|

SUMMARY PROSPECTUS |

||

|

Templeton January 1, 2018 as amended June 1, 2018  |

||

|

||

| Class A | Class C | Class R6 | Advisor Class |

| TCWAX | TCWCX | FCWRX | TACWX |

Before you invest, you may want to review the Fund's prospectus, which contains more information about the Fund and its risks. You can find the Fund’s prospectus, statement of additional information and other information about the Fund online at www.franklintempleton.com/prospectus. You can also get this information at no cost by calling (800) DIAL BEN/342-5236 or by sending an e-mail request to prospectus@franklintempleton.com. The Fund's prospectus and statement of additional information, both dated January 1, 2018, as may be supplemented, are all incorporated by reference into this Summary Prospectus.

Investment Goal

Long-term capital appreciation.

Fees and Expenses of the Fund

These tables describe the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts in Class A if you and your family invest, or agree to invest in the future, at least $50,000 in Franklin Templeton funds.More information about these and other discounts is available from your financial professional and under “Your Account” on page 28 in the Fund’s Prospectus and under “Buying and Selling Shares” on page 46 of the Fund’s Statement of Additional Information. In addition, more information about sales charge discounts and waivers for purchases of shares through specific financial intermediaries is set forth in Appendix A - “Intermediary Sales Charge Discounts and Waivers” to the Fund’s prospectus.

Please note that the tables and examples below do not reflect any transaction fees that may be charged by financial intermediaries, or commissions that a shareholder may be required to pay directly to its financial intermediary when buying or selling Class R6 or Advisor Class shares.

Shareholder Fees (fees paid directly from your investment)

| Class A | Class C | Class R6 | Advisor Class | |

| Maximum Sales Charge (Load) Imposed on Purchases (as percentage of offering price) | 5.75% | None | None | None |

| Maximum Deferred Sales Charge (Load) (as percentage of the lower of original purchase price or sale proceeds) | None1 | 1.00% | None | None |

1. There is a 1% contingent deferred sales charge that applies to investments of $1 million or more (see "Investments of $1 Million or More" under "Choosing a Share Class") and purchases by certain retirement plans without an initial sales charge on shares sold within 18 months of purchase.

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| Class A | Class C | Class R6 | Advisor Class | |

| Management fees | 1.30% | 1.30% | 1.30% | 1.30% |

| Distribution and service (12b-1) fees | 0.25% | 1.00% | None | None |

| Other expenses1 | 0.36% | 0.36% | 0.16% | 0.36% |

| Total annual Fund operating expenses1 | 1.91% | 2.66% | 1.46% | 1.66% |

| Fee waiver and/or expense reimbursement2 | -0.06% | -0.06% | -0.06% | -0.06% |

| Total annual Fund operating expenses after fee waiver and/or expense reimbursement2 | 1.85% | 2.60% | 1.40% | 1.60% |

1. Other expenses of the Fund have been restated to exclude non-recurring prior period expenses and for Class R6 shares, to reflect current fiscal year expenses. If the non-recurring prior period expenses were included in the table above, the amounts stated would have been greater. Consequently, the total annual Fund operating expenses differ from the ratio of expenses to average net assets shown in the Financial Highlights.

2. The investment manager has contractually agreed to waive or assume certain expenses so that common expenses (excluding Rule 12b-1 fees and expenses and certain non-routine expenses) for each class of the Fund do not exceed 1.60% through May 31, 2019. Contractual fee waiver and/or expense reimbursement agreements may not be changed or terminated during the time period set forth above.

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of the period. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. The Example reflects adjustments made to the Fund's operating expenses due to the fee waivers and/or expense reimbursements by management for the 1 Year numbers only. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Class A | $ 752 | $ 1,135 | $ 1,542 | $ 2,675 |

| Class C | $ 363 | $ 821 | $ 1,405 | $ 2,989 |

| Class R6 | $ 143 | $ 456 | $ 792 | $ 1,741 |

| Advisor Class | $ 163 | $ 518 | $ 897 | $ 1,960 |

| If you do not sell your shares: | ||||

| Class C | $ 263 | $ 821 | $ 1,405 | $ 2,989 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 7.92% of the average value of its portfolio.

Principal Investment Strategies

Under normal market conditions, the Fund invests at least 80% of its net assets in securities of "China companies." The Fund invests primarily in the equity securities of China companies, which are those:

- that are organized under the laws of, or with a principal office in, the People's Republic of China (China), Hong Kong or Taiwan; or

- for which the principal trading market is in China, Hong Kong or Taiwan; or

- that derive at least 50% of their revenues from goods or services sold or produced, or have at least 50% of their assets, in China.

The equity securities in which the Fund invests are primarily common stock. The Fund also invests in American, Global and European Depositary Receipts. China companies may be any size across the entire market capitalization spectrum. In addition to the Fund's main investments, the Fund may invest up to 20% of its net assets in securities that do not qualify as China company securities, but whose issuers, in the judgment of the investment manager, are expected to benefit from developments in the economy of China, Hong Kong or Taiwan. The Fund is a "non-diversified" fund, which means it generally invests a greater proportion of its assets in the securities of one or more issuers and invests overall in a smaller number of issuers than a diversified fund.

When choosing equity investments for the Fund, the investment manager applies a fundamental research, value-oriented, long-term approach, focusing on the market price of a company’s securities relative to the investment manager’s evaluation of the company’s long-term earnings, asset value and cash flow potential. The investment manager also considers a company’s profit and loss outlook, balance sheet strength, cash flow trends and asset value in relation to the current price of the company's securities.

Principal Risks

You could lose money by investing in the Fund. Mutual fund shares are not deposits or obligations of, or guaranteed or endorsed by, any bank, and are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other agency of the U.S. government.

Foreign Securities Investing in foreign securities typically involves more risks than investing in U.S. securities, and includes risks associated with: (i) internal and external political and economic developments – e.g., the political, economic and social policies and structures of some foreign countries may be less stable and more volatile than those in the U.S. or some foreign countries may be subject to trading restrictions or economic sanctions; (ii) trading practices – e.g., government supervision and regulation of foreign securities and currency markets, trading systems and brokers may be less than in the U.S.; (iii) availability of information – e.g., foreign issuers may not be subject to the same disclosure, accounting and financial reporting standards and practices as U.S. issuers; (iv) limited markets – e.g., the securities of certain foreign issuers may be less liquid (harder to sell) and more volatile; and (v) currency exchange rate fluctuations and policies. The risks of foreign investments may be greater in developing or emerging market countries.

There are special risks associated with investments in China, Hong Kong and Taiwan, including exposure to currency fluctuations, less liquidity, expropriation, confiscatory taxation, nationalization and exchange control regulations (including currency blockage). Inflation and rapid fluctuations in inflation and interest rates have had, and may continue to have, negative effects on the economy and securities markets of China, Hong Kong and Taiwan. In addition, investments in Taiwan could be adversely affected by its political and economic relationship with China. China, Hong Kong and Taiwan are deemed by the investment manager to be emerging markets countries, which means an investment in these countries has more heightened risks than general foreign investing due to a lack of established legal, political, business and social frameworks in these countries to support securities markets as well as the possibility for more widespread corruption and fraud.

Region Focus Because the Fund invests its assets primarily in companies in a specific region, the Fund is subject to greater risks of adverse developments in that region and/or the surrounding regions than a fund that is more broadly diversified geographically. Political, social or economic disruptions in the region, even in countries in which the Fund is not invested, may adversely affect the value of investments held by the Fund.

Developing Markets The Fund’s investments in securities of issuers in developing market countries are subject to all of the risks of foreign investing generally, and have additional heightened risks due to a lack of established legal, political, business and social frameworks to support securities markets, including: delays in settling portfolio securities transactions; currency and capital controls; greater sensitivity to interest rate changes; pervasiveness of corruption and crime; currency exchange rate volatility; and inflation, deflation or currency devaluation.

Market The market values of securities or other investments owned by the Fund will go up or down, sometimes rapidly or unpredictably. The market value of a security or other investment may be reduced by market activity or other results of supply and demand unrelated to the issuer. This is a basic risk associated with all investments. When there are more sellers than buyers, prices tend to fall. Likewise, when there are more buyers than sellers, prices tend to rise.

Stock prices tend to go up and down more dramatically than those of debt securities. A slower-growth or recessionary economic environment could have an adverse effect on the prices of the various stocks held by the Fund.

Smaller and Midsize Companies Securities issued by smaller and midsize companies may be more volatile in price than those of larger companies, involve substantial risks and should be considered speculative. Such risks may include greater sensitivity to economic conditions, less certain growth prospects, lack of depth of management and funds for growth and development, and limited or less developed product lines and markets. In addition, smaller and midsize companies may be particularly affected by interest rate increases, as they may find it more difficult to borrow money to continue or expand operations, or may have difficulty in repaying any loans.

Non-Diversification Because the Fund is non-diversified, it may be more sensitive to economic, business, political or other changes affecting individual issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s shares and greater risk of loss.

Value Style Investing A value stock may not increase in price as anticipated by the investment manager if other investors fail to recognize the company's value and bid up the price, the markets favor faster-growing companies, or the factors that the investment manager believes will increase the price of the security do not occur or do not have the anticipated effect.

Management The Fund is subject to management risk because it is an actively managed investment portfolio. The Fund's investment manager applies investment techniques and risk analyses in making investment decisions for the Fund, but there can be no guarantee that these decisions will produce the desired results.

Performance

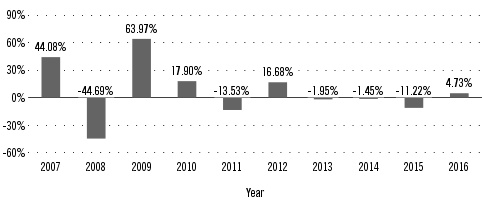

The following bar chart and table provide some indication of the risks of investing in the Fund. The bar chart shows changes in the Fund's performance from year to year for Class A shares. The table shows how the Fund's average annual returns for 1 year, 5 years, 10 years or since inception, as applicable, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. You can obtain updated performance information at franklintempleton.com or by calling (800) DIAL BEN/342-5236.

Sales charges are not reflected in the bar chart, and if those charges were included, returns would be less than those shown.

Class A Annual Total Returns

| Best Quarter: | Q2'09 | 32.45% |

| Worst Quarter: | Q3'15 | -21.80% |

| As of September 30, 2017, the Fund's year-to-date return was 30.29%. | ||

Average Annual Total Returns

(figures reflect sales charges)

For the periods ended December 31, 2016

| 1 Year | 5 Years | 10 Years | |

| Templeton China World Fund - Class A | |||

| Return Before Taxes | -1.29% | -0.24% | 2.79% |

| Return After Taxes on Distributions | -4.29% | -3.03% | 0.97% |

| Return After Taxes on Distributions and Sale of Fund Shares | 1.92% | -0.08% | 2.31% |

| Templeton China World Fund - Class C | 3.01% | 0.23% | 2.67% |

| Templeton China World Fund - Class R6 | 5.25% | -1.86%1 | — |

| Templeton China World Fund - Advisor Class | 4.98% | 1.24% | 3.70% |

| MSCI Golden Dragon Index (index reflects no deduction for fees, expenses or taxes) | 5.75% | 6.90% | 4.22% |

1. Since inception May 1, 2013.

The after-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown only for Class A and after-tax returns for other classes will vary.

Investment Manager

Templeton Asset Management Ltd. (Asset Management)

Portfolio Manager

Eddie Chow, CFA Investment Analyst of Asset Management and portfolio manager of the Fund since 2002.

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the Fund on any business day online through our website at franklintempleton.com, by mail (Franklin Templeton Investor Services, P.O. Box 33030, St. Petersburg, FL 33733-8030), or by telephone at (800) 632-2301. For Class A and C, the minimum initial purchase for most accounts is $1,000 (or $25 under an automatic investment plan). Class R6 and Advisor Class are only available to certain qualified investors and the minimum initial investment will vary depending on the type of qualified investor, as described under "Your Account — Choosing a Share Class — Qualified Investors — Class R6" and "— Advisor Class" in the Fund's prospectus. There is no minimum investment for subsequent purchases.

Taxes

The Fund’s distributions are generally taxable to you as ordinary income, capital gains, or some combination of both, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account, in which case your distributions would generally be taxed when withdrawn from the tax-deferred account.

Payments to Broker-Dealers and

Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your financial advisor or visit your financial intermediary's website for more information.

|

Franklin Templeton Distributors, Inc. Templeton |

|

Investment Company Act file #811-07876 |

|

|

© 2018 Franklin Templeton Investments. All rights reserved. |

|

|

188 PSUM 06/18 |

00070472 |