[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

Exhibit 10.1

Execution Copy

CO-BRANDED CREDIT CARD PROGRAM AGREEMENT

This Agreement is made this 27th day of February, 2015 by and between CITIBANK, N.A. (“Bank”), and COSTCO WHOLESALE CORPORATION, a corporation incorporated under the laws of the State of Washington, with its principal offices at 999 Lake Drive Issaquah, Washington 98027, United States (“Costco”).

WHEREAS, Bank and its Affiliates, among other things, issue and service credit cards and other account access devices (collectively referred to hereinafter as “Bank Cards”) upon which persons named on currently effective Bank Cards (“Bank Cardholders”) may charge purchases of goods and services;

WHEREAS, Costco owns and operates a chain of membership warehouse locations within the United States;

WHEREAS, the Parties desire to establish a co-branded credit card program pursuant to the terms of this Agreement pursuant to which Bank will issue co-branded cards, each of which will act as both a Bank Card and a Costco membership card; and

WHEREAS, Bank intends to enter into a purchase agreement with American Express whereby Bank would acquire the accounts attributable to the existing Costco co-branded card program from American Express.

NOW, THEREFORE, in consideration of the foregoing premises, the mutual covenants and conditions herein contained and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Costco and Bank hereby agree as follows:

ARTICLE 1

INTERPRETATION

1.01 Definitions.

Capitalized terms used herein but not otherwise defined herein shall have the meaning ascribed to such terms in the “Definitional Supplement” attached hereto as Exhibit A.

1.02 Headings.

The division of this Agreement into Articles and Sections and the insertion of headings are for convenience of reference only and do not affect the construction or interpretation of this Agreement. The terms “hereof”, “hereunder” and similar expressions refer to this Agreement and not to any particular Article, Section or other portion hereof. Unless something in the subject matter or context is inconsistent therewith, references herein to Articles, Sections and Schedules are to Articles and Sections of and Schedules to this Agreement.

- 1 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

1.03 Extended Meanings.

In this Agreement words importing the singular number include the plural and vice versa, words importing any gender include all genders and words importing persons include individuals, corporations, limited and unlimited liability companies, general and limited partnerships, associations, trusts, unincorporated organizations, joint ventures and Governmental Authorities. The term “including” means “including without limiting the generality of the foregoing” and the term “third party” means any person other than Bank and Costco or their respective Affiliates.

1.04 Statutory References.

In this Agreement, unless something in the subject matter or context is inconsistent therewith or unless otherwise herein provided, a reference to any statute is to that statute as now enacted or as the same may from time to time be amended, re-enacted or replaced and includes any regulations made thereunder.

1.05 Currency & Territory.

All references to currency herein are to lawful money of the United States. This Agreement governs the relationship of the Parties for the United States. Except as otherwise expressly set out herein, the scope of this Agreement is specifically limited to the United States.

1.06 No Partnership Intended.

Nothing in this Agreement is intended to create a partnership or joint venture between the Parties for purposes of the partnership laws or acts of any state, or for any other purposes.

1.07 Exhibits and Schedules.

The following are the Exhibits and Schedules to this Agreement:

- 2 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

Exhibit A | Definitional Supplement | |

Exhibit B | Riders and Reports | |

Schedule 1.01(a) | [*] | |

Schedule 1.01(b) | — | Bank Marks |

Schedule 1.01(c) | — | Costco Charge Transaction Data |

Schedule 1.01(d) | — | Costco Marks |

Schedule 1.01(f) | — | Fair Market Value |

Schedule 1.01(g) | — | Program Privacy Policy |

Schedule 2.06(a) | — | Competitors |

Schedule 3.02(a) | — | [*] |

Schedule 3.02(c)-1 | — | Program Credit Policy |

Schedule 3.02(c)-2 | — | [*] |

Schedule 3.02(e) | — | Credit Line Assignments |

Schedule 4.04(d) | — | Costco Membership Program |

Schedule 4.05(a) | — | Co-Branded Cardholder Account Terms |

Schedule 4.05(a)(ii) | — | Small Business Co-Branded Card Terms |

Schedule 4.06(a) | — | Loyalty Program Features |

Schedule 4.06(a)-1 | — | Additional Co-Branded Cardholder Benefits |

Schedule 5.01(d) | — | Use of Costco Marks and Bank Marks |

Schedule 5.04(a) | — | Costco Trademark Usage Policy |

Schedule 6.01(c) | — | [*] |

Schedule 7.01(a) | — | Data Security |

Schedule 7.02 | — | Operations Centers |

Schedule 7.03 | — | Service Level Agreements (SLAs) |

Schedule 7.05(a) | — | Monthly Reports |

Schedule 9.01 | — | Program Economics |

Schedule 9.07(a)(v) | — | [*] |

Schedule 9.07(a)(vii) | — | [*] |

Schedule 9.08 | — | P&L Statement |

Schedule 13.02(a) | — | Information Regarding the Program Assets |

Schedule 13.02(c) | — | Appraisal Information |

Schedule 13.03(b) | — | [*] |

ARTICLE 2

ESTABLISHMENT OF THE PROGRAM

2.01 The Program.

(a)Pursuant to the terms and conditions of this Agreement, Bank and Costco hereby establish a co-branded credit card program in the United States, pursuant to which generally: (i) Bank shall offer and issue to approved Applicants Co-Branded Cards and extend credit to Co-Branded Cardholders pursuant to the terms of the Co-Branded Cardholder Agreement; and (ii) Bank will promptly open a new Co-Branded Card Account and issue a new Co-Branded Card with respect to each Co-Branded Card

- 3 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

Application approved in accordance with the Program Credit Policy (collectively, and as detailed in this Agreement, the “Program”).

(b)In connection with the establishment of the Program, the purpose of this Agreement is to set out the terms and conditions according to which the Parties will regulate: (i) the commercial collaboration between Bank and Costco in connection with the promotion, offer and issuance of Co-Branded Cards, and (ii) other services and support tasks that Bank and Costco, respectively, shall provide in connection with the promotion, offer and issuance of Co-Branded Cards, all toward the end of operating a Program that is Competitive in all respects and delivers value to Costco Members.

2.02 Network.

(a)Costco has selected Visa as the initial Network for the Program.

(b)Costco shall have the right, in its sole discretion, to change the Network for the Co-Branded Cards [*] by providing written notice to Bank at least [*] that the Network for the Co-Branded Cards will be changed from the Network to a Competitive Network or any other card network or card association under which Bank is authorized to issue Bank Cards (“Other Network”) effective on [*]. Promptly following any such notice, and (subject to Section 2.03) with such commercially reasonable adjustments as may mutually be agreed to in order to account for any differing economics to the Program, Bank shall take all steps as may be reasonably required to transfer the Program to the Other Network.

2.03 Payment and Funds from Network.

Any payments or funds of any kind received by Costco from the Network or Other Network as a result of the agreement to use such card network or card association for the Program at any time before, during, or after the Term shall belong entirely to Costco, and shall not be considered related to, or part of, payment obligations of Bank under this Agreement.

2.04 Costco Exclusivity to Bank and Co-Branded Cards.

(a)In the United States, during the Term, neither Costco nor its United States Affiliates will (i) issue a Comparable Co-Branded Card; provided, however, that Costco may participate in the Amex Program until the Program Effective Date; or (ii) directly or in conjunction with any Person, issue, market, or co-brand any Comparable Co-Branded Card for acceptance at Costco Outlets or any other Acceptance Locations. This exclusivity obligation is subject to Section 2.04(b), Section 2.04(f), Section 2.04(g), Section 2.05 and Section 12.08.

(b)For clarity, subject to Section 2.04(c), Costco shall have the right, on its own or in collaboration with any Person, to issue, market and promote a [*], and with any terms, brands or marks, or value proposition as Costco in its sole discretion may elect (collectively, “Additional Payment Products”).

(c)Notwithstanding the foregoing, in no event will any Additional Payment Product have an associated spend-based rewards program that is equal or superior in value (e.g., a greater percentage cash rebate) to the Unique Value Proposition offered by the Co-Branded Cards.

(d)[*]

(e)In the event that Costco proposes to issue an Additional Payment Product during the Term and seeks to do so via a request for proposal, tender, bid, or other, similar competitive process, Bank shall

- 4 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

be invited to participate in such process on the same terms, but without preference, as all other participants (all such participants to be determined by Costco in its sole discretion).

(f)For clarity and subject to Section 2.04(c), Costco shall have the right, on its own or in collaboration with any third party, to issue, market and promote, any product, program or service of any kind (other than Comparable Co-Branded Cards to the extent prohibited by Section 2.04(a)) with any value proposition (including discounts, rebates or other promotions), including those programs and products listed on Schedule 2.04(f) hereto.

(g)[*]

2.05 Effect of Costco Acquisitions on Costco Exclusivity.

(a)If Costco or any of its Affiliates acquires (including by merger, consolidation, asset purchase, share purchase or other business combination) a business (an “Acquired Business”) that directly or through an Affiliate or unaffiliated third party issues a co-branded card in the United States, including Credit Cards similar to a Comparable Co-Branded Card (each, as applicable, an “Acquired Card Program”), the exclusivity provisions of Section 2.04(a) shall only apply to such Acquired Card Program as and to the extent provided in this Section 2.05. As a matter of clarification, if Costco or any of its Affiliates acquires an Acquired Business (including by merger, consolidation, asset purchase, share purchase or other business combination) that does not have a Comparable Co-Branded Card, including in a instance where the Acquired Business has an Other Store Card program, the exclusivity provisions of Section 2.04(a) shall not apply.

(b)If the cards that are issued as part of the Acquired Card Program (the “Acquired Cards”) are directly or indirectly issued by a third party pursuant to a program agreement or other contractual arrangement between such third party and such Acquired Business, Costco shall not be required to terminate such agreement or otherwise discontinue such arrangement. Rather, following completion of such acquisition, Costco and its Affiliates shall be entitled to continue to comply with and perform in all respects such agreements or arrangements related to the Acquired Business, and the ongoing operation of the Acquired Card Program (including pending election of the Conversion Option or Costco Rebranding Option, and after the Parties’ failure to enter into a written agreement regarding one or more such options) shall not violate the terms of this Agreement; provided that Costco continues to comply with Section 2.04(d) as it relates to Costco Warehouses other than the Acquired Warehouses and other locations or outlets of the Acquired Business. Without limiting its rights and obligations hereunder, Bank shall cooperate with Costco in an effort to ensure that the operation of the Program and the Co-Branded Card, and the Acquired Card Program, can both continue without disruption to the customer base of Costco and its Affiliates. For greater certainty, the ownership and operation by Costco and existence of the Acquired Card Program shall not constitute a breach of or default under this Agreement.

(c)If the Acquired Cards are issued by Bank or any of its Affiliates, upon the written request of Costco and subject to Applicable Laws, Bank shall integrate the Acquired Cards into the Program by converting the Acquired Card accounts into Co-Branded Card Accounts (with such commercially reasonable adjustments as may mutually be agreed to account for the differing characteristics of the Acquired Card Program and the cardholders for such Acquired Card Program), subject to the same terms and conditions as the Co-Branded Card Accounts (and subject to any adjustments made as contemplated above) and subject to this Agreement, and the Acquired Cards shall participate in the Program as if they were originated under this Agreement (the “Conversion Option”). In the event that the Conversion Option is exercised by Costco and the Parties agree to adjustments as contemplated by this Section 2.05(c), then Bank shall (or, if applicable, shall cause its Affiliates to) terminate the program agreement of the Acquired Business as of the conversion date to the Program. As a matter of clarification, if the Parties are unable

- 5 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

to agree upon such commercially reasonable adjustments as are needed to account for the differences in the Acquired Card Program, then the Acquired Card Program and Acquired Warehouses and other locations or outlets of the Acquired Business shall not be subject to the terms of this Agreement, including, without limitation, Sections 2.04(a), 2.04(d) or 2.07.

(d)In the event that the capital stock of Costco, or all or substantially all of the assets of Costco, are sold, conveyed, or otherwise transferred to another Person that is not an Affiliate of Costco, the terms of this Agreement shall not prevent such Person from carrying on its own credit card programs, including any private label or co-branded card program, nor shall the operation of any such programs constitute a breach of or default under this Agreement by Costco.

(e)Subject to the terms of Section 2.05(b), in the event the Acquired Business includes Acquired Cards, that are, in Costco’s sole discretion rebranded by Costco using the Costco Marks (the “Costco Rebranding Option”, with the locations so rebranded, the “Acquired Warehouses”)), then the restrictions of Sections 2.04(a), 2.04(d) and 2.07 shall apply to such Acquired Card Program or the Acquired Warehouses, commencing as of the latest of following: (i) effective date of such rebranding, (ii) the termination of the program agreement governing the Acquired Card Program, or (iii) the effective date for any commercially reasonable adjustment to account for the differing characteristic of the Acquired Card Program and the cardholder for such Acquired Card Program, as set forth in any written agreement between the Parties as contemplated by Section 2.05(c). As a matter of clarification, if the Parties are unable to agree upon such commercially reasonable adjustments as are needed to account for the differences in the Acquired Card Program, then the Acquired Card Program and Acquired Warehouses shall not be subject to the terms of this Agreement, including, without limitation, Sections 2.04(a), 2.04(d) or 2.07.

(f)In the event of the Conversion Option or the Costco Rebranding Option, thereafter whenever the Acquired Cards are accepted and used in any Costco Outlet, whether a Costco Warehouse or other Costco Outlet, or any other Costco Location wherever located, then [*].

(g)The election to exercise the Conversion Option or the Costco Rebranding Option, or to otherwise integrate or convert any Acquired Cards to Co-Branded Cards and cause such Acquired Cards to become subject to the terms of this Agreement and the Program, shall be at the election of Costco in its sole discretion as provided for herein. Accordingly, in no event shall Costco be required to integrate or convert any Acquired Cards to Co-Branded Cards or this Program.

2.06 Bank Exclusivity to Costco and Co-Branded Cards.

(a)In the United States, during the Term, neither Bank nor its Affiliates will issue, on its own or with any Person, (i) [*] or, (ii) as to any Person listed on Schedule 2.06(a) or any Affiliates of those Persons listed on Schedule 2.06(a), as may be amended from time to time (parts (i) and (ii) collectively, “Competitors”), a card product of the type shown thereon, regardless of FTD form factor. Costco may modify the list of Competitors set forth on Schedule 2.06(a) as follows:

(i)Not more [*] after the Program Effective Date, Costco may [*] to Schedule 2.06(a) upon written notice to Bank so long as such Person [*]. During each Renewal Term (or, if Costco elects to extend the Initial Term by providing the Initial Term Extension Notice, during such three (3) year Initial Term extension period), Costco may [*] to Schedule 2.06(a) upon written notice to Bank so long as such Person is a seller of goods in a business category where Costco has a presence. As of Bank’s receipt of any such notice, the additional Person designated by Costco shall be considered a Competitor.

(ii)[*]

- 6 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

2.07 Acceptance.

(a)Notwithstanding anything in this Agreement or any other agreement to the contrary, [*]. Without limiting the generality of the foregoing, nothing contained in this Agreement shall limit or prohibit Costco from accepting Additional Payment Products.

(b)For clarity, whenever the Co-Branded Card is accepted and used in any Costco Outlet, whether a Costco Warehouse or other Costco Outlet, or any other Costco Location, wherever located, then [*].

(c)Subject to the exclusivity obligation set forth in Section 2.04(a), the parties acknowledge that Costco has a vested interest in the types of new payment products, and in the security features attributable to such new payment products, that may potentially be offered to Costco Members and accepted at Costco Locations. Accordingly and notwithstanding anything to the contrary, Bank shall not issue or offer any form factor of the Co-Branded Card or other Financial Transaction Device with respect to the Co-Branded Card Accounts (other than a traditional physical card) to Co-Branded Cardholders without the prior written consent of Costco. Likewise, in no event shall Costco ever be required by this Agreement to accept any Financial Transaction Device (other than a traditional physical card for the Co-Branded Card) that has not been approved by Costco.

2.08 Exclusivity of Program Enhancements.

[*]

2.09 Purchase of Existing Provider Cards Portfolio.

Bank intends to enter into a definitive sale and purchase agreement with American Express (the “Amex Purchase Agreement”) whereby Bank would agree to acquire the existing accounts of the cardholders who are participating in the existing co-branded card program subject to the Amex Program Agreement (the “Amex Program”); [*]

ARTICLE 3

OWNERSHIP OF ACCOUNTS; UNDERWRITING

3.01 Ownership of Accounts.

(a)Subject always to the Purchase Right detailed in Article 13, and except to the extent of Costco’s ownership of the Costco Marks, Bank shall be the owner and holder of all Account Indebtedness, Co-Branded Card Accounts, Co-Branded Card Documentation, and the Co-Branded Card Application. All purchases of goods and/or services or other extensions of credit in connection with the Co-Branded Card Accounts and the Account Indebtedness shall create the relationship of debtor and creditor between the Co-Branded Cardholder and Bank, respectively.

(b)Subject to the terms of Article 9, Bank shall be entitled to (i) receive all payments made by Co-Branded Cardholders on Co-Branded Card Accounts; and (ii) retain for its account all Account Indebtedness and such other fees and Income authorized by the Co-Branded Cardholder Agreements and collected by or for Bank with respect to the Co-Branded Card Accounts.

(c)Bank shall fund all use of credit under the Co-Branded Card Accounts by a Co-Branded Cardholder.

- 7 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

(d)Bank acknowledges and agrees that Costco has no liability to Bank or otherwise with respect to any unpaid balances or other Account Indebtedness owed by Co-Branded Cardholders (other than as may arise with respect to amounts related to purchase returns, charge-backs or similar amounts owing or owed by Costco to Bank in accordance with the Network Rules and relating to original sales transactions made at Costco Outlets), and that all such risk of loss and related credit risk rests solely with Bank.

3.02 Underwriting and Risk Management.

(a)Bank shall accept or reject any Co-Branded Card Application based solely upon application of (i) the then-current Program Credit Policy and (ii) Bank’s then-current anti-money laundering and customer identification program policies, provided that Bank is also then applying such anti-money laundering and customer identification program policies to all Other Bank Card Programs. [*] As a matter of clarification, Bank makes no commitments as to the results of the application of the Program Credit Policy and reserves the right to change the Program Credit Policy from time to time so long as such Program Credit Policy remains in compliance with this Section 3.02, Schedule 3.02(a) and the other terms of this Agreement.

(b)Upon satisfaction of the applicable criteria set forth in the Program Credit Policy, Bank shall promptly establish a Co-Branded Card Account. Bank shall have the right to review periodically the creditworthiness of Co-Branded Cardholders in accordance with the Program Credit Policy to determine the range of credit limits to be made available to Co-Branded Cardholders and whether or not to suspend or terminate credit privileges of such Co-Branded Cardholders; provided, however, that Bank shall only decrease credit limits or suspend or terminate credit privileges consistent with the then current Program Credit Policy.

(c)The initial Program Credit Policy to be in effect as of the Program Effective Date is attached hereto as Schedule 3.02(c)-1, which Bank represents and warrants complies as of such date with Section 3.02(a). Except in the case of Legally Mandated Changes [*] or as the Parties may otherwise agree, Bank shall provide Costco with at least [*] prior written notice of any proposed changes to the Program Credit Policy. In the case of a Legally Mandated Change to the Program Credit Policy, Bank shall provide Costco with as much advance notice as reasonably possible prior to the implementation of such Legally Mandated Change and in any event, such notice shall be provided no later than [*] after Bank first receives notice of or otherwise becomes aware of the requirement for the Legally Mandated Change. [*]

(d)Bank shall perform all necessary security functions to appropriately manage fraud in the Program (i) due to lost, stolen or counterfeit cards, fraudulent Co-Branded Card Applications or otherwise, and (ii) in compliance with Applicable Law. Upon Bank's reasonable request, Costco agrees to use commercially reasonable efforts to cooperate with Bank in such functions (including with respect to any criminal investigations involving possible fraud at any Costco Location or involving Co-Branded Cardholders) so long as such efforts will not create an undue burden on Costco or require Costco to violate any Costco policies or Applicable Laws. All fraud losses, other than fraud resulting from Bank's failure to comply with Applicable Law, shall be [*].

(e)Subject to the Program Credit Policy, Bank agrees to comply, commencing on the Program Effective Date, with the provisions set forth in Schedule 3.02(e) relating to initial and average credit line assignments for Co-Branded Card Applications.

- 8 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

3.03 Amex Accounts.

The Amex Accounts acquired by Bank pursuant to the Amex Purchase Agreement shall become Co-Branded Card Accounts and subject to the terms of this Agreement and, in particular, the acquired Amex Accounts shall be subject to the terms of the Program Credit Policy.

ARTICLE 4

PROGRAM OPERATION

4.01 Management of the Program

(a)Each of the Parties shall perform its obligations under this Agreement (i) in compliance with the terms and conditions of this Agreement (including any policies, procedures and practices adopted pursuant to this Agreement), (ii) in good faith, and (iii) in a manner consistent with any reasonable annual targets and objectives set by Costco.

(b)The Program and this Agreement, and the collaboration of Bank and Costco in implementing and administering the Program and this Agreement, shall be administered by Program Managers and Program Executives, as detailed below.

(i)“Program Managers” means the individuals appointed by each of Bank and Costco (one each), respectively, to administer the Program from a program management perspective. Bank and Costco shall each appoint one Program Manager (the appointee of Costco, the “Costco Manager”; and the appointee of Bank, the “Bank Manager”). The Costco Manager and the Bank Manager shall be manager level or above full-time employees of Bank or Costco, as applicable, and shall be the leaders of their respective teams. The Program Managers and their teams shall conduct their responsibilities in accordance with the terms of this Agreement. Costco and Bank shall endeavour to provide stability and continuity in the Program Manager positions and other Program personnel.

(ii)“Program Executives” means the individuals appointed by each of Bank and Costco (one each), respectively, to administer the Program from an executive officer perspective and to assist in discussing and resolving Disputes.

(iii)At any time during the Term, a Program Manager or Program Executive may be removed and promptly replaced at the discretion of the relevant Party that appointed such person, provided that any Program Manager or Program Executive appointed hereunder shall meet the requirements for such position set forth in this Section 4.01(b).

4.02 General Obligations of Bank.

(a)Subject to the terms hereof, Bank will be responsible for all activities associated with servicing the Co-Branded Cards, including plastic card production, mailings, fulfillments, renewals, funding of receivables, funding of the Loyalty Program, administration of unclaimed property obligations, billing, Co-Branded Card Account maintenance, transaction and payment posting, authorizations, customer service, collections, handling billing disputes, merchant inquiries and fraud; provided that Costco may, in its sole discretion, require the use of different Co-Branded Credit Card plastics for certain types or classifications of Costco Members, at no charge to Costco. All services and activities shall be performed by Bank in compliance with Applicable Law. [*] In no event shall Costco be responsible for any Co-Branded Cardholder customer service unless and until Costco and Bank enter into an agreement regarding the assumption of such obligations by Costco.

- 9 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

(b)Bank shall establish a unique bank identification number (the “BIN Identifier”) and dedicated Interbank Card Association number, in accordance with the Network Rules, specifically and solely for Co-Branded Cards. The BIN Identifier shall permit Costco’s Systems to distinguish a Co-Branded Card automatically both at a POS terminal and through backend reporting. Bank shall not use the BIN Identifier designated for Costco for any business or purpose other than supporting the Program. In the event that Costco or a New Card Issuer designated by Costco acquires the Portfolio upon the expiration or termination of this Agreement, and subject to any covenants or obligations contained in the Network Rules applicable to Bank, Costco or such New Card Issuer shall own the BIN Identifier and all rights thereto, and Bank shall take all steps necessary or convenient to transfer to Costco or the New Card Issuer such BIN Identifier.

(c)Bank will promptly refer to Costco any complaint regarding Costco or its goods and services.

(d) Bank will timely submit to the Network the rider(s) or report(s) attached hereto as Exhibit B, as the same may be amended from time to time by Costco in its reasonable discretion. Upon the request of Costco from time to time, Bank shall provide such other assistance and cooperation as Costco may reasonably request in connection with that certain acceptance and co-branded incentive agreement between Costco and the Network related to the Program.

4.03 Bank’s Program Team.

(a)Bank shall be responsible for sustaining adequate and appropriate staffing levels and training as may be necessary for the Program. Without limiting the generality of the foregoing, Bank shall provide dedicated staffing for the Program (collectively, the “Bank Program Team”), which shall, within the time periods specified herein, consist of at least [*] employees as set forth in Section 4.03(b) [*] (excluding the Operation Center representatives), each of whom shall be a manager level or above, and shall provide [*]. The Bank Program Team shall have competitive expertise and experience, including experience in retail co-brand credit card portfolio marketing and management and account management, and Bank shall ensure that the all personnel supporting the Program, including the Bank Program Team, have adequate training and experience consistent with best industry practices.

(b)The Bank Program Team provided by Bank shall specifically include the following individuals, each of whom shall be a direct employee of Bank or its Affiliates:

(i)from and after the date hereof, the Bank Manager shall participate in conference calls, reviews and reporting activities related to the Program as appropriate and requested by Costco;

(ii)from and after the Program Effective Date, [*] to overseeing customer service and training support activities related to the Program in such Region, and (3) shall serve as the principal point of escalation for operational and other issues relating to the Program in such Region;

(iii)from and after the Program Effective Date, [*] to overseeing finance, reporting and analytics activities related to the Program;

(iv)from and after the date hereof, [*] to overseeing marketing activities related to the Program;

(v)from and after the Program Effective Date, [*] to overseeing the operations of the Program;

(vi)from and after the Program Effective Date, [*] to overseeing the risk management of the Program; and

- 10 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

(vii)as more particularly described in Article 7 (and as necessary to fulfill Bank’s obligations thereunder) and subject to Section 9.07(d), a sufficient number of full-time equivalent employees of the Operation Centers [*] to ensure that, other than in circumstances beyond Bank’s control from time to time (e.g., a third-party security breach), at least [*] of all incoming calls from Co-Branded Cardholders and Applicants are fielded by [*].

(c)In addition, upon Costco’s reasonable request and subject to Bank’s general human resources guidelines, Bank shall [*].

(d)Bank will provide training and materials to Costco’s employees, including training Costco Trainers, with respect to any aspect of the Program or the Co-Branded Cards as Costco may reasonably request.

(e)Neither the Bank Manager nor any other member of Bank’s Program Team (specifically excluding the individuals described in Section 4.03(b)(vii)) shall be reassigned to any program operated by Bank or any of its Affiliates pursuant to any agreement or arrangement with any Competitors any time up to [*] the date that such person last worked on the Program (including any such period of time that ends after this Agreement expires or is terminated other than in the event of any termination pursuant to Section 12.03).

(f)Costco shall not adopt, assume or otherwise become responsible for, either primarily or as a successor employer, co-employer or joint employer, any employee benefit plans or any assets or liabilities of any employee benefit plans, arrangements, commitments or policies currently or hereafter provided by Bank, relating to the Bank Program Team or otherwise; and if, and to the extent that, Costco is deemed by law or otherwise to be liable primarily or as a successor employer or co-employer or joint employer, for such purposes or for any other purposes, including any state or federal employment taxes, Bank shall indemnify, defend and hold harmless Costco, its Affiliates, and their respective officers, directors, and employees from and against and in respect of any and all Losses that may result therefrom.

(i)In the event Bank personnel are injured or hurt while performing functions under or in connection with this Agreement, whether the Bank Program Team or otherwise and whether onsite at Costco or otherwise, Bank shall ensure that: (1) Bank’s workers compensation coverage or other benefits provided by Bank to its employees or agents shall be the exclusive remedy for the personnel or agents utilized by Bank as it relates to the Program, and (2) such personnel, agents and the relevant carrier shall not have any right to compensation from Costco.

(ii)In addition to Bank’s workers compensation coverage being the exclusive remedy for injury to Bank personnel, whether the Bank Program Team or otherwise, while performing functions under or in connection with this Agreement as set forth above, Bank hereby agrees to indemnify, defend and hold harmless Costco, its Affiliates, and their respective officers, directors, and employees from and against and in respect of any and all Losses whatsoever nature brought, claimed or suffered by any of Bank’s employees, agents and/or personnel, including the Bank Program Team, relating to any such injuries or harm.

4.04 General Obligations of Costco.

(a)For each Applicant (who must first be a Costco Member) that completes a Co-Branded Card Application at a Costco Warehouse, Costco shall, [*], collect the Co-Branded Card Application or the information needed to complete a Co-Branded Card Application, and provide said Co-Branded Card Application or information to Bank in accordance with mutually agreed-upon procedures and subject to Applicable Laws. Costco shall comply with all applicable disclosure and other regulatory requirements

- 11 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

specified by Bank when conducting the above activities. Costco shall work together with Bank to improve the efficiency of the application process.

(b)Any Legally Mandated Changes shall be implemented by Costco as promptly as reasonably possible after notice from Bank but in no event later than required by Applicable Laws. In the event that Bank reasonably determines that any change to the Program or Costco’s practices is required in order to comply with Applicable Guidelines, Bank shall provide Costco with a written summary of such requirements. [*]

(c)Costco shall send to Bank, [*], all Costco Member information necessary to be included on the Co-Branded Card.

(d)Costco, [*], shall maintain and operate the Costco Membership Program while this Agreement is in effect. Attached to this Agreement as Schedule 4.04(d) is the Costco Membership Program description as of the date hereof. Costco agrees to provide Bank with sufficient written notice of any material modifications to the Costco Membership Program that directly affect the Program in order to permit Bank to modify (inclusive of Bank’s Systems) any aspect of its support of the Program, in order to comply with such modifications. Notwithstanding anything to the contrary, Costco may change the terms of the Costco Membership Program at any time.

(e)Costco will instruct its member services centers to promptly refer Co-Branded Cardholders to Bank that have material customer complaints that are received by Costco’s members’ services center regarding a Co-Branded Account or Co-Branded Card.

4.05 Co-Branded Cardholder Account Terms.

(a)The pricing, terms and conditions of all Co-Branded Card Accounts shall be the pricing, terms and conditions set forth on Schedule 4.05(a) and Schedule 4.05(a)(ii), as the same may be amended from time to time pursuant to this Agreement (the “Co-Branded Cardholder Account Terms”). [*]

(i)[Intentionally left blank.]

(ii)Commencing as of the Program Effective Date, Bank shall also offer a Co-Branded Card to business applicants, which shall be based upon the credit of the business, or the proprietor, or both, and subject to the applicable pricing, terms and conditions and specifications set forth on Schedule 4.05(a)(ii).

(iii)Notwithstanding the foregoing, Bank may implement a change to the pricing, terms and conditions of the Co-Branded Card Accounts [*], to the extent such change is:

(A)a Legally Mandated Change and in accordance with Section 4.04(b). Further, and in the case of a Legally Mandated Change to Co-Branded Cardholder Account Terms, Bank shall provide Costco with as much advance notice as reasonably possible prior to the implementation of such Legally Mandated Change and in any event, such notice shall be provided no later than thirty (30) days after Bank first receives notice of or otherwise becomes aware of the requirement for the Legally Mandated Change; or

(B)a change that affects terms and conditions [*], to the extent applicable, and provided that (I) the terms and conditions resulting from such change are, [*], and (II) Bank has provided Costco no less than thirty (30) days’ prior notice.

- 12 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

(b)Bank shall ensure that all Co-Branded Cards satisfy applicable EMV requirements for embedded microchip and PIN technology with respect to both contact card products and contactless card products and otherwise comply with all Applicable Laws, including security standards promulgated by or on behalf of the Major Card Networks or other Bank Card networks. Without limiting the generality of the foregoing, the Costco Member number of each Co-Branded Cardholder shall physically be printed on each Co-Branded Card and, further, such Costco Member number shall be embedded on the embedded microchip, bar code and magnetic stripe (or other applicable electronic component, and with respect to the magnetic stripe, embedded on Track 1), as applicable, of such Co-Branded Cardholder’s Co-Branded Card.

4.06 Loyalty Program.

(a)Unless otherwise provided for in this Agreement, during the Term, all elements of the Program set forth on Schedule 4.06(a) shall remain in effect and shall continue to be offered [*] in connection with the cash based rewards program offered to Co-Branded Card Accounts; provided, however, that such elements may be modified from time to time by Costco but only in accordance with the terms set out in this Agreement (e.g., Section 4.07) or otherwise as mutually agreed by Bank (such elements, together with such modifications, collectively, the “Loyalty Program”). The Co-Branded Cards will also have the standard Network benefits applicable to Credit Cards of the same card tier, as set forth on Schedule 4.06(a)-1, as such benefits may change from time to time.

(b)As provided in Schedule 4.06(a), as of the date hereof, Costco Members are eligible to receive rewards pursuant to the Loyalty Program (“Rewards”). The Rewards will be issued by the Bank in the form of one annual Costco Rewards coupon. From time to time, and subject to Applicable Laws, Costco may require a change to the method of funding Rewards to a gift card, statement credit, electronic credit or other electronic transfer, other FTD, or otherwise and shall provide Bank with at least [*] notice prior to the effectiveness of such change. Bank shall cooperate to implement the new Rewards payment method in such a way that it is compatible with the Costco point of sale equipment and consistent with Costco’s protocols and security requirements and that otherwise achieves Systems interoperability between Bank’s Systems and Costco’s Systems, and Bank shall otherwise cooperate with Costco in implementing such change, subject to Applicable Laws. Regardless of the method or form of the Rewards, Bank (and not Costco) shall be considered the issuer of such Rewards pursuant to the Loyalty Program, and, except with respect to the Executive Membership program, Bank shall be solely liable to Costco Members with respect to such Rewards. Other than its duty to redeem the Rewards in accordance with the Loyalty Program terms and conditions, Costco shall not have any obligation to Costco Members regarding such Rewards.

(c)[*] Costco will deliver to Bank a report at a frequency as mutually agreed by the Parties detailing all Rewards coupons (or such other method or form of Rewards provided under the Loyalty Program at such time) redeemed by Costco Members, together with a report setting out the aggregate value of such redeemed Rewards coupons, according to procedures mutually agreed upon by the Parties. Unless the amount set forth in the report regarding such redeemed Rewards coupons is disputed by Bank, and except with respect to costs incurred by Costco to provide benefits associated with Executive Membership, [*] as soon as practicable after receipt of a report in respect thereof by Bank, and in no event more than [*] after receipt thereof by Bank; provided that Bank shall have no obligation to make a payment to Costco with respect to Rewards paid by way of a statement credit. Except with respect to the Executive Membership program, Bank shall be solely responsible for complying with all state unclaimed property laws related to the Loyalty Program, including with respect to any unused or unredeemed Rewards issued by Bank to Costco Members, and Bank shall be responsible for reporting and remitting as unclaimed property to any state or other Governmental Entity any payments that are due in connection with or related to Rewards that are not redeemed, in accordance with such unclaimed property laws

- 13 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

(d)Costco may, after consultation with Bank and in accordance with Applicable Laws, elect to offer promotions, discounts, rewards, special offers or any other incentive, whether pursuant to the Loyalty Program or otherwise based on SKU level data to Co-Branded Cardholders (provided appropriate consents are obtained from Co-Branded Cardholders). Bank shall facilitate such offering by providing any and all reasonable support (including information technology support, software programming, changes to statements, customer service support, and other collateral, system or procedural changes) necessary to achieve Systems interoperability between Bank’s Systems and Costco’s Systems, excluding changes to the hardware components of Costco Systems. [*]

4.07 Improvements to Program.

(a)At any time and from time to time, and subject to the terms of this Section 4.07, Costco may request improvements, upgrades, or other value enhancements to the [*], the Loyalty Program, or any other aspect or feature of the overall Program (collectively, “Program Improvements”).

(b)[*]

(c)If the co-branded card program or private label card program for [*] includes the requested Program Improvement, other than with respect to Co-Branded Cardholder Account Terms (a “Warehouse Program Improvement”), then the cost to develop and implement such requested Warehouse Program Improvement shall be [*]. If the co-branded card program or private label card program for [*] includes the requested Program Improvement or if the requested Program Improvement generally becomes available in the market, [*] (a “Market Program Improvement”), then the cost to develop and implement such requested Market Program Improvement shall [*]. On the other hand, if the Program Improvement is not a Warehouse Program Improvement or a Market Program Improvement, or any change to the method of funding Rewards required by Costco pursuant to Section 4.06(b) (in each case, an “Innovative Program Improvement”), the costs for such Innovative Program Improvement shall be [*].

[*]

4.08 Dual Functionality of Co-Branded Cards.

(a)Co-Branded Cards will function as both (i) a Credit Card for purposes of, among other things, charging goods and services at Acceptance Locations, and (ii) a Costco Membership Program card which identifies (including in written form on the Co-Branded Card plastic and in electronic form, by way of information stored in the embedded microchip, bar code, magnetic stripe or other electronic component, as applicable, of the Co-Branded Card) the Co-Branded Cardholder as one permitted to make purchases at Costco Outlets in accordance with the Costco Member Program. The Co-Branded Cards shall otherwise satisfy the requirements detailed elsewhere in this Agreement, including Section 4.05(b).

(b)Should a Co-Branded Cardholder’s Costco Membership terminate, subject to Applicable Laws and Costco’s customer privacy policy, Costco shall notify Bank of such termination. The Parties shall mutually agree on an orderly process for terminating the Co-Branded Card Account. If a Co-Branded Cardholder’s Co-Branded Card Account terminates, or a supplementary Co-Branded Card on a Co-Branded Cardholder Account terminates, then, subject to the Program Privacy Policy, Bank shall promptly notify Costco of such termination and, unless prohibited by Applicable Laws, the reason for such termination. Costco, in its sole discretion, may then elect to issue that individual a new Costco Membership card.

(c)If any Co-Branded Cardholder’s Co-Branded Card Account is terminated due to the termination of his or her Costco Member status, or the Co-Branded Cardholder requests his or her Co-

- 14 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

Branded Card Account be closed, as part of the account closing process Bank shall offer such cardholder a proprietary Credit Card issued by Bank or its Affiliates, which Credit Card shall be approved by Costco in advance (the “Approved Transition Card”). If, within [*] of any such termination, such cardholder accepts the Approved Transition Card or any substitute offered by Bank or its Affiliates (a “Transitioned Card Account”), Bank shall ensure that, regardless of FTD form factor for such Transitioned Card Account: [*]

(d)In addition to Bank’s other obligations with respect to the Loyalty Program, Bank shall maintain records of the Rewards earned by terminated Co-Branded Cardholders for the period prior to the termination of their Co-Branded Card Account and, upon the request Costco, Bank shall cause such Rewards to be either [*].

4.09 Program Updates - Refresh Cards.

(a)Costco may, in its sole discretion, [*], require that Bank provide a modified Co-Branded Card which bears a new card design, value proposition and/or other features (each such Co-Branded Card, a “Refresh Card”); provided that the issuance of such Refresh Card and any changes regarding the value proposition or other features would not [*], and provided that all features and characteristics of the Refresh Card, and the issuance thereof, comply with Applicable Laws. Subject to the foregoing, each time Costco makes such a request, Bank will launch the Refresh Card within [*] after such request and such Refresh Card will contain the modifications requested by Costco.

(b)Unless otherwise agreed to by Costco in writing, Bank will not force migrate Co-Branded Card Accounts to Refresh Cards or to any other new credit card product. Bank will develop an operational strategy for review by Costco to accommodate any Co-Branded Cardholders who desire to migrate to the Refresh Card.

4.10 Billing For Costco Membership Fee.

Subject to Applicable Laws, the Co-Branded Card Application shall expressly disclose to the Applicant that, if such Co-Branded Card Application is approved, the applicable Costco Membership Fee set out in the Costco Membership Program conditions and regulations shall be automatically charged, including on a recurring basis as the relevant membership comes up for renewal, to the Co-Branded Card Account, unless the Applicant opts out of such by following the opt-out procedures prominently set forth in the Co-Branded Card Application. No Costco Membership Fee will be charged to a Co-Branded Account that has not yet been activated by the Applicant. In the event of regulatory concerns (including concerns expressed by any Governmental Authority) or material consumer concerns or complaints, Bank or Costco shall have the right to modify this process to instead require the Applicant, in the Co-Branded Card Application, to expressly opt-in for the Costco Membership Fee to be automatically charged to the approved Co-Branded Card Account. It is Costco’s responsibility to ensure that the amount and frequency of the Costco Membership Fee is disclosed on the Costco Membership Program marketing materials and agreements.

- 15 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

ARTICLE 5

MARKETING

5.01 Active Support and Promotion of Program.

(a)In accordance with the Marketing Plan and the provisions of this Agreement, Bank and Costco shall cooperate with each other as part of an effort to actively support and promote the Program to both existing and potential Co-Branded Cardholders. [*].

(b)Nothing in this Agreement shall be construed to preclude any Party from engaging in marketing activities in support of the Program, at such Party’s expense, in addition to those specifically contemplated by the then-current Marketing Plan or this Agreement, provided that such additional marketing activities shall be pursued only in compliance with the requirements and restrictions set forth in this Article 5, and otherwise in compliance with Applicable Law and this Agreement in all respects.

(c)Notwithstanding anything to the contrary in this Article 5, the Parties agree that Bank Cardholders (including Co-Branded Cardholders) who have opted out of receiving marketing materials from Bank with respect to product and services offered by Bank or its designees shall not be subject to targeted marketing pursuant to this Agreement, and Costco Members who have opted out of receiving marketing materials from Costco with respect to product and services offered by Costco shall not be subject to targeted marketing pursuant to this Agreement.

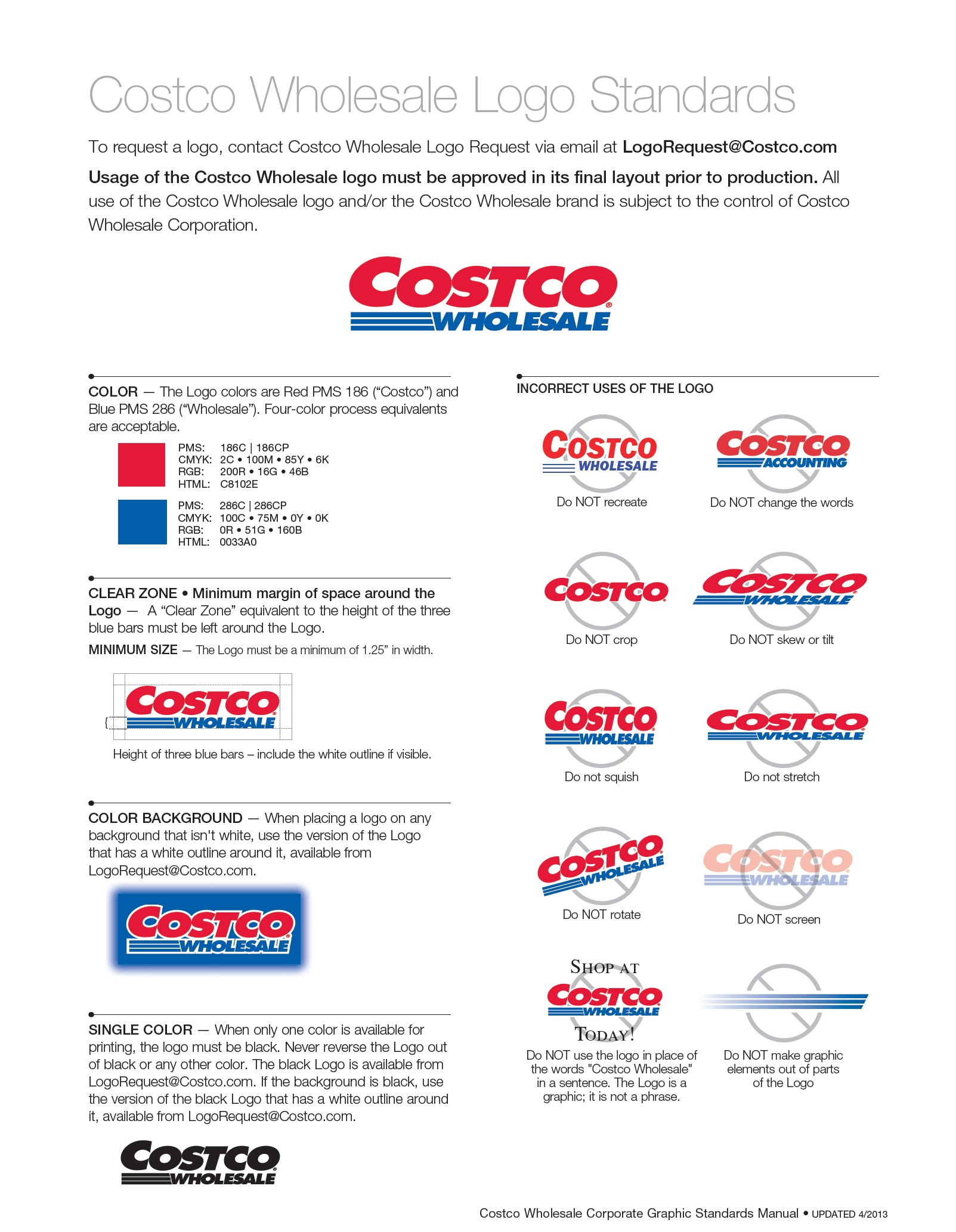

(d)In addition to the other terms and conditions of this Agreement, any use by one Party of the other Party’s Marks shall be governed by the provisions and the licenses detailed on Schedule 5.01(d). Bank shall not use the Costco Marks without the prior written consent of Costco and any approved use of the Costco Marks shall be in compliance with the terms set forth on Schedule 1.01(d) and the Costco trademark usage policy set forth on Schedule 5.04(a). Costco shall not use the Bank Marks without the prior written consent of Bank and approved use of the Bank Marks shall be in compliance with the terms and the Bank trademark usage policy set forth on Schedule 1.01(b)-1.

5.02 Annual Card Marketing Plan.

(a)Each draft marketing plan shall be prepared jointly by the Program Managers and shall include the information contained in this Section 5.02. The proposed marketing plan shall include specific goals and/or objectives for each Program Year, including expected Co-Branded Card annual spend inside and outside Costco Outlets, new Co-Branded Card Accounts by source (in-store, direct mail, online, etc.), together with the other information detailed in Sections 5.02(b) and 5.02(c) below.

(b)On or before the date that is no later than four (4) months prior to the expected Program Effective Date, Costco shall have the right to approve a marketing plan upon the recommendation of the Program Managers for the period beginning on the Program Effective Date and ending on the last day of the first Program Year. On or before the date that is one hundred and twenty (120) days prior to the end of the first Program Year, and each Program Year thereafter, the Program Managers will deliver to the Parties a draft marketing plan for the next Program Year, and the Parties will meet to review and discuss the draft marketing plan. Following such discussion and any modifications, on or before the date that is sixty (60) days prior to the end of the first Program Year or any Program Year thereafter, as applicable, Costco upon the recommendation of the Program Managers shall have the right to approve or reject a marketing plan for the next Program Year (the approved marketing plan shall be referred to as the “Marketing Plan”).

- 16 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

(c)Each Marketing Plan shall outline all programs and other initiatives to be pursued in support of the Program, and shall include at least the following information for each program:

(i)description of offer(s), if any and as applicable;

(ii)description of target audience;

(iii)planned budget funding and projected return on investment with respect to the program;

(iv)target implementation date (e.g., mailing dates, calling dates and delivery dates);

(v)measurement criteria for program performance; and

(vi)such other annual targets and objectives as Costco may prioritize in connection with the Program.

(d)Each Marketing Plan shall address development of Solicitation Materials and Co-Branded Card Documentation; new account acquisition strategies, including direct mailing and “take-one” acquisitions; preparation of unique collateral materials for Costco employees; activation, retention and usage; statement design and messaging; Onsert schedules; advertising of the Program; and such other marketing matters as mutually agreed by the Parties.

(e)Any Marketing Plan may be modified or supplemented by the Parties from time to time upon mutual agreement, provided such modifications or supplements, as the case may be, are approved by Costco upon the recommendation of the Program Managers.

5.03 Annual Membership Marketing Plan.

(a)Each draft membership plan shall be prepared jointly by the Program Managers and shall include the information contained in this Section 5.03. The proposed membership plan shall include specific goals and/or objectives to increase Costco Membership for each Program Year, including expected new Costco Membership by type (e.g. premium membership, business) per Region, together with the other information detailed in Sections 5.03(b) and 5.03(c) below.

(b)On or before the date that is no later than four (4) months prior to the expected Program Effective Date, Costco shall have the right to approve a Costco Membership plan upon the recommendation of the Program Managers for the period beginning on the Program Effective Date and ending on the last day of the first Program Year. On or before the date that is one hundred and twenty (120) days prior to the end of the first Program Year, and each Program Year thereafter, the Program Managers will deliver to the Parties a draft membership plan for the next Program Year, and the Parties will meet to review and discuss the draft membership plan. Following such discussion and any modifications, on or before the date that is sixty (60) days prior to the end of the first Program Year or any Program Year thereafter, as applicable, Costco upon the recommendation of the Program Managers shall have the right to approve or reject such a membership plan for the next Program Year (the approved membership plan shall be referred to as the “Membership Plan”).

(c)Each Membership Plan shall outline all programs and other initiatives to be pursued in support of the recruitment and retention of Costco Members, and shall include at least the following information for each program:

- 17 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

(i)description of offer(s), if any and as applicable;

(ii)description of target audience;

(iii)planned budget funding and projected return on investment with respect to the program;

(iv)target implementation date (e.g., mailing dates, calling dates and delivery dates);

(v)measurement criteria for program performance and aggregate number of new Costco Members expected to be obtained; and

(vi)such other annual targets and objectives as Costco may prioritize in connection with the Program and Costco Membership Program.

(d)Any Membership Plan may be modified or supplemented by the Parties from time to time upon mutual agreement, provided such modifications or supplements, as the case may be, are approved by Costco upon the recommendation of the Program Managers.

5.04 Co-Branded Card Documentation; Solicitation Materials.

(a)The Co-Branded Card Documentation and the Solicitation Materials shall be in the design and format approved by Costco subject to the Costco trademark usage policy attached as Schedule 5.04(a); provided that Bank shall be responsible for ensuring that the Co-Branded Card Documentation and the Solicitation Materials comply with Applicable Laws, and for ensuring that the Co-Branded Cards and the Solicitation Materials comply with the Co-Branded Card Documentation.

(b)[*]

(c)Bank, working directly with Costco, shall design and prepare Co-Branded Card designs and Welcome Kits for the Program prior to the Program Effective Date. The Co-Branded Card designs and all components of the Welcome Kits design will be [*]. For clarity, the production and mailing expenses related to the Welcome Kits will be [*]. The Co-Branded Card designs and the content, form and design of the Welcome Kits will require the prior written approval of Costco.

(d)Subject to Section 5.06, it is intended that Bank’s on-going, routine Co-Branded Card communications shall not contain Costco Marks but may use Costco’s name to identify the Program, and shall not require Costco’s prior approval, as follows: customer service communications (e.g., credit dunning, acquisition decisions, inquiry and dispute servicing, Security Breach notices, legal notifications, policy notices, generic service updates and generic Bank Card communications not unique to the Co-Branded Card).

(e)Ownership of Card Designs. The Parties agree that Section 7.09(b) does not apply to Co-Branded Card designs. [*]

5.05 Communication with Co-Branded Cardholders.

(a)Subject to Sections 5.04(d), and except for any message required by Applicable Laws or for the servicing of or collecting on any Co-Branded Card Account, Costco and its Affiliates shall have [*] to communicate with Co-Branded Cardholders through use of onserts (“Onserts”), in any and all billing statements (including electronic billing statements) that include marketing materials and are provided by Bank to Co-Branded Cardholders, subject to Applicable Laws, and provided that: (i) Bank shall ensure

- 18 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

that the content and distribution of any such Onserts shall comply with Applicable Laws relating to consumer financial products of Bank or its Affiliates [*]; (ii) any communication required by Applicable Laws (including billing statements provided by Bank to Co-Branded Cardholders) and past due Co-Branded Cardholder communications shall take precedence over any of Costco’s messages; and (iii) Costco shall provide to Bank any Onserts proposed to be circulated or used by Costco prior to such Onserts being circulated, but solely for the purpose of the Bank ensuring compliance with such Applicable Laws, non-infringement of Bank’s or its Affiliates’ Intellectual Property, and the exclusion of (A) materials promoting goods and services not sold by Costco, its Affiliates or Designees, and (B) [*]. Subject to the terms of this Agreement, Bank may include communications to promote the Program. Costco will provide all Onserts to Bank in a timely manner and within mutually agreed Bank System specifications.

(b)Subject to Section 5.04(d), Costco shall have [*] to use billing statement (including electronic billing statement) messages in each billing cycle to communicate with Co-Branded Cardholders, subject to Applicable Laws; provided that: (i) Bank shall ensure that the content and distribution of any such message or other form of correspondence or marketing material shall comply with Applicable Laws relating to consumer financial products of Bank or its Affiliates [*]; (ii) any message required by Applicable Laws and past due Co-Branded Cardholder communications shall take precedence over any of Costco’s messages; (iii) Costco shall provide to Bank any message proposed to be circulated or used by Costco prior to such message being circulated, but solely for the purpose of the Bank ensuring compliance with such Applicable Laws, non-infringement of Bank’s or its Affiliates’ Intellectual Property, and the exclusion of (A) materials promoting goods and services not sold by Costco, its Affiliates or Designees, and (B) [*]. Subject to the terms of the Marketing Plan and this Agreement, Bank may include communications to promote the Program. Notwithstanding the foregoing (including item (ii) of the proviso, but subject to items (i) and (iii) of the proviso), each billing statement shall include at least one page dedicated to Costco marketing messages (to be determined by Costco in its sole discretion), unless limited by an applicable statement’s size, layout, or required non-marketing notifications. Billing statement and envelope messages referred to in this Section 5.05(b) shall be included on the billing statements and envelopes at no cost to Costco as long as the costs do not exceed standard mailing rates. Costco shall retain all revenues it receives from all such messages.

5.06 Costco Marketing Obligations.

(a)Costco shall determine, in good faith and in its sole discretion, the promotional and marketing activities in support of the Program and the Co-Branded Card that it shall undertake, including in and with respect to Costco Warehouses; provided, however, in all events Costco shall comply with [*] the Marketing Plan. Further, Costco shall have exclusive responsibility for and control of marketing the Program in all Costco Outlets and shall market the Program benefits to Costco Members within Costco Warehouses and other Costco Outlets, and with such marketing materials, as it determines appropriate (subject in all events to the [*] and the Marketing Plan).

(b)Promotional and marketing activities undertaken by Costco may include, at Costco’s sole discretion and subject to Bank’s production and delivery obligations contained in Section 5.07(b), as appropriate:

(i) Costco placing and maintaining from time to time the following in each Costco Warehouse promoting Co-Branded Cards: (i) large hanging banners in high traffic locations designated by Costco, acting reasonably; (ii) signage over the Costco Membership desk, and (iii) lane dividers on cash registers;

(ii)Providing from time to time, with respect to certain inbound telephone calls designated by Costco, a hold message at the Costco central call center promoting the Co-Branded Cards;

- 19 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

(iii)Marketing the Co-Branded Cards in the Costco Member magazine, which is currently called “The Costco Connection”.

(c)Costco staff may promote Co-Branded Cards at the Costco Membership desk and through Costco’s digital channels and will distribute Co-Branded Card Applications to customers at the Costco Membership desk and other Co-Branded Card promotional materials to customers at the Costco Membership desk and on Costco’s digital channels, and answer general questions about the application process and the promotional materials available at the Costco Membership desk and on Costco’s digital channels. At Costco’s request (prior to the Program Effective Date and on an ongoing basis), Bank shall train Costco employees, including Costco Trainers (who in turn will train Costco employees), on how to perform the above activities, [*].

(d)Costco shall market the Co-Branded Cards on Costco’s Website, and will create an electronic link to the Bank website with the option to return to the Costco Website, which link and Costco website content using and surrounding the Marks, along with any changes to same, and the proposed URL for same, must be approved in writing by Bank under Schedule 5.01(d). Bank and Costco will work together in good faith to design and implement, according to a mutually agreed upon timeline, an integrated apply and buy experience on the Costco Website’s purchase and checkout path.

5.07 Bank Marketing Obligations.

(a)Bank shall create, produce and deliver to Costco Warehouses all Co-Branded Card Documentation, including the take-one Co-Branded Card Applications, tear sheet application and other applications mutually agreed upon by the Parties. Except as provided in Section 5.01(a) with respect to certain items that will be [*], the cost of such items will be [*]. Placement of all Co-Branded Card Applications at Costco Warehouses shall be [*]. The content and appearance of the Costco Marks in such Co-Branded Card Applications shall require the prior written approval of Costco.

(b)Bank shall create, produce and deliver to Costco Warehouses the signage and other items described in Section 5.06, including as requested by Costco. The cost of such items will be [*] of the Program. The content and appearance of all such signage and other items will require the prior written approval of Costco.

(c)Bank shall (i) include Co-Branded Cards [*] on the Bank’s United States website, with a prominence at least equivalent to that of other credit cards issued by Bank on those webpages that feature (A) all such credit cards and/or (B) the same classification of card as the Co-Branded Cards (e.g., cashback), and (ii) provide additional website placements on Bank’s United States website from time to time consistent with Bank’s general practice regarding its co-brand Other Bank Card Programs. Bank shall maintain a link to the Costco Website with the option to return to the Bank website on the Bank/Costco web page which link and Bank website content using and surrounding the Marks, along with any changes to same, and the proposed URL for same, must be approved in writing by Costco under Schedule 5.01(d). The capability for an Applicant to complete and submit a Co-Branded Card Application shall be available on the Bank website and shall comply with Applicable Laws.

(d)Bank shall promote, in accordance with Applicable Laws, and the Program Privacy Policy, Costco and Costco offers in its outgoing emails to Co-Branded Cardholders, including all monthly e-mails upon mutual agreement as to promotion offers, content and timing, excluding outgoing electronic mailing to Co-Branded Cardholders and Costco Members who have opted out of marketing messages. Bank will be deemed the sender, as that term is defined in the CAN-SPAM Act, when sending commercial email communications, as defined in CAN-SPAM, to Co-Branded Cardholders.

- 20 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

(e)Bank shall promote, in accordance with the Program Privacy Policy and Applicable Laws, Co-Branded Cards and Costco Membership in its posts on social media platforms. To the extent requested by Costco, Bank will allocate a percentage of its marketing commitment to social media advertising, marketing and promotion campaigns for the Program that is [*]. For the sake of clarity, Costco may elect the percentage of marketing commitment spent for social media up to the maximum percentage set forth above.

(f)As provided in the Marketing Plan, and subject to the Program Privacy Policy and Applicable Laws, Bank shall promote the Costco Membership Program, Costco products, Costco services and Costco programs via statement onserts and statement messaging to [*], the content, targeting, and method of distribution of which shall be mutually agreed.

(i) Subject to portfolio restrictions regarding the number of mailings that can be sent to such portfolios, such promotion shall occur [*] during the Term, with timing to be mutually agreed by the Parties.

(ii)It is Bank’s responsibility to comply with its own marketing opt-out list. Bank will cooperate with Costco as provided herein and as permitted under Applicable Laws and the terms of Bank’s agreements with Bank Cardholders to enable the Parties to target holders of [*].

(iii)Bank shall cooperate with Costco to leverage its file of target customers participating in [*] for marketing the Program and Costco products and services, subject in all events to Applicable Law and Bank’s Contractual Obligations.

(iv)Further, at Costco’s request, Bank shall allow reasonable promotion through [*], for purposes of promoting the Costco Membership Program and encouraging Bank customers to become Costco Members, subject in all events to Applicable Law and Bank’s Contractual Obligations.

(g)Bank shall, subject to Applicable Laws and the Program Privacy Policy, market exclusive offers to Co-Branded Cardholders to encourage an increase in Purchase Charges made with the Co-Branded Card at Acceptance Locations outside Costco Warehouses. [*] The content, which shall include Costco Marks, selection criteria and quantity of the direct mail or other form of direct communication will require the prior written approval of Costco.

(h)Except as expressly set out in this Agreement (e.g., Section 5.04(d)), Bank shall not use the Cardholder List or its knowledge of who is a Co-Branded Cardholder to direct any advertising, marketing or promotional activities to Co-branded Cardholders that do not include advertising, marketing or promotion of or reference to Costco or Costco Outlets unless Bank obtains the prior written consent of Costco.

(i)Beginning [*] prior to the opening of any new Costco Warehouse during the Term (each such Costco Warehouse, a “New Costco Warehouse”), Bank shall, with respect to each New Costco Warehouse and [*]:

(i)[*]

(ii)[*]

(iii)conduct such promotional activities at mutually agreed to Acceptance Locations and potential Acceptance Locations doing business within the Costco designated primary and secondary market areas associated with such New Costco Warehouse.

- 21 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

(j)Notwithstanding anything to the contrary to this Agreement, Bank has no obligation to market any product or service [*] offered or branded by another financial services provider.

5.08 Other Bank Products.

(a)During the Term [*], except as permitted by or in accordance with Section 6.03 or Section 14.01(e), without Costco’s prior approval:

(i)[*]

(ii)[*]. In no event may any Bank branded proprietary card or any offer or promotion related thereto designate Costco or warehouse clubs as a category for any adverse treatment for value proposition or rewards purposes offered in respect of any Bank branded proprietary cards at any time during the Term.

(b)Subject to Applicable Laws and Bank’s Contractual Obligations, Bank shall also promote the Costco Membership Program to cardholders under [*].

(c)[*], Costco will provide to such [*] (i) an updated Costco Member list, containing a "membership since" field, so that newly added Costco Members and the dates on which they became Costco Members [*], and (ii) a "membership closed" list so that Bank can identify individuals who are no longer Costco Members. Notwithstanding anything herein to the contrary, the Costco Member list or identity of any Person as a Costco Member may not be used by Bank for any purpose other than as provided in this Section 5.08(c) and Schedule 9.01, paragraphs 1 and 5.

(d)For the purposes of this Article 5, “targets” or “on a targeted basis” shall mean advertising, marketing or promotional activities, as applicable, addressed or directed to a Person by means of name, address, e-mail address or telephone number or the use of the Cardholder List to conduct such activities.

ARTICLE 6

CARDHOLDER INFORMATION

6.01 Customer Information.

(a)All collection, use, disclosure, retention and destruction of Personal Information under this Agreement shall be subject to the provisions of this Article 6. The Parties acknowledge that the same or similar information may be contained in the Co-Branded Card Account Data, Cardholder Data, the Costco Shopper Data, and other data that each Party independently collects outside of this Program and each such pool of data shall therefore be considered separate information subject to the specific provisions applicable to that data hereunder.

(b)Bank shall provide all privacy notices to Applicants and Co-Branded Cardholders that are required under Applicable Privacy Laws. Any changes to such privacy notices or to the Program Privacy Policy described therein shall be made by Bank only with the approval of Costco (other than a Legally Mandated Change or a change that Bank is making to all Other Bank Card Programs), which approval will not be unreasonably withheld. If any change to the Program Privacy Policy is made as a result of a Legally Mandated Change or as part of a change that Bank is making to all Other Bank Card Programs, Bank shall provide Costco with written notice sixty (60) days in advance of the effective date of such change (unless a shorter period is required by Applicable Law).

- 22 -

[*] Indicates confidential portions omitted pursuant to a request for confidential treatment filed separately with the Commission

(c)Each Party shall develop, implement and maintain a comprehensive written information security program that, at a minimum, is designed to: (i) ensure the security and confidentiality of the Co-Branded Card Account Data, the Cardholder Data and the Costco Shopper Data; (ii) protect against any reasonably anticipated threats or hazards to the security or integrity of the Co-Branded Card Account Data, the Cardholder Data and the Costco Shopper Data; (iii) protect against unauthorized access to or modification, destruction, disclosure or use of the Co-Branded Card Account Data, the Cardholder Data and the Costco Shopper Data; and (iv) ensure the proper and secure disposal of Co-Branded Card Account Data, Cardholder Data and Costco Shopper Data (collectively, the “Security Guidelines”). Additionally, such Security Guidelines shall meet or exceed current industry standards and shall be at least as protective as those used by each Party to protect its own Personal Information. Each Party shall use the same degree of care in protecting the Co‑Branded Card Account Data, the Cardholder Data and the Costco Shopper Data against unauthorized access, use, disclosure or modification as it accords to its own Personal Information, but in no event less than a reasonable standard of care. In the event an officer of a Party becomes aware of a Security Breach involving Co-Branded Card Account Data, Cardholder Data or Costco Shopper Data, such Party shall immediately notify the other Party and shall cooperate with the other Party (y) to assess the nature and scope of such incident, to contain and control such incident to prevent further unauthorized access to or use, modification, destruction or disclosure of Co-Branded Card Account Data, Cardholder Data or Costco Shopper Data, and to the extent reasonably required by the other Party, to provide prompt notice to affected Co-Branded Cardholders or affected Costco Shoppers, or (z) to take such other action as required by Applicable Laws. The cost and expenses of any such notice shall be borne solely by the Party that experienced the unauthorized use, modification, destruction or disclosure of, or access to, Co-Branded Card Account Data, Cardholder Data or Costco Shopper Data. Schedule 6.01(c) sets forth additional security requirements applicable to Costco to the extent Costco, or any of its Affiliates or Subcontractors, stores, or has in its possession or control, any Cardholder Data or Costco Charge Transaction Data and any additional security requirements applicable to Bank.