ROUGE RESOURCES LTD.

LISTING APPLICATION FOR COMMON SHARES

April 25, 2012

No Securities Regulatory Authority or the TSX Venture Exchange has expressed an opinion about the securities which are the subject of this application.

| TABLE OF CONTENTS | |

| PAGE | |

| TABLE OF CONTENTS | I |

| GLOSSARY OF DEFINED TERMS | II |

| SUMMARY OF LISTING APPLICATION | VI |

| ITEM 4: CORPORATE STRUCTURE | 1 |

| ITEM 5: DESCRIPTION OF THE BUSINESS | 1 |

| ITEM 6: FINANCINGS | 23 |

| ITEM 7: DIVIDENDS OR DISTRIBUTIONS | 26 |

| ITEM 8: MANAGEMENT’S DISCUSSION AND ANALYSIS | 26 |

| ITEM 9: DISCLOSURE OF OUTSTANDING SECURITY DATA ON FULLY DILUTED BASIS | 27 |

| ITEM 10: DESCRIPTION OF SECURITIES TO BE LISTED | 27 |

| ITEM 11: CAPITALIZATION | 28 |

| ITEM 12: STOCK OPTION PLAN | 28 |

| ITEM 13: PRIOR SALES | 29 |

| ITEM 14: ESCROWED SECURITIES AND SECURITIES SUBJECT TO RESTRICTION ON TRANSFER | 30 |

| ITEM 15: PRINCIPAL SECURITY HOLDERS | 31 |

| ITEM 16: DIRECTORS AND EXECUTIVE OFFICERS | 31 |

| ITEM 17: EXECUTIVE COMPENSATION | 37 |

| ITEM 18: INDEBTEDNESS OF DIRECTORS AND OFFICERS | 41 |

| ITEM 19: AUDIT COMMITTEE AND CORPORATE GOVERNANCE | 41 |

| ITEM 21: RISK FACTORS | 44 |

| ITEM 22: PROMOTERS | 48 |

| ITEM 23: LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 48 |

| ITEM 24: INTERESTS OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 49 |

| ITEM 25: INVESTOR RELATIONS ARRANGEMENTS | 49 |

| ITEM 26: AUDITORS, TRANSFER AGENTS AND REGISTRARS | 49 |

| ITEM 27: MATERIAL CONTRACTS | 49 |

| ITEM 28: EXPERTS | 49 |

| ITEM 29: OTHER MATERIAL FACTS | 50 |

| ITEM 30: ADDITIONAL INFORMATION – MINING APPLICANTS | 50 |

| ITEM 31: EXEMPTIONS | 50 |

| ITEM 32: FINANCIAL STATEMENT DISCLOSURE FOR ISSUERS | 50 |

| ITEM 33: SIGNIFICANT ACQUISITIONS | 50 |

| CERTIFICATE OF ROUGE RESOURCES LTD | 51 |

| ACKNOWLEDGEMENT – PERSONAL INFORMATION | 52 |

| APPENDIX “A” – FORM 2B PERSONAL INFORMATION COLLECTION POLICY | 53 |

| APPENDIX “B” – AUDIT COMMITTEE CHARTER | 54 |

II

GLOSSARY OF DEFINED TERMS

The following is a glossary of certain definitions used in this Listing Application. Terms and abbreviations used in the Issuer’s financial statements included as schedules to this Listing Application are defined separately and the terms and abbreviations defined below are not used therein, except where otherwise indicated. Words importing the singular, where the context requires, include the plural and vice versa and words importing any gender include all genders. All dollar amounts referred to in this Listing Application are in Canadian dollars, unless otherwise stated.

“Affiliate” means a company that is affiliated with another company as described below. A company is an “Affiliate” of another company if (a) one of them is the subsidiary of the other, or (b) each of them is controlled by the same Person. A company is “controlled” by a Person if (a) voting securities of a company are held, other than by way of security only, by or for the benefit of that Person, and (b) the voting securities, if voted, entitle the Person to elect a majority of the directors of a company. A Person beneficially owns securities that are beneficially owned by (a) a company controlled by that Person, or (b) an Affiliate of that Person or an Affiliate of any company controlled by that Person;

“Agency Agreement” means the agency agreement dated January 10, 2012 between the Agent and the Issuer;

“Agent” means Canaccord Genuity Corp.;

“Agent’s Commission” has the meaning set out in Item 6: Financings;

“Associate” when used to indicate a relationship with a Person, means (a) an issuer of which the Person beneficially owns or controls, directly or indirectly, voting securities entitling the holder to more than 10% of the voting rights attached to all outstanding voting securities of the issuer, (b) any partner of the Person, (c) any trust or estate in which the Person has a substantial beneficial interest or in respect of which the Person serves as trustee or in a similar capacity, (d) in the case of a Person who is an individual, (i) that Person’s spouse or child, or (ii) any relative of that Person or of that Person’s spouse who has the same residence as that Person; but (e) where the Exchange determines that two Persons shall, or shall not, be deemed to be associates with respect to a Member firm, Member corporation or holding company of a Member corporation, then such determination shall be determinative of their relationship in the application of Rule D of the Exchange with respect to that Member firm, Member corporation or holding company;

“Brokered Offering” means the brokered private placement of up to 4,000,000 Units at a price of $0.25 per unit each unit comprised of one Share and one transferable share purchase warrant;

“Closing Date” means the date closing of the Brokered Offering and Non-Brokered Offering occurs;

“Company” unless specifically indicated otherwise, means a corporation, incorporated association or organization, body corporate, partnership, trust, association or other entity other than an individual;

“Control Person” means any Person that holds or is one of a combination of Persons that holds a sufficient number of any of the securities of an issuer so as to affect materially the control of that issuer, or that holds more than 20% of the outstanding voting securities of an issuer except where there is evidence showing that the holder of those securities does not materially affect the control of the issuer;

“Corporate Finance Fee” has the meaning set out in Item 6: Financings;

III

“Dotted Lake Property” means the Original Dotted Lake Property and the Lampson Lake Property as described in the Technical Report;

“Exchange” means the TSX Venture Exchange Inc.;

“Existing Warrants” means the 30,000,000 share purchase warrants of the Issuer currently outstanding, each warrant entitling the holder to acquire one Share at a price of $0.10 per share until April 30, 2012;

“Final Exchange Bulletin” means the bulletin issued by the Exchange following the submission of all documentation required by the Exchange and which evidences the final Exchange acceptance of the Listing;

“Governmental Entity” means any: (i) national, federal, provincial, state, regional, municipal, local or other government, governmental or public department, central bank, court, tribunal, arbitral body, commission, board, bureau or agency, domestic or foreign; (ii) subdivision, agent, commission, board or authority of any of the foregoing; or (iii) quasi-governmental or private body exercising any regulatory, expropriation or taxing authority under or for the account of any of the foregoing;

“Insider” if used in relation to an issuer, means: (a) a director or senior officer of the issuer; (b) a director or senior officer of a company that is an Insider or subsidiary of the issuer; (c) a Person that beneficially owns or controls, directly or indirectly, voting shares carrying more than 10% of the voting rights attached to all outstanding voting shares of the issuer; or (d) the issuer itself if it holds any of its own securities;

“Issuer” means Rouge Resources Ltd;

“Lampson Lake Property” means the property described under claim numbers 4246254 and 4245668 located in the Thunder Bay Mining Division, Ontario;

“Listing” means the listing of the Shares for trading on the Exchange as a Tier 2 Mining Issuer;

“Member” means a Person who has executed the Members’ Agreement, as amended from time to time, and is accepted as and becomes a member of the Exchange under the Exchange requirements;

“Members’ Agreement” means the members’ agreement among the Exchange and each Person who, from time to time, is accepted as and becomes a member of the Exchange;

“MNDM” means the Ontario Ministry of Northern Development and Mines;

“NI 43-101” means National Instrument 43-101 (Standards of Disclosure for Mineral Projects);

“Non-Brokered Offering” means the non brokered private placement of up to 800,000 units at a price of $0.25 per unit, each unit comprised of one Share and one transferable share purchase warrant;

“Option” means the right to acquire the Lampson Lake Property pursuant to the terms of the Option Agreement;

“Option Agreement” means the option agreement dated April 20, 2010 entered into between the Issuer and certain Ontario prospectors pursuant to which the Issuer acquired the right to acquire the Lampson Lake Property;

IV

“Original Dotted Lake Property” means the property described under claim numbers 3011450, 4252412, 4252413, 4252414, 4252415, 4252416, 4252417, 4252418, 4252419 and 4252420 located in the Thunder Bay Mining Division, Ontario;

“Person” includes any individual, firm, partnership, joint venture, venture capital fund, limited liability company, unlimited liability company, association, trust, trustee, executor, administrator, legal personal representative, estate, group, body corporate, corporation, unincorporated association or organization, Governmental Entity, syndicate or other entity, whether or not having legal status;

“Promoter” means (a) a Person who, acting alone or in conjunction with one or more other Persons, directly or indirectly, takes the initiative in founding, organizing or substantially reorganizing the business of an issuer, or (b) a Person who, in connection with the founding, organizing or substantial reorganizing of the business of an issuer, directly or indirectly, receives in consideration of services or property, or both services and property, 10% or more of any class of securities of the issuer or 10% or more of the proceeds from the sale of any class of securities of a particular issue, but a Person who receives such securities or proceeds either solely as underwriting commissions or solely in consideration of property shall not be deemed a promoter within the meaning of this definition if such Person does not otherwise take part in founding, organizing, or substantially reorganizing the business;

“Shares” means common shares in the capital of the Issuer;

“Stock Option Plan” means the stock option plan of the Issuer currently in effect;

“Technical Report” means the report titled “Independent Technical Report, Dotted Lake Property” as prepared by Michael Thompson, H.B.Sc., P.Geo. and Caitlin Jeffs, H.B.Sc., P.Geo., of Fladgate Exploration Consulting Corporation of Thunder Bay Ontario, dated September 7, 2010 and revised on November 30, 2010;

“Unit” means a unit of the Issuer, comprised of one Share and one Unit Warrant;

“Unit Warrant” means the share purchase warrant of the Issuer comprising part of the Unit with each Unit Warrant entitling the holder thereof to acquire one Unit Warrant Share at an exercise price of $0.40 at any time during the 12 month period after the Closing Date;

“Unit Warrant Share” means the Share issuable upon the exercise of a Unit Warrant;

“Warrant Indenture” means warrant indenture entered into between the Issuer and Computershare Trust Company of Canada to be dated the Closing Date, and which sets out the terms and conditions governing the Unit Warrants;

“Work Program” means the proposed exploration and work program on the Dotted Lake Property, as described in the Technical Report.

V

FORWARD LOOKING STATEMENTS

Certain statements contained in this Listing Application constitute forward-looking statements. The use of any of the words “anticipate”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “should”, “believe” and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. These statements are current only as of the date of this Listing Application or as of the date specified in the documents incorporated by reference into this Listing Application, as the case may be.

The forward-looking information contained in this Listing Application is based on a number of assumptions that may prove to be incorrect, including, but not limited to, assumptions about general business and economic conditions, changes in financial markets generally, the Issuer’s ability to attract and retain skilled staff, and the Issuer’s planned exploration expenditure and capital expenditure program. Although the Issuer has attempted to identify material factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Actual results could differ materially from those anticipated in these forward-looking statements as a result of the risk factors set forth below and elsewhere in this Listing Application:

-

liabilities inherent in the Issuer’s exploration and potential mining operations;

-

uncertainties associated with estimated market demand and sector activity levels;

-

competition for, among other things, capital, acquisitions and skilled personnel;

-

fluctuations in interest rates and stock market volatility; and

-

other factors discussed under “Risk Factors”.

Readers are cautioned that the foregoing lists of factors are not exhaustive. The forward-looking statements contained in this Listing Application are expressly qualified by this cautionary statement. Except as required under applicable securities laws, the Issuer does not undertake any obligation to publicly update or revise any forward-looking statements.

DATE OF INFORMATION

Except as otherwise indicated in this Listing Application, all information disclosed in this Listing Application is as of April 25, 2012 and the phrase "as of the date hereof" and equivalent phrases refer to April 25, 2012.

VI

SUMMARY OF LISTING APPLICATION

The following is a summary of the principal features of this Listing Application and should be read together with the more detailed information and financial data and statements contained elsewhere in this Listing Application.

|

Issuer: |

Rouge Resources Ltd. |

|

|

|

|

Business of the Issuer: |

The Issuer is a mineral exploration company focused on the exploration of mineral properties, primarily in Canada. The Issuer’s only property is the Dotted Lake Property, located in north-central Ontario. The Issuer holds a 100% interest in the Original Dotted Lake Property. The Issuer has entered into an option agreement to acquire a 100% interest in the Lampson Lake Property, subject to certain royalties. See Item 5 - “Description of the Business”. |

|

|

|

|

The Issuer’s Listing Application |

The Issuer’s Shares are quoted on the OTCQB operated by OTC Markets Group, Inc. in the United States under the trading symbol “ROUGF”. The last trading price quoted for the Shares on April 17, 2012 (the last day prior to the date of this Listing Application that the Shares traded) was $0.50. This Listing Application has been written to apply for the Shares to be listed on the Exchange. Listing is subject to the Issuer fulfilling all of the requirements of the Exchange, including various financial and distribution requirements. See Item 10 - “Description of Securities to be Listed”. |

VII

|

Use of Proceeds: |

The maximum net proceeds to be received by the Issuer from the Brokered Offering after deduction of the Agent’s Commission and the maximum proceeds from the Non- Brokered Offering would total $1,130,000. After deduction of the Issuer’s working capital deficiency of approximately $339,923 as at March 31, 2012, the Issuer will have available funds of approximately $790,077, which is proposed to be used as follows: |

|

Item |

|

Cost |

|

|

To pay for the remaining costs of listing including legal and audit expenses, expenses of the Agent and regulatory fees |

$ |

61,500 |

|

|

To pay the Corporate Finance Fee (plus HST) (1) |

$ |

33,600 |

|

|

To pay the second and third option payment on the Lampson Lake claims (2) |

$ |

41,000 |

|

|

To fund phase one of the Work Program on the Dotted Lake Property as recommended in the Technical Report (2) |

$ |

226,600 |

|

|

To provide a reserve for the Issuer’s operating expenses for the ensuing twelve month period (3) |

$ |

197,000 |

|

|

To unallocated working capital (4) |

$ |

230,377 |

|

|

Total: |

$ |

790,077 |

|

| (1) |

See Item 6 “Financings” | |

| (2) |

See Item 5 “Description of the Business”. | |

| (3) |

Comprised of accounting and audit fees of $37,000/year, management fees of $60,000/year, rent of $30,000/year, office and general of $26,000/year, professional fees of $19,000/year, transfer agent and filing fees of $16,000/year and travel and promotion of $9,000/year. | |

| (4) |

Assuming that the maximum amount is sold under the Brokered and Non- Brokered Offerings. This amount must not be less than $100,000 as required by the initial listing requirements of the Exchange. |

The Issuer’s working capital deficiency of $339,923 includes a loan of $265,283 advanced by a director of the Issuer. The Issuer expects to repay the loan upon completion of the Brokered Offering and Non-Brokered Offering. The loan is currently non-interest bearing, unsecured, and with no fixed terms of repayment.

See Item 6 - “Financings”.

| VIII | |

|

|

|

|

Summary Financial Information: |

The selected financial information set out below is based on and derived from the audited financial statements and notes for the Issuer’s years ended January 31, 2011 and January 31, 2010 and the interim unaudited financial statements and notes for the nine months ended October 31, 2011 and should be read in conjunction with such financial statements which are included by reference in this Listing Application. See Item 32 - “Financial Statement Disclosure for Issuers”. |

| As At | As At | As At | |||||||

| Quarter Ended | Year Ended | Year Ended | |||||||

| October 31, 2011 | January 31, 2011 | January 31, 2010 | |||||||

| Statements of Financial Position | (unaudited) | (audited) | (audited) | ||||||

| Cash and Cash Equivalents | $ | 54,991 | $ | 144,952 | $ | 53,623 | |||

| Total Assets | $ | 283,854 | $ | 364,036 | $ | 169,424 | |||

| Total Liabilities | $ | 309,464 | $ | 193,436 | $ | 1,140,457 | |||

| Accumulated Deficit | ($3,189,763 | ) | ($2,993,553 | ) | ($2,737,861 | ) | |||

| Total Shareholders’ (Deficiency) Equity | ($25,610 | ) | $ | 170,600 | ($971,033 | ) | |||

| Nine Months | Year | Year | |||||||

| Ended | Ended | Ended | |||||||

| October 31, 2011 | January 31, 2011 | January 31, 2010 | |||||||

| Statements of Loss and Comprehensive Loss | (unaudited) | (audited) | (audited) | ||||||

| Revenue | $ | Nil | $ | Nil | $ | Nil | |||

| Total Expenses | $ | 196,210 | $ | 255,692 | $ | 170,603 | |||

| Other Item – A/P written off | $ | Nil | $ | Nil | $ | 51,681 | |||

| Net and Comprehensive Loss | ($196,210 | ) | ($255,692 | ) | ($118,922 | ) |

| Directors and Officers: | The directors and executive officers of the Issuer are: | |

| Linda J. Smith | President, Chief Executive Officer and Director | |

| Darcy T. Krell | Secretary, General Manager and Director | |

| J. Ronald McGregor | Chief Financial Officer and Director | |

| Brian A Lueck | Director | |

| Mark H. Holden | Director | |

| Steven J. Chan | Director | |

| James O. Burns | Director | |

| See Item 16 – “Directors and Executive Officers” | ||

IX

Risk Factors:

An investment in the Shares should be considered highly speculative due to the nature of the Issuer’s business is subject to a number of risks and uncertainties. The Issuer has a history of financial losses. Its inability to achieve profitability will negatively impact any investment in the Shares. The Issuer has limited financial resources and no source of operating cash flow. If it is unable to generate revenue, its business may fail. Very few mineral properties are ultimately developed into producing mines. If the Issuer is unable to prove that a mineral reserve exists on its mineral property interests, its business may fail. The Issuer’s ability to continue as a going concern is dependent on future financing. If the Issuer does not obtain additional financing, its business will fail. Mineral exploration involves a high degree of risk against which the Issuer is not currently insured. If an environmental liability was incurred, it may irreparably harm its business. If title to the Issuer’s mineral property interests is disputed, it may lose its business assets and its business may fail. The Issuer may require permits and licenses that it may not be able to obtain. If it is unable to obtain such permits and licenses, its business plan will fail. Mineral prices fluctuate widely. A decrease in mineral prices may prevent the Issuer from raising the capital necessary to continue the Issuer’s business plan in the future. As well, low mineral prices will reduce the value of any reserve the Issuer discovers on its mineral property interests. The resource industry is very competitive. The competitive nature of the business may increase the Issuer’s cost of operations and prevent it from obtaining interests in additional mineral properties. In conducting exploration on its mineral property interests, the Issuer will be subject to environmental regulations. In addition, its operations may be adversely affected by changes in environmental regulations. A significant change in such regulations may prevent the Issuer from proceeding with its business plan. The Issuer relies on the technical and financial skills and contributions of its management team, the loss of any one of which may adversely impact the Issuer’s business. Some of the Issuer’s directors are or will be directors of other companies, which could result in conflicts of interest.

See Item 21 “Risk Factors”.

Item 4: Corporate Structure

Name, Address and Incorporation

The Issuer was incorporated under the name “Gemstar Resources Ltd.” on March 31, 1988 pursuant to the provisions of the Company Act (British Columbia). In March 2006, the Issuer was transitioned to the Business Corporations Act (British Columbia). On March 25, 2008, the Issuer announced a change in its name to “Rouge Resources Ltd.”, consolidation of its outstanding share capital on a one new for ten old (1:10) share basis and an increase in its authorized share capital from 10 million shares without par value to an unlimited number of shares without par value. The Issuer’s registered office is located at 203 - 409 Granville Street, Vancouver, BC V6C 1T2 and its head office is located at 220 Decourcy Drive, Gabriola Island, BC V0R 1X0.

The Issuer has been a reporting issuer in British Columbia and Alberta since April 3, 1989 and became a foreign issuer in the United States pursuant to filings with the US Securities and Exchange Commission on or about November 15, 2003. The Issuer’s Shares are quoted on the OTCQB operated by OTC Markets Group, Inc. in the United States under the trading symbol “ROUGF”.

Item 5: Description of the Business

General

The Issuer is a mineral exploration company focused on the exploration of certain mining claims located in the Thunder Bay Mining District of North Central Ontario, Canada, called the Dotted Lake Property. The Dotted Lake Property has been the only focus of the Issuer’s exploration activities to date.

Three Year History

The material events in the development of the Issuer’s current business over the last three completed financial years to the date of this Listing Application are summarized as follows:

-

In March 2008, the Issuer consolidated its share capital on a 10 for 1 basis and changed its name from Gemstar Resources Ltd. to Rouge Resources Ltd.

-

In May 2008, the Issuer hired Caitlin Jeffs, P.Geo, of Fladgate Exploration Consulting Corporation as consulting geologist to conduct a soil sampling program on the Dotted Lake Property.

-

On August 5, 2008, Caitlin Jeffs, P.Geo completed an internal report of the results of the Issuer’s soil sampling program, indicating the possibility of both anomalous gold and anomalous zinc mineralization in two of the 47 samples collected and analyzed during the program.

-

On December 24, 2008, the Issuer announced the closing of a non-brokered private placement of 10,000,000 units at $0.05 per unit for gross proceeds of $500,000 before share issue costs. Each unit was comprised of one Share of the Issuer and one additional non-transferable share purchase warrant, each warrant entitling the holder to acquire one additional Share of the Issuer at a price of $0.10 per share for two years from the date of closing. Proceeds of the private placement were used for exploration expenditures on the Issuer’s property, operating expenses and general working capital purposes.

2

-

In October 2009, the Issuer expanded its holdings in the Dotted Lake Property to a 100% interest in a total of ten claims of 82 units by staking. Shortly thereafter, the Issuer commenced a new soil sampling program in accordance with the report dated August 5, 2008.

-

On May 13, 2010, the Issuer announced the closing of a non-brokered private placement of 30,000,000 units at a price of $0.05 per unit for gross proceeds of $1,500,000 before share issue costs. Each unit was comprised of one Share of the Issuer and one non-transferable share purchase warrant, each warrant entitling the holder to acquire one additional Share of the Issuer at a price of $0.10 per share for two years from the date of closing. Proceeds of the private placement were used for repayment of related party loans, exploration expenditures on the Original Dotted Lake Property, on-going operating expenses and general working capital purposes.

-

On April 20, 2010, the Issuer entered into an Option Agreement with certain Ontario prospectors to acquire a 100% undivided interest in the Lampson Lake Property, subject to certain royalty interests when and if future revenue is generated. Exercise of the Option requires the Issuer to pay a total of $60,000 to the vendors over a period of three years of which $35,000 has been paid to date.

-

On September 7, 2010, the Issuer’s independent consulting geologists completed a NI 43-101 compliant Technical Report, detailing all work completed on the Dotted Lake Property to date and recommendations for further exploration work.

-

On October 25, 2010, the Issuer announced the resignations of Shannon Krell, Ryan Krell and Ivan Martinez from its board of directors and the appointment of Brian A Lueck and Mark H. Holden in their stead as independent directors.

-

On November 30, 2010, a revised version of its NI 43-101 Technical Report was completed by the authors and delivered to the Issuer.

-

At the December 13, 2011 Annual General Meeting of shareholders, three new directors were elected: J. Ronald McGregor, Steven J. Chan and James O. Burns. Subsequently, Mr. J. Ronald McGregor was appointed Chief Financial Officer of the Issuer to replace Mr. Darcy T. Krell.

-

In February 2012, the Issuer entered into an agreement to defer $39,676 in debt owed to a professional advisor which amount has been converted from a short term to a long term liability of the Issuer. This amount is now due on July 31, 2013.

Mineral Property Interests

The Original Dotted Lake Property was originally comprised of one claim and was acquired by the Issuer in 2001 at a cost of $200,000. The claim was allowed to lapse in late 2002 and was re-staked by the Issuer in March 2003. This was less expensive than completing the exploration work assessment during the extreme winter weather conditions existing at the time. Since then, the Issuer has: conducted certain acquisition and exploration activities; completed a NI 43-101 compliant geological report; and, kept its mineral interests in the Dotted Lake Property in good standing with the MNDM for future exploration. In October 2009, the Issuer expanded its 100% owned holdings in the Original Dotted Lake Property from a single 15-unit claim to ten claims of 82 units by means of staking at a cost of approximately $11,000. Title to the Original Dotted Lake Property was held in trust for the Issuer by Mr. Darcy T. Krell.

3

On April 20, 2010, the Issuer entered into an option agreement with local prospectors (the “Optionors”) regarding the Lampson Lake Property. The Issuer has an exclusive option to purchase a 100% interest in the Lampson Lake Property by making option payments totalling $60,000 over the following 3 years as follows: $7,000 paid on April 20, 2010 when the agreement was signed; $12,000 paid on April 20, 2011; $16,000 paid on April 20, 2012; and $25,000 due on April 20, 2013. The Lampson Lake Property is subject to a 2% NSR in favour of the Optionors on claim #4246254 and, with respect to claim #4245668, a combination of a 2% NSR in favour of the Optionors and a 1% NSR on any metals and / or a 1% Net Sales Return Royalty payable to Ontario Exploration Corporation (“OEC”) on any precious stones recovered from the property. The Issuer has the right to buy back 1% of the NSR in favour of the Optionors for $1,000,000 and to buy back three-quarters (3/4) of 1% of the royalty vested with OEC on an increasing scale over 10 years from $15,000 to $750,000. In anticipation of meeting the final payment schedule, title was transferred by the Optionors to Mr. Darcy T. Krell on July 13, 2010 in trust for the Issuer. Mr. Krell transferred title to the Dotted Lake Property to the Issuer on January 27, 2012.

On final payment for the Option, the Issuer’s holdings will then total 12 claims of 104 mining units on 1,683 hectares. At present and pending approval of the MNDM, the Issuer will have $46,776 in banked credits which will mean all claims could be kept in good standing until 2013 with $18,107 credits remaining. The Dotted Lake Property is currently in good standing with the MNDM with due dates for work credits to be applied on claim anniversary dates ranging from November 17, 2012 to April 21, 2013. See “Property Description and Location” below, including the Table 1 thereunder.

As at October 31, 2011, the Issuer had incurred the following expenditures on the Dotted Lake Property since inception:

| As at | As at | |||||

| October 31, 2011 | January 31, 2011 | |||||

| Exploration and Evaluation Assets | ||||||

| Mineral properties | ||||||

| Staking | $ | 15,261 | $ | 15,261 | ||

| Option to purchase the Lampson Lake Property | 21,033 | 9,033 | ||||

| Deferred exploration costs | ||||||

| Geological survey | 142,637 | 142,637 | ||||

| Geological consulting fees | 33,948 | 33,948 | ||||

| $ | 212,879 | $ | 200,879 |

The Issuer continues to monitor claims in the Dotted Lake area and may make additional acquisitions from time to time when management considers the claims to be strategic or otherwise of possible benefit to the Issuer.

Technical Report

The following discussion regarding the Dotted Lake Property with the exception of the information set out in Table 1 below, is taken from the NI 43-101 compliant Technical Report dated September 7, 2010 (as revised on November 30, 2010) prepared by Caitlin Jeffs H. B.Sc., P.Geo. and Michael Thompson H. B.Sc., P.Geo. of Fladgate Exploration Consulting Corporation of Thunder Bay, Ontario. The full text of the Technical Report is available for review at the registered office of the Issuer at Suite 203-409 Granville Street, Vancouver, BC V6C 1T2 and may also be accessed online, under the Issuer’s profile, on the SEDAR website: www.sedar.com. The information in the table entitled “Table 1 Claims Details” below has been derived from a mineral tenure search dated April 24, 2012 conducted through the online database of the MNDM website.

4

Property Description and Location

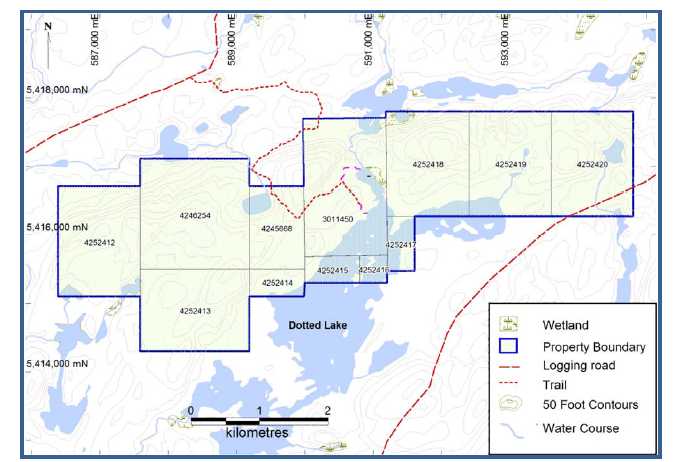

The Dotted Lake Property is located in the southeast part of the Black River Area Township and the southwest corner of the Olga Lake Township within the Thunder Bay Mining Division of Northwestern Ontario, Canada (Figure 1). The Dotted Lake Property lies 45 km south of the town of Manitouwadge on NTS Sheet 42C13. The centre of the Dotted Lake Property has approximate geographic coordinates of 48°54’26”N, 85°45’50”W (UTM NAD83 Zone 16N 590,597mE, 5,416,050mN). The Dotted Lake Property is comprised of 12 mining claims totaling 104 units and covering 1683 hectares oriented approximately east west, 8.5 km long by roughly 2 km wide in an irregular shape (Table 1).

The Dotted Lake Property is an exploration stage property. There have been no improvements or mining activities conducted on the property and no permanent structures have been built on the property. There have been no mineral resource estimations completed on the Dotted Lake Property. Work on the property in the past three years has identified gold mineralization hosted in sulphide rich shear bands in granitoid rock.

The Issuer has not applied for any environmental or work permits on the Dotted Lake Property. There are no environmental or work permits required by law in Ontario for the exploration activities described or proposed in the Technical Report. Stripping and trenching on mining claims in Ontario is allowed without permits so long as the stripped area is under 10,000 square metres. A Permit to Take Water is required by the Ministry of Environment in Ontario if more than 50,000 litres of water is taken in one day, this amount would only be taken if multiple drills were active on a property at one time.

The authors of the Technical Report are not aware of any outstanding environmental liabilities attached to the Dotted Lake Property and there is no reason to believe there should be any. There has been no active mining or processing on the Dotted Lake Property.

The Dotted Lake Property was initially registered in the name of 1179406 Ontario Ltd., a private Ontario company owned by Mr. R.J. Reukl, in trust for Gemstar Resources Ltd. (the Issuer’s former name) However, on April 8, 2009 the claim was transferred into the name of Darcy T. Krell, an officer and director of the Issuer, in trust for the Issuer. The registration of the Dotted Lake Property in the name of the Issuer was recorded on January 27, 2012.

The authors of the Technical Report verified titles and work summaries of the claims at the MNDM website. In order to maintain the claims in good standing, $400 of work is required per year per 16 hectare claim unit. The Dotted Lake Property claims (including the Lampson Lake Property) require approximately $41,000 of work in order to keep the claims in good standing each year. Work credits can be banked and used in future years. As of the date of the Technical Report, the Issuer had $7,323 banked for future credits and has spent $91,585 on a trenching and prospecting program that had not yet been submitted for assessment. Under the MNDM system, each claim comes due on the anniversary of the date the claim was recorded, therefore not all claims will come due on the same day in 2012 and 2013 (Table 1).

The Dotted Lake Property claims are outlined in Table 1 below and shown on Figure 1 and Figure 2. The property claim boundaries were located by records provided from Ontario’s MNDM website.

5

Table 1 – Dotted Lake Property Claims

|

Mining |

Township/Area |

Units |

Date |

Date Due for |

$ Work |

|

3011450 (i) |

Black River |

15 |

14-Mar-03 |

14-Mar-13 |

$6,000 |

|

4245668 (ii) |

Black River |

6 |

6-Mar-09 |

6-Mar-13 |

$1,869 |

|

4246254 (ii) |

Black River |

16 |

21-Apr-09 |

21-Apr-13 |

$6,400 |

|

4252412 (iii) |

Black River |

12 |

17-Nov-09 |

17-Nov-12 |

$4,800 |

|

4252413 (iii) |

Black River |

12 |

17-Nov-09 |

17-Nov-12 |

$4,800 |

|

4252414 (iii) |

Black River |

2 |

17-Nov-09 |

17-Nov-12 |

$800 |

|

4252415 (iii) |

Black River |

2 |

17-Nov-09 |

17-Nov-12 |

$800 |

|

4252416 (iii) |

Black River |

1 |

17-Nov-09 |

17-Nov-12 |

$400 |

|

4252417 (iii) |

Black River |

2 |

17-Nov-09 |

17-Nov-12 |

$800 |

|

4252418 (iii) |

Olga Lake |

12 |

17-Nov-09 |

17-Nov-12 |

$4,800 |

|

4252419 (iii) |

Olga Lake |

12 |

17-Nov-09 |

17-Nov-12 |

$4,800 |

|

4252420 (iii) |

Olga Lake |

12 |

17-Nov-09 |

17-Nov-12 |

$4,800 |

|

|

Totals |

104 |

|

|

$41,069 |

| (i) |

Issuer’s original claim re-staked in March 2003. |

| (ii) |

Lampson Lake Property optioned by Issuer on April 20, 2010. Title was transferred to Darcy T. Krell in trust for the Issuer on July 13, 2010 pending final option payment due on April 20, 2013. Title was subsequently transferred to the Issuer and recorded on January 27, 2012. |

| (iii) |

Staked by Darcy T. Krell on behalf of the Issuer in October 2009. Title was transferred from Mr. Krell to the Issuer on January 27, 2012. |

Accessibility, Local Resources and

Infrastructure

The Dotted Lake Property is situated in Northwestern Ontario and includes the north end of Dotted Lake. The property is not road accessible, but a newly constructed trail crossing the property to the northwest shoreline of Dotted Lake is suitable for ATV’s and wide enough for drill mobilization. The closest road is a logging road situated approximately 1 km north of the claims. This logging road branches east from Highway 614 at a point either 31 km south of Manitouwadge or 19.2 km north of the junction of Highway 614 with Highway 17, the TransCanada Highway. A blazed trail, starting at a distance of 8.2 km from Highway 614 along this logging road, leads into the property to the north end of Dotted Lake (Figure 2). The nearest towns are Manitouwadge 26 km to the north, Marathon 45 km to the southwest and White River 42 km to the southeast. The Hemlo Gold Camp is 23 km to the south-southwest along the TransCanada Highway. A pool of skilled labour for mining and exploration is present in the communities of Manitouwadge, Marathon and White River. All three communities have housing and facilities for educational, commercial and leisure activities. The city of Thunder Bay, 400 km to the west, is the nearest large regional population centre with many services and amenities for industrial, educational and leisure activities. The nearest railroad is the Canadian Pacific Railroad 20 km to the south along the TransCanada Highway. A Hydro One high voltage power transmission line passes 18 km south of the Dotted Lake Property.

6

Figure 1 – Provincial and Regional Location – Dotted Lake Property

7

Figure 2 – Dotted Lake Claims

Climate and Physiography

The climate is characterised by long cold winters and hot summers. Average daily temperatures in summer range from 10° to 24°C and from 0° to -22°C in the winter months. In general, soil sampling, geological mapping and trenching programs are limited to the summer months. Snow cover and freezing conditions prevail from mid-November until late April and make transportation through the property easier for large equipment during the months when swampy wet ground is frozen and easier to move across.

The Dotted Lake Property is covered by lakes, swamps and low wooded hills. Elevations on the property vary from 380 to 450 m above sea level. A steep slope that is difficult to move down or up crosses the centre of the property in a north easterly direction. Vegetation is typical for a mixed boreal forest and the dominant tree species are spruce, balsam, jackpine, birch and poplar.

History

| 1. |

Previous Exploration Programs |

High-grade zinc mineralization was first discovered on the Dotted Lake Property by trapper/prospector A. Fairservice in 1957 and is known as the “Fairservice zinc showing”. Initial work consisted of hand dug trenches and pits. A grab sample from the showing reported by Smyk contained 9.44% Zn, 0.012% Cu and 0.006 oz/ton gold. Since then the claims have been held by a variety of parties and several campaigns of AEM, and magnetic surveys have covered the property. Several campaigns of ground surveys along cut lines included VLF-EM, ground magnetics, HLEM, soil sampling and geological mapping have also been performed on the property.

8

The area has seen several periods of exploration. Initially the interest in the area was sparked by the Fairservice discovery and resulted in two companies exploring the property in the late 1950’s and through the 1960’s. After the Hemlo deposit discovery in the 1980’s, a new round of exploration was concentrated through the Schrieber-Hemlo Greenstone belt. The recent boom in commodities prices starting in 2003 has sparked a third round of exploration in the area.

Table 2 – Past Exploration at Dotted Lake

| Year | Operator | Work | Principal Reference |

| 1957 | A. Fairservice | Discovery of Fairservice showing, sampling and trenching | MNDMF Mineral Deposits Inventory (MDI) |

| 1964-1967 | Irish Copper Mines Ltd. | Airborne EM and Magnetic Survey | Rattew, A.R., 1965 |

| 1968 | Ontario Department of Mines | Geological mapping of Black River area | Milne, V.G., 1968 |

| 1982-1983 | Clear Mines Ltd. | Geology, soil sampling (577 samples), ground magnetics and VLF ground surveys (15km), AEM by Aerodat (1,1570 square kilometres) | Symonds, D.F e.a., 1983 Scott Hogg, R.L., 1983 |

| 1988 | McLaughlin Mines Ltd. | Soil sampling (120 samples), analysed for gold, silver and PGE | Ven Huizen, G.L., 1988 |

| 1989-1991 | Noranda | Ground HLEM, VLF and Magnetic surveys over 1km by 5km along 100m to 200m spaced lines. Diamond Drilling 3 holes, 502m | Degagne, P.,1991 Walmsley, T., 1991 |

| 1991 | Ontario Geological Survey | Mapping, description and sampling Fairservice showing | McKay, D., 1994 |

| 2005 | Gemstar Resources Ltd. | Airborne VLF and Magnetic survey 100km 2/50m spaced lines | Berrie, C., 2005 |

| 2005 | Gemstar Resources Ltd. | Ground Magnetic, VLF and line cutting 15km | Private Report |

| 2008 | Gemstar Resources Ltd. | Soil Sampling Program (3 traverses, 47 samples) | Jeffs, C., 2008 |

| 2009 | Ontario Exploration Corporation | Line cutting (5km grid), Magnetic and VLF-EM survey over 5km (400 samples at 12.5m intervals), Prospecting, 32 grab samples | Griggs, H., 2009 |

| 2009 | Rouge Resources Ltd. | Soil Sampling Program (5 traverse lines with 200m spacing; 61 samples with 50m spacing) | Jeffs, C., 2010 |

| 2010 | Rouge Resources Ltd. | Trenching and Prospecting, four trenches | Internal Information |

9

| 2. |

Significant Exploration Results |

a. 1950’s-1960’s

In 1965 Irish Copper Mines Limited carried out an airborne EM survey in the White Lake area which covered the north western arms of Dotted Lake. Although a number of EM anomalies were encountered in the area, they were all very weak and only one conductive zone was interpreted as a possible sulfide conductor. This conductive zone was the only anomalous feature recommended for ground follow up.

A combined EM and Magnetics airborne geophysical survey was conducted in 1965 for Carravelle Mines Ltd. by Selco Exploration Co. on the Pulfa Prospect, between Black River in the west and White Lake in the east. The objective of this survey was to test the ground for unknown mineral or bedrock conductors. This survey was done as part of a larger survey which covered territory adjoining to the Pulfa Group of claims, with a total area of approximately 83 square miles and included the entire Dotted Lake Property. More detailed airborne surveys were completed in later years.

b. 1980’s-1990’s

In 1983 Clear Mines Ltd. systematically soil sampled and mapped over the area of the Fairservice showing covering a 2 km by 1 km area. Airborne magnetic and EM surveys encompassing 1,570 square kilometres, including the Dotted Lake area, were performed by contractor Aerodat Ltd. for Clear Mines Ltd. Several EM anomalies were detected but none over the Fairservice showing. The geochemical survey showed scattered anomalies for copper, zinc and lead.

The most comprehensive geophysical groundwork was completed by Noranda in 1991. Systematic VLF, magnetic and multifrequency HLEM surveys were completed on 100 m to 200 m spaced lines over a 1 km by 5 km area. The Fairservice showing was found to be located on the western terminus of a 2.6 km long linear conductor/magnetic high. Noranda drilled three holes on this trend. The drilling, which included a hole at the Fairservice showing, did not intersect any significant mineralization but indicated that the long linear anomaly was possibly caused by magnetite and pyrrhotite bearing iron formation with local sphalerite at the Fairservice showing.

c. 2000’s

In 2005, the Issuer, then known as Gemstar Resources Ltd., completed an airborne magnetic survey covering the central portion of the present claim block, followed by ground VLF and magnetic survey over the northwestern side of Dotted Lake including the area of the Fairservice showing.

The results of this survey are outlined in an operations report by Terraquest Ltd. Note that the title of that report states that an airborne magnetic and VLF-EM survey was completed, but no VLF data was processed. The report includes a digital terrain model and three magnetic maps (total magnetic intensity map, a vertical magnetic derivative map and the measured horizontal gradient). Apart from the contoured maps, no other interpretative comments or material were provided in the report.

Ground VLF-EM and magnetic surveys were completed on cut lines in the north central portion of the property. One hundred metre spaced lines were cut in March of 2005 and a total of 16.5 km were surveyed from April 6 to 10, 2005. Magnetic and VLF readings were recorded every 12.5 m. The survey is the subject of a report titled: “Geophysical Report for Gemstar Resources Ltd. on the Dotted Lake Property, Black River Area” authored by J.C. Grant CET, FGAC, May 2005. The report describes the specifications of the survey and has an interpretative section that relates the VLF conductors and magnetic features to their possible causes.

In 2008 a soil sampling program was carried out on the 3011450 claim area. This project entailed sampling B horizon soils every 50 m intervals over three 1 km long traverse lines trending north northwest approximately perpendicular to the main trend of structures in the region.

10

A second soil sampling program in 2009 was carried out on the Dotted Lake Property over the 3011450 claim area. This project entailed sampling B horizon soils every 50 m intervals over five 500 m long traverse lines trending north northwest approximately perpendicular to the main trend of structures in the region. The B horizon was taken to follow up on anomalous results from the 2008 soil sampling program to try and determine a clear trend in anomalous mineralization and also to confirm that the anomaly returned during the 2008 program was not a discrete occurrence.

In 2009 OEC contracted Katrine Exploration and Development to carry out a line cutting program just south of Lampson Lake (currently included as part of the western half of the Dotted Lake Property). A grid was established of 5 line kilometres of cut grid lines, spaced at 100 m intervals. A magnetic and VLF EM survey was performed by Larder Geophysics over the cut grid. A total of 5 line kilometres of magnetometer/VLF EM survey was read, consisting of approximately 400 magnetometer VLF EM readings with a 12.5 m sample interval. Assays from the 2009 OEC funding proved to provide little encouragement in base metals. The best values returned from sampling were 781 ppm Cu and 425 ppm Zn. One sample returned a value of 2.33 g/t Au, approximately 300 m south of Lampson Lake and appears to lie along a presumed shear zone. The sample was described as “mafic volcanic, altered, intense biotite, sheared, 3-5% pyrite and non-magnetic”.

A trenching and prospecting program was completed by Fladgate Exploration for the Issuer in 2010. Four trenches were cut following up on soil anomalies returned in the 2008 and 2009 programs and prospecting.

Geological Setting

| 1. | Regional and Local Geography |

Information on the regional and area geology is mainly from government sources, maps and reports. The property is situated in the Wawa sub-province of the Superior province of the Canadian Shield. All rocks are of Archaean age, with the exception of Proterozoic diabase dykes. The claims cover a portion of the north eastern part of the Schreiber-Hemlo Greenstone Belt. The eastern segment is subdivided into the 2.77 billion year old Hemlo-Black River assemblage to the northeast and the 2.7 billion year old Heron Bay Assemblage to the southwest. The assemblages are separated by the Lake Superior-Hemlo fault zone. The primary rock type of the Hemlo-Greenstone Black River assemblage is mafic volcanics. Felsic and intermediate volcanic rocks and clastics overlie the mafic volcanics. The belt is intruded by numerous felsic granitoids. Several stages of regional folding occurred in the belt, the latest stage is the most pervasive and occurred contemporaneous to, or predated, the intrusion of the granitoid bodies.

| 2. | Property Geology |

Local geological data is taken from government reports and from exploration work by Clear Mines Ltd. and also from drill holes completed by Noranda in 1991 and are supplemented by a report prepared by Andre M. Pauwels in December 2005 for the Issuer, then known as Gemstar Resources Ltd.

The predominant rock type in the Dotted Lake arm is foliated, fine grained, dark green, amphibole rich metavolcanic rock. Medium and coarse grained amphibolites are less common and occasional remnant pillow textures have been observed indicating a submarine depositional environment. Small sills and dykes of granitoid rocks are common in the volcanic rocks. A few thin (1 cm to 30 cm) layers of intermediate to felsic volcanic tuffs were observed in the area just north of Dotted Lake in the general vicinity of the Fairservice zinc showing. Magnetite, pyrrhotite-rich and garnetiferous amphibolitic iron formation is reported from drill holes 2 and 3 drilled by Noranda and contains massive sphalerite at the Fairservice zinc showing. These horizons, although volumetrically a small proportion of the rocks in the area, appear to be continuous along strike within the metavolcanic rocks according to geophysical surveys. Foliation of the metavolcanic rock is persistently east-northeasterly trending within an isoclinal syncline within the metavolcanics of the Dotted Lake Arm. This syncline appears to plunge to the west-southwest. The metamorphism within the belt is amphibolite grade.

11

The eastern portion of the claims contain a mafic and ultramafic intrusive complex of gabbro, peridotite and serpentinized peridotite intruded along the southern flank of the mafic volcanics. Ground magnetic surveys in the area indicate that this complex extends 800m further to the west than indicated on the mapping done by the Ontario Geological Survey. This area is covered by overburden. Granitoid rocks of the Dotted Lake Batholith cover the southern portion of the property. The granatoids are pink to light pink in colour, foliated and medium grained, and appear to intrude both the metavolcanics and mafic/ultramafic rocks.

Deposit Types

No economic mineral deposits have been defined on the Dotted Lake Property to date. In the general area two types of deposits occur: The first type is represented by large metamorphosed VMS-style deposits, such as the Geco deposit located near Manitouwadge, 30km north of the Dotted Lake Property. Geco was mined by Noranda from 1954 to 1995 and produced 49.4 million tonnes of ore grading 1.86% Cu, 3.78% Zn, 50.04 g/t Ag.

The second type is represented by the gold deposits of the Hemlo gold camp located 22km southwest of the Dotted Lake Property. Past production to 2003 at the three Hemlo mines was: David Bell Mine – 7.9 million tonnes grading 13.34 g/t Au; Golden Giant Mine – 18.2 million tonnes grading 11.01 g/t Au; Williams mine – 41.2 million tonnes grading 5.82 g/t Au, for a total of 17.6 million ounces of gold produced.

Production numbers quoted in the Technical Report and referred to herein have not been verified by the authors of the Technical Report and are not meant to indicate that comparative resources will be discovered on the Issuer’s Dotted Lake Property.

Potential at Dotted Lake is principally for VMS style mineralization. Characteristics of Hemlo style gold mineralization have to date not been found on the property. Potential for VMS-style mineralization is indicated both by the style of mineralization at the Fairservice showing and its geological context as summarized below:

Table 3 – Dotted Lake Property potential VMS style deposit

|

General VMS Characteristics |

Observations at Fairservice/Dotted Lake |

|

Depositional Environment

|

Depositional Environment

|

|

Bimodal (felsic-mafic) volcanic succession |

Mainly mafic metavolcanics-minor felsic volcanic component at and near the showing. |

|

Host horizon grades laterally into exhalative horizon. |

The Fairservice showing is within an exhalite horizon (iron formation) that can be traced over at least 2.4km. |

|

Mineralization |

Mineralization |

12

|

General VMS Characteristics |

Observations at Fairservice/Dotted Lake |

|

Footwall Alteration

|

Footwall Alteration

|

Recent gold results on the property discussed in the section below titled “Mineralization” indicate there is potential for a new deposit style on the Dotted Lake Property. The gold mineralization does not appear to be Hemlo style as the host lithology is felsic and not mafic and there is no anomalous arsenic, mercury or molybdenum which are all key elements associated with the gold at the Hemlo Deposit. Preliminary observations indicate the potential for a sheared Archean granitoid type deposit similar to that of the Hammond Reef deposit currently being evaluated by Osisko Mining. It must be stressed that this is a preliminary conclusion based on limited observations and data. More exploration work is required to expand on these results.

Mineralization

Mineralization at the Dotted Lake Property was first discovered at the Fairservice zinc showing. The showing was described in detail by M. Smyk. According to Smyk, the showing is hosted within a narrow band (up to 80 cm wide) of iron formation within mafic volcanic rock. It is described as follows:

“The mineralized zone occurs in the mafic volcanics and is oriented parallel to both the host rock foliation and the elongation direction of the pillows. The host metavolcanics become noticeably altered within 1 m of the mineralized zone.”

The mineralization is further described to be exposed over a maximum 20 m length and to contain sphalerite, magnetite, amphibole and disseminated garnet. The southern contact of the mineralization is a 1 m to 2 m thin felsic dyke, in part with the appearance of fissile sericite schist. The mineralization was interpreted by McKay to be hosted by iron formation which can be seen in intermittent outcrops over 200 m to the east of the showing. Grab samples from this iron formation reported by Smyk showed low anomalous zinc values.

Several rock samples at the Ontario Geological Survey in Thunder Bay show a 2 cm band of massive, coarsely crystalline, dark brown sphalerite (35%) adjacent to well aligned coarse grains of magnetite (25%) intermixed with coarse crystals of sphalerite and a matrix of dark green amphibole and chlorite (40%) and a small amount of disseminated phyrrotite and chalcopyrite. A grab sample reported by Smyk contained 9.44% Zn, 0.012% Cu, and 0.006 oz per ton gold.

One other zinc occurrence hosted in iron formation is reported from the Dotted Lake Arm. This occurrence, called the Brinklow zinc showing, is located approximately 6 km to the southwest of the Fairservice zinc showing and 2.5 km west of the Dotted Lake Property boundary. The Brinklow showing was drilled by Noranda in 1994 with no significant results.

The occurrence of massive sulphide bands hosted in an exhalative sedimentary unit within sea floor volcanic rocks with a component of intermediate to felsic volcanic rock classifies the mineralization as a metamorphosed volcanogenic massive sulphide (VMS) type of occurrence.

During the 2010 trenching program a new zone of mineralization was discovered in trench Tr-10-4. This zone consists of a narrow (approximately 30 cm wide) sheared granitoid rock, with 5-10% pyrite, strong sericite and trace of arsenopyrite. A grab sample taken from this rock unit returned a grade of 16.95 ppm Au, 218 ppm Zn and 7.7 ppm Ag. The same unit was channel sampled later on as part of Tr-10-4 channel sampling and returned an assay of 9.02 ppm Au, 859 ppm Zn and 1.2 ppm Ag over 0.40 m. This shear zone appears to be related to shearing noted in the northern part of the property, following the same east-west trend.

13

Exploration

Since 2008 Fladgate Exploration has conducted three exploration campaigns consisting of soil sampling, rock sampling, prospecting and trenching programs on behalf of the Issuer on the Dotted Lake Property.

| 1. | Soil Sampling May 2008 |

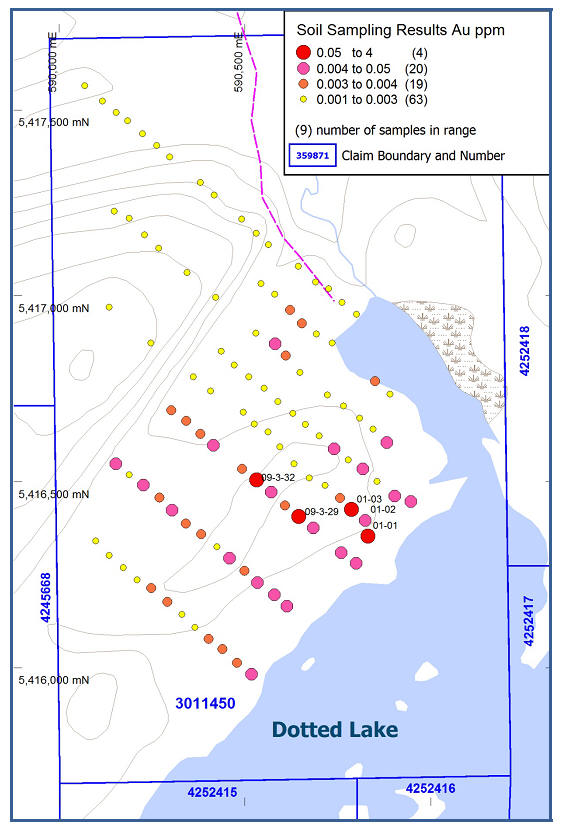

During the period of May 21 to May 25, 2008 work carried out by Fladgate Exploration on the Dotted Lake Property included soil sampling of the 3011450 claim area. This project entailed sampling B horizon soils every 50 m intervals over three 1 km long traverse lines spaced 200 metres apart. A total of 47 samples were collected and analyzed for base and precious metals. Two samples, 01-01 and sample 01-03 (see Figure 4) assayed 0.484 ppm Au and 0.144 ppm Au respectively. The two anomalous samples are approximately 80 metres apart and do not indicate clearly if there is significant strike length to the mineralization or any clear trend in the strike direction (Figure 4).

| 2. | Soil Sampling September 2009 |

During the period September 11 to September 14, 2009 work carried out by Fladgate Exploration on the Dotted Lake Property included soil sampling of the 3011450 claim area (see Figure 4). This project entailed sampling B horizon soils on 50 meter intervals over five 500 m long traverse lines spaced 200 m apart trending north northwest approximately perpendicular to the main trend of structures in the region. The subsoil B horizon was taken to follow up on anomalous results from the 2008 soil sampling program to try and determine a clear trend in anomalous mineralization and also to confirm that the anomaly returned during the 2008 program was not a discrete occurrence.

A total of 61 samples were collected and analyzed for base and precious metals. One high grade gold result, sample 3-29 assayed 0.234 ppm Au. The sample is one line west of the high grade gold results returned in the 2008 soil sampling program showing a possible east west trend to the gold anomalies and indicating a potential gold target in the bedrock below. Anomalous zinc was noted along the same trend in sample 4-41 located at 590,579 east and 5,416,197 north assaying 1,200 ppm Zn (Figure 4).

14

Figure 4 - Soil Sample Results

15

| 3. | Trenching 2010 |

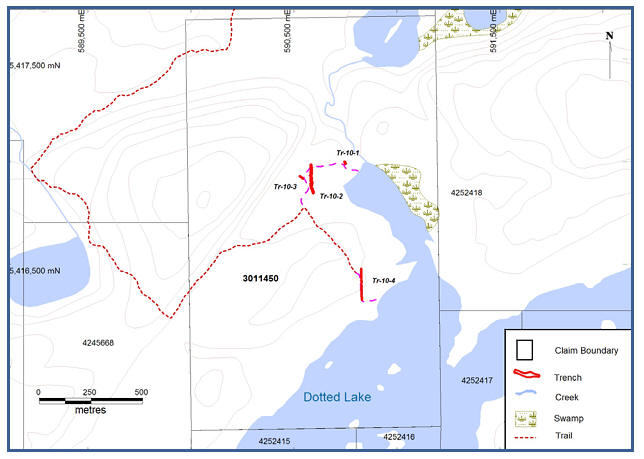

During May 25 to June 5, 2010, the exploration program carried out by Fladgate Exploration over the Dotted Lake Property included prospecting, stripping/trenching, channel sampling and trench mapping. The goal of this program was to expose and test the bed rock in the vicinity of the location of the encouraging soil anomalies encountered in 2008 and 2009. Limited additional prospecting samples provided a cursory examination of other areas of the property as well.

Four trenches and approximately 8 km of access trail were completed between May 25 and June 5, 2010. The proposed trench targets were determined based on the historical data and soil anomalies highlighted in the 2008 and 2009 soil sampling programs. Trench locations are shown on Figure 5. Trenches were generally oriented in a south-north direction, perpendicular to the east-west trend of the bedrock. The exposed rock was washed using high-pressure water pump, then geologically mapped and channel sampled. Sample locations were tagged with aluminum tags with the appropriate sample number.

Figure 5 - Trench Locations

A total of 339 m of trenching was completed in a series of four trenches during May 25 to June 5, 2010. Three of the trenches, Tr-10-1, Tr-10-2 and Tr-10-3 were completed in the area of the Fairservice zinc showing. The fourth trench, Tr-10-4, was excavated in the vicinity of gold soil anomalies from 2008 and 2009 soil sampling. The trenches were excavated to an average depth of 0.5 -2 m and a width of 4 m exposing a total surface of 1356 m2.

16

A summary of the trenching is set out below:

Table 4 – Trench Summary

| Trench No. | Length (m) | Width (m) | Depth of over burden (m) | Surface Area (m2) |

| Trench 1 | 17 | 4 | 0.5 | 68 |

| Trench 2 | 152 | 4 | 1 | 608 |

| Trench 3 | 23 | 4 | 1 | 92 |

| Trench 4 | 147 | 4 | 2 | 588 |

Mapping was completed between May 30 to June 6, and June 12 to 16, 2010, at a scale of 1:100. Trenches Tr-10-1, Tr-10-2 and Tr-10-3 exposed mainly metavolcanic rocks and series of quartz feldspar porphyry and granodioritic dykes running approximately east-west. The metamorphism for the most part is of amphibole grade. The fourth trench, Tr-10-4 exposed granodiorite and gneissic- porphyritic rocks with narrow shear zones. The shear zones are 0.1 to 3.0 m wide, trend roughly east west, are pyrite rich with predominantly gneissic characteristics.

a. Trench Tr-10-1

Trench Tr-10-1 is 17 metres long and 4 metres wide and is predominantly foliated amphibolized mafic volcanics with moderately stretched pillow selvages, local isolated white quartz veins parallel to the strike, disseminated pyrite and trace of chalcopyrite. The key elements of this trench are a fault trending at 296° with a minor displacement and a 2.1 m wide shear zone within the mafic volcanics. The shearing is described as strong with traces of sericite, local disseminated fine grained red garnets, massive pyrite and rusty quartz veins. This trench is cross cut by two quartz feldspar porphyry dykes at 260°. These dykes are white, fine grained, with traces of pyrite.

A total of 15 channel samples were cut and assayed for gold and zinc. The shear zone appears well mineralized due to significant amounts of pyrite but no significant gold or zinc values were returned from the samples.

b. Trench Tr-10-2

Trench Tr-10-2 is 152 m long and 4 m wide, located to the immediate west of the Fairservice zinc showing and exposed garntiferous amphibolitic iron formation, metavolcanics and a series of granitoid dykes. The iron formation is described as green, medium grained with fibrous amphibole matrix with up to 10% fine grained red garnets, minor narrow local bands of sphalerite, and up to 5% pyrite. The rest of the trench consists of a series of metavolcanics (amphibolite and amphibolized mafic pillows), granitoid dykes and gabbro dykes. There are also minor faults and fractures noted in this trench.

A total of 77 channel samples were taken from trench Tr-10-2 and tested for gold and zinc. One sample returned a relatively elevated zinc value of 1010 ppm.

c. Trench Tr-10-3

Trench Tr-10-3 is 23 m long and 4 m wide and exposes mainly metavolcanic and massive gabbro. There is also minor shearing near the southern portion of the trench. The metavolcanic unit is described as fine grained, amphibolized, well foliated, locally sheared with trace to 2% pyrite. The gabbro unit is massive with medium grained hornblende and a narrow quartz feldspar porphyry dyke near the upper part of the trench. The quartz feldspar porphry dyke is identical to the ones in Tr-10-1 and Tr-10-2. A total of 11 channel samples were cut and assayed on Tr-10-3, but no significant values were returned.

17

d. Trench Tr-10-4

Trench Tr-10- 4 is located approximately 500 m south east of Fairservice zinc showing and it is 147 m long by 4 m wide with an average depth of 2 m. Due to the rubbly bedrock and deeply pocketed shear zones, the extent of cleaning in this trench was limited. This trench was located near the soil sampling anomalies returned in the 2008-2009 exploration programs. Trench Tr-10-4 is predominantly granite, granodiorite (some are gneissic) and quartz monzonite. The only well mineralized portions of this trench are two narrow, 30-40 cm wide, shear zones with up to 10% pyrite, strong sericite alteration and local patchy translucent quartz eyes.

A total of 41 channel samples were cut and assayed for gold and zinc. The channel samples from trench Tr-10-4 returned two significant samples in sheared, mineralized granodiorite, one of which returned 9.02 ppm Au and 859 ppm Zn over 0.40 m and another that returned 1.14 ppm Au over 1.00 m. Significant portions of the trench in the area around the two mineralized samples were unable to be channelled due to intense shearing and rubbly rock creating deep sections of the trench that Fladgate was unable to clean and channel sample. There is a possibility that in these areas of intense shearing there could be more mineralization.

| 4. | Significant Results |

Significant assays from the exploration programs run by the Issuer from 2008-2009 have been summarized in Table 5 below:

Table 5 – Significant Assay Results

| Soil Samples | Sample ID | Year | Au ppm | Zn ppm |

| 01-01 | 2008 | 0.484 | 43 | |

| 01-03 | 2008 | 0.144 | 53 | |

| 03-29 | 2009 | 0.234 | 73 | |

| 03-32 | 2009 | 0.062 | 42 | |

| 04-41 | 2009 | 0.009 | 1215 | |

| Rock Samples | Sample ID | Year | Au ppm | Zn ppm |

| Tr-10-4 H073934 | 2010 | 9.02 | 859 | |

| Prospecting I920008 | 2010 | 16.95 | 218 |

| 5. | Prospecting |

Prospecting the Dotted Lake Property was also incorporated during the period of the trenching program, and was mostly focused in the vicinity of the soil anomalies to investigate and confirm the trench targets. A total of 11 rock samples were collected as part of the prospecting on claims 3011450, 4245668, 4252415 and 4246254.

Prospecting sample I920008 (see Table 5) returned Au 16.95 ppm, Zn 218 ppm and Ag 7.7 ppm near the 2008-2009 soil anomalies. This sample was taken from trench Tr-10-4 location as a rock sample during the excavation.

18

| 6. | Expenditures on the Issuer's Dotted Lake Property |

The Issuer has spent approximately $161,636 in exploration work on the Dotted Lake Property since re-acquiring the first claim in 2003, with $107,000 of that amount having been spent within the three years preceding the date of the Technical Report.

Table 6 – Dotted Lake Exploration Expenditures 2007-2010

|

Item |

CDN$ | Comments | |||

|

Accommodation |

$ | 6,474 | Hotel while in the field | ||

|

Assays |

$ | 9,781 | ALS Chemex | ||

|

Equipment rental |

$ | 28,410 | Trenching and Road Building, channel cutting saw and cleaning pumps | ||

|

Field supplies |

$ | 925 | Bags, trays, etc. | ||

|

Labour |

$ | 53,980 | Geologists, project manager, and geotechs. | ||

|

Meals |

$ | 1,361 | Meals for geologists and geotechs while in the field | ||

|

Travel and transportation |

$ | 3,121 | Trucks and Mob-deMob of excavator | ||

|

ATV's |

$ | 2,950 | ATV's for access to property | ||

|

Total |

$ | 107,002 |

| 7. | Dotted Lake Exploration Targets |

Two significant targets exist on the Dotted Lake Property, the Fairservice zinc target and the newly discovered gold zone.

Drilling

The Issuer has had no drilling completed on the Dotted Lake Property. Historically three diamond drillholes were completed by Noranda in 1991. The drilling is listed in Table 2 and results are discussed in the section titled “History”.

Sampling Method and Approach

In the past three years the Issuer has completed three exploration programs on the Dotted Lake Property all managed by Fladgate Exploration. The exploration programs included both rock and soil sampling.

| 1. | Soil Sampling |

A total of 109 soil samples were collected by Fladgate Exploration on the 3011450 claim of the Dotted Lake Property during the soil sampling programs completed in 2008-2009. During the 2008 soil sampling program samples were taken every 50 m on 200 m spaced lines. The spacing of the sampling lines and sample locations along lines was applicable for an initial exploration program assessing the property for an anomalous mineralization covering large areas of the property. A second soil sampling program was completed in 2009 to target anomalies returned in the 2008 program. In 2009 samples were taken every 50 metres on 200 metre spaced lines. The lines were between the 2008 sampling lines making a grid of samples taken every 50 metres on 100 metre spaced lines. The soil sampling program run in 2009 added tighter spacing to the sampling grid required to help further identify the nature of the anomalous mineralization discovered during the 2008 soil sampling program.

19

Samples were taken with a soil sampling auger and were between 100 and 400 grams. B horizon soils were taken wherever possible and some A and B horizon samples were taken when necessary. Samples were placed in a brown Kraft bag, the sample ID was written on the bag and also written in a notebook with a description including a location. Wherever soil was not present outcrop descriptions were noted. Records were kept of slope, vegetation and soil descriptions for each sample location.

The initial sample spacing from the Issuer’s 2008 soil sampling program was at a 200 metre sample line spacing suitable for an initial exploration program targeted at identifying any anomalous mineralization. The soil sampling assays returned anomalous gold and zinc mineralization, but did not clearly outline a specific strike of mineralization. The 2009 soil sampling program closed the soil sample lines to 100 metre spacing which returned further anomalous mineralization and identified a possible strike. Soil sampling has proven to be a useful exploration tool and could be used to expand on gold mineralization discovered during the 2010 trenching program. A similar soil sampling program could be useful in identifying any further mineralization on a property wide scale, but once again a second program might be necessary to infill soil sampling lines at tighter spacing in areas that return anomalous results.

| 2. | Channel Sampling |

From May 25 to June 17, 2010 channel sampling was carried out by Fladgate Exploration Consulting Corporation, utilizing a Stihl “quick-cut” rock saw. Two continuous parallel cuts on the outcrop were sawed then chipped out using a chisel. Each sample was placed in a thick plastic sample bag with the sample number clearly written on the outside of the bag with permanent marker and one portion of a three part sampling ticket placed inside. Each sample was sealed with a cable strap. The location of the samples was noted in the sample book and on the trench map. A total of 142 channel samples taken from the trenches including QA/QC samples, were tagged and bagged and shipped to ALS Chemex in Thunder Bay, Ontario by Fladgate Exploration personnel. All the collected samples were in the custody of Fladgate staff at all times. All the samples were assayed using ICP method. Assays were analyzed for a suite of 35 elements, including copper, gold, silver and zinc. Gold samples above 10 ppm were analyzed again using fire assay with an atomic absorption finish method.

Sample Preparation, Analysis and Security

Fladgate Exploration has managed the Issuer’s last three exploration programs on the Dotted Lake Property and implemented a similar QA/QC procedure for all three programs.

For the two soil sampling programs run in 2008 and 2009 all samples were sealed in a brown Kraft bag tied with orange flagging tape with the sample number clearly written in black marker on the outside of the bag. The sample number, description and UTM location was written in a field notebook. All samples were transported from the field location to Fladgate’s offices in Thunder Bay and hung in a secure building to dry. Once the soil samples were dry, they were transported to the ALS Chemex prep laboratory in Thunder Bay by Fladgate personnel.

Before the samples were taken to ALS Chemex for analysis, QA/QC samples were inserted into the sample series approximately every 25 samples. For the soil samples no QA/QC samples were submitted during the 2008 program and only blank samples were submitted for the 2009 program. For blank material, pure silica sand was obtained from Accurassay Laboratories in Thunder Bay. During the 2009 soil sampling program, insufficient amounts of silica sand were submitted and the lab was unable to run both the multi element ICP package and the precious metals analysis. As a result, only the multi-element analysis was completed and therefore no gold results are available. In the future better care must be taken with QA/QC procedures.

20

All soil samples were analyzed using a 33 element four acid digestion ICP method and Pt, Pd, Au fire assay with ICP finish analysis (ALS Chemex codes MEICP-61 and PGM-ICP23).

During the trenching and prospecting program completed in 2010 all samples were cut utilizing a Stihl “quick-cut” rock saw. Two continuous parallel cuts on the outcrop were sawed then chipped out using a chisel. Each sample was placed in a thick plastic sample bag with the sample number clearly written on the outside in of the bag with permanent marker and one portion of a three part sampling ticket placed inside. Each sample was sealed with a cable strap. Samples were then transported to Thunder Bay by Fladgate personnel and delivered directly to the ALS Chemex prep laboratory in Thunder Bay.

ALS Chemex Laboratories in Thunder Bay was used for assaying the samples taken during the trenching program in 2010. All trenching and prospecting samples were analyzed using a 35 element aqua regia ICP method and Au fire assay with ICP finish analysis (ALS Chemex codes MEICP-41 and Au-ICP21). One gold assay returned a value greater than 10 ppm and was analyzed using fire assay with atomic absorption finish.

The quality measures taken to insure the accuracy of the assaying and analytical procedures during the trenching program included four QA/QC samples inserted in the batch of samples. The QA/QC samples consisted of blank samples and gold standard samples. The blank samples consisted of a piece of granite from Nelson Granite in Vermillion Bay, ON. The gold standard samples were purchased from RockLabs Limited in Aukland, New Zealand. Only one standard type was used, SL-34, which was a mid grade gold standard with a recommended value of 5.893 ppm (Table 7).

A total of 2 standard reference samples were submitted for assay during the 2010 trenching program. Standard sample H073944 returned a gold value at 5.85 ppm, and sample H073945 returned a gold value of 5.58 ppm. Sample H073945 returned a value 0.256 ppm lower than the recommended value for the SL-34 standard, and sample H073944 was at the lower end of the +/- 5% bracket considered acceptable for the SL-34 standard (Table 8). It is possible the lab had a low bias for the samples assayed during the 2010 sampling program, but not enough standards were submitted to return a statistically relevant dataset. In future programs, specifically drilling programs, a more comprehensive QA/QC program should be implemented.

A total of 2 Blank samples, H073943 and H073946, were also sent for assay during the 2010 trenching program, which both were returned with a gold value of <0.001 ppm.

Table 7 – QA/QC Reference Samples Summary

|

Type of Reference Material |

Number of

|

Label |

Element |

Recommended |

95% Confidence Level | |

|

Low |

High | |||||

|

Gold Standard |

2 |

SL-34 |

Gold |

5.893 ppm |

5.836 ppm |

5.950 ppm |

Table 8 – Trenching QA/QC Standard Sample Results

|

Standard Reference Sample ID |

Sample ID |

Assay Result (ppm) |

|

SL-34 |

H073944 |

5.85 |

|

|

H073945 |

5.58 |

The QA/QC procedures implemented during these early stage exploration programs would not be sufficient for a drill program that could potentially be used in a resource estimate in the future. If further exploration work is done on the Dotted Lake Property a more comprehensive QA/QC procedure will be necessary.

21