a50455617.htm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

x

|

Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| |

|

For the quarterly period ended September 30, 2012

|

| |

|

Or

|

| |

|

o

|

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

| |

|

For the transition period from to .

|

| |

Commission File No. 000-24537

|

DYAX CORP.

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

Delaware

|

|

04-3053198

|

|

(State of Incorporation)

|

|

(I.R.S. Employer Identification Number)

|

|

55 Network Drive, Burlington, MA 01803

|

|

(Address of Principal Executive Offices)

|

|

(617) 225-2500

|

|

(Registrant’s Telephone Number, including Area Code)

|

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

YES x NO o

Indicate by check mark whether the registrant has submitted electronically and posted on it corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files).

YES x NO o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definitions of "accelerated filer", "large accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer x Non-accelerated filer o Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

YES o NO x

Number of shares outstanding of Dyax Corp.’s Common Stock, par value $0.01, as of October 18, 2012:99,195,806

DYAX CORP.

TABLE OF CONTENTS

PART I – FINANCIAL INFORMATION

Item 1 – FINANCIAL STATEMENTS

Dyax Corp. and Subsidiaries

Consolidated Balance Sheets (Unaudited)

| |

|

September 30,

2012

|

|

|

December 31,

2011

|

|

| |

|

(In thousands, except share data)

|

|

|

ASSETS

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

21,346 |

|

|

$ |

31,468 |

|

|

Short-term investments

|

|

|

9,043 |

|

|

|

26,036 |

|

|

Accounts receivable, net of allowances for doubtful accounts of $45 and $115 at September 30, 2012 and December 31, 2011, respectively

|

|

|

7,490 |

|

|

|

6,092 |

|

|

Inventory

|

|

|

3,838 |

|

|

|

2,121 |

|

|

Current portion of restricted cash

|

|

|

— |

|

|

|

1,266 |

|

|

Other current assets

|

|

|

2,314 |

|

|

|

4,968 |

|

|

Total current assets

|

|

|

44,031 |

|

|

|

71,951 |

|

|

Fixed assets, net

|

|

|

5,288 |

|

|

|

4,881 |

|

|

Restricted cash

|

|

|

1,100 |

|

|

|

1,100 |

|

|

Other assets

|

|

|

6,742 |

|

|

|

5,443 |

|

|

Total assets

|

|

$ |

57,161 |

|

|

$ |

83,375 |

|

|

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses

|

|

$ |

10,949 |

|

|

$ |

15,318 |

|

|

Current portion of deferred revenue

|

|

|

5,943 |

|

|

|

6,637 |

|

|

Current portion of long-term obligations

|

|

|

399 |

|

|

|

101 |

|

|

Other current liabilities

|

|

|

— |

|

|

|

1,709 |

|

|

Total current liabilities

|

|

|

17,291 |

|

|

|

23,765 |

|

|

Deferred revenue

|

|

|

6,906 |

|

|

|

9,265 |

|

|

Notes payable

|

|

|

77,191 |

|

|

|

75,372 |

|

|

Long-term obligations

|

|

|

1,045 |

|

|

|

— |

|

|

Deferred rent and other long-term liabilities

|

|

|

3,087 |

|

|

|

2,372 |

|

|

Total liabilities

|

|

|

105,520 |

|

|

|

110,774 |

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

|

Stockholders' deficit:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value; 1,000,000 shares authorized; 0 shares issued and outstanding

|

|

|

— |

|

|

|

— |

|

|

Common stock, $0.01 par value; 200,000,000 shares authorized;

99,140,550 and 98,798,065 shares issued and outstanding at September 30, 2012 and December 31, 2011, respectively

|

|

|

991 |

|

|

|

988 |

|

|

Additional paid-in capital

|

|

|

451,996 |

|

|

|

448,527 |

|

|

Accumulated deficit

|

|

|

(501,352 |

) |

|

|

(476,921 |

) |

|

Accumulated other comprehensive income

|

|

|

6 |

|

|

|

7 |

|

|

Total stockholders' deficit

|

|

|

(48,359 |

) |

|

|

(27,399 |

) |

|

Total liabilities and stockholders' deficit

|

|

$ |

57,161 |

|

|

$ |

83,375 |

|

The accompanying notes are an integral part of the unaudited consolidated financial statements.

Dyax Corp. and Subsidiaries Consolidated Statements of Operations and Comprehensive Loss (Unaudited)

| |

|

Three Months Ended

September 30,

|

|

|

Nine Months Ended

September 30,

|

|

| |

|

2012

|

|

|

2011

|

|

|

2012

|

|

|

2011

|

|

| |

|

(In thousands, except share and per share data)

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product sales, net

|

|

$ |

10,814 |

|

|

$ |

6,597 |

|

|

$ |

27,988 |

|

|

$ |

15,888 |

|

|

Development and license fee revenues

|

|

|

2,287 |

|

|

|

3,535 |

|

|

|

10,632 |

|

|

|

24,333 |

|

|

Total revenues, net

|

|

|

13,101 |

|

|

|

10,132 |

|

|

|

38,620 |

|

|

|

40,221 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of product sales

|

|

|

493 |

|

|

|

260 |

|

|

|

1,447 |

|

|

|

781 |

|

|

Research and development expenses

|

|

|

6,158 |

|

|

|

8,659 |

|

|

|

22,664 |

|

|

|

26,238 |

|

|

Selling, general and administrative expenses

|

|

|

9,117 |

|

|

|

8,790 |

|

|

|

29,872 |

|

|

|

27,120 |

|

|

Restructuring costs

|

|

|

— |

|

|

|

— |

|

|

|

1,440 |

|

|

|

— |

|

|

Total costs and expenses

|

|

|

15,768 |

|

|

|

17,709 |

|

|

|

55,423 |

|

|

|

54,139 |

|

|

Income (loss) from operations

|

|

|

(2,667 |

) |

|

|

(7,577 |

) |

|

|

(16,803 |

) |

|

|

(13,918 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

5 |

|

|

|

382 |

|

|

|

22 |

|

|

|

544 |

|

|

Interest and other expenses

|

|

|

(2,548 |

) |

|

|

(2,528 |

) |

|

|

(7,650 |

) |

|

|

(7,690 |

) |

|

Total other expense

|

|

|

(2,543 |

) |

|

|

(2,146 |

) |

|

|

(7,628 |

) |

|

|

(7,146 |

) |

|

Net loss

|

|

|

(5,210 |

) |

|

|

(9,723 |

) |

|

|

(24,431 |

) |

|

|

(21,064 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain (loss) on investments

|

|

|

4 |

|

|

|

(27 |

) |

|

|

(1 |

) |

|

|

(18 |

) |

|

Comprehensive loss

|

|

$ |

(5,206 |

) |

|

$ |

(9,750 |

) |

|

$ |

(24,432 |

) |

|

$ |

(21,082 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per share

|

|

$ |

(0.05 |

) |

|

$ |

(0.10 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.21 |

) |

|

Shares used in computing basic and diluted net loss per share

|

|

|

99,069,928 |

|

|

|

98,748,086 |

|

|

|

98,896,984 |

|

|

|

98,720,137 |

|

The accompanying notes are an integral part of the unaudited consolidated financial statements.

Dyax Corp. and Subsidiaries Consolidated Statements of Cash Flows (Unaudited)

| |

|

Nine Months Ended September 30,

|

|

| |

|

2012

|

|

|

2011

|

|

| |

|

(In thousands)

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(24,431 |

) |

|

$ |

(21,064 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Amortization of purchased premium/discount

|

|

|

49 |

|

|

|

190 |

|

|

Depreciation and amortization of fixed assets and intangible assets

|

|

|

826 |

|

|

|

973 |

|

|

Non-cash interest expense

|

|

|

1,915 |

|

|

|

1,612 |

|

|

Compensation expenses associated with stock-based compensation plans

|

|

|

2,775 |

|

|

|

3,110 |

|

|

Provision for doubtful accounts

|

|

|

(35 |

) |

|

|

10 |

|

|

Gain on sale of fixed assets

|

|

|

(110 |

) |

|

|

— |

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(1,363 |

) |

|

|

(1,485 |

) |

|

Other current assets

|

|

|

2,654 |

|

|

|

271 |

|

|

Inventory

|

|

|

(3,130 |

) |

|

|

(5,075 |

) |

|

Other long-term assets

|

|

|

151 |

|

|

|

(247 |

) |

|

Accounts payable and accrued expenses

|

|

|

(3,589 |

) |

|

|

(1,540 |

) |

|

Deferred revenue

|

|

|

(3,053 |

) |

|

|

(4,010 |

) |

|

Long-term deferred rent

|

|

|

715 |

|

|

|

(30 |

) |

|

Net cash used in operating activities

|

|

|

(26,626 |

) |

|

|

(27,285 |

) |

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Purchase of investments

|

|

|

(6,057 |

) |

|

|

(3,021 |

) |

|

Proceeds from maturity of investments

|

|

|

23,000 |

|

|

|

28,502 |

|

|

Purchase of fixed assets

|

|

|

(3,834 |

) |

|

|

(236 |

) |

|

Restricted cash

|

|

|

1,266 |

|

|

|

(178 |

) |

|

Proceeds from sale of fixed assets

|

|

|

200 |

|

|

|

— |

|

|

Net cash provided by investing activities

|

|

|

14,575 |

|

|

|

25,067 |

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Net proceeds from sale of common stock

|

|

|

— |

|

|

|

323 |

|

|

Repayment of long-term obligations

|

|

|

(135 |

) |

|

|

(1,584 |

) |

|

Proceeds from long-term obligations

|

|

|

1,382 |

|

|

|

— |

|

|

Proceeds from the issuance of common stock under employee stock purchase plan and exercise of stock options

|

|

|

682 |

|

|

|

159 |

|

|

Net cash provided by (used in) financing activities

|

|

|

1,929 |

|

|

|

(1,102 |

) |

|

Net decrease in cash and cash equivalents

|

|

|

(10,122 |

) |

|

|

(3,320 |

) |

|

Cash and cash equivalents at beginning of the period

|

|

|

31,468 |

|

|

|

18,601 |

|

|

Cash and cash equivalents at end of the period

|

|

$ |

21,346 |

|

|

$ |

15,281 |

|

|

Supplemental disclosure of cash flow information:

|

|

|

|

|

|

|

|

|

|

Interest paid

|

|

$ |

7,431 |

|

|

$ |

6,923 |

|

The accompanying notes are an integral part of the unaudited consolidated financial statements.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

1. BUSINESS OVERVIEW

Dyax Corp. (Dyax or the Company) is a biopharmaceutical company with two business elements:

The principal focus of the Company's efforts is to identify, develop and commercialize treatments for angioedemas that are identified as plasma kallikrein (bradykinin) mediated (PKM), including hereditary angioedema (HAE) and idiopathic angioedema.

The Company developed KALBITOR® (ecallantide) on its own and since February 2010, the Company has been selling it in the United States for the treatment of acute attacks of HAE. Outside of the United States, the Company has established partnerships to obtain regulatory approval for and to commercialize KALBITOR in certain markets and is evaluating opportunities in others.

The Company is expanding its franchise for the treatment of angioedemas in the following ways:

| ● |

Identifying diagnostic strategies to assist in the differentiation between histamine-mediated and plasma kallikrein (bradykinin) mediated angioedema, including development of a laboratory test. |

| ● |

Continuing the development of DX-2930, a fully human monoclonal antibody inhibitor of plasma kallikrein, which could be a candidate to prophylactically treat PKM angioedemas. |

|

●

|

Phage Display Licensing and Funded Research Program

|

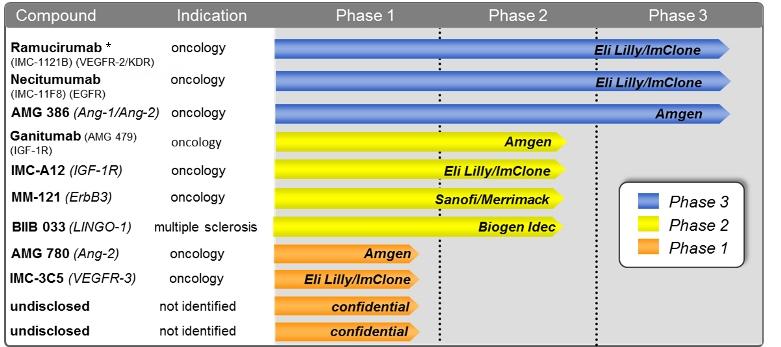

The Company leverages its proprietary phage display technology through its Licensing and Funded Research Program, referred to as the LFRP. This program has provided the Company a portfolio of product candidates being developed by its licensees, which currently includes 18 product candidates in various stages of clinical development, including three in Phase 3 trials. The LFRP generated revenue of approximately $15 million in 2011 and $9 million for the nine months ended September 30, 2012. To the extent that the Company’s licensees commercialize some of the Phase 3 product candidates, milestone and royalty revenues under the LFRP are expected to experience significant growth.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying unaudited interim consolidated financial statements have been prepared by the Company in accordance with accounting principles generally accepted in the United States of America (GAAP) for interim financial information. It is management’s opinion that the accompanying unaudited interim consolidated financial statements reflect all adjustments (which are normal and recurring) necessary for a fair statement of the results for the interim periods. The financial statements should be read in conjunction with the consolidated financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011. The accompanying December 31, 2011 consolidated balance sheet was derived from audited financial statements, but does not include all disclosures required by GAAP.

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect (i) the reported amounts of assets and liabilities, (ii) disclosure of contingent assets and liabilities at the dates of the financial statements and (iii) the reported amounts of revenue and expenses during the reporting periods. Actual results could differ from those estimates. The results of operations for the three and nine months ended September 30, 2012 are not necessarily indicative of the results that may be expected for the year ending December 31, 2012.

Basis of Consolidation

The accompanying consolidated financial statements include the accounts of the Company and the Company's European subsidiaries Dyax S.A. and Dyax BV. All inter-company accounts and transactions have been eliminated.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make certain estimates and assumptions that affect the amounts of assets and liabilities reported and disclosure of contingent assets and liabilities at the dates of the financial statements and the reported amounts of revenue and expenses during the reporting periods. The significant estimates and assumptions in these financial statements include revenue recognition, product sales allowances, useful lives with respect to long lived assets, valuation of stock options, accrued expenses and tax valuation reserves. Actual results could differ from those estimates.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to concentrations of credit risk consist principally of cash, cash equivalents, short-term investments and trade accounts receivable. At September 30, 2012 and December 31, 2011, approximately 92% and 61% of the Company's cash, cash equivalents and short-term investments were invested in money market funds backed by U.S. Treasury obligations, U.S. Treasury notes and bills, and obligations of United States government agencies held by one financial institution. The Company maintains balances in various operating accounts in excess of federally insured limits.

The Company provides most of its services and licenses its technology to pharmaceutical and biomedical companies worldwide, and makes all product sales to its distributors. Concentrations of credit risk with respect to trade receivable balances are usually limited on an ongoing basis, due to the diverse number of licensees and collaborators comprising the Company's customer base. As of September 30, 2012, two customers accounted for 45% and 33% of the accounts receivable balance. These two customers also accounted for approximately 43% and 34% of the Company's accounts receivable balance as of December 31, 2011, all of which were collected in the first quarter of 2012.

Cash and Cash Equivalents

All highly liquid investments purchased with an original maturity of ninety days or less are considered to be cash equivalents. Cash and cash equivalents consist principally of cash, money market and U.S. Treasury funds.

Investments

Short-term investments primarily consist of investments with original maturities greater than ninety days and remaining maturities less than one year at period end. The Company has also classified its investments with maturities beyond one year as short-term, based on their highly liquid nature and because such marketable securities represent the investment of cash that is available for current operations. The Company considers its investment portfolio of investments available-for-sale. Accordingly, these investments are recorded at fair value, which is based on quoted market prices. As of September 30, 2012, the Company's investments consisted of U.S. Treasury notes and bills with an amortized cost and estimated fair value of $27.9 million, and had an unrealized gain of $6,000. As of December 31, 2011, the Company's investments consisted of United States Treasury notes and bills with an estimated fair value and amortized cost of $34.9 million, and had an unrealized gain of $7,000, which is recorded in other comprehensive income on the accompanying consolidated balance sheet.

Inventories

Inventories are stated at the lower of cost or market with cost determined under the first-in, first-out, or FIFO, basis. The Company evaluates inventory levels and would write-down inventory that is expected to expire prior to being sold, inventory that has a cost basis in excess of its expected net realizable value, inventory in excess of expected sales requirements, or inventory that fails to meet commercial sale specifications, through a charge to cost of product sales. Included in the cost of inventory are employee stock-based compensation costs capitalized under Accounting Standards Codification (ASC) 718.

Fixed Assets

Property and equipment are recorded at cost and depreciated over the estimated useful lives of the related assets using the straight-line method. Laboratory and production equipment, furniture and office equipment are depreciated over a three to seven year period. Leasehold improvements are stated at cost and are amortized over the lesser of the non-cancelable term of the related lease or their estimated useful lives. Leased equipment is amortized over the lesser of the life of the lease or their estimated useful lives. Maintenance and repairs are charged to expense as incurred. When assets are retired or otherwise disposed of, the cost of these assets and related accumulated depreciation and amortization are eliminated from the balance sheet and any resulting gains or losses are included in operations in the period of disposal.

The Company records all proceeds received from the lessor for tenant improvements under the terms of its operating lease as deferred rent. These amounts are amortized on a straight-line basis over the term of the lease as an offset to rent expense.

Impairment of Long-Lived Assets

The Company’s long-lived assets, consisting primarily of fixed assets, are reviewed for impairment whenever events or changes in business circumstances indicate that the carrying amount of assets may not be fully recoverable or that the useful lives of these assets are no longer appropriate. Each impairment test is based on a comparison of the undiscounted cash flow to the recorded value of the asset. If impairment is indicated, the asset is written down to its estimated fair value on a discounted cash flow basis.

Revenue Recognition

The Company’s principal sources of revenue are product sales of KALBITOR, license fees, funding for research and development, and milestones and royalties derived from collaboration and license agreements. In all instances, revenue is recognized only when the price is fixed or determinable, persuasive evidence of an arrangement exists, delivery has occurred or services have been rendered, collectability of the resulting receivable is reasonably assured and the Company has no further performance obligations.

Product Sales and Allowances

Product Sales. Product sales are generated from the sale of KALBITOR to the Company’s wholesale and specialty distributors, and are recorded upon delivery when title and risk of loss have passed to the customer. Product sales are recorded net of applicable reserves for trade prompt pay and other discounts, government rebates, patient assistance programs, product returns and other applicable allowances.

Product Sales Allowances. The Company establishes reserves for trade distributor and prompt pay discounts, government rebates, patient assistance programs, product returns and other applicable allowances. Reserves established for these discounts and allowances are classified as a reduction of accounts receivable (if the amount is payable to the customer) or a liability (if the amount is payable to a party other than the customer).

Allowances against receivable balances primarily relate to prompt payment discounts and are recorded at the time of sale, resulting in a reduction in product sales revenue. Accruals related to government rebates, patient financial assistance programs, product returns and other applicable allowances are recognized at the time of sale, resulting in a reduction in product sales revenue and the recording of an increase in accrued expenses.

The Company maintains service contracts with its distributors. Accounting standards related to consideration given by a vendor to a customer, including a reseller of a vendor’s product, specify that each consideration given by a vendor to a customer is presumed to be a reduction of the selling price. Consideration should be characterized as a cost if the company receives, or will receive, an identifiable benefit in exchange for the consideration, and fair value of the benefit can be reasonably estimated. The Company has established that patient support services are at fair value and represent a separate and identifiable benefit related to these services and, accordingly, has classified them as selling, general and administrative expense.

Prompt Payment and Other Discounts. The Company offers a prompt payment discount to its United States distributors. Since the Company expects that these distributors will take advantage of this discount, the Company accrues 100% of the prompt payment discount that is based on the gross amount of each invoice, at the time of sale. The accrual is adjusted quarterly to reflect actual earned discounts.

Government Rebates and Chargebacks. The Company estimates reductions to product sales for Medicaid and Veterans' Administration (VA) programs and the Medicare Part D Coverage Gap Program, as well as with respect to certain other qualifying federal and state government programs. The Company estimates the amount of these reductions based on KALBITOR patient data and actual sales data. These allowances are adjusted each period based on actual experience.

Medicaid rebate reserves relate to the Company’s estimated obligations to states under the established reimbursement arrangements of each applicable state. Rebate accruals are recorded during the same period in which the related product sales are recognized. Actual rebate amounts are determined at the time of claim by the state, and the Company will generally make cash payments for such amounts after receiving billings from the state.

VA rebates or chargeback reserves represent the Company’s estimated obligations resulting from contractual commitments to sell products to qualified healthcare providers at a price lower than the list price charged to the Company’s distributor. The distributor will charge the Company for the difference between what the distributor pays for the product and the ultimate selling price to the qualified healthcare provider. Rebate accruals are established during the same period in which the related product sales are recognized. Actual chargeback amounts for Public Health Service are determined at the time of resale to the qualified healthcare provider from the distributor, and the Company will generally issue credits for such amounts after receiving notification from the distributor.

The Company offers a financial assistance program, which involves the use of a patient voucher, for qualified KALBITOR patients in order to aid a patient’s access to KALBITOR. The Company estimates its liability from this voucher program based on actual redemption rates.

Although allowances and accruals are recorded at the time of product sale, certain rebates are typically paid out, on average, up to six months or longer after the sale. Reserve estimates are evaluated quarterly and if necessary, adjusted to reflect actual results. Any such adjustments will be reflected in the Company’s operating results in the period of the adjustment.

Product Returns. Allowances for product returns are recorded during the period in which the related product sales are recognized, resulting in a reduction to product revenue. The Company does not provide its distributors with a general right of product return. It permits returns if the product is damaged or defective when received by customers or if the product has expired. The Company estimates product returns based upon historical trends in the pharmaceutical industry, trends for similar products sold by others and data provided by a distributor.

Development and License Fee Revenues

Collaboration Agreements. The Company enters into collaboration agreements with other companies for the research and development of therapeutic, diagnostic and separations products. The terms of the agreements may include non-refundable signing and licensing fees, funding for research and development, payments related to manufacturing services, milestone payments and royalties on any product sales derived from collaborations. These multiple element arrangements are analyzed to determine how the deliverables, which often include license and performance obligations such as research, steering committee and manufacturing services, are separated into units of accounting.

Before January 1, 2011, the Company evaluated license arrangements with multiple elements in accordance with ASC, 605-25 Revenue Recognition – Multiple-Element Arrangements. In October 2009, the FASB issued ASU 2009-13 Revenue Arrangements with Multiple Deliverables, or ASU 2009-13, which amended the accounting standards for certain multiple element arrangements to:

|

●

|

Provide updated guidance on whether multiple elements exist, how the elements in an arrangement should be separated and how the arrangement considerations should be allocated to the separate elements;

|

|

●

|

Require an entity to allocate arrangement consideration to each element based on a selling price hierarchy, also called the relative selling price method, where the selling price for an element is based on vendor-specific objective evidence (VSOE), if available; vendor objective evidence (VOE), if available and VSOE is not available; or the best estimate of selling price (BESP), if neither VSOE or VOE is available;

|

|

●

|

Eliminate the use of the residual method and require an entity to allocate arrangement consideration using the selling price hierarchy.

|

The Company evaluates all deliverables within an arrangement to determine whether or not they provide value to the licensee on a stand-alone basis. Based on this evaluation, the deliverables are separated into units of accounting. If VSOE or VOE is not available to determine the fair value of a deliverable, the Company determines the best estimate of selling price associated with the deliverable. The arrangement consideration, including upfront license fees and funding for research and development, is allocated to the separate units based on relative fair value.

VSOE is based on the price charged when an element is sold separately and represents the actual price charged for that deliverable. When VSOE cannot be established, the Company attempts to establish the selling price of the elements of a license arrangement based on VOE. VOE is determined based on third party evidence for similar deliverables when sold separately. In circumstances when the Company charges a licensee for pass-through costs paid to external vendors for development services, these costs represent VOE.

When the Company is unable to establish the selling price of an element using VSOE or VOE, management determines BESP for that element. The objective of BESP is to determine the price at which the Company would transact a sale if the element within the license agreement was sold on a stand-alone basis. The Company’s process for establishing BESP involves management’s judgment and considers multiple factors including discounted cash flows, estimated direct expenses and other costs and available data.

Based on the value allocated to each unit of accounting within an arrangement, upfront fees and other guaranteed payments are allocated to each unit based on relative value. The appropriate revenue recognition method is applied to each unit and revenue is accordingly recognized as each unit is delivered.

For agreements entered into prior to 2011, revenue related to upfront license fees was spread over the full period of performance under the agreement, unless the license was determined to provide value to the licensee on a stand-alone basis and the fair value of the undelivered performance obligations, typically including research or steering committee services was determinable.

Steering committee services that were not inconsequential or perfunctory and were determined to be performance obligations were combined with other research services or performance obligations required under an arrangement, if any, to determine the level of effort required in an arrangement and the period over which the Company expected to complete its aggregate performance obligations.

Whenever the Company determined that an arrangement should be accounted for as a single unit of accounting, it determined the period over which the performance obligations would be completed. Revenue is recognized using either an efforts-based or time-based (i.e. straight-line) proportional performance method. The Company recognizes revenue using an efforts-based proportional performance method when the level of effort required to complete its performance obligations under an arrangement can be reasonably estimated and such performance obligations are provided on a best-efforts basis. Direct labor hours or full-time equivalents are typically used as the measurement of performance.

If the Company cannot reasonably estimate the level of effort to complete its performance obligations under an arrangement, then revenue under the arrangement is recognized on a straight-line basis over the period the Company is expected to complete its performance obligations.

Many of the Company's collaboration agreements entitle it to additional payments upon the achievement of performance-based milestones. For all milestones achieved prior to 2011, substantive milestones were included in the Company's revenue model when achievement of the milestone was achieved. Milestones that were tied to regulatory approval were not considered probable of being achieved until such approval was received. All milestones achieved after January 1, 2011 which are determined to be substantive milestones are recognized as revenue in the period in which they are met in accordance with Accounting Standards Update (ASU) No. 2010-17, Revenue Recognition – Milestone Method. Milestones tied to counter-party performance are not included in the Company’s revenue model until performance conditions are met. Milestones determined to be non-substantive are allocated to each unit of accounting within an arrangement when met. The allocation of the milestone to each unit is based on relative value and revenue related to each unit is recognized accordingly.

Royalty revenue is recognized upon the sale of the related products provided the Company has no remaining performance obligations under the arrangement.

Costs of revenues related to product development and license fees are classified as research and development in the consolidated statements of operations and comprehensive loss.

Library Licenses. Standard terms of the proprietary phage display library agreements generally include non-refundable signing fees, license maintenance fees, development milestone payments, product license payments and royalties on product sales. Signing fees and maintenance fees are generally recognized on a straight line basis over the term of the agreement as deliverables within these arrangements are determined to not provide the licensee with value on a stand-alone basis and therefore are accounted for as a single unit of accounting. As milestones are achieved under a phage display library license, a portion of the milestone payment, equal to the percentage of the performance period completed when the milestone is achieved, multiplied by the amount of the milestone payment, will be recognized. The remaining portion of the milestone will be recognized over the remaining performance period on a straight-line basis. Milestone payments under these license arrangements are recognized when the milestone is achieved if the Company has no future obligations under the license. Product license payments, which are optional to the licensee, are substantive and therefore are excluded from the initial allocation of the arrangement consideration. These payments are recognized as revenue when the license is issued upon exercise of the licensee’s option, if the Company has no future obligations under the agreement. If there are future obligations under the agreement, product license payments are recognized as revenue only to the extent of the fair value of the license. Amounts paid in excess of fair value are recognized in a manner similar to milestone payments. Royalty revenue is recognized upon the sale of the related products provided the Company has no remaining performance obligations under the arrangement.

Payments received that have not met the appropriate criteria for revenue recognition are recorded as deferred revenue.

Patent Licenses. The Company previously licensed its phage display patents on a non-exclusive basis to third parties for use in connection with the research and development of therapeutic, diagnostic, and other products. The last of these patents will expire in November 2012. Even after patent expiration, the Company generally remains eligible under these patent licenses to receive milestones and/or royalties for products discovered prior to patent expiration, although certain existing patent licenses will no longer have a royalty obligation. The Company does not expect the expiration of these patents to have a material impact on its LFRP business.

Standard terms of the patent rights agreements include non-refundable signing fees, non-refundable license maintenance fees, development milestone payments and/or royalties on product sales. Signing fees and maintenance fees are generally recognized on a straight line basis over the term of the agreement or through the date of patent expiry, if shorter, except that in the case of perpetual patent licenses for which fees were recognized immediately if it was determined that the Company had no future obligations under the agreement and the payments were made upfront. Milestones are recognized as revenue in the period in which the milestone is achieved, and royalty revenue is recognized upon the sale of the related products, since the Company has no remaining performance obligations under the agreement.

Cost of Product Sales

Cost of product sales includes costs to procure, manufacture and distribute KALBITOR and manufacturing royalties. Costs associated with the manufacture of KALBITOR prior to regulatory approval in the United States were expensed when incurred as a research and development cost and accordingly, KALBITOR units sold during the three and nine months ended September 30, 2012 and 2011 do not include the full cost of drug manufacturing.

Research and Development

Research and development costs include all direct costs, including salaries and benefits for research and development personnel, outside consultants, costs of clinical trials, sponsored research, clinical trials insurance, other outside costs, depreciation and facility costs related to the development of drug candidates.

Income Taxes

The Company utilizes the asset and liability method of accounting for income taxes in accordance with ASC 740. Under this method, deferred tax assets and liabilities are recognized for the expected future tax consequences of temporary differences between the carrying amounts and the tax basis of assets and liabilities using the enacted statutory tax rates. At September 30, 2012 and December 31, 2011, there were no unrecognized tax benefits.

The Company accounts for uncertain tax positions using a "more-likely-than-not" threshold for recognizing and resolving uncertain tax positions. The evaluation of uncertain tax positions is based on factors that include, but are not limited to, changes in tax law, the measurement of tax positions taken or expected to be taken in tax returns, the effective settlement of matters subject to audit, new audit activity and changes in facts or circumstances related to a tax position. The Company evaluates uncertain tax positions on a quarterly basis and adjusts the level of the liability to reflect any subsequent changes in the relevant facts surrounding the uncertain positions.

Translation of Foreign Currencies

Assets and liabilities of the Company's foreign subsidiaries are translated at period end exchange rates. Amounts included in the statements of operations are translated at the average exchange rate for the period. All currency translation adjustments are recorded to other income (expense) in the consolidated statement of operations. For the three and nine months ending September 30, 2012 the Company recorded other income of $10,000 and other expense of $3,000, respectively, for the translation of foreign currency. For the three and nine months ending September 30, 2011 the Company recorded other expense of $32,000 and other income of $15,000, respectively, for the translation of foreign currency.

The Company’s share-based compensation program consists of share-based awards granted to employees in the form of stock options and restricted stock units, as well as its 1998 Employee Stock Purchase Plan, as amended (the Purchase Plan). The Company’s share-based compensation expense is recorded in accordance with ASC 718.

Income or Loss Per Share

The Company presents two earnings or loss per share (EPS) amounts, basic and diluted in accordance with ASC 260. Basic earnings or loss per share is computed using the weighted average number of shares of common stock outstanding. Diluted net loss per share does not differ from basic net loss per share since potential common shares from the exercise of stock options, warrants or rights under the Purchase Plan are anti-dilutive for the periods ended September 30, 2012 and 2011 and, therefore, are excluded from the calculation of diluted net loss per share.

Stock options and warrants to purchase a total of 11,379,953 and 11,682,969 shares of common stock were outstanding at September 30, 2012 and 2011, respectively.

Comprehensive Income (Loss)

The Company accounts for comprehensive income (loss) under ASC 220, Comprehensive Income, which established standards for reporting and displaying comprehensive income (loss) and its components in a full set of general purpose financial statements. The statement required that all components of comprehensive income (loss) be reported in a financial statement that is displayed with the same prominence as other financial statements.

Business Segments

The Company discloses business segments under ASC 280, Segment Reporting. The statement established standards for reporting information about operating segments and disclosures about products and services, geographic areas and major customers. The Company operates as one business segment within predominantly one geographic area.

Recent Accounting Pronouncements

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board (FASB) or other standard setting bodies, which are adopted by the Company as of the specified effective date. Unless otherwise discussed, the Company believes that the impact of recently issued standards that are not yet effective will not have a material impact on its financial position or results of operations upon adoption.

In December 2011, the FASB issued an amendment to the accounting guidance for disclosure of offsetting assets and liabilities and related arrangements. The amendment expands the disclosure requirements in that entities will be required to disclose both gross information and net information about both instruments and transactions eligible for offset in the statement of financial position and instruments and transactions subject to an agreement similar to a master netting arrangement. The amendment is effective for fiscal years, and interim periods within those years, beginning on or after January 1, 2013, and shall be applied retrospectively. The Company does not expect the adoption of this accounting pronouncement to have a material impact on its financial statements.

3. SIGNIFICANT TRANSACTIONS

Sigma-Tau

In June 2010, the Company entered into a strategic collaboration agreement with Sigma-Tau Rare Diseases S.A. (as successor-in-interest to Defiante Farmaceutica S.A.) (Sigma-Tau) to develop and commercialize subcutaneous ecallantide for the treatment of HAE and other therapeutic indications throughout Europe, North Africa, the Middle East and Russia. In December 2010, the original agreement was amended to expand the partnership to commercialize KALBITOR for the treatment of HAE in Australia and New Zealand (the first amendment). In May 2011, the Company further amended its agreement with Sigma-Tau to include development and commercialization rights in Latin America (excluding Mexico), the Caribbean and certain Asian territories (the second amendment). Three subsequent amendments to this agreement eliminated rights that Dyax had previously granted to Sigma-Tau for the Asian territories, the Middle East, North Africa, Latin America and the Caribbean.

Under the terms of the original agreement, Sigma-Tau made a $2.5 million upfront payment. In addition, Sigma-Tau purchased 636,132 shares of the Company's common stock at a price of $3.93 per share, which represented a 50% premium over the 20-day average closing price through June 17, 2010, for an aggregate purchase price of $2.5 million.

Under the terms of the first amendment, Sigma-Tau made an additional $500,000 upfront payment to the Company and also purchased 151,515 shares of the Company's common stock at a price of $3.30 per share, which represented a 50% premium over the 20-day average closing price through December 20, 2010, for an aggregate purchase price of $500,000. Both payments were received in January 2011.

Under the terms of a second amendment, Sigma-Tau made an additional upfront payment of $4.0 million in 2011 and was required to make an additional $3.0 million non-refundable payment to the Company by December 31, 2011. Under a third amendment, upon elimination of Sigma-Tau’s rights to certain Asian territories, the $3.0 million payment obligation was eliminated, as were the future milestones and royalties related to these territories.

Under the terms of the fourth and fifth amendments, Sigma-Tau’s rights to the Middle East, Latin America and the Caribbean were eliminated. The Company agreed to make payments to Sigma-Tau ranging from 5%-12.5% of the amounts received by the Company as a result of any future product sales for certain countries in these territories.

The Company is eligible to receive up to $100 million in development and sales milestones related to ecallantide and royalties equal to 41% of net sales of product, as adjusted for product costs, in all licensed territories. Sigma-Tau will pay costs associated with regulatory approval and commercialization in the licensed territories. In addition, the Company and Sigma-Tau will share equally the costs for all development activities for optional future indications developed in partnership with Sigma-Tau in the territories covered under the initial Sigma-Tau agreement. The partnership agreement may be terminated by Sigma-Tau, at will, upon 6 months’ prior written notice. Either party may terminate the partnership agreement in the event of an uncured material breach or declaration or filing of bankruptcy by the other party.

Prior to the second amendment in May 2011, revenue related to this multiple element arrangement was being recognized in accordance with ASC 605. The Company evaluated the terms of the second amendment relative to the entire arrangement and determined the amendment to be a material modification to the existing agreement for financial reporting purposes. As a result, the Company evaluated the entire arrangement under the guidance of ASU No. 2009-13 which was adopted in 2011.

Under the terms of the original agreement and first amendment, the Company analyzed this multiple element arrangement in accordance with ASC 605 and evaluated whether the performance obligations under this agreement, including the product license and development, steering committee, and manufacturing services should be accounted for as a single unit or multiple units of accounting. The Company determined that there were two units of accounting. The first unit of accounting included the product license, the committed future development services and the steering committee involvement. These deliverables were grouped into one unit of accounting due to the lack of objective and reliable evidence of fair value. The second unit of accounting related to the manufacturing services, and was determined to meet all of the criteria to be a separate unit of accounting. The Company had the ability to estimate the scope and timing of its involvement in the future development of the program, as the Company's obligations under the development period are clearly defined. Therefore, the Company recognized revenue related to the first unit of accounting utilizing a proportional performance model based on the actual effort performed in proportion to the total estimated level of effort. Under this model, the Company estimated the level of effort to be expended over the term of the agreement and recognized revenue based on the lesser of the amount calculated based on proportional performance of total expected revenue or the amount of non-refundable payments earned. As of the date of the second amendment, $4.8 million of revenue had been recognized for the first unit of accounting and $2.4 million of deferred revenue remained. To date, no revenue has been recognized related to manufacturing services, as no such services have been provided.

As the second amendment represented a material modification to the existing agreement under applicable accounting rules, the Company re-evaluated the entire arrangement under ASU No. 2009-13, and determined all undelivered items under the agreement and divided them into separate units of accounting based on whether the deliverable provided stand-alone value to the licensee. These units of accounting consist of (i) the license to develop and commercialize ecallantide for the treatment of HAE and other therapeutic indications in the territories granted under the original agreement and first amendment, (ii) the license to develop and commercialize ecallantide for the treatment of HAE and other therapeutic indications in the territories granted under the second amendment, (iii) steering committee services and (iv) committed future development services. The Company then determined the best estimate selling price (BESP) for the license and steering committee services and the fair value of committed future development services was determined using vendor objective evidence. The Company’s process for determining BESP involves management’s judgment and includes factors such as discounted cash flows, estimated direct expenses and other costs and available data.

The upfront fee of $4.0 million, the non-refundable payment of $3.0 million due in December 2011 and $2.4 million of previously deferred revenue under the Sigma-Tau contracts were allocated to the units of accounting based upon relative fair value.

Revenue related to steering committee services of $190,000 was deferred and is being recognized under the proportional performance model, as meetings are held through the estimated development period for ecallantide in the Sigma-Tau territories. Revenues associated with future committed development services will be recognized as incurred and billed to Sigma-Tau for reimbursement. As future milestones are achieved and to the extent they involve substantial effort on the Company’s part, revenue will be recognized in the period in which the milestone is achieved. The manufacturing services were determined to represent a contingent deliverable and, as such, have been excluded from the current revenue model.

The Company recognized revenue of approximately $69,000 and $156,000 related to the Sigma-Tau agreement, as amended, for the three and nine months ended September 30, 2012, respectively, and $280,000 and $12.2 million related to this agreement for the three and nine months ended September 30, 2011, respectively.

As of September 30, 2012 and December 31, 2011, the Company has deferred $111,000 and $158,000, respectively, of revenue related to this arrangement, which is recorded in deferred revenue on the accompanying consolidated balance sheets at such dates. The deferred revenue balance at September 30, 2012, relates to the joint steering committee obligation which is estimated to continue until 2014.

CMIC

In 2010, the Company entered into an agreement with CMIC Co., Ltd, (CMIC) to develop and commercialize subcutaneous ecallantide for the treatment of HAE and other angioedema indications in Japan.

Under the terms of the agreement, the Company received a $4.0 million upfront payment. The Company is also eligible to receive up to $102 million in development and sales milestones for ecallantide in HAE and other angioedema indications and royalties of 20%-24% of net product sales. CMIC is solely responsible for all costs associated with development, regulatory activities, and commercialization of ecallantide for all angioedema indications in Japan. CMIC will purchase drug product from the Company on a cost-plus basis for clinical and commercial supply.

The Company analyzed this multiple element arrangement in accordance with ASC 605 and evaluated whether the performance obligations under this agreement, including the product license, development of ecallantide for the treatment of HAE and other angioedema indications in Japan, steering committee, and manufacturing services should be accounted for as a single unit or multiple units of accounting. The Company determined that there were two units of accounting. The first unit of accounting includes the product license, the committed future development services and the steering committee involvement. The second unit of accounting relates to the manufacturing services. At this time the scope and timing of the future development of ecallantide for the treatment of HAE and other indications in the CMIC territory are the joint responsibility of the Company and CMIC and therefore, the Company cannot reasonably estimate the level of effort required to fulfill its obligations under the first unit of accounting. As a result, the Company is recognizing revenue under the first unit of accounting on a straight-line basis over the estimated development period of ecallantide for the treatment of HAE in the CMIC territory through 2016.

The Company recognized revenue of approximately $189,000 and $566,000 related to this agreement for the three and nine months ended September 30, 2012, respectively and approximately $148,000 and $444,000 for the three and nine months ended September 30, 2011, respectively. As of September 30, 2012 and December 31, 2011, the Company has deferred approximately $2.7 million and $3.3 million, respectively, of revenue related to this arrangement, which is recorded in deferred revenue on the accompanying consolidated balance sheets.

4. FAIR VALUE MEASUREMENTS

The following tables present information about the Company's financial assets that have been measured at fair value as of September 30, 2012 and December 31, 2011 and indicate the fair value hierarchy of the valuation inputs utilized to determine such fair value. In general, fair values determined by Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets or liabilities. Fair values determined by Level 2 inputs utilize observable inputs other than Level 1 prices, such as quoted prices, for similar assets or liabilities, quoted prices in markets that are not active or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the related assets or liabilities. Fair values determined by Level 3 inputs are unobservable data points for the asset or liability, and includes situations where there is little, if any, market activity for the asset or liability.

|

Description (in thousands)

|

|

September 30,

2012

|

|

|

Quoted

Prices in

Active

Markets

(Level 1)

|

|

|

Significant

Other

Observable

Inputs

(Level 2)

|

|

|

Significant

Unobservable

Inputs

(Level 3)

|

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash equivalents

|

|

$ |

18,893 |

|

|

$ |

18,893 |

|

|

$ |

— |

|

|

$ |

— |

|

|

Marketable debt securities

|

|

|

9,043 |

|

|

|

— |

|

|

|

9,043 |

|

|

|

— |

|

|

Total

|

|

$ |

27,936 |

|

|

$ |

18,893 |

|

|

$ |

9,043 |

|

|

$ |

— |

|

|

Description (in thousands)

|

|

December

31,

2011

|

|

|

Quoted

Prices in

Active

Markets

(Level 1)

|

|

|

Significant

Other

Observable

Inputs

(Level 2)

|

|

|

Significant

Unobservable

Inputs

(Level 3)

|

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash equivalents

|

|

$ |

8,825 |

|

|

$ |

8,825 |

|

|

$ |

— |

|

|

$ |

— |

|

|

Marketable debt securities

|

|

|

26,036 |

|

|

|

— |

|

|

|

26,036 |

|

|

|

— |

|

|

Total

|

|

$ |

34,861 |

|

|

$ |

8,825 |

|

|

$ |

26,036 |

|

|

$ |

— |

|

The following tables summarize the Company’s marketable securities at September 30, 2012 and December 31, 2011, in thousands:

| |

|

September 30, 2012

|

|

|

Description

|

|

Amortized

Cost

|

|

|

Gross

Unrealized

Gains

|

|

|

Gross

Unrealized

Losses

|

|

|

Fair Value

|

|

|

US Treasury Bills and Notes (due within 1 year)

|

|

$ |

9,037 |

|

|

$ |

6 |

|

|

$ |

— |

|

|

$ |

9,043 |

|

|

US Treasury Bills and Notes

(due after 1 year through 2 years)

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total

|

|

$ |

9,037 |

|

|

$ |

6 |

|

|

$ |

— |

|

|

$ |

9,043 |

|

| |

|

December 31, 2011

|

|

|

Description

|

|

Amortized

Cost

|

|

|

Gross

Unrealized

Gains

|

|

|

Gross

Unrealized

Losses

|

|

|

Fair Value

|

|

|

US Treasury Bills and Notes (due within 1 year)

|

|

$ |

23,013 |

|

|

$ |

7 |

|

|

$ |

— |

|

|

$ |

23,020 |

|

|

US Treasury Bills and Notes

(due after 1 year through 2 years)

|

|

|

3,016 |

|

|

|

— |

|

|

|

— |

|

|

|

3,016 |

|

|

Total

|

|

$ |

26,029 |

|

|

$ |

7 |

|

|

$ |

— |

|

|

$ |

26,036 |

|

As of September 30, 2012 and December 31, 2011, the Company's cash equivalents which are invested in money market funds are valued based on Level 1 inputs. As of September 30, 2012 and December 31, 2011, the Company’s short-term investments consisted of U.S. Treasury notes and bills valued based on Level 2 inputs. These assets have been initially valued at the transaction price and subsequently valued utilizing a third party pricing service. We validate the prices provided by our third party pricing service by understanding the models used and obtaining market values from other pricing sources. The Company has classified its investments with maturities beyond one year as short-term, based on their highly liquid nature and because such marketable securities represent the investment of cash that is available for current operations.

The carrying amounts reflected in the consolidated balance sheets for cash, cash equivalents, other current assets, accounts payable and accrued expenses and other current liabilities approximate fair value due to their short-term maturities.

5. INVENTORY

In December 2009, the Company received marketing approval of KALBITOR from the FDA. Costs associated with the manufacture of KALBITOR prior to regulatory approval were expensed when incurred, and therefore were not capitalized as inventory. As a result, the Company’s finished goods inventory does not include all costs of manufacturing drug substance currently being sold. Subsequent to FDA approval, all costs associated with the manufacture of KALBITOR have been recorded as inventory. Inventory on-hand that will be sold beyond the Company's normal operating cycle is classified as non-current and grouped with other assets on the Company's balance sheet. As of September 30, 2012, approximately $6.4 million of inventory is classified as non-current.

Inventory consists of the following (in thousands):

| |

|

September 30,

2012

|

|

|

December 31,

2011

|

|

|

Raw Materials

|

|

$ |

1,116 |

|

|

$ |

1,429 |

|

|

Work in Progress

|

|

|

8,189 |

|

|

|

5,474 |

|

|

Finished Goods

|

|

|

887 |

|

|

|

119 |

|

|

Total

|

|

$ |

10,192 |

|

|

$ |

7,022 |

|

The Company has revised the classification for $4.9 million of inventory from current assets to non-current other assets for the year ended December 31, 2011, to correct the classification of inventory based on the projected sale of inventory beyond the Company's normal operating cycle. The Company concluded this error was not material to the prior period financial statements.

6. FIXED ASSETS

Fixed assets consist of the following:

| |

|

|

|

| |

|

September 30,

2012

|

|

|

December 31,

2011

|

|

| |

|

(In thousands)

|

|

|

Laboratory equipment

|

|

$ |

7,629 |

|

|

$ |

9,103 |

|

|

Furniture and office equipment

|

|

|

1,588 |

|

|

|

1,095 |

|

|

Software and computers

|

|

|

4,711 |

|

|

|

4,445 |

|

|

Leasehold improvements

|

|

|

4,502 |

|

|

|

6,845 |

|

|

Construction in process

|

|

|

— |

|

|

|

3,960 |

|

|

Total

|

|

|

18,430 |

|

|

|

25,448 |

|

|

Less: accumulated depreciation and amortization

|

|

|

(13,142 |

) |

|

|

(20,567 |

) |

| |

|

$ |

5,288 |

|

|

$ |

4,881 |

|

Depreciation expense for the three and nine months ended September 30, 2012 was approximately $246,000 and $824,000, respectively, and $315,000 and $971,000 for the three and nine months ended September 30, 2011, respectively.

7. ACCOUNTS PAYABLE AND ACCRUED EXPENSES

Accounts payable and accrued expenses consist of the following (in thousands):

| |

|

September 30,

2012

|

|

|

December 31,

2011

|

|

|

Accounts payable

|

|

$ |

1,659 |

|

|

$ |

2,927 |

|

|

Accrued employee compensation and related taxes.

|

|

|

3,495 |

|

|

|

4,529 |

|

|

Accrued expenses

|

|

|

1,884 |

|

|

|

1,591 |

|

|

Accrued license fees

|

|

|

74 |

|

|

|

— |

|

|

Accrued legal

|

|

|

470 |

|

|

|

214 |

|

|

Accrued leasehold improvements

|

|

|

— |

|

|

|

2,472 |

|

|

Accrued restructuring

|

|

|

139 |

|

|

|

— |

|

|

Accrued sales allowances

|

|

|

921 |

|

|

|

525 |

|

|

Other accrued liabilities

|

|

|

2,307 |

|

|

|

3,060 |

|

|

Total

|

|

$ |

10,949 |

|

|

$ |

15,318 |

|

8. NOTES PAYABLE

HealthCare Royalty Partners

In August 2012, the Company completed an agreement with an affiliate of HealthCare Royalty Partners, formerly Cowen Healthcare Partners (HC Royalty) entered into in December 2011, to refinance its existing loans with HC Royalty. As of the refinancing, the aggregate principal amount of the new loan was $80.5 million, consisting of a $21.7 million Tranche A Loan and a $58.8 million Tranche B Loan (collectively, the “Loan”). The Loan bears interest at a rate of 12% per annum, payable quarterly. The Loan will mature in August 2018, and can be repaid without penalty beginning in August 2015.

In connection with the Loan, the Company entered into a security agreement granting HC Royalty a security interest in the intellectual property related to the LFRP, and the revenues generated by the Company through the license of the intellectual property related to the LFRP. The security agreement does not apply to the Company's internal drug development or to any of the Company's co-development programs.

Under the terms of the Loan agreement, the Company is required to repay the Loan based on the annual net LFRP receipts. Until September 30, 2016, required payments are equal to the sum of 75% of the first $15.0 million in specified annual LFRP receipts and 25% of specified annual LFRP receipts over $15.0 million. After September 30, 2016, and until the maturity date or the complete repayment of the Loan, HC Royalty will receive 90% of all included LFRP receipts. If the HC Royalty portion of LFRP receipts for any quarter exceeds the interest for that quarter, then the principal balance will be reduced. Any unpaid principal will be due upon the maturity of the Loan. If the HC Royalty portion of LFRP revenues for any quarterly period is insufficient to cover the cash interest due for that period, the deficiency may be added to the outstanding principal or paid in cash by the Company. After five years from the dates of the Tranche A Loan and the Tranche B Loan, respectively, the Company must repay to HC Royalty all additional accumulated principal above the original loan amounts of $21.7 million and $58.8 million, respectively.

Tranche A Loan

In December 2011, the Company entered into an agreement with an affiliate of HC Royalty and received a loan of $20 million (Tranche A Loan) and a commitment to refinance the amounts outstanding under the Company’s March 2009 amended and restated loan agreement (the March 2009 loan agreement) at a reduced interest rate in August 2012. The Tranche A Loan was unsecured and accrued interest at an annual rate of 13% through August 2012, at which time the Tranche A Loan and its accrued interest was combined with 102% of the unpaid principal and accrued interest outstanding under the March 2009 loan agreement upon the closing of the Tranche B Loan.

Upon execution of the Tranche A Loan, the terms of the Original Loans (defined below) were determined to be modified under ASC 470. Accordingly, during the three and nine months ending September 30 2012, interest expense on the Loan is being recorded in the Company’s financial statements at an effective interest rate of 12.5%.

Upon modification of the debt arrangement, the note payable balance related to the Tranche A Loan was reduced by $193,000 to reflect payment of legal fees in conjunction with the loan; these fees are being accreted over the life of the Loan, through August 2018.

Tranche B Loan

In 2008 and 2009, the Company entered into loan agreements with an affiliate of HC Royalty that provided aggregate loan proceeds of $65.0 million (the Original Loans), which had an outstanding principal and accrued interest balance of $57.6 million at the time of their refinancing in August 2012 (Tranche B Loan). The Original Loans bore interest at an annual rate of 17.4%, payable quarterly, and were secured by the Company’s LFRP.

In connection with the Original Loans, the Company issued affiliates of HC Royalty warrants to purchase shares of the Company’s common stock. In August 2008, the Company issued warrants to purchase 250,000 shares of the Company’s common stock at an exercise price of $5.50 per share. This warrant expires in August 2016 and became exercisable in August 2009. The Company estimated the relative fair value of the warrant to be $853,000 on the date of issuance, using the Black-Scholes valuation model, assuming a volatility factor of 83.64%, risk-free interest rate of 4.07%, an eight-year expected term and an expected dividend yield of zero. In March 2009, the Company issued HC Royalty a second warrant to purchase 250,000 shares of the Company’s common stock at an exercise price of $2.87 per share. This warrant expires in August 2016 and became exercisable in March 2010. The Company estimated the relative fair value of the warrant to be $477,000 on the date of issuance, using the Black-Scholes valuation model, assuming a volatility factor of 85.98%, risk-free interest rate of 2.77%, a seven-year, four-month expected term and an expected dividend yield of zero. The relative fair values of the warrants as of the date of issuance are recorded in additional paid-in capital on the Company's consolidated balance sheets.

The cash proceeds from the Original Loans were recorded as a note payable on the Company's consolidated balance sheet. The note payable balance was reduced by $1.3 million for the fair value of the warrants issued, and by $580,000 for payment of HC Royalty’s legal fees in conjunction with the Tranche B Loan. Prior to the December 2011 issuance of the Tranche A Loan, each of these amounts was being accreted over the life of the note through August 2016. Subsequent to the modification of the debt arrangement in December 2011, the unamortized portion of these amounts is being accreted over the life of the Loan through August 2018.

The Loan principal balance at September 30, 2012 and December 31, 2011 was $80.5 million and $76.7 million, respectively. For financial reporting purposes, the Loan is adjusted for discounts associated with the debt issuance, including warrants and fees.

Activity under the Loan is presented for financial reporting purposes, as follows (in thousands):

| |

|

September 30,

2012

|

|

|

December 31,

2011

|

|

|

Beginning balance

|

|

$ |

75,372 |

|

|

$ |

56,406 |

|

|