laws, regulations and permits, or that the costs of complying with current and future environmental and health and safety laws and permits will not materially adversely affect Canadian Zinc’s business, results of operations or financial condition. Environmental hazards may exist on the properties, including the Prairie Creek Property, on which Canadian Zinc holds interests which are unknown to Canadian Zinc at present and which have been caused by previous owners or operators of the properties.

Amendments to current laws, regulations and permits governing operations and activities of mining and exploration companies, or more stringent implementation thereof, could have a material adverse impact on Canadian Zinc and cause increases in exploration expenses, capital expenditures or production costs or require abandonment or delays in the development of mining properties.

The Prairie Creek Project has, on numerous occasions, experienced significant delays in obtaining permits and licences necessary for the conduct of its operations.

The environmental assessment of the Company’s application for a permit for an All Season Road which was ongoing for almost four years was completed in September 2017. The Mackenzie Valley Environmental Impact Review Board (“MVRB” or “Review Board”) concluded that an environmental impact review of this proposed development is not necessary and that the proposed All Season Road Project should proceed to the regulatory phase. The Environmental Assessment Report has been forwarded to the Federal Minister of Crown-Indigenous Relations and Northern Affairs, with a recommendation that the development be approved, subject to the measures described in the Report.

On January 18, 2018, the Minister of Crown Indigenous Relations and Northern Affairs Canada, invoked a two-month extension to the timeline for the Minister’s decision on the Report of Environmental Assessment for the Prairie Creek All Season Road, originally due by February 12, 2018, to allow the federal and territorial governments to complete aboriginal consultations.

In connection with such consultations on January 19, 2018, Indian and Northern Affairs Canada (“INAC”) provided Canadian Zinc with five information requests, identifying specific issues raised by Indigenous groups that need further clarity through proponent engagement, so the Responsible Ministers can be confident that the Crown has discharged its legal duty to consult by meaningfully and completely consulting with impacted Indigenous groups.

The issue of the information requests, pursuant to subsection 130 (4.06) of the Mackenzie Valley Resource Management Act, has the effect of stopping the clock on the five-month time limit for the Responsible Ministers to make a decision on the Report of Environmental Assessment. The time limit, extended by an additional two months, will resume only after the Company has provided an adequate response to the information sought.

Following approval by the Minister, the regulatory phase, conducted by the Mackenzie Valley Land and Water Board (the “Water Board”) with input from territorial and federal agencies, is the next permitting stage in which the road permit is issued by the Water Board.

If at any time permits essential to operations are not obtained, or not obtained in a timely manner, or are cancelled or revoked, there is a risk that the Company may not be able to operate a mine at the Prairie Creek Property.

Political and Legislative

Canadian Zinc’s operations are exposed to various levels of political, legislative and other risks and uncertainties.

Canadian Zinc conducts its operations in Canada and specifically in the Northwest Territories and the province of Newfoundland and Labrador. The Mackenzie Valley in the Northwest Territories of Canada is in an area which is claimed by the Dehcho First Nations as their traditional territory. The Dehcho have not settled their land claim with the Federal Government of Canada. The Dehcho and the Federal Government both claim legal title to this territory and legal title to the land remains in dispute. The Company’s operations are potentially subject to a number of political, legislative and other risks. Canadian Zinc is not able to determine the impact of political, legislative or other risks on its business or its future financial position.

| 12 |

Canadian Zinc’s operations are exposed to various levels of political, legislative and other risks and uncertainties. These risks and uncertainties include, but are not limited to, cancellation, renegotiation or nullification of existing leases, claims, permits and contracts; expropriation or nationalization of property; changes in laws or regulations; changes in taxation laws or policies; royalty and tax increases or claims by governmental, Aboriginal or other entities; retroactive tax or royalty claims and changing political conditions; government mandated social expenditures; governmental regulations or policies that favour or require the awarding of contracts to local or Aboriginal contractors or require contractors to employ residents of, or purchase supplies from, a particular jurisdiction or area; or that require that an operating project have a local joint venture partner, which may require to be subsidized; and other risks arising out of sovereignty or land claims over the area in which Canadian Zinc’s operations are conducted.

The mineral exploration, mine development, and proposed mining, processing activities of Canadian Zinc, and the anticipated production, transportation and sale of mineral concentrates are subject to extensive federal, territorial, international and local laws, regulations and treaties, including various laws governing prospecting, development, production, transportation taxes, labour standards and occupational health, mine safety, toxic substances including mercury, land use, water use and other matters. Such laws and regulations are subject to change and can become more stringent and costly over time. No assurance can be given that new laws, rules and regulations will not be enacted or that existing laws, rules and regulations will not be applied in a manner which could limit or curtail exploration, development, mining, processing, production and sale of concentrates. Amendments to current laws and regulations governing operations and activities of exploration and mining, or more stringent implementation thereof, could have a substantial adverse impact on Canadian Zinc.

There was a major change to the legislative and regulatory framework and regulations in the Mackenzie Valley between 1998 and 2000 with the enactment of the Mackenzie Valley Resource Management Act (“MVRMA”). In 2007, the Federal Government announced the Northern Regulatory Improvement Initiative to improve the current regulatory regime in the north of Canada and formally embarked on a review of environmental regulatory systems throughout the North.

In May 2010 the Federal Government announced an Action Plan to improve northern regulatory regimes, which anticipated changes to the current legislative framework and regulatory processes. This process, which included negotiations with the Government of the Northwest Territories and various Aboriginal Governments in the context of NWT devolution, led to several changes to the MVRMA, including creation of the Superboard, the effect of which would be to collapse the functions of the Wek’eezhii Land and Water Board (“WLWB”), the Sahtu Land and Water Board, and the Gwich’in Land and Water Board into one single land and water board, or “Superboard” - the Mackenzie Valley Land and Water Board.

Creation of the Mackenzie Valley “Superboard” was contemplated in the amendments to the MVRMA contained in the Northwest Territories Devolution Act 2014, The Superboard legislation was to take effect on April 1, 2015. The Tlicho Government objected on the grounds that the Tlicho Agreement expressly requires the establishment of the WLWB. The Tlicho further said that they were not consulted on the amendments. Canada maintained that the legislation is necessary to increase efficiency in the regulatory process. As a result of this disagreement, the Tlicho Government commenced an action against the Federal Government in May 2014, seeking among other things a declaration that Superboard legislation is unconstitutional, as well as an injunction preventing the Superboard legislation from taking effect until the constitutionality of the Superboard can be determined. The Supreme Court of the Northwest Territories granted an injunction to the Tlicho Government suspending the implementation of the “Superboard” legislation and the Federal Government appealed the decision. In December 2015 the new Liberal Government announced the suspension of the appeal. It is expected that the Liberal Government will introduce legislation further amending the MVRMA to remove the “Superboard” and re-establish the original regional water boards.

On April 1, 2014, The Northwest Territories Devolution Act which provides for the devolution of lands and resource management from the Government of Canada to the Government of the Northwest Territories (“GNWT”) came into force. Devolution in the Northwest Territories means the transfer of decision-making and administration for land and resource management in the NWT from the Government of Canada to the Government of the Northwest Territories. The Territorial government is now responsible for the management of onshore lands and the issuance of rights and interests with respect to onshore minerals and oil and gas. The GNWT now has the power to collect and share in resource revenues generated in the territory. The Northwest Territories Devolution Act includes certain amendments to the Mackenzie Valley Resource Management Act, which impose additional regulations and obligations on mining operations in the Mackenzie Valley.

| 13 |

A key feature of devolution was the establishment of an Intergovernmental Council which was established by the Northwest Territories Intergovernmental Agreement on Lands and Resources Management signed between the Government of the Northwest Territories (GNWT), Inuvialuit Regional Corporation, Northwest Territory Métis Nation, Sahtu Secretariat Incorporated, Gwich’in Tribal Council and the Tłįchǫ Government as part of the Devolution Agreement which came into effect on April 1, 2014. The Intergovernmental Agreement allows for other Aboriginal organizations to become a party and the GNWT is continuing discussions with the Dehcho First Nations and the Akaitcho Territory Dene First Nations about signing onto the Devolution Agreement and becoming members of the Council.

The Intergovernmental Council allows the public and Aboriginal governments to cooperate and collaborate on matters related to lands and resource management and provides an opportunity for northern leaders to cooperate on land and resource management across jurisdictions, while respecting the autonomy and authority of each government over its own lands. The goal of the Intergovernmental Council is to work together to explore ways to coordinate their respective land and resource management practices, share capacity, and avoid duplication.

The Intergovernmental Agreement provided at section 5.1 that “The duties of the Council are to … (c) address legislative requirements for benefit agreement requirements relating to resource development”. As per the approved Intergovernmental Council’s Terms of Reference, working groups may be established by the Council to address specific tasks or issues. The working groups are advisory and accountable to the Intergovernmental Council and do not have any decision-making authority. One such working group is the Impact Benefit Plans Working Group. The Impact Benefit Plans Working Group will undertake research to identify and assess potential options for the establishment of legislative requirements: a) for proponents who intend to undertake resource development activities in the NWT to enter into negotiations for benefit agreements with the affected Aboriginal groups and to conclude impact benefit agreements with affected Aboriginal groups; and b) for government to negotiate and conclude benefit agreements (e.g. socio-economic agreement) with affected Aboriginal groups.

As part of devolution the Government of the Northwest Territories also entered into the Northwest Territories Intergovernmental Resource Revenue Sharing Agreement with the Inuvialuit Regional Corporation, Northwest Territory Métis Nation, Sahtu Secretariat Incorporated, Gwich’in Tribal Council, and Tłįchǫ Government. The Resource Revenue Sharing agreement sets out terms and conditions for the sharing of resource revenues from public lands in the NWT among the GNWT and Aboriginal government signatories to the Devolution Agreement. The GNWT has committed to share up to 25% of its resource revenues with these Aboriginal governments.

The Government of the Northwest Territories (GNWT) is developing a new NWT Mineral Resources Act (MRA) intended to meet the unique needs of the NWT; increase investment in the exploration and mining sector; promote a sustainable and diversified economy; respect the rights and traditions of Indigenous peoples; protect the natural environment; provide benefits from mineral resources to the NWT; and enhance public geoscience knowledge of the NWT. The GNWT is considering making it a legal requirement under the proposed Mineral Resources Act for proponents who intend to undertake resource development activities in the NWT to enter into impact benefit agreements with affected Aboriginal groups.

Canadian Zinc is not able to predict future government actions or determine the impact, if any, on its business or operations if the Dehcho First Nations sign on to the Devolution Agreement and becoming members of the Intergovernmental Council, or if the proposed NWT Minerals Resources Act is enacted. There can be no assurance that these laws and regulations will not change in the future in a manner that could have an adverse effect on the Company’s activities and/or its financial condition. Amendments to current laws and regulations governing operations and activities of exploration and mining, or more stringent implementation thereof, could have a substantial adverse impact on Canadian Zinc.

| 14 |

In relation to Northwest Territories specifically, a number of policy and social issues exist which increase Canadian Zinc’s political and legislative risk. The Government of Canada and Government of the Northwest Territories are facing legal and political issues, such as land claims and social issues, all of which may impact future operations. This political climate increases the risk of the Government making changes in the future to its position on issues such as mining rights and land tenure, which in turn may adversely affect Canadian Zinc’s operations. Future government actions cannot be predicted, but may impact the operation and regulation of the Prairie Creek Mine. Changes, if any, in Government policies, or shifts in local political attitude in the Northwest Territories may adversely affect Canadian Zinc’s operations or business.

On January 18, 2018, the Minister of Crown Indigenous Relations and Northern Affairs Canada, invoked a two-month extension to the timeline for the Minister’s decision on the Report of Environmental Assessment for the Prairie Creek All Season Road, originally due by February 12, 2018, to allow the federal and territorial governments to complete aboriginal consultations.

In connection with such consultations on January 19, 2018, Indian and Northern Affairs Canada provided Canadian Zinc with five information requests, identifying specific issues raised by Indigenous groups that need further clarity through proponent engagement, so the Responsible Ministers can be confident that the Crown has discharged its legal duty to consult by meaningfully and completely consulting with impacted Indigenous groups.

INAC has requested Canadian Zinc to engage the Nahanni Butte Dene Band, Liidlii Kue First Nation and the Dehcho First Nations, as recommended by the Review Board, to gain an understanding of the Indigenous groups’ concerns, discuss and determine how the Indigenous groups will be included in monitoring and discuss the Indigenous groups’ requests for support to participate in implementation of the measures recommended by the Review Board and the commitments made by Canadian Zinc in the environmental assessment process.

In 2016, the Government of Canada announced the introduction of a national pan-Canadian framework that includes a national floor price on carbon which, if implemented, will increase the cost of power supply to the Company’s projects. Canadian provinces and territories will be given until 2018 to implement a carbon pricing policy, starting with a minimum price of $10 per tonne in 2018, increasing $10 per year to $50 per tonne by 2022.

In 2012, Environment Canada initiated a 10-year review process of the Metal Mining Effluent Regulations. Environment Canada proposes to establish BATEA based (best available technology economically achievable) effluent limits as a means to promote continuous improvement in the sector. On May 13, 2017, the proposed Regulations Amending the Metal Mining Effluent Regulations, were published in Canada Gazette Part 1. The proposed Amendments would impose more stringent limits for arsenic, copper, cyanide, lead, nickel, and zinc, as well as introduce limits for un-ionized ammonia. Several amendments are proposed to improve the efficiency of the environmental effects monitoring performance measurement and evaluation requirements. The proposed Amendments would require that mine effluent not be acutely lethal to Daphnia magna whereby a first acute lethality failure for Daphnia magna would not result in a loss of the authority to deposit, while subsequent failures would. The proposed Amendments would come into force on the day on which they are registered, which is expected to take place in 2018.

In February 2018, the Government of Canada tabled Bills C-68 and C-69 in Parliament that if enacted will replace the Canadian Environmental Assessment Act 2012 with an Impact Assessment Act and amend the Fisheries Act and the Navigation Protection Act (becoming the Canadian Navigable Waters Act). Although the Canadian Environmental Assessment Act does not impact the Prairie Creek Project, as the legislative and regulatory framework and regulations in the Mackenzie Valley are governed by the Mackenzie Valley Resource Management Act, the proposed new legislation is reflective of current federal government policies and may lead to changes in the Mackenzie Valley Resource Management Act. The key changes proposed to the environmental and regulatory system include shifting from environmental assessment to impact assessment which would look at all of a project’s impacts, including environmental, health, social and economic impacts. The proposed legislation is intended to provide more transparency and certainty that decisions would be based on robust science, evidence and Indigenous traditional knowledge, more and earlier opportunities for meaningful participation by Indigenous peoples and more Indigenous leadership of and partnership in project review.

Canadian Zinc’s exploration, development and production activities may be substantially affected by factors beyond Canadian Zinc’s control, any of which could materially adversely affect Canadian Zinc’s financial position or results of operations. The occurrence of these various factors and uncertainties cannot be accurately predicted. The Company is not able to determine the impact of these risks on its business.

| 15 |

Metal Prices and Marketability of Minerals

The market price of metals and minerals is volatile and cannot be controlled. Metal prices have fluctuated widely, particularly in recent years. If the price of metals and minerals should drop significantly, the economic prospects for the Prairie Creek Project could be significantly reduced or rendered uneconomic. There is no assurance that, a profitable market may exist for the sale of products, including concentrates from the Prairie Creek Project. Factors beyond the control of the Company may affect the marketability of minerals or concentrates produced. It is expected that the zinc concentrates to be produced from the Prairie Creek Mine will contain relatively high levels of mercury. United Nations proposals for a global treaty on mercury, intended to result in reduced global emissions of mercury, may place restrictions on the production, use and international movement of mercury and mercury-containing wastes which may, if adopted, result in restrictions on shipment of concentrates or other mineral products containing by-product or trace mercury.

The marketability of minerals is affected by numerous other factors beyond the control of the Company, including quality issues, impurities, deleterious elements, government regulations, royalties, allowable production and regulations regarding the importing and exporting of minerals, the effect of which cannot be accurately predicted.

Factors tending to affect the price of metals include:

| • | The relative strength of the U.S. dollar against other currencies; |

| • | Government monetary and fiscal policies; |

| • | Expectations of the future rate of global monetary inflation and interest rates; |

| • | General economic conditions and the perception of risk in capital markets; |

| • | Political conditions including the threat of terrorism or war; |

| • | Speculative trading; |

| • | Investment and industrial demand; and |

| • | Global production and inventory stocks. |

The effects of these factors, individually or in aggregate, on the prices of zinc, lead and/or silver is impossible to predict with accuracy. Fluctuations in metal prices may adversely affect Canadian Zinc’s financial performance and results of operations. Further, if the market price of zinc, lead and/or silver falls or remains depressed, Canadian Zinc may experience losses or asset write-downs and may curtail or suspend some or all of its exploration, development and mining activities.

Furthermore, sustained low metal prices can halt or delay the development of new and existing projects; reduce funds available for mineral exploration and may result in the recording of a write-down of mining interests due to the determination that future cash flows would not be expected to recover the carrying value.

Metal prices fluctuate widely and are affected by numerous factors beyond Canadian Zinc’s control such as the sale or purchase of such commodities by various central banks and financial institutions, interest rates, exchange rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand, and the political and economic conditions of major mineral and metal producing countries throughout the world.

Future production, if any, from Canadian Zinc’s mining properties is dependent on mineral prices that are adequate to make these properties economic. The prices of metals have fluctuated widely in recent years, and future or continued serious price declines could cause continued development of and commercial production from Canadian Zinc’s properties to be impracticable. Depending on the price of metal, cash flow from mining operations may not be sufficient and Canadian Zinc may never commence commercial production and may lose its interest in, or may be forced to sell, its properties.

The zinc concentrates to be produced from the Prairie Creek Mine will contain, to varying degrees, relatively high levels of mercury. Canadian Zinc has signed MOUs with Korea Zinc and Boliden for the sale of zinc concentrates. The MOUs set out the intentions of Canadian Zinc and each of Korea Zinc and Boliden to enter into concentrate sales agreements for the concentrates to be produced from the Prairie Creek Mine on the general terms set out in the MOUs, including commercial terms which are to be kept confidential. The sales agreements will provide that treatment charges will be set annually at the annual benchmark treatment charges and scales, as agreed between major smelters and major miners. Payables and penalties will be negotiated in good faith annually during the fourth quarter of the preceding year, including industry standard penalties based on indicative terms and agreed limits specified in each MOU.

| 16 |

Treatment and refining charges, including deductibles and penalties, vary with smelter location, and individual smelter terms and conditions. The economic model used in the 2016 Preliminary Feasibility Study has been prepared assuming average blended indicative treatment charges and penalties, however, no smelter or concentrate buyer has contractually committed to the assumed treatment charges or penalties. There can be no assurance that the assumed terms will be available to the Company.

In addition to adversely affecting Canadian Zinc’s reserve or resource estimates and its financial condition, declining commodity prices can impact operations by requiring a reassessment of the feasibility of a particular project. The need to conduct such a reassessment may cause substantial delays or may interrupt operations until the reassessment can be completed.

Currency fluctuations may affect the costs that Canadian Zinc incurs at its operations. Zinc, lead and silver are sold throughout the world based principally on the U.S. dollar price, but operating expenses are incurred in currencies other than the U.S. dollar. Appreciation of the Canadian dollar against the U.S. dollar increases the cost of production in U.S. dollar terms at mines located in Canada.

Exploration and Evaluation

Mineral exploration involves a high degree of risk.

The business of exploring for minerals and mining involves a high degree of risk. There is no assurance the Company’s mineral exploration activities will be successful. Few properties that are explored are ultimately developed into producing mines. In exploring and developing its mineral deposits the Company is subjected to an array of complex economic factors and technical considerations. Unusual or unexpected formations, formation pressures, power outages, labour disruptions, flooding, explosions, cave-ins, landslides, environmental hazards, and the inability to obtain suitable or adequate machinery, equipment or labour are other risks involved in the conduct of exploration and development programs. Such risks could materially adversely affect the business or the financial performance of the Company.

There is no certainty that the expenditures made by Canadian Zinc towards the search and evaluation of mineral deposits will result in discoveries of commercial quantities of ore. The exploration for and development of mineral deposits involves significant risks which even a combination of careful evaluation, experience and knowledge may not eliminate. Major expenses may be required to locate and establish mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. It is impossible to ensure that the exploration or development programs planned by Canadian Zinc will result in a profitable commercial mining operation. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices which are highly cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in Canadian Zinc not receiving an adequate return on invested capital.

A specific risk associated with the Prairie Creek Property is its remote location. Mining, processing, development and exploration activities depend, to one degree or another, on adequate infrastructure. Reliable roads, bridges, power sources and water supply are important factors, which affect capital and operating costs. Unusual or infrequent weather phenomena, government or other interference in the maintenance or provision of such infrastructure could adversely affect Canadian Zinc’s operations, financial condition and results of operations.

Mining operations generally involve a high degree of risk. Canadian Zinc’s mining operations will be subject to all the hazards and risks normally encountered in the development and production of minerals, including unusual and unexpected geologic formations, seismic activity, rock bursts, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. Mining and milling operations are subject to hazards such as equipment failure or failure of retaining dams around tailings disposal areas, which may result in environmental pollution and consequent liability.

| 17 |

Uncertainty in the Estimation of Mineral Reserves and Mineral Resources

There is uncertainty in the estimation of mineral reserves and mineral resources.

The figures for Mineral Reserves and Mineral Resources contained in this document are estimates only and no assurance can be given that the anticipated tonnages and grades will be achieved, that the indicated level of recovery will be realized or that Mineral Reserves and Mineral Resources can be mined or processed profitably. There are numerous uncertainties inherent in estimating Mineral Reserves and Mineral Resources, including many factors beyond Canadian Zinc’s control. Such estimation is a subjective process, and the accuracy of any reserve and resource estimate is a function of the quantity and quality of available data and of the assumptions made and judgments used in engineering and geological interpretation. In addition, there can be no assurance that mineral or metal recoveries in small scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production.

Inferred mineral resources do not have demonstrated economic viability. Due to the uncertainty which may attach to inferred mineral resources, there is no assurance that inferred mineral resources will be upgraded to measured and indicated mineral resources as a result of continued exploration.

Fluctuation in metal prices, results of drilling, metallurgical testing and production and the evaluation of mine plans subsequent to the date of any estimate may require revision of any such resource or reserve estimate. The volume and grade of resources mined and processed and recovery rates may not be the same as currently anticipated. Any material reductions in estimates of Mineral Reserves or Mineral Resources, or of Canadian Zinc’s ability to extract these Mineral Reserves or Mineral Resources, could have a material adverse effect on Canadian Zinc’s results of operations and financial condition.

Mineral reserve and mineral resource estimates are imprecise and depend partly on statistical inferences drawn from drilling and other data which may prove to be unreliable. Future production could differ dramatically from reserve or resource estimates for many reasons including the following:

• Mineralization or formations could be different from those predicted by drilling, sampling and similar examinations;

• Declines in the market price of metals may render the mining of some or all of Canadian Zinc’s Mineral Reserves or Mineral Resources uneconomic;

• Increases in operating mining costs and processing costs could adversely affect reserves or resources; and

• The grade of reserves or resources may vary significantly from time to time and there can be no assurance that any particular level of metal may be recovered from the reserves or resources.

Any of these factors may require Canadian Zinc to reduce its Mineral Reserve or Mineral Resources estimates.

Insurance and Uninsured Risks

The Company is not insured to cover all potential risks.

Canadian Zinc’s business is subject to a number of risks and hazards generally, including adverse environmental conditions, industrial accidents, labour disputes, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods and earthquakes. Such occurrences could result in damage to mineral properties or production facilities, personal injury or death, environmental damage to Canadian Zinc’s properties or the properties of others, delays in mining, monetary losses and possible legal liability.

Although Canadian Zinc maintains insurance to protect against certain risks in such amounts as it considers reasonable, its insurance will not cover all the potential risks associated with the Company’s mining operations. Canadian Zinc may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution or other hazards as a result of exploration and production is not generally available to Canadian Zinc or to other companies in the mining industry on acceptable terms. In particular, the Company is not insured for environmental liability or earthquake damage.

| 18 |

Canadian Zinc might also become subject to liability for pollution or other hazards which may not be insured against, or which Canadian Zinc may elect not to insure against, because of premium costs or other reasons. Losses from these events may cause Canadian Zinc to incur significant costs that could have a material adverse effect upon its financial performance and results of operations.

Title Matters

Title to the Company’s mineral properties may be challenged or defective. Aboriginal groups may raise title disputes in relation to land claims and any impairment or defect in title could have a negative impact on the Company.

Mining leases and surface leases issued to the Company by the Government have been surveyed but other parties may dispute the Company’s title to its mining properties. The mining claims in which the Company has an interest have not been surveyed and, accordingly, the precise location of the boundaries of the claims and ownership of mineral rights on specific tracts of land comprising the claims may be in doubt. These claims have not been converted to lease, and are, accordingly, subject to regular compliance with assessment work requirements. Failure to comply strictly with applicable laws, regulations and local practices relating to mineral right applications and tenure, could result in loss, reduction or expropriation of entitlements.

While the Company has investigated its title to all its mining leases, surface leases and mining claims and, to the best of its knowledge, title to all properties is in good standing, this should not be construed as a guarantee of title and title may be affected by undetected defects. The validity and ownership of mining property holdings can be uncertain and may be contested. There are currently a number of pending Aboriginal or Native title or Treaty or traditional land ownership claims relating to Northwest Territories. The Company’s properties at Prairie Creek are subject to Aboriginal or Native land claims. Title insurance generally is not available, and Canadian Zinc’s ability to ensure that it has obtained secure title to individual mineral properties or mining concessions may be severely constrained. Canadian Zinc’s mineral properties may be subject to prior unregistered liens, agreements, transfers or claims, including Native land claims, and title may be affected by, among other things, undetected defects. No assurances can be given that there are no title defects affecting such properties.

Executives and Conflicts of Interest

The Company is dependent on certain key executives and the loss of these executives may adversely affect our business and results of operations.

Canadian Zinc is dependent on the services of key executives, including its President and Chief Executive Officer, the Vice President of Exploration and Chief Operating Officer, and its Chief Financial Officer. Due to the relatively small size of the Company, the loss of these persons or Canadian Zinc’s inability to attract and retain additional highly skilled or experienced employees may adversely affect its business and future operations.

Certain of the directors and officers of the Company also serve as directors and/or officers of, or have significant shareholdings in, other companies involved in natural resource exploration and development and consequently there exists the possibility for such directors and officers to be in a position of conflict. Any decision made by any of such directors and officers involving Canadian Zinc will be made in accordance with their duties and obligations to deal fairly and in good faith with a view to the best interests of the Company and its shareholders. In addition, each of the directors is required to declare and refrain from voting on any matter in which such directors may have a conflict of interest in accordance with the procedures set forth in the Business Corporations Act (British Columbia) and other applicable laws.

To the extent that such other companies may participate in ventures in which Canadian Zinc may participate, the directors of Canadian Zinc may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation. In the event that such a conflict of interest arises at a meeting of the Company’s directors, a director who has such a conflict will abstain from voting for the approval of such participation or such terms.

| 19 |

From time to time several companies may collectively participate in the acquisition, exploration and development of natural resource properties thereby allowing for their participation in larger programs, permitting involvement in a greater number of programs and reducing financial exposure in respect of any one program. It may also occur that a particular company will assign all or a portion of its interest in a particular program to another of these companies due to the financial position of the company making the assignment. Under the laws of the Province of British Columbia, the directors of the Company are required to act honestly, in good faith and in the best interests of the Company. In determining whether or not Canadian Zinc will participate in a particular program and the interest therein to be acquired by it, the directors will primarily consider the degree of risk to which the Company may be exposed and its financial position at that time.

Acquisitions

From time to time Canadian Zinc undertakes evaluations of opportunities to acquire additional mining assets and businesses. Any resultant acquisitions may be significant in size, may change the scale of Canadian Zinc’s business, and may expose Canadian Zinc to new geographic, political, operating financial and geological risks. Canadian Zinc’s success in its acquisition activities depends on its ability to identify suitable acquisition candidates, to acquire them on acceptable terms, and integrate their operations successfully with those of Canadian Zinc. Any acquisition would be accompanied by risks, such as a significant decline in metal prices; the ore body proving to be below expectations; the difficulty of assimilating the operation and personnel; the potential disruption of Canadian Zinc’s ongoing business; the inability of management to maximize the financial and strategic position of Canadian Zinc through the successful integration of acquired assets and businesses; the maintenance of uniform standards, control, procedures and policies; the impairment of relationships with employees, customers and contractors as a result of any integration of new management personnel; and the potential unknown liabilities associated with acquired assets and business. In addition Canadian Zinc may need additional capital to finance an acquisition. Debt financing related to any acquisition will expose Canadian Zinc to the risk of leverage, while equity financing may cause existing shareholders to suffer dilution. There can be no assurance that Canadian Zinc would be successful in overcoming these risks or any other problems encountered in connection with such acquisitions.

Competition

The resource industry is very competitive.

The mining industry is competitive in all of its phases. There is aggressive competition within the mining industry for the discovery and acquisition of properties considered to have commercial potential. Canadian Zinc faces strong competition from other mining companies in connection with the acquisition of properties, mineral claims, leases and other mineral interests as well as for the recruitment and retention of qualified employees and other personnel. Many of these companies have greater financial resources, operational experience and technical capabilities than Canadian Zinc. As a result of this competition, Canadian Zinc may be unable to maintain or acquire attractive mining properties on terms it considers acceptable or at all. Consequently, Canadian Zinc’s operations and financial condition could be materially adversely affected.

Disclosure Controls and Procedures

The Company is subject to Canadian regulations regarding internal controls over financial reporting and and there are no assurances that the Company will be able to continue to comply with these heightened regulatory requirements.

Since 2007, the Company has documented and tested its internal control procedures in order to satisfy the requirements of Canadian National Instrument 52-109, which requires an annual assessment by management of the effectiveness of the Company’s internal control over financial reporting.

| 20 |