0000910521DEF 14Afalse00009105212022-04-012023-03-31000091052112022-04-012023-03-31000091052122022-04-012023-03-31000091052132022-04-012023-03-31iso4217:USD00009105212021-04-012022-03-3100009105212020-04-012021-03-310000910521deck:StockAwardsAdjustmentsMemberecd:PeoMember2022-04-012023-03-310000910521deck:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2022-04-012023-03-310000910521ecd:PeoMemberdeck:EquityAwardsGrantedInPriorYearsUnvestedMember2022-04-012023-03-310000910521deck:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2022-04-012023-03-310000910521deck:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2022-04-012023-03-310000910521deck:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2022-04-012023-03-310000910521deck:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2022-04-012023-03-310000910521deck:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2022-04-012023-03-310000910521deck:StockAwardsAdjustmentsMemberecd:PeoMember2021-04-012022-03-310000910521deck:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2021-04-012022-03-310000910521ecd:PeoMemberdeck:EquityAwardsGrantedInPriorYearsUnvestedMember2021-04-012022-03-310000910521deck:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2021-04-012022-03-310000910521deck:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2021-04-012022-03-310000910521deck:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2021-04-012022-03-310000910521deck:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2021-04-012022-03-310000910521deck:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2021-04-012022-03-310000910521deck:StockAwardsAdjustmentsMemberecd:PeoMember2020-04-012021-03-310000910521deck:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:PeoMember2020-04-012021-03-310000910521ecd:PeoMemberdeck:EquityAwardsGrantedInPriorYearsUnvestedMember2020-04-012021-03-310000910521deck:EquityAwardsGrantedInPriorYearsVestedMemberecd:PeoMember2020-04-012021-03-310000910521deck:StockAwardsAdjustmentsMemberecd:NonPeoNeoMember2020-04-012021-03-310000910521deck:EquityAwardsGrantedDuringTheYearUnvestedMemberecd:NonPeoNeoMember2020-04-012021-03-310000910521deck:EquityAwardsGrantedInPriorYearsUnvestedMemberecd:NonPeoNeoMember2020-04-012021-03-310000910521deck:EquityAwardsGrantedInPriorYearsVestedMemberecd:NonPeoNeoMember2020-04-012021-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | |

Filed by the Registrant x |

Filed by a Party other than the Registrant ¨ |

| Check the appropriate box: |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material under §240.14a-12 |

| | | | | | | | | | | | | | |

| DECKERS OUTDOOR CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| x | | No fee required. |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

| | | | | | | | | | | | | | |

| | | | |

| | 2023 PROXY STATEMENT SUMMARY | | |

| | | | |

This Proxy Statement Summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider when making voting decisions. You should read this Proxy Statement carefully and completely before voting.

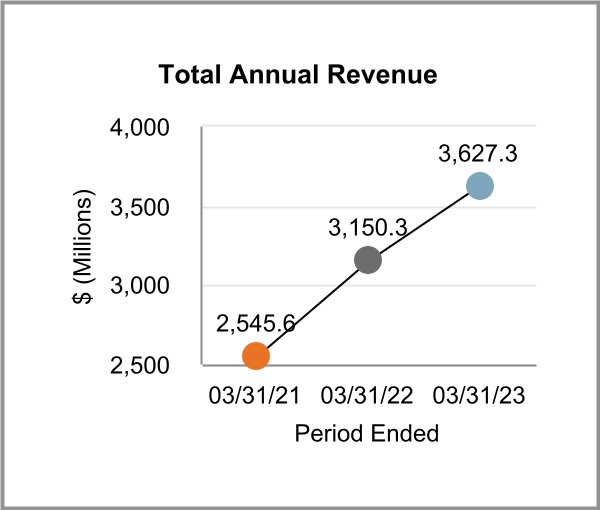

Deckers Outdoor Corporation, doing business as Deckers Brands, is a global leader in designing, marketing and distributing innovative footwear, apparel, and accessories developed for both everyday casual lifestyle use and high-performance activities through our portfolio of brands.

Our products are sold in more than 50 countries and territories through select department and specialty stores, Company-owned and -operated retail stores, and select online stores, including Company-owned websites. This year we are celebrating 50 years of history building niche footwear brands into lifestyle market leaders attracting millions of loyal customers globally.

| | |

|

| ANNUAL MEETING OF STOCKHOLDERS |

|

| | | | | |

| DATE | Monday, September 11, 2023 |

| TIME | 1:00 p.m. Pacific Time |

| VIRTUAL MEETING | The 2023 Annual Meeting of Stockholders, or Annual Meeting, will be held virtually via a live webcast, which can be accessed on the Internet by visiting www.virtualshareholdermeeting.com/DECK2023.

Stockholders will be able to vote and submit questions virtually during the Annual Meeting in accordance with the rules and procedures included on the meeting website.

To access the Annual Meeting you will need a 16-digit control number. Your control number is provided on the Notice of Internet Availability of Proxy Materials you received in the mail, on your proxy card (if you requested to receive printed proxy materials), or through your broker or other nominee if you hold your shares in "street name." |

| RECORD DATE | Thursday, July 13, 2023 |

| | |

|

| PROPOSALS TO BE VOTED UPON |

|

| | | | | | | | | | | |

| NUMBER | PROPOSAL | BOARD VOTING RECOMMENDATION | PAGE REFERENCE |

| | | |

| 1 | Elect ten directors to serve until the annual meeting of stockholders to be held in 2024, or until their successors are duly elected and qualified | "FOR" EACH DIRECTOR NOMINEE | |

| 2 | Ratify the selection of KPMG LLP as our independent registered public accounting firm for our fiscal year ending March 31, 2024 | "FOR" | |

| 3 | Approve, on a non-binding advisory basis, the compensation of our Named Executive Officers as described in the section of this Proxy Statement titled "Compensation Discussion and Analysis" | "FOR" | |

| 4 | Approve, on a non-binding advisory basis, the frequency of future advisory votes on Named Executive Officer compensation. | FOR EVERY "ONE YEAR" | |

We may also consider and vote upon any other business that may properly come before the Annual Meeting, or at any postponements or adjournments thereof. As of the date of this Proxy Statement, we are not aware of any business to be presented for consideration at the Annual Meeting other than the matters described in this Proxy Statement.

Your vote is important to the future of Deckers Outdoor Corporation. You are eligible to vote if you were a stockholder at the close of business on Thursday, July 13, 2023. Please refer to the section of this Proxy Statement titled "Questions and Answers About the Annual Meeting and Voting" for additional information on how to attend the Annual Meeting and vote your shares. Whether or not you plan to attend the Annual Meeting, we encourage you to read this Proxy Statement and submit your proxy or voting instructions as soon as possible to ensure your representation at the Annual Meeting.

| | |

|

PROPOSAL NO. 1

ELECTION OF DIRECTORS |

|

Our Board of Directors has nominated the following ten directors for election at the Annual Meeting:

| | | | | | | | | | | | | | |

| DIRECTOR NOMINEES |

| | | | |

| Michael F. Devine, III | David A. Burwick | Nelson C. Chan | Cynthia (Cindy) L. Davis | Juan R. Figuereo |

| Maha S. Ibrahim | Victor Luis | Dave Powers | Lauri M. Shanahan | Bonita C. Stewart |

| | | | | | | | | | |

| BOARD RECOMMENDATION: | | | | |

"FOR" each director nominee | | | | |

| | | | |

| We have an independent Board with extensive qualifications and skills. Our Board is also comprised of individuals with diverse backgrounds and experience. Each of our Board members is committed to representing the long-term interests of our stockholders. | | |

| QUALIFIED | QUALIFICATIONS AND SKILLS | | | |

| 7/10 Industry | 6/10 Technology Infrastructure/Cybersecurity | | |

| 9/10 Premium Branding | 6/10 Compliance and Risk Oversight | | |

| 9/10 International | 7/10 Corporate Governance | | |

| 3/10 High Level of Financial Literacy | 6/10 Mergers and Acquisitions | | |

| 8/10 Retail | 9/10 Public Company Executive | | |

| 5/10 Consumer Technology/Big Data | 8/10 Human Resources/Talent Management | | |

| 8/10 Sales and Marketing | 3/10 Corporate Responsibility | | |

| 4/10 Supply Chain Management | | | |

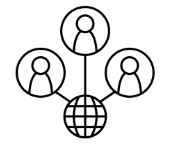

| DIVERSE | DEMOGRAPHICS | | | |

| 50% Ethnically Diverse | | | |

| 60% from Underrepresented Communities | | | |

| 40% Female | | | |

| INDEPENDENT | 9/10 Directors are Independent | | | |

| ENGAGED | During our fiscal year ended March 31, 2023, or fiscal year 2023, no director nominee attended fewer than 80% of the meetings of our Board or meetings of any Board committee on which he or she served during his or her term. | | |

Please refer to the section of this Proxy Statement titled "Proposal No. 1 - Election of Directors" for additional information. | | |

| | |

|

PROPOSAL NO. 2

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

|

| | | | | |

| BOARD RECOMMENDATION | |

"FOR" the ratification of the selection of KPMG LLP as our independent registered public accounting firm for our fiscal year ending March 31, 2024. | |

| |

•The Audit & Risk Management Committee is involved in the annual review and engagement of KPMG LLP to ensure its continuing audit independence.

•The Audit & Risk Management Committee believes the continued retention of KPMG LLP is in the best interests of the Company and our stockholders. |

Please refer to the section of this Proxy Statement titled "Proposal No. 2 - Ratification of the Selection of KPMG LLP as Independent Registered Public Accounting Firm" for additional information. |

| | |

|

PROPOSAL NO. 3

ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION |

|

| | | | | |

| BOARD RECOMMENDATION: | |

"FOR" the approval, on a non-binding advisory basis, of the compensation of our Named Executive Officers as described in the section of this Proxy Statement entitled "Compensation Discussion and Analysis." | |

| |

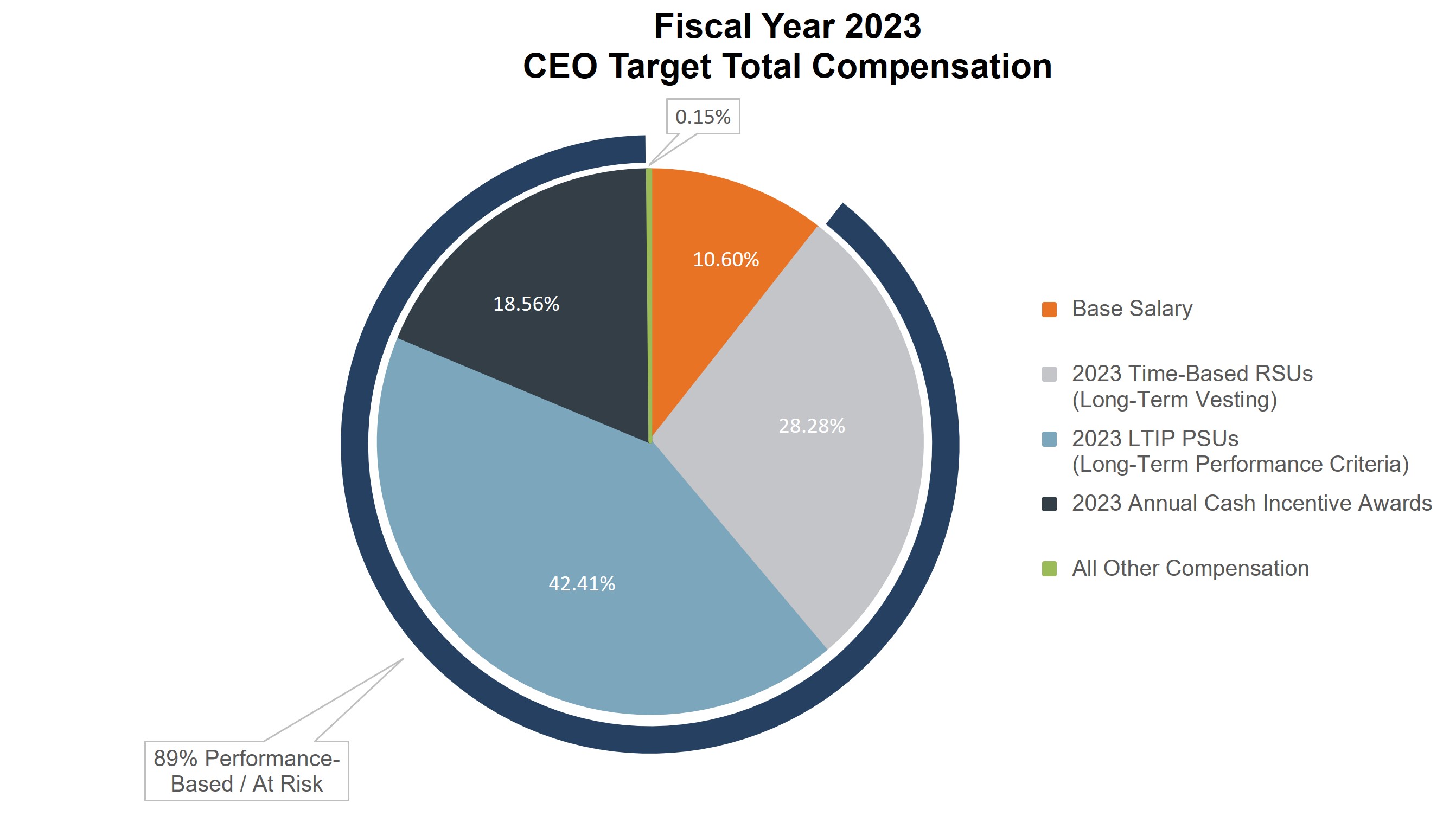

The primary objective of our executive compensation program is to compensate our executive officers in a manner that will attract, retain, and motivate talented executives with the skills needed to manage a complex and growing business in a competitive industry, while creating long-term value for our stockholders. The Talent & Compensation Committee seeks to design our executive compensation program in a manner that reflects direct alignment between the compensation opportunity provided to our executives and the achievement of our strategic objectives.

Consistent with our strategic objectives for fiscal year 2023, when designing our executive compensation program for the year, the Talent & Compensation Committee focused on continuing to build and retain our executive team, while incentivizing our executive officers to focus on increasing revenue, enhancing profitability, achieving ESG objectives, and creating long-term value for our stockholders.

When establishing our executive compensation program, the Talent & Compensation Committee is guided by the following four principles: |

•Pay for performance by having a significant portion of compensation earned based on the achievement of performance-based conditions.

•Align interests of executives with stockholders by tying a significant portion of compensation to performance that creates long-term value for our stockholders.

•Attract and retain executives with the background and experience necessary to lead the organization and achieve our strategic objectives.

•Reward achievement by offering incentives for achieving short-term and long-term financial goals that are directly tied to the achievement of strategic objectives. |

Please refer to the sections of this Proxy Statement titled “Compensation Discussion and Analysis” and "Proposal No. 3, Advisory Vote to Approve Named Executive Officer Compensation" for additional information. |

| | |

|

PROPOSAL NO. 4

ADVISORY VOTE ON FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION |

|

| | | | | |

| BOARD RECOMMENDATION: | |

For the approval, on a non-binding advisory basis, that the frequency of future advisory votes on the compensation of our Named Executive Officers shall occur every "ONE YEAR." | |

| |

•Non-binding advisory vote on whether the Company should hold an advisory vote to approve the compensation of our Named Executive Officers every "one year," "two years" or "three years."

•Our Board of Directors believes submitting the advisory vote on executive compensation on an annual basis is appropriate as it affords our stockholders the ability to provide routine feedback on our compensation program. |

Please refer to the section of this Proxy Statement titled "Proposal No. 4, Frequency of Future Advisory Vote on Named Executive Officer Compensation" for additional information. |

| | |

|

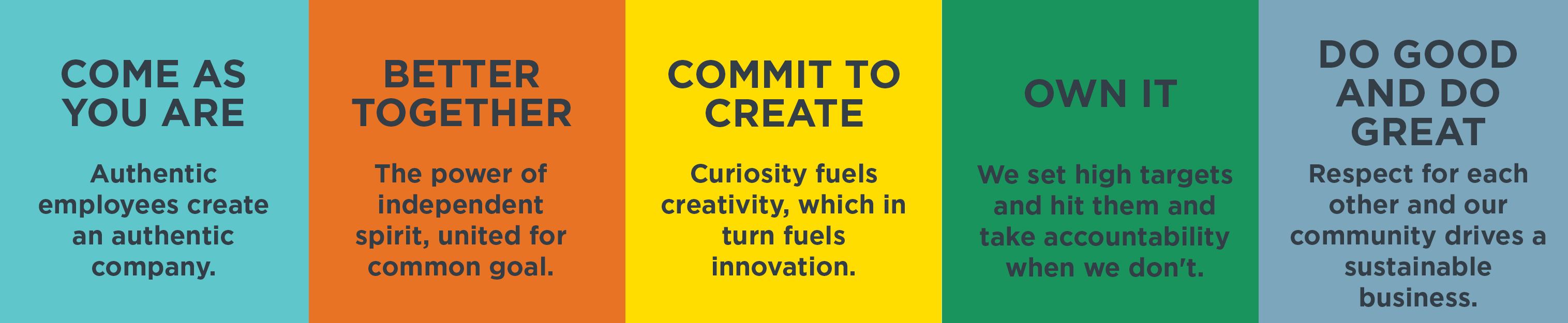

| OUR BUSINESS AND STRATEGIC OBJECTIVES |

|

| | | | | |

LONG-TERM STRATEGY AND GROWTH  | |

| |

| We remain committed to our long-term strategies, which have been the primary drivers of our success in recent years. Our strategic framework includes efforts to: |

•Expand global consumer adoption of the HOKA brand and increase its market share within the performance athletic space;

•Enhance the UGG brand's global positioning through elevated consumer experiences and segmented products that feature recognizable brand heritage;

•Adopt technology and analytical tools to further enhance our capabilities to support our evolving business, including expanding our digital marketing and e-commerce platforms; and

•Invest in enterprise infrastructure to support the increased scale of our organization and key global growth initiatives, including investment in talent as well as distribution and logistics needs. |

| We intend to closely monitor the planned investments in our business as we remain mindful of a challenging macroeconomic environment. We also intend to continue to focus on the achievement of ESG initiatives. We remain committed to delivering long-term stockholder value through the continued execution of our strategies. |

The achievement of ESG initiatives is a crucial part of our strategic objectives and corporate culture. We strive to do good and do great while minimizing our environmental impact and employing socially conscious operations. In the last year, we have continued to amplify our ESG program and are committed to maintaining open and interactive dialogue on ESG matters with our stakeholders to ensure their views are actively considered. The tables below reflect a select group of highlights from our ESG program during fiscal year 2023.

| | | | | |

ENVIRONMENTAL  | |

| |

•We began utilizing the HIGG Facility Environmental Module, a sustainability tool used by our factory partners to collect detailed and standardized information about a partner's waste, water, and energy consumption, and to identify and prioritize opportunities for sustainability performance improvements.

•We sourced all of our leather supplies from Leather Working Group-certified tanneries, which promote sustainable and environmentally friendly business practices within the leather industry.

•We continued our long-term grant with the Savory Institute to support regenerative farming practices on sheep farms in Australia, influencing over 300,000 acres and 80 farms. |

| | | | | |

SOCIAL  | |

| |

•We improved Black, Indigenous, and People of Color, or BIPOC, representation among U.S. leaders (director and above) to 24%, up from 12% three years ago, as we continue to make progress towards our target of 25% by the end of fiscal year 2027.

•Our employees volunteered over 15,000 hours.

•We continued to focus on our employees' growth, creating experiences that align with our strategic priorities and promote inclusion, performance, connection, and development across the globe through various employee engagement activities and programs. |

| | | | | |

GOVERNANCE  | |

| |

•We continued to ensure diverse perspectives are reflected on our Board, which includes four female directors and six directors from underrepresented communities.

•We made governance changes to further promote Board involvement and oversight of Chief Executive Officer succession planning.

•The Corporate Governance Committee's duties were expanded to specifically address ESG initiatives and the committee was renamed the Corporate Responsibility, Sustainability and Governance Committee. |

For additional information, please read our forthcoming corporate responsibility and sustainability report, or our Creating Change Report, and visit our website at www.deckers.com/responsibility. The information contained in our Creating Change Report or accessed through our website does not constitute part of this Proxy Statement and you should not consider that information in deciding how to vote your shares. References to our website address in this Proxy Statement are inactive textual references only.

| | | | | | | | | | | | | | |

| | | | |

| | NOTICE OF VIRTUAL ANNUAL MEETING OF STOCKHOLDERS | | |

| | | | |

TO OUR STOCKHOLDERS:

We are pleased to invite you to virtually attend the 2023 Annual Meeting of Stockholders of Deckers Outdoor Corporation to be held on Monday, September 11, 2023, at 1:00 p.m. Pacific Time.

Proposals to be Voted Upon:

| | | | | |

| 1 | Election of Directors. Elect ten directors to serve until the annual meeting of stockholders to be held in 2024, or until their successors are duly elected and qualified. |

| 2 | Ratification of Selection of Accounting Firm. Ratify the selection of KPMG LLP as our independent registered public accounting firm for fiscal year 2024, which covers the period from April 1, 2023 to March 31, 2024. |

| 3 | Advisory Vote on Executive Compensation. Approve, on a non-binding advisory basis, the compensation of our Named Executive Officers, as described in the section of this Proxy Statement entitled "Compensation Discussion and Analysis." |

| 4 | Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation. Approve, on a non-binding advisory basis, that the frequency of future votes on the compensation of our Named Executive Officers shall occur every one year. |

| Other Business. Consider and vote upon any other business that may properly come before the Annual Meeting, or any postponements or adjournments thereof. |

Virtual Annual Meeting:

The Annual Meeting will be held virtually and conducted via a live webcast. You will be able to attend the Annual Meeting online, submit your questions and vote your shares during the meeting by visiting www.virtualshareholdermeeting.com/DECK2023. We believe hosting a virtual annual meeting encourages increased stockholder attendance and participation, and reduces the costs associated with holding and attending the meeting.

Record Date:

Our Board of Directors has fixed the close of business on Thursday, July 13, 2023, or the Record Date, as the date for determining which stockholders are entitled to notice of and to vote at the Annual Meeting, or any postponements or adjournments thereof.

Board Recommendations:

Our Board of Directors recommends that you vote "FOR" each of the director nominees named in Proposal No. 1, "FOR" Proposal Nos. 2 and 3, and for every "ONE YEAR" for Proposal No. 4.

| | |

| BY ORDER OF THE BOARD OF DIRECTORS |

|

Dave Powers Chief Executive Officer and President |

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read this Proxy Statement and submit your proxy or voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail, the section of this Proxy Statement titled "Questions and Answers About the Annual Meeting and Voting," or, if you requested to receive printed proxy materials, your enclosed proxy card.

Approximate Date of Mailing of Notice of Internet Availability of Proxy Materials: August 2, 2023

Cautionary Note Regarding Forward-Looking Statements

This Proxy Statement contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements may relate to our future financial performance, business operations, and executive compensation decisions, or other future events. You can identify forward-looking statements by the use of words such as “may,” “will,” “could,” “anticipate,” “expect,” “intend,” “believe,” “continue,” or the negative of such terms, or other comparable terminology. Forward-looking statements also include the assumptions underlying or relating to such statements. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, results of operations and financial condition.

The outcomes of the events described in these forward-looking statements are subject to risks, uncertainties and other factors described in Item 1A, “Risk Factors,” and elsewhere, in our Annual Report on Form 10-K for fiscal year 2023, or the Annual Report, as well as the other reports we file with the Securities and Exchange Commission, or the SEC. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results could differ materially from those expressed or implied in the forward-looking statements. The forward-looking statements made in this Proxy Statement relate only to events as of the date of this Proxy Statement. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made.

VIRTUAL ANNUAL MEETING OF STOCKHOLDERS

Meeting Date: Monday, September 11, 2023

GENERAL INFORMATION

The enclosed Proxy Statement is solicited on behalf of the Board of Directors of Deckers Outdoor Corporation for use at our 2023 Annual Meeting of Stockholders, or the Annual Meeting, to be held virtually via a live webcast on Monday, September 11, 2023 at 1:00 p.m. Pacific Time, or at any postponements or adjournments thereof.

The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/DECK2023, where you will be able to attend the Annual Meeting, submit questions and vote your shares electronically.

The Annual Meeting is being held for the purposes described in this Proxy Statement and in the accompanying Notice of Annual Meeting of Stockholders.

| | |

|

| QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING |

|

The following questions and answers are intended to briefly address potential questions that our stockholders may have regarding this Proxy Statement and the Annual Meeting. They are also intended to provide our stockholders with certain information that is required to be provided under the Securities and Exchange Commission, or SEC, rules. These questions and answers may not address all of the questions that are important to you as a stockholder. If you have additional questions about this Proxy Statement or the Annual Meeting, please refer to the question titled "Whom should I contact with other questions?" below.

Q: When and where will the Annual Meeting be held?

A: The Annual Meeting will be held on Monday, September 11, 2023, at 1:00 p.m. Pacific Time. The Annual Meeting will be conducted entirely online via a live webcast. Our stockholders may participate in the Annual Meeting by visiting: www.virtualshareholdermeeting.com/DECK2023. You will need a 16-digit control number to attend and participate in the live webcast of the Annual Meeting. Please refer to the question titled "How can I vote my shares?" for information on obtaining your 16-digit control number.

Q: What proposals am I being asked to vote upon at the Annual Meeting?

A: The proposals to be voted on at the Annual Meeting, and our Board's recommendation with respect to each proposal, are as follows:

| | | | | | | | |

| NUMBER | PROPOSAL | BOARD VOTING RECOMMENDATION |

| | |

Proposal No. 1: Election of Directors | Elect ten director nominees to serve until the annual meeting of stockholders to be held in 2024, or until their successors are duly elected and qualified | "FOR" EACH DIRECTOR NOMINEE |

Proposal No. 2: Ratification of Selection of Accounting Firm | Ratify the selection of KPMG LLP as our independent registered public accounting firm for fiscal year 2024 | "FOR" |

Proposal No. 3: Advisory Vote on Executive Compensation | Approve, on a non-binding advisory basis, the compensation of our Named Executive Officers, as described in the section of this Proxy Statement titled "Compensation Discussion and Analysis" | "FOR" |

Proposal No. 4: Advisory Vote on Frequency of Future Advisory Votes on Executive Compensation | Approve, on a non-binding advisory basis, that the frequency of future votes on the compensation of our Named Executive Officers shall occur every one year. | FOR EVERY "ONE YEAR" |

Q: Why did I receive these proxy materials?

A: We are providing this Proxy Statement in connection with the solicitation by our Board of Directors of proxies to be voted at the Annual Meeting, or at any postponements or adjournments thereof. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Annual Meeting. You are invited to attend the Annual Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the Annual Meeting to vote your shares. Instead, you may vote your shares using one of the other voting methods described in this Proxy Statement.

Whether or not you plan to attend the Annual Meeting, we encourage you to read this Proxy Statement and submit your proxy or voting instructions as soon as possible to ensure your representation at the Annual Meeting.

Q: Why did I receive a notice in the mail regarding the Internet availability of proxy materials?

A: Instead of mailing printed copies to each of our stockholders, we have elected to provide access to the proxy materials over the Internet under SEC's "notice and access" rules. These rules allow us to make our stockholders aware of the Annual Meeting and the availability of the proxy materials by sending a Notice of Internet Availability of Proxy Materials, or the Notice, which provides instructions on how to access the full set of proxy materials through the Internet or make a request to have printed proxy materials delivered by mail. Accordingly, on or about August 2, 2023, we mailed the Notice to each of our stockholders. The Notice contains instructions on how to access the proxy materials, including this Proxy Statement and our

Annual Report, each of which are available at www.proxyvote.com. The Notice also provides instructions on how to vote your shares.

Q: Who can vote at the Annual Meeting?

A: Only our stockholders at the close of business on July 13, 2023, or the Record Date, will be entitled to attend and vote at the Annual Meeting. On the Record Date, there were 26,134,458 shares of our common stock outstanding and entitled to vote. Each share of common stock issued and outstanding on the Record Date is entitled to one vote on any matter to be voted upon by our stockholders at the Annual Meeting.

•Holders of Record - If, on the Record Date, your shares were registered directly in your name with our transfer agent, Computershare, then you are a "holder of record." As a holder of record, you may vote at the virtual Annual Meeting, or you may vote by proxy. If you are a holder of record and you indicate when voting that you wish to vote as recommended by our Board, or if you submit a vote by proxy without giving specific voting instructions, then the proxyholders will vote your shares as recommended by our Board on all matters described in this Proxy Statement. Thomas Garcia and Steven J. Fasching, the designated proxyholders, are members of our management.

•Beneficial Owners - If, on the Record Date, your shares were held in an account at a bank, broker, dealer, or other nominee, then you are the "beneficial owner" of shares held in "street name" and this Proxy Statement is being made available to you by that nominee. The nominee holding your account is considered the holder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your nominee on how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the holder of record, you may not vote your shares at the Annual Meeting unless you request and obtain a valid "legal proxy" or obtain a 16-digit control number from your nominee. Please contact your nominee directly for additional information.

Q: What is the quorum requirement for the Annual Meeting?

A: The presence at the Annual Meeting, virtually (even if not voting) or by proxy, of the holders of a majority of the voting power of all the shares of our common stock entitled to be voted at the Annual Meeting, will constitute a quorum at the Annual Meeting. We will treat shares of common stock represented by a properly voted proxy, including shares for which authority is withheld or that a stockholder abstains from voting, as well as broker non-votes, as present at the Annual Meeting for the purposes of determining the existence of a quorum. If a quorum is not present, the Annual Meeting will be adjourned until a quorum is obtained.

Q: What are the voting requirements to approve each of the proposals, and what happens if I do not vote?

A: The voting requirements to approve each of the proposals to be voted upon at the Annual Meeting, as well as the effects of abstentions and broker non-votes on each of the proposals, are as follows:

| | | | | | | | | | | | | | | | | |

| PROPOSAL | VOTING REQUIREMENT | | EFFECT OF ABSTENTIONS(1) | | EFFECT OF BROKER NON-VOTES(2) |

| | | | | |

Proposal No. 1: Election of Directors | Each director nominee in an uncontested election(3) will be elected by a majority of the votes cast by the shares present virtually or represented by proxy and entitled to vote on the election of directors at the Annual Meeting (assuming that a quorum is present).

A "majority of the votes cast" means that the number of votes "FOR" a director nominee must exceed 50% of the total votes cast in the election of directors. | | A "WITHHOLD" vote with respect to a director nominee will not count as a vote cast for that nominee, will not be included in the total number of votes cast, and will have no effect on the outcome of the vote on this proposal. | | Broker non-votes will not count as votes cast on this proposal, and will have no effect on the outcome of the vote on this proposal. |

Proposal No. 2: Ratification of Selection of Accounting Firm | Requires the affirmative vote of a majority of the outstanding shares present virtually or represented by proxy and entitled to vote on the proposal at the Annual Meeting (assuming that a quorum is present).

| | An "ABSTAIN" vote will be included in the total number of shares present and entitled to vote on this proposal, and will have the same effect as a vote "AGAINST" this proposal. | | Because a bank, broker, dealer or other nominee may generally vote without instructions on this proposal, we do not expect any broker non-votes to result for this proposal. |

Proposal No. 3: Advisory Vote on Executive Compensation | Requires the affirmative vote of a majority of the outstanding shares present virtually or represented by proxy and entitled to vote on the proposal at the Annual Meeting (assuming that a quorum is present).

| | An "ABSTAIN" vote will be included in the total number of shares present and entitled to vote on this proposal, and will have the same effect as a vote "AGAINST" this proposal. | | Broker non-votes will not count as votes cast on this proposal and will have no effect on the outcome of the vote on this proposal. |

Proposal No. 4: Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation | Stockholders may select every "one year," "two years" or "three years" with respect to this proposal. The option that receives the greatest number of votes will be considered the frequency selected by our stockholders. | | An "ABSTAIN" vote will have no effect on the outcome of this proposal. | | Broker non-votes will not count as votes cast on this proposal and will have no effect on the outcome of the vote on this proposal. |

(1)You may vote to "WITHHOLD" authority for one or more director nominees and may "ABSTAIN" from voting on one or more of the other proposals described in this Proxy Statement. Shares for which authority is withheld or that a stockholder abstains from voting will be counted for purposes of determining whether a quorum is present at the Annual Meeting.

(2)Pursuant to applicable New York Stock Exchange, or NYSE, rules, if you are a beneficial owner of shares held in street name and do not provide the nominee that holds your shares with specific voting instructions, the nominee may generally vote in its discretion on “routine” matters (such as Proposal No. 2). However, if the nominee that holds your shares does not receive instructions from you on how to vote your shares on a “non-routine” matter (such as Proposal Nos. 1, 3, and 4), it will be unable to vote your shares on that matter. When this occurs, it is generally referred to as a “broker non-vote.” Broker non-votes will be counted for purposes of determining whether a quorum is present at the Annual Meeting.

(3)An "uncontested election" is an election in which the number of director nominees is not greater than the number of directors to be elected. A "contested election" is an election in which the number of director nominees nominated by (i) our Board, (ii) any stockholder, or (iii) a combination of our Board and any stockholder, exceeds the number of directors to be elected. In a contested election, directors will be elected by a plurality of the votes cast by the shares present virtually or represented by proxy and entitled to vote on the election of directors at the Annual Meeting.

Q: What happens if a director nominee fails to receive a majority vote in an uncontested election at the Annual Meeting?

A: Each incumbent director standing for reelection at the Annual Meeting has tendered an irrevocable letter of resignation, effective upon such incumbent director not receiving a majority vote at the Annual Meeting and acceptance of such resignation by our Board. Our Board must accept or reject such resignation within 90 days following certification of the stockholder vote in accordance with the procedures established by our Amended and Restated Bylaws, or our Bylaws. If a director’s resignation offer is not accepted by our Board, that director will continue to serve until our annual meeting of stockholders to be held in 2024 or his or her successor is duly elected and qualified, or until such director’s earlier death, resignation, or removal.

Any director nominee who is not an incumbent director and who fails to receive a majority vote in an uncontested election will not be elected as a director, and a vacancy will be left on our Board. Our Board, in its sole discretion, may either fill a vacancy resulting from a director nominee not receiving a majority vote pursuant to our Bylaws or decrease the size of our Board to eliminate the vacancy. All director nominees are incumbent directors standing for reelection at the Annual Meeting.

Q: Could other matters be decided at the Annual Meeting?

A: As of the date of this Proxy Statement, we are not aware of any business to be presented for consideration at the Annual Meeting other than the matters described in this Proxy Statement. If, however, other matters are properly presented at the Annual Meeting, the persons named as proxies will vote in accordance with their discretion with respect to those matters.

Q: How can I vote my shares?

A: Your shares can be voted as follows:

• Holders of Record - Holders of record can vote by proxy or by attending the Annual Meeting where votes can be submitted electronically via live webcast. If you wish to vote by proxy, you can vote by Internet, telephone, or mail as described below. Whether or not you plan to attend the Annual Meeting, we encourage you to submit your proxy or voting instruction as soon as possible to ensure your representation at the Annual Meeting.

| | | | | |

| VOTING METHOD |

| |

| To vote at the Annual Meeting by live webcast, you must visit the following website: www.virtualshareholdermeeting.com/DECK2023. You will need the 16-digit control number included on the Notice or your proxy card (if you requested to receive printed proxy materials). The method you use to vote by proxy will not limit your right to attend or vote at the Annual Meeting. All shares that have been properly voted and not revoked will be voted at the Annual Meeting. However, even if you plan to attend the Annual Meeting, we recommend that you vote your shares in advance so that your vote will be counted if you later decide not to attend the Annual Meeting. |

| To vote by Internet, you will need the 16-digit control number included on the Notice or your proxy card (if you requested to receive printed proxy materials). Internet voting is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on Sunday, September 10, 2023 by visiting www.proxyvote.com and following the instructions. |

| To vote by telephone, you will need the 16-digit control number included on the Notice or on your proxy card (if you requested to receive printed proxy materials). Telephone voting is available 24 hours a day and will be accessible until 11:59 p.m. Eastern Time on Sunday, September 10, 2023 by calling 1-800-690-6903 and following the instructions. |

| To vote by mail, follow the instructions provided on your proxy card (if you requested to receive printed proxy materials). Simply mark, sign and date your proxy card and return it promptly in the postage-paid envelope provided. In order to be effective, completed proxy cards must be received by 11:59 p.m. Eastern Time on Sunday, September 10, 2023. This option is only available if you requested to receive printed proxy materials. |

• Beneficial Owners - If you are the beneficial owner of your shares, you should have received the Notice or a proxy card (if you requested to receive printed proxy materials) with this Proxy Statement from your nominee rather than from us. Simply (i) use the 16-digit control number to vote on the Internet or by telephone before the Annual Meeting, or vote at the Annual Meeting, or (ii) if you requested to receive printed proxy materials, vote by following the instructions provided on the proxy card you received from your nominee's website. Your 16-digit control number may be included in the voting instruction form that accompanied the proxy materials. If your nominee did not provide you with a 16-digit control number, you should contact your nominee to obtain your control number and access the Annual Meeting link. To vote at the Annual Meeting, you must first obtain a valid "legal proxy" from your nominee. Follow the instructions from your nominee to request a "legal proxy."

Q: What can I do if I change my mind after I vote my shares?

A: You may change your vote at any time before the polls are closed at the Annual Meeting.

• Holders of Record - If you are a holder of record, you may change your vote by (i) providing written notice of revocation to Deckers Outdoor Corporation, 250 Coromar Drive, Goleta, California 93117, Attention: Corporate Secretary, (ii) executing a subsequent proxy using any of the voting methods discussed above (subject to the deadlines for voting with respect to each method), or (iii) attending the Annual Meeting and voting electronically via live webcast. However, simply attending the Annual Meeting will not, by itself, revoke your proxy.

• Beneficial Owners - If you are a beneficial owner of your shares and you have instructed your nominee to vote your shares, you may change your vote by following the directions received from your nominee to change those voting instructions, or by attending the Annual Meeting and voting via live webcast, which can be accomplished as described above.

Subject to any revocation, all shares represented by properly executed proxies will be voted in accordance with the instructions on the applicable proxy, or, if no instructions are given, in accordance with the recommendations of our Board of Directors as described above.

Q: Who is paying for the cost of this proxy solicitation?

A: The solicitation of proxies is made on behalf of our Board and all the expenses of soliciting proxies from stockholders will be borne by us. In addition to the solicitation of proxies by use of the mail, our directors, officers, and employees may communicate with stockholders personally or by email, telephone, or otherwise for the purpose of soliciting such proxies. No additional compensation will be paid to any such persons for such solicitation, although we may reimburse them for reasonable out-of-pocket expenses incurred in connection with such solicitation. We will reimburse banks, brokers, dealers and other nominees for their reasonable out-of-pocket expenses in forwarding solicitation material to beneficial owners of shares held of record by such persons. The total estimated cost of the solicitation of proxies is approximately $125,000.

Q: How may I obtain an additional copy of the proxy materials? How may I reduce the number of copies our household receives?

A: We have adopted a procedure called "householding," which the SEC has approved. Under this procedure, we are delivering a single copy of the Notice and, if applicable, this Proxy Statement and the Annual Report, to multiple stockholders who share the same address unless we have received contrary instructions from one or more of the stockholders. This procedure reduces our printing and mailing costs. Stockholders who participate in householding will continue to be able to access and receive separate proxy materials. Upon written or oral request, we will promptly deliver a separate copy of the Notice and, if applicable, this Proxy Statement and the Annual Report, to any stockholder at a shared address to which we delivered a single copy of any of these documents. To receive a separate copy of the Notice and, if applicable, this Proxy Statement or the Annual Report, or if you wish to receive separate copies in the future, please contact: Deckers Outdoor Corporation, 250 Coromar Drive, Goleta, California 93117, Attention: Corporate Secretary, Telephone: (805) 967-7611.

In addition, if you are currently a stockholder sharing an address with another stockholder and wish to receive only one copy of future proxy materials for your household, please contact us using the contact information set forth above. Stockholders who are beneficial owners of shares held in street name may contact their bank, broker, dealer or other nominee to request information about householding.

Q: Where can I find the voting results of the Annual Meeting?

A: We will announce preliminary voting results with respect to each proposal at the Annual Meeting. In accordance with SEC rules, final voting results will be published in a Current Report on Form 8-K within four business days following the Annual Meeting, unless final results are not known at that time, in which case preliminary voting results will be published within four business days of the Annual Meeting and final voting results will be published once we know them.

Q: Where else can I find these proxy materials?

A: This Proxy Statement and the Annual Report are available under "SEC Filings" at ir.deckers.com. Other information contained on or accessed through our website does not constitute part of this Proxy Statement and you should not consider this other information in deciding how to vote your shares. References to our website address in this Proxy Statement are inactive textual references only.

Q: Whom should I contact with other questions?

A: If you have additional questions about this Proxy Statement or the Annual Meeting, or if you would like additional copies of this Proxy Statement, please contact: Deckers Outdoor Corporation, 250 Coromar Drive, Goleta, California 93117, Attention: Corporate Secretary, Telephone: (805) 967-7611.

| | |

|

PROPOSAL NO. 1

ELECTION OF DIRECTORS |

|

Board Characteristics

The Corporate Responsibility, Sustainability & Governance Committee considers many factors when identifying director nominees, including diversity with respect to personal characteristics (such as race, ethnicity, age, gender, and sexual orientation), as well as diversity with respect to experience and skills. We believe directors with diverse backgrounds create a Board that is positioned to best serve our Company, stockholders, employees, and communities by maximizing group dynamics in terms of range of professional experience, education, thought, and personal characteristics. We also value the mix of viewpoints provided by our directors with various levels of tenure, from those with a deep understanding of our business to those with fresh perspectives. Our strong commitment to diversity and inclusion is reflected within the composition of our Board.

A snapshot of certain characteristic of our ten director nominees is depicted in the charts below.

| | | | | | | | |

| BOARD COMMITTEES CHAIRED BY WOMEN | AGE DISTRIBUTION | BOARD REFRESHMENT |

| | |

| 67% | 52-67

61 (Average Age of Director Nominees) | 4 (New Directors Over Past 5 Years) |

| | |

| BOARD CHAIRMAN SUCCESSION | COMMITTEE CHAIR SUCCESSION |

| | |

October 2019 Michael F. Devine, III Appointed Chairman of the Board | October 2019 Cynthia (Cindy) L. Davis, Appointed Talent & Compensation Committee Chair

Lauri M. Shanahan, Appointed Corporate Responsibility, Sustainability & Governance Committee Chair |

June 2020 Juan R. Figuereo, Appointed Audit & Risk Management Committee Chair |

September 2021 Bonita C. Stewart, Appointed Corporate Responsibility, Sustainability & Governance Committee Chair |

Board Structure

Our Bylaws provide for the annual election of directors, and also provide that our Board will consist of not less than one nor more than ten members. The specific number of directors within this range is established by our Board. Our Board has adopted a resolution setting the current number of directors at ten.

At the Annual Meeting, our stockholders will be asked to elect ten directors to serve until the next annual meeting of stockholders to be held in 2024, or until their successors are duly elected and qualified. The names and certain information concerning the persons nominated by our Board to stand for election as directors at the Annual Meeting are set forth in the section of this Proxy Statement titled “Director Nominees” below.

If all director nominees are elected, then, immediately following the Annual Meeting, our Board will consist of ten members, and nine out of ten members of our Board, as well as each member of the Board's three standing committees, will be “independent directors” under applicable SEC and NYSE rules.

No Agreements or Family Relationships with Directors

No arrangement or understanding exists between any of our directors, director nominees, or executive officers and any other person pursuant to which any of them were selected as our director, director nominee, or executive officer.

There are no family relationships among any of our directors, director nominees or executive officers.

No Legal Proceedings

There are no legal proceedings related to any of our directors, director nominees, or executive officers which are required to be disclosed pursuant to applicable SEC rules.

Director Nominations

The Corporate Responsibility, Sustainability & Governance Committee is responsible for identifying and evaluating nominees for election to our Board. In addition to the candidates proposed by our Board or identified by the Corporate Responsibility, Sustainability & Governance Committee, the committee considers candidates for director proposed by stockholders, provided such recommendations are made in accordance with the procedures set forth in our Bylaws. Stockholder nominations that meet the criteria outlined below will receive the same consideration as nominations made by the Corporate Responsibility, Sustainability & Governance Committee.

Director Qualifications

Directors are responsible for overseeing and monitoring our business consistent with their fiduciary duties to our stockholders. This significant responsibility requires highly skilled individuals with various qualities, attributes, skills and professional experience. Our Board believes there are both general requirements for eligibility to serve as a member of our Board that are applicable to all directors, and other specialized characteristics that should be represented on our Board as a whole, but not necessarily by each director.

Qualifications for All Directors

Essential criteria for all director candidates considered by the Corporate Responsibility, Sustainability & Governance Committee include the following:

•Personal and professional integrity;

•Good business judgment;

•Relevant experience and skills;

•Ability to effectively serve the long-term interests of our stockholders; and

•Commitment to devoting sufficient time and energy to diligently performing duties as a director.

Our Board of Directors has nominated the following ten directors for reelection at the Annual Meeting. Important summary information about the director nominees is set forth in the table below, including the committee composition that we anticipate will be effective as of the date of the Annual Meeting. Following the table is certain biographical information about each director nominee, as well as selected information about the specific qualifications, attributes, skills, and experience that led our Board to conclude that each director nominee is qualified to serve on our Board. For information regarding committee composition as of the date of this Proxy Statement, please refer to the section titled "Corporate Governance--Board Committees."

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Committee Membership Following the Annual Meeting(1) |

Name,

Primary Occupation | Age | Director

Since | Independent | Number of Other Public Company Directorships | AR(2) | TC(2) | CG(2) |

| | | | | | | |

| Michael F. Devine, III | 64 | 2011 | YES | 1 | | | |

Corporate Director Chairman of our Board of Directors |

| David A. Burwick | 61 | 2021 | YES | 1 | | l | |

| President, Chief Executive Officer, Board Member, Boston Beer Company |

| Nelson C. Chan | 62 | 2014 | YES | 2 | l | | l |

| Private Investor, Entrepreneur and Corporate Director |

| Cynthia (Cindy) L. Davis | 61 | 2018 | YES | 2 | |

ª

| l |

| Corporate Director |

| Juan R. Figuereo | 67 | 2020 | YES | 2 |

ª

| | |

| Corporate Director |

| Maha S. Ibrahim | 52 | 2021 | YES | None | l | | |

| General Partner, Canaan Partners |

| Victor Luis | 56 | 2020 | YES | 1 | | l | |

| Corporate Director |

| Dave Powers | 57 | 2016 | NO | 1 | | | |

| Chief Executive Officer and President |

| Lauri M. Shanahan | 60 | 2011 | YES | 2 | l | | l |

| Corporate Director |

| Bonita C. Stewart | 66 | 2014 | YES | 1 | | l | ª |

| Board Partner, Gradient Ventures |

ª Committee Chair

(1) Subject to the reelection of each director nominee at the Annual Meeting.

(2) AR: Audit & Risk Management Committee, TC: Talent & Compensation Committee, CG: Corporate Responsibility, Sustainability & Governance Committee

| | | | | | | | |

| MICHAEL F. DEVINE, III | | |

Age: 64 Director Since: 2011 | |

| Chairman of our Board | Public Company Directorships: FIVE Below, Inc. (NYSE: FIVE) |

Mr. Devine previously served as a director and member of the audit committee of Express, Inc. (NYSE: EXPR) and currently serves as director and member of the audit committee and chair of the compensation committee at FIVE Below, Inc. (Nasdaq: FIVE). Mr. Devine retired as executive vice president and chief financial officer of Coach, Inc. in 2011. He served as a member of

the board of Sur La Table, Inc. and was previously a member of the board of directors of The Talbots Inc. From 2004 to 2007, Mr. Devine served as a member of the board of directors and chair of the audit committee of Educate, Inc., a leading K-12 education service company with solutions such as Sylvan Learning Center. Mr. Devine also previously served as a director and member of the audit committee of NutriSystem, Inc. (Nasdaq: NTRI).

Selected Qualifications and Skills

•High Level of Financial Literacy - In addition to experience as the current and former member and chair of four audit committees and experience at Coach, Inc., served as chief financial officer and vice president-finance of Mothers Work, Inc., a maternity apparel retailer that was previously listed on Nasdaq, from February 2000 to November 2001. From 1997 to 2000, was chief financial officer of Strategic Distribution, Inc. (Nasdaq: STRD), a Nasdaq-listed industrial store operator. From 1995 to 1997, was chief financial officer at Industrial System Associates, Inc., and for the prior six years was the director of finance and distribution for McMaster-Carr Supply Company. Holds a B.S. in Finance and Marketing from Boston College and an M.B.A. in Finance from the Wharton School of the University of Pennsylvania.

•Public Company Executive - Experience at Coach, Inc. involved in managing a public company during a period of high growth. Serves as a corporate director and chair of the audit committees of Express, Inc. and FIVE Below, Inc.

•Compliance and Risk Oversight - 17 years of experience as a corporate director with risk oversight responsibilities.

•Premium Branding - Coach, Inc. is a leading marketer of modern classic American accessories.

•International - Involved in a global brand with worldwide operations while at Coach, Inc.

•Industry - In addition to experience at Coach, Inc., serves as a director of Express, Inc., a nationally recognized specialty apparel and accessory retailer offering women’s and men’s merchandise.

•Supply Chain Management and Retail - Involved in supply chain and wholesale and retail distribution channels while at Coach, Inc.

| | | | | | | | |

| DAVID A. BURWICK | | |

Age: 61 Director Since: 2021 | |

Board Committees: Talent & Compensation | Public Company Directorships: The Boston Beer Company, Inc. (NYSE: SAM) |

Mr. Burwick has served on the board of directors of The Boston Beer Company, Inc. (NYSE: SAM) since May 2005 and was appointed as its president and chief executive officer in April 2018. Prior to April 2018, Mr. Burwick served as president and chief executive officer of Peet's Coffee & Tea, Inc., since December 2012. From April 2010 to December 2012, Mr. Burwick served as president, North America of WW International, Inc., formerly Weight Watchers International, Inc. Prior to that, Mr. Burwick held numerous positions with PepsiCo, Inc., including chief marketing officer, PepsiCo Americas Beverages from August 2008 to August 2009; executive vice president, Marketing, Sales and R&D, PepsiCo International from April 2008 to July 2008; President, Pepsi-QTG Canada from January 2006 to March 2008; chief marketing officer, Pepsi-Cola North America from June 2002 to December 2005; and various marketing roles from 1989 to 2002. Mr. Burwick has extensive experience leading consumer products organizations. During Mr. Burwick's tenure as a director of The Boston Beer Company, Inc., he has served as chair and as a member of its compensation committee, and as chair and as a member of the nominating/governance committee.

Selected Qualifications and Skills

•Premium Branding - Experience as an executive at Peet's Coffee & Tea, Inc., PepsiCo. Inc. and The Boston Beer Company, Inc.

•Public Company Executive - Extensive experience with several leading public and private companies, both as an executive and as a director.

•Sales and Marketing - Held key marketing and sales positions with PepsiCo. Inc., including chief marketing officer.

•Human Resources - Held executive positions with leading companies and is a member of the compensation committee and nominating/governance committee of The Boston Beer Company, Inc.

•Retail - Previously served as president and chief executive officer at Peet's Coffee & Tea, Inc., WW International, Inc. and PepsiCo, Inc.

| | | | | | | | |

| NELSON C. CHAN | | |

Age: 62 Director Since: 2014 | |

Board Committees: Audit & Risk Management Corporate Responsibility, Sustainability & Governance | Public Company Directorships: Synaptics, Inc. (Nasdaq: SYNA) Twist Bioscience Corporation (Nasdaq: TWST) |

Mr. Chan is a private investor and entrepreneur. Mr. Chan is a director and member of the nominating and corporate governance and audit committee of Twist Bioscience Corporation (Nasdaq: TWST), as well as chairman of the board and member of the audit committee and nominations and corporate governance committee of Synaptics, Inc. (Nasdaq: SYNA). He was chairman of the board, chair of the compensation committee, member of the audit committee and member of the nominating and corporate governance committee of Adesto Technologies Corporation (Nasdaq: IOTS). From 2016 to 2019, Mr. Chan served as a director and member of the compensation and nominating and governance committees of Socket Mobile, Inc. (Nasdaq: SCKT). From 2006 to 2008, he served as chief executive officer of Magellan Corporation, and from 1992 to 2006, he served in various management positions with SanDisk Corporation. Mr. Chan is also a director of several privately held companies.

Selected Qualifications and Skills

•Entrepreneurial - Expertise in building technology companies.

•High Level of Financial Literacy - Has held numerous senior management positions with leading companies, including chief executive officer at Magellan Corporation.

•Public Company Executive - Extensive experience with several leading public and private companies, both as an executive and as a director.

•Sales and Marketing - Held key sales, marketing and engineering positions at SanDisk Corporation, Chips and Technologies, Signetics and Delco Electronics.

•International - Served as the executive vice president and general manager of consumer business at SanDisk Corporation, a global multi-billion dollar company.

•Compliance and Risk Oversight - Currently serves as a member of our Audit & Risk Management Committee and has over 14 years of experience as a corporate director with risk oversight responsibilities.

•Technology Infrastructure and Cybersecurity - Extensive experience in technology-based companies including sales, marketing and engineering.

| | | | | | | | |

| CYNTHIA (CINDY) L. DAVIS | | |

Age: 61 Director Since: 2018 | |

Board Committees: Talent & Compensation (Chair) Corporate Responsibility, Sustainability & Governance | Public Company Directorships: Kennametal Inc. (NYSE: KMT) Brinker International, Inc. (NYSE: EAT) |

Ms. Davis currently serves as a member of the board of directors and is the chair of the compensation and human capital committee and member of the nominating and governance committee of Kennametal Inc. (NYSE: KMT), a global supplier of tooling, engineering components. In January 2019, she joined the board of directors and currently chairs the governance committee and is a member of the compensation committee of Brinker International, Inc. (NYSE: EAT). Prior to 2019, Ms. Davis served as a member of the board of directors, as chair of the compensation committee and on the governance committee of Buffalo Wild Wings, Inc. (Nasdaq: BWLD), a casual dining restaurant and sports bar chain, from 2015 to 2018. Ms. Davis served as vice president of NIKE, Inc. (NYSE: NKE) and president of Nike Golf at NIKE, Inc. from 2008 to 2014, and as U.S. general manager at Nike Golf from 2005 to 2008. Prior to NIKE, Inc., Ms. Davis served as senior vice president of golf sponsorships, sports marketing and new media at Golf Channel, a subsidiary of Comcast Corporation (Nasdaq: CMCSA), from 2001 to 2004. She is a Trustee for the Board of Trustees at Furman University.

Selected Qualifications and Skills

•Premium Branding - Experience as vice president of NIKE, Inc. and president of Nike Golf at NIKE, Inc., a company engaged in the design, development, manufacturing, and worldwide marketing and sales of footwear, apparel, equipment, accessories, and services.

•Sales and Marketing; Retail - In addition to leading the division’s sales, marketing, and strategy while serving as senior vice president of golf sponsorships, sports marketing and new media at Golf Channel, led the $800 million global golf business for NIKE, Inc.

•High Level of Financial Literacy - Served on the audit committee of Kennametal Inc. Holds an M.B.A. in Marketing and Finance from the University of Maryland College Park. Oversaw the profit and loss of a separate operating unit within NIKE, Inc.

•International - Involved in global brands with worldwide operations while at NIKE, Inc. and Kennametal Inc.

•Public Company Executive - Held various executive management positions at NIKE, Inc. and Golf Channel, currently serves as a director of Kennametal Inc. and Brinker International, Inc., and previously served as a director and chair of the compensation committee of Buffalo Wild Wings, Inc.

•Industry - Extensive experience in the footwear, apparel and equipment industries through various positions at NIKE, Inc.

•Compliance and Risk Oversight - In addition to leadership roles at NIKE, Inc., served as a corporate director on the audit committee and serves on the compensation and nominating and corporate governance committees of Kennametal, Inc., and serves on the board of directors, as well as the compensation and corporate governance committees, of Brinker International, Inc. Previously served as chair of the compensation committee and on the governance committee of Buffalo Wild Wings.

•Technology Infrastructure and Cybersecurity - Serves as a director and chair of the compensation and human capital committee and member of the nominating and governance committee of Kennametal Inc., a technology-based company.

| | | | | | | | |

| JUAN R. FIGUEREO | | |

Age: 67 Director Since: 2020 | |

Board Committees: Audit & Risk Management (Chair)

| Public Company Directorships: Western Alliance Bancorporation (NYSE: WAL) Diversey, Inc. (Nasdaq: DSEY) |

Mr. Figuereo currently serves as a director and member of the finance and investment committee and chair of the audit committee of Western Alliance Bancorporation (NYSE: WAL). In April 2021, he joined the board of directors and currently serves as chair of the audit committee and member of the nominating and corporate governance committee of Diversey, Inc. (Nasdaq: DSEY). Mr. Figuereo served as the executive vice president and chief financial officer of Revlon (NYSE: REV), a manufacturer and marketer of beauty and personal care products, from 2016 to 2017. From 2012 to 2015, he served as executive vice president and chief financial officer of NII Holdings, Inc. (NASDAQ: NIHD), a wireless communication services provider under the Nextel brand. NII Holdings, Inc. filed for bankruptcy protection in New York, New York on September 15, 2014. From 2009 to 2012, Mr. Figuereo served as executive vice president and chief financial officer of Newell Brands (NYSE: NWL), a global marketer of consumer and commercial products, and from 2007 to 2009 he served as executive vice president and chief financial officer of Cott Corporation (NYSE: PRMW). Mr. Figuereo has also served in senior management positions at Walmart, Inc. (NYSE: WMT) and PepsiCo, Inc. (Nasdaq: PEP). Mr. Figuereo served as a director and chair of the audit committee at PVH Corp. (NYSE: PVH), a leading apparel company with iconic brands such as Calvin Klein and Tommy Hilfiger in its portfolio. Mr. Figuereo is a venture partner with Ocean Azul Partners, LLC, an early stage investments fund based in South Florida. He is a member of the National Association of Corporate Directors and of the Florida Institute of CPAs.

Selected Qualifications and Skills

•Public Company Executive - Previously served as chief financial officer of several public companies with global footprints, including Revlon and Newell Brands, and held executive leadership roles at Walmart, Inc. and PepsiCo, Inc.

•High Level of Financial Literacy - Served as chief financial officer of several public companies and as chair of the audit committee of PVH Corp. Serves as the chair of the audit committee of Western Alliance Bancorporation and Diversey Inc. In addition, he serves as a member of the Audit & Risk Management Committee of our Company. Holds a B.B.A. from Florida International University, and previously worked for eight years as a certified public accountant.

•International - Significant executive leadership experience supporting global brands with worldwide operations.

•Supply Chain Management - Extensive experience in worldwide supply chain operations while in management roles for global companies.

•Sales and Marketing; Retail - Served as executive vice president of several global marketers, including Revlon and Newell Brands, and held senior management positions at Walmart, Inc. and PepsiCo, Inc.

•Mergers and Acquisitions - Previously served as the vice president in charge of mergers and acquisitions at Walmart, Inc.

| | | | | | | | |

MAHA S. IBRAHIM | | |

Age: 52 Director Since: 2021 | |

Board Committees: Audit & Risk Management | Public Company Directorships: None |

Ms. Ibrahim is currently a general partner of Canaan Partners, an early stage venture capital firm, where she has worked since March 2000. Prior to joining Canaan Partners, from 1998 to 2000 she served as vice president of e-business at Qwest Communications, where she architected the company’s e-business strategy and spearheaded the redesign of Qwest.com, and previously served as Qwest Communication’s vice president of business development. From 2012 through 2020, Ms. Ibrahim served as a member of the board of directors of The RealReal, Inc. (Nasdaq: REAL), an online brick-and-mortar marketplace for authenticated luxury consignment, providing leadership to the company through its 2019 initial public offering. Ms. Ibrahim currently serves on the boards of directors of a number of private innovative enterprise and consumer companies. Further, she has served as a trustee for the Carnegie Endowment for International Peace, a foreign policy think tank, since 2017.

Selected Qualifications and Skills

•Industry - Extensive experience in the apparel industry through her experience on the board of The RealReal, Inc.

•Premium Branding - Premium branding experience in the luxury consignment business during her time as a director of RealReal, Inc.

•Consumer Technology/Big Data - Served as vice president of e-business at Qwest Communications.

•Sales and Marketing; Retail - Served as vice president of business development at Qwest Communications.

•Technology Infrastructure and Cybersecurity - Extensive experience in wireless and telecommunications industries.

•Mergers and Acquisitions – Experience with mergers and acquisitions while serving as general partner of Canaan Partners.

•Corporate Responsibility - Served on the board of The RealReal, Inc. a sustainable luxury company that promotes the re-circulation of products across the multi-billion dollar fashion industry and experience serving on the board of a private luxury brand company that has implemented a sustainability program and related initiatives.

| | | | | | | | |

| VICTOR LUIS | | |

Age: 56 Director Since: 2020 | |

Board Committees: Talent & Compensation

| Public Company Directorships: FarFetch (NYSE: FTCH) |

Mr. Luis joined the board of directors of FarFetch Limited (NYSE: FTCH) in August 2020 and currently serves on the audit committee and as chair of the nominating and corporate governance committee. He served as the chief executive officer and on the board of directors of Tapestry, Inc. (formerly known as Coach, Inc.) (NYSE: TPR) from 2014 to 2019, where he led the company’s transformation into Tapestry Inc., a New York-based house of modern luxury brands including Coach, Kate Spade and Stuart Weitzman. Mr. Luis joined Coach, Inc. in 2006 as president and chief executive officer of Coach Japan. He rapidly assumed additional leadership responsibilities across Asia and Europe, becoming chief commercial officer of Coach, Inc. in 2013 and chief executive officer in 2014. Prior to joining Coach, Inc., from 2002 to 2006, Mr. Luis was president and chief executive officer of Baccarat, Inc., where he ran the North American operation of the French luxury brand. Mr. Luis joined the Moët-Hennessy Louis Vuitton Group in 1995, ultimately advancing to president and chief executive officer of its subsidiary, Givenchy, Japan Incorporated, before leaving in 2002.

Selected Qualifications and Skills

•International - Significant experience in managing multi-national teams while at Coach, Inc. and Moët-Hennessy Louis Vuitton Group.

•Retail - Previously served as chief executive officer of several global luxury retailers.

•Premium Branding - Premium global branding experience spanning over two decades as chief executive officer of Tapestry, Inc., overseeing its modern luxury brands, and as chief executive officer of Baccarat, Inc. and Givenchy, Japan Incorporated.

•Industry - Experience in footwear, apparel and accessories while on the board of Tapestry, Inc. with the brands Coach, Kate Spade and Stuart Weitzman.

•Public Company Executive - Executive management experience, including service as chief executive officer of publicly traded companies.

| | | | | | | | |

| DAVE POWERS | | |

Age: 57 Director Since: 2016 | |

Executive Positions: Chief Executive Officer and President

| Public Company Directorships: Solo Brands, Inc. (NYSE: DTC)

|

Mr. Powers became our Chief Executive Officer in June 2016 and joined our Board at that time. Mr. Powers joined our Company as President of Direct-to-Consumer in August 2012. He was appointed President of Omni-Channel in January 2014 and was appointed President in March 2015. Prior to joining our Company, Mr. Powers held several executive leadership roles at Converse Inc. (a subsidiary of NIKE, Inc.), Timberland LLC and Gap Inc. (NYSE: GPS). In May 2022, he joined the board of directors and currently serves on the audit committee of Solo Brands, Inc. (NYSE: DTC).

Selected Qualifications and Skills

•Industry - Extensive experience in the footwear and apparel industry through a variety of positions at three different footwear companies and a global apparel retailer.

•Supply Chain Management; Retail - As part of the NIKE, Inc. retail leadership team, was responsible for Converse Inc.'s global owned and distributor Direct-to-Consumer operations. During tenure at Timberland LLC and Gap Inc., held leadership roles with a variety of retail responsibilities from merchandising to store design.

•Sales and Marketing - Graduated cum laude from Northeastern University with a B.S. in Marketing. Throughout his career, has been responsible for the development of marketing strategy, with a focus on consumer engagement and

digital marketing. While President of Brands of our Company, led the Omni-Channel organization, elevating and advancing the Omni-Channel platform.

•International - While serving in leadership roles at Timberland LLC, led worldwide retail merchandising, marketing, visual and store design, and oversaw European retail operations.

•Public Company Executive - Serves as our Chief Executive Officer and President with global responsibilities and oversight. Other leadership roles have been with public companies.

| | | | | | | | |

| LAURI M. SHANAHAN | | |

Age: 60 Director Since: 2011 | |

Board Committees: Audit & Risk Management Corporate Responsibility, Sustainability & Governance | Public Company Directorships: Treasury Wine Estates Limited (ASX: TWE) CAVA Group, Inc. (NYSE: CAVA) |

Ms. Shanahan has over 25 years of senior-level experience in retail, consumer products and hospitality, ranging from global, multi-channel, multi-brand enterprises to small and mid-cap growth companies. In June 2023, she joined the board of directors and is the chair of the people, culture and compensation committee of CAVA Group Inc. (NYSE: CAVA). She serves on the board of directors, and chair of the human resources committee of Treasury Wine Estates Limited (ASX: TWE), a vertically integrated global wine business with over 70 brands. She joined Gap Inc. in 1992 and served in numerous leadership roles, including chief administrative officer and chief legal officer, during her 16-year career with the company. Since then, she has served as a principal of Maroon Peak Advisors, a consumer products and retail consulting firm.

Selected Qualifications and Skills

•Public Company Executive - Joined Gap Inc. in 1992 and served for 16 years in numerous leadership roles including chief administrative officer, chief legal officer and corporate secretary and chairman of the foundation board. Gap Inc. is a leading global specialty retailer offering clothing, footwear, accessories, and personal care products for men, women, children, and babies under the Gap, Banana Republic, Old Navy, and Athleta brands.

•International - Directly involved in global brand development, supply chain and worldwide operations while at Gap Inc. and as a director and consultant.

•Supply Chain Management and Retail - Involved in retail, franchise, online licensing and other distribution channels, as well as sourcing and supply chain, while at Gap Inc. and as a consultant.

•Sales and Marketing - Acquired sales and marketing experience throughout her career at Gap Inc. and as director and consultant.

•Industry - Experience in footwear, apparel and accessories at Gap Inc., Charlotte Russe Holdings, Inc. and through consulting firm.

•Premium Branding - Premium and luxury branding experience at Gap Inc., through serving on the board of Treasury Wine Estates Limited and through retail consulting firm.

•Compliance and Risk Oversight - In addition to other leadership roles at Gap Inc., served as chief compliance officer and chief legal officer, overseeing the global corporate risk committee, as well as the global governance and compliance organization.

•Corporate Responsibility - While at Gap Inc., led development and oversight of global strategy, organization and execution of comprehensive social and environmental programs involving product development, supply chain, stakeholder engagement and employee and consumer-facing initiatives. Was president of Gap Inc. Foundation and also led government affairs and public policy.

| | | | | | | | |

| BONITA C. STEWART | | |

Age: 66 Director Since: 2014 | |

Board Committees: Corporate Responsibility, Sustainability & Governance (Chair) Talent & Compensation | Public Company Directorships: PagerDuty, Inc. (NYSE: PD)

|