Exhibit 99.1

|

|

January 14, 2014

J.P. Morgan

2014 Healthcare Conference

Howard Robin

President & CEO

|

|

This presentation includes forward-looking statements regarding Nektar’s technology platform, drug candidates, clinical and regulatory objectives, market opportunity estimates, and royalty and milestone payment potential. Actual results could differ materially and these statements are subject to important risks detailed in Nektar’s filings with the SEC, including the Form 10-Q filed on November 7, 2013. Nektar undertakes no obligation to update forward-looking statements as a result of new information or otherwise.

|

|

| 3 |

|

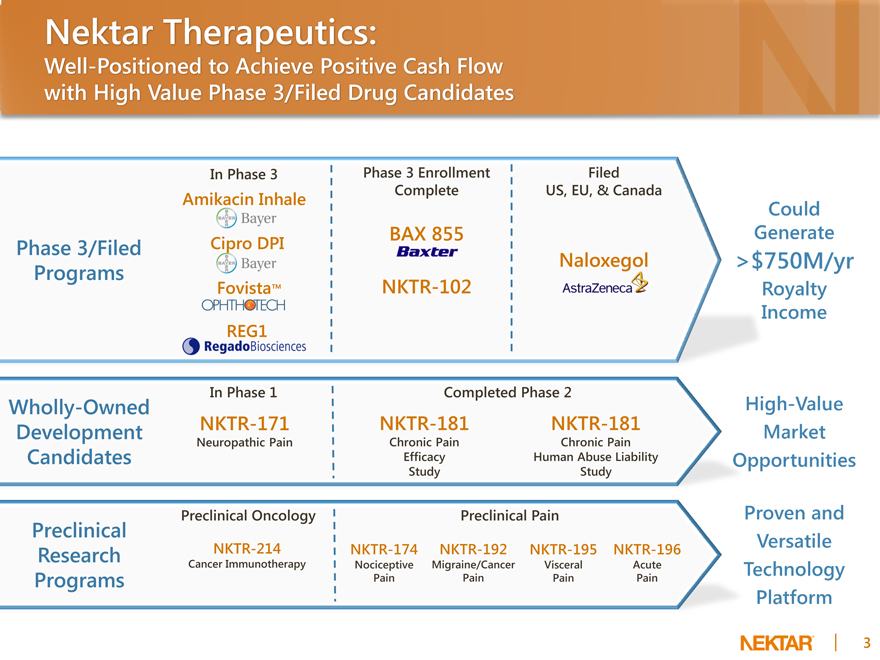

Nektar Therapeutics:

Well-Positioned to Achieve Positive Cash Flow with High Value Phase 3/Filed Drug Candidates

In Phase 3

Amikacin Inhale

Phase 3/Filed Cipro DPI Programs

Fovista™

REG1

Phase 3 Enrollment Complete

BAX 855

NKTR-102

Filed US, EU, & Canada

Naloxegol

In Phase 1

Wholly-Owned

Development NKTR-171

Neuropathic Pain

Candidates

Completed Phase 2

NKTR-181 NKTR-181

Chronic Pain Chronic Pain Efficacy Human Abuse Liability Study Study

Preclinical Oncology

Preclinical NKTR-214

Research Cancer Immunotherapy

Programs

Preclinical Pain

NKTR-174 NKTR-192 NKTR-195 NKTR-196

Nociceptive Migraine/Cancer Visceral Acute Pain Pain Pain Pain

Could Generate > $750M/yr Royalty Income High-Value Market Opportunities Proven and Versatile Technology Platform

Bayaer Fovista TM OPHIHOTECH RegadoBiosciences Baxter AstraZeneca

|

|

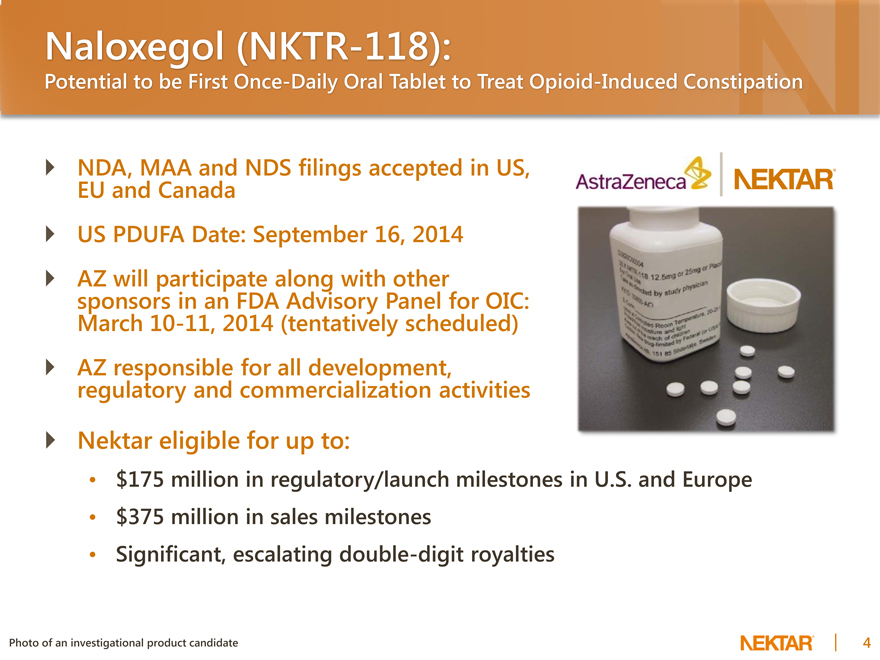

Naloxegol (NKTR-118):

Potential to be First Once-Daily Oral Tablet to Treat Opioid-Induced Constipation

NDA, MAA and NDS filings accepted in US, EU and Canada US PDUFA Date: September 16, 2014 AZ will participate along with other sponsors in an FDA Advisory Panel for OIC: March 10-11, 2014 (tentatively scheduled) AZ responsible for all development, regulatory and commercialization activities

Nektar eligible for up to: $175 million in regulatory/launch milestones in U.S. and Europe $375 million in sales milestones Significant, escalating double-digit royalties

Photo of an investigational product candidate

| 4 |

|

|

|

Opioid-Induced Constipation:

High Unmet Medical Need

$14.8 Billion

Of the $14.8 billion global opioid market, five markets account for ~80% of total unit volume: US (49%), UK (14%), Germany (5%), Canada (5%), France (5%).1 PCPs and Pain Management Specialists comprise the majority of prescribers in these markets.2

69 Million Patients

In these five markets, there are 69 million patients taking opioids for chronic pain (>30 days treatment).3 For these chronic pain opioid users, opioid induced constipation (OIC) is the most common side effect.4,5

28—35 Million Patients

Approximately 40-50% (28-35 million) patients taking opioids for chronic pain develop constipation.1,2,3* More than 50% of these patients do not get relief from laxatives.

| * |

|

Number of patients in major opioid markets |

SOURCE:1. IMS Health MIDAS MAT-2Q12, 2. IMS Health NPA MAT-2Q12, Cegedim MAT-2Q11) , 3IMS patient level data MAT-2Q09IMS patient level data MAT-2Q09, 4. Panchal, S et al. Opioid-Induced Bowel Dysfunction: Prevalence, Pathophysiology and Burden. Int J Clin Pract. 2007;61(7):1181-1187., 5. Reimer, K et al. Meeting the Challenges of Opioid-Induced Constipation in Chronic Pain Management – A Novel Approach. Pharmacology. 2009;83:10–17., 6 Pappagallo, M. (2001). Incidence, prevalence, and management of opioid bowel., dysfunction. Am J Surg 182(5A Suppl), 11S-18S.,7 Holzer Regulatory Peptides 155 (2009) 11-17.

| 5 |

|

|

|

| 6 |

|

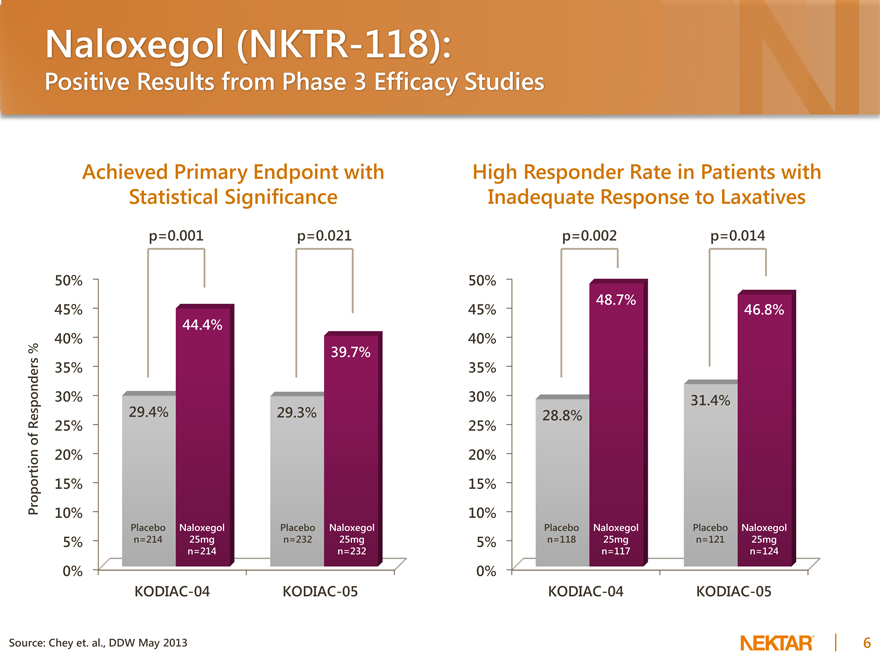

Naloxegol (NKTR-118):

Positive Results from Phase 3 Efficacy Studies

Achieved Primary Endpoint with Statistical Significance

p=0.001 p=0.021

Proportion of Responders %

50% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0%

44.4%

39.7%

29.4% 29.3%

Placebo Naloxegol Placebo Naloxegol n=214 25mg n=232 25mg n=214 n=232

KODIAC-04 KODIAC-05

High Responder Rate in Patients with Inadequate Response to Laxatives

p=0.002 p=0.014

50% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0%

48.7%

46.8%

31.4% 28.8%

Placebo Naloxegol Placebo Naloxegol n=118 25mg n=121 25mg n=117 n=124

KODIAC-04 KODIAC-05

Source: Chey et. al., DDW May 2013

|

|

| 7 |

|

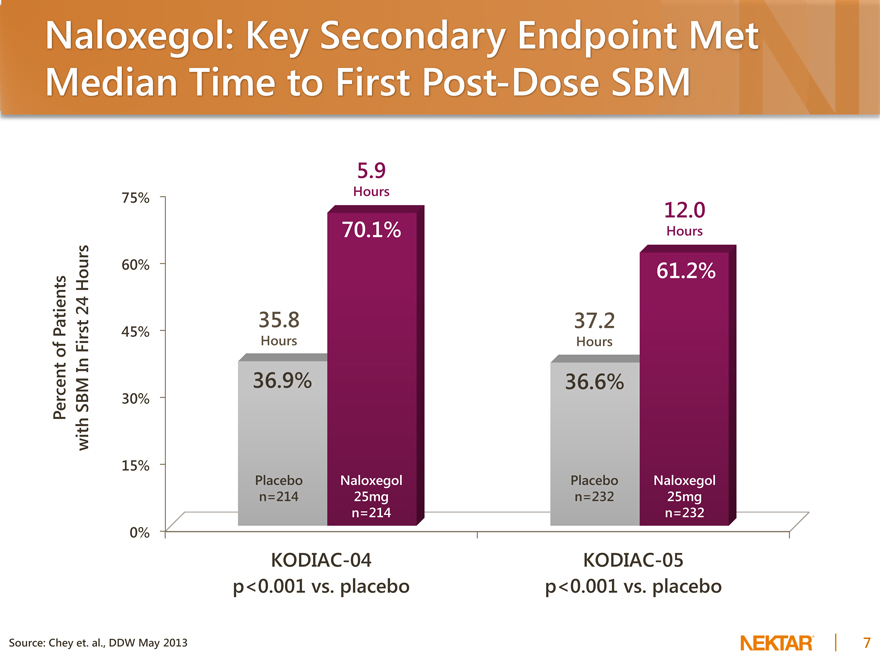

Naloxegol: Key Secondary Endpoint Met Median Time to First Post-Dose SBM

Percent of Patients with SBM In First 24 Hours

75% 60% 45% 30% 15% 0%

35.8

Hours

36.9%

Placebo n=214

5.9

Hours

70.1%

Naloxegol 25mg n=214

37.2

Hours

36.6%

Placebo n=232

12.0

Hours

61.2%

Naloxegol 25mg n=232

KODIAC-04 p<0.001 vs. placebo

KODIAC-05 p<0.001 vs. placebo

Source: Chey et. al., DDW May 2013

|

|

8

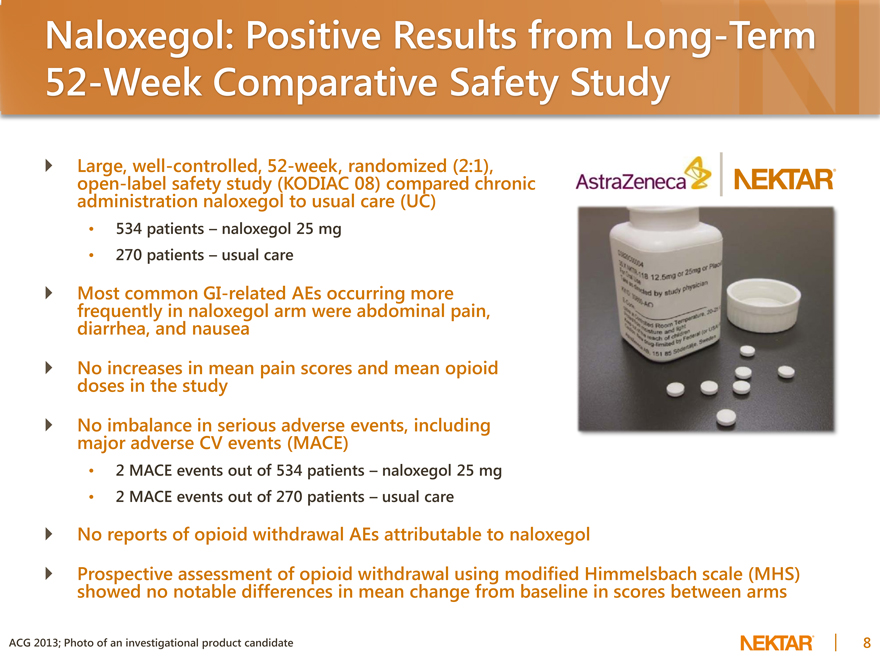

Naloxegol: Positive Results from Long-Term 52-Week Comparative Safety Study

Large, well-controlled, 52-week, randomized (2:1), open-label safety study (KODIAC 08) compared chronic administration naloxegol to usual care (UC)

534 patients – naloxegol 25 mg

270 patients – usual care

Most common GI-related AEs occurring more frequently in naloxegol arm were abdominal pain, diarrhea, and nausea No increases in mean pain scores and mean opioid doses in the study No imbalance in serious adverse events, including major adverse CV events (MACE)

2 MACE events out of 534 patients – naloxegol 25 mg

2 MACE events out of 270 patients – usual care

No reports of opioid withdrawal AEs attributable to naloxegol

Prospective assessment of opioid withdrawal using modified Himmelsbach scale (MHS) showed no notable differences in mean change from baseline in scores between arms

ACG 2013; Photo of an investigational product candidate

|

|

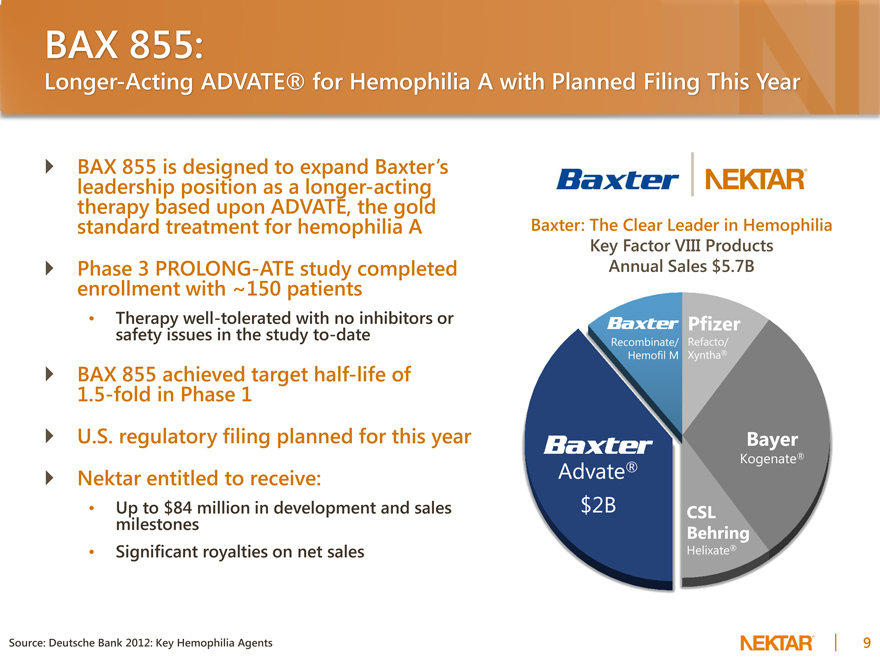

9

BAX 855:

Longer-Acting ADVATE® for Hemophilia A with Planned Filing This Year

BAX 855 is designed to expand Baxter’s leadership position as a longer-acting therapy based upon ADVATE, the gold standard treatment for hemophilia A Phase 3 PROLONG-ATE study completed enrollment with ~150 patients

Therapy well-tolerated with no inhibitors or safety issues in the study to-date

BAX 855 achieved target half-life of 1.5-fold in Phase 1

U.S. regulatory filing planned for this year

Nektar entitled to receive:

Up to $84 million in development and sales milestones

Significant royalties on net sales

Source: Deutsche Bank 2012: Key Hemophilia Agents

Baxter: The Clear Leader in Hemophilia

Key Factor VIII Products Annual Sales $5.7B

Pfizer

Recombinate/ Refacto/ Hemofil M Xyntha®

Bayer

Kogenate®

Advate®

$2B CSL Behring

Helixate®

|

|

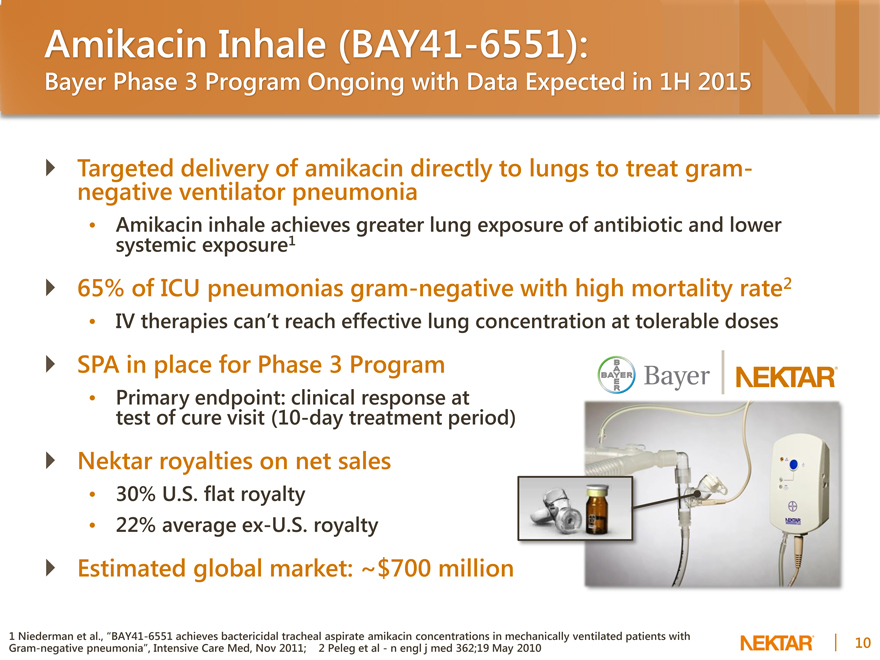

Amikacin Inhale (BAY41-6551):

Bayer Phase 3 Program Ongoing with Data Expected in 1H 2015

Targeted delivery of amikacin directly to lungs to treat gram-negative ventilator pneumonia Amikacin inhale achieves greater lung exposure of antibiotic and lower systemic exposure1

65% of ICU pneumonias gram-negative with high mortality rate2

IV therapies can’t reach effective lung concentration at tolerable doses

SPA in place for Phase 3 Program

Primary endpoint: clinical response at test of cure visit (10-day treatment period)

Nektar royalties on net sales

30% U.S. flat royalty

22% average ex-U.S. royalty

Estimated global market: ~$700 million

1 Gram-negative Niederman et pneumonia”, al., “BAY41-6551 Intensive achieves Care bactericidal Med, Nov 2011; tracheal 2 aspirate Peleg et amikacin al - n engl concentrations j med 362;19 May in mechanically 2010 ventilated patients with

10

|

|

11

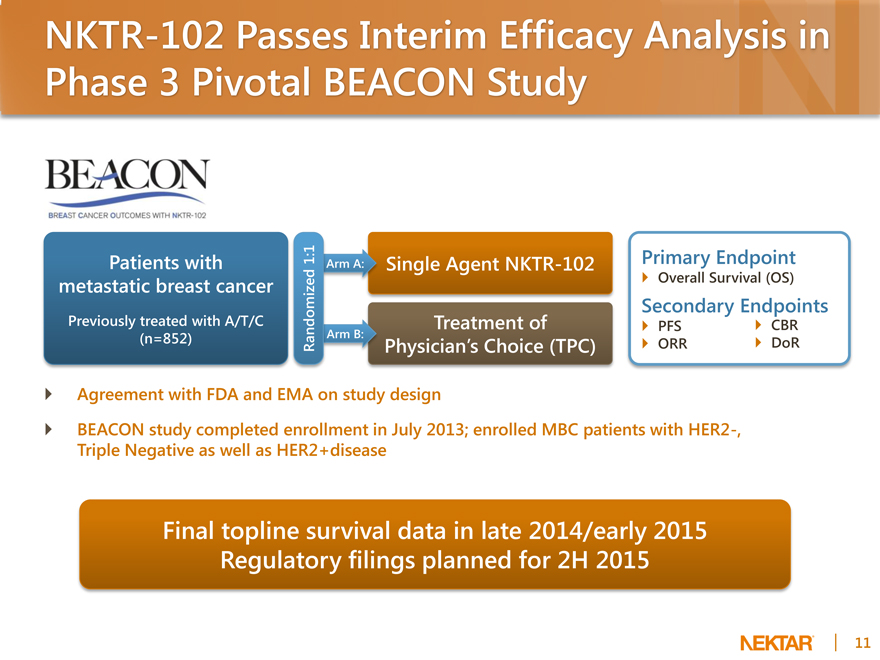

NKTR-102 Passes Interim Efficacy Analysis in Phase 3 Pivotal BEACON Study

Patients with metastatic breast cancer

Previously treated with A/T/C (n=852)

1:1

Arm A:

Randomized Arm B:

Single Agent NKTR-102

Treatment of

Physician’s Choice (TPC)

Primary Endpoint

Overall Survival (OS)

Secondary Endpoints

PFS CBR ORR DoR

Agreement with FDA and EMA on study design

BEACON study completed enrollment in July 2013; enrolled MBC patients with HER2-, Triple Negative as well as HER2+disease

Final topline survival data in late 2014/early 2015 Regulatory filings planned for 2H 2015

|

|

12

NKTR-102 Exceeded Primary Endpoint in Avastin-Resistant High-Grade Glioma Study

Glioma is one of the most deadly cancers

Limited data and limited survival in patients third-line or greater (after failing Avastin) NKTR-102 exceeded primary endpoint with 6-week PFS of 55%

6-Week PFS of 25% was needed to reach primary endpoint

50% of patients achieved stable disease (10/20 patients) with preliminary ORR at 6 weeks of 10%

As of January 2014, two patients still receiving study drug (one patient on study for over 12 months and one on study for seven months)

Mature PFS and OS data to be submitted for presentation at medical meeting in 2014

Preliminary data provided by Stanford Cancer Center

|

|

13

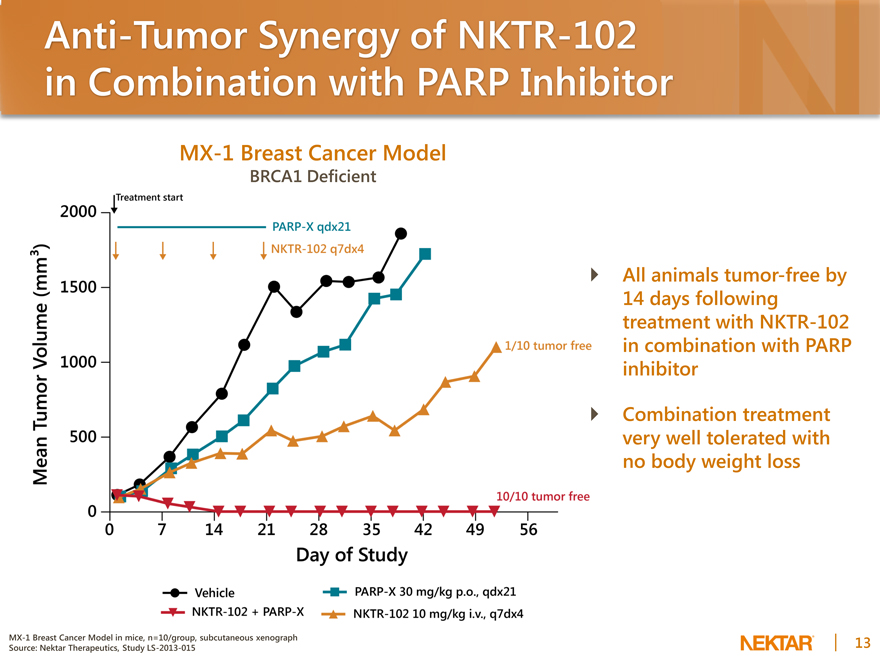

Anti-Tumor Synergy of NKTR-102 in Combination with PARP Inhibitor

MX-1 Breast Cancer Model

BRCA1 Deficient

All animals tumor-free by 14 days following treatment with NKTR-102 in combination with PARP inhibitor

Combination treatment very well tolerated with no body weight loss

MX-1 Breast Cancer Model in mice, n=10/group, subcutaneous xenograph Source: Nektar Therapeutics, Study LS-2013-015

2000 1500 1000 500 0 0 7 14 21 28 35 42 49 56 Day of Study Mean Tumor Volume (mm3)

Vehicle NKTR-102 + PARP-X PARP-X 30 mg/kg p.o., qdx21

nKTR-102 10 mg/kg i.v., q7dx4

Treatment start PARP-X qdx21 NKTR-102 q7dx4

1/10 tumor free 10/10 tumor free

|

|

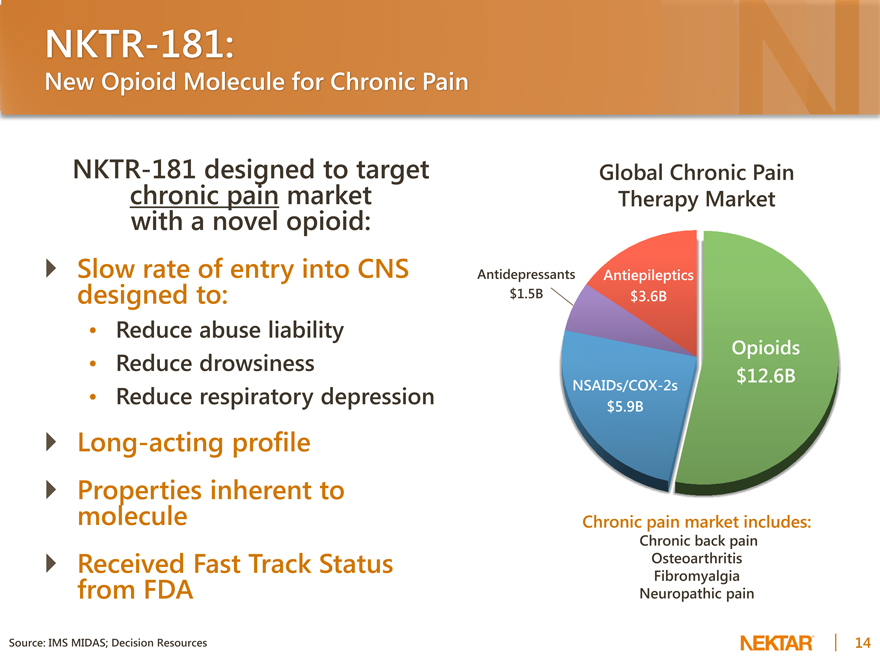

Global Chronic Pain Therapy Market

Antidepressants Antiepileptics $1.5B $3.6B

Opioids $12.6B

NSAIDs/COX-2s $5.9B

Chronic pain market includes:

Chronic back pain Osteoarthritis Fibromyalgia Neuropathic pain

NKTR-181:

New Opioid Molecule for Chronic Pain

NKTR-181 designed to target chronic pain market with a novel opioid: Slow rate of entry into CNS designed to:

Reduce abuse liability

Reduce drowsiness

Reduce respiratory depression

Long-acting profile

Properties inherent to molecule

Received Fast Track Status from FDA

Source: IMS MIDAS; Decision Resources

14

|

|

15

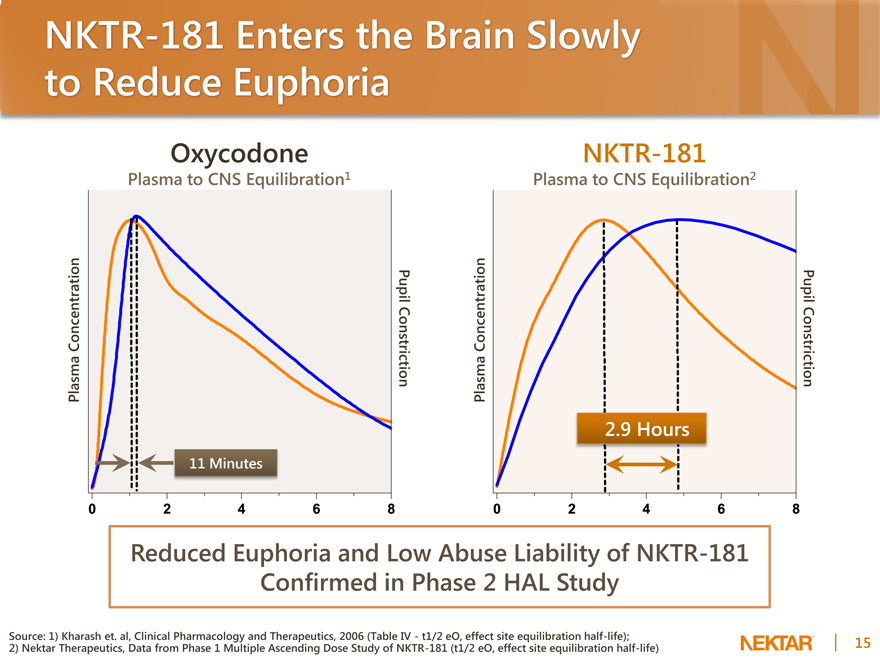

NKTR-181 Enters the Brain Slowly to Reduce Euphoria

Oxycodone

Plasma to CNS Equilibration1

Plasma Concentration

Pupil Constriction

11 Minutes

NKTR-181

Plasma to CNS Equilibration2

Plasma Concentration

2.9 Hours

Pupil Constriction

Reduced Euphoria and Low Abuse Liability of NKTR-181 Confirmed in Phase 2 HAL Study

Source: 2) Nektar 1) Therapeutics, Kharash et. al, Data Clinical from Pharmacology Phase 1 Multiple and Ascending Therapeutics, Dose 2006 Study (Table of NKTR-181 IV—t1/2 eO, (t1/2 effect eO, site effect equilibration site equilibration half-life); half-life)

|

|

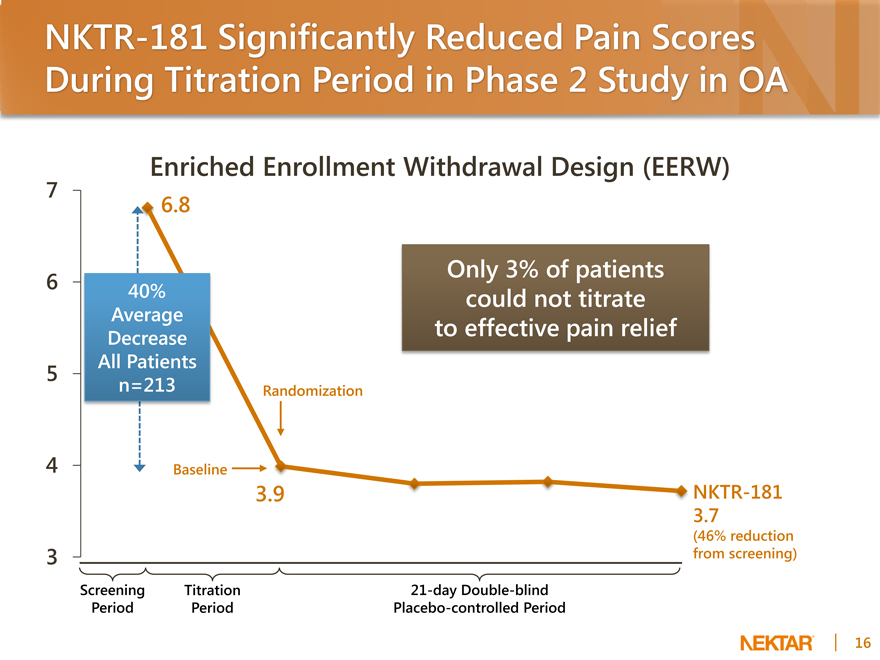

Screening Titration 21-day Double-blind Period Period Placebo-controlled Period

NKTR-181 Significantly Reduced Pain Scores During Titration Period in Phase 2 Study in OA

Enriched Enrollment Withdrawal Design (EERW)

| 7 |

|

6 5 4 3 |

6.8

40% Average Decrease All Patients n=213

Only 3% of patients could not titrate to effective pain relief

Randomization

Baseline

3.9

NKTR-181 3.7

(46% reduction from screening)

16

|

|

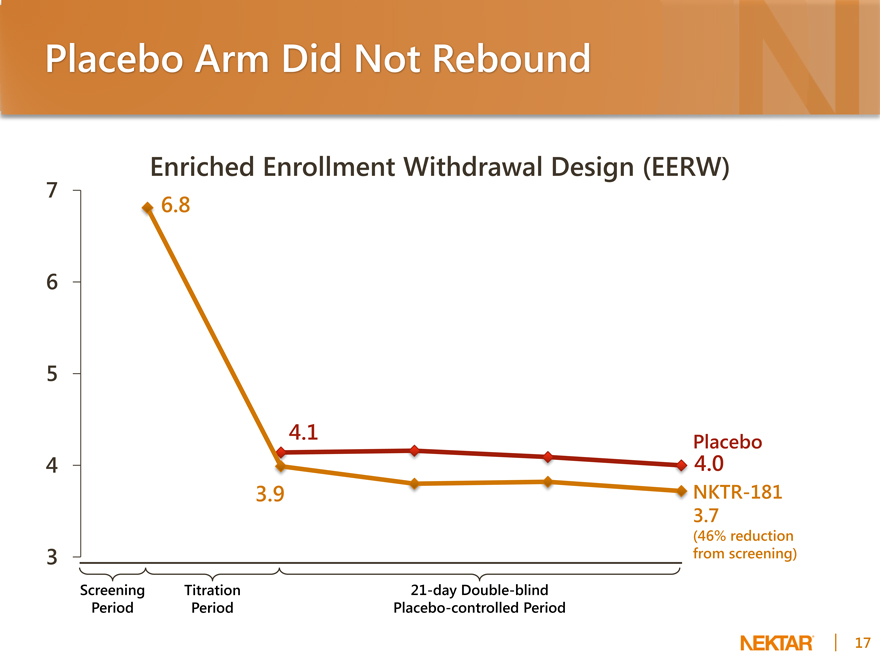

17

Placebo Arm Did Not Rebound

Enriched Enrollment Withdrawal Design (EERW)

7 6 5 4 3

6.8

4.1

3.9

Placebo

4.0

NKTR-181 3.7

(46% reduction from screening)

Screening Titration 21-day Double-blind Period Period Placebo-controlled Period

|

|

18

Reasons for Lack of Placebo Rebound

EERW design not optimal for a unique drug like NKTR-181 with low CNS side effects

EERW design adopted to study opioids with tolerability issues and high CNS side effects: typical drop-out rates >50%

NKTR-181 drop-out rate for AEs was only 18% because of low CNS side effects

With typical opioids, patients may be un-blinded when crossed to placebo in the EERW design because of removal of CNS side effects. The result is a significantly diminished placebo effect and a resulting rebound in pain scores.

Subjects were allowed to continue using their current non-opioid pain medications

NKTR-181 provided strong analgesia in titration, with 40% reduction of pain from baseline

This reduction at time of randomization allowed the background analgesics to maintain pain relief during the 3 week double-blind period, which prevented significant rebound.

WOMAC pain subscale is more reliable measurement than NRS

Pain scores collected in the clinic instead of self-reported patient diaries

Source: Leber and Davis, 1998

|

|

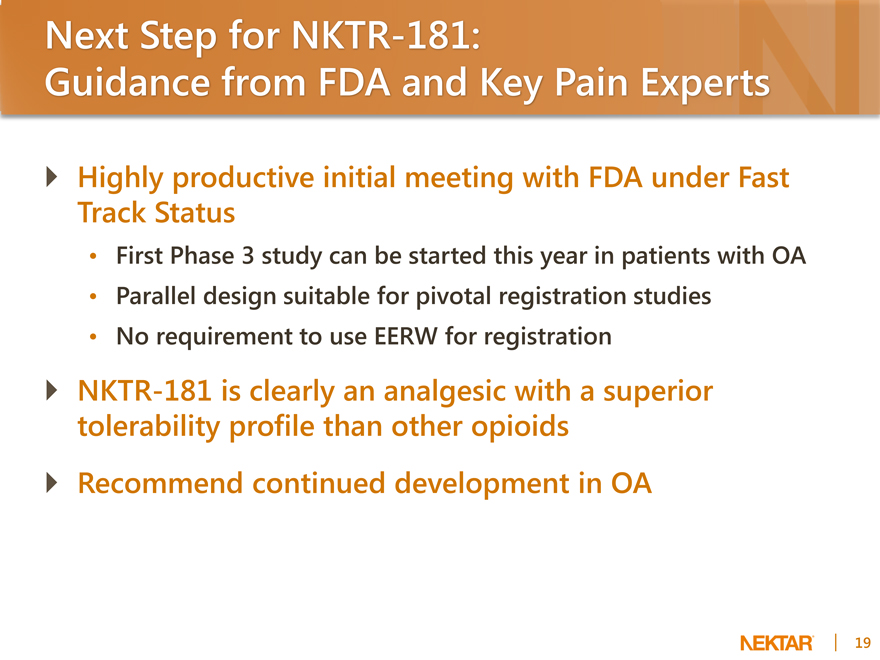

19

Next Step for NKTR-181:

Guidance from FDA and Key Pain Experts

Highly productive initial meeting with FDA under Fast

Track Status

First Phase 3 study can be started this year in patients with OA

Parallel design suitable for pivotal registration studies

No requirement to use EERW for registration

NKTR-181 is clearly an analgesic with a superior tolerability profile than other opioids

Recommend continued development in OA

|

|

20

Proposed Parallel Design Pivotal Study in Patients with Osteoarthritis

Blinded Titration to Analgesic Dose

12 Week Treatment Period

Patients with osteoarthritis (OA) of the knee (n~600)

Randomized 1:1

NKTR-181

Placebo

Primary Endpoint:

WOMAC Pain Subscale

Change from Baseline

Eliminate continued use of background medications Pain reduction measured by WOMAC Numeric Pain Subscale

Endpoint agreed to by FDA for approval in OA patients

Specific scale designed to measure OA pain

Pain scores collected in the clinic instead of self-reported patient diaries

Interim futility analysis at ~200 patients

|

|

21

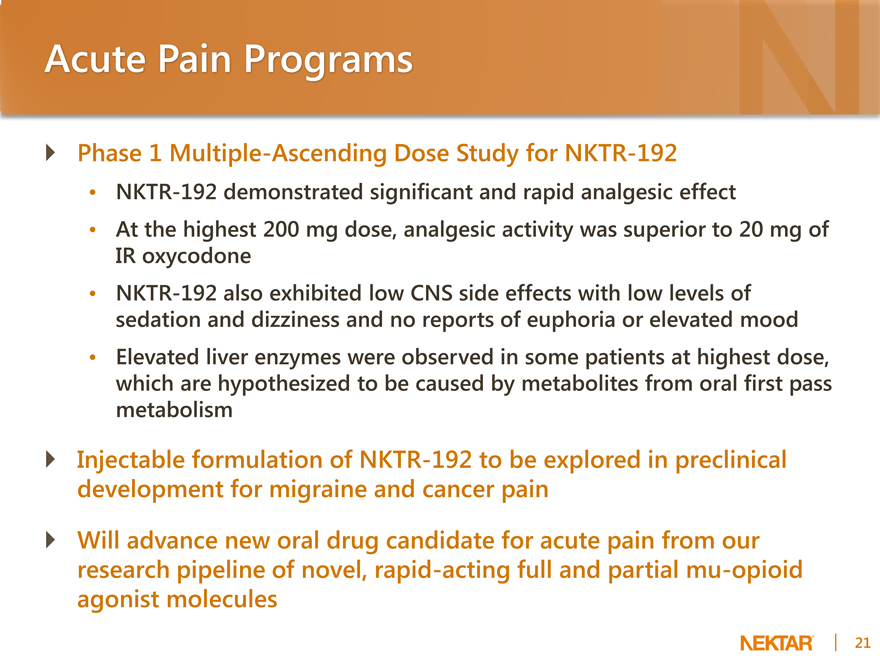

Acute Pain Programs

Phase 1 Multiple-Ascending Dose Study for NKTR-192

NKTR-192 demonstrated significant and rapid analgesic effect At the highest 200 mg dose, analgesic activity was superior to 20 mg of IR oxycodone NKTR-192 also exhibited low CNS side effects with low levels of sedation and dizziness and no reports of euphoria or elevated mood Elevated liver enzymes were observed in some patients at highest dose, which are hypothesized to be caused by metabolites from oral first pass metabolism

Injectable formulation of NKTR-192 to be explored in preclinical development for migraine and cancer pain Will advance new oral drug candidate for acute pain from our research pipeline of novel, rapid-acting full and partial mu-opioid agonist molecules

|

|

22

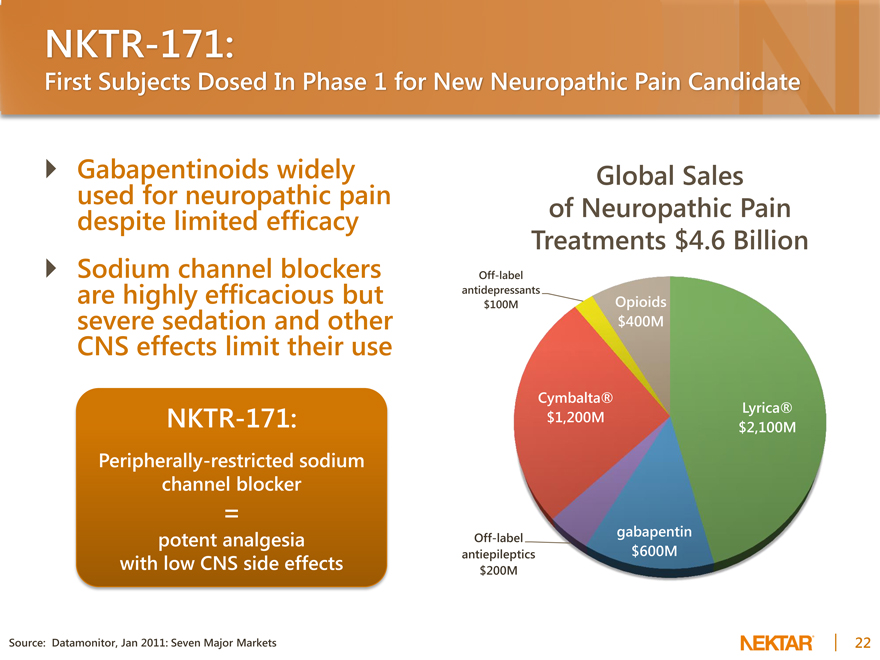

NKTR-171:

First Subjects Dosed In Phase 1 for New Neuropathic Pain Candidate

Gabapentinoids widely used for neuropathic pain despite limited efficacy Sodium channel blockers are highly efficacious but severe sedation and other CNS effects limit their use

NKTR-171:

Peripherally-restricted sodium channel blocker

=

potent analgesia with low CNS side effects

Source: Datamonitor, Jan 2011: Seven Major Markets

Global Sales of Neuropathic Pain Treatments $4.6 Billion

Off-label antidepressants

$100M Opioids $400M

Cymbalta®

Lyrica® $1,200M $2,100M

gabapentin $600M

Off-label antiepileptics $200M

|

|

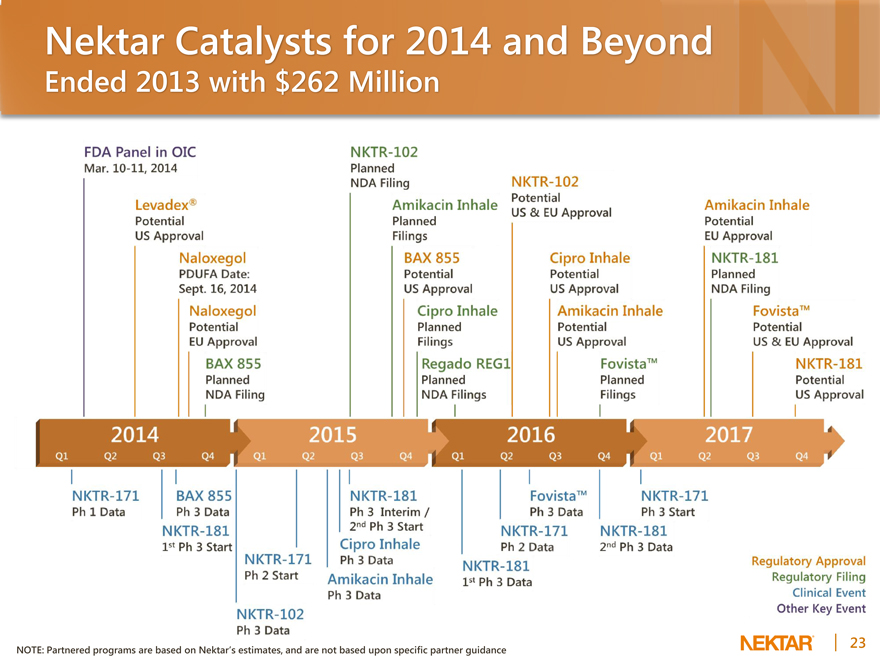

Nektar Catalysts for 2014 and Beyond

Ended 2013 with $262 Million

NOTE: Partnered programs are based on Nektar’s estimates, and are not based upon specific partner guidance

FDA Panel in OIC

Mar. 10-11, 2014 Levadex Potential US Approval Naloxegol PDUFA Date: Sept. 16, 2014 Naloxegol Potential EU Approval

BAX 855

Planned

NDA Filling NKTR Ph 1 Data BAX 855 Ph 3 Data 1st Ph 3 Start 2015 NKTR-102 Planned NDA Filling

Amikacin Inhale Planned Fillings

BAX 855 Potential US Approval

Cipro Inhale Planned Fillings

Regado REG1 NDA Fillings

NKTR-171 Ph2 Start NKTR-102

Ph 3 Data NKTR-181

Ph 3 Interim/

2nd Ph 3 Start Cipro Inhale Ph 3 Data

Amikacin Inhale

Ph 3 Data 2016

NKTR-102

Potential US & EU Approval Cipro Inhale Potential US Approval

Amikacin Inhale

Potential

US Approval

Fovista Planned Fillings

Fovista Ph 3 Data

NKTR-171 Ph 2 Data NKTR-181 1st Ph 3 Data

NKTR-181 2nd Ph 3 Data

2017 Amikacin Inhale Potential EU Approval NKTR-181

Planned

NDA Filling

Fovista

Potential

US & EU Approval

NKTR-181

Potential

US Approval