UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

|

|

|

x |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

o |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

DECKERS OUTDOOR CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

x |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

|

(1) |

Title of each class of securities to which transaction applies: |

||

|

|

|||

|

(2) |

Aggregate number of securities to which transaction applies: |

||

|

|

|||

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

||

|

|

|||

|

(4) |

Proposed maximum aggregate value of transaction: |

||

|

|

|||

|

(5) |

Total fee paid: |

||

|

|

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

|

(1) |

Amount Previously Paid: |

||

|

|

|||

|

(2) |

Form, Schedule or Registration Statement No.: |

||

|

|

|||

|

(3) |

Filing Party: |

||

|

|

|||

|

(4) |

Date Filed: |

||

|

|

|||

|

|

|

|

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION |

|

2017 |

|

|

|

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

|

|

ANNUAL MEETING OF STOCKHOLDERS |

|

|

|

|

|

DATE |

December 14, 2017 |

|

|

TIME |

[•] Pacific Time |

|

|

PLACE |

[•] |

|

|

RECORD DATE |

[•] |

|

|

VOTING |

Stockholders as of the close of business on [•] are entitled to vote at the Annual Meeting |

|

|

PROPOSALS TO BE VOTED ON |

|

PROPOSALS

MATTER

BOARD VOTE

RECOMMENDATION

PAGE

REFERENCE

1

Election of 10 directors

FOR EACH OF THE

BOARD’S NOMINEES

FOR DIRECTOR

[15]

2

Ratification of selection of KPMG LLP as independent registered public accounting firm for fiscal year 2018

FOR

[95]

3

Advisory vote to approve Named Executive Officer compensation

FOR

[97]

4

Advisory vote on the frequency of future advisory votes on Named Executive Officer compensation

ONE YEAR

[98]

5

If properly presented, stockholder proposal to repeal certain provisions or amendments to our bylaws

AGAINST

[99]

|

|

HOW TO VOTE |

|

Your vote is important to the future of Deckers Outdoor Corporation. You are eligible to vote if you were a stockholder at the close of business on [•]. Please refer to the section of this Proxy Statement titled "Questions and Answers about the 2017 Annual Meeting of Stockholders and Voting" for additional information on how to vote your shares.

It is important that your shares be represented and voted at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, please vote as soon as possible. Please sign, date and return the enclosed WHITE proxy card in the postage-paid envelope provided, or use the telephone or Internet voting instructions on the enclosed WHITE proxy card, even if you plan to

attend the Annual Meeting. If you hold your shares in an account at a bank, broker, dealer or other nominee, follow the instructions provided by your nominee to vote your shares. Voting your shares by proxy ensures that if you are unable to attend the Annual Meeting, your shares will be voted at the Annual Meeting. Voting now will not limit your right to change your vote or to attend the Annual Meeting.

If you have questions about the election of directors, this Proxy Statement or the Annual Meeting, if you would like additional copies of this Proxy Statement, or if you need assistance voting your shares, please contact:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

Stockholders call toll-free: (877) 750-0625

Banks and brokers call collect: (212) 750-5833

|

PROPOSAL NO. 1 |

|

The following table provides summary information about each director nominee.

Name,

Age

Director

Independent

Other

Previous

Deckers

Committees

A

C

CG

John M. Gibbons

68

2000

YES

—

3

Karyn O. Barsa

56

2008

YES

—

1

Nelson C. Chan

56

2014

YES

3

3

Michael F. Devine, III

59

2011

YES

2

2

+

Angel R. Martinez

62

2005

NO

2

—

John G. Perenchio

62

2005

YES

—

1

David Powers

51

2016

NO

—

—

James Quinn

65

2011

YES

—

3

+

Lauri M. Shanahan

55

2011

YES

2

—

+

Bonita C. Stewart

60

2014

YES

—

—

Primary Occupation

Since

Current

Public

Company

Boards

Public

Company

Boards

Chairman of our

Board of Directors

Director

•

•

Director

•

Director

•

Director

Director

•

•

Chief Executive Officer

and President at

Deckers Brands

Director

Director

Vice-President,

Global Partnerships

at Google Inc.

•

+ |

Committee Chair |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

A: |

Audit |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

C: |

Compensation |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

CG: |

Corporate Governance |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR ALL OF OUR DIRECTOR NOMINEES. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Marcato Capital Management LP (together with its affiliates, Marcato) has notified us of its intention to propose 10 director nominees for election at the Annual Meeting in opposition to the nominees recommended by our Board of Directors. In addition, Marcato has notified us of its intention to present a stockholder proposal at the Annual Meeting. As a result, you may receive solicitation materials, including a [color] proxy card, from Marcato seeking your proxy. Our Board does NOT endorse any Marcato nominee. WE URGE YOU TO NOT RETURN ANY [COLOR] PROXY CARD SENT TO YOU BY MARCATO, EVEN AS A PROTEST VOTE. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

PROPOSAL NO. 2 |

|

• |

As a matter of good corporate governance, we are asking our stockholders to ratify the selection of KPMG LLP as our independent registered public accounting firm for fiscal year 2018. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR PROPOSAL NO. 2. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

PROPOSAL NO. 3 |

|

• |

We are asking our stockholders to approve, on a non-binding advisory basis, the compensation of our Named Executive Officers, which we sometimes refer to as NEOs, as disclosed in the section of this Proxy Statement titled "Compensation Discussion and Analysis". |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

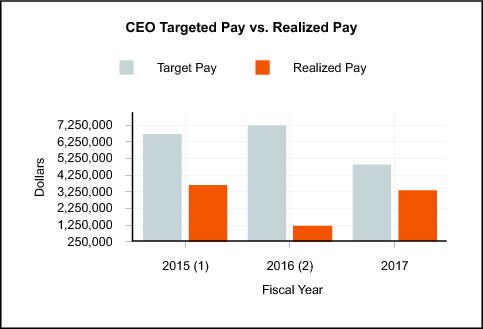

Below is an overview of certain elements of our fiscal year 2017 and fiscal year 2018 compensation program and how they are aligned to our strategic and business objectives. We believe that this structure closely aligns executive and stockholder incentives. It also incorporates perspectives from our stockholders, as detailed below under title “Stockholder Engagement.” |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR PROPOSAL NO. 3 because it believes that our compensation policies and practices reflect our pay-for-performance philosophy and are effective in achieving our goals of attracting and retaining key executives with the proper background and experience required to lead the organization forward, providing meaningful incentives for achieving short-term and long-term Company financial goals, and aligning the interests of our executives with those of our stockholders. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

ALIGNMENT OF COMPENSATION PROGRAM WITH STRATEGIC AND BUSINESS OBJECTIVES |

|

As previously publicly announced, we are driving toward an improvement in profitability in our long-range plan and expect that our executives will drive to a 13% operating margin by fiscal year 2020.

We have effectively and consistently tied our compensation program to our strategic and business objectives, and have evolved our program over time to emphasize profitability which reflects our long-range business and strategic plan, as well as input from our stockholders.

Alignment of Compensation Program with Strategic and Business Objective

Compensation Element

FY 2017

FY 2018

Annual Cash Incentive Awards

Utilized a mix of both revenue and operating income metrics to drive growth while still requiring

profitability discipline.

• Focus on core profitability metrics for all executives, with

revenue metrics tailored to specific business units for certain executives.

Due to our strong pay-for-performance design, no cash incentive payments were made to our

executives.

Maintain our strong pay-for-performance track record through meaningful performance gates and

targets derived from our long-range business and strategic plan.

Equity Awards

Changed from performance-based RSUs to performance stock options for LTIP awards to directly

align the interests of our executives with our stockholders under volatile market conditions.

Continue to use performance stock options and Pre-Tax Income performance metric for LTIP

awards.

Changed performance conditions for LTIP awards from consolidated EBITDA and Revenue to

Pre-Tax Income to focus our executives on driving profitability.

By tying LTIP equity awards to Pre-Tax Income, we reward achievement of our profitability

goals.

•

•

•

•

•

•

•

|

PROPOSAL NO. 4 |

|

• |

We are asking our stockholders to vote, on a non-binding advisory basis, on whether future advisory votes on the compensation of our Named Executive Officers should occur every “one year”, “two years”, or “three years.” |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE TO CONDUCT FUTURE ADVISORY VOTES ON NAMED EXECUTIVE OFFICER COMPENSATION EVERY “ONE YEAR.” |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

PROPOSAL NO. 5 |

|

• |

We received notice from Marcato of its intention to present a resolution for action at the Annual Meeting. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Adoption of this proposal would have the effect of repealing any provisions or amendments of our bylaws adopted without stockholder approval after May 24, 2016, and up to the Annual Meeting, without regard to the subject matter of any bylaw provisions or amendments in question. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

No provisions or amendments to our bylaws have been adopted after May 24, 2016. Although our Board does not currently expect to adopt any amendments to our bylaws prior to the Annual Meeting, our Board could determine prior to the Annual Meeting that an amendment is necessary and in the best interests of our Company or our stockholders. Our Board believes that the automatic repeal of any bylaw amendment, irrespective of its content, duly adopted by our Board (whether with or without stockholder approval) could have the effect of repealing one or more properly adopted bylaw amendments that our Board determined to be in the best interests of our Company and our stockholders and adopted in furtherance of its fiduciary duties, including in response to future events not yet known to us. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Our Board believes that this proposal represents no purpose other than to limit the actions of our Board that are otherwise permitted by our governing documents and Delaware law. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

OUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE AGAINST PROPOSAL NO. 5. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

STOCKHOLDER ENGAGEMENT |

|

• |

We remain committed to enhancing and expanding our stockholder outreach efforts, including by proactively soliciting and incorporating stockholder feedback on the design and effectiveness of our executive compensation program. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

For example, as more fully described below under the title “Compensation Discussion and Analysis,” in early 2017 we contacted investors holding over 60% of our common stock to discuss their views and any concerns regarding our compensation philosophy and program. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

During these conversations, we reviewed our business strategies and performance, discussed our executive compensation program design, reviewed our corporate governance initiatives, previewed potential changes to our executive compensation program, and provided responses to specific concerns raised by proxy advisory groups. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

In response to feedback from our stockholders and proxy advisory groups during these outreach efforts, we have made a number of significant changes to our executive compensation program during fiscal year 2017, and have continued to evolve our compensation program for fiscal year 2018. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

|

|

|

|

|

|

|

TO OUR STOCKHOLDERS:

We are pleased to invite you to attend the 2017 Annual Meeting of Stockholders of Deckers Outdoor Corporation, to be held on December 14, 2017, beginning at [•] Pacific Time. The meeting will be held at [•]. We refer to the 2017 Annual Meeting of Stockholders, together with any postponements, adjournments or other delays thereof, as the Annual Meeting.

Proposals to be Voted Upon:

1 |

Election of Directors. To elect 10 directors to serve until the Annual Meeting of Stockholders to be held in 2018, or until their successors are duly elected and qualified. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2 |

Ratification of Appointment of Independent Registered Public Accounting Firm. To ratify the selection of KPMG LLP as our independent registered public accounting firm for fiscal year 2018, which covers the period from April 1, 2017, to March 31, 2018. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

3 |

Advisory Vote to Approve Named Executive Officer Compensation. To approve, on a non-binding advisory basis, the compensation of our Named Executive Officers, as disclosed in the section of this Proxy Statement titled "Compensation Discussion and Analysis." |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

4 |

Frequency of Future Advisory Votes on Named Executive Officer Compensation. To vote, on a non-binding advisory basis, on the frequency of future advisory votes on the compensation of our Named Executive Officers. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

5 |

Stockholder Proposal. To consider a stockholder proposal, if properly presented at the Annual Meeting, to repeal certain provisions or amendments to our bylaws adopted after May 24, 2016, and prior to the Annual Meeting. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Board Recommendations:

Our Board of Directors recommends that you vote:

• |

“FOR” ALL director nominees named in Proposal No. 1; |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

“FOR” Proposal No. 2; |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

“FOR” Proposal No. 3; |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

For every “ONE YEAR” with respect to Proposal No. 4; and |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

“AGAINST” Proposal No. 5. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Voting at the Annual Meeting:

Our Board of Directors has fixed the close of business on [•] as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting. Only stockholders as of the close of business on the record date are entitled to notice of, and to vote at, the Annual Meeting.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ David Powers

David Powers

Chief Executive Officer and President

Your vote is very important.

It is important that your shares be represented and voted at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, please vote as soon as possible. Please sign, date and return the enclosed WHITE proxy card in the postage-paid envelope provided, or use the telephone or Internet voting instructions on the enclosed WHITE proxy card, even if you plan to attend the Annual Meeting. If you hold your shares in an account at a bank, broker, dealer or other nominee, follow the instructions provided by your nominee to vote your shares. Voting your shares by proxy ensures that if you are unable to attend the Annual Meeting, your shares will be voted at the Annual Meeting. Voting now will not limit your right to change your vote or to attend the Annual Meeting.

If you have additional questions about the election of directors, this Proxy Statement or the Annual Meeting, if you would like additional copies of this Proxy Statement, or if you need assistance voting your shares, please contact:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

Stockholders call toll-free: (877) 750-0625

Banks and brokers call collect: (212) 750-5833

Approximate Date of Mailing of this Proxy Statement: [•]

|

|

|

|||||

|

TABLE OF CONTENTS |

|

|

|||||

|

|||||||

|

|

1 |

|||||

|

Questions and Answers about the 2017 Annual Meeting of Stockholders and Voting |

|

|

2 |

||||

|

|

11 |

|||||

|

|

14 |

|||||

|

|

15 |

|||||

|

|

18 |

|||||

|

|

31 |

|||||

|

|

38 |

|||||

|

|

41 |

|||||

|

|

42 |

|||||

|

|

48 |

|||||

|

|

56 |

|||||

|

|

59 |

|||||

|

|

70 |

|||||

|

|

73 |

|||||

|

|

74 |

|||||

|

|

76 |

|||||

|

|

78 |

|||||

|

|

79 |

|||||

|

|

80 |

|||||

|

|

81 |

|||||

|

|

86 |

|||||

|

|

88 |

|||||

|

Security Ownership of Certain Beneficial Owners and Management |

|

|

89 |

||||

|

|

91 |

|||||

|

|

92 |

|||||

|

|

94 |

|||||

|

|

95 |

|||||

|

Proposal No. 3—Advisory Vote to Approve Named Executive Officer Compensation |

|

|

97 |

||||

|

Proposal No. 4—Frequency of Future Advisory Vote on Named Executive Officer Compensation |

|

|

98 |

||||

|

Proposal No. 5—Stockholder Proposal to Repeal Certain Provisions or Amendments to Our Bylaws |

|

|

99 |

||||

|

|

100 |

|||||

|

|

101 |

|||||

|

Annex A—Information Concerning Participants In the Solicitation of Proxies |

|

|

A-1 |

||||

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

ANNUAL MEETING OF STOCKHOLDERS

Meeting Date: December 14, 2017

|

|

|

|

|

|

|

The enclosed Proxy Statement is solicited on behalf of the Board of Directors of Deckers Outdoor Corporation, which we sometimes refer to as our Company, we, us, or our, for use at our Annual Meeting of Stockholders or any postponements, adjournments, or other delays thereof, or the Annual Meeting, to be held on December 14, 2017, at [•] Pacific Time. The meeting will be held at [•]. The Annual Meeting is being held for the purposes described in this Proxy Statement.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting to be Held on December 14, 2017.

This Proxy Statement and the Annual Report are available at www.deckers.com/investors.

1

|

|

|

|

QUESTIONS AND ANSWERS ABOUT THE 2017 ANNUAL MEETING OF STOCKHOLDERS AND VOTING |

|

|

|

The following questions and answers are intended to briefly address potential questions that our stockholders may have regarding this Proxy Statement and the Annual Meeting. They are also intended to provide our stockholders with certain information that is required to be provided under the rules and regulations of the Securities and Exchange Commission, or SEC. These questions and answers may not address all of the questions that are important to you as a stockholder. If you have additional questions about the election of directors, the Proxy Statement or the Annual Meeting, please see the question titled "Whom should I contact with other questions?" below.

Q: When and where will the Annual Meeting be held?

A: You are invited to attend the Annual Meeting on December 14, 2017, beginning at [•] Pacific Time. The Annual Meeting will be held at [•].

Q: What is our fiscal year end?

A: Our fiscal year end is March 31.

Q: On what securities exchange are our shares traded?

A: Our shares are traded on the New York Stock Exchange, or NYSE.

Q: Why did I receive these proxy materials?

A: We are providing this Proxy Statement in connection with the solicitation by our Board of Directors of proxies to be voted at the Annual Meeting. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. You are invited to attend the Annual Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may vote your shares using one of the other voting methods described below. Whether or not you expect to attend the Annual Meeting, please vote your shares as soon as possible in order to ensure your representation at the Annual Meeting.

Your vote is very important.

Please sign, date and return the enclosed WHITE proxy card in the postage-paid envelope provided, or use the telephone or Internet voting instructions on the enclosed WHITE proxy card. If you hold your shares in an account at a bank, broker, dealer or other nominee, follow the instructions provided by your nominee to vote your shares. Voting your shares by proxy ensures that if you are unable to attend the Annual Meeting, your shares will be voted at the Annual Meeting. Voting now will not limit your right to change your vote or to attend the Annual Meeting.

Q: What proposals am I being asked to vote upon at the Annual Meeting?

A: At the Annual Meeting, you will be asked to:

• |

Elect 10 director nominees to serve until the Annual Meeting of Stockholders to be held in 2018, or until their successors are duly elected and qualified (Proposal No. 1); |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Ratify the selection of KPMG LLP as our independent registered public accounting firm for fiscal year 2018 (Proposal No. 2); |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Approve, on a non-binding advisory basis, the compensation of our Named Executive Officers, as disclosed in the section of this Proxy Statement titled "Compensation Discussion and Analysis" (Proposal No. 3); |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

To vote, on a non-binding advisory basis, on the frequency of future advisory votes on executive compensation (Proposal No. 4); and |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

2

• |

To consider a stockholder proposal, if properly presented at the Annual Meeting, to repeal certain provisions or amendments to our bylaws adopted after May 24, 2016 (Proposal No. 5). |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Q: How does our Board of Directors recommend voting on the proposals?

A: Our Board of Directors unanimously recommends that you vote:

• |

“FOR” ALL of the 10 director nominees named in this Proxy Statement (Proposal No. 1); |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

“FOR” the ratification of the selection of KPMG LLP as our independent registered public accounting firm for fiscal year 2018 (Proposal No. 2); |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

“FOR” the approval, on a non-binding advisory basis, of the compensation of our Named Executive Officers (Proposal No. 3); |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

For every “ONE YEAR” with respect to the proposal to approve, on a non-binding advisory basis, the frequency of future advisory votes on the compensation of our Named Executive Officers (Proposal No. 4); and |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

“AGAINST” the stockholder proposal, if properly presented at the Annual Meeting, to repeal certain provisions or amendments to our bylaws adopted after May 24, 2016, and prior to the Annual Meeting (Proposal No. 5). |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Q: Will I receive proxy materials from anyone else?

A: Marcato Capital Management LP (together with its affiliates, Marcato) has provided notice to us of its intention to propose 10 director nominees for election at the Annual Meeting in opposition to the nominees recommended by our Board. In addition, Marcato has notified us of its intention to present a stockholder proposal at the Annual Meeting. As a result, you may receive solicitation materials, including a [color] proxy card, from Marcato seeking your proxy.

We are not responsible for the accuracy of any information provided by or relating to Marcato contained in any proxy solicitation materials filed or disseminated by, or on behalf of, Marcato or any other statements that Marcato may otherwise make.

Q: What should I do if I receive proxy materials from Marcato?

A: Our Board does NOT endorse any Marcato nominee or stockholder proposal and urges you to vote using the WHITE proxy card. Our Board urges you NOT to vote any [color] proxy card sent to you by Marcato.

Voting to “withhold” with respect to any of Marcato’s nominees on its [color] proxy card is not the same as voting for our Board’s nominees. This is because a vote to “withhold” with respect to any of Marcato’s nominees on its [color] proxy card will revoke any previous proxy submitted by you. DO NOT RETURN ANY [COLOR] PROXY CARD SENT TO YOU BY MARCATO, EVEN AS A PROTEST VOTE.

If you have already voted using a [color] proxy card sent to you by Marcato, you have every right to change your vote. We urge you to revoke that proxy by voting in favor of our Board’s nominees by using the enclosed WHITE proxy card. Only the latest-dated and validly executed proxy that you submit will count. If you hold your shares in an account at a bank, broker, dealer or other nominee, follow the instructions provided by your nominee to change your vote.

Q: What are the voting requirements to approve the proposals?

A: The voting requirements to approve each of the proposals to be voted upon at the Annual Meeting are as follows:

• |

Election of Directors (Proposal No. 1)—Our Board of Directors has adopted a majority voting standard for uncontested director elections. This means that each director nominee in an uncontested election will be elected by a majority of the votes cast by the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors (assuming that a quorum is present). An “uncontested election” is an election in which the number of nominees for director is not greater than the number of directors to be elected. A |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

3

|

“contested election” is an election in which the number of nominees for director nominated by (i) our Board of Directors, (ii) any stockholder, or (iii) a combination of our Board of Directors and any stockholder, exceeds the number of directors to be elected. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Because of the nomination by Marcato of candidates for election to our Board, in September 2017, our Board determined that the Annual Meeting will be a contested election. Accordingly, directors will be elected by a plurality of the votes cast by the shares present or represented by proxy at the Annual Meeting and entitled to vote on the election of directors. The 10 candidates receiving the most votes at the Annual Meeting will be elected as directors. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Under the rules applicable to brokers, brokers no longer possess discretionary authority to vote shares with respect to the election of directors. Accordingly, “broker non-votes” may result for this proposal if brokers do not receive instructions from beneficial owners of our shares. Broker non-votes are not votes cast and may result in the applicable nominees receiving fewer “FOR” votes for purposes of determining the nominee receiving the highest number of “FOR” votes. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Voting to “withhold” with respect to any of Marcato’s nominees on its [color] proxy card is not the same as voting for our Board’s nominees. This is because a vote to “withhold” with respect to any of Marcato’s nominees on its [color] proxy card will revoke any previous proxy submitted by you. DO NOT RETURN ANY [COLOR] PROXY CARD SENT TO YOU BY MARCATO, EVEN AS A PROTEST VOTE. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Ratification of Selection of Accounting Firm (Proposal No. 2)—Ratification of the selection of KPMG LLP as our independent registered public accounting firm for fiscal year 2018 will require the affirmative vote of a majority in voting power of the stockholders present in person or by proxy at the Annual Meeting and entitled to vote on the matter (assuming that a quorum is present). |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Abstentions will have the same effect as votes against this proposal. “Broker non-votes,” if any, will have no effect on this proposal. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Advisory Vote on Executive Compensation (Proposal No. 3)—Approval, on a non-binding advisory basis, of the compensation of our Named Executive Officers will require the affirmative vote of a majority in voting power of the stockholders present in person or by proxy at the Annual Meeting and entitled to vote on the matter (assuming that a quorum is present). |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Abstentions will have the same effect as votes against this proposal. “Broker non-votes,” if any, will have no effect on this proposal. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Advisory Vote on Frequency of Future Advisory Votes on Executive Compensation (Proposal No. 4)—The proposal to approve, on a non-binding advisory basis, the frequency of future advisory votes on the compensation of our Named Executive Officers will allow our stockholders to vote for every “one year,” “two years” or “three years,” or they may abstain from voting. The option of every one year, two years or three years that receives the greatest number of votes will be considered the frequency selected by our stockholders. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Abstentions and “broker non-votes,” if any, will have no effect on this proposal. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Stockholder Proposal to Repeal Certain Provisions or Amendments To Our Bylaws Adopted After May 24, 2016 (Proposal No. 5)—Approval of the proposal to repeal certain provisions or amendments to our bylaws adopted after May 24, 2016, will require the affirmative vote of the holders of not less than 662/3% of the voting power outstanding as of the Record Date. Abstentions and “broker non-votes,” if any, will have the same effect as votes against this proposal. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Q: What are “broker non-votes”?

A: “Broker non-votes” result from shares that are held by a bank, broker, dealer or other nominee that are represented at the Annual Meeting but with respect to which the nominee holding those shares (i) has not received instructions from the beneficial owner of the shares to vote on the particular proposal and (ii) does not have discretionary voting power with respect to the particular proposal. Please see the question titled “Who can vote at the Annual Meeting?” below for a

4

discussion of beneficial ownership. Whether a nominee has authority to vote shares that it holds is determined by stock exchange rules. Nominees holding shares of record for beneficial owners generally are entitled to exercise their discretion to vote on Proposal No. 2, but do not have the discretion to vote on Proposal Nos. 1, 3, 4 or 5, unless they receive voting instructions from the beneficial owners of the shares. However, if a nominee mails Marcato’s proxy materials to the accounts of the underlying beneficial owners, then such nominee will not be able to exercise its discretion to vote with respect to such accounts on any of the proposals at the Annual Meeting.

Q: Who can vote at the Annual Meeting?

A: Only our stockholders at the close of business on [•], 2017, the Record Date, will be entitled to vote at the Annual Meeting. On the Record Date, there were [•] shares of our common stock outstanding and entitled to vote. Each share of common stock issued and outstanding on the Record Date is entitled to one vote on any matter presented for consideration by our stockholders at the Annual Meeting.

• |

Holders of Record—If, on the Record Date, your shares were registered directly in your name with our transfer agent, Computershare, then you are a “holder of record.” As a holder of record, you may vote in person by ballot at the Annual Meeting, or you may vote by proxy. Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares using one of the voting methods described in this Proxy Statement. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Beneficial Owners—If, on the Record Date, your shares were held in an account at a bank, broker, dealer or other nominee, then you are the “beneficial owner” of shares held in “street name” and this Proxy Statement is being made available to you by that nominee. The nominee holding your account is considered the holder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your nominee on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the holder of record, you may not vote your shares at the Annual Meeting by ballot unless you request and obtain a valid “legal proxy” from your nominee and present it at the Annual Meeting. Please contact your nominee directly for additional information. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Q: What is the quorum requirement for the Annual Meeting?

A: The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the voting power of all the shares of our common stock outstanding as of the Record Date will constitute a quorum at the Annual Meeting. We will treat shares of common stock represented by a properly voted proxy, including abstentions and broker non-votes, as present at the Annual Meeting for the purposes of determining the existence of a quorum.

Q: How can I vote my shares?

A: • Holders of Record—Holders of record can vote by proxy or by attending the Annual Meeting and voting by ballot. If you wish to vote by proxy, you can vote by Internet, telephone or by mail as described below. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure that your vote is counted. You may still attend the Annual Meeting and vote by ballot if you have already voted by proxy. If you sign and return a WHITE proxy card but do not give voting instructions, the shares represented by that proxy will be voted as recommended by the Board of Directors.

5

|

|

|

|

|

|

|

VOTE BY INTERNET |

VOTE BY TELEPHONE |

VOTE BY MAIL |

VOTE AT THE |

|||

You can vote by proxy over the Internet by following the instructions provided on the WHITE proxy card. |

You can vote by proxy by telephone by following the instructions provided on the WHITE proxy card. |

You can vote by proxy by mail by following the instructions provided on the WHITE proxy card. If you choose to vote by mail, simply sign and date your WHITE proxy card and return it promptly in the postage-paid envelope provided. |

The method you use to vote by proxy will not limit your right to vote at the Annual Meeting by ballot if you decide to attend in person. |

• Beneficial Owner—If you are the beneficial owner of your shares, your bank, broker, dealer or other nominee has forwarded these proxy materials to you, including a WHITE voting instruction form. Simply follow the instructions on the enclosed WHITE voting instruction form to vote your shares. The WHITE voting instruction form will include instructions for voting by Internet or telephone if these methods of voting are available to you. Otherwise, you may sign, date and return the WHITE voting instruction form in the postage-paid envelope provided. To vote in person by ballot at the Annual Meeting, you must obtain a valid “legal proxy” from your broker, bank, trustee or nominee. Follow the instructions from your broker, bank, trustee or nominee to request a “legal proxy.”

Q: What should I know about attending the Annual Meeting?

A: You are entitled to attend the Annual Meeting only if you were a stockholder as of the Record Date, a proxy holder for such a stockholder, or an invited guest of our Company. Since seating is limited, admission to the Annual Meeting will be on a first-come, first-served basis. You should be prepared to present government-issued photo identification for admittance, such as a passport or driver’s license. If you are the beneficial owner of your shares, you also will need proof of ownership as of the Record Date to be admitted to the Annual Meeting, such as your most recent account statement prior to the Record Date, a copy of the voting instruction card provided by your bank, broker, dealer or other nominee, or similar evidence of ownership. For security reasons, you and your bags may be subject to search prior to your admittance to the Annual Meeting. If you do not comply with each of the foregoing requirements, you will not be admitted to the Annual Meeting.

Q: What can I do if I change my mind after I vote my shares?

A: You may change your vote at any time before the polls are closed at the Annual Meeting. If you are a holder of record, you may change your vote by (i) providing written notice of revocation to Deckers Outdoor Corporation, 250 Coromar Drive, Goleta, California 93117, Attention: Corporate Secretary, (ii) executing a subsequent proxy using any of the voting methods discussed above, or (iii) attending the Annual Meeting and voting by ballot. However, simply attending the Annual Meeting will not, by itself, revoke your proxy. If you are a beneficial owner of your shares and you have instructed your bank, broker, dealer or other nominee to vote your shares, you may change your vote by following directions received from your nominee to change those instructions. Subject to any revocation, all shares represented by properly executed proxies will be voted in accordance with the instructions on the applicable proxy, or, if no instructions are given, in accordance with the recommendation of our Board of Directors.

If you have already voted using a [color] proxy card sent to you by Marcato, you have every right to change your vote. We urge you to revoke that proxy by voting in favor of our Board’s nominees by using the enclosed WHITE proxy card. Only the latest-dated validly executed proxy that you submit will count. If you hold your shares in an account at a bank, broker, dealer or other nominee, follow the instructions provided by your nominee to change your vote.

6

Q: Could other matters be decided at the Annual Meeting?

A: As of the date of this Proxy Statement, we did not know of any matters to be raised at the Annual Meeting other than those referred to in this Proxy Statement. However, if any other matters are presented for consideration at the Annual Meeting, the persons named as proxyholders will have discretion to vote on these matters according to their best judgment.

Q: Who is paying for the cost of this proxy solicitation?

A: The solicitation of proxies is made on behalf of our Company and all the expenses of soliciting proxies from stockholders will be borne by our Company. In addition to the solicitation of proxies by use of the mail, directors, officers and regular employees of our Company may communicate with stockholders personally or by email, telephone, or otherwise for the purpose of soliciting such proxies. No additional compensation will be paid to any such persons for such solicitation, although we may reimburse them for reasonable out-of-pocket expenses incurred in connection with such solicitation. We will reimburse banks, brokers, dealers and other nominees for their reasonable out-of-pocket expenses in forwarding solicitation material to beneficial owners of shares held of record by such persons.

As a result of the proxy contest initiated by Marcato, we may incur substantial additional costs in connection with the solicitation of proxies. We have retained Innisfree M&A Incorporated, or Innisfree, to assist us in the solicitation of proxies for a fee of up to $[•] plus out-of-pocket expenses. Innisfree expects that approximately 50 of its employees will assist in the solicitation. Our expenses related to the solicitation of proxies from stockholders this year may substantially exceed those normally spent for an annual meeting of stockholders. Such additional costs are expected to aggregate to approximately $[•], exclusive of any costs related to any litigation in connection with the Annual Meeting. These additional solicitation costs are expected to include: the fee payable to our proxy solicitor; fees of outside counsel to advise our Company in connection with a contested solicitation of proxies; increased mailing costs, such as the costs of additional mailings of solicitation material to stockholders, including printing costs, mailing costs and the reimbursement of reasonable expenses of banks, brokerage houses and other agents incurred in forwarding solicitation materials to beneficial owners of common stock; and the costs of retaining an independent inspector of election. To date, we have incurred approximately $[•] of these solicitation costs.

Q: What is the deadline to submit stockholder proposals for the 2018 Annual Meeting?

A: Notice of any director nomination or other proposal that you intend to present for inclusion in the proxy materials to be distributed in connection with our 2018 Annual Meeting of Stockholders, or 2018 Annual Meeting, must be delivered to our corporate headquarters located at 250 Coromar Drive, Goleta, California 93117 no later than 90 days in advance of the 2018 Annual Meeting. In addition, your notice must satisfy the conditions for such proposals set forth in our bylaws, which contain requirements with respect to advance notice of director nominations and other stockholder proposals.

You may also submit a proposal for inclusion in our proxy materials for our 2018 Annual Meeting in accordance with Rule 14a-8 under the Exchange Act of 1934, as amended, or the Exchange Act. Such a proposal must be received by our Corporate Secretary (and be delivered to our corporate headquarters located at 250 Coromar Drive, Goleta, California 93117) no later than [•], 2018. To be eligible to submit such a proposal for inclusion in our proxy materials for an annual meeting of stockholders pursuant to Rule 14a-8, a stockholder must be a holder of either: (1) at least $2,000 in market value or (2) 1% of our common stock entitled to be voted on the proposal, and must have held such shares for at least one year, and continue to hold those shares through the date of such annual meeting. Such proposal must also meet the other requirements of the rules of the SEC relating to stockholders proposals, including Rule 14a-8, including the permissible number and length of proposals, the circumstances in which our Company is permitted to exclude proposals and other matters governed by such rules and regulations.

7

Q: How can stockholders nominate a candidate for election as a director?

A: Our bylaws provide that a stockholder seeking to nominate a candidate for election as a director at an annual meeting of stockholders must provide timely advance written notice to our Company. To be timely, a stockholder’s notice generally must be received at our corporate headquarters no later than 90 days prior to the scheduled date of the annual meeting.

Under our bylaws, a stockholder’s notice of a proposed nomination for director to be made at an annual meeting of stockholders must include the following information:

• |

The name and address of the stockholder and any Stockholder Affiliate (as defined in our bylaws) proposing to make the nomination and of the person or persons to be nominated; |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

The class and number of shares of our Company’s common stock that are, directly or indirectly, beneficially owned by the stockholder or any Stockholder Affiliate and any derivative positions held or beneficially held by the stockholder or any Stockholder Affiliate and whether and the extent to which any hedging or other transaction or series of transactions has been entered into by or on behalf of, or any other agreement, arrangement or understanding (including, but not limited to, any derivative position, short position, or any borrowing or lending of shares) has been made, the effect or intent of which is to mitigate loss to or manage risk or benefit of share price changes for, or to increase or decrease the voting power of, such stockholder or any Stockholder Affiliate; |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

A representation that the holder is a stockholder entitled to vote his or her shares at the annual meeting and intends to vote his or her shares in person or by proxy for the person nominated in the notice; |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

A description of all arrangements or understandings between the stockholder(s) or Stockholder Affiliate supporting the nomination and each nominee; |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Any other information concerning the proposed nominee(s) that our Company would be required to include in the Proxy Statement if our Board of Directors made the nomination; |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

The consent and commitment of the nominee(s) to serve as a director; |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

For each nominee, a completed and signed questionnaire, in a form provided by our Company upon written request, with respect to the background and qualification of such person being nominated and the background of any other person or entity on whose behalf the nomination is being made; |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

For each nominee, a written representation and agreement, in the form provided by our Company upon written request, with regards to any voting commitments, compensatory arrangements with a third party and compliance requirements applicable to directors of our Company; |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

A description of all agreements, arrangements and understandings between the stockholder and Stockholder Affiliate and any other person, including their names, in connection with the nominee; and |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Whether the stockholder or any Stockholder Affiliate intends to conduct a proxy solicitation. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The presiding officer of the annual meeting may refuse to acknowledge the nomination of any person not made in compliance with the foregoing procedure.

Q: How can stockholders propose other actions for consideration?

A: Our bylaws provide that a stockholder seeking to propose actions at an annual meeting of stockholders (other than nomination of directors) must provide timely advance written notice to our Company. To be timely, a stockholder’s notice generally must be received at our corporate headquarters no later than 90 days prior to the scheduled date of the annual meeting.

Under our bylaws, a stockholder’s notice of proposed action to be made at an annual meeting of stockholders must include the following information:

• |

A brief description of the business desired to be brought before the annual meeting and the reasons for conducting such business at the meeting; |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

The name and address of the stockholder and any Stockholder Affiliate proposing such business; |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

8

• |

The class and number of shares of our Company that are, directly or indirectly, beneficially owned by the stockholder and any Stockholder Affiliate; |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Any derivative positions held or beneficially held by the stockholder and any Stockholder Affiliate, and whether and the extent to which any hedging or other transaction or series of transactions has been entered into by or on behalf of, or any other agreement, arrangement or understanding (including, but not limited to, any derivative position, short position, or any borrowing or lending of shares) has been made, the effect or intent of which is to mitigate loss to or manage risk or benefit of share price changes for, or to increase or decrease the voting power of, such stockholder or any Stockholder Affiliate with respect to our securities; |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

A description of all agreements, arrangements and understandings between such stockholder or any Stockholder Affiliate and any other person or persons (including their names) in connection with the proposal of such business by such stockholder; |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Any material interest of the stockholder or any Stockholder Affiliate in such business; and |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Whether the stockholder or any Stockholder Affiliate intends to conduct a proxy solicitation. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Any stockholder providing such notice shall promptly provide any other information that our Company may reasonably request. The presiding officer of the annual meeting may refuse to acknowledge any business not brought before the meeting in compliance with the foregoing procedure.

You may also submit a proposal for inclusion in our proxy materials for our 2018 Annual Meeting in accordance with Rule 14a-8. Please refer to the question titled “What is the deadline to submit stockholder proposals for the 2018 Annual Meeting?” above for additional information.

Q: I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

A: We have adopted a procedure called “householding,” which the SEC has approved. Under this procedure, we may deliver a single copy of this Proxy Statement and the Annual Report to multiple stockholders who share the same address unless we have received contrary instructions from one or more of the stockholders. This procedure reduces our printing costs, mailing costs and fees. Stockholders who participate in householding will continue to be able to access and receive separate proxy materials. Upon written or oral request, we will promptly deliver a separate copy of this Proxy Statement and the Annual Report to any stockholder at a shared address to which we delivered a single copy of any of these documents. To receive a separate copy of this Proxy Statement or the Annual Report, or if you wish to receive separate copies in the future, please contact: Deckers Outdoor Corporation, 250 Coromar Drive, Goleta, California 93117, Attention: Corporate Secretary, Telephone: (805) 967-7611.

In addition, if you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future proxy materials for your household, please contact us using the contact information set forth above. Stockholders who hold shares in “street name” may contact their bank, broker, dealer or other nominee to request information about householding.

Q: Where can I find voting results of the Annual Meeting?

A: In accordance with SEC rules, final voting results will be published in a Current Report on Form 8-K within four business days following the Annual Meeting, unless final results are not known at that time, in which case preliminary voting results will be published within four business days of the Annual Meeting and final voting results will be published once they are known by our Company.

Q: Where else can I find proxy materials?

A: This Proxy Statement and the Annual Report are available at www.deckers.com/investors. Other information contained on or accessed through our website does not constitute part of this Proxy Statement. You should not consider other information contained on or accessed through our website in deciding how to vote your shares. References to our website address in this Proxy Statement are inactive textual references only.

9

Q: Whom should I contact with other questions?

A: If you have additional questions about the election of directors, this Proxy Statement or the Annual Meeting, if you would like additional copies of this Proxy Statement, or if you need assistance voting your shares, please contact:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

Stockholders call toll-free: (877) 750-0625

Banks and brokers call collect: (212) 750-5833

10

|

|

|

|

|

|

|

The following chronology summarizes the key meetings and events related to the proxy contest at the Annual Meeting. This chronology does not purport to catalogue every conversation of or among our Board or our representatives, and other parties.

On August 17, 2016, at Marcato’s request Dave Powers, our Chief Executive Officer, met with Richard T. McGuire III, the managing partner of Marcato, and Matthew P. Hepler, a managing director at Marcato. During this meeting, Messrs. McGuire and Hepler provided Marcato’s perspectives on our Company, with a focus on Marcato’s views on our retail strategy.

On November 9, 2016, Mr. Hepler spoke with Mr. Powers and Tom George, our Chief Financial Officer. The discussions focused on the previous quarter’s results and our guidance.

On February 8, 2017, Marcato filed a Schedule 13D reflecting beneficial ownership of approximately 6% of our common stock.

On February 21, 2017, Marcato sent a letter to our Board containing Marcato’s perspectives on our financial and operating performance. The letter advocated that we immediately begin a full review of strategic alternatives, including a sale of our Company. Marcato stated that if we were unable to “achieve an attractive outcome” for our stockholders in the immediate term, then it was prepared to seek significant change in the composition of our Board.

On February 24, 2017, John Gibbons, who at the time was our Lead Independent Director, and Angel Martinez, who at the time was the Chairman of our Board, met with representatives of Marcato, including Mr. McGuire. The purpose of this meeting was for the representatives of Marcato to provide us with Marcato’s perspectives on our Company. During this meeting, Mr. McGuire repeatedly called for our Company to be sold.

On March 3, 2017, Messrs. Gibbons and Martinez spoke with Mr. McGuire. Messrs. Gibbons and Martinez stated that our Board was continuing to consider Marcato’s perspectives and was focused on enhancing stockholder value. Mr. McGuire stated a willingness to enter into a confidentiality agreement with our Company that included a standstill.

On March 15, 2017, Messrs. Gibbons and Martinez spoke with Mr. McGuire.

On March 15, 2017, and March 16, 2017, our Board met and discussed Marcato’s perspectives on our Company.

On March 27, 2017, Red Mountain Capital Partners LLC, or Red Mountain, publicly disclosed a letter to our Board in which it urged the Board to explore a sale of our Company. Red Mountain stated that it beneficially owned approximately 3.3% of our common stock. Mr. Hepler was previously a partner at Red Mountain.

Also on March 27, 2017, Mr. McGuire and Messrs. Gibbons and Martinez discussed a possible confidentiality agreement.

On April 7, 2017, Messrs. Gibbons and McGuire spoke. Mr. Gibbons assured Mr. McGuire that our Board was taking his concerns seriously and was focused on enhancing stockholder value and considering a number of initiatives toward that goal.

Later on April 7, 2017, Marcato provided a draft confidentiality agreement that would have protected our Company’s confidential information from public disclosure for approximately one month.

On April 12, 2017, our Board met and discussed the confidentiality agreement proposed by Marcato. Our Board determined that it was not in the best interests of our Company and our stockholders to enter into a confidentiality agreement with a term of less than six months.

11

On April 13, 2017, Mr. Gibbons informed Mr. McGuire of our Board’s position on the appropriate term of a confidentiality agreement. Mr. McGuire stated that our Board should publicly disclose whether it was pursuing a sale of our Company.

On April 18, 2017, our Board met and discussed Marcato’s perspectives on our Company.

On April 25, 2017, we announced that our Board had initiated a process to review a broad range of strategic alternatives to enhance stockholder value, which may include a sale or other transaction. This announcement also affirmed our desire to improve operations and profitability. In this announcement, we made clear—as is customary in these types of strategic reviews—that we would not provide updates on the strategic review process.

Also on April 25, 2017, we announced that, in light of the strategic review process, we would not hold the Annual Meeting until the latter half of the fourth calendar quarter of 2017.

On May 25, 2017, we provided further details on our cost savings plan. More specifically, we announced that our previously announced cumulative savings will result in a $100 million improvement in our operating profit for fiscal year 2020. Coupled with low single digit revenue growth, this is expected to result in an operating margin of 13% in fiscal year 2020.

On May 31, 2017, Messrs. Gibbons and McGuire spoke. Mr. McGuire stated his interest in potentially nominating individuals to serve on our Board.

Also on May 31, 2017, Marcato made a request pursuant to Delaware law for a copy of our stockholder list and certain other information. Marcato has not signed a customary confidentiality agreement in order to receive the requested materials.

On June 12, 2017, and June 13, 2017, our Board met and discussed Marcato’s perspectives on our Company, as well as settlement options.

On June 21, 2017, Marcato sent a letter to the Board requesting that Mr. Hepler and an additional unnamed director be immediately appointed to our Board.

On June 27, 2017, Marcato sent a letter to our Board that, among other things, questioned a purported lack of transparency in the strategic review process and whether it was being appropriately conducted by our Board. This letter noted the earlier request by Marcato for representation on our Board. Marcato publicly disclosed this letter later on June 27, 2017.

On July 28, 2017, at Marcato’s request, representatives of Wilson Sonsini Goodrich & Rosati, Professional Corporation, or Wilson Sonsini, our outside counsel, and representatives of Moelis & Company LLC, or Moelis, our financial advisor, spoke with representatives of Cadwalader, Wickersham & Taft LLP, or Cadwalader, outside counsel to Marcato. The representatives of Cadwalader stated that Mr. McGuire did not believe that our strategic review process would result in a sale of our Company. As a result, Mr. McGuire wanted to discuss various commitments that we could make in connection with announcing that the strategic review process had concluded. These included (1) changes in the composition of our Board; (2) a return of capital to our stockholders and other changes to our capital structure; and (3) the potential divesture of certain of our brands.

On June 30, 2017, our Board met and considered the Board representation request from Marcato and its other perspectives. In light of the ongoing exploration of strategic alternatives, our Board determined that adding two additional directors was not presently in the best interests of our Company and our stockholders.

On August 4, 2017, Cadwalader, on behalf of Marcato, provided us with a draft settlement agreement. This agreement did not include a customary standstill limiting the actions that Marcato could take with respect to our Company. It also contemplated, among other things, (1) the immediate addition of Mr. Hepler and an additional unnamed director to the Board (one of whom would also be appointed as Chairman of our Board); (2) registration rights for Marcato’s shares of our common stock; (3) the repurchase of approximately $500 million of our common stock: (4) the divesture of certain of our brands; and (5) the retention of a management consultant to assist us in the evaluation and execution of margin improvement initiatives.

12

On August 8, 2017, our Board met and considered Marcato’s June 27 letter and August 4 settlement proposal. Our Board concluded that Marcato’s settlement proposal was not presently in the best interests of our Company and our stockholders. Our Board determined to continue to pursue our strategic review process. Our Board also determined that it was open to engaging with Marcato in the future concerning a possible settlement.

On August 24, 2017, our Board met and discussed Marcato’s perspectives on our Company, as well as settlement options.

On August 31, 2017, we announced that Mr. Gibbons would become the Chairman of our Board on September 1, 2017. Mr. Martinez continued to serve as a director.

On September 5, 2017, we announced December 14, 2017, as the date of the Annual Meeting.

On September 13, 2017, Marcato delivered a notice to us stating that it intended to propose 10 director nominees for election at the Annual Meeting in opposition to the nominees of our Board. In addition, Marcato notified us of its intention to present a stockholder proposal at the Annual Meeting. Marcato publicly disclosed its actions later on September 13, 2017.

Following Marcato’s submission of its director nominations, consistent with its charter, the Corporate Governance Committee commenced a review of the qualifications of Marcato’s nominees.

On September 19, 2017, we requested that Marcato make each of its nominees available for interviews by members of our Board.

On September 20, 2017, we again requested that Marcato make each of its nominees available for interviews by members of our Board.

On September 21, 2017, Marcato declined to make its nominees available for interviews.

On September 26, 2017, the Corporate Governance Committee met and considered Marcato’s nominees. The Corporate Governance Committee determined not to recommend any of Marcato’s nominees to our Board.

On September 28, 2017, our Board met and discussed Marcato and its nominees, as well as settlement options.

On October 2, 2017, Mr. Gibbons and representatives of each of Moelis and Wilson Sonsini spoke with Mr. McGuire and representatives of Cadwalader. Mr. Gibbons proposed resolving the proxy contest through the addition of two mutually agreed independent directors to our Board, as well as other commitments. Mr. McGuire stated that four or five members of our Board should be replaced in any settlement, and that additional cost-cutting initiatives should be implemented immediately.

On October 4, 2017, our Board met and discussed Marcato’s position on the composition of the Board, as well as settlement options.

On October 5, 2017, with the approval of our Board, representatives of Wilson Sonsini spoke to representatives of Cadwalader. The representatives of Wilson Sonsini proposed resolving the proxy contest through the addition of three mutually agreed independent directors to our Board.

Later on October 5, 2017, Marcato, through its representatives, declined our settlement offer. Marcato stated that it was only interested in discussing a change in a majority of our Board.

13

|

|

|

|

|

|

|

Marcato is seeking to replace all of the directors on our Board. Certain of our Company’s material agreements could be impacted if a “change in control” occurs as a result of Marcato’s proxy solicitation. Generally, a “change in control” would be deemed to occur under these agreements if a majority of the members of our Board were replaced with individuals not nominated or endorsed by those persons serving as our directors prior to the Annual Meeting. Our Board is comprised of 10 members, meaning that a “change in control” would be deemed to occur under these agreements if six or more of Marcato’s nominees were elected to our Board.

• |

Under our 2006 Equity Incentive Plan, if a “change in control” occurs, then certain equity awards granted under this plan could immediately accelerate and become exercisable. In addition, following the “change in control” our Board would be permitted to take certain actions with respect to the equity awards granted under this plan, including accelerating the vesting of, and terminating any restrictions on, all or any part of any such equity awards. Any acceleration of any equity awards granted under this plan could impact the retentive value of these awards. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Under our Amended and Restated Deferred Compensation Plan, if a “change in control” occurs, then all account balances under the plan would become immediately payable to the applicable participants in a lump sum. This would impact the retentive value of this plan and require us to make a payment to the applicable participants. The aggregate value of the amounts potentially payable to the applicable participants is $[•]. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Under our 2015 Stock Incentive Plan, if a “corporate transaction” occurs (which is equivalent to a “change in control” as described above) occurs, then certain equity awards granted under this plan could immediately accelerate and become exercisable. Any acceleration of any equity awards granted under this plan could impact the retentive value of these awards. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

• |

Under our Second Amended and Restated Credit Agreement, a “change in control” would constitute an event of default under this agreement and entitle the lenders to demand immediate repayment of any amounts outstanding. As of the date of this proxy statement, we had no amounts outstanding under this agreement. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Certain of these material agreements provide that our Board may have discretionary authority to certify Marcato’s nominees, prior to their election, as “continuing directors” solely for purposes of these agreements. If our Board were to do this, then the equity award acceleration described above would generally not occur or be permissible. As of the date of this proxy statement, our Board has not exercised its discretionary authority to certify Marcato’s nominees as “continuing directors.”

Our Board, as constituted after any “change in control,” would determine what actions, if any, to take with respect to our equity awards.

14

|

|

|

|

|

|

|

Overview

Our bylaws provide for the annual election of directors. Our bylaws also provide that our Board of Directors will consist of not less than one nor more than 10 members. The specific number of members of our Board within this range is established by our Board. There are currently 10 members of our Board.

At the Annual Meeting, stockholders will be asked to elect 10 directors to serve until the next Annual Meeting of Stockholders to be held in 2018, or until their successors are duly elected and qualified. The names and certain information concerning the persons nominated by our Board of Directors to stand for election as directors at the Annual Meeting are set forth in the section of this Proxy Statement titled “Director Nominees” below.

If all of our Board’s nominees for director are elected, then, following the Annual Meeting, our Board will consist of 10 members, and a majority of our Board, and all members of each of its standing committees, will continue to be “independent directors” under applicable SEC and NYSE rules.

Our Board recommends that you vote “FOR” ALL of the director nominees

listed in this Proxy Statement and on the enclosed WHITE proxy card.

No Agreements with Directors

No arrangement or understanding exists between any of our directors, nominees for director or executive officers and any other person pursuant to which any of them were selected as our director, nominee for director or executive officer.

No Family Relationships

There are no family relationships among any of our directors, nominees for director or executive officers.

Director Nominations

The Corporate Governance Committee is responsible for identifying and evaluating nominees for election to our Board. In addition to the candidates proposed by our Board of Directors or identified by the Corporate Governance Committee, the Corporate Governance Committee considers candidates for director proposed by stockholders, provided such recommendations are made in accordance with the procedures set forth in our bylaws. Please refer to the question titled “How can stockholders nominate a candidate for election as a director?” above. Stockholder nominations that meet the criteria outlined below will receive the same consideration as nominations made by the Corporate Governance Committee.

There have been no material changes to the procedures by which stockholders may recommend nominees for director.

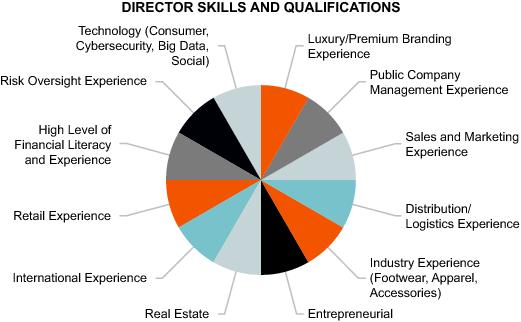

Director Qualifications

Directors are responsible for overseeing and monitoring our business consistent with their fiduciary duties to our stockholders. This significant responsibility requires highly-skilled individuals with various qualities, attributes, and professional experience. As detailed in the section of this Proxy Statement titled “Nominating Procedures and Criteria” below, our Board believes that there are both general requirements for service as a member of our Board that are applicable to all

15