ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

(Address of principal executive offices) (Zip code) | ||

Title of each class |

Trading Symbol(s) |

Name of exchange on which registered | ||

SM |

||||

th interest in a share of Fixed-to-Floating Rate Series A Noncumulative Perpetual Preferred Stock |

☒ |

Accelerated Filer |

☐ | ||||

Non-Accelerated Filer |

☐ |

Smaller Reporting Company |

||||

Emerging Growth Company |

Page |

||||||

1 |

||||||

3 |

||||||

7 |

||||||

19 |

||||||

31 |

||||||

31 |

||||||

31 |

||||||

31 |

||||||

32 |

||||||

35 |

||||||

36 |

||||||

70 |

||||||

76 |

||||||

134 |

||||||

134 |

||||||

135 |

||||||

135 |

||||||

135 |

||||||

135 |

||||||

136 |

||||||

136 |

||||||

137 |

||||||

139 |

||||||

140 |

||||||

Certifications |

||||||

| • | general economic conditions, either nationally or in some or all of the areas in which we and our customers conduct our respective businesses; |

| • | conditions in the securities markets and real estate markets or the banking industry; |

| • | changes in real estate values, which could impact the quality of the assets securing the loans in our portfolio; |

| • | changes in interest rates, which may affect our net income, prepayment penalty income, and other future cash flows, or the market value of our assets, including our investment securities; |

| • | any uncertainty relating to the LIBOR calculation process and the phasing out of LIBOR after 2021; |

| • | changes in the quality or composition of our loan or securities portfolios; |

| • | changes in our capital management policies, including those regarding business combinations, dividends, and share repurchases, among others; |

| • | heightened regulatory focus on CRE concentrations; |

| • | changes in competitive pressures among financial institutions or from non-financial institutions; |

| • | changes in deposit flows and wholesale borrowing facilities; |

| • | changes in the demand for deposit, loan, and investment products and other financial services in the markets we serve; |

| • | our timely development of new lines of business and competitive products or services in a changing environment, and the acceptance of such products or services by our customers; |

| • | our ability to obtain timely shareholder and regulatory approvals of any merger transactions or corporate restructurings we may propose; |

| • | our ability to successfully integrate any assets, liabilities, customers, systems, and management personnel we may acquire into our operations, and our ability to realize related revenue synergies and cost savings within expected time frames; |

| • | potential exposure to unknown or contingent liabilities of companies we have acquired, may acquire, or target for acquisition; |

| • | the ability to invest effectively in new information technology systems and platforms; |

| • | changes in future ALLL requirements based on our periodic review under relevant accounting and regulatory requirements; |

| • | the ability to pay future dividends at currently expected rates; |

| • | the ability to hire and retain key personnel; |

| • | the ability to attract new customers and retain existing ones in the manner anticipated; |

| • | changes in our customer base or in the financial or operating performances of our customers’ businesses; |

| • | any interruption in customer service due to circumstances beyond our control; |

| • | the outcome of pending or threatened litigation, or of matters before regulatory agencies, whether currently existing or commencing in the future; |

| • | environmental conditions that exist or may exist on properties owned by, leased by, or mortgaged to the Company; |

| • | any interruption or breach of security resulting in failures or disruptions in customer account management, general ledger, deposit, loan, or other systems; |

| • | operational issues stemming from, and/or capital spending necessitated by, the potential need to adapt to industry changes in information technology systems, on which we are highly dependent; |

| • | the ability to keep pace with, and implement on a timely basis, technological changes; |

| • | changes in legislation, regulation, policies, or administrative practices, whether by judicial, governmental, or legislative action, and other changes pertaining to banking, securities, taxation, rent regulation and housing (the Housing Stability and Tenant Protection Act of 2019), financial accounting and reporting, environmental protection, insurance, and the ability to comply with such changes in a timely manner; |

| • | changes in the monetary and fiscal policies of the U.S. Government, including policies of the U.S. Department of the Treasury and the Board of Governors of the Federal Reserve System; |

| • | changes in accounting principles, policies, practices, and guidelines; |

| • | changes in regulatory expectations relating to predictive models we use in connection with stress testing and other forecasting or in the assumptions on which such modeling and forecasting are predicated; |

| • | changes in our credit ratings or in our ability to access the capital markets; |

| • | unforeseen or catastrophic events including natural disasters, war, terrorist activities, and the emergence of a pandemic; and |

| • | other economic, competitive, governmental, regulatory, technological, and geopolitical factors affecting our operations, pricing, and services. |

| ADC—Acquisition, development, and construction loan ALCO—Asset and Liability Management Committee AMT—Alternative minimum tax AmTrust—AmTrust Bank AOCL—Accumulated other comprehensive loss ASC—Accounting Standards Codification ASU—Accounting Standards Update BOLI—Bank-owned life insurance BP—Basis point(s) C&I—Commercial and industrial loan CCAR—Comprehensive Capital Analysis and Review CDs—Certificates of deposit CECL—Current Expected Credit Loss CFPB—Consumer Financial Protection Bureau CMOs—Collateralized mortgage obligations CMT—Constant maturity treasury rate CPI—Consumer Price Index CPR—Constant prepayment rate CRA—Community Reinvestment Act CRE—Commercial real estate loan Desert Hills—Desert Hills Bank DIF—Deposit Insurance Fund DFA—Dodd-Frank Wall Street Reform and Consumer Protection Act DSCR—Debt service coverage ratio EaR—Earnings at Risk EPS—Earnings per common share ERM—Enterprise Risk Management ESOP—Employee Stock Ownership Plan EVE—Economic Value of Equity at Risk Fannie Mae—Federal National Mortgage Association FASB—Financial Accounting Standards Board FDI Act—Federal Deposit Insurance Act FDIC—Federal Deposit Insurance Corporation FHLB—Federal Home Loan Bank |

FHLB-NY—Federal Home Loan Bank of New YorkFOMC—Federal Open Market Committee FRB—Federal Reserve Board FRB-NY—Federal Reserve Bank of New YorkFreddie Mac—Federal Home Loan Mortgage Corporation FTEs—Full-time equivalent employees GAAP—U.S. generally accepted accounting principles GLBA—The Gramm Leach Bliley Act GNMA—Government National Mortgage Association GSEs—Government-sponsored enterprises HQLAs—High-quality liquid assets LIBOR—London Interbank Offered Rate LSA—Loss Share Agreements LTV—Loan-to-value ratioMBS—Mortgage-backed securities MSRs—Mortgage servicing rights NIM—Net interest margin NOL—Net operating loss NPAs—Non-performing assetsNPLs—Non-performing loansNPV—Net Portfolio Value NYSDFS—New York State Department of Financial Services NYSE—New York Stock Exchange OCC—Office of the Comptroller of the Currency OFAC—Office of Foreign Assets Control OREO—Other real estate owned OTTI—Other-than-temporary impairment ROU—Right of use asset SEC—U.S. Securities and Exchange Commission SIFI—Systemically Important Financial Institution TDRs—Troubled debt restructurings |

ITEM 1. |

BUSINESS |

| Name |

Jurisdiction of Organization |

Purpose | ||

| 100 Duffy Realty, LLC |

New York |

Owns a branch building. | ||

| Beta Investments, Inc. |

Delaware |

Holding company for Omega Commercial Mortgage Corp. and Long Island Commercial Capital Corp. | ||

| BSR 1400 Corp. |

New York |

Organized to own interests in real estate. | ||

| Ferry Development Holding Company |

Delaware |

Formed to hold and manage investment portfolios for the Company. | ||

| NYCB Specialty Finance Company, LLC |

Delaware |

Originates asset-based, equipment financing, and dealer-floor plan loans. | ||

| NYB Realty Holding Company, LLC |

New York |

Holding company for subsidiaries owning an interest in real estate. | ||

| NYCB Insurance Agency, Inc. |

New York |

Sells non-deposit investment products. | ||

| Pacific Urban Renewal, Inc. |

New Jersey |

Owns a branch building. | ||

| Richmond Enterprises, Inc. |

New York |

Holding company for previously sold entity. | ||

| Synergy Capital Investments, Inc. |

New Jersey |

Formed to hold and manage investment portfolios for the Company. | ||

| NYCB Mortgage Company, LLC |

Delaware |

Holding company for Walnut Realty Holding Company, LLC. | ||

| Woodhaven Investment Company, LLC |

Delaware |

Holding company for Ironbound Investment Company, Inc. and 1400 Corp. |

| Name |

Jurisdiction of Organization |

Purpose | ||

| 1400 Corp. |

New York |

Holding company for Roslyn Real Estate Asset Corp. | ||

| Ironbound Investment Company, LLC. |

Florida |

Organized for the purpose of investing in mortgage-related assets. | ||

| Long Island Commercial Capital Corporation |

New York |

A REIT organized for the purpose of investing in mortgage-related assets. | ||

| Omega Commercial Mortgage Corp. |

Delaware |

A REIT organized for the purpose of investing in mortgage-related assets. | ||

| Prospect Realty Holding Company, LLC |

New York |

Owns a back-office building. | ||

| Rational Real Estate II, LLC |

New York |

Owns a back-office building. | ||

| Roslyn Real Estate Asset Corp. |

Delaware |

A REIT organized for the purpose of investing in mortgage-related assets. | ||

| Walnut Realty Holding Company, LLC |

Delaware |

Established to own Bank-owned properties. |

ITEM 1A. |

RISK FACTORS |

| • | Operating results that vary from the expectations of our management or of securities analysts and investors; |

| • | Developments in our business or in the financial services sector generally; |

| • | Regulatory or legislative changes affecting our industry generally or our business and operations; |

| • | Operating and securities price performance of companies that investors consider to be comparable to us; |

| • | Changes in estimates or recommendations by securities analysts or rating agencies; |

| • | Announcements of strategic developments, acquisitions, dispositions, financings, and other material events by us or our competitors; |

| • | Changes or volatility in global financial markets and economies, general market conditions, interest or foreign exchange rates, stock, commodity, credit, or asset valuations; and |

| • | Significant fluctuations in the capital markets. |

| • | Our ability to successfully integrate the branches and operations we acquire, and to adopt appropriate internal controls and regulatory functions relating to such activities; |

| • | Our ability to limit the outflow of deposits held by customers in acquired branches, and to successfully retain and manage any loans we acquire; |

| • | Our ability to attract new deposits, and to generate new interest-earning assets, in geographic areas we have not previously served; |

| • | Our success in deploying any cash received in a transaction into assets bearing sufficiently high yields without incurring unacceptable credit or interest rate risk; |

| • | Our ability to control the incremental non-interest expense from acquired operations; |

| • | Our ability to retain and attract the appropriate personnel to staff acquired branches and conduct any acquired operations; |

| • | Our ability to generate acceptable levels of net interest income and non-interest income, including fee income, from acquired operations; |

| • | The diversion of management’s attention from existing operations; |

| • | Our ability to address an increase in working capital requirements; and |

| • | Limitations on our ability to successfully reposition the post-merger balance sheet when deemed appropriate. |

ITEM 1B. |

UNRESOLVED STAFF COMMENTS |

ITEM 2. |

PROPERTIES |

ITEM 3. |

LEGAL PROCEEDINGS |

ITEM 4. |

MINE SAFETY DISCLOSURES |

ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES |

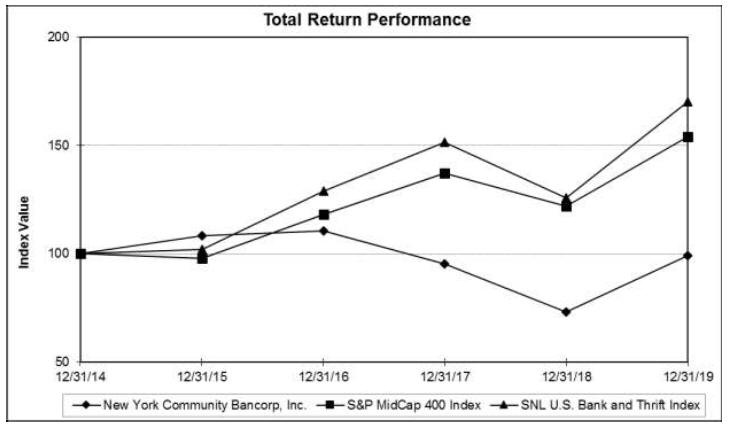

| 12/31/2014 |

12/31/2015 |

12/31/2016 |

12/31/2017 |

12/31/2018 |

12/31/2019 |

|||||||||||||||||||

| New York Community Bancorp, Inc. |

$ | 100.00 |

$ | 108.22 |

$ | 110.55 |

$ | 95.20 |

$ | 73.09 |

$ | 98.99 |

||||||||||||

| S&P Mid-Cap 400 Index |

$ | 100.00 |

$ | 97.82 |

$ | 118.11 |

$ | 137.30 |

$ | 122.08 |

$ | 154.07 |

||||||||||||

| SNL U.S. Bank and Thrift Index |

$ | 100.00 |

$ | 102.02 |

$ | 128.80 |

$ | 151.45 |

$ | 125.81 |

$ | 170.04 |

||||||||||||

| (dollars in thousands, except per share data) |

||||||||||||

| Period |

Total Shares of Common Stock Repurchased |

Average Price Paid per Common Share |

Total Allocation |

|||||||||

| First Quarter 2019 |

7,816,228 |

$ 9.57 |

$ | 74,788 |

||||||||

| Second Quarter 2019 |

3,485 |

11.14 |

39 |

|||||||||

| Third Quarter 2019 |

31,059 |

11.10 |

345 |

|||||||||

| Fourth Quarter 2019: |

||||||||||||

| October |

232 |

13.02 |

3 |

|||||||||

| November |

3,018 |

12.02 |

36 |

|||||||||

| December |

829 |

10.53 |

9 |

|||||||||

| Total Fourth Quarter 2019 |

4,079 |

11.78 |

48 |

|||||||||

| 2019 Total |

7,854,851 |

9.58 |

$ | 75,220 |

||||||||

ITEM 6. |

SELECTED FINANCIAL DATA |

| At or For the Years Ended December 31, |

||||||||||||||||||||

| (dollars in thousands, except share data) |

2019 |

2018 |

2017 |

2016 |

2015 |

|||||||||||||||

| EARNINGS SUMMARY: |

||||||||||||||||||||

| Net interest income (1) |

$ | 957,400 |

$ | 1,030,995 |

$ | 1,130,003 |

$ | 1,287,382 |

$ | 408,075 |

||||||||||

| Provision for (recovery of) losses on non-covered loans |

7,105 |

18,256 |

60,943 |

11,874 |

(3,334 |

) | ||||||||||||||

| Recovery of losses on covered loans |

— |

— |

(23,701 |

) | (7,694 |

) | (11,670 |

) | ||||||||||||

| Non-interest income |

84,230 |

91,558 |

216,880 |

145,572 |

210,763 |

|||||||||||||||

| Non-interest expense: |

||||||||||||||||||||

| Operating expenses (2) |

511,218 |

546,628 |

641,218 |

638,109 |

615,600 |

|||||||||||||||

| Amortization of core deposit intangibles |

— |

— |

208 |

2,391 |

5,344 |

|||||||||||||||

| Debt repositioning charge |

— |

— |

— |

— |

141,209 |

|||||||||||||||

| Merger-related expenses |

— |

— |

— |

11,146 |

3,702 |

|||||||||||||||

| Total non-interest expense |

511,218 |

546,628 |

641,426 |

651,646 |

765,855 |

|||||||||||||||

| Income tax expense (benefit) |

128,264 |

135,252 |

202,014 |

281,727 |

(84,857 |

) | ||||||||||||||

| Net income (loss) (3) |

395,043 |

422,417 |

466,201 |

495,401 |

(47,156 |

) | ||||||||||||||

| Basic earnings (loss) per common share (3) |

$ | 0.77 |

$ | 0.79 |

$ | 0.90 |

$ | 1.01 |

$ | (0.11 |

) | |||||||||

| Diluted earnings (loss) per common share (3) |

0.77 |

0.79 |

0.90 |

1.01 |

(0.11 |

) | ||||||||||||||

| Dividends paid per common share |

0.68 |

0.68 |

0.68 |

0.68 |

1.00 |

|||||||||||||||

| SELECTED RATIOS: |

||||||||||||||||||||

| Return on average assets (3) |

0.76 |

% | 0.84 |

% | 0.96 |

% | 1.00 |

% | (0.10 |

)% | ||||||||||

| Return on average common stockholders’ equity (3) |

5.88 |

6.20 |

7.12 |

8.19 |

(0.81 |

) | ||||||||||||||

| Average common stockholders’ equity to average assets |

11.82 |

12.51 |

12.76 |

12.28 |

11.90 |

|||||||||||||||

| Operating expenses to average assets (2) |

0.98 |

1.09 |

1.32 |

1.29 |

1.26 |

|||||||||||||||

| Efficiency ratio (1)(2) |

49.08 |

48.70 |

47.61 |

44.53 |

99.48 |

|||||||||||||||

| Net interest rate spread (1) |

1.79 |

2.06 |

2.47 |

2.85 |

0.69 |

|||||||||||||||

| Net interest margin (1) |

2.02 |

2.25 |

2.59 |

2.93 |

0.94 |

|||||||||||||||

| Dividend payout ratio |

88.31 |

86.08 |

75.56 |

67.33 |

— |

|||||||||||||||

| BALANCE SHEET SUMMARY: |

||||||||||||||||||||

| Total assets |

$ | 53,640,821 |

$ | 51,899,376 |

$ | 49,124,195 |

$ | 48,926,555 |

$ | 50,317,796 |

||||||||||

| Loans, net of allowance for loan losses |

41,746,517 |

40,006,088 |

38,265,183 |

39,308,016 |

38,011,995 |

|||||||||||||||

| Allowance for losses on non-covered loans |

147,638 |

159,820 |

158,046 |

158,290 |

147,124 |

|||||||||||||||

| Allowance for losses on covered loans |

— |

— |

— |

23,701 |

31,395 |

|||||||||||||||

| Securities |

5,885,887 |

5,644,071 |

3,531,427 |

3,817,057 |

6,173,645 |

|||||||||||||||

| Deposits |

31,657,132 |

30,764,430 |

29,102,163 |

28,887,903 |

28,426,758 |

|||||||||||||||

| Borrowed funds |

14,557,593 |

14,207,866 |

12,913,679 |

13,673,379 |

15,748,405 |

|||||||||||||||

| Common stockholders’ equity |

6,208,854 |

6,152,395 |

6,292,536 |

6,123,991 |

5,934,696 |

|||||||||||||||

| Common shares outstanding |

467,346,781 |

473,536,604 |

488,490,352 |

487,056,676 |

484,943,308 |

|||||||||||||||

| Book value per common share |

$ | 13.29 |

$ | 12.99 |

$ | 12.88 |

$ | 12.57 |

$ | 12.24 |

||||||||||

| Common stockholders’ equity to total assets |

11.57 |

% | 11.85 |

% | 12.81 |

% | 12.52 |

% | 11.79 |

% | ||||||||||

| ASSET QUALITY RATIOS (excluding covered assets and non-covered purchased credit-impaired loans): |

||||||||||||||||||||

| Non-performing non-covered loans to total non-covered loans |

0.15 |

% | 0.11 |

% | 0.19 |

% | 0.15 |

% | 0.13 |

% | ||||||||||

| Non-performing non-covered assets to total non-covered assets |

0.14 |

0.11 |

0.18 |

0.14 |

0.13 |

|||||||||||||||

| Allowance for losses on non-covered loans to non-performing non-covered loans |

241.07 |

351.21 |

214.50 |

277.19 |

310.08 |

|||||||||||||||

| Allowance for losses on non-covered loans to total non-covered loans |

0.35 |

0.40 |

0.41 |

0.42 |

0.41 |

|||||||||||||||

| Net charge-offs (recoveries) to average loans (4) |

0.05 |

0.04 |

0.16 |

0.00 |

(0.02 |

) | ||||||||||||||

(1) |

The 2015 amount reflects the impact of a $773.8 million debt repositioning charge recorded as interest expense in the fourth quarter of the year. |

(2) |

The 2015 amount includes state and local non-income taxes of $5.4 million resulting from the debt repositioning charge. |

(3) |

The 2015 amount reflects the $546.8 million after-tax impact of the debt repositioning charge recorded as interest expense and non-interest expense, combined. |

(4) |

Average loans include covered loans. |

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

| Constant Maturity Treasury Rates |

||||||||||||||||

| Five-Year |

Seven-Year |

|||||||||||||||

| 2019 |

2018 |

2019 |

2018 |

|||||||||||||

| High |

2.62 |

% | 3.09 |

% | 2.70 |

% | 3.18 |

% | ||||||||

| Low |

1.32 |

2.25 |

1.40 |

2.37 |

||||||||||||

| Average |

1.95 |

2.75 |

2.05 |

2.85 |

||||||||||||

| December |

||||||||

| 2019 |

2018 |

|||||||

| Unemployment rate: |

||||||||

| United States |

3.4 |

% | 3.7 |

% | ||||

| New York City |

3.2 |

3.9 |

||||||

| Arizona |

4.3 |

4.9 |

||||||

| Florida |

2.5 |

3.3 |

||||||

| New Jersey |

3.6 |

3.6 |

||||||

| New York |

3.7 |

3.9 |

||||||

| Ohio |

3.8 |

4.8 |

||||||

| For the Twelve Months Ended December |

||||||||

| 2019 |

2018 |

|||||||

| Change in prices: |

2.3 |

% | 1.9 |

% | ||||

| Year |

New York City Rental Vacancy Rate All Rental Units 1 |

New York City Rental Vacancy Rate Rent Stabilized Units 1 |

New York City Annual Average Unemployment Rate 2 |

|||||||||

| 2017 |

3.63 |

% | 2.06 |

% | 4.50 |

% | ||||||

| 2014 |

3.45 |

% | 2.12 |

% | 7.20 |

% | ||||||

| 2011 |

3.12 |

% | 2.55 |

% | 9.10 |

% | ||||||

| 2008 |

2.88 |

% | 2.14 |

% | 5.60 |

% | ||||||

| 2005 |

3.09 |

% | 2.68 |

% | 5.80 |

% | ||||||

| 2002 |

2.94 |

% | 2.52 |

% | 8.00 |

% | ||||||

| 1999 |

3.19 |

% | 2.46 |

% | 6.80 |

% | ||||||

| 1996 |

4.01 |

% | 3.57 |

% | 8.80 |

% | ||||||

| 1993 |

3.44 |

% | 3.10 |

% | 10.40 |

% | ||||||

| 1991 |

3.78 |

% | 3.54 |

% | 8.70 |

% | ||||||

(1) |

Source: Selected Initial Findings of the New York City Housing and Vacancy Survey |

(2) |

Source: http://www.labor.ny.gov/stats/laus.asp |

| • | Changes in lending policies and procedures, including changes in underwriting standards and collection, and charge-off and recovery practices; |

| • | Changes in international, national, regional, and local economic and business conditions and developments that affect the collectability of the portfolio, including the condition of various market segments; |

| • | Changes in the nature and volume of the portfolio and in the terms of loans; |

| • | Changes in the volume and severity of past-due loans, the volume of non-accrual loans, and the volume and severity of adversely classified or graded loans; |

| • | Changes in the quality of our loan review system; |

| • | Changes in the value of the underlying collateral for collateral-dependent loans; |

| • | The existence and effect of any concentrations of credit, and changes in the level of such concentrations; |

| • | Changes in the experience, ability, and depth of lending management and other relevant staff; and |

| • | The effect of other external factors, such as competition and legal and regulatory requirements, on the level of estimated credit losses in the existing portfolio. |

| • | Periodic inspections of the loan collateral by qualified in-house and external property appraisers/inspectors; |

| • | Regular meetings of executive management with the pertinent Board committees, during which observable trends in the local economy and/or the real estate market are discussed; |

| • | Assessment of the aforementioned factors by the pertinent members of the Board of Directors and management when making a business judgment regarding the impact of anticipated changes on the future level of loan losses; and |

| • | Analysis of the portfolio in the aggregate, as well as on an individual loan basis, taking into consideration payment history, underwriting analyses, and internal risk ratings. |

| At December 31, 2019 |

||||||||||||||||

| Multi-Family Loans |

Commercial Real Estate Loans |

|||||||||||||||

| (dollars in thousands) |

Amount |

Percent of Total |

Amount |

Percent of Total |

||||||||||||

| New York City: |

||||||||||||||||

| Manhattan |

$ | 7,788,722 |

25.00 |

% | $ | 3,360,067 |

47.45 |

% | ||||||||

| Brooklyn |

5,486,486 |

17.61 |

537,304 |

7.59 |

||||||||||||

| Bronx |

3,929,333 |

12.61 |

163,468 |

2.31 |

||||||||||||

| Queens |

2,583,430 |

8.29 |

618,644 |

8.73 |

||||||||||||

| Staten Island |

119,270 |

0.38 |

53,767 |

0.76 |

||||||||||||

| Total New York City |

$ | 19,907,241 |

63.89 |

% | $ | 4,733,250 |

66.84 |

% | ||||||||

| New Jersey |

3,752,028 |

12.04 |

532,029 |

7.51 |

||||||||||||

| Long Island |

602,884 |

1.93 |

806,580 |

11.39 |

||||||||||||

| Total Metro New York |

$ | 24,262,153 |

77.86 |

% | $ | 6,071,859 |

85.74 |

% | ||||||||

| Other New York State |

942,881 |

3.03 |

157,841 |

2.23 |

||||||||||||

| All other states |

5,953,638 |

19.11 |

852,210 |

12.03 |

||||||||||||

| Total |

$ | 31,158,672 |

100.00 |

% | $ | 7,081,910 |

100.00 |

% | ||||||||

| (in thousands) |

Multi- Family |

Commercial Real Estate |

One-to-Four Family |

Acquisition, Development, and Construction |

Other |

Total Loans |

||||||||||||||||||

| Amount due: |

||||||||||||||||||||||||

| Within one year |

$ | 10,989,614 |

$ | 2,264,268 |

$ | 109,605 |

$ | 142,281 |

$ | 1,856,687 |

$ | 15,362,455 |

||||||||||||

| After one year: |

||||||||||||||||||||||||

| One to five years |

19,324,070 |

4,212,409 |

248,216 |

57,030 |

842,900 |

24,684,625 |

||||||||||||||||||

| Over five years |

844,988 |

605,233 |

22,540 |

1,285 |

322,893 |

1,796,939 |

||||||||||||||||||

| Total due or repricing after one year |

20,169,058 |

4,817,642 |

270,756 |

58,315 |

1,165,793 |

26,481,564 |

||||||||||||||||||

| Total amounts due or repricing, gross |

$ | 31,158,672 |

$ | 7,081,910 |

$ | 380,361 |

$ | 200,596 |

$ | 3,022,480 |

$ | 41,844,019 |

||||||||||||

| Due after December 31, 2020 |

||||||||||||

| (in thousands) |

Fixed |

Adjustable |

Total |

|||||||||

| Mortgage Loans: |

||||||||||||

| Multi-family |

$ | 2,585,674 |

$ | 17,583,384 |

$ | 20,169,058 |

||||||

| Commercial real estate |

904,271 |

3,913,371 |

4,817,642 |

|||||||||

| One-to-four family |

64,793 |

205,963 |

270,756 |

|||||||||

| Acquisition, development, and construction |

40,930 |

17,385 |

58,315 |

|||||||||

| Total mortgage loans |

3,595,668 |

21,720,103 |

25,315,771 |

|||||||||

| Other loans |

1,014,240 |

151,553 |

1,165,793 |

|||||||||

| Total loans |

$ | 4,609,908 |

$ | 21,871,656 |

$ | 26,481,564 |

||||||

| For the Years Ended December 31, |

||||||||||||||||

| 2019 |

2018 |

|||||||||||||||

| (dollars in thousands) |

Amount |

Percent of Total |

Amount |

Percent of Total |

||||||||||||

| Mortgage Loan Originated for Investment: |

||||||||||||||||

| Multi-family |

$ | 5,981,700 |

56.44 |

% | $ | 6,621,808 |

65.84 |

% | ||||||||

| Commercial real estate |

1,226,272 |

11.57 |

966,731 |

9.61 |

||||||||||||

| One-to-four family residential |

102,829 |

0.97 |

12,624 |

0.13 |

||||||||||||

| Acquisition, development, and construction |

91,400 |

0.86 |

56,651 |

0.56 |

||||||||||||

| Total mortgage loans originated for investment |

7,402,201 |

69.84 |

7,657,814 |

76.14 |

||||||||||||

| Other Loans Originated for Investment: |

||||||||||||||||

| Specialty finance |

2,799,962 |

26.42 |

1,917,048 |

19.06 |

||||||||||||

| Other commercial and industrial |

391,702 |

3.70 |

478,619 |

4.76 |

||||||||||||

| Other |

4,200 |

0.04 |

4,116 |

0.04 |

||||||||||||

| Total other loans originated for investment |

3,195,864 |

30.16 |

2,399,783 |

23.86 |

||||||||||||

| Total loans originated for investment |

$ | 10,598,065 |

100.00 |

% | $ | 10,057,597 |

100.00 |

% | ||||||||

| At December 31, |

||||||||||||||||||||||||||||||||||||||||||||||||

| 2019 |

2018 |

2017 |

2016 |

2015 |

||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) |

Amount |

Percent of Total Loans |

Amount |

Percent of Total Loans |

Amount |

Percent of Total Loans |

Amount |

Percent of Total Loans |

Percent of Non-Covered Loans |

Amount |

Percent of Total Loans |

Percent of Non-Covered Loans |

||||||||||||||||||||||||||||||||||||

| Non-Covered Mortgage Loans: |

||||||||||||||||||||||||||||||||||||||||||||||||

| Multi-family |

$ | 31,158,672 |

74.46 |

% | $ | 29,883,919 |

74.46 |

% | $ | 28,074,709 |

73.12 |

% | $ | 26,945,052 |

68.28 |

% | 71.35 |

% | $ | 25,971,620 |

68.04 |

% | 71.93 |

% | ||||||||||||||||||||||||

| Commercial real estate |

7,081,910 |

16.93 |

6,998,834 |

17.44 |

7,322,226 |

19.07 |

7,724,362 |

19.57 |

20.45 |

7,857,204 |

20.58 |

21.76 |

||||||||||||||||||||||||||||||||||||

| One-to-four family |

380,361 |

0.91 |

446,094 |

1.11 |

477,228 |

1.24 |

381,081 |

0.97 |

1.01 |

116,841 |

0.31 |

0.32 |

||||||||||||||||||||||||||||||||||||

| Acquisition, development, and construction |

200,596 |

0.48 |

407,870 |

1.02 |

435,825 |

1.14 |

381,194 |

0.97 |

1.01 |

311,676 |

0.82 |

0.86 |

||||||||||||||||||||||||||||||||||||

| Total non-covered mortgage loans |

38,821,539 |

92.78 |

37,736,717 |

94.03 |

36,309,988 |

94.57 |

35,431,689 |

89.79 |

93.82 |

34,257,350 |

89.75 |

94.87 |

||||||||||||||||||||||||||||||||||||

| Non-Covered Other Loans: |

||||||||||||||||||||||||||||||||||||||||||||||||

| Specialty finance |

2,594,326 |

6.20 |

1,918,545 |

4.78 |

1,539,733 |

4.01 |

1,267,530 |

3.21 |

3.36 |

880,673 |

2.31 |

2.44 |

||||||||||||||||||||||||||||||||||||

| Other commercial and industrial |

420,052 |

1.00 |

469,875 |

1.17 |

500,841 |

1.31 |

632,915 |

1.60 |

1.68 |

569,883 |

1.49 |

1.58 |

||||||||||||||||||||||||||||||||||||

| Other loans |

8,102 |

0.02 |

8,724 |

0.02 |

8,460 |

0.02 |

24,067 |

0.06 |

0.06 |

32,583 |

0.09 |

0.09 |

||||||||||||||||||||||||||||||||||||

| Total non-covered other loans |

3,022,480 |

7.22 |

2,397,144 |

5.97 |

2,049,034 |

5.34 |

1,924,512 |

4.87 |

5.10 |

1,483,139 |

3.89 |

4.11 |

||||||||||||||||||||||||||||||||||||

| Total non-covered loans held for investment |

$ | 41,844,019 |

100.00 |

$ | 40,133,861 |

100.00 |

$ | 38,359,022 |

99.91 |

$ | 37,356,201 |

94.66 |

98.92 |

$ | 35,740,489 |

93.64 |

98.98 |

|||||||||||||||||||||||||||||||

| Loans held for sale |

— |

— |

— |

— |

35,258 |

0.09 |

409,152 |

1.04 |

1.08 |

367,221 |

0.96 |

1.02 |

||||||||||||||||||||||||||||||||||||

| Total non-covered loans |

$ | 41,844,019 |

100.00 |

% | $ | 40,133,861 |

100.00 |

% | $ | 38,394,280 |

100.00 |

$ | 37,765,353 |

95.70 |

100.00 |

% | $ | 36,107,710 |

94.60 |

100.00 |

% | |||||||||||||||||||||||||||

| Covered loans |

— |

— |

— |

— |

1,698,133 |

4.30 |

2,060,089 |

5.40 |

||||||||||||||||||||||||||||||||||||||||

| Total loans |

$ | 41,844,019 |

$ | 40,133,861 |

$ | 38,394,280 |

100.00 |

% | $ | 39,463,486 |

100.00 |

% | $ | 38,167,799 |

100.00 |

% | ||||||||||||||||||||||||||||||||

| Net deferred loan origination costs |

50,136 |

32,047 |

28,949 |

26,521 |

22,715 |

|||||||||||||||||||||||||||||||||||||||||||

| Allowance for losses on non-covered loans |

(147,638 |

) | (159,820 |

) | (158,046 |

) | (158,290 |

) | (147,124 |

) | ||||||||||||||||||||||||||||||||||||||

| Allowance for losses on covered loans |

— |

— |

— |

(23,701 |

) | (31,395 |

) | |||||||||||||||||||||||||||||||||||||||||

| Total loans and leases, net |

$ | 41,746,517 |

$ | 40,006,088 |

$ | 38,265,183 |

$ | 39,308,016 |

$ | 38,011,995 |

||||||||||||||||||||||||||||||||||||||

| Change from December 31, 2018 to December 31, 2019 |

||||||||||||||||

| (dollars in thousands) |

December 31, 2019 |

December 31, 2018 |

Amount |

Percent |

||||||||||||

| Non-Performing Loans: |

||||||||||||||||

| Non-accrual mortgage loans: |

||||||||||||||||

| Multi-family |

$ | 5,407 |

$ | 4,220 |

$ | 1,187 |

28.13 |

% | ||||||||

| Commercial real estate |

14,830 |

3,021 |

11,809 |

390.90 |

||||||||||||

| One-to-four family |

1,730 |

1,651 |

79 |

4.78 |

||||||||||||

| Acquisition, development, and construction |

— |

— |

— |

— |

||||||||||||

| Total non-accrual mortgage loans |

21,967 |

8,892 |

13,075 |

147.04 |

||||||||||||

| Non-accrual other loans(1) |

39,276 |

36,614 |

2,662 |

7.27 |

||||||||||||

| Total non-performing loans |

$ | 61,243 |

$ | 45,506 |

$ | 15,737 |

34.58 |

|||||||||

(1) |

Includes $30.4 million and $35.5 million of non-accrual taxi medallion-related loans at December 31, 2019 and 2018, respectively. |

| (in thousands) |

||||

| Balance at December 31, 2018 |

$ | 45,506 |

||

| New non-accrual |

46,650 |

|||

| Charge-offs |

(10,120 |

) | ||

| Transferred to repossessed assets |

(4,964 |

) | ||

| Loan payoffs, including dispositions and principal pay-downs |

(15,829 |

) | ||

| Restored to performing status |

— |

|||

| Balance at December 31, 2019 |

$ | 61,243 |

||

| Change from December 31, 2018 to December 31, 2019 |

||||||||||||||||

| (dollars in thousands) |

December 31, 2019 |

December 31, 2018 |

Amount |

Percent |

||||||||||||

| Loans 30-89 Days Past Due: |

||||||||||||||||

| Multi-family |

$1,131 |

$— |

$1,131 |

NM |

% | |||||||||||

| Commercial real estate |

2,545 |

— |

2,545 |

NM |

||||||||||||

| One-to-four family |

— |

9 |

(9 |

) | NM |

|||||||||||

| Acquisition, development, and construction |

— |

— |

— |

— |

||||||||||||

| Other loans (1) |

44 |

555 |

(511 |

) | (92.07 |

) | ||||||||||

| Total loans 30-89 days past due |

$3,720 |

$564 |

$3,156 |

559.57 |

||||||||||||

(1) |

Includes $0 and $530,000 of non-accrual taxi medallion-related loans at December 31, 2019 and 2018, respectively. |

| Loan No. 1 |

Loan No. 2 (2) |

Loan No. 3 (2) |

Loan No. 4 (2) |

Loan No. 5 |

||||||||||||||||

| Type of Loan |

CRE |

C&I |

Multi-Family |

C&I |

C&I |

|||||||||||||||

| Origination date |

06/20/14 |

10/31/17 |

1/05/06 |

4/29/14 |

06/01/16 |

|||||||||||||||

| Origination balance |

$9,750,000 |

$13,000,000 |

$12,640,000 |

$13,325,000 |

$4,080,000 |

|||||||||||||||

| Full commitment balance (1) |

$9,750,000 |

$13,000,000 |

$12,640,000 |

$13,325,000 |

$4,080,000 |

|||||||||||||||

| Balance at December 31, 2019 |

$9,750,000 |

$ 6,961,564 |

$ 3,576,758 |

$ 2,593,755 |

$2,145,995 |

|||||||||||||||

| Associated allowance |

None |

None |

None |

None |

None |

|||||||||||||||

| Non-accrual date |

October 2019 |

February 2019 |

March 2014 |

June 2017 |

August 2019 |

|||||||||||||||

| Origination LTV |

65 |

% | N/A |

79 |

% | N/A |

21 |

% | ||||||||||||

| Current LTV |

66 |

% | N/A |

28 |

% | N/A |

12 |

% | ||||||||||||

| Last appraisal |

October 2019 |

N/A |

February 2019 |

N/A |

October 2019 |

|||||||||||||||

(1) |

There are no funds available for further advances on the five largest non-performing loans. |

(2) |

Loan is a Troubled Debt Restructure. |

| |

No. 1 - |

The borrower is an owner of real estate and is based in New York. The loan is collateralized by a 8,566 square foot, retail condo unit located in New York, New York. | ||

| No. 2 - |

The borrower is an owner of an apparel company based in New York. The loan is collateralized by all of the borrower’s assets, including but not limited to: cash, accounts receivable, and inventory. | |||

| No. 3 - |

The borrower is an owner of real estate and is based in New Jersey. The loan is collateralized by a multi-family complex with 267 residential units and four retail stores in Atlantic City, New Jersey. | |||

| No. 4 - |

The borrower is a finance company based in New York. The loan is collateralized by various taxi medallion loans in New York, New York and Chicago, Illinois. | |||

| No. 5 - |

The borrower is an owner/operator of a quarry company based in New York. The loan is collateralized by 139.7 acres of land used for mining granite in White Hall, New York. |

| (in thousands) |

Accruing |

Non-Accrual |

Total |

|||||||||

| Balance at December 31, 2018 |

$ | 9,162 |

$ | 25,719 |

$ | 34,881 |

||||||

| New TDRs |

865 |

28,827 |

29,692 |

|||||||||

| Charge-offs |

— |

(8,367 |

) | (8,367 |

) | |||||||

| Transferred to repossessed assets |

— |

(368 |

) | (368 |

) | |||||||

| Loan payoffs, including dispositions and principal pay-downs |

(8,773 |

) | (6,566 |

) | (15,339 |

) | ||||||

| Balance at December 31, 2019 |

$ | 1,254 |

$ | 39,245 |

$ | 40,499 |

||||||

| At or for the Years Ended December 31, |

||||||||||||||||||||

| (dollars in thousands) |

2019 |

2018 |

2017 |

2016 |

2015 |

|||||||||||||||

| Allowance for Losses on Non-Covered Loans: |

||||||||||||||||||||

| Balance at beginning of year |

$ | 159,820 |

$ | 158,046 |

$ | 156,524 |

$ | 145,196 |

$ | 139,857 |

||||||||||

| Provision for (recovery of) losses on non-covered loans |

7,105 |

18,256 |

60,943 |

12,036 |

(2,846 |

) | ||||||||||||||

| Recovery from allowance on PCI loans |

— |

— |

1,766 |

— |

— |

|||||||||||||||

| Charge-offs: |

||||||||||||||||||||

| Multi-family |

(659 |

) | (34 |

) | (279 |

) | — |

(167 |

) | |||||||||||

| Commercial real estate |

— |

(3,191 |

) | — |

— |

(273 |

) | |||||||||||||

| One-to-four family residential |

(954 |

) | — |

(96 |

) | (170 |

) | (875 |

) | |||||||||||

| Acquisition, development, and construction |

— |

(2,220 |

) | — |

— |

— |

||||||||||||||

| Other loans |

(18,694 |

) | (12,897 |

) | (62,975 |

) | (3,413 |

) | (1,273 |

) | ||||||||||

| Total charge-offs |

(20,307 |

) | (18,342 |

) | (63,350 |

) | (3,583 |

) | (2,588 |

) | ||||||||||

| Recoveries |

1,020 |

1,860 |

2,163 |

2,875 |

10,773 |

|||||||||||||||

| Net (charge-offs) recoveries |

(19,287 |

) | (16,482 |

) | (61,187 |

) | (708 |

) | 8,185 |

|||||||||||

| Balance at end of year |

$ | 147,638 |

$ | 159,820 |

$ | 158,046 |

$ | 156,524 |

$ | 145,196 |

||||||||||

| Non-Performing Non-Covered Assets: |

||||||||||||||||||||

| Non-accrual non-covered mortgage loans: |

||||||||||||||||||||

| Multi-family |

$ | 5,407 |

$ | 4,220 |

$ | 11,078 |

$ | 13,558 |

$ | 13,904 |

||||||||||

| Commercial real estate |

14,830 |

3,021 |

6,659 |

9,297 |

14,920 |

|||||||||||||||

| One-to-four family residential |

1,730 |

1,651 |

1,966 |

9,679 |

12,259 |

|||||||||||||||

| Acquisition, development, and construction |

— |

— |

6,200 |

6,200 |

27 |

|||||||||||||||

| Total non-accrual non-covered mortgage loans |

21,967 |

8,892 |

25,903 |

38,734 |

41,110 |

|||||||||||||||

| Non-accrual non-covered other loans |

39,276 |

36,614 |

47,779 |

17,735 |

5,715 |

|||||||||||||||

| Loans 90 days or more past due and still accruing interest |

— |

— |

— |

— |

— |

|||||||||||||||

| Total non-performing non-covered loans(1) |

$ | 61,243 |

$ | 45,506 |

$ | 73,682 |

$ | 56,469 |

$ | 46,825 |

||||||||||

| Non-covered repossessed assets(2) |

12,268 |

10,794 |

16,400 |

11,607 |

14,065 |

|||||||||||||||

| Total non-performing non-covered assets |

$ | 73,511 |

$ | 56,300 |

$ | 90,082 |

$ | 68,076 |

$ | 60,890 |

||||||||||

| Asset Quality Measures: |

||||||||||||||||||||

| Non-performing non-covered loans to total non-covered loans |

0.15 |

% | 0.11 |

% | 0.19 |

% | 0.15 |

% | 0.13 |

% | ||||||||||

| Non-performing non-covered assets to total non-covered assets |

0.14 |

0.11 |

0.18 |

0.14 |

0.13 |

|||||||||||||||

| Allowance for losses on non-covered loans to non-performing non-covered loans |

241.07 |

351.21 |

214.50 |

277.19 |

310.08 |

|||||||||||||||

| Allowance for losses on non-covered loans to total non-covered loans |

0.35 |

0.40 |

0.41 |

0.42 |

0.41 |

|||||||||||||||

| Net charge-offs (recoveries) during the period to average loans outstanding during the period (3) |

0.05 |

0.04 |

0.16 |

0.00 |

(0.02 |

) | ||||||||||||||

| Non-Covered Loans 30-89 Days Past Due: |

||||||||||||||||||||

| Multi-family |

$ | 1,131 |

$ | — |

$ | 1,258 |

$ | 28 |

$ | 4,818 |

||||||||||

| Commercial real estate |

2,545 |

— |

13,227 |

— |

178 |

|||||||||||||||

| One-to-four family residential |

— |

9 |

585 |

2,844 |

1,117 |

|||||||||||||||

| Acquisition, development, and construction |

— |

— |

— |

— |

— |

|||||||||||||||

| Other loans |

44 |

555 |

2,719 |

7,511 |

492 |

|||||||||||||||

| Total loans 30-89 days past due(4) |

$ | 3,720 |

$ | 564 |

$ | 17,789 |

$ | 10,383 |

$ | 6,605 |

||||||||||

(1) |

The December 31, 2016 and 2015 amounts exclude loans 90 days or more past due of $131.5 million and $137.2 million, respectively, that are covered by FDIC loss sharing agreements. The December 31, 2016 and 2015 amounts also exclude $869,000 and $969,000, respectively, of non-covered PCI loans. |

(2) |

The December 31, 2016 and 2015 amounts exclude OREO of $17.0 million and $25.8 million, respectively, that were covered by FDIC loss sharing agreements. |

(3) |

Average loans include covered loans. |

(4) |

The December 31, 2016 and 2015 amounts exclude loans 30 to 89 days past due of $22.6 million and $32.8 million,, respectively, that are covered by FDIC loss sharing agreements. The December 31, 2016 amount also excludes $6 thousand of non-covered PCI loans. There were no non-covered PCI loans 30 to 89 days past due at any of the prior year-ends. |

| 2019 |

2018 |

2017 |

2016 |

2015 |

||||||||||||||||||||||||||||||||||||

| (dollars in thousands) |

Amount |

Percent of Loans in Each Category to Total Loans Held for Investment |

Amount |

Percent of Loans in Each Category to Total Loans Held for Investment |

Amount |

Percent of Loans in Each Category to Total Loans Held for Investment |

Amount |

Percent of Loans in Each Category to Total Non-Covered Loans Held for Investment |

Amount |

Percent of Loans in Each Category to Total Non-Covered Loans Held for Investment |

||||||||||||||||||||||||||||||

| Multi-family loans |

$ | 96,751 |

74.46 |

% | $ | 98,972 |

74.46 |

% | $ | 93,651 |

73.19 |

% | $ | 91,590 |

72.13 |

% | $ | 93,977 |

72.67 |

% | ||||||||||||||||||||

| Commercial real estate loans |

20,744 |

16.93 |

19,934 |

17.44 |

20,572 |

19.09 |

20,943 |

20.68 |

19,721 |

21.98 |

||||||||||||||||||||||||||||||

| One-to-four family residential loans |

1,051 |

0.91 |

1,333 |

1.11 |

1,360 |

1.24 |

1,484 |

1.02 |

612 |

0.33 |

||||||||||||||||||||||||||||||

| Acquisition, development, and construction loans |

4,148 |

0.48 |

10,744 |

1.02 |

12,692 |

1.14 |

9,908 |

1.02 |

8,402 |

0.87 |

||||||||||||||||||||||||||||||

| Other loans |

24,944 |

7.22 |

28,837 |

5.97 |

29,771 |

5.34 |

32,599 |

5.15 |

22,484 |

4.15 |

||||||||||||||||||||||||||||||

| Total loans |

$ | 147,638 |

100.00 |

% | $ | 159,820 |

100.00 |

% | $ | 158,046 |

100.00 |

% | $ | 156,524 |

100.00 |

% | $ | 145,196 |

100.00 |

% | ||||||||||||||||||||

| (in thousands) |

||||

| New York |

$ | 53,974 |

||

| New Jersey |

6,183 |

|||

| All other states |

1,086 |

|||

| Total non-performing loans |

$ | 61,243 |

||

| (in thousands) |

Certificates of Deposit |

Long-Term Debt (1) |

Operating Leases (2) |

Total |

||||||||||||

| One year or less |

$ | 13,310,426 |

$ | 3,425,000 |

$ | 27,304 |

$ | 16,762,730 |

||||||||

| One to three years |

711,615 |

1,097,661 |

51,865 |

1,861,141 |

||||||||||||

| Three to five years |

192,589 |

— |

25,078 |

217,667 |

||||||||||||

| More than five years |

228 |

8,934,932 |

279,961 |

9,215,121 |

||||||||||||

| Total |

$ | 14,214,858 |

$ | 13,457,593 |

$ | 384,208 |

$ | 28,056,659 |

||||||||

(1) |

Includes FHLB advances, repurchase agreements, and junior subordinated debentures. |

(2) |

Excludes imputed interest of $98.2 million. |

| (in thousands) |

||||

| Mortgage Loan Commitments: |

||||

| Multi-family and commercial real estate |

$ | 251,679 |

||

| One-to-four family |

801 |

|||

| Acquisition, development, and construction |

205,499 |

|||

| Total mortgage loan commitments |

$ | 457,979 |

||

| Other loan commitments (1) |

1,548,513 |

|||

| Total loan commitments |

$ | 2,006,492 |

||

| Commercial, performance stand-by, and financial stand-by letters of credit |

509,942 |

|||

| Total commitments |

$ | 2,516,434 |

||

(1) |

Includes unadvanced lines of credit. |

| At December 31, 2019 |

Actual |

Minimum |

||||||||||

| (dollars in thousands) |

Amount |

Ratio |

Required Ratio |

|||||||||

| Common equity tier 1 capital |

$ | 3,818,311 |

9.91 |

% | 4.50 |

% | ||||||

| Tier 1 risk-based capital |

4,321,151 |

11.22 |

6.00 |

|||||||||

| Total risk-based capital |

5,111,990 |

13.27 |

8.00 |

|||||||||

| Leverage capital |

4,321,151 |

8.66 |

4.00 |

|||||||||

| At December 31, 2018 |

Actual |

Minimum |

||||||||||

| (dollars in thousands) |

Amount |

Ratio |

Required Ratio |

|||||||||

| Common equity tier 1 capital |

$ | 3,806,857 |

10.55 |

% | 4.50 |

% | ||||||

| Tier 1 risk-based capital |

4,309,697 |

11.94 |

6.00 |

|||||||||

| Total risk-based capital |

5,112,079 |

14.16 |

8.00 |

|||||||||

| Leverage capital |

4,309,697 |

8.74 |

4.00 |

|||||||||

| • | Interest income increased $115.5 million or 6.8% to $1.8 billion on a year-over-year basis due to an $85.1 million or 5.8% increase in interest income from loans and a $51.5 million or 28.0% increase in interest income from securities. |

| • | The increase in interest income from loans was the result of a higher level of average loan balances in 2019 compared to 2018, as well as, a higher yield on the loans. Average loans increased $1.3 billion to $40.4 billion, up 3.2% compared to 2018. At the same time, the average yield on the loan portfolio rose ten basis points to 3.85%, year-over-year. In addition, prepayment income contributed $48.9 million and 11 basis points to interest income and the average yield from loans, respectively, compared to $44.9 million and ten basis points in the prior year. |

| • | The year-over-year improvement in interest income from securities was driven by a $1.5 billion increase in the average balance of securities partially offset by a ten basis point decline in the average yield to 3.72%. Prepayment income added $5.3 million and one basis point to the interest income and average yield from securities, respectively, relatively unchanged from 2018. |

| • | The average balance of interest-earning assets increased $1.6 billion or 3.4% to $47.5 billion and the average yield rose 12 basis points to 3.80%. |

| • | Interest expense increased $189.1 million to $847.8 million on a year-over-year basis as interest expense on deposits rose $150.9 million and interest expense on borrowed funds rose $38.1 million. |

| • | The year-over-year increase in interest expenses on deposits was due to a $1.7 billion increase in the average balance of deposits, mostly CD balances, and a 44 basis point increase in the average cost of deposits to 1.84%. |

| • | The year-over-year increase in interest expense from borrowed funds was driven primarily by a 29 basis point increase in the average cost of borrowings, while the average balance of borrowed funds was relatively unchanged. |

| • | As a result, the average balance of interest-bearing liabilities increased $1.6 billion or 4.0% to $42.3 billion and our average cost increased 39 basis points to 2.01%. |

| For the Twelve Months Ended |

||||||||||||

| Dec. 31, 2019 |

Dec. 31, 2018 |

Change (%) |

||||||||||

| (dollars in thousands) |

||||||||||||

| Total Interest Income |

$ | 1,805,160 |

$ | 1,689,673 |

7 |

% | ||||||

| Prepayment Income: |

||||||||||||

| Loans |

$ | 48,884 |

$ | 44,949 |

9 |

% | ||||||

| Securities |

5,304 |

4,957 |

7 |

% | ||||||||

| Total prepayment income |

$ | 54,188 |

$ | 49,906 |

9 |

% | ||||||

| GAAP Net Interest Margin |

2.02 |

% | 2.25 |

% | -23 |

bp | ||||||

| Less: |

||||||||||||

| Prepayment income from loans |

11 |

bp | 10 |

bp | 1 |

bp | ||||||

| Prepayment income from securities |

1 |

1 |

0 |

bp | ||||||||

| Plus: |

||||||||||||

| Subordinated debt issuance |

— |

|||||||||||

| Total prepayment income contribution to and subordinated debt impact on net interest margin |

12 |

bp | 11 |

bp | 1 |

bp | ||||||

| Adjusted Net Interest Margin (non-GAAP) |

1.90 |

% | 2.14 |

% | -24 |

bp | ||||||

| 1. | Adjusted net interest margin gives investors a better understanding of the effect of prepayment income on our net interest margin. Prepayment income in any given period depends on the volume of loans that refinance or prepay, or securities that prepay, during that period. Such activity is largely dependent on external factors such as current market conditions, including real estate values, and the perceived or actual direction of market interest rates. |

| 2. | Adjusted net interest margin is among the measures considered by current and prospective investors, both independent of, and in comparison with, our peers. |

| For the Years Ended December 31, |

||||||||||||||||||||||||||||||||||||

| 2019 |

2018 |

2017 |

||||||||||||||||||||||||||||||||||

| (dollars in thousands) |

Average Balance |

Interest |

Average Yield/ Cost |

Average Balance |

Interest |

Average Yield/ Cost |

Average Balance |

Interest |

Average Yield/ Cost |

|||||||||||||||||||||||||||

| ASSETS: |

||||||||||||||||||||||||||||||||||||

| Interest-earning assets: |

||||||||||||||||||||||||||||||||||||

| Mortgage and other loans and leases, net (1) |

$ | 40,384,573 |

$ | 1,553,004 |

3.85 |

% | $ | 39,122,724 |

$ | 1,467,944 |

3.75 |

% | $ | 38,400,003 |

$ | 1,417,237 |

3.69 |

% | ||||||||||||||||||

| Securities (2)(3) |

6,329,898 |

235,596 |

3.72 |

4,819,789 |

184,136 |

3.82 |

3,986,722 |

148,429 |

3.72 |

|||||||||||||||||||||||||||

| Interest-earning cash and cash equivalents |

744,204 |

16,560 |

2.23 |

1,955,837 |

37,593 |

1.92 |

1,227,137 |

16,573 |

1.35 |

|||||||||||||||||||||||||||

| Total interest-earning assets |

47,458,675 |

1,805,160 |

3.80 |

45,898,350 |

1,689,673 |

3.68 |

43,613,862 |

1,582,239 |

3.63 |

|||||||||||||||||||||||||||

| Non-interest-earning assets |

4,650,420 |

4,314,990 |

5,011,020 |

|||||||||||||||||||||||||||||||||

| Total assets |

$ | 52,109,095 |

$ | 50,213,340 |

$ | 48,624,882 |

||||||||||||||||||||||||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY: |

||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits: |

||||||||||||||||||||||||||||||||||||

| Interest-bearing checking and money market accounts |

$ | 10,597,285 |

$ | 174,347 |

1.65 |

% | $ | 12,033,213 |

$ | 167,972 |

1.40 |

% | $ | 12,787,703 |

$ | 98,980 |

0.77 |

% | ||||||||||||||||||

| Savings accounts |

4,737,423 |

35,705 |

0.75 |

4,902,728 |

28,994 |

0.59 |

5,170,342 |

28,447 |

0.55 |

|||||||||||||||||||||||||||

| Certificates of deposit |

13,532,036 |

320,234 |

2.37 |

10,236,599 |

182,383 |

1.78 |

8,164,518 |

102,355 |

1.25 |

|||||||||||||||||||||||||||

| Total interest-bearing deposits |

28,866,744 |

530,286 |

1.84 |

27,172,540 |

379,349 |

1.40 |

26,122,563 |

229,782 |

0.88 |

|||||||||||||||||||||||||||

| Borrowed funds |

13,393,837 |

317,474 |

2.37 |

13,454,912 |

279,329 |

2.08 |

12,836,919 |

222,454 |

1.73 |

|||||||||||||||||||||||||||

| Total interest-bearing liabilities |

42,260,581 |

847,760 |

2.01 |

40,627,452 |

658,678 |

1.62 |

38,959,482 |

452,236 |

1.16 |

|||||||||||||||||||||||||||

| Non-interest-bearing deposits |

2,588,040 |

2,550,163 |

2,782,155 |

|||||||||||||||||||||||||||||||||

| Other liabilities |

596,488 |

252,804 |

279,466 |

|||||||||||||||||||||||||||||||||

| Total liabilities |

45,445,109 |

43,430,419 |

42,021,103 |

|||||||||||||||||||||||||||||||||

| Stockholders’ equity |

6,663,986 |

6,782,921 |

6,603,779 |

|||||||||||||||||||||||||||||||||

| Total liabilities and stockholders’ equity |

$ | 52,109,095 |

$ | 50,213,340 |

$ | 48,624,882 |

||||||||||||||||||||||||||||||

| Net interest income/interest rate spread |

$ | 957,400 |

1.79 |

% | $ | 1,030,995 |

2.06 |

% | $ | 1,130,003 |

2.47 |

% | ||||||||||||||||||||||||

| Net interest margin |

2.02 |

% | 2.25 |

% | 2.59 |

% | ||||||||||||||||||||||||||||||

| Ratio of interest-earning assets to interest-bearing liabilities |

1.12x |

1.13x |

1.12x |

|||||||||||||||||||||||||||||||||

(1) |

Amounts are net of net deferred loan origination costs/(fees) and the allowances for loan losses and include non-performing loans. |

(2) |

Amounts are at amortized cost. |

(3) |

Includes FHLB stock. |

| Year Ended |

Year Ended |

|||||||||||||||||||||||

| December 31, 2019 |

December 31, 2018 |

|||||||||||||||||||||||

| Compared to Year Ended |

Compared to Year Ended |

|||||||||||||||||||||||

| December 31, 2018 |

December 31, 2017 |

|||||||||||||||||||||||

| Increase/(Decrease) |

Increase/(Decrease) |

|||||||||||||||||||||||

| Due to |

Due to |

|||||||||||||||||||||||

| (in thousands) |

Volume |

Rate |

Net |

Volume |

Rate |

Net |

||||||||||||||||||

| INTEREST-EARNING ASSETS: |

||||||||||||||||||||||||

| Mortgage and other loans and leases, net |

$ | 48,012 |

$ | 37,048 |

$ | 85,060 |

$ | 26,909 |

$ | 23,798 |

$ | 50,707 |

||||||||||||

| Securities and interest-earning cash and cash equivalents |

10,056 |

20,371 |

30,427 |

50,936 |

5,791 |

56,727 |

||||||||||||||||||

| Total |

58,068 |

57,419 |

115,487 |

77,845 |

29,589 |

107,434 |

||||||||||||||||||

| INTEREST-BEARING LIABILITIES: |

||||||||||||||||||||||||

| Interest-bearing checking and money market accounts |

$ | (12,836 |

) | $ | 19,211 |

$ | 6,375 |

$ | (5,468 |

) | $ | 74,460 |

$ | 68,992 |

||||||||||

| Savings accounts |

(940 |

) | 7,651 |

6,711 |

(1,225 |

) | 1,772 |

547 |

||||||||||||||||

| Certificates of deposit |

68,257 |

69,594 |

137,851 |

30,091 |

49,937 |

80,028 |

||||||||||||||||||

| Borrowed funds |

(1,262 |

) | 39,407 |

38,145 |

11,124 |

45,751 |

56,875 |

|||||||||||||||||

| Totals |

53,219 |

135,863 |

189,082 |

34,522 |

171,920 |

206,442 |

||||||||||||||||||

| Change in net interest income |

$ | 4,849 |

$ | (78,444 |

) | $ | (73,595 |

) | $ | 43,323 |

$ | (142,331 |

) | $ | (99,008 |

) | ||||||||

| For the Years Ended December 31, |

||||||||||||

| (in thousands) |

2019 |

2018 |

2017 |

|||||||||

| Fee income |

$ | 29,297 |

$ | 29,765 |

$ | 31,759 |

||||||

| BOLI income |

28,363 |

28,252 |

27,133 |

|||||||||

| Mortgage banking income |

— |

— |

19,337 |

|||||||||

| Net gain (loss) on securities |

7,725 |

(1,994 |

) | 29,924 |

||||||||

| FDIC indemnification expense |

— |

— |

(18,961 |

) | ||||||||

| Gain on sale of covered loans and mortgage banking operations |

— |

— |

82,026 |

|||||||||

| Other income: |

||||||||||||

| Third-party investment product sales |

6,468 |

12,474 |

12,771 |

|||||||||

| Recovery of OTTI securities |

55 |

146 |

1,120 |

|||||||||

| Other |

12,322 |

22,915 |

31,771 |

|||||||||

| Total other income |

18,845 |

35,535 |

45,662 |

|||||||||

| Total non-interest income |

$ | 84,230 |

$ | 91,558 |

$ | 216,880 |

||||||

| 2019 |

2018 |

|||||||||||||||||||||||||||||||

| (in thousands, except per share data) |

4th |

3rd |

2nd |

1st |

4th |

3rd |

2nd |

1st |

||||||||||||||||||||||||

| Net interest income |

$242,470 |

$235,915 |

$237,690 |

$241,325 |

$247,236 |

$249,506 |

$263,955 |

$270,298 |

||||||||||||||||||||||||

| Provision for (recovery of) loan losses |

1,702 |

4,781 |

1,844 |

(1,222 |

) | 2,770 |

1,201 |

4,714 |

9,571 |

|||||||||||||||||||||||

| Non-interest income |

17,462 |

24,386 |

17,597 |

24,785 |

23,073 |

22,922 |

22,706 |

22,857 |

||||||||||||||||||||||||

| Non-interest expense |

126,097 |

123,302 |

123,052 |

138,767 |

134,946 |

134,433 |

138,142 |

139,107 |

||||||||||||||||||||||||

| Income before income taxes |

132,133 |

132,218 |

130,391 |

128,565 |

132,593 |

136,794 |

143,805 |

144,477 |

||||||||||||||||||||||||

| Income tax expense |

30,959 |

33,172 |

33,145 |

30,988 |

30,854 |

30,022 |

36,451 |

37,925 |

||||||||||||||||||||||||

| Net income |

101,174 |

99,046 |

97,246 |

97,577 |

101,739 |

106,772 |

107,354 |

106,552 |

||||||||||||||||||||||||

| Preferred stock dividends |

8,207 |

8,207 |

8,207 |

8,207 |

8,207 |

8,207 |

8,207 |

8,207 |

||||||||||||||||||||||||

| Net income available to common shareholders |

$92,967 |

$90,839 |

$89,039 |

$89,370 |

$93,532 |

$98,565 |

$99,147 |

$98,345 |

||||||||||||||||||||||||

| Basic earnings per common share |

$0.20 |

$0.19 |

$0.19 |

$0.19 |

$0.19 |

$0.20 |

$0.20 |

$0.20 |

||||||||||||||||||||||||

| Diluted earnings per common share |

$0.20 |

$0.19 |

$0.19 |

$0.19 |

$0.19 |

$0.20 |

$0.20 |

$0.20 |

||||||||||||||||||||||||

| 1. | Tangible common stockholders’ equity is an important indication of the Company’s ability to grow organically and through business combinations, as well as its ability to pay dividends and to engage in various capital management strategies. |

| 2. | Tangible book value per common share and the ratio of tangible common stockholders’ equity to tangible assets are among the capital measures considered by current and prospective investors, both independent of, and in comparison with, the Company’s peers. |

| At or for the Twelve Months Ended December 31, |

||||||||

| (dollars in thousands) |

2019 |

2018 |

||||||

| Stockholders’ Equity |

$ | 6,711,694 |

$ | 6,655,235 |

||||

| Less: Goodwill |

(2,426,379 |

) | (2,436,131 |

) | ||||

| Preferred stock |

(502,840 |

) | (502,840 |

) | ||||

| Tangible common stockholders’ equity |

$ | 3,782,475 |

$ | 3,716,264 |

||||

| Total Assets |

$ | 53,640,821 |

$ | 51,899,376 |

||||

| Less: Goodwill |

(2,426,379 |

) | (2,436,131 |

) | ||||

| Tangible assets |

$ | 51,214,442 |

$ | 49,463,245 |

||||

| Common stockholders’ equity to total assets |

11.57 |

% | 11.85 |

% | ||||

| Tangible common stockholders’ equity to tangible assets |

7.39 |

7.51 |

||||||

| Book value per common share |

$13.29 |

$12.99 |

||||||

| Tangible book value per common share |

8.09 |

7.85 |

||||||

ITEM 7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

| At December 31, 2019 |

||||||||||||||||||||||||||||

| (dollars in thousands) |

Three Months or Less |

Four to Twelve Months |

More Than One Year to Three Years |

More Than Three Years to Five Years |

More Than Three Years to 10 Years |

More Than 10 Years |

Total |

|||||||||||||||||||||

| INTEREST-EARNING ASSETS: |

||||||||||||||||||||||||||||

| Mortgage and other loans (1) |

$ | 6,319,629 |

$ | 9,029,406 |

$ | 16,176,327 |

$ | 8,497,030 |

$ | 1,730,422 |

$ | 80,098 |

$ | 41,832,912 |

||||||||||||||

| Mortgage-related securities (2)(3) |

84,390 |

333,928 |

782,108 |

604,330 |

778,414 |

770,565 |

3,353,735 |

|||||||||||||||||||||

| Other securities (2) |

2,328,090 |

321,208 |

130,436 |

176,048 |

136,361 |

54,741 |

3,146,884 |

|||||||||||||||||||||

| Interest-earning cash and cash equivalents |

610,149 |

— |

— |

— |

— |

— |

610,149 |

|||||||||||||||||||||

| Total interest-earning assets |

9,342,258 |

9,684,542 |

17,088,871 |

9,277,408 |

2,645,197 |

905,404 |

48,943,680 |

|||||||||||||||||||||

| INTEREST-BEARING LIABILITIES: |

||||||||||||||||||||||||||||

| Interest-bearing checking and money market accounts |

4,872,458 |

1,067,266 |

1,863,357 |

1,007,278 |

1,419,785 |

— |

10,230,144 |

|||||||||||||||||||||

| Savings accounts |

907,224 |

1,190,375 |

792,123 |

550,256 |

1,340,029 |

— |

4,780,007 |

|||||||||||||||||||||

| Certificates of deposit |

3,485,350 |

9,840,035 |

699,077 |

190,366 |

30 |

— |

14,214,858 |

|||||||||||||||||||||

| Borrowed funds |

2,263,926 |

2,005,000 |

2,697,661 |

— |

7,450,000 |

141,006 |

14,557,593 |

|||||||||||||||||||||

| Total interest-bearing liabilities |

11,528,958 |

14,102,676 |

6,052,218 |

1,747,900 |

10,209,844 |

141,006 |

43,782,602 |

|||||||||||||||||||||

| Interest rate sensitivity gap per period (4) |

$ | (2,186,700 |

) | $ | (4,418,134 |

) | $ | 11,036,653 |

$ | 7,529,508 |

$ | (7,564,647 |

) | $ | 764,398 |

$ | 5,161,078 |

|||||||||||

| Cumulative interest rate sensitivity gap |

$ | (2,186,700 |

) | $ | (6,604,834 |

) | $ | 4,431,819 |

$ | 11,961,327 |

$ | 4,396,680 |

$ | 5,161,078 |

||||||||||||||

| Cumulative interest rate sensitivity gap as a percentage of total assets |

(4.08 |

)% | (12.31 |

)% | 8.26 |

% | 22.30 |

% | 8.20 |

% | 9.62 |

% | ||||||||||||||||

| Cumulative net interest-earning assets as a percentage of net interest-bearing liabilities |

81.03 |

% | 74.23 |

% | 113.99 |

% | 135.78 |

% | 110.07 |

% | 111.79 |

% | ||||||||||||||||

(1) |

For the purpose of the gap analysis, non-performing loans and the allowance for loan losses have been excluded. |

(2) |

Mortgage-related and other securities, including FHLB stock, are shown at their respective carrying amounts. |

(3) |

Expected amount based, in part, on historical experience. |

(4) |

The interest rate sensitivity gap per period represents the difference between interest-earning assets and interest-bearing liabilities. |

| Change in Interest Rates (in basis points) (1) |

Market Value of Assets |

Market Value of Liabilities |

Economic Value of Equity |

Net Change |

Estimated Percentage Change in Economic Value of Equity |

|||||||||||||||

| +200 |

$ | 51,468,631 |

$ | 45,446,988 |

$ | 6,021,643 |

$ | (792,352 |

) | (11.63 |

)% | |||||||||

| +100 |

52,585,995 |

46,020,438 |

6,565,557 |

(248,438 |

) | (3.65 |

) | |||||||||||||

| — |

53,597,005 |

46,783,010 |

6,813,995 |

— |

— |

|||||||||||||||

| - 100 |

54,328,065 |

47,728,811 |

6,599,254 |

(214,741 |

) | (3.15 |

) | |||||||||||||

(1) |

The impact of a 200-bp reduction in interest rates is not presented in view of the current level of the federal funds rate and other short-term interest rates. |

| Change in Interest Rates (in basis points) (1) (2) |

Estimated Percentage Change in Future Net Interest Income |

|||

| +100 over one year |

(1.94 |

)% | ||

| +200 over one year |

(3.91 |

) | ||

| -100 over one year |

2.52 |

|||

(1) |

In general, short- and long-term rates are assumed to increase in parallel fashion across all four quarters and then remain unchanged. |

(2) |

The impact of a 200-bp reduction in interest rates is not presented in view of the current level of the federal funds rate and other short-term interest rates. |

| • | Our ALCO Committee would inform the Board of Directors of the variance, and present recommendations to the Board regarding proposed courses of action to restore conditions to within-policy tolerances. |

| • | In formulating appropriate strategies, the ALCO Committee would ascertain the primary causes of the variance from policy tolerances, the expected term of such conditions, and the projected effect on capital and earnings. |

| • | Asset restructuring, involving sales of assets having higher risk profiles, or a gradual restructuring of the asset mix over time to affect the maturity or repricing schedule of assets; |

| • | Liability restructuring, whereby product offerings and pricing are altered or wholesale borrowings are employed to affect the maturity structure or repricing of liabilities; |

| • | Expansion or shrinkage of the balance sheet to correct imbalances in the repricing or maturity periods between assets and liabilities; and/or |

| • | Use or alteration of off-balance sheet positions, including interest rate swaps, caps, floors, options, and forward purchase or sales commitments. |

ITEM 8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

| December 31, |

||||||||

| (in thousands, except share data) |

2019 |

2018 |

||||||

| ASSETS: |

||||||||

| Cash and cash equivalents |

$ |

|

$ | |

||||

| Securities: |

||||||||

| Debt securities available-for-sale ($ |

|

|

||||||

| Equity investments with readily determinable fair values, at fair value |

|

|

||||||

| Total securities |

|

|

||||||

| Loans and leases, net of deferred loan fees and costs |

|

|

||||||

| Less: Allowance for loan losses |

( |

) | ( |

) | ||||

| Total loans and leases, net |

|

|

||||||

| Federal Home Loan Bank stock, at cost |

|

|

||||||

| Premises and equipment, net |

|

|

||||||

| Operating lease right-of-use assets |

|

— |

||||||

| Goodwill |

|

|

||||||