SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☒ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 | |

WESTERN ASSET HIGH INCOME

OPPORTUNITY FUND INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by the registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

BrandywineGLOBAL – Global Income Opportunities Fund (BWG) Western Asset Corporate Loan Fund (TLI) Western Asset High Income Opportunity Fund (HIO) FEBRUARY 2020 PRES

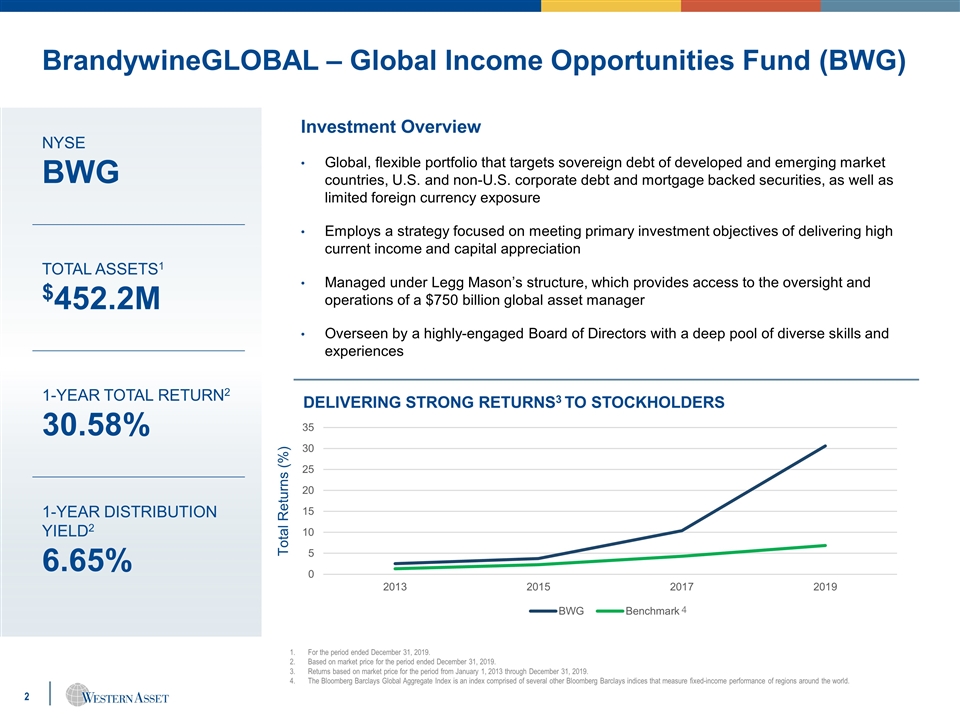

BrandywineGLOBAL – Global Income Opportunities Fund (BWG) For the period ended December 31, 2019. Based on market price for the period ended December 31, 2019. Returns based on market price for the period from January 1, 2013 through December 31, 2019. The Bloomberg Barclays Global Aggregate Index is an index comprised of several other Bloomberg Barclays indices that measure fixed-income performance of regions around the world. Investment Overview Global, flexible portfolio that targets sovereign debt of developed and emerging market countries, U.S. and non-U.S. corporate debt and mortgage backed securities, as well as limited foreign currency exposure Employs a strategy focused on meeting primary investment objectives of delivering high current income and capital appreciation Managed under Legg Mason’s structure, which provides access to the oversight and operations of a $750 billion global asset manager Overseen by a highly-engaged Board of Directors with a deep pool of diverse skills and experiences NYSE BWG TOTAL ASSETS1 $452.2M 1-YEAR TOTAL RETURN2 30.58% 1-YEAR DISTRIBUTION YIELD2 6.65% DELIVERING STRONG RETURNS3 TO STOCKHOLDERS Total Returns (%) 4

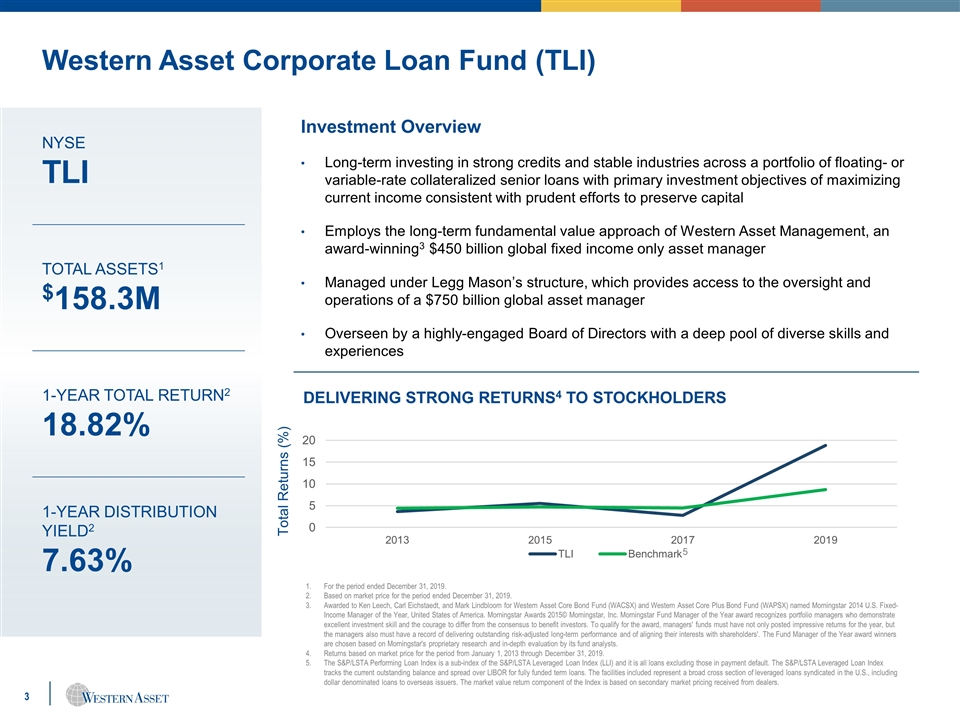

Western Asset Corporate Loan Fund (TLI) For the period ended December 31, 2019. Based on market price for the period ended December 31, 2019. Awarded to Ken Leech, Carl Eichstaedt, and Mark Lindbloom for Western Asset Core Bond Fund (WACSX) and Western Asset Core Plus Bond Fund (WAPSX) named Morningstar 2014 U.S. Fixed-Income Manager of the Year, United States of America. Morningstar Awards 2015© Morningstar, Inc. Morningstar Fund Manager of the Year award recognizes portfolio managers who demonstrate excellent investment skill and the courage to differ from the consensus to benefit investors. To qualify for the award, managers' funds must have not only posted impressive returns for the year, but the managers also must have a record of delivering outstanding risk-adjusted long-term performance and of aligning their interests with shareholders'. The Fund Manager of the Year award winners are chosen based on Morningstar's proprietary research and in-depth evaluation by its fund analysts. Returns based on market price for the period from January 1, 2013 through December 31, 2019. The S&P/LSTA Performing Loan Index is a sub-index of the S&P/LSTA Leveraged Loan Index (LLI) and it is all loans excluding those in payment default. The S&P/LSTA Leveraged Loan Index tracks the current outstanding balance and spread over LIBOR for fully funded term loans. The facilities included represent a broad cross section of leveraged loans syndicated in the U.S., including dollar denominated loans to overseas issuers. The market value return component of the Index is based on secondary market pricing received from dealers. Investment Overview Long-term investing in strong credits and stable industries across a portfolio of floating- or variable-rate collateralized senior loans with primary investment objectives of maximizing current income consistent with prudent efforts to preserve capital Employs the long-term fundamental value approach of Western Asset Management, an award-winning3 $450 billion global fixed income only asset manager Managed under Legg Mason’s structure, which provides access to the oversight and operations of a $750 billion global asset manager Overseen by a highly-engaged Board of Directors with a deep pool of diverse skills and experiences NYSE TLI TOTAL ASSETS1 $158.3M 1-YEAR TOTAL RETURN2 18.82% 1-YEAR DISTRIBUTION YIELD2 7.63% DELIVERING STRONG RETURNS4 TO STOCKHOLDERS Total Returns (%) 5

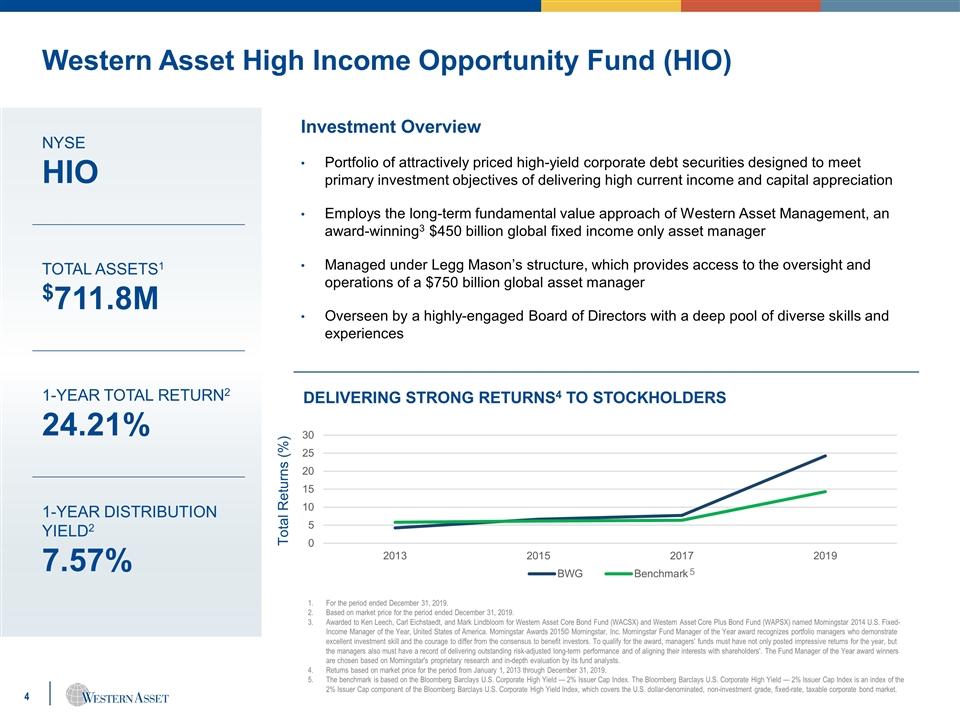

Western Asset High Income Opportunity Fund (HIO) For the period ended December 31, 2019. Based on market price for the period ended December 31, 2019. Awarded to Ken Leech, Carl Eichstaedt, and Mark Lindbloom for Western Asset Core Bond Fund (WACSX) and Western Asset Core Plus Bond Fund (WAPSX) named Morningstar 2014 U.S. Fixed-Income Manager of the Year, United States of America. Morningstar Awards 2015© Morningstar, Inc. Morningstar Fund Manager of the Year award recognizes portfolio managers who demonstrate excellent investment skill and the courage to differ from the consensus to benefit investors. To qualify for the award, managers' funds must have not only posted impressive returns for the year, but the managers also must have a record of delivering outstanding risk-adjusted long-term performance and of aligning their interests with shareholders'. The Fund Manager of the Year award winners are chosen based on Morningstar's proprietary research and in-depth evaluation by its fund analysts. Returns based on market price for the period from January 1, 2013 through December 31, 2019. The benchmark is based on the Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Index. The Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Index is an index of the 2% Issuer Cap component of the Bloomberg Barclays U.S. Corporate High Yield Index, which covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. Investment Overview Portfolio of attractively priced high-yield corporate debt securities designed to meet primary investment objectives of delivering high current income and capital appreciation Employs the long-term fundamental value approach of Western Asset Management, an award-winning3 $450 billion global fixed income only asset manager Managed under Legg Mason’s structure, which provides access to the oversight and operations of a $750 billion global asset manager Overseen by a highly-engaged Board of Directors with a deep pool of diverse skills and experiences NYSE HIO TOTAL ASSETS1 $711.8M 1-YEAR TOTAL RETURN2 24.21% 1-YEAR DISTRIBUTION YIELD2 7.57% DELIVERING STRONG RETURNS4 TO STOCKHOLDERS Total Returns (%) 5

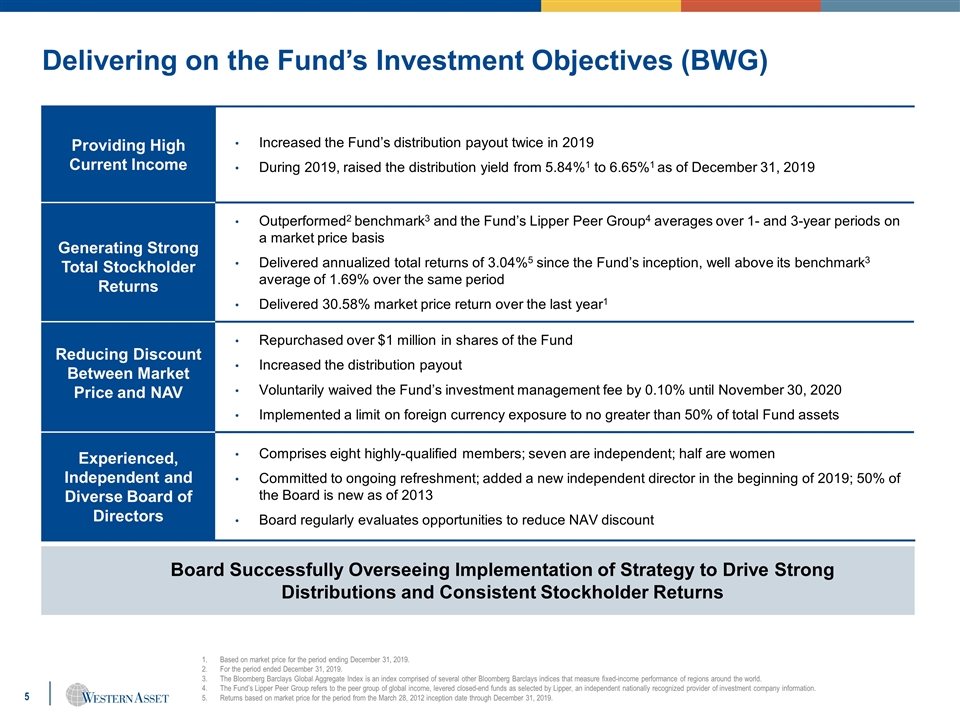

Delivering on the Fund’s Investment Objectives (BWG) Based on market price for the period ending December 31, 2019. For the period ended December 31, 2019. The Bloomberg Barclays Global Aggregate Index is an index comprised of several other Bloomberg Barclays indices that measure fixed-income performance of regions around the world. The Fund’s Lipper Peer Group refers to the peer group of global income, levered closed-end funds as selected by Lipper, an independent nationally recognized provider of investment company information. Returns based on market price for the period from the March 28, 2012 inception date through December 31, 2019. Providing High Current Income Increased the Fund’s distribution payout twice in 2019 During 2019, raised the distribution yield from 5.84%1 to 6.65%1 as of December 31, 2019 Generating Strong Total Stockholder Returns Outperformed2 benchmark3 and the Fund’s Lipper Peer Group4 averages over 1- and 3-year periods on a market price basis Delivered annualized total returns of 3.04%5 since the Fund’s inception, well above its benchmark3 average of 1.69% over the same period Delivered 30.58% market price return over the last year1 Reducing Discount Between Market Price and NAV Repurchased over $1 million in shares of the Fund Increased the distribution payout Voluntarily waived the Fund’s investment management fee by 0.10% until November 30, 2020 Implemented a limit on foreign currency exposure to no greater than 50% of total Fund assets Experienced, Independent and Diverse Board of Directors Comprises eight highly-qualified members; seven are independent; half are women Committed to ongoing refreshment; added a new independent director in the beginning of 2019; 50% of the Board is new as of 2013 Board regularly evaluates opportunities to reduce NAV discount Board Successfully Overseeing Implementation of Strategy to Drive Strong Distributions and Consistent Stockholder Returns

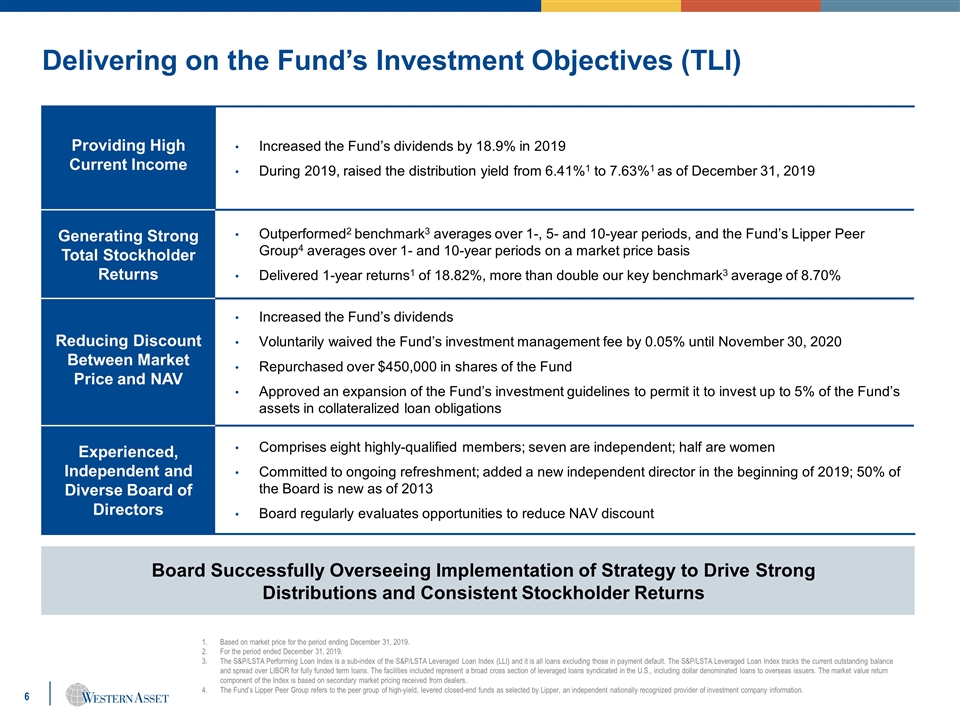

Delivering on the Fund’s Investment Objectives (TLI) Based on market price for the period ending December 31, 2019. For the period ended December 31, 2019. The S&P/LSTA Performing Loan Index is a sub-index of the S&P/LSTA Leveraged Loan Index (LLI) and it is all loans excluding those in payment default. The S&P/LSTA Leveraged Loan Index tracks the current outstanding balance and spread over LIBOR for fully funded term loans. The facilities included represent a broad cross section of leveraged loans syndicated in the U.S., including dollar denominated loans to overseas issuers. The market value return component of the Index is based on secondary market pricing received from dealers. The Fund’s Lipper Peer Group refers to the peer group of high-yield, levered closed-end funds as selected by Lipper, an independent nationally recognized provider of investment company information. Providing High Current Income Increased the Fund’s dividends by 18.9% in 2019 During 2019, raised the distribution yield from 6.41%1 to 7.63%1 as of December 31, 2019 Generating Strong Total Stockholder Returns Outperformed2 benchmark3 averages over 1-, 5- and 10-year periods, and the Fund’s Lipper Peer Group4 averages over 1- and 10-year periods on a market price basis Delivered 1-year returns1 of 18.82%, more than double our key benchmark3 average of 8.70% Reducing Discount Between Market Price and NAV Increased the Fund’s dividends Voluntarily waived the Fund’s investment management fee by 0.05% until November 30, 2020 Repurchased over $450,000 in shares of the Fund Approved an expansion of the Fund’s investment guidelines to permit it to invest up to 5% of the Fund’s assets in collateralized loan obligations Experienced, Independent and Diverse Board of Directors Comprises eight highly-qualified members; seven are independent; half are women Committed to ongoing refreshment; added a new independent director in the beginning of 2019; 50% of the Board is new as of 2013 Board regularly evaluates opportunities to reduce NAV discount Board Successfully Overseeing Implementation of Strategy to Drive Strong Distributions and Consistent Stockholder Returns

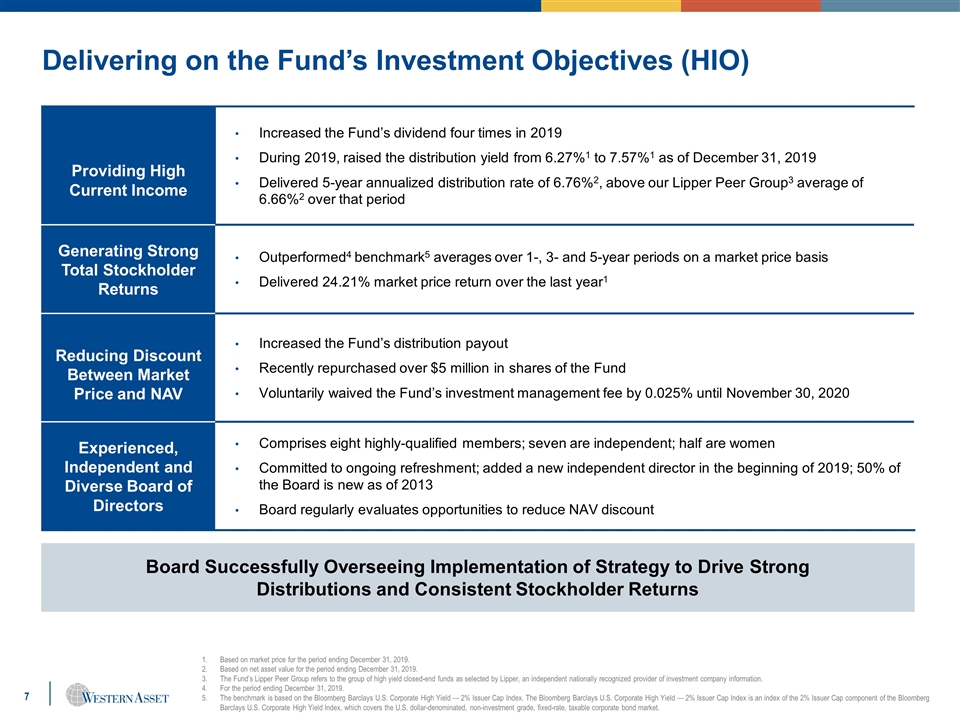

Delivering on the Fund’s Investment Objectives (HIO) Based on market price for the period ending December 31, 2019. Based on net asset value for the period ending December 31, 2019. The Fund’s Lipper Peer Group refers to the group of high yield closed-end funds as selected by Lipper, an independent nationally recognized provider of investment company information. For the period ending December 31, 2019. The benchmark is based on the Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Index. The Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Index is an index of the 2% Issuer Cap component of the Bloomberg Barclays U.S. Corporate High Yield Index, which covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. Providing High Current Income Increased the Fund’s dividend four times in 2019 During 2019, raised the distribution yield from 6.27%1 to 7.57%1 as of December 31, 2019 Delivered 5-year annualized distribution rate of 6.76%2, above our Lipper Peer Group3 average of 6.66%2 over that period Generating Strong Total Stockholder Returns Outperformed4 benchmark5 averages over 1-, 3- and 5-year periods on a market price basis Delivered 24.21% market price return over the last year1 Reducing Discount Between Market Price and NAV Increased the Fund’s distribution payout Recently repurchased over $5 million in shares of the Fund Voluntarily waived the Fund’s investment management fee by 0.025% until November 30, 2020 Experienced, Independent and Diverse Board of Directors Comprises eight highly-qualified members; seven are independent; half are women Committed to ongoing refreshment; added a new independent director in the beginning of 2019; 50% of the Board is new as of 2013 Board regularly evaluates opportunities to reduce NAV discount Board Successfully Overseeing Implementation of Strategy to Drive Strong Distributions and Consistent Stockholder Returns

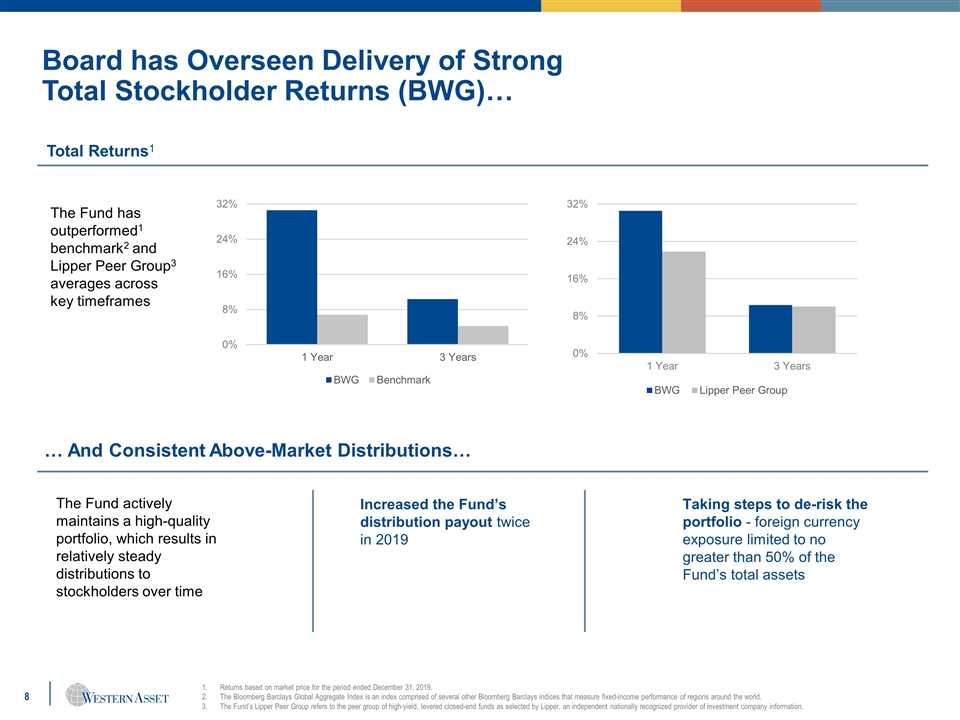

Board has Overseen Delivery of Strong Total Stockholder Returns (BWG)… The Fund has outperformed1 benchmark2 and Lipper Peer Group3 averages across key timeframes Returns based on market price for the period ended December 31, 2019. The Bloomberg Barclays Global Aggregate Index is an index comprised of several other Bloomberg Barclays indices that measure fixed-income performance of regions around the world. The Fund’s Lipper Peer Group refers to the peer group of high-yield, levered closed-end funds as selected by Lipper, an independent nationally recognized provider of investment company information. The Fund actively maintains a high-quality portfolio, which results in relatively steady distributions to stockholders over time Total Returns1 Increased the Fund’s distribution payout twice in 2019 Taking steps to de-risk the portfolio - foreign currency exposure limited to no greater than 50% of the Fund’s total assets … And Consistent Above-Market Distributions…

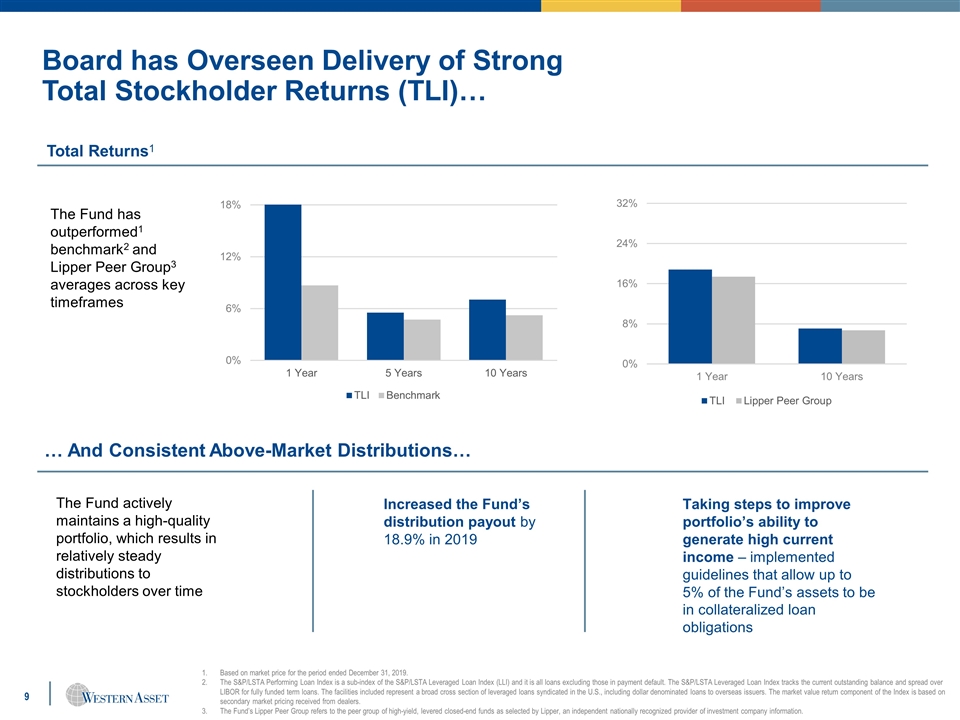

Taking steps to improve portfolio’s ability to generate high current income – implemented guidelines that allow up to 5% of the Fund’s assets to be in collateralized loan obligations Increased the Fund’s distribution payout by 18.9% in 2019 Board has Overseen Delivery of Strong Total Stockholder Returns (TLI)… The Fund has outperformed1 benchmark2 and Lipper Peer Group3 averages across key timeframes Based on market price for the period ended December 31, 2019. The S&P/LSTA Performing Loan Index is a sub-index of the S&P/LSTA Leveraged Loan Index (LLI) and it is all loans excluding those in payment default. The S&P/LSTA Leveraged Loan Index tracks the current outstanding balance and spread over LIBOR for fully funded term loans. The facilities included represent a broad cross section of leveraged loans syndicated in the U.S., including dollar denominated loans to overseas issuers. The market value return component of the Index is based on secondary market pricing received from dealers. The Fund’s Lipper Peer Group refers to the peer group of high-yield, levered closed-end funds as selected by Lipper, an independent nationally recognized provider of investment company information. The Fund actively maintains a high-quality portfolio, which results in relatively steady distributions to stockholders over time Total Returns1 … And Consistent Above-Market Distributions…

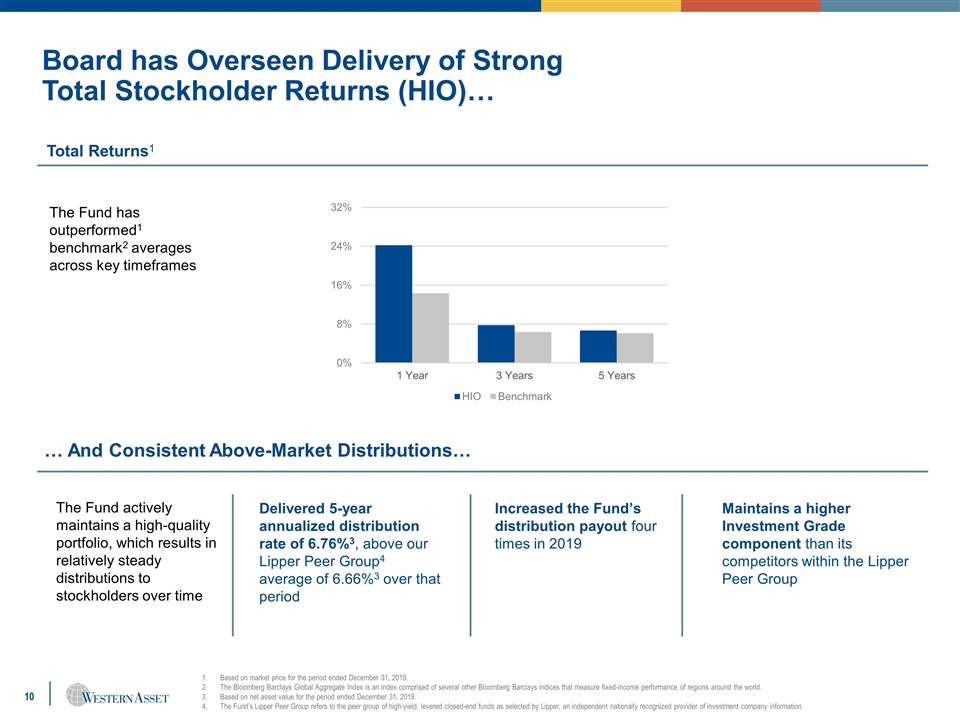

Board has Overseen Delivery of Strong Total Stockholder Returns (HIO)… The Fund has outperformed1 benchmark2 averages across key timeframes Based on market price for the period ended December 31, 2019. The Bloomberg Barclays Global Aggregate Index is an index comprised of several other Bloomberg Barclays indices that measure fixed-income performance of regions around the world. Based on net asset value for the period ended December 31, 2019. The Fund’s Lipper Peer Group refers to the peer group of high-yield, levered closed-end funds as selected by Lipper, an independent nationally recognized provider of investment company information. The Fund actively maintains a high-quality portfolio, which results in relatively steady distributions to stockholders over time Delivered 5-year annualized distribution rate of 6.76%3, above our Lipper Peer Group4 average of 6.66%3 over that period Increased the Fund’s distribution payout four times in 2019 Maintains a higher Investment Grade component than its competitors within the Lipper Peer Group … And Consistent Above-Market Distributions… Total Returns1

…While Taking Additional Actions to Position the Fund for Continued Success (BWG)… Over the past year, the Board has worked with the Fund’s investment advisor to take steps to build on our strong performance momentum and increase income distributions, identifying compelling income opportunities globally: Increased exposure to emerging market debt to take advantage of compelling income opportunities at attractive valuations. We continue to be selective with our currency exposure to this segment of the market. Increased high yield and investment grade debt exposure as we remain constructive on U.S. dollar denominated corporate debt, especially relative to the European and emerging market corporate debt markets. Reduced exposure to developed market sovereign bonds in light of the significant price appreciation of these securities last year. We continue to have an allocation to safe-haven debt due to the tenuous economic backdrop. Supported the portfolio’s ability to generate high current income by utilizing leverage tactically. Based on market price for the period ended December 31, 2019. The Fund’s Lipper Peer Group refers to the peer group of global income, levered closed-end funds as selected by Lipper, an independent nationally recognized provider of investment company information. The Bloomberg Barclays Global Aggregate Index is an index comprised of several other Bloomberg Barclays indices that measure fixed-income performance of regions around the world. Delivered 1-Year Returns1 of 30.58% Through Portfolio Enhancing Initiatives, Above Lipper Peer Group2 Average of 21.79% and Key Benchmark3 Average of 6.84% Over the Same Period

…While Taking Additional Actions to Position the Fund for Continued Success (TLI)… Over the past year, the Board has worked with the Fund’s investment advisor to take steps to build on our strong performance momentum and increase income distributions, including improving the overall quality of our portfolio and identifying compelling income opportunities globally: Increased allocation to CLO Securities from 0.0% to 2.6% Increased Bank Loan allocation to Technology, Transportation, Financial and Insurance sectors Decreased allocation to US High-Yield Credit from 8.9% to 0.7% Decreased Bank Loan allocation to Consumer Cyclical, Communications, Capital Goods and Energy sectors Based on market price for the period ended December 31, 2019. The Fund’s Lipper Peer Group refers to the peer group of high-yield, levered closed-end funds as selected by Lipper, an independent nationally recognized provider of investment company information. The S&P/LSTA Performing Loan Index is a sub-index of the S&P/LSTA Leveraged Loan Index (LLI) and it is all loans excluding those in payment default. The S&P/LSTA Leveraged Loan Index tracks the current outstanding balance and spread over LIBOR for fully funded term loans. The facilities included represent a broad cross section of leveraged loans syndicated in the U.S., including dollar denominated loans to overseas issuers. The market value return component of the Index is based on secondary market pricing received from dealers. Delivered 1-Year Returns1 of 18.82% Through Portfolio Enhancing Initiatives, Above Lipper Peer Group2 Average of 17.41% and Key Benchmark3 Average of 8.70% Over the Same Period

…While Taking Additional Actions to Position the Fund for Continued Success (HIO)… Over the past year, the Board has worked with the Fund’s investment advisor to take steps to build on our strong performance momentum and increase income distributions, including improving the overall quality of our portfolio and identifying compelling income opportunities globally: Increased allocation to Emerging Market Debt to take advantage of compelling income opportunities at attractive valuations Increased allocation to US Investment Grade Credit Securities from 15.8% to 18.1% Increased allocation to US Treasury Securities from 1.1% to 1.7% Decreased allocation to US High-Yield Credit from 59.5% to 57.3% Decreased allocation to CCC-rated securities Based on market price for the period ended December 31, 2019. The benchmark is based on the Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Index. The Bloomberg Barclays U.S. Corporate High Yield — 2% Issuer Cap Index is an index of the 2% Issuer Cap component of the Bloomberg Barclays U.S. Corporate High Yield Index, which covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable corporate bond market. Delivered 1-Year Returns1 of 24.21% Through Portfolio Enhancing Initiatives, Well Above the Key Benchmark2 Average of 14.32% Over the Same Period

…And Narrowing the Gap Between Market Price and NAV (BWG) Recently, the Board has approved several actions aimed at reducing the discount, including: Repurchasing over $1 million in shares of the Fund; Increasing the Fund’s dividends twice over the past year; Voluntarily waiving the Fund’s investment management fee by 0.10% until November 30, 2020; and Implementing a limit on foreign currency exposure within the portfolio to no greater than 50% of the Fund’s total assets Following these actions, there has been a significant reduction in the Fund’s discount The Fund has reduced its discount by almost 29% since the start of the year, from more than 17.37% in December 2018 to approximately 12.35% in December 2019 BWG had reduced its discount to 15.30% as of September 27,2019. This occurred prior to Bulldog first disclosing its position in the Fund on September 30, 2019 Material discount reduction occurred before any engagement from Bulldog For context, discounts between market price and NAV are common among closed-end funds across the industry Approximately 75% of closed-end funds were trading at a discount as of January 24, 2020 Nearly 53% of funds within the Lipper Peer Group1 traded at a discount as of December 31, 2019 1. The Fund’s Lipper Peer Group refers to the peer group of global income, levered closed-end funds as selected by Lipper, an independent nationally recognized provider of investment company information. Capitalizing on Opportunities to Reduce the Fund’s Discount without Compromising Ability to Achieve Investment Objectives

…And Narrowing the Gap Between Market Price and NAV (TLI) Recently, the Board has approved several actions aimed at reducing the discount, including: Increasing the Fund’s dividends over the past year by 18.9%; Voluntarily waiving the Fund’s investment management fee by 0.05% until November 30, 2020; Repurchasing over $450,000 in shares of the Fund; and Approving an expansion of the Fund’s investment guidelines to permit it to invest up to 5% of the Fund’s assets in collateralized loan obligations Following these actions, there has been a significant reduction in the Fund’s discount The Fund has reduced its discount by almost 41% since the start of the year, from more than 14.48% in December 2018 to approximately 8.58% in December 2019 TLI had reduced its discount to 7.56% as of December 20, 2019. This occurred prior to Bulldog first disclosing its position in the Fund on December 23, 2019 The vast majority of the discount reduction occurred before any engagement from Bulldog For context, discounts between market price and NAV are common among closed-end funds across the industry Approximately 75% of closed-end funds were trading at a discount as of January 24, 2020 Nearly 66% of funds within the Lipper Peer Group1 traded at a discount as of December 31, 2019 1. The Fund’s Lipper Peer Group refers to the peer group of high-yield, levered closed-end funds as selected by Lipper, an independent nationally recognized provider of investment company information. Capitalizing on Opportunities to Reduce the Fund’s Discount without Compromising Ability to Achieve Investment Objectives

…And Narrowing the Gap Between Market Price and NAV (HIO) Recently, the Board has approved several actions aimed at reducing the discount, including: Increasing the Fund’s dividends four times in 2019; Repurchasing over $5,000,000 in shares of the Fund; and Voluntarily waiving the Fund’s investment management fee by 0.025% until November 30, 2020 Following these actions, there has been a significant reduction in the Fund’s discount The Fund has reduced its discount by almost 38% since the start of the year, from more than 14.45% in December 2018 to approximately 8.98% in December 2019 HIO had reduced its discount to 9.28% as of March, 13, 2019. This occurred prior to Saba Capital first disclosing its position in the Fund on March 14, 2019 The vast majority of the discount reduction occurred before any engagement from Saba Capital For context, discounts between market price and NAV are common among closed-end funds across the industry Approximately 75% of closed-end funds were trading at a discount as of January 24, 2020 Nearly 66% of funds within the Lipper Peer Group1 traded at a discount as of December 31, 2019 1. The Fund’s Lipper Peer Group refers to the peer group of high-yield, levered closed-end funds as selected by Lipper, an independent nationally recognized provider of investment company information. Capitalizing on Opportunities to Reduce the Fund’s Discount without Compromising Ability to Achieve Investment Objectives

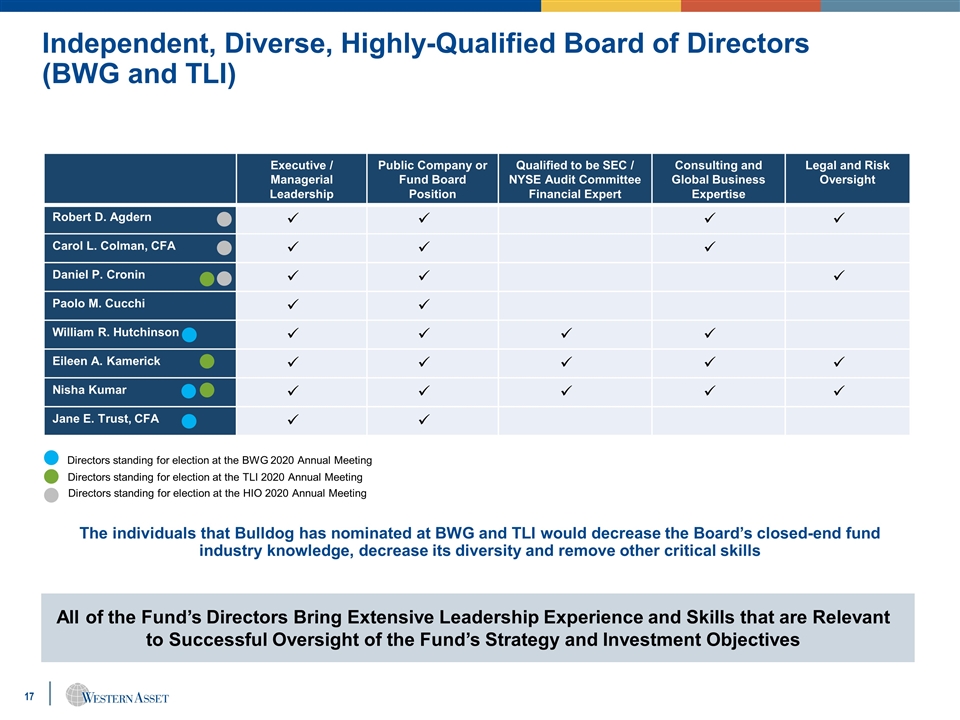

Independent, Diverse, Highly-Qualified Board of Directors (BWG and TLI) JF TEAM: CAN WE KEEP SOME OF THE COLORING OF THE MATRIX IN THE INITIAL DRAFT I SHARED TO MAKE THIS POP AND MORE CLEARLY DILINEATE BETWEEN OUR PEOPLE, THE SKILLS AND SABA’S PEOPLE Executive / Managerial Leadership Public Company or Fund Board Position Qualified to be SEC / NYSE Audit Committee Financial Expert Consulting and Global Business Expertise Legal and Risk Oversight Robert D. Agdern Carol L. Colman, CFA Daniel P. Cronin Paolo M. Cucchi William R. Hutchinson Eileen A. Kamerick Nisha Kumar Jane E. Trust, CFA All of the Fund’s Directors Bring Extensive Leadership Experience and Skills that are Relevant to Successful Oversight of the Fund’s Strategy and Investment Objectives Directors standing for election at the BWG 2020 Annual Meeting Directors standing for election at the TLI 2020 Annual Meeting Directors standing for election at the HIO 2020 Annual Meeting The individuals that Bulldog has nominated at BWG and TLI would decrease the Board’s closed-end fund industry knowledge, decrease its diversity and remove other critical skills

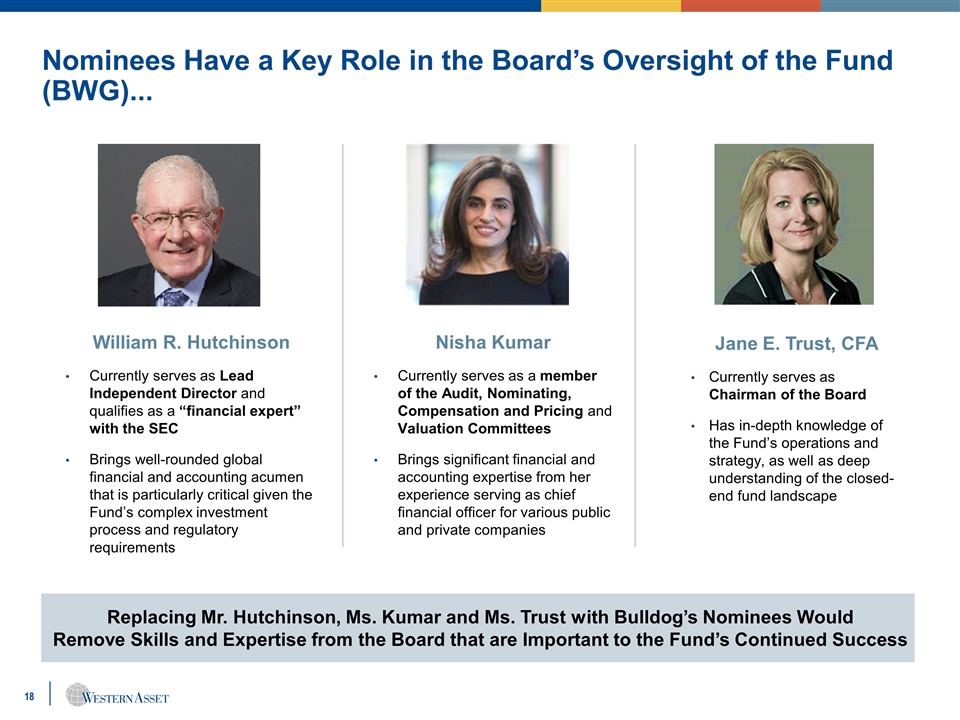

Nominees Have a Key Role in the Board’s Oversight of the Fund (BWG)... Jane E. Trust, CFA Currently serves as Chairman of the Board Has in-depth knowledge of the Fund’s operations and strategy, as well as deep understanding of the closed-end fund landscape Nisha Kumar Currently serves as a member of the Audit, Nominating, Compensation and Pricing and Valuation Committees Brings significant financial and accounting expertise from her experience serving as chief financial officer for various public and private companies Replacing Mr. Hutchinson, Ms. Kumar and Ms. Trust with Bulldog’s Nominees Would Remove Skills and Expertise from the Board that are Important to the Fund’s Continued Success William R. Hutchinson Currently serves as Lead Independent Director and qualifies as a “financial expert” with the SEC Brings well-rounded global financial and accounting acumen that is particularly critical given the Fund’s complex investment process and regulatory requirements

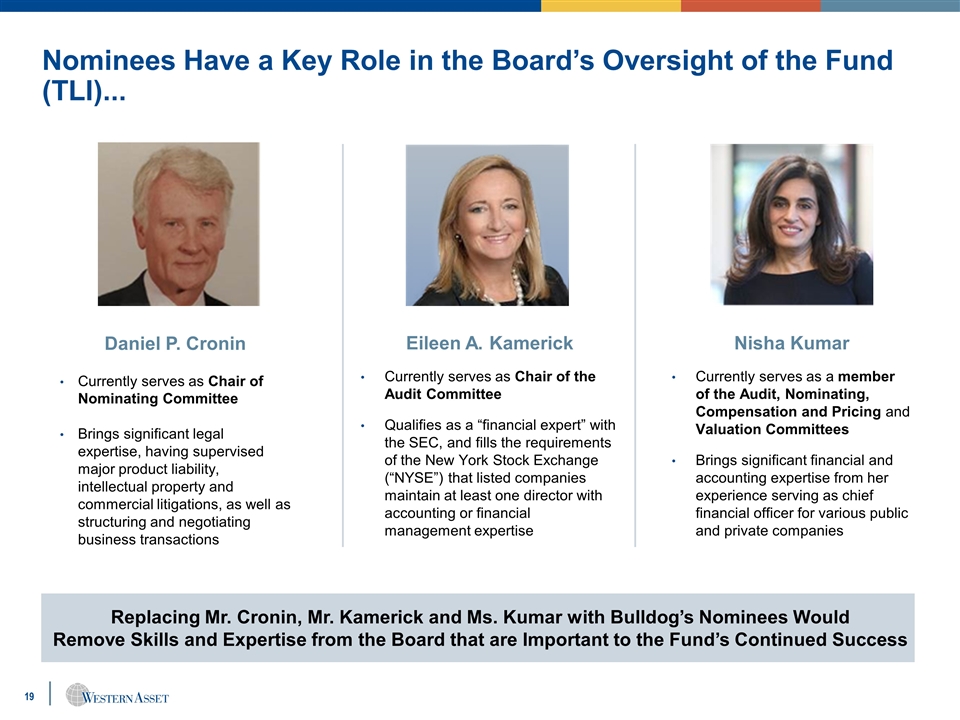

Nominees Have a Key Role in the Board’s Oversight of the Fund (TLI)... Daniel P. Cronin Currently serves as Chair of Nominating Committee Brings significant legal expertise, having supervised major product liability, intellectual property and commercial litigations, as well as structuring and negotiating business transactions Nisha Kumar Currently serves as a member of the Audit, Nominating, Compensation and Pricing and Valuation Committees Brings significant financial and accounting expertise from her experience serving as chief financial officer for various public and private companies Replacing Mr. Cronin, Mr. Kamerick and Ms. Kumar with Bulldog’s Nominees Would Remove Skills and Expertise from the Board that are Important to the Fund’s Continued Success Eileen A. Kamerick Currently serves as Chair of the Audit Committee Qualifies as a “financial expert” with the SEC, and fills the requirements of the New York Stock Exchange (“NYSE”) that listed companies maintain at least one director with accounting or financial management expertise

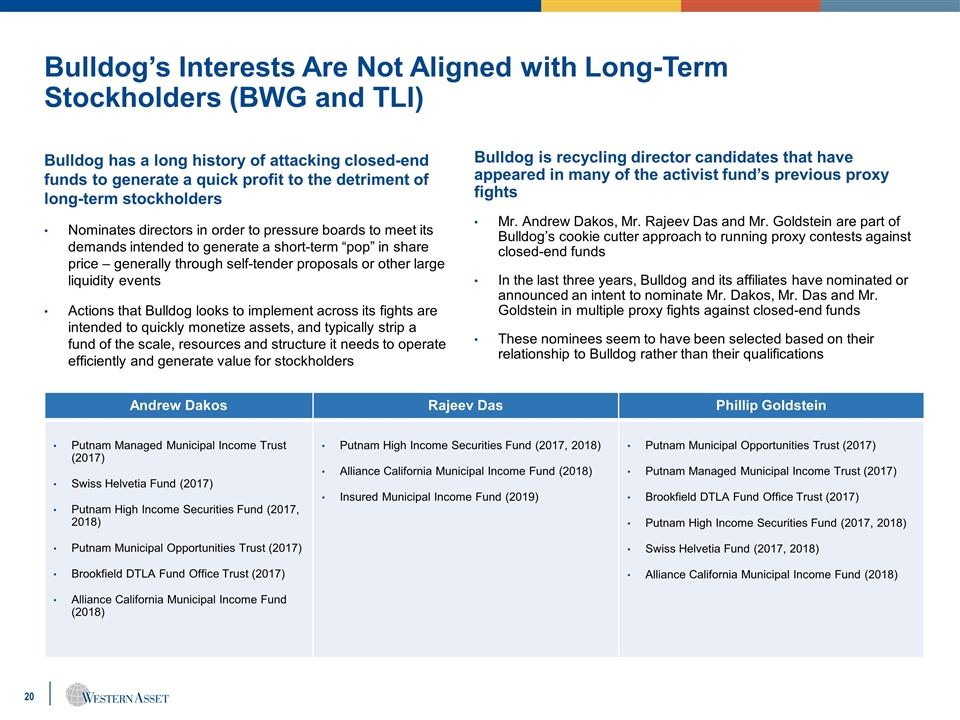

Bulldog’s Interests Are Not Aligned with Long-Term Stockholders (BWG and TLI) Bulldog has a long history of attacking closed-end funds to generate a quick profit to the detriment of long-term stockholders Nominates directors in order to pressure boards to meet its demands intended to generate a short-term “pop” in share price – generally through self-tender proposals or other large liquidity events Actions that Bulldog looks to implement across its fights are intended to quickly monetize assets, and typically strip a fund of the scale, resources and structure it needs to operate efficiently and generate value for stockholders Bulldog is recycling director candidates that have appeared in many of the activist fund’s previous proxy fights Mr. Andrew Dakos, Mr. Rajeev Das and Mr. Goldstein are part of Bulldog’s cookie cutter approach to running proxy contests against closed-end funds In the last three years, Bulldog and its affiliates have nominated or announced an intent to nominate Mr. Dakos, Mr. Das and Mr. Goldstein in multiple proxy fights against closed-end funds These nominees seem to have been selected based on their relationship to Bulldog rather than their qualifications Selling Out of Previous Positions… Saba Capital currently maintains minimal to no holdings in many of the funds it has targeted in past proxy contests Andrew Dakos Rajeev Das Phillip Goldstein Putnam Managed Municipal Income Trust (2017) Swiss Helvetia Fund (2017) Putnam High Income Securities Fund (2017, 2018) Putnam Municipal Opportunities Trust (2017) Brookfield DTLA Fund Office Trust (2017) Alliance California Municipal Income Fund (2018) Putnam High Income Securities Fund (2017, 2018) Alliance California Municipal Income Fund (2018) Insured Municipal Income Fund (2019) Putnam Municipal Opportunities Trust (2017) Putnam Managed Municipal Income Trust (2017) Brookfield DTLA Fund Office Trust (2017) Putnam High Income Securities Fund (2017, 2018) Swiss Helvetia Fund (2017, 2018) Alliance California Municipal Income Fund (2018)

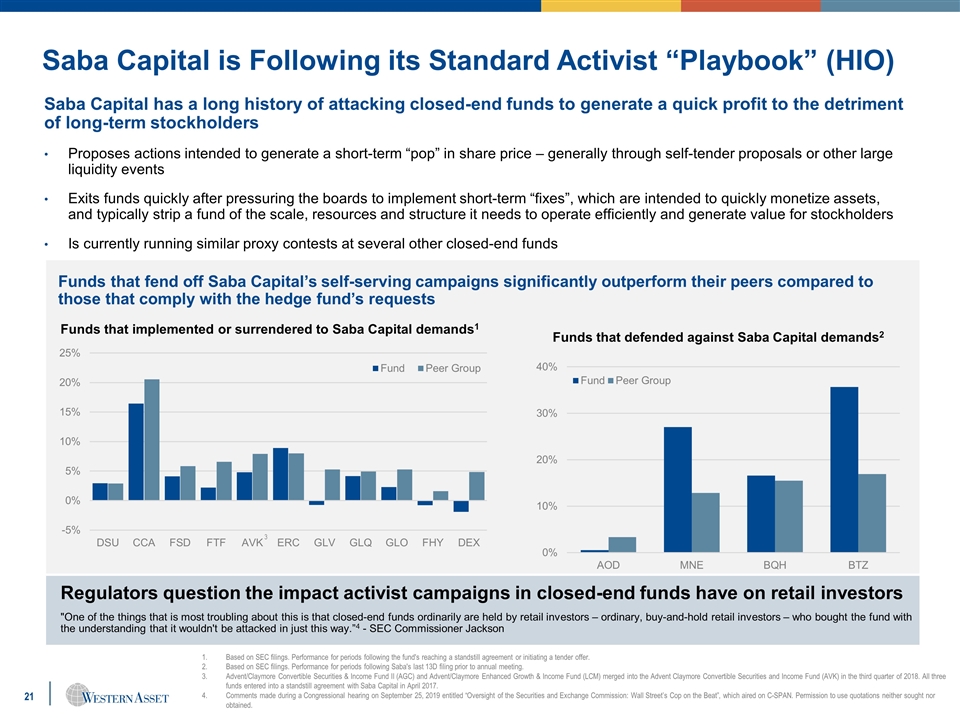

Saba Capital is Following its Standard Activist “Playbook” (HIO) Saba Capital has a long history of attacking closed-end funds to generate a quick profit to the detriment of long-term stockholders Proposes actions intended to generate a short-term “pop” in share price – generally through self-tender proposals or other large liquidity events Exits funds quickly after pressuring the boards to implement short-term “fixes”, which are intended to quickly monetize assets, and typically strip a fund of the scale, resources and structure it needs to operate efficiently and generate value for stockholders Is currently running similar proxy contests at several other closed-end funds Funds that fend off Saba Capital’s self-serving campaigns significantly outperform their peers compared to those that comply with the hedge fund’s requests Selling Out of Previous Positions… Saba Capital currently maintains minimal to no holdings in many of the funds it has targeted in past proxy contests Funds that implemented or surrendered to Saba Capital demands1 Funds that defended against Saba Capital demands2 Regulators question the impact activist campaigns in closed-end funds have on retail investors "One of the things that is most troubling about this is that closed-end funds ordinarily are held by retail investors – ordinary, buy-and-hold retail investors – who bought the fund with the understanding that it wouldn't be attacked in just this way.”4 - SEC Commissioner Jackson Based on SEC filings. Performance for periods following the fund's reaching a standstill agreement or initiating a tender offer. Based on SEC filings. Performance for periods following Saba's last 13D filing prior to annual meeting. Advent/Claymore Convertible Securities & Income Fund II (AGC) and Advent/Claymore Enhanced Growth & Income Fund (LCM) merged into the Advent Claymore Convertible Securities and Income Fund (AVK) in the third quarter of 2018. All three funds entered into a standstill agreement with Saba Capital in April 2017. Comments made during a Congressional hearing on September 25, 2019 entitled “Oversight of the Securities and Exchange Commission: Wall Street’s Cop on the Beat”, which aired on C-SPAN. Permission to use quotations neither sought nor obtained. 3

Forward-Looking Statement Past performance is no guarantee of future results. The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. All investments are subject to risk including the possible loss of principal. All benchmark performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in a benchmark.

BWG, TLI & HIO Board of Director Biographies

Robert D. Agdern Mr. Agdern held various executive positions with Amoco Corporations from 1975 through 1998, including Exploration and Production Company General Counsel and Executive Vice President – Natural Gas, Chemical Company General Counsel, and Associate General Counsel, Amoco Corporation. He also served as Deputy General Counsel, BP plc, responsible for Western Hemisphere matters. Mr. Agdern holds a B.S. in Engineering from the University of Michigan, a J.D. from the National Law Center, George Washington University and attended the Parker School of International Law, Columbia University and the Advanced Management Program at the Harvard Graduate School of Business.

Carol L. Colman, CFA Ms. Colman began her career with the U.S. Trust Company in New York in 1968. She was a Group Manager, member of the Investment Strategy Committee and earned her CFA. After ten years of research experience, she became a portfolio manager for both domestic and international clients and was the lead manager for overseas clients. In 1980 she joined J.P. Morgan as a portfolio manager for individual and eleemosynary clients, followed by positions at Madison Fund and William G. Campbell, boutique investment firms. From 1983-1990 Ms. Colman was a Managing Director of Inferential Focus, a research and consulting organization. The firm works with investment managers and corporations on developing long range strategy. Ms. Colman is a graduate of St. Lawrence University and is a member of several non-profit boards.

Daniel P. Cronin Mr. Cronin retired in 2004 from the pharmaceutical company Pfizer, Inc., ending his 30-year career as Associate General Counsel of the company. During his tenure with Pfizer he conceived and developed, with New York University’s Stern School of Business, the Pfizer Legal Leadership Series to teach business, financial and management principles to Pfizer’s attorneys. He supervised major product liability, intellectual property and commercial litigations, as well as structuring and negotiating business transactions. He was the chief lawyer for all Pfizer global business units as well as tax, treasury and licensing and development divisions. Mr. Cronin holds a B.S. from Fordham College and a J.D. from Brooklyn Law School.

Paolo M. Cucchi Mr. Cucchi is an Emeritus Professor of French and Italian at Drew University, a position he has held since 2014. He previously served as Vice President and Dean of College of Liberal Arts at Drew University from 1984 to 2009, and as a Professor of French and Italian at Drew University from 2009 to 2014.

William R. Hutchinson Prior to opening his energy consulting business in 2001, Mr. Hutchinson was associated with BP Amoco, PLC, from 1968 until his retirement in 2001. During that time he held various positions at Amoco and BP Amoco, including Treasurer; Vice President and Controller, Vice President of Mergers, Acquisitions and Negotiations, Vice President of Financial Operations, and Group Vice President Worldwide Mergers and Acquisitions. Mr. Hutchinson holds a B.A. from Trinity College, Dublin, Ireland, an M.Sc. from Cranfield College, Bedford, England, an M.B.A. from Harvard University, and earned the CPA designation in 1979.

Eileen A. Kamerick Ms. Kamerick has been Chief Financial Officer of such leading companies as Houlihan Lokey, Heidrick & Struggles, Leo Burnett, and BPAmoco Americas. In her role as CFO and as an experienced Audit Chairman for these funds and for other publicly traded companies, she has overseen the preparation of financial statements. She thus qualifies as an SEC Financial Expert. She is an adjunct professor of governance and corporate finance at leading law schools including University of Chicago and Washington University at St Louis. She is an NACD Board Leadership Fellow. Ms. Kamerick graduated Phi Beta Kappa and summa cum laude from Boston College. She received a law degree from the University of Chicago Law School and holds an MBA, with honors, in Finance and International Business from the Graduate School of Business of the University of Chicago.

Nisha Kumar Ms. Kumar brings to the Board significant financial and accounting experience from her current role as the CFO and Chief Compliance Officer of Greenbriar Equity Group LLC, a global private equity group as well as her previous experience as CFO and Chief Administrative Officer of Rent the Runway, Inc. From 2001 to 2007, she was at Time Warner, Inc. as VP of Mergers & Acquisitions and VP of Operations. Previously, she was VP of Corporate Development at Priceline.com. Since 2016 Ms. Kumar has been an independent director of The India Fund, Inc. and The Asia Tigers Fund, Inc., currently serving as the Audit Committee Financial Expert on both funds. In 2017 she became an independent director of the Aberdeen Income Credit Strategies Fund. She is a member of the Leadership Council of the Harvard School of Public Health, the Harvard School of Public Health’s India Advisory Council and the Council on Foreign Relations.

Jane E. Trust, CFA From 2007 to 2014, Ms. Trust held various roles with Legg Mason Capital Management. She became Executive Director and Head of Client Service for Legg Mason Capital Management, where she was responsible for the firm’s domestic and institutional client base including sovereign wealth funds, pension plans, public funds and mutual funds. During her tenure with Legg Mason Capital Management, Ms. Trust served as Chairman of the Fee Committee and as a member of the Investment Risk Analysis Committee. Before joining Legg Mason Capital Management, she was Head of Investments for Legg Mason Investment Counsel, supervising a team of equity and fixed income portfolio managers. Previously, Ms. Trust was a fixed income portfolio manager, which included managing Legg Mason’s tax-free bond mutual funds and money market fund. Ms. Trust first joined Legg Mason in 1987 after beginning her career as a management consultant for a privately held consulting firm. Ms. Trust holds a B.A. in Engineering Sciences from Dartmouth College and an M.A.S. in Finance from The Johns Hopkins University. She received the Chartered Financial Analysts designation in 1991 and is a member of the CFA Institute and the Baltimore CFA Society.