bfs-20230930000090725412/312023Q3FALSEP1YP1Y0.010.0100009072542023-01-012023-09-300000907254us-gaap:CommonStockMember2023-01-012023-09-300000907254us-gaap:SeriesDPreferredStockMember2023-01-012023-09-300000907254us-gaap:SeriesEPreferredStockMember2023-01-012023-09-3000009072542023-10-30xbrli:shares00009072542023-09-30iso4217:USD00009072542022-12-310000907254bfs:SeriesDCumulativeRedeemablePreferredStockMember2022-12-310000907254bfs:SeriesDCumulativeRedeemablePreferredStockMember2023-09-300000907254bfs:SeriesECumulativeRedeemablePreferredStockMember2023-09-300000907254bfs:SeriesECumulativeRedeemablePreferredStockMember2022-12-31iso4217:USDxbrli:shares00009072542023-07-012023-09-3000009072542022-07-012022-09-3000009072542022-01-012022-09-300000907254us-gaap:PreferredStockMember2022-12-310000907254us-gaap:CommonStockMember2022-12-310000907254us-gaap:AdditionalPaidInCapitalMember2022-12-310000907254bfs:UnitsInEscrowMember2022-12-310000907254us-gaap:RetainedEarningsMember2022-12-310000907254us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000907254us-gaap:ParentMember2022-12-310000907254us-gaap:NoncontrollingInterestMember2022-12-3100009072542023-01-012023-03-310000907254us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000907254us-gaap:ParentMember2023-01-012023-03-310000907254us-gaap:RetainedEarningsMember2023-01-012023-03-310000907254us-gaap:NoncontrollingInterestMember2023-01-012023-03-310000907254us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000907254bfs:SeriesDCumulativeRedeemablePreferredStockMemberus-gaap:DividendDeclaredMember2023-01-012023-03-310000907254us-gaap:RetainedEarningsMemberbfs:SeriesDCumulativeRedeemablePreferredStockMember2023-01-012023-03-310000907254us-gaap:ParentMemberbfs:SeriesDCumulativeRedeemablePreferredStockMember2023-01-012023-03-310000907254bfs:SeriesDCumulativeRedeemablePreferredStockMember2023-01-012023-03-310000907254bfs:SeriesECumulativeRedeemablePreferredStockMemberus-gaap:DividendDeclaredMember2023-01-012023-03-310000907254us-gaap:RetainedEarningsMemberbfs:SeriesECumulativeRedeemablePreferredStockMember2023-01-012023-03-310000907254us-gaap:ParentMemberbfs:SeriesECumulativeRedeemablePreferredStockMember2023-01-012023-03-310000907254bfs:SeriesECumulativeRedeemablePreferredStockMember2023-01-012023-03-310000907254us-gaap:DividendDeclaredMember2023-01-012023-03-310000907254us-gaap:PreferredStockMember2023-03-310000907254us-gaap:CommonStockMember2023-03-310000907254us-gaap:AdditionalPaidInCapitalMember2023-03-310000907254bfs:UnitsInEscrowMember2023-03-310000907254us-gaap:RetainedEarningsMember2023-03-310000907254us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000907254us-gaap:ParentMember2023-03-310000907254us-gaap:NoncontrollingInterestMember2023-03-3100009072542023-03-3100009072542023-04-012023-06-300000907254us-gaap:CommonStockMember2023-04-012023-06-300000907254us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-300000907254us-gaap:ParentMember2023-04-012023-06-300000907254us-gaap:RetainedEarningsMember2023-04-012023-06-300000907254us-gaap:NoncontrollingInterestMember2023-04-012023-06-300000907254us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300000907254bfs:SeriesDCumulativeRedeemablePreferredStockMemberus-gaap:DividendDeclaredMember2023-04-012023-06-300000907254us-gaap:RetainedEarningsMemberbfs:SeriesDCumulativeRedeemablePreferredStockMember2023-04-012023-06-300000907254us-gaap:ParentMemberbfs:SeriesDCumulativeRedeemablePreferredStockMember2023-04-012023-06-300000907254bfs:SeriesDCumulativeRedeemablePreferredStockMember2023-04-012023-06-300000907254bfs:SeriesECumulativeRedeemablePreferredStockMemberus-gaap:DividendDeclaredMember2023-04-012023-06-300000907254us-gaap:RetainedEarningsMemberbfs:SeriesECumulativeRedeemablePreferredStockMember2023-04-012023-06-300000907254us-gaap:ParentMemberbfs:SeriesECumulativeRedeemablePreferredStockMember2023-04-012023-06-300000907254bfs:SeriesECumulativeRedeemablePreferredStockMember2023-04-012023-06-300000907254us-gaap:DividendDeclaredMember2023-04-012023-06-300000907254us-gaap:PreferredStockMember2023-06-300000907254us-gaap:CommonStockMember2023-06-300000907254us-gaap:AdditionalPaidInCapitalMember2023-06-300000907254bfs:UnitsInEscrowMember2023-06-300000907254us-gaap:RetainedEarningsMember2023-06-300000907254us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000907254us-gaap:ParentMember2023-06-300000907254us-gaap:NoncontrollingInterestMember2023-06-3000009072542023-06-300000907254us-gaap:CommonStockMember2023-07-012023-09-300000907254us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300000907254us-gaap:ParentMember2023-07-012023-09-300000907254us-gaap:RetainedEarningsMember2023-07-012023-09-300000907254us-gaap:NoncontrollingInterestMember2023-07-012023-09-300000907254us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300000907254bfs:SeriesDCumulativeRedeemablePreferredStockMemberus-gaap:DividendDeclaredMember2023-07-012023-09-300000907254us-gaap:RetainedEarningsMemberbfs:SeriesDCumulativeRedeemablePreferredStockMember2023-07-012023-09-300000907254us-gaap:ParentMemberbfs:SeriesDCumulativeRedeemablePreferredStockMember2023-07-012023-09-300000907254bfs:SeriesDCumulativeRedeemablePreferredStockMember2023-07-012023-09-300000907254bfs:SeriesECumulativeRedeemablePreferredStockMemberus-gaap:DividendDeclaredMember2023-07-012023-09-300000907254us-gaap:RetainedEarningsMemberbfs:SeriesECumulativeRedeemablePreferredStockMember2023-07-012023-09-300000907254us-gaap:ParentMemberbfs:SeriesECumulativeRedeemablePreferredStockMember2023-07-012023-09-300000907254bfs:SeriesECumulativeRedeemablePreferredStockMember2023-07-012023-09-300000907254us-gaap:DividendDeclaredMember2023-07-012023-09-300000907254us-gaap:PreferredStockMember2023-09-300000907254us-gaap:CommonStockMember2023-09-300000907254us-gaap:AdditionalPaidInCapitalMember2023-09-300000907254bfs:UnitsInEscrowMember2023-09-300000907254us-gaap:RetainedEarningsMember2023-09-300000907254us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300000907254us-gaap:ParentMember2023-09-300000907254us-gaap:NoncontrollingInterestMember2023-09-300000907254us-gaap:PreferredStockMember2021-12-310000907254us-gaap:CommonStockMember2021-12-310000907254us-gaap:AdditionalPaidInCapitalMember2021-12-310000907254bfs:UnitsInEscrowMember2021-12-310000907254us-gaap:RetainedEarningsMember2021-12-310000907254us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000907254us-gaap:ParentMember2021-12-310000907254us-gaap:NoncontrollingInterestMember2021-12-3100009072542021-12-3100009072542022-01-012022-03-310000907254us-gaap:CommonStockMember2022-01-012022-03-310000907254us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310000907254us-gaap:ParentMember2022-01-012022-03-310000907254us-gaap:LimitedPartnerMember2022-01-012022-03-310000907254us-gaap:LimitedPartnerMemberus-gaap:NoncontrollingInterestMember2022-01-012022-03-310000907254us-gaap:RetainedEarningsMember2022-01-012022-03-310000907254us-gaap:NoncontrollingInterestMember2022-01-012022-03-310000907254bfs:SeriesDCumulativeRedeemablePreferredStockMemberus-gaap:DividendDeclaredMember2022-01-012022-03-310000907254us-gaap:RetainedEarningsMemberbfs:SeriesDCumulativeRedeemablePreferredStockMember2022-01-012022-03-310000907254us-gaap:ParentMemberbfs:SeriesDCumulativeRedeemablePreferredStockMember2022-01-012022-03-310000907254bfs:SeriesDCumulativeRedeemablePreferredStockMember2022-01-012022-03-310000907254bfs:SeriesECumulativeRedeemablePreferredStockMemberus-gaap:DividendDeclaredMember2022-01-012022-03-310000907254us-gaap:RetainedEarningsMemberbfs:SeriesECumulativeRedeemablePreferredStockMember2022-01-012022-03-310000907254us-gaap:ParentMemberbfs:SeriesECumulativeRedeemablePreferredStockMember2022-01-012022-03-310000907254bfs:SeriesECumulativeRedeemablePreferredStockMember2022-01-012022-03-310000907254us-gaap:DividendDeclaredMember2022-01-012022-03-310000907254us-gaap:PreferredStockMember2022-03-310000907254us-gaap:CommonStockMember2022-03-310000907254us-gaap:AdditionalPaidInCapitalMember2022-03-310000907254bfs:UnitsInEscrowMember2022-03-310000907254us-gaap:RetainedEarningsMember2022-03-310000907254us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310000907254us-gaap:ParentMember2022-03-310000907254us-gaap:NoncontrollingInterestMember2022-03-3100009072542022-03-310000907254us-gaap:LimitedPartnerMember2022-04-012022-06-300000907254us-gaap:CommonStockMember2022-04-012022-06-300000907254us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300000907254us-gaap:ParentMember2022-04-012022-06-3000009072542022-04-012022-06-300000907254us-gaap:LimitedPartnerMemberus-gaap:NoncontrollingInterestMember2022-04-012022-06-300000907254us-gaap:RetainedEarningsMember2022-04-012022-06-300000907254us-gaap:NoncontrollingInterestMember2022-04-012022-06-300000907254bfs:SeriesDCumulativeRedeemablePreferredStockMemberus-gaap:DividendDeclaredMember2022-04-012022-06-300000907254us-gaap:RetainedEarningsMemberbfs:SeriesDCumulativeRedeemablePreferredStockMember2022-04-012022-06-300000907254us-gaap:ParentMemberbfs:SeriesDCumulativeRedeemablePreferredStockMember2022-04-012022-06-300000907254bfs:SeriesDCumulativeRedeemablePreferredStockMember2022-04-012022-06-300000907254bfs:SeriesECumulativeRedeemablePreferredStockMemberus-gaap:DividendDeclaredMember2022-04-012022-06-300000907254us-gaap:RetainedEarningsMemberbfs:SeriesECumulativeRedeemablePreferredStockMember2022-04-012022-06-300000907254us-gaap:ParentMemberbfs:SeriesECumulativeRedeemablePreferredStockMember2022-04-012022-06-300000907254bfs:SeriesECumulativeRedeemablePreferredStockMember2022-04-012022-06-300000907254us-gaap:DividendDeclaredMember2022-04-012022-06-300000907254us-gaap:PreferredStockMember2022-06-300000907254us-gaap:CommonStockMember2022-06-300000907254us-gaap:AdditionalPaidInCapitalMember2022-06-300000907254bfs:UnitsInEscrowMember2022-06-300000907254us-gaap:RetainedEarningsMember2022-06-300000907254us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300000907254us-gaap:ParentMember2022-06-300000907254us-gaap:NoncontrollingInterestMember2022-06-3000009072542022-06-300000907254us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300000907254us-gaap:ParentMember2022-07-012022-09-300000907254us-gaap:RetainedEarningsMember2022-07-012022-09-300000907254us-gaap:NoncontrollingInterestMember2022-07-012022-09-300000907254us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300000907254bfs:SeriesDCumulativeRedeemablePreferredStockMemberus-gaap:DividendDeclaredMember2022-07-012022-09-300000907254us-gaap:RetainedEarningsMemberbfs:SeriesDCumulativeRedeemablePreferredStockMember2022-07-012022-09-300000907254us-gaap:ParentMemberbfs:SeriesDCumulativeRedeemablePreferredStockMember2022-07-012022-09-300000907254bfs:SeriesDCumulativeRedeemablePreferredStockMember2022-07-012022-09-300000907254bfs:SeriesECumulativeRedeemablePreferredStockMemberus-gaap:DividendDeclaredMember2022-07-012022-09-300000907254us-gaap:RetainedEarningsMemberbfs:SeriesECumulativeRedeemablePreferredStockMember2022-07-012022-09-300000907254us-gaap:ParentMemberbfs:SeriesECumulativeRedeemablePreferredStockMember2022-07-012022-09-300000907254bfs:SeriesECumulativeRedeemablePreferredStockMember2022-07-012022-09-300000907254us-gaap:DividendDeclaredMember2022-07-012022-09-300000907254us-gaap:PreferredStockMember2022-09-300000907254us-gaap:CommonStockMember2022-09-300000907254us-gaap:AdditionalPaidInCapitalMember2022-09-300000907254bfs:UnitsInEscrowMember2022-09-300000907254us-gaap:RetainedEarningsMember2022-09-300000907254us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300000907254us-gaap:ParentMember2022-09-300000907254us-gaap:NoncontrollingInterestMember2022-09-3000009072542022-09-300000907254bfs:SeriesDCumulativeRedeemablePreferredStockMember2023-01-012023-09-300000907254bfs:SeriesDCumulativeRedeemablePreferredStockMember2022-01-012022-09-300000907254bfs:SeriesECumulativeRedeemablePreferredStockMember2023-01-012023-09-300000907254bfs:SeriesECumulativeRedeemablePreferredStockMember2022-01-012022-09-30xbrli:purebfs:subsidiary0000907254bfs:ShoppingCentersMember2023-09-30bfs:property0000907254bfs:MixedUsePropertiesMember2023-09-300000907254bfs:NonoperatingDevelopmentPropertiesMember2023-09-30bfs:store0000907254bfs:GiantFoodMember2023-09-300000907254bfs:GiantFoodMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-09-300000907254bfs:NoIndividualTenantMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-09-300000907254bfs:SaulHoldingsLimitedPartnershipMember2023-01-012023-09-300000907254bfs:TwinbrookQuarterConstructionLoansMember2023-09-300000907254bfs:TwinbrookQuarterConstructionLoansMember2022-12-310000907254bfs:A7316WisconsinAvenueMember2023-09-300000907254bfs:A7316WisconsinAvenueMember2022-12-310000907254srt:OtherPropertyMember2023-09-300000907254srt:OtherPropertyMember2022-12-310000907254srt:MinimumMember2023-09-300000907254srt:MaximumMember2023-09-300000907254bfs:LeaseAcquisitionCostsMember2023-01-012023-09-300000907254bfs:LeaseAcquisitionCostsMember2022-01-012022-09-300000907254srt:MinimumMemberus-gaap:BuildingMember2023-09-300000907254srt:MaximumMemberus-gaap:BuildingMember2023-09-300000907254srt:MaximumMemberus-gaap:BuildingImprovementsMember2023-09-300000907254bfs:SaulHoldingsLimitedPartnershipMember2023-09-300000907254bfs:SaulHoldingsLimitedPartnershipMemberus-gaap:NoncontrollingInterestMember2023-09-300000907254bfs:ThirdPartyInvestorMember2023-09-300000907254bfs:LeaseholdInterestContributedInContributionAgreementMember2023-09-302023-09-300000907254us-gaap:NoncontrollingInterestMember2023-01-012023-09-300000907254us-gaap:NoncontrollingInterestMember2022-01-012022-09-300000907254us-gaap:LineOfCreditMember2023-09-300000907254us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-09-300000907254us-gaap:LineOfCreditMemberbfs:TermFacilityMember2023-09-300000907254us-gaap:LineOfCreditMemberbfs:TermFacilityMember2023-01-012023-09-300000907254bfs:SecuredOvernightFinancingRateSOFRMember2023-01-012023-09-300000907254bfs:SecuredOvernightFinancingRateSOFRMemberus-gaap:RevolvingCreditFacilityMember2023-01-012023-09-300000907254bfs:SecuredOvernightFinancingRateSOFRMemberbfs:TermFacilityMember2023-01-012023-09-300000907254bfs:UnsecuredRevolvingCreditFacilityMember2023-09-300000907254us-gaap:LetterOfCreditMember2023-09-3000009072542022-08-23bfs:swap0000907254us-gaap:SecuredDebtMemberbfs:TermLoanMember2022-08-230000907254bfs:AgreementEndingOctober12027Memberbfs:TermLoanMemberus-gaap:SecuredDebtMember2022-08-230000907254bfs:TermLoanMemberus-gaap:SecuredDebtMemberbfs:AgreementEndingOctober12030Member2022-08-230000907254srt:ScenarioForecastMemberbfs:AgreementEndingOctober12027Memberbfs:SecuredOvernightFinancingRateSOFRMemberbfs:TermLoanMemberus-gaap:SecuredDebtMember2027-10-010000907254srt:ScenarioForecastMemberbfs:SecuredOvernightFinancingRateSOFRMemberbfs:TermLoanMemberus-gaap:SecuredDebtMemberbfs:AgreementEndingOctober12030Member2030-10-010000907254us-gaap:InterestRateSwapMember2023-09-300000907254bfs:BJsWholesaleClubMemberus-gaap:MortgagesMember2023-03-080000907254bfs:BJsWholesaleClubMemberus-gaap:MortgagesMember2023-03-082023-03-080000907254us-gaap:MortgagesMember2023-03-082023-03-080000907254us-gaap:ConstructionLoansMemberbfs:ConstructionToPermanentLoanMember2023-06-300000907254us-gaap:ConstructionLoansMemberbfs:ConstructionToPermanentLoanMember2023-09-300000907254bfs:TwinbrookQuarterConstructionLoansMember2023-09-300000907254bfs:KentlandsPlaceMortgageMemberus-gaap:MortgagesMember2023-09-300000907254bfs:TheWaycroftMortgageMemberus-gaap:MortgagesMember2023-09-300000907254bfs:AshbrookMarketplaceMortgageMemberus-gaap:MortgagesMember2023-09-300000907254bfs:AvenelBusinessParkMember2023-09-300000907254bfs:AvenelBusinessParkMemberus-gaap:MortgagesMember2023-09-300000907254bfs:UnsecuredRevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-09-300000907254bfs:HampdenHouseConstructionLoansMember2023-09-300000907254bfs:TwinbrookQuarterConstructionLoansMember2022-12-310000907254bfs:HampdenHouseConstructionLoansMember2022-12-310000907254us-gaap:StockOptionMember2023-07-012023-09-300000907254us-gaap:StockOptionMember2022-07-012022-09-300000907254us-gaap:StockOptionMember2023-01-012023-09-300000907254us-gaap:StockOptionMember2022-01-012022-09-300000907254us-gaap:RelatedPartyMemberbfs:SharedServicesAgreementMember2023-01-012023-09-300000907254us-gaap:RelatedPartyMemberbfs:SharedServicesAgreementMember2022-01-012022-09-300000907254us-gaap:RelatedPartyMemberbfs:SharedServicesAgreementMember2023-09-300000907254us-gaap:RelatedPartyMemberbfs:SharedServicesAgreementMember2022-12-310000907254us-gaap:RelatedPartyMember2023-01-012023-09-300000907254us-gaap:RelatedPartyMember2022-01-012022-09-300000907254us-gaap:EmployeeStockOptionMember2023-01-012023-09-300000907254srt:OfficerMemberus-gaap:EmployeeStockOptionMember2023-01-012023-09-3000009072542023-06-302023-06-300000907254bfs:DirectorAndCertainOfficersMember2023-05-122023-05-120000907254srt:DirectorMemberbfs:May122023Member2023-01-012023-09-300000907254srt:DirectorMemberbfs:May132022Member2023-01-012023-09-300000907254srt:OfficerMemberbfs:May122023Member2023-01-012023-09-300000907254srt:OfficerMemberbfs:May132022Member2023-01-012023-09-3000009072542023-09-290000907254us-gaap:InterestRateSwapMember2023-01-012023-09-300000907254us-gaap:OtherAssetsMemberus-gaap:InterestRateSwapMember2023-09-300000907254us-gaap:OtherAssetsMemberus-gaap:InterestRateSwapMember2022-12-31bfs:segment0000907254us-gaap:OperatingSegmentsMemberbfs:ShoppingCentersMember2023-07-012023-09-300000907254us-gaap:OperatingSegmentsMemberbfs:MixedUsePropertiesMember2023-07-012023-09-300000907254us-gaap:CorporateNonSegmentMember2023-07-012023-09-300000907254us-gaap:OperatingSegmentsMemberbfs:ShoppingCentersMember2023-09-300000907254us-gaap:OperatingSegmentsMemberbfs:MixedUsePropertiesMember2023-09-300000907254us-gaap:CorporateNonSegmentMember2023-09-300000907254us-gaap:OperatingSegmentsMemberbfs:ShoppingCentersMember2022-07-012022-09-300000907254us-gaap:OperatingSegmentsMemberbfs:MixedUsePropertiesMember2022-07-012022-09-300000907254us-gaap:CorporateNonSegmentMember2022-07-012022-09-300000907254us-gaap:OperatingSegmentsMemberbfs:ShoppingCentersMember2022-09-300000907254us-gaap:OperatingSegmentsMemberbfs:MixedUsePropertiesMember2022-09-300000907254us-gaap:CorporateNonSegmentMember2022-09-300000907254us-gaap:OperatingSegmentsMemberbfs:ShoppingCentersMember2023-01-012023-09-300000907254us-gaap:OperatingSegmentsMemberbfs:MixedUsePropertiesMember2023-01-012023-09-300000907254us-gaap:CorporateNonSegmentMember2023-01-012023-09-300000907254us-gaap:OperatingSegmentsMemberbfs:ShoppingCentersMember2022-01-012022-09-300000907254us-gaap:OperatingSegmentsMemberbfs:MixedUsePropertiesMember2022-01-012022-09-300000907254us-gaap:CorporateNonSegmentMember2022-01-012022-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934.

For the quarterly period ended September 30, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 1-12254

| | |

| SAUL CENTERS, INC. |

| (Exact name of registrant as specified in its charter) |

| | | | | |

| Maryland | 52-1833074 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

7501 Wisconsin Avenue, Bethesda, Maryland 20814

(Address of principal executive office) (Zip Code)

Registrant’s telephone number, including area code (301) 986-6200

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class: | Trading symbol: | Name of exchange on which registered: |

| Common Stock, Par Value $0.01 Per Share | BFS | New York Stock Exchange |

| Depositary Shares each representing 1/100th of a share of 6.125% Series D Cumulative Redeemable Preferred Stock, Par Value $0.01 Per Share | BFS/PRD | New York Stock Exchange |

| Depositary Shares each representing 1/100th of a share of 6.000% Series E Cumulative Redeemable Preferred Stock, Par Value $0.01 Per Share | BFS/PRE | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirement for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☐ | Accelerated filer | | ☒ |

| | | |

| Non-accelerated filer | | ☐ | Smaller reporting company | | ☐ |

| | | | | |

| | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Number of shares of common stock, par value $0.01 per share outstanding as of October 30, 2023: 23,943,816.

SAUL CENTERS, INC.

Table of Contents

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | |

| (Dollars in thousands, except per share amounts) | September 30,

2023 | | December 31,

2022 |

| | | |

| Assets | | | |

| Real estate investments | | | |

| Land | $ | 511,529 | | | $ | 511,529 | |

| Buildings and equipment | 1,588,219 | | | 1,574,381 | |

| Construction in progress | 467,939 | | | 322,226 | |

| 2,567,687 | | | 2,408,136 | |

| Accumulated depreciation | (719,163) | | | (688,475) | |

| 1,848,524 | | | 1,719,661 | |

| Cash and cash equivalents | 6,586 | | | 13,279 | |

| Accounts receivable and accrued income, net | 56,894 | | | 56,323 | |

| Deferred leasing costs, net | 23,147 | | | 22,388 | |

| | | |

| Other assets | 25,772 | | | 21,651 | |

| Total assets | $ | 1,960,923 | | | $ | 1,833,302 | |

| Liabilities | | | |

| Notes payable, net | $ | 943,538 | | | $ | 961,577 | |

| Revolving credit facility payable, net | 249,521 | | | 161,941 | |

| Term loan facility payable, net | 99,493 | | | 99,382 | |

| Construction loan payable, net | 50,760 | | | — | |

| Accounts payable, accrued expenses and other liabilities | 60,819 | | | 42,978 | |

| Deferred income | 22,977 | | | 23,169 | |

| Dividends and distributions payable | 22,482 | | | 22,453 | |

| | | |

| Total liabilities | 1,449,590 | | | 1,311,500 | |

| Equity | | | |

Preferred stock, 1,000,000 shares authorized: | | | |

| | | |

| | | |

Series D Cumulative Redeemable, 30,000 shares issued and outstanding | 75,000 | | | 75,000 | |

Series E Cumulative Redeemable, 44,000 shares issued and outstanding | 110,000 | | | 110,000 | |

Common stock, $0.01 par value, 40,000,000 shares authorized, 24,064,211 and 24,016,009 shares issued and outstanding, respectively | 241 | | | 240 | |

| Additional paid-in capital | 449,076 | | | 446,301 | |

| Partnership units in escrow | 39,650 | | | 39,650 | |

| Distributions in excess of accumulated earnings | (285,024) | | | (273,559) | |

| Accumulated other comprehensive income | 4,724 | | | 2,852 | |

| Total Saul Centers, Inc. equity | 393,667 | | | 400,484 | |

| Noncontrolling interests | 117,666 | | | 121,318 | |

| Total equity | 511,333 | | | 521,802 | |

| Total liabilities and equity | $ | 1,960,923 | | | $ | 1,833,302 | |

The Notes to Financial Statements are an integral part of these statements.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands, except per share amounts) | Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | | | | | | | |

| Rental revenue | $ | 62,369 | | | $ | 59,951 | | | $ | 186,199 | | | $ | 179,765 | |

| Other | 1,397 | | | 1,136 | | | 4,325 | | | 3,759 | |

| Total revenue | 63,766 | | | 61,087 | | | 190,524 | | | 183,524 | |

| Expenses | | | | | | | |

| Property operating expenses | 9,720 | | | 8,995 | | | 27,502 | | | 26,174 | |

| Real estate taxes | 7,641 | | | 7,078 | | | 22,589 | | | 21,652 | |

| Interest expense, net and amortization of deferred debt costs | 12,419 | | | 11,103 | | | 36,518 | | | 32,162 | |

| Depreciation and amortization of deferred leasing costs | 12,096 | | | 12,195 | | | 36,227 | | | 36,899 | |

| General and administrative | 5,179 | | | 5,555 | | | 16,125 | | | 15,988 | |

| Loss on early extinguishment of debt | — | | | 648 | | | — | | | 648 | |

| Total expenses | 47,055 | | | 45,574 | | | 138,961 | | | 133,523 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net Income | 16,711 | | | 15,513 | | | 51,563 | | | 50,001 | |

| Noncontrolling interests | | | | | | | |

| Income attributable to noncontrolling interests | (3,892) | | | (3,563) | | | (12,080) | | | (11,670) | |

| Net income attributable to Saul Centers, Inc. | 12,819 | | | 11,950 | | | 39,483 | | | 38,331 | |

| | | | | | | |

| Preferred stock dividends | (2,798) | | | (2,798) | | | (8,395) | | | (8,395) | |

| Net income available to common stockholders | $ | 10,021 | | | $ | 9,152 | | | $ | 31,088 | | | $ | 29,936 | |

| Per share net income available to common stockholders | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic and diluted | $ | 0.42 | | | $ | 0.38 | | | $ | 1.29 | | | $ | 1.25 | |

| | | | | | | |

| | | | | | | |

The Notes to Financial Statements are an integral part of these statements.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (Dollars in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | $ | 16,711 | | | $ | 15,513 | | | $ | 51,563 | | | $ | 50,001 | |

| Other comprehensive income | | | | | | | |

| Change in unrealized gain on cash flow hedge | 2,211 | | | 4,256 | | | 2,598 | | | 4,256 | |

| Total comprehensive income | 18,922 | | | 19,769 | | | 54,161 | | | 54,257 | |

| Comprehensive income attributable to noncontrolling interests | (4,510) | | | (4,756) | | | (12,806) | | | (12,863) | |

| Total comprehensive income attributable to Saul Centers, Inc. | 14,412 | | | 15,013 | | | 41,355 | | | 41,394 | |

| | | | | | | |

| Preferred stock dividends | (2,798) | | | (2,798) | | | (8,395) | | | (8,395) | |

| Total comprehensive income available to common stockholders | $ | 11,614 | | | $ | 12,215 | | | $ | 32,960 | | | $ | 32,999 | |

The Notes to Financial Statements are an integral part of these statements.

CONSOLIDATED STATEMENTS OF EQUITY

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands, except per share amounts) | Preferred

Stock | | Common

Stock | | Additional Paid-in

Capital | | Partnership Units in Escrow | | Distributions in Excess of Accumulated Earnings | | Accumulated

Other Comprehensive

Income | | Total Saul

Centers, Inc. | | Noncontrolling

Interests | | Total |

| Balance, January 1, 2023 | $ | 185,000 | | | $ | 240 | | | $ | 446,301 | | | $ | 39,650 | | | $ | (273,559) | | | $ | 2,852 | | | $ | 400,484 | | | $ | 121,318 | | | $ | 521,802 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Issuance of shares of common stock: | | | | | | | | | | | | | | | | | |

13,227 shares pursuant to dividend reinvestment plan | — | | | — | | | 543 | | | — | | | — | | | — | | | 543 | | | — | | | 543 | |

699 shares due to share grants, exercise of stock options and issuance of directors’ deferred stock | — | | | — | | | 290 | | | — | | | — | | | — | | | 290 | | | — | | | 290 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | — | | | 13,502 | | | — | | | 13,502 | | | 4,161 | | | 17,663 | |

| Change in unrealized gain/loss on cash flow hedge | — | | | — | | | — | | | — | | | — | | | (1,450) | | | (1,450) | | | (564) | | | (2,014) | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Distributions payable preferred stock: | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Series D, $38.28 per share | — | | | — | | | — | | | — | | | (1,148) | | | — | | | (1,148) | | | — | | | (1,148) | |

Series E, $37.50 per share | — | | | — | | | — | | | — | | | (1,650) | | | — | | | (1,650) | | | — | | | (1,650) | |

Distributions payable common stock ($0.59/share) and distributions payable partnership units ($0.59/unit) | — | | | — | | | — | | | — | | | (14,165) | | | — | | | (14,165) | | | (5,486) | | | (19,651) | |

| Balance, March 31, 2023 | 185,000 | | | 240 | | | 447,134 | | | 39,650 | | | (277,020) | | | 1,402 | | | 396,406 | | | 119,429 | | | 515,835 | |

| | | | | | | | | | | | | | | | | |

| Issuance of shares of common stock: | | | | | | | | | | | | | | | | | |

15,588 shares pursuant to dividend reinvestment plan | — | | | — | | | 544 | | | — | | | — | | | — | | | 544 | | | — | | | 544 | |

3,104 shares due to share grants, exercise of stock options and issuance of directors’ deferred stock | — | | | — | | | 553 | | | — | | | — | | | — | | | 553 | | | — | | | 553 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | — | | | 13,162 | | | — | | | 13,162 | | | 4,027 | | | 17,189 | |

| Change in unrealized gain/loss on cash flow hedge | — | | | — | | | — | | | — | | | — | | | 1,729 | | | 1,729 | | | 672 | | | 2,401 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Distributions payable preferred stock: | | | | | | | | | | | | | | | | | |

Series D, $38.28 per share | — | | | — | | | — | | | — | | | (1,149) | | | — | | | (1,149) | | | — | | | (1,149) | |

Series E, $37.50 per share | — | | | — | | | — | | | — | | | (1,650) | | | — | | | (1,650) | | | — | | | (1,650) | |

Distributions payable common stock ($0.59/share) and distributions payable partnership units ($0.59/unit) | — | | | — | | | — | | | — | | | (14,193) | | | — | | | (14,193) | | | (5,486) | | | (19,679) | |

| Balance, June 30, 2023 | 185,000 | | | 240 | | | 448,231 | | | 39,650 | | | (280,850) | | | 3,131 | | | 395,402 | | | 118,642 | | | 514,044 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CONSOLIDATED STATEMENTS OF EQUITY (continued) (Unaudited) |

| (Dollars in thousands, except per share amounts) | Preferred

Stock | | Common

Stock | | Additional Paid-in

Capital | | Partnership Units in Escrow | | Distributions in Excess of Accumulated Earnings | | Accumulated

Other Comprehensive

Income | | Total Saul

Centers, Inc. | | Noncontrolling

Interests | | Total |

| | | | | | | | | | | | | | | | | |

| Issuance of shares of common stock: | | | | | | | | | | | | | | | | | |

14,690 shares pursuant to dividend reinvestment plan | — | | | 1 | | | 554 | | | — | | | — | | | — | | | 555 | | | — | | | 555 | |

895 shares due to share grants, exercise of stock options and issuance of directors’ deferred stock | — | | | — | | | 291 | | | — | | | — | | | — | | | 291 | | | — | | | 291 | |

| | | | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | — | | | 12,819 | | | — | | | 12,819 | | | 3,892 | | | 16,711 | |

| Change in unrealized gain on cash flow hedge | — | | | — | | | — | | | — | | | — | | | 1,593 | | | 1,593 | | | 618 | | | 2,211 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Distributions payable preferred stock: | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Series D, $38.28 per share | — | | | — | | | — | | | — | | | (1,148) | | | — | | | (1,148) | | | — | | | (1,148) | |

Series E, $37.50 per share | — | | | — | | | — | | | — | | | (1,650) | | | — | | | (1,650) | | | — | | | (1,650) | |

Distributions payable common stock ($0.59/share) and distributions payable partnership units ($0.59/unit) | — | | | — | | | — | | | — | | | (14,195) | | | — | | | (14,195) | | | (5,486) | | | (19,681) | |

| Balance, September 30, 2023 | $ | 185,000 | | | $ | 241 | | | $ | 449,076 | | | $ | 39,650 | | | $ | (285,024) | | | $ | 4,724 | | | $ | 393,667 | | | $ | 117,666 | | | $ | 511,333 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CONSOLIDATED STATEMENTS OF EQUITY (continued) (Unaudited) |

| (Dollars in thousands, except per share amounts) | Preferred

Stock | | Common

Stock | | Additional Paid-in

Capital | | Partnership Units in Escrow | | Distributions in Excess of Accumulated Earnings | | Accumulated

Other Comprehensive

Income | | Total Saul

Centers, Inc. | | Noncontrolling

Interests | | Total |

| Balance, January 1, 2022 | $ | 185,000 | | | $ | 238 | | | $ | 436,609 | | | $ | 39,650 | | | $ | (256,448) | | | $ | — | | | $ | 405,049 | | | $ | 125,438 | | | $ | 530,487 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Issuance of shares of common stock: | | | | | | | | | | | | | | | | | |

61,861 shares pursuant to dividend reinvestment plan | — | | | 1 | | | 2,948 | | | — | | | — | | | — | | | 2,949 | | | — | | | 2,949 | |

8,007 shares due to share grants, exercise of stock options and issuance of directors’ deferred stock | — | | | — | | | 594 | | | — | | | — | | | — | | | 594 | | | — | | | 594 | |

Issuance of 13,704 partnership units pursuant to dividend reinvestment plan | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 653 | | | 653 | |

| | | | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | — | | | 13,365 | | | — | | | 13,365 | | | 4,126 | | | 17,491 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Distributions payable preferred stock: | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Series D, $38.28 per share | — | | | — | | | — | | | — | | | (1,148) | | | — | | | (1,148) | | | — | | | (1,148) | |

Series E, $37.50 per share | — | | | — | | | — | | | — | | | (1,650) | | | — | | | (1,650) | | | — | | | (1,650) | |

Distributions payable common stock ($0.57/share) and distributions payable partnership units ($0.57/unit) | — | | | — | | | — | | | — | | | (13,625) | | | — | | | (13,625) | | | (5,292) | | | (18,917) | |

| Balance, March 31, 2022 | 185,000 | | | 239 | | | 440,151 | | | 39,650 | | | (259,506) | | | — | | | 405,534 | | | 124,925 | | | 530,459 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Issuance of shares of common stock: | | | | | | | | | | | | | | | | | |

57,821 shares pursuant to dividend reinvestment plan | — | | | 1 | | | 2,948 | | | — | | | — | | | — | | | 2,949 | | | — | | | 2,949 | |

19,618 shares due to share grants, exercise of stock options and issuance of directors’ deferred stock | — | | | — | | | 1,397 | | | — | | | — | | | — | | | 1,397 | | | — | | | 1,397 | |

| | | | | | | | | | | | | | | | | |

Issuance of 12,955 partnership units pursuant to dividend reinvestment plan | — | | | — | | | — | | | — | | | — | | | — | | | — | | | 669 | | | 669 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | — | | | 13,016 | | | — | | | 13,016 | | | 3,981 | | | 16,997 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Distributions payable preferred stock: | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Series D, $38.28 per share | — | | | — | | | — | | | — | | | (1,148) | | | — | | | (1,148) | | | — | | | (1,148) | |

Series E, $37.50 per share | — | | | — | | | — | | | — | | | (1,650) | | | — | | | (1,650) | | | — | | | (1,650) | |

Distributions payable common stock ($0.59/share) and distributions payable partnership units ($0.59/unit) | — | | | — | | | — | | | — | | | (14,156) | | | — | | | (14,156) | | | (5,486) | | | (19,642) | |

| Balance, June 30, 2022 | 185,000 | | | 240 | | | 444,496 | | | 39,650 | | | (263,444) | | | — | | | 405,942 | | | 124,089 | | | 530,031 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

CONSOLIDATED STATEMENTS OF EQUITY (continued) (Unaudited) |

| (Dollars in thousands, except per share amounts) | Preferred

Stock | | Common

Stock | | Additional Paid-in

Capital | | Partnership Units in Escrow | | Distributions in Excess of Accumulated Earnings | | Accumulated

Other Comprehensive

Income | | Total Saul

Centers, Inc. | | Noncontrolling

Interests | | Total |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Issuance of shares of common stock: | | | | | | | | | | | | | | | | | |

10,577 shares pursuant to dividend reinvestment plan | — | | | — | | | 537 | | | — | | | — | | | — | | | 537 | | | — | | | 537 | |

3,191 shares due to share grants exercise of stock options and issuance of directors’ deferred stock | — | | | — | | | 423 | | | — | | | — | | | — | | | 423 | | | — | | | 423 | |

| | | | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | — | | | 11,950 | | | — | | | 11,950 | | | 3,563 | | | 15,513 | |

| Change in unrealized loss on cash flow hedge | — | | | — | | | — | | | — | | | — | | | 3,063 | | | 3,063 | | | 1,193 | | | 4,256 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Distributions payable preferred stock: | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Series D, $38.28 per share | — | | | — | | | — | | | — | | | (1,148) | | | — | | | (1,148) | | | — | | | (1,148) | |

Series E, $37.50 per share | — | | | — | | | — | | | — | | | (1,650) | | | — | | | (1,650) | | | — | | | (1,650) | |

Distributions payable common stock ($0.59/share) and distributions payable partnership units ($0.59/unit) | — | | | — | | | — | | | — | | | (14,159) | | | — | | | (14,159) | | | (5,486) | | | (19,645) | |

| Balance, September 30, 2022 | $ | 185,000 | | | $ | 240 | | | $ | 445,456 | | | $ | 39,650 | | | $ | (268,451) | | | $ | 3,063 | | | $ | 404,958 | | | $ | 123,359 | | | $ | 528,317 | |

| | | | | | | | | | | | | | | | | |

The Notes to Financial Statements are an integral part of these statements.

| | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| (Unaudited) |

| Nine Months Ended September 30, |

| (Dollars in thousands) | 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net income | $ | 51,563 | | | $ | 50,001 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Loss on early extinguishment of debt | — | | | 648 | |

| | | |

| | | |

| | | |

| Depreciation and amortization of deferred leasing costs | 36,227 | | | 36,899 | |

| Amortization of deferred debt costs | 1,687 | | | 1,428 | |

| Compensation costs of stock and option grants | 1,134 | | | 1,220 | |

| Credit losses (recoveries) on operating lease receivables, net | 160 | | | (20) | |

| Increase in accounts receivable and accrued income | (731) | | | (3) | |

| Additions to deferred leasing costs | (3,856) | | | (1,417) | |

| | | |

| Increase in other assets | (4,304) | | | (1,531) | |

| Increase in accounts payable, accrued expenses and other liabilities | 3,352 | | | 4,085 | |

| Increase (decrease) in deferred income | (192) | | | 699 | |

| | | |

| Net cash provided by operating activities | 85,040 | | | 92,009 | |

| Cash flows from investing activities: | | | |

| | | |

| Additions to real estate investments | (18,612) | | | (12,215) | |

| Additions to development and redevelopment projects | (128,655) | | | (72,294) | |

| | | |

| | | |

| | | |

| Net cash used in investing activities | (147,267) | | | (84,509) | |

| Cash flows from financing activities: | | | |

| Proceeds from notes payable | 15,300 | | | 199,750 | |

| Repayments on notes payable | (33,910) | | | (166,290) | |

| | | |

| Proceeds from revolving credit facility | 113,000 | | | 119,000 | |

| Repayments on revolving credit facility | (26,000) | | | (97,000) | |

| Proceeds from construction loan | 53,306 | | | — | |

| Payments of debt extinguishment costs | — | | | (593) | |

| Additions to deferred debt costs | (423) | | | (9,800) | |

| Proceeds from the issuance of: | | | |

| Common stock | 1,642 | | | 7,629 | |

| Partnership units | — | | | 1,322 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Distributions to: | | | |

| | | |

| Series D preferred stockholders | (3,446) | | | (3,445) | |

| Series E preferred stockholders | (4,950) | | | (4,950) | |

| Common stockholders | (42,527) | | | (41,364) | |

| Noncontrolling interests | (16,458) | | | (16,062) | |

| Net cash provided by (used in) financing activities | 55,534 | | | (11,803) | |

| Net decrease in cash and cash equivalents | (6,693) | | | (4,303) | |

| Cash and cash equivalents, beginning of period | 13,279 | | | 14,594 | |

| Cash and cash equivalents, end of period | $ | 6,586 | | | $ | 10,291 | |

| Supplemental disclosure of cash flow information: | | | |

| Cash paid for interest | $ | 34,424 | | | $ | 30,295 | |

Accrued capital expenditures included in accounts payable, accrued expenses,

and other liabilities | $ | 33,495 | | | $ | 13,955 | |

The Notes to Financial Statements are an integral part of these statements.

Notes to Consolidated Financial Statements (Unaudited)

1. Organization, Basis of Presentation

Saul Centers, Inc. (“Saul Centers”) was incorporated under the Maryland General Corporation Law on June 10, 1993, and operates as a real estate investment trust (a “REIT”) under the Internal Revenue Code of 1986, as amended (the “Code”). The Company is required to annually distribute at least 90% of its REIT taxable income (excluding net capital gains) to its stockholders and meet certain organizational and other requirements. Saul Centers has made and intends to continue to make regular quarterly distributions to its stockholders. Saul Centers, together with its wholly-owned subsidiaries and the limited partnerships of which Saul Centers or one of its subsidiaries is the sole general partner, are referred to collectively as the “Company.” B. Francis Saul II serves as Chairman of the Board of Directors (the “Board”) and Chief Executive Officer of Saul Centers.

The Company, which conducts all of its activities through its subsidiaries, Saul Holdings Limited Partnership, a Maryland limited partnership (the “Operating Partnership”) and two subsidiary limited partnerships (the “Subsidiary Partnerships,” and, collectively with the Operating Partnership, the “Partnerships”), engages in the ownership, operation, management, leasing, acquisition, renovation, expansion, development and financing of community and neighborhood shopping centers and mixed-use properties, primarily in the Washington, D.C./Baltimore metropolitan area.

As of September 30, 2023, the Company’s properties (the “Current Portfolio Properties”) consisted of 50 shopping center properties (the “Shopping Centers”), seven mixed-use properties, which are comprised of office, retail and multi-family residential uses (the “Mixed-Use Properties”) and four (non-operating) land and development properties.

Because the properties are located primarily in the Washington, D.C./Baltimore metropolitan area, the Company is subject to a concentration of credit risk related to these properties. The Shopping Centers, a majority of which are anchored by one or more major tenants and 33 of which are anchored by a grocery store, offer primarily day-to-day necessities and services. Giant Food, a tenant at 11 Shopping Centers, individually accounted for 4.9% of the Company's total revenue for the nine months ended September 30, 2023. No other tenant individually accounted for 2.5% or more of the Company’s total revenue, excluding lease termination fees, for the nine months ended September 30, 2023.

The accompanying consolidated financial statements of the Company include the accounts of Saul Centers and its subsidiaries, including the Partnerships, which are majority owned by Saul Centers. Substantially all assets and liabilities of the Company as of September 30, 2023 and December 31, 2022, are comprised of the assets and liabilities of the Operating Partnership. Debt arrangements subject to recourse are described in Note 5. All significant intercompany balances and transactions have been eliminated in consolidation.

The Operating Partnership is a variable interest entity (“VIE”) because the limited partners do not have substantive kick-out or participating rights. The Company is the primary beneficiary of the Operating Partnership because it has the power to direct its activities and the rights to absorb 72.0% of its net income. Because the Operating Partnership is consolidated into the financial statements of the Company, classification of it as a VIE has no impact on the consolidated financial statements of the Company.

The accompanying consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. In the opinion of management, all adjustments necessary for the fair presentation of the financial position and results of operations of the Company for the interim periods have been included. All such adjustments are of a normal recurring nature. These consolidated financial statements and the accompanying notes should be read in conjunction with the audited consolidated financial statements of the Company for the year ended December 31, 2022, which are included in its Annual Report on Form 10-K. Certain information and note disclosures normally included in annual financial statements prepared in accordance with GAAP have been omitted pursuant to those instructions. The results of operations for interim periods are not necessarily indicative of results to be expected for the year.

Notes to Consolidated Financial Statements (Unaudited)

2. Summary of Significant Accounting Policies

Our significant accounting policies disclosed in our Annual Report on Form 10-K for the year ended December 31, 2022 have not changed significantly in number or composition.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. The most significant estimates and assumptions relate to collectability of operating lease receivables and impairment of real estate properties. Actual results could differ from those estimates.

Accounts Receivable, Accrued Income and Allowance for Doubtful Accounts

Accounts receivable are primarily comprised of rental and reimbursement billings due from tenants, and straight-line rent receivables representing the cumulative amount of adjustments necessary to present rental income on a straight-line basis. Individual leases are assessed for collectability and, upon the determination that the collection of rents is not probable, accrued rent and accounts receivable are charged off, and the charge off is reflected as an adjustment to rental revenue. Revenue from leases where collection is not probable is recorded on a cash basis until collectability is determined to be probable. Further, we assess whether operating lease receivables, at the portfolio level, are appropriately valued based upon an analysis of balances outstanding, historical bad debt levels and current economic trends. As of September 30, 2023, of the $9.4 million of rents previously deferred, $0.3 million has been written off and $0.4 million has not yet come due. The amount that has not yet come due is included in Accounts receivable and accrued income, net in the Consolidated Balance Sheets.

Reclassifications

Certain reclassifications have been made to the prior year financial statements to conform to the presentation used as of and for the nine months ended September 30, 2023.

3. Real Estate

Construction In Progress

Construction in progress includes land, preconstruction and development costs of active projects. Preconstruction costs include legal, zoning and permitting costs and other project carrying costs incurred prior to the commencement of construction. Development costs include direct construction costs and indirect costs incurred subsequent to the start of construction such as architectural, engineering, construction management and carrying costs consisting of interest, real estate taxes and insurance.

Construction in progress as of September 30, 2023 and December 31, 2022, is composed of the following:

| | | | | | | | | | | | |

| (In thousands) | | September 30, 2023 | | December 31, 2022 |

Twinbrook Quarter (1) | | $ | 328,862 | | | $ | 227,672 | |

Hampden House (2) | 120,787 | | | 80,704 | |

| | | | |

| | | | |

| Other | | 18,290 | | | 13,850 | |

| Total | | $ | 467,939 | | | $ | 322,226 | |

(1) Includes capitalized interest of $22.4 million and $12.4 million, as of September 30, 2023 and December 31, 2022, respectively.

(2) Includes capitalized interest of $12.4 million and $8.7 million, as of September 30, 2023 and December 31, 2022, respectively.

Leases

We lease Shopping Centers and Mixed-Use Properties to lessees in exchange for monthly payments that cover rent, and, where applicable, reimbursement for property taxes, insurance, and certain property operating expenses. Our leases have been determined to be operating leases and generally range in term from one to 15 years.

Some of our leases have termination options and/or extension options. Termination options allow the lessee and/or lessor to terminate the lease prior to the end of the lease term, provided certain conditions are met. Termination options generally require advance notification from the lessee and/or lessor and payment of a termination fee. Termination fees are recognized as revenue over the modified lease term. Extension options are subject to terms and conditions stated in the lease.

Notes to Consolidated Financial Statements (Unaudited)

An operating lease right of use asset and corresponding lease liability related to our headquarters sublease are reflected in other assets and other liabilities, respectively. The sublease expires on February 28, 2027. The right of use asset and corresponding lease liability totaled $2.7 million and $2.7 million, respectively, at September 30, 2023.

Deferred Leasing Costs

Deferred leasing costs primarily consist of initial direct costs incurred in connection with successful property leasing and amounts attributed to in-place leases associated with acquired properties. Such amounts are capitalized and amortized, using the straight-line method, over the term of the lease or the remaining term of an acquired lease. Initial direct costs primarily consist of leasing commissions, which are costs paid to third-party brokers and lease commissions paid to certain employees that are incremental to obtaining a lease and would not have been incurred if the lease had not been obtained. Unamortized deferred costs are charged to expense if the applicable lease is terminated prior to expiration of the initial lease term. Collectively, deferred leasing costs totaled $23.1 million and $22.4 million, net of accumulated amortization of $53.3 million and $51.3 million, as of September 30, 2023 and December 31, 2022, respectively. Amortization expense, included in depreciation and amortization of deferred leasing costs in the Consolidated Statements of Operations, totaled $3.1 million and $3.2 million for the nine months ended September 30, 2023 and 2022, respectively.

Real Estate Investment Properties

Depreciation is calculated using the straight-line method and estimated useful lives of generally between 35 and 50 years for base buildings, or a shorter period if management determines that the building has a shorter useful life, and up to 20 years for certain other improvements that extend the useful lives. Leasehold improvement expenditures are capitalized when certain criteria are met, including when the Company supervises construction and will own the improvements. Tenant improvements are amortized, over the shorter of the lives of the related leases or the useful life of the improvements, using the straight-line method. Depreciation expense in the Consolidated Statements of Operations totaled $33.1 million and $33.7 million for the nine months ended September 30, 2023 and 2022, respectively. Repairs and maintenance expense totaled $11.3 million and $11.1 million for the nine months ended September 30, 2023 and 2022, respectively, and is included in property operating expenses in the Consolidated Statements of Operations.

As of September 30, 2023, we have not identified any impairment triggering events, including the impact of COVID-19 and corresponding tenant requests for rent relief. Therefore, under applicable GAAP guidance, no impairment charges were recorded.

4. Noncontrolling Interests - Holders of Convertible Limited Partnership Units in the Operating Partnership

As of September 30, 2023, the B. F. Saul Company and certain other affiliated entities, each of which is controlled by B. Francis Saul II and his family members, (collectively, the “Saul Organization”) held an aggregate 26.6% limited partnership interest in the Operating Partnership represented by approximately 8.8 million convertible limited partnership units. These units are convertible into shares of Saul Centers’ common stock, at the option of the unit holder, on a one-for-one basis provided that, in accordance with the Company’s Articles of Incorporation, the rights may not be exercised at any time that the Saul Organization beneficially owns or will own after the exercise, directly or indirectly, in the aggregate more than 39.9% of the value of the outstanding common stock and preferred stock of Saul Centers (the “Equity Securities”). As of September 30, 2023, approximately 825,000 units could be converted into shares of Saul Centers common stock.

Notes to Consolidated Financial Statements (Unaudited)

As of September 30, 2023, a third party investor holds a 1.4% limited partnership interest in the Operating Partnership represented by 469,740 convertible limited partnership units. At the option of the unit holder, these units are convertible into shares of Saul Centers’ common stock on a one-for-one basis; provided that, in lieu of the delivery of Saul Centers’ common stock, Saul Centers may, in its sole discretion, deliver cash in an amount equal to the value of such Saul Centers’ common stock.

The impact of the aggregate 28.0% limited partnership interest in the Operating Partnership held by parties other than Saul Centers is reflected as Noncontrolling Interests in the accompanying consolidated financial statements. Weighted average fully diluted partnership units and common stock outstanding for the three months ended September 30, 2023 and 2022, was approximately 34.1 million and 34.0 million, respectively and for the nine months ended September 30, 2023 and 2022, was approximately 34.0 million and 34.0 million, respectively.

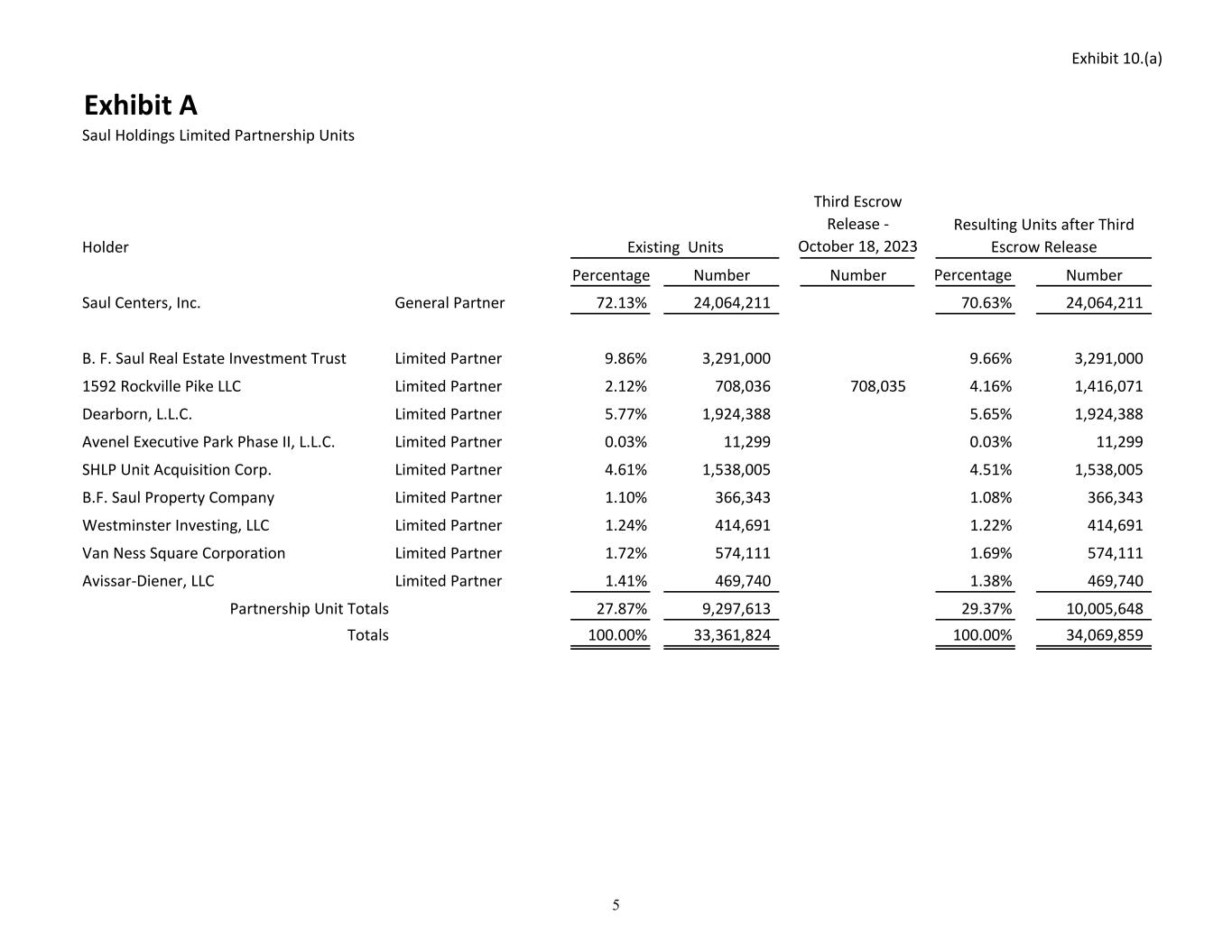

The Company previously issued 708,035 limited partnership units related to the contribution of Twinbrook Quarter that were held in escrow as of September 30, 2023 and were released on October 18, 2023, as scheduled. Prior to the escrow release date, the units were not eligible to receive distributions from the Operating Partnership.

5. Notes Payable, Bank Credit Facility, Interest and Amortization of Deferred Debt Costs

At September 30, 2023, the Company had a $525.0 million senior unsecured credit facility (the “Credit Facility”) comprised of a $425.0 million revolving credit facility and a $100.0 million term loan. The revolving credit facility matures on August 29, 2025, and may be extended by the Company for one additional year, subject to satisfaction of certain conditions. The term loan matures on February 26, 2027. Interest accrues at the Secured Overnight Financing Rate (“SOFR”) plus 10 basis points plus an applicable spread, which is determined by certain leverage tests. As of September 30, 2023, the applicable spread for borrowings was 140 basis points related to the revolving credit facility and 135 basis points related to the term loan. Letters of credit may be issued under the Credit Facility. On September 30, 2023, based on the value of the Company’s unencumbered properties calculated in accordance with the terms of the Credit Facility, approximately $110.5 million was available and undrawn under the Credit Facility, $351.0 million was outstanding and approximately $185,000 was committed for letters of credit.

On August 23, 2022, the Company entered into two floating-to-fixed interest rate swap agreements to manage the interest rate risk associated with $100.0 million of its variable-rate debt. The effective date of each swap agreement is October 3, 2022 and each has a $50.0 million notional amount. One agreement terminates on October 1, 2027 and effectively fixes SOFR at 2.96%. The other agreement terminates on October 1, 2030 and effectively fixes SOFR at 2.91%. Because the interest-rate swaps effectively fix SOFR for $100.0 million of variable-rate debt, unless otherwise indicated, $100.0 million of variable-rate debt is being treated as fixed-rate debt for disclosure purposes beginning September 30, 2022. The Company has designated the agreements as cash flow hedges for accounting purposes.

As of September 30, 2023, the fair value of the interest-rate swaps totaled approximately $6.6 million, which is included in Other assets in the Consolidated Balance Sheets. The change in value during the period is reflected in Other Comprehensive Income in the Consolidated Statements of Comprehensive Income.

On March 8, 2023, the Company closed on a 10-year, non-recourse, $15.3 million mortgage secured by BJ’s Wholesale Club in Alexandria, Virginia. The loan matures in 2033, bears interest at a fixed-rate of 6.07%, requires monthly principal and interest payments of $99,200 based on a 25-year amortization schedule and requires a final principal payment of $11.7 million at maturity. Proceeds were used to repay the remaining balance of approximately $9.3 million on the existing mortgage and reduce the outstanding balance of the Credit Facility.

During the second quarter of 2023, the Company commenced drawing on its $145.0 million construction-to-permanent loan related to the residential and retail portions of Phase I of the Twinbrook Quarter development project. As of September 30, 2023, the balance on the loan was $50.8 million, net of unamortized deferred debt costs.

Saul Centers and certain consolidated subsidiaries of the Operating Partnership have guaranteed the payment obligations of the Operating Partnership under the Credit Facility. The Operating Partnership is the guarantor of (a) the construction-to-permanent loan secured by Twinbrook Quarter Phase I (approximately $53.3 million at September 30, 2023), (b) the mortgage secured by Kentlands Place, Kentlands Square I and Kentlands Pad (totaling $27.5 million at September 30, 2023), (c) a portion of the mortgage secured by The Waycroft (approximately $23.6 million of the $150.0 million outstanding balance at September 30, 2023), (d) the mortgage secured by Ashbrook Marketplace (approximately $20.4 million at September 30, 2023)

Notes to Consolidated Financial Statements (Unaudited)

and (e) a portion of the mortgage secured by Avenel Business Park (approximately $6.3 million of the $21.9 million outstanding balance at September 30, 2023). All other notes payable are non-recourse.

The principal amount of the Company’s outstanding debt totaled approximately $1.36 billion at September 30, 2023, of which approximately $1.11 billion was fixed-rate debt and approximately $251.0 million was unhedged variable rate debt outstanding under the Credit Facility. The carrying amount of the properties collateralizing the notes payable totaled approximately $1.36 billion as of September 30, 2023.

At December 31, 2022, the principal amount of the Company’s outstanding debt totaled approximately $1.24 billion, of which $1.07 billion was fixed rate debt and $164.0 million was unhedged variable rate debt outstanding under the Credit Facility. The carrying amount of the properties collateralizing the notes payable totaled approximately $1.04 billion as of December 31, 2022.

At September 30, 2023, the future principal payments of debt, including scheduled maturities and amortization, for years ending December 31, were as follows:

| | | | | | | | | | | | | | |

| (In thousands) | | | | | Principal Payments | |

| October 1 through December 31, 2023 | | | | | $ | 8,424 | | |

| 2024 | | | | | 83,981 | | |

| 2025 | | | | | 303,085 | | (a) |

| 2026 | | | | | 162,468 | | |

| 2027 | | | | | 123,792 | | (b) |

| 2028 | | | | | 41,863 | | |

| Thereafter | | | | | 636,763 | | |

| Principal amount | | | | | 1,360,376 | | |

| Unamortized deferred debt costs | | | | | 17,064 | | |

| Net | | | | | $ | 1,343,312 | | |

(a) Includes $251.0 million outstanding under the Credit Facility.

(b) Includes $100.0 million outstanding under the Credit Facility.

Deferred debt costs consist of fees and costs incurred to obtain long-term financing, construction financing and the Credit Facility. These fees and costs are being amortized on a straight-line basis over the terms of the respective loans or agreements, which approximates the effective interest method. Deferred debt costs totaling $17.1 million and $15.8 million, net of accumulated amortization of $9.7 million and $7.9 million, at September 30, 2023 and December 31, 2022, respectively, are reflected as a reduction of the related debt in the Consolidated Balance Sheets. At September 30, 2023, deferred debt costs totaling $2.9 million related to the Hampden House construction-to-permanent loan, which has no outstanding balance, are included in Other Assets in the Consolidated Balance Sheet. At December 31, 2022, deferred debt costs totaling $2.7 million and $3.0 million, related to the Twinbrook Quarter and Hampden House construction-to-permanent loans, respectively, which had no outstanding balance, were included in Other Assets in the Consolidated Balance Sheet.

Interest expense, net and amortization of deferred debt costs for the three and nine months ended September 30, 2023 and 2022, were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (In thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Interest incurred | $ | 17,072 | | | $ | 13,627 | | | $ | 48,852 | | | $ | 38,408 | |

| Amortization of deferred debt costs | 564 | | | 486 | | | 1,687 | | | 1,428 | |

| Capitalized interest | (5,154) | | | (3,002) | | | (13,768) | | | (7,663) | |

| Interest expense | 12,482 | | | 11,111 | | | 36,771 | | | 32,173 | |

| Less: Interest income | 63 | | | 8 | | | 253 | | | 11 | |

| Interest expense, net and amortization of deferred debt costs | $ | 12,419 | | | $ | 11,103 | | | $ | 36,518 | | | $ | 32,162 | |

Notes to Consolidated Financial Statements (Unaudited)

6. Equity

The consolidated statements of operations for the nine months ended September 30, 2023 and 2022, reflect noncontrolling interests of $12.1 million and $11.7 million, respectively, representing income attributable to limited partnership units not held by Saul Centers.

At September 30, 2023, the Company had outstanding 3.0 million depositary shares, each representing 1/100th of a share of 6.125% Series D Cumulative Redeemable Preferred Stock (the “Series D Stock”). The depositary shares are redeemable at the Company's option, in whole or in part, at the $25.00 liquidation preference, plus accrued but unpaid dividends to but not including the redemption date. The depositary shares pay an annual dividend of $1.53125 per share, equivalent to 6.125% of the $25.00 liquidation preference. The Series D Stock has no stated maturity, is not subject to any sinking fund or mandatory redemption and is not convertible into any other securities of the Company except in connection with certain changes in control or delisting events. Investors in the depositary shares generally have no voting rights, but will have limited voting rights if the Company fails to pay dividends for six or more quarters (whether or not declared or consecutive) and in certain other events.

At September 30, 2023, the Company had outstanding 4.4 million depositary shares, each representing 1/100th of a share of 6.000% Series E Cumulative Redeemable Preferred Stock (the “Series E Stock”). The depositary shares may be redeemed at the Company’s option, in whole or in part, on or after September 17, 2024, at the $25.00 liquidation preference, plus accrued but unpaid dividends to but not including the redemption date. The depositary shares pay an annual dividend of $1.50 per share, equivalent to 6.000% of the $25.00 liquidation preference. The Series E Stock has no stated maturity, is not subject to any sinking fund or mandatory redemption and is not convertible into any other securities of the Company except in connection with certain changes in control or delisting events. Investors in the depositary shares generally have no voting rights, but will have limited voting rights if the Company fails to pay dividends for six or more quarters (whether or not declared or consecutive) and in certain other events.

Per Share Data

Per share data for net income (basic and diluted) is computed using weighted average shares of common stock. Convertible limited partnership units and employee stock options are the Company’s potentially dilutive securities. For all periods presented, the convertible limited partnership units are non-dilutive. The following table sets forth, for the indicated periods, weighted averages of the number of common shares outstanding, basic and diluted, the effect of dilutive options and the number of options which are not dilutive because the average price of the Company’s common stock was less than the exercise prices. The treasury stock method was used to measure the effect of the dilution.

| | | | | | | | | | | | | | | | | | | | | | | |

| Average Shares/Options Outstanding |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (In thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| Weighted average common stock outstanding-Basic | 24,059 | | | 23,997 | | | 24,043 | | | 23,948 | |

| Effect of dilutive options | 3 | | | 2 | | | 1 | | | 11 | |

| Weighted average common stock outstanding-Diluted | 24,062 | | | 23,999 | | | 24,044 | | | 23,959 | |

| Non-dilutive options | 1,654 | | | 1,542 | | | 1,690 | | | 1,328 | |

| Years non-dilutive options were issued | 2014 through 2022 | | 2014 through 2020 and 2022 | | 2013 through 2022 | | 2014 through 2020 and 2022 |

| | | | | | | |

Notes to Consolidated Financial Statements (Unaudited)

7. Related Party Transactions

The Chairman and Chief Executive Officer, the President and Chief Operating Officer, the Executive Vice President-Chief Legal and Administrative Officer and the Senior Vice President-Chief Accounting Officer and Treasurer of the Company are also officers of various members of the Saul Organization and their management time is shared with the Saul Organization. Their annual compensation is fixed by the Compensation Committee of the Board of Directors, with the exception of the Senior Vice President-Chief Accounting Officer and Treasurer whose share of annual compensation allocated to the Company is determined by the shared services agreement (described below).

The Company participates in a multiemployer 401K plan with entities in the Saul Organization which covers those full-time employees who meet the requirements as specified in the plan. Company contributions, which are included in general and administrative expense or property operating expenses in the Consolidated Statements of Operations, at the discretionary amount of up to 6% of the employee’s cash compensation, subject to certain limits, were $332,100 and $318,500 for the nine months ended September 30, 2023 and 2022, respectively. All amounts contributed by employees and the Company are fully vested.

The Company also participates in a multiemployer nonqualified deferred compensation plan with entities in the Saul Organization which covers those full-time employees who meet the requirements as specified in the plan. According to the plan, which can be modified or discontinued at any time, participating employees defer 2% of their compensation in excess of a specified amount. For the nine months ended September 30, 2023 and 2022, the Company credited to employee accounts $225,500 and $211,900, respectively, which is the sum of accrued earnings and up to three times the amount deferred by employees and is included in general and administrative expense. All amounts contributed by employees and credited by the Company are fully vested. The cumulative unfunded liability under this plan was $3.1 million and $3.0 million, at September 30, 2023 and December 31, 2022, respectively, and is included in accounts payable, accrued expenses and other liabilities in the Consolidated Balance Sheets.

The Company and the Saul Organization are parties to a shared services agreement (the “Agreement”) that provides for the sharing of certain personnel and ancillary functions such as computer hardware, software, and support services and certain direct and indirect administrative personnel. The method for determining the cost of the shared services is provided for in the Agreement and is based upon head count, estimates of usage or estimates of time incurred, as applicable. The terms of the Agreement and the payments made thereunder are deemed reasonable by management and are reviewed annually by the Audit Committee of the Board of Directors, which consists entirely of independent directors. Net billings by the Saul Organization for the Company’s share of these ancillary costs and expenses for the nine months ended September 30, 2023 and 2022, which included rental expense for the Company’s headquarters sublease, totaled approximately $8.0 million and $7.0 million, respectively. The amounts are generally expensed as incurred and are primarily reported as general and administrative expenses in the Consolidated Statements of Operations. As of September 30, 2023 and December 31, 2022, accounts payable, accrued expenses and other liabilities included approximately $0.9 million and $1.2 million, respectively, representing amounts due to the Saul Organization for the Company’s share of these ancillary costs and expenses.

The Company subleases its corporate headquarters space from a member of the Saul Organization. The sublease commenced in March 2002, expires in 2027, and provides for base rent increases of 3% per year, with payment of a pro-rata share of operating expenses over a base year amount. The Agreement requires each party to pay an allocation of total rental payments based on a percentage proportionate to the number of employees employed by each party. The Company’s rent expense for its headquarters location was $651,500 and $609,400 for the nine months ended September 30, 2023 and 2022, respectively, and is included in general and administrative expense.

The B. F. Saul Insurance Agency, Inc., a subsidiary of the B. F. Saul Company and a member of the Saul Organization, is a general insurance agency that receives commissions and fees in connection with the Company’s insurance program. Such commissions and fees amounted to $417,000 and $262,000 for the nine months ended September 30, 2023 and 2022, respectively.

Notes to Consolidated Financial Statements (Unaudited)

8. Stock-based Employee Compensation, Stock Option Plans, and Deferred Compensation Plan for Directors

In 2004, the Company established a stock incentive plan (the “Plan”), as amended. Under the Plan, options are granted at an exercise price not less than the market value of the common stock on the date of grant and expire ten years from the date of grant. Officer options vest ratably over four years following the grant and are charged to expense using the straight-line method over the vesting period. Director options vest immediately and are charged to expense as of the date of grant.

The Company uses the fair value method to value and account for employee stock options. The fair value of options granted is determined at the time of the grant using the Black-Scholes model, a widely used method for valuing stock-based employee compensation, and the following assumptions: (1) Expected Volatility determined using the most recent trading history of the Company’s common stock (month-end closing prices) corresponding to the average expected term of the options; (2) Average Expected Term of the options based on prior exercise history, scheduled vesting and the expiration date; (3) Expected Dividend Yield determined by management after considering the Company’s current and historic dividend yield, the Company’s yield in relation to other retail REITs and the Company’s market yield at the grant date; and (4) a Risk-free Interest Rate based upon the market yields of US Treasury obligations with maturities corresponding to the average expected term of the options at the grant date. The Company amortizes the value of options granted ratably over the vesting period and includes the amounts as compensation expense in general and administrative expenses.

Pursuant to the Plan, the Compensation Committee established a Deferred Compensation Plan for Directors for the benefit of the Company’s directors and their beneficiaries, which replaced a previous Deferred Compensation and Stock Plan for Directors. Annually, directors are given the ability to make an election to defer all or part of their fees and have the option to have their fees paid in cash, in shares of common stock or in a combination of cash and shares of common stock upon separation from the Board. If a director elects to have their fees paid in stock, fees earned during a calendar quarter are aggregated and divided by the closing market price of the Company’s common stock on the first trading day of the following quarter to determine the number of shares to be credited to the director. During the nine months ended September 30, 2023, 7,797 shares were credited to director’s deferred fee accounts and 8,225 shares were issued. As of September 30, 2023, the director's deferred fee accounts comprise 120,396 shares.

Effective May 12, 2023, the Company granted 253,500 options to its directors and certain officers. The following table summarizes the assumptions used in the valuation of the 2023 and 2022 option grants.

| | | | | | | | | | | | | | | | | | | |

| | Directors | | | Officers |

| Grant date | | May 12, 2023 | May 13, 2022 | | | May 12, 2023 | May 13, 2022 |

| Exercise price per share | | $ | 33.79 | $ | 47.90 | | | $ | 33.79 | $ | 47.90 |

| Fair value per option | | $ | 6.53 | $ | 8.34 | | | $ | 6.06 | $ | 7.66 |

| Volatility | | 0.319 | 0.300 | | | 0.288 | 0.271 |

| Expected life (years) | | 5.0 | 5.0 | | | 7.0 | 7.0 |

| Assumed yield | | 4.94% | 4.90% | | | 4.96% | 4.93% |