UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to §240.14a-12

|

Monarch Casino & Resort, Inc. |

|

(Name of Registrant as Specified In Its Charter) |

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

|

x |

No fee required. | |

|

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

|

(5) |

Total fee paid: |

|

|

|

|

|

o |

Fee paid previously with preliminary materials. | |

|

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

|

|

(1) |

Amount Previously Paid: |

|

|

|

|

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

|

(3) |

Filing Party: |

|

|

|

|

|

|

(4) |

Date Filed: |

|

|

|

|

FORWARD LOOKING STATEMENTS

This proxy statement contains statements that do not relate to historical or current facts, but are “forward looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to analyses and other information based on forecasts of future results and estimates of amounts not yet determinable. These statements may also relate to future events or trends, our future prospects, and proposed new services, developments, or business strategies, among other things. These statements can generally (although not always) be identified by their use of terms and phrases such as anticipate, appear, believe, could, would, estimate, expect, indicate, intend, may, plan, predict, project, pursue, will, continue, and other similar terms and phrases, as well as the use of the future tense.

Actual results could differ materially from those expressed or implied in our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and to inherent known and unknown risks and uncertainties. See Item 1A, Risk Factors, in our most recently filed Form 10-K Annual Report for a discussion of these and other risks and uncertainties. You should not assume at any point in the future that the forward-looking statements in this report are still valid. We do not intend, and undertake no obligation, to update our forward-looking statements to reflect future events or circumstances.

MONARCH CASINO & RESORT, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

June 9, 2015

To the Stockholders of Monarch Casino & Resort, Inc.:

The Annual Meeting of Stockholders of Monarch Casino & Resort, Inc. (the “Company”, “we”, “our” or “Monarch”) will be held at the Atlantis Casino Resort Spa (“Atlantis”), 3800 South Virginia Street, Reno, Nevada 89502, on Tuesday, June 9, 2015, at 10:00 a.m. local time, for the following purposes:

|

1. |

To elect Bob Farahi and Yvette E. Landau as directors of the Company, each to serve until the 2017 Annual Meeting of Stockholders and until his or her successor is elected and qualified, or until such director’s earlier death, resignation or removal; |

|

2. |

To consider and transact such other business as may properly come before the meeting. |

Only stockholders of record at the close of business on April 16, 2015 are entitled to notice of, and to vote at, the annual meeting. The stock transfer books will not be closed. On or about April 30, 2015, we will mail to our stockholders either a printed copy of our proxy statement and our annual report on Form 10-K or a notice containing instructions on how to access our proxy statement and annual report and how to vote online. The notice also contains instructions on how you can receive a paper copy of our annual meeting materials, including the notice of annual meeting, proxy statement and proxy card, should you wish.

Stockholders are cordially invited to attend the annual meeting in person. STOCKHOLDERS DESIRING TO VOTE IN PERSON MUST REGISTER AT THE ANNUAL MEETING WITH THE INSPECTORS OF ELECTION PRIOR TO COMMENCEMENT OF THE ANNUAL MEETING. IF YOU WILL NOT BE ABLE TO ATTEND THE ANNUAL MEETING IN PERSON, YOU ARE ENCOURAGED TO READ THE PROXY STATEMENT AND THEN CAST YOUR VOTE AS PROMPTLY AS POSSIBLE IN ACCORDANCE WITH THE INSTRUCTIONS IN THE NOTICE WE WILL MAIL TO CERTAIN STOCKHOLDERS ON OR ABOUT APRIL 30, 2015 OR, IF YOU RECEIVED A PRINTED COPY OF THE PROXY MATERIALS, ON THE ENCLOSED PROXY CARD.

|

|

By order of the Board of Directors, |

|

|

|

|

|

|

|

|

|

|

|

JOHN FARAHI |

|

|

SECRETARY |

MONARCH CASINO & RESORT, INC.

PROXY STATEMENT

|

|

Page |

|

|

|

|

4 | |

|

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN OTHER BENEFICIAL OWNERS |

5 |

|

6 | |

|

7 | |

|

8 | |

|

8 | |

|

8 | |

|

11 | |

|

11 | |

|

11 | |

|

11 | |

|

11 | |

|

11 | |

|

11 | |

|

12 | |

|

14 | |

|

14 | |

|

14 | |

|

14 | |

|

21 | |

|

22 | |

|

23 | |

|

23 | |

|

23 | |

|

23 | |

|

24 | |

|

24 | |

|

24 | |

|

24 | |

|

24 | |

|

25 | |

|

26 |

MONARCH CASINO & RESORT, INC.

3800 South Virginia Street

Reno, Nevada 89502

PROXY STATEMENT

This Proxy Statement is prepared for the stockholders of Monarch Casino & Resort, Inc. (the “Company”, “we”, “our” or “Monarch”) in connection with the annual meeting of stockholders of the Company to be held at the Atlantis Casino Resort Spa, 3800 South Virginia Street, Reno, Nevada 89502, on Tuesday, June 9, 2015, at 10:00 a.m. local time, and any adjournment thereof, for the purposes indicated in the Notice of Annual Meeting of Stockholders and more fully outlined herein.

QUESTIONS AND ANSWERS ABOUT THE MEETING

Question: What is the Notice of Internet Availability of Proxy Materials that I received in the mail instead of a full set of proxy materials?

Answer: Under rules adopted by the U.S. Securities and Exchange Commission, we are furnishing proxy materials to certain of our stockholders via the internet, instead of mailing printed copies of those materials to each stockholder. On or about April 30, 2015 we will mail to our stockholders either a printed copy of our proxy materials, including our proxy statement and our annual report on Form 10-K, or a Notice of Internet Availability containing instructions on how to access our proxy materials. This electronic access process is designed to expedite stockholders’ receipt of proxy materials, lower the costs of our annual meeting and help to conserve natural resources. However, if stockholders prefer to receive a printed copy of our proxy materials and a paper proxy card, they may do so by following the instructions included in the Notice of Internet Availability.

Question: Why am I being provided with access to or receiving these proxy materials?

Answer: You are being provided with access to or are receiving these proxy materials because you owned shares of Monarch common stock as of the close of business on April 16, 2015, our record date. This proxy statement describes in detail issues on which we would like you, our stockholder, to vote. It also gives you information on these issues so that you can make an informed decision. If you will not be able to attend the annual meeting and vote in person, you are encouraged to read this Proxy Statement and then cast your vote as promptly as possible in accordance with the instructions either in the Notice of Internet Availability or, if you received a printed copy of the proxy materials, on the enclosed proxy card. The shares represented by the proxy will be voted if the proxy is properly executed and received by the Company prior to the commencement of the annual meeting, or any adjournment thereof.

Question: On what questions am I being asked to vote?

Answer:

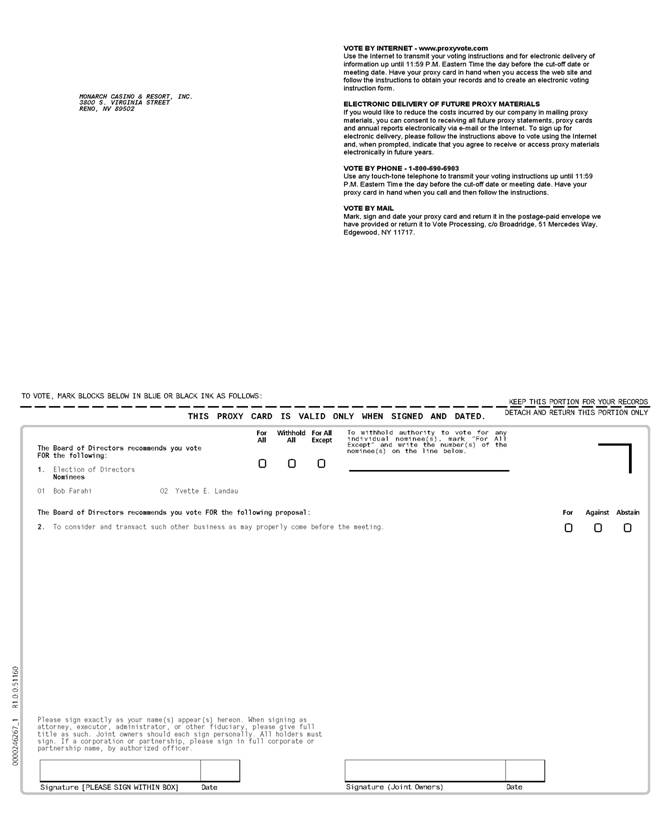

1. To elect Bob Farahi and Yvette E. Landau as directors of the Company, each to serve until the 2017 Annual Meeting of Stockholders and until his or her successor is elected and qualified, or until such director’s earlier death, resignation or removal;

2. To consider and transact such other business as may properly come before the meeting.

Question: How does the board of directors recommend I vote on these proposals?

Answer: Our board of directors (“Board of Directors” or “Board”) recommends that you vote your shares FOR each of the nominees for director named in this proxy statement and FOR transacting such other business as may properly come before the meeting.

Question: Do any of the proposals to be voted on create a statutory right of dissent under Nevada law?

Answer: None of the proposals to be voted on at the annual meeting creates a statutory right of dissent under Nevada law. A vote “FOR” or “AGAINST” any of the proposals set forth herein will only affect the outcome of the proposal.

Question: Who is entitled to vote?

Answer: The record date for the annual meeting is April 16, 2015. Stockholders of record as of the close of business on that date are entitled to vote at the annual meeting. Both “stockholders of record” and “street name holders” are entitled to vote or direct the voting of their Monarch common stock. You are a “stockholder of record” if you hold Monarch common stock that is registered in your name at our transfer agent, American Stock Transfer & Trust Company, LLC. You are a “street name holder” if you hold Monarch common stock indirectly through a nominee, such as a broker, bank or similar organization.

Question: If I am a stockholder of record, how do I vote?

Answer: You may vote via the Internet. You can vote by proxy over the Internet by following the instructions provided in the Notice or on the separate proxy card if you have received a printed set of the proxy materials.

You may vote by telephone. You can submit your vote by proxy over the telephone by following the instructions provided on the separate proxy card if you received a printed set of the proxy materials.

You may vote by mail. If you received a printed set of the proxy materials, you can submit your vote by completing and returning the separate proxy card in the prepaid and addressed envelope.

You may vote in person at the meeting. All stockholders of record may vote in person at the annual meeting. Written ballots will be passed out to anyone who wants to vote at the meeting.

Question: If my shares are held by a broker, bank or other nominee, how do I vote?

Answer: If your shares are held in street name by a broker, bank or other nominee, please refer to the instructions they provide regarding how to vote. In addition, if you are a street name holder and you wish to vote in person at the annual meeting, you must obtain a legal proxy from your broker, bank or other nominee in order to vote at the meeting.

Question: Can I revoke my proxy later?

Answer: Yes. You have the right to revoke your proxy at any time before the annual meeting. If you are a stockholder of record, you may do so by:

1. voting electronically via the Internet or by telephone on a subsequent date prior to 11:59 p.m. Eastern Time on the day before the annual meeting,

2. delivering a signed revocation or a subsequently dated, signed proxy card to the Secretary of Monarch before the annual meeting, or

3. attending the annual meeting and voting in person at the meeting (your mere presence at the annual meeting will not, by itself, revoke your proxy).

For shares you hold in street name, you may change your vote by submitting new voting instructions to your broker, bank or other nominee or, if you have obtained a legal proxy from your broker, bank or other nominee giving you the right to vote your shares at the annual meeting, by attending the meeting and voting in person.

Question: How many shares can vote?

Answer: As of the close of business on the record date of April 16, 2015, 16,843,349 shares of common stock were issued and outstanding. We have no other class of voting securities outstanding. Each share of common stock entitles its holder to one vote.

Question: How is a quorum determined?

Answer: Our Bylaws provide that the holders of fifty percent (50%) of the voting power of the stock issued and outstanding and entitled to vote at the meeting, represented in person or by proxy, constitute a quorum at a meeting of the stockholders. Abstentions and broker non-votes will be counted as present for quorum purposes.

Question: What is required to approve each proposal once a quorum has been established?

Answer:

Election of Directors. An affirmative vote of a majority of the votes present and entitled to vote at the meeting, either in person or by proxy, is required for the election of directors. A properly executed proxy marked “WITHHOLD AUTHORITY” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. Stockholders do not have the right to cumulate their votes for directors.

Other Items. For any other item which may properly come before the meeting, the affirmative vote of a majority of the votes present and entitled to vote at the meeting, either in person or by proxy, will be required for approval, unless otherwise required by law.

Question: What happens if I abstain?

Answer: Abstentions are treated as shares present or represented and voting, so abstaining has the same effect as a negative vote for each of the proposals. Abstentions are counted for purposes of determining whether there is a quorum.

Question: How will my shares be voted if I do not give specific voting instructions?

If you are a stockholder of record and you:

· Indicate when voting on the Internet or by telephone that you wish to vote as recommended by our Board of Directors; or

· Sign and send in your proxy card and do not indicate how you want to vote, then the proxyholders, John Farahi and Bob Farahi, will vote your shares in the manner recommended by our Board of Directors as follows: FOR each of the nominees for director named in this proxy statement and FOR transacting such other business as may properly come before the meeting.

All of the proposals contained in this proxy statement are considered non-discretionary items. If your shares are held by a broker on your behalf (that is, in “street name”), and you do not instruct the broker as to how to vote these shares on any of the proposals included in this proxy statement, the broker may not exercise discretion to vote for or against those proposals. This would be a “broker non-vote” and these shares will be counted for purposes of determining whether there is a quorum. Broker non-votes will be treated as though they are not entitled to vote and will not affect the outcome of the proposals. Please instruct your bank or broker so your vote can be counted.

Question: How will voting on any other business be conducted?

Answer: Although we do not know of any business to be considered at the annual meeting other than the proposals described in this proxy statement, if any other business properly comes before the annual meeting, your proxy or voting instruction gives authority to the proxyholders, John Farahi and Bob Farahi, to vote on those matters in their discretion.

Question: What if a quorum is not present at the meeting?

Answer: If a quorum is not present at the scheduled time of the annual meeting, we may adjourn the meeting, either with or without the vote of the stockholders. If we propose to have the stockholders vote whether to adjourn the meeting, the proxyholders will vote all shares for which they have authority in favor of the adjournment. We may also adjourn the meeting if for any reason we believe that additional time should be allowed for the solicitation of proxies. An adjournment will have no effect on the business that may be conducted at the annual meeting.

Question: How much stock do Monarch’s directors and executive officers own?

Answer: As of April 16, 2015, our current directors and executive officers collectively beneficially owned 4,864,030 shares of our common stock, constituting approximately 28.17% of the outstanding shares. It is expected that these persons will vote the shares held by them for each of the director nominees named in this proxy statement and in accordance with the Board of Directors’ recommendation on the other proposals contained in this proxy statement.

Question: Who will bear the costs of this solicitation?

Answer: Our Board of Directors is soliciting these proxies. We will pay the cost of this solicitation of proxies by mail. Our officers and regular employees may also solicit proxies in person or by telephone without additional compensation. We will make arrangements with brokerage houses, custodians, nominees and other fiduciaries to send proxy materials to their principals, and we will reimburse these persons for related postage and clerical expenses.

The close of business on April 16, 2015 has been fixed by the Board as the record date for determination of stockholders entitled to vote at the annual meeting. The securities entitled to vote at the annual meeting consist of shares of common stock, par value $.01 (“Common Stock”), of the Company, with each share entitling its owner to one vote. Common Stock is the only outstanding class of voting securities authorized by the Company’s Articles of Incorporation. The Company’s Articles of Incorporation authorize the Company to issue 10,000,000 shares of preferred stock, par value $.01 (“Preferred Stock”). None of the Preferred Stock is issued or outstanding, and the Company has no present plans to issue shares of Preferred Stock.

The Board is empowered to issue one or more series of Preferred Stock with such rights, preferences, restrictions, and privileges as may be fixed by the Board, without further action by the Company’s stockholders. The issuance of the Preferred Stock could adversely affect the rights, including voting rights, of the holders of the Common Stock and could impede an attempted takeover of the Company. In addition to none of the Preferred Stock being currently outstanding, the Preferred Stock does not presently possess general voting rights.

The number of outstanding shares of Common Stock at the close of business on April 16, 2015 was 16,843,349. The number of shares outstanding may change between such date and April 30, 2015 (the date on or about which we will mail to our stockholders either a printed copy of our proxy materials and our annual report on Form 10-K or a notice containing instructions on how to access our proxy statement and annual report and how to vote online) if any currently exercisable options to purchase Common Stock are exercised, if the Company elects to repurchase and cancel any shares in open market or privately negotiated transactions, or if the Company otherwise authorizes the issuance of any shares.

SECURITY OWNERSHIP OF MANAGEMENT

AND CERTAIN OTHER BENEFICIAL OWNERS

The following is a list of persons who beneficially owned more than 5% of the outstanding Common Stock and the ownership of all executive officers, directors, director nominees, and executive officers and directors as a group at the close of business on April 16, 2015, according to record ownership listings as of that date, according to the Securities and Exchange Commission Forms 3, 4 and 5 and Schedules 13D and 13G of which the Company has received copies, and according to verifications which the Company solicited and received from each executive officer and director:

|

Title of Class |

Beneficial Owner |

Amount and |

Percent of | |

|

Common |

John Farahi |

3,090,683 |

(3)(4) |

18.13% |

|

Common |

Bob Farahi |

1,590,242 |

(5)(6) |

9.39% |

|

Common |

David Farahi |

30,000 |

(7) |

* |

|

Common |

Ronald M. Rowan |

78,122 |

(8) |

* |

|

Common |

Yvette E. Landau |

30,500 |

(9) |

* |

|

Common |

Craig F. Sullivan |

38,383 |

(10) |

* |

|

Common |

Paul Andrews |

6,100 |

(11) |

* |

|

Common |

Ben Farahi |

1,822,372 |

(12) |

10.82% |

|

Common |

JPMorgan Chase & Co. |

1,367,600 |

(13) |

8.12% |

|

Common |

Epoch Investment Partners, Inc. |

974,481 |

(14) |

5.79% |

|

Common |

BlackRock Inc. |

974,151 |

(15) |

5.78% |

|

Common |

All executive officers and directors |

4,864,030 |

|

28.17% |

________________

* Less than 1%.

|

(1) |

|

Unless otherwise noted, the persons identified in this table have sole voting and sole investment power with regard to the shares beneficially owned by them. |

|

(2) |

|

Includes shares issuable upon exercise of options, which are exercisable within 60 days of April 16, 2015. |

|

(3) |

|

Includes 1,102,294 shares held in trust. |

|

(4) |

|

Includes options to purchase 200,002 shares under the 2014 Equity Incentive Plan (the “2014 Plan”). |

|

(5) |

|

Includes 1,696,790 shares that have been pledged as security. |

|

(6) |

|

Includes options to purchase 100,002 shares under the 2014 Plan. |

|

(7) |

|

Includes options to purchase 25,000 shares under the 2014 Plan. |

|

(8) |

|

Includes options to purchase 33,333 shares under the 2014 Plan. |

|

(9) |

|

Includes options to purchase 30,500 shares under the 2014 Plan. |

|

(10) |

|

Includes options to purchase 30,500 shares under the 2014 Plan. |

|

(11) |

|

Includes options to purchase 6,100 shares under the 2014 Plan. |

|

(12) |

|

Based on a Form 4 as filed with the SEC on July 16, 2014. |

|

(13) |

|

Based on a Schedule 13G/A as filed with the SEC on January 15, 2015. |

|

(14) |

|

Based on a Schedule 13G as filed with the SEC on February 9, 2015. |

|

(15) |

|

Based on a Schedule 13G as filed with the SEC on January 12, 2015. |

PROPOSAL 1: ELECTION OF DIRECTORS

The Bylaws of the Company provide for a board of directors consisting of three to twelve persons. The Board currently has five directors, divided into two classes designated as Class A (consisting of three directors) and Class B (consisting of two directors). Members of each class serve for a two-year term. At each annual meeting, the terms of one class of directors expire. The term of office of the current Class B directors will expire at the 2015 Annual Meeting of Stockholders. The term of office of the current Class A directors will be subject to renewal in 2016. Each director holds office until his or her successor has been duly elected and qualified, or the director’s earlier death, resignation or removal. Each of the nominees is a current director of the Company.

If the proxy is duly executed and received in time for the annual meeting and if no contrary specification is made as provided therein, the proxy will be voted in favor of electing the nominees Bob Farahi and Yvette E. Landau for terms of office expiring in 2017. If any such nominee shall decline or be unable to serve, the proxy will be voted for such person as shall be designated by the Board to replace any such nominee. The Board presently has no knowledge or reason to believe that any of the nominees will refuse or be unable to serve.

Any vacancies on the Board which occur during the year will be filled, if at all, by the Board through an appointment of an individual to serve only until the next annual meeting of stockholders.

The Company, through its direct wholly owned subsidiary, Golden Road Motor Inn, Inc. (“Golden Road”), owns and operates the Atlantis Casino Resort (the “Atlantis”) in Reno, Nevada, and through its indirect wholly owned subsidiary, Monarch Black Hawk, Inc., owns and operates the Monarch Casino Black Hawk (“Black Hawk”) in Black Hawk, Colorado.

The Company, each director and executive officer who has been required by the Nevada State Gaming Control Board and Nevada Gaming Commission (collectively, the “Nevada Gaming Authorities”) to be found suitable has been found suitable by the Nevada Gaming Authorities. Beginning in 2011, the Chairman of the Audit Committee is required to be found suitable by the Nevada Gaming Authorities. Future new members of the Board, if any, may be required to be found suitable in the discretion of the Nevada Gaming Authorities. The Colorado Division of Gaming (the “Colorado Regulatory Authorities”) also requires a finding of suitability for each director by the Colorado Regulatory Authorities. Each of our other directors has been found suitable by the Colorado Regulatory Authorities. Should any director later be found not to be suitable by the Nevada Gaming Authorities or the Colorado Gaming Authorities, that person will not be eligible to continue serving on the Board and a majority of the remaining directors may appoint a qualified replacement to serve as a director until the next annual meeting of stockholders.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION OF BOB FARAHI AND YVETTE E. LANDAU TO THE BOARD OF DIRECTORS.

The following information is furnished with respect to each member of the Board or nominee thereto. Similar information is provided for the Company’s executive officers and certain significant employees who are not directors. John Farahi and Bob Farahi are brothers. David Farahi, our Chief Operating Officer, is John Farahi’s son. There are no other family relationships between or among any directors, nominees to the Board, or executive officers of the Company. The statements as to beneficial ownership of Common Stock as to each director or nominee to the Board are based upon information furnished by him or her.

|

Name |

|

Age |

|

Director |

|

Position |

|

John Farahi |

|

67 |

|

1993 |

|

Co-Chairman of the Board, |

|

Bob Farahi |

|

64 |

|

1993 |

|

Co-Chairman of the Board, |

|

Paul Andrews Yvette E. Landau |

|

50

58 |

|

2014

2010 |

|

Director

Director |

|

Craig F. Sullivan |

|

68 |

|

1998 |

|

Director |

JOHN FARAHI has been Co-Chairman of the Board and Chief Executive Officer of the Company since its inception and of Golden Road since June 1993. He has served as Secretary of the Company since November 2011. From 1973 until June 1993, Mr. Farahi was President, Director, and General Manager of Golden Road. Mr. Farahi is a partner in Farahi Investment Company (“FIC”) which is engaged in real estate investment and development. Mr. Farahi served on the Washoe County Airport Authority as a Trustee from July 1997 until June 2005. Mr. Farahi is a former member of the Nevada Commission on Tourism and currently serves as a Board Member of the Reno-Sparks Convention and Visitors’ Authority. Mr. Farahi was appointed in 2013 by President Barack Obama to the United States Holocaust Memorial Council. Mr. Farahi holds a political science degree from the California State University at Hayward. The Board believes Mr. Farahi is qualified to serve as a director due to his specific experience as a casino operator and his knowledge of the casino industry.

BOB FARAHI has been Co-Chairman of the Board and President of the Company since its inception and of Golden Road since 1993. From 1973 until June 1993, Mr. Farahi was Vice President and a Director of Golden Road. Mr. Farahi divides his working time between the Company and the other private companies with which he is involved. Mr. Farahi is a partner in FIC. Mr. Farahi holds a biochemistry degree from the University of California at Berkeley. The Board believes Mr. Farahi is qualified to serve as a director due to his specific experience as a casino operator and in real estate development and his knowledge of the casino industry.

PAUL ANDREWS has been a member of the Board since May 2014 and is the President and CEO of the National Western Stock Show and Complex (“NWSS”), which plays host to the National Western Stock Show each January and over 170 other events each year in Denver, Colorado. Prior to joining NWSS in November 2010, Mr. Andrews spent 20 years in various capacities with Denver-based Kroenke Sports Enterprises LLC, owner of the Denver Nuggets, the Colorado Avalanche and the Pepsi Center Arena. Mr. Andrews served in various sales, marketing and administrative capacities while at Kroenke including the position of Executive Vice President in which he was responsible for all business operations. The Board believes Mr. Andrews is qualified to serve as a director due to his significant operations, marketing and sales experience.

YVETTE E. LANDAU has been a member of the Board since June 2010. Ms. Landau was general counsel and corporate secretary of Mandalay Resort Group from 1996 until 2005. Since 2005, Ms. Landau has been co-owner of W.A. Richardson Builders, LLC, a construction services firm specializing in casino resort development. Until May 2013, Ms. Landau served as a member of the Board of Directors of Greektown Superholdings, LLC which owns the Greektown Casino in Detroit, Michigan, and she currently serves as a member of the Board of Directors of Bossier Casino Venture, Inc. which owns the Margaritaville Resort Casino Bossier City in Louisiana. Ms. Landau is a past president of the International Association of Gaming Advisors, a worldwide organization of legal, financial and regulatory professionals in the gaming industry, and remains active with the organization as a counselor. Ms. Landau holds a bachelor’s degree from Arizona State University and a Juris Doctor degree from Northwestern University School of Law. The Board believes Ms. Landau is qualified to serve as a director due to her experience in hotel-casino management, her experience as an independent director of other casino companies and her experience in the legal and construction industries.

CRAIG F. SULLIVAN has been a member of the Board since September 1998. He was Chairman of the Board of Park Cattle Company (now Edgewood Companies) from July 2006 to June 2008. Since March 1998, Mr. Sullivan has been President of Sullivan & Associates, a strategic and financial consulting firm to companies in the gaming industry. Since 2013, Mr. Sullivan has been a director of PHL Local Gaming, LLC, which is currently bidding for Philadelphia, Pennsylvania’s second casino license. From April 1995 to March 1998, Mr. Sullivan served as Chief Financial Officer and Treasurer of Primadonna Resorts, Inc., and from February 1990 to April 1995, Mr. Sullivan served as Treasurer of Aztar Corporation. Mr. Sullivan also served on the Board of New York-New York Hotel & Casino from March 1996 to June 1998. Mr. Sullivan holds a bachelor’s degree in economics from the George Washington University and holds a master’s degree in international management from the American Graduate School of International Management. The Board believes Mr. Sullivan is qualified to serve as a director due to his experience as a senior executive in the hotel-casino industry.

Executive Officers and Significant Employees

In addition to John Farahi and Bob Farahi, whose biographical information is set forth above, our other executive officers and significant employees are set forth below.

DAVID FARAHI, age 33, has been Chief Operating Officer since April of 2012. Mr. Farahi most recently held the positions of Executive Director of Gaming Operations and Director of Investor Relations for Monarch. Mr. Farahi began his gaming and hospitality career in 1998. He has extensive experience in over a dozen positions at Atlantis Casino Resort Spa. From 2004 to 2006, Mr. Farahi held finance positions with HSBC Bank plc in their New York, London and Geneva offices, in both the investment and private banking divisions. Mr. Farahi holds an MBA from Columbia Business School with concentrations in both Real Estate and Finance and holds a BA in Economics and International Studies from Northwestern University.

RONALD ROWAN, age 50, Chief Financial Officer of the Company, joined the Company in June 2006. From December 2004 to June 2006, Mr. Rowan served as the Chief Operating and Financial Officer of Ztrading Industries, LLC, a retail software company. From June 2003 to December 2004, he served as the CFO of Camco, Inc., a specialty finance lender. Mr. Rowan was the CFO of the North/South American subsidiary of Aristocrat Technologies, Inc., a publicly held Australian based systems and gaming device company, from June 2001 through June 2003 and was employed by Casino Data Systems, also a publicly held systems and gaming company, from September 1996 through June 2001 as its Controller and then as its CFO. Prior to joining Casino Data Systems, Mr. Rowan was employed by Price Waterhouse in its audit practice for six years and then in its strategic consulting practice for four years. Mr. Rowan is a certified public accountant with a bachelor’s degree from the University of Southern California and an MBA from the University of California, Los Angeles.

DARLYNE SULLIVAN, age 60, has been the General Manager of Atlantis since February 2006 and Executive Vice President of Operations of Atlantis since 2004. From June 1993 until 2004, Mrs. Sullivan was Vice President of Sales and Marketing and Assistant General Manager of Atlantis. Mrs. Sullivan has held positions including Assistant General Manager/Director of Sales and Marketing, Reservations and Sales Manager, Front Desk Manager, Hotel Manager and Assistant Hotel Manager for Atlantis from May 1977 through June 1993.

The Board has certain standing committees including the Audit Committee and the Compensation Committee. The Audit Committee, currently comprised of Craig F. Sullivan, Chair, Yvette E. Landau and Paul Andrews, met seven times during the year ended December 31, 2014. The Audit Committee is comprised exclusively of directors who are not salaried employees and a majority of whom are, in the opinion of the Board, free from any relationship that would interfere with the exercise of independent judgment as a committee member. The Audit Committee’s function is to review reports of the auditors to the Company; to review Company financial practices, internal controls and policies with officers and key employees; to review such matters with the Company’s auditors to determine scope of compliance and any deficiencies; to consider selection of independent public accountants; to review and approve all related party transactions; and to make periodic reports on such matters to the Board. The Audit Committee adopted an Audit Committee Charter on June 4, 2000, and subsequently amended it effective June 7, 2001 and April 9, 2004. A copy of the charter may be viewed on the Company’s website at www.monarchcasino.com.

All members of the Audit Committee meet the definition of “independence” under the Securities Exchange Act of 1934 Rule 10A-3(b)(1) and are “independent directors,” as such term is defined in NASDAQ Rule 5605(a)(2).

The Company believes that Craig F. Sullivan, Chairman of the Audit Committee, is a financial expert as defined by the SEC rules applied pursuant to the Sarbanes-Oxley Act of 2002 and as defined in Regulation S-K, Item 407(d)(5)(ii). The relevant experience of Mr. Sullivan is summarized under “Election of Directions – Directors and Nominees” above.

The Compensation Committee, currently comprised of Yvette E. Landau, Chair, Craig F. Sullivan and Paul Andrews, met six times during the year ended December 31, 2014. The Compensation Committee recommends, and the Board ratifies, all compensation and awards to the Company’s executive officers and administers the 2014 Equity Incentive Plan. The Compensation Committee reviews the performance and the compensation of the chief executive officer, president and chief operating officer, and, following discussions with those individuals, presents recommendations for their compensation levels to the Board for review and ratification. For the remaining executive officers, the chief executive officer makes recommendations to the Compensation Committee that generally are approved and then passed onto the full Board for ratification. The Compensation Committee may delegate its authority to subcommittees or the Chair of the Compensation Committee when it deems appropriate and in the best interest of the Company. In conformity with NASDAQ rules, the Compensation Committee adopted a charter on October 1, 2013. A copy of the charter may be viewed on the Company’s website at www.monarchcasino.com.

The Company does not have a standing Nominating Committee, nor has the Board of Directors adopted a charter addressing the director nomination process. The Board of Directors believes that at this time it is appropriate for the Company not to have a nominating committee because the independent directors constituting the majority of the Board of Directors can adequately serve the function of considering potential director nominees from time to time as needed.

For stockholder meetings at which directors are to be elected, in compliance with NASDAQ rule 5605(e), director nominees are recommended for the Board’s nomination solely by a majority of the independent directors. In making such recommendation, the qualifications of the prospective nominee which will be considered include the nominee’s personal and professional integrity, experience, skills, professional relationships, ability and willingness to devote the time and effort necessary to be an effective board member, and commitment to act in the best interests of the Company and its stockholders.

The requirements for nomination of a person to the Board by a security holder are set forth in Article II, Section 16 of the Company’s Bylaws and the qualifications for a person to be a director of the Company are set forth in Article II, Section 14 of the Bylaws. Both sections of the Bylaws are set forth below.

14. Eligibility of Directors. No Director is eligible to continue to serve as a Director of the Corporation who is required under Nevada or Colorado gaming laws to be found suitable to serve as a director and who is not found suitable or whose finding of suitability is suspended or revoked by Nevada or Colorado gaming authorities. Such eligibility shall cease immediately following whatever act or event terminates the director’s eligibility under the laws and gaming regulations of either the State of Nevada or the State of Colorado.

16. Nomination of Directors. Only persons who are nominated in accordance with the procedures set forth in this Section 16 of Article II shall be eligible for election as Directors. Nominations of persons for election to the Board of Directors of the Corporation at the Annual Meeting may be made at a meeting of stockholders by or at the direction of the Board of Directors by any nominating committee or person appointed by the Board or by any stockholder of the Corporation entitled to vote for the election of Directors at the meeting who complies with the Notice procedures set forth in this Section 16 of Article II. Such nominations, other than those made by or at the direction of the Board, shall be made pursuant to timely notice in writing to the secretary of the Corporation. To be timely, unless waived by the Board of Directors, no person not already a Director shall be eligible to be elected or to serve as a Director unless such person’s notice of nomination shall be received at the principal executive offices of the Corporation at least seventy five (75) days before initiation of solicitation to the stockholders for election in the event of an election other than at an Annual Meeting and seventy five (75) days before the corresponding date that had been the record date for the previous year’s Annual Meeting or seventy five (75) days before the date of the next Annual Meeting of shareholders announced in the previous year’s proxy materials in the event of an election at an Annual Meeting. To be timely, no stockholder’s notice shall be received at the principal executive offices of the Corporation more than ninety (90) days before the meeting; provided, however, that in the event that less than ninety (90) days’ notice or prior public disclosure of the date of the meeting is given or made to stockholders, notice by the stockholder to be timely must be received not later than the close of business on the 15th day following the day on which such notice of the date of the meeting was mailed or such public disclosure was made, whichever first occurs. The stockholder’s notice to the Secretary shall set forth (a) as to each person whom the stockholder proposes to nominate for election or reelection as a Director, (i) the name, age, business address and residence address of the person, (ii) the principal occupation or employment of the person, (iii) the class and number of shares of stock of the Corporation which are beneficially owned by the person, (iv) a description of all arrangements or understandings between the stockholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the stockholder, and (b) any other information relating to the person that is required to be disclosed in solicitations for proxies for election of Directors pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (vi) the consent of such nominee to serve as Director of the Corporation, if he is so elected; and (c) as to the stockholder giving the notice, (i) the name and record address of stockholder, and (ii) the class and number of shares of stock of the Corporation which are beneficially owned by the stockholder. The Corporation may require any proposed nominee to furnish such other information as may reasonably be required by the Corporation to determine the eligibility of such proposed nominee to serve as Director of the Corporation. No person shall be eligible for election as a Director of the Corporation unless nominated in accordance with the procedures set forth in this Article II, Section 16. The Chairman of the meeting shall, if the facts warrant, determine and declare to the meeting that a nomination was not made in accordance with the foregoing procedure, and if he should so determine, he shall so declare to the meeting and the defective nomination shall be disregarded.

The Company did not receive the names of any proposed director candidates submitted by any stockholder for inclusion in this Proxy Statement under the guidelines set forth above.

John Farahi, the Company’s Co-Chairman, also serves as the Company’s Chief Executive Officer. Bob Farahi, the Company’s other Co-Chairman also serves as the Company’s President. The Company does not have a lead independent director. At the time of this filing, the Company believes this is the best structure to leverage John and Bob Farahi’s respective operating expertise, professional experience and longevity with the Company.

The Board of Directors’ overall diversity is a significant consideration in the director selection process. Monarch is an equal opportunity employer and does not discriminate based upon age, race, color, gender, national origin, disability or veteran status. It is the Board of Director’s desire that the Board should be composed of qualified individuals who bring diverse professional expertise and points of view. All prospective Director nominees are evaluated on their professional merits, technical qualifications, demonstrated expertise, experience and ability to contribute in such a way as to bolster and expand the collective professional perspective of the Board.

The Board held eight meetings during the year ended December 31, 2014. All directors attended at least 75% of the Board meetings and all committee members attended at least 75% of the committee meetings for the committees on which they served during the year ended December 31, 2014.

The Board has a policy that requires all directors to attend each Annual Meeting of Stockholders absent exigent circumstances. All of our directors attended the 2014 Annual Meeting of Stockholders.

The Company’s stockholders may contact directors by sending an email to Ronald Rowan at RRowan@MonarchCasino.com, which will be relayed to the board member or members specified in the message, or by addressing a letter to Monarch Casino & Resort, Inc., Board of Directors, 3800 South Virginia Street, Reno, Nevada 89502. Each communication should specify the applicable director or directors to be contacted.

Compensation Committee Interlocks and Insider Participation

Yvette E. Landau, Craig F. Sullivan, and Paul Andrews each served on the Compensation Committee during 2014. None of these directors is or has been a former or current executive officer of Monarch or had any relationships requiring disclosure by Monarch under the SEC’s rules requiring disclosure of certain relationships and related-party transactions. None of Monarch’s executive officers served as a director or a member of a compensation committee (or other committee serving an equivalent function) of any other entity, the executive officers of which served as a director or member of the Compensation Committee during 2014.

COMPENSATION DISCUSSION AND ANALYSIS

Our named executive officers (“NEOs”) are our (a) Chief Executive Officer (“CEO”), (b) President, (c) Chief Operating Officer (“COO”), and (d) Chief Financial Officer (“CFO”). We seek to compensate our NEOs in a manner that will attract and retain qualified individuals who are responsible for the management, growth and success of the Company. We believe that NEO compensation should be designed to:

1. motivate performance in areas consistent with our short and long-term objectives,

2. reward for achieving those objectives, and

3. encourage NEOs to continue in our employ.

We evaluate and establish the total compensation of our NEOs in light of what we believe to be the compensation practices, and relative corporate financial performance, of other companies in the gaming industry similar to us in terms of asset size and target market. In 2014, we did not engage compensation consultants in this process because i) we believed that the Compensation Committee was able to consider publicly available data and other data which provided us information upon which to make informed compensation decisions and ii) because the Board operates under a prudent cost management philosophy. Because certain comparable companies in the gaming industry do not publicly report their information, their compensation practices are not publicly available. As such, we rely on information that is publicly available, information that we obtain from industry sources, and the industry experience and knowledge of our Compensation Committee and other Board members in determining NEO compensation.

Our NEO compensation program utilizes four primary components, which include 1) annual salary, 2) annual cash bonus awards, 3) one-time cash awards and 4) stock option awards. Following is a discussion of each component.

Annual Salary

The salary element compensates each NEO for performance of the fundamental duties associated with that NEO’s position. In addition to what we believe to be the compensation practices and relative corporate financial performance of other companies in the gaming industry similar to us in asset size and target market, we consider other factors in establishing NEO annual salaries including the executive’s respective record of leadership and service to us, our growth during the NEO’s term of employment, the relative importance of the NEO in overseeing both our strategic direction and our day-to-day operations, the relative performance of our competitors and the NEO’s civic leadership. Salaries are reviewed annually and are adjusted as warranted.

Due to the decrease in company profit commensurate with the global recession that began in 2007, salaries for our NEOs remained flat from 2008 through 2011. In the fourth quarter of 2012, the annual salaries of our CEO and CFO were increased in recognition of their increased responsibilities related to the successful completion of our acquisition of the Riviera Black Hawk Casino in April 2012 (the “Acquisition”). Our COO’s annual salary was increased in the first quarter of 2014 in recognition of his performance and increased responsibilities. See the Summary Compensation Table below.

Annual Cash Bonus Awards

To align NEO performance with our short-term operational and profit objectives, we utilize an annual cash bonus program (the “Bonus Program”) with an annual target set by the Board as a percentage (the “Target Bonus Percentage”) of the NEO’s annual salary. Prior to the global recession that began in 2007, the Target Bonus Percentage was typically set at 20%. Until the effects of the global recession subside and Company profits grow to a more substantial level, it is likely that the Board will set the Target Bonus Percentage at percentages less than 20%.

The Bonus Program is comprised of both a quantitative and a qualitative component. The quantitative component is awarded based on achieving our annual profit goal, as established by the Board. The qualitative component of the cash bonus program is awarded at the discretion of the Compensation Committee, which considers several factors of the NEO’s performance including, but not limited to, performance against specific tactical objectives as established by the Board, staff development, staff retention, operating process improvement and the implementation of programs resulting in permanent cost reductions.

The profit target is defined as a determined level of Earnings Before Interest, Taxes, Depreciation and Amortization adjusted for any unusual or infrequent expenses (“Adjusted EBITDA”). The Board sets the Adjusted EBITDA target at a level they believe is both challenging and achievable. By establishing a target that is challenging, the Board believes that NEO performance, and therefore Company financial performance, is optimized. By setting a target that is also achievable, the Board believes that NEOs remain motivated to perform at the high level required to achieve the Adjusted EBITDA target. Adjusted EBITDA consists of net income plus provision for income taxes, stock based compensation expense, other one-time non-cash charges, interest expense, depreciation and amortization less interest income and any benefit for income taxes. The Adjusted EBITDA target for 2014 was $50.6 million. Under the Bonus Program, an additional evaluation is completed at year-end, which allows for the potential to exceed the Target Bonus Percentage. For every whole percentage point that our actual Adjusted EBITDA exceeds the full-year Adjusted EBITDA target, an additional 1% of NEO salary may be awarded up to a maximum of 40% of the NEO’s annual salary.

To motivate and reward actions that directly translate into increased Company profit, the Bonus Program is significantly weighted toward the quantitative component. Because of operating challenges primarily related to the global recession, beginning in 2008, the Target Bonus Percentage was set at 5%. For fiscal year 2012, the Adjusted EBITDA target was not achieved and bonuses under the Bonus Program were not awarded. For fiscal year 2013, the target was achieved and John Farahi, Bob Farahi, David Farahi and Ron Rowan were paid 5% bonuses accordingly. The target was not achieved for fiscal year 2014 and as such, NEO bonuses were not awarded.

One-Time Cash Awards

We may, from time to time, award one-time cash payments based on superior financial performance relative to the Board-established annual financial profit target when such performance is deemed to be extraordinary or in certain other exceptional circumstances.

Regarding extraordinary performance, such determination is based on several factors including, but not limited to, comparison of our financial performance relative to our competitors, the general market conditions in which those financial results were generated and other operating criteria that indicate that the financial results were abnormally strong given those market and operating conditions. Such performance criteria could serve as the basis for increasing an NEO’s salary level; however, by instead rewarding such performance with one-time cash awards, we believe we are more accurately promoting sustained, superior performance by more closely tying the reward with the timing of the performance. In 2012, for successful completion of the Acquisition, the Board awarded our CEO, President, COO and CFO one-time cash awards of $150,000; $50,000; $25,000 and $50,000, respectively. No one-time cash awards were paid for performance in fiscal years 2013 or 2014.

Stock Option Awards

While it is difficult to predict the value an NEO will ultimately realize from the stock option compensation component, the compensation package is designed with the expectation that stock options will provide the highest potential reward of the four components of the NEO compensation package. As such, the most significant driver of NEO compensation is designed to correlate directly with the financial gains of our stockholders through changes in stock prices. As our stock price increases or decreases, the value of NEO stock option awards also increases or decreases. By designing the compensation program in this way, we believe that a significant portion of NEO compensation has been directly aligned with the interests of our stockholders.

NEOs receive an initial stock option grant (the “Initial Grant”) on their hire date and receive subsequent grants (the “Subsequent Grants”) in amounts equal to, and commensurate with, the portion of the Initial Grant that vests. The Initial Grant vests, assuming continued employment, in three equal tranches beginning on the third anniversary of the grant date and is fully vested on the NEO’s fifth anniversary. The Subsequent Grants vest three years after their respective grant date. Neither Initial Grants nor Subsequent Grants vest earlier than three years and in the case of Initial Grants, do not fully vest earlier than five years.

Stock option awards are granted at exercise prices equal to the closing market price of our stock on the date the stock option award is granted, except for any Incentive Stock Option (“ISO”) grants to Messrs. John Farahi and Bob Farahi, whose exercise prices are 110% of the relevant closing market prices, since they are each the beneficial owners of more than 10% of our common stock. As such, the value of the award increases only if our stock price increases subsequent to the stock option’s grant date. Because these awards vest over time, the stock option component of NEO compensation also encourages NEO retention, as value related to unvested stock options is forfeited if an NEO ceases to be employed by us. To date, the Compensation Committee has not granted ISOs.

Our NEO’s are subject to a compensation clawback policy. In the event of a restatement of the Company’s financial results (other than a restatement caused by a change in applicable accounting rules or interpretations), the result of which is that any performance-based compensation paid or awarded to an NEO would have been a lower amount had it been calculated based on such restated results, the awarded compensation is subject to repayment by the NEO.

Stockholders approved the 2014 Equity Incentive Plan (the “2014 Plan”) on May 21, 2014. The 2014 Plan serves as the successor to our 1993 Employee Stock Option Plan, 1993 Executive Long-Term Incentive Plan and 1993 Directors’ Stock Option Plan (which plan terminated on June 13, 2013) (the “Predecessor Plans”). The 2014 Plan became effective as of May 21, 2014 and the remaining two Predecessor Plans terminated on that date (except with respect to awards previously granted under the Predecessor Plans that remain outstanding).

The vesting of outstanding stock options held by the NEOs under the Predecessor Plans will accelerate in connection with a change in control (as defined under the Predecessor Plans) of Monarch. In order for any equity award held by the NEOs under the 2014 Plan to accelerate, there must be a change in control (which is also a corporate transaction) of Monarch, and the NEO must have been involuntarily terminated without cause or have resigned for good reason (as defined in the 2014 Plan) within twelve months of the change in control (often referred to as a “double trigger”). Upon a change in control (which is not also a corporate transaction), any equity awards held by the NEOs under the 2014 Plan will automatically vest on the date of such change in control.

Other Benefits and Compensation Matters

401(k) and Health Benefit Plans. The NEOs are permitted to participate in our 401(k) and health benefit plans on the same basis, and at the same benefit level, as the rest of our full-time employees. The plans include subsidized health insurance benefits and an annual 401(k) matching contribution up to two percent of their annual salary.

Use of Company-provided Vehicle. Our CEO and President are each provided the use of a Company-provided vehicle in lieu of additional salary. Our COO is provided the use of a Company-provided vehicle as part of his compensation for his relocation to Denver, Colorado, which is related to his management of the Company’s property in Black Hawk, Colorado.

Use of Company-provided Housing. The Company leases a condominium in Denver, Colorado to house our COO who relocated to Denver, Colorado at the Company’s request in order to manage the Company’s property in Black Hawk, Colorado. In addition, the condominium serves to provide lodging for our CEO and President during their frequent travel to Denver, Colorado as they provide oversight of the Black Hawk property.

Prohibition of option repricing or cash buyouts. Our policy is to prohibit any form of option repricing or to exchange underwater stock options for a cash settlement unless approval of stockholders has been granted.

Prohibition of speculative and hedging transactions. All employees are prohibited from participating in short sales of, and trading in put and call options on, the Company’s securities.

The Compensation Committee recommends, and the Board ratifies, all compensation and awards to the NEOs. The Compensation Committee reviews the performance and the compensation of the CEO and President and, following discussions with those individuals, presents recommendations for their compensation levels to the Board for review and ratification. For the remaining NEOs, the CEO makes recommendations to the Compensation Committee that generally are approved and then passed on to the full Board for ratification. In evaluating and determining CEO compensation and recommending the compensation of all other NEOs, the Compensation Committee considers the results of the most recent stockholder advisory vote on executive compensation required by Section 14A of the Securities Exchange Act of 1934, as amended.

Compensation Committee Report

Notwithstanding any statement to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this Proxy Statement, in whole or in part, the following Compensation Committee Report on Executive Compensation shall not be incorporated by reference into any such filings or otherwise deemed filed.

Compensation Committee Report on Executive Compensation

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K with management and, based on such review and discussion, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy Statement.

|

|

THE COMPENSATION COMMITTEE | |

|

|

|

|

|

|

By: |

Yvette E. Landau, Chair |

|

|

|

Paul Andrews, Member |

|

|

|

Craig F. Sullivan, Member |

Summary Compensation Table

The following table presents information regarding compensation of our NEOs for services rendered during the last three completed fiscal years.

|

Name and Position |

Year |

Salary ($) |

Bonus ($) |

Stock |

Grant |

Non-Equity |

Nonqualified |

All Other |

Total ($) |

|

John Farahi, Co-Chairman of the Board, Secretary and Chief Executive Officer |

|

|

|

|

|

|

|

|

|

|

2012 |

$508,000 |

$150,000 |

- |

$219,356 |

- |

- |

- (4) |

$877,356 | |

|

2013 |

$750,000 |

$37,500 |

- |

$474,666 |

- |

- |

- (4) |

$1,262,166 | |

|

2014 |

$750,000 |

- |

- |

$249,004 |

- |

- |

$16,639 (3) |

$1,015,643 | |

|

Bob Farahi, Co-Chairman of the Board and President |

2012 |

$204,000 |

$50,000 |

- |

$109,681 |

- |

- |

- (4) |

$363,681 |

|

2013 |

$150,000 |

$7,500 |

- |

$237,340 |

- |

- |

- (4) |

$394,840 | |

|

2014 |

$150,000 |

- |

- |

$124,502 |

- |

- |

- (4) |

$274,502 | |

|

David Farahi, Chief Operating Officer (2) |

2012 |

$181,592 |

$25,000 |

- |

$91,998 |

- |

- |

$30,142 (5) |

$328,732 |

|

2013 |

$250,000 |

$12,500 |

- |

$45,319 |

- |

- |

$52,971 (6) |

$360,790 | |

|

|

2014 |

$318,077 |

- |

- |

$244,996 |

- |

- |

$52,971 (6) |

$616,044 |

|

Ronald Rowan, Chief Financial Officer and Treasurer |

2012 |

$276,000 |

$50,000 |

- |

$112,611 |

- |

- |

$6,783 (7) |

$445,394 |

|

2013 |

$300,000 |

$15,000 |

- |

$176,775 |

- |

- |

$6,000 (7) |

$497,775 | |

|

2014 |

$300,000 |

- |

- |

$167,864 |

- |

- |

$5,000 (7) |

$472,864 |

______________

(1) The bonuses reflect amounts earned in the specified year.

(2) David Farahi was appointed Chief Operating Officer on April 26, 2012.

(3) This amount reflects (a) $15,249 relating to the annual cost of the Company-owned automobile, which is calculated by amortizing the total cost of the automobile over five (5) years, and (b) $1,390 for the associated automobile insurance.

(4) The annual cost of the Company-owned vehicle is zero.

(5) This amount reflects (a) $8,204 relating to the cost of the Company-owned automobile, which is calculated by amortizing the total cost of the automobile over five (5) years, (b) $938 for the associated automobile insurance, and (c) $21,000 for a Company-provided condominium, for which the monthly lease payments are $3,500.

(6) This amount reflects (a) $9,845 relating to the annual cost of the Company-owned automobile, which is calculated by amortizing the total cost of the automobile over five (5) years, (b) $1,126 for the associated automobile insurance, and (c) $42,000 for a Company-provided condominium, for which the monthly lease payments are $3,500.

(7) This amount reflects the Company’s contribution to the Company’s 401(k) plan for the account of Ronald Rowan.

Grants of Plan Based Awards Made in Fiscal 2014

The following table presents information regarding the equity incentive awards granted to our NEOs for 2014.

|

|

|

Estimated Future Payouts Under |

Estimated Future Payouts Under |

All Other |

All Other Option |

Exercise or |

Grant Date | ||||

|

Name |

Grant Date |

Threshold |

Target |

Maximum |

Threshold |

Target |

Maximum |

Number of |

Awards: Number of |

Base Price |

Fair Value |

|

John Farahi, Co-Chairman of the Board, Secretary and Chief Executive |

10/21/2014 |

- |

- |

- |

- |

- |

- |

- |

66,668 (2) |

$12.32 |

$249,004 |

|

Bob Farahi, Co-Chairman of the Board and President |

10/21/2014 |

- |

- |

- |

- |

- |

- |

- |

33,334 (2) |

$12.32 |

$124,502 |

|

David Farahi, Chief Operating Officer |

1/17/2014 |

- |

- |

- |

- |

- |

- |

- |

40,000 (3) |

$19.00 |

$205,793 |

|

|

2/10/2014 |

- |

- |

- |

- |

- |

- |

- |

1,666 (2) |

$18.41 |

$8,259 |

|

|

7/12/2014 |

- |

- |

- |

- |

- |

- |

- |

6,667 (2) |

$14.95 |

$25,640 |

|

|

8/13/2014 |

- |

- |

- |

- |

- |

- |

- |

1,667 (2) |

$12.40 |

$5,304 |

|

Ronald Rowan, Chief Financial Officer and Treasurer |

6/19/2014 |

- |

- |

- |

- |

- |

- |

- |

33,333 (2) |

$15.60 |

$167,864 |

________________________________

(1) The Company’s policy is to set exercise prices for stock option awards equal to the closing price of the Company’s stock on the grant date. If the grant date falls on a date that the stock market is closed, the exercise price is set at the closing price on the last day that the market was open before the grant date.

(2) The option award vests 100% on the third anniversary of the grant date subject to continued employment on that date.

(3) The option award vests as follows subject to continued employment through the noted dates: 13,333 shares vest on January 17, 2017, 13,333 shares vest on January 17, 2018 and 13,334 shares vest on January 17, 2019.

Option Exercises and Stock Vested in Fiscal 2014

The following table provides information for our NEOs for options that were exercised, and stock awards that vested and released, during 2014 on an aggregate basis, and does not reflect shares withheld by the Company for exercise price or withholding taxes.

|

|

Option Awards |

Stock Awards | ||

|

Name |

Number of |

Value |

Number of |

Value |

|

John Farahi, Co-Chairman of the Board, Secretary and Chief Executive Officer |

200,000

270,002 |

$ 1,373,000

$ 2,086,822 |

-

- |

-

- |

|

Bob Farahi, Co-Chairman of the Board and President |

210,002 |

$ 1,788,920 |

- |

- |

|

David Farahi, Chief Operating Officer |

- |

- |

- |

- |

|

Ronald Rowan, Chief Financial Officer and Treasurer |

142,666 |

$ 1,248,927 |

- |

- |

(1) Represents the spread between (i) the market price of our Common Stock at exercise and (ii) the exercise price of all options exercised during the year, multiplied by the number of options exercised.

Outstanding Equity Awards at Fiscal 2014 Year-End

The following table presents information regarding the outstanding equity awards held by each of our NEOs as of December 31, 2014.

|

|

|

Option Awards |

|

Stock Awards |

| |||||||||||||||||||||||

|

Name |

|

|

Number of |

|

|

Number of |

|

|

Equity |

|

|

Option |

|

|

Option |

|

|

Number |

|

|

Market |

|

|

Equity |

|

|

Equity |

|

|

John Farahi, Co-Chairman of the Board, Secretary and Chief Executive Officer |

|

|

66,666 |

|

|

|

|

|

- |

|

|

$21.82 |

|

|

10/21/2016 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

|

66,668 |

|

|

|

|

|

- |

|

|

$29.00 |

|

|

10/21/2017 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

| |

|

|

|

66,668 |

|

|

|

|

|

- |

|

|

$9.33 |

|

|

10/21/2021 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

| |

|

|

|

|

|

|

66,666(1) |

|

|

- |

|

|

$8.56 |

|

|

10/9/2022 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

| |

|

|

|

|

|

|

|

66,666(2) |

|

|

- |

|

|

$21.71 |

|

|

10/21/2023 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

66,668(3) |

|

|

- |

|

|

$12.32 |

|

|

10/21/2024 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bob Farahi, Co-Chairman of the Board and President |

|

|

33,334 |

|

|

|

|

|

- |

|

|

$21.82 |

|

|

10/21/2016 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

|

33,334 |

|

|

|

|

|

- |

|

|

$29.00 |

|

|

10/21/2017 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

| |

|

|

|

33,334 |

|

|

|

|

|

- |

|

|

$9.33 |

|

|

10/21/2021 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

| |

|

|

|

|

|

|

33,334(1) |

|

|

- |

|

|

$8.56 |

|

|

10/9/2022 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

| |

|

|

|

|

|

|

|

33,334(2) |

|

|

- |

|

|

$21.71 |

|

|

10/21/2023 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

33,334(3) |

|

|

- |

|

|

$12.32 |

|

|

10/21/2024 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David Farahi, Chief Operating Officer |

|

|

3,300 |

|

|

1,700(4) |

|

|

- |

|

|

$6.72 |

|

|

2/10/2020 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

|

5,000 |

|

|

|

|

|

- |

|

|

$11.15 |

|

|

6/21/2020 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

| |

|

|

|

13,333 |

|

|

6,667(5) |

|

|

- |

|

|

$10.20 |

|

|

7/12/2020 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

| |

|

|

|

1,667 |

|

|

|

|

|

- |

|

|

$9.30 |

|

|

8/13/2021 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

| |

|

|

|

|

|

|

1,667(6) |

|

|

- |

|

|

$7.42 |

|

|

8/13/2022 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

| |

|

|

|

|

|

|

30,000(7) |

|

|

- |

|

|

$7.55 |

|

|

8/21/2022 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

| |

|

|

|

|

|

|

1,666(8) |

|

|

- |

|

|

$10.33 |

|

|

2/10/2023 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

| |

|

|

|

|

|

|

6,666(9) |

|

|

- |

|

|

$17.79 |

|

|

7/12/2023 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

| |

|

|

|

|

|

|

1,667(10) |

|

|

- |

|

|

$20.00 |

|

|

8/13/2023 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

| |

|

|

|

|

|

|

|

40,000(11) |

|

|

- |

|

|

$19.00 |

|

|

1/17/2024 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

1,666(12) |

|

|

- |

|

|

$18.41 |

|

|

2/10/2024 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

6,667(13) |

|

|

- |

|

|

$14.95 |

|

|

7/12/2024 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

1,667(14) |

|

|

- |

|

|

$12.40 |

|

|

8/13/2024 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|