File Nos. 333-104602 and 811-07876

As filed with the Securities and Exchange Commission on April 29, 2013

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-1A

|

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |

|

[ ] |

|

Pre-Effective Amendment No. |

|

|

|

|

|

|

|

Post-Effective Amendment No. 13

and/or |

|

[X] |

|

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 |

|

[ ] |

|

Amendment No. 17 |

|

[X] |

|

Templeton China World Fund |

|

(Exact Name of Registrant as Specified in Charter) |

|

|

|

300 S.E. 2nd Street, Fort Lauderdale, Florida 33301-1923 |

|

(Address of Principal Executive Offices) (Zip Code) |

|

|

|

(954) 527-7500 (Registrant's Telephone Number, Including Area Code) |

|

|

|

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906 |

|

(Name and Address of Agent for Service of Process) |

It is proposed that this filing will become effective (check appropriate box)

|

[ ] |

immediately upon filing pursuant to paragraph (b) |

|

|

|

|

[X] |

on May 1, 2013 pursuant to paragraph (b) |

|

|

|

|

[ ] |

60 days after filing pursuant to paragraph (a)(i) |

|

|

|

|

[ ] |

on (date) pursuant to paragraph (a)(i) |

|

|

|

|

[ ] |

75 days after filing pursuant to paragraph (a)(ii) |

|

|

|

|

[ ] |

on (date) pursuant to paragraph (a)(ii) of rule 485 |

If appropriate, check the following box:

|

[ ] |

This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

EXPLANATORY NOTE

This Amendment No. 13 (Amendment) to the Registration Statement of Templeton China World Fund (Registrant) on Form N-1A (File No. 811-07876) is being filed under the Securities Act of 1933, as amended (1933 Act), to amend and supplement Amendment No. 11 to the Registrant’s Registration Statement on Form N-1A filed with the U.S. Securities and Exchange Commission (Commission) on December 27, 2012 under the 1940 Act (Accession No. 0001379491-12-001030) (Amendment No. 15), as pertaining to the Parts A and Parts B of the Templeton China World Fund, series of the Registrant (Fund). The Parts A and the Parts B of the Fund, as filed in Amendment No.11, are incorporated herein by reference.

188 P-1 05/13

SUPPLEMENT DATED MAY 1, 2013

TO THE PROSPECTUS DATED JANUARY 1, 2013

OF

TEMPLETON CHINA WORLD FUND

The prospectus is amended as follows:

I. The Fund will begin offering Class R6 shares on or about May 1, 2013. Therefore, on or about May 1, 2013, the Fund will offer four classes of shares, Class A, Class C, Class R6 and Advisor Class.

II. The “Fund Summary – “Shareholder Fees” table, “Annual Fund Operating Expenses” table and “Example” table beginning on page 2 are replaced with the following:

SHAREHOLDER FEES (fees paid directly from your investment)

|

|

Class A |

Class C |

Class R61 |

Advisor |

|

Maximum Sales Charge (Load) Imposed on Purchases (as percentage of offering price) |

5.75% |

None |

None |

None |

|

Maximum Deferred Sales Charge (Load) (as percentage of the lower of original purchase price or sale proceeds) |

None |

1.00% |

None |

None |

1. The Fund began offering Class R6 shares on May 1, 2013.

|

ANNUAL FUND OPERATING EXPENSES |

(expenses that you pay each year as a percentage of the value of your investment) |

|||||

|

|

Class A |

Class C |

Class R6 |

Advisor |

|

|

|

Management fees |

1.10% |

1.10% |

1.10% |

1.10% |

|

|

|

Distribution and service (12b-1) fees |

0.30% |

0.99% |

None |

None |

|

|

|

Other expenses1 |

0.47% |

0.47% |

0.31% |

0.47% |

|

|

|

Total annual Fund operating expenses |

1.87% |

2.56% |

1.41% |

1.57% |

|

|

1. Other expenses for Class R6 represent an estimate of expenses, including the effect of this Class' lower shareholder servicing fees.

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of the period. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

1 Year |

3 Years |

5 Years |

10 Years |

|

Class A |

$ 754 |

$ 1,129 |

$ 1,528 |

$ 2,639 |

|

Class C |

$ 359 |

$ 796 |

$ 1,360 |

$ 2,895 |

|

Class R6 |

$ 143 |

$ 445 |

$ 769 |

$ 1,687 |

|

Advisor Class |

$ 160 |

$ 496 |

$ 855 |

$ 1,867 |

1

|

If you do not sell your shares: |

|

|

|

|

|

Class C |

$ 259 |

$ 796 |

$ 1,360 |

$ 2,895 |

III. The “Fund Summary – Principal Risks – Market” section on page 5 is replaced with the following:

Market The market values of securities owned by the Fund will go up or down, sometimes rapidly or unpredictably. A security’s market value may be reduced by market activity or other results of supply and demand unrelated to the issuer. This is a basic risk associated with all securities. When there are more sellers than buyers, prices tend to fall. Likewise, when there are more buyers than sellers, prices tend to rise.

Stock prices tend to go up and down more dramatically than those of debt securities. A slower-growth or recessionary economic environment could have an adverse effect on the prices of the various stocks held by the Fund.

IV. The “Fund Summary – Performance” section beginning on page 6 is revised with the following:

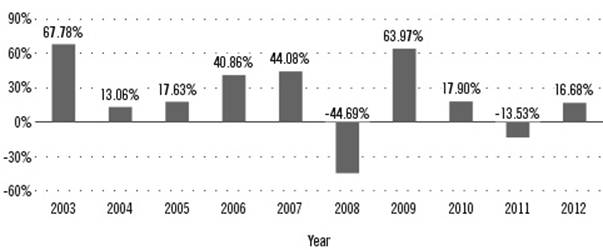

The following bar chart and table provide some indication of the risks of investing in the Fund. The bar chart shows changes in the Fund's performance from year to year for Class A shares. The table shows how the Fund's average annual returns for 1 year, 5 years, 10 years or since inception, as applicable, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. You can obtain updated performance information at franklintempleton.com or by calling (800) DIAL BEN/342-5236.

Sales charges are not reflected in the bar chart, and if those charges were included, returns would be less than those shown.

CLASS A ANNUAL TOTAL RETURNS

|

Best Quarter: |

Q2'09 |

32.45% |

|

Worst Quarter: |

Q3'11 |

-21.23% |

|

As of March 31, 2013, the Fund's year-to-date return was -2.14%. |

||

2

|

AVERAGE ANNUAL TOTAL RETURNS |

|||

|

|

1 Year |

5 Years |

10 Years |

|

Templeton China World Fund - Class A |

|

|

|

|

Return Before Taxes |

9.98% |

0.34% |

16.50% |

|

Return After Taxes on Distributions |

9.68% |

-0.26% |

15.86% |

|

Return After Taxes on Distributions and Sale of Fund Shares |

7.00% |

0.11% |

14.78% |

|

Templeton China World Fund - Class C |

14.87% |

0.82% |

16.41% |

|

Templeton China World Fund - Advisor Class |

17.04% |

1.83% |

17.58% |

|

MSCI Golden Dragon Index (index reflects no deduction for fees, expenses or taxes) |

22.65% |

-0.76% |

13.25% |

Performance information for Class R6 shares is not shown because it had not commenced operations as of the date of this prospectus.

Historical performance for the Fund prior to its conversion from a closed-end fund to an open-end fund in 2003 is based on the performance of the Fund's predecessor closed-end fund. The Fund's performance has been adjusted to reflect differences in all charges, fees and expenses between the Fund and the predecessor closed-end fund.

The after-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown only for Class A and after-tax returns for other classes will vary.

V. The “Fund Summary – Taxes” section on page 8 is replaced with the following:

The Fund’s distributions are generally taxable to you as ordinary income, capital gains, or some combination of both, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account, in which case your distributions would generally be taxed when withdrawn from the tax-deferred account.

VI. The “Fund Details – Management – Special Servicing Agreement” on page 19 is deleted it its entirety.

VII. The first paragraph and the table of the “Fund Details – Your Account – Choosing a Share Class” section beginning on page 27 is replaced with the following:

Each class has its own sales charge and expense structure, allowing you to choose the class that best meets your situation. Your investment representative (financial advisor) can help you decide. Investors may purchase Class C shares only for Fund accounts on which they have appointed an investment representative (financial advisor) of record. Investors who have not appointed an investment representative (financial advisor) to existing Class C share Fund accounts may not make additional purchases to those accounts but may exchange their shares for shares of a Franklin Templeton fund that offers Class C shares. Dividend and capital gain distributions may continue to be reinvested in existing Class C share Fund accounts. These provisions do not apply to Employer Sponsored Retirement Plans.

|

Class A |

Class C |

Class R6 |

Advisor Class |

|

Initial sales charge of 5.75% or less |

No initial sales charge |

See "Qualified Investors – Class R6" below |

See "Qualified Investors – Advisor Class |

|

Deferred sales charge of 1% on purchases of $1 million or more sold within 18 months |

Deferred sales charge of 1% on shares you sell within 12 months |

|

|

|

Lower annual expenses than Class C due to lower distribution fees |

Higher annual expenses than Class A due to higher distribution fees |

|

|

3

The Fund began offering Class R6 shares on May 1, 2013.

VIII. The “Fund Details – Your Account - Choosing a Share Class – Sales Charge Waivers” section, the first bullet under “Waivers for investments from certain payments” on page 31 is replaced with the following:

· Dividend and capital gain distributions from any Franklin Templeton fund. The distributions generally must be reinvested in the same share class. Certain exceptions apply, however, to Class R6, Advisor Class or Class Z shareholders of a Franklin Templeton fund who may reinvest their distributions in the Fund's Class A shares.

IX. The following is added to the “Fund Details – Your Account - Choosing a Share Class” beginning on page 27:

Qualified Investors - Class R6

Class R6 shares are available to the following investors:

· Employer Sponsored Retirement Plans where plan level or omnibus accounts are held on the books of Franklin Templeton Investor Services.

· Other Franklin Templeton funds.

X. The following is added to the “Fund Details – Your Account – Exchanging Shares” section beginning on page 48:

Class R6

You can exchange your Class R6 shares for Class R6 shares of other Franklin Templeton funds. You also may exchange your Class R6 shares for Advisor Class shares of a fund that does not currently offer Class R6 shares.

XI. The second paragraph under the “Fund Details – Your Account – Account Policies – Dealer Compensation – Other dealer and financial intermediary compensation” section on page 61 is replaced with the following:

Except with respect to Class R6 shares, Distributors and/or its affiliates may also make payments (a portion of which may be reimbursable under the terms of the Fund's Rule 12b-1 distribution plans) to certain financial intermediaries in connection with their activities that are intended to assist in the sale of shares of the Franklin Templeton mutual funds, directly or indirectly, to certain Employer Sponsored Retirement Plans. In the case of any one financial intermediary, such payments will not exceed 0.10% of the total assets of Franklin Templeton mutual funds held, directly or indirectly, by such Employer Sponsored Retirement Plans, on an annual basis.

Please keep this supplement for future reference.

188 SA-1 05/13

SUPPLEMENT DATED

MAY 1, 2013

TO THE STATEMENT OF ADDITIONAL INFORMATION

DATED JANUARY 1, 2013

OF

TEMPLETON

CHINA WORLD FUND

The statement of additional information is amended as follows:

I. The Fund will begin offering Class R6 shares on or about May 1, 2013. Therefore, on or about May 1, 2013, the Fund will offer four classes of shares, Class A, Class C, Class R6 and Advisor Class.

II. The third paragraph under “Shareholder servicing and transfer agent” on page 31 is replaced with the following:

For all classes of shares of the Fund, except for Class R6 shares, Investor Services may also pay servicing fees, that will be reimbursed by the Fund, in varying amounts to certain financial institutions (primarily to help offset their costs associated with client account maintenance support, statement preparation and transaction processing) that (i) maintain omnibus accounts with the Fund in the institution's name on behalf of numerous beneficial owners of Fund shares who are either direct clients of the institution or are participants in an IRS-recognized tax-deferred savings plan (including Employer Sponsored Retirement Plans and Section 529 Plans) for which the institution, or its affiliate, provides participant level recordkeeping services (called "Beneficial Owners"); or (ii) provide support for Fund shareholder accounts by sharing account data with Investor Services through the National Securities Clearing Corporation (NSCC) networking system. In addition to servicing fees received from the Fund, these financial institutions also may charge a fee for their services directly to their clients. Investor Services will also receive a fee from the Fund (other than for Class R6 shares) for services provided in support of Beneficial Owners and NSCC networking system accounts.

III. The second paragraph under “Organization, Voting Rights and Principal Holders” beginning on page 42 is replaced with the following:

The Fund currently offers four classes of shares, Class A, Class C, Class R6 and Advisor Class. The Fund may offer additional classes of shares in the future. The full title of each class is:

- Templeton China World Fund - Class A

- Templeton China World Fund - Class C

- Templeton China World Fund - Class R6

- Templeton China World Fund - Advisor Class

IV. The sixth and seventh paragraphs under “Organization, Voting Rights and Principal Holders” beginning on page 42 is replaced with the following:

As of April 1, 2013, the principal shareholders of the Fund, beneficial or of record, were:

|

|

|

|

|

Percentage |

|

Name and Address |

|

Share Class |

|

(%) |

|

Franklin Templeton Growth Allocation Fund Franklin Templeton Fund Allocator Series 3344 Quality Drive Rancho Cordova, CA 95670-7313

|

|

Advisor |

|

5.72 |

|

Franklin Templeton Moderate Allocation Fund Franklin Templeton Fund Allocator Series 3344 Quality Drive Rancho Cordova, CA 95670-7313

|

|

Advisor |

|

8.55 |

|

Comerica Bank FBO Charles Stewart Mott Foundation Trust P.O. Box 7500M C 3446 Detroit, MI 48275-0001 |

|

Advisor |

|

6.93 |

From time to time, the number of Fund shares held in the “street name” accounts of various securities dealers for the benefit of their clients or in centralized securities depositories may exceed 5% of the total shares outstanding.

V. The eighth paragraph under “Organization, Voting Rights and Principal Holders” beginning on page 42 is replaced with the following:

As of April 1, 2013, the officers and board members, as a group, owned of record and beneficially less than 1% of the outstanding shares of each class of the Fund. The board members may own shares in other funds in Franklin Templeton Investments.

VI. The first paragraph of the “Buying and Selling Shares – Initial sales charges” section beginning on page 44 is replaced with the following:

The maximum initial sales charge is 5.75% for Class A. There is no initial sales charge for Class C, Class R6 and Advisor Class.

VII. The second paragraph under the section entitled “The Underwriter,” beginning on page 49 is replaced with the following:

Distributors does not receive compensation from the Fund for acting as underwriter of the Fund's Class R6 and Advisor Class shares.

Please keep this supplement for future reference.

Templeton China World Fund

File Nos. 333-104602 and 811-07876

PART C

Other Information

Item 28. Exhibits

The following exhibits are incorporated by reference to the previously filed documents indicated below, except as noted:

(a) Agreement and Declaration of Trust

|

(i) |

Amended and Restated Agreement and Declaration of Trust dated October 18, 20065

|

|

(ii) |

Certificate of Trust dated December 3, 20021

|

|

(iii) |

Certificate of Amendment of Agreement and Declaration of Trust dated October 21, 20086 |

(b) By-laws

|

(i) |

Amended and Restated By-Laws dated October 18, 20065 |

(c) Instruments Defining Rights of Security Holders

|

(i) |

Amended and Restated Agreement and Declaration of Trust |

|

|

(a) Article III, Shares (b) Article V, Shareholders’ Voting Powers and Meetings (c) Article VI, Net Asset Value, Distributions, Redemptions and Transfers (d) Article VIII, Certain Transactions – Section 4 (e) Article X, Miscellaneous – Section 4

|

|

|

|

|

(ii) |

Amended and Restated By-Laws |

|

|

(a) Article II, Meetings of Shareholders (b) Article VI, Records and Reports – Section 1, 2 and 3 (c) Article VII, General Matters: - Sections 3, 4, 6 and 7 (d) Article VIII, Amendment – Section 1 |

|

|

|

|

(iii) |

Part B: Statement of Additional Information – Item 22 |

(d) Investment Advisory Contracts

|

(i) |

Investment Management Agreement between Registrant and Templeton Asset Management Ltd. dated December 3, 20023

|

|

(ii) |

Amendment to the Investment Management Agreement dated May 1, 20119 |

(e) Underwriting Contracts

|

(i) |

Distribution Agreement between Registrant and Franklin/Templeton Distributors, Inc. dated January 1, 20119

|

|

(ii) |

Form of Selling Agreements between Registrant, Franklin/Templeton Distributors, Inc. and Securities Dealers dated May 1, 20108 |

(f) Bonus or Profit Sharing Contracts

Not Applicable

(g) Custodian Agreements

|

(i) |

Custody Agreement dated September 7, 19931

|

|

(ii) |

Amendment dated March 2, 1998 to the Custody Agreement1

|

|

(iii) |

Amendment No. 2 dated July 23, 1998 to the Custody Agreement1

|

|

(iv) |

Amendment No. 3 dated May 1, 2001 to the Custody Agreement1

|

|

(v) |

Assignment and Assumption Agreement dated August 8, 2003 to the Custody Agreement4 |

(h) Other Material Contracts

|

(i) |

Amended and Restated Transfer Agent and Shareholder Services Agreement between Registrant and Franklin Templeton Investor Services, LLC dated January 1, 20119

|

|

(ii) |

Amended and Restated Fund Administration Agreement between Registrant and Franklin Templeton Services, LLC dated May 22, 201210

|

(i) Legal Opinion

|

(i) |

Opinion and Consent of Counsel2 |

(j) Other Opinion

|

|

Not Applicable

|

(k) Omitted Financial Statements

Not Applicable

(l) Initial Capital Agreements

Not Applicable

(m) Rule 12b-1 Plan

|

(i) |

Amended and Restated Distribution Plan - Class A Shares dated February 24, 20097

|

|

(ii) |

Amended and Restated Distribution Plan - Class C Shares dated July 15, 20097

|

|

(iii) |

Amended and Restated Distribution Plan - Class B Shares dated July 15, 20097 |

(n) Rule 18f-3 Plan

|

(i) |

Amended and Restated Multiple Class Plan dated December 6, 2012, effective May 1, 2013 |

(p) Code of Ethics

|

(i) |

Code of Ethics dated April 1, 201210 |

(q) Power of Attorney

|

(i) |

Power of Attorney dated December 7, 201210 |

1. Previously filed with Initial Form N-1A on April 17, 2003.

2. Previously filed with Pre-Effective Amendment No. 1 to the Form N-1A on July 22, 2003.

3. Previously filed with Post-Effective Amendment No. 1 to the Form N-1A on December 30, 2003.

4. Previously filed with Post-Effective Amendment No. 2 to the Form N-1A on December 2, 2004.

5. Previously filed with Post-Effective Amendment No. 5 to the Form N-1A on December 28, 2007.

6. Previously filed with Post-Effective Amendment No. 6 to the Form N-1A on December 29, 2008.

7. Previously filed with Post-Effective Amendment No. 7 to the Form N-1A on December 28, 2009.

8. Previously filed with Post-Effective Amendment No. 8 to the Form N-1A on October 29, 2011.

9. Previously filed with Post-Effective Amendment No. 9 to the Form N-1A on December 28, 2011.

10. Previously filed with Post-Effective Amendment No. 11 to the Form N-1A on December 27, 2012.

Item 29. Persons Controlled by or Under Common Control with Registrant

None

Item 30. Indemnification.

The Amended and Restated Agreement and Declaration of Trust (the “Declaration”) provides that any person who is or was a Trustee, officer, employee or other agent, including the underwriter, of such Trust shall be liable to the Trust and its shareholders only for (1) any act or omission that constitutes a bad faith violation of the implied contractual covenant of good faith and fair dealing, or (2) the person’s own willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of such person (such conduct referred to herein as Disqualifying Conduct) and for nothing else. Except in these instances and to the fullest extent that limitations of liability of agents are permitted by the Delaware Statutory Trust Act (the “Delaware Act”), these Agents (as defined in the Declaration) shall not be responsible or liable for any act or omission of any other Agent of the Trust or any investment adviser or principal underwriter. Moreover, except and to the extent provided in these instances, none of these Agents, when acting in their respective capacity as such, shall be personally liable to any other person, other than such Trust or its shareholders, for any act, omission or obligation of the Trust or any trustee thereof.

The Trust shall indemnify, out of its property, to the fullest extent permitted under applicable law, any of the persons who was or is a party, or is threatened to be made a party to any Proceeding (as defined in the Declaration) because the person is or was an Agent of such Trust. These persons shall be indemnified against any Expenses (as defined in the Declaration), judgments, fines, settlements and other amounts actually and reasonably incurred in connection with the Proceeding if the person acted in good faith or, in the case of a criminal proceeding, had no reasonable cause to believe that the conduct was unlawful. The termination of any Proceeding by judgment, order, settlement, conviction or plea of nolo contendere or its equivalent shall not in itself create a presumption that the person did not act in good faith or that the person had reasonable cause to believe that the person’s conduct was unlawful. There shall nonetheless be no indemnification for a person’s own Disqualifying Conduct.

Insofar as indemnification for liabilities arising under the Securities Act of 1933, as amended, may be permitted to Trustees, officers and controlling persons of the Trust pursuant to the foregoing provisions, or otherwise, the Trust has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Trust of expenses incurred or paid by a Trustee, officer or controlling person of the Trust in the successful defense of any action, suit or proceeding) is asserted by such Trustee, officer or controlling person in connection with securities being registered, the Trust may be required, unless in the opinion of its counsel the matter has been settled by controlling precedent, to submit to a court or appropriate jurisdiction the question whether such indemnification is against public policy as expressed in the Act and will be governed by the final adjudication of such issue.

Item 31. Business and Other Connections of the Investment Adviser

The officers and directors of Templeton Asset Management Ltd. (TAML) the Registrant’s investment manager, also serve as officers and/or directors/trustees for (1) TAML’s corporate parent, Franklin Resources, Inc., and/or (2) other investment companies in Franklin Templeton Investments.

For additional information please see Part B and Schedules A and D of Form ADV of TAML (SEC File 801-46997), incorporated herein by reference, which sets forth the officers and directors of TAML and information as to any business, profession, vocation or employment of a substantial nature engaged in by those officers and directors during the past two years.

Item 32. Principal Underwriter

|

(a) |

Franklin/Templeton Distributors, Inc., (Distributors) also acts as principal underwriter of shares of:

|

|

|

Franklin California Tax Free Income Fund |

|

|

Franklin California Tax Free Trust |

|

|

Franklin Custodian Funds |

|

|

Franklin Federal Tax-Free Income Fund |

|

|

Franklin Global Trust |

|

|

Franklin Gold and Precious Metals Fund |

|

|

Franklin High Income Trust |

|

|

Franklin Investors Securities Trust |

|

|

Franklin Managed Trust |

|

|

Franklin Money Fund |

|

|

Franklin Municipal Securities Trust |

|

|

Franklin Mutual Recovery Fund |

|

|

Franklin Mutual Series Funds |

|

|

Franklin New York Tax-Free Income Fund |

|

|

Franklin New York Tax-Free Trust |

|

|

Franklin Real Estate Securities Trust |

|

|

Franklin Strategic Mortgage Portfolio |

|

|

Franklin Strategic Series |

|

|

Franklin Tax-Exempt Money Fund |

|

|

Franklin Tax-Free Trust |

|

|

Franklin Templeton Fund Allocator Series |

|

|

Franklin Templeton Global Trust |

|

|

Franklin Templeton International Trust |

|

|

Franklin Templeton Money Fund Trust |

|

|

Franklin Templeton Variable Insurance Products Trust |

|

|

Franklin Value Investors Trust |

|

|

Institutional Fiduciary Trust |

|

|

|

|

|

Templeton Developing Markets Trust |

|

|

Templeton Funds |

|

|

Templeton Global Investment Trust |

|

|

Templeton Global Opportunities Trust |

|

|

Templeton Global Smaller Companies Fund |

|

|

Templeton Growth Fund, Inc. |

|

|

Templeton Income Trust |

|

|

Templeton Institutional Funds |

|

|

|

|

(b) |

The information required with respect to each director and officer of Distributors is incorporated by reference to Part B of this Form N-1A and Schedule A of Form BD filed by Distributors with the Securities and Exchange Commission pursuant to the Securities Act of 1934 (SEC File No. 008-05889) |

|

(c) |

Not Applicable. Registrant’s principal underwriter is an affiliated person of an affiliated person of the Registrant. |

Item 33. Location of Accounts and Records

Certain accounts, books, and other documents required to be maintained by Registrant pursuant to Section 31(a) of the Investment Company Act of 1940 and rules thereunder are located at 300 S.E. 2nd Street, Fort Lauderdale, Florida 3330194. Other records are maintained at the offices of Franklin Templeton Investor Services, LLC, 100 Fountain Parkway, St. Petersburg, Florida 33716-1205 and 3344 Quality Drive, Rancho Cordova, California 95670-7313.

Item 34. Management Services

There are no management-related service contracts not discussed in Part A or Part B.

Item 35. Undertakings

Not Applicable

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, and the Investment Company Act of 1940, as amended, the Registrant certifies that it meets all of the requirements for effectiveness of this Registration Statement pursuant to Rule 485(b) under the Securities Act of 1933, as amended, and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized in the City of Fort Lauderdale and the State of Florida, on the 26th day of April, 2013.

TEMPLETON CHINA WORLD FUND

(REGISTRANT)

By: /s/LORI A. WEBER_____________

Lori A. Weber,

Vice President and Secretary

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed below by the following persons in the capacities and on the date indicated:

|

Signature |

|

Title |

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

MARK MOBIUS* |

|

President and Chief |

|

|

|

Mark Mobius |

|

Executive Officer – Investment Management |

|

April 26, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAURA F. FERGERSON* |

|

|

|

|

|

Laura F. Fergerson |

|

Chief Executive Officer – Finance and Administration |

|

April 26, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MARK H. OTANI* |

|

|

|

|

|

Mark H. Otani |

|

Chief Financial Officer and Chief Accounting Officer |

|

April 26, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HARRIS J. ASHTON* |

|

|

|

|

|

Harris J. Ashton |

|

Trustee |

|

April 26, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

ANN TORRE BATES* |

|

|

|

|

|

Ann Torre Bates |

|

Trustee |

|

April 26, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

FRANK J. CROTHERS* |

|

|

|

|

|

Frank J. Crothers |

|

Trustee |

|

April 26, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

EDITH E. HOLIDAY* |

|

|

|

|

|

Edith E. Holiday |

|

Trustee |

|

April 26, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

CHARLES B. JOHNSON* |

|

|

|

|

|

Charles B. Johnson |

|

Trustee |

|

April 26, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

GREGORY E. JOHNSON* |

|

|

|

|

|

Gregory E. Johnson |

|

Trustee |

|

April 26, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

J. MICHAEL LUTTIG* |

|

|

|

|

|

J. Michael Luttig |

|

Trustee |

|

April 26, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

DAVID W. NIEMIEC* |

|

|

|

|

|

David W. Niemiec |

|

Trustee |

|

April 26, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

FRANK A. OLSON* |

|

|

|

|

|

Frank A. Olson |

|

Trustee |

|

April 26, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

LARRY D. THOMPSON* |

|

|

|

|

|

Larry D. Thompson |

|

Trustee |

|

April 26, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

CONSTANTINE D. TSERETOPOULOS* |

|

|

|

|

|

Constantine D. Tseretopoulos |

|

Trustee |

|

April 26, 2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

ROBERT E. WADE* |

|

|

|

|

|

Robert E. Wade |

|

Trustee |

|

April 26, 2013 |

* By: /s/LORI A. WEBER_____________

Lori A. Weber

Attorney-in-Fact

(Pursuant to Power of Attorney previously filed)

TEMPLETON CHINA WORLD FUND

REGISTRATION STATEMENT

|

EXHIBIT NO. |

DESCRIPTION |

LOCATION |

|

EX-99 (a)(i) |

Amended and Restated Agreement and Declaration of Trust dated October 18, 2006

|

* |

|

EX-99 (a)(ii) |

Certificate of Trust dated December 3, 2002

|

* |

|

EX-99 (a)(iii) |

Certificate of Amendment of Agreement and Declaration of Trust dated October 21, 2008

|

* |

|

EX-99 (b)(i) |

Amended and Restated By-Laws dated October 18, 2006

|

* |

|

EX-99 (d)(i) |

Investment Management Agreement between Registrant and Templeton Asset Management Ltd. dated December 3, 2002

|

* |

|

EX-99 (d)(ii) |

Amendment to the Investment Management Agreement dated May 1, 2011

|

* |

|

EX-99 (e)(i) |

Distribution Agreement between Registrant and Franklin/Templeton Distributors, Inc. dated January 1, 2011

|

* |

|

EX-99 (e)(ii) |

Forms of Selling Agreement between Registrant, Franklin/Templeton Distributors, Inc. and Securities Dealers dated May 1, 2010

|

* |

|

EX-99 (g)(i) |

Custody Agreement dated September 7, 1993

|

* |

|

EX-99 (g)(ii) |

Amendment to the Custody Agreement dated March 2, 1998

|

* |

|

EX-99 (g)(iii) |

Amendment No. 2 to the Custody Agreement dated July 23, 1998

|

* |

|

EX-99 (g)(iv) |

Amendment No. 3 to the Custody Agreement dated May 1, 2001

|

* |

|

EX-99 (g)(v) |

Assignment and Assumption dated August 8, 2003 to the Custody Agreement

|

* |

|

EX-99 (h)(i) |

Amended and Restated Transfer Agent and Shareholder Services Agreement between Registrant and Franklin Templeton Investor Services, LLC dated January 1, 2011

|

* |

|

EX-99 (h)(ii) |

Amended and Restated Fund Administration Agreement dated May 22, 2012

|

* |

|

EX-99 (i)(i) |

Opinion and Consent of Counsel

|

* |

|

EX-99 (m)(i) |

Amended and Restated Distribution Plan – Class A Shares dated February 24, 2009

|

* |

|

EX-99 (m)(ii) |

Amended and Restated Distribution Plan – Class C Shares dated July 15, 2009

|

* |

|

EX-99 (m)(iii) |

Amended and Restated Distribution Plan – Class B Shares dated July 15, 2009

|

* |

|

EX-99 (n)(i) |

Amended and Restated Multiple Class Plan dated December 6, 2012 effective May 1, 2013

|

Attached |

|

EX-99 (p)(i) |

Code of Ethics dated April 1, 2012

|

* |

|

EX-99 (q)(i) |

Power of Attorney dated December 7, 2012

|

* |