UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 1-12110

CAMDEN PROPERTY TRUST

(Exact name of registrant as specified in its charter)

Texas | 76-6088377 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

11 Greenway Plaza, Suite 2400 Houston, Texas | 77046 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (713) 354-2500

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

Common Shares of Beneficial Interest, $.01 par value | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one):

Large accelerated filer | ý | Accelerated filer | ¨ | ||

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||

Indicate by check mark whether the registrant is a shell company (as defined in the Rule 12b-2 of the Act). Yes ¨ No ý

The aggregate market value of voting and non-voting common equity held by non-affiliates of the registrant was $7,646,700,508 based on a June 30, 2016 share price of $88.42.

On February 10, 2017, 87,526,221 common shares of the registrant were outstanding, net of treasury shares and shares held in our deferred compensation arrangements.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Proxy Statement in connection with its Annual Meeting of Shareholders to be held May 12, 2017 are incorporated by reference in Part III.

1

TABLE OF CONTENTS

Page | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

ii

PART I

Item 1. Business

General

Formed on May 25, 1993, Camden Property Trust, a Texas real estate investment trust (“REIT”), is primarily engaged in the ownership, management, development, redevelopment, acquisition, and construction of multifamily apartment communities. Unless the context requires otherwise, “we,” “our,” “us,” and the “Company” refer to Camden Property Trust and its consolidated subsidiaries. Our multifamily apartment communities are referred to as “communities,” “multifamily communities,” “properties,” or “multifamily properties” in the following discussion.

Our corporate offices are located at 11 Greenway Plaza, Suite 2400, Houston, Texas 77046 and our telephone number is (713) 354-2500. Our website is located at www.camdenliving.com. On our website we make available free of charge our annual, quarterly, and current reports, and amendments to such reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission (the “SEC”). We also make available, free of charge on our website, our Guidelines on Governance, Code of Business Conduct and Ethics, Code of Ethical Conduct for Senior Financial Officers, and the charters of each of our Audit, Compensation, and Nominating and Corporate Governance Committees. Copies are also available, without charge, from Investor Relations, 11 Greenway Plaza, Suite 2400, Houston, Texas 77046. References to our website in this report are provided as a convenience and do not constitute, and should not be viewed as, an incorporation by reference of the information contained on, or available through our website, and therefore such information should not be considered part of this report.

Our annual, quarterly, and current reports, proxy statements, and other information are electronically filed with the SEC. You may read and copy any materials we file with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. Please contact the SEC at 1-800-SEC-0330 for further information about the operation of the SEC’s Public Reference Room. The SEC also maintains a website at www.sec.gov which contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

Narrative Description of Business

As of December 31, 2016, we owned interests in, operated, or were developing 159 multifamily properties comprised of 55,366 apartment homes across the United States. Of the 159 properties, seven properties were under construction and will consist of a total of 2,573 apartment homes when completed. We also own land holdings which we may develop into multifamily communities in the future.

Operating and Business Strategy

We believe producing consistent earnings growth through property operations, development and acquisitions, achieving market balance, and recycling capital are crucial factors to our success. We rely heavily on our sophisticated property management capabilities and innovative operating strategies to help us maximize the earnings potential of our communities.

Real Estate Investments and Market Balance. We believe we are well positioned in our current markets and have the expertise to take advantage of new opportunities as they arise. These capabilities, combined with what we believe is a conservative financial structure, should allow us to concentrate our growth efforts toward selective opportunities to enhance our strategy of having a geographically diverse portfolio of assets which meet the requirements of our residents.

We continue to operate in our core markets which we believe provides an advantage due to economies of scale. We believe, where possible, it is best to operate with a strong base of properties in order to benefit from the personnel allocation and the market strength associated with managing multiple properties in the same market. However, consistent with our goal of generating sustained earnings growth, we intend to selectively dispose of properties and redeploy capital for various strategic reasons, including if we determine a property cannot meet our long-term earnings growth expectations.

We try to maximize capital appreciation of our properties by investing in markets characterized by conditions favorable to multifamily property appreciation. These markets generally feature the following:

• | Strong economic growth leading to household formation and job growth, which in turn should support higher demand for our apartments; and, |

• | An attractive quality of life, which may lead to higher demand and retention for our apartments and allow us to more readily increase rents. |

1

Subject to market conditions, we intend to continue to seek opportunities to develop, redevelop and acquire existing communities. We also intend to evaluate our operating property and land development portfolio and plan to continue our practice of selective dispositions as market conditions warrant and opportunities arise.

We also intend to strengthen our capital and liquidity positions by continuing to focus on our core fundamentals which currently are generating positive cash flows from operations, maintaining appropriate debt levels and leverage ratios, and controlling overhead costs. We anticipate meeting our near-term liquidity requirements through a combination of one or more of the following: cash and cash equivalents, short-term investments, cash flows generated from operations, draws on our unsecured credit facility, proceeds from property dispositions, the use of debt and equity offerings under our automatic shelf registration statement, equity issued from our at-the-market ("ATM") share offering program, other unsecured borrowings, and secured mortgages.

Sophisticated Property Management. We believe the depth of our organization enables us to deliver quality services, promote resident satisfaction, and retain residents, thereby increasing our operating revenues and reducing our operating expenses. We manage our properties utilizing a staff of professionals and support personnel, including certified property managers, experienced apartment managers and leasing agents, and trained apartment maintenance technicians. Our on-site personnel are trained to deliver high-quality services to our residents, and we strive to motivate our on-site employees through incentive compensation arrangements based upon property operational results, rental rate increases, occupancy levels, and level of new leases and lease renewals achieved.

Operations. We believe an intense focus on operations is necessary to realize consistent, sustained earnings growth. Ensuring resident satisfaction, increasing rents as market conditions allow, maximizing rent collections, maintaining property occupancy at optimal levels, and controlling operating costs comprise our principal strategies to maximize property financial results. We believe our web-based property management and revenue management systems strengthen on-site operations and allow us to quickly adjust rental rates as local market conditions change. Lease terms are generally staggered based on vacancy exposure by apartment type so lease expirations are matched to each property's seasonal rental patterns. We generally offer leases ranging from six to eighteen months with individual property marketing plans structured to respond to local market conditions. In addition, we conduct ongoing customer service surveys to help ensure timely response to residents' changing needs and a high level of satisfaction.

Investments in Joint Ventures. We have entered into, and may continue in the future to enter into, joint ventures or partnerships, including limited liability companies, through which we own an indirect economic interest in less than 100% of the community or land owned directly by the joint venture or partnership. We currently have three discretionary investment Funds (the “Funds”), two of which are closed to future investments, and the third of which we formed in March 2015 for future multifamily investments of up to $450 million. See Note 8, “Investments in Joint Ventures,” and Note 13, “Commitments and Contingencies,” in the notes to Consolidated Financial Statements for further discussion of our investments in joint ventures.

Competition

There are numerous housing alternatives which compete with our communities in attracting residents. Our properties compete directly with other multifamily properties as well as condominiums and single-family homes which are available for rent or purchase in the markets in which our communities are located. This competitive environment could have a material adverse effect on our ability to lease apartment homes at our present properties or any newly developed or acquired property, as well as on the rents realized.

Employees

At December 31, 2016, we had approximately 1,600 employees, including executive, administrative, and community personnel.

Qualification as a Real Estate Investment Trust

As of December 31, 2016, we met the qualification of a REIT under Sections 856-860 of the Internal Revenue Code of 1986, as amended (the “Code”). As a result, we, with the exception of our taxable REIT subsidiaries, will not be subject to federal income tax to the extent we continue to meet certain requirements of the Code.

Item 1A. Risk Factors

In addition to the other information contained in this Form 10-K, the following risk factors should be considered carefully in evaluating our business. Our business, financial condition, or results of operations could be materially adversely affected by any of these risks.

2

Risks Associated with Capital Markets, Credit Markets, and Real Estate

Volatility in capital and credit markets, or other unfavorable changes in economic conditions, either nationally or regionally in one or more of the markets in which we operate, could adversely impact us.

The capital and credit markets are subject to volatility and disruption. We therefore may not be able to obtain new debt financing or refinance our existing debt on favorable terms or at all, which would adversely affect our liquidity, our ability to make distributions to shareholders, acquire assets and continue our development activities. Other weakened economic conditions, including job losses, high unemployment levels, stock market volatility, and uncertainty about the future, could adversely affect rental rates and occupancy levels. Unfavorable changes in economic conditions may have a material adverse impact on our cash flows and operating results.

Additional key economic risks which may adversely affect conditions in the markets in which we operate include the following:

• | local conditions, such as an oversupply of apartments or other housing available for rent, or a reduction in demand for apartments in the area; |

• | declines in the financial condition of our tenants, which may make it more difficult for us to collect rents from some tenants; |

• | declines in market rental rates; |

• | low mortgage interest rates and home pricing, making alternative housing more affordable; |

• | government or builder incentives which enable home buyers to put little or no money down, making alternative housing options more attractive; |

• | regional economic downturns, including, but not limited to, business layoffs, downsizing and increased unemployment, which may impact one or more of our geographical markets; and |

• | increased operating costs, if these costs cannot be passed through to residents. |

Short-term leases expose us to the effects of declining market rents.

Our apartment leases are generally for a term of eighteen months or less. As these leases typically permit the residents to leave at the end of the lease term without penalty, our rental revenues are impacted by declines in market rents more quickly than if our leases were for longer terms.

Competition could limit our ability to lease apartments or increase or maintain rental income.

There are numerous housing alternatives which compete with our properties in attracting residents. Our properties compete directly with other multifamily properties as well as condominiums and single-family homes which are available for rent or purchase in the markets in which our properties are located. This competitive environment could have a material adverse effect on our ability to lease apartment homes at our present properties or any newly developed or acquired property, as well as on the rents realized.

We face risks associated with land holdings and related activities.

We hold land for future development and may in the future acquire additional land holdings. The risks inherent in purchasing, owning, and developing land increase as demand for apartments, or rental rates, decrease. Real estate markets are highly uncertain and, as a result, the value of undeveloped land may fluctuate significantly. In addition, carrying costs can be significant and can result in losses or reduced profitability. As a result, we hold certain land, and may in the future acquire additional land, in our development pipeline at a cost we may not be able to fully recover or at a cost which may preclude our developing a profitable multifamily community. If there are subsequent changes in the fair market value of our land holdings which we determine is less than the carrying basis of our land holdings reflected in our financial statements plus estimated costs to sell, we may be required to take future impairment charges which would reduce our net income.

Potential reforms to Fannie Mae and Freddie Mac could adversely affect us.

There is significant uncertainty surrounding the futures of Fannie Mae and Freddie Mac. Through their lender originator networks, Fannie Mae and Freddie Mac are significant lenders both to us and to buyers of our properties. Fannie Mae and Freddie Mac have a mandate to support multifamily housing through their financing activities and any changes to their mandates, further reductions in their size or the scale of their activities, or loss of their key personnel could have a significant adverse impact on us and may, among other things, lead to lower values for our assets and higher interest rates on our

3

borrowings. Fannie Mae's and Freddie Mac's regulator has set overall volume limits on most of Fannie Mae's and Freddie Mac's lending activities. The regulator in the future could require Fannie Mae and Freddie Mac to focus more of their lending activities on small borrowers or properties the regulator deems affordable, which may or may not include our assets, which could also adversely impact us. In addition, the members of the current Presidential administration have announced restructuring and privatizing Fannie Mae and Freddie Mac is a priority of the current administration, and there is uncertainty regarding the impact of this action on us and buyers of our properties.

Risks Associated with Our Operations

Development, redevelopment and construction risks could impact our profitability.

We intend to continue to develop, redevelop and construct multifamily apartment communities for our portfolio. In 2017, we expect to incur costs between approximately $150 million and $170 million related to the construction of seven consolidated projects. Additionally, during 2017, we expect to incur costs between approximately $20 million and $30 million related to the start of new development activities and between approximately $24 million and $28 million related to redevelopment of existing properties. Our development, redevelopment and construction activities may be exposed to a number of risks which may increase our construction costs and decrease our profitability, including the following:

• | inability to obtain, or delays in obtaining, necessary zoning, land-use, building, occupancy, and other required permits and authorizations; |

• | increased materials and labor costs, problems with contractors or subcontractors, or other costs including those costs due to errors and omissions which occur in the design or construction process; |

• | inability to obtain financing with favorable terms; |

• | inability to complete construction and lease-up of a community on schedule; |

• | forecasted occupancy and rental rates may differ from the actual results; and |

• | the incurrence of costs related to the abandonment of development opportunities which we have pursued and subsequently deemed unfeasible. |

Our inability to successfully implement our development, redevelopment and construction strategy could adversely affect our results of operations and our ability to satisfy our financial obligations and pay distributions to shareholders.

One of our wholly-owned subsidiaries is engaged in the business of providing general contracting services under construction contracts entered into between it and third parties (which may include our nonconsolidated affiliates). The terms of those construction contracts generally require this subsidiary to estimate the time and costs to complete a project, and to assume the risk when these estimates may be greater than anticipated. As a result, profitability on those contracts is dependent on the ability to accurately predict such factors. The time and costs necessary to complete a project may be affected by a variety of factors, including, but not limited to, those listed above, many of which are beyond this subsidiary’s control. In addition, the terms of those contracts generally require this subsidiary to warrant its work for a period of time during which it may be required to repair, replace, or rebuild non-conforming work. Further, trailing liabilities, based on various legal theories such as claims of negligent construction, may result from such projects, and these trailing liabilities may go on for a number of years depending on the length of the statute of repose in the applicable jurisdictions.

Investments through joint ventures and discretionary funds involve risks not present in investments in which we are the sole investor.

We have invested and may continue to invest as a joint venture partner in joint ventures. These investments involve risks, including, but not limited to, the possibility the other joint venture partner may: have business goals which are inconsistent with ours, possess the ability to take or force action or withhold consent contrary to our requests, or become insolvent and require us to assume and fulfill the joint venture’s financial obligations. We and our joint venture partners may each have the right to initiate a buy-sell arrangement, which could cause us to sell our interest, or acquire a joint venture partner’s interest, at a time when we otherwise would not have entered into such a transaction. Each joint venture agreement is individually negotiated, and our ability to operate, finance, or dispose of a community in our sole discretion may be limited to varying degrees depending on the terms of the applicable joint venture agreement. The risks associated with our discretionary Funds, which we manage as the general partner and advisor, include, but are not limited to, the following:

• | one of our wholly-owned subsidiaries is the general partner of the Funds and has unlimited liability for the third-party debts, obligations, and liabilities of the Funds pursuant to partnership law; |

4

• | investors in the Funds (other than us), by majority vote, may remove our subsidiary as the general partner of the Funds with or without cause and the Funds’ advisory boards, by a majority vote of their members, may remove our subsidiary as the general partner of the Funds at any time for cause; |

• | while we have broad discretion to manage the Funds and make investment decisions on behalf of the Funds, the investors or the Funds' advisory boards must approve certain matters, and as a result we may be unable to make certain investments or implement certain decisions on behalf of the Funds which we consider beneficial; |

• | our ability to dispose of all or a portion of our investments in the Funds is subject to significant restrictions; and |

• | we may be liable if the Funds fail to comply with various tax or other regulatory matters. |

Competition could adversely affect our ability to acquire properties.

We expect other real estate investors, including insurance companies, pension and investment funds, private investors, and other multifamily REITs, will compete with us to acquire additional operating properties. This competition could increase prices for the type of properties we would likely pursue and adversely affect our ability to acquire these properties or achieve the expected profitability of such properties upon acquisition.

Our acquisition strategy may not produce the cash flows expected.

We may acquire additional operating properties on a selective basis. Our acquisition activities are subject to a number of risks, including, but not limited to, the following:

• | we may not be able to successfully integrate acquired properties into our existing operations; |

• | our estimates of the costs, if any, of repositioning or redeveloping the acquired property may prove inaccurate; |

• | the expected occupancy, rental rates and operating expenses may differ from the actual results; |

• | we may not be able to obtain adequate financing; and |

• | we may not be able to identify suitable candidates on terms acceptable to us and may not achieve expected returns or other benefits as a result of integration challenges, such as personnel and technology. |

Failure to qualify as a REIT could have adverse consequences.

We may not continue to qualify as a REIT in the future. Also, the Internal Revenue Service may challenge our qualification as a REIT for prior years.

For any taxable year we fail to qualify as a REIT and do not qualify under statutory relief provisions:

• | we would be subject to federal income tax on our taxable income at regular corporate rates, including any applicable alternative minimum tax; |

• | we would be disqualified from treatment as a REIT for the four taxable years following the year in which we failed to qualify, thereby reducing our net income, including any distributions to shareholders, as we would be required to pay significant income taxes for the year or years involved; and, |

• | our ability to expand our business and raise capital would be impaired, which may adversely affect the value of our common shares. |

We may face other tax liabilities in the future which may impact our cash flow. These potential tax liabilities may be calculated on our income or property values at either the corporate or individual property levels. Any additional tax expense incurred would decrease the cash available for cash distributions to our common shareholders and non-controlling interest holders. Additionally, in order for us to continue to qualify as a REIT we must meet a number of organizational and operational requirements, including a requirement to distribute annual dividends to our shareholders equal to a minimum of 90% of our adjusted taxable income.

Tax laws and related interpretations may change at any time, and any such legislative or other actions could have a negative effect on us.

Tax laws are under constant review by persons involved in the legislative process, at the Internal Revenue Service and the U.S. Department of the Treasury, and by various state and local tax authorities. Changes to tax laws, regulations, or administrative interpretations, which may be applied retroactively, could adversely affect us in a number of ways, including the following:

5

• | making it more difficult or more costly for us to qualify as a REIT; |

• | decreasing real estate values generally; and, |

• | lowering effective tax rates for non-REIT "C" corporations, which may cause investors to perceive investments in REITs to be less attractive than investments in the stock of non-REIT "C" corporations. |

We cannot predict whether, when, in what forms, or with what effective dates, the tax laws, regulations, and administrative interpretations applicable to us or our shareholders may be changed. Any such change may significantly affect our liquidity and results of operations, as well as the value of our shares.

Litigation risks could affect our business.

As a publicly-traded owner, developer and manager of multifamily properties, we may incur liability based on various conditions at our properties and the buildings thereon, and we also have become and in the future may become involved in legal proceedings, including consumer, employment, tort or commercial litigation, which if decided adversely to or settled by us, and not adequately covered by insurance, could result in liability which is material to our financial condition or results of operations.

Damage from catastrophic weather and other natural events could result in losses.

Certain of our properties are located in areas that may experience catastrophic weather and other natural events from time to time, including fires, snow or ice storms, windstorms, tornadoes or hurricanes, earthquakes, flooding or other severe weather. These adverse weather or natural events could cause substantial damages or losses to our properties which could exceed our insurance coverage. In the event of a loss in excess of insured limits, we could lose our capital invested in the affected property, as well as anticipated future revenue from that property. We could also continue to be obligated to repay any mortgage indebtedness or other obligations related to the property. Any such loss could materially and adversely affect our business and our financial condition and results of operations.

A cybersecurity incident and other technology disruptions could negatively impact our business.

We use technology in substantially all aspects of our business operations. We also use mobile devices, social networking, outside vendors and other online activities to connect with our employees, suppliers and residents. Such uses give rise to potential cybersecurity risks, including security breach, espionage, system disruption, theft and inadvertent release of information. Our business involves the storage and transmission of numerous classes of sensitive and confidential information and intellectual property, including residents' and suppliers' personal information, private information about employees, and financial and strategic information about us. Further, as we pursue our strategy to grow through acquisitions and developments and to pursue new initiatives to improve our operations, we are also expanding our information technologies, resulting in a larger technological presence and corresponding exposure to cybersecurity risk. If we fail to assess and identify cybersecurity risks associated with our operations, we may become increasingly vulnerable to such risks. Additionally, the measures we have implemented to prevent security breaches and cyber incidents may not be effective. The theft, destruction, loss, misappropriation, or release of sensitive data, confidential information or intellectual property, or interference with our information technology systems or the technology systems of third parties on which we rely, could result in business disruption, negative publicity, brand damage, violation of privacy laws, loss of residents, potential liability and competitive disadvantage, any of which could result in a material adverse effect on our financial condition or results of operations.

Our third-party service providers are primarily responsible for the security of their own information technology environments and in certain instances, we rely significantly on third-party service providers to supply and store our sensitive data in a secure manner. All of these third parties face risks relating to cybersecurity similar to ours which could disrupt their businesses and therefore adversely impact us. While we provide guidance and specific requirements in some cases, we do not directly control any of such parties' information technology security operations, or the amount of investment they place in guarding against cybersecurity threats. Accordingly, we are subject to any flaws in or breaches to their information technology systems or those which they operate for us, which could have a material adverse effect on our financial condition or results of operations.

Risks Associated with Our Indebtedness and Financing

We have significant debt, which could have adverse consequences.

As of December 31, 2016, we had outstanding debt of approximately $2.5 billion. This indebtedness could have adverse consequences, including, but not limited to:

6

• | if a property is mortgaged to secure payment of indebtedness, and if we are unable to meet our mortgage obligations, we could sustain a loss as a result of foreclosure on the mortgaged property; |

• | our vulnerability to general adverse economic and industry conditions is increased; and |

• | our flexibility in planning for, or reacting to, changes in business and industry conditions is limited. |

The mortgages on our properties subject to secured debt, our unsecured credit facilities, and the indenture under which our unsecured debt was issued, contain customary restrictions, requirements, and other limitations, as well as certain financial and operating covenants including maintenance of certain financial ratios. Maintaining compliance with these provisions could limit our financial flexibility. A default in these provisions, if uncured, could require us to repay the indebtedness before the scheduled maturity date, which could adversely affect our liquidity and increase our financing costs.

Insufficient cash flows could limit our ability to make required payments for debt obligations or pay distributions to shareholders.

Substantially all of our income is derived from rental and other income from our multifamily communities. As a result, our performance depends in large part on our ability to collect rent from residents, which could be negatively affected by a number of factors, including, but not limited to, the following:

• | delay in resident lease commencements; |

• | decline in occupancy; |

• | failure of residents to make rental payments when due; |

• | the attractiveness of our properties to residents and potential residents; |

• | our ability to adequately manage and maintain our communities; |

• | competition from other available apartments and housing alternatives; |

• | changes in market rents; and |

• | increases in operating expenses. |

Cash flow could be insufficient to meet required payments of principal and interest with respect to debt financing. In order for us to continue to qualify as a REIT we must meet a number of organizational and operational requirements, including a requirement to distribute annual dividends to our shareholders equal to a minimum of 90% of our adjusted taxable income. This requirement limits the cash available to meet required principal payments on our debt.

Issuances of additional debt may adversely impact our financial condition.

Our capital requirements depend on numerous factors, including the rental and occupancy rates of our multifamily properties, minimum dividend requirements to our equity holders, development, redevelopment and other capital expenditures, costs of operations, and potential acquisitions. If our capital requirements vary materially from our plans, we may require additional financing earlier than anticipated. If we issue more debt, we could become more leveraged, resulting in increased risk of default on our obligations and an increase in our debt service requirements, both of which could adversely affect our financial condition and ability to access debt and equity capital markets in the future.

We may be unable to renew, repay, or refinance our outstanding debt.

We are subject to the risk that indebtedness on our properties or our unsecured indebtedness will not be renewed, repaid, or refinanced when due or the terms of any renewal or refinancing will not be as favorable as the existing terms of such indebtedness. If we are unable to refinance our indebtedness on acceptable terms, or at all, we might be forced to dispose of one or more of the properties on disadvantageous terms, which might result in losses to us. Such losses could have a material adverse effect on us and our ability to make distributions to our shareholders and pay amounts due on our debt. Furthermore, if a property is mortgaged to secure payment of indebtedness and we are unable to meet mortgage payments, the mortgagee could foreclose on the property, appoint a receiver and exercise rights under an assignment of rents and leases, or pursue other remedies, all with a consequent loss of our revenues and asset value. Foreclosures could also create taxable income without accompanying cash proceeds, thereby hindering our ability to meet the REIT distribution requirements of the Code.

7

Rising interest rates could both increase our borrowing costs, thereby adversely affecting our cash flows and the amounts available for distribution to our shareholders, and decrease our share price, if investors seek higher yields through other investments.

We have mortgage debt with varying interest rates dependent upon various market indexes. In addition, we have an unsecured credit facility bearing interest at variable rates on all amounts drawn. We may incur additional variable rate debt in the future. Increases in interest rates would increase our interest expense, unless we make arrangements which hedge the risk of rising interest rates, and would increase the costs of refinancing existing debt and of issuing new debt. Accordingly, higher interest rates would adversely affect cash flow, net income, and cash available for payment of our debt obligations and distributions to shareholders.

An environment of rising interest rates could also lead holders of our securities to seek higher yields through other investments, which could adversely affect the market price of our shares. One of the factors which may influence the price of our stock in public markets is the annual distribution rate we pay as compared with the yields on alternative investments.

Failure to maintain our current credit ratings could adversely affect our cost of funds, related margins, liquidity, and access to capital markets.

Moody’s, Fitch, and Standard & Poor's, the major debt rating agencies, routinely evaluate our debt and have given us ratings of A3 with stable outlook, A- with stable outlook, and BBB+ with stable outlook, respectively, on our senior unsecured debt. These ratings are based on a number of factors, which include their assessment of our financial strength, liquidity, capital structure, asset quality, and sustainability of cash flow and earnings. Due to changes in market conditions, we may not be able to maintain our current credit ratings, which could adversely affect our cost of funds and related margins, liquidity, and access to capital markets.

Risks Associated with Our Shares

Share ownership limits and our ability to issue additional equity securities may prevent takeovers beneficial to shareholders.

For us to maintain our qualification as a REIT, we must have 100 or more shareholders during the year and not more than 50% in value of our outstanding shares may be owned, directly or indirectly, by five or fewer individuals. As defined for federal income tax purposes, the term “individuals” includes a number of specified entities. To minimize the possibility of us failing to qualify as a REIT under this test, our declaration of trust includes restrictions on transfers of our shares and ownership limits. The ownership limits, as well as our ability to issue other classes of equity securities, may delay, defer, or prevent a change in control. These provisions may also deter tender offers for our common shares which may be attractive to you or limit your opportunity to receive a premium for your shares which might otherwise exist if a third party were attempting to effect a change in control transaction.

Our share price will fluctuate.

The market price and trading volume of our common shares are subject to fluctuation due to general market conditions, the risks discussed in this report and other matters, including, but not limited to, the following:

• | operating results which vary from the expectations of securities analysts and investors; |

• | investor interest in our property portfolio; |

• | the reputation and performance of REITs; |

• | the attractiveness of REITs as compared to other investment vehicles; |

• | the results of our financial condition and operations; |

• | the perception of our growth and earnings potential; |

• | minimum dividend requirements; |

• | increases in market interest rates, which may lead purchasers of our common shares to demand a higher yield; and |

• | changes in financial markets and national and regional economic and general market conditions. |

The form, timing and amount of dividend distributions in future periods may vary and be impacted by economic and other considerations.

The form, timing and amount of dividend distributions will be declared at the discretion of our Board of Trust Managers and will depend on actual cash from operations, our financial condition, capital requirements, the annual distribution

8

requirements under the REIT provisions of the Code and other factors as the Board of Trust Managers may consider relevant. The Board of Trust Managers may modify the form, timing and amount of dividends from time to time.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

The Properties

Our properties typically consist of mid-rise buildings or two and three story buildings in a landscaped setting and provide residents with a variety of amenities common to multifamily rental properties.

Operating Properties (including properties held through unconsolidated joint ventures)

The 152 operating properties in which we owned interests and operated at December 31, 2016 averaged 953 square feet of living area per apartment home. For the year ended December 31, 2016, no single operating property accounted for greater than 1.7% of our total revenues. Our operating properties had a weighted average occupancy rate of approximately 95% and 96% for each of the years ended December 31, 2016 and 2015, respectively, and an average monthly rental revenue per apartment home of $1,405 and $1,342 for the same periods, respectively. Resident lease terms generally range from six to eighteen months. At December 31, 2016, 137 of our operating properties had over 200 apartment homes, with the largest having 1,005 apartment homes. Our operating properties have an average age of 12 years. Our operating properties were constructed and placed in service as follows:

Year Placed in Service | Number of Operating Properties |

2012-2016 | 24 |

2007-2011 | 30 |

2002-2006 | 32 |

1997-2001 | 42 |

1992-1996 | 16 |

Prior to 1991 | 8 |

9

Property Table

The following table sets forth information with respect to our 152 operating properties at December 31, 2016:

OPERATING PROPERTIES | ||||||||||||||

Property and Location | Year Placed in Service | Average Apartment Size (Sq. Ft.) | Number of Apartments | 2016 Average Occupancy (1) | 2016 Average Monthly Rental Rate per Apartment (2) | |||||||||

ARIZONA | ||||||||||||||

Phoenix/Scottsdale | ||||||||||||||

Camden Chandler (3) | 2015 | 1,146 | 380 | 94.1 | % | $ | 1,310 | |||||||

Camden Copper Square | 2000 | 786 | 332 | 95.7 | 1,084 | |||||||||

Camden Foothills | 2014 | 1,032 | 220 | 92.7 | 1,490 | |||||||||

Camden Hayden | 2015 | 1,043 | 234 | 90.6 | 1,384 | |||||||||

Camden Legacy | 1996 | 1,067 | 428 | 95.4 | 1,144 | |||||||||

Camden Montierra | 1999 | 1,071 | 249 | 95.7 | 1,266 | |||||||||

Camden Pecos Ranch | 2001 | 924 | 272 | 95.1 | 1,002 | |||||||||

Camden San Marcos | 1995 | 984 | 320 | 95.2 | 1,144 | |||||||||

Camden San Paloma | 1993/1994 | 1,042 | 324 | 95.5 | 1,153 | |||||||||

Camden Sotelo | 2008/2012 | 1,303 | 170 | 93.2 | 1,461 | |||||||||

CALIFORNIA | ||||||||||||||

Los Angeles/Orange County | ||||||||||||||

Camden Crown Valley | 2001 | 1,009 | 380 | 95.7 | 1,916 | |||||||||

Camden Glendale (3) | 2015 | 882 | 303 | 95.0 | 2,241 | |||||||||

Camden Harbor View | 2004 | 981 | 546 | 95.6 | 2,412 | |||||||||

Camden Main and Jamboree | 2008 | 1,011 | 290 | 96.2 | 2,026 | |||||||||

Camden Martinique | 1986 | 795 | 714 | 94.8 | 1,646 | |||||||||

Camden Sea Palms | 1990 | 891 | 138 | 96.0 | 1,844 | |||||||||

The Camden (4) | 2016 | 768 | 287 | Lease-up | 3,064 | |||||||||

San Diego/Inland Empire | ||||||||||||||

Camden Landmark | 2006 | 982 | 469 | 94.6 | 1,486 | |||||||||

Camden Old Creek | 2007 | 1,037 | 350 | 95.5 | 1,916 | |||||||||

Camden Sierra at Otay Ranch | 2003 | 962 | 422 | 95.2 | 1,795 | |||||||||

Camden Tuscany | 2003 | 896 | 160 | 95.9 | 2,485 | |||||||||

Camden Vineyards | 2002 | 1,053 | 264 | 96.0 | 1,501 | |||||||||

COLORADO | ||||||||||||||

Denver | ||||||||||||||

Camden Belleview Station | 2009 | 888 | 270 | 94.2 | 1,374 | |||||||||

Camden Caley | 2000 | 925 | 218 | 96.0 | 1,328 | |||||||||

Camden Denver West | 1997 | 1,015 | 320 | 95.3 | 1,566 | |||||||||

Camden Flatirons (3) | 2015 | 960 | 424 | 95.0 | 1,460 | |||||||||

Camden Highlands Ridge | 1996 | 1,149 | 342 | 95.3 | 1,583 | |||||||||

Camden Interlocken | 1999 | 1,010 | 340 | 95.8 | 1,470 | |||||||||

Camden Lakeway | 1997 | 932 | 451 | 95.5 | 1,399 | |||||||||

WASHINGTON DC METRO | ||||||||||||||

Camden Ashburn Farm | 2000 | 1,062 | 162 | 96.0 | 1,542 | |||||||||

Camden College Park | 2008 | 942 | 508 | 93.0 | 1,524 | |||||||||

Camden Dulles Station | 2009 | 978 | 382 | 96.3 | 1,628 | |||||||||

Camden Fair Lakes | 1999 | 1,056 | 530 | 95.8 | 1,715 | |||||||||

10

OPERATING PROPERTIES | ||||||||||||||

Property and Location | Year Placed in Service | Average Apartment Size (Sq. Ft.) | Number of Apartments | 2016 Average Occupancy (1) | 2016 Average Monthly Rental Rate per Apartment (2) | |||||||||

Camden Fairfax Corner | 2006 | 934 | 489 | 95.6 | % | $ | 1,773 | |||||||

Camden Fallsgrove | 2004 | 996 | 268 | 95.5 | 1,735 | |||||||||

Camden Grand Parc | 2002 | 674 | 105 | 97.0 | 2,417 | |||||||||

Camden Lansdowne | 2002 | 1,006 | 690 | 95.8 | 1,483 | |||||||||

Camden Largo Town Center | 2000/2007 | 1,027 | 245 | 94.0 | 1,616 | |||||||||

Camden Monument Place | 2007 | 856 | 368 | 95.4 | 1,524 | |||||||||

Camden NoMa | 2014 | 770 | 321 | 95.0 | 2,185 | |||||||||

Camden Potomac Yard | 2008 | 835 | 378 | 95.5 | 1,972 | |||||||||

Camden Roosevelt | 2003 | 856 | 198 | 95.6 | 2,630 | |||||||||

Camden Russett | 2000 | 992 | 426 | 94.9 | 1,451 | |||||||||

Camden Silo Creek | 2004 | 975 | 284 | 96.1 | 1,475 | |||||||||

Camden South Capitol (5) | 2013 | 821 | 281 | 94.3 | 2,130 | |||||||||

FLORIDA | ||||||||||||||

Southeast Florida | ||||||||||||||

Camden Aventura | 1995 | 1,108 | 379 | 95.8 | 1,959 | |||||||||

Camden Boca Raton | 2014 | 843 | 261 | 95.3 | 1,945 | |||||||||

Camden Brickell | 2003 | 937 | 405 | 96.5 | 2,059 | |||||||||

Camden Doral | 1999 | 1,120 | 260 | 96.9 | 1,868 | |||||||||

Camden Doral Villas | 2000 | 1,253 | 232 | 96.4 | 1,992 | |||||||||

Camden Las Olas | 2004 | 1,043 | 420 | 96.3 | 2,031 | |||||||||

Camden Plantation | 1997 | 1,201 | 502 | 96.8 | 1,591 | |||||||||

Camden Portofino | 1995 | 1,112 | 322 | 96.4 | 1,598 | |||||||||

Orlando | ||||||||||||||

Camden Hunter’s Creek | 2000 | 1,075 | 270 | 97.0 | 1,278 | |||||||||

Camden Lago Vista | 2005 | 955 | 366 | 96.4 | 1,130 | |||||||||

Camden LaVina | 2012 | 970 | 420 | 95.3 | 1,179 | |||||||||

Camden Lee Vista | 2000 | 937 | 492 | 96.9 | 1,082 | |||||||||

Camden Orange Court | 2008 | 817 | 268 | 95.1 | 1,288 | |||||||||

Camden Town Square | 2012 | 986 | 438 | 96.2 | 1,241 | |||||||||

Camden Waterford Lakes (5) | 2013 | 971 | 300 | 94.9 | 1,311 | |||||||||

Camden World Gateway | 2000 | 979 | 408 | 96.3 | 1,177 | |||||||||

Tampa/St. Petersburg | ||||||||||||||

Camden Bay | 1997/2001 | 943 | 760 | 95.6 | 1,072 | |||||||||

Camden Montague | 2012 | 975 | 192 | 95.4 | 1,216 | |||||||||

Camden Preserve | 1996 | 942 | 276 | 95.6 | 1,298 | |||||||||

Camden Royal Palms | 2006 | 1,017 | 352 | 96.2 | 1,110 | |||||||||

Camden Visconti (5) | 2007 | 1,125 | 450 | 95.6 | 1,255 | |||||||||

Camden Westchase Park | 2012 | 992 | 348 | 95.4 | 1,347 | |||||||||

GEORGIA | ||||||||||||||

Atlanta | ||||||||||||||

Camden Brookwood | 2002 | 912 | 359 | 96.2 | 1,288 | |||||||||

Camden Creekstone | 2002 | 990 | 223 | 95.6 | 1,200 | |||||||||

Camden Deerfield | 2000 | 1,187 | 292 | 95.1 | 1,324 | |||||||||

11

OPERATING PROPERTIES | ||||||||||||||

Property and Location | Year Placed in Service | Average Apartment Size (Sq. Ft.) | Number of Apartments | 2016 Average Occupancy (1) | 2016 Average Monthly Rental Rate per Apartment (2) | |||||||||

Camden Dunwoody | 1997 | 1,007 | 324 | 97.0 | % | $ | 1,219 | |||||||

Camden Fourth Ward | 2014 | 847 | 276 | 96.2 | 1,590 | |||||||||

Camden Midtown Atlanta | 2001 | 935 | 296 | 94.3 | 1,349 | |||||||||

Camden Paces (3) | 2015 | 1,407 | 379 | 94.2 | 2,498 | |||||||||

Camden Peachtree City | 2001 | 1,027 | 399 | 95.5 | 1,198 | |||||||||

Camden Phipps (5) | 1996 | 1,018 | 234 | 94.6 | 1,467 | |||||||||

Camden Shiloh | 1999/2002 | 1,143 | 232 | 96.4 | 1,176 | |||||||||

Camden St. Clair | 1997 | 999 | 336 | 95.5 | 1,234 | |||||||||

Camden Stockbridge | 2003 | 1,009 | 304 | 94.9 | 926 | |||||||||

Camden Vantage | 2010 | 901 | 592 | 95.8 | 1,286 | |||||||||

NORTH CAROLINA | ||||||||||||||

Charlotte | ||||||||||||||

Camden Ballantyne | 1998 | 1,048 | 400 | 95.5 | 1,215 | |||||||||

Camden Cotton Mills | 2002 | 905 | 180 | 96.0 | 1,448 | |||||||||

Camden Dilworth | 2006 | 857 | 145 | 96.2 | 1,431 | |||||||||

Camden Fairview | 1983 | 1,036 | 135 | 96.6 | 1,135 | |||||||||

Camden Foxcroft | 1979 | 940 | 156 | 96.3 | 994 | |||||||||

Camden Foxcroft II (6) | 1985 | 874 | 100 | 96.5 | 1,605 | |||||||||

Camden Grandview | 2000 | 1,059 | 266 | 95.2 | 1,065 | |||||||||

Camden Sedgebrook | 1999 | 972 | 368 | 96.4 | 1,100 | |||||||||

Camden South End | 2003 | 882 | 299 | 96.4 | 1,345 | |||||||||

Camden Southline (3) (5) | 2015 | 831 | 266 | 95.7 | 1,414 | |||||||||

Camden Stonecrest | 2001 | 1,098 | 306 | 95.9 | 1,263 | |||||||||

Camden Touchstone | 1986 | 899 | 132 | 96.6 | 978 | |||||||||

Raleigh | ||||||||||||||

Camden Asbury Village (5) | 2009 | 1,009 | 350 | 95.4 | 1,118 | |||||||||

Camden Crest | 2001 | 1,013 | 438 | 93.8 | 975 | |||||||||

Camden Governor’s Village | 1999 | 1,046 | 242 | 96.1 | 1,001 | |||||||||

Camden Lake Pine | 1999 | 1,066 | 446 | 95.3 | 1,041 | |||||||||

Camden Manor Park | 2006 | 966 | 484 | 96.0 | 1,014 | |||||||||

Camden Overlook | 2001 | 1,060 | 320 | 95.8 | 1,156 | |||||||||

Camden Reunion Park | 2000/2004 | 972 | 420 | 94.1 | 918 | |||||||||

Camden Westwood | 1999 | 1,027 | 354 | 94.4 | 985 | |||||||||

TEXAS | ||||||||||||||

Austin | ||||||||||||||

Camden Amber Oaks (5) | 2009 | 862 | 348 | 95.3 | 1,043 | |||||||||

Camden Amber Oaks II (5) | 2012 | 910 | 244 | 95.6 | 1,112 | |||||||||

Camden Brushy Creek (5) | 2008 | 882 | 272 | 95.8 | 1,091 | |||||||||

Camden Cedar Hills | 2008 | 911 | 208 | 95.8 | 1,220 | |||||||||

Camden Gaines Ranch | 1997 | 955 | 390 | 96.3 | 1,348 | |||||||||

Camden Huntingdon | 1995 | 903 | 398 | 95.5 | 1,071 | |||||||||

Camden La Frontera | 2015 | 901 | 300 | 94.9 | 1,186 | |||||||||

Camden Lamar Heights | 2015 | 838 | 314 | 94.6 | 1,436 | |||||||||

12

OPERATING PROPERTIES | ||||||||||||||

Property and Location | Year Placed in Service | Average Apartment Size (Sq. Ft.) | Number of Apartments | 2016 Average Occupancy (1) | 2016 Average Monthly Rental Rate per Apartment (2) | |||||||||

Camden Shadow Brook (5) | 2009 | 909 | 496 | 95.6 | % | $ | 1,117 | |||||||

Camden Stoneleigh | 2001 | 908 | 390 | 95.8 | 1,208 | |||||||||

Corpus Christi | ||||||||||||||

Camden Breakers | 1996 | 868 | 288 | 93.5 | 1,155 | |||||||||

Camden Copper Ridge | 1986 | 775 | 344 | 92.0 | 875 | |||||||||

Camden Miramar (7) | 1994-2014 | 494 | 1,005 | 73.7 | 1,112 | |||||||||

Camden South Bay (5) | 2007 | 1,055 | 270 | 93.8 | 1,260 | |||||||||

Dallas/Fort Worth | ||||||||||||||

Camden Addison | 1996 | 942 | 456 | 96.8 | 1,125 | |||||||||

Camden Belmont | 2010/2012 | 945 | 477 | 95.8 | 1,431 | |||||||||

Camden Buckingham | 1997 | 919 | 464 | 95.9 | 1,151 | |||||||||

Camden Centreport | 1997 | 911 | 268 | 96.6 | 1,058 | |||||||||

Camden Cimarron | 1992 | 772 | 286 | 96.7 | 1,113 | |||||||||

Camden Design District (5) | 2009 | 939 | 355 | 96.4 | 1,351 | |||||||||

Camden Farmers Market | 2001/2005 | 932 | 904 | 95.5 | 1,260 | |||||||||

Camden Henderson | 2012 | 967 | 106 | 95.9 | 1,540 | |||||||||

Camden Legacy Creek | 1995 | 831 | 240 | 96.7 | 1,176 | |||||||||

Camden Legacy Park | 1996 | 871 | 276 | 97.3 | 1,177 | |||||||||

Camden Panther Creek (5) | 2009 | 946 | 295 | 95.6 | 1,160 | |||||||||

Camden Riverwalk (5) | 2008 | 982 | 600 | 94.7 | 1,352 | |||||||||

Camden Valley Park | 1986 | 743 | 516 | 96.5 | 1,029 | |||||||||

Camden Victory Park (4) | 2016 | 861 | 423 | Lease-Up | 1,696 | |||||||||

Houston | ||||||||||||||

Camden City Centre | 2007 | 932 | 379 | 93.1 | 1,592 | |||||||||

Camden City Centre II | 2013 | 868 | 268 | 94.7 | 1,652 | |||||||||

Camden Cypress Creek (5) | 2009 | 993 | 310 | 93.9 | 1,237 | |||||||||

Camden Downs at Cinco Ranch (5) | 2004 | 1,075 | 318 | 93.7 | 1,242 | |||||||||

Camden Grand Harbor (5) | 2008 | 959 | 300 | 94.0 | 1,167 | |||||||||

Camden Greenway | 1999 | 861 | 756 | 95.0 | 1,408 | |||||||||

Camden Heights (5) | 2004 | 927 | 352 | 93.8 | 1,515 | |||||||||

Camden Holly Springs | 1999 | 934 | 548 | 92.9 | 1,249 | |||||||||

Camden Midtown | 1999 | 844 | 337 | 91.9 | 1,652 | |||||||||

Camden Northpointe (5) | 2008 | 940 | 384 | 94.6 | 1,104 | |||||||||

Camden Oak Crest | 2003 | 870 | 364 | 93.7 | 1,133 | |||||||||

Camden Park | 1995 | 866 | 288 | 93.7 | 1,105 | |||||||||

Camden Plaza | 2007 | 915 | 271 | 95.1 | 1,573 | |||||||||

Camden Post Oak | 2003 | 1,200 | 356 | 91.6 | 2,537 | |||||||||

Camden Royal Oaks | 2006 | 923 | 236 | 93.0 | 1,303 | |||||||||

Camden Royal Oaks II | 2012 | 1,054 | 104 | 90.3 | 1,512 | |||||||||

Camden Spring Creek (5) | 2004 | 1,080 | 304 | 93.6 | 1,227 | |||||||||

Camden Stonebridge | 1993 | 845 | 204 | 93.8 | 1,120 | |||||||||

Camden Sugar Grove | 1997 | 921 | 380 | 93.8 | 1,156 | |||||||||

Camden Travis Street | 2010 | 819 | 253 | 93.8 | 1,552 | |||||||||

13

OPERATING PROPERTIES | ||||||||||||||

Property and Location | Year Placed in Service | Average Apartment Size (Sq. Ft.) | Number of Apartments | 2016 Average Occupancy (1) | 2016 Average Monthly Rental Rate per Apartment (2) | |||||||||

Camden Vanderbilt | 1996/1997 | 863 | 894 | 94.6 | % | $ | 1,460 | |||||||

Camden Whispering Oaks | 2008 | 934 | 274 | 93.5 | 1,238 | |||||||||

Camden Woodson Park (5) | 2008 | 916 | 248 | 94.4 | 1,173 | |||||||||

Camden Yorktown (5) | 2008 | 995 | 306 | 93.9 | 1,161 | |||||||||

(1) | Represents average physical occupancy for the year except as noted. |

(2) | The average monthly rental rate per apartment incorporates vacant units and resident concessions calculated on a straight-line basis over the life of the lease. |

(3) | Development property stabilized during 2016—average occupancy calculated from date at which occupancy exceeded 90% through December 31, 2016. |

(4) | Property under lease-up at December 31, 2016. |

(5) | Property owned through an unconsolidated joint venture in which we currently own a 31.3% interest. The remaining interest is owned by an unaffiliated third party. |

(6) | Formerly known as Camden Simsbury. |

(7) | Miramar is a student housing project for Texas A&M University - Corpus Christi. Average occupancy includes summer months which are normally subject to high vacancies. |

Item 3. Legal Proceedings

None.

Item 4. Mine Safety Disclosures

None.

14

PART II

Item 5. Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

The high and low closing prices per share of our common shares, as reported on the New York Stock Exchange composite tape under the symbol “CPT,” and distributions per share declared for the quarters indicated are as follows:

High | Low | Distributions | |||||||||

2016 Quarters: | |||||||||||

First | $ | 84.09 | $ | 70.55 | $ | 0.75 | |||||

Second | 88.42 | 80.08 | 0.75 | ||||||||

Third | 90.67 | 83.69 | 5.00 | ||||||||

Fourth | 84.07 | 76.00 | 0.75 | ||||||||

2015 Quarters: | |||||||||||

First | $ | 80.92 | $ | 72.37 | $ | 0.70 | |||||

Second | 79.11 | 73.03 | 0.70 | ||||||||

Third | 81.28 | 69.45 | 0.70 | ||||||||

Fourth | 79.04 | 73.56 | 0.70 | ||||||||

In September 2016, our Board of Trust Managers declared a special dividend of $4.25 per common share to our common shareholders of record as of September 23, 2016, consisting of gains on dispositions of assets completed in 2016. The special dividend was in addition to our quarterly dividend of $0.75 per common share. We also paid equivalent amounts per unit to holders of the common operating partnership units.

In the first quarter of 2017, the Company's Board of Trust Managers maintained the $0.75 quarterly dividend rate per common share. Future dividend payments are paid at the discretion of the Board of Trust Managers and depend on cash flows generated from operations, the Company's financial condition and capital requirements, distribution requirements under the REIT provisions of the Internal Revenue Code of 1986, as amended, and other factors which may be deemed relevant by our Board of Trust Managers. Assuming similar dividend distributions for the remainder of 2017, our annualized dividend rate for 2017 would be $3.00.

15

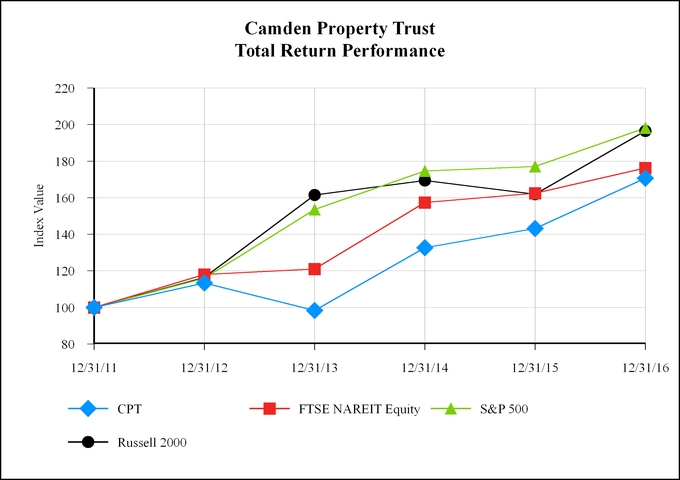

This graph assumes the investment of $100 on December 31, 2011 and quarterly reinvestment of dividends, including the special dividend paid in September 2016. (Source: SNL Financial LC)

Index | 2012 | 2013 | 2014 | 2015 | 2016 | ||||||||||||||

Camden Property Trust | $ | 113.41 | $ | 98.35 | $ | 132.62 | $ | 143.12 | $ | 170.65 | |||||||||

FTSE NAREIT Equity | 118.06 | 120.97 | 157.43 | 162.46 | 176.30 | ||||||||||||||

S&P 500 | 116.00 | 153.57 | 174.60 | 177.01 | 198.18 | ||||||||||||||

Russell 2000 | 116.35 | 161.52 | 169.43 | 161.95 | 196.45 | ||||||||||||||

As of February 7, 2017, there were approximately 413 shareholders of record and approximately 37,781 beneficial owners of our common shares.

In November 2014, we created an at-the-market share offering program (the "ATM program") through which we can, but have no obligation to, sell common shares having an aggregate offering price of up to $331.3 million, in amounts and at times as we determine, into the existing trading market at current market prices as well as through negotiated transactions. Actual sales from time to time may depend on a variety of factors including, among others, market conditions, the trading price of our common shares, and determinations by management of the appropriate sources of funding for us. We intend to use the net proceeds from any future sales under the ATM program for general corporate purposes, which may include reducing future borrowings under our unsecured credit facility, the repayment of other indebtedness, the redemption or other repurchase of outstanding debt or equity securities, funding for development, redevelopment and investment projects and financing for acquisitions. As of the date of this filing, we had common shares having an aggregate offering price of up to $315.3 million remaining available for sale under the ATM program. No shares were sold subsequent to December 31, 2016 through the date of this filing under the ATM program.

16

See Part III, Item 12, for a description of securities authorized for issuance under equity compensation plans.

In January 2008, our Board of Trust Managers approved a plan to allow for the repurchase of up to $500 million of our common equity securities through open market purchases, block purchases, and privately negotiated transactions. Under this program, we repurchased 4.3 million shares for a total of approximately $230.2 million from April 2007 through December 31, 2008 and there have not been any shares repurchased subsequent to that date. As of the date of this filing, the remaining dollar value of our common equity securities authorized to be repurchased under the program was approximately $269.8 million.

17

Item 6. Selected Financial Data

The following table provides selected financial data relating to our historical financial condition and results of operations as of and for each of the years ended December 31, 2012 through 2016. This data should be read in conjunction with Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes. Prior year amounts have been reclassified for discontinued operations.

COMPARATIVE SUMMARY OF SELECTED FINANCIAL AND PROPERTY DATA

Year Ended December 31, | |||||||||||||||||||

(in thousands, except per share amounts and property data) | 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||

Operating Data (a) | |||||||||||||||||||

Total property revenues | $ | 876,447 | $ | 835,618 | $ | 790,263 | $ | 737,033 | $ | 648,041 | |||||||||

Total property expenses | 311,355 | 301,000 | 285,700 | 266,572 | 237,715 | ||||||||||||||

Total non-property income | 14,577 | 7,332 | 14,611 | 21,197 | 16,407 | ||||||||||||||

Total other expenses | 425,190 | 412,022 | 399,314 | 377,026 | 355,672 | ||||||||||||||

Income from continuing operations attributable to common shareholders | 436,981 | 229,565 | 273,892 | 134,347 | 140,136 | ||||||||||||||

Net income attributable to common shareholders | 819,823 | 249,315 | 292,089 | 336,364 | 283,390 | ||||||||||||||

Earnings per common share from continuing operations: | |||||||||||||||||||

Basic | $ | 4.81 | $ | 2.55 | $ | 3.08 | $ | 1.50 | $ | 1.64 | |||||||||

Diluted | 4.79 | 2.54 | 3.06 | 1.50 | 1.63 | ||||||||||||||

Total earnings per common share: | |||||||||||||||||||

Basic | $ | 9.08 | $ | 2.77 | $ | 3.29 | $ | 3.82 | $ | 3.35 | |||||||||

Diluted | 9.05 | 2.76 | 3.27 | 3.78 | 3.32 | ||||||||||||||

Distributions declared per common share | $ | 3.00 | $ | 2.80 | $ | 2.64 | $ | 2.52 | $ | 2.24 | |||||||||

Special dividend per common share (b) | $ | 4.25 | $ | — | $ | — | $ | — | $ | — | |||||||||

Balance Sheet Data (at end of year) | |||||||||||||||||||

Total real estate assets, at cost (c) | $ | 7,376,690 | $ | 7,387,597 | $ | 7,025,376 | $ | 6,655,139 | $ | 6,262,645 | |||||||||

Total assets | 6,028,152 | 6,037,612 | 6,043,981 | 5,619,354 | 5,372,666 | ||||||||||||||

Notes payable | 2,480,588 | 2,724,687 | 2,730,613 | 2,517,979 | 2,497,962 | ||||||||||||||

Non-qualified deferred compensation share awards | 77,037 | 79,364 | 68,134 | 47,180 | — | ||||||||||||||

Equity | 3,095,553 | 2,892,896 | 2,888,409 | 2,760,181 | 2,626,708 | ||||||||||||||

Other Data | |||||||||||||||||||

Cash flows provided by (used in): | |||||||||||||||||||

Operating activities | $ | 443,063 | $ | 423,238 | $ | 418,528 | $ | 404,291 | $ | 324,267 | |||||||||

Investing activities (d) | 690,412 | (293,235 | ) | (326,587 | ) | (258,377 | ) | (526,770 | ) | ||||||||||

Financing activities | (904,237 | ) | (273,231 | ) | 43,482 | (154,181 | ) | 174,928 | |||||||||||

Funds from operations – diluted (e) | 425,464 | 414,497 | 378,043 | 368,321 | 313,337 | ||||||||||||||

Adjusted funds from operations – diluted (e) | 366,380 | 350,328 | 318,189 | 301,291 | 250,292 | ||||||||||||||

Property Data | |||||||||||||||||||

Number of operating properties (at the end of year) (f) | 152 | 172 | 168 | 170 | 193 | ||||||||||||||

Number of operating apartment homes (at end of year) (f) | 52,793 | 59,792 | 58,948 | 59,899 | 65,775 | ||||||||||||||

Number of operating apartment homes (weighted average) (f) (g) | 46,934 | 47,088 | 47,915 | 46,841 | 43,337 | ||||||||||||||

Weighted average monthly total property revenue per apartment home (a) | $ | 1,556 | $ | 1,479 | $ | 1,374 | $ | 1,311 | $ | 1,246 | |||||||||

Properties under development (at end of period) | 7 | 8 | 13 | 14 | 9 | ||||||||||||||

(a) | Excludes discontinued operations. See Note 2, "Summary of Significant Accounting Policies and Recent Accounting Pronouncements," and Note 7, "Acquisitions, Dispositions, Impairment, and Discontinued Operations," in the notes to Consolidated Financial Statements for further discussion of discontinued operations. |

(b) | A special dividend was paid on September 30, 2016. Refer to Note 4 "Common Shares" in the Notes to the Consolidated Financial Statements for further discussion of the special dividend. |

18

(c) | Includes operating properties held for sale at net book value and excludes discontinued operating properties and joint ventures for all periods presented. |

(d) | All periods presented have been changed to reflect our adoption of Accounting Standards Update 2016-18 ("ASU 2016-18"),"Statement of Cash Flows: Restricted Cash (A Consensus of the Emerging Issues Task Force)", which required retrospective application. See Note 2, "Summary of Significant Accounting Policies and Recent Accounting Pronouncements" for further discussion. |

(e) | Management considers Funds from Operations (“FFO”) and adjusted FFO ("AFFO") to be appropriate measures of the financial performance of an equity REIT. The National Association of Real Estate Investment Trusts (“NAREIT”) currently defines FFO as net income (computed in accordance with accounting principles generally accepted in the United States of America (“GAAP”)), excluding gains (or losses) associated with previously depreciated operating properties, real estate depreciation and amortization, impairments of depreciable assets, and adjustments for unconsolidated joint ventures. Our calculation of diluted FFO also assumes conversion of all potentially dilutive securities, including certain non-controlling interests, which are convertible into common shares. We consider FFO to be an appropriate supplemental measure of operating performance because, by excluding gains or losses on dispositions of operating properties, and depreciation, FFO can assist in the comparison of the operating performance of a company’s real estate investments between periods or to different companies. AFFO is calculated utilizing FFO less recurring capitalized expenditures which are necessary to help preserve the value of and maintain the functionality at our communities. We also consider AFFO to be a useful supplemental measure because it is frequently used by analysts and investors to evaluate a REIT's operating performance between periods or different companies. Our definition of recurring capital expenditures may differ from other REITs, and there can be no assurance our basis for computing this measure is comparable to other REITs. To facilitate a clear understanding of our consolidated historical operating results, we believe FFO and AFFO should be examined in conjunction with net income attributable to common shareholders as presented in the consolidated statements of income and comprehensive income and data included elsewhere in this report. FFO and AFFO are not defined by GAAP and should not be considered alternatives to net income attributable to common shareholders as an indication of our operating performance. Additionally, FFO and AFFO as disclosed by other REITs may not be comparable to our calculation. See "Funds from Operations and Adjusted FFO" in Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations" for reconciliations of net income attributable to common shareholders to FFO and AFFO. |

(f) | Includes operating properties held for sale and discontinued operating properties held for sale for all periods presented. |

(g) | Excludes apartment homes owned in joint ventures. |

19

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the consolidated financial statements and notes appearing elsewhere in this report. Historical results and trends which might appear in the consolidated financial statements should not be interpreted as being indicative of future operations.

We consider portions of this report to be “forward-looking” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, both as amended, with respect to our expectations for future periods. Forward-looking statements do not discuss historical fact, but instead include statements related to expectations, projections, intentions, or other items relating to the future; forward-looking statements are not guarantees of future performance, results, or events. Although we believe the expectations reflected in our forward-looking statements are based upon reasonable assumptions, we can give no assurance our expectations will be achieved. Any statements contained herein which are not statements of historical fact should be deemed forward-looking statements. Reliance should not be placed on these forward-looking statements as these statements are subject to known and unknown risks, uncertainties, and other factors beyond our control and could differ materially from our actual results and performance.

Factors which may cause our actual results or performance to differ materially from those contemplated by forward-looking statements include, but are not limited to, the following:

• | Volatility in capital and credit markets, or other unfavorable changes in economic conditions, either nationally or regionally in one or more of the markets in which we operate, could adversely impact us; |

• | Short-term leases expose us to the effects of declining market rents; |

• | Competition could limit our ability to lease apartments or increase or maintain rental income; |

• | We face risks associated with land holdings and related activities; |

• | Potential reforms to Fannie Mae and Freddie Mac could adversely affect us; |

• | Development, redevelopment and construction risks could impact our profitability; |

• | Investments through joint ventures and discretionary funds involve risks not present in investments in which we are the sole investor; |

• | Competition could adversely affect our ability to acquire properties; |

• | Our acquisition strategy may not produce the cash flows expected; |

• | Failure to qualify as a REIT could have adverse consequences; |

• | Tax laws and related interpretations may change at any time, and any such legislative or other actions could have a negative effect on us; |

• | Litigation risks could affect our business; |

• | Damage from catastrophic weather and other natural events could result in losses; |

• | A cybersecurity incident and other technology disruptions could negatively impact our business; |

• | We have significant debt, which could have adverse consequences; |

• | Insufficient cash flows could limit our ability to make required payments for debt obligations or pay distributions to shareholders; |

• | Issuances of additional debt may adversely impact our financial condition; |

• | We may be unable to renew, repay, or refinance our outstanding debt; |

• | Rising interest rates could both increase our borrowing costs, thereby adversely affecting our cash flows and the amounts available for distribution to our shareholders, and decrease our share price, if investors seek higher yields through other investments; |

• | Failure to maintain our current credit ratings could adversely affect our cost of funds, related margins, liquidity, and access to capital markets; |

• | Share ownership limits and our ability to issue additional equity securities may prevent takeovers beneficial to shareholders; |

• | Our share price will fluctuate; and |

20

• | The form, timing and amount of dividend distributions in future periods may vary and be impacted by economic and other considerations. |

These forward-looking statements represent our estimates and assumptions as of the date of this report, and we assume no obligation to update or supplement forward-looking statements because of subsequent events.

Executive Summary

We are primarily engaged in the ownership, management, development, redevelopment, acquisition, and construction of multifamily apartment communities. Overall, we focus on investing in markets characterized by high-growth economic conditions, strong employment, and attractive quality of life which we believe leads to higher demand and retention of our apartments. As of December 31, 2016, we owned interests in, operated, or were developing 159 multifamily properties comprised of 55,366 apartment homes across the United States as detailed in the following Property Portfolio table. In addition, we own other land holdings which we may develop into multifamily apartment communities in the future.

Property Operations

Our results for the year ended December 31, 2016 reflect an increase in same store revenues of 3.9% as compared to 2015. This increase was due to higher average rental rates and increased other property income, which we believe were due to, among other matters, the continuation of improving economic conditions, including job growth, favorable demographics, a manageable supply of new multifamily housing, and in part to more individuals choosing to rent versus buy as evidenced by the moderating level of homeownership rates, all of which have resulted in higher rental rates. We believe U.S. economic and employment growth is likely to continue during 2017 and the supply of new multifamily homes, although increasing, will likely remain at manageable levels. If economic conditions were to worsen, our operating results could be adversely affected.

Construction Activity

At December 31, 2016, we had seven projects under construction to be comprised of 2,573 apartment homes, with stabilization expected to be completed within the next 42 months. As of December 31, 2016, we estimate the additional cost to complete the construction of the seven projects to be approximately $240.6 million.

Acquisitions

During the year ended December 31, 2016, we acquired an aggregate of approximately of 4.6 acres of land located in Denver, Colorado and Charlotte, North Carolina for approximately $19.9 million. All of the land parcels acquired in 2016 are currently in development as of December 31, 2016.

Dispositions

Operating properties: During the year ended December 31, 2016, we sold one dual-phased property and six other operating properties comprised of an aggregate of 3,184 apartment homes with an average age of 24 years, located in Landover and Frederick, Maryland; Fullerton, California; and Tampa, Altamonte Springs, and St. Petersburg, Florida for an aggregate of approximately $523.4 million, and recognized a gain of approximately $294.9 million.

Land: During 2016, we also sold approximately 6.3 acres of land adjacent to an operating property in Tampa, Florida for approximately $2.2 million and recognized a gain of approximately $0.4 million.

Discontinued operations: In April 2016, we sold 15 operating properties, comprised of an aggregate of 4,918 apartment homes with an average age of 23 years, a retail center and approximately 19.6 acres of land, all located in Las Vegas, Nevada, to an unaffiliated third party for an aggregate of approximately $630.0 million and recognized a gain of approximately $375.2 million.

Future Outlook

Subject to market conditions, we intend to continue to seek opportunities to develop, redevelop and acquire existing communities. We also intend to evaluate our operating property and land development portfolio and plan to continue our practice of selective dispositions as market conditions warrant and opportunities arise. We further intend to strengthen our capital and liquidity positions by continuing to focus on our core fundamentals which currently are generating positive cash flows from operations, maintaining appropriate debt levels and leverage ratios, and controlling overhead costs. We anticipate meeting our near-term liquidity requirements through a combination of one or more of the following: cash and cash equivalents, short-term investments, cash flows generated from operations, draws on our unsecured credit facility, proceeds from property dispositions, the use of debt and equity offerings under our automatic shelf registration statement, equity issued from our ATM program, other unsecured borrowings, and secured mortgages.

21