UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07852

USAA Mutual Funds Trust

(Exact name of registrant as specified in charter)

| 15935 La Cantera Pkwy, San Antonio, Texas | 78256 | |

| (Address of principal executive offices) | (Zip code) |

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, Ohio 43219

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-235-8396

Date of fiscal year end: March 31

Date of reporting period: March 31, 2022

Item 1. Reports to Stockholders.

March 31, 2022

Annual Report

USAA Global Equity Income Fund

Victory Capital means Victory Capital Management Inc., the investment adviser of the USAA Mutual Funds. USAA Mutual Funds are distributed by Victory Capital Services, Inc., member FINRA, an affiliate of Victory Capital. Victory Capital and its affiliates are not affiliated with United Services Automobile Association or its affiliates. USAA and the USAA logos are registered trademarks and the USAA Mutual Funds and USAA Investments logos are trademarks of United Services Automobile Association and are being used by Victory Capital and its affiliates under license.

www.vcm.com

News, Information And Education 24 Hours A Day, 7 Days A Week

The Victory Capital website gives fund shareholders, prospective shareholders, and investment professionals a convenient way to access fund information, get guidance, and track fund performance anywhere they can access the Internet. The site includes:

• Detailed performance records

• Daily share prices

• The latest fund news

• Investment resources to help you become a better investor

• A section dedicated to investment professionals

Whether you're a potential investor searching for the fund that matches your investment philosophy, a seasoned investor interested in planning tools, or an investment professional, www.vcm.com has what you seek. Visit us anytime. We're always open.

USAA Mutual Funds Trust

TABLE OF CONTENTS

|

Shareholder Letter (Unaudited) |

2 |

||||||

|

Manager's Commentary (Unaudited) |

4 |

||||||

|

Investment Overview (Unaudited) |

6 |

||||||

|

Investment Objective & Portfolio Holdings (Unaudited) |

7 |

||||||

|

Schedule of Portfolio Investments |

8 |

||||||

|

Financial Statements |

|||||||

|

Statement of Assets and Liabilities |

16 | ||||||

|

Statement of Operations |

17 | ||||||

|

Statements of Changes in Net Assets |

18 | ||||||

|

Financial Highlights |

20 | ||||||

|

Notes to Financial Statements |

22 |

||||||

|

Report of Independent Registered Public Accounting Firm |

32 |

||||||

|

Supplemental Information (Unaudited) |

33 |

||||||

|

Trustee and Officer Information |

33 | ||||||

|

Proxy Voting and Portfolio Holdings Information |

38 | ||||||

|

Expense Examples |

38 | ||||||

|

Additional Federal Income Tax Information |

39 | ||||||

|

Advisory Contract Renewal |

40 | ||||||

|

Liquidity Risk Management Program |

43 | ||||||

|

Privacy Policy (inside back cover) |

|||||||

This report is for the information of the shareholders and others who have received a copy of the currently effective prospectus of the Fund, managed by Victory Capital Management Inc. It may be used as sales literature only when preceded or accompanied by a current prospectus, which provides further details about the Fund.

IRA DISTRIBUTION WITHHOLDING DISCLOSURE

We generally must withhold federal income tax at a rate of 10% of the taxable portion of your distribution and, if you live in a state that requires state income tax withholding, at your state's tax rate. However, you may elect not to have withholding apply or to have income tax withheld at a higher rate. Any withholding election that you make will apply to any subsequent distribution unless and until you change or revoke the election. If you wish to make a withholding election, or change or revoke a prior withholding election, call (800) 235-8396, and form W-4P (OMB No. 1545-0074 withholding certificate for pension or annuity payments) will be electronically sent.

If you do not have a withholding election in place by the date of a distribution, federal income tax will be withheld from the taxable portion of your distribution at a rate of 10%. If you must pay estimated taxes, you may be subject to estimated tax penalties if your estimated tax payments are not sufficient and sufficient tax is not withheld from your distribution.

For more specific information, please consult your tax adviser.

• NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

1

(Unaudited)

Dear Shareholder,

Just as the calendar year ended, investors were quickly reminded that financial markets go up and down. A host of worries have recently conspired to disturb the markets. Inflation data has been running hotter than expected; the U.S. Federal Reserve (the "Fed") has embarked on a new rate-hike cycle. And, of course, we're all watching a terrible war unfold in Eastern Europe. All these issues have ratcheted up uncertainties and market volatility in both stock and bond markets.

Given these concerns, it's no surprise that sentiment has turned negative and investors have become more focused on risk management and downside protection. We believe it's important to look back at financial markets through a wider lens. Despite the recent turmoil and the headwinds of the past year — including new COVID-19 variants, disruptions among global supply chains, and rising interest rates — the S&P 500® Index, the bell-weather proxy for our domestic stock market, once again delivered positive annual total returns during the annual reporting period.

Still, underlying this positive performance were interesting differences among investment styles and market capitalizations. In general, large-cap stocks outperformed smaller capitalization companies for the full annual reporting period. Meanwhile, growth-oriented styles led value-oriented investments during the first half of our annual reporting period, while the reverse was true during the back half of the year (as measured by the Russell family of indices). Perhaps this reflects investors' expectations for future higher interest rates and corresponding higher borrowing costs?

There were other notable subplots, too. During much of 2021 we watched crypto assets captivate investors, only to see them cycle up and down several times as we all sought to grasp the potential of their emerging blockchain technologies. Also intriguing was how the biotech sector struggled mightily for much of the past year despite the success and fanfare surrounding the COVID-19 vaccines. Meanwhile, rising oil prices fueled impressive gains across the energy landscape, and other commodities (including gold) helped fuel returns in some investors' diversified portfolios. These were just a few of the themes of the past year.

Despite the recent pullback, the S&P 500 Index still registered an impressive annual total return of nearly 16% for the 12-month period ended March 31, 2022. Over this same annual period, the yield on the 10-Year U.S. Treasury jumped 58 basis points (a basis point is 1/100th of a percentage point), thanks to the Fed's stated intentions to shift to a less accommodative monetary policy. This was evidenced in March 2022 when the Fed raised the target federal funds rate by 25 basis points, the first rate hike in three years. At the end of our reporting period, the yield on the 10-Year U.S. Treasury was trending higher and finished at 2.32%.

Although we were encouraged by another resilient year for financial markets, we fully acknowledge that unusual events of recent times — as well as the heightened volatility of early 2022 — may make investors uneasy. However, our experience managing portfolios through various economic cycles (including more than one unusual market crisis) has taught us to remain calm in the face of market turmoil. It is our view that, a long-term perspective, a well-diversified portfolio across asset

2

classes and investment types, and a clear understanding of individual risk tolerances are some of the key ingredients for staying the course and progressing on investment goals.

Of course, no one knows for certain what the future will bring. We are already facing a new and less accommodative Fed, which has unequivocally stated its intent to harness the recent elevated inflation readings. As a result, we believe interest rates appear ready to increase further. Labor shortages, continuing supply chain issues, elevated commodity prices, and the Russia-Ukraine war are among the headwinds investors are now navigating. There will be other challenges ahead, with some yet to be identified.

Thus, we cannot tell you with any certainty what markets will do in the future, but we can assure you that the investment professionals at all our independent franchises continually monitor the market environment and work hard to position portfolios opportunistically no matter what the markets bring.

On the following pages, you will find information relating to your USAA® Mutual Funds, brought to you by Victory Capital. If you have any questions, we encourage you to contact our Representatives. Call (800) 235-8396 or visit our website at www.vcm.com.

My colleagues and I sincerely appreciate the confidence you have placed in us, and we look forward to helping you work toward your investment goals.

Christopher K. Dyer, CFA

President,

USAA Mutual Funds Trust

3

USAA Mutual Funds Trust

USAA Global Equity Income Fund

Manager's Commentary

(Unaudited)

• What were the market conditions during the reporting period?

At the start of the reporting period, equity markets consolidated, and interest rates leveled off after large upswings during the second quarter of 2021. With strong first quarter gross domestic product and corporate earnings growth in the rearview mirror, investors seemed to be contemplating their next move. During the first half of the annual reporting period, equity markets rotated from value to growth leadership as Treasury bond yields retreated from the highs of March 2021. Inflation data increased as the economy reopened more quickly than expected. The U.S. Federal Reserve (the "Fed") maintained that inflationary pressure is transitory but could become more persistent. The inflationary environment was a key metric moving into the second half of the year.

The financial markets produced broadly flat returns in the third quarter. Conditions were initially supportive in July and August thanks to positive economic data and continued strength in corporate earnings. The picture changed in September, however, as investors began to focus on risk factors such as supply chain disruptions and rising inflation. In addition, the Fed indicated that it may begin tapering its stimulative quantitative easing policy — a development investors took as an indication that the first interest-rate increases may be on the way in 2022. News flow from overseas also took a negative turn in September, with the emergence of energy shortages in Europe and worries that the debt problems of Chinese property developer Evergrande could have a broader, systemic effect on China's economy.

Despite a number of headwinds to sentiment, U.S. equities posted solid gains in the fourth quarter of 2021 as reflected in the 11.03% return for the bellwether S&P 500 Index. The markets faced a shift in Fed policy as persistent inflation driven by supply chain issues and rising commodity prices led the central bank to announce and subsequently accelerate the tapering of its bond purchases that have helped keep longer-term borrowing costs low. In addition, the Fed began to signal the likelihood of two or more hikes in its benchmark overnight lending rate in 2022, representing a moving forward of the prior timetable. Prolonged negotiations over President Biden's Build Back Better spending bill put into question a source of anticipated fiscal stimulus. Finally, investors had to contend with the rapid emergence and spread of the Omicron variant of COVID-19, which threatened a new wave of lockdowns. Nonetheless, most major U.S. equity indices closed 2021 at or near all-time highs, supported by robust corporate profits and investor inflows given fixed income yields that remained unattractive.

At the end of the reporting period, the Russian invasion of Ukraine added significant volatility to both equity and bond markets that were already concerned with elevated levels of inflation, a hawkish Fed, and rising interest rates. In the first quarter of 2022, the combination of widening credit spreads and rising interest rates led to the worst quarter for the Bloomberg US Aggregate Bond Index in 40 years. Equity markets did not fare any better as the bellwether S&P 500 also posted a negative return during the quarter. With the Fed now embarking on a tightening cycle, the markets will remain focused on the Fed and whether it can engineer a soft landing amidst the highest inflation readings in 40 years.

4

USAA Mutual Funds Trust

USAA Global Equity Income Fund (continued)

Manager's Commentary (continued)

• How did the USAA Global Equity Income Fund (the "Fund") perform during the reporting period?

The Fund has two share classes: Fund Shares and Institutional Shares. For the fiscal year ended March 31, 2022, the Fund Shares and Institutional Shares had a total return (at net asset value) of 12.28% and 6.91%, respectively. This compares to returns of 9.41% for the MSCI World High Dividend Yield Index and 6.88% for the Lipper Global Equity Income Funds Index.

• What strategies did you employ during the reporting period?

The Fund focuses on income-oriented global equities and normally will have roughly equal weights in U.S. and international stocks, although this will vary to some degree depending on where we see the better value. In selecting stocks, we emphasize not only the current dividend but also a company's likely ability to grow its dividend. As a result, the average current dividend of companies held by the fund generally will be somewhat lower than the benchmark. However, our view is that a focus on dividend growers should provide an improved total return profile as we invest within the global dividend stock universe.

For the 12-month period ended March 31, 2022, strong stock selection drove relative performance while sector allocation detracted. Overweights to value sectors energy and financials and strong stock selection in information technology contributed to relative performance, while overweights to information technology and underweights to health care detracted from relative performance.

From a country perspective, strong overall stock selection in the United States positively contributed to relative performance against the benchmark. An overweight to Canada and underweight to Germany and Sweden relative to the benchmark added to performance, while an underweight to Australia and the United Kingdom negatively impacted performance relative to the benchmark.

On a long-term basis, we believe that focusing on quality companies with attractive valuations and dividend income is a sound strategy from a total return perspective.

Thank you for allowing us to assist you with your investment needs.

5

USAA Mutual Funds Trust

USAA Global Equity Income Fund

Investment Overview

(Unaudited)

Average Annual Total Return

Year Ended March 31, 2022

|

Fund Shares |

Institutional Shares |

||||||||||||||||||

|

INCEPTION DATE |

8/7/15 |

8/7/15 |

|||||||||||||||||

|

Net Asset Value |

Net Asset Value |

MSCI World High |

Lipper Global |

||||||||||||||||

|

One Year |

12.28 |

% |

6.91 |

% |

9.41 |

% |

6.88 |

% |

|||||||||||

|

Five Year |

9.27 |

% |

8.24 |

% |

8.06 |

% |

7.71 |

% |

|||||||||||

|

Since Inception |

8.02 |

% |

7.29 |

% |

7.79 |

% |

7.05 |

% |

|||||||||||

The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.vcm.com.

Total return measures the price change in a share assuming the reinvestment of all net investment income and realized capital gain distributions, if any. The total returns quoted do not reflect adjustments made to the enclosed financial statements in accordance with U.S. Generally Accepted Accounting Principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares. The total return figures set forth above include all waivers of fees. Without such fee waivers, the total returns would have been lower.

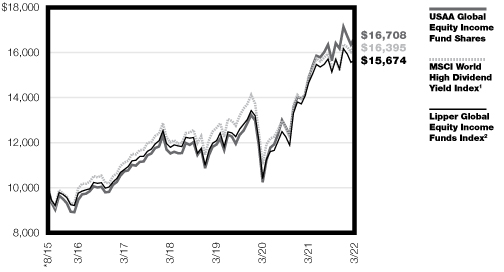

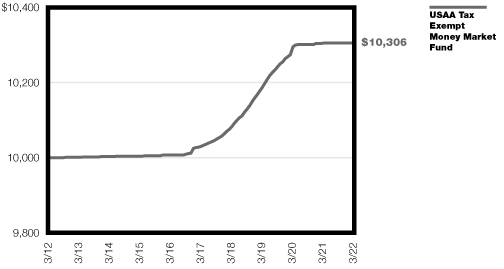

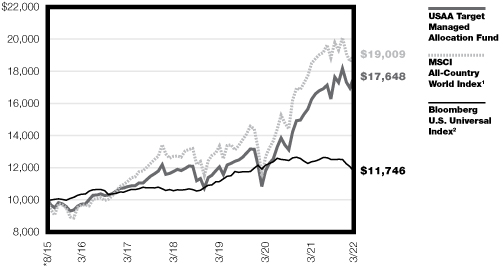

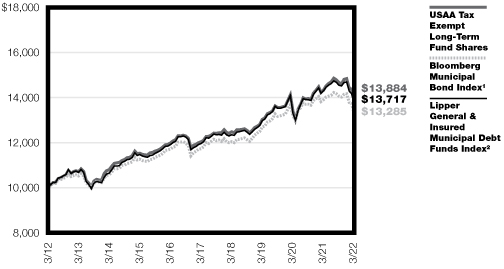

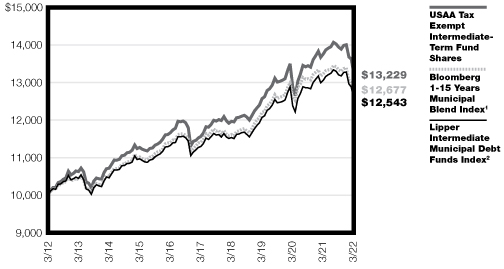

USAA Global Equity Income Fund — Growth of $10,000

*Inception Date for the Global Equity Income Fund is 08/07/15.

1The unmanaged MSCI World High Dividend Yield Index is a free float-adjusted market capitalization weighed index that is designed to measure the equity market performance of developed and emerging markets. This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund, and it is not possible to invest directly in an index.

2The unmanaged Lipper Global Equity Income Funds Index measures the Fund's performance to that of the Lipper Global Equity Income Funds category. This index does not include the effect of sales charges, commissions, expenses or taxes, is not representative of the Fund, and it is not possible to invest directly in an index.

The graph reflects investment of growth of a hypothetical $10,000 investment in the Fund.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares.

Past performance is not indicative of future results.

6

|

USAA Mutual Funds Trust USAA Global Equity Income Fund |

March 31, 2022 |

||||||

(Unaudited)

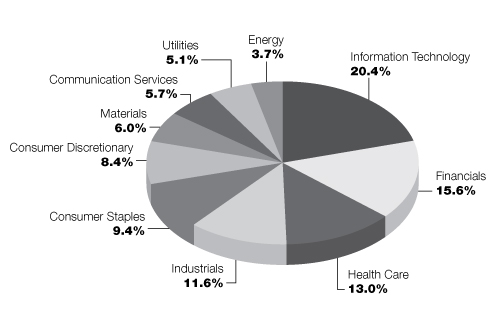

Investment Objective and Portfolio Holdings:

The Fund seeks total return with an emphasis on current income.

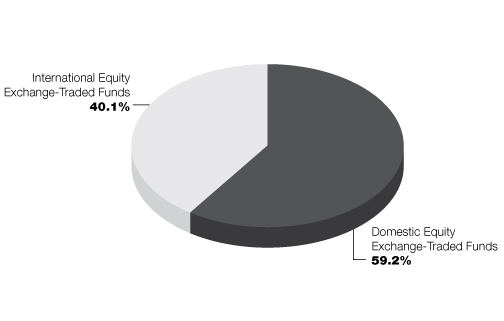

Sector Allocation*:

March 31, 2022

(% of Net Assets)

* Does not include futures contracts, money market instruments, and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

7

|

USAA Mutual Funds Trust USAA Global Equity Income Fund |

Schedule of Portfolio Investments March 31, 2022 |

||||||

(Amounts in Thousands, Except for Shares)

|

Security Description |

Shares |

Value |

|||||||||

|

Common Stocks (98.9%) |

|||||||||||

|

Australia (0.3%): |

|||||||||||

|

Consumer Discretionary (0.3%): |

|||||||||||

|

Domino's Pizza Enterprises Ltd. |

2,530 |

$ |

165 |

||||||||

|

Austria (0.2%): |

|||||||||||

|

Energy (0.2%): |

|||||||||||

|

OMV AG |

2,395 |

114 |

|||||||||

|

Belgium (0.5%): |

|||||||||||

|

Communication Services (0.2%): |

|||||||||||

|

Telenet Group Holding NV |

4,803 |

155 |

|||||||||

|

Consumer Staples (0.3%): |

|||||||||||

|

Etablissements Franz Colruyt NV (a) |

4,297 |

178 |

|||||||||

|

333 |

|||||||||||

|

Canada (5.5%): |

|||||||||||

|

Consumer Discretionary (0.3%): |

|||||||||||

|

Dollarama, Inc. |

3,899 |

221 |

|||||||||

|

Consumer Staples (0.1%): |

|||||||||||

|

Metro, Inc. |

1,399 |

81 |

|||||||||

|

Energy (0.8%): |

|||||||||||

|

Canadian Natural Resources Ltd. |

5,789 |

358 |

|||||||||

|

Parkland Corp. |

4,259 |

126 |

|||||||||

|

484 |

|||||||||||

|

Financials (4.3%): |

|||||||||||

|

Bank of Montreal |

5,065 |

596 |

|||||||||

|

Great-West Lifeco, Inc. |

5,647 |

166 |

|||||||||

|

IGM Financial, Inc. |

10,340 |

365 |

|||||||||

|

Manulife Financial Corp. |

13,254 |

283 |

|||||||||

|

Power Corp. of Canada |

4,887 |

151 |

|||||||||

|

Royal Bank of Canada |

771 |

85 |

|||||||||

|

Sun Life Financial, Inc. |

6,426 |

359 |

|||||||||

|

The Bank of Nova Scotia |

4,500 |

323 |

|||||||||

|

The Toronto-Dominion Bank |

5,611 |

445 |

|||||||||

|

2,773 |

|||||||||||

|

3,559 |

|||||||||||

|

Denmark (0.8%): |

|||||||||||

|

Health Care (0.7%): |

|||||||||||

|

Coloplast A/S Class B |

621 |

94 |

|||||||||

|

Novo Nordisk A/S Class B |

3,439 |

381 |

|||||||||

|

475 |

|||||||||||

|

Materials (0.1%): |

|||||||||||

|

Novozymes A/S B Shares |

871 |

60 |

|||||||||

|

535 |

|||||||||||

See notes to financial statements.

8

|

USAA Mutual Funds Trust USAA Global Equity Income Fund |

Schedule of Portfolio Investments — continued March 31, 2022 |

||||||

(Amounts in Thousands, Except for Shares)

|

Security Description |

Shares |

Value |

|||||||||

|

Finland (0.5%): |

|||||||||||

|

Communication Services (0.1%): |

|||||||||||

|

Elisa Oyj |

1,132 |

$ |

68 |

||||||||

|

Utilities (0.4%): |

|||||||||||

|

Fortum Oyj |

15,071 |

276 |

|||||||||

|

344 |

|||||||||||

|

France (1.2%): |

|||||||||||

|

Consumer Staples (0.5%): |

|||||||||||

|

L'Oreal SA |

780 |

311 |

|||||||||

|

Health Care (0.2%): |

|||||||||||

|

Sanofi |

1,691 |

173 |

|||||||||

|

Industrials (0.5%): |

|||||||||||

|

Bouygues SA |

8,738 |

305 |

|||||||||

|

789 |

|||||||||||

|

Germany (1.7%): |

|||||||||||

|

Consumer Discretionary (0.3%): |

|||||||||||

|

Volkswagen AG Preference Shares |

947 |

163 |

|||||||||

|

Financials (0.9%): |

|||||||||||

|

Allianz SE Registered Shares |

2,330 |

556 |

|||||||||

|

Industrials (0.3%): |

|||||||||||

|

Deutsche Post AG Registered Shares |

4,390 |

210 |

|||||||||

|

Utilities (0.2%): |

|||||||||||

|

E.ON SE |

12,518 |

145 |

|||||||||

|

1,074 |

|||||||||||

|

Hong Kong (0.6%): |

|||||||||||

|

Financials (0.2%): |

|||||||||||

|

Hong Kong Exchanges and Clearing Ltd. |

2,600 |

122 |

|||||||||

|

Utilities (0.4%): |

|||||||||||

|

Power Assets Holdings Ltd. |

37,000 |

241 |

|||||||||

|

363 |

|||||||||||

|

Ireland (1.1%): |

|||||||||||

|

Health Care (0.1%): |

|||||||||||

|

STERIS PLC |

353 |

86 |

|||||||||

|

Industrials (0.1%): |

|||||||||||

|

Trane Technologies PLC |

375 |

57 |

|||||||||

|

Information Technology (0.9%): |

|||||||||||

|

Seagate Technology Holdings PLC |

6,499 |

584 |

|||||||||

|

727 |

|||||||||||

|

Italy (0.5%): |

|||||||||||

|

Utilities (0.5%): |

|||||||||||

|

Snam SpA |

28,565 |

165 |

|||||||||

|

Terna — Rete Elettrica Nazionale |

19,120 |

164 |

|||||||||

|

329 |

|||||||||||

See notes to financial statements.

9

|

USAA Mutual Funds Trust USAA Global Equity Income Fund |

Schedule of Portfolio Investments — continued March 31, 2022 |

||||||

(Amounts in Thousands, Except for Shares)

|

Security Description |

Shares |

Value |

|||||||||

|

Japan (7.9%): |

|||||||||||

|

Communication Services (1.6%): |

|||||||||||

|

CyberAgent, Inc. |

12,862 |

$ |

159 |

||||||||

|

KDDI Corp. |

11,200 |

367 |

|||||||||

|

Nippon Telegraph & Telephone Corp. |

16,400 |

477 |

|||||||||

|

1,003 |

|||||||||||

|

Consumer Discretionary (1.5%): |

|||||||||||

|

Fast Retailing Co. Ltd. |

200 |

103 |

|||||||||

|

Iida Group Holdings Co. Ltd. |

22,000 |

379 |

|||||||||

|

Sony Group Corp. |

700 |

72 |

|||||||||

|

Toyota Motor Corp. |

21,200 |

383 |

|||||||||

|

937 |

|||||||||||

|

Consumer Staples (0.5%): |

|||||||||||

|

Seven & i Holdings Co. Ltd. |

6,400 |

305 |

|||||||||

|

Energy (0.5%): |

|||||||||||

|

ENEOS Holdings, Inc. |

80,400 |

301 |

|||||||||

|

Financials (1.2%): |

|||||||||||

|

Japan Post Holdings Co. Ltd. |

24,600 |

181 |

|||||||||

|

ORIX Corp. |

9,100 |

181 |

|||||||||

|

Resona Holdings, Inc. |

29,800 |

127 |

|||||||||

|

Sumitomo Mitsui Financial Group, Inc. |

10,000 |

316 |

|||||||||

|

805 |

|||||||||||

|

Health Care (0.2%): |

|||||||||||

|

Hoya Corp. |

1,100 |

125 |

|||||||||

|

Industrials (1.3%): |

|||||||||||

|

ITOCHU Corp. |

10,600 |

359 |

|||||||||

|

Kajima Corp. |

13,900 |

169 |

|||||||||

|

Mitsubishi Corp. |

4,100 |

154 |

|||||||||

|

Mitsui & Co. Ltd. |

6,700 |

182 |

|||||||||

|

864 |

|||||||||||

|

Information Technology (0.8%): |

|||||||||||

|

FUJIFILM Holdings Corp. |

2,200 |

134 |

|||||||||

|

Fujitsu Ltd. |

1,100 |

165 |

|||||||||

|

Nomura Research Institute Ltd. |

4,700 |

153 |

|||||||||

|

Seiko Epson Corp. (a) |

5,100 |

77 |

|||||||||

|

529 |

|||||||||||

|

Materials (0.3%): |

|||||||||||

|

Asahi Kasei Corp. |

13,300 |

115 |

|||||||||

|

Nissan Chemical Corp. |

1,300 |

76 |

|||||||||

|

191 |

|||||||||||

|

5,060 |

|||||||||||

See notes to financial statements.

10

|

USAA Mutual Funds Trust USAA Global Equity Income Fund |

Schedule of Portfolio Investments — continued March 31, 2022 |

||||||

(Amounts in Thousands, Except for Shares)

|

Security Description |

Shares |

Value |

|||||||||

|

Netherlands (2.1%): |

|||||||||||

|

Communication Services (0.3%): |

|||||||||||

|

Koninklijke KPN NV |

56,389 |

$ |

196 |

||||||||

|

Consumer Staples (0.2%): |

|||||||||||

|

Koninklijke Ahold Delhaize NV |

4,934 |

159 |

|||||||||

|

Industrials (0.5%): |

|||||||||||

|

Wolters Kluwer NV |

3,057 |

326 |

|||||||||

|

Information Technology (0.7%): |

|||||||||||

| ASML Holding NV |

625 |

417 |

|||||||||

|

Materials (0.4%): |

|||||||||||

|

LyondellBasell Industries NV Class A |

2,763 |

284 |

|||||||||

|

1,382 |

|||||||||||

|

Norway (0.3%): |

|||||||||||

|

Materials (0.3%): |

|||||||||||

|

Yara International ASA |

3,288 |

164 |

|||||||||

|

Singapore (0.3%): |

|||||||||||

|

Financials (0.3%): |

|||||||||||

|

Singapore Exchange Ltd. |

26,400 |

193 |

|||||||||

|

Spain (0.2%): |

|||||||||||

|

Utilities (0.2%): |

|||||||||||

|

Enagas SA |

6,585 |

146 |

|||||||||

|

Switzerland (5.3%): |

|||||||||||

|

Communication Services (0.3%): |

|||||||||||

|

Swisscom AG Registered Shares |

281 |

169 |

|||||||||

|

Consumer Discretionary (0.4%): |

|||||||||||

|

Garmin Ltd. |

1,881 |

223 |

|||||||||

|

Consumer Staples (0.8%): |

|||||||||||

|

Nestle SA Registered Shares |

4,121 |

536 |

|||||||||

|

Financials (0.8%): |

|||||||||||

|

Partners Group Holding AG |

96 |

119 |

|||||||||

|

Zurich Insurance Group AG |

843 |

416 |

|||||||||

|

535 |

|||||||||||

|

Health Care (1.9%): |

|||||||||||

|

Novartis AG Registered Shares |

8,016 |

704 |

|||||||||

|

Roche Holding AG |

1,375 |

544 |

|||||||||

|

1,248 |

|||||||||||

|

Industrials (0.9%): |

|||||||||||

|

Geberit AG Registered Shares |

660 |

407 |

|||||||||

|

SGS SA Registered Shares |

58 |

161 |

|||||||||

|

568 |

|||||||||||

|

Materials (0.2%): |

|||||||||||

|

Holcim Ltd. |

2,542 |

124 |

|||||||||

|

3,403 |

|||||||||||

See notes to financial statements.

11

|

USAA Mutual Funds Trust USAA Global Equity Income Fund |

Schedule of Portfolio Investments — continued March 31, 2022 |

||||||

(Amounts in Thousands, Except for Shares)

|

Security Description |

Shares |

Value |

|||||||||

|

United Kingdom (3.8%): |

|||||||||||

|

Consumer Staples (1.1%): |

|||||||||||

|

British American Tobacco PLC |

16,398 |

$ |

689 |

||||||||

|

Financials (0.2%): |

|||||||||||

|

Admiral Group PLC |

4,108 |

138 |

|||||||||

|

Health Care (0.3%): |

|||||||||||

|

GlaxoSmithKline PLC |

9,590 |

207 |

|||||||||

|

Industrials (0.5%): |

|||||||||||

|

Intertek Group PLC |

1,012 |

69 |

|||||||||

|

RELX PLC |

8,774 |

273 |

|||||||||

|

342 |

|||||||||||

|

Information Technology (0.2%): |

|||||||||||

|

The Sage Group PLC |

13,234 |

121 |

|||||||||

|

Materials (1.5%): |

|||||||||||

|

Rio Tinto PLC |

12,031 |

962 |

|||||||||

|

2,459 |

|||||||||||

|

United States (66.1%): |

|||||||||||

|

Communication Services (3.2%): |

|||||||||||

|

Omnicom Group, Inc. |

6,303 |

535 |

|||||||||

|

Sirius XM Holdings, Inc. (a) |

38,139 |

252 |

|||||||||

|

The Interpublic Group of Cos., Inc. |

5,500 |

195 |

|||||||||

|

Verizon Communications, Inc. |

21,437 |

1,092 |

|||||||||

|

2,074 |

|||||||||||

|

Consumer Discretionary (5.6%): |

|||||||||||

|

Best Buy Co., Inc. |

4,512 |

410 |

|||||||||

|

D.R. Horton, Inc. |

1,235 |

92 |

|||||||||

|

Genuine Parts Co. |

3,457 |

435 |

|||||||||

|

Lowe's Cos., Inc. |

2,334 |

472 |

|||||||||

|

McDonald's Corp. |

1,375 |

340 |

|||||||||

|

Starbucks Corp. |

1,909 |

174 |

|||||||||

|

Target Corp. |

3,227 |

685 |

|||||||||

|

The Home Depot, Inc. |

2,478 |

742 |

|||||||||

|

Tractor Supply Co. |

1,085 |

253 |

|||||||||

|

3,603 |

|||||||||||

|

Consumer Staples (5.9%): |

|||||||||||

|

Campbell Soup Co. |

4,710 |

210 |

|||||||||

|

Colgate-Palmolive Co. |

3,883 |

294 |

|||||||||

|

General Mills, Inc. |

5,218 |

353 |

|||||||||

|

Kimberly-Clark Corp. |

745 |

92 |

|||||||||

|

Philip Morris International, Inc. |

8,160 |

767 |

|||||||||

|

The Clorox Co. |

2,101 |

292 |

|||||||||

|

The Hershey Co. |

1,176 |

255 |

|||||||||

|

The Kroger Co. |

9,494 |

545 |

|||||||||

|

The Procter & Gamble Co. |

3,414 |

522 |

|||||||||

|

Tyson Foods, Inc. Class A |

3,145 |

282 |

|||||||||

See notes to financial statements.

12

|

USAA Mutual Funds Trust USAA Global Equity Income Fund |

Schedule of Portfolio Investments — continued March 31, 2022 |

||||||

(Amounts in Thousands, Except for Shares)

|

Security Description |

Shares |

Value |

|||||||||

|

Walgreens Boots Alliance, Inc. |

2,368 |

$ |

106 |

||||||||

|

Walmart, Inc. |

459 |

68 |

|||||||||

|

3,786 |

|||||||||||

|

Energy (2.2%): |

|||||||||||

|

ConocoPhillips |

3,816 |

382 |

|||||||||

|

Coterra Energy, Inc. |

16,779 |

452 |

|||||||||

|

EOG Resources, Inc. |

4,678 |

558 |

|||||||||

|

1,392 |

|||||||||||

|

Financials (7.7%): |

|||||||||||

|

Aflac, Inc. |

3,700 |

238 |

|||||||||

|

Ameriprise Financial, Inc. |

1,201 |

361 |

|||||||||

|

Comerica, Inc. |

1,389 |

126 |

|||||||||

|

Erie Indemnity Co. Class A |

1,217 |

214 |

|||||||||

|

Fifth Third Bancorp |

3,438 |

148 |

|||||||||

|

Huntington Bancshares, Inc. |

8,192 |

120 |

|||||||||

|

KeyCorp |

13,000 |

291 |

|||||||||

|

M&T Bank Corp. |

3,324 |

563 |

|||||||||

|

MetLife, Inc. |

4,221 |

297 |

|||||||||

|

Morgan Stanley |

3,816 |

333 |

|||||||||

|

MSCI, Inc. |

554 |

279 |

|||||||||

|

Regions Financial Corp. |

9,856 |

219 |

|||||||||

|

S&P Global, Inc. |

868 |

356 |

|||||||||

|

T. Rowe Price Group, Inc. |

2,666 |

403 |

|||||||||

|

The Allstate Corp. |

3,932 |

545 |

|||||||||

|

The Goldman Sachs Group, Inc. |

866 |

286 |

|||||||||

|

The PNC Financial Services Group, Inc. |

943 |

174 |

|||||||||

|

4,953 |

|||||||||||

|

Health Care (9.6%): |

|||||||||||

|

Abbott Laboratories |

1,054 |

125 |

|||||||||

|

AmerisourceBergen Corp. |

550 |

85 |

|||||||||

|

Amgen, Inc. |

3,112 |

752 |

|||||||||

|

Anthem, Inc. |

784 |

385 |

|||||||||

|

Bristol-Myers Squibb Co. |

3,256 |

238 |

|||||||||

|

Cardinal Health, Inc. |

8,791 |

498 |

|||||||||

|

CVS Health Corp. |

2,028 |

205 |

|||||||||

|

Danaher Corp. |

534 |

157 |

|||||||||

|

Eli Lilly & Co. |

2,272 |

651 |

|||||||||

|

Johnson & Johnson |

4,762 |

844 |

|||||||||

|

Medtronic PLC |

1,251 |

139 |

|||||||||

|

Pfizer, Inc. |

10,561 |

547 |

|||||||||

|

Quest Diagnostics, Inc. |

2,598 |

356 |

|||||||||

|

Stryker Corp. |

460 |

123 |

|||||||||

|

Thermo Fisher Scientific, Inc. |

258 |

152 |

|||||||||

|

UnitedHealth Group, Inc. |

1,812 |

924 |

|||||||||

|

6,181 |

|||||||||||

|

Industrials (7.5%): |

|||||||||||

|

3M Co. |

3,247 |

483 |

|||||||||

|

C.H. Robinson Worldwide, Inc. |

858 |

92 |

|||||||||

See notes to financial statements.

13

|

USAA Mutual Funds Trust USAA Global Equity Income Fund |

Schedule of Portfolio Investments — continued March 31, 2022 |

||||||

(Amounts in Thousands, Except for Shares)

|

Security Description |

Shares |

Value |

|||||||||

|

Cummins, Inc. |

1,636 |

$ |

336 |

||||||||

|

Fastenal Co. |

5,169 |

307 |

|||||||||

|

Honeywell International, Inc. |

956 |

186 |

|||||||||

|

Illinois Tool Works, Inc. |

1,208 |

253 |

|||||||||

|

Lockheed Martin Corp. |

1,758 |

776 |

|||||||||

|

Northrop Grumman Corp. |

627 |

280 |

|||||||||

|

PACCAR, Inc. |

3,754 |

331 |

|||||||||

|

Republic Services, Inc. |

668 |

89 |

|||||||||

|

Robert Half International, Inc. |

4,014 |

458 |

|||||||||

|

Rockwell Automation, Inc. |

922 |

258 |

|||||||||

|

Snap-on, Inc. |

700 |

144 |

|||||||||

|

Union Pacific Corp. |

547 |

150 |

|||||||||

|

United Parcel Service, Inc. Class B |

1,961 |

421 |

|||||||||

|

W.W. Grainger, Inc. |

384 |

198 |

|||||||||

|

Waste Management, Inc. |

482 |

76 |

|||||||||

|

4,838 |

|||||||||||

|

Information Technology (17.8%): |

|||||||||||

|

Apple, Inc. |

15,950 |

2,785 |

|||||||||

|

Broadcom, Inc. |

429 |

270 |

|||||||||

|

Cisco Systems, Inc. |

15,376 |

857 |

|||||||||

|

Hewlett Packard Enterprise Co. |

12,600 |

210 |

|||||||||

|

HP, Inc. |

19,588 |

711 |

|||||||||

|

Intel Corp. |

9,414 |

466 |

|||||||||

|

Intuit, Inc. |

430 |

207 |

|||||||||

|

Juniper Networks, Inc. |

4,700 |

175 |

|||||||||

|

Mastercard, Inc. Class A |

412 |

147 |

|||||||||

|

Microsoft Corp. |

7,427 |

2,290 |

|||||||||

|

NetApp, Inc. |

7,249 |

602 |

|||||||||

|

NVIDIA Corp. |

1,388 |

379 |

|||||||||

|

Oracle Corp. |

5,906 |

489 |

|||||||||

|

Paychex, Inc. |

3,287 |

449 |

|||||||||

|

QUALCOMM, Inc. |

1,417 |

216 |

|||||||||

|

Texas Instruments, Inc. |

4,024 |

738 |

|||||||||

|

The Western Union Co. |

17,481 |

328 |

|||||||||

|

Visa, Inc. Class A |

758 |

168 |

|||||||||

|

11,487 |

|||||||||||

|

Materials (3.2%): |

|||||||||||

|

Air Products and Chemicals, Inc. |

307 |

77 |

|||||||||

|

Celanese Corp. |

707 |

101 |

|||||||||

|

Nucor Corp. |

5,959 |

886 |

|||||||||

|

Packaging Corp. of America |

2,095 |

327 |

|||||||||

|

PPG Industries, Inc. |

1,600 |

210 |

|||||||||

|

RPM International, Inc. |

1,083 |

88 |

|||||||||

|

Steel Dynamics, Inc. |

2,438 |

203 |

|||||||||

|

The Sherwin-Williams Co. |

747 |

186 |

|||||||||

|

2,078 |

|||||||||||

See notes to financial statements.

14

|

USAA Mutual Funds Trust USAA Global Equity Income Fund |

Schedule of Portfolio Investments — continued March 31, 2022 |

||||||

(Amounts in Thousands, Except for Shares)

|

Security Description |

Shares |

Value |

|||||||||

|

Utilities (3.4%): |

|||||||||||

|

American Electric Power Co., Inc. |

1,400 |

$ |

139 |

||||||||

|

Duke Energy Corp. |

4,073 |

455 |

|||||||||

|

NRG Energy, Inc. |

14,807 |

568 |

|||||||||

|

OGE Energy Corp. |

6,617 |

270 |

|||||||||

|

The Southern Co. |

3,361 |

244 |

|||||||||

|

UGI Corp. |

14,447 |

523 |

|||||||||

|

2,199 |

|||||||||||

|

42,591 |

|||||||||||

|

Total Common Stocks (Cost $48,673) |

63,730 |

||||||||||

|

Collateral for Securities Loaned (0.7%)^ |

|||||||||||

|

United States (0.7%): |

|||||||||||

|

Fidelity Investments Money Market Government Portfolio, Institutional Shares, 0.16% (b) |

434,803 |

435 |

|||||||||

|

HSBC U.S. Government Money Market Fund, I Shares, 0.28% (b) |

19,009 |

19 |

|||||||||

|

Total Collateral for Securities Loaned (Cost $454) |

454 |

||||||||||

|

Total Investments (Cost $49,127) — 99.6% |

64,184 |

||||||||||

|

Other assets in excess of liabilities — 0.4% |

246 |

||||||||||

|

NET ASSETS — 100.00% |

$ |

64,430 |

|||||||||

^ Purchased with cash collateral from securities on loan.

(a) All or a portion of this security is on loan.

(b) Rate disclosed is the daily yield on March 31, 2022.

PLC — Public Limited Company

See notes to financial statements.

15

|

USAA Mutual Funds Trust |

Statement of Assets and Liabilities March 31, 2022 |

||||||

(Amounts in Thousands, Except Per Share Amounts)

|

USAA Global Equity Income Fund |

|||||||

|

Assets: |

|||||||

|

Investments, at value (Cost $49,127) |

$ |

64,184 |

(a) |

||||

|

Foreign currency, at value (Cost $5) |

5 |

||||||

|

Cash |

402 |

||||||

|

Receivables: |

|||||||

|

Interest and dividends |

230 |

||||||

|

Capital shares issued |

40 |

||||||

|

Reclaims |

124 |

||||||

|

From Adviser |

9 |

||||||

|

Prepaid expenses |

4 |

||||||

|

Total Assets |

64,998 |

||||||

|

Liabilities: |

|||||||

|

Payables: |

|||||||

|

Collateral received on loaned securities |

454 |

||||||

|

Capital shares redeemed |

10 |

||||||

|

Accrued expenses and other payables: |

|||||||

|

Investment advisory fees |

28 |

||||||

|

Administration fees |

8 |

||||||

|

Custodian fees |

5 |

||||||

|

Transfer agent fees |

8 |

||||||

|

Compliance fees |

— |

(b) |

|||||

|

Trustees' fees |

1 |

||||||

|

Other accrued expenses |

54 |

||||||

|

Total Liabilities |

568 |

||||||

|

Net Assets: |

|||||||

|

Capital |

45,896 |

||||||

|

Total accumulated earnings/(loss) |

18,534 |

||||||

|

Net Assets |

$ |

64,430 |

|||||

|

Net Assets |

|||||||

|

Fund Shares |

$ |

64,374 |

|||||

|

Institutional Shares |

56 |

||||||

|

Total |

$ |

64,430 |

|||||

|

Shares (unlimited number of shares authorized with no par value): |

|||||||

|

Fund Shares |

5,212 |

||||||

|

Institutional Shares |

5 |

||||||

|

Total |

5,217 |

||||||

|

Net asset value, offering and redemption price per share: (c) |

|||||||

|

Fund Shares |

$ |

12.35 |

|||||

|

Institutional Shares |

$ |

11.85 |

|||||

(a) Includes $502 thousand of securities on loan.

(b) Rounds to less than $1 thousand.

(c) Per share amount may not recalculate due to rounding of net assets and/or shares outstanding.

See notes to financial statements.

16

|

USAA Mutual Funds Trust |

Statement of Operations For the Year Ended March 31, 2022 |

||||||

(Amounts in Thousands)

|

USAA Global Equity Income Fund |

|||||||

|

Investment Income: |

|||||||

|

Dividends |

$ |

1,836 |

|||||

|

Securities lending (net of fees) |

3 |

||||||

|

Foreign tax withholding |

(87 |

) |

|||||

|

Total Income |

1,752 |

||||||

|

Expenses: |

|||||||

|

Investment advisory fees |

357 |

||||||

|

Administration fees — Fund Shares |

97 |

||||||

|

Administration fees — Institutional Shares |

— |

(a) |

|||||

|

Sub-Administration fees |

23 |

||||||

|

Custodian fees |

23 |

||||||

|

Transfer agent fees — Fund Shares |

91 |

||||||

|

Transfer agent fees — Institutional Shares |

— |

(a) |

|||||

|

Trustees' fees |

48 |

||||||

|

Compliance fees |

— |

(a) |

|||||

|

Legal and audit fees |

52 |

||||||

|

State registration and filing fees |

25 |

||||||

|

Interfund lending fees |

— |

(a) |

|||||

|

Interest fees |

1 |

||||||

|

Other expenses |

50 |

||||||

|

Total Expenses |

767 |

||||||

|

Expenses waived/reimbursed by Adviser |

(81 |

) |

|||||

|

Net Expenses |

686 |

||||||

|

Net Investment Income (Loss) |

1,066 |

||||||

|

Realized/Unrealized Gains (Losses) from Investments: |

|||||||

|

Net realized gains (losses) from investment securities and foreign currency transactions |

9,064 |

||||||

|

Net change in unrealized appreciation/depreciation on investment securities and foreign currency translations |

(2,170 |

) |

|||||

|

Net realized/unrealized gains (losses) on investments |

6,894 |

||||||

|

Change in net assets resulting from operations |

$ |

7,960 |

|||||

(a) Rounds to less than $1 thousand.

See notes to financial statements.

17

|

USAA Mutual Funds Trust |

Statements of Changes in Net Assets |

||||||

(Amounts in Thousands)

|

USAA Global Equity Income Fund |

|||||||||||

|

Year Ended March 31, 2022 |

Year Ended March 31, 2021 |

||||||||||

|

From Investments: |

|||||||||||

|

Operations: |

|||||||||||

|

Net Investment Income (Loss) |

$ |

1,066 |

$ |

1,215 |

|||||||

|

Net realized gains (losses) |

9,064 |

(359 |

) |

||||||||

|

Net change in unrealized appreciation/depreciation |

(2,170 |

) |

25,890 |

||||||||

|

Change in net assets resulting from operations |

7,960 |

26,746 |

|||||||||

|

Distributions to Shareholders: |

|||||||||||

|

Fund Shares |

(5,752 |

) |

(1,102 |

) |

|||||||

|

Institutional Shares |

(2 |

) |

(89 |

) |

|||||||

|

Change in net assets resulting from distributions to shareholders |

(5,754 |

) |

(1,191 |

) |

|||||||

|

Change in net assets resulting from capital transactions |

(13,488 |

) |

(14,549 |

) |

|||||||

|

Change in net assets |

(11,282 |

) |

11,006 |

||||||||

|

Net Assets: |

|||||||||||

|

Beginning of period |

75,712 |

64,706 |

|||||||||

|

End of period |

$ |

64,430 |

$ |

75,712 |

|||||||

|

Capital Transactions: |

|||||||||||

|

Fund Shares |

|||||||||||

|

Proceeds from shares issued |

$ |

5,342 |

$ |

5,174 |

|||||||

|

Distributions reinvested |

5,728 |

921 |

|||||||||

|

Cost of shares redeemed |

(18,352 |

) |

(20,644 |

) |

|||||||

|

Total Fund Shares |

$ |

(7,282 |

) |

$ |

(14,549 |

) |

|||||

|

Institutional Shares |

|||||||||||

|

Proceeds from shares issued |

$ |

60 |

$ |

— |

|||||||

|

Distributions reinvested |

2 |

— |

|||||||||

|

Cost of shares redeemed |

(6,268 |

) |

— |

||||||||

|

Total Institutional Shares |

$ |

(6,206 |

) |

$ |

— |

||||||

|

Change in net assets resulting from capital transactions |

$ |

(13,488 |

) |

$ |

(14,549 |

) |

|||||

|

Share Transactions: |

|||||||||||

|

Fund Shares |

|||||||||||

|

Issued |

422 |

499 |

|||||||||

|

Reinvested |

455 |

90 |

|||||||||

|

Redeemed |

(1,457 |

) |

(1,981 |

) |

|||||||

|

Total Fund Shares |

(580 |

) |

(1,392 |

) |

|||||||

|

Institutional Shares |

|||||||||||

|

Issued |

5 |

— |

|||||||||

|

Reinvested |

— |

(a) |

— |

||||||||

|

Redeemed |

(500 |

) |

— |

||||||||

|

Total Institutional Shares |

(495 |

) |

— |

||||||||

|

Change in Shares |

(1,075 |

) |

(1,392 |

) |

|||||||

(a) Rounds to less than 1 thousand shares.

See notes to financial statements.

18

This page is intentionally left blank.

19

|

USAA Mutual Funds Trust |

Financial Highlights |

||||||

For a Share Outstanding Throughout Each Period

|

Investment Activities |

Distributions to Shareholders From |

||||||||||||||||||||||||||

|

Net Asset Value, Beginning of Period |

Net Investment Income (Loss) |

Net Realized and Unrealized Gains (Losses) |

Total from Investment Activities |

Net Investment Income |

Net Realized Gains from Investments |

||||||||||||||||||||||

|

USAA Global Equity Income Fund |

|||||||||||||||||||||||||||

|

Fund Shares |

|||||||||||||||||||||||||||

|

Year Ended March 31: 2022 |

$ |

12.03 |

0.21 |

(b) |

1.27 |

1.48 |

(0.23 |

) |

(0.93 |

) |

|||||||||||||||||

|

2021 |

$ |

8.42 |

0.17 |

(b) |

3.61 |

3.78 |

(0.17 |

) |

— |

||||||||||||||||||

|

2020 |

$ |

10.51 |

0.24 |

(b) |

(1.57 |

) |

(1.33 |

) |

(0.22 |

) |

(0.54 |

) |

|||||||||||||||

|

2019 |

$ |

10.88 |

0.27 |

0.06 |

0.33 |

(0.27 |

) |

(0.43 |

) |

||||||||||||||||||

|

2018 |

$ |

10.42 |

0.23 |

0.54 |

0.77 |

(0.23 |

) |

(0.08 |

) |

||||||||||||||||||

|

Institutional Shares |

|||||||||||||||||||||||||||

|

Year Ended March 31: 2022 |

$ |

12.04 |

0.15 |

(b) |

0.66 |

0.81 |

(0.07 |

) |

(0.93 |

) |

|||||||||||||||||

|

2021 |

$ |

8.43 |

0.18 |

(b) |

3.61 |

3.79 |

(0.18 |

) |

— |

||||||||||||||||||

|

2020 |

$ |

10.52 |

0.25 |

(b) |

(1.56 |

) |

(1.31 |

) |

(0.24 |

) |

(0.54 |

) |

|||||||||||||||

|

2019 |

$ |

10.89 |

0.27 |

0.07 |

0.34 |

(0.28 |

) |

(0.43 |

) |

||||||||||||||||||

|

2018 |

$ |

10.43 |

0.23 |

0.54 |

0.77 |

(0.23 |

) |

(0.08 |

) |

||||||||||||||||||

* Assumes reinvestment of all net investment income and realized capital gain distributions, if any, during the period. Includes adjustments in accordance with U.S. Generally Accepted Accounting Principles and could differ from the Lipper reported return.

** For the period beginning July 1, 2019, the amount of any waivers or reimbursements and the amount of any recoupment is calculated without regard to the impact of any performance adjustment to the Fund's management fee.

^ The net expense ratio may not correlate to the applicable expense limits in place during the period since the current contractual expense limitation is applied for a period beginning July 1, 2019, and in effect through June 30, 2023, instead of coinciding with the Fund's fiscal year end. Details of the current contractual expense limitation in effect can be found in Note 4 of the accompanying Notes to Financial Statements.

† Does not include acquired fund fees and expenses, if any.

(a) Portfolio turnover is calculated on the basis of the Fund as a whole without distinguishing between the classes of shares issued.

(b) Per share net investment income (loss) has been calculated using the average daily shares method.

(c) Reflects a return to normal trading levels after a prior year transition or asset allocation shift.

(d) Reflects increased trading activity due to current year transition or asset allocation shift.

(e) Prior to August 1, 2018, USAA Asset Management Company ("AMCO")(previous investment Adviser) voluntarily agreed to limit the annual expenses of the Fund Shares to 1.20% of the Fund Shares' average daily net assets.

(f) Includes impact of Interfund lending fees and Interest fees. Without these fees, the net expense ratio would have been lower by 0.01%.

(g) Prior to August 1, 2018, AMCO voluntarily agreed to limit the annual expenses of the Institutional Shares to 1.10% of the Institutional Shares' average daily net assets.

See notes to financial statements.

20

|

USAA Mutual Funds Trust |

Financial Highlights — continued | ||||||

For a Share Outstanding Throughout Each Period

|

|

Ratios to Average Net Assets |

Supplemental Data |

|||||||||||||||||||||||||||||||||

|

Total Distributions |

Net Asset Value, End of Period |

Total Return* |

Net Expenses**^† |

Net Investment Income (Loss) |

Gross Expenses† |

Net Assets, End of Period (000's) |

Portfolio Turnover(a) |

||||||||||||||||||||||||||||

|

USAA Global Equity Income Fund |

|||||||||||||||||||||||||||||||||||

|

Fund Shares |

|||||||||||||||||||||||||||||||||||

|

Year Ended March 31: 2022 |

(1.16 |

) |

$ |

12.35 |

12.28 |

% |

1.04 |

% |

1.63 |

% |

1.15 |

% |

$ |

64,374 |

31 |

% |

|||||||||||||||||||

|

2021 |

(0.17 |

) |

$ |

12.03 |

45.23 |

% |

1.03 |

% |

1.65 |

% |

1.18 |

% |

$ |

69,690 |

46 |

%(c) |

|||||||||||||||||||

|

2020 |

(0.76 |

) |

$ |

8.42 |

(14.02 |

)% |

1.00 |

% |

2.30 |

% |

1.14 |

% |

$ |

60,491 |

109 |

%(d) |

|||||||||||||||||||

|

2019 |

(0.70 |

) |

$ |

10.51 |

3.43 |

% |

1.03 |

%(e) |

2.56 |

% |

1.10 |

% |

$ |

75,086 |

15 |

% |

|||||||||||||||||||

|

2018 |

(0.31 |

) |

$ |

10.88 |

7.41 |

% |

1.05 |

% |

2.17 |

% |

1.05 |

% |

$ |

96,101 |

22 |

% |

|||||||||||||||||||

|

Institutional Shares |

|||||||||||||||||||||||||||||||||||

|

Year Ended March 31: 2022 |

(1.00 |

) |

$ |

11.85 |

6.64 |

% |

1.13 |

%(f) |

1.25 |

% |

3.95 |

% |

$ |

56 |

31 |

% |

|||||||||||||||||||

|

2021 |

(0.18 |

) |

$ |

12.04 |

45.32 |

% |

0.93 |

% |

1.74 |

% |

1.25 |

% |

$ |

6,022 |

46 |

%(c) |

|||||||||||||||||||

|

2020 |

(0.78 |

) |

$ |

8.43 |

(13.90 |

)% |

0.90 |

% |

2.40 |

% |

1.51 |

% |

$ |

4,215 |

109 |

%(d) |

|||||||||||||||||||

|

2019 |

(0.71 |

) |

$ |

10.52 |

3.47 |

% |

0.97 |

%(g) |

2.58 |

% |

1.22 |

% |

$ |

5,261 |

15 |

% |

|||||||||||||||||||

|

2018 |

(0.31 |

) |

$ |

10.89 |

7.35 |

% |

1.10 |

% |

2.14 |

% |

1.29 |

% |

$ |

5,447 |

22 |

% |

|||||||||||||||||||

See notes to financial statements.

21

|

USAA Mutual Funds Trust |

Notes to Financial Statements March 31, 2022 |

||||||

1. Organization:

USAA Mutual Funds Trust (the "Trust") is organized as a Delaware statutory trust and is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as an open-end investment company. The Trust is comprised of 45 funds and is authorized to issue an unlimited number of shares, which are units of beneficial interest with no par value.

The accompanying financial statements are those of the USAA Global Equity Income Fund (the "Fund"). The Fund offers two classes of shares: Fund Shares and Institutional Shares. The Fund is classified as diversified under the 1940 Act.

Each class of shares of the Fund has substantially identical rights and privileges, except with respect to fees paid under distribution plans, expenses allocable exclusively to each class of shares, voting rights on matters solely affecting a single class of shares, and the exchange privilege of each class of shares.

Under the Trust's organizational documents, its officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with its vendors and others that provide for general indemnifications. The Fund's maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund. However, based on experience, the Fund expects that risk of loss to be remote.

2. Significant Accounting Policies:

The following is a summary of significant accounting policies followed by the Trust in the preparation of its financial statements. The policies are in conformity with U.S. Generally Accepted Accounting Principles ("GAAP"). The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from those estimates. The Fund follows the specialized accounting and reporting requirements under GAAP that are applicable to investment companies under Accounting Standards Codification Topic 946.

Investment Valuation:

The Fund records investments at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The valuation techniques described below maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. The inputs used for valuing the Fund's investments are summarized in the three broad levels listed below:

• Level 1 — quoted prices in active markets for identical securities

• Level 2 — other significant observable inputs (including quoted prices for similar securities or interest rates applicable to those securities, etc.)

• Level 3 — significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. The inputs or methodologies used for valuation techniques are not necessarily an indication of the risks associated with entering into those investments.

Victory Capital Management Inc. ("VCM" or the "Adviser") has established the Pricing and Liquidity Committee (the "Committee"), and subject to the Trust's Board of Trustees' (the "Board") oversight, the Committee administers and oversees the Fund's valuation policies and procedures, which are approved by the Board.

22

|

USAA Mutual Funds Trust |

Notes to Financial Statements — continued March 31, 2022 |

||||||

Portfolio securities listed or traded on securities exchanges, including Exchange-Traded Funds ("ETFs"), and American Depositary Receipts ("ADRs"), are valued at the closing price on the exchange or system where the security is principally traded, if available, or at the Nasdaq Official Closing Price. If there have been no sales for that day on the exchange or system, then a security is valued at the last available bid quotation on the exchange or system where the security is principally traded. In each of these situations, valuations are typically categorized as Level 1 in the fair value hierarchy.

Investments in open-end investment companies, other than ETFs, are valued at their net asset value ("NAV"). These valuations are typically categorized as Level 1 in the fair value hierarchy.

In the event that price quotations or valuations are not readily available, investments are valued at fair value in accordance with procedures established by and under the general supervision and responsibility of the Board. These valuations are typically categorized as Level 2 or Level 3 in the fair value hierarchy, based on the observability of inputs used to determine the fair value. The effect of fair value pricing is that securities may not be priced on the basis of quotations from the primary market in which they are traded, and the actual price realized from the sale of a security may differ materially from the fair value price. Valuing these securities at fair value is intended to cause the Fund's NAV to be more reliable than it otherwise would be.

A summary of the valuations as of March 31, 2022, based upon the three levels defined above, is included in the table below while the breakdown, by category, of investments is disclosed on the Schedule of Portfolio Investments (amounts in thousands):

|

Level 1 |

Level 2 |

Level 3 |

Total |

||||||||||||||||

|

Common Stocks |

$ |

47,384 |

$ |

16,346 |

$ |

— |

$ |

63,730 |

|||||||||||

|

Collateral for Securities Loaned |

454 |

— |

— |

454 |

|||||||||||||||

|

Total |

$ |

47,838 |

$ |

16,346 |

$ |

— |

$ |

64,184 |

|||||||||||

For the year ended March 31, 2022, there were no transfers in or out of Level 3 in the fair value hierarchy.

Real Estate Investment Trusts ("REITs"):

The Fund may invest in REITs, which report information on the source of their distributions annually. REITs are pooled investment vehicles that invest primarily in income producing real estate or real estate related loans or interests (such as mortgages). Certain distributions received from REITs during the year are recorded as realized gains or return of capital as estimated by the Fund or when such information becomes known.

Investment Companies:

Open-End Funds:

The Fund may invest in portfolios of open-end investment companies. These investment companies value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported sale price) and all other securities and assets at their fair value by the methods established by the board of directors of the underlying funds.

Derivative Instruments:

Foreign Exchange Currency Contracts:

The Fund may enter into foreign exchange currency contracts to convert U.S. dollars to and from various foreign currencies. A foreign exchange currency contract is an obligation by the Fund to purchase or sell a specific currency at a future date at a price (in U.S. dollars) set at the time of the contract. The Fund does not engage in "cross-currency" foreign exchange contracts (i.e., contracts to purchase or sell one foreign currency in exchange for another foreign currency). The Fund's foreign

23

|

USAA Mutual Funds Trust |

Notes to Financial Statements — continued March 31, 2022 |

||||||

exchange currency contracts might be considered spot contracts (typically a contract of one week or less) or forward contracts (typically a contract term over one week). A spot contract is entered into for purposes of hedging against foreign currency fluctuations relating to a specific portfolio transaction, such as the delay between a security transaction trade date and settlement date. Forward contracts are entered into for purposes of hedging portfolio holdings or concentrations of such holdings. Each foreign exchange currency contract is adjusted daily by the prevailing spot or forward rate of the underlying currency, and any appreciation or depreciation is recorded for financial statement purposes as unrealized until the contract settlement date, at which time the Fund records realized gains or losses equal to the difference between the value of a contract at the time it was opened and the value at the time it was closed. The Fund could be exposed to risk if a counterparty is unable to meet the terms of a foreign exchange currency contract or if the value of the foreign currency changes unfavorably. In addition, the use of foreign exchange currency contracts does not eliminate fluctuations in the underlying prices of the securities. As of March 31, 2022, the Fund had no open forward foreign exchange currency contracts.

Investment Transactions and Related Income:

Changes in holdings of investments are accounted for no later than one business day following the trade date. For financial reporting purposes, however, investment transactions are accounted for on trade date or the last business day of the reporting period. Interest income is determined on the basis of coupon interest accrued using the effective interest method which adjusts, where applicable, the amortization of premiums or accretion of discounts. Dividend income is recorded on the ex-dividend date. Gains or losses realized on sales of securities are recorded on the identified cost basis.

Withholding taxes on interest, dividends, and gains as a result of certain investments in ADRs by the Fund have been provided for in accordance with each investment's applicable country's tax rules and rates.

Securities Lending:

The Fund, through a Securities Lending Agreement with Citibank, N.A. ("Citibank"), may lend its securities to qualified financial institutions, such as certain broker-dealers and banks, to earn additional income, net of income retained by Citibank. Borrowers are required to initially secure their loans for collateral in the amount of at least 102% of the value of U.S. securities loaned or at least 105% of the value of non-U.S. securities loaned, marked-to-market daily. Any collateral shortfalls associated with increases in the valuation of the securities loaned are generally cured the next business day. The collateral can be received in the form of cash collateral and/or non-cash collateral. Non-cash collateral can include U.S. Government Securities and other securities as permitted by Securities and Exchange Commission ("SEC") guidelines. The cash collateral is invested in short-term instruments or cash equivalents, primarily open-end investment companies, as noted on the Fund's Schedule of Portfolio Investments. The Fund effectively does not have control of the non-cash collateral and therefore it is not disclosed on the Fund's Schedule of Portfolio Investments. Collateral requirements are determined daily based on the value of the Fund's securities on loan as of the end of the prior business day. During the time portfolio securities are on loan, the borrower will pay the Fund any dividends or interest paid on such securities plus any fee negotiated between the parties to the lending agreement. The Fund also earns a return from the collateral. The Fund pays Citibank various fees in connection with the investment of cash collateral and fees based on the investment income received from securities lending activities. Securities lending income (net of these fees) is disclosed on the Statement of Operations. Loans are terminable upon demand and the borrower must return the loaned securities within the lesser of one standard settlement period or five business days. Although risk is mitigated by the collateral, the Fund could experience a delay in recovering its securities and possible loss of income or value if the borrower fails to return them. In addition, there is a risk that the value of the short-term investments will be less than the amount of cash collateral required to be returned to the borrower.

The Fund's agreement with Citibank does not include master netting provisions. Non-cash collateral received by the Fund may not be sold or repledged, except to satisfy borrower default.

24

|

USAA Mutual Funds Trust |

Notes to Financial Statements — continued March 31, 2022 |

||||||

The following table (amounts in thousands) is a summary of the Fund's securities lending transactions as of March 31, 2022.

|

Value of Securities on Loan |

Non-Cash Collateral |

Cash Collateral |

|||||||||

| $ |

502 |

$ |

82 |

$ |

454 |

||||||

Foreign Currency Translations:

The accounting records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities of the Fund denominated in a foreign currency are translated into U.S. dollars at current exchange rates. Purchases and sales of securities, income receipts, and expense payments are translated into U.S. dollars at the exchange rates on the date of the transactions. The Fund does not isolate the portion of the results of operations resulting from changes in foreign exchange rates on investments from fluctuations arising from changes in market prices of securities held. Such fluctuations are disclosed as Net change in unrealized appreciation/depreciation on investment securities and foreign currency translations on the Statement of Operations. Any realized gains or losses from these fluctuations are disclosed as Net realized gains (losses) from investment securities and foreign currency transactions on the Statement of Operations.

Foreign Taxes:

The Fund may be subject to foreign taxes related to foreign income received (a portion of which may be reclaimable), capital gains on the sale of securities, and certain foreign currency transactions. All foreign taxes are recorded in accordance with the applicable regulations and rates that exist in the foreign jurisdictions in which the Fund invests.

Federal Income Taxes:

The Fund intends to continue to qualify as a regulated investment company by complying with the provisions available to certain investment companies, as defined in applicable sections of the Internal Revenue Code, and to make distributions of net investment income and net realized gains sufficient to relieve it from all, or substantially all, federal income taxes. Accordingly, no provision for federal income taxes is required in the financial statements. The Fund has a tax year end of March 31.

For the year ended March 31, 2022, the Fund did not incur any income tax, interest, or penalties, and has recorded no liability for net unrecognized tax benefits relating to uncertain tax positions.

Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the last four tax years, which includes the current fiscal tax year end). Management believes that there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken.

Allocations:

Expenses directly attributable to the Fund are charged to the Fund, while expenses that are attributable to more than one fund in the Trust, or jointly with an affiliated trust, are allocated among the respective funds in the Trust and/or an affiliated trust based upon net assets or another appropriate basis.