UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07876

Templeton China World Fund

(Exact name of registrant as specified in charter)

300 S.E. 2nd Street, Fort Lauderdale, FL 33301-1923

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: (954) 527-7500_

Date of fiscal year end: _8/31__

Date of reporting period: 2/28/15_

Item 1. Reports to Stockholders.

Semiannual Report and Shareholder Letter

February 28, 2015

Templeton China World Fund

Sign up for electronic delivery at franklintempleton.com/edelivery

Franklin Templeton Investments

Gain From Our Perspective®

At Franklin Templeton Investments, we’re dedicated to one goal: delivering exceptional asset management for our clients. By bringing together multiple, world-class investment teams in a single firm, we’re able to offer specialized expertise across styles and asset classes, all supported by the strength and resources of one of the world’s largest asset managers. This has helped us to become a trusted partner to individual and institutional investors across the globe.

Focus on Investment Excellence

At the core of our firm, you’ll find multiple independent investment teams—each with a focused area of expertise—from traditional to alternative strategies and multi-asset solutions. And because our portfolio groups operate autonomously, their strategies can be combined to deliver true style and asset class diversification.

All of our investment teams share a common commitment to excellence grounded in rigorous, fundamental research and robust, disciplined risk management. Decade after decade, our consistent, research-driven processes have helped Franklin Templeton earn an impressive record of strong, long-term results.

Global Perspective Shaped by Local Expertise

In today’s complex and interconnected world, smart investing demands a global perspective. Franklin Templeton pioneered international investing over 60 years ago, and our expertise in emerging markets spans more than a quarter of a century. Today, our investment professionals are on the ground across the globe, spotting investment ideas and potential risks firsthand. These locally based teams bring in-depth understanding of local companies, economies and cultural nuances, and share their best thinking across our global research network.

Strength and Experience

Franklin Templeton is a global leader in asset management serving clients in over 150 countries.1 We run our business with the same prudence we apply to asset management, staying focused on delivering relevant investment solutions, strong long-term results and reliable, personal service. This approach, focused on putting clients first, has helped us to become one of the most trusted names in financial services.

1. As of 12/31/14. Clients are represented by the total number of shareholder accounts.

Not FDIC Insured | May Lose Value | No Bank Guarantee

| Contents | |

| Shareholder Letter | 1 |

| Semiannual Report | |

| Templeton China World Fund | 3 |

| Performance Summary | 7 |

| Your Fund’s Expenses | 10 |

| Financial Highlights and | |

| Statement of Investments | 12 |

| Financial Statements | 19 |

| Notes to Financial Statements | 23 |

| Shareholder Information | 30 |

Semiannual Report

Templeton China World Fund

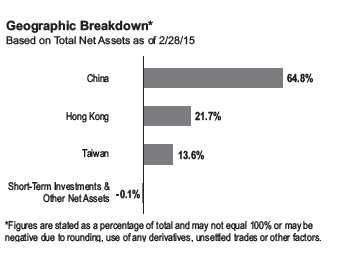

This semiannual report for Templeton China World Fund covers the period ended February 28, 2015.

Your Fund’s Goal and Main Investments

The Fund seeks long-term capital appreciation. Under normal market conditions, the Fund invests at least 80% of its net assets in securities of “China companies,” as defined in the Fund’s prospectus.

Economic and Market Overview

China’s economy, as measured by gross domestic product (GDP), grew an estimated 7.4% in 2014 compared to 7.7% in 2013.1 China’s economy appeared to stabilize as fiscal and monetary stimulus measures implemented in 2014’s second half began to gain traction. Strength in production and consumer spending helped offset weakness in fixed-asset investment. Domestic demand continued to account for a greater portion of GDP, as the government’s market-friendly policies supported new economic drivers. The trade surplus increased in 2014 as exports grew, driven by U.S. and European demand, and imports declined, resulting largely from lower imports of refined petroleum products and coal. The non-manufacturing sector’s expansion during the six months under review partially offset the manufacturing sector’s contraction toward period-end. China’s property market continued to cool as home sales and prices declined in most major cities.

The People’s Bank of China (PBOC) implemented various measures to support economic growth. These measures were initially selective, such as reducing yields on certain short-term bonds and loosening mortgage restrictions. In November, the PBOC broadened its monetary easing approach by cutting its benchmark interest rates for the first time since July 2012. Toward period-end, the PBOC provided short-term liquidity, extended its medium-term lending facility and lowered the reserve requirement ratio for commercial banks. With inflationary pressures trending downward, policymakers may have the flexibility to implement additional measures to support the economy.

Greater China and other emerging market stocks experienced volatility during the period amid concerns about moderating global economic growth, political instability and geopolitical tensions in certain regions, the future course of U.S. monetary policy, the devaluation of many currencies against the U.S. dollar and a sharp decline in crude oil prices. However, China’s fiscal and monetary stimulus measures, the European Central Bank’s monetary easing and the U.S. Federal Reserve Board’s accommodative policy provided investors with some optimism. A temporary solution to Greece’s dispute with the country’s international creditors, a Russia-Ukraine ceasefire agreement and market expectations that the PBOC would continue to take measures to bolster China’s economy supported stocks near period-end.

For the six months ended February 28, 2015, Greater China stocks, as measured by the MSCI Golden Dragon Index, generated a +2.64% total return, as many investors seemed to focus on the relatively attractive valuations of certain regional stocks.2 The MSCI China Index generated a +5.97% total return for the six-month period, compared with +0.35% for the MSCI Hong Kong Index and -0.93% for the MSCI Taiwan Index.2

1. Source: The website of the National Bureau of Statistics of the People’s Republic of China (www.stats.gov.cn).

2. Source: Morningstar.

The indexes are unmanaged and include reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 16.

franklintempleton.com

Semiannual Report | 3

TEMPLETON CHINA WORLD FUND

Investment Strategy

Our investment strategy employs a fundamental research, value-oriented, long-term approach. We focus on the market price of a company’s securities relative to our evaluation of the company’s long-term earnings, asset value and cash flow potential. We also consider a company’s profit and loss outlook, balance sheet strength, cash flow trends and asset value in relation to the current price. Our analysis considers the company’s corporate governance behavior as well as its position in its sector, the economic framework and political environment.

Performance Overview

For the six months ended February 28, 2015, the Fund’s Class A shares had a -4.67% cumulative total return. For comparison, the MSCI Golden Dragon Index generated a +2.64% total return for the same period.2 Also for comparison, the Standard & Poor’s®/International Finance Corporation Investable China Index, which measures Chinese stock market performance, produced a +1.90% total return for the same period.2

In line with our long-term investment strategy, we are pleased with our long-term results, which you will find in the Performance Summary beginning on page 7. For example, for the 10-year period ended February 28, 2015, the Fund’s Class A shares delivered a +146.49% cumulative total return, compared with the MSCI Golden Dragon Index’s +144.62% cumulative total return for the same period.3 Please note index performance information is provided for reference and we do not attempt to track the index but rather undertake investments on the basis of fundamental research.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Manager’s Discussion

During the six months under review, key contributors to the Fund’s absolute performance included TSMC (Taiwan Semiconductor Manufacturing Co.), Bank of China and China Construction Bank.

TSMC is the world’s largest independent integrated circuit foundry. Strong second-half 2014 earnings results and management updates indicating higher market share and progress in the company’s commercialization of advanced technological products supported share price performance. Robust January revenues, an upbeat 2015 corporate guidance and a proposed 50% dividend increase for 2014, which would be TSMC’s first dividend increase in six years, further enhanced investor confidence in the company. We sought to take advantage of the price appreciation and trimmed our position in TSMC, reducing concentration in one of the Fund’s largest holdings.

Shares of Bank of China and China Construction Bank, two of the country’s leading banks, performed well in late 2014 and early 2015 as the PBOC embarked on a monetary easing program. In addition to lowering its benchmark interest rate in November, the PBOC softened the terms of regulated loan-to-deposit ratio limits, which encouraged market speculation about the possibility of further easing measures. The PBOC followed through in early February with a reduction in the reserve requirement ratio for commercial banks. At period-end, the PBOC announced another interest rate cut to be effective on March 1. Better-than-expected fourth-quarter GDP growth also supported market sentiment. We added to the Fund’s position in China Construction Bank during the period.

In contrast, key detractors from the Fund’s absolute performance included CNOOC, Sinopec (China Petroleum and Chemical) and Dairy Farm International Holdings.

CNOOC is one of China’s biggest oil and gas exploration and production companies. Sinopec, one of China’s largest integrated energy companies and oil refiners, accounts for more than 20% of the country’s crude oil production. Lower oil prices in 2014’s second half pressured energy companies’ share prices, with production-oriented businesses, such as CNOOC, suffering more than businesses with an emphasis on refining and marketing, such as Sinopec. The decision by the Organization of the Petroleum Exporting Countries in late 2014 to maintain oil production levels despite global oversupply led prices to fall more than 40% in 2014’s fourth quarter, further weighing on energy stocks globally. Although Sinopec’s anticipated sale of stakes in its sales and marketing unit was considered by many investors as management’s move to adopt a more market-oriented stance,

3. Source: Morningstar. As of 2/28/15, the Fund’s Class A 10-year average annual total return not including sales charges was +9.44%, compared with the 10-year average

annual total return of +9.36% for the MSCI Golden Dragon Index.

The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

4 | Semiannual Report

franklintempleton.com

TEMPLETON CHINA WORLD FUND

| Top 10 Holdings | ||

| 2/28/15 | ||

| Company | % of Total | |

| Sector/Industry, Country | Net Assets | |

| Dairy Farm International Holdings Ltd. | 9.3 | % |

| Food & Staples Retailing, Hong Kong | ||

| TSMC (Taiwan Semiconductor Manufacturing Co.) Ltd. | 7.9 | % |

| Semiconductors & Semiconductor Equipment, Taiwan | ||

| Sinopec (China Petroleum and Chemical Corp.), H | 6.2 | % |

| Oil, Gas & Consumable Fuels, China | ||

| China Construction Bank Corp., H | 4.7 | % |

| Banks, China | ||

| China Mobile Ltd. | 4.6 | % |

| Wireless Telecommunication Services, China | ||

| Dongfeng Motor Group Co. Ltd., H | 3.6 | % |

| Automobiles, China | ||

| President Chain Store Corp. | 3.0 | % |

| Food & Staples Retailing, Taiwan | ||

| BOC Hong Kong (Holdings) Ltd. | 3.0 | % |

| Banks, Hong Kong | ||

| Cheung Kong Infrastructure Holdings Ltd. | 2.8 | % |

| Electric Utilities, Hong Kong | ||

| Industrial and Commercial Bank of China Ltd., H | 2.8 | % |

| Banks, China |

the sale’s completion in September at a lower-than-expected price hurt sentiment. Both companies’ shares recovered some of their earlier losses, however, as oil prices seemed to stabilize in February. We trimmed our positions in CNOOC and Sinopec to raise funds for redemptions and capital gain distributions, as well as to seek opportunities we considered to be more attractively valued within our investment universe.

Dairy Farm’s businesses include supermarkets, hypermarkets (combined supermarket and department store), health and beauty stores, convenience stores and home furnishing stores. The company reported disappointing first-half 2014 operating profits, resulting mainly from weaker-than-expected performance of its food and health and beauty businesses. Further

hurting investor confidence was the company’s subdued earnings guidance for the latter part of 2014. We trimmed our position in Dairy Farm to reduce concentration in the Fund’s biggest holding and to raise funds for capital gain distributions.

It is important to recognize the effect of currency movements on the Fund’s performance. In general, if the value of the U.S. dollar goes up compared with a foreign currency, an investment traded in that foreign currency will go down in value because it will be worth fewer U.S. dollars. This can have a negative effect on Fund performance. Conversely, when the U.S. dollar weakens in relation to a foreign currency, an investment traded in that foreign currency will increase in value, which can contribute to Fund performance. For the six months ended February 28, 2015, the U.S. dollar rose in value relative to most currencies. As a result, the Fund’s performance was negatively affected by the portfolio’s investment predominantly in securities with non-U.S. currency exposure.

During the period, our continued search for what we considered undervalued investments with attractive fundamentals and growth potential led us to make selective purchases in Taiwan, Hong Kong and China via China H and P Chip shares.4 Key purchases included additional shares in Tencent Holdings, one of China’s top Internet service portals, and new positions in Tingyi (Cayman Islands) Holdings, one of China’s leading manufacturers of instant noodles and packaged tea drinks, and Huaneng Renewable, one of China’s largest wind power generators.

Conversely, we conducted sales across the countries and sectors represented in the Fund’s portfolio to raise funds for share redemptions and capital gain distributions. We undertook some of the largest sales in Taiwan and China via China H and Red Chip shares.5 In sector terms, we reduced positions largely in energy and telecommunication services and made some of the biggest sales in consumer staples and information technology.6 Key sales included reducing shares in the aforementioned CNOOC, Sinopec and TSMC.

4. “China H” denotes shares of China-incorporated, Hong Kong Stock Exchange-listed companies with most businesses in China. “P Chip” denotes shares of Hong Kong

Stock Exchange-listed companies controlled by Chinese mainland individuals and incorporated outside of China, with a majority of their business in China.

5. “Red Chip” denotes shares of Hong Kong Stock Exchange-listed companies substantially owned by Chinese mainland entities, with significant exposure to China.

6. The energy sector comprises energy equipment and services; and oil, gas and consumable fuels in the SOI. The telecommunication services sector comprises diversified

telecommunication services and wireless telecommunication services in the SOI. The consumer staples sector comprises beverages, food and staples retailing, and food

products in the SOI. The information technology sector comprises electronic equipment, instruments and components; Internet software and services; IT services; and

semiconductors and semiconductor equipment in the SOI.

See www.franklintempletondatasources.com for additional data provider information.

franklintempleton.com

Semiannual Report | 5

TEMPLETON CHINA WORLD FUND

Thank you for your continued participation in Templeton China World Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of February 28, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

CFA® is a trademark owned by CFA Institute.

6 | Semiannual Report franklintempleton.com

TEMPLETON CHINA WORLD FUND

Performance Summary as of February 28, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| Net Asset Value | ||||||

| Share Class (Symbol) | 2/28/15 | 8/31/14 | Change | |||

| A (TCWAX) | $ | 31.42 | $ | 38.01 | -$ | 6.59 |

| C (TCWCX) | $ | 31.02 | $ | 37.52 | -$ | 6.50 |

| R6 (FCWRX) | $ | 31.61 | $ | 38.27 | -$ | 6.66 |

| Advisor (TACWX) | $ | 31.62 | $ | 38.26 | -$ | 6.64 |

| Distributions (9/1/14–2/28/15) | ||||||

| Dividend | Long-Term | |||||

| Share Class | Income | Capital Gain | Total | |||

| A | $ | 0.4474 | $ | 4.1603 | $ | 4.6077 |

| C | $ | 0.2616 | $ | 4.1603 | $ | 4.4219 |

| R6 | $ | 0.5777 | $ | 4.1603 | $ | 4.7380 |

| Advisor | $ | 0.5208 | $ | 4.1603 | $ | 4.6811 |

franklintempleton.com

Semiannual Report | 7

TEMPLETON CHINA WORLD FUND

PERFORMANCE SUMMARY

Performance as of 2/28/151

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum

sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R6/Advisor Class: no sales charges.

| Cumulative | Average Annual | Value of $10,000 | Average Annual Total | Total Annual | |||||||||

| Share Class | Total Return2 | Total Return3 | Investment4 | Return (3/31/15)5 | Operating Expenses6 | ||||||||

| A | 1.85 | % | |||||||||||

| 6-Month | -4.67 | % | -10.16 | % | $ | 8,984 | |||||||

| 1-Year | + | 7.17 | % | + | 1.01 | % | $ | 10,101 | + | 0.16 | % | ||

| 5-Year | + | 25.29 | % | + | 3.38 | % | $ | 11,809 | + | 2.35 | % | ||

| 10-Year | + | 146.49 | % | + | 8.79 | % | $ | 23,231 | + | 9.04 | % | ||

| C | 2.54 | % | |||||||||||

| 6-Month | -5.03 | % | -5.85 | % | $ | 9,415 | |||||||

| 1-Year | + | 6.40 | % | + | 5.48 | % | $ | 10,548 | + | 4.62 | % | ||

| 5-Year | + | 20.99 | % | + | 3.88 | % | $ | 12,099 | + | 2.85 | % | ||

| 10-Year | + | 130.21 | % | + | 8.70 | % | $ | 23,021 | + | 8.94 | % | ||

| R6 | 1.37 | % | |||||||||||

| 6-Month | -4.49 | % | -4.49 | % | $ | 9,551 | |||||||

| 1-Year | + | 7.63 | % | + | 7.63 | % | $ | 10,763 | + | 6.78 | % | ||

| Since Inception (5/1/13) | + | 2.24 | % | + | 1.22 | % | $ | 10,224 | + | 1.31 | % | ||

| Advisor | 1.55 | % | |||||||||||

| 6-Month | -4.57 | % | -4.57 | % | $ | 9,543 | |||||||

| 1-Year | + | 7.46 | % | + | 7.46 | % | $ | 10,746 | + | 6.53 | % | ||

| 5-Year | + | 27.19 | % | + | 4.93 | % | $ | 12,719 | + | 3.88 | % | ||

| 10-Year | + | 154.21 | % | + | 9.78 | % | $ | 25,421 | + | 10.02 | % |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value

will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown.

For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

8 | Semiannual Report

franklintempleton.com

TEMPLETON CHINA WORLD FUND

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. The government’s participation in the economy is still high and, therefore, the Fund’s investments in China will be subject to larger regulatory risk levels compared to many other countries. In addition, special risks are associated with international investing, including currency fluctuations, economic instability and political developments. Investments in emerging markets involve heightened risks related to the same factors. Also, as a nondiversified fund investing in China companies, the Fund may invest in a relatively small number of issuers and, as a result, be subject to a greater risk of loss with respect to its portfolio securities. The Fund may also experience greater volatility than a fund that is more broadly diversified geographically. Historically, smaller and midsized-company securities have experienced more price volatility than larger company stocks, especially over the short term. The Fund is designed for the aggressive portion of a well-diversified portfolio. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class C: These shares have higher annual fees and expenses than Class A shares.

Class R6: Shares are available to certain eligible investors as described in the prospectus.

Advisor Class: Shares are available to certain eligible investors as described in the prospectus.

1. The Fund has a fee waiver associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end.

Class R6 has a fee waiver contractually guaranteed through at least the Fund’s current fiscal year-end. Fund investment results reflect the fee waivers, to the extent

applicable; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated. Six-month return has not been annualized.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

franklintempleton.com

Semiannual Report | 9

TEMPLETON CHINA WORLD FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. | |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

10 | Semiannual Report

franklintempleton.com

TEMPLETON CHINA WORLD FUND

YOUR FUND’S EXPENSES

| Beginning Account | Ending Account | Expenses Paid During | ||||

| Share Class | Value 9/1/14 | Value 2/28/15 | Period* 9/1/14–2/28/15 | |||

| A | ||||||

| Actual | $ | 1,000 | $ | 953.26 | $ | 8.96 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,015.62 | $ | 9.25 |

| C | ||||||

| Actual | $ | 1,000 | $ | 949.75 | $ | 12.42 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,012.05 | $ | 12.82 |

| R6 | ||||||

| Actual | $ | 1,000 | $ | 955.10 | $ | 6.74 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,017.90 | $ | 6.95 |

| Advisor | ||||||

| Actual | $ | 1,000 | $ | 954.35 | $ | 7.61 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,017.01 | $ | 7.85 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 1.85%; C: 2.57%; R6: 1.39%; and Advisor: 1.57%), multiplied by the average account value over the period, multiplied by 181/365 to reflect the one-half year period.

franklintempleton.com

Semiannual Report | 11

TEMPLETON CHINA WORLD FUND

| Financial Highlights | ||||||||||||||||||

| Six Months Ended | ||||||||||||||||||

| February 28, 2015 | Year Ended August 31, | |||||||||||||||||

| (unaudited) | 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||

| Class A | ||||||||||||||||||

| Per share operating performance | ||||||||||||||||||

| (for a share outstanding throughout the period) | ||||||||||||||||||

| Net asset value, beginning of period | $ | 38.01 | $ | 35.78 | $ | 34.09 | $ | 37.62 | $ | 33.89 | $ | 29.91 | ||||||

| Income from investment operationsa: | ||||||||||||||||||

| Net investment income (loss)b | (0.09 | ) | 0.44 | 0.41 | 0.56 | 0.25 | 0.17 | |||||||||||

| Net realized and unrealized gains (losses) | (1.89 | ) | 3.94 | 2.11 | (3.53 | ) | 3.90 | 4.23 | ||||||||||

| Total from investment operations | (1.98 | ) | 4.38 | 2.52 | (2.97 | ) | 4.15 | 4.40 | ||||||||||

| Less distributions from: | ||||||||||||||||||

| Net investment income | (0.45 | ) | (0.52 | ) | (0.65 | ) | (0.25 | ) | (0.35 | ) | (0.42 | ) | ||||||

| Net realized gains | (4.16 | ) | (1.63 | ) | (0.18 | ) | (0.31 | ) | (0.07 | ) | — | |||||||

| Total distributions | (4.61 | ) | (2.15 | ) | (0.83 | ) | (0.56 | ) | (0.42 | ) | (0.42 | ) | ||||||

| Net asset value, end of period | $ | 31.42 | $ | 38.01 | $ | 35.78 | $ | 34.09 | $ | 37.62 | $ | 33.89 | ||||||

| Total returnc | (4.67 | )% | 12.76 | % | 7.22 | % | (7.86 | )% | 12.22 | % | 14.76 | % | ||||||

| Ratios to average net assetsd | ||||||||||||||||||

| Expenses | 1.85 | %e | 1.85 | %e | 1.85 | % | 1.87 | % | 1.92 | % | 2.02 | % | ||||||

| Net investment income (loss) | (0.51 | )% | 1.23 | % | 1.13 | % | 1.56 | % | 0.65 | % | 0.54 | % | ||||||

| Supplemental data | ||||||||||||||||||

| Net assets, end of period (000’s) | $ | 317,331 | $ | 373,231 | $ | 429,085 | $ | 482,277 | $ | 550,539 | $ | 462,960 | ||||||

| Portfolio turnover rate | 2.04 | % | 3.75 | % | 6.12 | % | 7.13 | % | 5.55 | % | 9.94 | % | ||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of waiver and payments by affiliates rounds to less than 0.01%.

12 | Semiannual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

TEMPLETON CHINA WORLD FUND

FINANCIAL HIGHLIGHTS

| Six Months Ended | ||||||||||||||||||

| February 28, 2015 | Year Ended August 31, | |||||||||||||||||

| (unaudited) | 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||

| Class C | ||||||||||||||||||

| Per share operating performance | ||||||||||||||||||

| (for a share outstanding throughout the period) | ||||||||||||||||||

| Net asset value, beginning of period | $ | 37.52 | $ | 35.30 | $ | 33.55 | $ | 37.02 | $ | 33.39 | $ | 29.58 | ||||||

| Income from investment operationsa: | ||||||||||||||||||

| Net investment income (loss)b | (0.21 | ) | 0.18 | 0.16 | 0.28 | (0.01 | ) | (0.05 | ) | |||||||||

| Net realized and unrealized gains (losses) | (1.87 | ) | 3.91 | 2.04 | (3.44 | ) | 3.83 | 4.17 | ||||||||||

| Total from investment operations | (2.08 | ) | 4.09 | 2.20 | (3.16 | ) | 3.82 | 4.12 | ||||||||||

| Less distributions from: | ||||||||||||||||||

| Net investment income | (0.26 | ) | (0.24 | ) | (0.27 | ) | — | (0.12 | ) | (0.31 | ) | |||||||

| Net realized gains | (4.16 | ) | (1.63 | ) | (0.18 | ) | (0.31 | ) | (0.07 | ) | — | |||||||

| Total distributions | (4.42 | ) | (1.87 | ) | (0.45 | ) | (0.31 | ) | (0.19 | ) | (0.31 | ) | ||||||

| Net asset value, end of period | $ | 31.02 | $ | 37.52 | $ | 35.30 | $ | 33.55 | $ | 37.02 | $ | 33.39 | ||||||

| Total returnc | (5.03 | )% | 11.98 | % | 6.50 | % | (8.51 | )% | 11.41 | % | 13.97 | % | ||||||

| Ratios to average net assetsd | ||||||||||||||||||

| Expenses | 2.57 | %e | 2.54 | %e | 2.55 | % | 2.56 | % | 2.62 | % | 2.71 | % | ||||||

| Net investment income (loss) | (1.23 | )% | 0.54 | % | 0.43 | % | 0.87 | % | (0.05 | )% | (0.15 | )% | ||||||

| Supplemental data | ||||||||||||||||||

| Net assets, end of period (000’s) | $ | 85,684 | $ | 103,346 | $ | 123,220 | $ | 134,050 | $ | 169,667 | $ | 153,897 | ||||||

| Portfolio turnover rate | 2.04 | % | 3.75 | % | 6.12 | % | 7.13 | % | 5.55 | % | 9.94 | % | ||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable, and is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of waiver and payments by affiliates rounds to less than 0.01%.

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Semiannual Report | 13

TEMPLETON CHINA WORLD FUND

FINANCIAL HIGHLIGHTS

| Six Months Ended | |||||||||

| February 28, 2015 | Year Ended August 31, | ||||||||

| (unaudited) | 2014 | 2013 | a | ||||||

| Class R6 | |||||||||

| Per share operating performance | |||||||||

| (for a share outstanding throughout the period) | |||||||||

| Net asset value, beginning of period | $ | 38.27 | $ | 36.03 | $ | 38.14 | |||

| Income from investment operationsb: | |||||||||

| Net investment income (loss)c | (0.02 | ) | 0.66 | 0.68 | |||||

| Net realized and unrealized gains (losses) | (1.90 | ) | 3.93 | (2.79 | ) | ||||

| Total from investment operations | (1.92 | ) | 4.59 | (2.11 | ) | ||||

| Less distributions from: | |||||||||

| Net investment income | (0.58 | ) | (0.72 | ) | — | ||||

| Net realized gains | (4.16 | ) | (1.63 | ) | — | ||||

| Total distributions | (4.74 | ) | (2.35 | ) | — | ||||

| Net asset value, end of period | $ | 31.61 | $ | 38.27 | $ | 36.03 | |||

| Total returnd | (4.49 | )% | 13.31 | % | (5.53 | )% | |||

| Ratios to average net assetse | |||||||||

| Expenses | 1.39 | %f | 1.37 | %f | 1.39 | % | |||

| Net investment income (loss) | (0.05 | )% | 1.71 | % | 1.59 | % | |||

| Supplemental data | |||||||||

| Net assets, end of period (000’s) | $ | 71,103 | $ | 73,067 | $ | 64,078 | |||

| Portfolio turnover rate | 2.04 | % | 3.75 | % | 6.12 | % | |||

aFor the period May 1, 2013 (effective date) to August 31, 2013.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dTotal return is not annualized for periods less than one year.

eRatios are annualized for periods less than one year.

fBenefit of waiver and payments by affiliates rounds to less than 0.01%.

14 | Semiannual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

TEMPLETON CHINA WORLD FUND

FINANCIAL HIGHLIGHTS

| Six Months Ended | ||||||||||||||||||

| February 28, 2015 | Year Ended August 31, | |||||||||||||||||

| (unaudited) | 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||||

| Advisor Class | ||||||||||||||||||

| Per share operating performance | ||||||||||||||||||

| (for a share outstanding throughout the period) | ||||||||||||||||||

| Net asset value, beginning of period | $ | 38.26 | $ | 36.01 | $ | 34.33 | $ | 37.91 | $ | 34.13 | $ | 30.06 | ||||||

| Income from investment operationsa: | ||||||||||||||||||

| Net investment income (loss)b | (0.02 | ) | 0.55 | 0.46 | 0.68 | 0.39 | 0.29 | |||||||||||

| Net realized and unrealized gains (losses) | (1.94 | ) | 3.98 | 2.20 | (3.58 | ) | 3.91 | 4.24 | ||||||||||

| Total from investment operations | (1.96 | ) | 4.53 | 2.66 | (2.90 | ) | 4.30 | 4.53 | ||||||||||

| Less distributions from: | ||||||||||||||||||

| Net investment income | (0.52 | ) | (0.65 | ) | (0.80 | ) | (0.37 | ) | (0.45 | ) | (0.46 | ) | ||||||

| Net realized gains | (4.16 | ) | (1.63 | ) | (0.18 | ) | (0.31 | ) | (0.07 | ) | — | |||||||

| Total distributions | (4.68 | ) | (2.28 | ) | (0.98 | ) | (0.68 | ) | (0.52 | ) | (0.46 | ) | ||||||

| Net asset value, end of period | $ | 31.62 | $ | 38.26 | $ | 36.01 | $ | 34.33 | $ | 37.91 | $ | 34.13 | ||||||

| Total returnc | (4.57 | )% | 13.12 | % | 7.54 | % | (7.57 | )% | 12.52 | % | 15.12 | % | ||||||

| Ratios to average net assetsd | ||||||||||||||||||

| Expenses | 1.57 | %e | 1.55 | %e | 1.55 | % | 1.57 | % | 1.62 | % | 1.71 | % | ||||||

| Net investment income (loss) | (0.23 | )% | 1.53 | % | 1.43 | % | 1.86 | % | 0.95 | % | 0.85 | % | ||||||

| Supplemental data | ||||||||||||||||||

| Net assets, end of period (000’s) | $ | 140,462 | $ | 223,825 | $ | 240,826 | $ | 354,249 | $ | 368,992 | $ | 330,254 | ||||||

| Portfolio turnover rate | 2.04 | % | 3.75 | % | 6.12 | % | 7.13 | % | 5.55 | % | 9.94 | % | ||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cTotal return is not annualized for periods less than one year.

dRatios are annualized for periods less than one year.

eBenefit of waiver and payments by affiliates rounds to less than 0.01%.

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Semiannual Report | 15

TEMPLETON CHINA WORLD FUND

| Statement of Investments, February 28, 2015 (unaudited) | ||||

| Country | Shares | Value | ||

| Common Stocks 100.1% | ||||

| Automobiles 8.3% | ||||

| Chongqing Changan Automobile Co. Ltd., B | China | 3,351,157 | $ | 9,103,951 |

| Dongfeng Motor Group Co. Ltd., H | China | 13,785,478 | 21,933,482 | |

| Great Wall Motor Co. Ltd., H | China | 320,845 | 2,045,654 | |

| Guangzhou Automobile Group Co. Ltd., H | China | 1,476,493 | 1,418,268 | |

| Jiangling Motors Corp. Ltd., B | China | 3,463,745 | 16,412,467 | |

| 50,913,822 | ||||

| Banks 13.3% | ||||

| Bank of China Ltd., H | China | 28,765,600 | 16,578,741 | |

| BOC Hong Kong (Holdings) Ltd. | Hong Kong | 5,313,000 | 18,701,355 | |

| China Construction Bank Corp., H | China | 34,814,926 | 28,998,037 | |

| Industrial and Commercial Bank of China Ltd., H | China | 23,615,725 | 17,325,435 | |

| 81,603,568 | ||||

| Beverages 0.8% | ||||

| Yantai Changyu Pioneer Wine Co. Ltd., B | China | 1,404,299 | 4,818,092 | |

| Commercial Services & Supplies 0.1% | ||||

| aIntegrated Waste Solutions Group Holdings Ltd. | Hong Kong | 11,062,000 | 435,015 | |

| Construction Materials 5.3% | ||||

| Anhui Conch Cement Co. Ltd., H | China | 912,000 | 3,104,341 | |

| Asia Cement China Holdings Corp. | China | 12,893,271 | 6,932,179 | |

| BBMG Corp., H | China | 5,042,000 | 4,446,615 | |

| China National Building Material Co. Ltd., H | China | 13,900,000 | 13,602,764 | |

| Huaxin Cement Co. Ltd., B | China | 3,919,226 | 4,710,910 | |

| 32,796,809 | ||||

| Distributors 1.5% | ||||

| Dah Chong Hong Holdings Ltd. | China | 15,580,563 | 9,321,198 | |

| Diversified Telecommunication Services 1.1% | ||||

| China Unicom (Hong Kong) Ltd. | China | 3,908,168 | 6,611,160 | |

| Electric Utilities 2.8% | ||||

| Cheung Kong Infrastructure Holdings Ltd. | Hong Kong | 2,042,548 | 17,381,482 | |

| Electronic Equipment, Instruments & Components 2.3% | ||||

| Simplo Technology Co. Ltd. | Taiwan | 1,787,948 | 8,870,933 | |

| Synnex Technology International Corp. | Taiwan | 3,549,094 | 5,175,433 | |

| 14,046,366 | ||||

| Energy Equipment & Services 0.0%† | ||||

| Anhui Tianda Oil Pipe Co. Ltd., H | China | 1,083,000 | 171,753 | |

| Food & Staples Retailing 13.3% | ||||

| Beijing Jingkelong Co. Ltd., H | China | 4,271,471 | 1,084,961 | |

| China Resources Enterprise Ltd. | China | 2,365,100 | 4,946,192 | |

| Dairy Farm International Holdings Ltd. | Hong Kong | 6,546,276 | 57,083,527 | |

| President Chain Store Corp. | Taiwan | 2,411,259 | 18,712,143 | |

| 81,826,823 | ||||

16 | Semiannual Report franklintempleton.com

TEMPLETON CHINA WORLD FUND

STATEMENT OF INVESTMENTS (UNAUDITED)

| Country | Shares | Value | ||

| Common Stocks (continued) | ||||

| Food Products 2.3% | ||||

| aChina Foods Ltd. | China | 5,966,000 | $ | 2,046,141 |

| Tingyi (Cayman Islands) Holding Corp. | China | 798,000 | 2,006,356 | |

| Uni-President China Holdings Ltd. | China | 9,498,280 | 7,470,426 | |

| Uni-President Enterprises Corp. | Taiwan | 1,420,572 | 2,385,542 | |

| 13,908,465 | ||||

| Gas Utilities 1.6% | ||||

| ENN Energy Holdings Ltd. | China | 1,870,100 | 9,958,306 | |

| Health Care Providers & Services 0.6% | ||||

| Shanghai Pharmaceuticals Holding Co. Ltd., H | China | 1,662,400 | 3,476,618 | |

| Hotels, Restaurants & Leisure 0.3% | ||||

| SJM Holdings Ltd. | Hong Kong | 1,241,000 | 1,792,092 | |

| Independent Power & Renewable Electricity Producers 0.3% | ||||

| Huaneng Renewables Corp. Ltd., H | China | 4,696,000 | 1,634,792 | |

| Industrial Conglomerates 2.5% | ||||

| Hopewell Holdings Ltd. | Hong Kong | 3,596,500 | 13,424,534 | |

| Shanghai Industrial Holdings Ltd. | China | 757,253 | 2,289,573 | |

| 15,714,107 | ||||

| Insurance 2.5% | ||||

| AIA Group Ltd. | Hong Kong | 2,604,300 | 15,295,018 | |

| Internet Software & Services 4.0% | ||||

| aBaidu Inc., ADR | China | 53,000 | 10,798,750 | |

| aSohu.com Inc. | China | 56,567 | 2,976,556 | |

| Tencent Holdings Ltd. | China | 603,000 | 10,565,921 | |

| 24,341,227 | ||||

| IT Services 0.8% | ||||

| Travelsky Technology Ltd., H | China | 4,921,941 | 5,279,956 | |

| Machinery 0.6% | ||||

| bZoomlion Heavy Industry Science and Technology Development Co. Ltd., H | China | 5,406,620 | 3,464,598 | |

| Marine 1.9% | ||||

| aChina Shipping Container Lines Co. Ltd., H | China | 8,660,000 | 2,679,784 | |

| aChina Shipping Development Co. Ltd., H | China | 9,938,000 | 6,791,183 | |

| aSinotrans Shipping Ltd. | China | 11,570,000 | 2,491,268 | |

| 11,962,235 | ||||

| Metals & Mining 0.2% | ||||

| Jiangxi Copper Co. Ltd., H | China | 810,043 | 1,389,090 | |

| Oil, Gas & Consumable Fuels 11.8% | ||||

| China Petroleum and Chemical Corp., H | China | 45,199,413 | 37,880,591 | |

| China Shenhua Energy Co. Ltd., H | China | 674,000 | 1,768,458 | |

| CNOOC Ltd. | China | 11,347,000 | 16,298,095 | |

| PetroChina Co. Ltd., H | China | 14,392,403 | 16,701,152 | |

| 72,648,296 | ||||

| Paper & Forest Products 1.9% | ||||

| Nine Dragons Paper Holdings Ltd. | China | 18,468,000 | 12,024,910 | |

| Pharmaceuticals 0.5% | ||||

| Tong Ren Tang Technologies Co. Ltd., H | China | 2,299,700 | 2,834,652 |

franklintempleton.com Semiannual Report | 17

TEMPLETON CHINA WORLD FUND

STATEMENT OF INVESTMENTS (UNAUDITED)

| Country | Shares | Value | |||

| Common Stocks (continued) | |||||

| Real Estate Management & Development 1.5% | |||||

| Cheung Kong (Holdings) Ltd. | Hong Kong | 323,690 | $ | 6,406,315 | |

| China Overseas Land & Investment Ltd. | China | 466,000 | 1,417,975 | ||

| Soho China Ltd. | China | 1,789,445 | 1,285,121 | ||

| 9,109,411 | |||||

| Semiconductors & Semiconductor Equipment 8.4% | |||||

| aGCL-Poly Energy Holdings Ltd. | Hong Kong | 12,955,000 | 3,123,559 | ||

| Taiwan Semiconductor Manufacturing Co. Ltd. | Taiwan | 10,113,330 | 48,408,376 | ||

| 51,531,935 | |||||

| Textiles, Apparel & Luxury Goods 2.5% | |||||

| Anta Sports Products Ltd. | China | 7,875,355 | 15,698,213 | ||

| Transportation Infrastructure 2.5% | |||||

| COSCO Pacific Ltd. | China | 7,542,012 | 10,891,203 | ||

| Sichuan Expressway Co. Ltd., H | China | 10,682,000 | 4,324,668 | ||

| 15,215,871 | |||||

| Wireless Telecommunication Services 4.6% | |||||

| China Mobile Ltd. | China | 2,068,270 | 28,187,257 | ||

| Total Common Stocks (Cost $329,193,782) | 615,393,137 | ||||

| Short Term Investments 0.5% | |||||

| Money Market Funds (Cost $1,064,874) 0.2% | |||||

| a,cInstitutional Fiduciary Trust Money Market Portfolio | United States | 1,064,874 | 1,064,874 | ||

| dInvestments from Cash Collateral Received for Loaned Securities | |||||

| (Cost $1,890,000) 0.3% | |||||

| Money Market Funds 0.3% | |||||

| a,cInstitutional Fiduciary Trust Money Market Portfolio | United States | 1,890,000 | 1,890,000 | ||

| Total Investments (Cost $332,148,656) 100.6% | 618,348,011 | ||||

| Other Assets, less Liabilities (0.6)% | (3,767,588 | ) | |||

| Net Assets 100.0% | $ | 614,580,423 |

See Abbreviations on page 29.

†Rounds to less than 0.1% of net assets.

aNon-income producing.

bA portion or all of the security is on loan at February 28, 2015. See Note 1(c).

cSee Note 3(f) regarding investments in Institutional Fiduciary Trust Money Market Portfolio.

dSee Note 1(c) regarding securities on loan.

18 | Semiannual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

TEMPLETON CHINA WORLD FUND

| Financial Statements | |||

| Statement of Assets and Liabilities | |||

| February 28, 2015 (unaudited) | |||

| Assets: | |||

| Investments in securities: | |||

| Cost - Unaffiliated issuers | $ | 329,193,782 | |

| Cost - Sweep Money Fund (Note 3f) | 2,954,874 | ||

| Total cost of investments | $ | 332,148,656 | |

| Value - Unaffiliated issuers | $ | 615,393,137 | |

| Value - Sweep Money Fund (Note 3f) | 2,954,874 | ||

| Total value of investments (includes securities loaned in the amount of $1,730,178) | 618,348,011 | ||

| Receivables: | |||

| Investment securities sold | 61,921 | ||

| Capital shares sold | 693,232 | ||

| Dividends | 2,492 | ||

| Other assets | 396 | ||

| Total assets | 619,106,052 | ||

| Liabilities: | |||

| Payables: | |||

| Capital shares redeemed | 1,502,271 | ||

| Management fees | 664,470 | ||

| Distribution fees | 135,954 | ||

| Transfer agent fees | 198,104 | ||

| Trustees’ fees and expenses | 1,898 | ||

| Payable upon return of securities loaned | 1,890,000 | ||

| Accrued expenses and other liabilities | 132,932 | ||

| Total liabilities | 4,525,629 | ||

| Net assets, at value | $ | 614,580,423 | |

| Net assets consist of: | |||

| Paid-in capital | $ | 296,886,392 | |

| Distributions in excess of net investment income | (1,818,546 | ) | |

| Net unrealized appreciation (depreciation) | 286,199,355 | ||

| Accumulated net realized gain (loss) | 33,313,222 | ||

| Net assets, at value | $ | 614,580,423 | |

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Semiannual Report | 19

| TEMPLETON CHINA WORLD FUND | ||

| FINANCIAL STATEMENTS | ||

| Statement of Assets and Liabilities (continued) | ||

| February 28, 2015 (unaudited) | ||

| Class A: | ||

| Net assets, at value | $ | 317,331,415 |

| Shares outstanding | 10,098,136 | |

| Net asset value per sharea | $ | 31.42 |

| Maximum offering price per share (net asset value per share ÷ 94.25%) | $ | 33.34 |

| Class C: | ||

| Net assets, at value | $ | 85,683,734 |

| Shares outstanding | 2,761,879 | |

| Net asset value and maximum offering price per sharea | $ | 31.02 |

| Class R6: | ||

| Net assets, at value | $ | 71,103,189 |

| Shares outstanding | 2,249,298 | |

| Net asset value and maximum offering price per share | $ | 31.61 |

| Advisor Class: | ||

| Net assets, at value | $ | 140,462,085 |

| Shares outstanding | 4,441,557 | |

| Net asset value and maximum offering price per share | $ | 31.62 |

| aRedemption price is equal to net asset value less contingent deferred sales charges, if applicable. | |

| 20 | Semiannual Report | The accompanying notes are an integral part of these financial statements. | franklintempleton.com |

TEMPLETON CHINA WORLD FUND

FINANCIAL STATEMENTS

Statement of Operations

for the six months ended February 28, 2015 (unaudited)

| Investment income: | |||

| Dividends (net of foreign taxes of $298,285) | $ | 4,372,255 | |

| Income from securities loaned | 34,046 | ||

| Total investment income | 4,406,301 | ||

| Expenses: | |||

| Management fees (Note 3a) | 4,279,683 | ||

| Distribution fees: (Note 3c) | |||

| Class A | 455,696 | ||

| Class C | 454,711 | ||

| Transfer agent fees: (Note 3e) | |||

| Class A | 304,099 | ||

| Class C | 83,987 | ||

| Class R6 | 125 | ||

| Advisor Class | 153,703 | ||

| Custodian fees (Note 4) | 81,662 | ||

| Reports to shareholders | 64,056 | ||

| Registration and filing fees | 47,146 | ||

| Professional fees | 37,053 | ||

| Trustees’ fees and expenses | 33,100 | ||

| Other | 13,645 | ||

| Total expenses | 6,008,666 | ||

| Expenses waived/paid by affiliates (Note 3f) | (1,162 | ) | |

| Net expenses | 6,007,504 | ||

| Net investment income (loss) | (1,601,203 | ) | |

| Realized and unrealized gains (losses): | |||

| Net realized gain (loss) from: | |||

| Investments | 35,143,665 | ||

| Foreign currency transactions | (61,532 | ) | |

| Net realized gain (loss) | 35,082,133 | ||

| Net change in unrealized appreciation (depreciation) on: | |||

| Investments | (71,761,848 | ) | |

| Translation of other assets and liabilities denominated in foreign currencies | (2,549 | ) | |

| Net change in unrealized appreciation (depreciation) | (71,764,397 | ) | |

| Net realized and unrealized gain (loss) | (36,682,264 | ) | |

| Net increase (decrease) in net assets resulting from operations | $ | (38,283,467 | ) |

franklintempleton.com The accompanying notes are an integral part of these financial statements. | Semiannual Report | 21

| TEMPLETON CHINA WORLD FUND | ||||||

| FINANCIAL STATEMENTS | ||||||

| Statements of Changes in Net Assets | ||||||

| Six Months Ended | ||||||

| February 28, 2015 | Year Ended | |||||

| (unaudited) | August 31, 2014 | |||||

| Increase (decrease) in net assets: | ||||||

| Operations: | ||||||

| Net investment income (loss) | $ | (1,601,203 | ) | $ | 10,096,866 | |

| Net realized gain (loss) from investments and foreign currency transactions | 35,082,133 | 83,844,124 | ||||

| Net change in unrealized appreciation (depreciation) on investments and translation of other | ||||||

| assets and liabilities denominated in foreign currencies | (71,764,397 | ) | (1,184,203 | ) | ||

| Net increase (decrease) in net assets resulting from operations | (38,283,467 | ) | 92,756,787 | |||

| Distributions to shareholders from: | ||||||

| Net investment income: | ||||||

| Class A | (4,134,433 | ) | (6,068,459 | ) | ||

| Class C | (678,371 | ) | (806,097 | ) | ||

| Class R6 | (1,083,024 | ) | (1,298,470 | ) | ||

| Advisor Class | (2,373,149 | ) | (4,264,360 | ) | ||

| Net realized gains: | ||||||

| Class A | (38,445,422 | ) | (18,942,902 | ) | ||

| Class C | (10,788,328 | ) | (5,434,403 | ) | ||

| Class R6 | (7,799,385 | ) | (2,944,484 | ) | ||

| Advisor Class | (18,957,393 | ) | (10,773,293 | ) | ||

| Total distributions to shareholders | (84,259,505 | ) | (50,532,468 | ) | ||

| Capital share transactions: (Note 2) | ||||||

| Class A | 4,903,498 | (76,437,722 | ) | |||

| Class C | (738,999 | ) | (25,579,983 | ) | ||

| Class R6 | 10,153,225 | 4,751,620 | ||||

| Advisor Class | (50,663,807 | ) | (28,698,529 | ) | ||

| Total capital share transactions | (36,346,083 | ) | (125,964,614 | ) | ||

| Net increase (decrease) in net assets | (158,889,055 | ) | (83,740,295 | ) | ||

| Net assets: | ||||||

| Beginning of period | 773,469,478 | 857,209,773 | ||||

| End of period | $ | 614,580,423 | $ | 773,469,478 | ||

| Undistributed net investment income (distributions in excess of net investment income) included | ||||||

| in net assets: | ||||||

| End of period | $ | (1,818,546 | ) | $ | 8,051,634 | |

22 | Semiannual Report | The accompanying notes are an integral part of these financial statements. franklintempleton.com

TEMPLETON CHINA WORLD FUND

Notes to Financial Statements (unaudited)

1. Organization and Significant Accounting Policies

Templeton China World Fund (Fund) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end management investment company and applies the specialized accounting and reporting guidance in U.S. Generally Accepted Accounting Principles (U.S. GAAP). The Fund offers four classes of shares: Class A, Class C, Class R6, and Advisor Class. Each class of shares differs by its initial sales load, contingent deferred sales charges, voting rights on matters affecting a single class, its exchange privilege and fees primarily due to differing arrangements for distribution and transfer agent fees.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Fund calculates the net asset value (NAV) per share at the close of the New York Stock Exchange (NYSE), generally at 4 p.m. Eastern time (NYSE close) on each day the NYSE is open for trading. Under compliance policies and procedures approved by the Fund’s Board of Trustees (the Board), the Fund’s administrator has responsibility for oversight of valuation, including leading the cross-functional Valuation and Liquidity Oversight Committee (VLOC). The VLOC provides administration and oversight of the Fund’s valuation policies and procedures, which are approved annually by the Board. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded or as of the NYSE close, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the NYSE close on the day that the value of the security is determined. Over-the-counter (OTC) securities are valued within the range of the most recent quoted

bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities. Investments in open-end mutual funds are valued at the closing NAV.

The Fund has procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the VLOC convenes on a regular basis to review such financial instruments and considers a number of factors, including significant unobservable valuation inputs, when arriving at fair value. The VLOC primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed. The VLOC employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis, and reviews of any related market activity.

Trading in securities on foreign securities stock exchanges and OTC markets may be completed before the daily NYSE close. In addition, trading in certain foreign markets may not take place on every NYSE business day. Occasionally, events occur between the time at which trading in a foreign security is completed and the close of the NYSE that might call into question the reliability of the value of a portfolio security held by the Fund. As a result, differences may arise between the value of the Fund’s portfolio securities as determined at the foreign market close and the latest indications of value at the close of the NYSE. In order to minimize the potential for these differences, the VLOC monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depositary Receipts, futures contracts and exchange traded funds). These price movements are measured against established trigger thresholds for each specific market proxy to assist in determining if an event has occurred that may call into

franklintempleton.com

Semiannual Report | 23

TEMPLETON CHINA WORLD FUND

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

1. Organization and Significant Accounting

Policies (continued)

a. Financial Instrument Valuation (continued)

question the reliability of the values of the foreign securities held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

When the last day of the reporting period is a non-business day, certain foreign markets may be open on those days that the NYSE is closed, which could result in differences between the value of the Fund’s portfolio securities on the last business day and the last calendar day of the reporting period. Any significant security valuation changes due to an open foreign market are adjusted and reflected by the Fund for financial reporting purposes.

b. Foreign Currency Translation

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Board.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments in the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign

exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c. Securities Lending

The Fund participates in an agency based securities lending program to earn additional income. The Fund receives cash collateral against the loaned securities in an amount equal to at least 102% of the fair value of the loaned securities. Collateral is maintained over the life of the loan in an amount not less than 100% of the fair value of loaned securities, as determined at the close of fund business each day; any additional collateral required due to changes in security values is delivered to the Fund on the next business day. The collateral is deposited into a joint cash account with other funds and is used to invest in a money market fund managed by Franklin Advisers, Inc., an affiliate of the Fund. The total cash collateral received at period end was $1,890,000. The Fund may receive income from the investment of cash collateral, in addition to lending fees and rebates paid by the borrower. Income from securities loaned is reported separately in the Statement of Operations. The Fund bears the market risk with respect to the collateral investment, securities loaned, and the risk that the agent may default on its obligations to the Fund. If the borrower defaults on its obligation to return the securities loaned, the Fund has the right to repurchase the securities in the open market using the collateral received. The securities lending agent has agreed to indemnify the Fund in the event of default by a third party borrower.

d. Income and Deferred Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Fund may be subject to foreign taxation related to income received, capital gains on the sale of securities and certain foreign currency transactions in the foreign jurisdictions in which it invests. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. When a capital gain tax is determined to apply the Fund records an estimated deferred tax liability in an amount that would be payable if the securities were disposed of on the valuation date.

24 | Semiannual Report

franklintempleton.com

TEMPLETON CHINA WORLD FUND

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of February 28, 2015, and for all open tax years, the Fund has determined that no liability for unrecognized tax benefits is required in the Fund’s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

e. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Estimated expenses are accrued daily. Dividend income is recorded on the ex-dividend date except for certain dividends from foreign securities where the dividend rate is not available. In such cases, the dividend is recorded as soon as the information is received by the Fund. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with U.S. GAAP. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

f. Accounting Estimates

The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

g. Guarantees and Indemnifications

Under the Fund’s organizational documents, its officers and trustees are indemnified by the Fund against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

2. Shares of Beneficial Interest

At February 28, 2015, there were an unlimited number of shares authorized (without par value). Transactions in the Fund’s shares were as follows:

| Six Months Ended | Year Ended | ||||||||||

| February 28, 2015 | August 31, 2014 | ||||||||||

| Shares | Amount | Shares | Amount | ||||||||

| Class A Shares: | |||||||||||

| Shares sold | 805,163 | $ | 26,782,956 | 1,585,370 | $ | 57,443,425 | |||||

| Shares issued in reinvestment of distributions | 1,359,641 | 40,993,162 | 677,380 | 23,803,166 | |||||||

| Shares redeemed | (1,884,763 | ) | (62,872,620 | ) | (4,437,514 | ) | (157,684,313 | ) | |||

| Net increase (decrease) | 280,041 | $ | 4,903,498 | (2,174,764 | ) | $ | (76,437,722 | ) | |||

| Class C Shares: | |||||||||||

| Shares sold | 136,063 | $ | 4,401,000 | 302,066 | $ | 10,808,891 | |||||

| Shares issued in reinvestment of distributions | 331,271 | 9,871,865 | 144,885 | 5,049,231 | |||||||

| Shares redeemed | (460,059 | ) | (15,011,864 | ) | (1,182,615 | ) | (41,438,105 | ) | |||

| Net increase (decrease) | 7,275 | $ | (738,999 | ) | (735,664 | ) | $ | (25,579,983 | ) | ||

| franklintempleton.com | Semiannual Report | 25 | ||||||||||

TEMPLETON CHINA WORLD FUND

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

| 2. Shares of Beneficial Interest (continued) | |||||||||||

| Six Months Ended | Year Ended | ||||||||||

| February 28, 2015 | August 31, 2014 | ||||||||||

| Shares | Amount | Shares | Amount | ||||||||

| Class R6 Shares: | |||||||||||

| Shares sold | 112,276 | $ | 3,547,420 | 89,090 | $ | 3,258,440 | |||||

| Shares issued in reinvestment of distributions | 293,149 | 8,882,409 | 120,333 | 4,242,954 | |||||||

| Shares redeemed | (65,300 | ) | (2,276,604 | ) | (78,830 | ) | (2,749,774 | ) | |||

| Net increase (decrease) | 340,125 | $ | 10,153,225 | 130,593 | $ | 4,751,620 | |||||

| Advisor Class Shares: | |||||||||||

| Shares sold | 391,594 | $ | 13,174,159 | 890,446 | $ | 32,477,219 | |||||

| Shares issued in reinvestment of distributions | 521,966 | 15,826,017 | 284,001 | 10,022,406 | |||||||

| Shares redeemed | (2,322,647 | ) | (79,663,983 | ) | (2,012,193 | ) | (71,198,154 | ) | |||

| Net increase (decrease) | (1,409,087 | ) | $ | (50,663,807 | ) | (837,746 | ) | $ | (28,698,529 | ) | |

3. Transactions with Affiliates

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Fund are also officers, and/or directors, of the following subsidiaries:

| Subsidiary | Affiliation |

| Templeton Asset Management Ltd. (TAML) | Investment manager |

| Franklin Templeton Services, LLC (FT Services) | Administrative manager |

| Franklin Templeton Distributors, Inc. (Distributors) | Principal underwriter |

| Franklin Templeton Investor Services, LLC (Investor Services) | Transfer agent |

a. Management Fees

The Fund pays an investment management fee to TAML based on the average weekly net assets of the Fund as follows:

| Annualized Fee Rate | Net Assets | |

| 1.300 | % | Up to and including $1 billion |

| 1.250 | % | Over $1 billion, up to and including $5 billion |

| 1.200 | % | Over $5 billion, up to and including $10 billion |

| 1.150 | % | Over $10 billion, up to and including $15 billion |

| 1.100 | % | Over $15 billion, up to and including $20 billion |

| 1.050 | % | In excess of $20 billion |

b. Administrative Fees

Under an agreement with TAML, FT Services provides administrative services to the Fund. The fee is paid by TAML based on average weekly net assets, and is not an additional expense of the Fund.

c. Distribution Fees

The Board has adopted distribution plans for each share class, with the exception of Class R6 and Advisor Class shares, pursuant to Rule 12b-1 under the 1940 Act. Distribution fees are not charged on shares held by affiliates. Under the Fund’s Class A reimbursement distribution plan, the Fund reimburses Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. Under the Class A reimbursement distribution plan, costs exceeding the maximum for the current plan year cannot be reimbursed in subsequent periods. In addition, under the Fund’s Class C compensation

26 | Semiannual Report

franklintempleton.com

TEMPLETON CHINA WORLD FUND

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

distribution plan, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. The plan year, for purposes of monitoring compliance with the maximum annual plan rate, is February 1 through January 31.

The maximum annual plan rates, based on the average daily net assets, for each class, are as follows:

| Class A | 0.35 | % |

| Class C | 1.00 | % |

The Board has set the current rate at 0.30% per year for Class A shares until further notice and approval by the Board.

d. Sales Charges/Underwriting Agreements

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses of the Fund. These charges are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as applicable. Distributors has advised the Fund of the following commission transactions related to the sales and redemptions of the Fund’s shares for the period:

| Sales charges retained net of commissions paid to unaffiliated broker/dealers | $ | 27,184 |

| CDSC retained | $ | 2,476 |

e. Transfer Agent Fees

Each class of shares, except for Class R6, pays transfer agent fees to Investor Services for its performance of shareholder servicing obligations and reimburses Investor Services for out of pocket expenses incurred, including shareholding servicing fees paid to third parties. These fees are allocated daily based upon their relative proportion of such classes’ aggregate net assets. Class R6 pays Investor Services transfer agent fees specific to that class.

For the period ended February 28, 2015, the Fund paid transfer agent fees of $541,914, of which $262,068 was retained by Investor Services.

f. Investments in Institutional Fiduciary Trust Money Market Portfolio

The Fund invests in Institutional Fiduciary Trust Money Market Portfolio (Sweep Money Fund), an affiliated open-end management investment company. Management fees paid by the Fund are waived on assets invested in the Sweep Money Fund, as noted in the Statement of Operations, in an amount not to exceed the management and administrative fees paid directly or indirectly by the Sweep Money Fund. Prior to September 1, 2013, the waiver was accounted for as a reduction to management fees.

g. Waiver and Expense Reimbursements

Investor Services has contractually agreed in advance to waive or limit its fees so that the Class R6 transfer agent fees do not exceed 0.01% until December 31, 2015. There were no Class R6 transfer agent fees waived during the period ended February 28, 2015.

h. Other Affiliated Transactions

At February 28, 2015, one or more of the funds in Franklin Fund Allocator Series owned 11.40% of the Fund’s outstanding shares.

4. Expense Offset Arrangement

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the period ended February 28, 2015, there were no credits earned.

franklintempleton.com

Semiannual Report | 27

TEMPLETON CHINA WORLD FUND

NOTES TO FINANCIAL STATEMENTS (UNAUDITED)

5. Income Taxes

At February 28, 2015, the cost of investments and net unrealized appreciation (depreciation) for income tax purposes were as follows:

| Cost of investments | $ | 334,113,367 | |

| Unrealized appreciation | $ | 312,876,760 | |

| Unrealized depreciation | (28,642,116 | ) | |

| Net unrealized appreciation (depreciation) | $ | 284,234,644 | |

Differences between income and/or capital gains as determined on a book basis and a tax basis are primarily due to differing treatments of passive foreign investment company shares and corporate actions.

6. Investment Transactions

Purchases and sales of investments (excluding short term securities) for the period ended February 28, 2015, aggregated $13,608,586 and $124,054,394, respectively.

7. Concentration of Risk

Investing in securities of “China companies” may include certain risks and considerations not typically associated with investing in U.S. securities. In general, China companies are those that are organized under the laws of, or with a principal office or principal trading market in, the People’s Republic of China, Hong Kong, or Taiwan. Such risks include fluctuating currency values and changing local and regional economic, political and social conditions, which may result in greater market volatility. In addition, these securities may not be as liquid as U.S. securities.

8. Credit Facility

The Fund, together with other U.S. registered and foreign investment funds (collectively, Borrowers), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $2 billion (Global Credit Facility) which matures on February 12, 2016. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.