Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

Nektar Therapeutics

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

Table of Contents

NEKTAR THERAPEUTICS

455 Mission Bay Boulevard South

San Francisco, California 94158

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 17, 2020

AT 2:00 P.M. PACIFIC TIME

Dear Stockholder:

You are cordially invited to attend the 2020 Annual Meeting of Stockholders of Nektar Therapeutics, a Delaware corporation which will be held by live webcast only. The 2020 Annual Meeting will be held on Wednesday, June 17, 2020, at 2:00 p.m. solely by webcast for the following purposes:

| 1. | To elect three directors with terms to expire at the 2023 Annual Meeting of Stockholders. |

| 2. | To approve an amendment of our Amended and Restated 2017 Performance Incentive Plan to increase the aggregate number of shares of common stock authorized for issuance under the plan by 10,000,000 shares. |

| 3. | To approve an amendment and restatement of our Amended and Restated Employee Stock Purchase Plan to increase the aggregate number of shares of common stock authorized for issuance under the plan by 1,000,000 shares. |

| 4. | To ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2020. |

| 5. | To approve a non-binding advisory resolution regarding our executive compensation (a “say-on-pay” vote). |

| 6. | To conduct any other business properly brought before the 2020 Annual Meeting. |

These items of business are more fully described in the Proxy Statement accompanying this Notice of Annual Meeting of Stockholders. The record date for the 2020 Annual Meeting is April 20, 2020. Only stockholders of record at the close of business on that date are entitled to notice of, and to vote at, the 2020 Annual Meeting or any adjournment thereof.

Due to the public health and travel concerns our stockholders may have related to the coronavirus (COVID-19) and the protocols that federal, state, and local governments may impose, we have elected to hold the Annual Meeting of Stockholders solely by means of remote communication. The webcast of the Annual Meeting will begin promptly at 2:00 p.m. Pacific Time.

To participate in the live webcast, please visit www.virtualshareholdermeeting.com/NKTR2020. You will need the control number included on your Notice, proxy card, or voting instruction form. We encourage you to access the meeting prior to the start time.

Your vote is very important. Whether or not you participate in the 2020 Annual Meeting which will be held by live webcast on the day of the meeting, it is important that your shares be represented. You may vote your proxy on the Internet, by phone or by mail in accordance with the instructions in the Notice of Availability of Proxy Materials.

On behalf of the Board of Directors, thank you for your participation in this important annual process.

By Order of the Board of Directors

/s/ Mark A. Wilson

Mark A. Wilson

Senior Vice President, General Counsel and Secretary

San Francisco, California

April 29, 2020

YOU ARE CORDIALLY INVITED TO ATTEND THE ANNUAL MEETING IN VIA LIVE WEBCAST ON THE DAY OF THE MEETING. WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE VOTE ON THE INTERNET, BY PHONE OR BY MAIL AS INSTRUCTED IN THE NOTICE OF AVAILABILITY OF PROXY MATERIALS, AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. EVEN IF YOU HAVE VOTED BY PROXY, YOU MAY STILL VOTE DURING THE LIVE WEBCAST IF YOU ATTEND THE ANNUAL MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE ANNUAL MEETING, YOU MUST OBTAIN A PROXY ISSUED IN YOUR NAME FROM THAT RECORD HOLDER.

Table of Contents

Table of Contents

NEKTAR THERAPEUTICS

455 Mission Bay Boulevard South

San Francisco, California 94158

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 17, 2020

AT 2:00 P.M. PACIFIC TIME

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING PROCEDURES

Due to the public health and travel concerns our stockholders may have related to the coronavirus (COVID-19) and the protocols that federal, state, and local governments may impose, we have elected to hold the Annual Meeting of Stockholders solely by means of remote communication.

WHY AM I RECEIVING THESE MATERIALS?

We sent you a Notice of Availability of Proxy Materials (the “Notice”) because the board of directors of Nektar Therapeutics, a Delaware corporation (“Nektar,” the “Company,” “we” or “us”), is soliciting your proxy to vote at our 2020 annual meeting of stockholders (the “Annual Meeting”) to be solely by live webcast on June 17, 2020 at 2:00 p.m. There will be no in-person meeting. We invite you to attend the Annual Meeting by live webcast to vote on the proposals described in this proxy statement. However, you do not need to attend the live webcast meeting to vote your shares. Instead, you may vote by proxy over the Internet or by phone by following the instructions provided in the Notice or, if you request printed copies of the proxy materials by mail, you may vote by mail. Please visit our website at www.nektar.com for updated information related to the Annual Meeting. As always, we encourage you to vote your shares prior to the Annual Meeting.

The webcast of the Annual Meeting will begin promptly at 2:00 p.m. Pacific Time. To participate in the live webcast, please visit www.virtualshareholdermeeting.com/NKTR2020. You will need the control number included on your Notice, proxy card, or voting instruction form. We encourage you to access the meeting prior to the start time.

The Notice was first sent or made available on or about April 29, 2020 to all stockholders of record entitled to vote at the Annual Meeting.

WHO CAN VOTE AT THE ANNUAL MEETING?

Only stockholders of record at the close of business on April 20, 2020 will be entitled to vote at the Annual Meeting. On this record date, there were 177,914,327 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If, on April 20, 2020, your shares were registered directly in your name with our transfer agent, Computershare Inc., then you are a stockholder of record. The Notice will be sent to you by mail directly by us. As a stockholder of record, you may vote remotely at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting remotely, we urge you to vote on the Internet or by phone as instructed in the Notice or by proxy by mail by requesting a paper copy of the proxy materials as instructed in the Notice to ensure your vote is counted.

1

Table of Contents

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If, on April 20, 2020, your shares were held in an account at a brokerage firm, bank or other agent, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank or other agent on how to vote the shares in your account. Your brokerage firm, bank or other agent will not be able to vote in the election of directors unless they have your voting instructions, so it is very important that you indicate your voting instructions to the institution holding your shares.

You are also invited to attend the Annual Meeting by live webcast. However, since you are not the stockholder of record, you may not vote your shares remotely at the Annual Meeting by live webcast unless you request and obtain a valid proxy from your broker, bank or other agent.

WHAT AM I VOTING ON?

There are five matters scheduled for a vote:

| • | Proposal 1: To elect three directors with terms to expire at the 2023 Annual Meeting of Stockholders. |

| • | Proposal 2: To approve an amendment of our Amended and Restated 2017 Performance Incentive Plan to increase the aggregate number of shares of common stock authorized for issuance under the plan by 10,000,000 shares. |

| • | Proposal 3: To approve an amendment and restatement of our Amended and Restated Employee Stock Purchase Plan to increase the aggregate number of shares of common stock authorized for issuance under the plan by 1,000,000 shares. |

| • | Proposal 4: To ratify the selection of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2020. |

| • | Proposal 5: To approve a non-binding advisory resolution regarding our executive compensation (a “say-on-pay” vote). |

HOW ARE PROXY MATERIALS DISTRIBUTED?

Under rules adopted by the Securities and Exchange Commission (“SEC”), we are sending the Notice to our stockholders of record and beneficial owners as of April 20, 2020. Stockholders will have the ability to access the proxy materials, including this proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, on the Internet at www.nektar.com or to request a printed or electronic set of the proxy materials at no charge. Instructions on how to access the proxy materials over the Internet and how to request a printed copy may be found on the Notice.

In addition, any stockholder may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. Choosing to receive future proxy materials by email will save us the cost of printing and mailing documents to stockholders and will reduce the impact of annual meetings on the environment. A stockholder who chooses to receive future proxy materials by email will receive an email prior to next year’s annual meeting with instructions containing a link to those materials and a link to the proxy voting website. A stockholder’s election to receive proxy materials by email will remain in effect until the stockholder terminates it.

2

Table of Contents

HOW DO I VOTE?

You may either vote “For” or “Against” or abstain from voting with respect to each nominee to the board of directors. For Proposals 2, 3, 4 and 5, you may vote “For” or “Against” or abstain from voting. The procedures for voting are:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record as of April 20, 2020, you may vote remotely at the Annual Meeting by live webcast, vote by proxy over the Internet or by phone by following the instructions provided in the Notice or, if you request printed copies of the proxy materials by mail, you may vote by mail. If your proxy is properly executed in time to be voted at the Annual Meeting, the shares represented by the proxy will be voted in accordance with the instructions you provide. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote remotely if you have already voted by proxy.

| 1. | To vote during the meeting, attend the Annual Meeting which will be held by live webcast. To attend the live meeting go to www.virtualshareholdermeeting.com/NKTR2020 on the day and time of the meeting. You will need the control number included on your Notice, proxy card, or voting instruction form. We encourage you to access the meeting prior to the start time. |

| 2. | To vote on the Internet prior to the Annual Meeting, go to www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the 16-digit control number from the Notice and follow the instructions. Your vote must be received by 11:59 p.m. Eastern Time on June 16, 2020 to be counted. |

| 3. | To vote by phone, request a paper or email copy of the proxy materials by following the instructions on the Notice and call the number provided with the proxy materials to transmit your voting instructions. Your vote must be received by 11:59 p.m. Eastern Time on June 16, 2020 to be counted. |

| 4. | To vote by mail, request a paper copy of the proxy materials by following the instructions on the Notice and complete, sign and date the proxy card enclosed with the paper copy of the proxy materials and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a Notice and voting instructions from that organization rather than from us. Simply follow the instructions to ensure that your vote is counted. To vote by live webcast at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included with the Notice, or contact your broker, bank or other agent.

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

HOW MANY VOTES DO I HAVE?

On each matter to be voted upon, you have one vote for each share of common stock you owned as of April 20, 2020.

3

Table of Contents

WHAT IS THE QUORUM REQUIREMENT?

A quorum of stockholders is necessary to take any action during the meeting (other than to adjourn the meeting). The presence, by live webcast, or by proxy duly authorized, of the holders of a majority of the outstanding shares of stock entitled to vote will constitute a quorum. On April 20, 2020, there were 177,914,327 shares outstanding and entitled to vote.

Your shares will be counted towards the quorum only if you submit a valid proxy or vote during the live webcast at the Annual Meeting. Even if your valid proxy card indicates that you abstain from voting or if a broker indicates on a proxy that it lacks discretionary authority to vote your shares on a particular matter, commonly referred to as “broker non-votes,” your shares will still be counted for purposes of determining the presence of a quorum at the Annual Meeting. If there is no quorum, the chairman of the Annual Meeting or a majority of the votes present at the Annual Meeting may adjourn the Annual Meeting to another date.

WHAT IF I RETURN A PROXY CARD BUT DO NOT MAKE SPECIFIC CHOICES?

If you are a stockholder of record and you return a proxy card without marking any voting selections, your shares will be voted:

| 1. | Proposal 1: “For” election of the three nominees for director. |

| 2. | Proposal 2: “For” the approval of an amendment to the Amended and Restated 2017 Performance Incentive Plan to increase the aggregate number of shares of common stock authorized for issuance under the plan by 10,000,000 shares. |

| 3. | Proposal 3: “For” the approval of an amendment and restatement of our Amended and Restated Employee Stock Purchase Plan to increase the aggregate number of shares of common stock authorized for issuance under the plan by 1,000,000 shares. |

| 4. | Proposal 4: “For” the ratification of the Audit Committee’s selection of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2020. |

| 5. | Proposal 5: “For” the approval of a non-binding advisory resolution regarding our executive compensation (a “say-on-pay” vote). |

If any other matter is properly presented at the meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using his best judgment.

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, your shares are held by your broker, bank or other agent as your nominee (that is, in “street name”) and you will need to obtain a proxy form from the organization that holds your shares and follow the instructions included on that form regarding how to instruct the organization to vote your shares. If you do not give instructions to your broker, bank or other agent, it can vote your shares with respect to “discretionary” items but not with respect to “non-discretionary” items. Discretionary items are proposals considered routine under the rules of various national securities exchanges, and, in the absence of your voting instructions, your broker, bank or other agent may vote your shares held in street name on such proposals. Non-discretionary items are proposals considered non-routine under the rules of various national securities exchanges, and, in the absence of your voting instructions, your broker, bank or other agent may not vote your shares held in street name on such proposals and the shares will be treated as broker non-votes. Proposals 1, 2, 3 and 5 are matters considered non-routine under the applicable rules. If you do not give your broker specific instructions, the broker will not vote your shares on Proposals 1, 2, 3, and 5 and your shares will constitute broker non-votes which will be counted for purposes of determining whether a quorum exists but will not affect the outcome of these proposals. Proposal 4 involves a matter we believe to be routine and thus if you do not give instructions to your broker, the broker may vote your shares in its discretion on Proposal 4 and therefore no broker non-votes are expected to exist in connection with Proposal 4.

4

Table of Contents

HOW ARE VOTES COUNTED?

Votes will be counted by the inspector of election appointed for the Annual Meeting, with respect to Proposal 1, “For” votes, “Against” votes, abstentions and broker non-votes for each nominee, with respect to Proposal 2, 3 and 5, “For” votes, “Against” votes, abstentions and broker non-votes, and with respect to Proposal 4, “For” votes, “Against” votes and abstentions.

WHO WILL SERVE AS INSPECTOR OF ELECTIONS?

A representative of Broadridge Financial Solutions, Inc. will serve as the inspector of elections.

HOW MANY VOTES ARE NEEDED TO APPROVE EACH PROPOSAL?

| • | For Proposal 1 electing three members of the board of directors, each director must receive a “For” vote from a majority of the votes cast during the live webcast or by proxy at the Annual Meeting on the election of the director. A majority of the votes cast shall mean that the number of shares voted “For” a director’s election exceeds fifty percent (50%) of the number of the votes cast with respect to that director’s election. |

| • | For Proposal 2 approving an amendment to our Amended and Restated 2017 Performance Incentive Plan to increase the aggregate number of shares of common stock authorized for issuance under the plan, the proposal must receive a “For” vote from a majority of the votes cast either during the live webcast or by proxy at the Annual Meeting. |

| • | For Proposal 3 approving an amendment and restatement of our Amended and Restated Employee Stock Purchase Plan to increase the aggregate number of shares of common stock available for issuance under the plan. The proposal must receive a “For” vote from a majority of the votes cast either during the live webcast or by proxy at the Annual Meeting. |

| • | For Proposal 4 ratifying the Audit Committee’s selection of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2020, the proposal must receive a “For” vote from a majority of the votes cast either during the live webcast or by proxy at the Annual Meeting. |

| • | For Proposal 5 approving the resolution regarding executive compensation, the proposal must receive a “For” vote from a majority of the votes cast either during the live webcast or by proxy at the Annual Meeting. |

For purposes of all proposals above, votes cast shall include any shares voted “Against” and shall exclude abstentions and, to the extent applicable, broker non-votes.

WHO IS PAYING FOR THIS PROXY SOLICITATION?

We will pay for the entire cost of soliciting proxies. In addition to the Notice and the proxy materials, our directors and employees may also solicit proxies during the live webcast, by telephone or by other means of communication. We have retained Georgeson LLC to assist in the distribution of proxy materials and the solicitation of proxies from brokerage firms, fiduciaries, custodians, and other similar organizations representing beneficial owners of shares for the Annual Meeting. We have agreed to pay Georgeson a fee of approximately $14,795 plus customary costs and expenses for these services. We will not pay our directors and employees any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding the Notice and any other proxy materials to beneficial owners.

WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE NOTICE?

If you receive more than one Notice, your shares are registered in more than one name or are registered in different accounts. Please vote by proxy according to each Notice to ensure that all of your shares are voted.

5

Table of Contents

CAN I CHANGE MY VOTE AFTER SUBMITTING MY PROXY?

Yes, you can revoke your proxy at any time before the final vote at the Annual Meeting. If you are a stockholder of record, you may revoke your proxy in any one of three ways:

| 1. | A duly executed proxy card with a later date or time than the previously submitted proxy; |

| 2. | A written notice that you are revoking your proxy to our Secretary, care of Nektar Therapeutics, at 455 Mission Bay Boulevard South, San Francisco, California 94158; or |

| 3. | A later-dated vote on the Internet or by phone or a ballot cast during the live webcast at the Annual Meeting (simply attending the Annual Meeting will not, by itself, revoke your proxy). |

If you are a beneficial owner, you may revoke your proxy by submitting new instructions to your broker, bank or other agent, or if you have received a proxy from your broker, bank or other agent giving you the right to vote your shares at the Annual Meeting, by attending the meeting and voting during the live webcast.

WHEN ARE STOCKHOLDER PROPOSALS DUE FOR NEXT YEAR’S ANNUAL MEETING?

Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), some stockholder proposals may be eligible for inclusion in our 2021 proxy statement. Any such proposal must be submitted in writing by December 30, 2020, to our Secretary, care of Nektar Therapeutics, 455 Mission Bay Boulevard South, San Francisco, California 94158. If we change the date of our 2021 annual meeting by more than 30 days from the date of the previous year’s annual meeting, the deadline shall be a reasonable time before we begin to print and send our proxy materials. Stockholders interested in submitting such a proposal are advised to contact knowledgeable counsel with regard to the detailed requirements of the applicable securities laws and our bylaws. The submission of a stockholder proposal does not guarantee that it will be included in our proxy statement.

Alternatively, under our bylaws, if you wish to submit a proposal that is not to be included in next year’s proxy statement or nominate a director, you must provide specific information to us no earlier than March 19, 2021 and no later than the close of business on April 18, 2021. If we change the date of our 2021 annual meeting by more than 30 days from the date of the previous year’s annual meeting, the deadline shall be changed to not later than the sixtieth day prior to such annual meeting and no earlier than the close of business on the ninetieth day prior to such annual meeting. The public announcement of an adjournment or postponement of the 2021 annual meeting does not commence a new time period (or extend any time period) for the giving of a stockholder’s notice as described in this proxy statement. You are advised to review our bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominees.

A stockholder’s submission must include certain specific information concerning the proposal or nominee, as the case may be, and information as to the stockholder’s ownership of our common stock. Proposals or nominations not meeting these requirements will not be entertained at any annual meeting.

In relation to stockholder proposals and nominations, in certain instances we may exercise discretionary voting authority under proxies held by the board of directors. For instance, if we do not receive a stockholder proposal by April 18, 2021, we may exercise discretionary voting authority under proxies held by the board of directors on such stockholder proposal. If we change the date of our 2021 annual meeting by more than 30 days from the date of the previous year’s annual meeting, the deadline will change to a reasonable time before we begin to print and send our proxy materials. In addition, even if we are notified of a stockholder proposal within the time requirements discussed above, if the stockholder does not comply with certain requirements of the Exchange Act, we may exercise discretionary voting authority under proxies held by the board of directors on such stockholder proposal if we include advice in our proxy statement on the nature of the matter and how we intend to exercise our discretion to vote on the matter.

6

Table of Contents

WHAT IS “HOUSEHOLDING” AND HOW DOES IT AFFECT ME?

We have adopted a procedure approved by the SEC called “householding.” Under this procedure, stockholders who have the same address may receive only one copy of the Notice, unless one or more of these stockholders notifies us that they wish to receive individual copies of the Notice and, if requested, other proxy materials. This process potentially means extra convenience for stockholders and cost savings for companies.

If you are a beneficial owner of our common stock, once you receive notice from your broker, bank or other agent that they will be householding communications to your address, householding will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding and would prefer to receive separate Notices or other proxy materials, please notify your broker, bank or other agent, direct your written request to Nektar Therapeutics, Secretary, 455 Mission Bay Boulevard South, San Francisco, California 94158 or contact our Secretary at (415) 482-5300. Stockholders who currently receive multiple copies of the Notice or other proxy materials at their address and would like to request householding of their communications should contact their broker, bank or other agent.

HOW CAN I FIND OUT THE RESULTS OF THE VOTING AT THE ANNUAL MEETING?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be published in a Current Report on Form 8-K filed with the SEC within four business days following the Annual Meeting.

7

Table of Contents

ELECTION OF DIRECTORS

Our board of directors is presently comprised of eight (8) directors and is divided into three (3) classes. Class III currently consists of two directors, and each of Classes I and II currently consists of three directors. Each class has a three (3) year term. The three (3) current directors in Class I are Howard W. Robin, Karin Eastham, and Myriam J. Curet, M.D., whose term expires in 2020. Each of the current directors in Class I have been nominated for reelection at the Annual Meeting. Mr. Robin was previously elected by the stockholders. Ms. Eastham was appointed to our board of directors in September 2018 and Dr. Curet was appointed to our board of directors in December 2019.

Vacancies on the board, including vacancies created by an increase in the number of directors, are filled only by persons elected by a majority of the remaining directors. A director elected by the board to fill a vacancy in a class serves until the earliest of the end of the remaining term of that class, the election and qualification of his or her successor or such director’s death, resignation or removal.

Directors are elected by a majority of the votes cast at the Annual Meeting on the election of directors. A majority of votes cast shall mean that the number of shares voted “For” a director’s election exceeds fifty percent (50%) of the number of votes cast with respect to that director’s election, with votes cast including votes “Against” in each case but excluding abstentions and broker non-votes with respect to that director’s election. Shares represented by executed proxies by stockholders of record will be voted for the election of the three nominees named below, unless the “Against” or “Abstain” voting selection has been marked on the proxy card. Neither abstentions nor broker non-votes will have an effect on the outcome of the vote.

If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would otherwise be voted for such nominee will be voted for the election of a substitute nominee proposed by the Nominating and Corporate Governance Committee and nominated by the board of directors. Each person nominated for election has agreed to serve if elected. Our management has no reason to believe that any nominee will be unable to serve. If elected at the Annual Meeting, each of the nominees will serve until the earliest of the 2023 annual meeting of our stockholders, the election and qualification of his or her successor or his or her death, resignation or removal.

The following is a brief biography of each nominee.

Karin Eastham

Karin Eastham, age 70, was appointed to serve as a member of our board of directors in September 2018. Ms. Eastham currently serves on the boards of directors of several life sciences companies. Ms. Eastham has served on the board of directors of Geron Corporation since March 2009, Veracyte, Inc. since December 2012, and Personalis, Inc. since November 2019. Ms. Eastham served as a member of the board of directors of Ilumina Inc. from August 2004 to May 2019, MorphoSys AG from May 2012 to May 2017, Amylin Pharmaceuticals, Inc. from September 2005 until its acquisition in August 2012, Genoptix, Inc. from July 2008 until its acquisition in March 2011, Tercica, Inc. from December 2003 until its acquisition in October 2008, and Trius Therapeutics, Inc. from February 2007 until its acquisition in September 2013. From May 2004 to September 2008, Ms. Eastham served as Executive Vice President and Chief Operating Officer, and as a member of the Board of Trustees, of the Burnham Institute for Medical Research (now Sanford Burnham Prebys Medical Discovery Institute), a non-profit corporation engaged in biomedical research. From April 1999 to May 2004, Ms. Eastham served as Senior Vice President, Chief Financial Officer and Secretary of Diversa Corporation, a biotechnology company. Ms. Eastham previously held similar positions with CombiChem, Inc., a computational chemistry company, and Cytel Corporation, a biopharmaceutical company. Ms. Eastham also held several positions, including Vice President, Finance, at Boehringer Mannheim Diagnostics, from 1976 to 1988. Ms. Eastham received a B.S. in Accounting and an M.B.A. from Indiana University and is a Certified Public Accountant.

8

Table of Contents

Myriam J. Curet, M.D.

Myriam J. Curet, M.D., age 63, was appointed to serve as a member of our board of directors in December 2019. Dr. Curet currently serves as the Executive Vice President and Chief Medical Officer of Intuitive Surgical, Inc. Prior to being promoted as Executive Vice President and Chief Medical Officer in November 2017, Dr. Curet served as the Chief Medical Advisor for Intuitive Surgical from December 2005 to February 2014 and as Intuitive Surgical’s Senior Vice President and Chief Medical Officer from February 2014 to November 2017. Dr. Curet also has a faculty position as Professor of Surgery at Stanford University School of Medicine. Since October 2010, she has served as a Consulting Professor of Surgery at Stanford University with a part time clinical appointment at the Palo Alto Veteran’s Administration Medical Center. She was also on the faculty at the University of New Mexico for six years prior to joining Stanford University in 2000. Dr. Curet received her M.D. from Harvard Medical School and completed her general surgery residency program at the University of Chicago and her Surgical Endoscopy fellowship at the University of New Mexico.

Howard W. Robin

Howard W. Robin, age 67, has served as our President and Chief Executive Officer since January 2007 and has served as a member of our board of directors since February 2007. Mr. Robin served as Chief Executive Officer, President and a director of Sirna Therapeutics, Inc., a biotechnology company, from July 2001 to November 2006 and from January 2001 to June 2001, served as their Chief Operating Officer, President and as a director. From 1991 to 2001, Mr. Robin was Corporate Vice President and General Manager at Berlex Laboratories, Inc. (“Berlex”), a pharmaceutical products company that is a subsidiary of Schering, AG, and from 1987 to 1991 he served as Vice President of Finance and Business Development and Chief Financial Officer. From 1984 to 1987, Mr. Robin was Director of Business Planning and Development at Berlex. He was a Senior Associate with Arthur Andersen & Co. prior to joining Berlex. He received his B.S. in Accounting and Finance from Fairleigh Dickinson University and serves as a member of its Board of Trustees.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH NAMED NOMINEE.

9

Table of Contents

APPROVAL OF AN AMENDMENT TO OUR AMENDED AND RESTATED 2017 PERFORMANCE INCENTIVE PLAN

At the Annual Meeting, our stockholders will be asked to approve an amendment to the Nektar Therapeutics Amended and Restated 2017 Performance Incentive Plan (the “2017 Plan” and as amended, the “A&R 2017 Plan”) to increase the authorized shares under the A&R 2017 Plan by 10,000,000 shares. The 2017 Plan was approved by our board of directors on March 28, 2017, subject to stockholder approval which was received on June 14, 2017, and was previously amended on June 26, 2018. Our board of directors approved the A&R 2017 Plan on March 31, 2020, subject to stockholder approval at the Annual Meeting.

Prior to the adoption of the 2017 Plan, the Company maintained the Nektar Therapeutics 2012 Plan, as amended (the “2012 Plan”), the Nektar Therapeutics 2008 Equity Incentive Plan, as amended (the “2008 Plan”), the Nektar Therapeutics 2000 Equity Incentive Plan, as amended (the “2000 Plan”), and the Nektar therapeutics 2000 Non-Officer Equity Incentive Plan, as amended (the (“2000 Non-Officer Plan”). The 2000 Non-Officer Plan together with the 2012 Plan, the 2008 Plan and 2000 Plan, are referred to as the “Prior Plans.” Following stockholder approval of the 2017 Plan, no further awards were made under the Prior Plans. As of April 1, 2020, 10,465,708 shares were subject to outstanding stock options and restricted stock units granted under the 2017 Plan and 5,038,066 shares remained available for future grants. In addition, under the terms of the 2017 Plan, the reserve pool under the 2017 Plan may be increased by shares subject to awards granted under the Prior Plans that were outstanding as of December 31, 2017 in the event that such awards expire, or for any reason are cancelled or terminated, without being exercised. As of April 1, 2020 7,219,813 shares remained subject to outstanding stock options and restricted stock units granted under the Prior Plans. If stockholders approve the amendment to the 2017 Plan, as of April 1, 2020, the number of shares available for future awards under the A&R 2017 Plan will increase by 10,000,000 shares to 14,932,121 shares.

Additional Information on Outstanding Awards and Available Shares under the 2017 Plan and the Prior Plans

The following provides additional information on the total equity compensation awards outstanding and available shares.

| Shares Outstanding and Available for Grant under the 2017 Plan and the Prior Plans | As of April 1, 2020 | |||

| Total shares subject to outstanding stock options |

13,251,260 | |||

| Total shares subject to outstanding deferred restricted stock, restricted stock units, and performance restricted stock units |

4,434.261 | |||

| Weighted-average exercise price of outstanding stock options under all stock incentive plans |

$ | 25.35 | ||

| Weighted-average remaining term of outstanding stock options (years) |

4.05 | |||

| Total shares available for grant under all stock incentive plans but not yet granted (1) |

5,038,066 | |||

|

(1) Excludes shares available for purchase under the ESPP (573,266) |

| |||

Based solely on the closing price of our common stock as reported by the NASDAQ Global Select Market on April 1, 2020 and the maximum number of shares that would have been available for awards as of such date, taking into account the proposed increase described herein, the maximum aggregate market value of the common stock that could potentially be issued under the A&R 2017 Plan is $262,506,687.

Given the limited number of shares that currently remain available under the 2017 Plan, our board of directors and management believe it is important that this amendment be approved in order to maintain the Company’s ability to grant stock-based awards to retain employees and continue to provide them with strong

10

Table of Contents

incentives to contribute to the Company’s future success. The Company believes that incentives and stock-based awards focus employees on the objective of creating stockholder value and promoting the success of the Company, and that incentive compensation plans like the 2017 Plan are an important attraction, retention and motivation tool for participants in the plan.

All members of the board of directors and all of the Company’s executive officers will be eligible for awards under the A&R 2017 Plan and thus have a personal interest in the approval of the amendment to the 2017 Plan.

Stockholders are requested in this Proposal 2 to approve the amendment to the 2017 Plan. Approval of the amendment to the 2017 Plan requires the affirmative vote of a majority of the votes cast, in person during the live webcast or by proxy, and entitled to vote at the Annual Meeting. Abstentions and broker non-votes, to the extent applicable, are not included in the tabulation of the voting results and therefore will not have an effect on the outcome of the vote. If stockholders do not approve this amendment, the 2017 Plan will continue in accordance with its current terms.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE IN FAVOR OF PROPOSAL 2.

The essential features of the 2017 Plan, as proposed to be amended, are outlined below:

The principal terms of the A&R 2017 Plan are summarized below. The following summary is qualified in its entirety by the full text of the A&R 2017 Plan, which appears as Exhibit A to this proxy statement.

Summary of the A&R 2017 Plan

Purpose. The purpose of the A&R 2017 Plan is to promote the success of the Company and the interests of our stockholders by providing an additional means for us to attract, motivate, retain and reward directors, officers, employees and other eligible persons through the grant of awards. Equity-based awards are also intended to further align the interests of award recipients and our stockholders.

Administration. Our board of directors or one or more committees appointed by our board of directors will administer the A&R 2017 Plan. Our board of directors has delegated general administrative authority for the A&R 2017 Plan to the organization and compensation committee of our board of directors. The organization and compensation committee may delegate some or all of its authority with respect to the A&R 2017 Plan to another committee of directors, and certain limited authority to grant awards to employees may be delegated to one or more officers of the Company. (The appropriate acting body, be it the board of directors, a committee within its delegated authority, or an officer within his or her delegated authority, is referred to in this proposal as the “Administrator”).

The Administrator has broad authority under the A&R 2017 Plan with respect to award grants including, without limitation, the authority:

| • | to select participants and determine the type(s) of award(s) that they are to receive; |

| • | to determine the number of shares that are to be subject to awards and the terms and conditions of awards, including the price (if any) to be paid for the shares or the award; |

| • | to cancel, modify, or waive the Company’s rights with respect to, or modify, discontinue, suspend, or terminate any or all outstanding awards, subject to any required consents; |

| • | to accelerate or extend the vesting or exercisability or extend the term of any or all outstanding awards; |

| • | subject to the other provisions of the A&R 2017 Plan, to make certain adjustments to an outstanding award and to authorize the termination, conversion, succession or substitution of an award; and |

| • | to allow the purchase price of an award or shares of the Company’s common stock to be paid in the form of cash, check, or electronic funds transfer, by the delivery of already-owned shares of the |

11

Table of Contents

| Company’s common stock or by a reduction of the number of shares deliverable pursuant to the award, by services rendered by the recipient of the award, by notice and third party payment or cashless exercise on such terms as the Administrator may authorize, or any other form permitted by law. |

No Repricing. In no case (except due to an adjustment to reflect a stock split or other events referred to under “Adjustments” below, or any repricing that may be approved by stockholders) will the Administrator (1) amend an outstanding stock option or stock appreciation right to reduce the exercise price or base price of the award, (2) cancel, exchange, or surrender an outstanding stock option or stock appreciation right in exchange for cash or other awards for the purpose of repricing the award, or (3) cancel, exchange, or surrender an outstanding stock option or stock appreciation right in exchange for an option or stock appreciation right with an exercise or base price that is less than the exercise or base price of the original award.

Eligibility. Persons eligible to receive awards under the A&R 2017 Plan include officers or employees of the Company or any of its subsidiaries, directors of the Company or any of its subsidiaries, and certain consultants and advisors to the Company or any of its subsidiaries. As of April 1, 2020, approximately 652 employees (including executive officers) and seven non-employee directors would be eligible to participate in the 2017 Plan.

Authorized Shares; Limits on Awards. Subject to the adjustment provisions included in the 2017 Plan, the maximum number of shares of the Company’s common stock initially available for issuance pursuant to awards under the 2017 Plan equaled 8,300,000 shares of the Company’s common stock (reduced by the number of shares of common stock subject to awards granted under the 2012 Plan on or after March 31, 2017 and prior to the adoption of the 2017 Plan), which was increased to 19,200,000 by stockholder approval in June 2018. The proposed amendment to the 2017 Plan would increase the available shares to 29,200,000 Shares issued in respect of any “full-value award” granted under the A&R 2017 Plan will be counted against the share limit described in the preceding sentence as 1.50 shares for every one share actually issued in connection with the award. For example, if the Company granted 100 restricted stock units under the A&R 2017 Plan, 150 shares would be charged against the share limit with respect to that award. For this purpose, a “full-value award” generally means any award granted under the plan other than a stock option or stock appreciation right.

The following other limits are also contained in the A&R 2017 Plan:

| • | The maximum number of shares that may be delivered pursuant to options qualified as incentive stock options granted under the plan is 29,200,000. |

| • | The maximum number of shares subject to options and stock appreciation rights that are granted during any calendar year to any individual under the plan is 3,000,000 shares. |

| • | “Performance-based awards” under Section 5.2 of the A&R 2017 Plan granted to a participant in any one calendar year will not provide for payment of more than (1) in the case of awards payable only in cash and not related to shares, $5,000,000, and (2) in the case of awards related to shares (and in addition to options and stock appreciation rights which are subject to the limit referred to above), 3,000,000 shares. |

| • | The aggregate value of cash compensation and the grant date fair value (computed in accordance with generally accepted accounting principles) of shares of common stock that may be paid or granted during any calendar year to any non-employee director shall not exceed $1,200,000 for existing non-employee directors and $2,200,000 for new non-employee directors. |

Except as described in the next sentence, shares that are subject to or underlie awards which expire or for any reason are cancelled or terminated, are forfeited, fail to vest, or for any other reason are not paid or delivered under the A&R 2017 Plan or the Prior Plans will again be available for subsequent awards under the A&R 2017 Plan (with any such shares subject to full-value awards increasing the A&R 2017 Plan’s share limit based on the full-value award ratio described above or, in the case of an award granted under a Prior Plan, the full-value award ratio set forth in such Prior Plan). Shares that are exchanged by a participant or withheld by the Company to pay

12

Table of Contents

the exercise price of an award granted under the A&R 2017 Plan, as well as any shares exchanged or withheld to satisfy the tax withholding obligations related to any award, will not be available for subsequent awards under the A&R 2017 Plan. To the extent that an award granted under the A&R 2017 Plan or a Prior Plan is settled in cash or a form other than shares, the shares that would have been delivered had there been no such cash or other settlement will again be available for subsequent awards under the A&R 2017 Plan (with any such shares subject to full-value awards increasing the A&R 2017 Plan’s share limit based on the full-value award ratio described above or, in the case of an award granted under a Prior Plan, the full-value award ratio set forth in such Prior Plan). In the event that shares are delivered in respect of a dividend equivalent right, the actual number of shares delivered with respect to the award shall be counted against the share limits of the A&R 2017 Plan. (For purposes of clarity, if 1,000 dividend equivalent rights are granted and outstanding when the Company pays a dividend, and 50 shares are delivered in payment of those rights with respect to that dividend, 75 shares (after adjustment for the full-value award share counting ratio described above) shall be counted against the share limits of the plan.) To the extent that shares are delivered pursuant to the exercise of a stock appreciation right or stock option, the number of underlying shares as to which the exercise related shall be counted against the applicable share limits, as opposed to only counting the shares issued. (For purposes of clarity, if a stock appreciation right relates to 100,000 shares and is exercised at a time when the payment due to the participant is 15,000 shares, 100,000 shares shall be charged against the applicable share limits with respect to such exercise.) In addition, the A&R 2017 Plan generally provides that shares issued in connection with awards that are granted by or become obligations of the Company through the assumption of awards (or in substitution for awards) in connection with an acquisition of another company will not count against the shares available for issuance under the A&R 2017 Plan. The Company may not increase the applicable share limits of the A&R 2017 Plan by repurchasing shares of common stock on the market (by using cash received through the exercise of stock options or otherwise).

Types of Awards. The A&R 2017 Plan authorizes stock options, stock appreciation rights, stock bonuses, restricted stock, performance stock, stock units, phantom stock or similar rights to purchase or acquire shares, whether at a fixed or variable price or ratio related to the common stock, upon the passage of time, the occurrence of one or more events or the satisfaction of performance criteria or other conditions, awards of any similar securities with a value derived from the value of or related to the common stock and/or returns thereon, or cash awards. The A&R 2017 Plan retains flexibility to offer competitive incentives and to tailor benefits to specific needs and circumstances. Awards granted under the A&R 2017 Plan will be subject to such terms and conditions as established by the Administrator and set forth in the underlying award agreement, including terms relating to the treatment of an award upon a termination of employment. Any award may be paid or settled in cash.

A stock option is the right to purchase shares of the Company’s common stock at a future date at a specified price per share (the “exercise price”). The per share exercise price of an option may not be less than the fair market value of a share of the Company’s common stock on the date of grant. The maximum term of an option is eight years from the date of grant. An option may either be an incentive stock option or a nonqualified stock option. Incentive stock option benefits are taxed differently from nonqualified stock options, as described under “Federal Income Tax Consequences of Awards Under the A&R 2017 Plan” below. Incentive stock options are also subject to more restrictive terms and are limited in amount by the U.S. Internal Revenue Code of 1986, as amended (the “Code”) and the A&R 2017 Plan. Incentive stock options may only be granted to employees of the Company or a subsidiary.

A stock appreciation right is the right to receive payment of an amount equal to the excess of the fair market value of share of the Company’s common stock on the date of exercise of the stock appreciation right over the base price of the stock appreciation right. The base price will be established by the Administrator at the time of grant of the stock appreciation right and may not be less than the fair market value of a share of the Company’s common stock on the date of grant. Stock appreciation rights may be granted in connection with other awards or independently. The maximum term of a stock appreciation right is eight years from the date of grant.

Performance-Based Awards. The Administrator may grant performance-based awards under the A&R 2017 Plan. Performance-based awards are in addition to any of the other types of awards that may be granted under

13

Table of Contents

the A&R 2017 Plan. Performance-based awards may be in the form of restricted stock, performance stock, stock units, other rights, or cash bonus opportunities.

The vesting or payment of performance-based awards may depend on the absolute or relative performance of the Company on a consolidated, subsidiary, segment, division, or business unit basis. The Administrator will establish the criterion or criteria and target(s) on which performance will be measured. The criteria that the Administrator may use for this purpose may include, without limitation, any one or more of the following: earnings per share; cash flow (which means cash and cash equivalents derived from either net cash flow from operations or net cash flow from operations, financing and investing activities); working capital; stock price; total stockholder return; revenue; gross profit; operating income; net earnings (before or after interest, taxes, depreciation and/or amortization); gross margin; operating margin; net margin; return on equity or on assets or on net investment; cost containment or reduction; regulatory submissions or approvals; manufacturing production; completion of strategic partnerships; research milestones; any other measure selected by the Administrator or any combination thereof. As applicable, these terms are used as applied under generally accepted accounting principles or in the financial reporting of the Company or of its subsidiaries. The applicable performance goals may be applied on a pre- or post-tax basis and may be adjusted to include or exclude determinable components of any performance goal, including, without limitation, foreign exchange gains and losses, asset write-downs, acquisitions and divestitures, change in fiscal year, unbudgeted capital expenditures, special charges such as restructuring or impairment charges, debt refinancing costs, extraordinary or noncash items, unusual, infrequently occurring, nonrecurring or one-time events affecting the Company or its financial statements or changes in law or accounting principles.

The performance measurement period with respect to an award may range from three months to ten years. Performance-based awards may be paid in stock or in cash (in either case, subject to the limits described under the heading “Authorized Shares; Limits on Awards” above). The Administrator has discretion to determine the performance target or targets and any other restrictions or other limitations of performance-based awards and may reserve discretion to reduce payments below maximum award limits.

Dividend Equivalents; Deferrals. The Administrator may provide for the deferred payment of awards, and may determine the other terms applicable to deferrals. The Administrator may provide that awards under the A&R 2017 Plan (other than options or stock appreciation rights), and/or deferrals, earn dividends or dividend equivalents based on the amount of dividends paid on outstanding shares of common stock, provided that as to any dividends or dividend equivalent rights granted in connection with an award granted under the A&R 2017 Plan that is subject to vesting requirements, no dividends or dividend equivalent payments will be made unless the related vesting conditions of the award are satisfied.

Award Agreements. Each award shall be evidenced by either (1) a written award agreement in a form approved by the Administrator and executed by the Company by an officer duly authorized to act on its behalf, or (2) an electronic notice of award grant in a form approved by the Administrator. The award agreement shall set forth the material terms and conditions of the award as established by the Administrator consistent with the express limitations of the A&R 2017 Plan. Notwithstanding anything in the A&R 2017 Plan to the contrary, the Administrator may approve an award agreement that, upon the termination of a participant’s employment or service, provides that, or may, in its sole discretion based on a review of all relevant facts and circumstances, otherwise take action regarding an award agreement such that (i) any or all outstanding stock options and stock appreciation rights will become exercisable in part or in full, (ii) all or a portion of the restriction or vesting period applicable to any outstanding award will lapse, (iii) all or a portion of the performance measurement period applicable to any outstanding award will lapse and (iv) the performance goals applicable to any outstanding award (if any) will be deemed to be satisfied at the target, maximum or any other interim level.

Assumption and Termination of Awards. Generally, and subject to limited exceptions set forth in the A&R 2017 Plan, upon the occurrence of a “change in control,” as defined in the A&R 2017 Plan, the Administrator may provide for the cash payment in settlement of, or for the termination, assumption, substitution or exchange

14

Table of Contents

of any or all outstanding awards granted under the A&R 2017 Plan. To the extent the administrator does not provide for the assumption, substitution or other continuation of the awards, then all awards then-outstanding under the A&R 2017 Plan will become fully vested or paid, as applicable, and will terminate or be terminated in such circumstances, provided that the holder of a stock option or stock appreciation right would be given reasonable advance (but no more than ten days’) notice of the impending termination and a reasonable opportunity to exercise his or her vested stock option or stock appreciation right (after giving effect to any accelerated vesting required in the circumstances) in accordance with their terms before the termination of such awards. The Administrator also has the discretion to establish other change in control provisions with respect to awards granted under the A&R 2017 Plan. For example, the Administrator could provide for the acceleration of vesting or payment of an award in connection with a change in control and provide that any such acceleration shall be automatic upon the occurrence of any such event, including a termination of employment within a limited period of time following a corporate transaction.

Transfer Restrictions. Subject to certain exceptions contained in the A&R 2017 Plan, awards under the A&R 2017 Plan generally are not transferable by the recipient other than by will or the laws of descent and distribution and are generally exercisable, during the recipient’s lifetime, only by the recipient. Any amounts payable or shares issuable pursuant to an award generally will be paid only to the recipient or the recipient’s beneficiary or representative. The Administrator has discretion, however, to establish written conditions and procedures for the transfer of awards to other persons or entities, provided that such transfers comply with applicable federal and state securities laws and are not made for value (other than nominal consideration, settlement of marital property rights, or for interests in an entity in which more than 50% of the voting securities are held by the award recipient or by the recipient’s family members).

Adjustments. As is customary in incentive plans of this nature, each share limit and the number and kind of shares available under the A&R 2017 Plan and any outstanding awards, as well as the exercise or purchase prices of awards, and performance targets under certain types of performance-based awards, are subject to adjustment in the event of certain reorganizations, mergers, combinations, recapitalizations, stock splits, stock dividends, or other similar events that change the number or kind of shares outstanding, and extraordinary dividends or distributions of property to the stockholders.

No Limit on Other Authority. The A&R 2017 Plan does not limit the authority of the board of directors or any committee to grant awards or authorize any other compensation, with or without reference to the Company’s common stock, under any other plan or authority.

Termination of or Changes to the A&R 2017 Plan. The board of directors may amend or terminate the A&R 2017 Plan at any time and in any manner. Stockholder approval for an amendment will be required only to the extent then required by applicable law or any applicable listing agency or required under Sections 422 or 424 of the Code to preserve the intended tax consequences of the plan. Unless terminated earlier by the board of directors, the authority to grant new awards under the 2017 Plan will terminate on March 27, 2027. Outstanding awards, as well as the Administrator’s authority with respect thereto, generally will continue following the expiration or termination of the plan. Generally speaking, outstanding awards may be amended by the Administrator (except for a repricing), but the consent of the award holder is required if the amendment (or any plan amendment) materially and adversely affects the holder.

Clawback Policy. The awards under the A&R 2017 Plan are subject to the terms of the Company’s clawback policy as it may be in effect from time to time.

Federal Income Tax Consequences of Awards under the A&R 2017 Plan

The U.S. federal income tax consequences of the A&R 2017 Plan under current federal law, which is subject to change, are summarized in the following discussion of the general tax principles applicable to the A&R 2017 Plan. This summary is not intended to be exhaustive and, among other considerations, does not

15

Table of Contents

describe the deferred compensation provisions of Section 409A of the Code to the extent an award is subject to and does not satisfy those rules, nor does it describe state, local, or international tax consequences.

With respect to nonqualified stock options, the Company is generally entitled to deduct, except to the extent limited by Section 162(m) of the Code, and the participant recognizes taxable income in an amount equal to the difference between the option exercise price and the fair market value of the shares at the time of exercise. With respect to incentive stock options, the Company is generally not entitled to a deduction nor does the participant recognize income at the time of exercise, although if the participant is subject to the U.S. federal alternative minimum tax, the difference between the option exercise price and the fair market value of the shares at the time of exercise is includible for purposes of such alternative minimum tax. If the shares acquired by exercise of an incentive stock option are held for at least two years from the date the option was granted and one year from the date it was exercised, any gain or loss arising from a subsequent disposition of those shares will be taxed as long-term capital gain or loss, and the Company will not be entitled to any deduction. If, however, such shares are disposed of within the above-described period, then in the year of that disposition the participant will recognize compensation taxable as ordinary income equal to the excess of the lesser of (i) the amount realized upon that disposition and (ii) the excess of the fair market value of those shares on the date of exercise over the purchase price, and the Company will be entitled to a corresponding deduction, except to the extent limited by Section 162(m) of the Code.

The current federal income tax consequences of other awards authorized under the A&R 2017 Plan generally follow certain basic patterns: nontransferable restricted stock subject to a substantial risk of forfeiture results in income recognition equal to the excess of the fair market value over the price paid (if any) only at the time the restrictions constituting a substantial risk of forfeiture lapse (unless the recipient elects to accelerate recognition as of the date of grant); bonuses, restricted stock units, stock appreciation rights, cash and stock-based performance awards, dividend equivalents, stock units, and other types of awards are generally subject to tax at the time of payment; and compensation otherwise effectively deferred is taxed when paid. In each of the foregoing cases, the Company will generally have a corresponding deduction at the time the participant recognizes income, except to the extent limited by Section 162(m) of the Code.

If an award is accelerated under the A&R 2017 Plan in connection with a “change in control” (as defined in the A&R 2017 Plan), the Company may not be permitted to deduct the portion of the compensation attributable to the acceleration (“parachute payments”) if it exceeds certain threshold limits under Section 280G of the Code (and certain related excise taxes may be triggered). Furthermore, Section 162(m) of the Code limits to $1 million the amount that a publicly held corporation is allowed each year to deduct for compensation paid to the corporation’s “covered employees.” “Covered employees” include the corporation’s chief executive officer, chief financial officer and three next most highly compensated executive officers. If an individual is determined to be a covered employee for any year beginning after December 31, 2016, then that individual will continue to be a covered employee for future years, regardless of changes in the individual’s compensation or position.

16

Table of Contents

New Plan Benefits

The Company has not approved any awards that are conditioned upon stockholder approval of the amendment to the 2017 Plan. The Administrator has the discretion to grant awards under the A&R 2017 Plan and, therefore, it is not possible as of the date of this proxy statement to determine future awards that will be received by the Company’s named executive officers or others under the A&R 2017 Plan. Accordingly, in lieu of providing information regarding benefits that will be received under the A&R Plan, the following table provides information concerning the benefits that were received by the following persons and groups during 2019: each named executive officer; all current executive officers, as a group; all current directors who are not executive officers, as a group; and all current employees who are not executive officers, as a group.

| Name and Position | Stock Options | Restricted Stock Units | ||||||||||||||

| Number of (#) |

Average ($) |

Number of (#) |

Dollar

Value ($)(1) |

|||||||||||||

| Howard W. Robin President and Chief Executive Officer |

379,900 | 21.79 | 188,200 | 4,100,859 | ||||||||||||

| Gil M. Labrucherie Senior Vice President, Chief Operating Officer and Chief Financial Officer |

322,100 | 20.23 | 155,300 | 3,131,971 | ||||||||||||

| John Northcott Senior Vice President and Chief Commerical Officer |

200,000 | 19.48 | 200,000 | 3,895,980 | ||||||||||||

| Jillian B Thomsen Senior Vice President and Chief Accounting Officer |

65,000 | 21.79 | 29,800 | 649,339 | ||||||||||||

| Jonathan Zalevsky, Ph.D. Chief Research and Development Officer |

313,200 | 20.18 | 155,300 | 3,131,971 | ||||||||||||

| All executive officers (5 persons) | 1,280,200 | 20.64 | (2) | 728,600 | 14,910,121 | (3) | ||||||||||

| All non-executive directors (7 persons other than Mr. Robin) | 101,400 | 19.49 | (2) | 50,700 | 988,138 | (3) | ||||||||||

| All employees (other than current executive officers) (approximately 647 persons)* | 460,193 | 25.78 | (2) | 2,409,497 | 58,960,820 | (3) | ||||||||||

| * | As of April 1, 2020 |

| (1) | The valuation of stock awards is based on the grant date fair value computed in accordance with FASB ASC Topic 718. For a discussion of the assumptions used in calculating these values, see Note 11 to our consolidated financial statements in our annual report on Form 10-K for the fiscal year ended December 31, 2019. |

| (2) | Represents the weighted average exercise price for the group. |

| (3) | Represents the aggregate grant date fair value for the group. |

17

Table of Contents

Equity Compensation Plan Information

The following table presents aggregate summary information as of December 31, 2019, regarding the common stock that may be issued upon the exercise of options and rights under all of our existing equity compensation plans:

| Plan Category |

Number of

Securities to be Issued Upon Exercise of Outstanding Options & Vesting of RSUs (a) |

Weighted-Average Exercise Price of Outstanding Options (b) |

Number of

Securities Remaining Available for Issuance Under Equity Compensation Plans (Excluding Securities Reflected in Column(a) (c) |

|||||||||

| Equity compensation plans approved by security holders |

19,809 | $ | 25.24 | 9,145 | ||||||||

| Equity compensation plans not approved by security holders |

8 | $ | 7.21 | — | ||||||||

|

|

|

|

|

|

|

|||||||

| Total |

19,817 | $ | 25.23 | 9,145 | ||||||||

|

|

|

|

|

|||||||||

THE BOARD OF DIRECTORS RECOMMENDS A VOTE IN FAVOR OF PROPOSAL 2 FOR APPROVAL OF THE AMENDMENT TO OUR AMENDED AND RESTATED 2017 PERFORMANCE INCENTIVE PLAN AS DESCRIBED ABOVE AND SET FORTH IN EXHIBIT A HERETO.

18

Table of Contents

APPROVAL OF AN AMENDMENT AND RESTATEMENT OF OUR AMENDED AND RESTATED EMPLOYEE STOCK PURCHASE PLAN

In February 1994, our board of directors adopted, and our stockholders subsequently approved, our Amended and Restated Employee Stock Purchase Plan (the “Purchase Plan”). The Purchase Plan was amended and restated in May 2002, and an amended and restated version of the Purchase Plan was approved by our stockholders in June 2002. In June 2014, an amended and restated version of the Purchase Plan was approved by our stockholders. On March 31, 2020, subject to stockholder approval, our board of directors amended the Purchase Plan to increase the number of shares of common stock available for issuance under the Purchase Plan by an additional 1,000,000 shares. Our board of directors adopted this amendment in order to ensure that a sufficient reserve of shares of common stock remains available for the grant of purchase rights under the Purchase Plan at levels determined appropriate by the board of directors.

Currently, 2,500,000 shares of common stock are authorized for issuance under the Purchase Plan. As of April 1, 2020, 573,266 shares of common stock remain available for future grant under the Purchase Plan. If stockholders approve the amendment and restatement to the Purchase Plan, the maximum number of shares authorized for issuance under the Purchase Plan will increase from 2,500,000 shares to 3,500,000 shares. If approved, the additional 1,000,000 shares would bring the total number of shares currently available for grant under the Purchase Plan to 1,573,266 shares.

The additional shares that are proposed to be reserved under the amended and restated Purchase Plan have an aggregate value of $175,800,000, based on the April 1, 2020 closing price of our common stock, as reported on the NASDAQ Global Select Market, of $17.58 per share. We believe that the proposed share reserve increase to the Purchase Plan is reasonable, appropriate, and in the best interest of our stockholders. Stockholders are requested in this Proposal 3 to approve the amendment and restatement to the Purchase Plan. The affirmative vote of the holders of a majority of the shares present during the live webcast or represented by proxy at the Annual Meeting and cast on this proposal will be required to approve the amendment and restatement to the Purchase Plan. Abstentions and broker non-votes, to the extent applicable, are not included in the tabulation of the voting results and therefore will not have an effect on the outcome of the vote.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE IN FAVOR OF PROPOSAL 3.

The essential features of the Purchase Plan, as amended and restated (the “A&R Purchase Plan”), are outlined below:

Summary of the A&R Purchase Plan

The principal terms of the Purchase Plan, as proposed to be amended and restated, are summarized below. The following summary is qualified in its entirety by the full text of the A&R Purchase Plan, which appears as Exhibit B to this proxy statement.

Purpose. The purpose of the A&R Purchase Plan is (i) to provide a means by which our employees (and employees of any of our subsidiaries designated by the board of directors to participate in the A&R Purchase Plan) may be given an opportunity to purchase our common stock through payroll deductions, (ii) to assist us in retaining the services of our employees and secure and retain the services of new employees, and (iii) to provide incentives for such persons to exert maximum efforts for our success. All of our employees are eligible to participate in the A&R Purchase Plan provided that they satisfy the eligibility requirements described below.

The rights to purchase common stock granted under the A&R Purchase Plan are intended to qualify as options issued under an “employee stock purchase plan” as that term is defined in Section 423(b) of the Code.

19

Table of Contents

Administration. The board of directors will administer the A&R Purchase Plan and has the final power to construe and interpret both the A&R Purchase Plan and the rights granted under it. The board of directors has the power, subject to the provisions of the A&R Purchase Plan, to determine when and how rights to purchase common stock will be granted, the provisions of each offering of such rights (which need not be identical), and whether employees of any of our subsidiaries will be eligible to participate in the A&R Purchase Plan.

The board of directors has the power, which it has not yet exercised, to delegate administration of the A&R Purchase Plan to a committee composed of not fewer than two members of the board of directors. As used herein with respect to the A&R Purchase Plan, the “board of directors” refers to any committee the board of directors appoints and to the board of directors.

Stock Subject to Purchase Plan. Currently, a maximum of 2,500,000 shares of common stock are authorized for issuance under the Purchase Plan. If stockholders approve the amendment and restatement to the Purchase Plan, the maximum number of shares authorized for issuance under the A&R Purchase Plan will increase from 2,500,000 shares to 3,500,000 shares (an increase of 1,000,000 shares). If rights granted under the A&R Purchase Plan expire, lapse or otherwise terminate without being exercised, the shares of common stock not purchased under such rights again become available for issuance under the A&R Purchase Plan.

Offerings. The A&R Purchase Plan is implemented by offerings of rights to all eligible employees from time to time by the board of directors. The maximum length for an offering under the A&R Purchase Plan is twenty-seven months. Currently, under the Purchase Plan, each offering is twenty-four months long and is divided into four shorter “purchase periods” approximately six months long.

Eligibility. Unless otherwise determined by the board of directors in accordance with the terms of the A&R Purchase Plan, any person who is customarily employed at least twenty hours per week and five months per calendar year by us (or by any of our parent or subsidiary designated by the board of directors) on the first day of an offering is eligible to participate in that offering, provided that such employee has been continuously employed by us or the designated parent or subsidiary corporation for at least six months preceding the first day of the offering. Officers who are “highly compensated” as defined in the Code may be eligible to participate in the A&R Purchase Plan.

However, no employee is eligible to participate in the A&R Purchase Plan if, immediately after the grant of purchase rights, the employee would own, directly or indirectly, stock possessing 5% or more of the total combined voting power or value of all classes of our stock or of any parent or subsidiary (including any stock which such employee may purchase under all outstanding rights and options). In addition, no employee may purchase more than $25,000 worth of common stock (determined at the fair market value of the shares at the time such rights are granted) under all of our employee stock purchase plans and the employee stock purchase plans of any of our parent or subsidiary corporations in any calendar year.

As of April 1, 2020, approximately 652 individuals employed by the Company and participating subsidiaries are eligible to participate in the Purchase Plan.

Participation. Eligible employees enroll in the A&R Purchase Plan by delivering to us, prior to the date selected by the board of directors for the offering, an agreement authorizing payroll deductions of up to 15% of such employees’ total compensation during the offering.

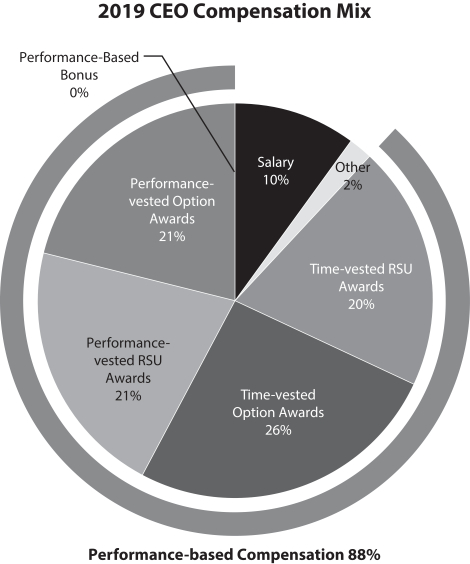

Purchase Price. The purchase price per share at which shares of common stock are sold in an offering under the A&R Purchase Plan is no less than the lower of (i) 85% of the fair market value of a share of common stock on first day of the offering or (ii) 85% of the fair market value of a share of common stock on the applicable purchase dates.