registrationstatement.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-4

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 File No. 033-66496

|

Pre-Effective Amendment No.

|

o

|

|

Post-Effective Amendment No. 2 3

|

þ

|

and

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940File No. 811-07908

(Check appropriate box or boxes.)

NATIONWIDE VA SEPARATE ACCOUNT - C

(Exact Name of Registrant)

NATIONWIDE LIFE AND ANNUITY INSURANCE COMPANY

(Name of Depositor)

One Nationwide Plaza, Columbus, Ohio 43215

(Address of Depositor's Principal Executive Offices)(Zip Code)

|

Depositor's Telephone Number, including Area Code

|

(614) 249-7111

|

Robert W. Horner, III, Vice President Corporate Governance and Secretary, One Nationwide Plaza, Columbus, Ohio 43215

(Name and Address of Agent for Service)

|

Approximate Date of Proposed Public Offering

|

May 1, 201 2

|

It is proposed that this filing will become effective (check appropriate box)

o immediately upon filing pursuant to paragraph (b)

þ on May 1, 201 2 pursuant to paragraph (b)

o 60 days after filing pursuant to paragraph (a)(1)

o on (date) pursuant to paragraph (a)(1)

If appropriate, check the following box:

o this post-effective amendment designates a new effective date for a previously filed post-effective amendment.

|

Title of Securities Being Registered

|

Individual Deferred Variable Annuity Contract

|

The One Investor Annuity SM

NATIONWIDE LIFE AND ANNUITY INSURANCE COMPANY

Individual Deferred Variable Annuity Contracts

Issued by Nationwide Life and Annuity Insurance Company through its Nationwide VA Separate Account-C

The date of this prospectus is May 1, 201 2 .

|

This prospectus contains basic information you should understand about the contracts before investing. Please read this prospectus carefully and keep it for future reference.

Variable annuities are complex investment products with unique benefits and advantages that may be particularly useful in meeting long-term savings and retirement needs. There are costs and charges associated with these benefits and advantages - costs and charges that are different, or do not exist at all, within other investment products. With help from financial consultants and advisors, investors are encouraged to compare and contrast the costs and benefits of the variable annuity described in this prospectus against those of other investment products, especially other variable annuity and variable life insurance products offered by Nationwide and its affiliates. Nationwide offers a wide array of such products, many with different charges, benefit features and underlying investment options. This process of comparison and analysis should aid in determining whether the purchase of the contract described in this prospectus is consistent with your investment objectives, risk tolerance, investment time horizon, marital status, tax situation and other personal characteristics and needs.

The Statement of Additional Information (dated May 1, 201 2 ) which contains additional information about the contracts and the Variable Account has been filed with the Securities and Exchange Commission ("SEC") and is incorporated herein by reference. The table of contents for the Statement of Additional Information is on page 30. For general information or to obtain free copies of the Statement of Additional Information or to make any other service or transaction requests, please contact the Service Center by one if the methods decribed in the "Contacting the Service Center" provision.

Information about us and the product (including the Statement of Additional Information) may also be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C., or may be obtained, upon payment of a duplicating fee, by writing the Public

Reference Section of the SEC, 100 F Street NE, Washington, D.C. 20549. Additional information on the operation of the Public Reference Room may be obtained by calling the SEC at (202) 551-8090. The SEC also maintains a web site (www.sec.gov) that contains the prospectus, the SAI, material incorporated by reference, and other information.

Before investing, understand that annuities and/or life insurance products are not insured by the Federal Deposit Insurance Corporation or any other federal government agency, and are not deposits or obligations of, guaranteed by, or insured by the depository institution where offered or any of its affiliates. Variable annuity contracts involve investment risk and may lose value. These securities have not been approved or disapproved by the SEC, nor has the SEC passed upon the accuracy or adequacy of the prospectus. Any representation to the contrary is a criminal offense.

|

The Sub-Accounts available under this contract invest in the underlying mutual funds of the following portfolio companies:

|

·

|

Fidelity Variable Insurance Products Fund

|

|

·

|

JPMorgan Insurance Trust

|

|

·

|

Nationwide Variable Insurance Trust

|

For a complete list of the available Sub-Accounts, please refer to the Appendix A: Underlying Mutual Funds. For more information on the underlying mutual funds, please refer to the prospectus for the mutual fund.

Purchase payments not invested in the underlying mutual fund options of the Nationwide VA Separate Account-C may be allocated to the Fixed Account.

Glossary of Special Terms

Accumulation Unit - An accounting unit of measure used to calculate the Contract Value allocated to the Variable Account before the Annuitization Date.

Annuitant – The person upon whose continuation of life benefit payments involving life contingencies depends.

Annuitization Date - The date on which annuity payments begin.

Annuity Commencement Date - The date on which the annuity payments are scheduled to begin. This date may be changed by the Contract Owner with Nationwide’s consent.

Annuity Unit - An accounting unit of measure used to calculate the variable annuity payments.

Contract Owner – The person(s) who owns all the rights under the contract. All references in this prospectus to "you" shall mean the Contract Owner.

Contract Value - The sum of the value of all variable Sub-Account Accumulation Units attributable to a contract, plus amounts allocated to the Fixed Account.

Contract Year - Each year the contract is in force beginning with the date the contract is issued.

Daily Net Assets – A figure that is calculated at the end of each Valuation Date and represents the sum of all the Contract Owner’s interests in the variable Sub-Accounts after the deduction of contract and underlying mutual fund expenses.

ERISA - The Employee Retirement Income Security Act of 1974, as amended.

Fixed Account - An investment option that is funded by Nationwide’s general account. Amounts allocated to the Fixed Account will receive periodic interest, subject to a guaranteed minimum crediting rate.

Individual Retirement Account - An account that qualifies for favorable tax treatment under Section 408(a) of the Internal Revenue Code, but does not include Roth IRAs.

Individual Retirement Annuity - An annuity contract that qualifies for favorable tax treatment under Section 408 (b) of the Internal Revenue Code, but does not include Roth IRAs or Simple IRAs.

Nationwide - Nationwide Life and Annuity Insurance Company. All references in this prospectus to "we" or "us" shall mean Nationwide.

Net Asset Value - The value of one share of an underlying mutual fund at the close of the New York Stock Exchange.

Non-Qualified Contract - A contract that does not qualify for favorable tax treatment as a Qualified Plan, Individual Retirement Annuity, Roth IRA, SEP IRA, or Tax Sheltered Annuity.

Qualified Plans - Retirement plans that receive favorable tax treatment under Section 401 of the Internal Revenue Code.

Roth IRA - An annuity contract that qualifies for favorable tax treatment under Section 408A of the Internal Revenue Code.

SEC - Securities and Exchange Commission.

SEP IRA - A retirement plan that receives favorable tax treatment under Section 408(k) of the Internal Revenue Code.

Service Center - The department of Nationwide responsible for receiving all service and transaction requests relating to the contract. For service and transaction requests submitted other than by telephone (including fax requests), the Service Center is Nationwide's mail and document processing facility. For service and transaction requests communicated by telephone, the Service Center is Nationwide's operations processing facility. Information on how to contact the Service Center is in the "Contacting the Service Center" provision.

Sub-Accounts - Divisions of the Variable Account each of which invests in a single underlying mutual fund.

Tax Sheltered Annuity - An annuity that qualifies for favorable tax treatment under Section 403(b) of the Internal Revenue Code.

Valuation Date - Each day the New York Stock Exchange is open for business, or any other day during which there is a sufficient degree of trading of underlying mutual fund shares such that the current Net Asset Value of Accumulation Units or Annuity Units might be materially affected. Values of the Variable Account are determined as of the close of the New York Stock Exchange which generally closes at 4:00 p.m. Eastern Time, but may close earlier on certain days and as conditions warrant.

Valuation Period - The period of time commencing at the close of a Valuation Date and ending at the close of the New York Stock Exchange for the next succeeding Valuation Date.

Variable Account - Nationwide VA Separate Account-C, a separate account of Nationwide that contains Variable Account allocations. The Variable Account is divided into Sub-Accounts, each of which invests in shares of a separate underlying mutual fund.

|

Table of Contents

|

Page

|

|

Glossary of Special Terms

|

2

|

|

Contract Expenses

|

5

|

|

Underlying Mutual Fund Annual Expenses

|

6

|

|

Example

|

6

|

|

Synopsis of the Contracts

|

7

|

|

Surrenders

|

|

|

Minimum Initial and Subsequent Purchase Payments

|

|

|

Dollar Limit Restrictions

|

|

|

Purpose of the Contract

|

|

|

Charges and Expenses

|

|

|

Annuity Payments

|

|

|

Taxation

|

|

|

Right to Examine and Cancel

|

|

|

Financial Statements

|

8

|

|

Condensed Financial Information

|

8

|

|

Nationwide Life and Annuity Insurance Company

|

8

|

|

Nationwide Investment Services Corporation

|

8

|

|

Investing in the Contract

|

8

|

|

The Variable Account and Underlying Mutual Funds

|

|

|

The Fixed Account

|

|

|

Contacting the Service Center

|

10

|

|

The Contract in General

|

10

|

|

Distribution, Promotional and Sales Expenses

|

|

|

Underlying Mutual Fund Payments

|

|

|

Profitability

|

|

|

Contract Modification

|

|

|

Charges and Deductions

|

12

|

|

Mortality and Expense Risk Charge

|

|

|

Administration Charge

|

|

|

Contingent Deferred Sales Charge

|

|

|

Premium Taxes

|

|

|

Contract Ownership

|

14

|

|

Joint Ownership

|

|

|

Annuitant

|

|

|

Beneficiary and Contingent Beneficiary

|

|

|

Operation of the Contract

|

15

|

|

Minimum Initial and Subsequent Purchase Payments

|

|

|

Pricing

|

|

|

Allocation of Purchase Payments

|

|

|

Determining the Contract Value

|

|

|

Transfers Prior to Annuitization

|

|

|

Transfers After Annuitization

|

|

|

Transfer Requests

|

|

|

Transfer Restrictions

|

|

|

Right to Examine and Cancel

|

19

|

|

Surrender (Redemption) Prior to Annuitization

|

19

|

|

Partial Surrenders (Partial Redemptions)

|

|

|

Full Surrenders (Full Redemptions)

|

|

|

Surrenders Under a Qualified Contract or Tax Sheltered Annuity

|

|

|

Surrenders Under a Texas Optional Retirement Program or the Louisiana Optional Retirement Plan

|

|

|

Loan Privilege

|

20

|

|

Minimum and Maximum Loan Amounts

|

|

|

Maximum Loan Processing Fee

|

|

|

How Loan Requests are Processed

|

|

|

Loan Interest

|

|

|

Loan Repayment

|

|

|

Distributions and Annuity Payments

|

|

|

Transferring the Contract

|

|

|

Table of Contents (continued)

|

Page

|

|

Grace Period and Loan Default

|

|

|

Assignment

|

21

|

|

Contract Owner Services

|

22

|

|

Asset Rebalancing

|

|

|

Dollar Cost Averaging

|

|

|

Enhanced Fixed Account Dollar Cost Averaging

|

|

|

Systematic Withdrawals

|

|

|

Annuity Commencement Date

|

23

|

|

Annuitizing the Contract

|

23

|

|

Annuitization Date

|

|

|

Annuitization

|

|

|

Fixed Payment Annuity

|

|

|

Variable Payment Annuity

|

|

|

Frequency and Amount of Annuity Payments

|

|

|

Annuity Payment Options

|

|

|

Death Benefits

|

25

|

|

Death of Contract Owner – Non-Qualified Contracts

|

|

|

Death of Annuitant – Non-Qualified Contracts

|

|

|

Death of Contract Owner/Annuitant

|

|

|

How the Death Benefit Value is Determined

|

|

|

Death Benefit Payment

|

|

|

Statements and Reports

|

26

|

|

Legal Proceedings

|

26

|

|

Table of Contents of Statement of Additional Information

|

30

|

|

Appendix A: Underlying Mutual Funds

|

31

|

|

Appendix B: Condensed Financial Information

|

33

|

|

Appendix C: Contract Types and Tax Information

|

36

|

The following tables describe the fees and expenses that a Contract Owner will pay when buying, owning, or surrendering the contract.

The first table describes the fees and expenses a Contract Owner will pay at the time the contract is purchased, surrendered, or when cash value is transferred between investment options.

|

Contract Owner Transaction Expenses

|

|

Maximum Contingent Deferred Sales Charge ("CDSC") (as a percentage of purchase payments surrendered)

Range of CDSC over time:

|

|

| |

Number of Completed Years from Date of Purchase Payment

|

0

|

1

|

2

|

3

|

4

|

5

|

6

|

7

|

|

| |

CDSC Percentage

|

7%

|

6%

|

5%

|

4%

|

3%

|

2%

|

1%

|

0%

|

|

|

Some state jurisdictions require a lower CDSC schedule. Please refer to your contract for state specific information.

|

|

|

Maximum Loan Processing Fee

|

|

|

Maximum Premium Tax Charge (as a percentage of purchase payments)

|

|

|

Maximum Short-Term Trading Fee (as a percentage of transaction amount)

|

|

The next table describes the fees and expenses that a Contract Owner will pay periodically during the life of the contract (not including underlying mutual fund fees and expenses).

|

Recurring Contract Expenses

|

|

Annual Loan Interest Charge

|

|

Variable Account Annual Expenses (assessed as an annualized percentage of Daily Net Assets)6

|

|

|

Mortality and Expense Risk Charge

|

1.25%

|

|

Administration Charge

|

0.05%

|

|

Total Variable Account Annual Expenses

|

1.30%

|

1 For contracts issued before September 1, 1999, or before state insurance authorities approve applicable contract modifications, the contract owner may withdraw, during the first Contract Year, without a CDSC, any amount in order for the contract to meet minimum distribution requirements under the Internal Revenue Code. Starting with the second year after a purchase payment has been made, the Contract Owner may withdraw without a CDSC the greater of:

(1) an amount equal to 10% of each purchase payment; or

(2) any amount withdrawn for this contract to meet minimum distribution requirements under the Internal Revenue Code.

This free withdrawal privilege is non-cumulative. Free amounts not taken during any given Contract Year cannot be taken as free amounts in a subsequent Contract Year.

For contracts issued on or after September 1, 1999, or on or after the date state insurance authorities approve applicable contract modifications, each Contract Year the Contract Owner may withdraw without a CDSC the greater of:

(1) 10% of each purchase payment made to the contract; or

(2) any amount withdrawn to meet minimum distribution requirements under the Internal Revenue Code.

This free withdrawal privilege is cumulative. Free amounts not taken during any given Contract Year can be taken as free amounts in a subsequent Contract Year.

The Internal Revenue Code may impose restrictions on surrenders from contracts issued as Tax Sheltered Annuities or contracts issued to fund Qualified Plans.

2 Nationwide may assess a loan processing fee at the time each new loan is processed. Loans are only available for contracts issued as Tax Sheltered Annuities or contracts issued to fund Qualified Plans. Loans are not available in all states. In addition, some states may not permit Nationwide to assess a loan processing fee.

3 Nationwide will charge between 0% and 5% of purchase payments for premium taxes levied by state or other government entities. The amount assessed to the contract will equal the amount assessed by the state or government entity.

4 The transaction amount is the amount of the transfer determined to be engaged in short-term trading. See "Short-Term Trading Fees" later in this prospectus.

5 The loan interest rate is determined, based on market conditions, at the time of loan application or issuance. The loan balance in the collateral fixed account is credited with interest at 2.25% less than the loan interest rate. Thus, the net loan interest charge is an annual rate of 2.25%, which is applied against the outstanding loan balance.

6 These charges apply only to Sub-Account allocations. They do not apply to allocations made to the Fixed Account. They are charged on a daily basis at the annualized rate noted above.

Underlying Mutual Fund Annual Expenses

The next table provides the minimum and maximum total operating expenses, as of December 31, 20 11 , charged by the underlying mutual funds that you may pay periodically during the life of the contract. More detail concerning each underlying mutual fund’s fees and expenses, including waivers and reimbursements, is contained in the prospectus for each underlying mutual fund.

|

Total Annual Underlying Mutual Fund Operating Expenses

|

Minimum

|

Maximum

|

| |

|

|

|

(expenses that are deducted from underlying mutual fund assets, including management fees, distribution (12b-1) fees, and other expenses, as a percentage of average underlying mutual fund assets)

|

0.56%

|

1.22%

|

The minimum and maximum underlying mutual fund operating expenses indicated above do not reflect voluntary or contractual reimbursements and/or waivers applied to some underlying mutual funds. Therefore, actual expenses could be lower. Refer to the underlying mutual fund prospectuses for specific expense information.

This Example is intended to help Contract Owners compare the cost of investing in the contract with the cost of investing in other variable annuity contracts. These costs include Contract Owner transaction expenses, contract fees, Variable Account annual expenses, and underlying mutual fund fees and expenses. The example does not reflect premium taxes which, if reflected, would result in higher expenses.

The Example assumes:

|

·

|

a $10,000 investment in the contract for the time periods indicated;

|

|

·

|

the maximum and the minimum fees and expenses of any of the underlying mutual funds;

|

|

·

|

the total Variable Account charges associated with the contract (1.30%).

|

| |

If you surrender your contract

at the end of the applicable

time period

|

If you annuitize your contract

at the end of the applicable

time period

|

If you do not

surrender

your contract

|

| |

1 Yr.

|

3 Yrs.

|

5 Yrs.

|

10 Yrs.

|

1 Yr.

|

3 Yrs.

|

5 Yrs.

|

10 Yrs.

|

1 Yr.

|

3 Yrs.

|

5 Yrs.

|

10 Yrs.

|

|

Maximum Total Underlying Mutual Fund Operating Expenses (1.22%)

|

$ 865

|

$ 1,213

|

$ 1,587

|

$ 2,945

|

*

|

$813

|

$1,387

|

$2,945

|

$265

|

$813

|

$1,387

|

$2,945

|

|

Minimum Total Underlying Mutual Fund Operating Expenses (0.56%)

|

$ 795

|

$ 1,004

|

$ 1,238

|

$ 2,244

|

*

|

$604

|

$1,038

|

$2,244

|

$195

|

$604

|

$1,038

|

$2,244

|

*The contracts sold under this prospectus do not permit annuitization during the first two Contract Years.

Synopsis of the Contracts

The contracts described in this prospectus are flexible purchase payment contracts. The contracts may be issued as either individual or group contracts. In those states where contracts are issued as group contracts, references throughout this prospectus to "contract" will also mean "certificate." References to "Contract Owner" will mean "participant" unless the plan otherwise permits or requires the Contract Owner to exercise contract rights under the plan terms.

The contracts can be categorized as:

|

·

|

Individual Retirement Annuities ("IRAs");

|

|

·

|

Non-Qualified Contracts;

|

|

·

|

Simplified Employee Pension IRAs ("SEP IRAs"); and

|

|

·

|

Tax Sheltered Annuities.

|

For more detailed information with regard to the differences in contract types see, "Types of Contracts," in Appendix C: Contract Types and Tax Information. Prospective purchasers may apply to purchase a contract through broker dealers that have entered into a selling agreement with Nationwide Investment Services Corporation.

Surrenders

Contract Owners may generally surrender some or all of their Contract Value at any time prior to annuitization by notifying the Service Center in writing. See the "Surrender (Redemption) Prior to Annuitization" section later in this prospectus. After the Annuitization Date, surrenders are not permitted. See the "Surrender (Redemption) After Annuitization" section later in this prospectus.

Minimum Initial and Subsequent Purchase Payments

|

Contract

Type

|

Minimum Initial Purchase Payment*

|

Minimum Subsequent Payments

|

|

IRA

|

$2,000

|

$10

|

|

Non-Qualified Contract

|

$2,000

|

$10

|

|

Qualified Plan

|

$0

|

$10

|

|

Roth IRA

|

$2,000

|

$10

|

|

SEP IRA

|

$2,000

|

$10

|

|

Tax Sheltered Annuity**

|

$0

|

$10

|

*A Contract Owner will meet the minimum initial purchase payment requirement by making purchase payments equal to the required minimum over the course of the first Contract Year.

**Only available for individual 403(b) Tax Sheltered Annuity contracts subject to ERISA and certain state Optional Retirement Plans and/or Programs that have purchased at least one individual annuity contract issued by Nationwide prior to September 25, 2007.

Nationwide reserves the right to refuse any purchase payment that would result in the cumulative total for all contracts issued by Nationwide on the life of any one Annuitant or owned by any one Contract Owner to exceed $1,000,000. Its decision as to whether or not to accept a purchase payment in excess of that amount will be based on one or more factors, including, but not limited to: age, spouse age (if applicable), Annuitant age, state of issue, total purchase payments, optional benefits elected, current market conditions, and current hedging costs. All such decisions will be based on internally established actuarial guidelines and will be applied in a non-discriminatory manner. In the event that we do not accept a purchase payment under these guidelines, we will immediately return the purchase payment in its entirety in the same manner as it was received. If we accept the purchase payment, it will be applied to the contract immediately and will receive the next calculated Accumulation Unit value. Any references in this prospectus to purchase payment amounts in excess of $1,000,000 are assumed to have been approved by Nationwide.

Dollar Limit Restrictions

In addition to the potential purchase payment restriction listed above, certain features of the contract have additional purchase payment and/or Contract Value limitations associated with them:

Annuitization. Your annuity payment options will be limited if you submit total purchase payments in excess of $2,000,000. Furthermore, if the amount to be annuitized is greater than $5,000,000, we may limit both the amount that can be annuitized on a single life and the annuity payment options.

Death benefit calculations. Purchase payments up to $3,000,000 will result in a higher death benefit payment than purchase payments in excess of $3,000,000.

Purpose of the Contract

The annuity described in this prospectus is intended to provide benefits to a single individual and his/her beneficiaries. It is not intended to be used:

|

·

|

by institutional investors;

|

|

·

|

in connection with other Nationwide contracts that have the same Annuitant; or

|

|

·

|

in connection with other Nationwide contracts that have different Annuitants, but the same Contract Owner.

|

By providing these annuity benefits, Nationwide assumes certain risks. If Nationwide determines that the risks it intended to assume in issuing the contract have been altered by misusing the contract as described above, Nationwide reserves the right to take any action it deems necessary to reduce or eliminate the altered risk, including, but not limited to, rescinding the contract and returning the Contract Value (less any applicable Contingent Deferred Sales Charge and/or market value adjustment). Nationwide also reserves the right to take any action it deems necessary to reduce or eliminate altered risk resulting from materially false, misleading, incomplete or otherwise deficient information provided by the Contract Owner.

Charges and Expenses

Nationwide deducts a Mortality and Expense Risk Charge equal to an annualized rate of 1.25% of the Daily Net Assets

of the Variable Account. Nationwide assesses these charges in return for bearing certain mortality and administrative risks.

Nationwide deducts an Administration Charge equal to an annualized rate of 0.05% of the Daily Net Assets of the Variable Account. This charge reimburses Nationwide for administrative expenses related to issuance and maintenance of the contracts.

Nationwide does not deduct a sales charge from purchase payments upon deposit into the contract. However, Nationwide may deduct a Contingent Deferred Sales Charge ("CDSC") if any amount is withdrawn from the contract. This CDSC reimburses Nationwide for sales expenses. The amount of the CDSC will not exceed 7% of purchase payments surrendered.

Underlying Mutual Fund Annual Expenses

The underlying mutual funds charge fees and expenses that are deducted from underlying mutual fund assets. These fees and expenses are in addition to the fees and expenses assessed by the contract. The prospectus for each underlying mutual fund provides information regarding the fees and expenses applicable to the fund.

Short-Term Trading Fees

Some underlying mutual funds may assess (or reserve the right to assess) a short-term trading fee in connection with transfers from a Sub-Account that occur within 60 days after the date of allocation to the Sub-Account. Any short-term trading fee assessed by any underlying mutual fund available in conjunction with the contracts described in this prospectus will equal 1% of the amount determined to be engaged in short-term trading.

Annuity Payments

Annuity payments begin on the Annuitization Date and will be based on the annuity payment option chosen prior to annuitization. Nationwide will send annuity payments no later than 7 days after each annuity payment date.

Taxation

How distributions from an annuity contract are taxed depends on the type of contract issued and the purpose for which the contract is purchased. Generally, distributions from an annuity contract, including the paymernt of death benefits, are taxable to the extent they exceed investment in the contract. Nationwide will charge against the contract any premium taxes levied by any governmental authority. Premium tax rates currently range from 0% to 5% (see, "Federal Tax Considerations," in Appendix C: Contract Types and Tax Information and "Premium Taxes").

Right to Examine and Cancel

Under state insurance laws, Contract Owners have the right, during a limited period of time, to examine their contract and decide if they want to keep it or cancel it. This right is referred to as a "free look" right. The length of this time period depends on state law and may vary depending on whether your purchase is replacing another annuity contract you own.

If the Contract Owner elects to cancel the contract pursuant to the free look provision, where required by law, Nationwide will return the greater of the Contract Value or the amount of purchase payment(s) applied during the free look period, less any applicable federal and state income tax withholding. Otherwise, Nationwide will return the Contract Value, less any applicable federal and state income tax withholding.

Financial statements for the Variable Account and Consolidated Financial Statements for Nationwide Life and Annuity Insurance Company are located in the Statement of Additional Information. A current Statement of Additional Information may be obtained without charge by contacting the Service Center.

Condensed Financial Information

The value of an Accumulation Unit is determined on the basis of changes in the per share value of the underlying mutual funds and the assessment of Variable Account charges (for more information on the calculation of Accumulation Unit values, see "Determining Variable Account Value – Valuing an Accumulation Unit"). Please refer to Appendix B: Condensed Financial Information for information regarding Accumulation Units.

Nationwide Life and Annuity Insurance Company

Nationwide, the depositor, is a stock life insurance company organized under Ohio law in February 1981, with its home office at One Nationwide Plaza, Columbus, Ohio 43215. Nationwide is a provider of life insurance products, annuities and retirement products.

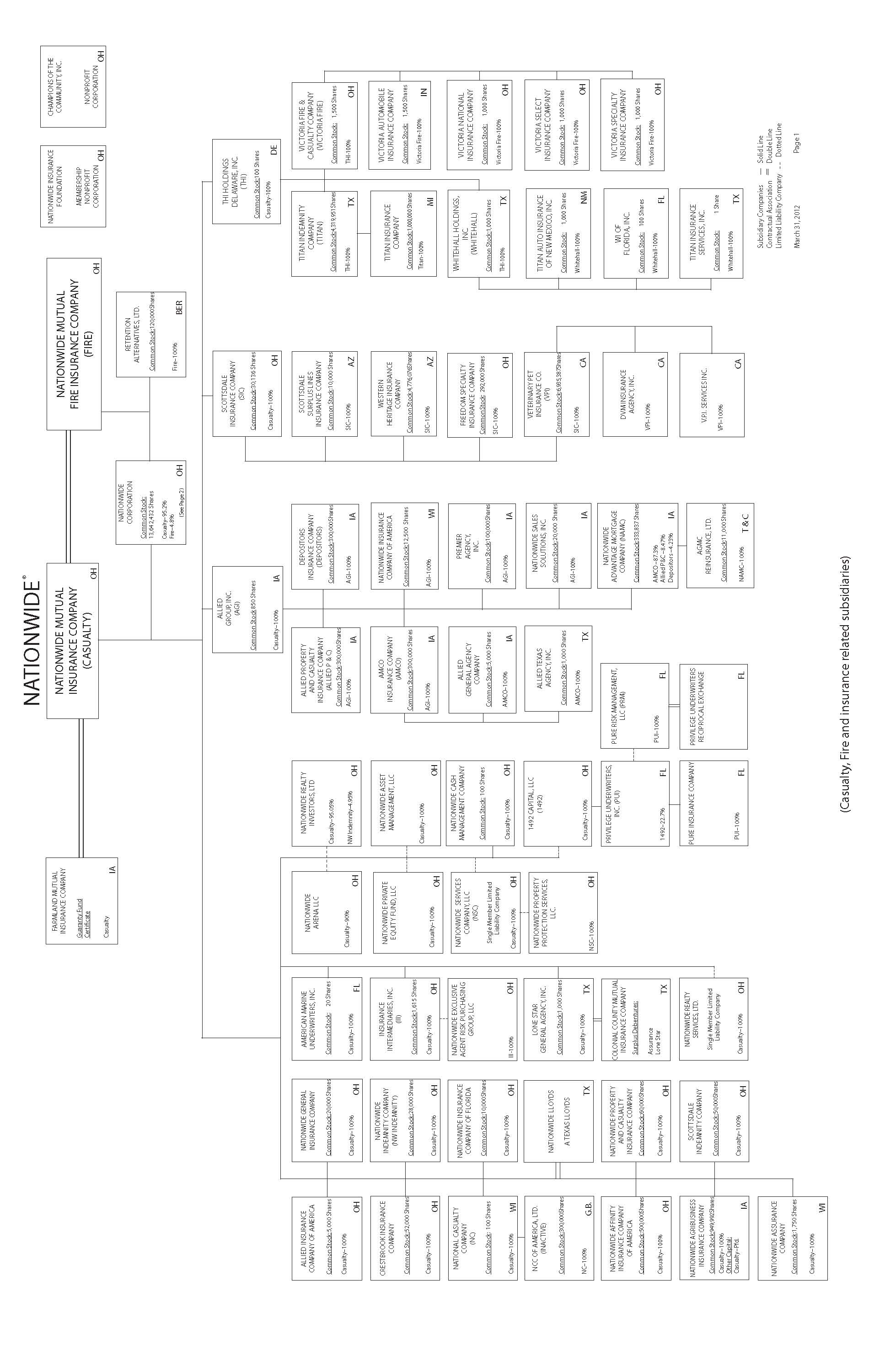

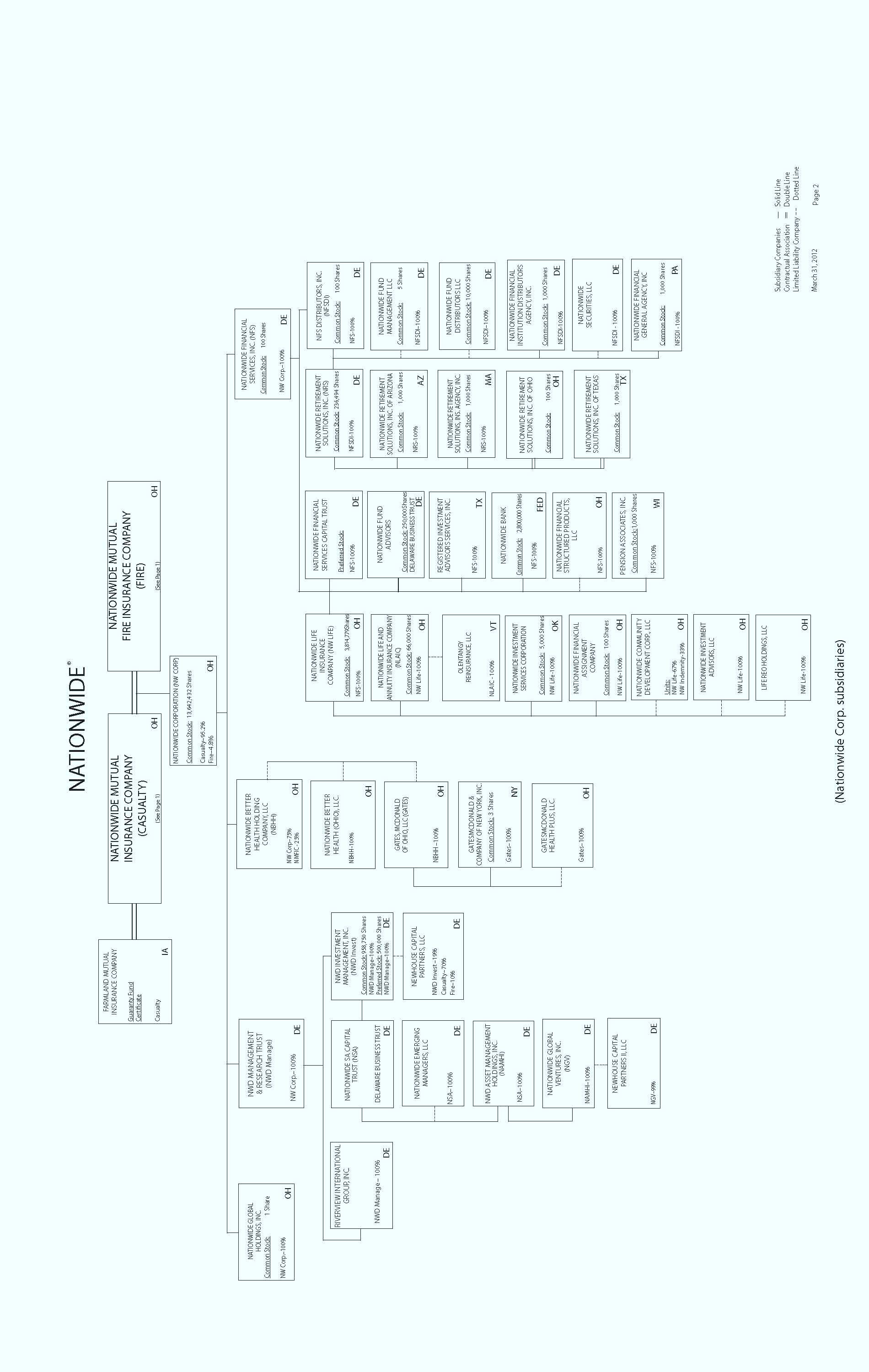

Nationwide is a member of the Nationwide group of companies. Nationwide Mutual Insurance Company and Nationwide Mutual Fire Insurance Company (the "Companies") are the ultimate controlling persons of the Nationwide group of companies. The Companies were organized under Ohio law in December 1925 and 1933 respectively. The Companies engage in a general insurance and reinsurance business, except life insurance.

Nationwide Investment Services Corporation

The contracts are distributed by the general distributor, Nationwide Investment Services Corporation ("NISC"), One Nationwide Plaza, Columbus, Ohio 43215. NISC is a wholly owned subsidiary of Nationwide Life Insurance Company.

Investing in the Contract

The Variable Account and Underlying Mutual Funds

Nationwide VA Separate Account-C is a Variable Account that invests in the underlying mutual funds listed in Appendix

A: Underlying Mutual Funds. Nationwide established the Variable Account on July 24, 1991, pursuant to Ohio law. Although the Variable Account is registered with the SEC as a unit investment trust pursuant to the Investment Company Act of 1940 ("1940 Act"), the SEC does not supervise the management of Nationwide or the Variable Account.

Income, gains, and losses credited to, or charged against, the Variable Account reflect the Variable Account’s own investment experience and not the investment experience of Nationwide’s other assets. The Variable Account’s assets are held separately from Nationwide’s assets and are not chargeable with liabilities incurred in any other business of Nationwide. Nationwide is obligated to pay all amounts promised to Contract Owners under the contracts.

The Variable Account is divided into Sub-Accounts, each corresponding to a single underlying mutual fund. Nationwide uses the assets of each Sub-Account to buy shares of the underlying mutual funds based on Contract Owner instructions.

Contract Owners receive underlying mutual fund prospectuses when they make their initial Sub-Account allocations and any time they change those allocations. Contract Owners can obtain prospectuses for underlying funds at any other time by contacting the Service Center. Contract Owners should read these prospectuses carefully before investing.

Underlying mutual funds in the Variable Account are NOT publicly traded mutual funds. They are only available as investment options in variable life insurance policies or variable annuity contracts issued by life insurance companies, or in some cases, through participation in certain qualified pension or retirement plans.

The investment advisors of the underlying mutual funds may manage publicly traded mutual funds with similar names and investment objectives. However, the underlying mutual funds are NOT directly related to any publicly traded mutual fund. Contract Owners should not compare the performance of a publicly traded fund with the performance of underlying mutual funds participating in the Variable Account. The performance of the underlying mutual funds could differ substantially from that of any publicly traded funds.

The particular underlying mutual funds available under the contract may change from time to time. Specifically, underlying mutual funds or underlying mutual fund share classes that are currently available may be removed or closed off to future investment. New underlying mutual funds or new share classes of currently available underlying mutual funds may be added. Contract Owners will receive notice of any such changes that affect their contract.

Voting Rights

Contract Owners who have allocated assets to the underlying mutual funds are entitled to certain voting rights. Nationwide will vote Contract Owner shares at special shareholder meetings based on Contract Owner instructions. However, if the law changes and Nationwide is allowed to vote in its own right, it may elect to do so.

Contract Owners with voting interests in an underlying mutual fund will be notified of issues requiring the shareholders’ vote as soon as possible before the shareholder meeting. Notification will contain proxy materials and a form with which to give Nationwide voting instructions. Nationwide will vote shares for which no instructions are received in the same proportion as those that are received.

The number of shares which a Contract Owner may vote is determined by dividing the cash value of the amount they have allocated to an underlying mutual fund by the Net Asset Value of that underlying mutual fund. Nationwide will designate a date for this determination not more than 90 days before the shareholder meeting. What this means to you is that when only a small number of Contract Owners vote, each vote has a greater impact on, and may control the outcome.

Material Conflicts

The underlying mutual funds may be offered through separate accounts of other insurance companies, as well as through other separate accounts of Nationwide. Nationwide does not anticipate any disadvantages to this. However, it is possible that a conflict may arise between the interests of the Variable Account and one or more of the other separate accounts in which these underlying mutual funds participate.

Material conflicts may occur due to a change in law affecting the operations of variable life insurance policies and variable annuity contracts, or differences in the voting instructions of the Contract Owners and those of other companies. If a material conflict occurs, Nationwide will take whatever steps are necessary to protect Contract Owners and variable annuity payees, including withdrawal of the Variable Account from participation in the underlying mutual fund(s) involved in the conflict.

Substitution of Securities

Nationwide may substitute, eliminate, or combine shares of another underlying mutual fund for shares already purchased or to be purchased in the future if either of the following occurs:

|

(1)

|

shares of a current underlying mutual fund are no longer available for investment; or

|

|

(2)

|

further investment in an underlying mutual fund is inappropriate.

|

No substitution, elimination, or combination of shares may take place without the prior approval of the SEC. All affected Contract Owners will be notified in the event there is a substitution, elimination or combination of shares.

Deregistration of the Separate Account

Nationwide may deregister Nationwide VA Separate Account - C under the 1940 Act in the event the separate account meets an exemption from registration under the 1940 Act, if there are no shareholders in the separate account or for any other purpose approved by the SEC.

No deregistration may take place without the prior approval of the SEC. All Contract Owners will be notified in the event Nationwide deregisters Nationwide VA Separate Account - C.

The Fixed Account

The Fixed Account is an investment option that is funded by Nationwide’s general account. The general account contains all of Nationwide’s assets other than those in this and other Nationwide separate accounts and is used to support Nationwide’s annuity and insurance obligations. The general account is not subject to the same laws as the Variable Account and the SEC has not reviewed material in this prospectus relating to the Fixed Account.

Purchase payments will be allocated to the Fixed Account by election of the Contract Owner. Nationwide reserves the right to limit or refuse purchase payments allocated to the Fixed Account at its sole discretion. Nationwide reserves the right to refuse transfers into the Fixed Account if the Fixed Account value is (or would be after the transfer) equal to or greater than 30% of the Contract Value at the time the transfer is requested. Generally, Nationwide will invoke this right when interest rates are low by historical standards. The investment income earned by the Fixed Account will be allocated to the contracts at varying guaranteed interest rate(s) depending on the following categories of Fixed Account allocations:

|

·

|

New Money Rate – The rate credited on the Fixed Account allocation when the contract is purchased or when subsequent purchase payments are made. Subsequent purchase payments may receive different New Money Rates than the rate when the contract was issued, since the New Money Rate is subject to change based on market conditions.

|

|

·

|

Variable Account to Fixed Rate – Allocations transferred from any of the Sub-Accounts in the Variable Account to the Fixed Account may receive a different rate. The rate may be lower than the New Money Rate. There may be limits on the amount and frequency of movements from the Variable Account to the Fixed Account.

|

|

·

|

Renewal Rate – The rate available for maturing Fixed Account allocations which are entering a new guarantee period. The Contract Owner will be notified of this rate in a letter issued with the quarterly statements when any of the money in the Contract Owner’s Fixed Account matures. At that time, the Contract Owner will have an opportunity to leave the money in the Fixed Account and receive the Renewal Rate or the Contract Owner can move the money to any of the other underlying mutual fund options.

|

|

·

|

Dollar Cost Averaging Rate – From time to time, Nationwide may offer a more favorable rate for an initial purchase payment into a new contract when used in conjunction with a dollar cost averaging program (see "Enhanced Rate Dollar Cost Averaging Program").

|

All of these rates are subject to change on a daily basis; however, once applied to the Fixed Account, the interest rates are guaranteed until the end of the calendar quarter during which the 12 month anniversary of the Fixed Account allocation occurs.

Credited interest rates are annualized rates – the effective yield of interest over a one-year period. Interest is credited to each contract on a daily basis. As a result, the credited interest rate is compounded daily to achieve the stated effective yield.

The guaranteed rate for any purchase payment will be effective for not less than twelve months. Nationwide guarantees that the rate will not be less than the minimum interest rate required by applicable state law per year.

Any interest in excess of the minimum interest rate required by applicable state law will be credited to Fixed Account allocations at Nationwide’s sole discretion. The Contract Owner assumes the risk that interest credited to Fixed Account allocations may not exceed the minimum interest rate required by applicable state law for any given year.

Nationwide guarantees that the Fixed Account value will not be less than the amount of the purchase payments allocated to the Fixed Account, plus interest credited as described above, less surrenders and any applicable charges including CDSC.

Contacting the Service Center

All inquiries, paperwork, information requests, service requests, and transaction requests should be made to the Service Center:

|

·

|

by telephone at 1-800-848-6331 (TDD 1-800-238-3035)

|

|

·

|

by mail to P.O. Box 182021, Columbus, Ohio 43218-2021

|

|

·

|

by fax at 1-888-634-4472

|

|

·

|

by Internet at www.nationwide.com .

|

Nationwide reserves the right to restrict or remove the ability to submit service requests via Internet, phone, or fax upon written notice.

Not all methods of communication are available for all types of requests. To determine which methods are permitted for a particular request, refer to the specific transaction provision in this prospectus, or call the Service Center. Requests submitted by means other than described in this prospectus could be returned or delayed.

Service and transaction requests will generally be processed on the Valuation Date they are received at the Service Center as long as the request is in good order. Good order generally means that all necessary information to process the request is complete and in a form acceptable to Nationwide. If a request is not in good order, Nationwide will take reasonable actions to obtain the information necessary to process the request. Requests that are not in good order may be delayed or returned. Nationwide reserves the right to process any purchase payment or withdrawal request sent to a location other than the Service Center on the Valuation Date it is received at the Service Center.

Nationwide may be required to provide information about your contract to government regulators. If mandated under applicable law, Nationwide may be required to reject a purchase payment and to refuse to process transaction requests

for transfers, withdrawals, loans, and/or death benefits until instructed otherwise by the appropriate regulator.

Nationwide will use reasonable procedures to confirm that instructions are genuine and will not be liable for following instructions that it reasonably determined to be genuine. Nationwide may record telephone requests. Telephone and computer systems may not always be available. Any telephone system or computer, whether yours or Nationwide's, can experience outages or slowdowns for a variety of reasons. The outages or slowdowns could prevent or delay processing. Although Nationwide has taken precautions to support heavy use, it is still possible to incur an outage or delay. To avoid technical difficulties, submit transaction requests by mail.

The Contract in General

Due to state law variations, the options and benefits described in this prospectus may vary or may not be available depending on the state in which the contract is issued. Possible state law variations include, but are not limited to, minimum initial and subsequent purchase payment amounts, investment options, age issuance limitations, availability of certain optional benefits, free look rights, annuity payment options, ownership and interests in the contract, assignment, death benefit calculations, and CDSC-free withdrawal privileges. This prospectus describes all the material features of the contract. To review a copy of the contract and any endorsements, please contact the Service Center.

In order to comply with the USA Patriot Act and rules promulgated thereunder, Nationwide has implemented procedures designed to prevent contracts described in this prospectus from being used to facilitate money laundering or the financing of terrorist activities.

These contracts are offered to customers of various financial institutions and brokerage firms. No financial institution or brokerage firm is responsible for any of the contractual insurance benefits and features guaranteed under the contracts. These guarantees are the sole responsibility of Nationwide.

In general, deferred variable annuities are long-term investments; they are not intended as short-term investments. Accordingly, Nationwide has designed the contract to offer features, pricing, and investment options that encourage long-term ownership. It is very important that Contract Owners and prospective Contract Owners understand all the costs associated with owning a contract, and if and how those costs change during the lifetime of the contract. Contract and optional charges may not be the same in later Contract Years as they are in early Contract Years. The various contract charges are assessed in order to compensate Nationwide for administrative services, distribution and operational expenses, and assumed actuarial risks associated with the contract.

Following is a discussion of some relevant factors that may be of particular interest to prospective investors.

Distribution, Promotional and Sales Expenses

Nationwide pays commissions to the firms that sell the contracts. The maximum gross commission that Nationwide will pay on the sale of the contracts is 8.5% of purchase payments. Note that the individual registered representatives typically receive only a portion of this amount; the remainder is retained by the firm. Nationwide may also, instead of a premium-based commission, pay an asset-based commission (sometimes referred to as "trails" or "residuals"), or a combination of the two.

In addition to, or partially in lieu of, commission, Nationwide may also pay the selling firms a marketing allowance, which is based on the firm’s ability and demonstrated willingness to promote and market Nationwide's products. How any marketing allowance is spent is determined by the firm, but generally will be used to finance firm activities that may contribute to the promotion and marketing of Nationwide's products. For more information on the exact compensation arrangement associated with this contract, please consult your registered representative.

Underlying Mutual Fund Payments

Nationwide’s Relationship with the Underlying Mutual Funds

The underlying mutual funds incur expenses each time they sell, administer, or redeem their shares. The Variable Account aggregates Contract Owner purchase, redemption, and transfer requests and submits net or aggregated purchase/redemption requests to each underlying mutual fund daily. The Variable Account (and not the Contract Owners) is the underlying mutual fund shareholder. When the Variable Account aggregates transactions, the underlying mutual fund does not incur the expense of processing individual transactions it would normally incur if it sold its shares directly to the public. Nationwide incurs these expenses instead.

Nationwide also incurs the distribution costs of selling the contract (as discussed above), which benefit the underlying mutual funds by providing Contract Owners with Sub-Account options that correspond to the underlying mutual funds.

An investment advisor or subadvisor of an underlying mutual fund or its affiliates may provide Nationwide or its affiliates with wholesaling services that assist in the distribution of the contract and may pay Nationwide or its affiliates to participate in educational and/or marketing activities. These activities may provide the advisor or subadvisor (or their affiliates) with increased exposure to persons involved in the distribution of the contract.

Types of Payments Nationwide Receives

In light of the above, the underlying mutual funds and their affiliates make certain payments to Nationwide or its affiliates (the "payments"). The amount of these payments is typically based on a percentage of assets invested in the underlying mutual funds attributable to the contracts and other variable contracts Nationwide and its affiliates issue, but in some cases may involve a flat fee. These payments may be used by us for any corporate purpose, which include reducing the prices of the contracts, paying expenses that Nationwide or its affiliates incur in promoting, marketing, and administering the contracts and the underlying mutual funds, and achieving a profit.

Nationwide or its affiliates receive the following types of payments:

|

·

|

Underlying mutual fund 12b-1 fees, which are deducted from underlying mutual fund assets;

|

|

·

|

Sub-transfer agent fees or fees pursuant to administrative service plans adopted by the underlying mutual fund, which may be deducted from underlying mutual fund assets; and

|

|

·

|

Payments by an underlying mutual fund’s advisor or subadvisor (or its affiliates). Such payments may be derived, in whole or in part, from the advisory fee, which is deducted from underlying mutual fund assets and is reflected in mutual fund charges.

|

Furthermore, Nationwide benefits from assets invested in Nationwide’s affiliated underlying mutual funds (i.e., Nationwide Variable Insurance Trust) because its affiliates also receive compensation from the underlying mutual funds for investment advisory, administrative, transfer agency, distribution, and/or other services. Thus, Nationwide may receive more revenue with respect to affiliated underlying mutual funds than unaffiliated underlying mutual funds.

Nationwide took into consideration the anticipated payments from the underlying mutual funds when we determined the charges imposed under the contracts (apart from fees and expenses imposed by the underlying mutual funds). Without these payments, Nationwide would have imposed higher charges under the contract.

Amount of Payments Nationwide Receives

For the year ended December 31, 201 1 , the underlying mutual fund payments Nationwide and its affiliates received from the underlying mutual funds did not exceed 0.60 % (as a percentage of the average Daily Net Assets invested in the underlying mutual funds) offered through this contract or other variable contracts that Nationwide and its affiliates issue. Payments from investment advisors or subadvisors to participate in educational and/or marketing activities have not been taken into account in this percentage.

Most underlying mutual funds or their affiliates have agreed to make payments to Nationwide or its affiliates, although the applicable percentages may vary from underlying mutual fund to underlying mutual fund and some may not make any payments at all. Because the amount of the actual payments Nationwide and its affiliates receive depends on the assets of the underlying mutual funds attributable to the contract, Nationwide and its affiliates may receive higher payments from underlying mutual funds with lower percentages (but greater assets) than from underlying mutual funds that have higher percentages (but fewer assets).

Identification of Underlying Mutual Funds

Nationwide may consider several criteria when identifying the underlying mutual funds, including some or all of the following: investment objectives, investment process, investment performance, risk characteristics, investment capabilities, experience and resources, investment consistency, and fund expenses. Another factor Nationwide considers during the identification process is whether the underlying mutual fund’s advisor or subadvisor is one of our affiliates or whether the underlying mutual fund, its advisor, its subadvisor(s), or an affiliate will make payments to us or our affiliates.

There may be underlying mutual funds with lower fees, as well as other variable contracts that offer underlying mutual funds with lower fees. You should consider all of the fees and charges of the contract in relation to its features and benefits when making your decision to invest. Please note that higher contract and underlying mutual fund fees and charges have a direct effect on and may lower your investment performance.

Profitability

Nationwide does consider profitability when determining the charges in the contract. In early Contract Years, Nationwide does not anticipate earning a profit, since that is a time when administrative and distribution expenses are typically higher. Nationwide does, however, anticipate earning a profit in later Contract Years. In general, Nationwide's profit will be greater the higher the investment return and the longer the contract is held.

Contract Modification

Nationwide may modify the annuity contracts, but no modification will affect the amount or term of any annuity contract unless a modification is required to conform the annuity contract to applicable federal or state law. No modification will affect the method by which the Contract Values are determined.

Mortality and Expense Risk Charge

Nationwide deducts a Mortality and Expense Risk Charge from the Variable Account. This amount is computed on a daily basis, and is equal to an annualized rate of 1.25% of the Daily Net Assets of the Variable Account.

The Mortality Risk Charge compensates Nationwide for guaranteeing the annuity purchase rates of the contracts. This guarantee ensures that the annuity purchase rates will not change regardless of the death rates of annuity payees or the general population.

The Expense Risk Charge compensates Nationwide for guaranteeing that charges will not increase regardless of actual expenses.

If the Mortality and Expense Risk Charge is insufficient to cover actual expenses, the loss is borne by Nationwide. Nationwide may realize a profit from this charge.

Administration Charge

Nationwide deducts an Administration Charge equal to an annualized rate of 0.05% of the Daily Net Assets of the Variable Account. This charge is designed to reimburse Nationwide for administrative expenses related to the issuance and maintenance of the contracts.

Contingent Deferred Sales Charge

No sales charge deduction is made from purchase payments when amounts are deposited into the contracts. However, if any part of the contract is surrendered, Nationwide will deduct a CDSC. The CDSC will not exceed 7% of purchase payments surrendered.

The CDSC is calculated by multiplying the applicable CDSC percentage (noted below) by the amount of purchase payments surrendered.

For purposes of calculating the CDSC, surrenders are considered to come first from the oldest purchase payment made to the contract, then the next oldest purchase payment, and so forth. Earnings are not subject to the CDSC, but may not be distributed prior to the distribution of all purchase payments. For tax purposes, a surrender is usually treated as a withdrawal of earnings first.

The CDSC applies as follows:

|

Number of Completed Years from Date of Purchase Payment

|

CDSC

Percentage

|

|

0

|

7%

|

|

1

|

6%

|

|

2

|

5%

|

|

3

|

4%

|

|

4

|

3%

|

|

5

|

2%

|

|

6

|

1%

|

|

7

|

0%

|

The CDSC is used to cover sales expenses, including commissions, production of sales material, and other promotional expenses. If expenses are greater than the CDSC, the shortfall will be made up from Nationwide’s general account, which may indirectly include portions of the Administration Charge and other Variable Account charges, since Nationwide may generate a profit from these charges.

All or a portion of any withdrawal may be subject to federal income taxes. Contract Owners taking withdrawals before age 59½ may be subject to a 10% tax penalty.

Waiver of Contingent Deferred Sales Charge

For contracts issued before September 1, 1999, or a date on which state insurance authorities approve applicable contract modifications, the Contract Owner may withdraw, during the first Contract Year, without a CDSC, any amount in order for this contract to meet minimum distribution requirements under the Internal Revenue Code. Starting with the second year after a purchase payment has been made, the Contract Owner may withdraw without a CDSC the greater of:

|

(a)

|

an amount equal to 10% of each purchase payment; or

|

|

(b)

|

an amount withdrawn to meet minimum distribution requirements for this contract under the Internal Revenue Code.

|

This free withdrawal privilege is non-cumulative. Free amounts not taken during any Contract Year cannot be taken as free amounts in a subsequent Contract Year.

Purchase payments surrendered under the CDSC-free withdrawal privilege are not, for purposes of calculating the maximum amount that can be withdrawn annually without a CDSC in subsection (a) above and for determining the waiver of CDSC for partial surrenders discussed later in this prospectus, considered a surrender of purchase payments.

For contracts issued on or after September 1, 1999, or a date on which state insurance authorities approve applicable contract modifications, each Contract Year the Contract Owner may withdraw without a CDSC the greater of:

|

(a)

|

10% of each purchase payment made to the contract; or

|

|

(b)

|

any amount withdrawn to meet the minimum distribution requirements under the Internal Revenue Code.

|

This free withdrawal privilege is cumulative. Free amounts not taken during any Contract Year can be taken as free amounts in a subsequent Contract Year.

For all contracts, no CDSC will be deducted:

|

(2)

|

upon payment of a death benefit; or

|

|

(3)

|

from any values which have been held under a contract for at least 7 years.

|

No CDSC applies to transfers among Sub-Accounts, the Fixed Account, or the Variable Account.

Nationwide may waive or reduce the CDSC when sales are to employees of JPMorgan Chase & Co. or the employees of its affiliates, subsidiaries or holding companies.

A contract held by a Charitable Remainder Trust (within the meaning of Internal Revenue Code Section 664) may withdraw CDSC-free the greater of (a) or (b), where:

|

(a)

|

is the amount which would otherwise be available for withdrawal without a CDSC; and

|

|

(b)

|

is the difference between the total purchase payments made to the contract as of the date of the withdrawal (reduced by previous withdrawals) and the Contract Value at the close of the day prior to the date of the withdrawal.

|

For Tax Sheltered Annuity Contracts, Qualified Contracts, and SEP IRA Contracts, Nationwide will waive the CDSC when:

|

(a)

|

the plan participant experiences a case of hardship (as provided in Internal Revenue Code section 403(b) and as defined for purposes of Internal Revenue Code section 401(k));

|

|

(b)

|

the plan participant becomes disabled (within the meaning of Internal Revenue Code section 72(m)(7));

|

|

(c)

|

the plan participant attains age 59½ and has participated in the contract for at least 5 years, as determined from the contract anniversary date immediately preceding the distribution;

|

|

(d)

|

the plan participant has participated in the contract for at least 15 years as determined from the contract anniversary date immediately preceding the distribution;

|

|

(e)

|

the plan participant dies; or

|

|

(f)

|

the contract is annuitized after 2 years from the inception of the contract.

|

The Contract Owner may be subject to income tax on all or a portion of any such withdrawals and to a tax penalty if the Contract Owner takes withdrawals prior to age 59½ (see "Non-Qualified Contracts - Natural Persons as Contract Owners").

The CDSC for any type of contract issued will not be eliminated if to do so would be unfairly discriminatory or prohibited by state law.

Premium Taxes

Nationwide will charge against the Contract Value any premium taxes levied by a state or other government entity. Premium tax rates currently range from 0% to 5%. This range is subject to change. Nationwide will assess premium taxes to the contract at the time Nationwide is assessed the premium taxes by the state. Premium tax requirements vary from state to state.

Premium taxes may be deducted from death benefit proceeds.

Contract Ownership

The Contract Owner has all rights under the contract, including the right to designate and change any designations of the Contract Owner, Annuitant, beneficiary, contingent beneficiary, annuity payment option, and Annuity Commencement Date. Contract Owners must be age 80 or younger at the time of contract issuance. Purchasers who name someone other than themselves as the Contract Owner will have no rights under the contract.

Contract Owners may name a new Contract Owner at any time before the Annuitization Date. Any change of Contract Owner automatically revokes any prior Contract Owner designation. Changes in contract ownership may result in federal income taxation and may be subject to state and federal gift taxes.

A change in contract ownership must be submitted in writing and recorded at the Service Center. . Once recorded, the change will be effective as of the date signed. No change will be effective unless and until it is received and recorded at the Service Center. However, the change will not affect any payments made or actions taken by Nationwide before the change was recorded.

The Contract Owner may also request a change in the Annuitant, beneficiary, or contingent beneficiary before the Annuitization Date. These changes must be:

|

·

|

signed by the Contract Owner; and

|

|

·

|

received at the Service Center before the Annuitization Date.

|

Nationwide must review and approve any change requests. If the Contract Owner is not a natural person and there is a change of the Annuitant, distributions will be made as if the Contract Owner died at the time of the change.

On the Annuitization Date, the Annuitant will become the Contract Owner, unless the Contract Owner is a Charitable Remainder Trust.

Joint Ownership

Joint owners each own an undivided interest in the contract. A joint owner will receive a death benefit if a Contract Owner who is also the Annuitant dies before the Annuitization Date. If a Contract Owner who is not the Annuitant dies before the Annuitization Date, the joint owner becomes the Contract Owner.

Contract Owners can name a joint owner at any time before annuitization subject to the following conditions:

|

·

|

joint owners can only be named for Non-Qualified Contracts;

|

|

·

|

joint owners must be spouses at the time joint ownership is requested, unless state law requires Nationwide to allow non-spousal joint owners;

|

|

·

|

the exercise of any ownership right in the contract generally will require a written request signed by both joint owners;

|

|

·

|

an election in writing signed by both Contract Owners must be made to authorize Nationwide to allow the exercise of ownership rights independently by either joint owner; and

|

|

·

|

Nationwide will not be liable for any loss, liability, cost, or expense for acting in accordance with the instructions of either joint owner.

|

Annuitant

The Annuitant is the person designated to receive annuity payments during annuitization of the contract and upon whose continuation of life any annuity payment involving life contingencies depends. This person must be age 80 or younger at the time of contract issuance, unless Nationwide approves a request for an Annuitant of greater age. The Annuitant may be changed prior to the Annuitization Date with the consent of Nationwide.

Beneficiary and Contingent Beneficiary

The beneficiary is the person who the Contract Owner designates to receive the death benefit upon the death of the Annuitant. The joint owner may be entitled to the death benefit (see "Death Benefits – Death of the Contract Owner/Annuitant").

The Contract Owner can name more than one beneficiary. The beneficiaries will share the death benefit equally, unless otherwise specified.

If no beneficiary survives the Annuitant, the contingent beneficiary receives the death benefit. Contingent beneficiaries will share the death benefit equally, unless otherwise specified.

If no beneficiaries or contingent beneficiaries survive the Annuitant, the Contract Owner or the last surviving Contract Owner’s estate will receive the death benefit.

If the Contract Owner is a Charitable Remainder Trust and the Annuitant dies before the Annuitization Date, the death benefit will accrue to the Charitable Remainder Trust. Any designation in conflict with the Charitable Remainder Trust’s right to the death benefit will be void.

The Contract Owner may change the beneficiary or contingent beneficiary during the Annuitant’s lifetime by submitting a written request to Nationwide. Once recorded, the change will be effective as of the date it was signed, whether or not the Annuitant was living at the time the change was recorded. The change will not affect any action taken by Nationwide before the change was recorded.

Operation of the Contract

Minimum Initial and Subsequent Purchase Payments

|

Contract

Type

|

Minimum Initial Purchase Payment*

|

Minimum Subsequent Payments

|

|

IRA

|

$2,000

|

$10

|

|

Non-Qualified Contract

|

$2,000

|

$10

|

|

Qualified Plan

|

$0

|

$10

|

|

Roth IRA

|

$2,000

|

$10

|

|

SEP IRA

|

$2,000

|

$10

|

|

Tax Sheltered Annuity**

|

$0

|

$10

|

*A Contract Owner will meet the minimum initial purchase payment requirement by making purchase payments equal to the required minimum over the course of the first Contract Year.

**Only available for individual 403(b) Tax Sheltered Annuity contracts subject to ERISA and certain state Optional Retirement Plans and/or Programs that have purchased at least one individual annuity contract issued by Nationwide prior to September 25, 2007.

The cumulative total of all purchase payments under contracts issued by Nationwide on the life of any one Annuitant or owned by any one Contract Owner cannot exceed $1,000,000 without Nationwide’s prior consent. Any references in this prospectus to purchase payment amounts in excess of $1,000,000 are assumed to have been approved by Nationwide.

Due to state law variations, the options and benefits described in this prospectus may vary or may not be available depending on the state in which the contract is issued. Possible state law variations include, but are not limited to, minimum initial and subsequent purchase payment amounts, investment options, age issuance limitations, availability of certain optional benefits, free look rights, annuity payment options, ownership and interests in the contract, assignment, death benefit calculations, and CDSC-free withdrawal privileges. This prospectus describes all the material features of the contract. To review a copy of the contract and any endorsements, please contact the Nationwide Service Center.

Nationwide prohibits subsequent purchase payments made after death of the Contract Owner, joint owner or Annuitant. If upon notification of death of the Contract Owner, joint owner or Annuitant, it is determined that death occurred prior to a subsequent purchase payment being made, Nationwide reserves the right to return the purchase payment subject to investment performance.

Pricing

Initial purchase payments allocated to Sub-Accounts will be priced at the Accumulation Unit value determined no later than 2 business days after receipt of an order to purchase if the application and all necessary information are complete. If the application is not complete, Nationwide may retain a purchase payment for up to 5 business days while attempting to complete it. If the application is not completed within 5 business days after receipt at the Service Center , the prospective purchaser will be informed of the reason for the delay. The purchase payment will be returned unless the prospective purchaser specifically consents to allow Nationwide to hold the purchase payment until the application is completed.

Subsequent purchase payments will be priced based on the next available Accumulation Unit value after the payment is received at the Service Center . The cumulative total of all purchase payments under contracts issued by Nationwide on the life of any one Annuitant or owned by any one Contract Owner cannot exceed $1,000,000 without Nationwide’s prior consent. Any references in this prospectus to purchase payment amounts in excess of $1,000,000 are assumed to have been approved by Nationwide. If a subsequent purchase payment is received at the Service Center (along with all necessary information) after the close of the New York Stock Exchange, it will be priced at the Accumulation Unit value determined on the following Valuation Date.

Except on the days listed below and on weekends, purchase payments, transfers and surrenders are priced every day. Purchase payments will not be priced when the New York Stock Exchange is closed or on the following nationally recognized holidays:

|

· New Year’s Day

|

· Independence Day

|

|

· Martin Luther King, Jr. Day

|

· Labor Day

|

|

· Presidents’ Day

|

· Thanksgiving

|

|

· Good Friday

|

· Christmas

|

|

· Memorial Day

|

|

Nationwide also will not price purchase payments if:

|

(1)

|

trading on the New York Stock Exchange is restricted;

|

|

(2)

|

an emergency exists making disposal or valuation of securities held in the Variable Account impracticable; or

|

|

(3)

|

the SEC, by order, permits a suspension or postponement for the protection of security holders.

|

Rules and regulations of the SEC will govern as to when conditions described in (2) and (3) exist.

If Nationwide is closed on days when the New York Stock Exchange is open, Contract Value may change and Contract Owners will not have access to their accounts.

Allocation of Purchase Payments

Nationwide allocates purchase payments to Sub-Accounts and/or the Fixed Account as instructed by the Contract Owner on the application . Shares of the Sub-Accounts are purchased at Net Asset Value, then converted into Accumulation Units. Nationwide reserves the right to limit or refuse purchase payments allocated to the Fixed Account at its sole discretion.

Contract Owners can change allocations or make exchanges among the Sub-Accounts or the Fixed Account after the time of application by submitting a written request to the Service Center . Certain transactions may be subject to conditions imposed by the underlying mutual funds, as well as those set forth in the contract.

Determining the Contract Value

The Contract Value is:

|

(1)

|

the value of amounts allocated to the Sub-Accounts of the Variable Account; and

|

|

(2)

|

amounts allocated to the Fixed Account.

|

If part or all of the Contract Value is surrendered, or charges are assessed against the Contract Value, Nationwide will deduct a proportionate amount from each Sub-Account and the Fixed Account based on current cash values.

Determining Variable Account Value – Valuing an Accumulation Unit

Purchase payments or transfers allocated to Sub-Accounts are accounted for in Accumulation Units. Accumulation Unit values (for each Sub-Account) are determined by calculating the net investment factor for the underlying mutual funds for the current Valuation Period and multiplying that result with the Accumulation Unit values determined on the previous Valuation Period.

Nationwide uses the net investment factor as a way to calculate the investment performance of a Sub-Account from Valuation Period to Valuation Period. For each Sub-Account, the net investment factor shows the investment performance of the underlying mutual fund in which a particular Sub-Account invests, including the charges assessed against that Sub-Account for a Valuation Period.

The net investment factor for any particular Sub-Account is determined by dividing (a) by (b), and then subtracting (c) from the result, where

|

(1)

|

the Net Asset Value of the underlying mutual fund as of the end of the current Valuation Period; and

|

|

(2)

|

the per share amount of any dividend or income distributions made by the underlying mutual fund (if the date of the dividend or income distribution occurs during the current Valuation Period).

|

|

(b)

|

is the Net Asset Value of the underlying mutual fund determined as of the end of the preceding Valuation Period.

|

|

(c)

|

is a factor representing the daily Variable Account charges. The factor is equal to an annualized rate of 1.30% of the Daily Net Assets of the Variable Account.

|

Based on the net investment factor, the value of an Accumulation Unit may increase or decrease. Changes in the net investment factor may not be directly proportional to changes in the Net Asset Value of the underlying mutual fund shares because of the deduction of Variable Account charges.