UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box: ¨

| ¨ | Preliminary Proxy Statement | |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ¨ | Definitive Proxy Statement | |

| x | Definitive Additional Materials | |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 | |

Ultratech Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

N/A | |||

| (2) | Aggregate number of securities to which transaction applies:

N/A | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

N/A | |||

| (4) | Proposed maximum aggregate value of transaction:

N/A | |||

| (5) | Total fee paid:

N/A | |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

N/A | |||

| (2) | Form, Schedule or Registration Statement No.:

N/A | |||

| (3) | Filing Party:

N/A | |||

| (4) | Date Filed:

N/A | |||

| Company Contacts: Ultratech, Inc. Bruce R. Wright, 408/321-8835 Senior Vice President and CFO

Investor Relations: The Blueshirt Group Suzanne Schmidt, 415/217-4962 suzanne@blueshirtgroup.com Melanie Solomon, 415/217-4964 melanie@blueshirtgroup.com |

Media Relations: Joele Frank, Wilkinson Brimmer Katcher Steve Frankel / Nick Leasure 212/355-4449

|

ULTRATECH’S BOARD OF DIRECTORS SENDS LETTER TO STOCKHOLDERS

Urges Stockholders to Vote “FOR” All of the Ultratech Board’s Highly Qualified Director

Nominees on the WHITE Proxy Card Today

SAN JOSE, Calif., June 20, 2016 – Ultratech, Inc. (Nasdaq: UTEK), a leading supplier of lithography, laser-processing and inspection systems used to manufacture semiconductor devices and high-brightness LEDs (HB- LEDs), as well as atomic layer deposition (ALD) systems, today announced that it has mailed a letter to Ultratech stockholders in connection with its 2016 Annual Meeting of Stockholders scheduled for July 19, 2016.

The Ultratech Board of Directors unanimously recommends that stockholders vote the WHITE proxy card “FOR” the Company’s highly qualified and experienced director nominees – Arthur W. Zafiropoulo, Michael Child, Dr. Paramesh Gopi, Nicholas Konidaris, Dennis R. Raney, Henri Richard and Rick Timmins.

The full text of the letter follows:

June 20, 2016

Dear Fellow Stockholder,

Ultratech’s Board of Directors and management team are focused on executing a strategic plan to enhance the value of your investment. We have taken – and continue to take – disciplined actions to address industry challenges, diversify our business and position Ultratech for future growth and success. These actions are already generating positive momentum as evidenced by our strong revenue and bookings through the first quarter and into the second quarter of 2016.

Ultratech is committed to obtaining every order, increasing our market share and strengthening our relationships with new and existing customers. We have technology and industry leadership across a number of applications and have made significant progress in our re-prioritization of R&D for both technology future needs and reduction in cost of ownership. As a result, Ultratech continues to outperform its peer group on a total stockholder return basis and our stock price is up approximately 14 percent since the beginning of this yeari. Your Board and management team are focused on capitalizing upon our current momentum to enhance value for all of our stockholders.

1

ULTRATECH’S BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT

STOCKHOLDERS VOTE “FOR” ALL SEVEN OF ITS DIRECTOR NOMINEES

On July 19, 2016, Ultratech will hold its Annual Meeting of Stockholders (“2016 Annual Meeting”). The Board urges Ultratech stockholders to vote “FOR” the re-election of six of the Company’s highly qualified and experienced director nominees – Arthur W. Zafiropoulo, Michael Child, Nicholas Konidaris, Dennis R. Raney, Henri Richard and Rick Timmins – as well as its new nominee, Dr. Paramesh Gopi.

Longtime board member Joel Gemunder has decided not to stand for re-election at the 2016 Annual Meeting and will retire from the Board, effective immediately prior to the 2016 Annual Meeting. Mr. Gemunder’s decision represents an opportunity for the Company to refresh its Board through the nomination of Dr. Gopi, President and Chief Executive Officer of Applied Micro. Dr. Gopi was initially identified by an independent Ultratech stockholder. After a thorough vetting process by the Company’s Nominating and Corporate Governance Committee, the Board has determined that Dr. Gopi is highly qualified given his experience serving in senior operating positions of publicly traded semiconductor companies, deep technology background and established relationships with several of Ultratech’s existing customers.

The Board unanimously recommends that stockholders vote “FOR” all seven of its director nominees today.

ULTRATECH’S BOARD AND MANAGEMENT TEAM ARE COMMITTED TO STRONG

CORPORATE GOVERNANCE AND CONTINUING STOCKHOLDER ENGAGEMENT

Following last year’s Annual Meeting of Stockholders, the Company’s Board of Directors and Compensation Committee expanded its dialogue with stockholders to better understand their perspectives on compensation and corporate governance issues. Since July 2015, the Board has engaged with and solicited feedback from stockholders that currently control more than 50 percent of Ultratech’s outstanding shares.

Based on input from our stockholders, Ultratech instituted a number of changes to its executive compensation program for fiscal years 2015 and 2016. In addition, the Company maintains a number of compensation provisions that we believe serve to keep stockholder interests a priority. Highlights include the following:

| • | We implemented new, stock price-based performance measures into our named executive officers’ (NEO) long-term incentive awards for 2015 and did not grant new awards to them for 2016. |

| • | We capped maximum payouts under our incentive awards. |

| • | We maintain stock ownership guidelines with a 10x guideline level of ownership for our Chief Executive Officer. |

2

| • | We implemented anti-hedging and anti-pledging policies. |

| • | We adopted a clawback policy. |

| • | We updated our peer group of companies. |

| • | NEO salaries and target annual incentives remain flat. |

Ultratech is dedicated to maintaining openness, transparency and the highest level of integrity in all its actions, business dealings and interactions with other companies and individuals.

ULTRATECH’S BOARD AND MANAGEMENT TEAM HAVE ACTIVELY ENGAGED

WITH NEUBERGER BERMAN

You may be aware that Neuberger Berman (“Neuberger”) has launched a proxy fight to try to replace two members of the Board. In its letter to Mr. Zafiropoulo, dated August 4, 2015, Neuberger expressed its desire to discuss issues including Board refreshment and management succession planning.

Beginning in 2015, your Board and management team have actively engaged with Neuberger regarding these issues, and taken action on both fronts:

| • | In December 2015, Ultratech announced its intention to appoint one or more new Board members with technology expertise. |

| • | This process led to the nomination of Dr. Gopi to stand for election at the 2016 Annual Meeting. |

| • | In addition, the Nominating and Corporate Governance Committee continues to evaluate potential candidates who possess strong track records and relevant expertise to join the Board. |

| • | The nomination of Dr. Gopi addresses Neuberger’s concern about the average age of Ultratech’s Board members. Furthermore, the Board has committed to continuing the Board refreshment process for the next two to three years, adding a highly-qualified director candidate for each of the following two to three years. |

| • | In February 2016, Ultratech announced the promotion of two individuals to executive officer positions – Tammy D. Landon and Dave Ghosh – as part of an ongoing leadership succession process. |

| • | Each of Ms. Landon and Mr. Ghosh has more than 30 years of experience in relevant industries and positions and are intimately familiar with Ultratech’s business, operations and strategy for driving growth. |

ULTRATECH’S BOARD THOROUGHLY VETTED

NEUBERGER’S NOMINEES AND DETERMINED THEY WERE NOT ADDITIVE TO

THE ULTRATECH BOARD

The Nominating and Corporate Governance Committee met with and thoroughly vetted the credentials of the two individuals suggested by Neuberger – Ronald Black and

3

Beatriz Infante. These evaluations included in-person and telephonic interviews, and the completion of in-depth questionnaires. Ultimately, the Board determined that Dr. Black’s role as CEO of Rambus is not aligned with the interests of Ultratech’s customers. With respect to Ms. Infante, the Board believes she lacks relevant semiconductor experience to add value to the Board.

NEUBERGER HAS FAILED TO DISCLOSE MATERIAL NEGATIVE HISTORIES AND

OTHER FACTS REGARDING ITS TWO DIRECTOR NOMINEES

Neuberger touts its two nominees as “highly qualified.” In reality, Neuberger omits material negative histories for its two nominees.

In performing its due diligence, your Board discovered that both Dr. Black and Ms. Infante have track records of consistently suboptimal performance with regard to their board and/or managerial experience at other companies:

| • | Dr. Ronald Black |

| • | Joined Rambus as President and Chief Executive Officer in June of 2012. |

| • | Rambus has established a reputation for patent litigation within the industry, including numerous cases that have targeted Ultratech customers. The Company believes that adding a director to the Board who is associated with these types of litigation matters would have a material and adverse effect on Ultratech’s relationships with its customers. |

| • | From September 2010 to August 2011, Dr. Black was CEO of MobiWire (formerly Sagem Wireless). MobiWire filed for bankruptcy protection in the French Courts in May 2011. |

| • | From September 2004 to June 2009, Dr. Black was CEO of Wavecom S.A. In 2009, Wavecom was acquired by Sierra Wireless in the wake of a sharp drop in Wavecom’s 2008 revenue. In March 2009, Sierra Wireless informed Dr. Black that it was its intention to have him replaced and he resigned on June 30, 2009. |

| • | Additionally, Dr. Black currently sits on the Board of Directors of four companies, both public and private, including Rambus, and is an example of a director who is “overboarded.” |

| • | Ms. Beatriz Infante |

| • | From April 2010 to October 2011, Ms. Infante served as the CEO of ENXSuite. Under her leadership, ENXSuite was acquired by Infor, Inc., and according to analysis by research firm Gartner, “[t]he acquisition was an appealing option for ENXSuite after the decline of its customer growth and market penetration.” |

| • | Ms. Infante formerly served as President, CEO and Chairman of Aspect Communications Corporation. From April 2000, when she was first appointed President and CEO, to August 2003, when her departure from Aspect was announced, Aspect’s share price declined from $34.44ii to $7.53iii, representing a decline of more than 78 percent. |

| • | Ms. Infante was one of five co-founders of Momenta, which was created in 1989. Ms. Infante was the director of software development at Momenta and, by August 1992, after struggling to obtain additional financing, Momenta laid off most of its employees, lost its CEO and filed for bankruptcy protection. |

4

| • | Ms. Infante also has had a problematic history at numerous other publicly traded companies where she was a director or executive officer: |

| • | Liquidity, Current Director – Stock down approximately 59 percent. |

| • | Sonus, Current Director – Stock down approximately 30 percent. |

| • | Emulex Corp., Past Director – Defendant in a stockholder suit. |

Ultratech believes that Ultratech stockholders deserve to be told the full truth regarding Neuberger’s director nominees, not the selective disclosure that Neuberger has utilized.

While the Board concluded it was not in the best interests of the Company and its stockholders to move forward with either candidate, the Board greatly respects Neuberger’s position as a stockholder of Ultratech. Importantly, the Board remains open and willing to work with Neuberger to identify candidates with the right credentials to serve on the Company’s Board.

NEUBERGER HAS MADE FALSE AND MISLEADING STATEMENTS CONCERNING

MR. ZAFIROPOULO AND ULTRATECH

Neuberger used selective time periods and stock indices to cast Ultratech’s stock performance in a negative light.

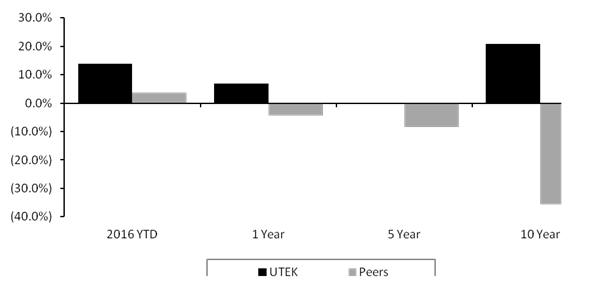

| • | When compared to our semiconductor capital equipment peers, Ultratech has outperformed this group year-to-date as of June 17, 2016, as well as over one, five and 10-year calendar periods. |

Peer Index reflects the median total shareholder return of the following: Axcelis Technologies, Cascade Microtech, Cohu, Electro Scientific Industries, FormFactor, GSI Technology, Mattson Technology, Nanometrics Incorporated, PDF Solutions, Rudolph Technologies, Veeco Instruments and Xcerra Corporation. TSR Data from Factset with dividends re-invested on ex-date.

5

Neuberger claims that according to Ultratech’s proxy statements, Mr. Zafiropoulo has been paid more than $25 million in the last 10 years.

| • | However, and consistent with competitive and industry practices, the majority of this compensation was in the form of equity awards, with values directly linked to and dependent upon our stock price, to directly align with stockholder interests. |

Neuberger “estimates” that Mr. Zafiropoulo has liquidated three-quarters of his ownership interest in Ultratech.

| • | Neuberger’s analysis fails to consider his substantial ownership interest in the Company since its formation. |

| • | In addition, compared to a group of companies considered as “peers” by Ultratech’s compensation committee, Mr. Zafiropoulo’s ownership percentage in Ultratech still far exceeds the ownership of other peer group CEOs. |

Neuberger falsely states that Scott Zafiropoulo, the Company’s General Manager of Laser Products and SVP of Marketing, was paid $500,000 in compensation last year and questions his senior leadership role at Ultratech.

| • | In fact, his base salary and bonus totaled approximately $314,000 in 2015 (excluding any restricted stock unit grants, which vest over a 50-month period). Scott’s total compensation ranks him after Senior Executives and other Senior Vice Presidents. |

| • | Scott has been with Ultratech since 1993 in various marketing and technical roles and worked his way up from an Associate Marketing Coordinator through 11 promotions. |

| • | Scott completed the Marketing Management Program at Stanford School of Business in 2002 and has coauthored numerous articles in trade publications. |

Neuberger claims that Ultratech sponsored an auto racing team with which Mr. Zafiropoulo is affiliated.

| • | In fact, Ultratech has never paid any money to sponsor the racing team. |

| • | Instead, Mr. Zafiropoulo used personal funds to sponsor the racing team under Ultratech’s name in order to further raise the Company’s profile. |

ULTRATECH’S EXPERIENCED, INDEPENDENT AND DIVERSE BOARD AND

SKILLED MANAGEMENT TEAM ARE COMMITTED TO CREATING STOCKHOLDER VALUE

Ultratech has an experienced Board that is actively engaged in overseeing the Company’s growth and creating stockholder value. Your Board is composed of carefully selected and highly-qualified directors with a deep understanding of and relevant experience in the semiconductor industry. Your Board also has members with significant financial expertise, public company experience and notable backgrounds in consumer electronics and software.

| • | Arthur W. Zafiropoulo, Chairman and CEO – Well-known for both his leadership skills and technical expertise throughout the semiconductor industry, with more than five decades of relevant experience. |

6

| • | Michael Child – More than 25 years of experience investing in and acquiring technology and related companies, with semiconductor Board positions at IPG Photonics and Finisar Corporation. |

| • | Nicholas Konidaris – 17 years of experience in consumer electronics, semiconductors, passive components and LED markets as CEO at Electro Scientific Industries and Advantest America. |

| • | Dennis R. Raney – Decades of finance, accounting and corporate governance experience and international experience in high-technology companies and other industries. |

| • | Henri Richard – 14 years of experience at semiconductor and related companies including Freescale, SanDisk, NetApp and Advanced Micro Devices. |

| • | Rick Timmins, Lead Director – Deep financial background, including 12 years as Vice President of Finance for Cisco and experience with accounting, governance and audit committee matters. |

| • | Dr. Paramesh Gopi, Nominee for Director – President and Chief Executive Officer of Applied Micro, a named inventor under 30 patents involving device-related inventions, and a publisher of numerous articles and papers on a variety of technical engineering and industry topics. |

PLEASE VOTE THE WHITE PROXY CARD TODAY – BY TELEPHONE, THE

INTERNET OR BY SIGNING, DATING AND RETURNING THE ENCLOSED WHITE

PROXY CARD IN THE POSTAGE PAID ENVELOP PROVIDED

Your Ultratech Board unanimously recommends that stockholders vote “FOR” all seven of the Company’s highly qualified and experienced director nominees – Arthur W. Zafiropoulo, Michael Child, Paramesh Gopi, Nicholas Konidaris, Dennis R. Raney, Henri Richard and Rick Timmins.

Whether or not you plan to attend the 2016 Annual Meeting, you have an opportunity to protect your investment in Ultratech by voting the WHITE proxy card. We urge you to vote today by telephone, by Internet or by signing and dating the enclosed WHITE proxy card and returning it in the postage-paid envelope provided. You may receive an opposing proxy statement and gold proxy card, as well as letters or other proxy solicitation materials from Neuberger. Please do not return or otherwise vote any proxy card sent to you by Neuberger.

On behalf of your Board of Directors and management team, we thank you for your continued support.

| Sincerely,

Arthur W. Zafiropoulo Chairman and Chief Executive Officer |

Rick Timmins Lead Director |

7

Your Vote Is Important, No Matter How Many Or How Few Shares You Own.

Please vote the WHITE proxy card TODAY. If you have any questions or require any

assistance with voting your shares or if you need additional copies of the proxy materials,

please contact:

D.F. King & Co., Inc.

48 Wall Street

New York, NY 10005

Stockholders May Call Toll-Free: (800) 252-8173

Banks & Brokers May Call: (212) 269-5550

About Ultratech

Ultratech, Inc. (Nasdaq: UTEK) designs, builds and markets manufacturing systems for the global technology industry. Founded in 1979, Ultratech serves three core markets: front-end semiconductor, back-end semiconductor, and nanotechnology. The company is the leading supplier of lithography products for bump packaging of integrated circuits and high- brightness LEDs. Ultratech is also the market leader and pioneer of laser spike anneal technology for the production of advanced semiconductor devices. In addition, the company offers solutions leveraging its proprietary coherent gradient sensing (CGS) technology to the semiconductor wafer inspection market and provides atomic layer deposition (ALD) tools to leading research organizations, including academic and industrial institutions. Visit Ultratech online at: www.ultratech.com.

Important Additional Information

In connection with the solicitation of proxies, Ultratech, Inc. (“Ultratech”) has filed with the Securities and Exchange Commission (the “SEC”), a definitive proxy statement and other relevant documents concerning the proposals to be presented at Ultratech’s 2016 Annual Meeting of Stockholders (the “2016 Annual Meeting”). The proxy statement contains important information about Ultratech and the 2016 Annual Meeting. In connection with the 2016 Annual Meeting, Ultratech has mailed the definitive proxy statement to stockholders. In addition, Ultratech files annual, quarterly and special reports, proxy statements and other information with the SEC. You are urged to read the proxy statement and other information because they contain important information about Ultratech and the proposals to be presented at the 2016 Annual Meeting. These documents are available free of charge at the SEC’s website (www.sec.gov) or from Ultratech at our investor relations website (http://ir.ultratech.com). The contents of any websites referenced herein are not deemed to be incorporated by reference into the proxy statement.

Ultratech and its directors, executive officers and certain employees may be deemed to be participants in the solicitation of proxies from Ultratech’s stockholders in connection with the election of directors and other matters to be proposed at the 2016 Annual Meeting. Information regarding the interests, if any, of these directors, executive officers and specified employees is included in the definitive proxy statement and other materials filed by Ultratech with the SEC.

8

Forward-Looking Statements

This release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can generally be identified by words such as “anticipates,” “expects,” “remains,” “thinks,” “intends,” “believes,” “estimates,” and similar expressions and include management’s current expectation of its longer term prospects for success. These forward-looking statements are based on our current expectations, estimates, assumptions and projections about our business and industry, and the markets and customers we serve, and they are subject to numerous risks and uncertainties that may cause these forward-looking statements to be inaccurate. Such risks and uncertainties include the timing and possible delays, deferrals and cancellations of orders by customers; quarterly revenue fluctuations; industry and sector cyclicality, instability and unpredictability; market demand for consumer devices utilizing semiconductors produced by our clients; our ability to manage costs; new product introductions, market acceptance of new products and enhanced versions of our existing products; reliability and technical acceptance of our products; our lengthy sales cycles, and the timing of system installations and acceptances; lengthy and costly development cycles for laser-processing and lithography technologies and applications; competition and consolidation in the markets we serve; improvements, including in cost and technical features, of competitors’ products; rapid technological change; pricing pressures and product discounts; our ability to collect receivables; customer and product concentration and lack of product revenue diversification; inventory obsolescence; general economic, financial market and political conditions and other factors outside of our control; domestic and international tax policies; cybersecurity threats in the United States and globally that could impact our industry, customers, and technologies; and other factors described in our SEC reports including our Annual Report on Form 10-K filed for the year ended December 31, 2015 and our Quarterly Report on Form 10-Q filed for the quarterly period ended April 2, 2016. Due to these and other factors, the statements, historical results and percentage relationships set forth herein are not necessarily indicative of the results of operations for any future period. We undertake no obligation to revise or update any forward-looking statements to reflect any event or circumstance that may arise after the date of this release.

(UTEKF)

i Based on year-to-date stock performance as of June 17, 2016.

ii Aspect’s closing stock price on April 5, 2000, the last trading day prior to the announcement of Ms. Infante’s appointment as Aspect’s President and CEO.

iii Aspect’s closing stock price on August 17, 2003, the last trading day prior to the announcement of Ms. Infante’s departure from Aspect.

9