UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07876

Templeton China World Fund

(Exact name of registrant as specified in charter)

300 S.E. 2nd Street, Fort Lauderdale, FL 33301-1923

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: (954) 527-7500

Date of fiscal year end: 8/31

Date of reporting period: 8/31/17

| Item 1. | Reports to Stockholders. |

|

|

Annual Report and Shareholder Letter August 31, 2017 |

Sign up for electronic delivery at franklintempleton.com/edelivery

Franklin Templeton Investments

Gain From Our Perspective®

At Franklin Templeton Investments, we’re dedicated to one goal: delivering exceptional asset management for our clients. By bringing together multiple, world-class investment teams in a single firm, we’re able to offer specialized expertise across styles and asset classes, all supported by the strength and resources of one of the world’s largest asset managers. This has helped us to become a trusted partner to individual and institutional investors across the globe.

Dear Shareholder:

| Not FDIC Insured | |

May Lose Value | |

No Bank Guarantee |

|

franklintempleton.com |

Not part of the annual report |

1 |

|

2 |

Annual Report |

franklintempleton.com |

1. Source: Morningstar.

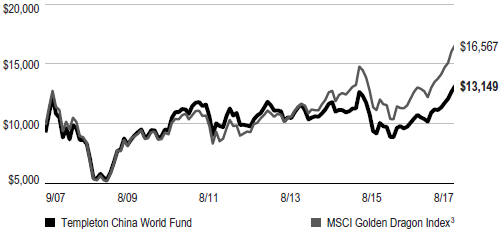

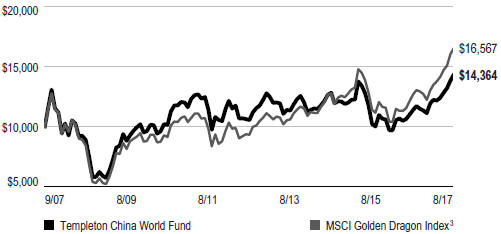

2. Source: Morningstar. As of 8/31/17, the Fund’s Class A 10-year average annual total return not including sales charges was +3.39%, compared with the 10-year average annual total return of +5.18% for the MSCI Golden Dragon Index.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

3. Source: The website of the National Bureau of Statistics of the People’s Republic of China (www.stats.gov.cn).

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 14.

|

franklintempleton.com |

Annual Report |

3 |

TEMPLETON CHINA WORLD FUND

|

4 |

Annual Report |

franklintempleton.com |

TEMPLETON CHINA WORLD FUND

CFA® is a trademark owned by CFA Institute.

4. “China H” denotes shares of China-incorporated, Hong Kong Stock Exchange-listed companies with most businesses in China.

5. The materials sector comprises chemicals, construction materials, and paper and forest products in the SOI. The consumer staples sector comprises beverages, food and staples retailing, and food products in the SOI. The consumer discretionary sector comprises auto components; automobiles; distributors; internet and direct marketing retail; leisure products; media; and textiles, apparel and luxury goods in the SOI. The industrials sector comprises industrial conglomerates, marine and transportation infrastructure in the SOI. The utilities sector comprises electric utilities and independent power and renewable electricity producers in the SOI.

See www.franklintempletondatasources.com for additional data provider information.

|

franklintempleton.com |

Annual Report |

5 |

TEMPLETON CHINA WORLD FUND

Performance Summary as of August 31, 2017

The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 8/31/17

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.75% and the minimum is 0%. Class A: 5.75% maximum initial sales charge; Advisor Class: no sales charges. For other share classes, visit franklintempleton.com.

| Share Class | Cumulative Total Return1 |

Average Annual Total Return2 | ||||

|

A |

||||||

|

1-Year |

+26.00% | +18.76% | ||||

|

5-Year |

+34.54% | +4.86% | ||||

|

10-Year |

+39.52% | +2.78% | ||||

|

Advisor |

||||||

|

1-Year |

+26.31% | +26.31% | ||||

|

5-Year |

+36.43% | +6.41% | ||||

|

10-Year |

+43.64% | +3.69% | ||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 8 for Performance Summary footnotes.

|

6 |

Annual Report |

franklintempleton.com |

TEMPLETON CHINA WORLD FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

Class A (9/1/07–8/31/17)

Advisor Class (9/1/07–8/31/17)

See page 8 for Performance Summary footnotes.

|

franklintempleton.com |

Annual Report |

7 |

TEMPLETON CHINA WORLD FUND

PERFORMANCE SUMMARY

Distributions (9/1/16–8/31/17)

| Share Class | Net Investment Income |

Long-Term Capital Gain |

Total | |||

| A |

$0.1884 | $2.5662 | $2.7546 | |||

| C |

$ — | $2.5662 | $2.5662 | |||

| R6 |

$0.3142 | $2.5662 | $2.8804 | |||

| Advisor |

$0.2528 | $2.5662 | $2.8190 |

Total Annual Operating Expenses4

| Share Class | ||

| A |

1.91% | |

| Advisor |

1.66% |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. The government’s participation in the economy is still high and, therefore, the Fund’s investments in China will be subject to larger regulatory risk levels compared to many other countries. In addition, special risks are associated with international investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets involve heightened risks related to the same factors. The Fund may also experience greater volatility than a fund that is more broadly diversified geographically. Historically, smaller and midsized securities have experienced more price volatility than larger company stocks, especially over the short term. Also, as a nondiversified fund investing in China companies, the Fund may invest in a relatively small number of issuers and, as a result, be subject to a greater risk of loss with respect to its portfolio securities. The Fund is designed for the aggressive portion of a well-diversified portfolio. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

3. Source: Morningstar. The MSCI Golden Dragon Index is a free float-adjusted, market capitalization-weighted index designed to measure equity market performance of China, Hong Kong and Taiwan.

4. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown. See www.franklintempletondatasources.com for additional data provider information.

|

8 |

Annual Report |

franklintempleton.com | ||||

TEMPLETON CHINA WORLD FUND

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual (actual return after expenses) |

Hypothetical (5% annual return before expenses) |

|||||||||||

| Expenses | Expenses | Net | ||||||||||

| Beginning | Ending | Paid During | Ending | Paid During | Annualized | |||||||

| Share | Account | Account | Period | Account | Period | Expense | ||||||

| Class | Value 3/1/17 | Value 8/31/17 | 3/1/17–8/31/171,2 | Value 8/31/17 | 3/1/17–8/31/171,2 | Ratio2 | ||||||

|

|

|

|

| |||||||||

| A |

$1,000 | $1,174.50 | $10.74 | $1,015.32 | $9.96 | 1.96% | ||||||

| C |

$1,000 | $1,169.40 | $14.82 | $1,011.54 | $13.74 | 2.71% | ||||||

| R6 |

$1,000 | $1,177.10 | $7.96 | $1,017.90 | $7.38 | 1.45% | ||||||

| Advisor |

$1,000 | $1,175.80 | $9.32 | $1,016.64 | $8.64 | 1.70% | ||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 184/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

|

franklintempleton.com |

Annual Report |

9 |

TEMPLETON CHINA WORLD FUND

| Year Ended August 31, | ||||||||||||||||||||

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

| Class A |

||||||||||||||||||||

| Per share operating performance (for a share outstanding throughout the year) |

||||||||||||||||||||

| Net asset value, beginning of year |

$21.51 | $26.19 | $38.01 | $35.78 | $34.09 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||

| Net investment incomeb | 0.15 | 0.17 | 0.32 | 0.44 | 0.41 | |||||||||||||||

| Net realized and unrealized gains (losses) | 4.59 | 2.19 | (7.53 | ) | 3.94 | 2.11 | ||||||||||||||

|

|

|

|||||||||||||||||||

| Total from investment operations |

4.74 | 2.36 | (7.21 | ) | 4.38 | 2.52 | ||||||||||||||

|

|

|

|||||||||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income | (0.19 | ) | (0.46 | ) | (0.45 | ) | (0.52 | ) | (0.65 | ) | ||||||||||

| Net realized gains | (2.57 | ) | (6.58 | ) | (4.16 | ) | (1.63 | ) | (0.18 | ) | ||||||||||

|

|

|

|||||||||||||||||||

| Total distributions |

(2.76 | ) | (7.04 | ) | (4.61 | ) | (2.15 | ) | (0.83 | ) | ||||||||||

|

|

|

|||||||||||||||||||

| Net asset value, end of year |

$23.49 | $21.51 | $26.19 | $38.01 | $35.78 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Total returnc |

26.00% | 11.19% | (20.57)% | 12.76% | 7.22% | |||||||||||||||

| Ratios to average net assets |

||||||||||||||||||||

| Expenses |

1.94% | d,e | 1.91% | d,e | 1.84% | e | 1.85% | e | 1.85% | |||||||||||

| Net investment income |

0.71% | 0.77% | 0.98% | 1.23% | 1.13% | |||||||||||||||

| Supplemental data |

||||||||||||||||||||

| Net assets, end of year (000’s) |

$188,885 | $186,850 | $232,814 | $373,231 | $429,085 | |||||||||||||||

| Portfolio turnover rate |

7.92% | 3.87% | 7.42% | 3.75% | 6.12% | |||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

dBenefit of expense reduction rounds to less than 0.01%.

eBenefit of waiver and payments by affiliates rounds to less than 0.01%.

|

10 |

Annual Report | |

The accompanying notes are an integral part of these financial statements. |

franklintempleton.com |

TEMPLETON CHINA WORLD FUND

FINANCIAL HIGHLIGHTS

| Year Ended August 31, | ||||||||||||||||||||

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||||

| Class C |

||||||||||||||||||||

| Per share operating performance |

||||||||||||||||||||

| (for a share outstanding throughout the year) |

||||||||||||||||||||

| Net asset value, beginning of year |

$21.18 | $25.76 | $37.52 | $35.30 | $33.55 | |||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||

| Net investment income (loss)b |

(0.03 | ) | — | c | 0.08 | 0.18 | 0.16 | |||||||||||||

| Net realized and unrealized gains (losses) |

4.54 | 2.17 | (7.42 | ) | 3.91 | 2.04 | ||||||||||||||

| Total from investment operations |

4.51 | 2.17 | (7.34 | ) | 4.09 | 2.20 | ||||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

— | (0.17 | ) | (0.26 | ) | (0.24 | ) | (0.27 | ) | |||||||||||

| Net realized gains |

(2.57 | ) | (6.58 | ) | (4.16 | ) | (1.63 | ) | (0.18 | ) | ||||||||||

| Total distributions |

(2.57 | ) | (6.75 | ) | (4.42 | ) | (1.87 | ) | (0.45 | ) | ||||||||||

| Net asset value, end of year |

$23.12 | $21.18 | $25.76 | $37.52 | $35.30 | |||||||||||||||

| Total returnd |

24.97% | 10.41% | (21.16)% | 11.98% | 6.50% | |||||||||||||||

| Ratios to average net assets |

||||||||||||||||||||

| Expenses |

2.69% | e,f | 2.66% | e,f | 2.56% | f | 2.54% | f | 2.55% | |||||||||||

| Net investment income (loss) |

(0.04)% | 0.02% | 0.26% | 0.54% | 0.43% | |||||||||||||||

| Supplemental data |

||||||||||||||||||||

| Net assets, end of year (000’s) |

$42,577 | $48,769 | $63,486 | $103,346 | $123,220 | |||||||||||||||

| Portfolio turnover rate |

7.92% | 3.87% | 7.42% | 3.75% | 6.12% | |||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

eBenefit of expense reduction rounds to less than 0.01%.

fBenefit of waiver and payments by affiliates rounds to less than 0.01%.

| franklintempleton.com | The accompanying notes are an integral part of these financial statements. | Annual Report | 11 |

TEMPLETON CHINA WORLD FUND

FINANCIAL HIGHLIGHTS

| Year Ended August 31, | ||||||||||||||||||||

| 2017 | 2016 | 2015 | 2014 | 2013a | ||||||||||||||||

| Class R6 |

||||||||||||||||||||

| Per share operating performance |

||||||||||||||||||||

| (for a share outstanding throughout the year) |

||||||||||||||||||||

| Net asset value, beginning of year |

$21.68 | $26.41 | $38.27 | $36.03 | $38.14 | |||||||||||||||

| Income from investment operationsb: |

||||||||||||||||||||

| Net investment incomec |

0.27 | 0.31 | 0.49 | 0.66 | 0.68 | |||||||||||||||

| Net realized and unrealized gains (losses) |

4.59 | 2.18 | (7.61 | ) | 3.93 | (2.79 | ) | |||||||||||||

| Total from investment operations |

4.86 | 2.49 | (7.12 | ) | 4.59 | (2.11 | ) | |||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

(0.31 | ) | (0.64 | ) | (0.58 | ) | (0.72 | ) | — | |||||||||||

| Net realized gains |

(2.57 | ) | (6.58 | ) | (4.16 | ) | (1.63 | ) | — | |||||||||||

| Total distributions |

(2.88 | ) | (7.22 | ) | (4.74 | ) | (2.35 | ) | — | |||||||||||

| Net asset value, end of year |

$23.66 | $21.68 | $26.41 | $38.27 | $36.03 | |||||||||||||||

| Total returnd |

26.62% | 11.76% | (20.20)% | 13.31% | (5.53)% | |||||||||||||||

| Ratios to average net assetse |

||||||||||||||||||||

| Expenses before waiver and payments by affiliates |

1.49% | 1.45% | 1.37% | 1.37% | 1.39% | |||||||||||||||

| Expenses net of waiver and payments by affiliates |

1.44% | f | 1.42% | f | 1.37% | g | 1.37% | g | 1.39% | |||||||||||

| Net investment income |

1.21% | 1.26% | 1.45% | 1.71% | 1.59% | |||||||||||||||

| Supplemental data |

||||||||||||||||||||

| Net assets, end of year (000’s) |

$1,213 | $720 | $711 | $73,067 | $64,078 | |||||||||||||||

| Portfolio turnover rate |

7.92% | 3.87% | 7.42% | 3.75% | 6.12% | |||||||||||||||

aFor the period May 1, 2013 (effective date) to August 31, 2013.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fBenefit of expense reduction rounds to less than 0.01%.

gBenefit of waiver and payments by affiliates rounds to less than 0.01%.

|

12 |

Annual Report | |

The accompanying notes are an integral part of these financial statements. |

franklintempleton.com |

TEMPLETON CHINA WORLD FUND

FINANCIAL HIGHLIGHTS

| Year Ended August 31, | ||||||||||||||||||

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||||||

| Advisor Class |

||||||||||||||||||

| Per share operating performance |

||||||||||||||||||

| (for a share outstanding throughout the year) |

||||||||||||||||||

| Net asset value, beginning of year |

$21.68 | $26.39 | $38.26 | $36.01 | $34.33 | |||||||||||||

| Income from investment operationsa: |

||||||||||||||||||

| Net investment incomeb | 0.22 | 0.22 | 0.42 | 0.55 | 0.46 | |||||||||||||

| Net realized and unrealized gains (losses) | 4.60 | 2.22 | (7.61 | ) | 3.98 | 2.20 | ||||||||||||

| Total from investment operations |

4.82 | 2.44 | (7.19 | ) | 4.53 | 2.66 | ||||||||||||

| Less distributions from: |

||||||||||||||||||

| Net investment income | (0.25 | ) | (0.57 | ) | (0.52 | ) | (0.65 | ) | (0.80) | |||||||||

| Net realized gains | (2.57 | ) | (6.58 | ) | (4.16 | ) | (1.63 | ) | (0.18) | |||||||||

| Total distributions |

(2.82 | ) | (7.15 | ) | (4.68 | ) | (2.28 | ) | (0.98) | |||||||||

| Net asset value, end of year |

$23.68 | $21.68 | $26.39 | $38.26 | $36.01 | |||||||||||||

| Total return |

26.31% | 11.51% | (20.38)% | 13.12% | 7.54% | |||||||||||||

| Ratios to average net assets |

||||||||||||||||||

| Expenses |

1.69% | c,d | 1.66% | c,d | 1.56% | d | 1.55% | d | 1.55% | |||||||||

| Net investment income |

0.96% | 1.02% | 1.26% | 1.53% | 1.43% | |||||||||||||

| Supplemental data |

||||||||||||||||||

| Net assets, end of year (000’s) |

$83,172 | $73,504 | $107,454 | $223,825 | $240,826 | |||||||||||||

| Portfolio turnover rate |

7.92% | 3.87% | 7.42% | 3.75% | 6.12% | |||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cBenefit of expense reduction rounds to less than 0.01%.

dBenefit of waiver and payments by affiliates rounds to less than 0.01%.

|

franklintempleton.com |

The accompanying notes are an integral part of these financial statements. | Annual Report |

13 |

TEMPLETON CHINA WORLD FUND

| Statement of Investments, August 31, 2017 | ||||||||

| Country | Shares | Value | ||||||

| Common Stocks 98.4% |

||||||||

| Auto Components 0.2% |

||||||||

| Weifu High-Technology Co. Ltd., B |

China | 279,527 | $ 644,730 | |||||

| a,b Xinyi Automobile Glass Hong Kong Enterprises Ltd., Reg S |

Hong Kong | 16,250 | 3,115 | |||||

| 647,845 | ||||||||

| Automobiles 5.5% |

||||||||

| Chongqing Changan Automobile Co. Ltd., B |

China | 2,812,457 | 3,680,126 | |||||

| Dongfeng Motor Group Co. Ltd., H |

China | 4,737,478 | 6,150,603 | |||||

| Jiangling Motors Corp. Ltd., B |

China | 3,502,646 | 7,465,675 | |||||

| 17,296,404 | ||||||||

| Banks 6.9% |

||||||||

| BOC Hong Kong (Holdings) Ltd. |

Hong Kong | 110,800 | 564,215 | |||||

| China Construction Bank Corp., H |

China | 16,704,926 | 14,643,520 | |||||

| Industrial and Commercial Bank of China Ltd., H |

China | 8,637,725 | 6,468,056 | |||||

| 21,675,791 | ||||||||

| Beverages 0.4% |

||||||||

| Yantai Changyu Pioneer Wine Co. Ltd., B. |

China | 516,099 | 1,281,394 | |||||

| Capital Markets 0.8% |

||||||||

| China Everbright Ltd. |

China | 872,000 | 1,992,328 | |||||

| GF Securities Co. Ltd., H |

China | 195,400 | 416,982 | |||||

| 2,409,310 | ||||||||

| Chemicals 0.4% |

||||||||

| Green Seal Holding Ltd. |

China | 505,167 | 1,309,227 | |||||

| Construction Materials 2.6% |

||||||||

| Asia Cement China Holdings Corp. |

China | 12,893,271 | 4,316,594 | |||||

| Huaxin Cement Co. Ltd., B |

China | 3,422,326 | 3,788,515 | |||||

| 8,105,109 | ||||||||

| Distributors 0.4% |

||||||||

| Dah Chong Hong Holdings Ltd. |

China | 2,410,063 | 1,197,994 | |||||

|

| ||||||||

| Electric Utilities 1.2% |

||||||||

| CK Infrastructure Holdings Ltd. |

Hong Kong | 416,348 | 3,772,068 | |||||

| Electronic Equipment, Instruments & Components 0.6% |

||||||||

| Hon Hai Precision Industry Co. Ltd. |

Taiwan | 200,000 | 779,824 | |||||

| Synnex Technology International Corp. |

Taiwan | 978,648 | 1,094,423 | |||||

| 1,874,247 | ||||||||

| Food & Staples Retailing 4.4% |

||||||||

| Beijing Jingkelong Co. Ltd., H |

China | 1,378,471 | 399,853 | |||||

| Dairy Farm International Holdings Ltd. |

Hong Kong | 1,243,176 | 10,069,726 | |||||

| President Chain Store Corp. |

Taiwan | 421,059 | 3,528,037 | |||||

| 13,997,616 | ||||||||

| Food Products 5.0% |

||||||||

| Uni-President China Holdings Ltd. |

China | 15,444,280 | 13,202,938 | |||||

| Uni-President Enterprises Corp. |

Taiwan | 1,280,394 | 2,727,768 | |||||

| 15,930,706 | ||||||||

| Health Care Equipment & Supplies 0.5% |

||||||||

| Ginko International Co. Ltd. |

Taiwan | 201,000 | 1,564,111 | |||||

| Health Care Providers & Services 1.8% |

||||||||

| Shanghai Pharmaceuticals Holding Co. Ltd., H |

China | 2,134,500 | 5,253,264 | |||||

| Sinopharm Group Co. Ltd. |

China | 100,000 | 451,717 | |||||

| 5,704,981 | ||||||||

|

14 |

Annual Report |

franklintempleton.com |

TEMPLETON CHINA WORLD FUND

STATEMENT OF INVESTMENTS

| Country | Shares | Value | ||||||

| Common Stocks (continued) |

||||||||

| Independent Power & Renewable Electricity Producers 0.4% |

||||||||

| Huaneng Renewables Corp. Ltd., H. |

China | 4,092,000 | $ 1,254,942 | |||||

| Industrial Conglomerates 3.1% |

||||||||

| CK Hutchison Holdings Ltd. |

Hong Kong | 264,690 | 3,463,493 | |||||

| Hopewell Holdings Ltd. |

Hong Kong | 1,575,500 | 6,190,708 | |||||

| 9,654,201 | ||||||||

| Insurance 4.7% |

||||||||

| AIA Group Ltd. |

Hong Kong | 1,350,100 | 10,359,905 | |||||

| China Life Insurance Co. Ltd., H |

China | 1,310,000 | 4,201,669 | |||||

| Ping An Insurance (Group) Co. of China Ltd. |

China | 40,000 | 317,671 | |||||

| 14,879,245 | ||||||||

| Internet & Direct Marketing Retail 0.6% |

||||||||

| a Ctrip.com International Ltd., ADR |

China | 12,000 | 617,400 | |||||

| a JD.com Inc., ADR |

China | 30,937 | 1,296,570 | |||||

| 1,913,970 | ||||||||

| Internet Software & Services 20.4% |

||||||||

| a Alibaba Group Holding Ltd., ADR |

China | 123,520 | 21,213,325 | |||||

| a Baidu Inc., ADR |

China | 32,960 | 7,516,528 | |||||

| Tencent Holdings Ltd. |

China | 848,000 | 35,650,740 | |||||

| 64,380,593 | ||||||||

| IT Services 2.1% |

||||||||

| TravelSky Technology Ltd., H |

China | 2,387,841 | 6,529,741 | |||||

| Leisure Products 0.1% |

||||||||

| Merida Industry Co. Ltd. |

Taiwan | 67,800 | 298,109 | |||||

| Marine 1.2% |

||||||||

| COSCO Shipping Energy Transportation Co. Ltd., H |

China | 4,154,000 | 2,372,744 | |||||

| Sinotrans Shipping Ltd. |

China | 5,040,500 | 1,571,593 | |||||

| 3,944,337 | ||||||||

| Media 0.3% |

||||||||

| Poly Culture Group Corp. Ltd., H |

China | 448,300 | 1,019,684 | |||||

| Oil, Gas & Consumable Fuels 6.7% |

||||||||

| China Petroleum & Chemical Corp., H |

China | 21,440,478 | 16,411,115 | |||||

| CNOOC Ltd |

China | 1,502,400 | 1,796,959 | |||||

| PetroChina Co. Ltd., H |

China | 4,412,403 | 2,819,175 | |||||

| 21,027,249 | ||||||||

| Paper & Forest Products 5.1% |

||||||||

| Nine Dragons Paper Holdings Ltd. |

China | 9,649,400 | 16,103,500 | |||||

| Pharmaceuticals 1.0% |

||||||||

| Tong Ren Tang Technologies Co. Ltd., H |

China | 2,260,700 | 3,177,697 | |||||

| Real Estate Management & Development 1.7% |

||||||||

| Cheung Kong Property Holdings Ltd. |

Hong Kong | 141,690 | 1,243,863 | |||||

| China Merchants Shekou Industrial Zone Holdings Co.Ltd., A. |

China | 763,000 | 2,196,408 | |||||

| China Overseas Land & Investment Ltd. |

China | 594,000 | 2,075,968 | |||||

| 5,516,239 | ||||||||

| Semiconductors & Semiconductor Equipment 9.8% |

||||||||

| Taiwan Semiconductor Manufacturing Co. Ltd. |

Taiwan | 4,297,330 | 30,873,468 | |||||

| Textiles, Apparel & Luxury Goods 5.3% |

||||||||

| Anta Sports Products Ltd. |

China | 4,293,355 | 16,897,573 | |||||

|

franklintempleton.com |

Annual Report |

15 |

TEMPLETON CHINA WORLD FUND

STATEMENT OF INVESTMENTS

| Country | Shares | Value | ||||||

|

Common Stocks (continued) |

||||||||

| Transportation Infrastructure 2.1% |

||||||||

| COSCO Shipping Ports Ltd. |

China | 3,291,088 | $ 3,890,076 | |||||

| Sichuan Expressway Co. Ltd., H |

China | 7,084,000 | 2,896,712 | |||||

| 6,786,788 | ||||||||

| Wireless Telecommunication Services 3.1% |

||||||||

| China Mobile Ltd. |

China | 913,270 | 9,686,215 | |||||

| Total Common Stocks (Cost $143,790,494) |

310,710,354 | |||||||

| Short Term Investments (Cost $3,939,549) 1.2% |

||||||||

| Money Market Funds 1.2% |

||||||||

| c,d Institutional Fiduciary Trust Money Market Portfolio, 0.66% |

United States | 3,939,549 | 3,939,549 | |||||

| Total Investments (Cost $147,730,043) 99.6% |

314,649,903 | |||||||

| Other Assets, less Liabilities 0.4% |

1,196,861 | |||||||

| Net Assets 100.0% |

$315,846,764 | |||||||

See Abbreviations on page 27.

aNon-income producing.

bSecurity was purchased pursuant to Regulation S under the Securities Act of 1933, which exempts from registration securities offered and sold outside of the United States. Such a security cannot be sold in the United States without either an effective registration statement filed pursuant to the Securities Act of 1933, or pursuant to an exemption from registration. This security has been deemed liquid under guidelines approved by the Fund’s Board of Trustees. At August 31, 2017, the value of this security was $3,115, representing less than 0.1% of net assets.

cSee Note 3(f) regarding investments in affiliated management investment companies.

dThe rate shown is the annualized seven-day yield at period end.

|

16 |

Annual Report | |

The accompanying notes are an integral part of these financial statements. |

franklintempleton.com |

TEMPLETON CHINA WORLD FUND

Statement of Assets and Liabilities

| August 31, 2017 |

||

| Assets: |

||

| Investments in securities: |

||

| Cost - Unaffiliated issuers |

$143,790,494 | |

| Cost - Non-controlled affiliates (Note 3f) |

3,939,549 | |

|

| ||

| Value - Unaffiliated issuers |

$310,710,354 | |

| Value - Non-controlled affiliates (Note 3f) |

3,939,549 | |

| Receivables: |

||

| Investment securities sold |

1,764,642 | |

| Capital shares sold |

137,544 | |

| Dividends |

1,131,013 | |

| Other assets |

116 | |

|

| ||

| Total assets |

317,683,218 | |

|

| ||

| Liabilities: |

||

| Payables: |

||

| Investment securities purchased |

867,927 | |

| Capital shares redeemed |

257,278 | |

| Management fees |

333,081 | |

| Distribution fees |

74,790 | |

| Transfer agent fees |

182,548 | |

| Accrued expenses and other liabilities |

120,830 | |

|

| ||

| Total liabilities |

1,836,454 | |

|

| ||

| Net assets, at value |

$315,846,764 | |

|

| ||

| Net assets consist of: |

||

| Paid-in capital |

$121,935,671 | |

| Undistributed net investment income |

1,853,829 | |

| Net unrealized appreciation (depreciation) |

166,919,906 | |

| Accumulated net realized gain (loss) |

25,137,358 | |

|

| ||

| Net assets, at value |

$315,846,764 | |

|

| ||

| Class A: |

||

| Net assets, at value |

$188,885,250 | |

|

| ||

| Shares outstanding |

8,042,249 | |

|

| ||

| Net asset value per sharea |

$23.49 | |

|

| ||

| Maximum offering price per share (net asset value per share ÷ 94.25%) |

$24.92 | |

|

| ||

| Class C: |

||

| Net assets, at value |

$ 42,576,808 | |

|

| ||

| Shares outstanding |

1,841,234 | |

|

| ||

| Net asset value and maximum offering price per sharea |

$23.12 | |

|

| ||

| Class R6: |

||

| Net assets, at value |

$ 1,212,910 | |

|

| ||

| Shares outstanding |

51,262 | |

|

| ||

| Net asset value and maximum offering price per share |

$23.66 | |

|

| ||

| Advisor Class: |

||

| Net assets, at value |

$ 83,171,796 | |

|

| ||

| Shares outstanding |

3,512,929 | |

|

| ||

| Net asset value and maximum offering price per share |

$23.68 | |

|

| ||

aRedemption price is equal to net asset value less contingent deferred sales charges, if applicable.

|

franklintempleton.com |

The accompanying notes are an integral part of these financial statements. | Annual Report |

17 |

TEMPLETON CHINA WORLD FUND

FINANCIAL STATEMENTS

Statement of Operations

for the year ended August 31, 2017

| Investment income: |

||

| Dividends:a |

||

| Unaffiliated issuers |

$ 7,782,732 | |

| Non-controlled affiliates (Note 3f) |

6,232 | |

| Income from securities loaned (net of fees and rebates) |

945 | |

|

| ||

| Total investment income |

7,789,909 | |

|

| ||

| Expenses: |

||

| Management fees (Note 3a) |

3,816,190 | |

| Distribution fees: (Note 3c) |

||

| Class A |

439,318 | |

| Class C |

432,483 | |

| Transfer agent fees: (Note 3e) |

||

| Class A |

450,613 | |

| Class C |

110,983 | |

| Class R6 |

601 | |

| Advisor Class |

188,744 | |

| Custodian fees (Note 4) |

71,458 | |

| Reports to shareholders |

77,730 | |

| Registration and filing fees |

126,772 | |

| Professional fees. |

85,837 | |

| Trustees’ fees and expenses. |

26,402 | |

| Other |

17,850 | |

|

| ||

| Total expenses |

5,844,981 | |

| Expense reductions (Note 4) |

(60) | |

| Expenses waived/paid by affiliates (Note 3f) |

(5,914) | |

|

| ||

| Net expenses |

5,839,007 | |

|

| ||

| Net investment income |

1,950,902 | |

|

| ||

| Realized and unrealized gains (losses): |

||

| Net realized gain (loss) from: |

||

| Investments: |

||

| Unaffiliated issuers. |

33,827,605 | |

| Foreign currency transactions |

(20,055) | |

|

| ||

| Net realized gain (loss) |

33,807,550 | |

|

| ||

| Net change in unrealized appreciation (depreciation) on: |

||

| Investments: |

||

| Unaffiliated issuers. |

31,421,949 | |

| Translation of other assets and liabilities denominated in foreign currencies |

1,101 | |

|

| ||

| Net change in unrealized appreciation (depreciation) |

31,423,050 | |

|

| ||

| Net realized and unrealized gain (loss) |

65,230,600 | |

|

| ||

| Net increase (decrease) in net assets resulting from operations |

$67,181,502 | |

|

| ||

| .aForeign taxes withheld on dividends |

$ 633,907 | |

|

18 |

Annual Report | |

The accompanying notes are an integral part of these financial statements. |

franklintempleton.com |

TEMPLETON CHINA WORLD FUND

FINANCIAL STATEMENTS

Statements of Changes in Net Assets

| Year Ended August 31, | ||||||||

| 2017 | 2016 | |||||||

|

|

||||||||

| Increase (decrease) in net assets: |

||||||||

| Operations: |

||||||||

| Net investment income. |

$ | 1,950,902 | $ | 2,351,018 | ||||

| Net realized gain (loss) |

33,807,550 | 45,347,419 | ||||||

| Net change in unrealized appreciation (depreciation) |

31,423,050 | (13,387,852) | ||||||

|

|

|

|||||||

| Net increase (decrease) in net assets resulting from operations |

67,181,502 | 34,310,585 | ||||||

|

|

|

|||||||

| Distributions to shareholders from: |

||||||||

| Net investment income: |

||||||||

| Class A |

(1,477,590) | (3,603,536) | ||||||

| Class C |

— | (360,294) | ||||||

| Class R6 |

(15,613) | (16,616) | ||||||

| Advisor Class |

(815,698) | (2,085,592) | ||||||

| Net realized gains: |

||||||||

| Class A |

(20,126,270) | (51,937,159) | ||||||

| Class C |

(5,283,432) | (14,292,109) | ||||||

| Class R6 |

(127,513) | (170,910) | ||||||

| Advisor Class |

(8,280,242) | (24,134,243) | ||||||

|

|

|

|||||||

| Total distributions to shareholders. |

(36,126,358) | (96,600,459) | ||||||

|

|

|

|||||||

| Capital share transactions: (Note 2) |

||||||||

| Class A |

(16,581,589) | (10,848,333) | ||||||

| Class C |

(10,209,121) | (4,950,385) | ||||||

| Class R6 |

376,846 | 116,915 | ||||||

| Advisor Class |

1,363,660 | (16,652,155) | ||||||

|

|

|

|||||||

| Total capital share transactions |

(25,050,204) | (32,333,958) | ||||||

|

|

|

|||||||

| Net increase (decrease) in net assets |

6,004,940 | (94,623,832 | ) | |||||

| Net assets: |

||||||||

| Beginning of year |

309,841,824 | 404,465,656 | ||||||

|

|

|

|||||||

| End of year |

$ | 315,846,764 | $ | 309,841,824 | ||||

|

|

|

|||||||

| Undistributed net investment income included in net assets: |

||||||||

| End of year |

$ | 1,853,829 | $ | 2,186,597 | ||||

|

|

|

|||||||

|

franklintempleton.com |

The accompanying notes are an integral part of these financial statements. | Annual Report |

19 |

TEMPLETON CHINA WORLD FUND

|

20 |

Annual Report |

franklintempleton.com |

TEMPLETON CHINA WORLD FUND

NOTES TO FINANCIAL HIGHLIGHTS

|

franklintempleton.com |

Annual Report |

21 |

TEMPLETON CHINA WORLD FUND

NOTES TO FINANCIAL STATEMENTS

1. Organization and Significant Accounting

Policies (continued)

d. Income and Deferred Taxes (continued)

2. Shares of Beneficial Interest

At August 31, 2017, there were an unlimited number of shares authorized (without par value). Transactions in the Fund’s shares were as follows:

| Year Ended August 31, | ||||||||||||||||

| 2017 | 2016 | |||||||||||||||

| Shares

|

Amount

|

Shares

|

Amount

|

|||||||||||||

| Class A Shares: |

||||||||||||||||

| Shares sold | 1,985,678 | $ | 40,952,259 | 1,594,515 | $ | 33,963,897 | ||||||||||

| Shares issued in reinvestment of distributions | 1,169,105 | 20,938,679 | 2,701,529 | 53,733,408 | ||||||||||||

| Shares redeemed | (3,797,828) | (78,472,527) | (4,500,910) | (98,545,638) | ||||||||||||

| Net increase (decrease) | (643,045) | $ | (16,581,589) | (204,866) | $ | (10,848,333) | ||||||||||

|

22 |

Annual Report |

franklintempleton.com |

TEMPLETON CHINA WORLD FUND

NOTES TO FINANCIAL STATEMENTS

| Year Ended August 31, |

||||||||||||||||

|

2017 |

2016 |

|||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

|||||||||||||

| Class C Shares: |

||||||||||||||||

| Shares sold |

193,489 | $ | 3,935,482 | 230,824 | $ | 4,829,005 | ||||||||||

| Shares issued in reinvestment of distributions |

269,624 | 4,777,743 | 642,345 | 12,641,362 | ||||||||||||

| Shares redeemed |

(924,869) | (18,922,346) | (1,034,646) | (22,420,752) | ||||||||||||

| Net increase (decrease) |

(461,756) | $ | (10,209,121) | (161,477) | $ | (4,950,385) | ||||||||||

| Class R6 Shares: |

||||||||||||||||

| Shares sold |

22,853 | $ | 489,161 | 7,081 | $ | 139,108 | ||||||||||

| Shares issued in reinvestment of distributions |

7,960 | 143,126 | 9,386 | 187,526 | ||||||||||||

| Shares redeemed |

(12,754) | (255,441) | (10,192) | (209,719) | ||||||||||||

| Net increase (decrease) |

18,059 | $ | 376,846 | 6,275 | $ | 116,915 | ||||||||||

| Advisor Class Shares: |

||||||||||||||||

| Shares sold |

1,164,396 | $ | 24,754,639 | 947,626 | $ | 21,494,473 | ||||||||||

| Shares issued in reinvestment of distributions |

416,531 | 7,505,881 | 1,051,692 | 21,044,361 | ||||||||||||

| Shares redeemed |

(1,458,050) | (30,896,860) | (2,680,734) | (59,190,989) | ||||||||||||

| Net increase (decrease) |

122,877 | $ | 1,363,660 | (681,416) | $ | (16,652,155) | ||||||||||

3. Transactions with Affiliates

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Fund are also officers, and/or directors of the following subsidiaries:

| Subsidiary |

Affiliation | |||

|

Templeton Asset Management Ltd. (TAML)

|

Investment manager | |||

|

Franklin Templeton Services, LLC (FT Services)

|

Administrative manager | |||

|

Franklin Templeton Distributors, Inc. (Distributors)

|

Principal underwriter | |||

|

Franklin Templeton Investor Services, LLC (Investor Services)

|

Transfer agent |

a. Management Fees

The Fund pays an investment management fee to TAML based on the average weekly net assets of the Fund as follows:

| Annualized Fee Rate | Net Assets | |||

|

1.300%

|

Up to and including $1 billion | |||

|

1.250%

|

Over $1 billion, up to and including $5 billion | |||

|

1.200%

|

Over $5 billion, up to and including $10 billion | |||

|

1.150%

|

Over $10 billion, up to and including $15 billion | |||

|

1.100%

|

Over $15 billion, up to and including $20 billion | |||

|

1.050%

|

In excess of $20 billion |

For the year ended August 31, 2017, the effective investment management fee rate was 1.300% of the Fund’s average weekly net assets.

|

franklintempleton.com |

Annual Report |

23 |

TEMPLETON CHINA WORLD FUND

NOTES TO FINANCIAL STATEMENTS

3. Transactions with Affiliates (continued)

b. Administrative Fees

Under an agreement with TAML, FT Services provides administrative services to the Fund. The fee is paid by TAML based on average weekly net assets, and is not an additional expense of the Fund.

c. Distribution Fees

The Board has adopted distribution plans for each share class, with the exception of Class R6 and Advisor Class shares, pursuant to Rule 12b-1 under the 1940 Act. Under the Fund’s Class A reimbursement distribution plan, the Fund reimburses Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. Under the Class A reimbursement distribution plan, costs exceeding the maximum for the current plan year cannot be reimbursed in subsequent periods. In addition, under the Fund’s Class C compensation distribution plan, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. The plan year, for purposes of monitoring compliance with the maximum annual plan rate, is February 1 through January 31.

The maximum annual plan rates, based on the average daily net assets, for each class, are as follows:

| Class A |

0.35 | % | ||

| Class C |

1.00 | % |

The Board has set the current rate at 0.25% per year for Class A shares until further notice and approval by the Board.

d. Sales Charges/Underwriting Agreements

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses of the Fund. These charges are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as applicable. Distributors has advised the Fund of the following commission transactions related to the sales and redemptions of the Fund’s shares for the year:

| Sales charges retained net of commissions paid to |

$ | 25,659 | ||

| CDSC retained |

$ | 3,017 |

e. Transfer Agent Fees

Each class of shares, except for Class R6, pays transfer agent fees to Investor Services for its performance of shareholder servicing obligations and reimburses Investor Services for out of pocket expenses incurred, including shareholder servicing fees paid to third parties. These fees are allocated daily based upon their relative proportion of such classes’ aggregate net assets. Class R6 pays Investor Services transfer agent fees specific to that class.

For the year ended August 31, 2017, the Fund paid transfer agent fees of $750,941, of which $313,320 was retained by Investor Services.

|

24 |

Annual Report |

franklintempleton.com |

TEMPLETON CHINA WORLD FUND

NOTES TO FINANCIAL STATEMENTS

f. Investments in Affiliated Management Investment Companies

The Fund invests in one or more affiliated management investment companies for purposes other than exercising a controlling influence over the management or policies. Management fees paid by the Fund are waived on assets invested in the affiliated management investment companies, as noted in the Statement of Operations, in an amount not to exceed the management and administrative fees paid directly or indirectly by each affiliate. Prior to September 1, 2013, the waiver was accounted for as a reduction to management fees. During the year ended August 31, 2017, the Fund held investments in affiliated management investment companies as follows:

| Number of Shares Held at Beginning of Year |

Gross Additions |

Gross Reductions |

Number of Held at End |

Value at End of Year |

Dividend Income |

Realized Gain (Loss) |

Net Change in Unrealized (Depreciation) | |||||||||||||||||||||||

| Non-Controlled Affiliates |

||||||||||||||||||||||||||||||

| Institutional Fiduciary Trust Money Market Portfolio, 0.66% |

2,513,332 | 50,784,626 | (49,358,409 | ) | 3,939,549 | $3,939,549 | $6,232 | $ — | $— | |||||||||||||||||||||

g. Waiver and Expense Reimbursements

Investor Services has contractually agreed in advance to waive or limit its fees so that the Class R6 transfer agent fees do not exceed 0.01% until December 31, 2017.

4. Expense Offset Arrangement

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the year ended August 31, 2017, the custodian fees were reduced as noted in the Statement of Operations.

5. Income Taxes

The tax character of distributions paid during the years ended August 31, 2017 and 2016, was as follows:

| 2017 | 2016 | |||||||

| Distributions paid from: |

||||||||

| Ordinary income |

$ | 2,308,901 | $ | 6,066,038 | ||||

| Long term capital gain |

33,817,457 | 90,534,421 | ||||||

| $ | 36,126,358 | $ | 96,600,459 | |||||

At August 31, 2017, the cost of investments, net unrealized appreciation (depreciation), undistributed ordinary income and undistributed long term capital gains for income tax purposes were as follows:

| Cost of investments |

$ | 149,427,500 | ||

| Unrealized appreciation |

$ | 173,859,318 | ||

| Unrealized depreciation |

(8,636,915 | ) | ||

| Net unrealized appreciation (depreciation) |

$ | 165,222,403 | ||

| Undistributed ordinary income |

$ | 3,541,292 | ||

| Undistributed long term capital gains |

25,147,350 | |||

| Distributable earnings |

$ | 28,688,642 | ||

|

franklintempleton.com |

Annual Report |

25 |

TEMPLETON CHINA WORLD FUND

NOTES TO FINANCIAL STATEMENTS

5. Income Taxes (continued)

Differences between income and/or capital gains as determined on a book basis and a tax basis are primarily due to differing treatment of passive foreign investment company shares.

The Fund utilized a tax accounting practice to treat a portion of the proceeds from capital shares redeemed as a distribution from realized capital gains.

6. Investment Transactions

Purchases and sales of investments (excluding short term securities) for the year ended August 31, 2017, aggregated $23,254,391 and $85,928,935, respectively.

7. Concentration of Risk

Investing in securities of “China companies” may include certain risks and considerations not typically associated with investing in U.S. securities. In general, China companies are those that are organized under the laws of, or with a principal office or principal trading market in, the People’s Republic of China, Hong Kong, or Taiwan. Such risks include fluctuating currency values and changing local and regional economic, political and social conditions, which may result in greater market volatility. In addition, these securities may not be as liquid as U.S. securities.

8. Credit Facility

The Fund, together with other U.S. registered and foreign investment funds (collectively, Borrowers), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $2 billion (Global Credit Facility) which matures on February 9, 2018. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

Under the terms of the Global Credit Facility, the Fund shall, in addition to interest charged on any borrowings made by the Fund and other costs incurred by the Fund, pay its share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon its relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.15% based upon the unused portion of the Global Credit Facility. These fees are reflected in other expenses in the Statement of Operations. During the year ended August 31, 2017, the Fund did not use the Global Credit Facility.

9. Fair Value Measurements

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s financial instruments and are summarized in the following fair value hierarchy:

| • | Level 1 – quoted prices in active markets for identical financial instruments |

| • | Level 2 – other significant observable inputs (including quoted prices for similar financial instruments, interest rates, prepayment speed, credit risk, etc.) |

| • | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of financial instruments) |

The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level.

|

26 |

Annual Report |

franklintempleton.com |

TEMPLETON CHINA WORLD FUND

NOTES TO FINANCIAL STATEMENTS

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

At August 31, 2017, all of the Fund’s investments in financial instruments carried at fair value were valued using Level 1 inputs. For detailed categories, see the accompanying Statement of Investments.

10. Subsequent Events

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

Abbreviations

Selected Portfolio

ADR American Depositary Receipt

|

franklintempleton.com |

Annual Report |

27 |

TEMPLETON CHINA WORLD FUND

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of the Templeton China World Fund

In our opinion, the accompanying statement of assets and liabilities, including the statement of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of the Templeton China World Fund (the “Fund”) as of August 31, 2017, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities as of August 31, 2017 by correspondence with the custodian, transfer agent and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

San Francisco, California

October 17, 2017

|

28 |

Annual Report |

franklintempleton.com |

TEMPLETON CHINA WORLD FUND

Under Section 852(b)(3)(C) of the Internal Revenue Code (Code), the Fund hereby reports the maximum amount allowable but no less than $38,250,548 as a long term capital gain dividend for the fiscal year ended August 31, 2017.

Under Section 854(b)(1)(B) of the Code, the Fund hereby reports the maximum amount allowable but no less than $1,701,075 as qualified dividends for purposes of the maximum rate under Section 1(h)(11) of the Code for the fiscal year ended August 31, 2017. Distributions, including qualified dividend income, paid during calendar year 2017 will be reported to shareholders on Form 1099-DIV by mid-February 2018. Shareholders are advised to check with their tax advisors for information on the treatment of these amounts on their individual income tax returns.

At August 31, 2016, more than 50% of the Fund’s total assets were invested in securities of foreign issuers. In most instances, foreign taxes were withheld from income paid to the Fund on these investments. As shown in the table below, the Fund hereby reports to shareholders the foreign source income and foreign taxes paid, pursuant to Section 853 of the Code. This written statement will allow shareholders of record on December 21, 2016, to treat their proportionate share of foreign taxes paid by the Fund as having been paid directly by them. The shareholder shall consider these amounts as foreign taxes paid in the tax year in which they receive the Fund distribution.

The following table provides a detailed analysis of foreign tax paid, foreign source income, and foreign source qualified dividends as reported by the Fund, to Class A, Class C, Class R6, and Advisor Class shareholders of record.

| Class | Foreign Tax Paid Per Share |

Foreign Source Income Per Share |

Foreign Source Qualified Dividends Per Share |

|||||||||

| Class A |

$0.0562 | $0.2480 | $0.0495 | |||||||||

| Class C |

$0.0562 | $0.0555 | $0.0111 | |||||||||

| Class R6 |

$0.0562 | $0.3747 | $0.0749 | |||||||||

| Advisor Class |

$0.0562 | $0.3124 | $0.0625 | |||||||||

Foreign Tax Paid Per Share (Column 1) is the amount per share available to you, as a tax credit (assuming you held your shares in the Fund for a minimum of 16 days during the 31-day period beginning 15 days before the ex-dividend date of the Fund’s distribution to which the foreign taxes relate), or, as a tax deduction.

Foreign Source Income Per Share (Column 2) is the amount per share of income dividends attributable to foreign securities held by the Fund, plus any foreign taxes withheld on these dividends. The amounts reported include foreign source qualified dividends that have not been adjusted for the rate differential applicable to such dividend income.1

Foreign Source Qualified Dividends Per Share (Column 3) is the amount per share of foreign source qualified dividends, plus any foreign taxes withheld on these dividends. These amounts represent the portion of the Foreign Source Income reported to you in column 2 that were derived from qualified foreign securities held by the Fund.1

By mid-February 2017, shareholders received Form 1099-DIV which included their share of taxes paid and foreign source income distributed during the calendar year 2016. The Foreign Source Income reported on Form 1099-DIV has not been adjusted for the rate differential on foreign source qualified dividend income. Shareholders are advised to check with their tax advisors for information on the treatment of these amounts on their 2016 individual income tax returns.

1Qualified dividends are taxed at reduced long term capital gains tax rates. In determining the amount of foreign tax credit that may be applied against the U.S. tax liability of individuals receiving foreign source qualified dividends, adjustments may be required to the foreign tax credit limitation calculation to reflect the rate differential applicable to such dividend income. The rules however permit certain individuals to elect not to apply the rate differential adjustments for capital gains and/or dividends for any taxable year. Please consult your tax advisor and the instructions to Form 1116 for more information.

|

franklintempleton.com |

Annual Report |

29 |

TEMPLETON CHINA WORLD FUND

The name, year of birth and address of the officers and board members, as well as their affiliations, positions held with the Fund, principal occupations during at least the past five years and number of US registered portfolios overseen in the Franklin Templeton Investments fund complex, are shown below. Generally, each board member serves until that person’s successor is elected and qualified.

Independent Board Members

| Name, Year of Birth and Address |

Position | Length of Time Served |

Number of Portfolios in Fund Complex Overseen by Board Member* |

Other Directorships Held During at Least the Past 5 Years | ||||

| Harris J. Ashton (1932) 300 S.E. 2nd Street Fort Lauderdale, FL 33301-1923 |

Trustee | Since 1993 | 140 | Bar-S Foods (meat packing company) (1981-2010). | ||||

|

Principal Occupation During at Least the Past 5 Years: Director of various companies; and formerly, Director, RBC Holdings, Inc. (bank holding company) (until 2002); and President, Chief Executive Officer and Chairman of the Board, General Host Corporation (nursery and craft centers) (until 1998).

| ||||||||

| Ann Torre Bates (1958) 300 S.E. 2nd Street Fort Lauderdale, FL 33301-1923 |

Trustee | Since 2008 | 42 | Ares Capital Corporation (specialty finance company) (2010-present), United Natural Foods, Inc. (distributor of natural, organic and specialty foods) (2013-present), Allied Capital Corporation (financial services) (2003-2010), SLM Corporation (Sallie Mae) (1997-2014) and Navient Corporation (loan management, servicing and asset recovery) (2014-2016). | ||||

| Principal Occupation During at Least the Past 5 Years: | ||||||||

| Director of various companies; and formerly, Executive Vice President and Chief Financial Officer, NHP Incorporated (manager of multifamily housing) (1995-1997); and Vice President and Treasurer, US Airways, Inc. (until 1995).

| ||||||||

| Mary C. Choksi (1950) 300 S.E. 2nd Street Fort Lauderdale, FL 33301-1923 |

Trustee | Since October 2016 | 134 | Avis Budget Group Inc. (car rental) (2007-present), Omnicom Group Inc. (advertising and marketing communications services) (2011-present) and White Mountains Insurance Group, Ltd. (holding company) (August 2017-present). | ||||

|

Principal Occupation During at Least the Past 5 Years: | ||||||||

| Director of various companies; and formerly, Founder and Senior Advisor, Strategic Investment Group (investment management group) (2015-2017); Founding Partner and Senior Managing Director, Strategic Investment Group (1987-2015); Founding Partner and Managing Director, Emerging Markets Management LLC (investment management firm) (1987-2011); and Loan Officer/Senior Loan Officer/Senior Pension Investment Officer, World Bank Group (international financial institution) (1977-1987).

| ||||||||

| Edith E. Holiday (1952) 300 S.E. 2nd Street Fort Lauderdale, FL 33301-1923 |

Lead Independent Trustee |

Trustee since 1996 and Lead Independent Trustee since 2007 | 140 | Hess Corporation (exploration of oil and gas) (1993-present), Canadian National Railway (railroad) (2001-present), White Mountains Insurance Group, Ltd. (holding company) (2004-present), Santander Consumer USA Holdings, Inc. (consumer finance) (2016-present); RTI International Metals, Inc. (manufacture and distribution of titanium) (1999-2015) and H.J. Heinz Company (processed foods and allied products) (1994-2013). | ||||

|

Principal Occupation During at Least the Past 5 Years: | ||||||||

| Director or Trustee of various companies and trusts; and formerly, Assistant to the President of the United States and Secretary of the Cabinet (1990-1993); General Counsel to the United States Treasury Department (1989-1990); and Counselor to the Secretary and Assistant Secretary for Public Affairs and Public Liaison – United States Treasury Department (1988-1989). | ||||||||

|

30 |

Annual Report |

franklintempleton.com |

TEMPLETON CHINA WORLD FUND

Independent Board Members (continued)

| Name, Year of Birth and Address |

Position | Length of Time Served |

Number of Portfolios in Fund Complex Overseen by Board Member* |

Other Directorships Held During at Least the Past 5 Years | ||||

| J. Michael Luttig (1954) 300 S.E. 2nd Street Fort Lauderdale, FL 33301-1923 |

Trustee | Since 2009 | 140 | Boeing Capital Corporation (aircraft financing) (2006-2013). | ||||

|

Principal Occupation During at Least the Past 5 Years: Executive Vice President, General Counsel and member of the Executive Council, The Boeing Company (aerospace company) (2006-present); and formerly, Federal Appeals Court Judge, U.S. Court of Appeals for the Fourth Circuit (1991-2006).

| ||||||||

| David W. Niemiec (1949) 300 S.E. 2nd Street Fort Lauderdale, FL 33301-1923 |

Trustee | Since 2005 | 42 | Hess Midstream Partners LP (oil and gas midstream infrastructure) (April 2017-present). | ||||

|

Principal Occupation During at Least the Past 5 Years: | ||||||||

| Advisor, Saratoga Partners (private equity fund); and formerly, Managing Director, Saratoga Partners (1998-2001) and SBC Warburg Dillon Read (investment banking) (1997-1998); Vice Chairman, Dillon, Read & Co. Inc. (investment banking) (1991-1997); and Chief Financial Officer, Dillon, Read & Co. Inc. (1982-1997).

| ||||||||

| Larry D. Thompson (1945) 300 S.E. 2nd Street Fort Lauderdale, FL 33301-1923 |

Trustee | Since 2005 | 140 | The Southern Company (energy company) (2014-present; previously 2010-2012), Graham Holdings Company (education and media organization) (2011-present) and Cbeyond, Inc. (business communications provider) (2010-2012). | ||||

|

Principal Occupation During at Least the Past 5 Years: | ||||||||

| Director of various companies; Counsel, Finch McCranie, LLP (law firm) (2015-present); Independent Compliance Monitor and Auditor, Volkswagen AG (manufacture of automobiles and commercial vehicles) (April 2017-present); John A. Sibley Professor of Corporate and Business Law, University of Georgia School of Law (2015-present; previously 2011-2012); and formerly, Executive Vice President – Government Affairs, General Counsel and Corporate Secretary, PepsiCo, Inc. (consumer products) (2012-2014); Senior Vice President – Government Affairs, General Counsel and Secretary, PepsiCo, Inc. (2004-2011); Senior Fellow of The Brookings Institution (2003-2004); Visiting Professor, University of Georgia School of Law (2004); and Deputy Attorney General, U.S. Department of Justice (2001-2003).

| ||||||||

| Constantine D. Tseretopoulos (1954) 300 S.E. 2nd Street Fort Lauderdale, FL 33301-1923 |

Trustee | Since 1999 | 26 | None | ||||

|

Principal Occupation During at Least the Past 5 Years: | ||||||||

| Physician, Chief of Staff, owner and operator of the Lyford Cay Hospital (1987-present); director of various nonprofit organizations; and formerly, Cardiology Fellow, University of Maryland (1985-1987); and Internal Medicine Resident, Greater Baltimore Medical Center (1982-1985).

| ||||||||

| Robert E. Wade (1946) 300 S.E. 2nd Street Fort Lauderdale, FL 33301-1923 |

Trustee | Since 2006 | 42 | El Oro Ltd (investments) (2003-present). | ||||

|

Principal Occupation During at Least the Past 5 Years: | ||||||||

| Attorney at law engaged in private practice as a sole practitioner (1972-2008) and member of various boards. | ||||||||

|

franklintempleton.com |

Annual Report |

31 |

TEMPLETON CHINA WORLD FUND

Interested Board Members and Officers

| Name, Year of Birth and Address |

Position | Length of Time Served |

Number of Portfolios in Fund Complex Overseen by Board Member* |

Other Directorships Held During at Least the Past 5 Years | ||||

| **Gregory E. Johnson (1961) One Franklin Parkway San Mateo, CA 94403-1906 |

Trustee | Since 2007 | 156 | None | ||||

|

Principal Occupation During at Least the Past 5 Years: Chairman of the Board, Member – Office of the Chairman, Director and Chief Executive Officer, Franklin Resources, Inc.; officer and/or director or trustee, as the case may be, of some of the other subsidiaries of Franklin Resources, Inc. and of 44 of the investment companies in Franklin Templeton Investments; Vice Chairman, Investment Company Institute; and formerly, President, Franklin Resources, Inc. (1994-2015).

| ||||||||

| **Rupert H. Johnson, Jr. (1940) One Franklin Parkway San Mateo, CA 94403-1906 |

Chairman of the Board, Trustee and Vice President |

Chairman of the Board and Trustee since 2013 and Vice President since 1996 | 140 | None | ||||

|

Principal Occupation During at Least the Past 5 Years: | ||||||||

| Vice Chairman, Member – Office of the Chairman and Director, Franklin Resources, Inc.; Director, Franklin Advisers, Inc.; Senior Vice President, Franklin Advisory Services, LLC; and officer and/or director or trustee, as the case may be, of some of the other subsidiaries of Franklin Resources, Inc. and of 42 of the investment companies in Franklin Templeton Investments.

| ||||||||

| Alison E. Baur (1964) One Franklin Parkway San Mateo, CA 94403-1906 |

Vice President | Since 2012 | Not Applicable | Not Applicable | ||||

|

Principal Occupation During at Least the Past 5 Years: | ||||||||

| Deputy General Counsel, Franklin Templeton Investments; and officer of some of the other subsidiaries of Franklin Resources, Inc. and of 45 of the investment companies in Franklin Templeton Investments.

| ||||||||

| Stephen H. Dover (1961) One Franklin Parkway San Mateo, CA 94403-1906 |

President and Chief Executive Officer – Investment Management |

Since June 2017 | Not Applicable | Not Applicable | ||||

|

Principal Occupation During at Least the Past 5 Years: | ||||||||

| Chief Investment Officer, Templeton Emerging Market Group; Executive Vice President, Franklin Advisers, Inc.; and officer of four of the investment companies in Franklin Templeton Investments.

| ||||||||

| Aliya S. Gordon (1973) One Franklin Parkway San Mateo, CA 94403-1906 |

Vice President | Since 2009 | Not Applicable | Not Applicable | ||||

|

Principal Occupation During at Least the Past 5 Years: | ||||||||

| Senior Associate General Counsel, Franklin Templeton Investments; and officer of 45 of the investment companies in Franklin Templeton Investments.

| ||||||||

| Steven J. Gray (1955) One Franklin Parkway San Mateo, CA 94403-1906 |

Vice President | Since 2009 | Not Applicable | Not Applicable | ||||

|

Principal Occupation During at Least the Past 5 Years: | ||||||||

| Senior Associate General Counsel, Franklin Templeton Investments; Vice President, Franklin Templeton Distributors, Inc.; and FT AlphaParity, LLC; and officer of 45 of the investment companies in Franklin Templeton Investments.

| ||||||||

| Matthew T. Hinkle (1971) One Franklin Parkway San Mateo, CA 94403-1906 |

Chief Executive Officer – Finance and Administration |

Since June 2017 | Not Applicable | Not Applicable | ||||

|

Principal Occupation During at Least the Past 5 Years: | ||||||||

| Senior Vice President, U.S. Fund Administration Reporting & Fund Tax, Franklin Templeton Investments; officer of 45 of the investment companies in Franklin Templeton Investments; and formerly, Vice President, Global Tax (2012-April 2017) and Treasurer/Assistant Treasurer, Franklin Templeton Investments (2009-2017). | ||||||||

|

32 |

Annual Report |

franklintempleton.com |

TEMPLETON CHINA WORLD FUND

Interested Board Members and Officers (continued)

| Name, Year of Birth and Address |

Position | Length of Time Served |

Number of Portfolios in Fund Complex Overseen by Board Member* |

Other Directorships Held During at Least the Past 5 Years | ||||

| Robert G. Kubilis (1973) 300 S.E. 2nd Street Fort Lauderdale, FL 33301-1923 |

Chief Financial Officer, Chief Accounting Officer and Treasurer |

Since June 2017 | Not Applicable | Not Applicable | ||||

|

Principal Occupation During at Least the Past 5 Years: |

||||||||

| 300 S.E. 2nd Street | ||||||||

| Fort Lauderdale, FL 33301-1923 | ||||||||

| Treasurer, U.S. Fund Administration & Reporting, Franklin Templeton Investments; and officer of 18 of the investment companies in Franklin Templeton Investments.

| ||||||||

| Robert Lim (1948) One Franklin Parkway San Mateo, CA 94403-1906 |

Vice President – AML Compliance |

Since 2016 | Not Applicable | Not Applicable | ||||

|

Principal Occupation During at Least the Past 5 Years: | ||||||||

| Vice President, Franklin Templeton Companies, LLC; Chief Compliance Officer, Franklin Templeton Distributors, Inc. and Franklin Templeton Investor Services, LLC; and officer of 45 of the investment companies in Franklin Templeton Investments.

| ||||||||

| Kimberly H. Novotny (1972) 300 S.E. 2nd Street Fort Lauderdale, FL 33301-1923 |

Vice President | Since 2013 | Not Applicable | Not Applicable | ||||

|

Principal Occupation During at Least the Past 5 Years: | ||||||||

| Associate General Counsel, Franklin Templeton Investments; Vice President and Corporate Secretary, Fiduciary Trust International of the South; Vice President, Templeton Investment Counsel, LLC; Assistant Secretary, Franklin Resources, Inc.; and officer of 45 of the investment companies in Franklin Templeton Investments.

| ||||||||

| Robert C. Rosselot (1960) 300 S.E. 2nd Street Fort Lauderdale, FL 33301-1923 |

Chief Compliance Officer |

Since 2013 | Not Applicable | Not Applicable | ||||

|

Principal Occupation During at Least the Past 5 Years: | ||||||||

| Director, Global Compliance, Franklin Templeton Investments; Vice President, Franklin Templeton Companies, LLC; officer of 45 of the investment companies in Franklin Templeton Investments; and formerly, Senior Associate General Counsel, Franklin Templeton Investments (2007-2013); and Secretary and Vice President, Templeton Group of Funds (2004-2013).

| ||||||||

| Karen L. Skidmore (1952) | Vice President | Since 2009 | Not Applicable | Not Applicable | ||||

| One Franklin Parkway | ||||||||

| San Mateo, CA 94403-1906 | ||||||||

|

Principal Occupation During at Least the Past 5 Years: | ||||||||

| Senior Associate General Counsel, Franklin Templeton Investments; and officer of 45 of the investment companies in Franklin Templeton Investments.

| ||||||||

| Navid J. Tofigh (1972) | Vice President | Since 2015 | Not Applicable | Not Applicable | ||||

| One Franklin Parkway | ||||||||

| San Mateo, CA 94403-1906 | ||||||||

|

Principal Occupation During at Least the Past 5 Years: | ||||||||

| Associate General Counsel, Franklin Templeton Investments; and officer of 45 of the investment companies in Franklin Templeton Investments.

| ||||||||

| Craig S. Tyle (1960) | Vice President | Since 2005 | Not Applicable | Not Applicable | ||||

| One Franklin Parkway | ||||||||

| San Mateo, CA 94403-1906 | ||||||||

|

Principal Occupation During at Least the Past 5 Years: | ||||||||

| General Counsel and Executive Vice President, Franklin Resources, Inc.; and officer of some of the other subsidiaries of Franklin Resources, Inc. and of 45 of the investment companies in Franklin Templeton Investments. | ||||||||

|

franklintempleton.com |

Annual Report |

33 |

TEMPLETON CHINA WORLD FUND

Interested Board Members and Officers (continued)

| Name, Year of Birth and Address |

Position | Length of Time Served |

Number of Portfolios in Fund Complex Overseen by Board Member* |

Other Directorships Held During at Least the Past 5 Years | ||||