Exhibit 99.1

LITHIUM MARKET OUTLOOK F oro del Litio August 2018 D aniel Jimenez SV P Iodine, Lithium and Industrial Chemicals

Agenda 2 4 Lithium at SQM 2 Demand 3 Supply 2 .1 Global 1 Lithium Market 2 .2 Li - ion Batteries and Electric Vehicles

• Lithium is widely spread in nature (1) . • Lithium is found in: – Continental brines ( 100 - 2,700 ppm) » Dried out “ Salares ” (e.g. Atacama in Chile, Hombre Muerto in Argentina, Uyuni in Bolivia and Silver Peak in the US). » Salt lakes (e.g. Zhabuye and Qinghai in China). – Minerals ( 2,300 - 18,000 ppm) » About 145 mineralogical species, however only a few are commercial sources of Lithium (e.g. spodumene , petalite and lepidolite ). – Other resources » Oil field brines (e.g. Smackover, Texas, USA) (60 - 500 ppm) » Geothermal brines (e.g. Imperial Valley, California, USA) (50 - 400 ppm ) » Sedimentary clays (e.g. hectorites in USA y jaderites in Serbia) ( 2,000 - 3,000 ppm) » Sea water (0.17 ppm) 3 3 Brines Minerals (1) 20 ppm, similar in abundance as other common elements (Nickel: 84 ppm, Zinc: 70 ppm, Copper: 60 ppm, Cobalt: 25 ppm, Lead: 14 ppm, Tin: 1,3 ppm, Beryllium: 2,8 ppm, Molybdenum: 1,2 ppm. Lithium Market Background

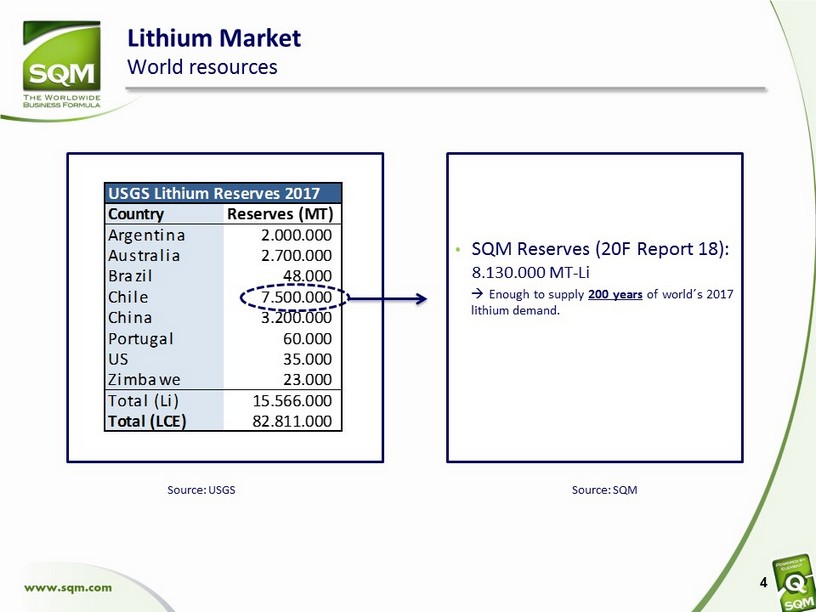

• SQM Reserves (20F Report 18): 8.130.000 MT - Li Enough to supply 200 years of world ´ s 2017 lithium demand . 4 Source : USGS Lithium Market World resources Source : SQM USGS Lithium Reserves 2017 Country Reserves (MT) Argentina 2.000.000 Australia 2.700.000 Brazil 48.000 Chile 7.500.000 China 3.200.000 Portugal 60.000 US 35.000 Zimbawe 23.000 Total (Li) 15.566.000 Total (LCE) 82.811.000

5 Active Brine SQM Projects Active Mineral Potential Mineral Lithium Market Global resources Producing [2017] 17 Brownfield [2018 - 2022] 8 Greenfield [2018 - 2022] 10 Total Projects 35 Existing and New Projects Potential Brine

Agenda 6 4 Lithium at SQM 2 Demand 3 Supply 2 .1 Global 1 Lithium Market 2 .2 Li - ion Batteries and Electric Vehicles

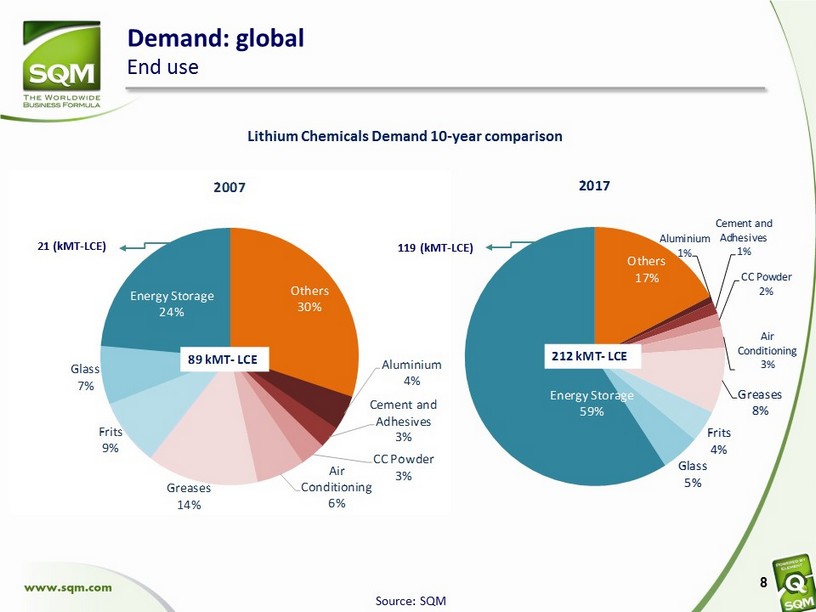

Demand: global End use 7 Energy storage market share in 2017: 59% Others 17% Aluminium 1% Cement and Adhesives 1% CC Powder 2% Air Conditioning 3% Greases 8% Frits 4% Glass 5% Energy Storage 59% Lithium Chemicals Demand 2017 212 kMT - LCE

Demand: global End use 8 Source: SQM Others 17% Aluminium 1% Cement and Adhesives 1% CC Powder 2% Air Conditioning 3% Greases 8% Frits 4% Glass 5% Energy Storage 59% 2017 212 kMT - LCE Others 30% Aluminium 4% Cement and Adhesives 3% CC Powder 3% Air Conditioning 6% Greases 14% Frits 9% Glass 7% Energy Storage 24% 2007 89 kMT - LCE Lithium Chemicals Demand 10 - year comparison 21 ( kMT - LCE) 119 ( kMT - LCE)

Inorganic derivatives • Glass • Frits • Metallurgy • Battery Materials • Glass • Frits • Aluminum • CC Powder • Construction Lithium Carbonate • Molecular Sieves • Air treatment • Construction Lithium Chloride • Greases • Battery Materials • Dyes Lithium Hydroxide • Batteries (Primary) • Al - Li alloys • Pharmaceutical • Chemicals Lithium Metal Lithium Carbonate: • Lithium Bromide • Lithium Fluoride • Lithium Nitrate Lithium Hydroxide: • Lithium Carbonate HP • Lithium Peroxide • Butiylilithium • Lithium Diisopropylamide • Lithium Hydride • Others Organic derivatives Lithium Concentrates Lithium Chemicals Minerals Brines Natural Resources SQM entering each market 1997 2000 Demand: global Overview of Lithium production (2017) 127 kMT - LCE 115 kMT - LCE Source: SQM 30 kMT - LCE 85 kMT LCE Concentrate 2 003 212 kMT - LCE 9

10 Demand: global Lithium products 10 2017 Lithium Hydroxide : Lithium Carbonate ratio = 2:5 Source: SQM Li2CO3 60% LiOH 23% LiCl 3% LiM 5% Buli 4% Other Deriv 5% Lithium Chemicals 2017 (%) 212 kMT - LCE Li2CO3 = Lithium Carbonate LiOH = Lithium Hydroxide LiCl = Lithium Chloride LiM = Lithium Metal Buli = Butiylilithium Other Deriv = Inorganic and Organic Derivatives

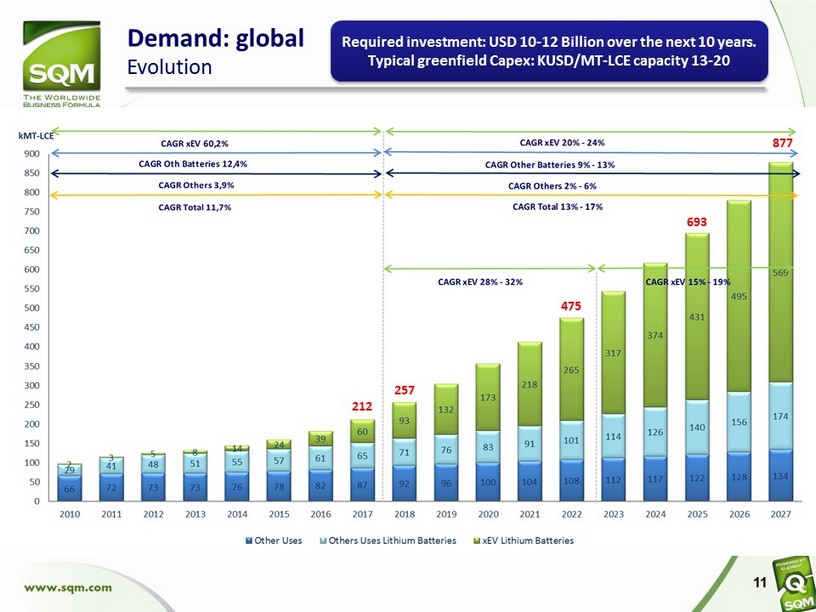

11 Demand: global Evolution Required investment: USD 10 - 12 Billion over the next 10 years. Typical greenfield Capex: KUSD/MT - LCE capacity 13 - 20 212 475 257 693 877

Demand: global Lithium market relative to Copper market Cu L i Source: Cochilco , SQM N ote : Assuming a US$2.8/ lb as long - term Cu price bUS$34 bUS$1 ~ bUS$4 bUS$126 bUS$3 Cu L i Global Chile 2017 2027 ~ bUS$146 ~ bUS$9 ~ bUS$39 x 17 (6%) x 11 (9%) 12

Agenda 13 4 Lithium at SQM 2 Demand 3 Supply 2 .1 Global 1 Lithium Market 2 .2 Li - ion Batteries and Electric Vehicles

NCM cathodes: Lithium (Li) mixed with Nickel (Ni), Cobalt (Co) and Manganese (Mn) OEM target: higher energy density (High Ni) and lower cost (Low Co) 14 Demand: Li - ion Batteries Cathode types Source: SQM Higher Nickel content More Lithium Hydroxide use High capacity Stability + Co Mn Ni LCO LMO NCA Reversability Safety Capacity NCM 1 - 1 - 1 NCM 6 - 2 - 2 NCM 8 - 1 - 1 NCM 4 - 2 - 4 NCM 5 - 2 - 3 Low cost region High stability region

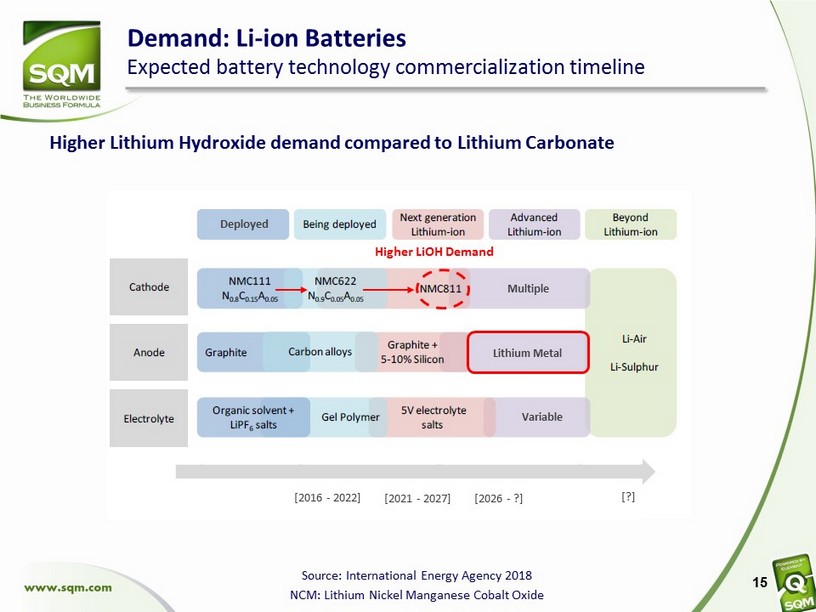

Demand: Li - ion Batteries Expected battery technology commercialization timeline Source: International Energy Agency 2018 NCM: Lithium Nickel Manganese Cobalt Oxide 15 Higher LiOH Demand Multiple Lithium Metal Variable [2016 - 2022] [2021 - 2027] [2026 - ?] Deployed [?] Higher Lithium Hydroxide demand compared to Lithium Carbonate

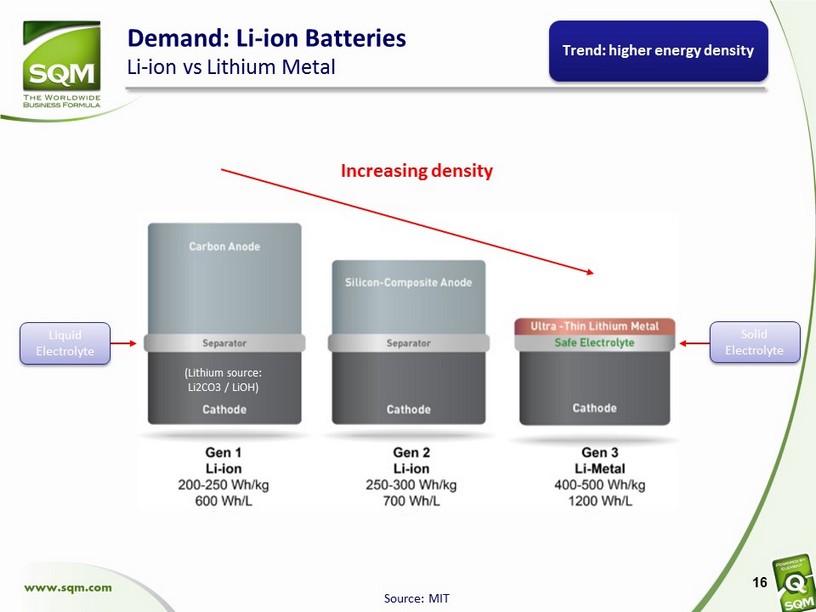

Demand: Li - ion Batteries Li - ion vs Lithium Metal Source: MIT 16 Liquid Electrolyte Solid Electrolyte (Lithium source: Li2CO3 / LiOH ) Increasing density Trend: higher energy density

Demand: Li - ion Batteries Li - ion battery cost breakdown 17 Source: UBS LIB cost does not include depreciation not labor (only materials) 7% of cost 6% of cost 7% of cost 8% of cost Lithium cost is ~ 7% of Li - ion battery materials 70% 81% 77% 73%

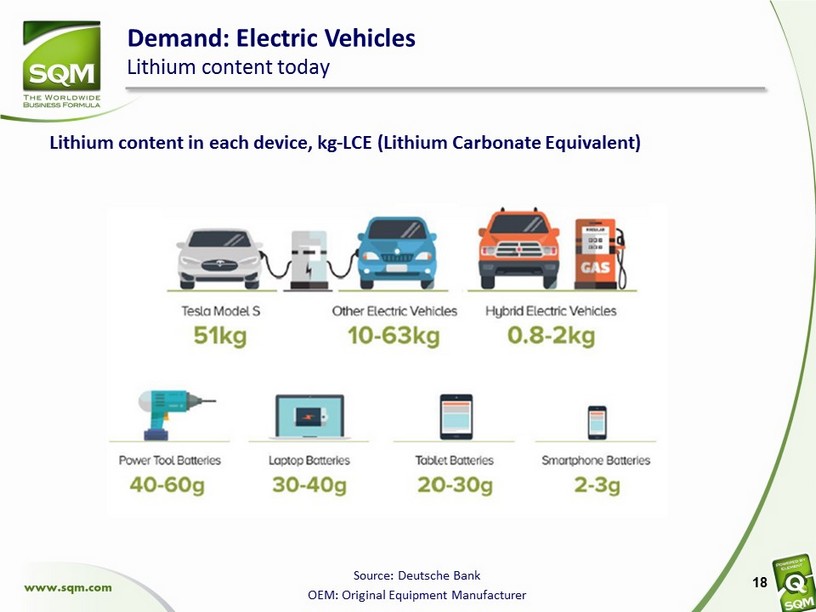

Demand: Electric Vehicles Lithium content today Source: Deutsche Bank OEM: Original Equipment Manufacturer 18 Lithium content in each device, kg - LCE (Lithium Carbonate Equivalent)

19 EU Q 1 - 18 Sales : 8 , 947 units Range : 241 Km Battery Pack: 41 kWh Li used : 31 Kg LCE MSRP : US$ 23,000 Demand: Electric Vehicles Best selling Battery Electric Vehicles (BEV) US Q 1 - 18 Sales : 8 , 180 units Range : 354 Km Battery Pack : 50 kWh Li used : 38 Kg LCE MSRP : US $ 35 , 000 China Q 1 - 18 Sales : 19 , 808 units Range : 156 Km Battery Pack : 20 kWh Li used : 15 Kg LCE MSRP : US $ 24 , 000 Renault Zoe Tesla Model 3* BAIC EC - SERIES ** Several sources *Base Model ** Features for BAIC EC - 180 EV Performance between 6 - 8 Km/kWh Performance: 6 - 8 Km/kWh

Demand: Electric Vehicles OEMs announcements Several Sources O EM: Original Equipment Manufacturer 20 Region OEM Year Investment xEV Target Ford 2022 $11 billion 40 xEV including 16 BEV GM 2022 >20 BEV Tesla 2024 Sales of Model 3 around 274 kunits xEVs to account for 15-25% of sales 25 electrified models (12 BEV) € 12 billion xEVs for 15-25% of sales >10 BEV models 40 hybrid models Volvo 2025 50% of sales to be electric 2025 Over € 20 billion 80 xEV models 2030 $40 billion Electrified versions of all +300 global models 2/3 of total car sales to be electrified 2020 Launching 10 EVs 2030 Selling 5.5 million electrified vehicles (including hybrids and hydrogen fuel cells) 8 new EV models Sales of 1 million units Dongfeng 2022 xEV sales accounting for 30% of total sales BYD 2020 Sales of 600 kunits BAIC 2020 Production of 800 kunits NAFTA Toyota Daimler Nissan BMW Honda VW EMEA 2025 2025 ASIA Announcements 2022 2030 Car manufacturers committed to Electric Vehicles

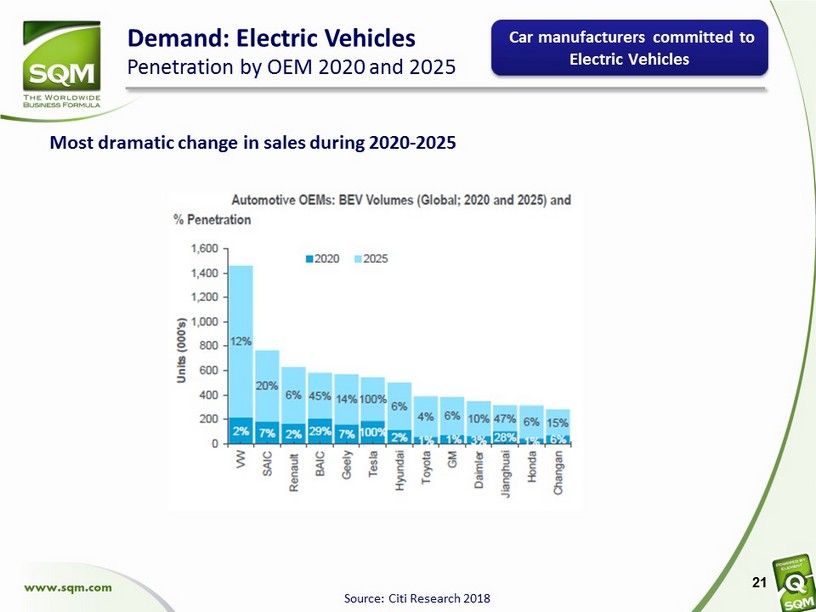

Demand: Electric Vehicles Penetration by OEM 2020 and 2025 Source: Citi Research 2018 Most dramatic change in sales during 2020 - 2025 21 Car manufacturers committed to Electric Vehicles

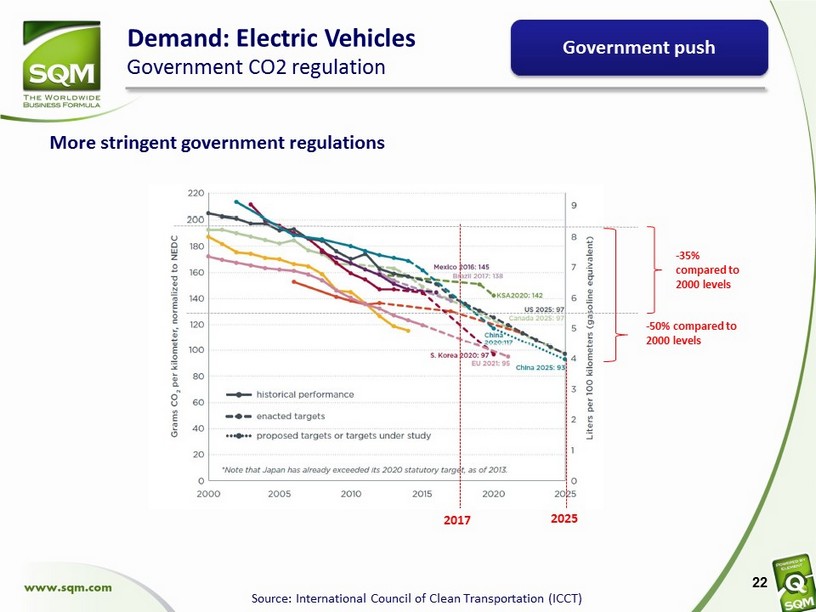

Demand: Electric Vehicles Government CO2 regulation Source: International Council of Clean Transportation (ICCT) More stringent government regulations 2017 22 Government push - 35% compared to 2000 levels - 50% compared to 2000 levels 2025

Demand: Electric Vehicles ICE announced sales bans and access restrictions Source: International Energy Agency 2018 23 Internal Combustion Engines (ICE) bans

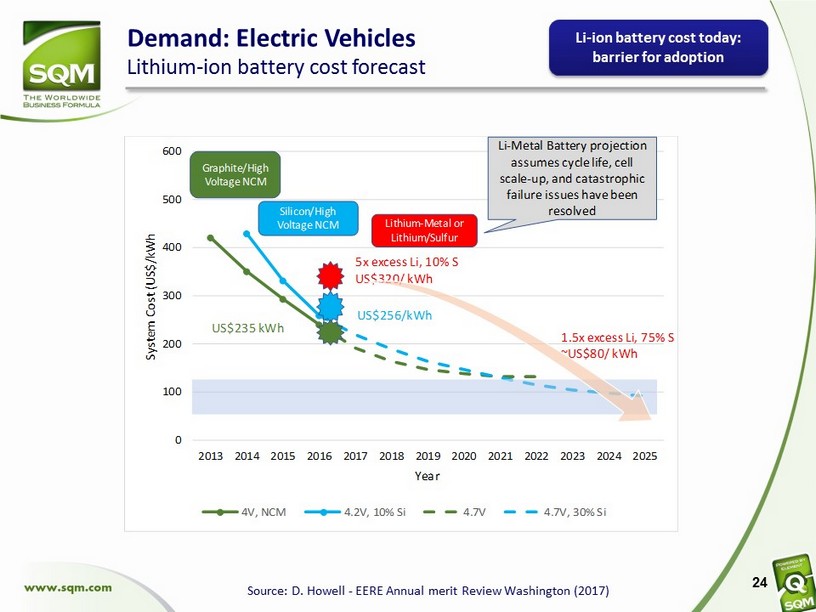

Demand: Electric Vehicles Lithium - ion battery cost forecast Source: D. Howell - EERE Annual merit Review Washington (2017) 24 0 100 200 300 400 500 600 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 System Cost (US$/kWh Year 4V, NCM 4.2V, 10% Si 4.7V 4.7V, 30% Si 5x excess Li, 10% S US$320/ kWh US$256/ kWh US$235 kWh Graphite /High Voltage NCM Silicon/High Voltage NCM Lithium - Metal or Lithium / Sulfur Li - Metal Battery projection assumes cycle life , cell scale - up, and catastrophic failure issues have been resolved 1.5x excess Li, 75% S ~US$80/ kWh Li - ion battery cost today: barrier for adoption

The decision of buying an electric is not only economics Demand: Electric Vehicles Qualitative aspects S everal Sources High Tech, forefront design & environmentally friendly 25 Consumer Preferences

Agenda 26 4 Lithium at SQM 2 Demand 3 Supply 2 .1 Global 1 Lithium Market 2 .2 Li - ion Batteries and Electric Vehicles

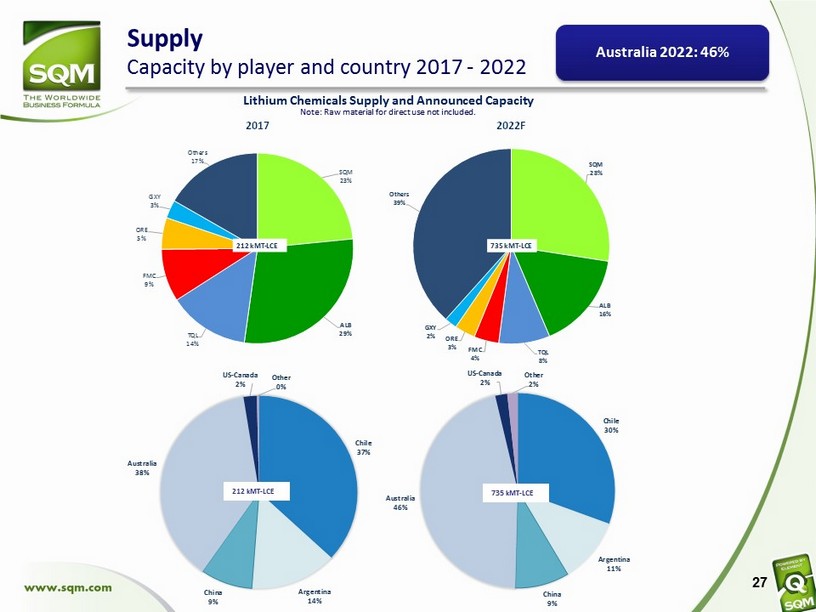

Supply Capacity by player and country 2017 - 2022 27 Note: Raw material for direct use not included. Lithium Chemicals Supply and Announced Capacity Chile 37% Argentina 14% China 9% Australia 38% US - Canada 2% Other 0% 212 kMT - LCE Chile 30% Argentina 11% China 9% Australia 46% US - Canada 2% Other 2% 735 kMT - LCE Australia 2022: 46% SQM 23% ALB 29% TQL 14% FMC 9% ORE 5% GXY 3% Others 17% 2017 212 kMT - LCE SQM 28% ALB 16% TQL 8% FMC 4% ORE 3% GXY 2% Others 39% 2022F 735 kMT - LCE

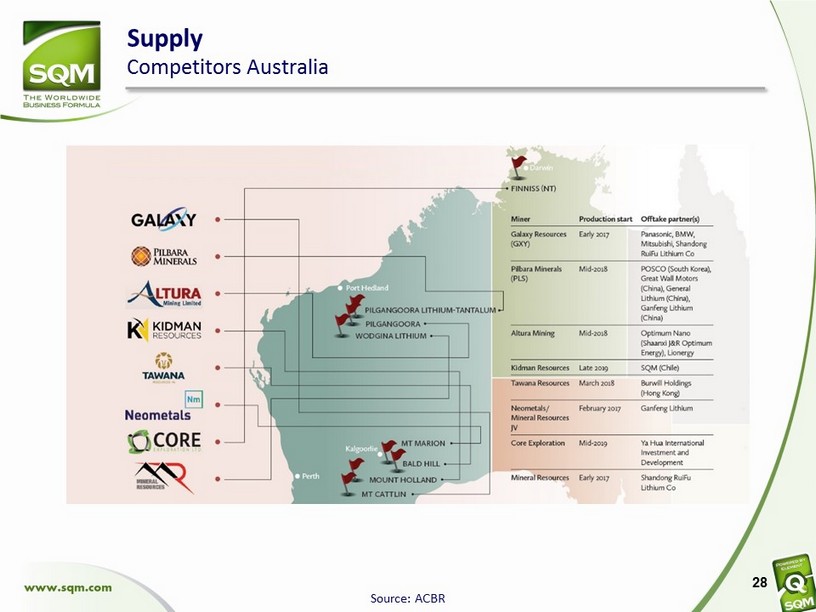

Supply Competitors Australia 28 Source: ACBR

Agenda 29 4 Lithium at SQM 2 Demand 3 Supply 2 .1 Global 1 Lithium Market 2 .2 Li - ion Batteries and Electric Vehicles

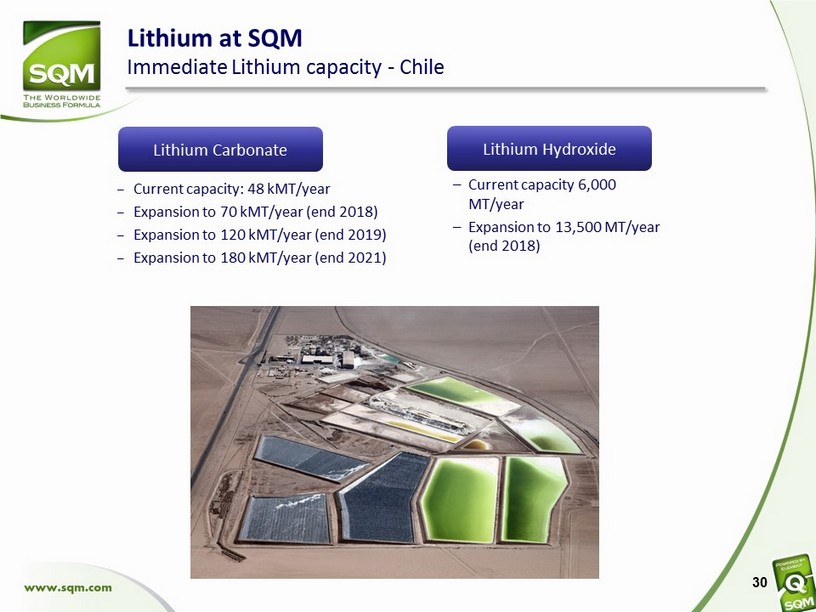

Lithium at SQM Immediate Lithium capacity - Chile – Current capacity 6,000 MT/year – Expansion to 13,500 MT/year (end 2018) 30 – Current capacity: 48 kMT /year – Expansion to 70 kMT /year (end 2018) – Expansion to 120 kMT /year (end 2019) – Expansion to 180 kMT /year (end 2021) Lithium Carbonate Lithium Hydroxide

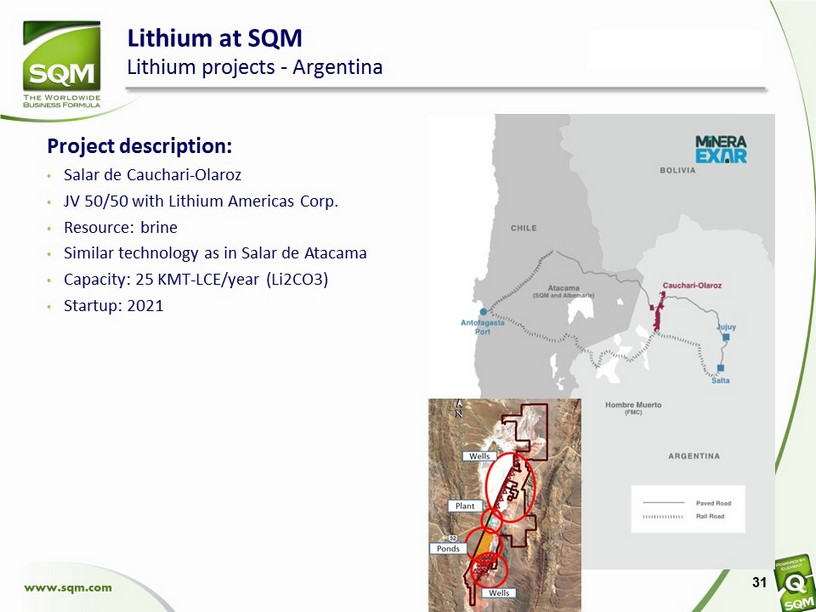

Lithium at SQM Lithium projects - Argentina Project description: • Salar de Cauchari - Olaroz • JV 50/50 with Lithium Americas Corp. • Resource: brine • Similar technology as in Salar de Atacama • Capacity: 25 KMT - LCE/year (Li2CO3) • Startup: 2021 31

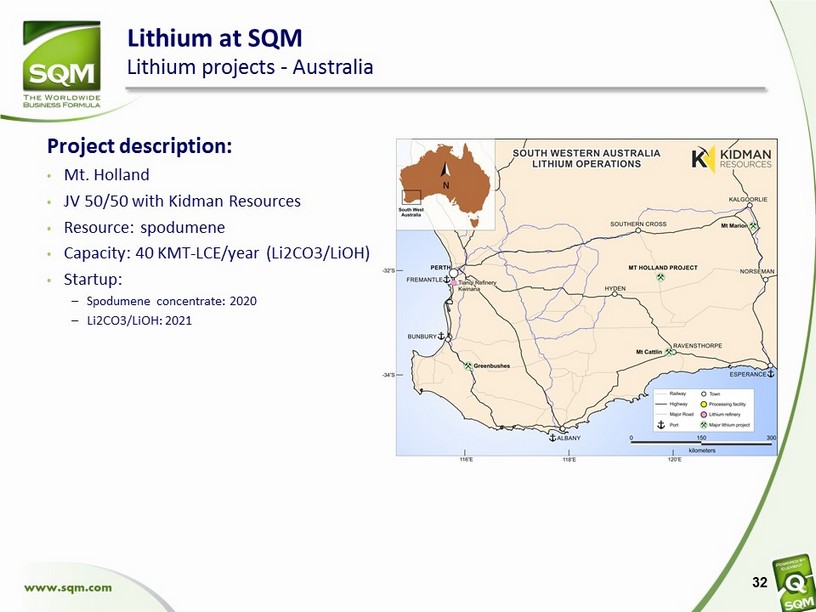

Lithium at SQM Lithium projects - Australia Project description: • Mt. Holland • JV 50/50 with Kidman Resources • Resource: spodumene • Capacity: 40 KMT - LCE/year (Li2CO3/ LiOH ) • Startup: – Spodumene concentrate: 2020 – Li2CO3/LiOH: 2021 32

Lithium at SQM Challenges for brine producers 33 • Chemical: ‒ Higher purity ‒ Customized contaminants profile ‒ Magnetic metallic particles • Physical: ‒ Micronization : Customized particle size distribution Lithium Carbonate Lithium Hydroxide • Chemical: ‒ Higher purity ‒ Customized contaminants profile ‒ Magnetic metallic particles • Physical: ‒ Micronization : customized particle size distribution ‒ Caking • Process Development: ‒ Brine to Lithium Hydroxide Source: SQM Continuous quality improvement Lithium Metal • Chemical: ‒ TBD • Process Development: ‒ Efficiency ‒ Low cost

Lithium Market Outlook Final Remarks Lithium is abundant and well spread geographically Lithium demand growing at high rates: CAGR 15% (2017 - 2027) Main driver: energy storage (particularly Electric Vehicles) • OEM commitment + Environmental regulations + Consumer preferences + Mass production / Cost reduction Lithium - ion battery the predominant technology for Electric Vehicles (10 - 15 years) • High Nickel Lithium - ion: Lithium Carbonate / Lithium Hydroxide New battery technologies will continue requiring lithium • Solid - State: Lithium Metal Lithium represents a small portion of Li - ion battery total cost Many new lithium projects, Australia to become the leading Lithium producer SQM to take back the # 1 global lithium producer: • Technical know - how and deep commercial knowledge • Diversified resource base • Ready to face the future industry challenges (e.g. quality, product) 34

Thank You…