UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

LETTER TO OUR SHAREHOLDERS

FROM OUR LEAD INDEPENDENT TRUSTEE AND OUR CHAIRMAN AND CEO

April 8, 2024

515 N. Flagler Drive, Suite 408, West Palm Beach, FL 33401

(212) 692-7200

Dear Fellow Shareholders:

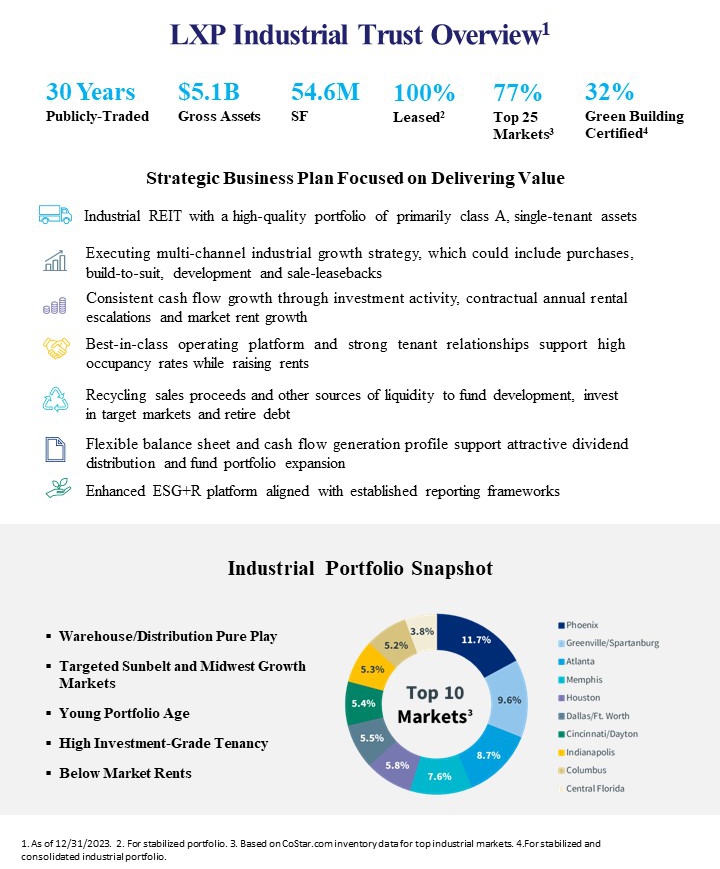

LXP delivered strong operating results in 2023 with notable accomplishments in leasing and development, dispositions and leverage reduction. Our portfolio transformation is substantially complete, which has resulted in a pure-play industrial REIT focused on primarily single-tenant, Class A warehouse/distribution properties with strong income and capital appreciation potential. Our properties are concentrated primarily in key growth markets in the Sunbelt and Midwest that are benefiting from long-term demographic trends. We are confident LXP has the best strategy to drive long-term growth and value creation.

Fiscal 2023 Highlights

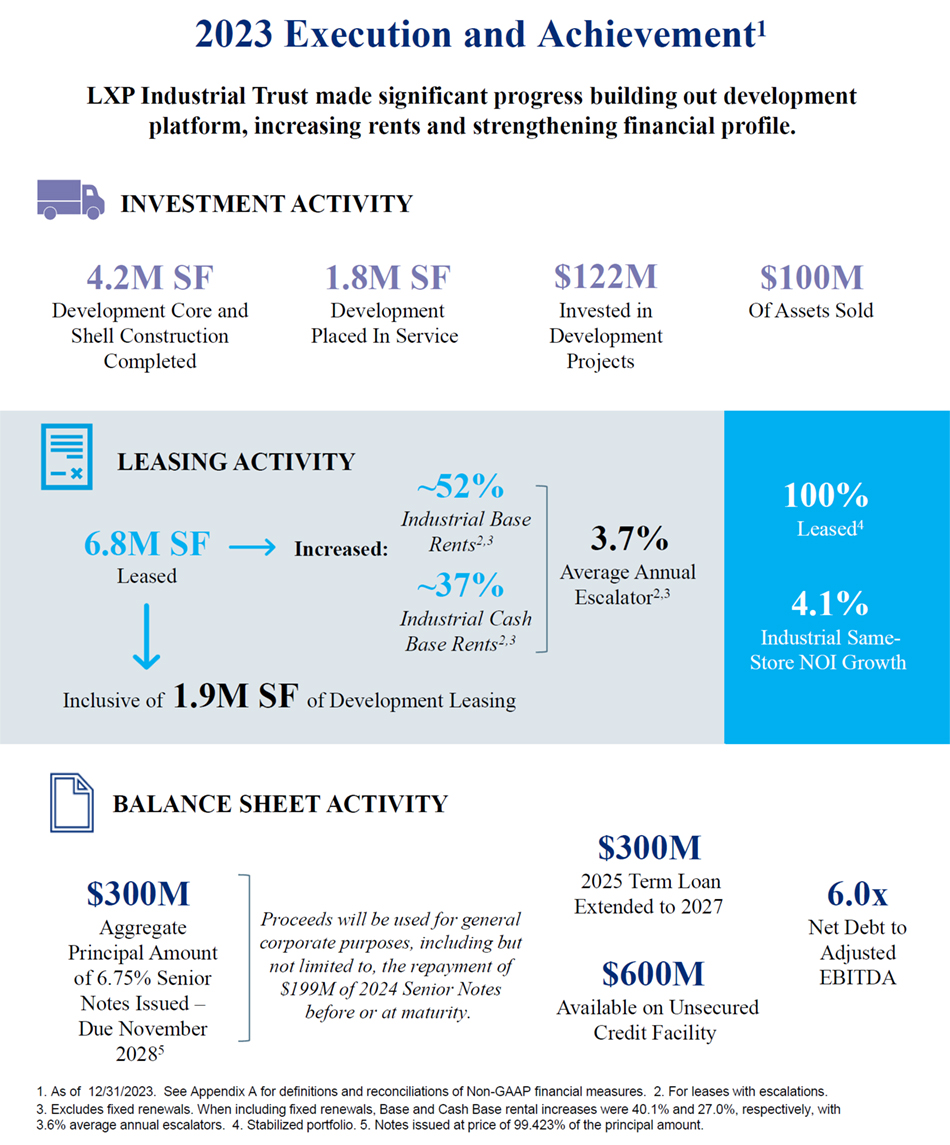

Our 2023 performance reflects considerable progress in our key business areas and further enhances the strong platform we have built. We delivered same-store NOI growth of 4.1% largely driven by our robust leasing momentum. We completed 6.8 million square feet of industrial new leases and lease extensions at attractive Base and Cash Base rental increases of approximately 52.3% and 37.3%, respectively, excluding fixed-rate renewals. This execution highlights the value in our investment strategy and the demand for our high-quality assets. Additionally, our stabilized industrial portfolio was 100% leased at year-end, representing a significant milestone for our business and one that would have been difficult to achieve had we remained invested in office assets.

We also continued to execute on our development pipeline. In 2023, we invested $122.1 million in development projects, including the completion of the base building construction of seven new warehouse/distribution facilities totaling 4.2 million square feet, which further expanded our footprint in our target markets.

We disposed of additional non-industrial assets and ended the year with two remaining office assets. These office assets are currently under contract for sale this year, and, once the sale is completed, our consolidated portfolio will essentially be 100% industrial.

On the capital markets side, we took advantage of the bond and term loan markets and effectively extended our consolidated maturities to 2027. At year-end, our net-debt to Adjusted EBITDA was 6.0 times, which is an improvement from year-end 2022.

As we look ahead, we believe LXP is well positioned for strong performance with the combination of low new spec construction starts and expected interest rate cuts in 2024 that could be very beneficial for our business. Furthermore, we believe the building blocks to increased revenue growth in our portfolio are strongly in our favor, including average annual fixed rental escalations of 2.6%, rents on leases expiring through 2029 estimated to be 23% below market and occupancy gains in our development portfolio.

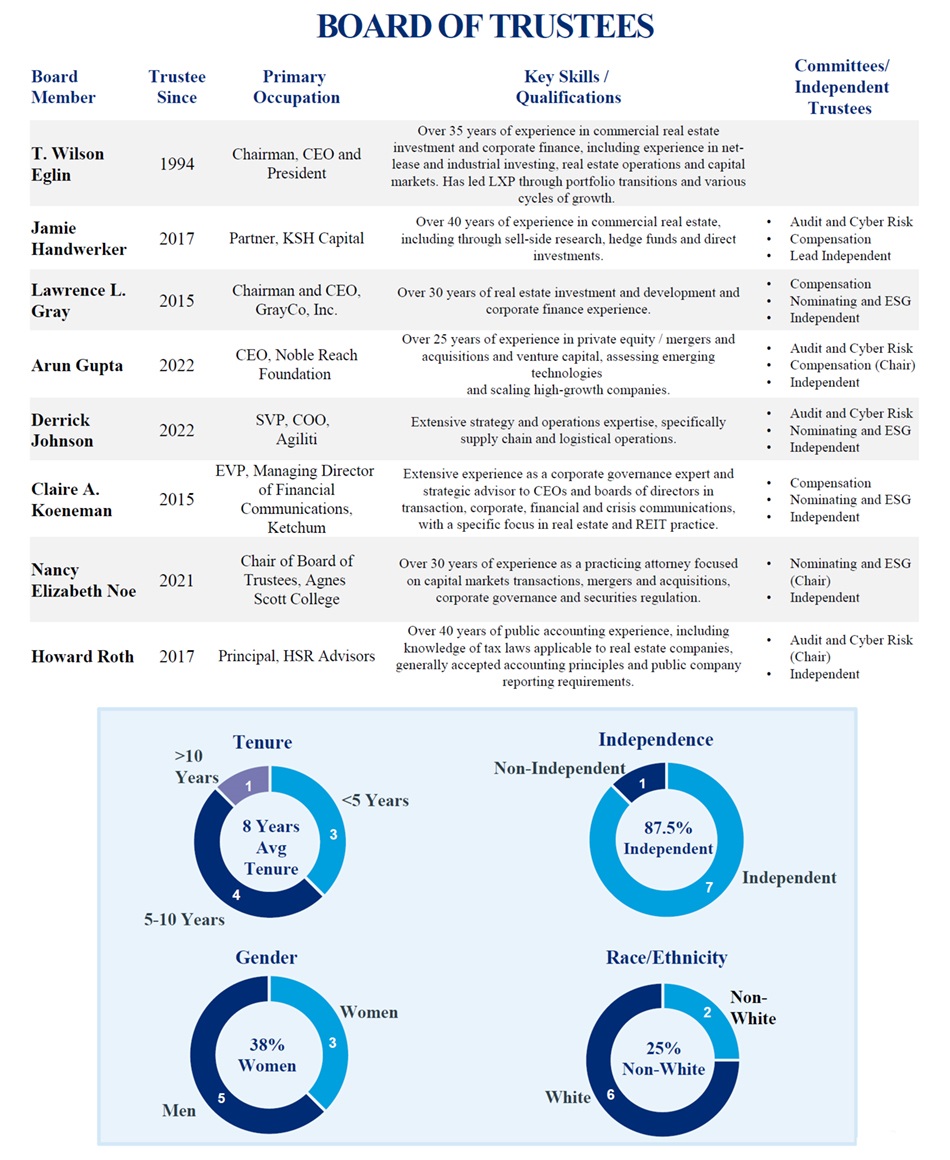

Highly Skilled, Engaged and Refreshed Board

Our highly engaged and skilled Board of Trustees encompasses expertise relevant to the Company’s strategy, including real estate investment, supply chain and logistics, information technology and business development. We have a strong track record of refreshing the Board with diverse trustees that further enhance the skillset of our Board. Since 2017, we have appointed five new independent trustees and Jamie Handwerker was appointed as our lead independent trustee in May 2023. As part of our ongoing committee refreshment, in 2023, we rotated Board committee leadership

roles by appointing Elizabeth Noe as Nominating and ESG Committee Chair and Arun Gupta as Compensation Committee Chair. We thank Claire Koeneman and Lawrence Gray for their committee leadership and look forward to Elizabeth and Arun’s continued contributions to the Board in their new roles.

ESG+R Advancements

We continue to grow our environmental, social, governance and resilience (“ESG+R”) program, which is aligned with our business goals and commitment to shareholder value creation. In 2023, our ESG+R priorities focused on increasing renewable energy across the portfolio, engaging with tenants to assess incorporating sustainability clauses into leases and advancing employees training and professional development opportunities. At year-end 2023, over 17 million square feet, or 32%, of our consolidated industrial properties were green building certified. Our continued progress has been reflected in our improved 2023 GRESB® Real Estate Assessment score and 2023 tenant satisfaction survey that exceeded the Kingsley Index’s overall satisfaction rate.

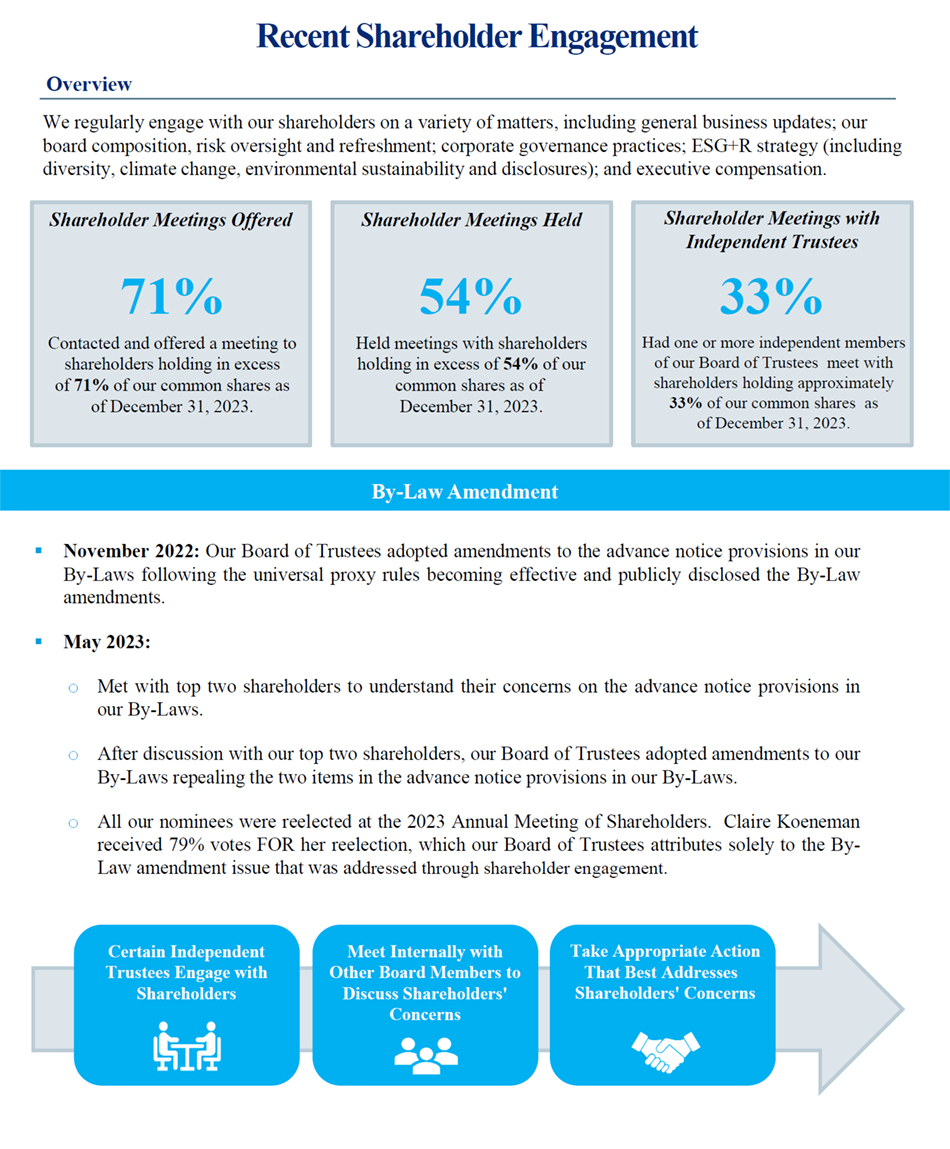

Continuous and Valuable Shareholder Engagement

Regular shareholder engagement is important to us and integral to LXP’s success. In 2023, we held 123 meetings with potential shareholders and shareholders representing 54% of our outstanding shares as of December 31, 2023, to discuss a variety of topics, including business updates, board composition, risk oversight and refreshment, corporate governance, ESG+R strategy and executive compensation. We also enhanced the advance notice provision in the Company’s bylaws to reflect the interests of our shareholders. As regular shareholder engagement and feedback helps inform our strategy and advance our collective goal of driving shareholder value, we look forward to our continued engagement.

Setting a Course for Value Creation

Through our portfolio transformation, we have built the foundation for long-term income growth and capital appreciation. In 2024 we will focus on further deleveraging of the Company’s balance sheet, delivering strong mark-to market leasing outcomes, leasing our remaining development pipeline and exploring build-to-suit investments to prudently expand our portfolio. We believe that these steps will position us to accelerate NOI growth and deliver consistent shareholder returns in the years ahead.

On behalf of the Board of Trustees, we thank you for your interest in LXP and support on the matters contained in this proxy statement.

Sincerely,

|

|

Jamie Handwerker Lead Independent Trustee |

T. Wilson Eglin Chairman and CEO |

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS

WHEN: Tuesday, May 21, 2024, 2:00 p.m. Eastern Time

WHERE: Virtually via the internet at https://meetnow.global/MM6K9CF

To the Shareholders of LXP Industrial Trust:

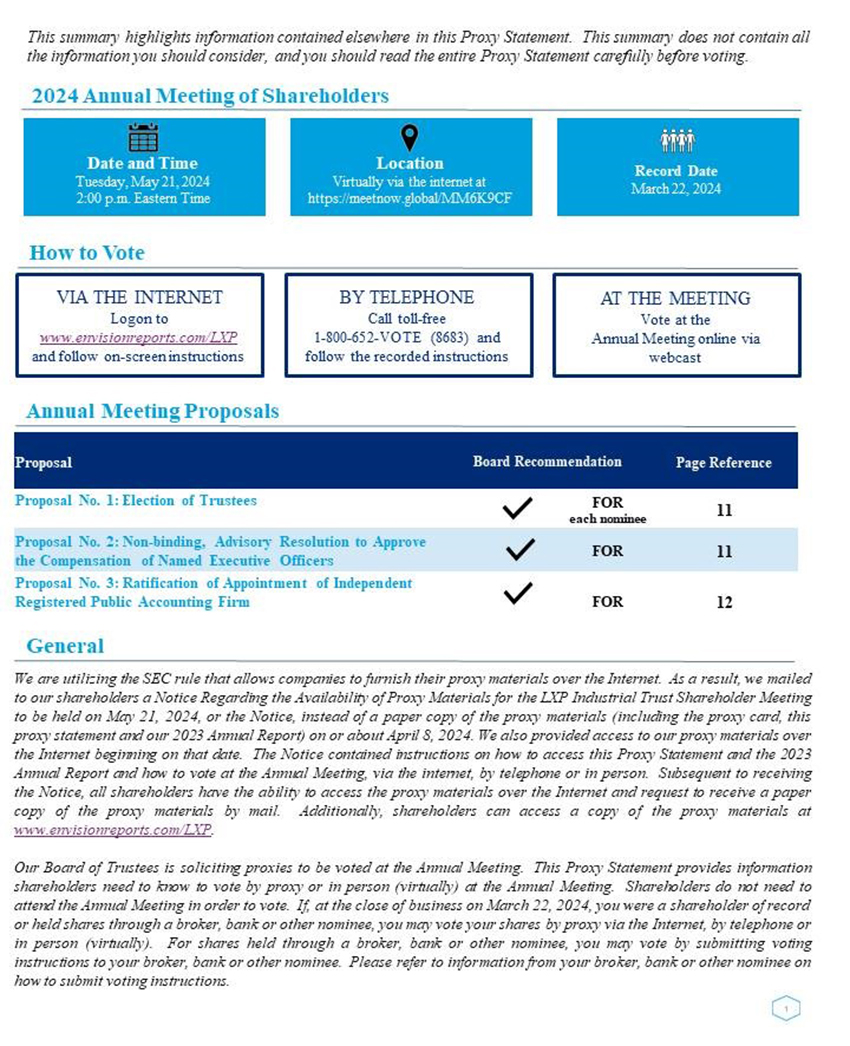

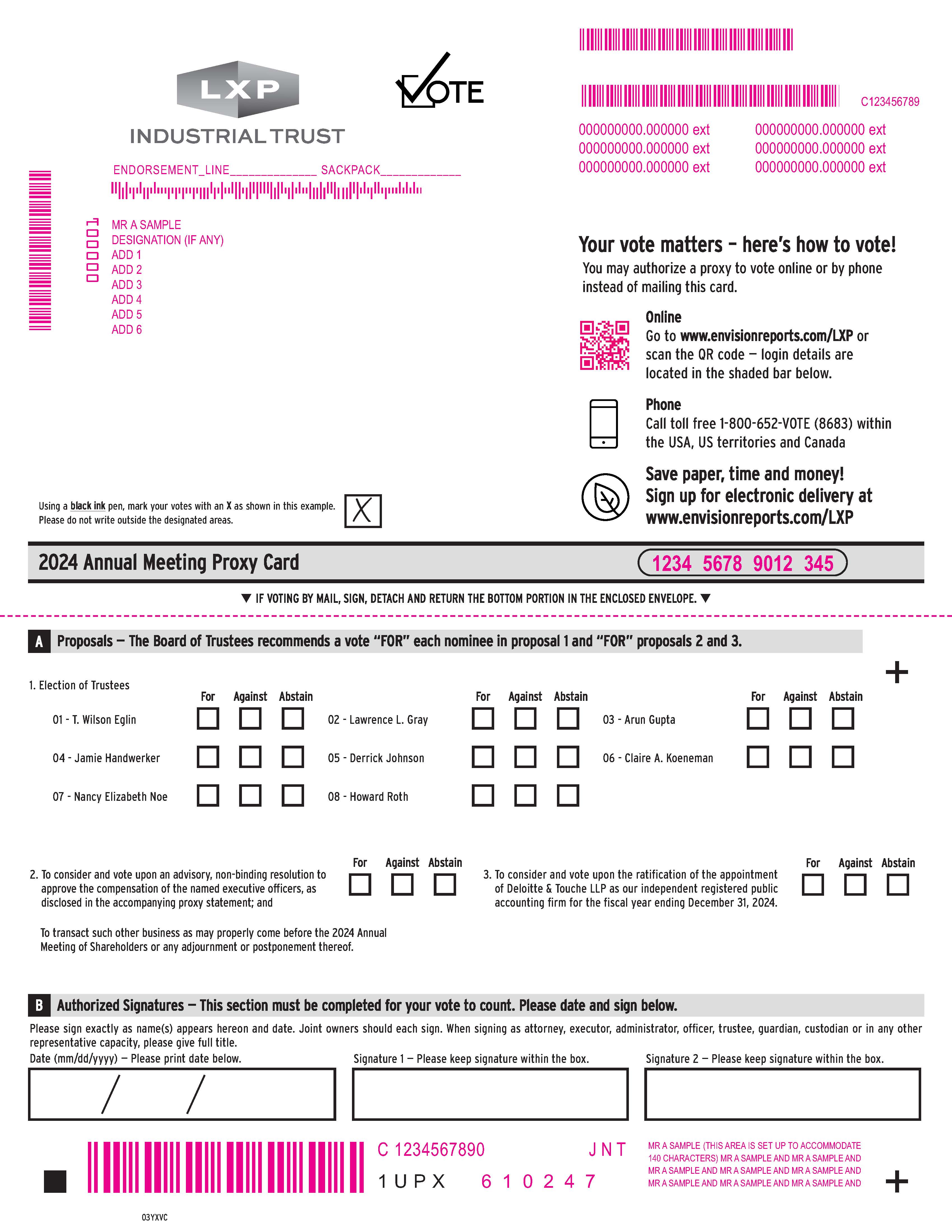

The 2024 Annual Meeting of Shareholders of LXP Industrial Trust, a Maryland real estate investment trust, will be held on Tuesday, May 21, 2024, at 2:00 p.m., Eastern time, virtually via the internet at https://meetnow.global/MM6K9CF for the following purposes:

| (1) | to elect eight trustees to serve until the 2025 Annual Meeting of Shareholders or their earlier removal or resignation and until their respective successors, if any, are elected and qualify; |

| (2) | to consider and vote upon an advisory, non-binding resolution to approve the compensation of the named executive officers, as disclosed in the accompanying proxy statement; |

| (3) | to consider and vote upon the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024; and |

| (4) | to transact such other business as may properly come before the 2024 Annual Meeting of Shareholders or any adjournment or postponement thereof. |

Only holders of record at the close of business on March 22, 2024 are entitled to notice of and to vote at the 2024 Annual Meeting of Shareholders or any adjournment or postponement thereof.

On behalf of our Board of Trustees, we thank you for your support and participation.

By Order of the Board of Trustees,

|

Joseph S. Bonventre, Secretary

West

Palm Beach, FL

April 8, 2024

Whether or not you expect to participate at the 2024 Annual Meeting of Shareholders, we urge you to authorize your proxy electronically via the Internet or by completing and returning the proxy card if you requested paper proxy materials. Voting instructions are provided in the Important Notice Regarding the Availability of Proxy Materials for the LXP Industrial Trust Shareholder Meeting to be Held on May 21, 2024 (the “Notice”), or, if you requested printed materials, the instructions are printed on your proxy card and included in the accompanying proxy statement. Any person giving a proxy has the power to revoke it at any time prior to the meeting and shareholders who participate in the meeting may withdraw their proxies and vote in person via webcast.

PROXY STATEMENT

FOR THE 2024 ANNUAL MEETING OF SHAREHOLDERS TO BE HELD MAY 21, 2024

The Board of Trustees of LXP Industrial Trust, a Maryland real estate investment trust, is soliciting proxies to be voted at the 2024 Annual Meeting of Shareholders, which we refer to herein as the Annual Meeting. The Annual Meeting will be held Tuesday, May 21, 2024, at 2:00 p.m., Eastern time, virtually via the internet at https://meetnow.global/MM6K9CF. This proxy statement summarizes the information you need to know to vote by proxy or in person via webcast at the Annual Meeting or any postponements or adjournments thereof. You do not need to attend the Annual Meeting in person via webcast in order to have your shares voted at the Annual Meeting.

All references to the “Trust,” “Company,” “LXP,” “we,” “our” and “us” in this proxy statement mean LXP Industrial Trust. All references to “Shareholder” and “you” refer to a holder of shares of beneficial interest, par value $0.0001 per share, of the Company, classified as “Common Stock,” which we refer to as common shares or shares, as of the close of business on March 22, 2024, which we refer to as the Record Date.

1

TABLE OF CONTENTS

2

LXP Proxy Statement Summary

3

LXP Proxy Statement Summary

4

LXP Proxy Statement Summary

5

LXP Proxy Statement Summary

6

LXP Proxy Statement Summary

7

LXP Proxy Statement Summary

8

LXP Proxy Statement Summary

9

LXP Proxy Statement Summary

10

PROPOSALS

PROPOSAL NO. 1 ELECTION OF TRUSTEES

Our Board of Trustees currently consists of eight trustees and no vacancies. All our current trustees are nominated for election at the Annual Meeting.

| Trustee Name | Age | Independent | Lead Trustee | Audit and Cyber Risk | Compensation | Nominating and ESG | ||||||

| T. Wilson Eglin | 59 | |||||||||||

| Lawrence L. Gray | 59 | ✓ | ✓ | ✓ | ||||||||

| Arun Gupta | 55 | ✓ | ✓ | C | ||||||||

| Jamie Handwerker | 63 | ✓ | ✓ | ✓ | ✓ | |||||||

| Derrick Johnson | 54 | ✓ | ✓ | ✓ | ||||||||

| Claire A. Koeneman | 54 | ✓ | ✓ | ✓ | ||||||||

| Nancy Elizabeth Noe | 59 | ✓ | C | |||||||||

| Howard Roth | 67 | ✓ | C |

C = Chair

Each nominee currently serves on our Board of Trustees and has consented to being named in this proxy statement and to serve if elected. If elected, all trustees will serve until our 2025 Annual Meeting of Shareholders or their earlier resignation or removal and until their respective successors, if any, are elected and qualify. Background information relating to our nominees begins on page 9 of this Proxy Statement.

A majority of the votes cast with respect to a trustee will be sufficient to elect such trustee. The enclosed proxy, if signed, dated and returned, and any proxy properly authorized via the Internet or telephone, unless withheld, a broker non-vote or a contrary vote is indicated, will be voted FOR the election of the eight nominees. In the event any such nominee becomes unavailable for election, votes will be cast, pursuant to authority granted by the proxy, for such substitute nominee as may be nominated by our Board of Trustees, unless the Board of Trustees alternatively acts to reduce the size of the Board of Trustees or maintain a vacancy on the Board of Trustees in accordance with our bylaws.

| THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR EACH OF THE ABOVE NOMINEES. |

PROPOSAL

NO. 2 ADVISORY RESOLUTION TO APPROVE THE

COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) and Section 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), require that we seek an advisory resolution from our Shareholders to approve the compensation awarded to our named executive officers as disclosed in this proxy statement. Although the advisory resolution is non-binding, the Board of Trustees and the Compensation Committee will review the results of the vote and will consider our Shareholders’ views and take them into account in future determinations concerning our executive compensation programs. Please refer to the section entitled “Compensation Discussion and Analysis” for details about our executive compensation programs.

A proposal in the form of the following resolution will be submitted for a non-binding, advisory vote at the Annual Meeting:

“RESOLVED, that the Shareholders approve, on a non-binding, advisory basis, the compensation of the Trust’s named executive officers set forth in the 2024 Proxy Statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission (which disclosure includes the Compensation Discussion and Analysis, the Summary Compensation Table and accompanying compensation tables and related information).”

11

The advisory resolution to approve the compensation of our named executive officers requires a majority of the votes cast on the proposal at the Annual Meeting. Although the vote on this Proposal No. 2 is a nonbinding, advisory vote, the Board of Trustees will carefully consider the voting results.

| THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE FOR PROPOSAL NO. 2. |

PROPOSAL

NO. 3 RATIFICATION OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit and Cyber Risk Committee has appointed Deloitte & Touche LLP (“Deloitte”) as our independent registered public accounting firm for the fiscal year ending December 31, 2024. Although Shareholder ratification of the appointment of our independent registered public accounting firm is not required by our bylaws or otherwise, we are submitting the selection of Deloitte for ratification as a matter of good corporate governance practice. Even if the selection is ratified, the Audit and Cyber Risk Committee in its discretion may appoint an alternative independent registered public accounting firm if it deems such action appropriate. If the Audit and Cyber Risk Committee’s selection is not ratified by the Shareholders, the Audit and Cyber Risk Committee will take that fact into consideration, together with such other factors it deems relevant, in determining its next selection of an independent registered public accounting firm.

There are no affiliations between us and Deloitte’s partners, associates or employees, other than as pertaining to Deloitte’s engagement as our independent registered public accounting firm. Representatives of Deloitte are expected to be present at the Annual Meeting and will be given the opportunity to make a statement if they so desire and to respond to appropriate questions.

Ratification of the appointment of Deloitte as our independent registered public accounting firm for the fiscal year ending December 31, 2024 requires the affirmative vote of a majority of the votes cast on the proposal at the Annual Meeting.

| THE BOARD OF TRUSTEES UNANIMOUSLY RECOMMENDS

THAT SHAREHOLDERS VOTE FOR PROPOSAL NO. 3. |

12

Our Board of Trustees regularly refreshes its membership and our Board of Trustees members have a diverse range of relevant backgrounds. The following information relates to the nominees for election as our trustees:

|

T. WILSON EGLIN Age: 59 Trustee Since 1994

|

As LXP’s Chief Executive Officer, Mr. Eglin provides our Board of Trustees with extensive experience in net-lease and industrial real estate investing, real estate operations and capital markets.

Experience and Expertise: ● CEO/Operations: Has led LXP as the Chief Executive Officer since January 2003 and served as the Chief Operating Officer of LXP from October 1993 to December 2010. ● Capital Markets: Significant capital markets experience through strategic transactions and overseeing LXP’s equity and debt capital raising efforts throughout the last 30 years. ● Strategic Planning: Has steered LXP through various cycles of growth and was the chief architect of our transition from a diversified net lease real estate investment trust (“REIT”) to an industrial-focused REIT. ● Commercial Real Estate: More than three decades of experience in commercial real estate investment, including underwriting, acquisitions, large portfolio transactions, dispositions and leasing. ● Investor Relations: Expertise gained through focus on investor relations and corporate financial communications throughout his career as the primary spokesperson for LXP.

Career Highlights: ● Chairman of LXP Industrial Trust since April 2019 ● Chief Executive Officer of LXP Industrial Trust since January 2003 ● President of LXP Industrial Trust since April 1996 ● Executive Vice President of LXP Industrial Trust from October 1993 to April 1996 ● Chief Operating Officer of LXP Industrial Trust from October 1993 to December 2010 ● Previously a Trustee and the Chair of the Finance Committee of Connecticut College

|

LAWRENCE L. GRAY Age: 59 Trustee Since 2015

Committee Experience: Compensation |

Mr. Gray provides our Board of Trustees with extensive real estate investment and development, capital markets and corporate finance experience.

Experience and Expertise: ● CEO/Operations: Leadership and operational experience gained through his more than a decade-long tenure as Chief Executive Officer of a private real estate company for over 13 years. ● Capital Markets: Deep capital markets background through investment banking experience as a Managing Director of Wachovia Corporation where he led capital markets transactions for REITs and other real estate companies. At Wachovia, he had direct responsibility for the Real Estate Investment Banking, Corporate Banking, Private Equity, Homebuilder Finance and Structured Finance groups. ● Strategic Planning: Significant expertise developed through his investment banking roles serving as an advisor to boards of directors on equity, debt and mergers/acquisition transactions. In addition, as Chairman of a private real estate company, Mr. Gray has strategic planning experience through various market cycles. ● Commercial Real Estate: More than three decades of experience in commercial real estate investment as an investment banker and CEO of GrayCo, Inc.

Career Highlights: ● Chairman and Chief Executive Officer of GrayCo, Inc., a private real estate company that owns and manages apartment communities, master planned community investments and timberlands located throughout the Southeast region of the U.S.; serving as Chief Executive Officer since 2010 and Chairman since 2016 ● Managing Director of Wachovia Corporation from 1997 to 2009 ● Real estate investment banking groups at J.P. Morgan and Morgan Stanley prior to 1997 |

13

|

ARUN GUPTA Age: 55 Trustee since 2022

Committee Experience: Audit & Cyber Risk Compensation, Chair

|

Mr. Gupta provides our Board of Trustees with extensive mergers and acquisitions/private equity, venture capital and cybersecurity expertise.

Experience and Expertise: ● Cybersecurity: Recognized cybersecurity expert as a member of the Tech & Cybersecurity Advisory Committee for U.S. Senator Mark Warner and a long-term investor in technology-focused companies. ● Other Public Company Director: Seasoned public company director of various technology-focused companies. ● Capital Markets: Significant capital markets experience through venture funding of private companies that have gone public. ● Strategic Planning: Deep strategic planning expertise overseeing portfolio companies and through his tenure as an undergraduate and graduate-level business school professor.

Career Highlights: ● Adjunct Entrepreneurship Professor and Senior Advisor to Provost at Georgetown University and Member of Georgetown Entrepreneurship Advisory Board since January 2018 ● Lecturer, Stanford University and Member of Stanford in Washington Advisory Board and Freeman-Spogli Institute of International Studies Advisory Council since April 2019 ● CEO and Board Member of Noble Reach Foundation since September 2022 ● Venture Partner of Columbia Capital, a venture capital firm focused on Enterprise IT, Mobility and Digital Infrastructure, since 2000 ● Tech & Cybersecurity Advisory Committee Member for U.S. Senator Mark Warner ● Current member of the board of directors of: – Daz 3D – LMI (formerly Logistics Management Institute) ● Carlyle Venture Partners from 1998 to 2000 (focused on software investments) ● Arthur D. Little from 1995 to 1998 (telecom and technology consulting) |

14

● Previously a board director of: – C5 Acquisition Corp. (NYSE:CXAC) – Millennial Media (NYSE:MM) – Altamira – Endgame – 1901 Group – Verato – Webs | |

|

JAMIE HANDWERKER Age: 63 Trustee since 2017

Lead Trustee since 2023

Committee Experience: Audit and Cyber Risk Compensation

|

Ms. Handwerker has extensive experience analyzing and investing in real estate investment trusts and engaging with buy-side investors as a sell-side analyst, providing our Board of Trustees with related insight.

Experience and Expertise: ● Corporate Finance and Financial Analysis: Significant experience analyzing and investing in real estate and real estate related companies, including REITs, as a sell-side analyst and hedge fund manager. ● Other Public Company Director: Current member of the Board of Directors of Franklin BSP Realty Trust, Inc., a publicly traded REIT, where she serves on the audit committee and the nominating and corporate governance committee and as chairperson of the compensation committee. ● Strategic Planning: Strong strategic planning background gained through her oversight of portfolio companies as a partner at KSH Capital, a private equity firm. ● Commercial Real Estate: Spent over 40 years focused on commercial real estate and investing directly in real estate and indirectly in real estate companies, including REITs.

Career Highlights: ● Partner of KSH Capital, providing real estate entrepreneurs with capital and expertise to seed or grow their platform, since May 2016 ● Independent director and compensation committee chair of the Board of Directors of Franklin BSP Realty Trust, Inc. ● Member of the University of Pennsylvania School of Arts & Sciences Board of Overseers ● Founder and Chairperson of Penn Arts & Sciences Professional Women’s Alliance ● Previously: – Senior roles at Cramer Rosenthal McGlynn LLC, where she managed the CRM Windridge Partners hedge funds – Managing Director and Portfolio Manager with ING Furman Selz Asset Management, a NY based holding company operating as a wholly-owned subsidiary of the Dutch financial conglomerate, – ING Group – Managing Director and Senior Equity Research Analyst (Sell- Side) at the international corporate and investment bank ING Barings and its predecessor, Furman Selz, LLC, where she focused exclusively on real estate companies, including the REIT industry |

15

|

DERRICK JOHNSON Age: 54 Trustee since 2022

Committee Experience: Audit and Cyber Risk Nominating and ESG

|

Mr. Johnson has extensive experience in strategy, marketing, business development, finance and operations, specifically logistical operations, within organizations ranging from startups to Fortune 50 companies, providing our Board of Trustees with related insight.

Experience and Expertise: ● Logistics: Deep logistics background having spent most of his career in the logistic sector, including over 20 years at United Parcel Service (UPS). ● Operations: Significant operations experience through operational roles at UPS and Agiliti, a medical equipment management and services company. ● Strategic Planning: Transformational leader with strategic experience at organizations ranging from early-stage startups to Fortune 50 corporations. ● Corporate Finance and Financial Analysis: Expertise formed through banking and management consulting roles and solidified through senior roles at other publicly-traded companies.

Career Highlights: ● Senior Vice President of Operations (since March 2021) and Chief Operating Officer (since May 2023) at Agiliti, a medical equipment management and services company ● Former President of Southeast at United Parcel Service (UPS), holding a variety of strategic and operational roles for over 20 years ● Member of the Georgia Commission on Freight and Logistics ● Previously, Mr. Johnson was an Associate of Fixed Income Sales at Citigroup and an Associate at Oliver Wyman (formerly Mercer Management Consulting)

|

|

CLAIRE A. KOENEMAN Age: 54 Trustee since 2015

Committee Experience: Compensation Nominating and ESG |

Ms. Koeneman has spent many years as a corporate governance expert and strategic advisor to CEOs and boards of directors on all types of communications. She provides our Board of Trustees with extensive public and investor relations knowledge.

Experience and Expertise: ● Investor Relations: Strong expertise in investor relations having spent her entire career in the public/investor relations and communications sector, specifically transactions, corporate, financial and crisis communications. ● Risk Management: Significant risk management expertise as an advisor to Fortune 50 companies on crisis communications. ● Strategic Planning: Established the leading REIT and real estate practice in the U.S. as President of the Financial Relations Board, an investor relations firm, gaining significant strategic planning experience. ● Corporate Responsibility: Recognized corporate responsibility expert.

|

16

|

Career Highlights: ● EVP, Managing Director, Financial Communications at Ketchum, a global public relations and communications firm ● Senior positions at global public relations agencies, including GOLIN and Hill+Knowlton, as well as at Bully Pulpit Interactive, a boutique digital- first communications firm ● Previously president of Financial Relations Board (FRB), an investor relations firm where she established the leading REIT & real estate practice in the U.S.

| |

|

NANCY ELIZABETH NOE Age: 59 Trustee since 2021

Committee Experience: Nominating and ESG, Chair

|

Ms. Noe brings expertise in securities regulation, capital markets transactions and the governance of public companies to our Board of Trustees.

Expertise and Experience: ● Legal: Over 30 years of experience as a practicing attorney focused on capital markets transactions, mergers/acquisitions, corporate governance and securities regulation. ● Corporate Responsibility: Deep expertise gained through advising companies on corporate governance best practices. ● Capital Markets: Significant experience with all aspects of structuring, negotiating and documenting various capital markets transactions. ● Strategic Planning: Spent many years as an advisor to public and private company boards of directors.

Career Highlights: ● Chair of the Board of Trustees of Agnes Scott College ● Former Partner of Paul Hastings LLP, a global law firm, from February 2001 until February 2021 and Chair of the Corporate Department from February 2010 until February 2020

|

|

HOWARD ROTH Age: 67 Trustee since 2017

Committee Experience: Audit and Cyber Risk, Chair

|

Mr. Roth provides our Board of Trustees with extensive public accounting experience, including knowledge of tax laws applicable to real estate companies, generally accepted accounting principles and public company reporting requirements.

Experience and Expertise: ● Audit and REIT Tax: Audit and REIT tax expertise gained through 40 years as a certified public accountant at “Big Four” accounting firms and predecessor firms. ● Strategic Planning: Strong experience gained as advisory board member to companies in various industries. ● Commercial Real Estate: Entire career spent focused on real estate companies, including leading the global real estate, hospitality and construction group at Ernst & Young LLP. ● Risk Management: Deep risk management expertise as a partner in a “big four” accounting firm. As a practice group head, he implemented services for the assurance, tax and regulatory environments and digital solutions focused on cybersecurity and data analytics.

Career Highlights: ● Principal of HSR Advisors, a consulting firm that provides strategic and financial advice ● Venture Partner of Blu Venture Investors, a venture capital fund focused on early stage cybersecurity, healthtech, and B2B SaaS.

|

17

● Advisory Board Member of Voyager Space Holdings ● Advisory Board Member of Hodes Weill & Associates ● Advisory Board Member of the BlackChamber Group ● Board Member of Space for Humanity ● Previously: – Advisor to the CEO of Avison Young – Partner and the leader of Ernst & Young LLP’s global Real Estate, Hospitality & Construction (RHC) practice – Partner of Kenneth Leventhal & Co. |

Board Skills

The nominees for our Board of Trustees have a diverse skill set:

| Skill: | CEO | Other Public Company Director | Operations | Capital Markets | Corporate Finance | Financial Analysis | Commercial Real Estate | Strategic Planning | Risk Management | Logistics | Legal | Investor Relations | Audit | Corporate Responsibility | Cybersecurity | ||||||||||||||||

| T. Wilson Eglin | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||

| Lawrence L. Gray | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||

| Arun Gupta | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||

| Jamie Handwerker | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||

| Derrick Johnson | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||

| Claire A. Koeneman | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||

| Nancy Elizabeth Noe | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||

| Howard Roth | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

The absence of a check mark for a particular skill does not mean that the trustee does not possess that qualification, skill, or experience. We look to each trustee to be knowledgeable in these areas; however, the check mark indicates that the item is a particularly prominent qualification, skill, or experience that the trustee brings to our Board of Trustees.

Our Board of Trustees believes that finance/analysis, commercial real estate and strategic planning are core skills for its members. Our Board of Trustees seeks candidates with a variety of skills and in recent years have added additional corporate governance, logistics and cybersecurity expertise.

18

CORPORATE RESPONSIBILITY

We seek to create a sustainable environmental, social, governance and resilience (“ESG+R”) platform that enhances both our company and shareholder value. We are committed to supporting our shareholders, employees, tenants, suppliers, creditors, and communities as we execute on ESG+R objectives and initiatives. The objectives below are integrated throughout our investment process and contribute to our ongoing long-term success on behalf of our shareholders.

Due to the properties in our portfolio being primarily subject to net leases where tenants are responsible for maintaining the buildings and are in control of their energy usage and environmental sustainability practices, our ability to implement ESG+R initiatives throughout our portfolio may be limited.

The Nominating and ESG Committee of our Board of Trustees oversees our ESG+R strategy and initiatives. Our website has a dedicated Corporate Responsibility section, www.LXP.com/corporate-responsibility, which contains additional information on our ESG+R initiatives and a copy of our most recent Corporate Responsibility Report. The contents of our website are not incorporated into this Proxy Statement.

Awards and Recognition

ESG+R

| ENVIRONMENTAL | |

Developing strategies that reduce our environmental impact and operational costs is a critical component of our ESG+R program. When feasible, we implement base building upgrades and provide tenants with improvement allowance funds to complete sustainability efforts.

| |

| Actions | Performance |

|

● Track and monitor all landlord-paid utilities and track tenant utility data wherever possible. ● Strategically implement green building certifications to highlight sustainability initiatives and pursue ENERGY STAR® certification for eligible properties annually. ● Annually evaluate opportunities to improve efficiency, reduce our operating costs and reduce properties’ environmental footprint. ● Evaluate the opportunity to increase renewable energy across the portfolio.

|

● Benchmarked landlord paid energy, water, waste and recycling across the portfolio and working to expand tenant-paid utility coverage. ● Completed a Greenhouse Gas (GHG) Inventory of our 2022 Scope 1, 2, and 3 GHG Emissions. ● Obtained green building certifications for eight properties and submitted ENERGY STAR applications for six properties in our portfolio during 2023. ● Circulated and maintained sustainability-focused resources for tenants and property managers, including a Tenant Fit-Out Guide and an Industrial Tenant Sustainability Guide. ● Evaluated sustainability and efficiency initiatives across the portfolio in an effort to reduce energy consumption and drive down greenhouse gas emissions. ● Included ESG+R in metrics for executive cash incentive awards.

|

Green Building Certifications and Energy Ratings

19

| SOCIAL | |

|

We believe that actively engaging with stakeholders is critical to our business and ESG+R efforts, providing valuable insight to inform strategy, attract and retain top talent, and strengthen tenant relationships. | |

| Actions | Performance |

|

● Routinely engage with our tenants to understand leasing and operational needs at our assets and provide tools and resources to promote sustainable tenant operations. ● Collaborate with tenants and property managers on health and well-being focused initiatives. ● Assess our tenant and employee satisfaction and feedback through annual surveys. ● Circulate ESG+R focused newsletter to tenants and maintain a tenant portal with ESG+R resources. ● Provide our employees with periodic trainings, industry updates and access to tools and resources related to ESG+R. ● Provide our employees with health and well-being resources focused on physical, emotional and financial health. ● Track and highlight the diversity and inclusion metrics of our employees, board and executive management team. ● Support and engage with local communities through philanthropic volunteer events, focusing on food insecurity and diversity, equity and inclusion initiatives. ● Incorporate sustainability clauses into tenant leases, allowing collaboration on our ESG+R initiatives.

|

● Conducted a tenant feedback survey through Kingsley Associates and achieved a satisfaction score in excess of the Kingsley Associates Index. ● Engaged with our employees through regular surveys, including an employee satisfaction survey. ● Organized employee volunteer opportunities at non-profit organizations on Company time and held clothing and food drives. ● Maintained a paid-time off policy for employees to volunteer in their local communities. ● Organized step and other health-related challenges for our employees. ● Provided an employee assistance program with 24/7 unlimited access to referrals and resources for all work-life needs, including access to face-to-face and telephonic counseling sessions, legal and financial referrals and consultations. ● Awarded as a 2023 Best Company to Work for in New York. ● Sponsored a women’s mentorship program, where female employees are paired with female mentors for career-related advice and support. ● Named a 2023 Green Lease Leader with Gold recognition by the Institution for Market Transformation and the U.S. Department of Energy’s Better Buildings Alliance. |

Key Commitments

Partner Organizations

20

| GOVERNANCE | |

| Transparency to our stakeholders is essential. We pride ourselves on providing our stakeholders with regular reports and detailed disclosures on our operational and financial health and ESG+R efforts. | |

| Actions | Performance |

|

● Strive to implement best governance practices, mindful of the concerns of our shareholders. ● Increase our ESG+R transparency and disclosure by providing regular ESG updates to shareholders and other stakeholders and aligning with appropriate reporting to frameworks and industry groups, including GRESB, SASB, GRI and TCFD. ● Monitor compliance with applicable benchmarking and disclosure legislation, including utility data reporting, audit and retro-commissioning requirements and GHG emission laws. ● Ensure employees operate in accordance with the highest ethical standards and maintain the policies outlined in our Code of Business Conduct and Ethics.

|

● Updated and publicly disclosed our Code of Business Conduct and Ethics, which includes a whistleblower policy, and provide annual training to all employees. ● Performed enterprise risk assessments and management succession planning. ○ Placed 3rd in U.S. Industrial Distribution/Warehouse Listed peer group. ○ Achieved a Real Estate Benchmark score of 74, a five-point increase compared to 2022. ○ Received Public Disclosure Score of 96 (A), above the comparison group and global group average, and placed first in U.S. Industrial Peer Group. ● Published 2022 Corporate Responsibility Report, aligned with GRI, SASB, SDGs and TCFD. ● Maintained a Stakeholder Engagement Policy to disclose our process when working with our key stakeholders, including investors, property management teams and tenants. ● Continued to support the UN Women’s Empowerment Principles and the CEO Action for Diversity & Inclusion. ● Conducted annual ESG+R training for asset managers. |

Reporting and Transparency

| RESILIENCE | |

| We believe that our resilience to climate change-related physical and transition risks is critical to our long-term success. | |

| Actions | Performance |

|

● Align our resilience program with the Task Force on Climate- Related Financial Disclosures (“TCFD”) framework. ● Evaluate physical and transition climate-related risks as part of our acquisition due diligence process. ● Utilize climate analytics metrics to (1) identify physical risk exposure across the portfolio, (2) identify high risk assets and (3) implement mitigation measures and emergency preparedness plans. ● Assess transition risks and opportunities arising from the shift to a low-carbon economy, including market, reputation, policy, legal and technology risk and opportunities. |

● Engaged a third-party consultant to conduct ESG+R assessments on all acquisitions. ● Continued to be a supporter of the TCFD reporting framework. ● Engaged a climate analytics firm to evaluate physical risk due to climate change across the portfolio.

|

21

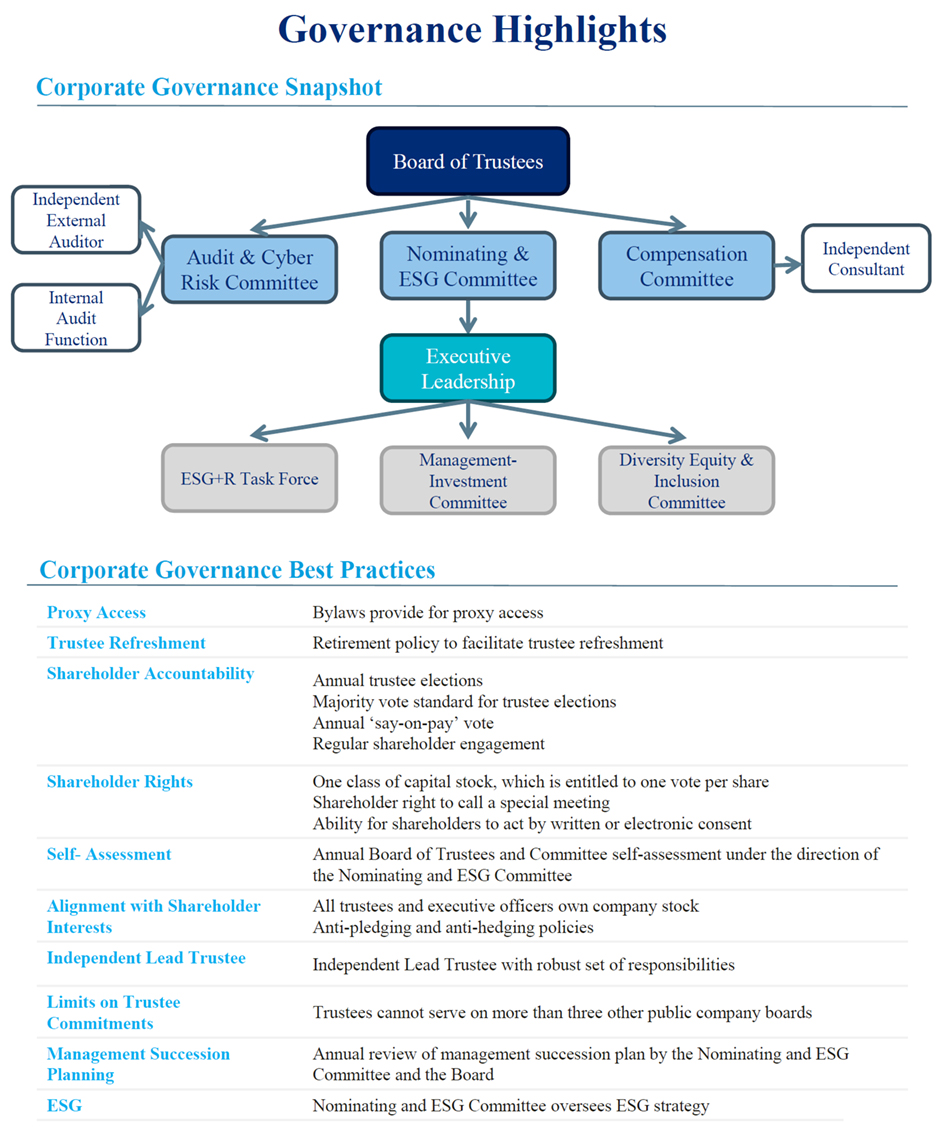

In addition to the items disclosed elsewhere, we maintain the following corporate governance practices:

| Proxy Access | Our bylaws provide for proxy access. |

| Trustee Refreshment |

Our Board of Trustees began a refreshment process in 2015. Since 2015, we have added seven new independent trustees. Pursuant to the retirement policy set forth in our Corporate Governance Guidelines, the Board of Trustees may not nominate a trustee for re-election unless he or she will be 75 years of age or younger on the first day of such Board term. |

| Management Succession Plan | On at least an annual basis, our Chief Executive Officer submits a management succession plan that provides for the ordinary course and emergency succession for our Chief Executive Officer and other key members of management, which is reviewed by the Nominating and ESG Committee and the Board of Trustees. During 2023, at each quarterly meeting of our Board of Trustees, our Board of Trustees either discussed, or was given the opportunity to discuss, the succession plan during its executive sessions. |

| Self-Assessment | Our Board of Trustees and its committees each perform an annual self- assessment under the direction of the Nominating and ESG Committee. For the 2023 cycle, this assessment was facilitated by the Trust’s outside corporate counsel and included individual interviews with each trustee and a peer review. |

| Board Independence | Our Board of Trustees is 87.5% independent. |

| Independent Lead Trustee |

We have an Independent Lead Trustee with robust duties because our Chairman is also our Chief Executive Officer. The duties of the independent Lead Trustee include: ■ Preside at all meetings of the Board of Trustees at which the Chairman is not present. ■ Preside at all executive sessions of the non-management trustees and independent trustees and set the format and agenda, with input from other independent trustees, at such executive sessions. ■ Call additional meetings of the non-management trustees and independent trustees, as deemed necessary. ■ Facilitate discussion and open dialogue among the independent trustees during Board of Trustees meetings, executive sessions and outside of Board of Trustees meetings. ■ Serve as principal liaison between the independent trustees and the Chairman and management. ■ Communicate to the Chairman and management, as appropriate, any decisions reached, suggestions, views or concerns expressed by independent trustees in executive sessions or outside of meetings of the Board of Trustees. ■ Provide the Chairman with comment to Board of Trustees meeting agendas and meeting schedules. ■ Periodically meet with independent trustees, as a group or individually, to discuss Board of Trustees and committee performance, effectiveness and composition. ■ If appropriate, and in coordination with executive management, be available for consultation and direct communication with major shareholders.

The Lead Trustee is selected and appointed by the independent members of the Board of Trustees following recommendation by the Nominating and ESG Committee. The Nominating and ESG Committee seeks input from all trustees and outside advisors when making a recommendation on the Lead Trustee. |

| Anti-Pledging/Hedging | We prohibit margin and/or pledging and/or hedging arrangements by our trustees, executive officers and employees. |

| Insider Trading Policy | We believe it is improper and inappropriate for our employees, officers and trustees to engage in short-term or speculative transactions involving our common shares or other securities. We maintain an insider trading policy that restricts trading in our securities during certain times and requires covered persons, including employees, officers and trustees, to obtain approval prior to trading in our securities. Executive officers and trustees complete annual questionnaires to confirm their compliance with our insider trading policy. |

| Share Ownership |

We have the following common share beneficial ownership requirements (after a phase-in period): |

22

● Chief Executive Officer: at least six times annual base salary. ● Three next most highly compensated executive officers: at least three times annual base salary. ● The fifth most highly compensated executive officer: at least two times annual base salary. ● Non-management trustees: at least three times annual retainer.

| |

| Share Retention | We require our executive officers to maintain beneficial ownership of at least 50% of any common shares acquired by them through our equity award plans from the later of November 2009 and the date of appointment as an executive officer of the Company, including, without limitation, through option awards and vesting of restricted shares, after taxes and transaction costs, until retirement or other termination of employment. |

| Anti-Bribery/Anti-Corruption | We maintain anti-bribery and anti-corruption policies in our employee handbook and Code of Business Conduct and Ethics. Employees annually certify compliance with our policies, including our employee handbook and Code of Business Conduct and Ethics. |

| Trustee Compensation | Our non-management trustees are paid 67% of their base annual retainer in our common shares, which we believe further aligns their interests with shareholders. |

| Share Options | Our equity plan prohibits cash buyouts of underwater options. |

| Tax Gross-Ups | We have no tax gross-ups or single-trigger change-in-control severance arrangements. |

| Tenure | The average tenure of our independent trustees is less than six years as of the date of this proxy statement. |

| Declawed Blank Check Preferred | Blank check preferred shares cannot be issued as a “takeover” defense. |

| Shareholder Written Consent | Shareholders can act by written or electronic consent to the same extent shareholders can act at a meeting at which all shares are present and voted. |

| Special Meetings | Shareholders holding at least 25% of our outstanding common shares can call a special meeting of the shareholders. |

| No Exclusive Venue/Forum | There is no exclusive venue or forum for shareholder litigation. |

| No Fee Shifting | There is no fee shifting provision for unsuccessful shareholder litigants. |

| No Poison Pill | We do not have a poison pill. |

| Bylaw Amendment | Shareholders have concurrent power to amend our bylaws. |

23

MANAGEMENT AND CORPORATE GOVERNANCE

Our Board of Trustees

Our Board of Trustees held 10 meetings during the fiscal year ended December 31, 2023. Each individual that was a trustee at the time of such meetings attended at least 75% of the aggregate of the total number of meetings of our Board of Trustees and all committees of the Board of Trustees on which he or she served during the year.

All our then trustees attended the 2023 Annual Meeting of Shareholders, which was held on May 23, 2023.

Outside Commitments:

| ● | Service on the Board of Trustees requires significant time and attention, and our trustees are expected to spend the time needed and meet as often as necessary to discharge their responsibilities. Our Nominating and ESG Committee considers competing outside commitments in making its trustee nomination recommendations. |

| ● | Our Corporate Governance Guidelines provide that when a trustee’s principal occupation or business association changes substantially from the position he or she held when originally invited to join the Board of Trustees, the trustee shall tender a letter of resignation to the Nominating and ESG Committee and the Nominating and ESG Committee shall consider whether the change will impair the trustees effectiveness and then recommend to the Board of Trustees whether to accept the proposed resignation. |

| ● | Our Corporate Governance Guidelines also provides that (i) trustees should advise the chairperson of the Nominating and ESG Committee and the CEO before accepting membership on other boards of directors/trustees or any audit committee or other significant committee assignment on any other board of directors/trustees, or establishing other significant relationships with businesses, institutions, governmental units or regulatory entities, particularly those that may result in significant time commitments or a change in the trustee’s relationship to the Trust, and (ii) trustees should not serve on more than three other boards of public companies, and (iii) no member of the Audit and Cyber Risk Committee should serve on more than three public company audit committees (including the Trust’s Audit and Cyber Risk Committee). |

| ● | No trustee serves on the board of three or more other public companies. |

Independence:

| ● | Our Corporate Governance Guidelines and the rules and regulations of the New York Stock Exchange (the “NYSE”) each require that a majority of our Board of Trustees are “independent” as that term is defined in the rules and regulations of the NYSE. |

| ● | The Nominating and ESG Committee, on behalf of our Board of Trustees, performed its annual independence review and determined that, except for Mr. Eglin, our trustees are independent. Mr. Eglin is not independent because of his role as an executive officer of LXP. |

Committees of our Board of Trustees

Our Board of Trustees has three standing committees: Audit and Cyber Risk Committee, Compensation Committee and Nominating and ESG Committee. Each of our committees consists solely of trustees meeting the independence requirements of applicable NYSE rules and our independence standards and are “non-employee directors” within the meaning of Rule 16b-3 of the Exchange Act, and our Audit and Cyber Risk Committee consists solely of trustees meeting the independence requirements of Rule 10A-3 under the Exchange Act.

Each committee operates under a written charter, all of which were reviewed by the Nominating and ESG Committee, the respective members of the applicable committee and the Board of Trustees during 2023. The charters of each of our standing committees are available on our web site at www.LXP.com. The contents of our website are not incorporated into this Proxy Statement.

24

Each committee operates with transparency and every trustee is invited to attend quarterly in-person meetings of each committee and the quarterly Audit and Cyber Risk Committee meetings to review our financial statements, regardless of committee membership.

|

Audit and Cyber Risk Committee

Members: Howard Roth (Chair) Arun Gupta Jamie Handwerker Derrick Johnson

Independence: All

Meetings in 2023: 8

|

Summary of Responsibilities:

Overseeing: ○ the integrity of our financial statements; ○ the qualifications, independence and performance of our independent registered public accounting firm; ○ the performance of the personnel responsible for the Trust’s internal audit function; ○ our policies and practices with respect to publicly disclosed non-GAAP measures; ○ the assurance of our ESG information; ○ management in connection with key risks and our enterprise risk management, including enterprise cybersecurity, privacy and data security risks; ○ technology and information systems; and ○ compliance with legal and regulatory requirements.

Appointing, setting compensation for, retaining and overseeing the work of the independent registered public accounting firm.

Pre-approving all auditing services and, to the extent permitted under applicable law, non-audit services to be provided to the Company by the independent registered public accounting firm engaged by the Company.

|

|

Our Board of Trustees has determined that Mr. Roth qualifies as an “Audit Committee Financial Expert” in accordance with Item 407(d)(5) of Regulation S-K and that all members of the Audit and Cyber Risk Committee are financially literate under NYSE rules.

The Audit and Cyber Risk Committee previously adopted an Internal Audit Charter, which formalizes the internal audit function of the Company. For the year ended December 31, 2023, the Audit and Cyber Risk Committee retained Ernst & Young LLP to provide internal audit assistance.

| |

25

|

Compensation Committee

Members: Arun Gupta (Chair) Lawrence L. Gray Claire A. Koeneman Jamie Handwerker

Independence: All

Meetings in 2023: 6

|

Summary of Responsibilities:

Reviewing and approving of: ○ corporate goals and objectives relevant to executive officer compensation; ○ evaluating executive officer performance; and ○ determining and approving executive officer compensation.

Determining and approving the compensation of non-employee members of the Board of Trustees.

Reviewing and approving incentive-compensation and equity-based plans.

Overseeing the drafting and reviewing of the Compensation Disclosure & Analysis and related disclosures.

Preparing and approving an annual report of the Compensation Committee.

|

|

Nominating and ESG Committee

Members: Nancy Elizabeth Noe (Chair) Lawrence L. Gray Jamie Handwerker Claire A. Koeneman

Independence: All

Meetings in 2023: 4 |

Summary of Responsibilities:

Identifying individuals qualified to become trustees.

Assisting the Board of Trustees in fulfilling its oversight responsibilities with regard to, including, but not limited to, environmental, climate change, human capital, health and safety, corporate social responsibility, sustainability, philanthropy, corporate governance, reputation, diversity, equity and inclusion, community issues, political contributions and lobbying and other public policy matters (including our Human Rights Policy) relevant to the Trust.

Leading the annual independence review and self-evaluation of the Board of Trustees and its committees and making recommendations for service on committees.

Overseeing succession planning for the Board of Trustees and our executive management.

Monitoring the refreshment and diversification of the membership of the Board of Trustees. |

In an effort led by the Nominating and ESG Committee, each committee annually reviews its charter and makes recommended revisions.

Each committee has the authority to consult with its own legal or other advisors, all in accordance with the authority granted to such committee under its charter. Each committee may form and delegate authority to subcommittees when and as such committee deems necessary and appropriate.

Board Leadership Structure and Strategy and Risk Oversight

Our board leadership structure currently consists of an independent Lead Trustee and an executive Chairman. Our Board of Trustees currently believes that it is appropriate to combine the positions of Chairman and Chief Executive Officer at this time due to Mr. Eglin’s critical role in creating and implementing our current strategy. Mr. Eglin has guided us through various market cycles and our transformation from a diversified net-

26

lease REIT into an industrial REIT, and our Board of Trustees believes that he is the appropriate person to continue to serve as our Chairman.

Our Board of Trustees believes that a Lead Trustee, who is independent, is necessary and appropriate to provide additional, independent leadership to the Board. Our Corporate Governance Guidelines provide that the Lead Trustee shall have the authority and specific responsibilities set forth under “Corporate Responsibility—Governance—Independent Lead Trustee,” above.

Ms. Handwerker has been our independent Lead Trustee since May 23, 2023. Ms. Handwerker has experience as a sell-side analyst, a hedge fund manager and a direct real estate investor and she is also an independent board member of another publicly traded real estate investment trust, which our Board of Trustees, including the members of the Nominating and ESG Committee, believed made her a candidate suitable for our Lead Trustee.

Strategy and risk are an integral part of our Board of Trustees and Committee deliberations throughout the year. Management regularly updates, and reports to our Board of Trustees with respect to, our business plan. Management also performs a quarterly fraud risk assessment, which is reported to our Board of Trustees. The quarterly fraud risk assessment assesses the critical risks we face (e.g., strategic, operational, financial, legal/regulatory, and reputational), their relative magnitude and management’s actions to mitigate these risks. In addition, the Audit and Cyber Risk Committee assists our Board of Trustees with the oversight of our risk management program, including its oversight of our internal audit function, enterprise risk management and cybersecurity risks.

Cybersecurity

As a smaller company, we use third-party vendors to assist us with our network and information technology requirements. Since 2019, BDO USA, LLC has provided us with virtual chief technology officer services, including chief information security officer services. In 2022, Mr. Gupta, a cyber security expert, joined our Board of Trustees. Mr. Gupta has significant experience in, among other areas, emerging technologies and coordinating national security and technology policy.

On at least a quarterly basis, we and BDO USA, LLC report to our Board of Trustees or the Audit and Cyber Risk Committee on information technology matters. On a regular basis, our Audit and Cyber Risk Committee commissions an internal audit or assessment of our cybersecurity practices and receives a report from our internal auditor on our cybersecurity risks. In addition, our management participates in annual tabletop exercises and simulations as part of our business continuity, incident response and disaster recovery planning.

Please see our Annual Report on Form 10-K for the year ended December 31, 2023, for more information on our processes and procedures for addressing and managing cybersecurity risks.

Shareholder Nominations

Our Board of Trustees believes that the Nominating and ESG Committee is qualified and in the best position to identify, review, evaluate and select qualified candidates for membership on our Board of Trustees based on the criteria described in the next paragraph. The Nominating and ESG Committee intends to consider nominees recommended by shareholders, but only if the submission of a recommendation includes a current resume and curriculum vitae of the candidate, a statement describing the candidate’s qualifications, contact information for personal and professional references, the name and address of the shareholder who is submitting the candidate for nomination, the number of shares which are owned of record or beneficially by the submitting shareholder and a description of all arrangements or understandings between the submitting shareholder and the candidate for nomination. Submissions should be made to: LXP Industrial Trust, 515 N. Flagler Drive, Suite 408, West Palm Beach, FL 33401, Attention: Secretary. The Nominating and ESG Committee’s consideration process includes completion of a standard questionnaire, a background check and interviews with the Nominating and ESG Committee and other members of the Board of Trustees. The Nominating and ESG Committee has no obligation to recommend such candidates for nomination.

In recommending candidates for membership on our Board of Trustees, the Nominating and ESG Committee’s assessment includes consideration of issues of judgment, diversity, expertise, and experience. The Nominating and ESG Committee believes that a diverse board is one that includes differences of viewpoints, professional experience, education, skill, and other individual qualities and attributes that contribute to board

27

heterogeneity. The Nominating and ESG Committee also considers other relevant factors as it deems appropriate. Generally, qualified candidates for board membership should (i) demonstrate personal integrity and moral character, (ii) be willing to apply sound and independent business judgment for the long-term interests of shareholders, (iii) possess relevant business or professional experience, technical expertise, or specialized skills, (iv) possess personality traits and backgrounds that fit with those of the other trustees to produce a collegial and cooperative environment, (v) be responsive to our needs, and (vi) have the ability to commit sufficient time to effectively carry out the duties of a trustee.

The Nominating and ESG Committee follows legal and regulatory requirements, such as those relating to independence, and gives due consideration to characteristics, such as race, gender, ethnicity and sexual orientation.

Our Board of Trustees believes its effectiveness is enhanced by being comprised of individuals with diverse skills, experience and backgrounds that are relevant to the role of our Board of Trustees and the needs of our business. The objective of our Board of Trustees is to foster a diverse and inclusive culture which solicits multiple perspectives and views and is free of conscious or unconscious bias and discrimination. Accordingly, the Nominating and ESG Committee regularly reviews the changing needs of our business and the skills, experience and backgrounds of its members, with the intention that our Board of Trustees will be periodically “renewed” as certain Trustees rotate off and new Trustees are recruited. Our Board of Trustee’s commitment to diversity and “renewal” will be tempered by the need to balance change with continuity, experience and a collaborative approach with each other and our Chief Executive Officer.

After completing this evaluation and review, the Nominating and ESG Committee makes a recommendation to our Board of Trustees as to the persons who should be nominated by our Board of Trustees, and our Board of Trustees determines the nominees after considering the recommendation and report of the Nominating and ESG Committee.

To the extent there is a vacancy on our Board of Trustees, the Nominating and ESG Committee will either identify individuals qualified to become trustees through relationships with our trustees or executive officers or by engaging a third party. Our Board of Trustees currently consists of eight individuals. However, the size of our Board of Trustees may increase in the future by a limited number to further diversify and refresh the membership of our Board of Trustees.

In addition, our bylaws provide that any shareholder that complies with the “advance notice” or “proxy access” provisions in our bylaws may also nominate individuals for election to our Board of Trustees. See “Q&A—How do I nominate a trustee or submit a proposal for the 2025 Annual Meeting of Shareholders?”

Shareholder Communications

Parties wishing to communicate directly with our Board of Trustees, an individual trustee, the Lead Trustee or the non-management members of our Board of Trustees as a group should address their inquiries to our General Counsel by mail sent to our principal office located at 515 N. Flagler Drive, Suite 408, West Palm Beach, FL 33401. The mailing envelope should contain a clear notification indicating that the enclosed letter is an “Interested Party/Shareholder-Board Communication,” “Interested Party/Shareholder-Trustee Communication,” “Interested Party/Shareholder-Lead Trustee Communication” or “Interested Party/ Shareholder-Non-Management Trustee Communication,” as the case may be.

Complaint Procedures for Accounting and Auditing Matters

We have established “whistleblower” procedures set forth in our Code of Business Conduct and Ethics for (1) the receipt, retention and treatment of complaints and allegations regarding accounting, internal accounting controls or auditing matters (“Accounting Matters”) and (2) the confidential, anonymous submission by Covered Persons (as defined therein) of concerns regarding Accounting Matters. Under these procedures, anyone with concerns regarding accounting matters or otherwise, may, as applicable, report their concerns to our compliance hotline by telephone at 844-502-7786 or on the web at http://LXP.ethicspoint.com. Complaints are reviewed by the Chairman of the Audit and Cyber Risk Committee and our General Counsel, as appropriate, and reported to our Board of Trustees on an as needed basis, but not less than quarterly. In the event of a complaint, our internal and external auditors are informed and we work with our outside legal counsel to investigate the complaint.

28

Periodic Reports, Code of Ethics, Committee Charters and Corporate Governance Guidelines

Our Internet address is www.LXP.com. We make available free of charge through our web site our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements, other filings with the SEC, and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after we electronically file such materials with the SEC. We also have made available on our web site copies of our current Audit and Cyber Risk Committee Charter, Compensation Committee Charter, Nominating and ESG Committee Charter, Code of Business Conduct and Ethics, and Corporate Governance Guidelines. In the event of any changes to these charters or the code or the guidelines, updated copies will also be made available on our web site. The contents of our website are not incorporated into this Proxy Statement.

You may request a copy of any of the documents referred to above, without charge to you, by contacting us at the following address, email or telephone number:

LXP Industrial Trust

515 N. Flagler Drive, Suite 408

West Palm Beach, FL 33401

Attention: Investor Relations ir@lxp.com

(212) 692-7200

Certain Relationships and Related Transactions

Policy. Under our policy regarding the review, approval and ratification of any related party transaction, the Audit and Cyber Risk Committee or the Board of Trustees (consisting of all of the non-conflicted members) reviews the relevant facts and circumstances of each related party transaction, including whether the transaction is on terms comparable to those that could be obtained in arm’s length dealings with an unrelated third party and the extent of the related party’s interest in the transaction, taking into account the conflicts of interest and corporate opportunity provisions of our Code of Business Conduct and Ethics, and the Audit and Cyber Risk Committee or the Board of Trustees (consisting of all of the non-conflicted members) either approves or disapproves the related party transaction. Any related amendment to, or waiver of any provision of, our Code of Business Conduct and Ethics for executive officers or trustees must be approved by the Nominating and ESG Committee (consisting of the non-conflicted members) and will be promptly disclosed to our shareholders as required by applicable laws, rules or regulations including, without limitation, the requirements of the NYSE.

Any related party transaction will be consummated and continue only if the Audit and Cyber Risk Committee or the Board of Trustees (consisting of all of the non-conflicted members) has approved or ratified such transaction in accordance with the guidelines set forth in the policy. For purposes of our policy, a “Related Party” is:

| (1) | any person who is, or at any time since the beginning of our last fiscal year was, one of our trustees or executive officers or a nominee to become one of our trustees; |

| (2) | any person who is known to be the beneficial owner of more than 5% of any class of our voting securities; |

| (3) | any immediate family member of any of the foregoing persons, which means any spouse, child, stepchild, parent, stepparent, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother- in-law, or sister-in-law; and |

| (4) | any firm, corporation, or other entity in which any of the foregoing persons is employed, is a general partner, principal, or in a similar position, or in which such person has a 5% or greater beneficial ownership interest. |

Indemnification Agreements. Our trustees and certain of our executive officers have entered into indemnification agreements with us. Pursuant to these agreements, we agree to indemnify the trustee or executive officer who is a party to such an agreement against any and all judgments, penalties, fines, settlements, and reasonable expenses (including attorneys’ fees) actually incurred by the trustee or executive officer or in a similar capacity for any other entity at our request. These agreements include certain limitations on our obligations in certain circumstances, particularly in situations in which such indemnification is prohibited or limited by applicable law.

29

Hedging Policy

We have adopted a policy that prohibits our trustees, officers and employees, as well as certain of their immediate family members, from buying or selling Company securities while in possession of material, non- public information. In addition, we have adopted a policy prohibiting trustees, officers, and employees from pledging our securities and from establishing short positions and hedging transactions, including through prepaid variable forwards, equity swaps, collars and exchange funds.

Charitable Contributions

We maintain a charitable giving policy to help us make charitable contributions with an emphasis in the areas of food insecurity, children and education. We seek input from our employees before making charitable contributions. The charities we support are located in the cities where we maintain corporate offices. During 2023, we did not make any charitable contribution to any tax-exempt organization in which any independent trustee serves as an executive officer.

Compensation Committee Interlocks and Insider Participation

During 2023, none of the members of the Compensation Committee were or had been one of our executive officers. Further, none of our executive officers have ever served as a member of the compensation committee or as a director of another entity whose executive officers served on our Compensation Committee or as a member of our Board of Trustees.

Employee Stock Purchase Plan

We maintain an Employee Stock Purchase Plan, which provides an opportunity for employees to elect to purchase common shares at 95% of the fair market value on the date of purchase. Employees participate through payroll deductions.

30

EXECUTIVE OFFICERS

The following sets forth certain information as of the date of this Proxy Statement concerning our executive officers:

|

T. Wilson Eglin

Chairman, Chief Executive Officer & President

|

59 | Mr. Eglin’s business experience is set forth in this Proxy Statement under “Trustee Nominees” on page 13. | ||

|

Beth Boulerice Executive Vice President, Chief Financial Officer & Treasurer

|

59 | Ms. Boulerice is an Executive Vice President and serves as Chief Financial Officer and Treasurer. She previously served as our Chief Accounting Officer. Prior to joining the firm in 2007, Ms. Boulerice was employed by First Winthrop Corporation and was the Chief Accounting Officer of Newkirk Realty Trust. She graduated from the University of Rhode Island and is a Certified Public Accountant. | ||

|

Joseph S. Bonventre Executive Vice President, Chief Operating Officer, General Counsel & Secretary

|

49 | Mr. Bonventre is an Executive Vice President and serves as Chief Operating Officer, General Counsel and Secretary. Prior to joining us in September 2004, he was an associate in the corporate department of the law firm now known as Paul Hastings LLP. He received his B.A. from New York University in 1998 and his J.D. from Benjamin N. Cardozo School of Law/Yeshiva University in 2001. Mr. Bonventre is admitted to practice law in the State of New York. | ||

|

Brendan Mullinix

Executive Vice President & Chief Investment Officer |

49 | Mr. Mullinix is an Executive Vice President and serves as Chief Investment Officer. He joined us in 1996 and previously served as a Senior Vice President and a Vice President. Mr. Mullinix graduated from Columbia College, Columbia University. | ||

31

|

James Dudley

Executive Vice President & Director of Asset Management

|

43 | Mr. Dudley is an Executive Vice President and Director of Asset Management. He has been with us since 2006 and has held various roles within the Asset Management Department. Prior to joining the firm, Mr. Dudley was employed by ORIX Capital Markets. Mr. Dudley has a B.A. from Angelo State University and an M.S. from The University of Texas at Arlington. | ||

|

Nabil Andrawis

Executive Vice President & Director of Taxation

|

53 |

Mr. Andrawis is an Executive Vice President and serves as Director of Taxation. Prior to joining us in 2002, he was employed by Vornado Realty Trust and Deloitte & Touche LLP. Mr. Andrawis was previously the Co-Chairman of the National Association of Real Estate Investment Trusts State and Local Tax Subcommittee. Mr. Andrawis graduated from The Bernard M. Baruch College and is a Certified Public Accountant.

| ||

|

Mark Cherone

Senior Vice President & Chief Accounting Officer |

42 | Mr. Cherone is a Senior Vice President and serves as Chief Accounting Officer. Prior to joining us in March 2019, he served as Corporate Controller for Brandywine Realty Trust since 2012. Mr. Cherone graduated from The Pennsylvania State University and is a Certified Public Accountant. | ||

32

COMPENSATION OF EXECUTIVE OFFICERS

Compensation Discussion and Analysis

Introduction.

2023 Company Highlights. During 2023, our management team accomplished the following1:

| Investment Execution |

| ● | Meaningful progress made in development program |

| ○ | Invested $122 million in development projects |

| ○ | Completed core and shell construction of 4.2 million square feet of new development |

| ○ | Placed 1.8 million square feet of industrial development into service |

| ○ | Leased 1.9 million square feet in development portfolio |

| ● | Continued to strengthen the quality of portfolio |

| ○ | Sold $100 Million of non-core assets |

| ○ | Decreased virtually all consolidated office portfolio exposure, with the two remaining office assets under contract for sale |

| Operational Performance |

| ● | Achieved robust leasing volume with strong mark-to-market outcomes |

| ○ | Leased 6.8 million square feet |

| ▪ | Increased Industrial Base and Cash Base rents by ~52% and ~37%, respectively, with 3.7% average annual escalators (adjusted for fixed renewals)2,3 |

| ● | Eliminated industrial portfolio vacancy and increased same-store NOI growth |

| ○ | Stabilized portfolio 100% leased4 |

| ○ | Same-store NOI growth of 4.1% |

| Balance Sheet Flexibility |

| ● | Capitalized on refinancing opportunities |

| ○ | Executed a $300 million bond issuance (aggregate principal amount of 6.75% senior notes due November 2028)5 |

| ○ | Extended $300 million 2025 term loan to 2027 |

| ● | Reduced leverage |

| ○ | 6.0x net debt to Adjusted EBITDA |

| Financial Performance |

| ● | Delivered strong financial results |

| ○ | Produced Adjusted Company FFO of $0.70 per common share |

| ● | Increased quarterly dividend |

| ○ | $0.02 annualized dividend increase authorized by Board of Trustees represents a 4% increase over prior year |

1. As of 12/31/2023. See Appendix A for definitions and reconciliations of Non-GAAP financial measures. 2. For leases with escalations. 3. Including fixed renewals, Base and Cash Base rental increases are 40.1% and 27.0%, respectively, with 3.6% average annual escalators. 4. Stabilized portfolio. 5. Notes issued at price of 99.423% of the principal amount.

33

Named Executive Officers. Our named executive officers are:

| Name | Title | |

| T. Wilson Eglin | Chairman, Chief Executive Officer and President | |

| Beth Boulerice | Executive Vice President, Chief Financial Officer and Treasurer | |

| Joseph S. Bonventre | Executive Vice President, Chief Operating Officer, General Counsel and Secretary | |

| Brendan P. Mullinix | Executive Vice President and Chief Investment Officer | |

| James Dudley | Executive Vice President and Director of Asset Management |

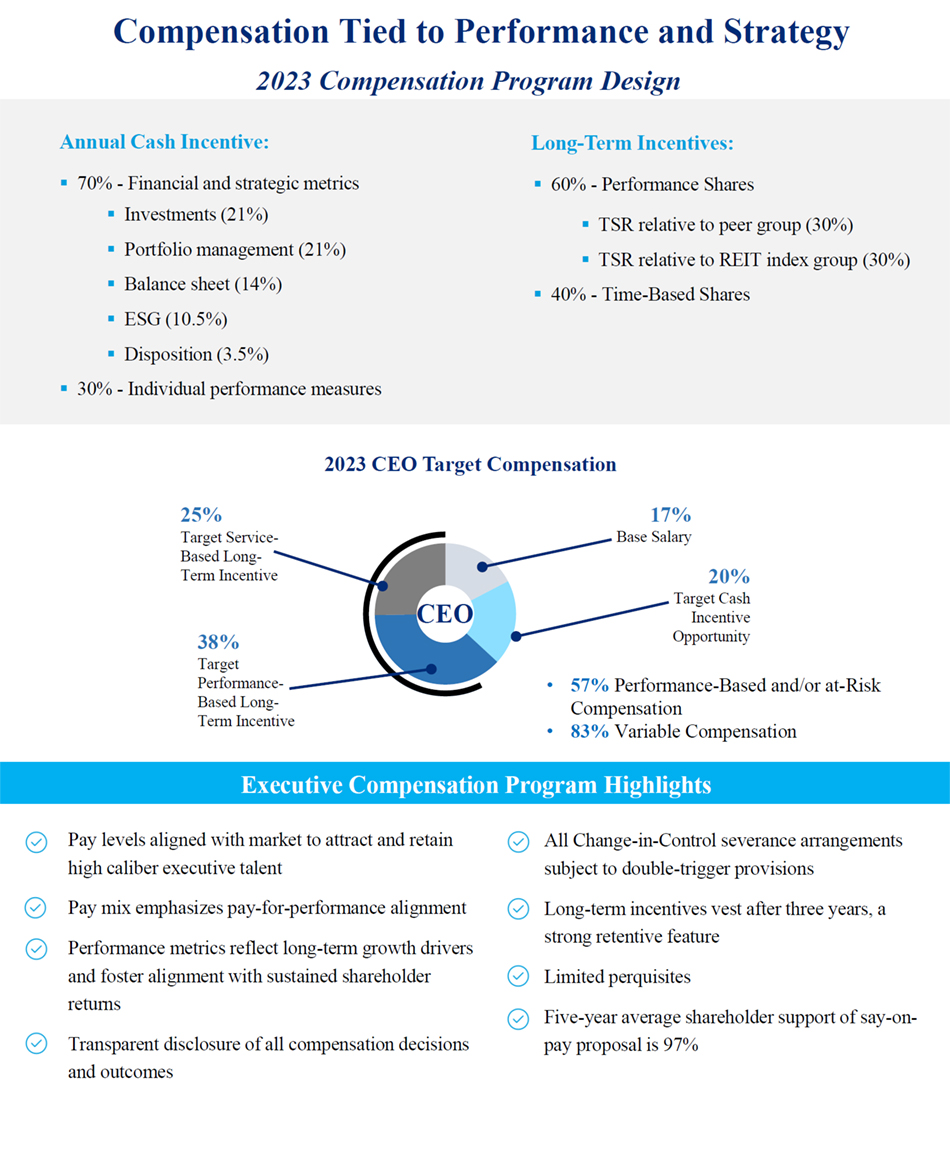

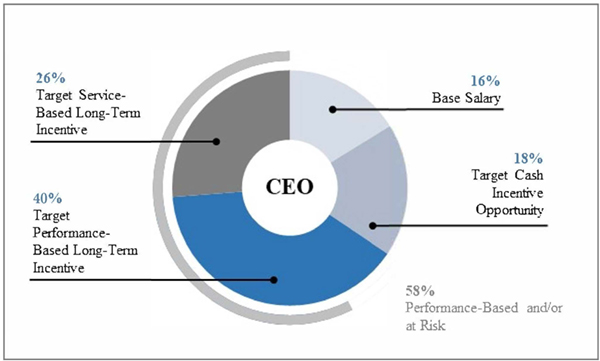

Compensation Committee Responsibility and Philosophy. The Compensation Committee administers the compensation policies and programs for our named executive officers and regularly reviews and approves our compensation strategy and principles to ensure that they are aligned with our business strategy and objectives, encourage high performance, promote accountability and ensure that management’s interests are aligned with the interests of our shareholders. The Compensation Committee believes that the compensation program should further both short-term and long-term business goals and strategies while enhancing shareholder value. In keeping with this philosophy, the compensation program’s objectives are to:

| ● | maintain a transparent compensation program that is easy for all of our shareholders to understand; |

| ● | further align the interests of our named executive officers with those of our shareholders; |

| ● | strengthen the relationship between executive pay and company performance; and |

| ● | retain key members of management. |

The Compensation Committee believes that the business judgment of its members is necessary to properly evaluate and design an executive compensation program.

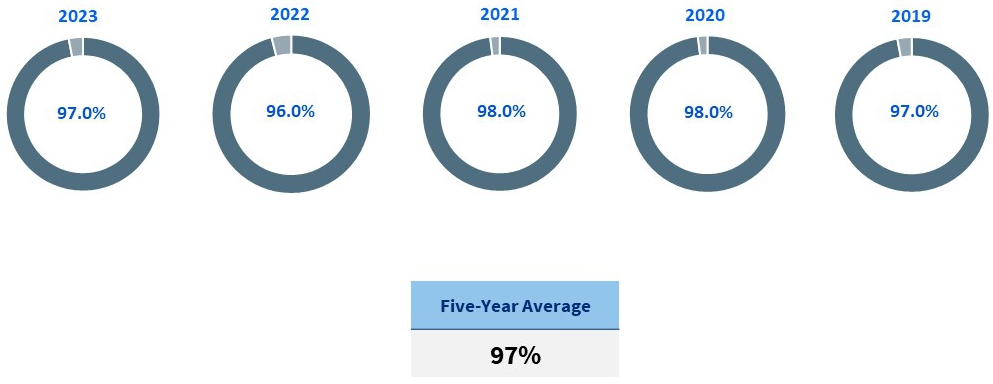

2023 “Say on Pay” Advisory Vote

In 2023, approximately 96.8% of the votes cast voted “FOR” the compensation of our named executive officers as disclosed in the related proxy statement, which has been consistent with the votes for the previous years.

34