Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07874

JPMorgan Insurance Trust

(Exact name of registrant as specified in charter)

270 Park Avenue

New York, NY 10017

(Address of principal executive offices) (Zip code)

Noah D. Greenhill

270 Park Avenue

New York, NY 10017

(Name and Address of Agent for Service)

Registrant’s telephone number, including area code: (800) 480-4111

Date of fiscal year end: December 31

Date of reporting period: January 1, 2018 through June 30, 2018

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Table of Contents

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1).

Table of Contents

Semi-Annual Report

JPMorgan Insurance Trust

June 30, 2018 (Unaudited)

JPMorgan Insurance Trust Core Bond Portfolio

| NOT FDIC INSURED • NO BANK

GUARANTEE • MAY LOSE VALUE

|

|

Table of Contents

| CEO’s Letter | 1 | |||

| 2 | ||||

| Schedule of Portfolio Investments | 4 | |||

| Financial Statements | 36 | |||

| Financial Highlights | 40 | |||

| Notes to Financial Statements | 42 | |||

| Schedule of Shareholder Expenses | 48 | |||

Investments in the Portfolio are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Portfolio’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of the Portfolio or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of the Portfolio.

This Portfolio is intended to be a funding vehicle for variable annuity contracts and variable life insurance policies (collectively “Policies”) offered by the separate accounts of various insurance companies. Portfolio shares may also be offered to qualified pension and retirement plans and accounts permitting accumulation of assets on a tax-deferred basis (“Eligible Plans”). Individuals may not purchase shares directly from the Portfolio.

Prospective investors should refer to the Portfolio’s prospectuses for a discussion of the Portfolio’s investment objective, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about the Portfolio, including management fees and other expenses. Please read it carefully before investing.

Table of Contents

August 6, 2018 (Unaudited)

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 1 | ||||||

Table of Contents

JPMorgan Insurance Trust Core Bond Portfolio

SIX MONTHS ENDED JUNE 30, 2018 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Portfolio (Class 1 Shares)* | (1.64)% | |||

| Bloomberg Barclays U.S. Aggregate Bond Index (formerly Bloomberg Barclays U.S. Aggregate Index) | (1.62)% | |||

| Net Assets as of 6/30/2018 | $ | 302,254,163 | ||

| Duration as of 6/30/2018 | 5.6 years | |||

| 2 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

| AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2018 |

||||||||||||||||||

| INCEPTION DATE OF CLASS |

6 MONTH* | 1 YEAR | 5 YEAR | 10 YEAR | ||||||||||||||

| CLASS 1 SHARES |

May 1, 1997 | |

(1.64 |

)% |

(0.46 | )% | 2.05 | % | 3.97 | % | ||||||||

| CLASS 2 SHARES |

August 16, 2006 | |

(1.74 |

) |

(0.74 | ) | 1.79 | 3.71 | ||||||||||

| * | Not annualized. |

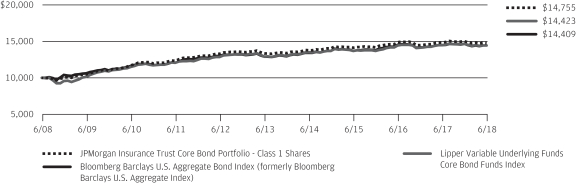

TEN YEAR PERFORMANCE (6/30/08 TO 6/30/18)

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 3 | ||||||

Table of Contents

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2018 (Unaudited)

SEE NOTES TO FINANCIAL STATEMENTS.

| 4 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 5 | ||||||

Table of Contents

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2018 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 6 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 7 | ||||||

Table of Contents

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2018 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 8 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 9 | ||||||

Table of Contents

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2018 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 10 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 11 | ||||||

Table of Contents

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2018 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 12 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 13 | ||||||

Table of Contents

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2018 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 14 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 15 | ||||||

Table of Contents

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2018 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 16 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 17 | ||||||

Table of Contents

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2018 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 18 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 19 | ||||||

Table of Contents

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2018 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 20 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 21 | ||||||

Table of Contents

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2018 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 22 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 23 | ||||||

Table of Contents

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2018 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 24 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 25 | ||||||

Table of Contents

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2018 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 26 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 27 | ||||||

Table of Contents

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2018 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 28 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 29 | ||||||

Table of Contents

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2018 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 30 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 31 | ||||||

Table of Contents

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2018 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 32 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 33 | ||||||

Table of Contents

JPMorgan Insurance Trust Core Bond Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2018 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 34 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 35 | ||||||

Table of Contents

STATEMENT OF ASSETS AND LIABILITIES

AS OF JUNE 30, 2018 (Unaudited)

| JPMorgan Insurance |

||||

| ASSETS: |

||||

| Investments in non-affiliates, at value |

$ | 294,762,169 | ||

| Investments in affiliates, at value |

8,633,644 | |||

| Cash |

30,305 | |||

| Receivables: |

||||

| Investment securities sold |

263,613 | |||

| Portfolio shares sold |

150,817 | |||

| Interest from non-affiliates |

1,425,788 | |||

| Dividends from affiliates |

11,686 | |||

|

|

|

|||

| Total Assets |

305,278,022 | |||

|

|

|

|||

| LIABILITIES: |

||||

| Payables: |

||||

| Investment securities purchased |

155,686 | |||

| Investment securities purchased — delayed delivery securities |

2,576,595 | |||

| Portfolio shares redeemed |

73,078 | |||

| Accrued liabilities: |

||||

| Investment advisory fees |

83,245 | |||

| Administration fees |

17,075 | |||

| Distribution fees |

27,977 | |||

| Custodian and accounting fees |

32,983 | |||

| Trustees’ and Chief Compliance Officer’s fees |

376 | |||

| Other |

56,844 | |||

|

|

|

|||

| Total Liabilities |

3,023,859 | |||

|

|

|

|||

| Net Assets |

$ | 302,254,163 | ||

|

|

|

|||

| NET ASSETS: |

||||

| Paid-in-Capital |

$ | 302,364,452 | ||

| Accumulated undistributed net investment income |

3,516,434 | |||

| Accumulated net realized gains (losses) |

(271,148 | ) | ||

| Net unrealized appreciation (depreciation) |

(3,355,575 | ) | ||

|

|

|

|||

| Total Net Assets |

$ | 302,254,163 | ||

|

|

|

|||

| Net Assets: |

||||

| Class 1 |

$ | 164,403,611 | ||

| Class 2 |

137,850,552 | |||

|

|

|

|||

| Total |

$ | 302,254,163 | ||

|

|

|

|||

| Outstanding units of beneficial interest (shares) |

||||

| (unlimited number of shares authorized, no par value): |

||||

| Class 1 |

15,686,095 | |||

| Class 2 |

13,293,147 | |||

| Net Asset Value, offering and redemption price per share (a): |

||||

| Class 1 |

$ | 10.48 | ||

| Class 2 |

10.37 | |||

|

|

|

|||

| Cost of investments in non-affiliates |

$ | 298,118,179 | ||

| Cost of investments in affiliates |

8,633,209 | |||

| (a) | Per share amounts may not recalculate due to rounding of net assets and/or shares outstanding. |

SEE NOTES TO FINANCIAL STATEMENTS.

| 36 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED JUNE 30, 2018 (Unaudited)

| JPMorgan Insurance |

||||

| INVESTMENT INCOME: |

||||

| Interest income from non-affiliates |

$ | 4,797,688 | ||

| Dividend income from affiliates |

44,605 | |||

|

|

|

|||

| Total investment income |

4,842,293 | |||

|

|

|

|||

| EXPENSES: |

||||

| Investment advisory fees |

584,712 | |||

| Administration fees |

118,570 | |||

| Distribution fees — Class 2 |

161,006 | |||

| Custodian and accounting fees |

95,517 | |||

| Professional fees |

44,969 | |||

| Trustees’ and Chief Compliance Officer’s fees |

12,973 | |||

| Printing and mailing costs |

26,840 | |||

| Transfer agency fees — Class 1 |

1,514 | |||

| Transfer agency fees — Class 2 |

506 | |||

| Other |

12,075 | |||

|

|

|

|||

| Total expenses |

1,058,682 | |||

|

|

|

|||

| Less fees waived |

(86,597 | ) | ||

| Less expense reimbursements |

(872 | ) | ||

|

|

|

|||

| Net expenses |

971,213 | |||

|

|

|

|||

| Net investment income (loss) |

3,871,080 | |||

|

|

|

|||

| REALIZED/UNREALIZED GAINS (LOSSES): |

||||

| Net realized gain (loss) on transactions from: |

||||

| Investments in non-affiliates |

(270,391 | ) | ||

| Investments in affiliates |

(461 | ) | ||

|

|

|

|||

| Net realized gain (loss) |

(270,852 | ) | ||

|

|

|

|||

| Change in net unrealized appreciation/depreciation on: |

||||

| Investments in non-affiliates |

(8,539,475 | ) | ||

| Investments in affiliates |

1,015 | |||

|

|

|

|||

| Change in net unrealized appreciation/depreciation |

(8,538,460 | ) | ||

|

|

|

|||

| Net realized/unrealized gains (losses) |

(8,809,312 | ) | ||

|

|

|

|||

| Change in net assets resulting from operations |

$ | (4,938,232 | ) | |

|

|

|

|||

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 37 | ||||||

Table of Contents

STATEMENTS OF CHANGES IN NET ASSETS

FOR THE PERIODS INDICATED

| JPMorgan Insurance Trust Core Bond Portfolio |

||||||||

| Six Months Ended June 30, 2018 |

Year Ended December 31, |

|||||||

| CHANGE IN NET ASSETS RESULTING FROM OPERATIONS: |

||||||||

| Net investment income (loss) |

$ | 3,871,080 | $ | 6,964,245 | ||||

| Net realized gain (loss) |

(270,852 | ) | 492,048 | |||||

| Change in net unrealized appreciation/depreciation |

(8,538,460 | ) | 1,596,482 | |||||

|

|

|

|

|

|||||

| Change in net assets resulting from operations |

(4,938,232 | ) | 9,052,775 | |||||

|

|

|

|

|

|||||

| DISTRIBUTIONS TO SHAREHOLDERS: |

||||||||

| Class 1 |

||||||||

| From net investment income |

(3,919,683 | ) | (4,505,586 | ) | ||||

| From net realized gains |

(267,081 | ) | — | |||||

| Class 2 |

||||||||

| From net investment income |

(3,064,554 | ) | (2,166,547 | ) | ||||

| From net realized gains |

(225,154 | ) | — | |||||

|

|

|

|

|

|||||

| Total distributions to shareholders |

(7,476,472 | ) | (6,672,133 | ) | ||||

|

|

|

|

|

|||||

| CAPITAL TRANSACTIONS: |

||||||||

| Change in net assets resulting from capital transactions |

20,004,639 | 41,777,773 | ||||||

|

|

|

|

|

|||||

| NET ASSETS: |

||||||||

| Change in net assets |

7,589,935 | 44,158,415 | ||||||

| Beginning of period |

294,664,228 | 250,505,813 | ||||||

|

|

|

|

|

|||||

| End of period |

$ | 302,254,163 | $ | 294,664,228 | ||||

|

|

|

|

|

|||||

| Accumulated undistributed net investment income |

$ | 3,516,434 | $ | 6,629,591 | ||||

|

|

|

|

|

|||||

| CAPITAL TRANSACTIONS: |

||||||||

| Class 1 |

||||||||

| Proceeds from shares issued |

$ | 14,308,579 | $ | 22,714,827 | ||||

| Distributions reinvested |

4,186,764 | 4,505,586 | ||||||

| Cost of shares redeemed |

(18,501,946 | ) | (34,060,959 | ) | ||||

|

|

|

|

|

|||||

| Change in net assets resulting from Class 1 capital transactions |

$ | (6,603 | ) | $ | (6,840,546 | ) | ||

|

|

|

|

|

|||||

| Class 2 |

||||||||

| Proceeds from shares issued |

$ | 27,419,337 | $ | 67,288,642 | ||||

| Distributions reinvested |

3,289,708 | 2,166,547 | ||||||

| Cost of shares redeemed |

(10,697,803 | ) | (20,836,870 | ) | ||||

|

|

|

|

|

|||||

| Change in net assets resulting from Class 2 capital transactions |

$ | 20,011,242 | $ | 48,618,319 | ||||

|

|

|

|

|

|||||

| Total change in net assets resulting from capital transactions |

$ | 20,004,639 | $ | 41,777,773 | ||||

|

|

|

|

|

|||||

| SHARE TRANSACTIONS: |

||||||||

| Class 1 |

||||||||

| Issued |

1,341,913 | 2,081,814 | ||||||

| Reinvested |

401,416 | 417,571 | ||||||

| Redeemed |

(1,725,082 | ) | (3,120,491 | ) | ||||

|

|

|

|

|

|||||

| Change in Class 1 Shares |

18,247 | (621,106 | ) | |||||

|

|

|

|

|

|||||

| Class 2 |

||||||||

| Issued |

2,588,053 | 6,231,833 | ||||||

| Reinvested |

318,770 | 202,670 | ||||||

| Redeemed |

(1,007,856 | ) | (1,931,490 | ) | ||||

|

|

|

|

|

|||||

| Change in Class 2 Shares |

1,898,967 | 4,503,013 | ||||||

|

|

|

|

|

|||||

SEE NOTES TO FINANCIAL STATEMENTS.

| 38 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

THIS PAGE IS INTENTIONALLY LEFT BLANK

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 39 | ||||||

Table of Contents

FOR THE PERIODS INDICATED

| Per share operating performance | ||||||||||||||||||||||||||||

| Investment operations | Distributions | |||||||||||||||||||||||||||

| Net asset value, beginning of period |

Net investment income (loss) (b) |

Net realized gains (losses)

on |

Total from investment operations |

Net investment income |

Net realized gain |

Total distributions |

||||||||||||||||||||||

| JPMorgan Insurance Trust Core Bond Portfolio |

|

|||||||||||||||||||||||||||

| Class 1 |

|

|||||||||||||||||||||||||||

| Six Months Ended June 30, 2018 (Unaudited) |

$ | 10.94 | $ | 0.15 | $ | (0.33 | ) | $ | (0.18 | ) | $ | (0.26 | ) | $ | (0.02 | ) | $ | (0.28 | ) | |||||||||

| Year Ended December 31, 2017 |

10.84 | 0.29 | 0.09 | 0.38 | (0.28 | ) | — | (0.28 | ) | |||||||||||||||||||

| Year Ended December 31, 2016 |

10.91 | 0.30 | (0.07 | ) | 0.23 | (0.30 | ) | — | (0.30 | ) | ||||||||||||||||||

| Year Ended December 31, 2015 |

11.19 | 0.34 | (0.21 | ) | 0.13 | (0.41 | ) | — | (0.41 | ) | ||||||||||||||||||

| Year Ended December 31, 2014 |

11.09 | 0.38 | 0.16 | 0.54 | (0.44 | ) | — | (0.44 | ) | |||||||||||||||||||

| Year Ended December 31, 2013 |

11.78 | 0.44 | (0.60 | ) | (0.16 | ) | (0.53 | ) | — | (0.53 | ) | |||||||||||||||||

| Class 2 |

|

|||||||||||||||||||||||||||

| Six Months Ended June 30, 2018 (Unaudited) |

10.82 | 0.13 | (0.32 | ) | (0.19 | ) | (0.24 | ) | (0.02 | ) | (0.26 | ) | ||||||||||||||||

| Year Ended December 31, 2017 |

10.73 | 0.26 | 0.09 | 0.35 | (0.26 | ) | — | (0.26 | ) | |||||||||||||||||||

| Year Ended December 31, 2016 |

10.81 | 0.27 | (0.07 | ) | 0.20 | (0.28 | ) | — | (0.28 | ) | ||||||||||||||||||

| Year Ended December 31, 2015 |

11.10 | 0.31 | (0.21 | ) | 0.10 | (0.39 | ) | — | (0.39 | ) | ||||||||||||||||||

| Year Ended December 31, 2014 |

11.01 | 0.35 | 0.16 | 0.51 | (0.42 | ) | — | (0.42 | ) | |||||||||||||||||||

| Year Ended December 31, 2013 |

11.72 | 0.40 | (0.59 | ) | (0.19 | ) | (0.52 | ) | — | (0.52 | ) | |||||||||||||||||

| (a) | Annualized for periods less than one year, unless otherwise noted. |

| (b) | Calculated based upon average shares outstanding. |

| (c) | Not annualized for periods less than one year. |

| (d) | Includes adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset values for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for shareholder transactions. |

| (e) | Includes earnings credits and interest expense, if applicable, each of which is less than 0.005% unless otherwise noted. |

SEE NOTES TO FINANCIAL STATEMENTS.

| 40 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

|

|

Ratios/Supplemental data | |||||||||||||||||||||||||

| Ratios to average net assets (a) | ||||||||||||||||||||||||||

| Net asset end of |

Total return (c)(d) |

Net assets, end of period |

Net expenses (e) |

Net investment income (loss) |

Expenses without waivers, reimbursements and earnings credits |

Portfolio turnover rate (c) |

||||||||||||||||||||

| $ | 10.48 | (1.64 | )% | $ | 164,403,611 | 0.55 | % | 2.76 | % | 0.61 | % | 10 | % | |||||||||||||

| 10.94 | 3.57 | 171,382,596 | 0.57 | 2.66 | 0.63 | 21 | ||||||||||||||||||||

| 10.84 | 2.12 | 176,565,657 | 0.59 | 2.73 | 0.64 | 29 | ||||||||||||||||||||

| 10.91 | 1.12 | 178,547,019 | 0.59 | 3.08 | 0.61 | 20 | ||||||||||||||||||||

| 11.19 | 4.92 | 152,618,612 | 0.59 | 3.40 | 0.64 | 18 | ||||||||||||||||||||

| 11.09 | (1.47 | ) | 176,728,891 | 0.59 | 3.86 | 0.60 | 13 | |||||||||||||||||||

| 10.37 | (1.74 | ) | 137,850,552 | 0.80 | 2.51 | 0.86 | 10 | |||||||||||||||||||

| 10.82 | 3.30 | 123,281,632 | 0.82 | 2.41 | 0.87 | 21 | ||||||||||||||||||||

| 10.73 | 1.84 | 73,940,156 | 0.84 | 2.47 | 0.89 | 29 | ||||||||||||||||||||

| 10.81 | 0.86 | 58,993,588 | 0.84 | 2.83 | 0.86 | 20 | ||||||||||||||||||||

| 11.10 | 4.71 | 46,498,141 | 0.84 | 3.14 | 0.88 | 18 | ||||||||||||||||||||

| 11.01 | (1.74 | ) | 25,187,518 | 0.84 | 3.58 | 0.85 | 13 | |||||||||||||||||||

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 41 | ||||||

Table of Contents

AS OF JUNE 30, 2018 (Unaudited)

1. Organization

JPMorgan Insurance Trust (the “Trust”) is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company and is a Massachusetts business trust.

The following is a separate Portfolio of the Trust (the “Portfolio”) covered by this report:

| Classes Offered | Diversified/Non-Diversified | |||

| JPMorgan Insurance Trust Core Bond Portfolio | Class 1 and Class 2 | Diversified |

The investment objective of the Portfolio is to seek to maximize total return by investing primarily in a diversified portfolio of intermediate- and long-term debt securities.

Portfolio shares are offered only to separate accounts of participating insurance companies and Eligible Plans. Individuals may not purchase shares directly from the Portfolio.

All classes of shares have equal rights as to earnings, assets and voting privileges, except that each class may bear different transfer agency fees and distribution fees and each class has exclusive voting rights with respect to its distribution plan and administrative services plan.

J.P. Morgan Investment Management Inc. (“JPMIM”), an indirect, wholly-owned subsidiary of JPMorgan Chase & Co. (“JPMorgan”), acts as Adviser (the “Adviser”) and Administrator (the “Administrator”) to the Portfolio.

2. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Portfolio in the preparation of its financial statements. The Portfolio is an investment company and, accordingly, follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standards Codification Topic 946 — Investment Companies, which is part of U.S. generally accepted accounting principles (“GAAP”). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

A. Valuation of Investments — The valuation of investments is in accordance with GAAP and the Portfolio’s valuation policies set forth by and under the supervision and responsibility of the Board of Trustees (the “Board”), which established the following approach to valuation, as described more fully below: (i) investments for which market quotations are readily available shall be valued at such unadjusted quoted prices and (ii) all other investments for which market quotations are not readily available shall be valued at their fair value as determined in good faith by the Board.

The Administrator has established the J.P. Morgan Asset Management Americas Valuation Committee (“AVC”) to assist the Board with the oversight and monitoring of the valuation of the Portfolio’s investments. The Administrator implements the valuation policies of the Portfolio’s investments, as directed by the Board. The AVC oversees and carries out the policies for the valuation of investments held in the Portfolio. This includes monitoring the appropriateness of fair values based on results of ongoing valuation oversight including, but not limited to, consideration of macro or security specific events, market events and pricing vendor and broker due diligence. The Administrator is responsible for discussing and assessing the potential impacts to the fair values on an ongoing basis, and at least on a quarterly basis with the AVC and the Board.

A market-based approach is primarily used to value the Portfolio’s investments. Investments for which market quotations are not readily available are fair valued by approved affiliated and unaffiliated pricing vendors or third party broker-dealers (collectively referred to as “Pricing Services”) or may be internally fair valued using methods set forth by the valuation policies approved by the Board. This may include related or comparable assets or liabilities, recent transactions, market multiples, book values and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may be used in which the anticipated future cash flows of the investment are discounted to calculate the fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Valuations may be based upon current market prices of securities that are comparable in coupon, rating, maturity and industry. It is possible that the estimated values may differ significantly from the values that would have been used, had a ready market for the investments existed, and such differences could be material.

Fixed income instruments are valued based on prices received from Pricing Services. The Pricing Services use multiple valuation techniques to determine the valuation of fixed income instruments. In instances where sufficient market activity exists, the Pricing Services may utilize a market-based approach through which trades or quotes from market makers are used to determine the valuation of these instruments. In instances where sufficient market activity may not exist, the Pricing Services also utilize proprietary valuation models which may consider market transactions in comparable securities and the various relationships between securities in determining fair value and/or market characteristics in order to estimate the relevant cash flows, which are then discounted to calculate the fair values.

Investments in open-end investment companies (the “Underlying Funds”) are valued at each Underlying Fund’s net asset values (“NAV”) per share as of the report date.

See the table on “Quantitative Information about Level 3 Fair Value Measurements” for information on the valuation techniques and inputs used to value level 3 securities held by the Portfolio at June 30, 2018.

| 42 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

Valuations reflected in this report are as of the report date. As a result, changes in valuation due to market events and/or issuer related events after the report date and prior to issuance of the report are not reflected herein.

The various inputs that are used in determining the valuation of the Portfolio’s investments are summarized into the three broad levels listed below.

| • | Level 1 — Unadjusted inputs using quoted prices in active markets for identical investments. |

| • | Level 2 — Other significant observable inputs including, but not limited to, quoted prices for similar investments, inputs other than quoted prices that are observable for investments (such as interest rates, prepayment speeds, credit risk, etc.) or other market corroborated inputs. |

| • | Level 3 — Significant inputs based on the best information available in the circumstances, to the extent observable inputs are not available (including the Portfolio’s assumptions in determining the fair value of investments). |

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input, both individually and in the aggregate, that is significant to the fair value measurement. The inputs or methodology used for valuing instruments are not necessarily an indication of the risk associated with investing in those instruments.

The following table represents each valuation input as presented on the Schedule of Portfolio Investments:

| Level 1 Quoted prices |

Level 2 Other significant observable inputs |

Level 3 Significant |

Total | |||||||||||||

| Investments in Securities |

||||||||||||||||

| Debt Securities |

||||||||||||||||

| Asset-Backed Securities |

$ | — | $ | 25,908,706 | $ | 6,902,223 | $ | 32,810,929 | ||||||||

| Collateralized Mortgage Obligations |

— | 30,138,396 | 1,904,658 | 32,043,054 | ||||||||||||

| Commercial Mortgage-Backed Securities |

— | 11,351,016 | 2,640,577 | 13,991,593 | ||||||||||||

| Corporate Bonds |

|

|||||||||||||||

| Banks |

— | 13,119,044 | — | (a) | 13,119,044 | |||||||||||

| Other Corporate Bonds |

— | 54,746,216 | — | 54,746,216 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Corporate Bonds |

— | 67,865,260 | — | (a) | 67,865,260 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Foreign Government Securities |

— | 891,149 | — | 891,149 | ||||||||||||

| Mortgage-Backed Securities |

— | 42,212,118 | — | 42,212,118 | ||||||||||||

| Municipal Bonds |

— | 303,555 | — | 303,555 | ||||||||||||

| U.S. Government Agency Securities |

— | 24,998,415 | — | 24,998,415 | ||||||||||||

| U.S. Treasury Obligations |

— | 79,646,096 | — | 79,646,096 | ||||||||||||

| Short-Term Investments |

|

|||||||||||||||

| Investment Companies |

8,633,644 | — | — | 8,633,644 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total Investments in Securities |

$ | 8,633,644 | $ | 283,314,711 | $ | 11,447,458 | $ | 303,395,813 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (a) | Value is zero. |

Transfers between fair value levels are valued utilizing values as of the beginning of the period.

There were no transfers between level 1 and level 2 during the six months ended June 30, 2018.

The following is a summary of investments for which significant unobservable inputs (level 3) were in used in determining fair value:

| Balance as of December 31, 2017 |

Realized gain (loss) |

Change in unrealized appreciation (depreciation) |

Net accretion (amortization) |

Purchases1 | Sales2 | Transfers into Level 3 |

Transfers out of Level 3 |

Balance as of June 30, 2018 |

||||||||||||||||||||||||||||

| Investments in Securities: |

||||||||||||||||||||||||||||||||||||

| Asset-Backed Securities |

$ | 8,402,501 | $ | 1,830 | $ | (44,351 | ) | $ | (331 | ) | $ | 998,750 | $ | (744,559 | ) | $ | 429,290 | $ | (2,140,907 | ) | $ | 6,902,223 | ||||||||||||||

| Collateralized Mortgage Obligations |

2,014,990 | 1,444 | (83,327 | ) | 2,832 | — | (31,281 | ) | — | — | 1,904,658 | |||||||||||||||||||||||||

| Commercial Mortgage-Backed Securities |

1,389,232 | 2,009 | (33,442 | ) | 605 | 534,442 | (51,699 | ) | 799,430 | — | 2,640,577 | |||||||||||||||||||||||||

| Corporate Bond — Banks |

— | (a) | — | — | — | — | — | — | — | — | (a) | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| $ | 11,806,723 | $ | 5,283 | $ | (161,120 | ) | $ | 3,106 | $ | 1,533,192 | $ | (827,539 | ) | $ | 1,228,720 | $ | (2,140,907 | ) | $ | 11,447,458 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| 1 | Purchases include all purchases of securities and securities received in corporate actions. |

| 2 | Sales include all sales of securities, maturities, paydowns and securities tendered in corporate actions. |

| (a) | Value is zero. |

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 43 | ||||||

Table of Contents

NOTES TO FINANCIAL STATEMENTS

AS OF JUNE 30, 2018 (Unaudited) (continued)

Transfers from level 3 to level 2 are due to an increase in market activity (e.g. frequency of trades), which resulted in an increase of available market inputs to determine the price for the six months ended June 30, 2018.

The changes in net unrealized appreciation (depreciation) attributable to securities owned at June 30, 2018, which were valued using significant unobservable inputs (level 3) amounted to $(158,680). This amount is included in Change in net unrealized appreciation/depreciation of investments in non-affiliates on the Statement of Operations.

Quantitative Information about Level 3 Fair Value Measurements #

| Fair Value at June 30, 2018 |

Valuation Technique(s) | Unobservable Input | Range (Weighted Average) | |||||||||

| $ | 4,655,027 | Discounted Cash Flow | Constant Prepayment Rate | 0.00% - 30.00% (7.01%) | ||||||||

| Constant Default Rate | 0.00% - 4.39% (0.28%) | |||||||||||

| Yield (Discount Rate of Cash Flows) | 2.32% - 4.65% (3.50%) | |||||||||||

|

|

|

|||||||||||

| Asset-Backed Securities | 4,655,027 | |||||||||||

|

|

||||||||||||

| 448,123 | Discounted Cash Flow | Constant Prepayment Rate | 0.00% - 28.00% (10.31%) | |||||||||

| Constant Default Rate | 0.00% - 6.40% (2.54%) | |||||||||||

| Yield (Discount Rate of Cash Flows) | 0.29% - 49.50% (6.34%) | |||||||||||

|

|

|

|||||||||||

| Collateralized Mortgage Obligations | 448,123 | |||||||||||

|

|

||||||||||||

| 2,089,808 | Discounted Cash Flow | Constant Prepayment Rate | 0.00% - 100.00% (0.01%) | |||||||||

| Yield (Discount Rate of Cash Flows) | 2.39% - 5.12% (4.18%) | |||||||||||

|

|

|

|||||||||||

| Commercial Mortgage-Backed Securities | 2,089,808 | |||||||||||

|

|

||||||||||||

| — | (a) | Pending Distribution Amount | Expected Recovery | 0.00% (0.00%) | ||||||||

| Corporate Bonds | — | (a) | ||||||||||

|

|

||||||||||||

| Total | $ | 7,192,958 | ||||||||||

|

|

||||||||||||

| # | The table above does not include certain level 3 investments that are valued by brokers and pricing services. At June 30, 2018, the value of these investments was $4,254,500. The inputs for these investments are not readily available or cannot be reasonably estimated and generally are those inputs described in Note 2.A. |

| (a) | Value is zero. |

The significant unobservable inputs used in the fair value measurement of the Portfolio’s investments are listed above. Generally, a change in the assumptions used in any input in isolation may be accompanied by a change in another input. Significant changes in any of the unobservable inputs may significantly impact the fair value measurement. The impact is based on the relationship between each unobservable input and the fair value measurement. Significant increases (decreases) in the yield and default rate may decrease (increase) the fair value measurement. A significant change in the prepayment rate (Constant Prepayment Rate or PSA Prepayment Model) may decrease or increase the fair value measurement.

B. Restricted Securities — Certain securities held by the Portfolio may be subject to legal or contractual restrictions on resale. Restricted securities generally are resold in transactions exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”). Disposal of these securities may involve time-consuming negotiations and expense. Prompt sale at the current valuation may be difficult and could adversely affect the net asset value of the Portfolio.

As of June 30, 2018, the Portfolio had no investments in restricted securities other than securities sold to the Portfolio under Rule 144A or Regulation S under the Securities Act.

C. When-Issued Securities, Delayed Delivery Securities and Forward Commitments — The Portfolio purchased when-issued securities and entered into contracts to purchase or sell securities for a fixed price that may be settled a month or more after the trade date, or purchased delayed delivery securities which generally settle seven days after the trade date. When-issued securities are securities that have been authorized, but not issued in the market. A forward commitment involves entering into a contract to purchase or sell securities for a fixed price at a future date that may be settled a month or more after the trade date. A delayed delivery security is agreed upon in advance between the buyer and the seller of the security and is generally delivered beyond seven days of the agreed upon date. The purchase of securities on a when-issued, delayed delivery or forward commitment basis involves the risk that the value of the security to be purchased declines before the settlement date. The sale of securities on a forward commitment basis involves the risk that the value of the securities sold may increase before the settlement date. The Portfolio may be exposed to credit risk if the counterparty fails to perform under the terms of the transaction. Interest income for securities purchased on a when-issued, delayed delivery or forward commitment basis is not accrued until the settlement date.

The Portfolio had delayed delivery securities outstanding as of June 30, 2018, which are shown as a Payable for Investment securities purchased-delayed delivery securities on the Statement of Assets and Liabilities. The values of these securities held at June 30, 2018 are detailed on the SOI.

D. Security Transactions and Investment Income — Investment transactions are accounted for on the trade date (the date the order to buy or sell is executed). Securities gains and losses are calculated on a specifically identified cost basis. Interest income is determined on the basis of coupon

| 44 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

interest accrued using the effective interest method which adjusts for amortization of premiums and accretion of discounts. Dividend income is recorded on the ex-dividend date or when the Portfolio first learns of the dividend.

E. Allocation of Income and Expenses — Expenses directly attributable to a portfolio are charged directly to that portfolio, while the expenses attributable to more than one portfolio of the Trust are allocated among the respective portfolios. In calculating the NAV of each class, investment income, realized and unrealized gains and losses and expenses, other than class-specific expenses, are allocated daily to each class of shares based upon the proportion of net assets of each class at the beginning of each day.

F. Federal Income Taxes — The Portfolio is treated as a separate taxable entity for Federal income tax purposes. The Portfolio’s policy is to comply with the provisions of the Internal Revenue Code (the “Code”), applicable to regulated investment companies and to distribute to shareholders all of its distributable net investment income and net realized capital gains on investments. Accordingly, no provision for Federal income tax is necessary. The Portfolio is also a segregated portfolio of assets for insurance purposes and intends to comply with the diversification requirements of Subchapter L of the Code. Management has reviewed the Portfolio’s tax positions for all open tax years and has determined that as of June 30, 2018, no liability for income tax is required in the Portfolio’s financial statements for net unrecognized tax benefits. However, management’s conclusions may be subject to future review based on changes in, or the interpretation of, the accounting standards or tax laws and regulations. The Portfolio’s Federal tax returns for the prior three fiscal years remain subject to examination by the Internal Revenue Service.

G. Distributions to Shareholders — Distributions from net investment income, if any, are generally declared and paid at least annually and are declared separately for each class. No class has preferential dividend rights; differences in per share rates are due to differences in separate class expenses. Net realized capital gains, if any, are distributed at least annually. The amount of distributions from net investment income and net realized capital gains is determined in accordance with Federal income tax regulations, which may differ from GAAP. To the extent these “book/tax” differences are permanent in nature (i.e., that they result from other than timing of recognition — “temporary differences”), such amounts are reclassified within the capital accounts based on their Federal tax-basis treatment.

3. Fees and Other Transactions with Affiliates

A. Investment Advisory Fee — Pursuant to an Investment Advisory Agreement, the Adviser supervises the investments of the Portfolio and for such services is paid a fee. The fee is accrued daily and paid monthly based on the Portfolio’s average daily net assets at an annual rate of 0.40%.

The Adviser waived Investment Advisory fees and/or reimbursed expenses as outlined in Note 3.E.

B. Administration Fee — Pursuant to an Administration Agreement, the Administrator provides certain administration services to the Portfolio. In consideration of these services, the Administrator receives a fee accrued daily and paid monthly at an annual rate of 0.15% of the first $25 billion of the average daily net assets of all funds in the J.P. Morgan Funds Complex covered by the Administration Agreement (excluding certain funds of funds and money market funds) and 0.075% of the average daily net assets in excess of $25 billion of all such funds. For the six months ended June 30, 2018, the effective annualized rate was 0.08% of the Portfolio’s average daily net assets, notwithstanding any fee waivers and/or expense reimbursements.

JPMorgan Chase Bank, N.A (“JPMCB”), a wholly-owned subsidiary of JPMorgan serves as the Portfolio’s sub-administrator (the “Sub-administrator”). For its services as Sub-administrator, JPMCB receives a portion of the fees payable to the Administrator.

The Administrator waived Administration fees as outlined in Note 3.E.

C. Distribution Fees — Pursuant to a Distribution Agreement, JPMorgan Distribution Services, Inc. (“JPMDS”), an indirect, wholly-owned subsidiary of JPMorgan, serves as the Trust’s principal underwriter and promotes and arranges for the sale of the Portfolio’s shares.

The Board has adopted a Distribution Plan (the “Distribution Plan”) for Class 2 Shares of the Portfolio in accordance with Rule 12b-1 under the 1940 Act. The Class 1 Shares do not charge a distribution fee. The Distribution Plan provides that the Portfolio shall pay distribution fees, including payments to JPMDS, at an annual rate of 0.25% of the average daily net assets of Class 2 Shares.

D. Custodian and Accounting Fees — JPMCB provides portfolio custody and accounting services to the Portfolio. For performing these services, the Portfolio pays JPMCB transaction and asset-based fees that vary according to the number of transactions and positions, plus out-of-pocket expenses. The amounts paid directly to JPMCB by the Portfolio for custody and accounting services are included in Custodian and accounting fees on the Statement of Operations. Interest income earned on cash balances at the custodian, if any, is included in Interest income from affiliates on the Statement of Operations. Prior to March 1, 2018, payments to the custodian were reduced by credits earned by the Portfolio, based on uninvested cash balances held by the custodian. Such earnings credits, if any, are presented separately on the Statement of Operations.

Interest expense paid to the custodian related to cash overdrafts, if any, is included in Interest expense to affiliates on the Statement of Operations.

E. Waivers and Reimbursements — The Adviser (for all share classes), Administrator (for all share classes) and/or JPMDS (for Class 2 Shares) have contractually agreed to waive fees and/or reimburse the Portfolio to the extent that total annual operating expenses of the Portfolio (excluding acquired fund fees and expenses other than certain money market fund fees as described below, dividend expenses related to short sales, interest, taxes, expenses related to litigation and potential litigation, extraordinary expenses and expenses related to the Board’s deferred compensation plan) exceed the percentages of the Portfolio’s respective average daily net assets as shown in the table below:

| Class 1 | Class 2 | |||||||

| 0.60 | % | 0.85 | % | |||||

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 45 | ||||||

Table of Contents

NOTES TO FINANCIAL STATEMENTS

AS OF JUNE 30, 2018 (Unaudited) (continued)

The expense limitation agreement was in effect for the six months ended June 30, 2018 and is in place until at least April 30, 2019.

For the six months ended June 30, 2018, the Portfolio’s service providers waived/reimbursed fees for the Portfolio as follows. None of these parties expect the Portfolio to repay any such waived fees in future years.

| Contractual Waivers | ||||||||||||||||

| Investment Advisory Fees |

Administration Fees |

Total | Contractual Reimbursements |

|||||||||||||

| $ | 72,357 | $ | 7,873 | $ | 80,230 | $ | 872 | |||||||||

Additionally, the Portfolio may invest in one or more money market funds advised by the Adviser or its affiliates (affiliated money market funds). The Adviser, Administrator and/or JPMDS have contractually agreed to waive fees and/or reimburse expenses in an amount sufficient to offset the respective net fees each collects from the affiliated money market fund on the Portfolio’s investment in such affiliated money market fund.

The amount of waivers resulting from investments in these money market funds for the six months ended June 30, 2018 was $6,367.

F. Other — Certain officers of the Trust are affiliated with the Adviser, the Administrator and JPMDS. Such officers, with the exception of the Chief Compliance Officer, receive no compensation from the Portfolio for serving in their respective roles.

The Board appointed a Chief Compliance Officer to the Portfolio in accordance with Federal securities regulations. The Portfolio, along with other affiliated portfolios, makes reimbursement payments, on a pro-rata basis, to the Administrator for a portion of the fees associated with the Office of the Chief Compliance Officer. Such fees are included in Trustees’ and Chief Compliance Officer’s fees on the Statement of Operations.

The Trust adopted a Trustee Deferred Compensation Plan (the “Plan”) which allows the Independent Trustees to defer the receipt of all or a portion of compensation related to performance of their duties as Trustees. The deferred fees are invested in various J.P. Morgan Funds until distribution in accordance with the Plan.

During the six months ended June 30, 2018, the Portfolio purchased securities from an underwriting syndicate in which the principal underwriter or members of the syndicate were affiliated with the Adviser.

The Portfolio may use related party broker-dealers. For the six months ended June 30, 2018, the Portfolio did not incur any brokerage commissions with broker-dealers affiliated with the Adviser.

The Securities and Exchange Commission (“SEC”) has granted an exemptive order permitting the Portfolio to engage in principal transactions with J.P. Morgan Securities, Inc., an affiliated broker, involving taxable money market instruments, subject to certain conditions.

4. Investment Transactions

During the six months ended June 30, 2018, purchases and sales of investments (excluding short-term investments) were as follows:

| Purchases (excluding U.S. Government) |

Sales (excluding U.S. Government) |

Purchases of U.S. Government |

Sales of U.S. Government |

|||||||||||||

| $ | 30,294,023 | $ | 23,961,307 | $ | 17,706,210 | $ | 4,340,798 | |||||||||

5. Federal Income Tax Matters

For Federal income tax purposes, the estimated cost and unrealized appreciation (depreciation) in value of investments held at June 30, 2018 were as follows:

| Aggregate Cost |

Gross Unrealized Appreciation |

Gross Unrealized Depreciation |

Net Unrealized Appreciation (Depreciation) |

|||||||||||||

| $ | 306,751,388 | $ | 3,321,731 | $ | 6,677,306 | $ | (3,355,575 | ) | ||||||||

At December 31, 2017, the Portfolio did not have any net capital loss carryforwards.

6. Borrowings

The Portfolio relies upon an exemptive order granted by the SEC (the “Order”) permitting the establishment and operation of an Interfund Lending Facility (the “Facility”). The Facility allows the Portfolio to directly lend and borrow money to or from any other fund relying upon the Order at rates beneficial to both the borrowing and lending funds. Advances under the Facility are taken primarily for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities, and are subject to the Portfolio’s borrowing restrictions. The Interfund loan rate is determined, as specified in the Order, by averaging the current repurchase agreement rate and the current bank loan rate. The Order was granted to the Trust and may be relied upon by the Portfolio because the Portfolio and the series of the Trust are all investment companies in the same “group of investment companies” (as defined in Section 12(d)(1)(G) of the 1940 Act).

The Trust and JPMCB have entered into a financing arrangement. Under this arrangement, JPMCB provides an unsecured, uncommitted credit facility in the aggregate amount of $100 million to certain of the J.P. Morgan Funds, including the Portfolio. Advances under the arrangement are taken

| 46 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

primarily for temporary or emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities, and are subject to the Portfolio’s borrowing restrictions. Interest on borrowings is payable at a rate determined by JPMCB at the time of borrowing. This agreement has been extended until November 5, 2018.

The Portfolio had no borrowings outstanding from the unsecured, uncommitted credit facility during the six months ended June 30, 2018.

The Trust, along with certain other trusts (“Borrowers”), has entered into a joint syndicated senior unsecured revolving credit facility totaling $1.5 billion (“Credit Facility”) with various lenders and The Bank of New York Mellon, as administrative agent for the lenders. This Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the meeting of redemption requests that otherwise might require the untimely disposition of securities. Under the terms of the Credit Facility, a borrowing portfolio must have a minimum of $25,000,000 in adjusted net asset value and not exceed certain adjusted net asset coverage ratios prior to and during the time in which any borrowings are outstanding. If a portfolio does not comply with the aforementioned requirements, the Portfolio must remediate within three business days with respect to the $25,000,000 minimum adjusted net asset value or within one business day with respect to certain asset coverage ratios or the administrative agent at the request of, or with the consent of, the lenders may terminate the Credit Facility and declare any outstanding borrowings to be due and payable immediately.

Interest associated with any borrowing under the Credit Facility is charged to the borrowing portfolio at a rate of interest equal to 1.00% plus the greater of the federal funds effective rate or one month LIBOR. The annual commitment fee to maintain the Credit Facility is 0.15% and is incurred on the unused portion of the Credit Facility and is allocated to all participating portfolios pro rata based on their respective net assets. Effective August 14, 2018, this agreement has been amended and restated for a term of 364 days, unless extended.

The Portfolio did not utilize the Credit Facility during the six months ended June 30, 2018.

7. Risks, Concentrations and Indemnifications

In the normal course of business, the Portfolio enters into contracts that contain a variety of representations which provide general indemnifications. The Portfolio’s maximum exposure under these arrangements is unknown. The amount of exposure would depend on future claims that may be made against the Portfolio that have not yet occurred. However, based on experience, the Portfolio expects the risk of loss to be remote.

As of June 30, 2018, the Portfolio had three omnibus accounts which collectively represented 49.0% of the Portfolio’s outstanding shares. Significant shareholder transactions by these shareholders may impact the Portfolio’s performance.

The Portfolio is subject to interest rate and credit risk. The value of debt securities may decline as interest rates increase. The Portfolio could lose money if the issuer of a fixed income security is unable to pay interest or repay principal when it is due. The Portfolio invests in floating rate loans and other floating rate debt securities. Although these investments are generally less sensitive to interest rate changes than other fixed rate instruments, the value of floating rate loans and other floating rate investments may decline if their interest rates do not rise as quickly, or as much, as general interest rates. Many factors can cause interest rates to rise. Some examples include central bank monetary policy, rising inflation rates and general economic conditions. Given that the Federal Reserve has recently raised interest rates and may continue to do so, the Portfolio may face a heightened level of interest rate risk. The ability of the issuers of debt to meet their obligations may be affected by the economic and political developments in a specific industry or region.

The Portfolio is subject to risks associated with securities with contractual cash flows including asset-backed and mortgage-related securities such as collateralized mortgage obligations, mortgage pass-through securities and commercial mortgage-backed securities, including securities backed by sub-prime mortgage loans. The value, liquidity and related income of these securities are sensitive to changes in economic conditions, including real estate value, prepayments, delinquencies and/or defaults, and may be adversely affected by shifts in the market’s perception of the issuers and changes in interest rates.

The Portfolio is subject to the risk that should the Portfolio decide to sell an illiquid investment when a ready buyer is not available at a price the Portfolio deems representative of its value, the value of the Portfolio’s net assets could be adversely affected.

The Portfolio invests in preferred securities. These securities are typically issued by corporations, generally in the form of interest bearing notes with preferred security characteristics and may include provisions that permit the issuer, in its discretion, to defer or omit distributions for a certain period of time.

8. New Accounting Pronouncement

In March 2017, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update (“ASU”) 2017-08 (“ASU 2017-08”) Premium Amortization on Purchased Callable Debt Securities, which shortens the premium amortization period for purchased non-contingently callable debt securities. ASU 2017-08 requires that the premium be amortized to the earliest call date, for purchased non-contingently callable debt securities. ASU 2017-08 is effective for the fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. Management is currently evaluating the implications of these changes on the financial statements, if any.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 47 | ||||||

Table of Contents

SCHEDULE OF SHAREHOLDER EXPENSES

(Unaudited)

Hypothetical $1,000 Investment

| Beginning Account Value January 1, 2018 |

Ending Account Value June 30, 2018 |

Expenses Paid During |

Annualized Expense Ratio |

|||||||||||||

| JPMorgan Insurance Trust Core Bond Portfolio |

||||||||||||||||

| Class 1 |

||||||||||||||||

| Actual |

$ | 1,000.00 | $ | 983.60 | $ | 2.71 | 0.55 | % | ||||||||

| Hypothetical |

1,000.00 | 1,022.07 | 2.76 | 0.55 | ||||||||||||

| Class 2 |

||||||||||||||||

| Actual |

1,000.00 | 982.60 | 3.93 | 0.80 | ||||||||||||

| Hypothetical |

1,000.00 | 1,020.83 | 4.01 | 0.80 | ||||||||||||

| * | Expenses are equal to each Class' respective annualized expense ratio, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| 48 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

J.P. Morgan Funds are distributed by JPMorgan Distribution Services, Inc., which is an affiliate of JPMorgan Chase & Co. Affiliates of JPMorgan Chase & Co. receive fees for providing various services to the funds.

Contact JPMorgan Distribution Services, Inc. at 1-800-480-4111 for a portfolio prospectus. You can also visit us at www.jpmorganfunds.com. Investors should carefully consider the investment objectives and risk as well as charges and expenses of the mutual fund before investing. The prospectus contains this and other information about the mutual fund. Read the prospectus carefully before investing.

The Portfolio files a complete schedule of its portfolio holdings for the first and third quarters of its fiscal year with the SEC on Form N-Q. The Portfolio’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330. Shareholders may request the Form N-Q without charge by calling 1-800-480-4111 or by visiting the variable insurance portfolio section of the J.P. Morgan Funds’ website at www.jpmorganfunds.com.

A description of the Portfolio’s policies and procedures with respect to the disclosure of the Portfolio’s holdings is available in the prospectuses and Statement of Additional Information.

A copy of proxy policies and procedures is available without charge upon request by calling 1-800-480-4111 and on the Portfolio’s website at www.jpmorganfunds.com. A description of such policies and procedures is on the SEC’s website at www.sec.gov. The Trustees have delegated the authority to vote proxies for securities owned by the Portfolio to the Adviser. A copy of the Portfolio’s voting record for the most recent 12-month period ended June 30 is available on the SEC’s website at www.sec.gov or at the Portfolio’s website at www.jpmorganfunds.com no later than August 31 of each year. The Portfolio’s proxy voting record will include, among other things, a brief description of the matter voted on for each portfolio security, and will state how each vote was cast, for example, for or against the proposal.

Table of Contents

J.P. Morgan Asset Management is the marketing name for the asset management businesses of JPMorgan Chase & Co. Those businesses include, but are not limited to, J.P. Morgan Investment Management Inc., Security Capital Research & Management Incorporated and J.P. Morgan Alternative Asset Management, Inc.

| © JPMorgan Chase & Co., 2018. All rights reserved. June 2018. | SAN-JPMITCBP-618 |

Table of Contents

Semi-Annual Report

JPMorgan Insurance Trust

June 30, 2018 (Unaudited)

JPMorgan Insurance Trust Mid Cap Value Portfolio

| NOT FDIC INSURED • NO BANK

GUARANTEE • MAY LOSE VALUE

|

|

Table of Contents

| CEO’s Letter | 1 | |||

| Portfolio Commentary | 2 | |||

| Schedule of Portfolio Investments | 5 | |||

| Financial Statements | 8 | |||

| Financial Highlights | 12 | |||

| Notes to Financial Statements | 14 | |||

| Schedule of Shareholder Expenses | 18 | |||

Investments in the Portfolio are not deposits or obligations of, or guaranteed or endorsed by, any bank and are not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency. You could lose money if you sell when the Portfolio’s share price is lower than when you invested.

Past performance is no guarantee of future performance. The general market views expressed in this report are opinions based on market and other conditions through the end of the reporting period and are subject to change without notice. These views are not intended to predict the future performance of the Portfolio or the securities markets. References to specific securities and their issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Such views are not meant as investment advice and may not be relied on as an indication of trading intent on behalf of the Portfolio.

This Portfolio is intended to be a funding vehicle for variable annuity contracts and variable life insurance policies (collectively “Policies”) offered by the separate accounts of various insurance companies. Portfolio shares may also be offered to qualified pension and retirement plans and accounts permitting accumulation of assets on a tax-deferred basis (“Eligible Plans”). Individuals may not purchase shares directly from the Portfolio.

Prospective investors should refer to the Portfolio’s prospectus for a discussion of the Portfolio’s investment objective, strategies and risks. Call J.P. Morgan Funds Service Center at 1-800-480-4111 for a prospectus containing more complete information about the Portfolio, including management fees and other expenses. Please read it carefully before investing.

Table of Contents

August 6, 2018 (Unaudited)

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 1 | ||||||

Table of Contents

JPMorgan Insurance Trust Mid Cap Value Portfolio

SIX MONTHS ENDED JUNE 30, 2018 (Unaudited)

| REPORTING PERIOD RETURN: | ||||

| Portfolio (Class 1 Shares)* | (0.21)% | |||

| Russell Midcap Value Index | (0.16)% | |||

| Net Assets as of 6/30/2018 | $537,377,028 | |||

| 2 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 3 | ||||||

Table of Contents

JPMorgan Insurance Trust Mid Cap Value Portfolio

PORTFOLIO COMMENTARY

SIX MONTHS ENDED JUNE 30, 2018 (Unaudited) (continued)

| AVERAGE ANNUAL TOTAL RETURNS AS OF JUNE 30, 2018 |

||||||||||||||||||||||

| INCEPTION DATE OF CLASS |

6 MONTH* | 1 YEAR | 5 YEAR | 10 YEAR | ||||||||||||||||||

| CLASS 1 SHARES |

September 28, 2001 | (0.21 | )% | 6.93 | % | 10.81 | % | 10.56 | % | |||||||||||||

| * | Not annualized. |

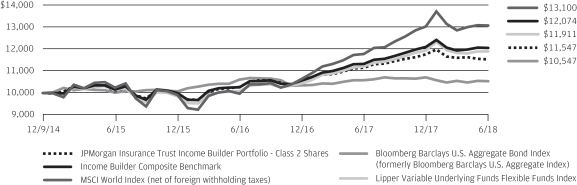

TEN YEAR PERFORMANCE (6/30/08 TO 6/30/18)

| 4 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

JPMorgan Insurance Trust Mid Cap Value Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2018 (Unaudited)

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 5 | ||||||||

Table of Contents

JPMorgan Insurance Trust Mid Cap Value Portfolio

SCHEDULE OF PORTFOLIO INVESTMENTS

AS OF JUNE 30, 2018 (Unaudited) (continued)

SEE NOTES TO FINANCIAL STATEMENTS.

| 6 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 7 | ||||||

Table of Contents

STATEMENT OF ASSETS AND LIABILITIES

AS OF JUNE 30, 2018 (Unaudited)

| JPMorgan Insurance Trust Mid Cap Value |

||||

| ASSETS: |

||||

| Investments in non-affiliates, at value |

$ | 526,282,182 | ||

| Investments in affiliates, at value |

11,776,705 | |||

| Receivables: |

||||

| Portfolio shares sold |

37,464 | |||

| Dividends from non-affiliates |

770,331 | |||

| Dividends from affiliates |

19,440 | |||

|

|

|

|||

| Total Assets |

538,886,122 | |||

|

|

|

|||

| LIABILITIES: |

||||

| Payables: |

||||

| Portfolio shares redeemed |

1,104,530 | |||

| Accrued liabilities: |

||||

| Investment advisory fees |

286,753 | |||

| Administration fees |

35,958 | |||

| Custodian and accounting fees |

4,611 | |||

| Other |

77,242 | |||

|

|

|

|||

| Total Liabilities |

1,509,094 | |||

|

|

|

|||

| Net Assets |

$ | 537,377,028 | ||

|

|

|

|||

| NET ASSETS: |

||||

| Paid-in-Capital |

$ | 323,037,812 | ||

| Accumulated undistributed net investment income |

2,628,337 | |||

| Accumulated net realized gains (losses) |

15,471,594 | |||

| Net unrealized appreciation (depreciation) |

196,239,285 | |||

|

|

|

|||

| Total Net Assets |

$ | 537,377,028 | ||

|

|

|

|||

| Outstanding units of beneficial interest (shares) (unlimited number of shares authorized, no par value): |

|

46,729,497 |

| |

| Net asset value, offering and redemption price per share (a): |

$ | 11.50 | ||

| Cost of investments in non-affiliates |

$ | 330,042,897 | ||

| Cost of investments in affiliates |

11,776,705 | |||

| (a) | Per share amounts may not recalculate due to rounding of net assets and/or shares outstanding. |

SEE NOTES TO FINANCIAL STATEMENTS.

| 8 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED JUNE 30, 2018 (Unaudited)

| JPMorgan Insurance Trust Mid Cap Value Portfolio |

||||

| INVESTMENT INCOME: |

| |||

| Dividend income from non-affiliates |

$ | 4,747,965 | ||

| Dividend income from affiliates |

82,378 | |||

| Interest income from non-affiliates |

2 | |||

|

|

|

|||

| Total investment income |

4,830,345 | |||

|

|

|

|||

| EXPENSES: |

| |||

| Investment advisory fees |

1,773,945 | |||

| Administration fees |

221,388 | |||

| Custodian and accounting fees |

15,634 | |||

| Professional fees |

29,801 | |||

| Trustees’ and Chief Compliance Officer’s fees |

12,997 | |||

| Printing and mailing costs |

41,758 | |||

| Transfer agency fees |

3,233 | |||

| Other |

20,759 | |||

|

|

|

|||

| Total expenses |

2,119,515 | |||

|

|

|

|||

| Less fees waived |

(24,339 | ) | ||

|

|

|

|||

| Net expenses |

2,095,176 | |||

|

|

|

|||

| Net investment income (loss) |

2,735,169 | |||

|

|

|

|||

| REALIZED/UNREALIZED GAINS (LOSSES): |

||||

| Net realized gain (loss) on transactions from investments in non-affiliates |

18,211,494 | |||

| Change in net unrealized appreciation/depreciation on investments in non-affiliates |

(22,058,375 | ) | ||

|

|

|

|||

| Net realized/unrealized gains (losses) |

(3,846,881 | ) | ||

|

|

|

|||

| Change in net assets resulting from operations |

$ | (1,111,712 | ) | |

|

|

|

|||

SEE NOTES TO FINANCIAL STATEMENTS.

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 9 | ||||||

Table of Contents

STATEMENTS OF CHANGES IN NET ASSETS

FOR THE PERIODS INDICATED

| JPMorgan Insurance Trust Mid Cap Value Portfolio | ||||||||

| Six Months Ended June 30, 2018 (Unaudited) |

Year Ended December 31, 2017 |

|||||||

| CHANGE IN NET ASSETS RESULTING FROM OPERATIONS: |

| |||||||

| Net investment income (loss) |

$ | 2,735,169 | $ | 5,388,768 | ||||

| Net realized gain (loss) |

18,211,494 | 10,533,790 | ||||||

| Change in net unrealized appreciation/depreciation |

(22,058,375 | ) | 56,823,802 | |||||

|

|

|

|

|

|||||

| Change in net assets resulting from operations |

(1,111,712 | ) | 72,746,360 | |||||

|

|

|

|

|

|||||

| DISTRIBUTIONS TO SHAREHOLDERS: |

| |||||||

| From net investment income |

(5,217,181 | ) | (4,602,779 | ) | ||||

| From net realized gains |

(8,720,730 | ) | (25,669,250 | ) | ||||

|

|

|

|

|

|||||

| Total distributions to shareholders |

(13,937,911 | ) | (30,272,029 | ) | ||||

|

|

|

|

|

|||||

| CAPITAL TRANSACTIONS: |

| |||||||

| Change in net assets resulting from capital transactions |

(20,093,139 | ) | (14,124,058 | ) | ||||

|

|

|

|

|

|||||

| NET ASSETS: |

| |||||||

| Change in net assets |

(35,142,762 | ) | 28,350,273 | |||||

| Beginning of period |

572,519,790 | 544,169,517 | ||||||

|

|

|

|

|

|||||

| End of period |

$ | 537,377,028 | $ | 572,519,790 | ||||

|

|

|

|

|

|||||

| Accumulated undistributed net investment income |

$ | 2,628,337 | $ | 5,110,349 | ||||

|

|

|

|

|

|||||

| CAPITAL TRANSACTIONS: |

||||||||

| Proceeds from shares issued |

$ | 29,249,686 | $ | 82,826,144 | ||||

| Distributions reinvested |

13,937,911 | 30,272,029 | ||||||

| Cost of shares redeemed |

(63,280,736 | ) | (127,222,231 | ) | ||||

|

|

|

|

|

|||||

| Change in net assets resulting from capital transactions |

$ | (20,093,139 | ) | $ | (14,124,058 | ) | ||

|

|

|

|

|

|||||

| SHARE TRANSACTIONS: |

| |||||||

| Issued |

2,490,252 | 7,342,610 | ||||||

| Reinvested |

1,220,483 | 2,792,623 | ||||||

| Redeemed |

(5,375,424 | ) | (11,291,321 | ) | ||||

|

|

|

|

|

|||||

| Change in Shares |

(1,664,689 | ) | (1,156,088 | ) | ||||

|

|

|

|

|

|||||

SEE NOTES TO FINANCIAL STATEMENTS.

| 10 | JPMORGAN INSURANCE TRUST | JUNE 30, 2018 | ||||

Table of Contents

THIS PAGE IS INTENTIONALLY LEFT BLANK

| JUNE 30, 2018 | JPMORGAN INSURANCE TRUST | 11 | ||||||

Table of Contents

FOR THE PERIODS INDICATED

|

|

Per share operating performance | |||||||||||||||||||||||||||

| Investment operations | Distributions | |||||||||||||||||||||||||||

| Net asset value, beginning of period |

Net investment income (loss) |

Net realized and unrealized gains (losses) on investments |

Total from investment operations |

Net investment income |

Net realized gain |

Total distributions |

||||||||||||||||||||||

| JPMorgan Insurance Trust Mid Cap Value Portfolio |

||||||||||||||||||||||||||||

| Six Months Ended June 30, 2018 (Unaudited) |

$ | 11.83 | $ | 0.06 | (e) | $ | (0.09 | ) | $ | (0.03 | ) | $ | (0.11 | ) | $ | (0.19 | ) | $ | (0.30 | ) | ||||||||

| Year Ended December 31, 2017 |

10.98 | 0.11 | (e) | 1.34 | 1.45 | (0.09 | ) | (0.51 | ) | (0.60 | ) | |||||||||||||||||

| Year Ended December 31, 2016 |

10.19 | 0.10 | (e) | 1.33 | 1.43 | (0.09 | ) | (0.55 | ) | (0.64 | ) | |||||||||||||||||

| Year Ended December 31, 2015 |