UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ⌧ | ||

| ||

Filed by a Party other than the Registrant ◻ | ||

| ||

Check the appropriate box: | ||

◻ | Preliminary Proxy Statement | |

◻ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

⌧ | Definitive Proxy Statement | |

◻ | Definitive Additional Materials | |

◻ | Soliciting Material under §240.14a-12 | |

| ||

Monarch Casino & Resort, Inc. | ||

(Name of Registrant as Specified In Its Charter) | ||

| ||

| ||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

| ||

Payment of Filing Fee (Check the appropriate box): | ||

⌧ | No fee required. | |

| | |

◻ | Fee paid previously with preliminary materials. | |

| | |

◻ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

MONARCH CASINO & RESORT, INC.

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

May 25, 2022

To the Stockholders of Monarch Casino & Resort, Inc.:

The 2022 Annual Meeting of Stockholders of Monarch Casino & Resort, Inc. will be held at the Monarch Casino Resort Spa Black Hawk (“Monarch Black Hawk”), 488 Main Street, Black Hawk, Colorado 80422, on Wednesday, May 25, 2022 at 10:00 a.m. Mountain time, for the following purposes:

| 1. | To elect John Farahi, Craig F. Sullivan and Paul Andrews as Directors of the Company, each to serve until the 2024 Annual Meeting of Stockholders and until a successor is elected and qualified, or until such director’s earlier death, resignation or removal; |

| 2. | To approve, on a non-binding, advisory basis, the executive compensation of our named executive officers. |

In addition, we will consider and transact such other business as may properly come before the meeting.

Only stockholders of record at the close of business on March 21, 2022 are entitled to notice of, and to vote at, the annual meeting. The stock transfer books will not be closed. On or about April 5, 2022, we mailed to our stockholders either a printed copy of our proxy statement and our 2021 annual report on Form 10-K, or a notice containing instructions on how to access our proxy statement and annual report and how to vote online. The notice also contains instructions on how you can receive a paper copy of our proxy materials, including the notice of annual meeting, proxy statement and proxy card, should you wish.

Stockholders are cordially invited to attend the annual meeting in person. STOCKHOLDERS DESIRING TO VOTE IN PERSON MUST REGISTER AT THE ANNUAL MEETING WITH THE INSPECTORS OF ELECTION PRIOR TO COMMENCEMENT OF THE ANNUAL MEETING. IF YOU WILL NOT BE ABLE TO ATTEND THE ANNUAL MEETING IN PERSON, YOU ARE ENCOURAGED TO READ THE PROXY STATEMENT AND THEN CAST YOUR VOTE AS PROMPTLY AS POSSIBLE IN ACCORDANCE WITH THE INSTRUCTIONS IN THE NOTICE OF INTERNET AVAILABILITY OR, IF YOU RECEIVED A PRINTED COPY OF THE PROXY MATERIALS, ON THE ENCLOSED PROXY CARD.

| By order of the Board of Directors, |

| |

|

|

| |

| JOHN FARAHI |

| SECRETARY |

We mailed a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and 2021 annual report on Form 10-K on or about April 5, 2022.

MONARCH CASINO & RESORT, INC.

PROXY STATEMENT

| | Page |

| 4 | |

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN OTHER BENEFICIAL OWNERS | | 5 |

| 6 | |

| 6 | |

| 8 | |

| 8 | |

| 8 | |

| 8 | |

| 9 | |

| 9 | |

| 9 | |

| 9 | |

| 12 | |

| 12 | |

| 12 | |

| 12 | |

| 13 | |

| 14 | |

| 15 | |

| 15 | |

| 15 | |

| 15 | |

| 15 | |

| 16 | |

| 16 | |

Potential Payments Upon Termination in Connection with Change in Control | | 19 |

| 20 | |

| 21 | |

| 22 | |

| 22 | |

| 23 | |

| 23 | |

| 24 | |

| 24 | |

| 24 | |

| 25 | |

| 25 | |

| 26 | |

| 26 | |

| |

MONARCH CASINO & RESORT, INC.

3800 South Virginia Street

Reno, Nevada 89502

PROXY STATEMENT

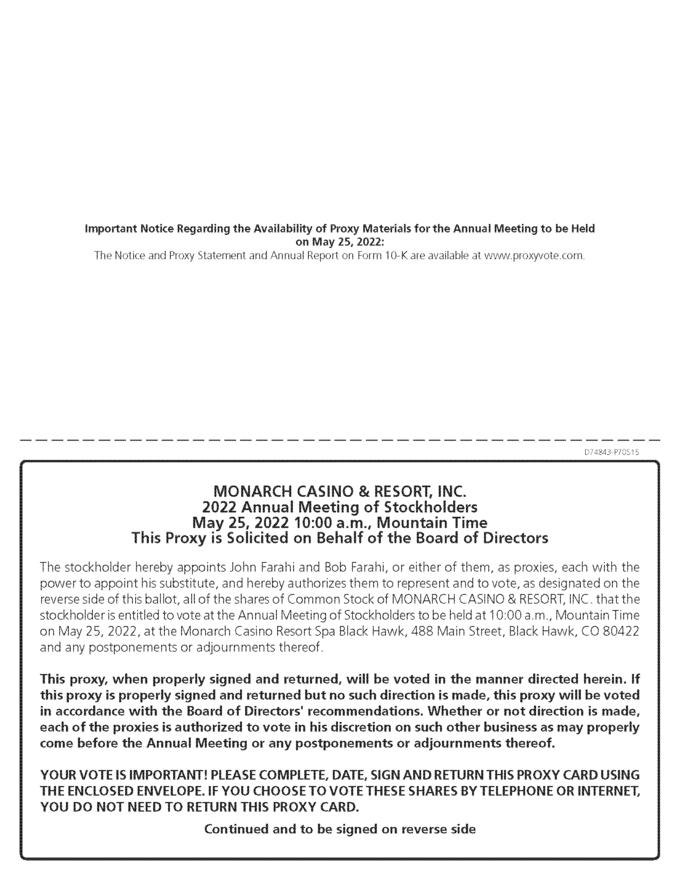

This proxy statement (the “Proxy Statement”) is prepared for the stockholders of Monarch Casino & Resort, Inc. (the “Company,” “we,” “us,” “our” or “Monarch”) in connection with the 2022 annual meeting of stockholders of the Company to be held at the Monarch Casino Resort Spa Black Hawk, 488 Main Street, Black Hawk, Colorado 80422, on Wednesday, May 25, 2022, at 10:00 a.m., Mountain time, and any adjournment thereof, for the purposes indicated in the Notice of Annual Meeting of Stockholders and more fully outlined herein.

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to be held on May 25, 2022

This Proxy Statement, form of proxy and our 2021 annual report on Form 10-K are available online at www.proxyvote.com.

QUESTIONS AND ANSWERS ABOUT THE MEETING

Question: What is the Notice of Internet Availability of Proxy Materials that I received in the mail instead of a full set of proxy materials?

Answer: Under rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), we are furnishing proxy materials to our stockholders via the internet, instead of mailing printed copies of those materials to each stockholder. On or about April 5, 2022, we will mail to our stockholders either a printed copy of our proxy materials, including our Proxy Statement and our 2021 annual report on Form 10-K, or a Notice of Internet Availability containing instructions on how to access our proxy materials. This electronic access process is designed to expedite stockholders’ receipt of proxy materials, lower the costs of our annual meeting and help to conserve natural resources. However, if you prefer to receive a printed copy of our proxy materials and a paper proxy card, you may do so by following the instructions included in the Notice of Internet Availability.

Question: Why am I being provided with access to or receiving these proxy materials?

Answer: You are being provided with access to or are receiving these proxy materials because you owned shares of Monarch’s common stock par value $.01 per share (the “Common Stock”) as of the close of business on March 21, 2022, our record date. This Proxy Statement describes in detail matters on which we would like you, our stockholder, to vote. It also gives you information on these matters so that you can make an informed decision. If you will not be able to attend the annual meeting and vote in person, you are encouraged to read this Proxy Statement and then cast your vote as promptly as possible in accordance with the instructions either in the Notice of Internet Availability or, if you received a printed copy of the proxy materials, on the enclosed proxy card. The shares represented by the proxy will be voted if the proxy is properly executed and received by us prior to the commencement of the annual meeting, or any adjournment thereof.

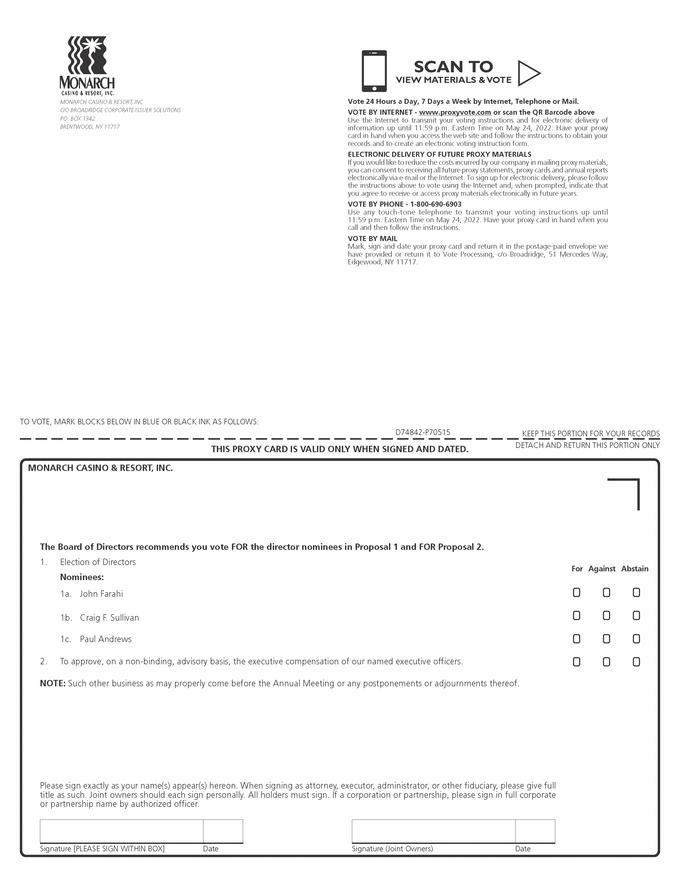

Question: On what matters am I being asked to vote?

Answer:

| 1. | To elect John Farahi, Craig F. Sullivan and Paul Andrews as Directors of the Company, each to serve until the 2024 Annual Meeting of Stockholders and until a successor is elected and qualified, or until such director’s earlier death, resignation or removal; and |

| 2. | To approve, on a non-binding, advisory basis, the executive compensation of our named executive officers. |

Question: How does the Board of Directors recommend I vote on these proposals?

Answer: Our Board recommends that you vote your shares “FOR” each of the nominees for director named in this Proxy Statement, and “FOR” the executive compensation paid to our named executive officers.

1

Question: Do any of the proposals to be voted on create a statutory right of dissent under Nevada law?

Answer: None of the proposals to be voted on at the annual meeting creates a statutory right of dissent under Nevada law.

Question: Who is entitled to vote?

Answer: The record date for the annual meeting is March 21, 2022. Stockholders of record as of the close of business on that date are entitled to vote at the annual meeting. Both “stockholders of record” and “street name holders” are entitled to vote or direct the voting of their Common Stock. You are a “stockholder of record” if you hold Common Stock that is registered in your name at our transfer agent, Broadridge. You are a “street name holder” if you hold Common Stock indirectly through a nominee, such as a broker, bank or similar organization.

Question: If I am a stockholder of record, how do I vote?

Answer: You may vote via the Internet. You can vote by proxy over the Internet by following the instructions provided in the notice or on the separate proxy card if you have received a printed set of the proxy materials.

You may vote by telephone. You can submit your vote by proxy over the telephone by following the instructions provided in the notice or on the separate proxy card if you received a printed set of the proxy materials.

You may vote by mail. If you received a printed set of the proxy materials, you can submit your vote by completing and returning the separate proxy card in the prepaid and addressed envelope, which must be received by us prior to the commencement of the annual meeting, or adjournment thereof.

You may vote in person at the meeting. All stockholders of record may vote in person at the annual meeting. Written ballots will be passed out to anyone who wants to vote at the meeting.

Question: If my shares are held by a broker, bank or other nominee, how do I vote?

Answer: If your shares are held in street name by a broker, bank or other nominee, please refer to the instructions they provide regarding how to vote. In addition, if you are a street name holder and you wish to vote in person at the annual meeting, you must obtain a legal proxy from your broker, bank or other nominee in order to vote at the meeting.

Question: Can I revoke my proxy later?

Answer: Yes. You have the right to revoke your proxy at any time before the annual meeting. If you are a stockholder of record, you may do so by:

| 1. | voting electronically via the Internet or by telephone on a subsequent date prior to 11:59 p.m. Eastern Time on the day before the annual meeting, |

| 2. | delivering a signed revocation or a subsequently dated, signed proxy card to the Secretary of Monarch before the annual meeting, or |

| 3. | attending the annual meeting and voting in person at the meeting (your mere presence at the annual meeting will not, by itself, revoke your proxy). |

For shares you hold in street name, you may change your vote by submitting new voting instructions to your broker, bank or other nominee or, if you have obtained a legal proxy from your broker, bank or other nominee giving you the right to vote your shares at the annual meeting, by attending the meeting and voting in person.

Question: How many shares can vote?

Answer: As of the close of business on the record date of March 21, 2022, 18,855,575 shares of Common Stock were issued and outstanding. We have no other class of voting securities outstanding. Each share of Common Stock entitles its holder to one vote.

Question: How is a quorum determined?

Answer: Our Bylaws provide that the holders of fifty percent (50%) of the voting power of the stock issued and outstanding and entitled to vote at the meeting, represented in person or by proxy, constitute a quorum at a meeting of the stockholders. Abstentions and broker non-votes will be counted as present for quorum purposes.

2

Question: What is required to approve each proposal once a quorum has been established?

Answer:

Election of Directors. An affirmative vote of a majority of the shares present and entitled to vote at the meeting, either virtually or by proxy, is required for the election of Directors. Stockholders do not have the right to cumulate their votes for Directors.

Advisory Vote on Executive Compensation. An affirmative vote of a majority of the shares present and entitled to vote at the meeting, either in person or by proxy, is required for approval of the advisory vote on executive compensation. Because your vote is advisory, it will not be binding on the Board of Directors or the Company. However, the Board of Directors will review the voting results and take them into consideration when making future decisions regarding executive compensation.

Other Items. For any other item which may properly come before the meeting, the affirmative vote of a majority of the shares present and entitled to vote at the meeting, either in person or by proxy, will be required for approval, unless otherwise required by law.

Question: What happens if I abstain?

Answer: Abstentions are treated as shares present or represented and voting, so abstaining has the same effect as a negative vote for each of the proposals. Abstentions are counted for purposes of determining whether there is a quorum.

Question: How will my shares be voted if I do not give specific voting instructions?

Answer: If you are a stockholder of record and you:

| ● | Indicate when voting on the Internet or by telephone that you wish to vote as recommended by our Board of Directors; or |

| ● | Sign and send in your proxy card and do not indicate how you want to vote, then the proxyholders, John Farahi and Bob Farahi, will vote your shares in the manner recommended by our Board of Directors as follows: “FOR” each of the nominees for director named in this Proxy Statement, and “FOR” the executive compensation paid to our named executive officers. |

All of the proposals contained in this Proxy Statement are considered non-routine matters. If your shares are held by a broker on your behalf (that is, in “street name”), and you do not instruct the broker as to how to vote these shares on any of the proposals included in this Proxy Statement, the broker may not exercise discretion to vote for or against those proposals. This would be a “broker non-vote” and these shares will be counted for purposes of determining whether there is a quorum. Broker non-votes will be treated as though they are not entitled to vote and will not affect the outcome of the proposals. Please instruct your bank or broker so your vote can be counted.

Question: How will voting on any other business be conducted?

Answer: Although we do not know of any business to be considered at the annual meeting other than the proposals described in this Proxy Statement, if any other business properly comes before the annual meeting, your proxy or voting instruction gives authority to the proxyholders, John Farahi and Bob Farahi, to vote on those matters in their discretion.

Question: What if a quorum is not present at the meeting?

Answer: If a quorum is not present at the scheduled time of the annual meeting, we may adjourn the meeting, either with or without the vote of the stockholders. If we propose to have the stockholders vote whether to adjourn the meeting, the proxyholders will vote all shares for which they have authority in favor of the adjournment. We may also adjourn the meeting if for any reason we believe that additional time should be allowed for the solicitation of proxies. An adjournment will have no effect on the business that may be conducted at the annual meeting.

3

Question: How much stock do Monarch’s Directors and executive officers own?

Answer: As of March 21, 2022, our current Directors and executive officers collectively beneficially owned, 4,159,008 shares of our Common Stock, excluding any shares issuable upon exercise of stock options, constituting 22.06% of the outstanding shares. It is expected that these persons will vote the shares held by them for each of the director nominees named in this Proxy Statement and in accordance with the Board of Directors’ recommendation on the other proposals contained in this Proxy Statement.

Question: Who will bear the costs of this solicitation?

Answer: Our Board of Directors, on behalf of the Company, is soliciting these proxies. We will pay the cost of this solicitation of proxies by mail. Our officers and regular employees may also solicit proxies in person or by telephone without additional compensation. We will make arrangements with brokerage houses, custodians, nominees and other fiduciaries to send proxy materials to the beneficial owners, and we will reimburse these persons for related postage and clerical expenses.

2023 ANNUAL MEETING OF STOCKHOLDERS

Proposals for Inclusion in the Proxy Statement. The next annual meeting of stockholders is expected to be held on or about May 31, 2023 (the “2023 Annual Meeting”). The date by which stockholder proposals must be received by us for inclusion in proxy materials relating to the 2023 Annual Meeting is December 6, 2022. Upon receipt of any such proposal, we will determine whether or not to include such proposal in the proxy materials in accordance with SEC regulations governing the solicitation of proxies.

Proposals not Included in the Proxy Statement and Nominations for Director. Stockholder proposals not included in our Proxy Statement and stockholder nominations for director may be brought before an annual meeting of stockholders in accordance with the advance notice procedures described in our Bylaws. Stockholders desiring to present proper proposals, other than the nomination of persons for election to the Board, must submit proposals that meet the eligibility criteria under our Bylaws, including submission of notice to the Company no later than March 17, 2023. Stockholders desiring to present nominations of persons for election to the Board must submit such nominations to the Company. We must receive such nomination no earlier than March 2, 2023, and no later than March 17, 2023.

Unless a stockholder proposal for the 2023 Annual Meeting is submitted to the Company prior to March 17, 2023, management may use its discretionary voting authority to vote management proxies on any such stockholder proposal.

4

SECURITY OWNERSHIP OF MANAGEMENT

AND CERTAIN OTHER BENEFICIAL OWNERS

The following table shows the beneficial ownership as of March 21, 2022, of our Common Stock held by each person known to us to be the beneficial owner of more than 5% of the outstanding Common Stock, all named executive officers and directors, and all executive officers and directors as a group. The percentages shown are based on 19,531,312 shares of Common Stock outstanding as of March 21, 2022, and shares issuable upon exercise of options, which are exercisable within 60 days of March 21, 2022. Except as set forth below, the address for all listed parties is 3800 South Virginia Street, Reno, Nevada 89502.

| | | Shares of Common | | |

|

| | | Stock Beneficially | | Percent of |

|

| Beneficial Owner | | Owned (1)(2) | | Class |

|

| John Farahi |

| 3,397,611 | (3)(4) | 17.58 | % |

| Bob Farahi |

| 1,276,430 | (5)(6) | 6.75 | % |

| David Farahi |

| — | (7) | * | |

| Edwin S. Koenig | | 104 | (8) | * | |

| Yvette E. Landau |

| 73,200 | (9) | * | |

| Craig F. Sullivan |

| 42,700 | (10) | * | |

| Paul Andrews |

| 44,700 | (11) | * | |

| BlackRock, Inc. |

| 2,013,714 | (12) | 10.68 | % |

| 55 East 52nd Street |

|

|

|

| |

| New York, NY 10055 |

|

|

| | |

| Ben Farahi |

| 1,510,053 | (13) | 8.01 | % |

| 3652 S. Virginia Street; Suite C7 |

|

|

|

| |

| Reno, NV 89502 |

|

|

| | |

| Janus Henderson Group plc | | 1,073,366 | (14) | 5.69 | % |

| 201 Bishopsgate | |

|

|

| |

| EC2M 3AE, United Kingdom | |

|

| | |

| All executive officers and directors as a group (7 persons) |

| 4,834,745 | (15) | 24.75 | % |

* | Less than 1%. |

| (1) | Unless otherwise noted, the persons identified in this table have sole voting and sole investment power with regard to the shares beneficially owned by them. |

| (2) | Includes shares issuable upon exercise of options which are exercisable within 60 days of March 21, 2022. |

| (3) | Includes 2,424,613 shares held in trusts and 506,332 shares held directly. |

| (4) | Includes options to purchase 466,666 shares under the 2014 Equity Incentive Plan (the “2014 Plan”). |

| (5) | Includes1,013,600 shares held in trusts and 196,163 shares held directly. |

| (6) | Includes options to purchase 66,667 shares under the 2014 Plan. |

| (7) | Mr. David Farahi resigned his position as Chief Operating Officer, effective September 3, 2021. |

| (8) | Represents options to purchase 104 shares under the 2014 Plan. |

| (9) | Includes options to purchase 54,900 shares under the 2014 Plan and 18,300 shares held directly. |

| (10) | Represents options to purchase 42,700 shares under the 2014 Plan. |

| (11) | Represents options to purchase 44,700 shares under the 2014 Plan. |

| (12) | Based on a Schedule 13G/A filed by BlackRock, Inc. with the SEC on January 27, 2022. BlackRock, Inc. has sole voting power with respect to 1,995,088 shares and sole investment power with respect to all of the shares beneficially owned. |

| (13) | Based on a brokerage records. |

| (14) | Based on a Schedule 13G filed by Janus Henderson Group plc with the SEC on February 11, 2022. |

| (15) | Includes options to purchase 675,737 shares under the 2014 Plan. |

5

PROPOSAL 1: ELECTION OF DIRECTORS

Our Bylaws provide for a Board of Directors consisting of five persons; however, the Bylaws may be amended from time to time to permit between three and twelve directors. The Board currently has five directors, divided into two classes designated as Class A (consisting of three directors) and Class B (consisting of two directors). Members of each class serve for a two-year term. At each annual meeting, the terms of one class of directors expire. The term of office of the current Class A directors will expire at the 2022 Annual Meeting of Stockholders. The term of office of the current Class B directors will expire in 2023. Each director holds office until his or her successor has been duly elected and qualified, or the director’s earlier death, resignation or removal. Each of the nominees is a current director of the Company.

If the proxy is duly executed and received in time for the annual meeting and if no contrary specification is made as provided therein, the proxy will be voted in favor of electing the nominees John Farahi, Craig F. Sullivan and Paul Andrews for terms of office expiring in 2024. If any such nominee shall decline or be unable to serve, the proxy will be voted for such person as shall be designated by the Board to replace any such nominee. The Board presently has no knowledge or reason to believe that any of the nominees will refuse or be unable to serve.

Any vacancies on the Board which occur during the year will be filled, if at all, by the Board through an appointment of an individual to serve only until the next annual meeting of stockholders. If re-elected at such meeting, such director would serve until the expiration of the term applicable to the vacated position.

The Company, each director and executive officer who has been required by the Nevada State Gaming Control Board and Nevada Gaming Commission (collectively, the “Nevada Gaming Authorities”) to be found suitable has been found suitable by the Nevada Gaming Authorities. Future new members of the Board, if any, may be required to be found suitable in the discretion of the Nevada Gaming Authorities and the Chair of the Audit Committee is required to be found suitable. The Colorado Division of Gaming (the “Colorado Regulatory Authorities”) also requires a finding of suitability for each director by the Colorado Regulatory Authorities. Each of our directors has been found suitable by the Colorado Regulatory Authorities. Should any director later be found not to be suitable by the Nevada Gaming Authorities or the Colorado Gaming Authorities, that person will not be eligible to continue serving on the Board and a majority of the remaining directors may appoint a qualified replacement to serve as a director until the next annual meeting of stockholders.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF JOHN FARAHI, CRAIG F. SULLIVAN AND PAUL ANDREWS TO THE BOARD OF DIRECTORS.

The following information is furnished with respect to each member of the Board or nominee thereto. Similar information is provided for the Company’s executive officers who are not directors. John Farahi and Bob Farahi are brothers. David Farahi, our former Chief Operating Officer, is John Farahi’s son. There are no other family relationships between or among any directors, nominees to the Board, or executive officers of the Company.

| | | | Director | | |

Name | | Age | | Since | | Position |

John Farahi |

| 74 |

| 1993 |

| Co-Chairman of the Board, |

(Nominee for term expiring in 2024) | | | | | | Chief Executive Officer, Secretary and Director |

Bob Farahi | | 71 | | 1993 | | Co-Chairman of the Board, |

(Term expiring in 2023) | | | | | | President and Director |

Paul Andrews | | 57 | | 2014 | | Director |

(Nominee for term expiring in 2024) | | | | | | |

Yvette E. Landau | | 65 | | 2010 | | Director |

(Term expiring in 2023) | | | | | | |

Craig F. Sullivan | | 75 | | 1998 | | Director |

(Nominee for term expiring in 2024) | | | | | | |

6

JOHN FARAHI has been Co-Chairman of the Board and Chief Executive Officer of the Company since its inception and of Golden Road, a direct wholly owned subsidiary of the Company, since June 1993. He has served as Secretary of the Company since November 2011. From 1973 until June 1993, Mr. Farahi was President, Director, and General Manager of Golden Road. Mr. Farahi is a partner in Farahi Investment Company (“FIC”), which is engaged in real estate investment and development. Mr. Farahi served on the Washoe County Airport Authority as a Trustee from July 1997 until June 2005. Mr. Farahi is a former member of the Nevada Commission on Tourism and served as a Board Member of the Reno-Sparks Convention and Visitors’ Authority until 2017. Mr. Farahi was appointed in 2013 by President Barack Obama to the United States Holocaust Memorial Council. Mr. Farahi holds a political science degree from the California State University at Hayward. The Board believes Mr. Farahi is qualified to serve as a director due to his specific experience as a casino operator and his knowledge of the casino industry.

BOB FARAHI has been Co-Chairman of the Board and President of the Company since its inception and of Golden Road, a direct wholly owned subsidiary of the Company, since 1993. From 1973 until June 1993, Mr. Farahi was Vice President and a Director of Golden Road. Mr. Farahi divides his working time between the Company and the other private companies with which he is involved. Mr. Farahi is a partner in FIC. Mr. Farahi holds a biochemistry degree from the University of California at Berkeley. The Board believes Mr. Farahi is qualified to serve as a director due to his specific experience as a casino operator and in real estate development and his knowledge of the casino industry.

PAUL ANDREWS has been a member of the Board since May 2014 and is the President and CEO of the National Western Stock Show and Complex (“NWSS”), which plays host to the National Western Stock Show each January and over 240 other events each year in Denver, Colorado. Prior to joining NWSS in November 2010, Mr. Andrews spent 20 years in various capacities with Denver-based Kroenke Sports Enterprises LLC, owner of the Denver Nuggets, the Colorado Avalanche and the Pepsi Center Arena. Mr. Andrews served in various sales, marketing and administrative capacities while at Kroenke including the position of Executive Vice President in which he was responsible for all business operations. The Board believes Mr. Andrews is qualified to serve as a director due to his significant operations, marketing and sales experience.

YVETTE E. LANDAU has been a member of the Board since June 2010. Ms. Landau was general counsel and corporate secretary of Mandalay Resort Group from 1996 until 2005. Since 2005, Ms. Landau has been co-owner of W.A. Richardson Builders, LLC, a construction services firm specializing in casino resort development. Until January 2019, Ms. Landau served as a member of the Board of Directors of Bossier Casino Venture, Inc. which owned the Margaritaville Resort Casino in Bossier City, Louisiana. Ms. Landau currently serves as a member of the Board of Directors of PlayAGS, Inc. (NYSE: AGS), a designer and supplier of electronic gaming products and services. Ms. Landau is a past president of the International Association of Gaming Advisors, a worldwide organization of legal, financial and regulatory professionals in the gaming industry, and remains active with the organization as a counselor. Ms. Landau holds a bachelor’s degree from Arizona State University and a Juris Doctor degree from Northwestern University School of Law. The Board believes Ms. Landau is qualified to serve as a director due to her experience in hotel-casino management, her experience as an independent director of other casino companies and her experience in the legal and construction industries.

CRAIG F. SULLIVAN has been a member of the Board since September 1998. He was Chairman of the Board of Park Cattle Company (now Edgewood Companies) from July 2006 to June 2008. Since March 1998, Mr. Sullivan has been President of Sullivan & Associates, a strategic and financial consulting firm to companies in the gaming industry. Mr. Sullivan was a director of PHL Local Gaming, LLC, which was a bidder for Philadelphia, Pennsylvania’s second casino license. From April 1995 to March 1998, Mr. Sullivan served as Chief Financial Officer and Treasurer of Primadonna Resorts, Inc., and from February 1990 to April 1995, Mr. Sullivan served as Treasurer of Aztar Corporation. Mr. Sullivan also served on the Board of New York-New York Hotel & Casino from March 1996 to June 1998. Mr. Sullivan holds a bachelor’s degree in economics from the George Washington University and holds a master’s degree in international management from the American Graduate School of International Management (now Thunderbird School of Global Management). The Board believes Mr. Sullivan is qualified to serve as a director due to his experience as a senior executive in the hotel-casino industry.

7

PROPOSAL 2: ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) requires that the Company’s stockholders have the opportunity to cast a non-binding, advisory vote regarding the approval of the compensation disclosed in this Proxy Statement of the Company’s named executive officers. We have disclosed the compensation of the named executive officers pursuant to rules adopted by the SEC.

We believe that the compensation policies for the named executive officers are designed to attract, motivate and retain talented executive officers and are aligned with the long-term interests of the Company’s stockholders. This advisory stockholder vote, commonly referred to as a “say-on-pay” vote, gives you as a stockholder the opportunity to approve or not approve the compensation of the named executive officers that is disclosed in this Proxy Statement by voting for or against the following resolution (or by abstaining with respect to the resolution):

RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed in this proxy statement pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Summary Compensation Table, other executive compensation tables and related narrative disclosures is hereby APPROVED.

Because your vote is advisory, it will not be binding on either the Board of Directors or the Company. However, the Compensation Committee will take into account the outcome of the stockholder vote on this proposal when considering future executive compensation arrangements.

The Board of Directors UNANIMOUSLY recommends a vote “FOR” approvAL of the compensation paid to our named executive officers.

In addition to John Farahi and Bob Farahi, whose biographical information is set forth above, our other executive officer is set forth below.

EDWIN S. KOENIG, age 54, has been the Chief Accounting Officer since March of 2016. Mr. Koenig served as the Company’s Director of Corporate Development and Analysis from May 2015 until March 2016. Prior to joining the Company, Mr. Koenig served in various assurance roles at Ernst & Young LLP from November 2003 to April 2015. Mr. Koenig is a certified public accountant with Bachelor’s degrees in Accounting from the University of Nevada Las Vegas and in Business Management from Sonoma State University.

Board Leadership Structure and Role in Risk Oversight

John Farahi, the Board’s Co-Chairman, also serves as the Company’s Chief Executive Officer. Bob Farahi, the Board’s other Co-Chairman also serves as the Company’s President. The Company does not have a lead independent director. At the time of this filing, we believe this is the best structure to leverage John and Bob Farahi’s respective operating expertise, professional experience and longevity with the Company. The Board is responsible for risk oversight. The Board regularly reviews information regarding our Company’s credit, liquidity and operations. In addition, each of our Board committees considers the risks within its area of responsibilities. For example, the Compensation Committee assesses the risks that may be implicated by our executive compensation programs and the Audit Committee discusses with our independent auditor our major financial risk exposures. The Board believes that its leadership structure supports the Board’s effective oversight of the Company’s risks.

8

Each year, the Board undertakes a review of director independence, which includes a review of each director’s responses to questionnaires asking about any relationships with us. This review is designed to identify and evaluate any transactions or relationships between a director or any member of his or her immediate family and us, or members of our senior management or other members of our Board of Directors, and all relevant facts and circumstances regarding any such transactions or relationships. Consistent with these considerations, the Board has determined that Paul Andrews, Yvette E. Landau and Craig F. Sullivan are “independent directors,” as such term is defined in Nasdaq Rule 5605(a)(2).

Director Diversity

The following table presents board level diversity statistics, based on voluntary self-identification of each member of the Company’s Board of Directors, as of April 1, 2022. Based on the following diversity statistics, the Board currently satisfies the diversity objectives under Nasdaq Rule 5605(f)(2)(D).

BOARD DIVERSITY MATRIX | |||||||||

| | | | | | | | | |

Total Number of Directors | | | | | 5 | | | | |

|

| Female |

| Male |

| Non-Binary | | Did Not Disclose | |

Part I: Gender Identity | | | | | | | | | |

Directors | | 1 | | 1 | | — | | 3 | |

Part II: Demographic Background |

| | | | | | | | |

African American or Black | | — | | — | | — | | — | |

Alaskan Native or Native American | | — | | — | | — | | — | |

Asian |

| — | | — | | — | | — | |

Hispanic or Latinx |

| — | | — | | — | | — | |

Native Hawaiian or Pacific Islander | | — | | — | | — | | — | |

White | | 1 | | 1 | | — | | — | |

Two or More Races or Ethnicities | | — | | — | | — | | — | |

LGBTQ+ | | — | | — | | — | | — | |

Did Not Disclose Demographic Background |

| | | | | | | 3 | |

The Board held three meetings during 2021. Each incumbent director attended at least 75% of the aggregate of (1) the total number of meetings of the Board during the period in which he or she was a director and (2) the total number of meetings of all committees on which he or she served during the period in which he or she was a director.

The Board has a policy that requires all directors to attend each annual meeting of stockholders absent exigent circumstances. All of our directors attended the 2021 annual meeting of stockholders.

The Board has a standing Audit Committee, Compensation Committee, and Marketing Committee.

9

Audit Committee

The Audit Committee is currently comprised of Craig F. Sullivan, Chair, Yvette E. Landau and Paul Andrews. During 2021, the Audit Committee held nine meetings. The Audit Committee oversees our management, internal audit and independent public accountants with respect to corporate accounting, financial reporting and systems of internal control established by management. Among other duties, the Audit Committee’s functions are: to review reports of the auditors to the Company; to review Company financial practices, internal controls and policies with officers and key employees; to review such matters with the Company’s auditors to determine the scope of compliance and any deficiencies; to evaluate the independence of and select our independent public accountants; to review and approve all related party transactions; and to make periodic reports on such matters to the Board. The Audit Committee adopted an Audit Committee Charter, a copy of which may be viewed on the Company’s website at www.monarchcasino.com, by clicking on “Corporate Overview” and then “Corporate Governance.”

The Board has determined that all members of the Audit Committee meet the enhanced definition of “independence” under the SEC rules and are “independent directors,” under the Nasdaq listing standards.

Additionally, the Board has determined that Craig F. Sullivan, Chairman of the Audit Committee, is a financial expert as defined by the SEC rules. The relevant experience of Mr. Sullivan is summarized under “Election of Directions ― Directors and Nominees” above.

Compensation Committee

The Compensation Committee is currently comprised of Yvette E. Landau, Chair, Craig F. Sullivan and Paul Andrews. During 2021, the Compensation Committee held three meetings. The Compensation Committee determines and approves, or recommends to the Board for approval, all compensation and awards to the Company’s chief executive officer and other executive officers, and administers the 2014 Plan. The Compensation Committee reviews at least annually the performance and the compensation of the chief executive officer in light of the corporate goals and objectives applicable to the compensation of the chief executive officer, and determines and approves the compensation level of the chief executive officer based on this evaluation. In determining compensation, or making recommendations regarding executive compensation, the Compensation Committee considers the results of the most recent stockholder advisory vote on executive compensation. Our chief executive officer provides the Compensation Committee with evaluations of each named executive officer, including himself, and recommendations regarding base salary levels for the upcoming year for each named executive officer, other than himself, and an evaluation of the extent to which the named executive officer met his bonus target. Our chief executive officer cannot be present during any voting or deliberations by the Compensation Committee on his compensation. The Compensation Committee may delegate its authority to subcommittees of the Compensation Committee when it deems appropriate and in the best interest of the Company. The Compensation Committee has adopted a Compensation Committee Charter, a copy of which may be viewed on the Company’s website at www.monarchcasino.com by clicking on “Corporate Overview” and then “Corporate Governance.” As set forth in the “Compensation Discussion and Analysis” section below, the Compensation Committee did not engage compensation consultants in 2021. The Board has determined that all of the members of the Compensation Committee meet the independence requirements of the Nasdaq listing standards, including the heightened independence requirements specific to compensation committee members.

Nominations Function

The Company does not have a standing nominating committee, nor has the Board of Directors adopted a charter addressing the director nomination process. The Board of Directors believes that, at this time, it is appropriate for the Company not to have a nominating committee because the independent directors constituting the majority of the Board of Directors can adequately serve the function of considering potential director nominees from time to time as needed.

For annual meetings of stockholders, at which directors are to be elected in compliance with Nasdaq Rule 5605(e), director nominees are recommended for the Board’s nomination solely by a majority of the independent directors. In making such recommendation, the qualifications of the prospective nominee to be considered include the nominee’s personal and professional integrity, experience, skills, diversity, professional relationships, ability and willingness to devote the time and effort necessary to be an effective board member, and commitment to act in the best interests of the Company and its stockholders.

10

The Board of Directors’ overall diversity is a significant consideration in the director selection process. Monarch is an equal opportunity employer and does not discriminate based upon age, race, color, gender, national origin, disability, religion or veteran status. It is the Board of Director’s desire that the Board should be composed of qualified individuals who bring diverse professional expertise and points of view. All prospective Director nominees are evaluated on their professional merits, technical qualifications, demonstrated expertise, experience and ability to contribute in such a way as to bolster and expand the collective professional perspective of the Board.

The Board will consider all appropriate candidates proposed by our stockholders in accordance with the Company’s Bylaws. Potential candidates will be evaluated according to the same criteria, regardless of whether the candidate was recommended by the independent directors of the Board or stockholders. The requirements for nomination of a person to the Board by a security holder are set forth in Article II, Section 16 of the Company’s Bylaws and the qualifications for a person to be a director of the Company are set forth in Article II, Section 14 of the Bylaws. Both sections of the Bylaws are set forth below.

14. Eligibility of Directors. No Director is eligible to continue to serve as a Director of the Corporation who is required under Nevada or Colorado gaming laws to be found suitable to serve as a director and who is not found suitable or whose finding of suitability is suspended or revoked by Nevada or Colorado gaming authorities. Such eligibility shall cease immediately following whatever act or event terminates the director’s eligibility under the laws and gaming regulations of either the State of Nevada or the State of Colorado.

16. Nomination of Directors. Only persons who are nominated in accordance with the procedures set forth in this Section 16 of Article II shall be eligible for election as Directors. Nominations of persons for election to the Board of Directors of the Corporation at the Annual Meeting may be made at a meeting of stockholders by or at the direction of the Board of Directors by any nominating committee or person appointed by the Board or by any stockholder of the Corporation entitled to vote for the election of Directors at the meeting who complies with the Notice procedures set forth in this Section 16 of Article II. Such nominations, other than those made by or at the direction of the Board, shall be made pursuant to timely notice in writing to the secretary of the Corporation. To be timely, unless waived by the Board of Directors, no person not already a Director shall be eligible to be elected or to serve as a Director unless such person’s notice of nomination shall be received at the principal executive offices of the Corporation at least seventy five (75) days before initiation of solicitation to the stockholders for election in the event of an election other than at an Annual Meeting and seventy five (75) days before the corresponding date that had been the record date for the previous year’s Annual Meeting or seventy five (75) days before the date of the next Annual Meeting of shareholders announced in the previous year’s proxy materials in the event of an election at an Annual Meeting. To be timely, no stockholder’s notice shall be received at the principal executive offices of the Corporation more than ninety (90) days before the meeting; provided, however, that in the event that less than ninety (90) days’ notice or prior public disclosure of the date of the meeting is given or made to stockholders, notice by the stockholder to be timely must be received not later than the close of business on the 15th day following the day on which such notice of the date of the meeting was mailed or such public disclosure was made, whichever first occurs. The stockholder’s notice to the Secretary shall set forth (a) as to each person whom the stockholder proposes to nominate for election or reelection as a Director, (i) the name, age, business address and residence address of the person, (ii) the principal occupation or employment of the person, (iii) the class and number of shares of stock of the Corporation which are beneficially owned by the person, (iv) a description of all arrangements or understandings between the stockholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the stockholder, and (b) any other information relating to the person that is required to be disclosed in solicitations for proxies for election of Directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (vi) the consent of such nominee to serve as Director of the Corporation, if he is so elected; and (c) as to the stockholder giving the notice, (i) the name and record address of stockholder, and (ii) the class and number of shares of stock of the Corporation which are beneficially owned by the stockholder. The Corporation may require any proposed nominee to furnish such other information as may reasonably be required by the Corporation to determine the eligibility of such proposed nominee to serve as Director of the Corporation. No person shall be eligible for election as a Director of the Corporation unless nominated in accordance with the procedures set forth in this Article II, Section 16. The Chairman of the meeting shall, if the facts warrant, determine and declare to the meeting that a nomination was not made in accordance with the foregoing procedure, and if he should so determine, he shall so declare to the meeting and the defective nomination shall be disregarded.

11

The Company did not receive any proposed director candidates submitted by any stockholder for inclusion in this Proxy Statement under the guidelines set forth above.

The Company’s stockholders may contact directors by sending an email to Jason Gumer, Corporate Vice President and Associate General Counsel, at JGumer@MonarchCasino.com, which will be relayed to the board member or members specified in the message, or by addressing a letter to Monarch Casino & Resort, Inc., Board of Directors, 3800 South Virginia Street, Reno, Nevada 89502. Each communication should specify the applicable director or directors to be contacted.

Compensation Committee Interlocks and Insider Participation

Yvette E. Landau, Craig F. Sullivan, and Paul Andrews each served on the Compensation Committee during 2021. None of these directors is a former or current executive officer of Monarch or had any relationships requiring disclosure by Monarch under the SEC’s rules requiring disclosure of certain relationships and related-party transactions. None of Monarch’s executive officers served as a director or a member of a compensation committee (or other committee serving an equivalent function) of any other entity, the executive officers of which served as a director or member of the Compensation Committee during 2021.

COMPENSATION DISCUSSION AND ANALYSIS

Our named executive officers (“NEOs”) are (a) John Farahi, our Chief Executive Officer (“CEO”), (b) Bob Farahi, our President, and (c) Edwin Koenig, our Chief Accounting Officer (“CAO”). David Farahi, our former Chief Operating Officer resigned effective September 3, 2021. Based on his 2021 compensation, David Farahi also qualifies as a NEO under SEC rules. We seek to compensate our NEOs in a manner that will attract and retain qualified individuals who are responsible for the management, growth and success of the Company. We believe that NEO compensation should be designed to:

| 1. | motivate performance in areas consistent with our short and long-term objectives, |

| 2. | reward for achieving those objectives, and |

| 3. | encourage NEOs to continue in our employ. |

We evaluate and establish the total compensation of our NEOs in light of what we believe to be the compensation practices, and relative corporate financial performance, of other companies in the gaming industry similar to us in terms of asset size and target market. In 2021, the Compensation Committee did not engage compensation consultants in this process because it believed that the Compensation Committee was able to consider publicly available data and other data which provided information upon which to make informed compensation decisions. Because certain comparable companies in the gaming industry do not publicly report their compensation information, their compensation practices are not publicly available. As such, we rely on information that is publicly available, information that we obtain from industry sources, and the industry experience and knowledge of our Compensation Committee and other Board members in determining NEO compensation.

12

Our NEO compensation program utilizes four primary components, which include: 1) annual salary; 2) annual cash bonus awards; 3) one-time cash or equity awards; and 4) stock option awards. Following is a discussion of each component.

Annual Salary

The salary element compensates each NEO for performance of the fundamental duties associated with that NEO’s position. In addition to what we believe to be the compensation practices and relative corporate financial performance of other companies in the gaming industry similar to us in asset size and target market, we consider other factors in establishing NEO annual salaries including the executive’s respective record of leadership and service to us, our growth during the NEO’s term of employment, the relative importance of the NEO in overseeing both our strategic direction and our day-to-day operations, the relative performance of our competitors and the NEO’s civic leadership. Salaries are reviewed annually and are adjusted as warranted.

Annual Cash Bonus Awards

To align NEO performance with our short-term operational and financial objectives, we utilize an annual cash bonus program (the “Bonus Program”) with an annual target set by the Compensation Committee as a percentage (the “Target Bonus Percentage”) of the NEO’s annual salary.

The Bonus Program is comprised of discretionary quantitative and a qualitative components. The quantitative component may be awarded based on achieving our annual financial goal, as established by the Board. The qualitative component of the cash bonus program for our NEOs is awarded at the discretion of the Compensation Committee, which considers several factors of the NEO’s performance including, but not limited to, performance against specific tactical objectives as established by the Board, staff development, staff retention, operating process improvement and the implementation of programs resulting in permanent cost reductions. The qualitative component of the cash bonus program for the other executive officers is determined by the chief executive officer, subject to the Compensation Committee review and approval, and is based on their overall performance, as well as on completing specific projects and achieving specific goals.

The financial target currently used by our Compensation Committee is “Adjusted EBITDA.” The Board sets the Adjusted EBITDA target at a level it believes is both challenging and achievable. By establishing a target that is challenging, the Board believes that NEO performance, and, therefore, Company financial performance, is optimized. By setting a target that is also achievable, the Board believes that NEOs remain motivated to perform at the high level required to achieve the Adjusted EBITDA target. Adjusted EBITDA consists of net income plus provision for income taxes, stock based compensation expense, other one-time non-cash charges, interest expense, depreciation and amortization less interest income and any benefit for income taxes. Further, the Compensation Committee determined that Adjusted EBITDA is an appropriate indicator of the Company’s financial performance and that each NEO could have a direct impact on it.

In 2021, the Target Bonus Percentage was set at 20% of the NEO’s annual salary, the standard Target Bonus Percentage per our Bonus Program. For 2021, the Adjusted EBITDA target was set at $111.5 million, driven by projected increase in market share at both resorts and improvement in operational margins. For 2021, the Adjusted EBITDA target was exceeded by 23%.

The Compensation Committee evaluated the financial results and considered other factors related to the performance of the NEOs in 2021 and approved a 20% bonus award to the CEO, President and CAO for 2021. This was consistent with the bonus awarded to the senior management and property’s management.

One-Time Cash or Equity Awards

We may, from time to time, award one-time cash or equity award based on superior financial performance relative to the Board-established annual financial profit target or specific strategic projects or initiatives, when such performance is deemed to be extraordinary or in certain other exceptional circumstances.

13

Regarding extraordinary performance, such determination is based on several factors including, but not limited to, comparison of our financial performance relative to our competitors, the general market conditions in which those financial results or other goals were reached and other operating criteria that indicate that the financial results or strategic goals achievements were abnormally strong given those market and operating conditions. By rewarding such performance with one-time cash or equity awards, we believe we are more accurately promoting sustained, superior performance by more closely linking the reward with the timing of the performance and results.

In 2021, the Company successfully completed the Monarch Black Hawk Hotel and Expanded Casino project. The Compensation Committee considered and evaluated the CEO’s and President’s work during the 5-year construction period to manage strategically, as well as day-to-day, the construction. The Compensation Committee concluded that the CEO’s and President’s project management direction and execution, which were in addition to their normal responsibilities in their roles in the Company, led to the successful completion of the project. Based on this, the Compensation Committee approved a one-time bonus award of $2,397,900 to the CEO, which was paid as a combination of cash and shares of Company’s common stock, pursuant to the 2014 Plan, which shares are subject to a transfer restriction of six (6) months. The Compensation Committee approved a one-time bonus award of $586,450 to the President paid in shares of Company’s common stock, pursuant to the 2014 Plan, which shares are subject to a transfer restriction of six (6) months.

Stock Option Awards

While it is difficult to predict the value an NEO will ultimately realize from the stock option compensation component, the compensation package is designed with the expectation that stock options will provide the highest potential reward of the four components of the NEO compensation package. As such, the most significant driver of NEO compensation is designed to correlate directly with the financial gains of our stockholders through changes in stock prices. As our stock price increases or decreases, the value of NEO stock option awards also increases or decreases. By designing the compensation program in this way, we believe that a significant portion of NEO compensation has been directly aligned with the interests of our stockholders.

NEOs receive an initial stock option grant (the “Initial Grant”) on their hire date and receive subsequent grants (the “Subsequent Grants”) in amounts equal to, and commensurate with, the portion of the Initial Grant that vests. The Initial Grant vests, assuming continued employment, in three equal tranches beginning on the third anniversary of the grant date and is fully vested on the fifth anniversary of the grant date. The Subsequent Grants vest three years after their respective grant date. Neither Initial Grants nor Subsequent Grants vest earlier than three years and in the case of Initial Grants, do not fully vest earlier than five years.

Stock option awards are granted at exercise prices equal to the closing market price of our stock on the date the stock option award is granted, except for any Incentive Stock Option (“ISO”) that might be granted to Mr. John Farahi, whose exercise price would be 110% of the relevant closing market price, since he is the beneficial owner of more than 10% of our Common Stock. As such, the value of the award increases only if our stock price increases subsequent to the stock option’s grant date. Because these awards vest over time, the stock option component of NEO compensation also encourages NEO retention, as value related to unvested stock options is forfeited if an NEO ceases to be employed by us. To date, the Compensation Committee has not granted ISOs.

In 2021, the following stock option grants were made to our NEO’s, under the 2014 Plan: on December 31, 2022, John Farahi was issued an annual grant of stock options for 66,666 shares, exercisable at $73.95 per share, vesting in 3 years from the date of the grant; on December 31, 2022, Bob Farahi was also issued an annual grant of stock options for 33,334 shares, exercisable at $73.95 per share, vesting in 3 years from the date of the grant; and on June 30, 2021, Mr. Koenig received a stock option grant for 3,333 shares, exercisable at $66.17 per share, vesting in 3 years from the date of the grant, and a stock option grant for 5,000 shares, exercisable at $66.17 per share, vesting in three equal tranches beginning on the third anniversary of the grant date and fully vested on the fifth anniversary of the grant date.

Our NEOs are subject to a compensation clawback policy. In the event of a restatement of the Company’s financial results (other than a restatement caused by a change in applicable accounting rules or interpretations), the result of which is that any performance-based compensation paid or awarded to an NEO would have been a lower amount had it been calculated based on such restated results, the awarded compensation is subject to repayment by the NEO.

14

Employment Agreements or Arrangements

We do not currently have any written or unwritten employment agreement or arrangement with any of our NEOs.

Stockholders approved the 2014 Plan on May 21, 2014. The 2014 Plan serves as the successor to our 1993 Employee Stock Option Plan, 1993 Executive Long-Term Incentive Plan and 1993 Directors’ Stock Option Plan (which plan terminated on June 13, 2013) (the “Predecessor Plans”). The 2014 Plan became effective as of May 21, 2014, and the remaining two Predecessor Plans terminated on that date (except with respect to awards previously granted under the Predecessor Plans that remain outstanding).

In order for any equity award held by the NEOs under the 2014 Plan to accelerate, there must be a change in control (which is also a corporate transaction) of Monarch, and the NEO must have been involuntarily terminated without cause or have resigned for good reason (as defined in the 2014 Plan) within twelve months of the change in control (often referred to as a “double trigger”). Upon a change in control (which is not also a corporate transaction), any equity awards held by the NEOs under the 2014 Plan will automatically vest on the date of such change in control.

Other Benefits and Compensation Matters

401(k) and Health Benefit Plans. The NEOs are permitted to participate in our 401(k) and health benefit plans on the same basis, and at the same benefit level, as the rest of our full-time employees. The plans include subsidized health insurance benefits and an annual 401(k) matching contribution up to two percent of their annual salary, subject to an annual cap.

Use of Company-provided Vehicle. Our CEO and President are each provided the use of a Company-provided vehicle.

Prohibition of option repricing or cash buyouts. Our policy is to prohibit any form of option repricing or to exchange underwater stock options for a cash settlement unless approval of stockholders has been granted.

Prohibition of speculative and hedging transactions. All directors, executive officers and employees at the level of “director” or higher are prohibited from participating in short sales of, and trading in put and call options on the Company’s securities.

The Compensation Committee determines and approves, or recommends to the Board for approval, all compensation and awards to the Company’s CEO and other executive officers. In making this determination, the recommendation and advice of certain executives is considered. The Compensation Committee solicits the CEO’s recommendation regarding executive officers’ compensation, other than himself. Each NEO also provides input about his individual contribution to the Company’s success for the period being assessed. The Compensation Committee reviews at least annually the performance and the compensation of the CEO in light of the corporate goals and objectives applicable to the compensation of the CEO, and determines and approves the compensation level of the CEO based on this evaluation. In determining compensation, or making recommendations regarding executive compensation, the Compensation Committee considers the results of the most recent stockholder advisory vote on executive compensation.

In establishing and reviewing our executive compensation program, we consider, among other things, whether the program properly motivates NEOs to focus on the creation of stockholder value without encouraging unnecessary or excessive risk taking. To this end, the Compensation Committee carefully reviews the principal components of NEO compensation. Base salaries are fixed in amount and represent on average 28% of each NEO’s total compensation. Annual incentive pay is focused on achievement of certain specific overall financial goals and is determined using multiple performance criteria. The other major component of our NEOs’ compensation is long-term incentives through stock options, which we believe is important to help further align NEOs’ interests with those of our stockholders. We believe that these cash and incentive awards, especially when combined with the compensation clawback policy described above, appropriately balance risk, payment for performance and align NEO compensation with stockholders interests without encouraging unnecessary or excessive risk taking.

15

COMPENSATION COMMITTEE REPORT

Notwithstanding any statement to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this Proxy Statement, in whole or in part, the following Compensation Committee Report on Executive Compensation shall not be incorporated by reference into any such filings or otherwise deemed filed.

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussion, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement.

| THE COMPENSATION COMMITTEE | |

| | |

| By: | Yvette E. Landau, Chair |

| | Paul Andrews, Member |

| | Craig F. Sullivan, Member |

Summary Compensation Table

The following table presents information regarding compensation of our NEOs for services rendered during the last three completed fiscal years.

| | | | | | | | | Stock | | Option | | All Other | | | | ||||

| | | | Salary | | Bonus | | Awards | | Awards | | Compensation | | Total | ||||||

Name and Position | | Year | | ($) | | ($) (1) | | ($) (2) | | ($) (2) | | ($) | | ($) | ||||||

John Farahi, |

| 2019 | | $ | 750,000 | | $ | 75,000 |

| $ | — | | $ | 843,767 |

| $ | 28,298 | | $ | 1,697,065 |

Co-Chairman of the Board, |

| 2020 | | $ | 591,351 | | $ | — |

| $ | — | | $ | 1,632,278 |

| $ | 29,658 | | $ | 2,253,287 |

Secretary and |

| 2021 | | $ | 750,000 | | $ | 1,275,000 |

| $ | 1,272,900 | (3) | $ | 2,114,758 |

| $ | 30,259 | (5) | $ | 5,442,917 |

Chief Executive Officer | | | | | | | | | | | | | | | | | | | | |

Bob Farahi, |

| 2019 | | $ | 250,000 | | $ | 25,000 |

| $ | — | | $ | 421,883 |

| $ | 25,944 | | $ | 722,827 |

Co-Chairman of the Board |

| 2020 | | $ | 225,958 | | $ | — |

| $ | — | | $ | 816,114 |

| $ | 21,911 | | $ | 1,063,983 |

and President |

| 2021 | | $ | 250,000 | | $ | — |

| $ | 636,450 | (4) | $ | 1,057,411 |

| $ | 5,812 | (6) | $ | 1,949,673 |

David Farahi, |

| 2019 | | $ | 400,000 | | $ | 40,000 |

| $ | — | | $ | 446,547 |

| $ | 26,000 | | $ | 912,547 |

Former Chief Operating Officer |

| 2020 | | $ | 361,540 | | $ | 600,000 |

| $ | — | | $ | 533,781 |

| $ | 27,223 | | $ | 1,522,544 |

|

| 2021 | | $ | 290,772 | | $ | — |

| $ | — | | $ | 824,996 |

| $ | 48,649 | (7) | $ | 1,164,417 |

Edwin S. Koenig, |

| 2019 | | $ | 165,000 | | $ | 16,500 |

| $ | — | | $ | 43,889 |

| $ | 3,728 | | $ | 229,117 |

Chief Accounting Officer |

| 2020 | | $ | 152,935 | | $ | — |

| $ | — | | $ | 57,328 |

| $ | 3,389 | | $ | 213,652 |

|

| 2021 | | $ | 170,759 | | $ | 34,151 |

| $ | — | | $ | 226,554 |

| $ | 3,415 | (8) | $ | 434,879 |

| (1) | The amounts reflect annual cash bonus awards earned in the specified year. |

| (2) | The amounts in this column do not reflect compensation actually received by the NEO nor do they reflect the actual value that will be recognized by the NEO. Instead the amounts reflect the aggregate grant date fair value of the stock option awards computed in accordance with FASB ASC Topic 718. For additional information on the valuation assumptions regarding the stock option awards, refer to Note 9 to our financial statements for the years ended December 31, 2021 and 2020, which are included in our Annual Report on Form 10-K for the years ended December 31, 2021 and 2020 and Note 10 to our financial statements for the year ended December 31, 2019, which is included in our Annual Report on Form 10-K for the year ended December 31, 2019, each filed with the SEC. |

| (3) | This amount reflects the dollar value of 15,000 shares of restricted Company’s stock, driven by the grant date closing price of the Company’s stock. |

| (4) | This amount reflects the dollar value of 7,500 shares of restricted Company’s stock, driven by the grant date closing price of the Company’s stock. |

| (5) | This amount reflects (a) $24,041 relating to the annual cost of the Company-owned automobile, which is calculated by amortizing the total cost of the automobile over five (5) years, and (b) $5,343 for the associated automobile insurance and registration. |

| (6) | This amount reflects $5,140 for the Company-owned automobile insurance and registration. Company-owned automobile. The automobile was fully depreciated in 2020. |

| (7) | This amount reflects (a) $14,337 relating to the annual cost of the Company-owned automobile, based on five (5) years amortization schedule and 8 months of David Farahi’s employment in the Company, (b) $3,646 for the associated automobile insurance and registration and (c) $30,000 paid to David Farahi for consulting services, following his departure. |

| (8) | This amount reflects the Company’s contribution to Mr. Koenig’s 401(k) plan. |

16

Grants of Plan Based Awards Made in Fiscal Year 2021

The following table presents information regarding the equity incentive awards granted to our NEOs for 2021.

| | | | Option | | | | | Grant | |

| | | | Awards: | | Exercise | | Date Fair | ||

| | | | Number of | | or Base | | Value of | ||

| | | | Securities | | Price of | | Stock and | ||

| | | | Underlying | | Option | | Option | ||

| | | | Options | | Awards | | Awards | ||

Name |

| Grant Date |

| (#) | | ($/Sh) (1) |

| ($) (2) | ||

John Farahi, | | 12/31/2021 | | 66,666 | (3) | $ | 73.95 | | $ | 2,114,758 |

Co-Chairman of the | | | | | | | | | | |

Board, Secretary and | | | | | | | | | | |

Chief Executive Officer | | | | | | | | | | |

Bob Farahi, |

| 12/31/2021 | | 33,334 | (3) | $ | 73.95 | | $ | 1,057,411 |

Co-Chairman of the | | | | | | | | | | |

Board and President | | | | | | | | | | |

David Farahi, |

| 3/31/2021 | | 15,000 | (4) | $ | 60.62 | | $ | 371,887 |

Former Chief Operating Officer |

| 6/30/2021 | | 16,666 | (4) | $ | 66.17 | | $ | 453,109 |

Edwin S. Koenig, |

| 6/30/2021 | | 8,333 | (4) | $ | 66.17 | | $ | 226,554 |

Chief Accounting Officer | | | | | | | | | | |

| (1) | The Company’s policy is to set exercise prices for stock option awards equal to the closing price of the Company’s stock on the grant date. If the grant date falls on a date that the stock market is closed, the exercise price is set at the closing price on the last day that the market was open before the grant date. |

| (2) | The amounts in this column represent the aggregate grant date fair value of equity awards granted to our NEOs during the fiscal year ended December 31, 2021, calculated in accordance with FASB ASC Topic 718. |

| (3) | The option award vests 100% on the third anniversary of the grant date subject to continued employment on that date. |

| (4) | The option awards forfeited upon Mr. David Farahi’s separation with the Company, effective September 3, 2021. |

Option Exercises in Fiscal Year 2021

The following table provides information for our NEOs for options that were exercised during 2021on an aggregate basis, and does not reflect shares withheld by the Company for exercise price or withholding taxes.

| | Option Awards | | |||

| | Number of Shares | | | Value | |

| | Acquired on | | | Realized on | |

| | Exercise | | | Exercise | |

Name | | (#) | | | ($) (1) | |

John Farahi, |

| 66,668 | | $ | 3,884,744 |

|

Co-Chairman of the Board, Secretary and Chief Executive Officer | | | | | | |

Bob Farahi, |

| 12,339 | | $ | 718,747 |

|

Co-Chairman of the Board and President | | | | | | |

David Farahi, |

| 49,999 | | $ | 1,263,424 |

|

Former Chief Operating Officer | | | | | | |

Edwin S. Koenig, |

| — | | $ | — |

|

Chief Accounting Officer | | | | | | |

| (1) | Represents the spread between (i) the market price of our common stock at exercise and (ii) the exercise price of all options exercised during the year, multiplied by the number of options exercised. |

17

Outstanding Equity Awards at Fiscal 2021 Year-End

The following table presents information regarding the outstanding equity awards held by each of our NEOs as of December 31, 2021.

| | Option Awards | | |||||||

| | Number of | | Number of | | | | | | |

| | Securities | | Securities | | | | | | |

| | Underlying | | Underlying | | | | | | |

| | Unexercised | | Unexercised | | Option | | | | |

| | Options | | Options | | Exercise | | Option | | |

| | Exercisable | | Unexercisable | | Price | | Expiration | | |

Name | | (#) | | (#) | | ($) | | Date | | |

John Farahi, |

| 66,666 | | |

| $ | 8.56 |

| 10/9/2022 |

|

Co-Chairman of the |

| 66,666 | | |

| $ | 21.71 |

| 10/21/2023 |

|

Board, Secretary and |

| 66,668 | | |

| $ | 12.32 |

| 10/21/2024 |

|

Chief Executive Officer |

| 66,666 |

| | | $ | 17.62 |

| 10/21/2025 |

|

| | 66,666 |

| | | $ | 23.08 |

| 11/1/2026 |

|

| | 66,668 | | | | $ | 45.32 | | 11/1/2027 |

|

| | 66,666 | | | | $ | 39.82 |

| 11/1/2028 | |

| | |

| 66,666 | (1) | $ | 43.24 | | 11/1/2029 |

|

| | | | 66,668 | (2) | $ | 61.22 | | 12/31/2030 | |

| | | | 66,666 | (3) | $ | 73.95 | | 12/31/2031 | |

Bob Farahi, |

| 33,334 | | |

| $ | 21.71 |

| 10/21/2023 |

|

Co-Chairman of the |

| 33,334 | | |

| $ | 17.62 |

| 10/21/2025 |

|

Board and President |

| 33,333 | | |

| $ | 23.08 |

| 11/1/2026 |

|

|

| 33,333 |

| |

| $ | 45.32 |

| 11/1/2027 |

|

| | 33,334 |

| | | $ | 39.82 |

| 11/1/2028 |

|

| | |

| 33,333 | (1) | $ | 43.24 | | 11/1/2029 |

|

| | | | 33,333 | (2) | $ | 61.22 | | 12/31/2030 |

|

| | | | 33,334 | (3) | $ | 73.95 | | 12/31/2031 | |

David Farahi, |

| | | — | (4) | | — | | — |

|

Former Chief Operating Officer |

| | | | | | | | |

|

Edwin S. Koenig, |

| 3,333 | | | | $ | 45.74 | | 6/1/2028 |

|

Chief Accounting Officer | | | | 3,333 | (5) | $ | 43.03 | | 6/1/2029 | |

| | | | 3,334 | (6) | $ | 44.60 | | 9/30/2030 | |

| | | | 3,333 | (7) | $ | 66.17 | | 6/30/2031 | |

| | | | 5,000 | (8) | $ | 66.17 | | 6/30/2031 | |

| (1) | Vests in full on November 1, 2022, subject to continued employment through that date. |

| (2) | Vests in full on December 31, 2023, subject to continued employment through that date. |

| (3) | Vests in full on December 31, 2024, subject to continued employment through that date. |

| (4) | All unvested options were forfeited at the time of Mr. David Farahi’s separation with the Company, effective September 3, 2021. |

| (5) | Vests in full on June 1, 2022, subject to continued employment through that date. |

| (6) | Vests in full on September 30, 2023, subject to continued employment through that date. |

| (7) | Vests in full on September 30, 2024, subject to continued employment through that date. |

| (8) | Vests as follows subject to continued employment through the noted dates: 1,666 shares vest on September 30, 2024; 1,667 shares vest on September 30, 2025; and 1,667 shares vest on September 30, 2026. |

18

Potential Payments Upon Termination in Connection with Change in Control

Our 2014 Plan provides for acceleration of equity awards to our NEOs upon termination in connection with a Corporate Transaction or Change in Control of our Company. Unless otherwise provided in an award agreement, in order for any equity award held by the NEOs under the 2014 Plan, that are assumed or replaced, to accelerate, there must be a Corporate Transaction or a Change in Control (which is also a Corporate Transaction) of Monarch, and the NEO must have been involuntarily terminated without Cause or have resigned for Good Reason within twelve months of the Corporate Transaction or Change in Control (often referred to as a “double trigger”). Upon a Change in Control (which is not also a Corporate Transaction) or a Corporate Transaction, any equity awards held by the NEOs under the 2014 Plan (or in the case of a Corporate Transaction, any awards that are neither assumed or replaced by the Company or a successor entity) will automatically vest immediately prior to the effective date of such Change in Control or Corporate Transaction.

Other than as described above, we have no contract, agreement, plan or arrangement, whether written or unwritten, that would provide for payments to our NEOs at, following, or in connection with any termination, including resignation, severance, retirement or a change in control of the Company.

Under our 2014 Plan: