UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

Form 10-K

ANNUAL REPORT

(Mark One)

þ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the fiscal year ended December 31, 2015

OR

o Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from to

Commission File Number: 1-12162

BorgWarner Inc.

(Exact name of registrant as specified in its charter)

Delaware | 13-3404508 | |

State or other jurisdiction of Incorporation or organization | (I.R.S. Employer Identification No.) | |

3850 Hamlin Road,

Auburn Hills, Michigan 48326

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (248) 754-9200

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | New York Stock Exchange |

Securities registered Pursuant to Section 12(g) of the Act: None

__________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | þ | Accelerated filer | o | Non-accelerated filer | o | Smaller reporting company | o |

(Do not check if a smaller reporting company) | |||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No þ

The aggregate market value of the voting common stock of the registrant held by stockholders (not including voting common stock held by directors and executive officers of the registrant) on June 30, 2015 (the last business day of the most recently completed second fiscal quarter) was approximately $12.8 billion.

As of February 5, 2016, the registrant had 218,638,591 shares of voting common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the following documents are incorporated herein by reference into the Part of the Form 10-K indicated.

Document | Part of Form 10-K into which incorporated |

Portions of the BorgWarner Inc. Proxy Statement for the 2016 Annual Meeting of Stockholders | Part III |

BORGWARNER INC.

FORM 10-K

YEAR ENDED DECEMBER 31, 2015

INDEX

Page No. | ||

2

CAUTIONARY STATEMENTS FOR FORWARD-LOOKING INFORMATION

Statements contained in this Form 10-K (including Management's Discussion and Analysis of Financial Condition and Results of Operations) may contain forward-looking statements as contemplated by the 1995 Private Securities Litigation Reform Act (the “Act”) that are based on management's current outlook, expectations, estimates and projections. Words such as "anticipates," "believes," "continues," "could," "designed," "effect," "estimates," "evaluates," "expects," "forecasts," "goal," "initiative," "intends," "outlook," "plans," "potential," "project," "pursue," "seek," "should," "target," "when," "would," and variations of such words and similar expressions are intended to identify such forward-looking statements. All statements, other than statements of historical fact contained or incorporated by reference in this Form 10-K, that we expect or anticipate will or may occur in the future regarding our financial position, business strategy and measures to implement that strategy, including changes to operations, competitive strengths, goals, expansion and growth of our business and operations, plans, references to future success and other such matters, are forward-looking statements. Accounting estimates, such as those described under the heading "Critical Accounting Policies" in Item 7 of this Annual Report on Form 10-K, are inherently forward-looking. These statements are based on assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances. Forward-looking statements are not guarantees of performance and the Company's actual results may differ materially from those expressed, projected or implied in or by the forward-looking statements.

You should not place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report. Forward-looking statements are subject to risks and uncertainties, many of which are difficult to predict and generally beyond our control. Such risks and uncertainties include: the

failure to receive the anticipated benefits from BorgWarner’s acquisition of Remy International Inc. ("Remy"), the possibility that the parties may be unable to successfully integrate Remy’s operations with those of BorgWarner, that such integration may be more difficult, time-consuming or costly than expected, revenues following the transaction may be lower than expected, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, or suppliers) may be greater than expected following the transaction; the retention of key employees at Remy may not be achieved, fluctuations in domestic or foreign vehicle production; the continued use by original equipment manufacturers of outside suppliers, fluctuations in demand for vehicles containing our products; changes in general economic conditions; and the other risks noted under Item 1A, “Risk Factors,” and in other reports that we file with the Securities and Exchange Commission. We do not undertake any obligation to update or announce publicly any updates to or revision to any of the forward-looking statements in this Form 10-K to reflect any change in our expectations or any change in events, conditions, circumstances, or assumptions underlying the statements.

This section and the discussions contained in Item 1A, "Risk Factors," and in Item 7, subheading "Critical Accounting Policies" in this report, are intended to provide meaningful cautionary statements for purposes of the safe harbor provisions of the Act. This should not be construed as a complete list of all of the economic, competitive, governmental, technological and other factors that could adversely affect our expected consolidated financial position, results of operations or liquidity. Additional risks and uncertainties not currently known to us or that we currently believe are immaterial also may impair our business, operations, liquidity, financial condition and prospects.

3

PART I

ITEM 1. BUSINESS

BorgWarner Inc. and Consolidated Subsidiaries (the “Company”) is a Delaware corporation incorporated in 1987. We are a leading global supplier of highly engineered automotive systems and components primarily for powertrain applications. Our products help improve vehicle performance, fuel efficiency, stability and air quality. These products are manufactured and sold worldwide, primarily to original equipment manufacturers (“OEMs”) of light vehicles (passenger cars, sport-utility vehicles ("SUVs"), vans and light trucks). The Company's products are also sold to other OEMs of commercial vehicles (medium-duty trucks, heavy-duty trucks and buses) and off-highway vehicles (agricultural and construction machinery and marine applications). We also manufacture and sell our products to certain Tier One vehicle systems suppliers and into the aftermarket for light, commercial and off-highway vehicles. The Company operates manufacturing facilities serving customers in Europe, Asia, the Americas and Africa and is an original equipment supplier to every major automotive OEM in the world.

Financial Information About Reporting Segments

Refer to Note 19, “Reporting Segments and Related Information,” to the Consolidated Financial Statements in Item 8 of this report for financial information about the Company's reporting segments.

Narrative Description of Reporting Segments

The Company reports its results under two reporting segments: Engine and Drivetrain. Net sales by reporting segment for the years ended December 31, 2015, 2014 and 2013 are as follows:

Year Ended December 31, | |||||||||||

(millions of dollars) | 2015 | 2014 | 2013 | ||||||||

Engine | $ | 5,500.0 | $ | 5,705.9 | $ | 5,022.1 | |||||

Drivetrain | 2,556.7 | 2,631.4 | 2,446.5 | ||||||||

Inter-segment eliminations | (33.5 | ) | (32.2 | ) | (32.0 | ) | |||||

Net sales | $ | 8,023.2 | $ | 8,305.1 | $ | 7,436.6 | |||||

The sales information presented above excludes the sales by the Company's unconsolidated joint ventures (See sub-heading “Joint Ventures”). Such unconsolidated sales totaled approximately $650 million, $694 million and $756 million for the years ended December 31, 2015, 2014 and 2013, respectively.

Engine

The Engine Segment develops and manufactures products to improve fuel economy, reduce emissions and enhance performance. Increasingly stringent regulation of, and consumer demand for, better fuel economy and emissions performance are driving demand for the Engine Segment's products in gasoline and diesel engines and alternative powertrains. The Engine Segment's products include: turbochargers, timing systems, emissions systems, thermal systems, thermostats, diesel cold start and gasoline ignition technology.

Turbochargers provide several benefits including increased power for a given engine size, improved fuel economy and reduced emissions. The Engine Segment has benefited from the growth in turbocharger demand around the world for both diesel and gasoline engines. The Engine Segment provides turbochargers for light, commercial and off-highway applications for diesel and gasoline engine manufacturers in the Americas, Europe and Asia. The Engine Segment also designs and manufactures turbo actuators using integrated electronics to precisely control turbocharger speed and pressure ratio.

4

Sales of turbochargers for light vehicles represented approximately 31%, 28% and 26% of total net sales for the years ended December 31, 2015, 2014 and 2013, respectively. The Engine Segment currently supplies turbochargers to many OEMs including BMW, Daimler, Fiat Chrysler Automobiles ("FCA"), Ford, General Motors, Great Wall, Hyundai, Renault, Volkswagen and Volvo. The Engine Segment also supplies turbochargers to several commercial vehicle and off-highway OEMs including Caterpillar, Daimler, Deutz, John Deere, MAN, Navistar and Weichai.

The Engine Segment's turbocharger technologies include regulated two-stage turbocharging system, known as R2S®, regulated 3-stage turbocharging systems known as R3S™, variable turbine geometry ("VTG") turbochargers and turbochargers for gasoline direct injected engines, all of which may be found in numerous applications around the world. For example, the Engine Segment supplies its award winning VTG turbocharger technology to BMW, FCA, Hyundai and Renault. Also, the Engine Segment supplies its award winning R2S® turbocharger technology to Volkswagen for its high-performing 2.0 liter diesel engine and its R3S™ turbocharger system, an industry first, to BMW for its high-powered 3.0 diesel engine. Ford selected the Engine Segment's leading gasoline turbocharger technology for its 1.5 liter, 1.6 liter and 2.0 liter four-cylinder EcoBoost engines, as did Volvo for its new four-cylinder gasoline engines.

The Engine Segment's timing systems enable precise control of air and exhaust flow through the engine, improving fuel economy and emissions. The Engine Segment's timing systems products include timing chain, variable cam timing (“VCT”), crankshaft and camshaft sprockets, tensioners, guides and snubbers, HY-VO® front-wheel drive (“FWD”) transmission chain and four-wheel drive (“4WD”) chain for light vehicles. The Engine Segment is a leading manufacturer of timing systems to OEMs around the world.

BorgWarner timing chain systems are featured on Ford's family of engines, including Duratec, Modular and in-line four-cylinder engines, General Motors' Small Gas Engine, Volkswagen's EA888 family, Hyundai's Gamma, Nu and Theta families and numerous other applications around the world.

The Engine Segment's engine timing technology includes VCT with mid position lock, which allows a greater range of camshaft positioning thereby enabling greater control over airflow and the opportunity to improve fuel economy, reduce emissions and improve engine performance compared with conventional VCT systems. VCT with mid position lock made its debut on Subaru's Boxer® 2.0 liter engine and is now on Hyundai's 3.0 to 3.8 liter six-cylinder engines and Ford's 5.0 liter eight-cylinder engine.

The Engine Segment's emissions and systems products improve emissions performance and fuel economy. Products include electric air pumps and exhaust gas recirculation ("EGR") modules, EGR coolers, EGR tubes and EGR valves for gasoline and diesel applications.

The Engine Segment's thermal systems products are designed to optimize engine temperatures and minimize parasitic horsepower losses, which improve engine efficiency, fuel economy and emissions performance. Products include viscous fan drives that sense and respond to multiple cooling requirements, polymer fans and coolant pumps. The Engine Segment has been awarded the "standard position" (the OEM-designated preferred supplier of component systems available to the end-customer) at several major global commercial vehicle OEMs.

The Engine Segment's ignition systems products improve combustion efficiency for both diesel and gasoline engines. Products include glow plugs and instant starting systems that enhance combustion for diesel engines during cold starts, pressure sensor glow plugs that also monitor the combustion process of a diesel engine and advanced ignition technology for gasoline engines.

On February 28, 2014, the Company acquired 100% of the equity interests in Gustav Wahler GmbH u. Co. KG and its general partner ("Wahler"). Wahler was a producer of EGR valves, EGR tubes and thermostats, and had operations in Germany, Brazil, the U.S., China and Slovakia. The Wahler acquisition

5

is expected to strengthen the Company's strategic position as a producer of complete EGR systems and create additional market opportunities in both passenger and commercial vehicle applications.

The Company sold its tire pressure monitoring and spark plug businesses during the fourth quarter of 2011 and third quarter of 2012, respectively. The sale of these businesses will allow the Company to continue to focus on expanding BERU Systems' core products of glow plugs, diesel cold start systems and other gasoline ignition technologies.

In 2009, the Company announced the purchase of advanced gasoline ignition technology and related intellectual property from Florida-based Etatech, Inc. The high-frequency ignition technology is expected to enable high-performing, lean-burning engines to significantly improve fuel economy and reduce emissions compared with conventional combustion technologies.

Drivetrain

The Drivetrain Segment develops and manufactures mechanical products for automatic transmissions and all-wheel drive ("AWD") vehicles and rotating electrical components for light and commercial vehicle OEMs and the aftermarket. Precise controls, better response times and minimal parasitic losses, all of which improve fuel economy and vehicle performance, are the core design features of the Drivetrain Segment's mechanical product portfolio, while meeting the demands of increasing vehicle electric loads, improved fuel efficiency, reduced weight and lowered electrical and mechanical noise are the core design features of its rotating electrical components portfolio. The Drivetrain Segment's mechanical products include friction, mechanical and controls products for automatic transmissions and torque management products for AWD vehicles, and its rotating electrical components include starter motors, alternators and hybrid electric motors.

Friction and mechanical products for automatic transmissions include dual clutch modules, friction clutch modules, friction and steel plates, transmission bands, torque converter clutches, one-way clutches and torsional vibration dampers. Controls products for automatic transmissions feature electro-hydraulic solenoids for standard and high pressure hydraulic systems, transmission solenoid modules and dual clutch control modules. The Company's 50%-owned joint venture in Japan, NSK-Warner KK ("NSK-Warner"), is a leading producer of friction plates and one-way clutches in Japan and China.

The Drivetrain Segment has led the globalization of today's dual clutch transmission ("DCT") technology for over 10 years. BorgWarner's award-winning DualTronic® technology enables a conventional, manual gearbox to function as a fully automatic transmission by eliminating the interruption in power flow that occurs when shifting a single clutch manual transmission. The result is a smooth shifting automatic transmission with the fuel efficiency and driving experience of a manual gearbox.

The Drivetrain Segment established its industry-leading position in 2003 with the production launch of its DualTronic® innovations with VW/Audi, followed by program launches with Ford and BMW. In 2007, the Drivetrain Segment launched its first dual-clutch technology application in a Japanese transmission with Nissan. In 2008, the Company entered into a joint venture agreement with China Automobile Development United Investment Company, a company owned by 12 leading Chinese automakers, to produce various DCT modules for the Chinese market. The Company owns 66% of the joint venture. In 2013, the Drivetrain Segment launched its first DCT application in a Chinese transmission with SAIC. The Drivetrain Segment is working on several other DCT programs with OEMs around the world.

The Drivetrain Segment's torque management products include rear-wheel drive (“RWD”)-AWD transfer case systems, FWD-AWD coupling systems and cross-axle coupling systems. The Drivetrain Segment's focus is on developing electronically controlled torque management devices and systems that will benefit fuel economy and vehicle dynamics.

6

Transfer cases are installed on RWD based light trucks, SUVs, cross-over utility vehicles, and passenger cars. A transfer case attaches to the transmission and distributes torque to the front and rear axles improving vehicle traction and stability in dynamic driving conditions. There are many variants of the Drivetrain Segment's transfer case technology in the market today, including Torque On-Demand (TOD®), chain-driven, gear-driven, Pre-Emptive, Part-Time, 1-speed and 2-speed transfer cases. The Drivetrain Segment's transfer cases are featured on the Ford F-150 and on the Dodge Ram light-duty and heavy-duty trucks.

The Drivetrain Segment is involved in the AWD market for FWD based vehicles with couplings that use electronically-controlled clutches to distribute power to the rear wheels as traction is required. The Drivetrain Segment's latest coupling innovation, the Centrifugal Electro-Hydraulic (“CEH”) Actuator, which is utilized to engage the clutches in the coupling, produces outstanding vehicle stability and traction while promoting better fuel economy with reduced weight. The CEH Actuator is found in the AWD couplings featured in several current FWD-AWD vehicles including the BMW X1, Range Rover Evoque, Volvo XC90 and VW Tiguan.

In 2015, the Company acquired Remy International, Inc. (“Remy”), a global market leader in the design, manufacture, remanufacture and distribution of rotating electrical components for light and commercial vehicles, OEMs and the aftermarket. Principal products include starter motors, alternators and hybrid electric motors. The Company’s starter motors and alternators are used in gasoline, diesel, natural gas and alternative fuel engines for light vehicle, commercial vehicle, industrial, construction and agricultural applications. The product technology continues to evolve to meet the demands of increasing vehicle electrical loads, improved fuel efficiency, reduced weight and lowered electrical and mechanical noise. The Company’s hybrid electric motors are used in both light and commercial vehicles including construction, public transit and agricultural applications. These include both pure electric applications as well as hybrid applications, where the electric motors are combined with traditional gasoline or diesel propulsion systems. While the market for these systems is in early stages of development, BorgWarner’s technology and capabilities are ideally suited for this growing product category.

The Company sells new starters, alternators and hybrid electric motors to OEMs globally for factory installation on new vehicles, and remanufactured and new starters and alternators to aftermarket customers and to OEMs for original equipment service. As a leading remanufacturer, BorgWarner obtains used starters and alternators, commonly referred to as cores, then disassembles, cleans, combines them with new subcomponents and reassembles them into saleable, finished products, which are tested to meet OEM requirements.

In 2011, the Company acquired the Traction Systems division of Haldex Group, a leading provider of innovative AWD products for the global vehicle industry headquartered in Stockholm, Sweden. This acquisition has accelerated BorgWarner's growth in the global AWD market as it continues to shift toward FWD based vehicles. The acquisition adds industry leading AWD technologies for FWD based vehicles, with a strong European customer base, to BorgWarner's portfolio of front- and rear-wheel drive based products and enables BorgWarner to offer global customers a broader range of AWD solutions to meet their vehicle needs.

7

Joint Ventures

As of December 31, 2015, the Company had eight joint ventures in which it had a less-than-100% ownership interest. Results from the six joint ventures in which the Company is the majority owner are consolidated as part of the Company's results. Results from the two joint ventures in which the Company's effective ownership interest is 50% or less, were reported by the Company using the equity method of accounting.

Management of the unconsolidated joint ventures is shared with the Company's respective joint venture partners. Certain information concerning the Company's joint ventures is set forth below:

Joint venture | Products | Year organized | Percentage owned by the Company | Location of operation | Joint venture partner | Fiscal 2015 net sales (millions of dollars) (a) | |||||||||

Unconsolidated: | |||||||||||||||

NSK-Warner | Transmission components | 1964 | 50 | % | Japan/China | NSK Ltd. | $ | 519.0 | |||||||

Turbo Energy Private Limited (b) | Turbochargers | 1987 | 32.6 | % | India | Sundaram Finance Limited; Brakes India Limited | $ | 130.5 | |||||||

Consolidated: | |||||||||||||||

BorgWarner Transmission Systems Korea Ltd. (c) | Transmission components | 1987 | 60 | % | Korea | NSK-Warner | $ | 300.4 | |||||||

Divgi-Warner Private Limited | Transfer cases and synchronizer rings | 1995 | 60 | % | India | Divgi Metalwares, Ltd. | $ | 17.5 | |||||||

Borg-Warner Shenglong (Ningbo) Co. Ltd. | Fans and fan drives | 1999 | 70 | % | China | Ningbo Shenglong Automotive Powertrain Systems Co., Ltd. | $ | 31.9 | |||||||

BorgWarner TorqTransfer Systems Beijing Co. Ltd. | Transfer cases | 2000 | 80 | % | China | Beijing Automotive Components Stock Co. Ltd. | $ | 93.0 | |||||||

SeohanWarner Turbo Systems Ltd. | Turbochargers | 2003 | 71 | % | Korea | Korea Flange Company | $ | 264.6 | |||||||

BorgWarner United Transmission Systems Co. Ltd. | Transmission components | 2009 | 66 | % | China | China Automobile Development United Investment Co., Ltd. | $ | 26.0 | |||||||

________________

(a) | All sales figures are for the year ended December 31, 2015, except NSK-Warner and Turbo Energy Private Limited. NSK-Warner’s sales are reported for the 12 months ended November 30, 2015. Turbo Energy Private Limited’s sales are reported for the 12 months ended September 30, 2015. |

(b) | The Company made purchases from Turbo Energy Private Limited totaling $36.5 million, $36.5 million and $39.1 million for the years ended December 31, 2015, 2014 and 2013, respectively. |

(c) | BorgWarner Inc. owns 50% of NSK-Warner, which has a 40% interest in BorgWarner Transmission Systems Korea Ltd. This gives the Company an additional indirect effective ownership percentage of 20%. This results in a total effective ownership interest of 80%. |

Financial Information About Geographic Areas

During the year ended December 31, 2015, approximately 75% of the Company's consolidated net sales were outside the United States ("U.S."), attributing sales to the location of production rather than the location of the customer.

Refer to Note 19, “Reporting Segments and Related Information,” to the Consolidated Financial Statements in Item 8 of this report for financial information about geographic areas.

Product Lines and Customers

During the year ended December 31, 2015, approximately 84% of the Company's net sales were for light-vehicle applications; approximately 7% were for commercial vehicle applications; approximately 4% were for off-highway vehicle applications; and approximately 5% were to distributors of aftermarket replacement parts.

8

The Company’s worldwide net sales to the following customers (including their subsidiaries) were approximately as follows:

Year Ended December 31, | ||||||||

Customer | 2015 | 2014 | 2013 | |||||

Volkswagen | 15 | % | 17 | % | 16 | % | ||

Ford | 15 | % | 13 | % | 14 | % | ||

No other single customer accounted for more than 10% of our consolidated net sales in any of the years presented.

The Company's automotive products are generally sold directly to OEMs, substantially pursuant to negotiated annual contracts, long-term supply agreements or terms and conditions as may be modified by the parties. Deliveries are subject to periodic authorizations based upon OEM production schedules. The Company typically ships its products directly from its plants to the OEMs.

Sales and Marketing

Each of the Company's businesses within its two reporting segments has its own sales function. Account executives for each of our businesses are assigned to serve specific customers for one or more of a businesses' products. Our account executives spend the majority of their time in direct contact with customers' purchasing and engineering employees and are responsible for servicing existing business and for identifying and obtaining new business. Because of their close relationship with customers, account executives are able to identify and meet customers' needs based upon their knowledge of our products' design and manufacturing capabilities. Upon securing a new order, account executives participate in product launch team activities and serve as a key interface with customers. In addition, sales and marketing employees of our Engine and Drivetrain reporting segments often work together to explore cross-development opportunities where appropriate.

Seasonality

Our operations are directly related to the automotive industry. Consequently, we may experience seasonal fluctuations to the extent automotive vehicle production slows, such as in the summer months when many customer plants typically close for model year changeovers or vacations. Historically, model changeovers or vacations have generally resulted in lower sales volume in the third quarter.

Research and Development

The Company conducts advanced Engine and Drivetrain research at the reporting segment level. This advanced engineering function looks to leverage know-how and expertise across product lines to create new Engine and Drivetrain systems and modules that can be commercialized. This function manages a venture capital fund that was created by the Company as seed money for new innovation and collaboration across businesses.

In addition, each of the Company's businesses within its two reporting segments has its own research and development (“R&D”) organization, including engineers and technicians, engaged in R&D activities at facilities worldwide. The Company also operates testing facilities such as prototype, measurement and calibration, life cycle testing and dynamometer laboratories.

By working closely with the OEMs and anticipating their future product needs, the Company's R&D personnel conceive, design, develop and manufacture new proprietary automotive components and systems. R&D personnel also work to improve current products and production processes. The Company believes its commitment to R&D will allow it to continue to obtain new orders from its OEM customers.

9

The Company's net R&D expenditures are included in selling, general and administrative expenses of the Consolidated Statements of Operations. Customer reimbursements are netted against gross R&D expenditures as they are considered a recovery of cost. Customer reimbursements for prototypes are recorded net of prototype costs based on customer contracts, typically either when the prototype is shipped or when it is accepted by the customer. Customer reimbursements for engineering services are recorded when performance obligations are satisfied in accordance with the contract and accepted by the customer. Financial risks and rewards transfer upon shipment, acceptance of a prototype component by the customer or upon completion of the performance obligation as stated in the respective customer agreement.

Year Ended December 31, | |||||||||||

(millions of dollars) | 2015 | 2014 | 2013 | ||||||||

Gross R&D expenditures | $ | 386.2 | $ | 392.8 | $ | 350.4 | |||||

Customer reimbursements | (78.8 | ) | (56.6 | ) | (47.2 | ) | |||||

Net R&D expenditures | $ | 307.4 | $ | 336.2 | $ | 303.2 | |||||

Net R&D expenditures as a percentage of net sales were 3.8%, 4.0% and 4.1% for the years ended December 31, 2015, 2014 and 2013, respectively. The Company has contracts with several customers at the Company's various R&D locations. No such contract exceeded 5% of net R&D expenditures in any of the years presented.

Intellectual Property

The Company has more than 5,600 active domestic and foreign patents and patent applications pending or under preparation, and receives royalties from licensing patent rights to others. While it considers its patents on the whole to be important, the Company does not consider any single patent, any group of related patents or any single license essential to its operations in the aggregate or to the operations of any of the Company's business groups individually. The expiration of the patents individually and in the aggregate is not expected to have a material effect on the Company's financial position or future operating results. The Company owns numerous trademarks, some of which are valuable, but none of which are essential to its business in the aggregate.

The Company owns the “BorgWarner” and “Borg-Warner Automotive” trade names and housemarks, and variations thereof, which are material to the Company's business.

Competition

The Company's reporting segments compete worldwide with a number of other manufacturers and distributors that produce and sell similar products. Many of these competitors are larger and have greater resources than the Company. Technological innovation, application engineering development, quality, price, delivery and program launch support are the primary elements of competition.

10

The Company’s major competitors by product type follow:

Product Type: Engine | Names of Competitors | |||

Turbochargers: | Cummins Turbo Technology | IHI | ||

Honeywell | Mitsubishi Heavy Industries (MHI) | |||

Bosch Mahle Turbo Systems | ||||

Emissions systems: | Mahle | T.RAD | ||

Denso | Pierburg | |||

Bosch | NGK | |||

Eldor | ||||

Timing devices and chains: | Denso | Schaeffler Group | ||

Iwis | Tsubaki Group | |||

Thermal systems: | Horton | Usui | ||

Mahle | Xuelong | |||

Product Type: Drivetrain | Names of Competitors | |||

Torque transfer: | American Axle | JTEKT | ||

GKN Driveline | Magna Powertrain | |||

Rotating electrical devices: | Denso | Melco | ||

Transmission systems: | Bosch | FCC | ||

Dynax | Schaeffler Group | |||

In addition, a number of the Company's major OEM customers manufacture, for their own use and for others, products that compete with the Company's products. Other current OEM customers could elect to manufacture products to meet their own requirements or to compete with the Company. There is no assurance that the Company's business will not be adversely affected by increased competition in the markets in which it operates.

For many of its products, the Company's competitors include suppliers in parts of the world that enjoy economic advantages such as lower labor costs, lower health care costs, lower tax rates and, in some cases, export subsidies and/or raw materials subsidies. Also, see Item 1A, "Risk Factors."

Workforce

As of December 31, 2015, the Company had a salaried and hourly workforce of approximately 30,000 (as compared with approximately 22,000 at December 31, 2014), of which approximately 6,900 were in the U.S. Approximately 16% of the Company's U.S. workforce is unionized. The workforces at certain international facilities are also unionized. The Company believes the present relations with our workforce to be satisfactory.

We have domestic collective bargaining agreements for one facility in New York, which expires in September 2016, and one facility in Oklahoma, which expires in March 2019.

11

Raw Materials

The Company uses a variety of raw materials in the production of its automotive products including aluminum, copper, nickel, plastic resins, steel and certain alloy elements. Manufacturing operations for each of the Company's operating segments are dependent upon natural gas, fuel oil and electricity.

The Company uses a variety of tactics in order to limit the impact of supply shortages and inflationary pressures. The Company's global procurement organization works to accelerate cost reductions, purchases from lower cost regions, rationalize the supply base, mitigate risk and collaborate on its buying activities. In addition, the Company uses long-term contracts, cost sharing arrangements, design changes, customer buy programs and limited financial instruments to help control costs. The Company intends to use similar measures in 2016 and beyond. Refer to Note 10, “Financial Instruments,” of the Consolidated Financial Statements in Item 8 of this report for information related to the Company's hedging activities.

For 2016, the Company believes that its supplies of raw materials are adequate and available from multiple sources to support its manufacturing requirements.

Available Information

Through its Internet website (www.borgwarner.com), the Company makes available, free of charge, its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, all amendments to those reports, and other filings with the Securities and Exchange Commission, as soon as reasonably practicable after they are filed or furnished. The Company also makes the following documents available on its Internet website: the Audit Committee Charter; the Compensation Committee Charter; the Corporate Governance Committee Charter; the Company's Corporate Governance Guidelines; the Company's Code of Ethical Conduct; and the Company's Code of Ethics for CEO and Senior Financial Officers. You may also obtain a copy of any of the foregoing documents, free of charge, if you submit a written request to Investor Relations, 3850 Hamlin Road, Auburn Hills, Michigan 48326. The public may read and copy materials filed by the Company with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC, 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

12

Executive Officers of the Registrant

Set forth below are the names, ages, positions and certain other information concerning the executive officers of the Company as of February 11, 2016.

Name | Age | Position with the Company | ||

James R. Verrier | 53 | President and Chief Executive Officer | ||

Ronald T. Hundzinski | 57 | Vice President and Chief Financial Officer | ||

Steven G. Carlson | 65 | Vice President and Controller | ||

Stefan Demmerle | 51 | Vice President | ||

Brady D. Ericson | 44 | Vice President | ||

Joseph F. Fadool | 49 | Vice President | ||

John J. Gasparovic | 58 | Vice President, General Counsel and Secretary | ||

Kim R. Jenett | 56 | Vice President, Human Resources | ||

Robin Kendrick | 51 | Vice President | ||

Frederic B. Lissalde | 48 | Vice President | ||

Thomas J. McGill | 49 | Vice President and Treasurer | ||

Daniel Paterra | 61 | Vice President | ||

Mr. Verrier has been President, Chief Executive Officer and member of BorgWarner's Board of Directors since January 1, 2013. From March 2012 through December 2012, he was the President and Chief Operating Officer of the Company. From January 2010 to March 2012, he was Vice President of the Company and President and General Manager of BorgWarner Morse TEC Inc.

Mr. Hundzinski has been Vice President and Chief Financial Officer of the Company since March 2012. From August 2011 through March 2012, he was Vice President and Treasurer of the Company. From April 2010 until August 2011, he was Vice President and Controller of the Company.

Mr. Carlson has been Vice President and Controller of the Company since May 2012. From August 2011 through April 2012, he was Vice President of Finance of BorgWarner Transmissions Systems Inc. From June 2009 until August 2011, he was Vice President of Finance of BorgWarner Morse TEC Inc.

Dr. Demmerle has been Vice President of the Company and President and General Manager of BorgWarner TorqTransfer Systems Inc. since September 2012 and President and General Manager of BorgWarner PDS (Indiana) Inc. since December 2015. From July 2010 to September 2012, he was Vice President, Engine Control Electronics at Continental Automotive Systems.

Mr. Ericson has been Vice President of the Company and President and General Manager of BorgWarner Emissions Systems LLC (formerly known as BorgWarner Emissions Systems Inc.) since March 2014, at which time BorgWarner BERU Systems GmbH was combined with BorgWarner Emissions Systems Inc. He was Vice President of the Company and President and General Manager of BorgWarner BERU Systems GmbH and Emissions Systems Inc. from September 2011 until March 2014. He was Vice President and General Manager of BorgWarner Emissions Systems Inc. from April 2010 through August 2011.

Mr. Fadool has been Vice President of the Company and President and General Manager of BorgWarner Ithaca LLC (d/b/a BorgWarner Morse Systems) since July 2015. From May 2012 to July 2015, he was the Vice President of the Company and President and General Manager of BorgWarner Morse TEC Inc. He was Vice President of the Company and President and General Manager of BorgWarner TorqTransfer Systems Inc. from June 2011 until September 2012. He was Vice President and General Manager of BorgWarner TorqTransfer Systems Inc. from July 2010 until June 2011.

13

Mr. Gasparovic has been Vice President, General Counsel and Secretary of the Company since January 2007.

Ms. Jenett has been Vice President, Human Resources of the Company since September 2013. From July 2009 until September 2013, she was Vice President, Human Resources for BorgWarner Morse TEC Inc. and BorgWarner Thermal Systems Inc.

Mr. Kendrick has been Vice President of the Company and President and General Manager of BorgWarner Transmissions Systems LLC (formerly known as BorgWarner Transmissions Systems Inc.) since September 2011. From January 2011 until September 2011, he was President and Chief Executive Officer of Ruia Global Fasteners, a spin-off of Acument Global Technologies.

Mr. Lissalde has been Vice President of the Company and President and General Manager of BorgWarner Turbo Systems LLC (formerly known as BorgWarner Turbo Systems Inc.) since May 2013. From May 2011 until May 2013 he was Vice President of the Company and President and General Manager of BorgWarner Turbo Systems Passenger Car Products. He was Acting President and General Manager of BorgWarner Turbo Systems Passenger Car Products from March 2011 until May 2011. He was Vice President and General Manager for BorgWarner Turbo Systems Passenger Car from January 2010 until March 2011.

Mr. McGill has been Vice President and Treasurer of the Company since May 2012. He was Vice President of Finance of BorgWarner Turbo Systems Inc. from April 2010 until May 2012.

Mr. Paterra has been Vice President of the Company and President and General Manager of BorgWarner Thermal Systems Inc. since May 2013. From January 2010 to May 2013 he was Senior Director of Operations for the North American Metals Division of Cooper-Standard Holdings Inc.

Item 1A. Risk Factors

The following risk factors and other information included in this Annual Report on Form 10-K should be considered. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impact our business operations. If any of the following risks occur, our business including its financial performance, financial condition, operating results and cash flows could be adversely affected.

Risks related to our industry

Conditions in the automotive industry may adversely affect our business.

Our financial performance depends on conditions in the global automotive industry. Automotive and truck production and sales are cyclical and sensitive to general economic conditions and other factors including interest rates, consumer credit, and consumer spending and preferences. Economic declines that result in significant reduction in automotive or truck production would have an adverse effect on our sales to OEMs.

14

We face strong competition.

We compete worldwide with a number of other manufacturers and distributors that produce and sell products similar to ours. Price, quality, delivery, technological innovation, engineering development and program launch support are the primary elements of competition. Our competitors include vertically integrated units of our major OEM customers, as well as a large number of independent domestic and international suppliers. We are not as large as a number of these companies and do not have as many financial or other resources. Although OEMs have indicated that they will continue to rely on outside suppliers, a number of our major OEM customers manufacture products for their own uses that directly compete with our products. These OEMs could elect to manufacture such products for their own uses in place of the products we currently supply. The competitive environment has changed dramatically over the past few years as our traditional U.S. OEM customers, faced with intense international competition, have expanded their worldwide sourcing of components. As a result, we have experienced competition from suppliers in other parts of the world that enjoy economic advantages, such as lower labor costs, lower health care costs, lower tax rates and, in some cases, export or raw materials subsidies. Increased competition could adversely affect our business.

Risks related to our business

We are under substantial pressure from OEMs to reduce the prices of our products.

There is substantial and continuing pressure on OEMs to reduce costs, including costs of products we supply. Annual price reductions to OEM customers are a permanent component of our business. To maintain our profit margins, we seek price reductions from our suppliers, improved production processes to increase manufacturing efficiency, updated product designs to reduce costs and develop new products, the benefits of which support stable or increased prices. Our ability to pass through increased raw material costs to our OEM customers is limited, with cost recovery often less than 100% and often on a delayed basis. Inability to reduce costs in an amount equal to annual price reductions, increases in raw material costs, and increases in employee wages and benefits could have an adverse effect on our business.

We continue to face volatile costs of commodities used in the production of our products.

The Company uses a variety of commodities (including aluminum, copper, nickel, plastic resins, steel, other raw materials and energy) and materials purchased in various forms such as castings, powder metal, forgings, stampings and bar stock. Increasing commodity costs will have an impact on our results. We have sought to alleviate the impact of increasing costs by including a material pass-through provision in our customer contracts wherever possible and by selectively hedging certain commodity exposures. Customers frequently challenge these contractual provisions and rarely pay the full cost of any material increases. The discontinuation or lessening of our ability to pass-through or hedge increasing commodity costs could adversely affect our business.

From time to time, commodity prices may also fall rapidly. When this happens, suppliers may withdraw capacity from the market until prices improve which may cause periodic supply interruptions. The same may be true of our transportation carriers and energy providers. If these supply interruptions occur, it could adversely affect our business.

We use important intellectual property in our business. If we are unable to protect our intellectual property or if a third party makes assertions against us or our customers relating to intellectual property rights, our business could be adversely affected.

We own important intellectual property, including patents, trademarks, copyrights and trade secrets, and are involved in numerous licensing arrangements. Our intellectual property plays an important role in maintaining our competitive position in a number of the markets that we serve. Our competitors may develop

15

technologies that are similar or superior to our proprietary technologies or design around the patents we own or license. Further, as we expand our operations in jurisdictions where the enforcement of intellectual property rights is less robust, the risk of others duplicating our proprietary technologies increases, despite efforts we undertake to protect them. Developments or assertions by or against us relating to intellectual property rights, and any inability to protect or enforce these rights, could adversely affect our business and our competitive position.

We are subject to business continuity risks associated with increasing centralization of our information technology systems.

To improve efficiency and reduce costs, we have regionally centralized the information systems that support our business processes such as invoicing, payroll and general management operations. If the centralized systems are disrupted or disabled, key business processes could be interrupted, which could adversely affect our business.

A failure of our information technology (IT) infrastructure could adversely impact our business and operations.

We rely on the capacity, reliability and security of our IT systems and infrastructure. IT systems are vulnerable to disruptions, including those resulting from natural disasters, cyber-attacks or failures in third-party-provided services. Disruptions and attacks on our IT systems pose a risk to the security of our systems and our ability to protect our networks and the confidentiality, availability and integrity of our third-party data. As a result, such attacks or disruptions could potentially lead to the inappropriate disclosure of confidential information, including our intellectual property, improper use of our systems and networks, manipulation and destruction of data, production downtimes and both internal and external supply shortages. This could cause significant damage to our reputation, affect our relationships with our customers and suppliers, lead to claims against the Company and ultimately adversely affect our business.

Our business success depends on attracting and retaining qualified personnel.

Our ability to sustain and grow our business requires us to hire, retain and develop a highly skilled and diverse management team and workforce worldwide. Any unplanned turnover or inability to attract and retain key employees in numbers sufficient for our needs could adversely affect our business.

Part of our workforce is unionized which could subject us to work stoppages.

As of December 31, 2015, approximately 16% of our U.S. workforce was unionized. We have domestic collective bargaining agreements for one facility in New York, which expires in September 2016, and one facility in Oklahoma, which expires in March 2019. The workforce at certain of our international facilities is also unionized. A prolonged dispute with our employees could have an adverse effect on our business.

We are impacted by the rising cost of providing benefits and certain retirement benefit plans we sponsor are currently unfunded or underfunded.

We sponsor certain retirement benefit plans worldwide that are unfunded or underfunded and will require cash payments. If the performance of the assets in our funded pension plans do not meet our expectations, if medical costs continue to increase or actuarial assumptions are modified, our required cash payments may be higher than we expect.

16

We are subject to extensive environmental regulations.

Our operations are subject to laws governing, among other things, emissions to air, discharges to waters and the generation, handling, storage, transportation, treatment and disposal of waste and other materials. The operation of automotive parts manufacturing plants entails risks in these areas, and we cannot assure that we will not incur material costs or liabilities as a result. Through various acquisitions over the years, we have acquired a number of manufacturing facilities, and we cannot assure that we will not incur material costs and liabilities relating to activities that predate our ownership. In addition, potentially significant expenditures could be required in order to comply with evolving environmental, health and safety laws that may be adopted in the future. Costs associated with failure to comply with environmental regulations could have an adverse effect on our business.

We have liabilities related to environmental, product warranties, litigation and other claims.

We and certain of our current and former direct and indirect corporate predecessors, subsidiaries and divisions have been identified by the United States Environmental Protection Agency and certain state environmental agencies and private parties as potentially responsible parties at various hazardous waste disposal sites under the Comprehensive Environmental Response, Compensation and Liability Act and equivalent state laws.

We provide product warranties to our customers for some of our products. Under these product warranties, we may be required to bear costs and expenses for the repair or replacement of these products. We cannot assure that costs and expenses associated with these product warranties will not be material, or that those costs will not exceed any amounts accrued for such product warranties in our financial statements.

We are currently, and may in the future become, subject to legal proceedings and commercial or contractual disputes. These claims typically arise in the normal course of business and may include, but not be limited to, commercial or contractual disputes with our customers and suppliers, intellectual property matters, personal injury, product liability (including claims associated with the presence of asbestos in historical products), environmental and employment claims. There is a possibility that such claims may have an adverse impact on our business that is greater than we anticipate. While the Company maintains insurance for certain risks, the amount of insurance may not be adequate to cover all insured claims and liabilities. The incurring of significant liabilities for which there is no, or insufficient, insurance coverage could adversely affect our business.

Compliance with and changes in laws could be costly and could affect operating results. In addition, government disruptions could negatively impact our ability to conduct our business.

We have operations in multiple countries that can be impacted by expected and unexpected changes in the legal and business environments in which we operate. Compliance related issues in certain countries associated with laws such as the Foreign Corrupt Practices Act and other anti-corruption laws could also adversely affect our business.

Changes that could impact the legal environment include new legislation, new regulations, new policies, investigations and legal proceedings and new interpretations of existing legal rules and regulations, in particular, changes in import and export control laws or exchange control laws, additional restrictions on doing business in countries subject to sanctions, and changes in laws in countries where we operate or intend to operate. In addition, government disruptions, such as government shutdowns, may delay or halt the granting and renewal of permits, licenses and other items required by us and our customers to conduct our business.

17

Changes in tax laws or tax rates taken by taxing authorities and tax audits could adversely affect our business.

Changes in tax laws or tax rates, the resolution of tax assessments or audits by various tax authorities, and the ability to fully utilize our tax loss carryforwards and tax credits could adversely affect our operating results. In addition, we may periodically restructure our legal entity organization.

If taxing authorities were to disagree with our tax positions in connection with any such restructurings, our effective tax rate could be materially affected. Our tax filings for various periods are subject to audit by the tax authorities in most jurisdictions where we conduct business. We have received tax assessments from various taxing authorities and are currently at varying stages of appeals and/or litigation regarding these matters. These audits may result in assessment of additional taxes that are resolved with the authorities or through the courts. We believe these assessments may occasionally be based on erroneous and even arbitrary interpretations of local tax law. Resolution of any tax matters involves uncertainties and there are no assurances that the outcomes will be favorable.

Our growth strategy may prove unsuccessful.

We have a stated goal of increasing sales and operating income at a rate greater than global vehicle production by increasing content per vehicle with innovative new components and through select acquisitions.

We may not meet our goal because of any of the following, or other factors: (a) the failure to develop new products that will be purchased by our customers; (b) technology changes rendering our products obsolete; and (c) a reversal of the trend of supplying systems (which allows us to increase content per vehicle) instead of components.

We expect to continue to pursue business ventures, acquisitions, and strategic alliances that leverage our technology capabilities, enhance our customer base, geographic representation, and scale to complement our current businesses and we regularly evaluate potential growth opportunities, some of which could be material. While we believe that such transactions are an integral part of our long-term strategy, there are risks and uncertainties related to these activities. Assessing a potential growth opportunity involves extensive due diligence. However, the amount of information we can obtain about a potential growth opportunity may be limited, and we can give no assurance that past or future business ventures, acquisitions, and strategic alliances will positively affect our financial performance or will perform as planned. We may not be able to successfully assimilate or integrate companies that we have acquired or acquire in the future, including their personnel, financial systems, distribution, operations and general operating procedures. The integration of companies that we have acquired or acquire in the future may be more difficult, time consuming or costly than expected. Revenues following the acquisition of a company may be lower than expected, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, or suppliers) may be greater than expected and the retention of key employees at the acquired company may not be achieved. We may also encounter challenges in achieving appropriate internal control over financial reporting in connection with the integration of an acquired company. If we fail to assimilate or integrate acquired companies successfully, our business, reputation and operating results could be adversely affected. Likewise, our failure to integrate and manage acquired companies successfully may lead to future impairment of any associated goodwill and intangible asset balances. Failure to execute our growth strategy could adversely affect our business.

18

We are subject to risks related to our international operations.

We have manufacturing and technical facilities in many regions including Europe, Asia, the Americas and Africa. For 2015, approximately 75% of our consolidated net sales were outside the U.S. Consequently, our results could be affected by changes in trade, monetary and fiscal policies, trade restrictions or prohibitions, import or other charges or taxes, fluctuations in foreign currency exchange rates, limitations on the repatriation of funds, changing economic conditions, unreliable intellectual property protection and legal systems, insufficient infrastructures, social unrest, political instability and disputes, and international terrorism. Compliance with multiple and potentially conflicting laws and regulations of various countries is challenging, burdensome and expensive.

The financial statements of foreign subsidiaries are translated to U.S. dollars using the period-end exchange rate for assets and liabilities and an average exchange rate for each period for revenues, expenses and capital expenditures. The local currency is the functional currency for substantially all of the Company's foreign subsidiaries. Significant foreign currency fluctuations and the associated translation of those foreign currencies could adversely affect our business.

Our business in China is subject to aggressive competition and is sensitive to economic, political and market conditions.

Maintaining a strong position in the Chinese market is a key component of our global growth strategy. The automotive supply market in China is highly competitive, with competition from many of the largest global manufacturers and numerous smaller domestic manufacturers. As the Chinese market evolves, we anticipate that market participants will act aggressively to increase or maintain their market share. Increased competition may result in price reductions, reduced margins and our inability to gain or hold market share. In addition, our business in China is sensitive to economic, political and market conditions that drive sales volume in China. If we are unable to maintain our position in the Chinese market or if vehicle sales in China decrease, our business and financial results could be adversely affected.

A downgrade in the ratings of our debt could restrict our ability to access the debt capital markets.

Changes in the ratings that rating agencies assign to our debt may ultimately impact our access to the debt capital markets and the costs we incur to borrow funds. If ratings for our debt fall below investment grade, our access to the debt capital markets could become restricted.

Our revolving credit agreement includes an increase in interest rates if the ratings for our debt are downgraded. The interest costs on our revolving credit agreement are based on a rating grid agreed to in our credit agreement. Further, an increase in the level of our indebtedness and related interest costs may increase our vulnerability to adverse general economic and industry conditions and may affect our ability to obtain additional financing.

We could incur additional restructuring charges as we continue to execute actions in an effort to improve future profitability and competitiveness and may not achieve the anticipated savings and benefits from these actions.

We have and may continue to initiate restructuring actions designed to improve future profitability and competitiveness, enhance treasury management flexibility or create an optimal legal entity structure. We may not realize anticipated savings or benefits from past or future actions in full or in part or within the time periods we expect. We are also subject to the risks of labor unrest, negative publicity and business disruption in connection with our actions. Failure to realize anticipated savings or benefits from our actions could have an adverse effect on our business.

19

Risks related to our customers

We rely on sales to major customers.

We rely on sales to OEMs around the world of varying credit quality and manufacturing demands. Supply to several of these customers requires significant investment by the Company. We base our growth projections, in part, on commitments made by our customers. These commitments generally renew yearly during a program life cycle. If actual production orders from our customers do not approximate such commitments due to a variety of factors including non-renewal of purchase orders, a customer's financial hardship or other unforeseen reasons, it could adversely affect our business.

Some of our sales are concentrated. Our worldwide sales in 2015 to Volkswagen and Ford constituted approximately 15% each of our 2015 consolidated net sales.

We are sensitive to the effects of our major customers’ labor relations.

All three of our primary North American customers, Ford, Fiat Chrysler Automobiles and General Motors, have major union contracts with the United Automobile, Aerospace and Agricultural Implement Workers of America. Because of domestic OEMs' dependence on a single union, we are affected by labor difficulties and work stoppages at OEMs' facilities. Similarly, a majority of our global customers' operations outside of North America are also represented by various unions. Any extended work stoppage could have an adverse effect on our business.

Risks related to our suppliers

We could be adversely affected by supply shortages of components from our suppliers.

In an effort to manage and reduce the cost of purchased goods and services, we have been rationalizing our supply base. As a result, we are dependent on fewer sources of supply for certain components used in the manufacture of our products. The Company selects suppliers based on total value (including total landed price, quality, delivery, and technology), taking into consideration their production capacities and financial condition. We expect that they will deliver to our stated written expectations.

However, there can be no assurance that capacity limitations, labor unrest, weather emergencies, commercial disputes, government actions, riots, wars, sabotage, cyber attacks, non-conforming parts, acts of terrorism, “Acts of God," or other problems experienced by our suppliers will not result in occasional shortages or delays in their supply of components to us. If we were to experience a significant or prolonged shortage of critical components from any of our suppliers and could not procure the components from other sources, we would be unable to meet the production schedules for some of our key products and could miss customer delivery expectations. This could adversely affect our customer relations and business.

Suppliers’ economic distress could result in the disruption of our operations and could adversely affect our business.

Rapidly changing industry conditions such as volatile production volumes; credit tightness; changes in foreign currencies; raw material, commodity, transportation, and energy price escalation; drastic changes in consumer preferences; and other factors could adversely affect our supply chain, and sometimes with little advanced notice. These conditions could also result in increased commercial disputes and supply interruption risks. In certain instances, it would be difficult and expensive for us to change suppliers that are critical to our business. On occasion, we must provide financial support to distressed suppliers or take other measures to protect our supply lines. We cannot predict with certainty the potential adverse effects these costs might have on our business.

20

We are subject to possible insolvency of outsourced service providers.

The Company relies on third party service providers for administration of legal claims, health care benefits, pension benefits, stockholder and bondholder registration and other services. These service providers contribute to the efficient conduct of the Company's business. Insolvency of one or more of these service providers could adversely affect our business.

We are subject to possible insolvency of financial counterparties.

The Company engages in numerous financial transactions and contracts including insurance policies, letters of credit, credit line agreements, financial derivatives, and investment management agreements involving various counterparties. The Company is subject to the risk that one or more of these counterparties may become insolvent and therefore be unable to meet its obligations under such contracts.

Other risks

A variety of other factors could adversely affect our business.

Any of the following could materially and adversely affect our business: the loss of or changes in supply contracts or sourcing strategies of our major customers or suppliers; start-up expenses associated with new vehicle programs or delays or cancellation of such programs, utilization of our manufacturing facilities, which can be dependent on a single product line or customer; inability to recover engineering and tooling costs; market and financial consequences of recalls that may be required on products we supplied; delays or difficulties in new product development; the possible introduction of similar or superior technologies by others; global excess capacity and vehicle platform proliferation; and the impact of fire, flood or other natural disasters.

Item 1B. | Unresolved Staff Comments |

The Company has received no written comments regarding its periodic or current reports from the staff of the Securities and Exchange Commission that were issued 180 days or more preceding the end of its 2015 fiscal year that remain unresolved.

21

Item 2. | Properties |

As of December 31, 2015, the Company had 74 manufacturing, assembly, and technical locations worldwide. In addition to its 20 U.S. locations, the Company had nine locations in China; eight locations in Germany; seven locations in South Korea; six locations in India; five locations in Mexico; three locations in each of Brazil, Hungary and Japan; and one location in each of Canada, France, Ireland, Italy, Poland, Portugal, Spain, Sweden, Tunisia and the United Kingdom. Individual locations may design or manufacture for both operating segments. The Company also has several sales offices, warehouses and technical centers. The Company's worldwide headquarters are located in a leased facility in Auburn Hills, Michigan. In general, the Company believes its facilities to be suitable and adequate to meet its current and reasonably anticipated needs.

The following is additional information concerning principal manufacturing, assembly, and technical facilities operated by the Company, its subsidiaries, and affiliates.

ENGINE(a)

Americas | Europe | Asia | ||

Asheville, North Carolina | Arcore, Italy | Aoyama, Japan | ||

Auburn Hills, Michigan (d) | Bradford, England | Chennai, India (b) | ||

Cadillac, Michigan | Esslingen, Germany | Chungju-City, South Korea | ||

Dixon, Illinois | Kirchheimbolanden, Germany | Jiangsu, China (b) | ||

El Salto Jalisco, Mexico | Ludwigsburg, Germany | Kakkalur, India | ||

Fletcher, North Carolina | Markdorf, Germany | Manesar, India (b) | ||

Itatiba, Brazil | Muggendorf, Germany | Nabari City, Japan | ||

Ithaca, New York | Oberboihingen, Germany | Ningbo, China (b) (c) | ||

Marshall, Michigan | Oroszlany, Hungary (d) | Pune, India (c) (d) | ||

Piracicaba, Brazil | Rzeszow, Poland (d) | Pyongtaek, South Korea (b) (c) | ||

Ramos, Mexico | Tralee, Ireland | |||

Viana de Castelo, Portugal | ||||

Vigo, Spain | ||||

DRIVETRAIN(a)

Americas | Europe and Africa | Asia | |||

Addison, Illinois (b) | Livonia, Michigan | Arnstadt, Germany | Beijing, China (b) | ||

Anderson, Indiana (b) | Pendleton, Indiana (b) | Heidelberg, Germany | Dae-Gu, South Korea (b) | ||

Bay Shore, New York (b) | Peru, Indiana (b) | Jemmal, Tunisia (b) | Dalian, China (b) | ||

Bellwood, Illinois | Piedras Negras, Mexico (b) | Landskrona, Sweden (b) | Eumsung, South Korea | ||

Brusque, Brazil (b) | San Luis Potosi, Mexico (b) | Mezokovesd, Hungary | Fukuroi City, Japan | ||

Edmond, Oklahoma (b) | Seneca, South Carolina | Mikoic, Hungary (b) | Jingzhou City, China (b) | ||

Frankfort, Illinois | Twinsburg, Ohio (b) | Tulle, France | Kyungsangman, South Korea | ||

Irapuato, Mexico | Water Valley, Mississippi | Ochang, South Korea (b) | |||

Laredo, Texas (b) | Winnipeg, Canada (b) | Shanghai, China (b) | |||

Sirsi, India | |||||

Tianjin, China (b) | |||||

Wuhan, China (b) | |||||

________________

(a) | The table excludes joint ventures owned less than 50% and administrative offices. |

(b) | Indicates leased land rights or a leased facility. |

(c) | City has 2 locations: a wholly owned subsidiary and a joint venture. |

(d) | Location serves both segments. |

22

Item 3. | Legal Proceedings |

The Company is subject to a number of claims and judicial and administrative proceedings (some of which involve substantial amounts) arising out of the Company’s business or relating to matters for which the Company may have a contractual indemnity obligation. See Note 14, "Contingencies," to the Consolidated Financial Statements in Item 8 of this report for a discussion of environmental, product liability and other litigation, which is incorporated herein by reference.

Item 4. | Mine Safety Disclosures |

Not applicable.

PART II

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

The Company's common stock is listed for trading on the New York Stock Exchange under the symbol BWA. As of February 5, 2016, there were 1,796 holders of record of Common Stock.

On July 24, 2013 the Company announced the reinstatement of its quarterly dividend. Cash dividends declared and paid per share, adjusted for the stock split in December 2013, were as follows:

2015 | 2014 | 2013 | 2012 | 2011 | ||||||||||||||||

Dividend amount | $ | 0.52 | $ | 0.51 | $ | 0.25 | $ | — | $ | — | ||||||||||

While the Company currently expects that comparable quarterly cash dividends will continue to be paid in the future, the dividend policy is subject to review and change at the discretion of the Board of Directors.

High and low prices (as reported on the New York Stock Exchange composite tape) for the Company's common stock for each quarter in 2014 and 2015 were:

Quarter Ended | High | Low | |||||

March 31, 2014 | $ | 62.42 | $ | 51.32 | |||

June 30, 2014 | $ | 66.16 | $ | 59.06 | |||

September 30, 2014 | $ | 67.38 | $ | 52.61 | |||

December 31, 2014 | $ | 58.75 | $ | 50.24 | |||

March 31, 2015 | $ | 63.01 | $ | 50.46 | |||

June 30, 2015 | $ | 62.08 | $ | 56.84 | |||

September 30, 2015 | $ | 57.65 | $ | 38.89 | |||

December 31, 2015 | $ | 45.53 | $ | 39.82 | |||

23

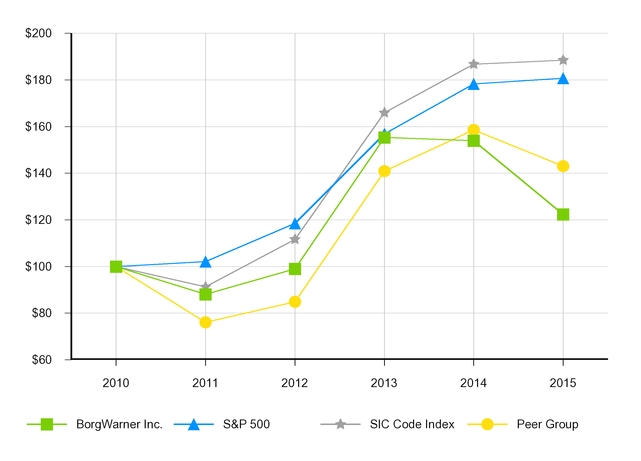

The line graph below compares the cumulative total shareholder return on our Common Stock with the cumulative total return of companies on the Standard & Poor's (S&P's) 500 Stock Index, companies within our peer group (as selected by the Company) and companies within Standard Industrial Code (“SIC”) 3714 - Motor Vehicle Parts.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among BorgWarner Inc., the S&P 500 Index,

SIC 3714 Motor Vehicle Parts and a Peer Group

___________

*$100 invested on 12/31/2010 in stock or index, including reinvestment of dividends. Fiscal year ending December 31.

Copyright© 2015 S&P, a division of The McGraw-Hill Companies Inc. All rights reserved.

BWA, S&P 500 and Peer Group data are from Capital IQ; SIC Code Index data are from Research Data Group

December 31, | ||||||||||||||||||

2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |||||||||||||

BorgWarner Inc.(1) | $ | 100.00 | $ | 88.09 | $ | 98.98 | $ | 155.31 | $ | 153.97 | $ | 122.38 | ||||||

S&P 500(2) | 100.00 | 102.11 | 118.45 | 156.82 | 178.29 | 180.75 | ||||||||||||

SIC Code Index(3) | 100.00 | 91.24 | 111.67 | 165.93 | 186.80 | 188.51 | ||||||||||||

Peer Group(4) | 100.00 | 76.02 | 84.86 | 140.92 | 158.58 | 143.08 | ||||||||||||

________________

(1)BorgWarner Inc.

(2)S&P 500 — Standard & Poor’s 500 Total Return Index

(3)Standard Industrial Code (“SIC”) 3714-Motor Vehicle Parts

(4)Selected Peer Group Companies — Consists of the following companies:

American Axle & Manufacturing Holdings, Inc., Autoliv, Inc., Gentex Corporation, Johnson Controls, Inc., Lear Corporation, Magna International Inc., Meritor, Inc., Modine Manufacturing Company, Tenneco Inc. and Visteon Corporation

24

Purchase of Equity Securities

In February 2015, the Company's Board of Directors authorized the purchase of up to $1.0 billion of the Company's common stock over three years. The Company's Board of Directors has authorized the purchase of up to 69.6 million shares of the Company's common stock in the aggregate. As of December 31, 2015, the Company had repurchased 59,073,460 shares in the aggregate under the Common Stock Repurchase Program. All shares purchased under this authorization have been and will continue to be repurchased in the open market at prevailing prices and at times and in amounts to be determined by management as market conditions and the Company's capital position warrant. The Company may use Rule 10b5-1 and 10b-18 plans to facilitate share repurchases. Repurchased shares will be deemed common stock held in treasury and may subsequently be reissued for general corporate purposes.

Employee transactions include restricted shares withheld to offset statutory minimum tax withholding that occurs upon vesting of restricted shares. The BorgWarner Inc. Amended and Restated 2004 Stock Incentive Plan and the BorgWarner Inc. 2014 Stock Incentive Plan provide that the withholding obligations be settled by the Company retaining stock that is part of the Award. Withheld shares will be deemed common stock held in treasury and may subsequently be reissued for general corporate purposes.

The following table provides information about the Company's purchases of its equity securities that are registered pursuant to Section 12 of the Exchange Act during the quarter ended December 31, 2015:

Issuer Purchases of Equity Securities | |||||||||||||

Period | Total number of shares purchased | Average price per share | Total number of shares purchased as part of publicly announced plans or programs | Maximum number of shares that may yet be purchased under the plans or programs | |||||||||

Month Ended October 31, 2015 | |||||||||||||

Common Stock Repurchase Program | 661,000 | $ | 43.44 | 661,000 | 15,260,117 | ||||||||

Employee transactions | — | $ | — | — | |||||||||

Month Ended November 30, 2015 | |||||||||||||

Common Stock Repurchase Program | 2,233,443 | $ | 42.04 | 2,233,443 | 13,026,674 | ||||||||

Employee transactions | — | $ | — | — | |||||||||

Month Ended December 31, 2015 | |||||||||||||