Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 1-12158

(Exact name of Registrant as specified in its charter)

Sinopec Shanghai Petrochemical Company Limited

(Translation of Registrant’s name into English)

The People’s Republic of China

(Jurisdiction of incorporation or organization)

No. 48 Jinyi Road, Jinshan District, Shanghai, PRC 200540

(Address of principal executive offices)

Mr. Zhang Jingming

No. 48 Jinyi Road, Jinshan District, Shanghai, 200540

The People’s Republic of China

Tel: +86 (21) 57943143

Fax: +86 (21) 57940050

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class |

Name of each exchange on which registered | |

| American Depositary Shares, each representing 100 Class H Ordinary Shares, par value RMB1.00 per Share Class H Ordinary Shares, par value RMB1.00 per Share |

New York Stock Exchange The Stock Exchange of Hong Kong Limited |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

2,330,000,000 H Shares, par value RMB1.00 per Share

4,870,000,000 Domestic Shares, par value RMB1.00 per Share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or (15) (d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232,405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large Accelerated Filer x Accelerated Filer ¨ Non-Accelerated Filer ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ¨ | International Financial Reporting Standards as issued by the International Accounting Standards Board x Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ¨ Item 18 ¨

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Table of Contents

i

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Information in this Annual Report which does not relate to historical financial information may be deemed to constitute forward- looking statements. The words or phrases “may”, “will”, “expect”, “anticipate”, “plan”, “will likely result”, “estimate”, “project”, “believe”, “intends to” or similar expressions identify “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are subject to risks and uncertainties that could cause actual results to differ materially from historical results and those presently anticipated or projected in the forward-looking statements. We caution readers not to place undue reliance on any forward looking statements, which speak only as of the date made. We undertake no obligations to update any forward-looking statements to reflect events and circumstances after the date on which the statements are made or reflect the occurrence of unanticipated events. Among the factors that could cause our actual results in the future to differ materially from the forward-looking statements are the availability of crude oil supply channels and relevant prices, effects of the macroeconomic policy of The People’s Republic of China, government control of currency conversion and the prices of refined oil products, and other factors discussed in Item 3.D “Key Information - Risk Factors”.

Unless otherwise specified, references in this Annual Report to “US dollars” or “US$” are to United States dollars, references to “HK dollars” or “HK$” are to Hong Kong dollars and references to “Renminbi” or “RMB” are to Renminbi yuan, the legal tender currency of the PRC.

We publish our financial statements in Renminbi. Unless otherwise indicated, all translations from Renminbi to US dollars have been made at a rate of RMB6.6000 to US$1.00, the noon buying rate on December 30, 2010 as set forth in the H.10 statistical release of the U.S. Federal Reserve Board. We do not represent that Renminbi or US dollar amounts could be converted into US dollars or Renminbi, as the case may be, at any particular rate.

References to “we” or “us” are references to Sinopec Shanghai Petrochemical Company Limited and our subsidiaries, unless the context requires otherwise. Before our formation, these references relate to the petrochemical businesses carried on by Shanghai Petrochemical Complex.

References to “China” or the “PRC” are references to The People’s Republic of China which, for the purpose of this Annual Report and for geographical reference only, excludes Hong Kong, Macau and Taiwan.

References to our “A Shares” are references to 720,000,000 of our domestic shares, par value RMB1.00 per share, which are ordinary shares subscribed for and traded exclusively on the Shanghai Stock Exchange by and between Chinese investors.

References to “ADSs” are references to our American Depositary Shares, which are listed and traded on the New York Stock Exchange. Each ADS represents 100 H Shares.

References to our “domestic shares” are references to all of our domestic shares, par value RMB1.00 per share, which are ordinary shares held by Chinese investors.

References to our “H Shares” are references to our overseas-listed foreign ordinary shares, par value RMB1.00 per share, which are listed and traded on the Stock Exchange of Hong Kong Limited (“HKSE”) under the number “338”.

“Rated Capacity” is the output capacity of a given production plant or, where appropriate, the throughput capacity, calculated by estimating the number of days in a year that the production plant is expected to operate, including downtime for regular maintenance, and multiplying that number by an amount equal to the plant optimal daily output or throughput, as the case may be.

All references to “tons” are to metric tons.

Unless otherwise noted, references to sales volume are to sales to entities other than us or our divisions and subsidiaries.

ii

Table of Contents

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS. |

Not applicable.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE. |

Not applicable.

| ITEM 3. | KEY INFORMATION. |

A. Selected Financial Data.

Our selected consolidated statements of income (except for ADS data) and cash flow data for each of the years ended December 31, 2008, 2009 and 2010 and our selected consolidated balance sheet data as of December 31, 2009 and 2010 are derived from our consolidated financial statements included in Item 17. Financial Statements. Our selected consolidated statements of income and cash flow data for the years ended December 31, 2006 and 2007 and our consolidated balance sheet data as of December 31, 2006, 2007 and 2008 are derived from our consolidated financial statements not included in this Annual Report. Our selected consolidated financial data should be read in conjunction with our consolidated financial statements, and the notes thereto, and Item 5. Operating and Financial Review and Prospects. Our consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board.

Selected Consolidated Financial Data

(in thousands, except per share and per ADS data)

| Years Ended December 31, | ||||||||||||||||||||

| 2006 (RMB) |

2007 (RMB) |

2008 (RMB) |

2009 (RMB) |

2010 (RMB) |

||||||||||||||||

| STATEMENTS OF INCOME DATA |

||||||||||||||||||||

| Net sales: |

||||||||||||||||||||

| Synthetic fibers |

4,711,667 | 4,328,742 | 3,662,023 | 2,823,663 | 3,906,636 | |||||||||||||||

| Resins and plastics |

15,753,304 | 15,878,803 | 14,850,284 | 12,263,540 | 14,900,012 | |||||||||||||||

| Intermediate petrochemicals |

6,775,721 | 9,372,658 | 10,271,840 | 8,421,035 | 17,206,440 | |||||||||||||||

| Petroleum products |

19,387,666 | 21,036,581 | 27,552,859 | 18,917,890 | 28,733,890 | |||||||||||||||

| All others |

3,289,765 | 3,637,905 | 2,992,765 | 4,919,136 | 7,348,904 | |||||||||||||||

| Income/(loss) from operations |

552,907 | 892,656 | (7,817,264 | ) | 2,023,476 | 2,967,092 | ||||||||||||||

| Earnings/(loss) before income tax |

964,200 | 2,151,352 | (8,014,438 | ) | 2,166,509 | 3,533,376 | ||||||||||||||

| Net income/(loss) attributable to equity shareholders of the Company |

844,407 | 1,634,080 | (6,238,444 | ) | 1,590,988 | 2,771,646 | ||||||||||||||

| Net income attributable to non-controlling interests |

66,555 | 49,056 | 36,717 | 64,471 | 25,358 | |||||||||||||||

| Basic earnings/(loss) per share(a) |

0.12 | 0.23 | (0.87 | ) | 0.22 | 0.38 | ||||||||||||||

| Basic earnings/(loss) per ADS(a) |

11.73 | 22.70 | (86.65 | ) | 22.10 | 38.50 | ||||||||||||||

| (a) | The calculation of earnings per share is based on the weighted average number of shares outstanding during the year of 7,200,000,000 in each of 2010, 2009, 2008, 2007 and 2006, respectively. Earnings per ADS are calculated on the basis that one ADS is equivalent to 100 shares. |

1

Table of Contents

| Years Ended December 31, | ||||||||||||||||||||

| 2006 (RMB) |

2007 (RMB) |

2008 (RMB) |

2009 (RMB) |

2010 (RMB) |

||||||||||||||||

| CASH FLOW DATA |

||||||||||||||||||||

| Net cash generated from/ (used in) operating activities |

1,696,615 | 1,441,998 | (3,986,490 | ) | 3,346,890 | 3,973,719 | ||||||||||||||

| Capital expenditures |

2,008,779 | 2,134,123 | 1,511,072 | 2,120,292 | 1,356,845 | |||||||||||||||

| Net proceeds from issuance of corporate bonds |

2,977,800 | — | — | 1,000,000 | — | |||||||||||||||

| Proceeds from loans and borrowings |

13,939,126 | 17,605,887 | 32,528,75 | 29,211,434 | 39,355,780 | |||||||||||||||

| Repayment of loans and borrowings |

15,910,127 | 16,166,938 | 27,377,61 | 31,849,620 | 42,631,344 | |||||||||||||||

| BALANCE SHEET DATA |

||||||||||||||||||||

| Current assets |

7,563,106 | 8,936,764 | 6,511,351 | 9,061,425 | 8,531,841 | |||||||||||||||

| Property, plant and equipment |

13,359,862 | 14,977,237 | 13,272,899 | 14,977,205 | 13,570,559 | |||||||||||||||

| Total assets |

27,406,060 | 29,853,050 | 27,533,027 | 29,908,486 | 28,568,742 | |||||||||||||||

| Short-term debt(a) |

4,270,337 | 4,091,969 | 9,372,725 | 7,774,673 | 4,395,438 | |||||||||||||||

| Current liabilities |

7,030,050 | 8,261,732 | 13,342,720 | 14,304,925 | 10,573,225 | |||||||||||||||

| Long-term debt (excluding current portion) |

1,063,654 | 639,289 | 429,021 | 304,258 | 175,000 | |||||||||||||||

| Total equity attributable to equity shareholders of the Company |

18,976,343 | 20,648,038 | 13,496,933 | 15,005,018 | 17,560,664 | |||||||||||||||

| (a) | Including corporate bonds and current portion of long-term debt. |

Dividends

The following table sets forth certain information concerning the dividends since January 1, 1994:

| Dividend Period |

Dividend per Share | |

| January 1, 1994-June 30, 1994 |

RMB0.04(US$0.0059) | |

| July 1, 1994-December 31, 1994 |

RMB0.085(US$0.0125) | |

| January 1, 1995-June 30, 1995 |

RMB0.04 (US$0.0059) | |

| July 1, 1995-December 31, 1995 |

RMB0.09 (US$0.0132) | |

| January 1, 1996-June 30, 1996 |

RMB0.04 (US$0.0059) | |

| July 1, 1996-December 31, 1996 |

RMB0.08 (US$0.0117) | |

| January 1, 1997-December 31, 1997 |

RMB0.06 (US$0.0088) | |

| January 1, 1998-December 31, 1998 |

RMB0.03 (US$0.0044) | |

| January 1, 1999-December 31, 1999 |

RMB0.05 (US$0.0073) | |

| January 1, 2000-December 31, 2000 |

RMB0.06 (US$0.0088) | |

| January 1, 2001-December 31, 2001 |

No dividend | |

| January 1, 2002-December 31, 2002 |

RMB0.05 (US$0.0073) | |

| January 1, 2003-December 31, 2003 |

RMB0.08 (US$0.0117) | |

| January 1, 2004-December 31, 2004 |

RMB0.20 (US$0.0293) | |

| January 1, 2005-December 31, 2005 |

RMB0.10 (US$0.0147) | |

| January 1, 2006-December 31, 2006 |

RMB0.04 (US$0.0059) | |

| January 1, 2007-December 31, 2007 |

RMB0.09 (US$0.0132) | |

| January 1, 2008-December 31, 2008 |

No dividend | |

| January 1, 2009-December 31, 2009 |

RMB0.03 (US$0.0044) | |

| January 1, 2010-December 31, 2010 |

RMB0.10 (US$0.0152) |

See also Item 8.A. Financial Information – Consolidated Statements and Other Financial Information – Dividend Policy.

Exchange Rates

The Chinese government controls its foreign currency reserves in part through direct regulation of the conversion of Renminbi into foreign exchange and through restrictions on foreign trade. See Item 10.D. Additional Information – Exchange Controls.

2

Table of Contents

The following table sets forth information concerning exchange rates between Renminbi and US dollars for the periods indicated:

| Noon Buying Rates (RMB/US$) | ||||||||||||||||

| Period |

Period End | Average(1) | High | Low | ||||||||||||

| 2006 |

7.8041 | 7.9579 | 8.0702 | 7.8041 | ||||||||||||

| 2007 |

7.2946 | 7.5806 | 7.8127 | 7.2946 | ||||||||||||

| 2008 |

6.8225 | 6.9477 | 7.2946 | 6.7899 | ||||||||||||

| 2009 |

6.8259 | 6.8307 | 6.8470 | 6.8176 | ||||||||||||

| 2010 |

6.6000 | 6.7696 | 6.8330 | 6.6000 | ||||||||||||

| November 2010 |

6.6670 | 6.6537 | 6.6906 | 6.6233 | ||||||||||||

| December 2010 |

6.6000 | 6.6497 | 6.6745 | 6.6000 | ||||||||||||

| January 2011 |

6.6017 | 6.5964 | 6.6364 | 6.5809 | ||||||||||||

| February 2011 |

6.5713 | 6.5761 | 6.5965 | 6.5520 | ||||||||||||

| March 2011 |

6.5483 | 6.5645 | 6.5743 | 6.5483 | ||||||||||||

| April 2011 |

6.4900 | 6.5267 | 6.5477 | 6.4900 | ||||||||||||

Source: The sources of the exchange rates are: (i) with respect to any period ending on or prior to December 31, 2008, the Federal Reserve Bank of New York, and (ii) with respect to any period ending on or after January 1, 2009, the H.10 statistical release of the Federal Reserve Board.

Note:(1) Determined by averaging the rates on the last business day of each month during the respective period.

B. Capitalization and Indebtedness.

Not applicable.

C. Reasons for the Offer and Use of Proceeds.

Not applicable.

D. Risk Factors.

An investment in our ADSs involves significant risks. The risks and uncertainties described below are not the only ones we face. You should consider carefully all of the information in this annual report, including the risks and uncertainties described below and our consolidated financial statements and related notes, before making an investment in our ADSs. Any of the following risks could have a material adverse effect on our business, financial condition and results of operations. In any such case, the market price of our ADSs could decline, and you may lose all or part of your investment.

Our operations may be adversely affected by the cyclical nature of the petroleum and petrochemical market and by the volatility of prices of crude oil and petrochemical products.

Most of our revenues are attributable to petrochemical products, which have historically been cyclical and sensitive to the availability and price of raw materials and general economic conditions. Markets for many of our products are sensitive to changes in industry capacity and output levels, cyclical changes in regional and global economic conditions, the price and availability of substitute products and changes in consumer demand, which from time to time have had a significant impact on product prices in the regional and global markets. Many of our products have become increasingly subject to the cyclical nature of regional and global petroleum and petrochemical markets, which may adversely affect our operation.

As crude oil costs accounted for RMB39.695 billion or 58.11% of the Group’s annual cost of sales in 2010, changes in crude oil prices can affect the Group’s profitability. In recent years, due to various reasons, the price of crude oil has fluctuated significantly. Furthermore, we cannot rule out the possibility of the occurrence of certain global emergencies which might disrupt our crude oil supply. We expect that the volatility and uncertainty of the prices of crude oil and petrochemical products will continue, and that increasing crude oil prices and declines in prices of petrochemical products may adversely affect our business and results of operations and financial condition.

3

Table of Contents

Some of our major products are subject to government price controls, and we are not able to pass on all cost increases from rising crude oil prices through higher product prices.

We consume large amounts of crude oil to manufacture our products of which more than 90% is imported. We attempt to mitigate the effect of increased costs due to rising crude oil prices. However, our ability to pass on these increased costs to our customers is dependent on market conditions and government regulations. Given that the increase of the sales prices of our products may lag behind the increase of crude oil costs, we may fail to completely cover the increased costs by increasing our sales prices, particularly where government regulations restrict the prices of certain of our fuel products. In particular, gasoline, diesel and jet fuel, and liquefied petroleum gas are subject to government price controls at present. In 2008, 2009 and 2010, approximately 43.52%, 47.70% and 34.41% of our net sales were from such products subject to price control. Although we sometimes receive subsidies from the Chinese government to, among other things, cover part of our losses resulting from such price controls, the amount of such subsidies vary substantially from year to year or even quarter to quarter and is difficult to predict. In some years, we receive no subsidy at all. Although the Chinese government has adopted a new pricing mechanism for domestic refined oil products that indirectly links the prices of these products to international crude oil prices (see “—Item 4. Information on the Company – B. Business Overview – Product Pricing”), such pricing mechanism is still not transparent enough and is faced with the risk of inadequate or untimely adjustment. Moreover, the Chinese government controls the distribution of many petroleum products in China. For instance, some of our petroleum products are required to be sold to designated distributors (such as the subsidiaries of China Petroleum & Chemical Corporation). Because we cannot freely sell our fuel products to take advantage of opportunities for higher prices we may not be able to fully cover increases in crude oil prices by increases in the sale prices of our products, which has had and will possibly continue to have a material adverse effect on our financial condition, results of operations and cash flows.

Our development and operation plans have significant capital expenditure and financing requirements, which are subject to a number of risks and uncertainties.

The petrochemical business is a capital intensive business. Our ability to maintain and increase our revenues, net income and cash flows depends upon continued capital spending. Our current business strategy contemplates capital expenditures for 2011 of approximately RMB3.000 billion (US$0.455 billion), which will be provided through financing activities and use of our own capital. Our actual capital expenditures may vary significantly from these planned amounts due to our ability to generate sufficient cash flows from operations, investments and other factors that may be beyond our control. In addition, there can be no assurance as to whether, or at what cost, our capital projects will be completed or the success of these projects if completed.

As of March 31, 2011, we had aggregate outstanding indebtedness of approximately RMB6.018 billion (US$0.912 billion). Most of our loans are with state-controlled banks in China and structured as short-term debt obligations with payment due in one year or less. These banks have generally been willing to provide new short-term loans while we pay off existing loans, as our overall debt level has been reduced slightly since 2009. China Petroleum & Chemical Corporation (“Sinopec Corp”), our controlling shareholder, did not provide any guarantee or credit support for our debt for the year ended December 31, 2010 and for the three-month period ended March 31, 2011.

Our ability to obtain external financing in the future and our ability to make timely repayments of our debt obligations are subject to a variety of uncertainties, including: our future results of operations, financial condition and cash flows; the condition of the economy in China and the markets for our products; the cost of financing and the condition of financial markets; the issuance of relevant government approvals and other project risks associated with the development of infrastructure in China; and the continuing willingness of banks to provide new loans as we pay down existing debt.

While we anticipate that we will rely less on debt to finance capital expenditures and operations as the global economic outlook continues to improve, if we fail to obtain sufficient funding for our operations or development plans or are unable to obtain new short-term debt to pay off existing debt, our business, results of operations and financial condition could be adversely affected.

We could face increased competition.

Our principal market, Eastern China, which is comprised of Shanghai, Jiangsu, Zhejiang, Anhui and Jiangxi, has enjoyed stronger economic growth and a higher demand for petrochemical products than other regions of China. As a result, we believe that competitors will try to expand their sales and build up their distribution networks in our principal market. We believe this will have an adverse impact on the production and sale of our major products. Moreover, Chinese private enterprises have gradually overcome technological and funding barriers to extend their business from the downstream processing sector to the upstream petrochemical field. These enterprises have advantages in many areas such as flexibility in operation costs, preferential policy treatment and regional presence, and may use these advantages to compete with us in markets for our products.

4

Table of Contents

Related party transactions; non-competition; conflicts of interests.

We have engaged from time to time and will continue to engage in a variety of transactions with Sinopec Corp and China Petrochemical Corporation (“Sinopec Group”), the controlling company of Sinopec Corp, and their various subsidiaries or affiliates who provide a number of services to us, including the supply of raw materials, product distribution and sales agency, project design and installment service, petrochemical industry related insurance and financial services. We also sell oil and petrochemical products to Sinopec Corp and its affiliates. Our transactions with these companies are governed by a Mutual Product Supply and Sales Services Framework Agreement with Sinopec Corp and a Comprehensive Services Framework Agreement with Sinopec Group, the terms of which were negotiated on an arm’s length basis, see Item 7. B. Related Party Transactions – Intercompany Service Agreement and Business-related Dealings. Our business and results of operations could be adversely affected if Sinopec Corp refuses to engage in such transactions or if it seeks to amend the contracts between the parties in a way adverse to us. In addition, Sinopec Corp has interests in businesses which compete or are likely to compete, either directly or indirectly, with our businesses. Because Sinopec Corp is our controlling shareholder and its interests may conflict with our own interests, Sinopec Corp may take actions that favor itself over our interests.

We are controlled by Sinopec Corp, whose interests may not be aligned with yours.

As of April 1, 2011, Sinopec Corp owned 55.56% of our shares. Accordingly, it has voting and management control over us, and its interests may be different from your interests and the interests of our other shareholders. Subject to our Articles of Association and applicable laws and regulations, Sinopec Corp will be in a position to cause us to declare dividends, determine the outcome of corporate actions requiring shareholder approval or effect corporate transactions without the approval of the holders of the H shares and ADSs. Any such increase in our dividend payout would reduce funds available for reinvestment in our business and any such actions or transactions could adversely affect us or our minority shareholders. Additionally, Sinopec Corp may experience changes in its own business strategy and policies. Although we are not currently aware of any specific changes, they could, in turn, lead Sinopec Corp to change its policies or practices toward us in ways that we cannot predict, with corresponding unpredictable consequences for our business.

Our business operations may be adversely affected by present or future environmental regulations.

We are subject to extensive environmental protection laws and regulations in China. These laws and regulations permit:

| • | the imposition of fees and penalties for the discharge of waste substances; |

| • | the levy of payments and fines for damages for environmental offenses; and |

| • | the government to close or suspend any facility which fails to comply with orders and require it to correct or stop operations causing environmental damage. |

Our production operations produce substantial amounts of waste materials. In addition, our production and operations require permits that are subject to renewal, modification and revocation. At present, we believe that our operations substantially comply with all applicable Chinese environmental laws and regulations as they have been previously interpreted and enforced. The Chinese government, however, has moved, and may move further, toward more rigorous enforcement of applicable laws, and toward the adoption of more stringent environmental standards. Chinese national or local authorities may also impose additional regulations or apply more rigorous enforcement of such regulations which would require additional expenditures on environmental matters.

Our business may be limited or adversely affected by government regulations.

The central and local Chinese governments continue to exercise a certain degree of control over the petrochemical industry in China by, among other things:

| • | mandating distribution channels for our fuel products; |

| • | setting the allocations and pricing of certain resources, products and services; |

| • | assessing taxes and fees payable; |

| • | setting import and export quotas and procedures; and |

| • | setting safety, environmental and quality standards. |

5

Table of Contents

As a result, we may face significant constraints on our flexibility and ability to expand our business operations or to maximize our profitability. In the past, we have benefited from favorable regulatory policies that have, for example, reduced the competition we face from illegal imports of petroleum products. Existing policies that favor our industry may change in the future and our business could be adversely affected by any such changes.

Our development plans may require regulatory approval.

We are currently engaged in a number of construction and expansion projects. Most of our projects are subject to governmental review and approval. The timing and cost of completion of these projects will depend on numerous factors, including approvals from relevant government authorities and general economic conditions in China.

While in general we attempt to obtain governmental approval as far in advance as practicable, we may not be able to control the timing and outcome of these governmental reviews and approvals. If any of our important projects required for our future growth are not approved, or not approved on a timely basis, our results of operations and financial condition could be adversely affected.

China’s entry into the World Trade Organization, or WTO, may significantly increase foreign competition in our lines of business.

China joined the WTO on December 11, 2001. As part of its membership, China has committed to eliminate some tariff and non-tariff barriers to foreign competition in the domestic petrochemical industry that benefited us in the past. In particular, China:

| • | has reduced tariffs on imported petrochemicals products that compete with ours; |

| • | increased levels of permitted foreign investment in the domestic petrochemicals industry, allowing foreign investors to own 100% of a domestic petrochemicals company from December 11, 2004; |

| • | has gradually relaxed restrictions on the import of crude oil by non-state owned companies; |

| • | has granted foreign-owned companies the right to import petrochemical products; and |

| • | has permitted foreign-owned companies to distribute and market fuel products in both retail and wholesale markets in China. |

As a result of these measures, we face increased competition from foreign companies and imports. In 2011, the impact of the financial crisis will continue, the global market for petrochemical products may be slow to recover, and many overseas petrochemical companies, in particular those from neighboring areas, such as Japan, South Korea and the Middle East, have switched their focus to sales in China, which we believe, will further intensify competition in the Chinese domestic petrochemical market. In addition, tariff reductions could reduce our profit margins or otherwise negatively impact our revenue from certain products, including a small number of significant products. The PRC government may also reduce the tariffs imposed on production equipment that we may import in the future.

Political and economic policies in China could affect our business in unpredictable ways.

The economy of China differs from the economies of most countries belonging to the Organization for Economic Co-operation and Development in a number of respects, including:

| • | structure; |

| • | level of government involvement; |

| • | level of development; |

| • | level of capital reinvestment; |

| • | control of foreign exchange; and |

| • | allocation of resources. |

Before its adoption of reform and open-door policies beginning in 1978, China was primarily a planned economy. Since that time, the Chinese government has been reforming the Chinese economic system, and has also begun reforming the government structure. These reforms have resulted in significant economic growth and social progress. Although the Chinese government still owns a significant portion of the productive assets in China, economic reform policies since the late 1980s have emphasized autonomous enterprises and the utilization of market mechanisms. We currently expect that the Chinese government will continue these reforms, further reduce government intervention and rely more heavily on market mechanisms to allocate resources. Although we believe these reforms will have a positive effect on our overall long-term development, we cannot predict whether changes to China’s political, economic and social conditions, laws, regulations and policies will have any adverse effect on our current or future business or results of operations.

6

Table of Contents

If the Chinese government changes current regulations that allow us to make payments in foreign currencies, we may be unable to obtain the foreign currency which is necessary for our business.

The Renminbi currently is not a freely convertible currency. We receive most of our revenue in Renminbi. A portion of our Renminbi revenue must be converted into other currencies to meet our foreign currency obligations. We have substantial requirements for foreign currency, including:

| • | debt service costs on foreign currency-denominated debt; |

| • | purchases of imported equipment; |

| • | payment of any cash dividends declared in respect of the H shares; and |

| • | import of crude oil and other materials. |

Under existing foreign exchange regulations in China, we may undertake current account foreign exchange transactions, including the payment of dividends, without prior approval from the State Administration of Foreign Exchange by producing commercial documents evidencing the foreign exchange transactions, provided that they are processed through Chinese banks licensed to engage in foreign exchange transactions. The Chinese government has stated publicly that it intends to eventually make the Renminbi freely convertible in the future. However, uncertainty exists as to whether the Chinese government may restrict access to foreign currency for current account transactions if foreign currency becomes scarce in China.

Foreign exchange transactions under the capital account (international revenues and expenditures that increase or decrease debt or equity, including principal payments in respect of foreign currency-denominated obligations) continue to be subject to limitations and require the prior approval of the State Administration of Foreign Exchange. These limitations could affect our ability to obtain foreign exchange through debt financing, or to make capital expenditures in foreign currency.

If the Chinese government restricts our ability to make payments in foreign currency, we may be unable to obtain the foreign currency which is necessary for our business. In that case, our business may be materially adversely affected, and we may default on our obligations.

The change of currency policy and the fluctuation of Renminbi might adversely affect our business and operation results.

The exchange rate between the Renminbi and the U.S. Dollar or other foreign currencies might fluctuate and be affected by the change of Chinese political and economic conditions. In July, 2005, the Chinese government changed its policy of pegging the Renminbi to the U.S. Dollar. Under the new policy, the Renminbi is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. Since the adoption of this new policy, the value of the Renminbi has fluctuated daily within a narrow band, but overall has appreciated against the US Dollar. Nevertheless, the PRC government continues to receive significant international pressure to further liberalize its currency policy which could result in a further and more significant appreciation in the value of the Renminbi against the US Dollar.

A small portion of our cash and its equivalents is denominated in foreign currencies (including the U.S. Dollar). The appreciation in the value of Renminbi against foreign currencies (including the U.S. Dollar) may cause a decrease in the value of our cash and its equivalents that are denominated in foreign currencies. In addition, the appreciation of Renminbi may harm the exports of our downstream manufacturers, thus adversely affecting the market demand for our products. Most our revenue is denominated in Renminbi, however, most of our purchase of crude oil and some equipment and certain loan repayments are made in foreign currencies. As such, any depreciation of the Renminbi would increase our cost and adversely affect our capacity of making profits. In addition, any depreciation of the Renminbi could adversely affect the value of the dividends of our H shares and ADSs, which we pay in foreign currencies.

The rejection of the proposed share reforms required of companies listed on the Shanghai Stock Exchange may adversely affect our market image and our ability to effectuate future transactions such as public offerings on the Shanghai Stock Exchange.

7

Table of Contents

Pursuant to regulations issued by the China Securities Regulatory Commission (the “CSRC”), we were required to gain shareholder approval for and implement certain share reforms in 2006. Under the share reform plans proposed by holders of our non-circulating A Shares in 2006 and 2007, respectively, all non-circulating A Shares would be converted into circulating A Shares and may be sold publicly on the Shanghai Stock Exchange subject to any applicable lock-up period under the condition that holders of our non-circulating A Shares transfer a portion of their A Shares to holders of our circulating A Shares. However, holders of our circulating A Shares rejected both share reform plans for various reasons. No specific new proposals have yet been presented to implement the required share reforms. We are uncertain as to when such share reforms will be completed. On January 8, 2007, the Shanghai Stock Exchange began to impose stricter regulations on its listed companies that are required but unable to complete the share reforms, including imposing a cap and a basket on the price fluctuation rate set at 5% daily, stricter trading information disclosure requirements and more restrictions on future financing abilities. Since March 26, 2007, the Shanghai Stock Exchange has required us to make public announcements periodically regarding the status of our share reforms. In addition, the CSRC is expected to more strictly scrutinize any securities-related applications by publicly listed PRC companies that are required to but have failed to complete such share reforms, their major shareholders and ultimate beneficial owners. The failure to complete the proposed share reforms may adversely affect our market image and our ability to effectuate future transactions such as public offerings on the Shanghai Stock Exchange. The possibility that the CSRC and the Shanghai Stock Exchange will impose more restrictions cannot be eliminated.

Interpretation and enforcement of Chinese laws and regulations is uncertain.

The Chinese legal system is based on statutory law. Under this system, prior court decisions may be cited as persuasive authority, but do not have the binding effect of precedents. Since 1979, the Chinese government has been developing a comprehensive system of commercial laws and considerable progress has been made in the promulgation of laws and regulations dealing with economic matters, such as corporate organization and governance, foreign investment, commerce, taxation and trade. Because these laws, regulations and legal requirements are relatively new and not all accessible to the public and because prior court decisions have little precedential value, the interpretation and enforcement of these laws, regulations and legal requirements involve greater uncertainty than in other jurisdictions.

You may not enjoy shareholders’ protections that you would be entitled to in other jurisdictions.

As most of our business is conducted in China, our operations are governed principally by the laws of China. Despite the ceaseless improvement of the PRC Company Law and Securities Law, Chinese legal provisions for the protection of shareholders’ rights and access to information are different from those applicable to companies formed in the United States, Hong Kong, the United Kingdom and other developed countries or regions. You may not enjoy shareholders’ protections under Chinese law that you would be entitled to in other jurisdictions.

Our Articles of Association require you to submit your disputes with us and other persons to arbitration. You will have no legal right to a court proceeding.

Our Articles of Association require holders of our H shares or ADSs having a claim against, or a dispute with, us, our directors, supervisors, executive officers or a holder of our domestic shares relating to any rights or obligations conferred or imposed by our Articles of Association, the Chinese Company Law or any other Chinese laws or regulations relating to our affairs, to submit such claim or dispute to arbitration with the China International Economic and Trade Arbitration Commission or to the Hong Kong International Arbitration Center. Our Articles of Association further provide that any arbitration decisions with respect to such disputes or claims shall be final and binding on all parties.

We may be or become a passive foreign investment company, which could result in adverse U.S. federal income tax consequences to U.S. investors.

We may be classified as a passive foreign investment company (“PFIC”) by the U.S. Internal Revenue Service for U.S. federal income tax purposes. Such characterization could result in adverse U.S. federal income tax consequences to you if you are a U.S. investor. For example, U.S. investors who owned our ADSs during any taxable year in which we were a PFIC generally are subject to increased U.S. tax liabilities and reporting requirements for that taxable year and all succeeding years, regardless of whether we actually continue to be a PFIC, although a shareholder election to terminate such deemed PFIC status may be available in certain circumstances. We do not intend to provide information to permit you to make a qualified electing fund election to avoid the adverse U.S. tax consequences described above. The same adverse U.S. federal income tax consequences will apply to U.S. investors who acquire our ADSs during the current taxable year or any subsequent taxable year if we are treated as a PFIC for that taxable year.

8

Table of Contents

The determination of whether or not we are a PFIC is made on an annual basis and depends on the composition of our income and assets, from time to time. Specifically, we will be classified as a PFIC for U.S. tax purposes for a taxable year if either (a) 75% or more of our gross income for such taxable year is passive income, or (b) 50% or more of the average percentage of our assets during such taxable year either produce passive income or are held for the production of passive income. For such purposes, if we directly or indirectly own 25% or more of the shares of another corporation, we generally will be treated as if we (a) held directly a proportionate share of the other corporation’s assets, and (b) received directly a proportionate share of the other corporation’s income.

We do not believe that we are currently a PFIC. However, because the PFIC determination is highly fact intensive and made at the end of each taxable year, there can be no assurance that we will not be a PFIC for the current or any future taxable year or that the IRS will not challenge our determination concerning our PFIC status. For further discussion of the adverse U.S. federal income tax consequences of our possible classification as a PFIC, see “Taxation” below.

Negative publicity regarding, and divestments by investors in response to, our affiliation with Sinopec Corp. and Sinopec Group, and their respective business activities in certain countries identified by the U.S. government as state sponsors of terror, may adversely impact our stock price.

We are affiliated with Sinopec Corp. and Sinopec Group, both of which have been identified in the news media as engaging in operations in or purchasing substantial volumes of crude oil sourced from countries identified by the U.S. government as state sponsors of terrorism such as Iran, Syria, Cuba and Sudan. We do not conduct any material operations in, nor do we purchase any material volume of crude oil from these countries. Further, we have no control over the activities of Sinopec Group or Sinopec Corp. in connection with any activities they may have related to Iran, Syria, Sudan or Cuba. Nevertheless, certain articles in the press have identified institutional investors, many of whom have substantial investment portfolios and purchasing power, that may have divested, or intend to divest or otherwise not invest in, our stock because of the alleged operations of our affiliates in such countries. Decisions by such large investors may have the effect of reducing demand for our stock in the market, perhaps significantly, which could cause substantial downward pressure on our stock price. Any such downward pressure likely would result in a reduction of our market capitalization and could impact not only the value of our existing stockholders’ investment in our company, but also potentially our ability to raise equity or debt financing in the future.

| ITEM 4. | INFORMATION ON THE COMPANY. |

A. History and Development of the Company

General Information

We were established in the People’s Republic of China as a joint stock limited company under the Chinese Company Law on June 29, 1993 as Shanghai Petrochemical Company Limited. On October 12, 2000, we changed our name to Sinopec Shanghai Petrochemical Company Limited. Our registered office is at No. 48 Jinyi Road, Jinshan District, Shanghai, China 200540. Our telephone number there is (86-21) 5794-1941.

Our Predecessor

Our predecessor, Shanghai Petrochemical Complex (the “Complex”), was founded in 1972 as one of the first large scale Chinese petrochemical enterprises using advanced imported technology and equipment. Prior to June 29, 1993, the Complex was wholly-owned by China Petrochemical Corporation, at the time a ministerial level enterprise (before its restructuring in 1998, “Sinopec”). The Complex’s location was chosen because of accessibility by water and land transportation to Shanghai, a major industrial city of China, and the availability of reclaimable land. The Complex was initially under the administration of the Ministry of Textile Industry and in 1983 was placed under the administration of Sinopec.

The Complex and we, as its successor, have undergone five major stages of construction. The first stage of construction (1972 -1976) included reclamation of land and the installation of 18 production units. The second stage of construction (1980-1986) increased the Complex’s capacity for processing crude oil and doubled its capacity for synthetic fiber production. The third stage of construction (1987- 1992) primarily consisted of the installation of a 300,000 ton Rated Capacity ethylene unit, an additional crude oil refining unit and other units for the production of petrochemical products. The third stage of construction completed our transition from a synthetic fiber producer to a highly integrated producer of a wide variety of petrochemical products. The fourth stage of construction (2000-2002) mainly included the 700,000 ton Ethylene Expansion Project and Coal-Fired Power Plant Expansion Project. The fifth stage of construction (2003-2009) was mainly designed to optimize our structure and realize sustainable development, and mainly included 3,300,000t/a diesel hydrogenation unit, 1,200,000t/a delayed coking unit and other projects implemented for removing “bottlenecks” in refinery, the building of new 600,000t/a PX hydrocarbon complex unit, 150,000t/a C5 segregation unit, 380,000t/a ethane unit, etc. By implementing the fifth stage of construction, we have further optimized our structure of resources and products, maintained our comprehensive edges based on our integrated refinery and petrochemical production and enhanced our strengths in scale, cost, technology content, product quality and other aspects. See Item 4. Information on the Company – Property, Plant and Equipment – Capital Expansion Program for a description of the fifth stage of construction.

9

Table of Contents

Over the past thirty-seven years, the Company built up an infrastructure system to support its production needs. The Company has its own facilities to supply water, electricity, steam and other utilities and to treat waste water, as well as ocean and inland waterway wharfs and railroad and road transportation facilities.

Our Initial Public Offering and Listing

We were established as a subsidiary of Sinopec on June 29, 1993. In preparation for our initial public offering of ordinary shares, all assets and liabilities of the Complex were transferred either to us or to Sinopec Shanghai Jinshan Industrial Company (“JI”), a separate subsidiary of Sinopec. The Complex’s non-core businesses and assets, such as housing, stores, schools, transportation and medical services were transferred to JI. The Complex’s core business and assets was transferred to us. The Complex then ceased to exist as a legal entity. In 1998, Sinopec was restructured into a limited liability company under the name of China Petrochemical Corporation (“Sinopec Group”). On February 25, 2000, Sinopec Group transferred its interest in us to its subsidiary, Sinopec Corp. In 1997, JI was restructured and its subsidiaries were either transferred to Sinopec or Shanghai Jinshan District. Sinopec Group now provides community services to us that were formerly provided by JI.

Our H Shares were listed on the HKSE on July 26, 1993. Our ADSs, each representing 100 H Shares, are listed on the New York Stock Exchange (“NYSE”). Our A Shares are listed on the Shanghai Securities Exchange. We were the first Chinese joint stock limited company to have securities concurrently traded in Hong Kong, the United States and China. On November 8, 1993, our A Shares were included in the Shanghai Securities Exchange Stock Index.

Description of Principal Capital Expenditures and Divestitures

In the fourth quarter of 2001, we established a Sino-foreign equity joint venture, Shanghai Secco Petrochemical Company Limited (“Secco”), together with BP Chemicals East China Investments Limited (“BP”) and Sinopec Corp. We own 20%, while BP and Sinopec Corp own 50% and 30% of the equity interest of Secco, respectively. Secco was established to build and operate a 900,000 ton Rated Capacity ethylene petrochemical manufacturing facility in order to manufacture and market ethylene, polyethylene, styrene, polystyrene, propylene, acrylonitrile, polypropylene, butadiene, aromatics and by-products; provide related after-sales services and technical advice with respect to such petrochemical products and by products; and engage in polymers application development. Secco completed construction in 2005. Secco’s registered capital is US$901,440,964 of which we were obligated to contribute an amount in Renminbi equivalent to US$180,287,952 prior to the end of 2005. As of December 31, 2005, we had contributed such amount in full. For a description of capital expansion projects related to our facilities, see Item 4. Information on the Company – Property, Plant and Equipment – Capital Expansion Program.

B. Business Overview

We are one of the largest petrochemical companies in China based on 2010 net sales and ethylene production. Our highly integrated petrochemical complex processes crude oil into a broad range of products in four major product areas:

| • | synthetic fibers, |

| • | resins and plastics, |

| • | intermediate petrochemicals, and |

| • | petroleum products. |

Based on 2010 sales volumes, we are a leading Chinese producer of synthetic fibers and resins and plastic products. We believe that we are also a leading competitor in sales of petroleum products and intermediate petrochemicals in our regional markets.

10

Table of Contents

Our net sales by product category, as a percentage of total net sales in each of 2010, 2009 and 2008 are summarized as follows:

Net Sales of RMB72,095.9 million in 2010

| Synthetic fibers |

5.42 | % | ||

| Resins and plastics |

20.67 | % | ||

| Intermediate petrochemicals |

23.87 | % | ||

| Petroleum products |

39.86 | % | ||

| All others |

10.18 | % | ||

| Total |

100.00 | % |

Net Sales of RMB47,345.3 million in 2009

| Synthetic fibers |

5.96 | % | ||

| Resins and plastics |

25.90 | % | ||

| Intermediate petrochemicals |

17.79 | % | ||

| Petroleum products |

39.96 | % | ||

| All others |

10.39 | % | ||

| Total |

100.00 | % |

Net Sales of RMB59,330 million in 2008

| Synthetic fibers |

6.17 | % | ||

| Resins and plastics |

25.03 | % | ||

| Intermediate petrochemicals |

17.31 | % | ||

| Petroleum products |

46.44 | % | ||

| All others |

5.05 | % | ||

| Total |

100.00 | % |

We derive a substantial portion of our revenues from customers in Eastern China (principally Shanghai and its six neighboring provinces), an area that has experienced economic growth above the national average in recent years. We believe that we are well- positioned to take advantage of opportunities which may arise through the growth of economy of China generally and in this area in particular. Shown by geographic region and exports, our net sales by product category as a percentage of total net sales for each of 2010, 2009 and 2008 are as follows:

| 2010 Net Sales by Region (%) | ||||||||||||

| Eastern China | Other parts of China | Exports | ||||||||||

| Synthetic fibers |

85.05 | 14.08 | 0.87 | |||||||||

| Resins and plastics |

87.20 | 12.80 | 0 | |||||||||

| Intermediate petrochemicals |

83.07 | 14.08 | 2.85 | |||||||||

| Petroleum products |

99.55 | 0.45 | 0 | |||||||||

| Total net sales |

92.32 | 7.01 | 0.67 | |||||||||

| 2009 Net Sales by Region (%) | ||||||||||||

| Eastern China | Other parts of China | Exports | ||||||||||

| Synthetic fibers |

83.00 | 16.04 | 0.96 | |||||||||

| Resins and plastics |

86.66 | 13.34 | 0 | |||||||||

| Intermediate petrochemicals |

83.78 | 14.49 | 1.73 | |||||||||

| Petroleum products |

99.84 | 0.16 | 0 | |||||||||

| Total net sales |

92.74 | 6.92 | 0.34 | |||||||||

| 2008 Net Sales by Region (%) | ||||||||||||

| Eastern China | Other parts of China | Exports | ||||||||||

| Synthetic fibers |

80.84 | 17.12 | 2.04 | |||||||||

| Resins and plastics |

86.06 | 13.94 | 0 | |||||||||

| Intermediate petrochemicals |

84.88 | 13.79 | 1.33 | |||||||||

| Petroleum products |

99.55 | 0.45 | 0 | |||||||||

| Total net sales |

92.32 | 7.30 | 0.38 | |||||||||

11

Table of Contents

Business Strategy

2011 marks the commencement of the “Twelfth Five-year Plan”. We will actively capitalize on a relatively favorable market environment and other opportunities; focus on safety, environmental protection, energy conservation and emissions reduction; promote a green and healthy environment; continue to maintain safe and stable production and operations; improve sophisticated management standards on an ongoing basis; steadily push forward various internal reform programs; fully proceed with the construction of the Phase 6 Project; further strengthen staff team building; continue to maintain the harmony and stability of the enterprise; and endeavor to achieve stable growth in profitability.

To achieve our business objectives in 2011, we will conscientiously carry out the tasks in the following areas:

(a) Consistently devoting efforts to HSE (health, safety and environment), energy conservation and emissions reduction work.

We will devote efforts to production safety, environmental protection, occupational health, energy conservation and emissions reduction as we have done in the past. We will put safety and environmental protection work as our priority by fully implementing the all-staff HSE accountability system to strictly prevent safety and environment-related accidents and control the discharge of pollutants; continue to step up troubleshooting, prevention and control by increasing efforts to strengthen safety and environmental monitoring in key areas, key plants and vital parts; and improve the archives of occupational health of employees and implement prevention and control measures for occupational hazards. In accordance with the control objectives for energy conservation and emissions reduction set in the “Twelfth Five-year Plan”, we will further proceed with various tasks and fully enforce the responsibilities and measures for energy conservation and emissions reduction.

(b) Continuously optimizing production and operations for profitability.

We will continue to leverage our overall strength in the oil refining-petrochemical integrated industry chain, endeavor to maintain high-load and stable operation of our oil refining and petrochemical plants, and further increase the total physical production volume of our products. We will continue to improve the management and optimization of production and operations, establishing and strengthening the PIMS system to improve the overall efficiency of production and operations. We will further push forward the optimization and adjustment of raw and auxiliary materials, product mix, fuel, power and other aspects, further enhancing the standards for major technical and economic indicators. We will endeavor to reduce the procurement costs of crude oil, bulk raw materials of petrochemicals and fuels, as well as the operating costs of plants and various production and operation expenses; make efforts on product sales and after-sales service; and increase market shares, with a view to improving profitability.

(c) Pushing forward in full scale the construction of the Phase 6 Project and the progress on corporate technology.

In accordance with our requirements for “sound and fast development”, we will push forward the construction of the Phase 6 Project which comprises the refinery renovation project as the principal component. We will strengthen the all-process management of the project construction and put emphasis on controls over safety, progress, quality and costs, endeavoring to build the Phase 6 Project as a “safe, quality, profitable and sunshine project”. We will continue to focus on “bottle necks” in production operations and “short board” in market competition; accomplish practical technology development, new technology applications as well as research and development of high value-added products; and seek to explore a new direction and a new way for industry and product mix adjustments. We will continue to further the application of the computerization project and strive to rank at the top in Sinopec Corp’s evaluation on corporate information system development and application standards.

(d) Pushing forward sophisticated management on an ongoing basis

With reference to international and domestic advanced levels of management, we will deepen our work that to improve corporate sophisticated management standards on an ongoing basis. We will formulate plans for implementing recommendations to improve our operations, and integrate such recommendations into every segment of production, operations and management. We will establish a system governing cost objective indicators, and a plan to push forward the management of cost objectives for all staff on an ongoing basis. We will further improve budget management; and strengthen the formulation, control, analysis and evaluation of budget. It will lay down standardized operations that regulate internal control processes and push forward a full-scale implementation of the internal control system for all staff and in all processes within the Company.

(e) Further enhancing management systems and mechanisms

We will modify and improve the management system and mechanism to further enhance organizational performance. We will integrate various elements and resources of management; regulate our organizational structure, job responsibilities, staffing and operation flow; and build a three-tier management model at the “company-management-workshop” levels. We will commence the establishment of an integrated management system in full scale; systematically streamline and comprehensively modify the existing system; and complete the standardization reform for the system within the year. We will improve on our all-staff performance appraisal system to further strengthen the appraisal of organizational performance. We will reinforce the management of foreign investment businesses to enable them to become leading, specialized and superior enterprises that support the principal operations. We will continue to accomplish good tracking management of reformed enterprises to facilitate the continuous improvement of their capabilities and standards for self-management, self-operation and self-development.

12

Table of Contents

(f) Proactively maintaining a cohesive, harmonious and stable corporate atmosphere.

We will conscientiously implement our development outline for building a corporate culture. We will vigorously carry out practical education activities for corporate culture, and proactively nurture an institutional culture and behavioral style being consistent with corporate values and philosophy, thereby creating a positive, harmonious, stable, striving and dedicated atmosphere. We will continue to reinforce the building of the operation management team, the professional technical team and the skills operation team; further improve and optimize the restructuring of human resources; streamline the path for the development of technical and skilled staff; improve the remuneration and benefits systems for staff; and improve the working environment and living conditions for staff, with a view to fully mobilizing the enthusiasm and creativity of different staff members and continuously enhancing the cohesiveness and sense of belonging among staff so as to ensure the safety, stability and harmony of the enterprise.

13

Table of Contents

Principal Products

We produce four principal types of products with different specifications, including synthetic fibers, resins and plastics, intermediate petrochemicals and petroleum products. We use many of the important petroleum products and intermediate petrochemicals we produce in producing our own downstream products. The following table shows our 2010 net sales by major products as a percentage of total net sales together with the typical uses of these products.

| Product | % of net sales | Typical Use | ||||||

| SYNTHETIC FIBERS | ||||||||

| Polyester staple fiber | 0.93 | Textiles and apparel | ||||||

| Acrylic staple fiber | 4.21 | Woven into fabrics or blended with other material fabrics to make fabric or acrylic top | ||||||

| Others | 0.28 | |||||||

| Sub-total |

5.42 | |||||||

| RESINS AND PLASTICS | ||||||||

| Polyester chips | 5.85 | Polyester fibers, films and containers | ||||||

| PE pellets | 7.88 | Films, ground sheeting, wire and cable compound and other injection molding products such as housewares and toys | ||||||

| PP pellets | 5.95 | Extruded films or sheets, injection molded products such as housewares, toys and household electric appliance and automobile parts | ||||||

| PVA | 0.59 | PVA fibers, building coating materials and textile starch | ||||||

| Others | 0.40 | |||||||

| Sub-total |

20.67 | |||||||

| INTERMEDIATE PETROCHEMICALS | ||||||||

| Ethylene | 2.42 | Feedstock for Polyethylene, EG, PVC and other intermediate petrochemicals which can be further processed into resins and plastics and synthetic fiber. | ||||||

| Ethylene oxide | 2.02 | Intermediate for chemical and pharmaceutical industry, dyes, detergents and auxiliary agents | ||||||

| Benzene | 3.55 | Intermediate petrochemical products, styrene, plastics, explosives, dyes, detergents, epoxies and nylon | ||||||

| Paraxylene | 5.64 | |||||||

| Butadiene | 2.45 | Synthetic rubber and plastics | ||||||

| Ethylene glycol | 1.83 | Fine chemicals | ||||||

| Others | 5.96 | |||||||

| Sub-total |

23.87 | |||||||

| PETROLEUM PRODUCTS | ||||||||

| Gasoline | 7.06 | Transportation fuels | ||||||

| Diesel | 22.43 | Transportation fuels and agricultural fuels | ||||||

| Jet Fuel | 3.87 | Transportation fuels | ||||||

| Others | 6.50 | |||||||

| Sub-total |

39.86 | |||||||

| ALL OTHERS | 10.18 | |||||||

| Total |

100.00 | |||||||

Production Processes

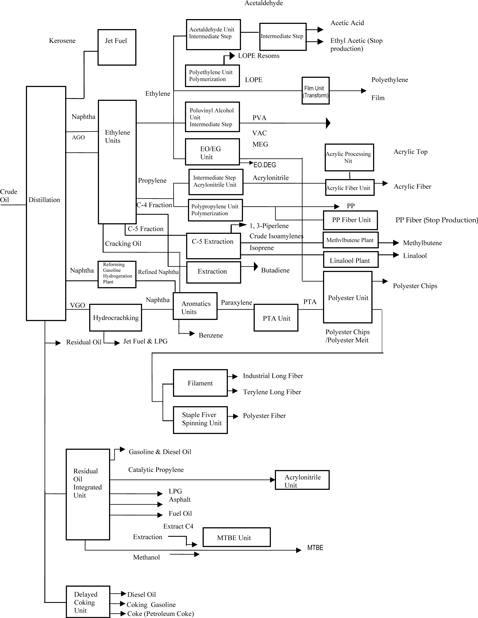

The key sectors in our vertically integrated production plants are the ethylene units which produce ethylene and propylene, and our aromatics plants which principally produce paraxylene (“PX”) and benzene. Ethylene is the major raw material in the production of polyethylene (“PE”) and monoethylene glycol (“MEG”) which, together with pure terephthalic acid (“PTA”), is used to manufacture polyester. Propylene is the major raw material in the production of acrylonitrile and polypropylene (“PP”). These products are produced through the processing of a series of petrochemical units from crude oil. Our production processes are shown in the flow chart below.

14

Table of Contents

15

Table of Contents

Our refinery units refine crude oil into five basic components: (1) naphtha, (2) kerosene, (3) atmospheric gas oil (“AGO”), (4) VGO, and (5) residual oil. Part of the Naphtha and part of the AGO is fed to the ethylene units primarily to produce ethylene and propylene. Part of the Naphtha is fed to the reforming prehydrogenation units to produce refined Naphtha which shall be used for the production of Aromatics. The other part of the AGO is processed into diesel oil, and kerosene is fed to the jet fuel sweetening unit to produce jet fuel. Part of the VGO is further processed in a hydrocracking unit producing mainly light and heavy naphtha, liquefied petroleum gas (“LPG”), diesel oil, various aromatic hydrocarbon products and jet fuel. The other part of the VGO and residual oil can be further processed into gasoline, diesel oil, LPG, propylene and other products.

Intermediate Petrochemicals

Ethylene – Ethylene is either directly processed into PE resins or processed into other intermediate petrochemicals. The most important of these is MEG. MEG is a key ingredient in polyester. It is produced by oxidizing ethylene in the ethylene oxide (“EO”)/ethylene glycol (“EG”) unit. Ethylene is also used to produce vinyl acetate which is processed into PVA.

Propylene – Propylene is either processed directly into PP resins or is further processed into other intermediate petrochemicals such as acrylonitrile, acetonitrile, hydroxyl acetonitrile and sodium cyanide. Acrylonitrile is used in producing acrylics.

Vacuum gas oil – VGO is passed through the hydrocracker, and the resulting heavy naphtha is fed into the aromatics plants to produce PX and benzene. PX is processed into PTA, one of the principal raw materials in producing polyester.

Resins and Plastics and Synthetic Fibers

We process our intermediate petrochemical products into five kinds of synthetic fiber raw materials: (1) polyester, (2) acrylonitrile, (3) PP, (4) PE and (5) PVA. Each of these five products has its own production line or lines. We further process polyester and acrylonitrile into various types of synthetic fibers.

Polyester – MEG and PTA are fed into a polymerization unit which produces polyester chips and polyester melt. Both chips and melt are used as raw materials in the production of polyester staple and filaments. Some chips are also sold to third parties.

Polyester staple fiber is a multi-strand fiber cut into short lengths which can be spun into fabric on its own or blended with cotton, wool or flax to produce textiles. Polyester filaments are a class of more highly processed polyester materials which have been drawn and oriented to produce a long thread-like fiber.

Acrylonitrile – We produce polyacrylonitrile by feeding acrylonitrile into a polymerization unit. By passing the polyacrylonitrile through the fiber unit, acrylic fiber and acrylic staple fiber are produced, including cotton and wool type staple fibers. Wool acrylic staple fiber can be processed into acrylic wool strips.

Polypropylene – We produce PP resins by feeding propylene into a polymerization unit. Our fiber grade PP resin is the main ingredient for PP fiber production.

Polyethylene – We have three sets of units producing PE, two of which produce LDPE using the kettle type process, and the other unit produces all density PE products using the Borstar bimodal process.

Polyvinyl acetate – PVA granules are produced from vinyl acetate (“VAC”), derived from ethylene.

Raw Materials

Crude Oil

Crude oil is our primary raw material and the most significant raw material we purchase from outside sources. In 2010, crude oil accounted for approximately 58.11 % of our total cost of sales. Accordingly, the supply and price of crude oil are key factors in determining our profitability.

Allocation and Transportation – All crude oil required by us, whether from domestic or foreign sources, is purchased through the channels of Sinopec Corp. as an agent. During 2010, we did not experience any significant problems in obtaining sufficient crude oil to meet our production needs.

Sinopec Group is responsible for preparing an annual plan on demand and supply for crude oil and petroleum products that forms the basis of the Chinese government’s annual “balancing plan” which effectively dictates our planned volume of crude oil processing in each year. Likewise, under the “balancing plan”, some of our petroleum products are designated for sale to the subsidiaries of Sinopec Group or other designated customers at market prices and we must consult Sinopec Group to sell elsewhere.

16

Table of Contents

We have received confirmation from Sinopec Corp that we will receive an allocation of 0.8 million tons of domestic offshore crude oil and 10.4 million tons of foreign crude oil in 2011. Sinopec Corp has further confirmed that, subject to China’s national crude oil policy and our actual production needs, it will continue to allocate sufficient quantities and appropriate kinds of crude oil to us, including domestic offshore and foreign crude oil, to satisfy our anticipated annual needs. We anticipate fully utilizing our 2011 allocation of crude oil. We believe that the mix of crude oil feedstocks currently available is satisfactory for our 2011 production capacity and targets. Additionally, as part of China’s commitment at its accession into WTO, certain non-state-owned enterprises have been granted an increasing quota to import crude oil. Although we do not expect to obtain crude oil through this channel in the foreseeable future due to the current crude oil allocation system, this may provide us with an alternative source of crude oil supply.

Crude Oil Mix – Our refining equipment is designed to process certain grades of crude oil. Therefore, the origin and quality of the crude oil available can be important to our business. We believe, as we are significantly increasing usage of foreign crude oil, we will continue to be able to obtain from the market such foreign crude oil that is compatible with our refining equipment. The overall mix of foreign versus domestic crude oil we process in 2011 will depend on a variety of factors, including the amount of future allocations of domestic offshore crude oil and the availability, price, quality, processing profitability and compatibility with our refining capabilities of foreign crude oil. Provided there are no significant modifications to the existing channels of crude oil acquisition, we believe that sufficient supplies of crude oil will be available on the domestic or international markets for our 2011 production capacity and goals.

In 2010, our crude oil was sourced as follows:

| Domestic offshore crude oil | 9.87 | % | ||

| Foreign crude oil | 90.13 | % | ||

| Total: |

100.00 | % |

In 2010, a minimal amount of our foreign crude oil was sourced from Iran, which is a country identified by the U.S. State Department as a state sponsor of terrorism and subject to U.S. economic sanctions and export controls. Details of the purchase volume and purchase expenses are provided below:

| Volume (thousand tons) |

% of total | Amount (RMB billion) |

% of total | |||||||||||||

| Iran |

139.2 | 1.5 | 0.480 | 1.4 | ||||||||||||

| Others |

8,843.0 | 98.5 | 34.580 | 98.6 | ||||||||||||

| Total |

8,982.2 | 100.0 | 35.060 | 100.0 | ||||||||||||

As a result of a consistent decrease in the supply of domestic crude oil, we expect that we will continue to rely principally on foreign sources for our crude oil supply. However, we believe that we will be able to maintain our processing efficiency through technological adjustments of our equipment and quality control and that increased use of imported oil will not materially adversely impact our business and results of operations.

Foreign and domestic offshore crude oil is supplied by tanker and pipeline to our oil terminal wharf and oil storage tank. See Item 4.D. Property, Plants and Equipment -Wharfs.

In the past, we have not experienced disruption in our crude oil supply. We have on-site crude oil storage tanks at Chenshan wharf capable of storing approximately 300,000 cubic meters of crude oil, primarily to provide crude oil to our No. 2 atmosphere vacuum distillation facility. This crude oil storage can provide us with approximately a 2-week supply of crude oil. The crude oil for our No. 3 atmosphere vacuum distillation facility is mainly supplied from the Ningbo-Shanghai-Nanjing oil pipeline. Due to our ability to obtain crude oil from multiple sources, we are able to meet our normal requirements for crude oil.

Pricing – The price of domestic offshore crude oil is controlled by China National Offshore Oil Corporation (“CNOOC”) and Sinopec Group based on government pricing policies and by reference to the price of the crude oil of the same quality in the international market, while imported crude oil is generally sold to us at prevailing international market prices. The average cost of foreign and domestic offshore crude oil in 2010 was RMB3,921 (US$594) per ton and RMB3,966 (US$601) per ton, respectively. In 2010, we processed 9.56 million tons of foreign crude oil and 960 thousand tons of domestic offshore crude oil.

17

Table of Contents

Until March 2001 the Chinese government implemented a unified pricing system for crude oil. Each month, the National Development and Reform Commission (“NDRC”) would establish an indicative price for each grade of domestic onshore crude oil based on comparable international market prices, inclusive of any duties that would have been imposed had the oil been imported. The actual price for domestic onshore oil would be such indicative price plus a surcharge. This surcharge was determined by CNPC and Sinopec Group to reflect any transportation and other miscellaneous costs that would have been incurred in having the oil delivered to various refineries. Beginning March 2001, the NDRC ceased publishing an indicative price. Instead, the indicative price for domestic onshore oil is calculated and determined directly by CNPC and Sinopec Group based on the principles and methods formerly applied by the NDRC.

Sinopec Corp will allocate crude oil to us in sources selected and quantities confirmed by the Company at market prices. On this basis, we believe that changes in crude oil prices should not have a material effect on our competitiveness with other domestic producers. Nevertheless, any increase in the price of crude oil could have an adverse impact on our profitability to the extent that we are unable to pass cost increases on to our customers.

Coal

Most of the coal used for electricity generation is purchased through a unified system of procurement by Sinopec Corp, and the rest is purchased directly by us from mines. Coal is transported by rail from the mines to Qinhuangdao port and shipped by barge to Jinshanwei where it is delivered to the plant via a wharf and conveyer system. Our cost of coal is primarily dependent on coal price and transportation charges. Although coal may be purchased from alternative sources, railroad transportation must be obtained by allocation from the Chinese government on a monthly basis.