SUMMARY PROSPECTUS | |||||||

TEMPLETON CHINA WORLD FUND | |||||||

January 1, 2024 | |||||||

| |||||||

Class A | Class C | Class R6 | Advisor Class |

TCWAX | TCWCX | FCWRX | TACWX |

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, statement of additional information, reports to shareholders and other information about the Fund online at www.franklintempleton.com/prospectus. You can also get this information at no cost by calling (800) DIAL BEN/342-5236 or by sending an e-mail request to prospectus@franklintempleton.com. The Fund’s prospectus and statement of additional information, both dated January 1, 2024, as may be supplemented, are all incorporated by reference into this Summary Prospectus.

TEMPLETON

CHINA WORLD FUND

SUMMARY PROSPECTUS

Investment Goal

Long-term capital appreciation.

Fees and Expenses of the Fund

These tables describe the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. You may pay other fees (including on Class R6 and Advisor Class shares), such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below. You may qualify for sales charge discounts in Class A if you and your family invest, or agree to invest in the future, at least $25,000 in Franklin Templeton funds and certain other funds distributed through Franklin Distributors, LLC, the Fund’s distributor. More information about these and other discounts is available from your financial professional and under “Your Account” on page 35 in the Fund’s Prospectus and under “Buying and Selling Shares” on page 48 of the Fund’s Statement of Additional Information. In addition, more information about sales charge discounts and waivers for purchases of shares through specific financial intermediaries is set forth in Appendix A – “Intermediary Sales Charge Discounts and Waivers” to the Fund’s prospectus.

Shareholder Fees

(fees paid directly from your investment)

| Class A |

| Class C |

| Class R6 |

| Advisor

| |

Maximum Sales Charge

(Load) | 5.50% |

| None |

| None |

| None | |

Maximum

Deferred Sales Charge | None | 1 | 1.00% |

| None |

| None | |

|

|

|

|

|

|

|

|

|

1. | There is a 1% contingent deferred sales charge that applies to investments of $1 Million or more (see "Investment of $1 Million or More" under "Choosing a Share Class") and purchases by certain retirement plans without an initial sales charge on shares sold within 18 months of purchase. | |||||||

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Class A |

| Class C |

| Class R6 |

| Advisor

|

Management fees1 | 1.10% |

| 1.10% |

| 1.10% |

| 1.10% |

Distribution and service (12b-1) fees | 0.25% |

| 1.00% |

| None |

| None |

Other expenses2 | 0.40% |

| 0.40% |

| 0.32% |

| 0.40% |

Total annual Fund operating expenses | 1.75% |

| 2.50% |

| 1.42% |

| 1.50% |

Fee waiver and/or expense reimbursement3 | -0.01% |

| -0.01% |

| -0.13% |

| -0.01% |

Total annual Fund operating expenses after fee waiver and/or expense reimbursement | 1.74% |

| 2.49% |

| 1.29% |

| 1.49% |

2 | Summary Prospectus | franklintempleton.com |

TEMPLETON

CHINA WORLD FUND

SUMMARY PROSPECTUS

1. Management fees have been restated to reflect the reduced management fee approved by the board of trustees effective on May 1, 2023. Consequently, the Fund’s total annual Fund operating expenses differ from the ratio of expenses to average net assets shown in the Financial Highlights.

2. Other expenses have been restated to reflect fees and expenses for the current fiscal year. Consequently, the total annual Fund operating expenses differ from the ratio of expenses to average net assets shown in the Financial Highlights.

3. The investment manager has agreed to waive fees and/or reimburse operating expenses (excluding Rule 12b-1 fees, acquired fund fees and expenses, interest expense and certain non-routine expenses or costs, such as those relating to litigation, indemnification, reorganizations and liquidations) for the Fund so that the ratio of total annual fund operating expenses will not exceed 1.60% for each share class. The investment manager has also agreed to reduce its fees to reflect reduced services resulting from the Fund’s investments in Franklin Templeton affiliated funds. In addition, transfer agency fees on Class R6 shares of the Fund have been capped so that transfer agency fees for that class do not exceed 0.03%. These arrangements are expected to continue until December 31, 2024. During the terms, the fee waiver and expense reimbursement agreements may not be terminated or amended without approval of the board of trustees except to add series or classes, to reflect the extension of termination dates or to lower the waiver and expense limitation (which would result in lower fees for shareholders).

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of the period. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. The Example reflects adjustments made to the Fund's operating expenses due to the fee waivers and/or expense reimbursements by management for the 1 Year numbers only. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| 1 Year |

| 3 Years |

| 5 Years |

| 10 Years |

Class A |

| $717 |

| $1,070 |

| $1,446 |

| $2,498 | |

Class C |

| $352 |

| $777 |

| $1,329 |

| $2,651 | |

Class R6 |

| $131 |

| $436 |

| $764 |

| $1,692 | |

Advisor Class |

| $152 |

| $474 |

| $818 |

| $1,790 | |

If you do not sell your shares: |

|

|

|

|

|

|

| ||

Class C |

| $252 |

| $777 |

| $1,329 |

| $2,651 | |

|

|

|

|

|

|

|

|

| |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 30.20% of the average value of its portfolio.

franklintempleton.com | Summary Prospectus | 3 |

TEMPLETON

CHINA WORLD FUND

SUMMARY PROSPECTUS

Principal Investment Strategies

Under normal market conditions, the Fund invests at least 80% of its net assets in securities of "China companies.” The Fund invests primarily in the equity securities of China companies, which are those:

· that are organized under the laws of, or with a principal office in, the People’s Republic of China (China), Hong Kong or Taiwan; or.

· for which the principal trading market is in China, Hong Kong or Taiwan; or

· that derive at least 50% of their revenues from goods or services sold or produced, or have at least 50% of their assets, in China.

The equity securities in which the Fund invests are primarily common stock. The Fund also invests in American, Global and European Depositary Receipts. China companies may be any size across the entire market capitalization spectrum, including midsize companies and smaller, newly organized and relatively unseasoned issuers. Investments in Chinese companies may be made through a special structure known as a variable interest entity (VIE) that is designed to provide foreign investors with exposure to Chinese companies that operate in certain sectors in which China restricts or prohibits foreign investments. In addition to the Fund's main investments, the Fund may invest up to 20% of its net assets in securities that do not qualify as China company securities, but whose issuers, in the judgment of the investment manager, are expected to benefit from developments in the economy of China, Hong Kong or Taiwan. The Fund is a "non-diversified" fund, which means it generally invests a greater proportion of its assets in the securities of one or more issuers and invests overall in a smaller number of issuers than a diversified fund.

When choosing equity investments for the Fund, the investment manager applies a fundamental, research-driven, long-term approach, focusing on companies with sustainable earnings power that are trading at a discount to intrinsic worth. In assessing individual investment opportunities, the investment manager considers a variety of factors, including a company’s profit and loss outlook, balance sheet strength, cash flow trends and asset value in relation to the current price of the company’s securities. The investment manager also focuses on incorporating environmental, social and governance (ESG) factors throughout the investment process, including the Fund’s security-selection and portfolio construction process.

The Fund focuses on companies with appropriate and/or good management of material ESG issues, and in analyzing ESG factors, the investment manager conducts a materiality-based ESG assessment through both in-depth research and engagement with companies as appropriate to assess how a company's practices are aimed at improving or maintaining the ESG footprint of its operating model.

4 | Summary Prospectus | franklintempleton.com |

TEMPLETON

CHINA WORLD FUND

SUMMARY PROSPECTUS

The following provides examples of ESG elements that can be taken into consideration when assessing a company:

· Environmental considerations, which can include issues such as resource efficiency, carbon emissions management, waste prevention and recycling and pollution prevention and control.

· Social considerations, which can include issues such as labor standards, fair wages, diversity and gender balance, health and safety practices and product safety.

· Governance considerations, which can include issues such as appropriate accounting practices, alignment of interests, board effectiveness, capital allocation, shareholder rights and quality of disclosures.

In addition, the investment manager assesses the potential for improvement through the Fund’s engagement as an active owner. These are targeted engagements with specific goals and objectives based on scope for improvement. The investment manager seeks companies that are good or improving stewards aligned with shareholder interest and the investment manager’s governance assessment includes regular dialogue with companies, monitoring material ESG issues and voting proxies.

The Fund also applies specific ESG exclusions, including companies which, according to the investment manager’s analysis:

· repeatedly and/or seriously violate the United Nations Global Compact Principles;

· manufacture nuclear or controversial weapons defined as anti-personnel mines, biological & chemical weaponry, depleted uranium and cluster munitions or those that manufacture components intended for use in such weapons (companies that derive more than 5% revenue from any other weapons are also be excluded);

· derive more than 25% of their revenue from thermal coal extraction; or

· manufacture tobacco or tobacco products.

The investment manager may consider selling an equity security when it believes the security has become overvalued due to either its price appreciation or changes in the company’s fundamentals, when there is significant deterioration of its ESG factors, or when the investment manager believes another security is a more attractive investment opportunity.

Principal Risks

You could lose money by investing in the Fund. Mutual fund shares are not deposits or obligations of, or guaranteed or endorsed by, any bank, and are not

franklintempleton.com | Summary Prospectus | 5 |

TEMPLETON

CHINA WORLD FUND

SUMMARY PROSPECTUS

insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other agency of the U.S. government.

Foreign Securities (non-U.S.): Investing in foreign securities typically involves more risks than investing in U.S. securities, and includes risks associated with: (i) internal and external political and economic developments – e.g., the political, economic and social policies and structures of some foreign countries may be less stable and more volatile than those in the U.S. or some foreign countries may be subject to trading restrictions or economic sanctions; diplomatic and political developments could affect the economies, industries, and securities and currency markets of the countries in which the Fund is invested, which can include rapid and adverse political changes; social instability; regional conflicts; sanctions imposed by the United States, other nations or other governmental entities, including supranational entities; terrorism; and war; (ii) trading practices – e.g., government supervision and regulation of foreign securities and currency markets, trading systems and brokers may be less than in the U.S.; (iii) availability of information – e.g., foreign issuers may not be subject to the same disclosure, accounting and financial reporting standards and practices as U.S. issuers; (iv) limited markets – e.g., the securities of certain foreign issuers may be less liquid (harder to sell) and more volatile; and (v) currency exchange rate fluctuations and policies – e.g., fluctuations may negatively affect investments denominated in foreign currencies and any income received or expenses paid by the Fund in that foreign currency. The risks of foreign investments may be greater in developing or emerging market countries.

There are special risks associated with investments in China, Hong Kong and Taiwan, including exposure to currency fluctuations, less liquidity, expropriation, confiscatory taxation, nationalization and exchange control regulations (including currency blockage). Inflation and rapid fluctuations in inflation and interest rates have had, and may continue to have, negative effects on the economy and securities markets of China, Hong Kong and Taiwan. In addition, investments in Taiwan and Hong Kong could be adversely affected by their respective political and economic relationship with China. China, Hong Kong and Taiwan are deemed by the investment manager to be emerging markets countries, which means an investment in these countries has more heightened risks than general foreign investing due to a lack of established legal, political, business and social frameworks and accounting standards or auditor oversight in the country to support securities markets as well as the possibility for more widespread corruption and fraud. In addition, the standards for environmental, social and corporate governance matters in China, Hong Kong and Taiwan also tend to be lower than such standards in more developed economies. Also, certain securities issued by companies located or operating in China, such as China A-Shares, are subject to

6 | Summary Prospectus | franklintempleton.com |

TEMPLETON

CHINA WORLD FUND

SUMMARY PROSPECTUS

trading restrictions, quota limitations, and clearing and settlement risks. In addition, there may be significant obstacles to obtaining information necessary for investigations into or litigation against companies located in or operating in China and shareholders may have limited legal remedies.

Trade disputes and the imposition of tariffs on goods and services can affect the Chinese economy, particularly in light of China's large export sector, as well as the global economy. Trade disputes can result in increased costs of production and reduced profitability for non-export-dependent companies that rely on imports to the extent China engages in retaliatory tariffs. Trade disputes may also lead to increased currency exchange rate volatility.

Certain investments in Chinese companies are made through a special structure known as a VIE. In a VIE structure, foreign investors, such as the Fund, will only own stock in a shell company rather than directly in the VIE, which must be owned by Chinese nationals (and/or Chinese companies) to obtain the licenses and/or assets required to operate in a restricted or prohibited sector in China. The value of the shell company is derived from its ability to consolidate the VIE into its financials pursuant to contractual arrangements that allow the shell company to exert a degree of control over, and obtain economic benefits arising from, the VIE without formal legal ownership. While VIEs are a longstanding industry practice and are well known by Chinese officials and regulators, the structure historically has not been formally recognized under Chinese law and it is uncertain whether Chinese officials or regulators will withdraw their implicit acceptance of the structure. It is also uncertain whether the contractual arrangements, which may be subject to conflicts of interest between the legal owners of the VIE and foreign investors, would be enforced by Chinese courts or arbitration bodies. Prohibitions of these structures by the Chinese government, or the inability to enforce such contracts, from which the shell company derives its value, would likely cause the VIE-structured holding(s) to suffer significant, detrimental, and possibly permanent losses, and in turn, adversely affect the Fund’s returns and net asset value.

Regional Focus: Because the Fund may invest at least a significant portion of its assets in companies in a specific region, the Fund is subject to greater risks of adverse developments in that region and/or the surrounding regions than a fund that is more broadly diversified geographically. Political, social or economic disruptions in the region, even in countries in which the Fund is not invested, may adversely affect the value of investments held by the Fund.

Emerging Market Countries: The Fund’s investments in emerging market countries are subject to all of the risks of foreign investing generally, and have additional heightened risks due to a lack of established legal, political, business and social frameworks to support securities markets, including: delays in settling

franklintempleton.com | Summary Prospectus | 7 |

TEMPLETON

CHINA WORLD FUND

SUMMARY PROSPECTUS

portfolio securities transactions; currency and capital controls; greater sensitivity to interest rate changes; pervasiveness of corruption and crime; currency exchange rate volatility; and inflation, deflation or currency devaluation.

Market: The market values of securities or other investments owned by the Fund will go up or down, sometimes rapidly or unpredictably. The market value of a security or other investment may be reduced by market activity or other results of supply and demand unrelated to the issuer. This is a basic risk associated with all investments. When there are more sellers than buyers, prices tend to fall. Likewise, when there are more buyers than sellers, prices tend to rise.

The global outbreak of the novel strain of coronavirus, COVID-19 and its subsequent variants, has resulted in market closures and dislocations, extreme volatility, liquidity constraints and increased trading costs. The long-term impact on economies, markets, industries and individual issuers is not known. Some sectors of the economy and individual issuers have experienced or may experience particularly large losses. Periods of extreme volatility in the financial markets; reduced liquidity of many instruments; and disruptions to supply chains, consumer demand and employee availability, may continue for some time.

Stock prices tend to go up and down more dramatically than those of debt securities. A slower-growth or recessionary economic environment could have an adverse effect on the prices of the various stocks held by the Fund.

Small and Mid Capitalization Companies: Securities issued by small and mid capitalization companies may be more volatile in price than those of larger companies and may involve substantial risks. Such risks may include greater sensitivity to economic conditions, less certain growth prospects, lack of depth of management and funds for growth and development, and limited or less developed product lines and markets. In addition, small and mid capitalization companies may be particularly affected by interest rate increases, as they may find it more difficult to borrow money to continue or expand operations, or may have difficulty in repaying any loans.

Non-Diversification: Because the Fund is non-diversified, it may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may negatively impact the Fund's performance and result in greater fluctuation in the value of the Fund’s shares.

Management: The Fund is subject to management risk because it is an actively managed investment portfolio. The Fund's investment manager applies investment techniques and risk analyses in making investment decisions for the Fund, but there can be no guarantee that these decisions will produce the desired results.

8 | Summary Prospectus | franklintempleton.com |

TEMPLETON

CHINA WORLD FUND

SUMMARY PROSPECTUS

ESG Considerations: ESG considerations are one of a number of factors that the investment manager examines when considering investments for the Fund’s portfolio. In light of this, the issuers in which the Fund invests may not be considered ESG-focused issuers and may have lower or adverse ESG assessments. Consideration of ESG factors may affect the Fund’s exposure to certain issuers or industries and may not work as intended. In addition, ESG considerations assessed as part of the Fund’s investment process may vary across types of eligible investments and issuers. In certain circumstances, there may be times when not every investment is assessed for ESG factors and, when they are, not every ESG factor may be identified or evaluated. The investment manager’s assessment of an issuer’s ESG factors is subjective and will likely differ from that of investors, third party service providers (e.g., ratings providers) and other funds. As a result, securities selected by the investment manager may not reflect the beliefs and values of any particular investor. The investment manager also may be dependent on the availability of timely, complete and accurate ESG data reported by issuers and/or third-party research providers, the timeliness, completeness and accuracy of which is out of the investment manager’s control. ESG factors are often not uniformly measured or defined, which could impact the investment manager’s ability to assess an issuer. While the investment manager views ESG considerations as having the potential to contribute to the Fund’s long-term performance, there is no guarantee that such results will be achieved.

Cybersecurity: Cybersecurity incidents, both intentional and unintentional, may allow an unauthorized party to gain access to Fund assets, Fund or customer data (including private shareholder information), or proprietary information, cause the Fund, the investment manager, and/or their service providers (including, but not limited to, Fund accountants, custodians, sub-custodians, transfer agents and financial intermediaries) to suffer data breaches, data corruption or loss of operational functionality or prevent Fund investors from purchasing, redeeming or exchanging shares or receiving distributions. The investment manager has limited ability to prevent or mitigate cybersecurity incidents affecting third party service providers, and such third party service providers may have limited indemnification obligations to the Fund or the investment manager. Cybersecurity incidents may result in financial losses to the Fund and its shareholders, and substantial costs may be incurred in an effort to prevent or mitigate future cybersecurity incidents. Issuers of securities in which the Fund invests are also subject to cybersecurity risks, and the value of these securities could decline if the issuers experience cybersecurity incidents.

Because technology is frequently changing, new ways to carry out cyber attacks are always developing. Therefore, there is a chance that some risks have not been identified or prepared for, or that an attack may not be detected, which puts

franklintempleton.com | Summary Prospectus | 9 |

TEMPLETON

CHINA WORLD FUND

SUMMARY PROSPECTUS

limitations on the Fund's ability to plan for or respond to a cyber attack. Like other funds and business enterprises, the Fund, the investment manager, and their service providers are subject to the risk of cyber incidents occurring from time to time.

Performance

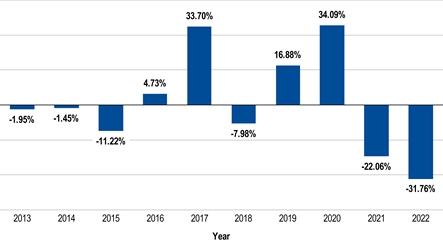

The following bar chart and table provide some indication of the risks of investing in the Fund. The bar chart shows changes in the Fund's performance from year to year for Class A shares. The table shows how the Fund's average annual returns for 1 year, 5 years, 10 years or since inception, as applicable, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. You can obtain updated performance information at franklintempleton.com or by calling (800) DIAL BEN/342-5236.

Sales charges are not reflected in the bar chart, and if those charges were included, returns would be less than those shown.

Class A Annual Total Returns

Best Quarter: | 2020, Q2 | 20.69% |

Worst Quarter: | 2022, Q3 | -27.35% |

As of September 30, 2023, the Fund’s year-to-date return was -15.28%. |

10 | Summary Prospectus | franklintempleton.com |

TEMPLETON

CHINA WORLD FUND

SUMMARY PROSPECTUS

Average Annual Total Returns

(figures reflect sales charges)

For periods ended December 31, 2022

|

| 1 Year |

| 5 Years |

| 10 Years |

| Since Inception |

| |

Templeton China World Fund - Class A |

|

|

|

|

|

|

|

|

| |

| Return before taxes |

| -35.51% |

| -6.23% |

| -1.38% |

| — |

|

| Return after taxes on distributions |

| -35.68% |

| -8.61% |

| -4.23% |

| — |

|

| Return after taxes on distributions and sale of Fund shares |

| -20.91% |

| -3.76% |

| -0.60% |

| — |

|

Templeton China World Fund - Class C |

| -32.92% |

| -5.87% |

| -1.54% |

| — |

| |

Templeton China World Fund - Class R6 |

| -31.47% |

| -4.77% |

| — |

| -0.19% | 1 | |

Templeton China World Fund - Advisor Class |

| -31.57% |

| -4.92% |

| -0.55% |

| — |

| |

MSCI China Index-NR (index reflects no deduction for fees, expenses or taxes but are net of dividend tax withholding) |

| -21.93% |

| -4.54% |

| 2.43% |

| — |

| |

|

|

|

|

|

|

|

|

|

|

|

1. | Since inception May 1, 2013. | |||||||||

The figures in the average annual total returns table above reflect the Class A shares maximum front-end sales charge of 5.50%. Prior to September 10, 2018, Class A shares were subject to a maximum front-end sales charge of 5.75%. If the prior maximum front-end sales charge of 5.75% was reflected, performance for Class A shares in the average annual total returns table would be lower.

The after-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown only for Class A and after-tax returns for other classes will vary.

Investment Manager

Templeton Asset Management Ltd. (Asset Management)

Portfolio Managers

Nicholas Chui, CFA

Portfolio Manager of Asset Management and portfolio manager of the Fund since May 2023.

Eric Mok, CFA

Portfolio Manager of Asset Management and portfolio manager of the Fund since 2020.

franklintempleton.com | Summary Prospectus | 11 |

TEMPLETON

CHINA WORLD FUND

SUMMARY PROSPECTUS

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the Fund on any business day online through our website at franklintempleton.com, by mail (Franklin Templeton Investor Services, P.O. Box 33030, St. Petersburg, FL 33733-8030) or by telephone at (800) 632-2301. For Class A and C, the minimum initial purchase for most accounts is $1,000 (or $25 under an automatic investment plan). Class R6 and Advisor Class are only available to certain qualified investors and the minimum initial investment will vary depending on the type of qualified investor, as described under "Your Account — Choosing a Share Class — Qualified Investors — Class R6" and "— Advisor Class" in the Fund's prospectus. There is no minimum investment for subsequent purchases.

Taxes

The Fund’s distributions are generally taxable to you as ordinary income, capital gains, or some combination of both, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account, in which case your distributions would generally be taxed when withdrawn from the tax-advantaged account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your financial advisor or visit your financial intermediary's website for more information.

12 | Summary Prospectus | franklintempleton.com |

TEMPLETON

CHINA WORLD FUND

SUMMARY PROSPECTUS

This page intentionally left blank

franklintempleton.com | Summary Prospectus | 13 |

TEMPLETON

CHINA WORLD FUND

SUMMARY PROSPECTUS

This page intentionally left blank

14 | Summary Prospectus | franklintempleton.com |

TEMPLETON

CHINA WORLD FUND

SUMMARY PROSPECTUS

This page intentionally left blank

franklintempleton.com | Summary Prospectus | 15 |

| |

Franklin Distributors, LLC One Franklin Parkway San Mateo, CA 94403-1906 franklintempleton.com Templeton China World Fund | |

Investment Company Act file #811-07876 © 2024 Franklin Templeton. All rights reserved.

| 188 PSUM 01/24 |

10% Total Recycled Fiber 00070472

10% Total Recycled Fiber 00070472