| Label |

Element |

Value |

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Document Type |

dei_DocumentType |

Other |

|

| Document Period End Date |

dei_DocumentPeriodEndDate |

Aug. 31,

2010 |

|

| Registrant Name |

dei_EntityRegistrantName |

TEMPLETON CHINA WORLD FUND |

|

| Central Index Key |

dei_EntityCentralIndexKey |

0000909226 |

|

| Amendment Flag |

dei_AmendmentFlag |

false |

|

| Document Creation Date |

dei_DocumentCreationDate |

Jul. 14,

2011 |

|

| Document Effective Date |

dei_DocumentEffectiveDate |

Jul. 15,

2011 |

|

| Prospectus Date |

rr_ProspectusDate |

Jul. 15,

2011 |

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

Fund Summary |

|

|

Templeton China World Fund

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

Investment Goal |

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

Long-term capital appreciation. |

|

| Expense [Heading] |

rr_ExpenseHeading |

Fees and Expenses of the Fund |

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

These tables describe the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts in Class A if you and your family invest, or agree to invest in the future, at least $50,000 in Franklin Templeton funds. More information about these and other discounts is available from your financial professional and under “Your Account” on page 25 in the Fund's Prospectus and under “Buying and Selling Shares” on page 39 of the Fund’s Statement of Additional Information. |

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

SHAREHOLDER FEES (fees paid directly from your investment) |

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) |

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio Turnover |

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate was 9.94% of the average value of its portfolio. |

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

9.94% |

|

| Expense Breakpoint Discounts [Text] |

rr_ExpenseBreakpointDiscounts |

You may qualify for sales charge discounts in Class A if you and your family invest, or agree to invest in the future, at least $50,000 in Franklin Templeton funds. |

|

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

50,000 |

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Example |

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of the period. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be: |

|

| Expense Example, No Redemption, By Year, Caption [Text] |

rr_ExpenseExampleNoRedemptionByYearCaption |

If you do not sell your shares: |

|

| Strategy [Heading] |

rr_StrategyHeading |

Principal Investment Strategies |

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

Under normal market conditions, the Fund invests at least 80% of its net assets in securities of "China companies." The Fund invests primarily in the equity securities of China companies, which are those: that are organized under the laws of, or with a principal office in, the People's Republic of China (China), Hong Kong or Taiwan; or for which the principal trading market is in China, Hong Kong or Taiwan; or that derive at least 50% of their revenues from goods or services sold or produced, or have at least 50% of their assets, in China. The equity securities in which the Fund invests are primarily common stock. The Fund also invests in American, Global and European Depositary Receipts. China companies may be any size, and include smaller capitalization companies. In addition to the Fund's main investments, the Fund may invest up to 20% of its net assets in securities that do not qualify as China company securities, but whose issuers, in the judgment of the investment manager, are expected to benefit from developments in the economy of China. The Fund is a "non-diversified" fund, which means it generally invests a greater proportion of its assets in the securities of one or more issuers and invests overall in a smaller number of issuers than a diversified fund. When choosing equity investments for the Fund, the investment manager applies a “bottom-up,” value-oriented, long-term approach, focusing on the market price of a company’s securities relative to the investment manager’s evaluation of the company’s long-term earnings, asset value and cash flow potential. The investment manager also considers a company’s price/earnings ratio, profit margins and liquidation value. |

|

| Risk [Heading] |

rr_RiskHeading |

Principal Risks |

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

You could lose money by investing in the Fund. Mutual fund shares are not deposits or obligations of, or guaranteed or endorsed by, any bank, and are not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other agency of the U.S. government. Foreign Securities Investing in foreign securities typically involves more risks than investing in U.S. securities, and includes risks associated with: political and economic developments - the political, economic and social structures of some foreign countries may be less stable and more volatile than those in the U.S.; trading practices - government supervision and regulation of foreign security and currency markets, trading systems and brokers may be less than in the U.S.; availability of information - foreign issuers may not be subject to the same disclosure, accounting and financial reporting standards and practices as U.S. issuers; limited markets - the securities of certain foreign issuers may be less liquid (harder to sell) and more volatile; and currency exchange rate fluctuations and policies. Although not typically subject to currency exchange rate risk, depositary receipts may be subject to the same risks as foreign securities generally. The risks of foreign investments typically are greater in less developed countries or emerging market countries. There are special risks associated with investments in China, Hong Kong and Taiwan, including exposure to currency fluctuations, less liquidity, expropriation, confiscatory taxation, nationalization and exchange control regulations (including currency blockage). Inflation and rapid fluctuations in inflation and interest rates have had, and may continue to have, negative effects on the economy and securities markets of China, Hong Kong and Taiwan. In addition, investments in Taiwan could be adversely affected by its political and economic relationship with China. China, Hong Kong and Taiwan are deemed by the investment manager to be emerging markets countries, which means an investment in these countries have more heightened risks than general foreign investing due to a lack of established legal, political, business and social frameworks in these countries to support securities markets. Region Focus Because the Fund invests its assets primarily in companies in a specific region, the Fund is subject to greater risks of adverse developments in that region and/or the surrounding regions than a fund that is more broadly diversified geographically. Political, social or economic disruptions in the region, even in countries in which the Fund is not invested, may adversely affect the value of securities values held by the Fund. Market The market value of securities owned by the Fund will go up and down, sometimes rapidly or unpredictably. A security’s market value may be reduced by market activity or other results of supply and demand unrelated to the issuer. This is a basic risk associated with all securities. When there are more sellers than buyers, prices tend to fall. Likewise, when there are more buyers than sellers, prices tend to rise. Generally, stocks have historically outperformed other types of investments over the long term. Individual stock prices, however, tend to go up and down more dramatically. A slower-growth or recessionary economic environment could have an adverse effect on the price of the various stocks held by the Fund. Smaller Companies Securities issued by smaller companies may be more volatile in price than those of larger companies, involve substantial risks and should be considered speculative. Such risks may include greater sensitivity to economic conditions, less certain growth prospects, lack of depth of management and funds for growth and development and limited or less developed product lines and markets. In addition, smaller companies may be particularly affected by interest rate increases, as they may find it more difficult to borrow money to continue or expand operations, or may have difficulty in repaying any loans. Non-Diversification Because the Fund is non-diversified, it may be more sensitive to economic, business, political or other changes affecting similar issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s shares and greater risk of loss. Value Style Investing A value stock may not increase in price as anticipated by the investment manager if other investors fail to recognize the company's value and bid up the price, the markets favor faster-growing companies, or the factors that the investment manager believes will increase the price of the security do not occur. Management The Fund is subject to management risk because it is an actively managed investment portfolio. The Fund's investment manager applies investment techniques and risk analyses in making investment decisions for the Fund, but there can be no guarantee that these decisions will produce the desired results. |

|

| Risk Nondiversified Status [Text] |

rr_RiskNondiversifiedStatus |

Because the Fund is non-diversified, it may be more sensitive to economic, business, political or other changes affecting similar issuers or investments than a diversified fund, which may result in greater fluctuation in the value of the Fund’s shares and greater risk of loss |

|

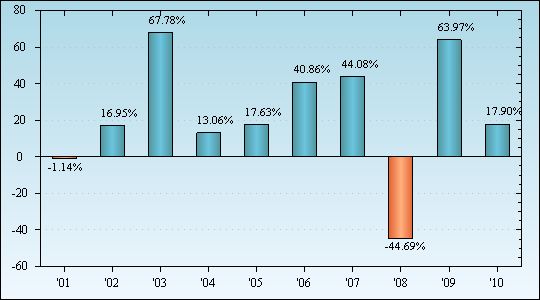

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Performance |

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

The following bar chart and table provide some indication of the risks of investing in the Fund. The bar chart shows changes in the Fund's performance from year to year for Class A shares. The table shows how the Fund's average annual returns for 1 year, 5 years, 10 years or since inception, as applicable, compared with those of a broad measure of market performance. The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. You can obtain updated performance information at franklintempleton.com or by calling (800) DIAL BEN/342-5236. Sales charges are not reflected in the bar chart, and if those charges were included, returns would be less than those shown. |

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The following bar chart and table provide some indication of the risks of investing in the Fund. The bar chart shows changes in the Fund's performance from year to year for Class A shares. The table shows how the Fund's average annual returns for 1 year, 5 years, 10 years or since inception, as applicable, compared with those of a broad measure of market performance. |

|

| Performance Availability Phone [Text] |

rr_PerformanceAvailabilityPhone |

(800) DIAL BEN/342-5236 |

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

franklintempleton.com |

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

The Fund's past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. |

|

| Bar Chart [Heading] |

rr_BarChartHeading |

CLASS A ANNUAL TOTAL RETURNS |

|

| Bar Chart Does Not Reflect Sales Loads [Text] |

rr_BarChartDoesNotReflectSalesLoads |

Sales charges are not reflected in the bar chart, and if those charges were included, returns would be less than those shown. |

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

| Best Quarter: | Q2'09 | 32.45% | | Worst Quarter: | Q3'01 | -19.72% | | As of March 31, 2011, the Fund's year-to-date return was 2.16% for Class A. |

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

AVERAGE ANNUAL TOTAL RETURNS

(figures reflect sales charges) For the periods ended December 31, 2010 |

|

| Performance Table Closing [Text Block] |

rr_PerformanceTableClosingTextBlock |

Historical performance for the Fund prior to its conversion from a closed-end fund to an open-end fund in 2003 is based on the performance of the Fund's predecessor closed-end fund. The Fund's performance has been adjusted to reflect differences in all charges, fees and expenses between the Fund and the predecessor closed-end fund. The after-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown only for Class A and after-tax returns for other classes will vary. |

|

|

Templeton China World Fund | Class A

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Cumulative Sales Charge (as a percentage of Offering Price) |

rr_MaximumCumulativeSalesChargeOverOfferingPrice |

5.75% |

|

| Maximum Deferred Sales Charge (as a percentage of Offering Price) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Redemption Fee (as a percentage of Amount Redeemed) |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management Fees (as a percentage of Assets) |

rr_ManagementFeesOverAssets |

1.09% |

[1] |

| Distribution and Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.30% |

[2] |

| Other Expenses (as a percentage of Assets): |

rr_OtherExpensesOverAssets |

0.47% |

|

| Expenses (as a percentage of Assets) |

rr_ExpensesOverAssets |

1.86% |

[1] |

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

753 |

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

1,126 |

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,523 |

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

2,629 |

|

| Annual Return 2001 |

rr_AnnualReturn2001 |

(1.14%) |

|

| Annual Return 2002 |

rr_AnnualReturn2002 |

16.95% |

|

| Annual Return 2003 |

rr_AnnualReturn2003 |

67.78% |

|

| Annual Return 2004 |

rr_AnnualReturn2004 |

13.06% |

|

| Annual Return 2005 |

rr_AnnualReturn2005 |

17.63% |

|

| Annual Return 2006 |

rr_AnnualReturn2006 |

40.86% |

|

| Annual Return 2007 |

rr_AnnualReturn2007 |

44.08% |

|

| Annual Return 2008 |

rr_AnnualReturn2008 |

(44.69%) |

|

| Annual Return 2009 |

rr_AnnualReturn2009 |

63.97% |

|

| Annual Return 2010 |

rr_AnnualReturn2010 |

17.90% |

|

| Year to Date Return, Label |

rr_YearToDateReturnLabel |

As of March 31, 2011, the Fund's year-to-date return was 2.16% for Class A. |

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Best Quarter: |

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Jun. 30,

2009 |

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

32.45% |

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Worst Quarter: |

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Sep. 30,

2001 |

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(19.72%) |

|

| Label |

rr_AverageAnnualReturnLabel |

Return Before Taxes |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

11.12% |

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

15.39% |

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

18.10% |

|

|

Templeton China World Fund | Class A | After Taxes on Distributions

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

10.97% |

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

14.53% |

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

17.32% |

|

|

Templeton China World Fund | Class A | After Taxes on Distributions and Sales

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

7.49% |

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

13.23% |

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

16.11% |

|

|

Templeton China World Fund | Class B

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Cumulative Sales Charge (as a percentage of Offering Price) |

rr_MaximumCumulativeSalesChargeOverOfferingPrice |

none

|

[3] |

| Maximum Deferred Sales Charge (as a percentage of Offering Price) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

4.00% |

[3] |

| Redemption Fee (as a percentage of Amount Redeemed) |

rr_RedemptionFeeOverRedemption |

none

|

[3] |

| Management Fees (as a percentage of Assets) |

rr_ManagementFeesOverAssets |

1.09% |

[1] |

| Distribution and Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.99% |

|

| Other Expenses (as a percentage of Assets): |

rr_OtherExpensesOverAssets |

0.47% |

|

| Expenses (as a percentage of Assets) |

rr_ExpensesOverAssets |

2.55% |

[1] |

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

658 |

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

1,093 |

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,555 |

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

2,717 |

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

258 |

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

793 |

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

1,355 |

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

2,717 |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

13.08% |

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

15.75% |

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

18.16% |

|

|

Templeton China World Fund | Class C

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Cumulative Sales Charge (as a percentage of Offering Price) |

rr_MaximumCumulativeSalesChargeOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (as a percentage of Offering Price) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

1.00% |

|

| Redemption Fee (as a percentage of Amount Redeemed) |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management Fees (as a percentage of Assets) |

rr_ManagementFeesOverAssets |

1.09% |

[1] |

| Distribution and Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

1.00% |

|

| Other Expenses (as a percentage of Assets): |

rr_OtherExpensesOverAssets |

0.47% |

|

| Expenses (as a percentage of Assets) |

rr_ExpensesOverAssets |

2.56% |

[1] |

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

359 |

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

796 |

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

1,360 |

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

2,895 |

|

| Expense Example, No Redemption, 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

259 |

|

| Expense Example, No Redemption, 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

796 |

|

| Expense Example, No Redemption, 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

1,360 |

|

| Expense Example, No Redemption, 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

2,895 |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

16.07% |

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

15.97% |

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

18.01% |

|

|

Templeton China World Fund | Advisor Class

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Cumulative Sales Charge (as a percentage of Offering Price) |

rr_MaximumCumulativeSalesChargeOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (as a percentage of Offering Price) |

rr_MaximumDeferredSalesChargeOverOfferingPrice |

none

|

|

| Redemption Fee (as a percentage of Amount Redeemed) |

rr_RedemptionFeeOverRedemption |

none

|

|

| Management Fees (as a percentage of Assets) |

rr_ManagementFeesOverAssets |

1.09% |

[1] |

| Distribution and Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Other Expenses (as a percentage of Assets): |

rr_OtherExpensesOverAssets |

0.47% |

|

| Expenses (as a percentage of Assets) |

rr_ExpensesOverAssets |

1.56% |

[1] |

| Expense Example, with Redemption, 1 Year |

rr_ExpenseExampleYear01 |

159 |

|

| Expense Example, with Redemption, 3 Years |

rr_ExpenseExampleYear03 |

493 |

|

| Expense Example, with Redemption, 5 Years |

rr_ExpenseExampleYear05 |

850 |

|

| Expense Example, with Redemption, 10 Years |

rr_ExpenseExampleYear10 |

1,856 |

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

18.24% |

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

17.12% |

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

19.20% |

|

|

Templeton China World Fund | MSCI Golden Dragon Index

|

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

13.60% |

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

13.09% |

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

9.53% |

|

|

|

|