United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 10-K

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31, 2020

or

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission file number 000-24498

(Exact name of registrant as specified in its charter)

| (State of incorporation) | (I.R.S. Employer Identification No.) | |||||||

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (614 ) 255-3333

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | ☒ | ||||||||||||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||||||||

| Emerging growth company | ||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of

the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.

7262(b)) by the registered public accounting firm that prepared or issued its audit report.☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common shares (the only common equity of the registrant) held by non-affiliates on the NASDAQ Global Select Market was $353,257,260 , based on the closing price of $113.67 on June 30, 2020. For these purposes only, calculation of holdings by non-affiliates is based upon the assumption, that the registrant’s executive officers and directors are affiliates.

The number of shares outstanding of the issuer’s common stock, as of February 25, 2021, is 3,160,419 shares.

Documents Incorporated by Reference

Diamond Hill Investment Group, Inc.

Form 10-K

For the Fiscal Year Ended December 31, 2020

Index

| Required Information | Page | ||||

2

PART I

| Item 1. | Business | ||||

Forward-Looking Statements

Throughout this Annual Report on Form 10-K and the documents incorporated herein by reference, Diamond Hill Investment Group, Inc. (“Diamond Hill”) may make forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “1933 Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such statements are provided under the “safe harbor” protection of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, but are not limited to, statements regarding anticipated operating results, prospects and levels of assets under management, technological developments, economic trends (including interest rates and market volatility), expected transactions and similar matters. The words “believe,” “expect,” “anticipate,” “target,” “project,” “estimate,” “would,” “will,” “continue,” “should,” “hope,” “seek,” “plan,” “intend,” and variations of such words and similar expressions identify such forward-looking statements, which speak only as of the date made. While we believe that the assumptions underlying our forward-looking statements are reasonable, investors are cautioned that any of the assumptions could prove to be inaccurate and, accordingly, our actual results and experiences could differ materially from the anticipated results or other expectations expressed in our forward-looking statements.

Factors that could cause such actual results or experiences to differ from results discussed in the forward-looking statements include, but are not limited to: (i) any reduction in our assets under management (“AUM”); (ii) withdrawal, renegotiation, or termination of investment advisory agreements; (iii) damage to our reputation; (iv) failure to comply with investment guidelines or other contractual requirements; (v) challenges from the competition we face in our business; (vi) adverse regulatory and legal developments; (vii) unfavorable changes in tax laws or limitations; (viii) interruptions in or failure to provide critical technological service by us or third parties; (ix) adverse civil litigation and government investigations or proceedings; (x) risk of loss on our investments; (xi) lack of sufficient capital on satisfactory terms; (xii) losses or costs not covered by insurance; (xiii) impairment of goodwill or intangible assets; (xiv) a decline in the performance of our products; (xv) changes in interest rates; (xvi) changes in national and local economic and political conditions; (xvii) the continuing economic uncertainty in various parts of the world; (xviii) the effects of the COVID-19 pandemic and the actions taken in connection therewith; (xix) political uncertainty caused by, among other things, political parties, economic nationalist sentiments, tensions surrounding the current socioeconomic landscape, and other risks identified from time-to-time in other public documents on file with the U. S. Securities and Exchange Commission (“SEC”), including those discussed below in Item 1A.

We do not undertake or plan to update or revise any such forward-looking statements to reflect actual results, changes in plans, assumptions, estimates or projections, or other circumstances occurring after the date of this Annual Report on Form 10-K, even if such results, changes, or circumstances make it clear that any forward-looking information will not be realized. If there are any future public statements or disclosures by us which modify or impact any of the forward-looking statements contained in or accompanying this Annual Report on Form 10-K, such statements or disclosures will be deemed to modify or supersede such statements in this Annual Report on Form 10-K. Throughout this Annual Report on Form 10-K, when we use the terms the “Company,” “management,” “we,” “us,” and “our,” we mean Diamond Hill and its subsidiaries.

Overview

Diamond Hill, an Ohio corporation organized in April 1990, derives its consolidated revenue and net income from investment advisory and fund administration services provided by its wholly owned subsidiary, Diamond Hill Capital Management, Inc., and Ohio corporation (“DHCM”). DHCM is a registered investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). DHCM sponsors, distributes, and provides investment advisory and related services to clients through the Diamond Hill Funds (each a “Fund”, and collectively, the “Funds”), sub-advised mutual funds, and separately managed accounts.

DHCM is a client-centric organization committed to a set of shared investment principles and core values intended to enable excellent investment outcomes for clients. By committing to valuation disciplined active portfolio management, fundamental bottom-up research, and a long-term business owner mindset, DHCM has created a suite of investment strategies designed for long-term strategic allocations from institutionally-oriented investors. DHCM’s core values of curiosity, ownership, trust, and respect create an environment where investment professionals can focus on results and all teammates focus on the overall client experience. The combination of these investment principles and core values create an aligned boutique model ensuring associates succeed when clients succeed. This alignment with clients is emphasized through: (i) personal investment by Diamond Hill employees in the strategies managed, (ii) a fee philosophy focused on a fair sharing of the economics among clients, employees, and shareholders, (iii) a strict adherence to capacity discipline ensuring the ability to add value for existing clients, and (iv) compensation driven by the value created.

3

Our primary objective is to fulfill our fiduciary duty to our clients. Our secondary objective is to grow our intrinsic value to achieve an adequate long-term return for our shareholders.

Investment Advisory Activities

Investment Advisory Fees

Our principal source of revenue is investment advisory fee income earned from managing client accounts under investment advisory and sub-advisory agreements. The fees earned depend on the type of investment strategy, account size, and servicing requirements. Revenues depend on the total value and composition of AUM. Accordingly, net cash flows from clients, market fluctuations in client portfolios, and the composition of AUM impact our revenues and results of operations. We also have certain agreements that allow us to earn performance-based fees if investment returns exceed targeted amounts during a measurement period.

Assets Under Management

The following tables show AUM by product and investment objective, as well as net client cash flows, for each of the past five years ended December 31, 2020:

| Assets Under Management As of December 31, | |||||||||||||||||||||||||||||

| (in millions) | 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||||||||||

| Proprietary funds | $ | 17,615 | $ | 16,148 | $ | 13,440 | $ | 15,974 | $ | 13,618 | |||||||||||||||||||

| Sub-advised funds | 3,185 | 2,029 | 1,358 | 1,518 | 1,445 | ||||||||||||||||||||||||

| Separately managed accounts | 5,611 | 5,222 | 4,310 | 4,825 | 4,318 | ||||||||||||||||||||||||

| Total AUM | $ | 26,411 | $ | 23,399 | $ | 19,108 | $ | 22,317 | $ | 19,381 | |||||||||||||||||||

| Assets Under Management by Investment Strategy As of December 31, | |||||||||||||||||||||||||||||

| (in millions) | 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||||||||||

| Small Cap | $ | 556 | $ | 795 | $ | 1,048 | $ | 1,525 | $ | 1,843 | |||||||||||||||||||

| Small-Mid Cap | 2,810 | 3,243 | 2,770 | 3,528 | 3,329 | ||||||||||||||||||||||||

| Mid Cap | 992 | 569 | 143 | 130 | 59 | ||||||||||||||||||||||||

| Large Cap | 15,075 | 12,316 | 9,611 | 10,864 | 8,494 | ||||||||||||||||||||||||

| Large Cap Concentrated | 27 | 28 | 26 | 3 | 3 | ||||||||||||||||||||||||

| All Cap Select | 446 | 528 | 432 | 444 | 402 | ||||||||||||||||||||||||

| Long-Short | 2,056 | 3,605 | 3,767 | 4,980 | 4,613 | ||||||||||||||||||||||||

| Global/International | 33 | 35 | 18 | 6 | 2 | ||||||||||||||||||||||||

| Total Equity | 21,995 | 21,119 | 17,815 | 21,480 | 18,745 | ||||||||||||||||||||||||

| Short Duration Securitized Bond | 1,132 | 809 | 579 | 313 | 197 | ||||||||||||||||||||||||

| Core Fixed Income | 541 | 300 | 55 | 44 | 40 | ||||||||||||||||||||||||

| Long Duration Treasury | 62 | 52 | 52 | — | — | ||||||||||||||||||||||||

| Corporate Credit | 2,020 | 1,147 | 757 | 668 | 549 | ||||||||||||||||||||||||

| High Yield | 724 | 135 | 54 | 31 | 32 | ||||||||||||||||||||||||

| Total Fixed Income | 4,479 | 2,443 | 1,497 | 1,056 | 818 | ||||||||||||||||||||||||

| Total Equity and Fixed Income | 26,474 | 23,562 | 19,312 | 22,536 | 19,563 | ||||||||||||||||||||||||

(Less: Investments in affiliated funds)(a) | (63) | (163) | (204) | (219) | (182) | ||||||||||||||||||||||||

| Total AUM | $ | 26,411 | $ | 23,399 | $ | 19,108 | $ | 22,317 | $ | 19,381 | |||||||||||||||||||

(a) Certain of the Funds own shares of the Diamond Hill Short Duration Securitized Bond Fund. The Company reduces its total AUM by these investments held in this affiliated fund.

4

| Change in Assets Under Management For the Year Ended December 31, | |||||||||||||||||||||||||||||

| (in millions) | 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||||||||||

| AUM at beginning of the year | $ | 23,399 | $ | 19,108 | $ | 22,317 | $ | 19,381 | $ | 16,841 | |||||||||||||||||||

| Net cash inflows (outflows) | |||||||||||||||||||||||||||||

| proprietary funds | 879 | (499) | (978) | 843 | 548 | ||||||||||||||||||||||||

| sub-advised funds | 713 | 216 | (25) | (164) | 639 | ||||||||||||||||||||||||

| separately managed accounts | (63) | (394) | (99) | (254) | (1,023) | ||||||||||||||||||||||||

| 1,529 | (677) | (1,102) | 425 | 164 | |||||||||||||||||||||||||

| Net market appreciation/(depreciation) and income | 1,483 | 4,968 | (2,107) | 2,511 | 2,376 | ||||||||||||||||||||||||

| Increase (decrease) during the year | 3,012 | 4,291 | (3,209) | 2,936 | 2,540 | ||||||||||||||||||||||||

| AUM at end of the year | $ | 26,411 | $ | 23,399 | $ | 19,108 | $ | 22,317 | $ | 19,381 | |||||||||||||||||||

Capacity

Our ability to retain and grow our AUM has been, and will be, primarily driven by delivering attractive long-term investment results, which requires strict adherence to capacity discipline. In the event that we determine that the size of a strategy could begin to hinder our ability to add value for our clients based on the strategy’s investment return goals, we will close that strategy to new clients. Our commitment to capacity discipline inherently impacts our ability to grow our AUM. Investment results will always be prioritized over asset accumulation. As of December 31, 2020, our Small-Mid Cap strategy remains closed to new investors. We anticipate closing our Large Cap strategy to most new investors by the end of the first quarter of 2021.

Total capacity is estimated to be $30 – 40 billion for our existing domestic equity strategies, at least $15 billion for our International and Global strategies, and at least $40 billion for our existing fixed income strategies. Total firm capacity is not the sum of the individual strategy capacities as it is affected by overlap of investment opportunity across strategies. Firm level capacity increases with the development of new products or strategies.

Growth Strategy

As a deliberately capacity constrained organization, growth is intentional and centers first and foremost on delivering an investment and client experience that enables investors to have better outcomes over the long term. Our core values and aligned boutique model encourage development of strategies and vehicles that are designed to meet clients’ objectives and embody our shared investment principles.

There is ample opportunity for growth within more recently developed strategies. In 2021, the International, Core Bond, and Short Duration Securitized Bond strategies will reach their five-year track records. All three strategies have shown the ability to exceed their investment objectives and serve important strategic roles in client portfolios.

There are three natural extensions of our current strategies that we will expand on in early 2021. We will extend our Large Cap Concentrated strategy to be available as a new fund in our Diamond Hill Funds lineup. We will launch a limited partnership focused on micro-cap companies allowing us to leverage our experience evaluating small publicly traded business. We are also working on the expansion of our fixed income separate account offerings with additional securitized bond strategies. We continue to develop and identify new long-term oriented investment offerings that meet client objectives and align with our investment principles.

We provide investment advisory services primarily to institutions and through intermediaries who utilize institutional decision-making processes. We look to attract like-minded, long-term focused clients across all our offerings. We have dedicated resources to developing distribution technology and content led marketing efforts. These initiatives supplement and make more efficient the business development and relationship management efforts. We believe the combination of all these efforts will lead to a deeper understanding of our investment strategies and ultimately longer holding periods for investors.

5

Distribution Channels

Our investment advisory services are distributed through multiple channels. Below is a summary of AUM by distribution channel for each of the five years ended December 31, 2020:

| AUM by Distribution Channel As of December 31, | |||||||||||||||||||||||||||||

| (in millions) | 2020 | 2019 | 2018 | 2017 | 2016 | ||||||||||||||||||||||||

| Proprietary funds: | |||||||||||||||||||||||||||||

| Registered investment adviser | $ | 4,315 | $ | 3,603 | $ | 3,243 | $ | 4,010 | $ | 3,508 | |||||||||||||||||||

| Independent broker-dealer | 4,274 | 3,563 | 2,900 | 3,581 | 2,922 | ||||||||||||||||||||||||

| Wirehouse | 3,529 | 3,026 | 2,319 | 2,660 | 2,011 | ||||||||||||||||||||||||

| Bank Trust | 2,546 | 2,907 | 2,672 | 3,456 | 3,175 | ||||||||||||||||||||||||

| Defined contribution | 2,716 | 2,723 | 1,904 | 1,840 | 1,535 | ||||||||||||||||||||||||

| Other | 235 | 326 | 402 | 427 | 467 | ||||||||||||||||||||||||

| Total proprietary funds | 17,615 | 16,148 | 13,440 | 15,974 | 13,618 | ||||||||||||||||||||||||

| Sub-advised funds | 3,185 | 2,029 | 1,358 | 1,518 | 1,445 | ||||||||||||||||||||||||

| Separately managed accounts: | |||||||||||||||||||||||||||||

| Institutional consultant | 2,504 | 2,397 | 2,122 | 2,357 | 2,074 | ||||||||||||||||||||||||

| Financial intermediary | 2,371 | 1,777 | 1,506 | 1,691 | 1,358 | ||||||||||||||||||||||||

| Direct | 736 | 1,048 | 682 | 777 | 886 | ||||||||||||||||||||||||

| Total separately managed accounts | 5,611 | 5,222 | 4,310 | 4,825 | 4,318 | ||||||||||||||||||||||||

| Total AUM | $ | 26,411 | $ | 23,399 | $ | 19,108 | $ | 22,317 | $ | 19,381 | |||||||||||||||||||

Fund Administration Activities

We provide fund administration services to the Funds. Fund administration services are broadly defined in our administration agreements with the Funds as portfolio and regulatory compliance, treasury and financial oversight, oversight of back-office service providers, such as the custodian, fund accountant, and transfer agent, and general business management and governance of the mutual fund complex.

Competition

Competition in the investment management industry is intense, and competitors include investment management firms, broker-dealers, banks, and insurance companies, some of whom offer various investment alternatives, including passive index strategies. Many competitors are better known, offer a broader range of investment products, and have more dedicated resources for business development and marketing.

Regulation

Our firm and business are subject to various federal, state, and non-U.S. laws and regulations. As a matter of public policy, regulatory bodies are charged with safeguarding the integrity of the securities and other financial markets and with protecting the interests of participants in those markets, including investment advisory clients and shareholders of investment funds. If an adviser fails to comply with these laws and regulations, agencies that regulate investment advisers have broad administrative powers, including the power to limit, restrict, or prohibit an investment adviser from carrying on its business. Possible sanctions that regulatory bodies may impose, include civil and criminal liability, the suspension of individual employees, limitations on engaging in certain lines of business for specified periods of time, revocation of investment adviser, broker-dealer, and other registrations, censures, and fines.

6

DHCM is registered with the SEC under the Advisers Act and operates in a highly regulated environment. The Advisers Act imposes numerous obligations on registered investment advisers, including fiduciary duties, recordkeeping requirements, operational requirements, and disclosure obligations. All Funds are registered with the SEC under the Investment Company Act of 1940, as amended (the “1940 Act”), and are required to make notice filings with all states where the Funds are offered for sale. Virtually all aspects of our investment advisory and fund administration business are subject to various federal and state laws and regulations.

DHCM is a “fiduciary” under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), with respect to benefit plan clients, and therefore, is subject to ERISA regulations. ERISA and applicable provisions of the Internal Revenue Code of 1986, as amended, impose certain duties on persons who are fiduciaries, prohibit certain transactions involving ERISA plan clients, and provide monetary penalties for violations of these prohibitions. The U.S. Department of Labor, which administers ERISA, has been increasingly active in proposing and adopting regulations affecting the asset management industry.

Our trading activities for client accounts are regulated by the SEC under the Exchange Act, which includes regulations governing trading on inside information, market manipulation, and a broad number of trading and market regulation requirements in the United States (e.g., volume limitations and reporting obligations).

The preceding descriptions of the regulatory and statutory provisions applicable to us are not exhaustive or complete and are qualified in their entirety by reference to their respective statutory or regulatory provisions. Failure to comply with these requirements could have a material adverse effect on our business.

Contractual Relationships with the Funds

We are highly dependent on our contractual relationships with the Funds. If any of our advisory or administration agreements with the Funds were terminated or not renewed, or were amended or modified to reduce fees, we would be materially and adversely affected. We generated approximately 75%, 77%, and 79% of our 2020, 2019, and 2018 revenues, respectively, from our advisory and administrative contracts with the Funds. We believe that we have a strong relationship with the Funds and their board of trustees, and we have no reason to believe that these advisory or administration contracts will not be renewed in the future. However, there is no assurance that the Funds will choose to continue their relationships with us. Please see Item 1A for risk factors regarding this relationship.

Human Capital

Our people are our greatest asset, and each role within our firm contributes to our mission to deliver outstanding client outcomes. As our greatest asset, we diligently care for and invest in our employees. We are a small firm with an important purpose, and we rely on each other and our positive culture to create the environment which allows us to deliver on our vision.

Workforce Data

Attracting, developing, and retaining talented employees is an integral aspect of our human capital strategy and critical to our success. We depend on highly skilled personnel, both investment professionals and business professionals, many of whom have specialized expertise and extensive experience in the investment management industry. As of December 31, 2020, we employed 126 full-time equivalent employees. As of December 31, 2019, the number of full-time equivalent employees was 129.

Our average employee tenure is approximately 6 years, and more than 20% of our employees have been employed by us for more than ten years. Our employee turnover rate continues to be well below industry average. We believe these realities reflect employees’ genuine commitment to our clients, our business, and each other, as well as our firm’s value proposition.

Competitive Pay and Benefits

Since our founding, aligning our interests directly with the clients we serve has been imperative. Inherent in this alignment is a passion for excellence enabling us to exceed client expectations. To achieve this level of excellence, it is important that consistent with our compensation philosophy, we attract, retain, and motivate associates who embody our values, act like owners, and advocate for client outcomes. We align our employees’ compensation with our overall performance, as well as team and individual results.

We know there are many places exceptional talent can choose to work, which is why we aim to take exceptional care of our employees throughout their career. We believe that their well-being and financial security will enable them to do their best work and advocate for client outcomes. Some of our most competitive package components are:

7

•Competitive annual compensation comprised of a base salary, discretionary cash incentive compensation and, for certain roles, a long-term equity incentive;

•An equity grant in the first year of joining our firm to instill an ownership mindset;

•A market-leading 401k match program; and

•Employees are also eligible for health, dental and vision insurance, health savings accounts, telemedicine, flexible time off, paid and unpaid leave, life and disability insurance, paid parental leave, fertility benefits, a wellness program with subsidized gym membership, professional development opportunities including reimbursement for job-related professional designations such as the CFA program, and paid parking.

Our Culture

The way our employees embody our core values creates an exceptional corporate culture that differentiates our business from other firms.

Our culture revolves around the fact that Diamond Hill is a fiduciary first and foremost. Our primary focus is serving our clients and this mindset permeates our organization. We intentionally staff our team to ensure a high level of service to our clients, and we believe our client-centric approach is difficult for competitors to replicate. Our long-term, value-disciplined investment philosophy and process are foundational to who we are as an organization and have been consistently implemented since the firm’s inception. All members of the investment team believe in, and adhere to, the same philosophy. As a result, our investment professionals focus their efforts solely on finding attractive investment opportunities for clients.

Our employees also invest in our strategies alongside our clients. Our portfolio managers have significant personal investments in the strategies they manage. In addition, DHCM’s Code of Ethics states that all Diamond Hill employees are prohibited from investing in individual securities or competing firms’ funds in segments of the market in which Diamond Hill has an investment strategy. This limitation ensures we continue to focus on finding the best opportunities for client portfolios while avoiding the conflicts of interest inherent in managing personal accounts.

To further ensure our portfolio managers consistently remain focused on achieving the best long-term outcomes possible for our clients, we link the majority of portfolio managers’ annual incentive compensation to trailing five-year investment results of the strategies they manage. We believe that we are one of few firms to focus only on long-term performance, with no separate consideration for one- or three-year returns in evaluating portfolio managers. This approach ensures that our portfolio managers are motivated to make sound long-term investment decisions, rather than on achieving a particular short-term return goal.

Diversity, Equity, and Inclusion

We view diversity, equity, and inclusion (“DEI”) as essential parts of our business and operating model to ensure sustainability. Diversity, equity, and inclusion are embedded in our policies, practices, strategic initiatives, and are linked to our firm’s core values.

We believe our goal of being an exceptional active investment boutique that our clients trust to deliver excellent long-term investment outcomes is better served by the engagement and encouragement of varied perspectives in decision making as is inherent in a diverse team.

With that vision in mind, in 2020, we committed to several DEI initiatives and measures to ensure our efforts are sustained and positive changes occur within our firm, in the industry, and within our community. More specifically, in 2020:

•Along with 750+ other Columbus, Ohio-based business leaders, we signed a letter supporting a Columbus City Council resolution declaring racism a public health issue;

•We created an employee-led, DEI advisory group to help guide and prioritize our DEI efforts and ensure our ideas become actions;

•Approximately 30% of employees from across the firm have volunteered to be part of our DEI efforts;

•We partnered with third parties to increase the number of diverse candidates applying for our open positions and to ensure that we consider a diverse pool of candidates for our full-time and part-time openings and within our intern program;

8

•We partnered with organizations that assist people of color and women to achieve inclusion in the financial services industry and support financial and investment literacy;

•We are working to ensure that we are conducting business with vendors who embrace our commitment to DEI;

•We created a DEI resource group to raise awareness about a variety of topics and foster understanding; and

•At the community level, we pledged $1 million over the next five years to organizations that support anti-racism and DEI efforts.

We believe we should all be held to a higher standard and we pledge our commitment to do so. As of December 31, 2020, females represent 42% of our Board of Directors, 66% of our management team, and 30% of our employees. As of December 31, 2020, minorities represent approximately 14% of our workforce.

Health and Well-Being

Conducting business in the COVID-19 era has heightened the importance of protecting employee health and well-being and has inspired new ways of engaging with a physically distanced workforce. We more acutely recognize the importance of being supportive, open, and flexible in order to retain our great people.

We recognize that individual circumstances are unique and evolving, and that flexible working is a part of our future. We are committed to offering flexibility to our employees to ensure their well-being, safety, and productivity. We support managers and employees by providing training and mental health support including confidential counseling services, and are continuously exploring new ways of collaborating.

Employee Development / Training

We offer both formal and informal training programs to foster and retain talent. The challenges of 2020 reinforced our belief that continuous learning is vital, far beyond our typical functional scope. Despite the majority of our employees being based in Columbus, Ohio and accustomed to working in the office with access to desktops and desk phones, the COVID-19 pandemic required our business to adapt quickly and seamlessly to new technologies, new hardware and software, and to learn various collaboration tools. In 2020, we also offered LinkedIn Learning licenses to supplement internal and external training.

SEC Filings

We maintain an Internet website at www.diamond-hill.com. Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports that we file or furnish from time-to-time pursuant to Section 13(a) or 15(d) of the Exchange Act, are made available free of charge, on or through our website, as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. These filings are also available on the SEC’s website at http://www.sec.gov free of charge.

| ITEM 1A. | Risk Factors | ||||

Our future results of operations, financial condition, liquidity, and capital resources, as well as the market price of our common stock, are subject to various risks, including those risks mentioned below and those risks that are discussed from time-to-time in our other periodic filings with the SEC. Investors should carefully consider these risks, along with the other information contained in this Annual Report on Form 10-K, before making an investment decision regarding our common shares. There may be additional risks of which we are currently unaware, or which we currently consider immaterial. The occurrence of any of these risks could have a material adverse effect on our financial condition, results of operations, liquidity, capital resources and the value of our common stock. Please see “Forward Looking Statements” within Part I, Item 1, of this Annual Report on Form 10-K.

9

Business Risks

Poor investment results or adverse reviews of our products could affect our ability to attract new clients or reduce our AUM, potentially negatively impacting revenue and net income.

If we fail to deliver acceptable investment results for our clients, both in the short and long term, we could experience diminished investor interest and a decreased level of AUM.

Investment strategies are assessed and rated by independent third parties, including rating agencies, industry analysts, and publications. Investors can be influenced by such ratings. If a strategy receives an adverse report, it could negatively influence our AUM and our revenue.

Our success depends on our key personnel, and our financial performance could be negatively affected by the loss of their services.

Our success depends on highly skilled personnel, including portfolio managers, research analysts, and management, many of whom have specialized expertise and extensive experience in the investment management industry. Financial services professionals are in high demand, and we face significant competition for qualified employees. Other than our Chief Executive Officer, our employees do not have employment contracts and generally can terminate their employment at any time. We may not be able to retain or replace key personnel. In order to retain or replace our key personnel, we may be required to increase compensation, which would decrease net income. The loss of key personnel could damage our reputation and make it more difficult to retain and attract new employees and clients. A loss of client assets resulting from the departure of key personnel may materially decrease our revenues and net income.

Our investment results and/or the growth in our AUM may be constrained if appropriate investment opportunities are not available or if we close certain of our investment strategies to new investors.

Our ability to deliver strong investment results depends in large part on our ability to identify appropriate investment opportunities in which to invest client assets. If we are unable to identify sufficient investment opportunities for existing and new client assets on a timely basis, our investment results could be adversely affected. The risk that appropriate investment opportunities may be unavailable is influenced by a number of factors, including general market conditions, and is likely to increase if our AUM increases rapidly. In addition, if we determine that sufficient investment opportunities are not available for an investment strategy, or we believe that it is necessary in order to continue to produce attractive returns from an investment strategy, we will consider closing the investment strategy to new investors. As of December 31, 2020, we have one investment strategy closed to new investors. If we misjudge the point at which it would be optimal to close an investment strategy, the investment results of the strategy could be negatively impacted.

We are subject to substantial competition in all aspects of our business.

Our investment products compete against investment products and services from:

•Asset management firms;

•Mutual fund companies;

•Commercial banks and thrift institutions;

•Insurance companies;

•Exchange traded funds;

•Private funds, including hedge funds and private equity funds; and

•Brokerage and investment banking firms.

Many of our competitors have substantially greater resources and may operate in more markets or offer a broader range of products, including passively managed or “index” products. Some of these institutions operate in a different regulatory environment, which may give them certain competitive advantages in the investment products and portfolio structures that they offer. We compete with other providers of investment services primarily based upon our philosophy, performance, and client service. Some institutions have a broader array of products and distribution channels, which makes it more difficult for us to compete. If current or potential customers decide to use one of our competitors, we could face a significant decline in market share, AUM, revenues, and net income. If we are required to lower our fees to remain competitive, our net income could be significantly reduced because some of our expenses are fixed, especially over shorter periods of time, and our expenses may not decrease in proportion to the decrease in revenues. Additionally, over the past several years, investors have

10

generally shown a preference for passive investment products, such as index and exchange traded funds, over actively managed strategies. If this trend continues, our AUM may be negatively impacted.

Market and competitive pressures in recent years have created a trend towards lower management fees in the asset management industry and there can be no assurance that we will be able to maintain our current fee structure. As a result, a shift in our AUM from higher to lower fee generating clients and strategies could result in a decrease in profitability even if our AUM increases or remains unchanged.

The loss of access to, or increased fees required by, third-party distribution sources to market our portfolios and access our client base could adversely affect our results of operations.

Our ability to attract additional AUM is dependent on our relationship with third-party financial intermediaries. We compensate some of these intermediaries for access to investors and for various marketing services provided. These distribution sources and client bases may not continue to be accessible to us for reasonable terms, or at all. If such access is restricted or eliminated, it could have an adverse effect on our results of operations. Fees paid to financial intermediaries for investor access and marketing services have generally increased in recent years. If such fee increases continue, refusal to pay them could restrict our access to those client bases while paying them could adversely affect our profitability.

A significant portion of our revenues are based on advisory and administrative agreements with the Funds that are subject to termination without cause and on short notice.

We are highly dependent on our contractual relationships with the Funds. If our advisory or administration agreements with the Funds were terminated or not renewed, or were amended or modified to reduce fees, we would be materially and adversely affected. Generally, these agreements are terminable by either party upon 60 days’ prior written notice without penalty. The agreements are subject to annual approval by either: (i) the board of trustees of the Funds, or (ii) a vote of the majority of the outstanding voting securities of each Fund. These agreements automatically terminate in the event of their assignment by either us or the Funds. We generated approximately 75%, 77%, and 79% of our 2020, 2019, and 2018 revenues, respectively, from our advisory and administrative contracts with the Funds, including 26%, 17%, and 11% from the advisory contracts with the Diamond Hill Large Cap Fund, the Diamond Hill Long-Short Fund, and the Diamond Hill Small-Mid Cap Fund, respectively, during 2020. The loss of any of the Diamond Hill Large Cap Fund, the Diamond Hill Long-Short Fund, or the Diamond Hill Small-Mid Cap Fund contracts would have a material adverse effect on us. We believe that we have a strong relationship with the Funds and their boards of trustees, and we have no reason to believe that these advisory or administration contracts will not be renewed in the future. However, there can be no assurance that the Funds will choose to continue their relationships with us.

The COVID-19 pandemic and other possible similar pandemics or outbreaks could have a material adverse effect on our business, financial position, results of operations, and cash flows.

COVID-19 has resulted in temporary, and sometimes prolonged, closures of many corporate offices, retail stores, manufacturing facilities, and factories around the world. In addition, as COVID-19 continues to spread across the globe, supply chains worldwide have been interrupted, slowed, or rendered inoperable, and an increasing number of individuals have and may continue to become ill, quarantined, or otherwise unable to work and/or travel due to health reasons or governmental restrictions. Governmental mandates to control the outbreak may require additional forced shutdowns and limit the re-opening of various business facilities for extended or indefinite periods. COVID-19, and the various governmental, industry, and consumer actions related to the containment thereof, are having, and could continue to have, negative effects on our business and risk exposure. These effects include, without limitation, potential significant financial market volatility, decreases in the demand for our investment products, changes in consumer behavior and preferences, limitations on our employees’ ability to work and travel, potential financial and operational difficulties of vendors and suppliers, significant changes in economic or political conditions, and financial market declines or recessions that could generally negatively affect the level of our AUM and consequently our revenue, investment income (loss), and net income.

The global effect of the COVID-19 pandemic continues to evolve, and it is uncertain what the effect of various legislative and other responses that have been taken, and that may be taken in the future in the United States and other countries, will have on the economy, financial markets, international trade, our industries, our businesses, and the businesses of our clients and vendors. Many countries, including the United States, have reacted to both the initial outbreak and subsequent outbreaks by instituting quarantines and restrictions on travel to and from actual and potentially affected areas, and the outbreak could have a continued adverse effect on economic and market conditions. The future effect of the COVID-19 pandemic on global markets is difficult to predict, and it is uncertain the extent to which the COVID-19 pandemic may negatively affect our operating results or disrupt the duration of any potential business. The emergence of new variants of the virus and delay or difficulties in administering vaccines could continue to cause uncertainty. Any potential effect on our business and results of operations will depend to a large extent on future developments and new information that may emerge regarding the duration and severity of

11

the COVID-19 pandemic and the actions taken by authorities and other entities to contain the spread of the virus, all of which are beyond our control.

In addition, the COVID-19 pandemic has significantly affected the way we operate. While we have in place business continuity plans that address the impact of the COVID-19 pandemic on our personnel, facilities, and technologies that enable our personnel to work effectively from home, no assurance can be given that the steps we have taken will continue to be effective or appropriate. Although our employees have been able to continue conducting business while working remotely for an extended period of time, operational challenges may arise in the future, which may reduce our organizational efficiency or effectiveness, and increase operational, compliance, and cybersecurity risks. In addition, because most of our employees have not previously worked remotely for such an extended period of time, we are unsure of the impact that the remote work environment and lack of in-person meetings with colleagues, clients, and business partners will have on the growth of our business and the results of our operations. Many of our key service providers also have transitioned to working remotely for an extended period of time. If we or they were to experience material disruptions in the ability of our or their employees to work remotely (e.g., from illness due to the COVID-19 pandemic or disruption in internet-based communication systems and networks), our ability to operate our business could be materially adversely disrupted. Any such disruptions could have a material adverse impact on our results of operations, cash flows, financial condition, and/or reputation.

Moreover, our future success and profitability substantially depend on the management skills of our executive officers and directors, many of whom have held officer and director positions with us for many years. The unanticipated loss or unavailability of key employees due to COVID-19 or any similar pandemic could harm our ability to operate our business or execute our business strategy. We may not be successful in finding and integrating suitable successors in the event of key employee loss or unavailability.

Even after the COVID-19 pandemic subsides, local and foreign economies will likely require time to recover, the length of which is unknown and during which the United States or other countries may experience a recession. Our business could be materially and adversely affected by any such recession.

To the extent the effects of COVID-19 adversely impact our business, financial condition, liquidity, capital resources, or results of operations, it may also have the effect of heightening many of the other risks described in this section.

Operational Risks

Unauthorized disclosure of sensitive or confidential client or customer information, whether through a breach of our computer or other systems or otherwise, could severely harm our business.

As part of our business, we collect, process, and transmit sensitive and confidential information about our clients and employees, as well as proprietary information about our business. We have policies and procedures pursuant to which we take numerous security measures to prevent cyberattacks of various kinds as well as fraudulent and inadvertent activity by persons who have been granted access to such confidential information. Nevertheless, our systems, like all technology systems, remain vulnerable to unauthorized access, which can result in theft or corruption of information. In addition, we share information with third parties upon whom we rely for various functions. The systems of such third parties also are vulnerable to cyber threats. Attacks can come from unrelated third parties through the internet, from access to hardware removed from our premises or those of third parties or from employees acting intentionally or inadvertently.

Cybersecurity incidents can involve, among other things: (i) deliberate attacks designed to corrupt our information systems and make them unusable by us to operate our business; (ii) theft of information used by the perpetrators for financial and other gain; or (iii) inadvertent releases of information by employees or third parties with whom we do business.

Cyberattacks that corrupt our information systems and make them unusable could impair our ability to trade securities in our clients’ accounts. Corruption of the systems of our third-party vendors could impact us to the same extent as corruption of our own systems. If information about our employees is intentionally stolen or inadvertently made public, that information could be used to commit identity theft, obtain credit in an employee’s name, or steal from an employee. If information about our business is obtained by unauthorized persons, whether through intentional attacks or inadvertent releases of information, it could be used to harm our competitive position.

Whether information is corrupted, stolen, or inadvertently disclosed, and regardless of the type and nature of the information (e.g., proprietary information about our business or personal information about clients or employees), the results could be multiple and materially harmful to us, including the following:

•Our reputation could be harmed, resulting in the loss of clients, vendors, and employees or making payments or concessions to such persons to maintain our relationships with them;

12

•Our inability to operate our business fully, even if temporarily, and thus, fulfill contracts with clients or vendors, could result in terminations of contracts and loss of revenue;

•Harm suffered by clients or vendors whose contracts have been breached, or by clients, vendors, or employees whose information is compromised, could result in costly litigation against us;

•Our need to focus attention on remediation of a cyber problem could take our attention away from the operation of our business, resulting in lost revenue;

•We could incur costs to repair systems made inoperable by a cyberattack and to make changes to our systems to reduce future cyber threats. Those changes could include, among other things, obtaining additional technologies as well as employing additional personnel and training employees; and

•The interruption of our business or theft of proprietary information could harm our ability to compete.

All of the above potential impacts of a cybersecurity incident could have a material adverse effect on our business, financial condition, and results of operations.

We may not be able to adapt to technological change.

The financial services industry is continually undergoing rapid technological change with frequent introductions of new technology-driven products and services. The effective use of technology increases efficiency and enables financial institutions to better serve customers while reducing costs. Our future success depends, in part, upon our ability to address customer needs by using technology to provide products and services that will satisfy customer demands, as well as to create additional efficiencies in our operations. We may not be able to implement effectively new technology-driven products and services or be successful in marketing these products and services to our customers. Failure to successfully keep pace with technological changes affecting the financial services industry could negatively affect our growth, revenue, and profit.

Operational risks may disrupt our business, result in losses, or limit our growth.

We are dependent on the capacity and reliability of the communications, information and technology systems supporting our operations, whether developed, owned, or operated internally by us or by third parties. Operational risks, such as trading or operational errors, interruption of our financial, accounting, trading, compliance and other data processing systems, the loss of data contained in such systems, or compromised systems due to cyberattack, could result in a disruption of our business, liability to clients, regulatory intervention, or reputational damage, and thus, adversely affect our business.

Negative public opinion can result from our actual or alleged conduct in any number of activities, including trading practices, corporate governance and acquisitions, social media and other marketing activities and from actions taken by governmental regulators and community organizations in response to any of the foregoing. Negative public opinion could adversely affect our ability to attract and maintain clients, could expose us to potential litigation or regulatory action, and could have a material adverse effect on our stock price or result in heightened volatility.

Trading in our common shares is limited, which may adversely affect the time and the price at which you can sell your shares.

Although our common shares are listed on the NASDAQ Global Select Market, the shares are held by a relatively small number of shareholders, and trading in our common shares is relatively inactive. The spread between the bid and the asked prices is often wide. As a result, shareholders may not be able to sell their shares on short notice, and the sale of a large number of shares at one time could temporarily depress the market price. In addition, certain shareholders, including certain of our directors and officers, own a significant number of shares. The sale of a large number of shares by any such individual could temporarily depress the market price of our shares.

Industry, Market, and Economic Risks

Our AUM, which impacts revenue, is subject to significant fluctuations.

The majority of our revenue is calculated as a percentage of AUM or is related to the general performance of the equity securities markets. A decline in securities prices or in the sale of investment products, or an increase in fund redemptions, generally will reduce revenue and net income. Financial market declines will generally negatively impact the level of our AUM, and consequently, our revenue and net income. A recession or other economic or political events, whether in the United States or globally, could also adversely impact our revenue, if such events led to a decreased demand for products, a higher redemption rate, or a decline in securities prices.

13

Our investment approach may underperform other investment approaches during certain market conditions.

Our investment strategies are best suited for investors with long-term investment time horizons. Our investment strategies may not perform well during certain periods of time. Additionally, we could have common positions and industry concentrations across our strategies at the same time. As such, factors leading to underperformance may impact multiple strategies simultaneously.

Our investment income and asset levels may be negatively impacted by fluctuations in our investment portfolio.

We currently have a substantial portion of our assets invested in investments that we sponsor. All of these investments are subject to market risk and our non-operating investment income could be adversely affected by adverse market performance. Fluctuations in investment income are expected to occur in the future.

Regulatory Risks

Changes in tax laws and unanticipated tax obligations could have an adverse impact on our financial condition, results of operations, and cash flow.

We are subject to federal, state, and local income taxes in the United States. Tax authorities may disagree with certain positions we have taken or implement changes in tax policy, which may result in the assessment of additional taxes. We regularly assess the appropriateness of our tax positions and reporting. We cannot provide assurances, however, that we will accurately predict the outcomes of audits, and the actual outcomes of these audits could be unfavorable.

Our business is subject to substantial governmental regulation, which can change frequently and may increase costs of compliance, reduce revenue, result in fines, penalties, and lawsuits for noncompliance, and adversely affect our results of operations and financial condition.

Our business is subject to a variety of federal securities laws, including the Advisers Act, the 1940 Act, the 1933 Act, the Exchange Act, the Sarbanes-Oxley Act of 2002, the U.S. PATRIOT Act of 2001, and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. In addition, we are subject to significant regulation and oversight by the SEC. Changes in legal, regulatory, accounting, tax, and compliance requirements could have a significant effect on our operations and results, including, but not limited to, increased expenses and reduced investor interest in certain Funds and other investment products we offer. We continually monitor legislative, tax, regulatory, accounting, and compliance developments that could impact our business. We and our directors, officers, and employees could be subject to lawsuits or regulatory proceedings for violations of such laws and regulations, which could result in the payment of fines or penalties and cause reputational harm to us which could negatively affect our financial condition and results of operations, as well as divert management’s attention from our operations.

General Risk Factors

Our insurance policies may not cover all losses and costs to which we may be exposed.

We carry insurance in amounts and under terms that we believe are appropriate. Our insurance may not cover all liabilities and losses to which we may be exposed. Certain insurance coverage may not be available or may be prohibitively expensive in future periods. As our insurance policies come up for renewal, we may need to assume higher deductibles or pay higher premiums, which could have an adverse impact on our results of operations and financial condition.

| ITEM 1B. | Unresolved Staff Comments | ||||

None.

| ITEM 2. | Properties | ||||

We lease office space and conduct our general operations at one location, the address of which is 325 John H. McConnell Boulevard, Suite 200, Columbus, Ohio 43215.

We do not own any real estate or interests in real estate.

| ITEM 3. | Legal Proceedings | ||||

There are currently no matters pending that we believe could have a material adverse effect on our consolidated financial statements.

14

| ITEM 4. | Mine Safety Disclosures | ||||

Not applicable.

15

PART II

| ITEM 5. | Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities | ||||

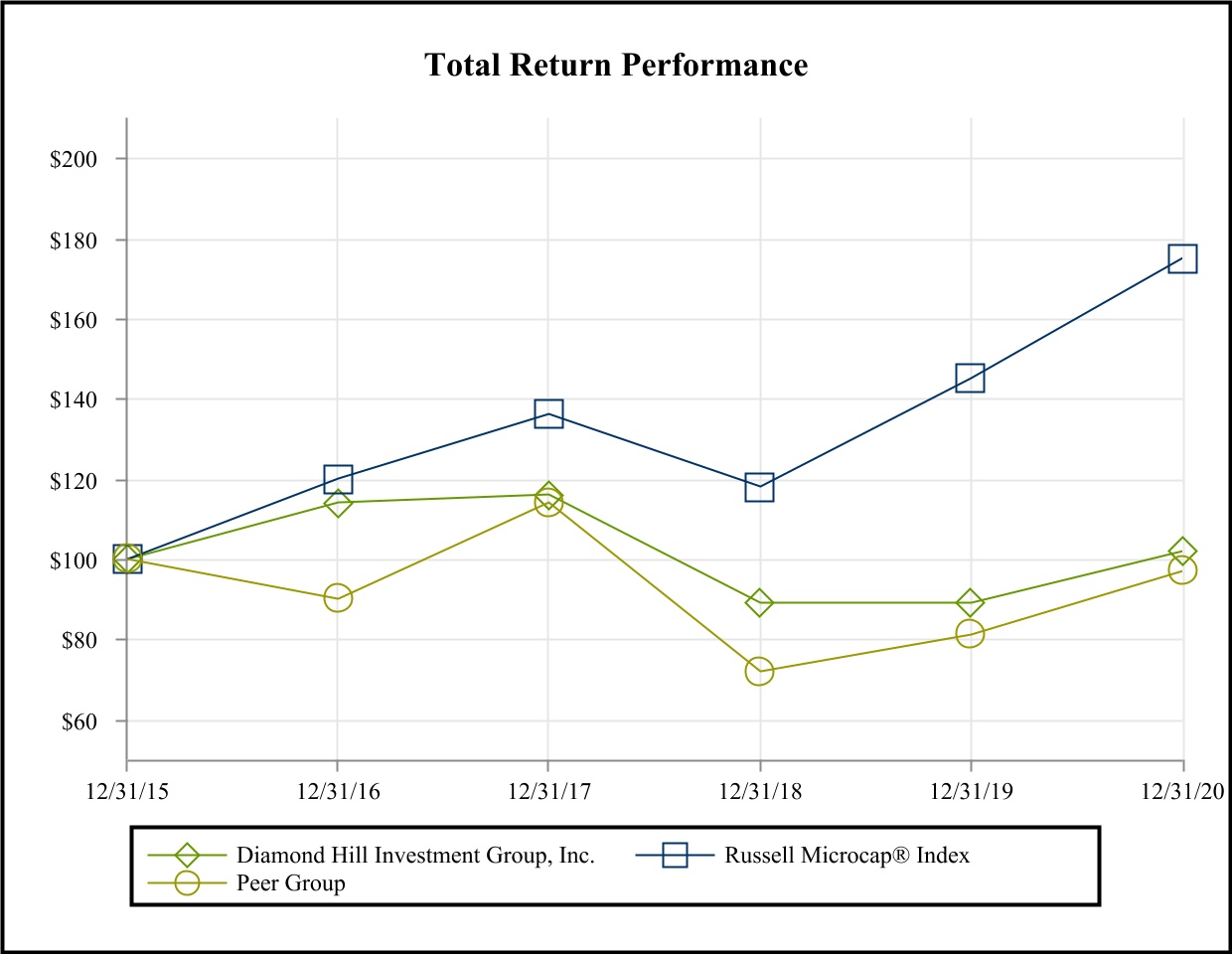

The following performance graph compares the total shareholder return of an investment in our common shares to that of the Russell Microcap® Index, and to a peer group index of publicly-traded asset management firms for the five-year period ended on December 31, 2020. The graph assumes that the value of the investment in our common shares and each index was $100 on December 31, 2015. Total return includes reinvestment of all dividends. The Russell Microcap® Index makes up less than 3% of the U.S. equity market and is a market-value-weighted index of the smallest 1,000 securities in the small-cap Russell 2000® Index plus the next 1,000 smallest securities. Peer Group returns are weighted by the market capitalization of each firm at the beginning of the measurement period. The historical information set forth below is not necessarily indicative of future performance. We do not make or endorse any predictions as to future stock performance.

| 12/31/2015 | 12/31/2016 | 12/31/2017 | 12/31/2018 | 12/31/2019 | 12/31/2020 | Cumulative 5 Year Total Return | ||||||||||||||||||||||||||||||||

| Diamond Hill Investment Group, Inc. | $100 | $114 | $116 | $89 | $89 | $102 | 2 | % | ||||||||||||||||||||||||||||||

| Russell Microcap® Index | $100 | $120 | $136 | $118 | $145 | $175 | 75 | % | ||||||||||||||||||||||||||||||

| Peer Group* | $100 | $90 | $114 | $72 | $81 | $97 | (3) | % | ||||||||||||||||||||||||||||||

* The Peer Group is based upon all publicly-traded asset managers with market cap of less than $5 billion excluding: (i) firms whose primary business is hedge fund or private equity, and (ii) firms with multiple lines of business. The following companies are included in the Peer Group: Alliance Bernstein Holding L.P., Affiliated Managers Group, Inc., Artisan Partners Asset Management Inc., Cohen & Steers, Inc., Federated Investors, Inc., GAMCO Investors, Inc., Hennessy Advisors, Inc., Manning & Napier, Inc., Pzena Investment Management, Inc., Teton Advisors, Inc., U.S. Global Investors, Inc., Virtus Investment Partners, Inc., Waddell & Reed Financial, Inc., Wisdomtree Investments, Inc., and Westwood Holdings Group, Inc.

16

Our common shares trade on the NASDAQ Global Select Market under the ticker symbol DHIL. The following table sets forth the high and low daily close prices during each quarter of 2020 and 2019:

| 2020 | 2019 | ||||||||||||||||||||||||||||||||||

| High Price | Low Price | Dividend Per Share | High Price | Low Price | Dividend Per Share | ||||||||||||||||||||||||||||||

| Quarter ended: | |||||||||||||||||||||||||||||||||||

| March 31 | $ | 144.40 | $ | 81.70 | $ | — | $ | 158.74 | $ | 133.52 | $ | — | |||||||||||||||||||||||

| June 30 | $ | 122.13 | $ | 86.00 | $ | — | $ | 148.30 | $ | 137.73 | $ | — | |||||||||||||||||||||||

| September 30 | $ | 128.08 | $ | 111.80 | $ | — | $ | 142.80 | $ | 127.18 | $ | — | |||||||||||||||||||||||

| December 31 | $ | 160.00 | $ | 128.01 | $ | 12.00 | $ | 149.60 | $ | 132.70 | $ | 9.00 | |||||||||||||||||||||||

Due to the relatively low trading volume of our shares, bid/ask spreads can be wide at times, and therefore, quoted prices may not be indicative of the price a shareholder may receive in an actual transaction. During the years ended December 31, 2020 and 2019, approximately 4,331,369 and 4,384,590, of our common shares were traded, respectively. The dividends indicated above were special dividends.

On October 27, 2020, our board of directors approved a special cash dividend of $12.00 per share paid on December 4, 2020, to shareholders of record as of November 25, 2020. This dividend reduced shareholders' equity by approximately $38.0 million.

On October 27, 2020, our board of directors also approved the initiation of a regular quarterly dividend beginning the first of quarter 2021. Subject to approval each quarter by our board of directors and compliance with applicable law, we expect to pay a regular quarterly dividend of $1.00 per share. Going forward, at the end of each year, our board of directors will decide whether to pay an additional special dividend. Although we currently expect to pay the aforementioned dividends, depending on the circumstances and the board of directors’ judgment, we may not pay such dividends as described.

The approximate number of record holders of our common shares at February 25, 2021 was 82, although we believe that the number of beneficial owners of our common shares is substantially greater.

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

The following table sets forth information regarding our current common share repurchase program (the “2020 Repurchase Program”) and shares withheld for tax payments due upon vesting of employee restricted stock units and restricted stock awards that vested during the fourth quarter of fiscal year 2020:

| Period | Total Number of Shares Purchased for Employee Tax Withholdings(a) | Total Number of Shares Purchased as part of Publicly Announced Program(b) | Average Price Paid Per Share Purchased Under the Program | Purchase Price of Shares Purchased Under the Program | Aggregate Purchase Price Yet To Be Purchased Under the Program | ||||||||||||||||||||||||

| October 1, 2020 through October 31, 2020 | 2,954 | — | — | — | $ | 35,375,676 | |||||||||||||||||||||||

| November 1, 2020 through November 30, 2020 | — | — | — | — | $ | 35,375,676 | |||||||||||||||||||||||

| December 1, 2020 through December 31, 2020 | — | — | — | — | $ | 35,375,676 | |||||||||||||||||||||||

| Total | 2,954 | — | — | $ | 35,375,676 | ||||||||||||||||||||||||

(a)We regularly withhold shares for tax payments due upon the vesting of employee Restricted Stock. During the quarter ended December 31, 2020, we purchased 2,954 shares for employee tax withholdings at an average price paid per share of $126.32.

(b)On February 27, 2020, our board of directors approved the 2020 Repurchase Program, authorizing management to repurchase up to $50.0 million of our common shares in the open market and in private transactions in accordance with applicable securities laws. The 2020 Repurchase Program will expire in February 2022, or upon the earlier completion of all authorized purchases under such program.

17

| ITEM 6. | Selected Financial Data | ||||

Not applicable.

| ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | ||||

In this Item 7, we discuss and analyze our consolidated results of operations for the past three fiscal years and other factors that may affect our future financial performance. This discussion should be read in conjunction with our Consolidated Financial Statements, Notes to Consolidated Financial Statements, and Selected Financial Data contained in this Annual Report on Form 10-K.

Business Environment

The performances of the U.S. and international equity markets, as well as the U.S. fixed income market, have a direct impact on our operations and financial position.

Equity Markets

The year 2020 was challenging due to the global spread of COVID-19 and related pandemic. Economic activity ground to a halt as countries hardest hit by the pandemic faced closing businesses, spending declines, and record unemployment levels. Despite unprecedented economic and market disruption, global equities posted positive returns in excess of 16% in 2020 (as measured by the MSCI All Country World Index) and U.S. stocks returned in excess of 18% (as measured by the S&P 500® Index), a remarkable advance given the economic backdrop. Technology stocks were clear winners in 2020 as the work from home era took hold. Online retailers also did well, benefiting from a shift to online shopping in the wake of the pandemic. Energy stocks struggled as oil demand and prices fell on weak economic and transportation activity. In the second half of the year, central bank liquidity, fiscal stimulus, and optimism of rapid-to-market COVID-19 vaccines provided stocks a welcome tailwind.

Fixed Income Markets

Throughout 2020, Federal Reserve and U.S. Treasury intervention played a key role in the fixed income markets. In the first quarter of 2020, the Federal Reserve cut rates in response to signs of a slowing economy exacerbated by an oil production glut as OPEC and Russia failed to come to terms on production cuts. Starting in mid-March, as it became clear the coronavirus pandemic would result in wide scale business shutdowns, central banks globally moved quickly and decidedly to provide liquidity and support while governments directed stimulus support to citizens and businesses facing economic uncertainty. Corporate bond purchasing programs initiated by the U.S. government were barely utilized but served as the impetus for a historic pace of debt issuance in both investment grade and high yield corporate credit markets. The Bloomberg Barclays U.S. Aggregate Bond Index returned 7.5%, second only to 2019 for its best performance since 2002, while the Bloomberg Barclays Investment Grade Corporate Index returned 9.9%, its second-best year since 2009. The ICE BofA U.S. High Yield Index returned 7.1%, rebounding from the worst first quarter’s performance (down 12.7%) since 2008.

Industry Update

Ongoing trends in the investment management industry, including the shift toward private market investments, downward fee pressure, industry consolidation, rising demand for ESG, and expanding conversations around DEI continued in 2020 and do not show any signs of abating.

Investor dollars continue moving toward private markets and less liquid vehicles as investors seek higher returns and lower correlation, contributing to a decline in the number of publicly traded companies. At the same time, investors continue to seek lower cost alternatives to acquire their beta exposure, often utilizing passive exchange-traded funds (“ETFs”), which in turn drives performance of some of the largest publicly traded companies held by broad indexes, making it a difficult environment for active managers to outperform.

The COVID-19 pandemic saw a reduction in travel, which resulted in increased use of technology-based communications. Investors also responded to the pandemic and other social justice events in 2020 by requesting greater clarity on ESG strategies as well as greater transparency on diversity initiatives and commitments.

Consolidation continued, especially in the consulting and wealth management arenas. In fact, over the past five years, we have seen a large number of decision makers leave the market. Some have left the industry all together, some required a liquidity event as a transition of ownership was needed, while others pursued growth and scale via mergers and acquisitions. We

18

continue to see moves away from individual decision-making structures in favor of decision-making teams or outsourcing investment decisions to professional buyer groups such as home offices or outsourced chief investment officers, and we expect net new flows to be driven heavily by these groups going forward.

When you consider these trends in combination with the impact of the COVID-19 pandemic and the asset management industry’s own life cycle, you get a glimpse into the “new normal” in which asset managers operate. We believe Diamond Hill is well positioned to navigate these changing tides and adapt to the evolving industry landscape. We continue to believe we can deliver market-beating returns over a full market cycle through active management. Our commitment to managing our portfolios with a strict capacity discipline helps protect our ability to deliver excellent investment outcomes for clients. Our long-standing relationships with professional buyer groups enable us to reach investors who share our long-term perspective. Helping clients achieve their desired investment outcomes is our priority, and we believe our commitment to capacity discipline, alignment of interests with our clients and strong investment results will result in a successful and sustainable future.

Investment Results

It is important to note the past decade has seen a lengthy period of dominance for growth over value stocks, with the performance differential becoming particularly wide over the past three years. In the 10 years ended December 31, 2020, the Russell 3000 Growth Index annualized 16.9% versus 10.4% for the Russell 3000 Value Index. In 2020, the growth index returned 38.3% to the value index’s 2.9% — a performance gap that eclipses any single calendar year since the inception of the Russell 3000 Growth and Value indices in 1995. Because of our valuation-discipline, many clients choose to measure performance against value indices.

The following is a summary of the investment returns for each of our equity strategies as of December 31, 2020, relative to their respective core and value indices, as applicable.

19

| As of December 31, 2020 | |||||||||||||||||||||||||||||||||||

| Equity Composites | Inception | 1 Year | 3 Year | 5 Year | 10 Year | Since Inception | |||||||||||||||||||||||||||||

| Diamond Hill Small Cap | 12/31/2000 | (0.03) | % | 1.3 | % | 5.80 | % | 7.22 | % | 9.83 | % | ||||||||||||||||||||||||

| Russell 2000 Index | 19.96 | % | 10.25 | % | 13.26 | % | 11.2 | % | 8.74 | % | |||||||||||||||||||||||||

| Russell 2000 Value Index | 4.63 | % | 3.72 | % | 9.65 | % | 8.66 | % | 8.54 | % | |||||||||||||||||||||||||

| Diamond Hill Small-Mid Cap | 12/31/2005 | 1.55 | % | 4.43 | % | 7.99 | % | 9.88 | % | 8.59 | % | ||||||||||||||||||||||||

| Russell 2500 Index | 19.99 | % | 11.33 | % | 13.64 | % | 11.97 | % | 9.55 | % | |||||||||||||||||||||||||

| Russell 2500 Value Index | 4.88 | % | 4.34 | % | 9.43 | % | 9.33 | % | 7.47 | % | |||||||||||||||||||||||||

| Diamond Hill Mid Cap | 12/31/2013 | (1.47) | % | 3.77 | % | 8.00 | % | NA | 6.98 | % | |||||||||||||||||||||||||

| Russell Midcap Index | 17.1 | % | 11.61 | % | 13.40 | % | NA | 10.96 | % | ||||||||||||||||||||||||||

| Russell Midcap Value Index | 4.96 | % | 5.37 | % | 9.73 | % | NA | 8.22 | % | ||||||||||||||||||||||||||

| Diamond Hill Large Cap | 6/30/2001 | 9.49 | % | 9.56 | % | 12.70 | % | 12.31 | % | 9.43 | % | ||||||||||||||||||||||||

| Russell 1000 Index | 20.96 | % | 14.82 | % | 15.60 | % | 14.01 | % | 8.36 | % | |||||||||||||||||||||||||

| Russell 1000 Value Index | 2.8 | % | 6.07 | % | 9.74 | % | 10.5 | % | 7.07 | % | |||||||||||||||||||||||||

| Diamond Hill Large Cap Concentrated | 12/31/2011 | 10.03 | % | 10.06 | % | 13.50 | % | NA | 13.49 | % | |||||||||||||||||||||||||

| Russell 1000 Index | 20.96 | % | 14.82 | % | 15.60 | % | NA | 15.49 | % | ||||||||||||||||||||||||||

| Russell 1000 Value Index | 2.8 | % | 6.07 | % | 9.74 | % | NA | 11.69 | % | ||||||||||||||||||||||||||

| Diamond Hill All Cap Select | 6/30/2000 | 14.83 | % | 9.95 | % | 12.06 | % | 12.15 | % | 10.36 | % | ||||||||||||||||||||||||

| Russell 3000 Index | 20.89 | % | 14.49 | % | 15.43 | % | 13.79 | % | 7.17 | % | |||||||||||||||||||||||||

| Russell 3000 Value Index | 2.87 | % | 5.89 | % | 9.74 | % | 10.36 | % | 7.36 | % | |||||||||||||||||||||||||

| Diamond Hill Long-Short | 6/30/2000 | 0.5 | % | 5.31 | % | 6.81 | % | 7.72 | % | 7.24 | % | ||||||||||||||||||||||||

| Russell 1000 Index | 20.96 | % | 14.82 | % | 15.60 | % | 14.01 | % | 7.08 | % | |||||||||||||||||||||||||

| 60% Russell 1000 Index / 40% BofA ML US T-Bill 0-3 Month Index | 13.3 | % | 9.81 | % | 9.92 | % | 8.7 | % | 5.14 | % | |||||||||||||||||||||||||

| Diamond Hill Global | 12/31/2013 | 1.93 | % | 4.44 | % | 10.68 | % | NA | 7.35 | % | |||||||||||||||||||||||||

| Morningstar Global Markets Index | 16.07 | % | 9.73 | % | 12.11 | % | NA | 8.80 | % | ||||||||||||||||||||||||||

| Diamond Hill International | 12/31/2016 | 6.94 | % | 6.38 | % | NA | NA | 12.32 | % | ||||||||||||||||||||||||||

| Morningstar Global Markets ex US Index | 11.17 | % | 5.07 | % | NA | NA | 10.25 | % | |||||||||||||||||||||||||||

________________________

| - | Composite returns are net of fees. | ||||

| - | Index returns do not reflect any fees. | ||||

20

The following is a summary of the investment returns for each of our fixed income strategies as of December 31, 2020, relative to their respective passive benchmarks.

| As of December 31, 2020 | |||||||||||||||||||||||||||||||||||

| Fixed Income Composites | Inception | 1 Year | 3 Year | 5 Year | 10 Year | Since Inception | |||||||||||||||||||||||||||||

| Diamond Hill Short Duration Securitized Bond | 7/31/2016 | 3.29 | % | 3.89 | % | NA | NA | 3.83 | % | ||||||||||||||||||||||||||

| Bloomberg Barclays US 1-3 Yr. Gov./Credit Index | 3.33 | % | 2.98 | % | NA | NA | 2.12 | % | |||||||||||||||||||||||||||

| Diamond Hill Core Bond | 7/31/2016 | 8.13 | % | 6.01 | % | NA | NA | 4.43 | % | ||||||||||||||||||||||||||

| Bloomberg Barclays US Aggregate Index | 7.51 | % | 5.34 | % | NA | NA | 3.66 | % | |||||||||||||||||||||||||||

| Diamond Hill Corporate Credit | 9/30/2002 | 9.95 | % | 7.92 | % | 8.83 | % | 6.96 | % | 7.38 | % | ||||||||||||||||||||||||

| BofA ML US Corporate & High Yield Index | 9.34 | % | 6.91 | % | 7.07 | % | 5.83 | % | 6.36 | % | |||||||||||||||||||||||||

| Diamond Hill High Yield | 12/31/2014 | 13.84 | % | 10.08 | % | 11.11 | % | NA | 9.36 | % | |||||||||||||||||||||||||

| BofA ML US High Yield Index | 6.17 | % | 5.89 | % | 8.43 | % | NA | 6.14 | % | ||||||||||||||||||||||||||

________________________

| - | Composite returns are net of fees. | ||||

| - | Index returns do not reflect any fees. | ||||

Key Financial Performance Indicators

There are a variety of key performance indicators that we monitor to evaluate our business results. The following table presents the results of certain key performance indicators over the past three fiscal years:

| For the Years Ended December 31, | |||||||||||||||||

| 2020 | 2019 | 2018 | |||||||||||||||

| Ending AUM (in millions) | $ | 26,411 | $ | 23,399 | $ | 19,108 | |||||||||||

| Average AUM (in millions) | 21,907 | 21,653 | 21,950 | ||||||||||||||

| Net cash inflows (outflows) (in millions) | 1,529 | (677) | (1,102) | ||||||||||||||

| Total revenue (in thousands) | 126,388 | 136,624 | 145,628 | ||||||||||||||

| Net operating income | 45,538 | 47,935 | 71,256 | ||||||||||||||

Net operating income, as adjusted(a) | 47,757 | 53,912 | 69,134 | ||||||||||||||

| Average advisory fee rate | 0.54 | % | 0.59 | % | 0.62 | % | |||||||||||

| Operating profit margin | 36 | % | 35 | % | 49 | % | |||||||||||

Operating profit margin, as adjusted(a) | 38 | % | 39 | % | 47 | % | |||||||||||

(a) Net operating income, as adjusted, and operating profit margin, as adjusted, are non-GAAP (as defined below) performance measures. See Use of Supplemental Data as Non-GAAP Performance Measure section within this Annual Report on Form 10-K.

Assets Under Management

Our revenue is derived primarily from investment advisory and administration fees. Investment advisory and administration fees paid to us are generally based on the value of the investment portfolios we manage and fluctuate with changes in the total value of our AUM. We recognize revenue when we satisfy the performance obligations under the terms of a contract with a client.