EX-2.1

Exhibit 2.1

EXECUTION VERSION

STOCK PURCHASE AGREEMENT

BETWEEN

QCR HOLDINGS, INC.

AND

VAN DIEST INVESTMENT COMPANY

MAY 23, 2016

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

| ARTICLE 1 THE STOCK PURCHASE |

|

|

1 |

|

|

|

Section 1.1 |

|

Sale and Purchase of Bank Stock |

|

|

1 |

|

|

|

Section 1.2 |

|

Effective Time; Closing |

|

|

1 |

|

|

|

Section 1.3 |

|

Absence of Control |

|

|

2 |

|

|

|

Section 1.4 |

|

Alternative Structure |

|

|

2 |

|

|

|

| ARTICLE 2 REPRESENTATIONS AND WARRANTIES OF SELLER |

|

|

2 |

|

|

|

Section 2.1 |

|

Seller Organization |

|

|

2 |

|

|

|

Section 2.2 |

|

Subsidiary Organization |

|

|

3 |

|

|

|

Section 2.3 |

|

Authorization; Enforceability |

|

|

3 |

|

|

|

Section 2.4 |

|

No Conflict |

|

|

3 |

|

|

|

Section 2.5 |

|

Bank Capitalization |

|

|

4 |

|

|

|

Section 2.6 |

|

Bank Subsidiary Capitalization |

|

|

4 |

|

|

|

Section 2.7 |

|

Financial Statements and Reports; Regulatory Filings |

|

|

5 |

|

|

|

Section 2.8 |

|

Books and Records |

|

|

5 |

|

|

|

Section 2.9 |

|

Properties |

|

|

6 |

|

|

|

Section 2.10 |

|

Loans; Loan Loss Reserve |

|

|

6 |

|

|

|

Section 2.11 |

|

Taxes |

|

|

7 |

|

|

|

Section 2.12 |

|

Employee Benefits |

|

|

8 |

|

|

|

Section 2.13 |

|

Compliance with Legal Requirements |

|

|

10 |

|

|

|

Section 2.14 |

|

Legal Proceedings; Orders |

|

|

11 |

|

|

|

Section 2.15 |

|

Absence of Certain Changes and Events |

|

|

11 |

|

|

|

Section 2.16 |

|

Material Contracts |

|

|

13 |

|

|

|

Section 2.17 |

|

No Defaults |

|

|

15 |

|

|

|

Section 2.18 |

|

Insurance |

|

|

15 |

|

|

|

Section 2.19 |

|

Compliance with Environmental Laws |

|

|

16 |

|

|

|

Section 2.20 |

|

Transactions with Affiliates |

|

|

16 |

|

|

|

Section 2.21 |

|

Brokerage Commissions |

|

|

16 |

|

|

|

Section 2.22 |

|

Approval Delays |

|

|

16 |

|

|

|

Section 2.23 |

|

Labor Matters |

|

|

17 |

|

|

|

Section 2.24 |

|

Intellectual Property |

|

|

17 |

|

|

|

Section 2.25 |

|

Investments |

|

|

17 |

|

|

|

Section 2.26 |

|

Accuracy of Information Furnished; Only Representations |

|

|

18 |

|

|

|

| ARTICLE 3 REPRESENTATIONS AND WARRANTIES OF PURCHASER |

|

|

19 |

|

|

|

Section 3.1 |

|

Organization |

|

|

19 |

|

|

|

Section 3.2 |

|

Authorization; Enforceability |

|

|

19 |

|

|

|

Section 3.3 |

|

No Conflict |

|

|

19 |

|

|

|

Section 3.4 |

|

Approval Delays |

|

|

20 |

|

|

|

Section 3.5 |

|

Adequate Funds |

|

|

20 |

|

|

|

Section 3.6 |

|

Brokerage Commissions |

|

|

20 |

|

|

|

Section 3.7 |

|

Accuracy of Information Furnished; Only Representations |

|

|

20 |

|

|

|

| ARTICLE 4 SELLER’S COVENANTS |

|

|

20 |

|

|

|

Section 4.1 |

|

Access and Investigation |

|

|

20 |

|

ii

|

|

|

|

|

|

|

|

|

|

|

Section 4.2 |

|

Operation of Seller and Seller Subsidiaries |

|

|

21 |

|

|

|

Section 4.3 |

|

Advice of Changes |

|

|

24 |

|

|

|

Section 4.4 |

|

Other Offers |

|

|

25 |

|

|

|

Section 4.5 |

|

Seller Shareholder Approval |

|

|

26 |

|

|

|

Section 4.6 |

|

Information Provided to Purchaser |

|

|

26 |

|

|

|

Section 4.7 |

|

Employee Benefit Plans |

|

|

26 |

|

|

|

Section 4.8 |

|

Title to Real Estate |

|

|

27 |

|

|

|

Section 4.9 |

|

Surveys |

|

|

27 |

|

|

|

Section 4.10 |

|

Environmental Investigation |

|

|

27 |

|

|

|

Section 4.11 |

|

Additional Accruals and Reserves |

|

|

28 |

|

|

|

Section 4.12 |

|

Indemnification; Insurance |

|

|

28 |

|

|

|

Section 4.13 |

|

Discussions with Employees or Customers |

|

|

29 |

|

|

|

| ARTICLE 5 PURCHASER’S COVENANT |

|

|

29 |

|

|

|

Section 5.1 |

|

Advice of Changes |

|

|

29 |

|

|

|

| ARTICLE 6 COVENANTS OF ALL PARTIES; ADDITIONAL AGREEMENTS |

|

|

29 |

|

|

|

Section 6.1 |

|

Regulatory Approvals |

|

|

29 |

|

|

|

Section 6.2 |

|

Publicity |

|

|

30 |

|

|

|

Section 6.3 |

|

Reasonable Best Efforts; Cooperation |

|

|

30 |

|

|

|

Section 6.4 |

|

Supplement to Disclosure Schedules |

|

|

30 |

|

|

|

Section 6.5 |

|

Tax Matters |

|

|

31 |

|

|

|

Section 6.6 |

|

Employees and Employee Benefits |

|

|

31 |

|

|

|

| ARTICLE 7 NON-SURVIVAL OF REPRESENTATIONS AND WARRANTIES |

|

|

33 |

|

|

|

Section 7.1 |

|

Nonsurvival of Representations and Warranties |

|

|

33 |

|

|

|

| ARTICLE 8 CONDITIONS PRECEDENT TO OBLIGATIONS OF PURCHASER |

|

|

33 |

|

|

|

Section 8.1 |

|

Accuracy of Representations and Warranties |

|

|

33 |

|

|

|

Section 8.2 |

|

Performance by Seller |

|

|

33 |

|

|

|

Section 8.3 |

|

Shareholder Approval |

|

|

33 |

|

|

|

Section 8.4 |

|

No Proceedings |

|

|

33 |

|

|

|

Section 8.5 |

|

Regulatory Approvals |

|

|

33 |

|

|

|

Section 8.6 |

|

Officers’ Certificate |

|

|

34 |

|

|

|

Section 8.7 |

|

No Material Adverse Effect |

|

|

34 |

|

|

|

Section 8.8 |

|

Consents |

|

|

34 |

|

|

|

Section 8.9 |

|

Other Documents |

|

|

34 |

|

|

|

| ARTICLE 9 CONDITIONS PRECEDENT TO THE OBLIGATIONS OF SELLER |

|

|

34 |

|

|

|

Section 9.1 |

|

Accuracy of Representations and Warranties |

|

|

34 |

|

|

|

Section 9.2 |

|

Performance of Purchaser |

|

|

35 |

|

|

|

Section 9.3 |

|

No Proceedings |

|

|

35 |

|

|

|

Section 9.4 |

|

Officers’ Certificate |

|

|

35 |

|

|

|

Section 9.5 |

|

Other Documents |

|

|

35 |

|

|

|

| ARTICLE 10 TERMINATION |

|

|

35 |

|

|

|

Section 10.1 |

|

Termination of Agreement |

|

|

35 |

|

iii

|

|

|

|

|

|

|

|

|

|

|

Section 10.2 |

|

Effect of Termination or Abandonment |

|

|

37 |

|

|

|

Section 10.3 |

|

Fees and Expenses |

|

|

37 |

|

|

|

| ARTICLE 11 MISCELLANEOUS |

|

|

37 |

|

|

|

Section 11.1 |

|

Governing Law |

|

|

37 |

|

|

|

Section 11.2 |

|

Assignments, Successors and No Third Party Rights |

|

|

38 |

|

|

|

Section 11.3 |

|

Modification |

|

|

38 |

|

|

|

Section 11.4 |

|

Extension of Time; Waiver, Specific Performance |

|

|

38 |

|

|

|

Section 11.5 |

|

Notices |

|

|

39 |

|

|

|

Section 11.6 |

|

Entire Agreement |

|

|

40 |

|

|

|

Section 11.7 |

|

Severability |

|

|

40 |

|

|

|

Section 11.8 |

|

Further Assurances |

|

|

40 |

|

|

|

Section 11.9 |

|

Counterparts |

|

|

40 |

|

|

|

| ARTICLE 12 DEFINITIONS |

|

|

41 |

|

|

|

Section 12.1 |

|

Definitions |

|

|

41 |

|

|

|

Section 12.2 |

|

Principles of Construction |

|

|

47 |

|

iv

INDEX OF DEFINED TERMS

|

|

|

|

|

| Acquisition Proposal |

|

|

41 |

|

| Affiliate |

|

|

41 |

|

| Agreement |

|

|

1 |

|

| Bank |

|

|

1 |

|

| Bank Capitalization Date |

|

|

4 |

|

| Bank Employees |

|

|

23 |

|

| Bank ERISA Affiliate |

|

|

42 |

|

| Bank Financial Statements |

|

|

5 |

|

| Bank Loans |

|

|

6 |

|

| Bank Stock |

|

|

1 |

|

| Borrowing Affiliate |

|

|

23 |

|

| Business Day |

|

|

42 |

|

| Closing |

|

|

2 |

|

| Closing Date |

|

|

2 |

|

| Code |

|

|

42 |

|

| Confidentiality Agreement |

|

|

21 |

|

| Contemplated Transactions |

|

|

42 |

|

| Contract |

|

|

42 |

|

| Control, Controlling or Controlled |

|

|

42 |

|

| Covered Employees |

|

|

32 |

|

| CRA |

|

|

42 |

|

| DOL |

|

|

42 |

|

| Effective Time |

|

|

2 |

|

| Employee Benefit Plan |

|

|

42 |

|

| Environment |

|

|

43 |

|

| Environmental Laws |

|

|

43 |

|

| Environmental Report |

|

|

28 |

|

| ERISA |

|

|

43 |

|

| Exchange Act |

|

|

43 |

|

| FDIC |

|

|

43 |

|

| Federal Reserve |

|

|

43 |

|

| GAAP |

|

|

43 |

|

| Hazardous Materials |

|

|

43 |

|

| IBCA |

|

|

43 |

|

| Immediate Family Member |

|

|

43 |

|

| Insurance Subsidiary |

|

|

43 |

|

| Investment Securities |

|

|

18 |

|

| IRS |

|

|

43 |

|

| Knowledge |

|

|

43 |

|

| Legal Requirement |

|

|

44 |

|

| Material Adverse Effect |

|

|

44 |

|

| Material Contract |

|

|

14 |

|

| NASDAQ Rules |

|

|

44 |

|

| New Plans |

|

|

32 |

|

| Old Plans |

|

|

32 |

|

v

|

|

|

|

|

| Order |

|

|

44 |

|

| Ordinary Course of Business |

|

|

44 |

|

| OREO |

|

|

45 |

|

| PBGC |

|

|

45 |

|

| Permitted Exceptions |

|

|

6 |

|

| Person |

|

|

45 |

|

| Phase I Report |

|

|

28 |

|

| Phase II Report |

|

|

28 |

|

| Post-Closing Tax Period |

|

|

45 |

|

| Pre-Closing Tax Period |

|

|

45 |

|

| Pre-Closing Taxes |

|

|

45 |

|

| Previously Disclosed |

|

|

48 |

|

| Proceeding |

|

|

45 |

|

| Purchaser |

|

|

1 |

|

| Purchaser Benefit Plan |

|

|

45 |

|

| Purchaser Bylaws |

|

|

46 |

|

| Purchaser Certificate of Incorporation |

|

|

46 |

|

| Purchaser Disclosure Schedules |

|

|

48 |

|

| Purchaser ERISA Affiliate |

|

|

46 |

|

| Purchaser SEC Reports |

|

|

46 |

|

| Regulatory Authority |

|

|

46 |

|

| Remediation Cost |

|

|

28 |

|

| Representative |

|

|

46 |

|

| Requisite Regulatory Approvals |

|

|

46 |

|

| Schedules |

|

|

48 |

|

| SEC |

|

|

46 |

|

| Securities Act |

|

|

46 |

|

| Seller |

|

|

1 |

|

| Seller Adverse Recommendation |

|

|

26 |

|

| Seller Articles of Incorporation |

|

|

46 |

|

| Seller Board |

|

|

46 |

|

| Seller Bylaws |

|

|

46 |

|

| Seller Disclosure Schedules |

|

|

48 |

|

| Seller Shareholder Approval |

|

|

47 |

|

| Stock Purchase |

|

|

1 |

|

| Stock Purchase Consideration |

|

|

1 |

|

| Subsidiary |

|

|

47 |

|

| Superior Proposal |

|

|

47 |

|

| Tax |

|

|

47 |

|

| Tax Return |

|

|

47 |

|

| Termination Date |

|

|

36 |

|

| Termination Fee |

|

|

37 |

|

| Transition Date |

|

|

47 |

|

| U.S. |

|

|

47 |

|

| Written Consent |

|

|

26 |

|

vi

STOCK PURCHASE AGREEMENT

THIS STOCK PURCHASE AGREEMENT (together with all exhibits

and schedules, this “Agreement”) is entered into as of May 23, 2016, by and between QCR Holdings, Inc., a Delaware corporation (“Purchaser”), and Van Diest Investment Company, an Iowa corporation

(“Seller”).

RECITALS

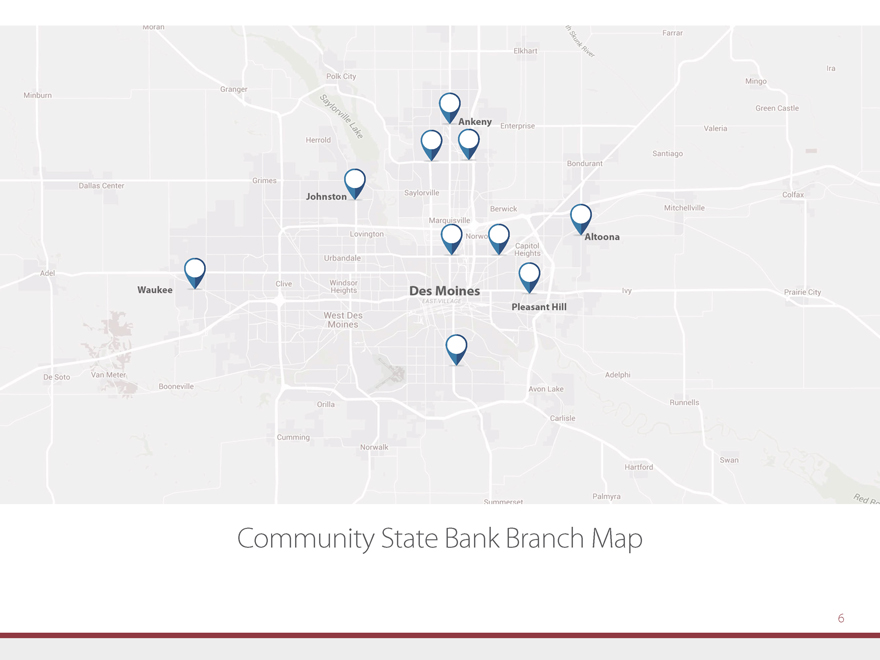

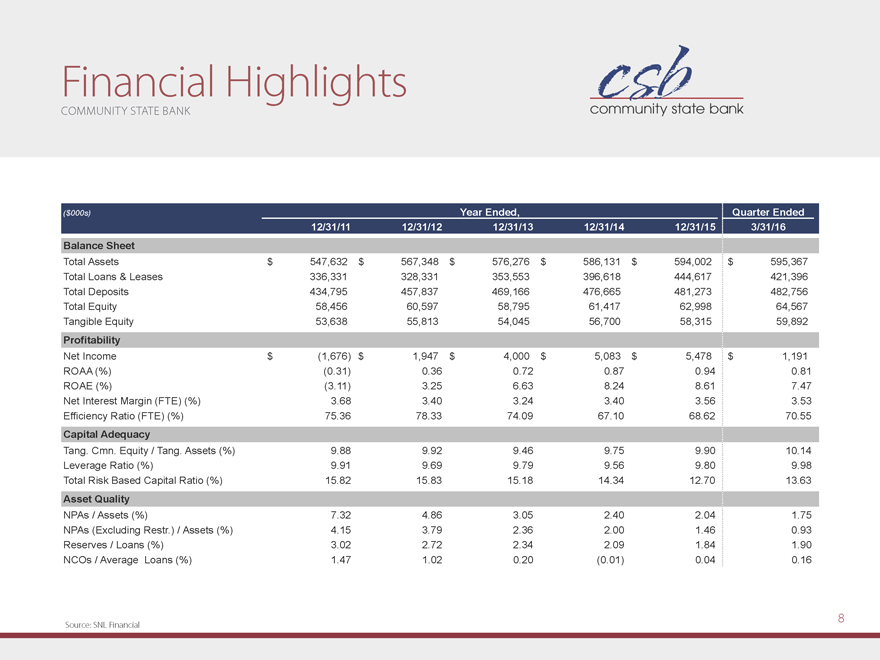

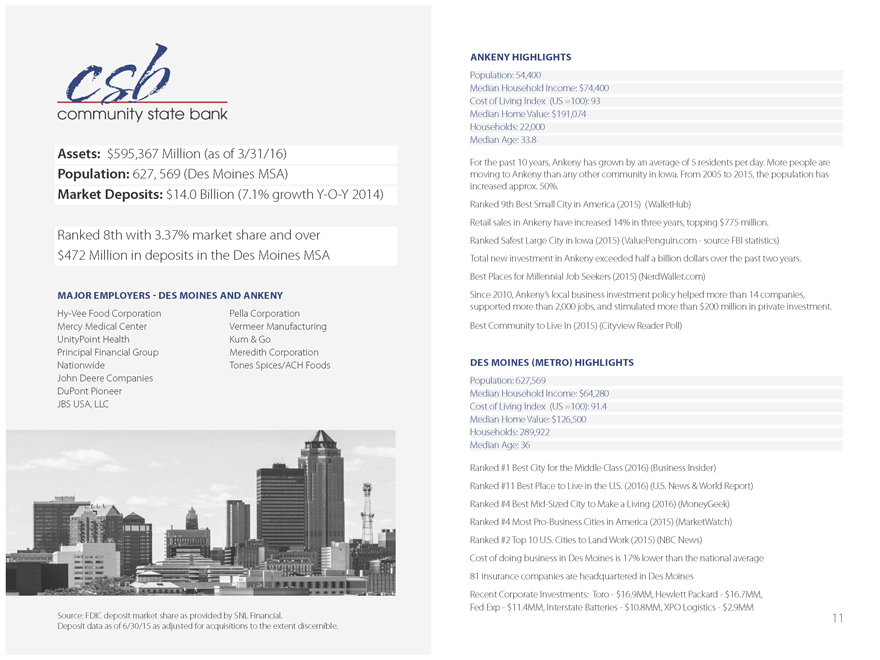

A. Community State Bank is an Iowa chartered commercial bank with its main office located in Ankeny, Iowa (the

“Bank”).

B. Seller is the sole owner of 6,000 shares of the common stock of the Bank, $100.00 par

value per share, which represent all issued and outstanding capital stock of the Bank (the “Bank Stock”).

C.

Purchaser desires to purchase from Seller, and Seller desires to sell to Purchaser, on the following terms and conditions, the Bank Stock (the “Stock Purchase”).

D. The boards of directors of each of Purchaser and Seller, respectively, have approved this Agreement and the Stock Purchase.

E. It is the intention of the parties that the Bank’s earnings from the date of this Agreement through the Closing Date

shall accrue to the benefit of Purchaser.

F. The parties desire to make certain representations, warranties and agreements

in connection with the Stock Purchase and the other transactions contemplated by this Agreement and also agree to certain prescribed conditions to the Stock Purchase and other transactions.

AGREEMENTS

In

consideration of the foregoing premises and the following mutual promises, covenants and agreements, the parties hereby agree as follows:

ARTICLE 1

THE STOCK

PURCHASE

Section 1.1 Sale and Purchase of Bank Stock. On the terms and subject to the conditions hereinafter set

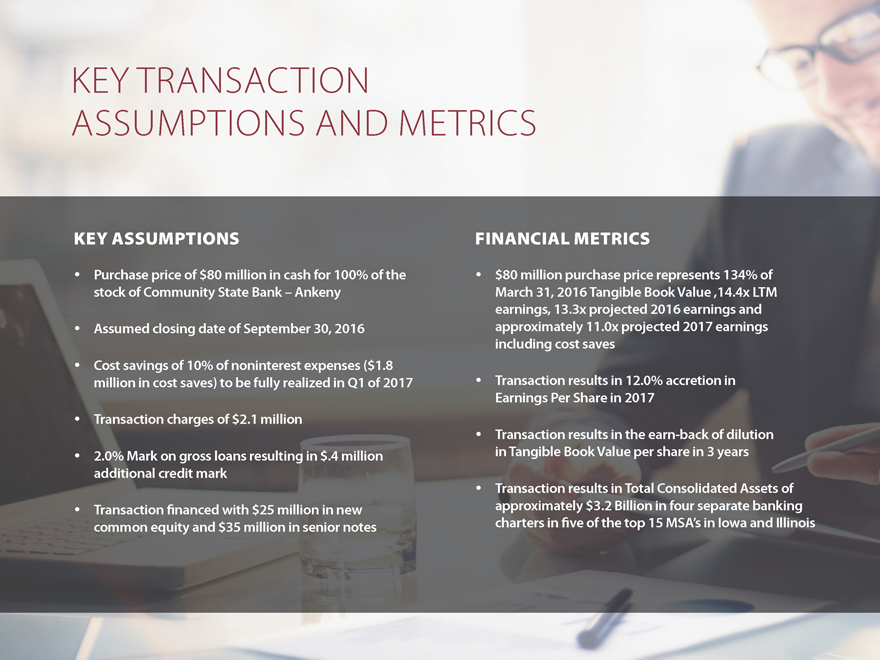

forth, Seller agrees to sell the Bank Stock to Purchaser, and Purchaser agrees to purchase and accept delivery of the Bank Stock, in exchange for the payment to Seller of $80,000,000 (the “Stock Purchase Consideration”).

Section 1.2 Effective Time; Closing. Provided that this Agreement shall not prior thereto have been terminated in

accordance with its express terms, the closing of the

Contemplated Transactions (the “Closing”) shall occur through the mail or at a place that is mutually acceptable to Purchaser and Seller, or if they fail to agree, at

the offices of Barack Ferrazzano Kirschbaum & Nagelberg LLP, located at 200 West Madison Street, Suite 3900, Chicago, Illinois 60606, at 10:00 a.m., local time, on the date that is within ten (10) Business Days after the

satisfaction or waiver (subject to applicable Legal Requirements) of the latest to occur of the conditions set forth in Article 8 and Article 9 (other than those conditions that by their nature are to be satisfied or waived at the

Closing, but subject to the satisfaction or waiver of those conditions) or at such other time and place as Purchaser and Seller may agree in writing (the “Closing Date”). Subject to the provisions of Article 10, failure to

consummate the Contemplated Transactions on the date and time and at the place determined pursuant to this Section 1.2 will not result in the termination of this Agreement and will not relieve any party of any obligation under this

Agreement. The Contemplated Transactions shall be deemed to be effective at 11:59 p.m. on the Closing Date (the “Effective Time”).

Section 1.3 Absence of Control. Subject to any specific provisions of this Agreement, it is the intent of the parties to

this Agreement that Purchaser, by reason of this Agreement, shall not be deemed (until consummation of the Contemplated Transactions) to control, directly or indirectly, the Bank or any of its Subsidiaries and shall not exercise, or be deemed to

exercise, directly or indirectly, a controlling influence over the management or policies of the Bank or any of its Subsidiaries.

Section 1.4 Alternative Structure. Notwithstanding anything to the contrary contained in this Agreement, before the

Effective Time, the parties may mutually agree to change the method of effecting the Contemplated Transactions if and to the extent that it deems such a change to be desirable; provided, that: (a) any such change shall not

affect the U.S. federal income tax consequences of the Contemplated Transactions to Seller; and (b) no such change shall (i) alter or change the amount or kind of the consideration to be issued to Seller as consideration for the Stock

Purchase or (ii) materially impede or delay consummation of the Contemplated Transactions. If the parties agree to make such a change, they shall execute appropriate documents to reflect the change.

ARTICLE 2

REPRESENTATIONS AND WARRANTIES OF SELLER

Except as Previously Disclosed, Seller hereby represents and warrants to Purchaser as follows, as of the date hereof (unless a representation

or warranty expressly relates to another specified date):

Section 2.1 Seller Organization. Seller: (a) is a

corporation duly organized, validly existing and in good standing under the laws of the State of Iowa and is also in good standing in each other jurisdiction in which the nature of the business conducted or the properties or assets owned or leased

by it makes such qualification necessary, except where the failure to be so qualified and in good standing would not have a Material Adverse Effect on Seller; (b) is

2

registered with the Federal Reserve as a bank holding company under the Bank Holding Company Act of 1956, as amended; and (c) has full power and authority, corporate and otherwise, to

operate as a bank holding company and to own, operate and lease its properties as presently owned, operated and leased, and to carry on its business as it is now being conducted. Seller has delivered or made available to Purchaser copies of the

Seller Articles of Incorporation and Seller Bylaws and all amendments thereto, each of which are true, complete and correct, and in full force and effect as of the date of this Agreement.

Section 2.2 Subsidiary Organization. The Bank is an Iowa state chartered bank duly organized, validly existing and in good

standing under the laws of the State of Iowa. The Insurance Subsidiary is a corporation duly organized, validly existing and in good standing under the laws of the State of Iowa. Each Seller Subsidiary has full power and authority, corporate and

otherwise, to own, operate and lease its properties as presently owned, operated and leased, and to carry on its business as it is now being conducted, and is duly qualified to do business and is in good standing in each jurisdiction in which the

nature of the business conducted or the properties or assets owned or leased by it makes such qualification necessary. The deposit accounts of the Bank are insured by the FDIC through the Deposit Insurance Fund to the fullest extent permitted by

applicable Legal Requirements, and all premiums and assessments required to be paid in connection therewith have been paid when due. Seller has delivered or made available to Purchaser copies of the articles of incorporation or charter (or similar

organizational documents) and bylaws of each Seller Subsidiary and all amendments thereto, each of which are true, complete and correct and in full force and effect as of the date of this Agreement. The Bank has no subsidiaries other than the

Insurance Subsidiary.

Section 2.3 Authorization; Enforceability. Seller has the requisite corporate power and

authority to enter into and perform its obligations under this Agreement. The execution, delivery and performance of this Agreement by Seller, and the consummation by it of its obligations under this Agreement, have been authorized by all necessary

corporate action, subject to the Seller Shareholder Approval, and, subject to the receipt of the Requisite Regulatory Approvals, this Agreement constitutes a legal, valid and binding obligation of Seller enforceable in accordance with its terms,

except as such enforcement may be limited by bankruptcy, insolvency, reorganization or other Legal Requirements affecting creditors’ rights generally and subject to general principles of equity.

Section 2.4 No Conflict. Neither the execution nor delivery of this Agreement nor the consummation or performance of any of

the Contemplated Transactions will, directly or indirectly (with or without notice or lapse of time): (a) contravene, conflict with or result in a violation of any provision of the articles of incorporation or charter (or similar organizational

documents) or bylaws, each as in effect on the date hereof, or any currently effective resolution adopted by the board of directors or shareholders of, Seller or any Seller Subsidiary; (b) assuming receipt of the Requisite Regulatory Approvals,

contravene, conflict with or result in a violation of, or give any Regulatory Authority or other Person the valid and enforceable right to challenge any of the Contemplated Transactions or to exercise any remedy or obtain any relief under, any Legal

Requirement or any Order to which Seller or any Seller Subsidiary, or any of

3

their respective assets that are owned or used by them, may be subject, except for any contravention, conflict or violation that is permissible by virtue of obtaining the Requisite Regulatory

Approvals; (c) contravene, conflict with or result in a violation or breach of any provision of, or give any Person the right to declare a default or exercise any remedy under, or to accelerate the maturity or performance of, or to cancel,

terminate or modify any Material Contract; or (d) result in the creation of any material lien, charge or encumbrance upon or with respect to any of the assets owned or used by the Bank or its Subsidiaries. Except for the Requisite

Regulatory Approvals and Seller Shareholder Approval, neither Seller nor any of its Subsidiaries is or will be required to give any notice to or obtain any consent from any Person in connection with the execution and delivery of this Agreement or

the consummation or performance of any of the Contemplated Transactions.

Section 2.5 Bank Capitalization.

(a) The authorized capital stock of the Bank currently consists exclusively of 25,000 shares of the Bank Stock, of which, as of April 30,

2016 (the “Bank Capitalization Date”), 6,000 shares were issued and outstanding. The Bank does not have outstanding any bonds, debentures, notes or other debt obligations having the right to vote (or convertible into, or exchangeable

for, securities having the right to vote) with Seller on any matter. All of the issued and outstanding shares of Bank Stock have been duly authorized and validly issued and are fully paid and nonassessable. All of the issued and outstanding

shares of Bank Stock are directly owned by Seller, free and clear of any liens, pledges, charges, claims and security interests and similar encumbrances, and all of such shares are duly authorized and validly issued and are fully paid and

nonassessable.

(b) None of the shares of Bank Stock were issued in violation of any federal or state securities laws or any other

applicable Legal Requirement. There are: (i) no outstanding subscriptions, Contracts, conversion privileges, options, warrants, calls or other rights obligating the Bank to issue, sell or otherwise dispose of, or to purchase, redeem or

otherwise acquire, any shares of Bank Stock; and (ii) no contractual obligations of the Bank to repurchase, redeem or otherwise acquire any shares of Bank Stock or any securities representing the right to purchase or otherwise receive any

shares of Bank Stock. Except as permitted by this Agreement, since the Bank Capitalization Date, no shares of Bank Stock have been purchased, redeemed or otherwise acquired, directly or indirectly, by the Bank or any of its Subsidiaries and no

dividends or other distributions payable in any equity securities of the Bank or any of its Subsidiaries have been declared, set aside, made or paid to Seller. The Bank does not own or have any Contract to acquire, any equity interests or other

securities of any Person or any direct or indirect equity or ownership interest in any other business.

Section 2.6 Bank

Subsidiary Capitalization. All of the issued and outstanding shares of capital stock or other equity ownership interests of each Subsidiary of the Bank are directly owned by the Bank, free and clear of any liens, pledges, charges, claims and

security interests and similar encumbrances, and all of such shares or equity ownership interests are duly authorized and validly issued and are fully paid and nonassessable. No Subsidiary of the Bank has or is bound by any outstanding

subscriptions, Contracts, conversion privileges,

4

options, warrants, calls or other rights obligating such Subsidiary to issue, sell or otherwise dispose of, or to purchase, redeem or otherwise acquire, any shares of capital stock or any

other equity security of such Subsidiary. No Subsidiary of the Bank owns or has any Contract to acquire, any equity interests or other securities of any Person or any direct or indirect equity or ownership interest in any other business.

Section 2.7 Financial Statements and Reports; Regulatory Filings.

(a) True and complete copies of the following financial statements (collectively, the “Bank Financial Statements”) have been

made available to Purchaser: (i) the audited consolidated balance sheets of the Bank as of December 31, 2013, 2014 and 2015, and the related statements of income, changes in shareholders’ equity and cash flows for the fiscal years

then ended; and (ii) the unaudited consolidated interim balance sheet of the Bank as of March 31, 2016 and the related statement of income for the three-month period then ended.

(b) The Bank Financial Statements have been prepared in conformity with GAAP, except in each case as indicated in such statements or the notes

thereto, and comply in all material respects with all applicable Legal Requirements. The Bank Financial Statements are complete and correct in all material respects and fairly and accurately present the respective financial position, assets,

liabilities and results of operations of the Bank and its Subsidiaries at the respective dates of and for the periods referred to in Bank Financial Statements. To the Knowledge of Seller, the Bank Financial Statements do not include any assets

or omit to state any liabilities, absolute or contingent, or other facts, which inclusion or omission would render the Bank Financial Statements misleading in any material respect as of the respective dates thereof and for the periods referred to

therein.

(c) The Bank and each of its Subsidiaries has filed all forms, reports and documents required to be filed since January 1,

2013, with all applicable federal or state securities or banking authorities. Such forms, reports and documents: (i) complied as to form with applicable Legal Requirements; and (ii) did not at the time they were filed, after giving effect

to any amendment thereto filed prior to the date hereof, contain an untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary in order to make the statements therein, in light of the

circumstances under which they were made, not misleading, except that information filed as of a later date (but before the date of this Agreement) is deemed to modify information as of an earlier date.

Section 2.8 Books and Records. The books of account, minute books, stock record books and other records of the Bank and its

Subsidiaries are complete and correct in all material respects and have been maintained in accordance with the Bank’s business practices and all applicable Legal Requirements, including the maintenance of an adequate system of internal controls

required by such Legal Requirements. The minute books of the Bank and each of its Subsidiaries contain accurate and complete records in all material respects of all meetings held of, and corporate action taken by, its respective shareholders,

boards of directors and committees of the boards of directors. At the Closing, all of those books and records will be in the possession of the Bank and its Subsidiaries.

5

Section 2.9 Properties.

(a) Section 2.9(a) of the Seller Disclosure Schedule lists or describes all interests in real property owned by the Bank and its

Subsidiaries, including OREO, and the principal buildings and structures located thereon, together with the address of such real estate, and each lease of real property to which the Bank or any of its Subsidiaries is a party, identifying the parties

thereto, the annual rental payable, the expiration date thereof and a brief description of the property covered, and in each case of either owned or leased real property, the proper identification, if applicable, of each such property as a branch or

main office or other office.

(b) The Bank and each of its Subsidiaries has good and marketable title to all assets and properties,

whether real or personal, tangible or intangible, that it purports to own, subject to no liens, mortgages, security interests, encumbrances or charges of any kind except: (a) as noted in the most recent Bank Financial Statements;

(b) statutory liens for Taxes not yet delinquent or being contested in good faith by appropriate Proceedings and for which appropriate reserves have been established and reflected on the Bank Financial Statements; (c) pledges or liens

required to be granted in connection with the acceptance of government deposits, granted in connection with repurchase or reverse repurchase agreements or otherwise incurred in the Ordinary Course of Business; (d) easements, rights of way, and

other similar encumbrances that do not materially affect the use of the properties or assets subject thereto or affected thereby or otherwise materially impair business operations at such properties; and (e) minor defects and irregularities in

title and encumbrances that do not materially impair the use thereof for the purposes for which they are held (collectively, the “Permitted Exceptions”). The Bank and each of its Subsidiaries as lessee has the right under valid

and existing leases to occupy, use, possess and control any and all of the respective property leased by it, and each such lease is valid and without default thereunder by the lessee or, to the Knowledge of Seller, the lessor. To the Knowledge of

the Seller, all buildings and structures owned by the Bank and each of its Subsidiaries lie wholly within the boundaries of the real property owned or validly leased by it, and do not encroach upon the property of, or otherwise conflict with the

property rights of, any other Person.

Section 2.10 Loans; Loan Loss Reserve.

(a) Each loan, loan agreement, note, lease or other borrowing agreement by the Bank, any participation therein, and any guaranty, renewal or

extension thereof (the “Bank Loans”) reflected as an asset on any of the Bank Financial Statements or reports filed with the Regulatory Authorities is evidenced by documentation that is customary and legally sufficient in all

material respects and constitutes, to the Knowledge of Seller, the legal, valid and binding obligation of the obligor named therein, enforceable in accordance with its terms, except to the extent that the enforceability thereof may be limited by

bankruptcy, insolvency, reorganization, moratorium or similar laws relating to or affecting the enforcement of creditors’ rights generally or equitable principles or doctrines; provided, however, any representation made in this

Section 2.10(a) will not be deemed to be a representation of the collectability of such loans or similar items.

6

(b) All Bank Loans originated or purchased by the Bank were made or purchased in all respects in

accordance with the policies of the board of directors of the Bank (or exceptions thereto consistent with past practice) and in the Ordinary Course of Business of the Bank. The Bank’s interest in all Bank Loans is free and clear of any security

interest, lien, encumbrance or other charge, and the Bank has complied in all material respects with all Legal Requirements relating to such Bank Loans. There has been no default on, or forgiveness or waiver of, in whole or in part, any Bank Loan

made to an executive officer or director of Seller or any of its Subsidiaries or an entity controlled by an executive officer or director during the three (3) years immediately preceding the date hereof.

(c) The Bank is not a party to any Bank Loan: (i) under the terms of which the obligor is more than ninety (90) days delinquent in

payment of principal or interest or in default of any other material provision as of the dates shown thereon or for which the Bank has discontinued the accrual of interest; (ii) that has been classified as “substandard,”

“doubtful,” “loss,” “other loans especially mentioned” or any comparable classifications by the Bank; (iii) that has been listed on any “watch list” or similar internal report of the Bank; (iv) that

has been the subject of any notice from any obligor of adverse environmental conditions potentially affecting the value of any collateral for such Bank Loan; (v) with respect to which the Bank is aware of potential violations of any

Environmental Laws that may have occurred on the property serving as collateral for such Bank Loan or by any obligor of such Bank Loan; or (vi) that represents an extension of credit to an executive officer or director of the Bank or an entity

controlled by an executive officer or director.

(d) The Bank’s allowance for loan and lease losses reflected in the Bank Financial

Statements (including footnotes thereto) was determined and calculated on the basis of the Bank’s quarterly review and evaluation of the portfolio of Bank Loans under the requirements of GAAP and Legal Requirements, was established in a manner

consistent with the Bank’s internal policies, and, in the reasonable judgment of the Bank, was adequate under the requirements of GAAP and all Legal Requirements to provide for possible losses, net of recoveries relating to Bank Loans

previously charged-off, on outstanding Bank Loans.

(e) To Seller’s knowledge, none of the Bank Loans is subject to any material

offset or claim of offset.

Section 2.11 Taxes.

(a) Seller and each of the Seller Subsidiaries have duly and timely filed all Tax Returns required to be filed by them on or before the

Closing Date for all taxable or reporting periods ending on or before the Closing Date, and each such Tax Return is true, correct and complete in all material respects. Seller and each of the Seller Subsidiaries have paid, or made adequate provision

for the payment of, all Taxes (whether or not reflected in Tax Returns as filed or to be filed) due and payable by Seller and each of the Seller Subsidiaries, or claimed to be due and payable by any Regulatory Authority, and are not delinquent in

the payment of any Tax, except such Taxes as are being contested in good faith and as to which adequate reserves have been provided.

7

(b) There is no claim or assessment pending or, to the Knowledge of Seller, threatened against

Seller and the Seller Subsidiaries for any Taxes that they owe. No audit, examination or investigation related to Taxes paid or payable by Seller and each of the Seller Subsidiaries is presently being conducted or, to the Knowledge of Seller,

threatened by any Regulatory Authority. Neither Seller nor the Seller Subsidiaries are the beneficiary of any extension of time within which to file any Tax Return, and there are no liens for Taxes (other than Taxes not yet due and payable) upon any

of Seller’s or the Seller Subsidiaries’ assets. Neither Seller nor the Seller Subsidiaries has executed an extension or waiver of any statute of limitations on the assessment or collection of any Tax that is currently in effect. None

of Seller or any of the Seller Subsidiaries is a party to a tax sharing, tax allocation or similar agreement.

(c) Seller and each of the

Seller Subsidiaries have delivered or made available to Purchaser true, correct and complete copies of all Tax Returns relating to income taxes and franchise taxes owed by Seller and the Seller Subsidiaries with respect to the last three

(3) fiscal years.

(d) Seller and each of the Seller Subsidiaries have not engaged in any transaction that could affect the Tax

liability for any Tax Returns not closed by applicable statute of limitations: (i) which is a “reportable transaction” or a “listed transaction” or (ii) a “significant purpose of which is the avoidance or evasion

of U.S. federal income tax” within the meaning of Sections 6662, 6662A, 6011, 6111 or 6707A of the Code or of the regulations of the U.S. Department of the Treasury promulgated thereunder or pursuant to notices or other guidance published by

the IRS (irrespective of the effective dates).

Section 2.12 Employee Benefits.

(a) Section 2.12(a) of Seller Disclosure Schedules includes a complete and correct list of each Employee Benefit Plan. Seller has

delivered to Purchaser true and complete copies of the following with respect to each Employee Benefit Plan: (i) copies of each Employee Benefit Plan (including a written description where no formal plan document exists), and all related plan

descriptions and other written communications provided to participants of Employee Benefit Plans; (ii) to the extent applicable, the last three (3) years’ annual reports on Form 5500, including all schedules thereto and the opinions

of independent accountants; and (iii) the following documents:

(i) current contracts with third party administrators, actuaries,

investment managers, consultants, insurers, and independent contractors;

(ii) all notices and other communications that were given by

Seller, any Seller Subsidiary, or any Employee Benefit Plan to the IRS, the DOL or the PBGC pursuant to applicable law within the three (3) years preceding the date of this Agreement; and

8

(iii) all notices or other communications that were given by the IRS, the PBGC, or the DOL to

Seller, any Seller Subsidiary, or any Employee Benefit Plan within the three (3) years preceding the date of this Agreement.

(b)

Neither the execution and delivery of this Agreement nor the consummation of the transactions contemplated hereby (including possible terminations of employment in connection therewith) will cause a payment, vesting, increase or acceleration of

benefits or benefit entitlements under any Employee Benefit Plan or any other increase in the liabilities of the Bank or any of its Subsidiaries under any Employee Benefit Plan as a result of the transactions contemplated by this Agreement. No

Employee Benefit Plan provides for payment of any amount which, considered in the aggregate with amounts payable pursuant to all other Employee Benefit Plans, would result in any amount being non-deductible for federal income tax purposes by virtue

of Section 280G or 162(m) of the Code.

(c) Neither the Bank nor any of the Bank ERISA Affiliates sponsors, maintains, administers or

contributes to, or has ever sponsored, maintained, administered or contributed to, or has or could have any liability with respect to, (i) any “multiemployer plan” (as defined in Section 3(37) of ERISA), or (ii) any

“multiple employer welfare arrangement” (as defined in Section 3(40) of ERISA). Neither the Bank nor any of the Bank ERISA Affiliates sponsors, maintains, administers or contributes to, or has ever sponsored, maintained, administered

or contributed to, or has, has had or could have any liability with respect to, any Employee Benefit Plan subject to Title IV of ERISA, Section 302 of ERISA or Section 412 of the Code, or any tax-qualified “defined benefit plan”

(as defined in Section 3(35) of ERISA).

(d) Each Employee Benefit Plan that is intended to qualify under Section 401 and

related provisions of the Code is the subject of a favorable determination letter from the IRS to the effect that it is so qualified under the Code and that its related funding instrument is tax exempt under Section 501 of the Code (or Seller

and the Seller Subsidiaries are otherwise relying on an opinion or advisory letter issued to the preapproved plan sponsor), and there are no facts or circumstances that would reasonably be expected to adversely affect the qualified status of any

Employee Benefit Plan or the tax-exempt status of any related trust.

(e) Each Employee Benefit Plan is and has been administered in all

material respects in compliance with its terms and with all applicable Legal Requirements.

(f) Other than routine claims for benefits

made in the Ordinary Course of Business, there is no litigation, claim or assessment pending or, to Seller’s Knowledge, threatened by, on behalf of, or against any Employee Benefit Plan or against the administrators or trustees or other

fiduciaries of any Employee Benefit Plan that alleges a violation of applicable state or federal law or violation of any Employee Benefit Plan document or related agreement.

(g) To the Knowledge of the Seller, no Employee Benefit Plan fiduciary or any other person has any liability to any Employee Benefit Plan

participant, beneficiary or any other person under any provisions of ERISA or any other applicable law by reason of any action or failure to act in connection with any Employee Benefit Plan, including any liability by any reason of any payment of,

or failure to pay, benefits or any other amounts or by reason of any

9

credit or failure to give credit for any benefits or rights. No party in interest (as defined in Code Section 4975(e)(2)) of any Employee Benefit Plan has engaged in any nonexempt prohibited

transaction (as described in Code Section 4975(c) or ERISA Section 406) which could reasonably be expected to result in any liability to the Bank or any Bank Subsidiary.

(h) All accrued contributions and other payments to be made by the Bank or any of its Subsidiaries to any Employee Benefit Plan

(i) through the date hereof have been made or reserves adequate for such purposes have been set aside therefor and reflected in the Bank Financial Statements and (ii) through the Closing Date will have been made or reserves adequate for

such purposes will have been set aside therefore and reflected in Bank Financial Statements.

(i) There are no obligations under any

Employee Benefit Plans to provide health or other welfare benefits to retirees or other former employees, directors, consultants or their dependents (other than rights under Section 4980B of the Code or Section 601 of ERISA or comparable

state laws).

(j) No condition exists as a result of which the Bank or any of its Subsidiaries would have any liability, whether absolute

or contingent, under any Employee Benefit Plan with respect to any misclassification of a person performing services for the Bank any of its Subsidiaries as an independent contractor rather than as an employee. All individuals participating in

Employee Benefit Plans are in fact eligible and authorized to participate in such Employee Benefit Plan.

(k) Section 2.12(k)

of Seller Disclosure Schedules includes the name of each Person who is or would be entitled pursuant to any Contract or Employee Benefit Plan to receive any payment from the Bank or any Subsidiary as a result of the consummation of the Contemplated

Transactions (including any payment that is or would be due as a result of any actual or constructive termination of a Person’s employment or position following such consummation) and the maximum amount of such payment.

Section 2.13 Compliance with Legal Requirements. The Bank and each of its Subsidiaries hold all material licenses,

certificates, permits, franchises and rights from all appropriate Regulatory Authorities necessary for the conduct of their respective businesses. The Bank and each of its Subsidiaries is, and at all times since January 1, 2014, has been, in

compliance with each material Legal Requirement that is or was applicable to it or to the conduct or operation of its respective businesses or the ownership or use of any of its respective assets. Except for normal examinations conducted by a

Regulatory Authority in the Ordinary Course of Business, no Regulatory Authority has initiated since January 1, 2014, or has pending any proceeding, enforcement action or investigation into the business, disclosures or operations of the Bank or

any Subsidiary. Since January 1, 2014, no Regulatory Authority has resolved any proceeding, enforcement action or investigation into the business, disclosures or operations of the Bank or any Subsidiary. Since January 1, 2014, the Bank and

its Subsidiaries have fully complied with, and there is no unresolved violation, criticism or exception by any Regulatory Authority with respect to, any report or statement relating to any examination or inspection of the Bank or any Subsidiary.

Since January 1, 2014, there have been no formal or informal inquiries by, or disagreements or disputes with, any

10

Regulatory Authority with respect to the business, operations, policies or procedures of the Bank or any Subsidiary (other than normal examinations conducted by a Regulatory Authority in the

Ordinary Course of Business). To the Knowledge of Seller, there has not been any event or occurrence since January 1, 2014, that would result in a determination that the Bank is not an eligible depository institution as defined in 12 C.F.R.

§ 303.2(r).

Section 2.14 Legal Proceedings; Orders.

(a) Since January 1, 2014, there have been, and currently are, no Proceedings or Orders pending, entered into or, to the Knowledge of

Seller, threatened against or affecting the Bank or any Subsidiary or any of their respective assets, businesses, current or former directors or executive officers, or the Contemplated Transactions, that have not been fully satisfied or terminated.

No officer, director, employee or agent of the Bank or Subsidiary is subject to any Order that prohibits such officer, director, employee or agent from engaging in or continuing any conduct, activity or practice relating to the businesses of the

Bank or any Subsidiary as currently conducted.

(b) Neither the Bank nor any of its Subsidiaries: (i) is subject to any cease and

desist or other Order or enforcement action issued by; (ii) is a party to any written agreement, consent agreement or memorandum of understanding with; (iii) is a party to any commitment letter or similar undertaking to; (iv) is

subject to any order or directive by; (v) is subject to any supervisory letter from; (vi) has been ordered to pay any civil money penalty, which has not been paid, by; or (vii) has adopted any policies, procedures or board

resolutions at the request of any Regulatory Authority that currently restricts in any material respect the conduct of its business, in any manner relates to its capital adequacy, restricts its ability to pay dividends or interest or limits in any

material manner its credit or risk management policies, its management or its business. To the Knowledge of Seller, none of the foregoing has been threatened by any Regulatory Authority.

Section 2.15 Absence of Certain Changes and Events. Since December 31, 2015, the Bank and each of its Subsidiaries

have conducted their respective businesses only in the Ordinary Course of Business, and without limiting the foregoing with respect to each, since December 31, 2015, there has not been any:

(a) change in the Seller’s or the Seller’s Subsidiaries’ authorized or issued capital stock; grant of any stock option or right

to purchase shares of their capital stock; issuance of any security convertible into such capital stock or evidences of indebtedness (except in connection with customer deposits); grant of any registration rights; purchase, redemption, retirement or

other acquisition by them of any shares of any such capital stock; or declaration or payment of any dividend or other distribution or payment in respect of shares of their capital stock, except as reflected on Bank Financial Statements;

(b) amendment the Seller’s or the Seller’s Subsidiaries’ articles of incorporation, charter or bylaws or adoption of any

resolutions by their board of directors or shareholders with respect to the same;

11

(c) payment or increase of any bonus, salary or other compensation to any of their shareholders,

directors, officers or employees, except for normal increases in the Ordinary Course of Business or in accordance with any then-existing Employee Benefit Plan, or entry into any employment, consulting, non-competition, change in control, severance

or similar Contract with any shareholder, director, officer or employee, except for the Contemplated Transactions and except for any employment, consulting or similar agreement or arrangement that is not terminable at will or upon thirty

(30) days’ notice or less, without penalty or premium;

(d) adoption, amendment (except for any amendment necessary to comply

with any Legal Requirement or normal annual renewals of benefit programs) or termination of, or increase in the payments to or benefits under, any Employee Benefit Plan;

(e) damage to or destruction or loss of any of their tangible assets or property, whether or not covered by insurance and where the resulting

diminution in value individually or in the aggregate is greater than $25,000;

(f) entry into, termination or extension of, or receipt of

notice of termination of any joint venture or similar agreement pursuant to any Contract or any similar transaction;

(g) except for this

Agreement, and except in the Ordinary Course of Business, entry into any new, or modification, amendment, renewal or extension (through action or inaction) of the terms of any existing, lease, Contract or license that has a term of more than one

year or that involves the payment by the Bank of more than $25,000 in the aggregate;

(h) Bank Loan or commitment to make any Bank Loan

other than in the Ordinary Course of Business;

(i) except as set forth in the Bank’s List of Past Due Credits and Pending Actions,

or except as done it the Ordinary Course of Business, any Bank Loan or commitment to make, renew, extend the term or increase the amount of any Bank Loan to any Person if such Bank Loan or any other Bank Loans to such Person or an Affiliate of such

Person is on the “watch list” or similar internal report of the Bank, or has been classified by the Bank or any Regulatory Authority as “substandard,” “doubtful,” “loss,” or “other loans specially

mentioned” or listed as a “potential problem loan”;

(j) incurrence by them of any known obligation or liability (fixed or

contingent) other than in the Ordinary Course of Business;

(k) sale, lease or other disposition of any of their assets or properties, or

mortgage, pledge or imposition of any lien or other encumbrance upon any of their material assets or properties, except: (i) for Permitted Exceptions; or (ii) as otherwise incurred in the Ordinary Course of Business;

(l) cancellation or waiver by them of any claims or rights with a value in excess of $25,000;

12

(m) any investment by them of a capital nature (e.g., construction of a structure or an addition

to an existing structure on property owned by the Bank or any of its Subsidiaries) individually exceeding $50,000 or in the aggregate exceeding $100,000;

(n) except for the Contemplated Transactions, merger or consolidation with or into any other Person, or acquisition of any stock, equity

interest or business of any other Person;

(o) transaction for the borrowing or loaning of monies, or any increase in any outstanding

indebtedness, other than in the Ordinary Course of Business;

(p) material change in any policies and practices with respect to liquidity

management and cash flow planning, marketing, deposit origination, lending, budgeting, profit and Tax planning, accounting or any other material aspect of their business or operations, except for such changes as may be required in the opinion of the

management of Seller or its Subsidiaries, as applicable, to respond to then-current market or economic conditions or as may be required by any Regulatory Authorities or Legal Requirement;

(q) filing of any applications for additional branches, opening of any new office or branch, closing of any current office or branch, or

relocation of operations from existing locations;

(r) discharge or satisfaction of any material lien or encumbrance on their assets or

repayment of any material indebtedness for borrowed money, except for obligations incurred and repaid in the Ordinary Course of Business;

(s) entry into any Contract or agreement to buy, sell, exchange or otherwise deal in any assets or series of assets, including any investment

securities, but excluding OREO, individually or in the aggregate in excess of $25,000, except for the pledging of collateral to secure public funds or entry into any repurchase agreements in the Ordinary Course of Business;

(t) purchase or other acquisition of any investments, direct or indirect, in any derivative securities, financial futures or commodities or

entry into any interest rate swap, floors and option agreements, or other similar interest rate management agreements, other than in the Ordinary Course of Business;

(u) hiring of any employee with an annual salary in excess of $50,000 which employment is not terminable at will or upon thirty

(30) days’ notice or less, without penalty or premium;

(v) agreement, whether oral or written, by it to do any of the

foregoing; or

(w) to the Knowledge of Seller, event or events that have had or would reasonably be expected to have, either individually

or in the aggregate, a Material Adverse Effect on the Bank.

Section 2.16 Material Contracts. Except for Contracts

evidencing Bank Loans made by the Bank in the Ordinary Course of Business, Section 2.16 of Seller Disclosure

13

Schedules lists or describes the following with respect to the Bank and each of its Subsidiaries (each such agreement or document, a “Material Contract”), true, complete and

correct copies of each of which have been delivered or made available to Purchaser:

(a) all loan and credit agreements, conditional sales

Contracts or other title retention agreements or security agreements relating to money borrowed by it, exclusive of deposit agreements with customers of the Bank entered into in the Ordinary Course of Business, agreements for the purchase of federal

funds and repurchase agreements and Federal Home Loan Bank advances;

(b) each Contract that involves performance of services or delivery

of goods or materials by it of an amount or value in excess of $25,000;

(c) each Contract that was not entered into in the Ordinary

Course of Business and that involves expenditures or receipts by it in excess of $25,000;

(d) each Contract not referred to elsewhere in

this Section 2.16 that relates to the future purchase of goods or services that materially exceeds the requirements of its business at current levels or for normal operating purposes;

(e) each lease, rental, license, installment and conditional sale agreement and other Contract affecting the ownership of, leasing of, title

to or use of, any personal property (except personal property leases and installment and conditional sales agreements having aggregate payments of less than $15,000);

(f) each licensing agreement or other Contract with respect to patents, trademarks, copyrights, or other intellectual property, including

agreements with current or former employees, consultants or contractors regarding the appropriation or the nondisclosure of any of its intellectual property;

(g) each collective bargaining agreement and other Contract to or with any labor union or other employee representative of a group of

employees;

(h) each joint venture, partnership and other Contract (however named) involving a sharing of profits, losses, costs or

liabilities by it with any other Person;

(i) each Contract containing covenants that in any way purport to restrict, in any material

respect, the business activity of Seller or its Subsidiaries or limit, in any material respect, the ability of Seller or its subsidiaries to engage in any line of business or to compete with any Person;

(j) each Contract providing for payments to or by any Person based on sales, purchases or profits, other than direct payments for goods;

(k) each employment agreement, consulting agreement, non-competition, severance or change in control agreement or similar arrangement or plan

providing for payments in excess of $25,000;

14

(l) each Contract entered into other than in the Ordinary Course of Business that contains or

provides for an express undertaking by the Bank to be responsible for consequential damages;

(m) each Contract for capital expenditures

in excess of $25,000;

(n) each warranty, guaranty or other similar undertaking with respect to contractual performance extended by the

Bank or any Subsidiary other than in the Ordinary Course of Business;

(o) any Contract in which Seller is a party that requires consent

or approval by another Person for Seller to enter into this Agreement or to consummate the Contemplated Transactions; and

(p) each

amendment, supplement and modification in respect of any of the foregoing.

Section 2.17 No Defaults. Each Material

Contract is in full force and effect and is valid and enforceable in accordance with its terms, except as such enforcement may be limited by bankruptcy, insolvency, reorganization or other Legal Requirements affecting creditors’ rights

generally and subject to general principles of equity. To the Knowledge of the Seller, no event has occurred or circumstance exists that (with or without notice or lapse of time) may contravene, conflict with or result in a violation or breach of,

or give the Bank, any Subsidiary or other Person the right to declare a default or exercise any remedy under, or to accelerate the maturity or performance of, or to cancel, terminate or modify, any Material Contract. Except in the Ordinary Course of

Business with respect to any Bank Loan, neither the Bank nor any of its Subsidiaries has given to or received from any other Person, at any time since January 1, 2013, any notice or other communication (whether oral or written) regarding any

actual, alleged, possible or potential violation or breach of, or default under, any Material Contract, that has not been terminated or satisfied prior to the date of this Agreement. Other than in the Ordinary Course of Business, there are no

renegotiations of, attempts to renegotiate or outstanding rights to renegotiate, any material amounts paid or payable to the Bank or any of its Subsidiaries under current or completed Material Contracts with any Person, and no such Person has made

written demand for such renegotiation.

Section 2.18 Insurance. Section 2.18 of Seller Disclosure Schedules

lists all insurance policies and bonds owned or held by Seller or the Seller Subsidiaries with respect to business, operations, properties or assets (including bankers’ blanket bond but excluding insurance providing benefits for employees) of

the Bank and its Subsidiaries, true, complete and correct copies of each of which have been made available to Purchaser. The Seller Subsidiaries are insured with reputable insurers against such risks and in such amounts as the management of Seller

reasonably has determined to be prudent and consistent with industry practice. Seller and the Seller Subsidiaries, as applicable, are in compliance in all material respects with such insurance policies and are not in default under any of the terms

thereof. Each such policy is outstanding and in full force and effect and, except for policies insuring against potential

15

liabilities of officers, directors and employees of the Seller Subsidiaries, the relevant Seller Subsidiary thereof is the sole beneficiary of such policies. All premiums and other

payments due under any such policy have been paid, and all claims thereunder have been filed in due and timely fashion. Section 2.18 of Seller Disclosure Schedules lists and briefly describes all claims that have been filed under such

insurance policies and bonds within the past five (5) years prior to the date of this Agreement that individually or in the aggregate exceed $25,000 and the current status of such claims. All such claims have been filed in due and timely

fashion. None of Seller or any of its Subsidiaries has had any insurance policy or bond cancelled or nonrenewed by the issuer of the policy or bond within the past five (5) years.

Section 2.19 Compliance with Environmental Laws. There are no actions, suits, investigations, liabilities, inquiries,

Proceedings or Orders involving the Bank or any of its Subsidiaries or any of their respective assets that are pending or, to the Knowledge of Seller, threatened, nor, to the Knowledge of Seller, is there any factual basis for any of the foregoing,

as a result of any asserted failure of the Bank or any of its Subsidiaries of, or any predecessor thereof, to comply with any Environmental Law. No environmental clearances are required for the conduct of the business of the Bank or the any of

its Subsidiaries or the consummation of the Contemplated Transactions. To the Knowledge of Seller, neither the Bank nor any of its Subsidiaries is the owner of any interest in real estate on which any substances have been generated, used, stored,

deposited, treated, recycled or disposed of, which substances if known to be present on, at or under such property, would require notification to any Regulatory Authority, clean up, removal or some other remedial action under any Environmental Law

at such property or any impacted adjacent or down gradient property. To the Knowledge of Seller, the Bank and its Subsidiaries have complied in all respects with all Environmental Laws applicable to it and its business operations.

Section 2.20 Transactions with Affiliates. No officer or director of Seller or any of its Subsidiaries, any Immediate

Family Member of any such Person, and no entity that any such Person “controls” within the meaning of Regulation O of the Federal Reserve has (a) any Bank Loan or any other agreement with Seller or any of its Subsidiaries or

(b) any interest in any material property, real, personal or mixed, tangible or intangible, used in or pertaining to, the business of Seller or any of its Subsidiaries.

Section 2.21 Brokerage Commissions. None of Seller or its Subsidiaries, or any of their respective Representatives, has

incurred any obligation or liability, contingent or otherwise, for brokerage or finders’ fees or agents’ commissions or other similar payment in connection with this Agreement.

Section 2.22 Approval Delays. To the Knowledge of Seller, there is no reason why the granting of any of the Requisite

Regulatory Approvals would be denied or unduly delayed. The Bank’s most recent CRA rating was “satisfactory” or better.

16

Section 2.23 Labor Matters.

(a) There are no collective bargaining agreements or other labor union Contracts applicable to any employees of the Bank or any of its

Subsidiaries. There is no labor dispute, strike, work stoppage or lockout, or, to the Knowledge of Seller, threat thereof, by or with respect to any employees of the Bank or any of its Subsidiaries, and there has been no labor dispute, strike, work

stoppage or lockout in the previous three (3) years. There are no organizational efforts with respect to the formation of a collective bargaining unit presently being made, or to the Knowledge of Seller, threatened, involving employees of the

Bank or any of its Subsidiaries. Neither the Bank nor any of its Subsidiaries has engaged or is engaging in any unfair labor practice. The Bank and its Subsidiaries are in compliance with all applicable Legal Requirements respecting employment and

employment practices, terms and conditions of employment, wages, hours of work and occupational safety and health. No Proceeding asserting that the Bank or any of its Subsidiaries has committed an unfair labor practice (within the meaning of the

National Labor Relations Act of 1935) or seeking to compel the Bank or any of its Subsidiaries to bargain with any labor organization as to wages or conditions of employment is pending or, to the Knowledge of Seller, threatened with respect to the

Bank or any of its Subsidiaries before the National Labor Relations Board, the Equal Employment Opportunity Commission or any other Regulatory Authority.

(b) Neither the Bank nor any of its Subsidiaries is a party to, or otherwise bound by, any consent decree with, or citation by, any Regulatory

Authority relating to employees or employment practices. None of the Bank or any of its Subsidiaries or any of its or their executive officers has received within the past three (3) years any written notice of intent by any Regulatory Authority

responsible for the enforcement of labor or employment laws to conduct an investigation relating to the Bank or any of its Subsidiaries and no such investigation is in progress.

Section 2.24 Intellectual Property. Each of the Bank and its Subsidiaries has the unrestricted right and authority, and

will have the unrestricted right and authority from and after the Effective Time, to use all patents, trademarks, copyrights, service marks, trade names or other intellectual property as is necessary to enable them to conduct and to continue to

conduct all material phases of the businesses of the Bank and its Subsidiaries in the manner presently conducted by them, and, to the Knowledge of Seller, such use does not, and will not, conflict with, infringe on or violate any patent, trademark,

copyright, service mark, trade name or any other intellectual property right of any Person.

Section 2.25

Investments.

(a) Section 2.25(a) of Seller Disclosure Schedules includes a complete and correct list and

description as of March 28, 2016, of: (i) all investment and debt securities, mortgage-backed and related securities, marketable equity securities and securities purchased under agreements to resell that are owned by the Bank or any of its

Subsidiaries, other than, with respect to the Bank, in a fiduciary or agency capacity (the “Investment Securities”);

17

and (ii) any such Investment Securities that are pledged as collateral to another Person. The Bank and its Subsidiaries has good and marketable title to all Investment

Securities held by it, free and clear of any liens, mortgages, security interests, encumbrances or charges, except for Permitted Exceptions and except to the extent such Investment Securities are pledged in the Ordinary Course of Business consistent

with prudent banking practices to secure obligations of the Bank or any of its Subsidiaries. The Investment Securities are valued on the books of the Bank and its Subsidiaries in accordance with GAAP.

(b) Except as may be imposed by applicable securities laws and restrictions that may exist for securities that are classified as “held to

maturity,” none of the Investment Securities is subject to any restriction, whether contractual or statutory, that materially impairs the ability of the Bank or any of its Subsidiaries to dispose of such investment at any time. With respect to

all material repurchase agreements to which the Bank or any of its Subsidiaries is a party, the Bank or any of its Subsidiaries, as the case may be, has a valid, perfected first lien or security interest in the securities or other collateral

securing each such repurchase agreement, and the value of the collateral securing each such repurchase agreement equals or exceeds the amount of the debt secured by such collateral under such agreement.

(c) None of the Bank or any of its Subsidiaries has sold or otherwise disposed of any Investment Securities in a transaction in which the

acquiror of such Investment Securities or other person has the right, either conditionally or absolutely, to require the Bank or any of its Subsidiaries to repurchase or otherwise reacquire any such Investment Securities.

(d) There are no interest rate swaps, caps, floors, option agreements or other interest rate risk management arrangements to which the Bank or

any of its Subsidiaries is bound.

Section 2.26 Accuracy of Information Furnished; Only Representations. Neither any

representation nor warranty of Seller in, nor any Seller Disclosure Schedule to, this Agreement contains any untrue statement of a material fact, or omits to state a material fact necessary to make the statements contained herein or therein, in

light of the circumstances under which they were made, not misleading. No notice given pursuant to Section 4.3 will contain any untrue statement or omit to state a material fact necessary to make the statements therein or in this

Agreement, in light of the circumstances under which they were made, not misleading. Except for the representations and warranties contained in this Article II (including the related portions of the Seller Disclosure Schedules), neither

Seller nor any other Person has made or makes any other express or implied representation or warranty, either written or oral, on behalf of Seller or any of the Seller Subsidiaries, including any representation or warranty as to the accuracy or

completeness of any information regarding the Bank or any of its Subsidiaries furnished or made available to Purchaser and its Representatives and any information, documents or material made available to Purchaser in due diligence, management

presentations or in any other form in expectation of the transactions contemplated hereby or as to the future revenue, profitability or success of the Bank or any of its Subsidiaries, or any representation or warranty arising from statute or

otherwise in law.

18

ARTICLE 3

REPRESENTATIONS AND WARRANTIES OF PURCHASER

Except as Previously Disclosed, Purchaser hereby represents and warrants to Seller as follows, as of the date of this Agreement:

Section 3.1 Organization. Purchaser: (a) is a corporation duly organized, validly existing and in good standing under

the laws of the State of Delaware and is also in good standing in each other jurisdiction in which the nature of the business conducted or the properties or assets owned or leased by it makes such qualification necessary, except where the failure to

be so qualified and in good standing would not have a Material Adverse Effect on Purchaser; (b) is registered with the Federal Reserve as a financial holding company under the federal Gramm-Leach-Bliley Act; and (c) has full power and

authority, corporate and otherwise, to operate as a bank holding company and to own, operate and lease its properties as presently owned, operated and leased, and to carry on its business as it is now being conducted. The copies of the Purchaser

Certificate of Incorporation and the Purchaser Bylaws and all amendments thereto set forth in the Purchaser SEC Reports are true, complete and correct, and in full force and effect as of the date of this Agreement. Purchaser has no Subsidiaries

other than as set forth in the Purchaser SEC Reports.

Section 3.2 Authorization; Enforceability. Purchaser has

the requisite corporate power and authority to enter into and perform its obligations under this Agreement. The execution, delivery and performance of this Agreement by Purchaser, and the consummation by it of its obligations under this Agreement,

have been authorized by all necessary corporate action, and, subject to the receipt of the Requisite Regulatory Approvals, this Agreement constitutes a legal, valid and binding obligation of Purchaser enforceable in accordance with its terms, except

as such enforcement may be limited by bankruptcy, insolvency, reorganization or other Legal Requirements affecting creditors’ rights generally and subject to general principles of equity.

Section 3.3 No Conflict. Neither the execution nor delivery of this Agreement nor the consummation or performance of any of