UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

|

Preliminary Proxy Statement |

|

|

|

|

|

☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

|

|

|

☒ |

|

Definitive Proxy Statement |

|

|

|

|

|

☐ |

|

Definitive Additional Materials |

|

|

|

|

|

☐ |

|

Soliciting Material under Rule 14a-12 |

NVR, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

|

No fee required. |

||

|

|

|

|

||

|

☐ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

||

|

|

|

|

||

|

|

|

(1) |

|

Title of each class of securities to which transaction applies:

|

|

|

|

(2) |

|

Aggregate number of securities to which transaction applies:

|

|

|

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4) |

|

Proposed maximum aggregate value of transaction:

|

|

|

|

(5) |

|

Total fee paid:

|

|

|

|

|

||

|

☐ |

|

Fee paid previously with preliminary materials. |

||

|

|

|

|

||

|

☐ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

||

|

|

|

|

||

|

|

|

(1) |

|

Amount Previously Paid:

|

|

|

|

(2) |

|

Form, Schedule or Registration Statement No.:

|

|

|

|

(3) |

|

Filing Party:

|

|

|

|

(4) |

|

Date Filed:

|

NVR, INC.

11700 Plaza America Drive

Reston, VA 20190

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held on Thursday, May 4, 2017

11:00 A.M. Eastern Time

NVR, Inc. will hold its Annual Meeting of Shareholders at 11:00 A.M. (Eastern Time) on Thursday, May 4, 2017. We will hold the meeting at our corporate headquarters located at 11700 Plaza America Drive, Suite 500, Reston, Virginia, 20190.

We are holding the meeting for the following purposes:

|

|

1. |

To elect thirteen directors from the nominees named in the attached Proxy Statement; |

|

|

2. |

To ratify the appointment of the accounting firm of KPMG LLP as our independent auditor for the year ending December 31, 2017; |

|

|

3. |

To vote on an advisory resolution regarding the approval of compensation paid to certain executive officers; |

|

|

4. |

To vote on advisory resolution regarding the frequency of advisory votes on executive compensation; and |

|

|

5. |

To transact other business that may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

The above items are fully described in the attached Proxy Statement. We have not received notice of any other matters that may properly be presented at the meeting.

Only shareholders of record at the close of business on March 3, 2017 will be entitled to vote at the meeting. Whether or not you plan to attend the meeting, you are urged to date and sign the enclosed proxy card and return it promptly in the accompanying envelope. You are invited to attend the meeting in person. If you do attend the meeting, you may withdraw your proxy and vote in person.

|

|

|

By order of the Board of Directors, |

|

|

|

|

|

|

|

|

|

|

|

James M. Sack |

|

March 31, 2017 |

|

Secretary and General Counsel |

|

|

|

|

|

Page |

|

I. |

|

|

1 |

|

|

|

|

|

|

|

|

II. |

|

|

3 |

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

III. |

|

|

6 |

|

|

|

|

Board Leadership Structure, Committee Composition and Role in Risk Oversight |

|

6 |

|

|

|

|

8 |

|

|

|

|

|

9 |

|

|

|

|

|

11 |

|

|

|

|

Review, Approval or Ratification of Related Person Transactions |

|

12 |

|

|

|

|

12 |

|

|

|

|

Security Ownership of Certain Beneficial Owners and Management |

|

13 |

|

|

|

|

15 |

|

|

|

|

|

|

|

|

IV. |

|

|

16 |

|

|

|

|

|

27 |

|

|

|

|

|

28 |

|

|

|

|

|

28 |

|

|

|

|

|

30 |

|

|

|

|

|

31 |

|

|

|

|

|

31 |

|

|

|

|

Narrative Disclosures of Termination and Change of Control Payments |

|

33 |

|

|

|

|

37 |

|

|

|

|

|

|

|

|

V. |

|

Proposal No. 2 - Ratification of Appointment of Independent Auditor |

|

40 |

|

|

|

|

|

|

|

VI. |

|

|

41 |

|

|

|

|

|

|

|

|

VII. |

|

Proposal No. 4 - Advisory Vote on Frequency of Future Advisory Votes on Executive Compensation |

|

42 |

|

|

|

|

|

|

|

VIII. |

|

|

43 |

|

|

|

|

|

|

|

11700 Plaza America Drive

Suite 500

Reston, VA 20190

This Proxy Statement, proxy card and the Annual Report for the year ended December 31, 2016 are being mailed to our shareholders on or about March 31, 2017 in connection with the solicitation on behalf of the Board of Directors (the “Board”) of NVR, Inc., a Virginia corporation, of proxies for use at our Annual Meeting of Shareholders. The Annual Meeting will be held on Thursday, May 4, 2017, at our corporate headquarters located at 11700 Plaza America Drive, Suite 500, Reston, Virginia 20190, at 11:00 A.M., Eastern Time, and at any and all postponements and adjournments thereof. Shareholders should contact NVR’s Investor Relations Department at the same address to obtain directions to be able to attend the Annual Meeting in person.

We bear the cost of proxy solicitation, including expenses in connection with preparing, assembling and mailing the proxy solicitation materials and all papers accompanying them. We may reimburse brokers or persons holding shares in their names or in the names of their nominees for their expenses in sending proxies and proxy materials to beneficial owners. In addition to solicitation by mail, certain of our officers, directors and regular employees, who will receive no extra compensation for their services, may solicit proxies by telephone, facsimile transmission, internet or personally. We have retained Georgeson Inc. to assist in the solicitation of brokers, bank nominees and institutional holders for a fee of approximately $5,500 plus out-of-pocket expenses.

All voting rights are vested exclusively in the holders of our common stock, par value $.01 per share (the “Common Stock”). Only shareholders of record as of the close of business on March 3, 2017 (the “Record Date”) are entitled to receive notice of and to vote at the Annual Meeting. Shareholders include holders (the “Participants”) owning stock in our Profit Sharing Trust Plan and Employee Stock Ownership Plan (together, the “Plans”).

The accompanying proxy card should be used to instruct the persons named as proxies to vote the shareholder’s shares in accordance with the shareholder’s directions. The persons named in the accompanying proxy card will vote shares of Common Stock represented by all valid proxies in accordance with the instructions contained thereon. In the absence of instructions, shares represented by properly executed proxies will be voted:

|

|

• |

FOR the election of the thirteen director nominees named in this Proxy Statement; |

|

|

• |

FOR the ratification of the appointment of KPMG LLP as our independent auditor for 2017; |

|

|

• |

FOR the approval of the compensation paid to certain executive officers; |

|

|

• |

“1 Year” for the frequency to conduct an advisory vote on the compensation paid to certain executive officers; and |

|

|

• |

in the discretion of the named proxies with respect to any other matters presented at the Annual Meeting. |

If a shareholder holds shares in a brokerage account or through a broker, bank, trust or other nominee, the rules of the New York Stock Exchange (the “NYSE”) prohibit the nominee from voting the shareholder’s shares on any proposal to be voted on at the Annual Meeting, other than ratification of the appointment of KPMG LLP as our independent auditor, unless the nominee has received an instruction from the shareholder regarding how the shares should be voted. Any shares for which an instruction has not been received will result in a “broker non-vote” on the proposal for which no instruction was provided. With respect to the tabulation of proxies at the Annual Meeting, abstentions and broker non-votes will be counted for the purpose of establishing a quorum but will not be considered votes cast and therefore will have no effect on the result of the vote on any proposal. We strongly encourage all of our shareholders who hold shares of Common Stock in a brokerage account or through any other nominee to provide voting instructions to their broker, bank, trustee or other nominee to ensure that their shares are voted at the Annual Meeting.

Any shareholder may revoke his or her proxy at any time prior to its use by (1) providing our Secretary, at 11700 Plaza America Drive, Suite 500, Reston, Virginia 20190, written notice of revocation, (2) duly executing a proxy card bearing a later date than the date of the previously duly executed proxy card, or (3) attending the Annual Meeting and voting in person (attendance at the Annual Meeting alone will not act to revoke a prior proxy card). Execution of the enclosed proxy card will not affect your right to vote in person if you should later decide to attend the Annual Meeting.

The proxy card also should be used by Participants to instruct the trustee of the Plans how to vote shares of Common Stock held on their behalf. The trustee is required under the trust agreement to establish procedures to ensure that the instructions received from Participants are held in confidence and not divulged, released or otherwise utilized in a manner that might influence the Participants’ free exercise of their voting rights. Proxy cards representing shares held by Participants must be returned to the tabulator by May 1, 2017 using the enclosed return envelope and should not be returned to NVR. If shares are owned through the Plans and the Participant does not submit voting instructions by May 1, 2017, the trustee of the Plans will vote such shares in the same proportion as

1

the voting instructions received from other Participants. Participants who wish to revoke a proxy will need to contact the trustee and follow its instructions.

As of the Record Date, we had a total of 3,726,332 shares of Common Stock outstanding, each share of which is entitled to one vote. The presence, either in person or by proxy, of persons entitled to vote a majority of the outstanding Common Stock is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Under our Restated Articles of Incorporation and Bylaws, holders of Common Stock are not entitled to vote such shares on a cumulative basis, including with respect to the voting for directors.

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to Be Held on May 4, 2017:

This Proxy Statement and our Annual Report for the year ended December 31, 2016 are available at www.edocumentview.com/nvr.

2

(Proposal No. 1)

Director Nominees

Our Restated Articles of Incorporation state that the number of directors on our Board will be no less than seven and no more than thirteen, as established from time to time by Board resolution. Our Board has currently set the size of the Board at thirteen members. The following persons have been nominated by the Board to be elected to hold office for a one-year term ending at the 2018 Annual Meeting and until their successors are duly elected and qualified:

|

Name |

|

Age |

|

Year First Elected or Appointed |

|

Dwight C. Schar |

|

75 |

|

1993 |

|

C. E. Andrews |

|

65 |

|

2008 |

|

Timothy M. Donahue |

|

68 |

|

2006 |

|

Thomas D. Eckert |

|

69 |

|

2011 |

|

Alfred E. Festa |

|

57 |

|

2008 |

|

Ed Grier |

|

62 |

|

2013 |

|

Manuel H. Johnson |

|

68 |

|

1993 |

|

Mel Martinez |

|

70 |

|

2012 |

|

William A. Moran |

|

70 |

|

1993 |

|

David A. Preiser |

|

59 |

|

1993 |

|

W. Grady Rosier |

|

68 |

|

2008 |

|

Susan Williamson Ross |

|

55 |

|

2016 |

|

Paul W. Whetsell |

|

66 |

|

2007 |

All of the director nominees are current directors standing for re-election. Each nominee has consented to serve as one of our directors if elected. Our Board has affirmatively determined that each of the proposed nominees is independent, with the exception of Messrs. Schar and Moran. Our Board does not contemplate that any of its proposed nominees listed above will be unwilling to serve or become unavailable for any reason, but if any such circumstance should occur before the Annual Meeting, proxies may be voted for another nominee selected by the Board.

Biographical Information for Our Director Nominees

The biographies below describe the skills, attributes and experience of the nominees who were considered by the Board and Nominating Committee.

Dwight C. Schar has been Chairman of the Board since September 30, 1993. Effective February 4, 2009, Mr. Schar relinquished his executive officer title with NVR, but remains the Chairman of the Board. Mr. Schar also served as the President and Chief Executive Officer of NVR from September 30, 1993 through June 30, 2005.

The Board believes that Mr. Schar is highly qualified to serve on the Board, based on his founding status with NVR, his lengthy homebuilding industry and real estate experience, his successful senior leadership experience from being a Chief Executive Officer of NVR and its predecessors, his brand marketing expertise and his expertise in managing a company in a cyclical industry.

C. E. Andrews has been a director since May 6, 2008. Mr. Andrews has been Chief Executive Officer and a member of the board of directors of MorganFranklin Consulting, LLC since May 2013. From June 2009 until February 2012, Mr. Andrews was the president of RSM McGladrey Business Services, Inc. Prior to that, Mr. Andrews served as the president of SLM Corporation (“Sallie Mae”). He joined Sallie Mae in 2003 as the executive vice president of accounting and risk management, and held the title of chief financial officer from 2006 to 2007. Prior to joining Sallie Mae, Mr. Andrews spent approximately 30 years at Arthur Andersen. He served as managing partner for Arthur Andersen’s mid-Atlantic region, and was promoted to global managing partner for audit and advisory services in 2002. Mr. Andrews serves on the boards of Marriott Vacations Worldwide Corporation, WashingtonFirst Bankshares, Inc. and Washington Mutual Investors Fund. Additionally, Mr. Andrews serves on the boards of Vemo Education, Inc., Junior Achievement of the National Capital Area and Global Good Fund. He is also a member of the advisory board of the R.B. Pamplin College of Business and Accounting Department at Virginia Tech.

The Board believes that Mr. Andrews is highly qualified to serve on our Board based on the varied business experience that he obtained over his thirty year career in public accounting, his financial and accounting expertise, and his experience on other public boards.

3

Timothy M. Donahue has been a director since January 1, 2006. Prior to his retirement, Mr. Donahue was Executive Chairman of Sprint Nextel Corporation from August 2005 to December 2006. He previously served as president and chief executive officer of Nextel Communications, Inc. He began his career with Nextel in January 1996 as president and chief operating officer. Before joining Nextel, Mr. Donahue served as northeast regional president for AT&T Wireless Services operations from 1991 to 1996. Prior to that, he served as president for McCaw Cellular's paging division in 1986 and was named McCaw's president for the U.S. central region in 1989. Within the past five years, Mr. Donahue also served as a director of The ADT Corporation, Eastman Kodak, Covidien Limited and Tyco International Ltd.

The Board considered Mr. Donahue’s senior leadership experience from being a Chief Executive Officer of a publicly-traded company, his operational expertise in providing global strategic vision to the overall operating entity, his experience serving on other public boards, and his brand marketing expertise in concluding that Mr. Donahue is highly qualified to serve as one of our directors.

Thomas D. Eckert has been a director since December 1, 2011. Mr. Eckert was Chairman of Capital Automotive Real Estate Services, Inc. (“Capital Automotive”) until October 2014. He was one of the founders of Capital Automotive in October 1997 and led its initial public offering in 1998. Capital Automotive went private in 2005. Mr. Eckert serves as a director of Dupont-Fabros Technologies, Inc., Chesapeake Lodging Trust and Gramercy Property Trust. Within the past five years, Mr. Eckert also served on the board of the Munder Funds (and its successor, Victory Funds).

The Board believes that Mr. Eckert is highly qualified to serve as one of our directors because of his senior leadership experience from being a founder of Capital Automotive, his public board experience, and his operational expertise of being responsible for setting global strategic vision for an entire organization.

Alfred E. Festa has been a director since December 1, 2008. Mr. Festa is Chairman and Chief Executive Officer of W. R. Grace & Co (“Grace”). He joined Grace as president and chief operating officer in November 2003, assumed the CEO role in June 2005, and became Chairman of the Board of Grace on January 1, 2008. From November 2002 until November 2003, Mr. Festa was a partner in Morgenthaler Private Equity Partners (“Morgenthaler”), a venture/buyout firm focused on mid-market industrial build-ups. Mr. Festa serves as a director of the American Chemistry Council and the National Association of Manufacturers.

The Board believes that Mr. Festa is highly qualified to serve on our Board based on his experience of managing Grace during different business cycles, his senior leadership experience as a Chief Executive Officer of a publicly-traded company, his role setting global strategic vision for an entire organization, and his experience serving on another public board.

Ed Grier has been a director since May 7, 2013. Mr. Grier has been the Dean of the Virginia Commonwealth University (“VCU”) School of Business since March 2010. Prior to joining VCU, Mr. Grier spent approximately 29 years with the Walt Disney Company beginning in 1981. He served as the President of the Disneyland Resort from 2006 until 2010. Mr. Grier held various senior financial and operational roles during his career with Disney. Mr. Grier serves as a director of the Middleburg Trust Company and Capital Senior Living. Mr. Grier also serves on the boards of the following non-profit entities: Colonial Williamsburg, Brandman University, The Richmond Forum and ChildFund International.

The Board believes that Mr. Grier is highly qualified to serve on our Board based on his operational expertise from operating a multi-billion dollar business for Disney, his brand marketing expertise obtained while managing one of the world’s most recognized brands and his financial expertise.

Manuel H. Johnson has been a director since September 30, 1993. Dr. Johnson has been co-chairman and senior partner in Johnson Smick International, Inc., an international financial policy-consulting firm, since 1990. From August 1, 1997 until December 2003, Dr. Johnson was the chairman of the board of trustees and president of the Financial Accounting Foundation, which oversees the Financial Accounting Standards Board. Also during 1997, Dr. Johnson was named a member of the Independence Standards Board (which was dissolved on July 31, 2001), formed jointly by the SEC and the American Institute of Certified Public Accountants. Dr. Johnson is a founder and co-chairman of the Group of Seven Council, an international commission supporting economic cooperation among the major industrial nations. Dr. Johnson is a director of Morgan Stanley Funds. Additionally, he is a director with the following non-profit and educational institutions: National Sporting Library and Museum, Upperville Colt and Horse Show, Troy University Foundation and Mercatus Center at George Mason University.

The Board believes that Dr. Johnson is highly qualified to serve on our Board based on his financial and macroeconomic expertise, his knowledge of governmental and financial regulatory matters, his ability to access multiple high level information channels in the public and private sectors, his public board experience, and his lengthy experience as one of our directors.

Mel Martinez has been a director since December 1, 2012. Mr. Martinez has been Chairman of the South East and Latin America for JPMorgan Chase & Co. since August 2010. Prior to joining JPMorgan, Mr. Martinez was a partner in the law firm DLA Piper from September 2009 to July 2010. Mr. Martinez served as a United States Senator from Florida from January 2005 to September 2009. Prior to his election, Mr. Martinez served as the Secretary of the United States Department of Housing and Urban

4

Development (“HUD”) from January 2001 to January 2004. Mr. Martinez also serves on the boards of Marriott Vacations Worldwide Corporation, where he is the lead director, and the Orlando Magic Youth Foundation. Within the past five years, Mr. Martinez was a director of Progress Energy, Inc.

The Board believes that Mr. Martinez is highly qualified to serve as one of our directors based upon his government and housing regulatory matters experience in connection with his service as Secretary of HUD, his ability to access high level information channels in the public sector and his public board experience.

William A. Moran has been a director since September 30, 1993. Mr. Moran has been the chairman of Elm Street Development, Inc. (“Elm Street”) since 1996. Mr. Moran is also a director and owner of Legend Management Group, which builds and owns apartment projects in the Washington, DC metro area. Until January 1, 2010, Mr. Moran was a director of Craftmark, Inc., a homebuilder in Virginia, Maryland, Pennsylvania and Delaware and Craftstar, Inc., which develops, invests in and periodically sells apartments, condominiums, single family homes and townhomes in Virginia and Maryland.

The Board considered Mr. Moran’s lengthy homebuilding, real estate and land development experience, his senior leadership experience from being a Chief Executive Officer, his operational expertise and his expertise in managing a company within a cyclical industry in concluding that Mr. Moran is highly qualified to serve as one of our directors.

David A. Preiser has been a director since September 30, 1993. Mr. Preiser has been Co-President of the investment banking firm of Houlihan Lokey since 2013 and a member of its board of directors since 2001. Since January 1, 2005, Mr. Preiser has served as Chairman of Houlihan Lokey– Europe, pursuant to which he leads Houlihan Lokey’s European investment banking activities, including Houlihan Lokey’s European restructuring business. Mr. Preiser is also active in Houlihan Lokey’s investment banking and restructuring activities in the United States. Since 1990, Mr. Preiser had been active in coordinating Houlihan Lokey's real estate and financial restructuring activities as a senior managing director. Mr. Preiser is also a director of Ronald McDonald House New York. Within the last five years, Mr. Preiser was also a director of AIT Holding Company, LLC.

The Board believes that Mr. Preiser is highly qualified to serve as one of our directors based on his expertise of managing workouts of distressed companies, his senior leadership experience of setting global strategic vision for an organization, his financial expertise from working in the investment banking field, his knowledge of capital markets, his business development and mergers and acquisitions experience and his experience sitting on other public boards.

W. Grady Rosier has been a director since December 1, 2008. Mr. Rosier has been the President and CEO of McLane Company, Inc. (“McLane”), a supply chain services company, since 1995. Prior to 1995, Mr. Rosier held various senior management roles since joining McLane in 1984. Mr. Rosier serves as a director of NuStar Energy L.P.

The Board believes that Mr. Rosier is highly qualified to serve as one of our directors because of his senior leadership experience from being a Chief Executive Officer, his other public board experience, and his operational expertise of being responsible for setting global strategic vision for an entire organization.

Susan Williamson Ross has been a director since July 28, 2016. Ms. Ross has been the President of the privately-held majority investor in Clark Construction Group, Shirley Contracting and several other construction, development and real estate businesses since January 2016. She has been employed by Clark Construction Group since December 1986 in various positions, including Chief Administrative Officer since July 2004 and Executive Vice President since January 2008.

The Board believes that Ms. Ross is highly qualified to serve as one of our directors because of her senior leadership experience and her construction, development and real estate experience.

Paul W. Whetsell has been a director since March 1, 2007. Mr. Whetsell has been the Vice Chairman of Loews Hotels Holding Corporation (“Loews”) since March 2015. Mr. Whetsell was President and CEO of Loews from January 2012 until March 2015. From 2006 until January 2012, Mr. Whetsell was the president and chief executive officer of Capstar Hotel Company. From August 1998 until May 2006, Mr. Whetsell served as the chairman and chief executive officer of Meristar Hospitality Corporation, and as the Chairman of Interstate Hotels and Resorts, Inc. (“Interstate”) from August 1998 until March 2009. From August 1998 until October 2003, he also served as the chief executive officer of Interstate and its predecessor. He also serves on the board of Boyd Gaming Corporation, Hilton Grand Vacations Inc. and the Cystic Fibrosis Foundation. In the past five years, Mr. Whetsell was also a director of Virgin Hotels North America, LLC.

The Board considered Mr. Whetsell’s senior leadership experience from being a chief executive officer of a publicly-traded company, his public board service experience, his operational expertise, his real estate experience, and his brand marketing expertise in concluding that Mr. Whetsell is highly qualified to serve as one of our directors.

5

Pursuant to our Corporate Governance Guidelines, the Board expects a director to tender his or her resignation if he or she fails to receive the required number of votes for re-election. Under the Guidelines, the Board shall nominate for re-election as a director only candidates who agree to tender their resignation if they fail to receive the required number of votes for re-election. In addition, the Board shall fill director vacancies and new directorships only with candidates who agree to tender their resignation if they fail to receive the required number of votes for re-election.

If a director fails to be re-elected by a majority of votes cast, the Nominating Committee shall promptly consider the resignation offer of any such director and recommend to the Board whether to accept the tendered resignation or reject it. The Board shall take action with respect to the Nominating Committee's recommendation no later than 90 days following the submission of any such resignation offer. Following the Board's action regarding the Nominating Committee's recommendation, we will promptly file a Current Report on Form 8-K with the Securities and Exchange Commission (the “SEC”) which shall detail the Board's decision regarding a tendered resignation. This report shall include an explanation of the process by which the Board's decision was reached and the reasons for the Board's decision.

To the extent that one or more directors’ resignations are accepted by the Board, the Nominating Committee will recommend to the Board whether to fill the vacancy or vacancies or to reduce the size of the Board.

The Board expects that any director who tenders his or her resignation pursuant to this policy will not participate in the Nominating Committee recommendation or Board action regarding whether to accept or reject the tendered resignation. If, however, a majority of the members of the Nominating Committee fails to receive the required number of votes for re-election in the election, the independent directors who did not fail to receive the required number of votes for re-election shall form a committee amongst themselves for the purposes of evaluating the tendered resignations and recommending to the Board whether to accept or reject them.

Required Vote

Each director shall be elected by a majority of the votes cast in the election at the Annual Meeting, assuming that a quorum is present. A majority of the votes cast means that the number of shares voted "for" a director must exceed the number of shares voted "against" that director. Unless marked otherwise, proxies received will be voted FOR the election of the thirteen nominees designated above. Shareholders may abstain from voting for any particular nominee by so indicating in the space provided on the accompanying proxy card. An abstention will not be counted as a vote cast “for” or “against” a director’s election.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS VOTING “FOR” ALL OF THE FOREGOING NOMINEES AS DIRECTORS OF NVR.

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS

We are committed to having sound corporate governance principles and practices. Having and acting on that commitment is essential to running our business efficiently and to maintaining our integrity in the marketplace. Our primary corporate governance documents, including our Corporate Governance Guidelines, Code of Ethics and all of our Board Committee Charters, are available to the public on our website at http://www.nvrinc.com.

Board Leadership Structure, Committee Composition and Role in Risk Oversight

Board Leadership Structure

Mr. Schar, our Chairman of the Board (“Chairman”) and a non-management director, leads our Board, which meets at least quarterly. In addition, our Board has named an independent lead director to chair meetings of our independent directors. Our independent lead director position rotates annually among the chairs of the Audit, Compensation, Corporate Governance and Nominating Committees. The independent lead director chairs any meetings held by the independent directors. Mr. Johnson, the Chairman of our Audit Committee, is serving as our independent lead director until the 2017 Annual Meeting. Our Board is comprised solely of non-management directors. Information regarding how to communicate with the lead director or the non-management or independent directors as a group is available on our website at http://www.nvrinc.com.

We have separated the roles of the Chairman and the Chief Executive Officer (“CEO”). Mr. Schar serves as the Chairman, and Paul C. Saville serves as CEO. While the Board retains the discretion to combine the roles of Chairman and CEO at any time, we expect that the roles of Chairman and CEO will remain separated for the foreseeable future.

6

Our Board has the following five committees: Audit, Compensation, Corporate Governance, Nominating, and Executive. The members of the committees are shown in the table below.

|

Name |

|

Audit Committee |

|

Compensation Committee |

|

Corporate Governance Committee |

|

Nominating Committee |

|

Executive Committee |

|

Dwight C. Schar |

|

|

|

|

|

|

|

|

|

Chair |

|

C. E. Andrews |

|

Member |

|

|

|

Chair |

|

|

|

|

|

Timothy M. Donahue |

|

|

|

|

|

|

|

Member |

|

Member |

|

Thomas D. Eckert |

|

|

|

Chair |

|

|

|

|

|

|

|

Alfred E. Festa |

|

Member |

|

|

|

|

|

Member |

|

|

|

Ed Grier |

|

Member |

|

|

|

|

|

|

|

|

|

Manuel H. Johnson (L) |

|

Chair |

|

|

|

|

|

|

|

Member |

|

Mel Martinez |

|

|

|

|

|

Member |

|

Member |

|

|

|

William A. Moran |

|

|

|

|

|

|

|

|

|

Member |

|

David A. Preiser |

|

|

|

Member |

|

|

|

Chair |

|

|

|

W. Grady Rosier |

|

|

|

Member |

|

Member |

|

|

|

|

|

Susan Williamson Ross |

|

|

|

|

|

|

|

Member |

|

|

|

Paul W. Whetsell |

|

|

|

Member |

|

Member |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(L) - Independent lead director |

|

|

|

|

|

|

|

|

|

|

Attendance at Board, Committee and Annual Shareholder Meetings

Each committee, other than the Executive Committee, meets at least annually. During 2016, the Board met six times. Our Board requires that our directors attend each Board and Committee meeting in person, unless personal circumstances affecting a director make such attendance impractical or inappropriate. Each of our Board members attended at least 75% of the Board meetings and the meetings of Committees of which he or she was a member during 2016, except for Ms. Ross. Ms. Ross was unable to attend one Board meeting, and one committee meeting held on the same day, due to a death in her immediate family. Because she did not join the Board until July 2016, her absence from those two meetings resulted in her attending less than 75% of the four meetings held during her service on the Board in 2016.

Our Board also requires that all current directors and all nominees for election to our Board attend in person our annual meetings of shareholders, unless personal circumstances affecting such director or director nominee make such attendance impractical or inappropriate. Each of our then-serving directors attended the 2016 Annual Meeting of Shareholders.

Executive Sessions of the Board

Our non-management directors met twice during 2016 in executive session without the presence of management. Mr. Schar chaired the meetings of the non-management directors.

Our independent directors met once during 2016 in executive session without the presence of the non-independent directors or management. Mr. Johnson, our independent lead director in 2016, chaired the meeting of the independent directors.

Our Audit Committee meets in executive sessions at each Audit Committee meeting, separately with (1) our external auditor, (2) the Vice President of Internal Audit and Corporate Governance and (3) the Chief Financial Officer and Chief Accounting Officer. Mr. Johnson, the Chairman of the Audit Committee, chairs these executive sessions.

Board Role in Risk Oversight

Our Board oversees our business risks and operational performance through regularly scheduled Board and Committee meetings, as well as through frequent and informal communications between management and the Board. Further, our Bylaws and each of the various Board Committee Charters provide additional detail regarding the areas, duties and functions for which the Board or a Board Committee provides specific oversight of specified areas of risk.

That oversight includes a variety of operational and regulatory matters, including: approval of the annual business plan and the periodic review of our actual performance in comparison to the approved plan, approval of short-term and long-term management incentive compensation plans, review and analysis of our operational and financial performance compared to our peer group, review of our five year business plan, review of management succession planning throughout our organization for key

7

management positions, review of our response to new laws, rules or regulations to which we are subject, direct oversight of our internal audit function and our whistleblower hotline and many other items. Below is a discussion of how the Board oversees certain of our more significant business risks.

Land Acquisition:

We believe our continued success is contingent upon our ability to control an adequate supply of finished lots on which to build. We expend substantial monetary resources to place deposits under lot acquisition contracts, typically ranging up to 10% of the aggregate purchase price of the finished lots. The lot acquisition policy under which management operates is a Board-approved policy. The policy requires Board pre-approval of any lot acquisition contract that is above certain parameters set by the Board, measured by the aggregate size of the deposit or investment to be made. The policy also includes the parameters under which we can acquire zoned, unimproved raw land. Further, all related-party lot acquisition contracts require Board approval (see Transactions with Related Persons below).

Liquidity:

Being in a cyclical industry, it is imperative that we focus on our liquidity needs throughout the various stages of the cycle, while maintaining an efficient capital structure. The Board’s role in ensuring that management prudently manages our cash includes the following:

|

|

• |

We invest our excess cash pursuant to a Board-approved policy that specifies the types of investments allowed. The primary objective of the policy is to minimize risk and to adequately provide for daily liquidity needs. |

|

|

• |

Stock repurchases and debt repurchases must be pre-approved by the Board. |

|

|

• |

All capital transactions for the issuance of debt or equity must be pre-approved by the Board. |

|

|

• |

The Board reviews our short-term and long-term cash needs in connection with its reviews of our quarterly forecasts and our annual and five year business plans. |

Financial Reporting, Internal Control and Regulatory Matters:

Our Audit Committee takes a lead role in overseeing a number of risks as enumerated within its Charter:

|

|

• |

Our Internal Audit function performs a primary role in risk management. Our Vice President of Internal Audit and Corporate Governance reports directly to the Audit Committee, and the Audit Committee formally approves the annual internal audit budget and staffing. |

|

|

• |

The Audit Committee approves the annual internal audit plan, which is prepared using a comprehensive risk-based approach. |

|

|

• |

On a quarterly basis, Internal Audit Senior Management and our external auditor each have a private session with the Audit Committee without the presence of management. |

|

|

• |

Management reports to the Audit Committee the occurrence of governmental regulatory reviews or audits conducted on our operations, including mortgage regulatory matters and SEC comment letters. The Audit Committee also obtains a report from management at the conclusion of any such review. |

|

|

• |

The Audit Committee monitors compliance with our Code of Ethics and our Standards of Business Conduct. |

Related Party Transactions:

Our Bylaws require that the disinterested, independent members of the Board approve any related party transaction. This has been a requirement since we incorporated in 1993.

Our Board has established director independence standards to assist us in determining director independence, which standards meet the independence requirements of the New York Stock Exchange (“NYSE”) corporate governance listing standards. Our independence standards are included within our Corporate Governance Guidelines, which are available on our website at http://www.nvrinc.com. Our Board considers all relevant facts and circumstances in making an independence determination. As required by the rules of the NYSE, for a director to be considered "independent" under our independence standards, our Board must affirmatively determine that the director has no material relationship with us (other than as a director), directly or indirectly.

Our Board has affirmatively determined that our directors, other than Mr. Schar and Mr. Moran, are independent pursuant to our independence standards. Mr. Schar, our former Executive Chairman, and Mr. Moran, who controls a company from which we

8

acquire a small portion of our finished lots upon which to build our homes, have been determined by our Board not to be “independent.”

When our Board analyzed the independence of its members, it considered relevant transactions, relationships and arrangements, including those specified in the NYSE listing standards and our independence guidelines. The Board considered that certain directors serve as directors or employees of other companies with which we engage in ordinary course of business transactions. In accordance with our independence standards, none of these relationships constitute material relationships (in all instances, the payments to each other company totaled less than $2,500) that would impair the independence of these directors.

Audit Committee

We have a separately designated standing Audit Committee comprised of four members, each of whom satisfies the independence standards specified above and Rule 10A-3(b)(1) under the Securities Exchange Act of 1934 (“1934 Act”). All current members of our Audit Committee are financially literate and are able to read and understand fundamental financial statements, including a balance sheet, income statement and cash flow statement. Our Board has determined that Manuel H. Johnson and C.E. Andrews qualify as audit committee financial experts as defined within Item 407(d)(5) of Regulation S-K under the 1934 Act. The Audit Committee met five times during 2016.

Our Audit Committee operates pursuant to a charter adopted by our Board that is available at http://www.nvrinc.com. As enumerated in the charter, our Audit Committee was established to assist our Board’s oversight of:

|

|

• |

the integrity of our accounting and financial reporting processes; |

|

|

• |

our compliance with legal and regulatory requirements; |

|

|

• |

our independent external auditor’s qualifications and independence; and |

|

|

• |

the performance of our internal audit function and our independent external auditors. |

Among other things, our Audit Committee:

|

|

• |

prepares the Audit Committee Report for inclusion in our proxy statement; |

|

|

• |

appoints, evaluates and determines the compensation of our independent external auditors; |

|

|

• |

maintains written procedures for the receipt, retention and treatment of complaints on accounting, internal accounting controls or auditing matters, as well as for the confidential, anonymous submissions by our employees of concerns regarding questionable accounting or auditing matters; |

|

|

• |

reviews substantiated complaints received from internal and external sources regarding accounting, internal accounting controls or auditing matters; |

|

|

• |

oversees our internal audit department; |

|

|

• |

reviews reports from management regarding significant accounting, internal accounting controls, auditing, legal and regulatory matters; |

|

|

• |

discusses the scope and results of the audit with our independent external auditors and reviews our interim and year end operating results with management and our independent external auditors; |

|

|

• |

functions as a qualified legal compliance committee under Part 205 of the rules of the SEC; and |

|

|

• |

annually reviews our Audit Committee Charter and the Audit Committee’s performance. |

Our Audit Committee has the authority and available funding to engage any independent legal counsel and any accounting or other expert advisors, as our Audit Committee deems necessary to carry out its duties.

Compensation Committee

We have a separately designated standing Compensation Committee comprised of four members, each of whom satisfies our independence standards specified above, as well as the NYSE’s heightened independence standards for compensation committee members. Our Compensation Committee operates pursuant to a charter adopted by our Board that is available at http://www.nvrinc.com. The Compensation Committee met two times during 2016.

9

Among other things, our Compensation Committee:

|

|

• |

reviews and determines all compensation of our CEO and, based in part on the recommendation of the CEO, of all of our other executive officers; |

|

|

• |

periodically reviews and makes recommendations to the Board with respect to the compensation of our directors; |

|

|

• |

administers and interprets incentive compensation and equity plans for our employees (except as otherwise described below); |

|

|

• |

assists in preparing the Compensation Discussion and Analysis and prepares our Compensation Committee Report for inclusion in our annual meeting proxy statement in accordance with applicable rules and regulations of the SEC; |

|

|

• |

makes recommendations to our Board about succession planning for our CEO, and in conjunction with the CEO, also considers succession planning for other key positions; |

|

|

• |

reviews and approves any employment agreements, or amendments thereto, with our CEO and other applicable executive officers; and |

|

|

• |

annually reviews our Compensation Committee Charter and the Compensation Committee’s performance. |

The Compensation Committee charter provides that the Committee may delegate its authority to one or more members of the Committee. Any person to whom authority is delegated must report any actions taken by him or her to the full Committee at its next regularly scheduled meeting. During 2016, the Compensation Committee did not delegate any of its authority to any individual member of the Committee.

The Compensation Committee’s charter also provides that the Compensation Committee may delegate to a senior executive officer of NVR the authority to grant equity awards to non-executive employees, within limits prescribed by the full Board. Any equity awards granted by a senior executive officer pursuant to delegated authority must be reported to the Compensation Committee at its next regularly scheduled meeting. Our Compensation Committee, by resolution, delegated authority to Mr. Saville, acting jointly with the Senior Vice President of Human Resources, to grant equity awards to new and existing employees below the executive officer rank during 2016. The Senior Vice President of Human Resources is required to report any equity awards granted pursuant to this delegated authority to the Compensation Committee at its next scheduled meeting after the delegated authority is exercised.

For a discussion of the role of Mr. Saville in recommending the amount or form of compensation paid to our named executive officers during 2016, see the Compensation Discussion and Analysis below.

Compensation Consultants

Pursuant to its charter, the Compensation Committee has the sole authority and the entitlement to funding to obtain advice and assistance from compensation consultants, as well as internal or outside legal, accounting or other expert advisors, that it determines to be necessary to carry out its duties. The Compensation Committee engages a compensation consultant to provide advice regarding executive officer compensation. In 2016, the Compensation Committee engaged Aon Hewitt to assist us in analyzing the compensation of our named executive officers as compared to our peer group. During 2016, Aon Hewitt did not provide any other services for us. The Compensation Committee has analyzed the independence of Aon Hewitt under the standards established by the NYSE and determined that its work did not present any conflict of interest.

Compensation Committee Interlocks and Insider Participation

During 2016, our Compensation Committee was comprised of Messrs. Eckert, Preiser, Rosier and Whetsell. During that time, none of our executive officers served as a member of the board of directors or compensation committee of any entity that had one or more executive officers serving as a member of our Board or our Compensation Committee; accordingly, there were no interlocks with other companies within the meaning of Item 407(e)(4) of SEC Regulation S-K during 2016.

Nominating Committee

We have a separately designated standing Nominating Committee comprised of five members, each of whom satisfies our independence standards specified above. The Nominating Committee operates pursuant to a charter adopted by the Board that is available at http://www.nvrinc.com. The Nominating Committee met three times during 2016.

Among other things, the Nominating Committee:

|

|

• |

identifies individuals qualified to become Board members; |

10

|

|

• |

recommends that our Board select the director nominees for the next annual meeting of shareholders; |

|

|

• |

recommends to our Board names of individuals to fill any vacancies on our Board that arise between annual meetings of shareholders; |

|

|

• |

considers from time to time our Board committee structure and makeup, including diversity of our members; and |

|

|

• |

annually reviews our Nominating Committee Charter and the Nominating Committee’s performance. |

Our Nominating Committee also has the sole authority and appropriate funding to obtain advice and assistance from executive search firms, and internal or outside legal, accounting or other expert advisors that it determines necessary to carry out its duties.

Criteria for Nomination to the Board of Directors

Our Nominating Committee will consider shareholder nominees as described in our Policies and Procedures for the Consideration of Board of Director Candidates, which is available at http://www.nvrinc.com. These policies and procedures include minimum qualifications for director nominees and the process for identifying and evaluating director nominees, including nominees submitted by our security holders. Our Nominating Committee has a stated goal of identifying well-qualified director candidates that would enhance the Board’s diversity. In searching for potential director candidates, the Nominating Committee first seeks the most qualified candidates with a record of success. The Committee also searches for candidates that contribute to a diversity of views, backgrounds, experience and skills on the Board.

Proxy Access

Our Bylaws allow eligible shareholders to propose director nominees for inclusion in the proxy statement in addition to the nominees proposed by the Board. The proxy access bylaw permits shareholders owning 3% or more of our common stock for at least three years, to nominate up to 20% of our Board. The number of shareholders who may aggregate their shares to meet the 3% ownership threshold is limited to 20. The shareholder(s) and nominees(s) must also satisfy the other requirements in our Bylaws.

Corporate Governance Committee

We have a separately designated standing Corporate Governance Committee comprised of four members, each of whom satisfies our independence standards specified above. The Corporate Governance Committee operates pursuant to a charter adopted by our Board that is available at http://www.nvrinc.com. Our Corporate Governance Guidelines are also available at http://www.nvrinc.com. The Corporate Governance Committee met two times during 2016.

Among other things, the Corporate Governance Committee:

|

|

• |

develops and recommends to our Board a set of corporate governance principles; |

|

|

• |

annually reviews and assesses the adequacy of our Corporate Governance Guidelines, including ensuring that they reflect best practices where appropriate; |

|

|

• |

manages the Board’s annual self-evaluation process; and |

|

|

• |

annually reviews our Corporate Governance Committee Charter and the Corporate Governance Committee’s performance. |

Our Corporate Governance Committee must obtain Board approval for funding to obtain advice and assistance from internal or outside legal, accounting or other expert advisors that it determines necessary to carry out its duties.

Executive Committee

Our Executive Committee was established pursuant to our Bylaws to have such powers, authority and responsibilities as may be determined by a majority of our Board. Our Executive Committee has never met, nor has our Board ever delegated any powers, authority or responsibilities to the Executive Committee. Our Board intends to continue the practice of considering corporate matters outside the scope of our other existing Board committees at the full Board level.

Communications with the Board of Directors

Our Policies and Procedures Regarding Communications with the NVR, Inc. Board of Directors, the Independent Lead Director and the Non-Management Directors as a Group are available at http://www.nvrinc.com.

11

Review, Approval or Ratification of Related Person Transactions

We have a policy that requires that all related person transactions be considered, reviewed and approved or ratified by the disinterested, independent members of our Board, regardless of the type of transaction or amount involved. Under this policy, the related person must notify the Chief Financial Officer (“CFO”) of any proposed transaction with a related person. The CFO must seek approval of the disinterested, independent members of the Board for any related person transaction. The disinterested, independent directors must review the material facts before determining whether to approve or ratify the transaction. This requirement is set forth in Section 7.05 of our Bylaws (available on our website at http://www.nvrinc.com), Sections 1 and 4 of our Code of Ethics (available on our website at http://www.nvrinc.com), and our internal Standards of Business Conduct, Human Resources Policies and Procedures, and Financial Policies and Procedures.

Transactions with Related Persons

During the year ended December 31, 2016, we entered into new forward lot purchase agreements to purchase finished building lots for a total purchase price of approximately $65,159,000 with Elm Street Development, Inc. (“Elm Street”), which is controlled by one of our directors, Mr. Moran. During 2016, NVR also purchased 307 developed lots at market prices from Elm Street for approximately $44,512,000. We also continue to control a parcel of raw land expected to yield approximately 2,400 finished lots through a joint venture entered into with Elm Street during 2009. We did not make any capital contributions to the joint venture in 2016. Finally, during 2016 we paid Elm Street approximately $143,000 to manage the development of a parcel of zoned, unimproved land that we purchased from Elm Street in 2010. The independent members of our Board approved these transactions.

12

Security Ownership of Certain Beneficial Owners and Management

The following tables set forth certain information as to the beneficial ownership of Common Stock by each person known by us to be the beneficial owner of more than 5% of the outstanding Common Stock as of the dates indicated, and by each director, director nominee and named executive officer and by all directors and executive officers as a group as of March 3, 2017. Except as otherwise indicated, all shares are owned directly and the owner has sole voting and investment power with respect thereto.

Certain Beneficial Owners

|

Name and Address of Holder |

|

Number of Shares |

|

|

|

Percent of Class |

|

||

|

BlackRock, Inc. |

|

|

336,776 |

|

(1) |

|

|

9.0 |

% |

|

55 East 52nd Street |

|

|

|

|

|

|

|

|

|

|

New York, NY 10055 |

|

|

|

|

|

|

|

|

|

|

The Vanguard Group |

|

|

279,212 |

|

(2) |

|

|

7.5 |

% |

|

100 Vanguard Blvd. |

|

|

|

|

|

|

|

|

|

|

Malvern, PA 19355 |

|

|

|

|

|

|

|

|

|

|

Manulife Financial Corporation |

|

|

188,152 |

|

(3) |

|

|

5.0 |

% |

|

200 Bloor Street East |

|

|

|

|

|

|

|

|

|

|

Toronto, Ontario |

|

|

|

|

|

|

|

|

|

|

Canada M4W 1E5 |

|

|

|

|

|

|

|

|

|

|

(1) |

As reported within a Schedule 13G filed January 25, 2017, the entity has sole power to vote or direct the vote for 323,094 shares and the sole power to dispose or direct the disposition of 336,776 shares. |

|

(2) |

As reported within a Schedule 13G filed February 10, 2017, the entity has sole power to vote or direct the vote for 2,062 shares, shared power to vote or direct the vote for 434 shares, sole power to dispose or direct the disposition of 276,905 shares and shared power to dispose or direct the disposition of 2,307 shares. |

|

(3) |

As reported within a Schedule 13G filed February 14, 2017, Manulife Financial Corporation owns these shares through the following indirect, wholly-owned subsidiaries, each of which has sole power to vote or direct the vote and the sole power to dispose or direct the disposition of its shares: Manulife Asset Management (US) LLC – 182,950 shares, Manulife Asset Management (North America) Limited – 2,229 shares, Manulife Asset Management Limited – 2,935 shares, and Manulife Asset Management (Hong Kong) Limited – 38 shares. |

Directors and Management

|

Name |

|

Number of Shares |

|

|

|

Percent of Class |

|

||

|

Dwight C. Schar |

|

|

102,412 |

|

(1) |

|

|

2.7 |

% |

|

C. E. Andrews |

|

|

3,552 |

|

(2) |

|

* |

|

|

|

Timothy M. Donahue |

|

|

3,583 |

|

(3) |

|

* |

|

|

|

Thomas D. Eckert |

|

|

3,865 |

|

(4) |

|

* |

|

|

|

Alfred E. Festa |

|

|

1,471 |

|

(5) |

|

* |

|

|

|

Ed Grier |

|

|

825 |

|

(5) |

|

* |

|

|

|

Manuel H. Johnson |

|

|

4,316 |

|

(6) |

|

* |

|

|

|

Mel Martinez |

|

|

456 |

|

(7) |

|

* |

|

|

|

William A. Moran |

|

|

31,192 |

|

(8) |

|

* |

|

|

|

David A. Preiser |

|

|

3,987 |

|

(9) |

|

* |

|

|

|

W. Grady Rosier |

|

|

4,074 |

|

(5) |

|

* |

|

|

|

Susan Williamson Ross |

|

|

- |

|

|

|

|

|

|

|

Paul W. Whetsell |

|

|

2,472 |

|

(10) |

|

* |

|

|

|

Paul C. Saville |

|

|

203,996 |

|

(11) |

|

|

5.4 |

% |

|

Daniel D. Malzahn |

|

|

22,944 |

|

(12) |

|

* |

|

|

|

Jeffrey D. Martchek |

|

|

30,994 |

|

(13) |

|

* |

|

|

|

Robert W. Henley |

|

|

13,801 |

|

(14) |

|

* |

|

|

|

Eugene J. Bredow |

|

|

9,974 |

|

(15) |

|

* |

|

|

|

All directors, director nominees and executive officers as a group (18 persons) |

|

|

443,914 |

|

|

|

|

11.3 |

% |

|

* |

Less than 1%. |

|

(1) |

Includes 34,571 vested options issued under equity incentive plans. |

|

(2) |

Includes 2,414 vested options issued under equity incentive plans. |

13

|

(4) |

Includes 2,685 vested options issued under equity incentive plans. |

|

(5) |

Includes 650 vested options issued under equity incentive plans. |

|

(6) |

Includes 3,716 vested options issued under equity incentive plans and 200 shares held by a charitable foundation, of which Mr. Johnson is a trustee but in which he has no economic interest. |

|

(7) |

Includes 325 vested options issued under equity incentive plans. |

|

(8) |

Includes 650 vested options issued under equity incentive plans and 5,107 shares held in trusts for the benefit of his adult children. |

|

(9) |

Includes 3,716 vested options issued under equity incentive plans. |

|

(10) |

Includes 1,414 vested options issued under equity incentive plans. |

|

(11) |

Includes 73,168 vested options issued under equity incentive plans, 3,235 vested shares held by the NVR, Inc. Employee Stock Ownership Plan in trust, 4,514 shares held as a discretionary investment in the NVR, Inc. Profit Sharing Plan and 105,883 vested shares held in a Deferred Compensation Rabbi Trust. Excludes 777 shares held in a Deferred Compensation Plan which are not distributable until six months subsequent to separation of service. |

|

(12) |

Includes 18,844 vested options issued under equity incentive plans, 1,013 vested shares held by the NVR, Inc. Employee Stock Ownership Plan in trust and 362 shares held as a discretionary investment in the NVR, Inc. Profit Sharing Plan. |

|

(13) |

Includes 24,322 vested options issued under equity incentive plans, 2,235 vested shares held by the NVR, Inc. Employee Stock Ownership Plan in trust, 114 shares held as a discretionary investment in the NVR, Inc. Profit Sharing Plan and 598 vested shares held in a Deferred Compensation Rabbi Trust. |

|

(14) |

Includes 12,424 vested options issued under equity incentive plans, 1,129 vested shares held by the NVR, Inc. Employee Stock Ownership Plan in trust and 248 shares held as a discretionary investment in the NVR, Inc. Profit Sharing Plan. |

|

(15) |

Includes 8,974 vested options issued under equity incentive plans and 141 vested shares held by the NVR, Inc. Employee Stock Ownership Plan in trust. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the 1934 Act requires our directors and executive officers and persons who own more than 10% of our Common Stock to file reports of ownership and changes in ownership of such stock with the SEC and the national securities exchange upon which our shares are publicly traded. Directors, executive officers and greater than 10% shareholders are required by SEC regulations to furnish us with copies of all such forms filed. Based solely on a review of the copies of such reports furnished to us and written representations from our directors and executive officers, we believe that all Section 16(a) filing requirements applicable to our directors, executive officers and greater than 10% shareholders were timely met during 2016, except that a Form 5 for 2015 was filed for Mr. Moran on January 20, 2017 with respect to a gift of 635 shares of Common Stock on September 25, 2015.

14

THE FOLLOWING REPORT OF THE AUDIT COMMITTEE SHALL NOT BE DEEMED TO BE “SOLICITING MATERIAL” OR TO BE “FILED” WITH THE SECURITIES AND EXCHANGE COMMISSION UNDER THE SECURITIES ACT OF 1933 OR THE SECURITIES EXCHANGE ACT OF 1934 OR INCORPORATED BY REFERENCE IN ANY DOCUMENT SO FILED.

Our management has primary responsibility for preparing our financial statements and establishing financial reporting systems and internal controls. Management also has the responsibility of reporting on the effectiveness of our internal control over financial reporting. Our independent external auditor, KPMG LLP, is responsible for expressing opinions on the conformity of our audited financial statements with accounting principles generally accepted in the United States of America and on the effectiveness of our internal control over financial reporting. In this context, the Audit Committee hereby reports as follows:

|

1. |

The Audit Committee has reviewed and discussed the audited financial statements and management’s assessment of the effectiveness of our internal control over financial reporting with management, and reviewed and discussed KPMG LLP’s audit opinions with KPMG LLP; |

|

2. |

The Audit Committee has discussed with KPMG LLP the matters required to be discussed under the rules adopted by the Public Company Accounting Oversight Board (“PCAOB”); |

|

3. |

The Audit Committee has received the written disclosures and the letter from KPMG LLP required by the applicable requirements of the PCAOB regarding KPMG LLP’s communications with the Audit Committee concerning independence, and has discussed with KPMG LLP its independence; and |

|

4. |

Based on the reviews and discussions referred to in paragraphs (1) through (3) above, the Audit Committee recommended to the Board, and the Board has approved, that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2016, for filing with the SEC. |

The undersigned, constituting all of the members of the Audit Committee, have submitted this report to the Board of Directors.

Manuel H. Johnson (Chairman), C.E. Andrews, Alfred E. Festa and Ed Grier

15

COMPENSATION DISCUSSION AND ANALYSIS

Executive Summary

This Compensation Discussion and Analysis describes our executive compensation philosophy and program for our named executive officers. Our named executive officers for 2016 were:

|

Name |

|

Title |

|

Paul C. Saville |

|

President and Chief Executive Officer |

|

Daniel D. Malzahn |

|

Senior Vice President, Chief Financial Officer and Treasurer |

|

Jeffrey D. Martchek |

|

President of Homebuilding Operations |

|

Robert W. Henley |

|

President, NVR Mortgage |

|

Eugene J. Bredow |

|

Vice President, Chief Accounting Officer and Controller |

Our executive compensation program is designed to motivate and retain highly qualified and experienced executives, provide performance-based incentives and align our compensation with long-term creation of shareholder value. The compensation program for our named executive officers includes three components:

|

|

• |

Base salaries; |

|

|

• |

Annual performance-based cash bonuses; and |

|

|

• |

Long-term equity-based compensation. |

We awarded no new equity compensation to our executive officers during 2016, except for a grant of stock options to Jeffrey D. Martchek upon his promotion to President of Homebuilding Operations on January 1, 2016. Compensation paid to our other executive officers for 2016 consisted, therefore, of salary and annual incentive compensation, with the maximum amount of annual incentive compensation limited to 100% of the executive officer’s base salary.

Performance Overview

Our 2016 financial results reflect the continued improvement in the housing market (all comparisons are to our 2015 financial results):

|

|

• |

Revenues increased 13%; |

|

|

• |

Pre-tax profit increased 10%; |

|

|

• |

Net income increased 11%; |

|

|

• |

Diluted earnings per share increased 15%; |

|

|

• |

New orders increased 11%; and |

|

|

• |

The average sales price of new orders increased 2%. |

In addition, we returned approximately $455 million of cash to our shareholders during 2016 through repurchases of approximately 280,000 shares of Common Stock, which represented 7% of our shares outstanding as of December 31, 2015.

Our business philosophy has been to develop and operate a business model to maximize shareholder value in a cyclical industry. Our goal is to deliver industry leading rates of return and growth in earnings per share. During the past 10 years, we have led the homebuilding peer group in total shareholder return (“TSR”), return on capital and return on revenue:

|

|

|

10 Years Ended December 31, 2016 |

|

|||||||||

|

|

|

Total |

|

|

Average Annual |

|

|

Average Annual |

|

|||

|

|

|

Shareholder Return |

|

|

Return on Capital |

|

|

Return on Revenue |

|

|||

|

NVR |

|

|

159 |

% |

|

|

14.8 |

% |

|

|

9.8 |

% |

|

Rank vs. Peers |

|

1st |

|

|

1st |

|

|

1st |

|

|||

16

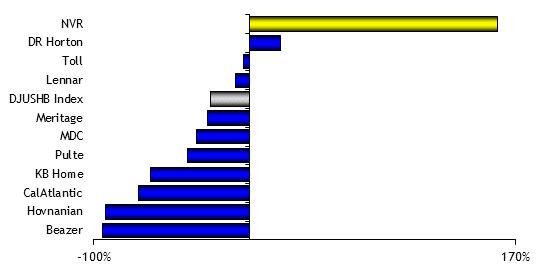

Our share price performed significantly better than the share price of our homebuilding peers during the 10-year period ending December 31, 2016 as illustrated by our TSR of 158.8%. All but one of our homebuilding peers experienced negative TSR during the 10-year period as illustrated below.

10-Year TSR

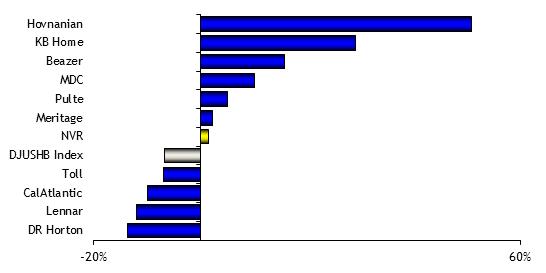

On a 3-year basis, our TSR of 62.7% was the highest in the homebuilding peer group and far exceeded the TSR for the Dow Jones US Homebuilder Index of 11.0% as illustrated below.

3-Year TSR

17

While our TSR of 1.6% during 2016 was in the middle of our peer group, it exceeded the TSR for the Dow Jones US Homebuilder Index of -6.7% as illustrated below.

1-Year TSR

We believe these superior results relative to our homebuilding peers are due to:

|

|

• |

our macro view that housing is a cyclical industry and our development of the appropriate business model and strategies to be successful in that environment; and |

|

|

• |

our highly skilled and motivated management team that has remained extremely disciplined in executing our more capital efficient business model. |

Additionally, these key aspects of our strategy are well engrained in our corporate culture:

|

|

• |

a strong alignment between management incentives (at all levels, not just named executive officers) and long-term shareholder returns; |

|

|

• |

stability and long-term retention of our management team; and |

|

|

• |

generation of cash flow through all points in the homebuilding cycle. |

What We Do

|

|

• |

We tie pay to performance by making the majority of compensation “at risk” and linking it to shareholders’ interests. |

|

|

• |

Our annual bonuses are performance-based and limited to a maximum of 100% of base salary. |

|

|

• |

The majority of our named executive officers’ compensation is in the form of long-term equity-based compensation. |

|

|

• |

We make periodic, not annual, grants of long-term equity-based compensation. Our last periodic grant was made in 2014 following shareholder approval of the NVR, Inc. 2014 Equity Incentive Plan. The vesting for 50% of our stock options granted in 2014 was subject to the attainment of a performance condition in addition to continued employment. |

|

|

• |

We have robust NVR share ownership requirements to further align the interests of our named executive officers with our shareholders’ interests. |

|

|

• |

Our equity agreements and employment agreements include double trigger change in control provisions for post-employment benefits and equity awards. |

|

|

• |

Our equity agreements have a clawback provision. |

18

|

|

• |

We mitigate the potential dilutive effect of equity awards through our robust share repurchase program. |

|

|

• |

Our Compensation Committee utilizes an independent compensation consultant. |

What We Don’t Do

|

|

• |

We do not award any discretionary cash compensation. |

|

|

• |

We do not provide perquisites. |

|

|

• |

We do not permit hedging or pledging of NVR stock by named executive officers or directors. |

|

|

• |

We do not re-price stock options. |

|

|

• |

We do not grant stock options having an exercise price below 100% of fair market value. |

|

|

• |

We do not provide any excise tax gross-ups. |

|

|

• |

We do not provide defined benefit or supplemental executive retirement plans. |

|

|

• |

Our equity plans do not have evergreen provisions. |

Say on Pay Results

In 2016, approximately 97% of the shares voted were cast in favor of the 2015 compensation of our named executive officers. While the vote was advisory in nature, the Compensation Committee views the vote as confirmation that our shareholders generally believe that the compensation of our named executive officers is appropriately aligned with their performance and our financial performance as well as the interests of our shareholders. The Compensation Committee will continue to consider the results of say-on-pay votes when making future compensation decisions for the named executive officers.

General Compensation Philosophy and Objectives