SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☒ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12 | |

WESTERN ASSET HIGH INCOME

OPPORTUNITY FUND INC.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by the registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Your Vote Is Important

No Matter How Many or How

Few Shares You Own

February 3, 2020

Dear Fellow Stockholder:

The Western Asset High Income Opportunity Fund Inc. Board of Directors and management team are achieving the Fund’s investment objectives of providing high current income and

capital appreciation. Over the past year, the Board and management team have taken action to adapt to changing market conditions, improve the Fund’s performance and increase distributions in order to deliver enhanced value to all stockholders.

The Board is committed to continuing to work with the management team to build on the Fund’s strong momentum to the benefit of all stockholders. Ahead of our

Annual Meeting of Stockholders on March 20, 2020 (“the Annual Meeting”), we urge you to support the Board of Directors that is enhancing value for you by voting “FOR” all three of the Board’s nominees up for election

— Robert D. Agdern, Carol L. Colman and Daniel P. Cronin.

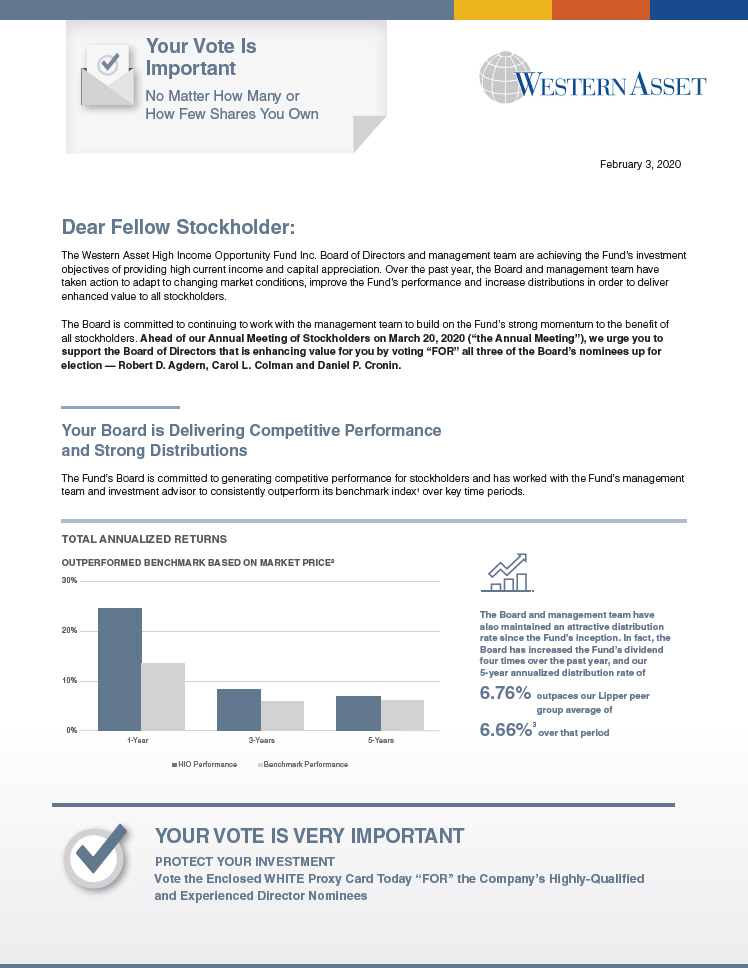

Your Board is Delivering Competitive Performance and Strong Distributions

The Fund’s Board is committed to generating competitive performance for stockholders and has worked with the Fund’s management team and investment advisor to consistently

outperform its benchmark index1 over key time periods.

TOTAL ANNUALIZED RETURNS

OUTPERFORMED BENCHMARK BASED ON MARKET PRICE2 The Board and management team have also maintained an attractive distribution rate since the Fund’s inception.

In fact, the Board has increased the Fund’s dividend four times over the past year, and our

5-year annualized

distribution rate of outpaces our Lipper peer group average of over that period

YOUR VOTE IS VERY IMPORTANT PROTECT YOUR INVESTMENT

Vote the Enclosed WHITE Proxy Card Today “FOR” the Company’s Highly-Qualified and Experienced Director Nominees

Protect the Value of Your Investment — Vote Today

Saba Capital — a professional activist hedge fund — has submitted a non-binding shareholder proposal (the “Self-Tender Offer/

Liquidation Proposal”) requesting that the Fund implement a self-tender offer, which could lead to liquidation or conversion of the Fund into an open-end fund. The Board unanimously opposes this proposal,

as it believes that it represents an attempt by Saba Capital to pressure the Board into facilitating the hedge fund’s short-term agenda at the expense of long-term stockholders and their regular distributions.

The Western Asset High Income Opportunity Fund Board unanimously recommends that you vote “FOR” the Board’s highly qualified nominees who are committed to continuing

to enhance value for stockholders and “AGAINST” Saba Capital’s non-binding Self-Tender Offer/Liquidation Proposal by voting on the enclosed Proxy Card today.

Your vote is important, no matter how many or how few shares you own.

We urge you to support

the Board that is committed to executing a plan to generate long-term, sustainable value for you.

Thank you for your support.

Sincerely,

The Western Asset High Income Opportunity Fund Inc. Board of Directors

Your Vote is Important, No Matter How

Many or How Few Shares You Own

You can vote by internet, telephone or by signing and dating the enclosed Proxy Card and

mailing it in the envelope provided.

If you have any questions about how to

vote your shares or need additional assistance,

please contact:

Innisfree

M&A Stockholders Call Toll Free: (877) 825-8621

Incorporated Banks and Brokers Call: (212) 750-5833

Notes

1 The

benchmark is based on the Bloomberg Barclays U.S. Corporate High Yield – 2% Issuer Cap Index. The Bloomberg Barclays U.S. Corporate High Yield

— 2%

Issuer Cap Index is an index of the 2% Issuer Cap component of the Bloomberg Barclays U.S. Corporate High Yield Index, which covers the U.S. dollar-denominated, non-investment grade, fixed-rate, taxable

corporate bond market.

2 For the period ended December 31, 2019.

3 Yield based on net asset value as of December 31, 2019.

Forward

Looking Statement Past performance is no guarantee of future results. The information provided is not intended to be a forecast of future events, a guarantee of future results or investment advice. All investments are subject to risk including the

possible loss of principal. All benchmark performance reflects no deduction for fees, expenses or taxes. Please note that an investor cannot invest directly in a benchmark.