false0000906163DEF 14A00009061632022-01-012022-12-310000906163nvr:SavilleMember2022-01-012022-12-31iso4217:USD0000906163nvr:BredowMember2022-01-012022-12-31xbrli:pure0000906163nvr:SavilleMember2021-01-012021-12-3100009061632021-01-012021-12-310000906163nvr:SavilleMember2020-01-012020-12-3100009061632020-01-012020-12-310000906163nvr:GrantDateFVReportedInTheSCTMembernvr:BredowMemberecd:PeoMember2022-01-012022-12-310000906163nvr:FVAsOfEndOfYearOfAllUnvestedAwardsGrantedDuringYearMembernvr:BredowMemberecd:PeoMember2022-01-012022-12-310000906163nvr:BredowMembernvr:ChangeInFVOfAwardsGrantedInPriorYearsThatAreOutstandingAndUnvestedMemberecd:PeoMember2022-01-012022-12-310000906163nvr:ChangeInFVOfAwardsGrantedInPriorYearsThatVestedDuringYearMembernvr:BredowMemberecd:PeoMember2022-01-012022-12-310000906163nvr:GrantDateFVReportedInTheSCTMembernvr:SavilleMemberecd:PeoMember2022-01-012022-12-310000906163nvr:SavilleMembernvr:FVAsOfEndOfYearOfAllUnvestedAwardsGrantedDuringYearMemberecd:PeoMember2022-01-012022-12-310000906163nvr:SavilleMembernvr:ChangeInFVOfAwardsGrantedInPriorYearsThatAreOutstandingAndUnvestedMemberecd:PeoMember2022-01-012022-12-310000906163nvr:SavilleMembernvr:ChangeInFVOfAwardsGrantedInPriorYearsThatVestedDuringYearMemberecd:PeoMember2022-01-012022-12-310000906163nvr:GrantDateFVReportedInTheSCTMembernvr:SavilleMemberecd:PeoMember2021-01-012021-12-310000906163nvr:SavilleMembernvr:FVAsOfEndOfYearOfAllUnvestedAwardsGrantedDuringYearMemberecd:PeoMember2021-01-012021-12-310000906163nvr:ChangeInFVOfAwardsGrantedInPriorYearsThatAreOutstandingAndUnvestedMemberecd:PeoMember2021-01-012021-12-310000906163nvr:ChangeInFVOfAwardsGrantedInPriorYearsThatVestedDuringYearMemberecd:PeoMember2021-01-012021-12-310000906163nvr:GrantDateFVReportedInTheSCTMembernvr:SavilleMemberecd:PeoMember2020-01-012020-12-310000906163nvr:SavilleMembernvr:FVAsOfEndOfYearOfAllUnvestedAwardsGrantedDuringYearMemberecd:PeoMember2020-01-012020-12-310000906163nvr:ChangeInFVOfAwardsGrantedInPriorYearsThatAreOutstandingAndUnvestedMemberecd:PeoMember2020-01-012020-12-310000906163nvr:ChangeInFVOfAwardsGrantedInPriorYearsThatVestedDuringYearMemberecd:PeoMember2020-01-012020-12-310000906163nvr:GrantDateFVReportedInTheSCTMemberecd:NonPeoNeoMember2022-01-012022-12-310000906163nvr:FVAsOfEndOfYearOfAllUnvestedAwardsGrantedDuringYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000906163ecd:NonPeoNeoMembernvr:ChangeInFVOfAwardsGrantedInPriorYearsThatAreOutstandingAndUnvestedMember2022-01-012022-12-310000906163nvr:ChangeInFVOfAwardsGrantedInPriorYearsThatVestedDuringYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000906163nvr:GrantDateFVReportedInTheSCTMemberecd:NonPeoNeoMember2021-01-012021-12-310000906163nvr:FVAsOfEndOfYearOfAllUnvestedAwardsGrantedDuringYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000906163ecd:NonPeoNeoMembernvr:ChangeInFVOfAwardsGrantedInPriorYearsThatAreOutstandingAndUnvestedMember2021-01-012021-12-310000906163nvr:ChangeInFVOfAwardsGrantedInPriorYearsThatVestedDuringYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000906163nvr:GrantDateFVReportedInTheSCTMemberecd:NonPeoNeoMember2020-01-012020-12-310000906163nvr:FVAsOfEndOfYearOfAllUnvestedAwardsGrantedDuringYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000906163ecd:NonPeoNeoMembernvr:ChangeInFVOfAwardsGrantedInPriorYearsThatAreOutstandingAndUnvestedMember2020-01-012020-12-310000906163nvr:ChangeInFVOfAwardsGrantedInPriorYearsThatVestedDuringYearMemberecd:NonPeoNeoMember2020-01-012020-12-31000090616312022-01-012022-12-31000090616322022-01-012022-12-31000090616332022-01-012022-12-31000090616342022-01-012022-12-31000090616352022-01-012022-12-31000090616362022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant X Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | | | | |

| ☐ | | Preliminary Proxy Statement |

| | |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| X | | Definitive Proxy Statement |

| | |

| ☐ | | Definitive Additional Materials |

| | |

| ☐ | | Soliciting Material under Rule 14a-12 |

NVR, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | | | | | | | |

| X | | No fee required. |

| ☐ | | Fee paid previously with preliminary materials. |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

NVR, INC.

11700 Plaza America Drive

Suite 500

Reston, VA 20190

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held on Tuesday, May 2, 2023

11:00 A.M. Eastern Time

NVR, Inc. will hold its Annual Meeting of Shareholders at 11:00 A.M. (Eastern Time) on Tuesday, May 2, 2023. We will hold the meeting at our corporate headquarters located at 11700 Plaza America Drive, Suite 500, Reston, Virginia, 20190.

We are holding the meeting for the following purposes:

1. To elect ten directors from the nominees named in the attached Proxy Statement;

2. To ratify the appointment of the accounting firm of KPMG LLP as our independent auditor for the year ending December 31, 2023;

3. To vote on an advisory resolution regarding the approval of compensation paid to certain executive officers;

4. To vote on an advisory resolution regarding the frequency of advisory votes on executive compensation; and

5. To transact other business that may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting.

The above items are fully described in the attached Proxy Statement. We have not received notice of any other matters that may properly be presented at the meeting.

Only shareholders of record at the close of business on March 1, 2023 will be entitled to vote at the meeting. Whether or not you plan to attend the meeting, you are urged to date and sign the enclosed proxy card and return it promptly in the accompanying envelope. You are invited to attend the meeting in person. If you do attend the meeting, you may withdraw your proxy and vote in person.

| | | | | | | | |

| | By Order of the Board of Directors, |

| | | |

| | | James M. Sack |

| | Secretary and General Counsel |

| | March 15, 2023 |

Table of Contents

| | | | | | | | | | | | | | |

| | | | | Page |

| I. | | | | |

| | | | |

| | | | | |

| II. | | | | |

| | | | | |

| | | | | |

| III. | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| IV. | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | |

| | | | |

| | | | | |

| | | | | |

| V. | | | | |

| | | | | |

| VI. | | | | |

| | | | | |

| VII. | | | | |

| | | | | |

| VIII. | | | | |

NVR, INC.

11700 Plaza America Drive

Suite 500

Reston, VA 20190

Proxy Statement

This Proxy Statement, proxy card and the Annual Report for the year ended December 31, 2022 are being mailed to our shareholders on or about March 15, 2023 in connection with the solicitation on behalf of the Board of Directors (the “Board”) of NVR, Inc. ("NVR"), a Virginia corporation, of proxies for use at our Annual Meeting of Shareholders. The Annual Meeting will be held on Tuesday, May 2, 2023, at our corporate headquarters located at 11700 Plaza America Drive, Suite 500, Reston, Virginia 20190, at 11:00 A.M., Eastern Time, and at any and all postponements and adjournements thereof. Shareholders should contact NVR’s Investor Relations Department at the same address to obtain directions to be able to attend the Annual Meeting in person.

We bear the cost of proxy solicitation, including expenses in connection with preparing, assembling and mailing the proxy solicitation materials and all papers accompanying them. We may reimburse brokers or persons holding shares in their names or in the names of their nominees for their expenses in sending proxies and proxy materials to beneficial owners. In addition to solicitation by mail, certain of our officers, directors and regular employees, who will receive no extra compensation for their services, may solicit proxies by telephone, facsimile transmission, internet or personally. We have retained Georgeson Inc. to assist in the solicitation of brokers, bank nominees and institutional holders for a fee of approximately $9,000 plus out-of-pocket expenses.

All voting rights are vested exclusively in the holders of our common stock, par value $0.01 per share (the “Common Stock”). Only shareholders of record as of the close of business on March 1, 2023 (the “Record Date”) are entitled to receive notice of and to vote at the Annual Meeting. Shareholders include holders (the “Participants”) owning stock in our Profit Sharing Trust Plan and Employee Stock Ownership Plan (together, the “Plans”).

The accompanying proxy card should be used to instruct the persons named as proxies to vote the shareholder’s shares in accordance with the shareholder’s directions. The persons named in the accompanying proxy card will vote shares of Common Stock represented by all valid proxies in accordance with the instructions contained thereon. In the absence of instructions, shares represented by properly executed proxies will be voted:

•FOR the election of the ten director nominees named in this Proxy Statement;

•FOR the ratification of the appointment of KPMG LLP as our independent auditor for 2023;

•FOR the approval of the compensation paid to certain executive officers;

•“1 Year” for the frequency to conduct an advisory vote on the compensation paid to certain executive officers; and

•in the discretion of the named proxies with respect to any other matters presented at the Annual Meeting.

If a shareholder holds shares in a brokerage account or through a broker, bank, trust or other nominee, the rules of the New York Stock Exchange (the “NYSE”) prohibit the nominee from voting the shareholder’s shares on any proposal to be voted on at the Annual Meeting, other than ratification of the appointment of KPMG LLP as our independent auditor, unless the nominee has received an instruction from the shareholder regarding how the shares should be voted. Any shares for which an instruction has not been received will result in a “broker non-vote” on the proposal for which no instruction was provided.

For a quorum to exist at the Annual Meeting, holders of shares representing a majority of the votes entitled to be cast on each matter must be present in person or by proxy. Shares voted “abstain” or represented by a broker non-vote on a matter will be considered present at the Annual Meeting for the purpose of establishing a quorum. For a director to be deemed elected, the director must receive a majority of votes cast “for” and “against” the director's election. Similarly for other proposals, the proposal must receive a majority of votes cast “for” and “against” the proposal. For these proposals, therefore, abstentions and broker non-votes will have no effect on the result of the vote.

We strongly encourage all of our shareholders who hold shares of Common Stock in a brokerage account or through any other nominee to provide voting instructions to their broker, bank, trustee or other nominee to ensure that their shares are voted at the Annual Meeting.

Any shareholder may revoke his or her proxy at any time prior to its use by (1) providing our Secretary, at 11700 Plaza America Drive, Suite 500, Reston, Virginia 20190, written notice of revocation, (2) duly executing a proxy card bearing a later date than the date of the previously duly executed proxy card, or (3) attending the Annual Meeting and voting in person

(attendance at the Annual Meeting alone will not act to revoke a prior proxy card). Execution of the enclosed proxy card will not affect your right to vote in person if you should later decide to attend the Annual Meeting.

The proxy card also should be used by Participants to instruct the trustee of the Plans how to vote shares of Common Stock held on their behalf. The trustee is required under the trust agreement to establish procedures to ensure that the instructions received from Participants are held in confidence and not divulged, released or otherwise utilized in a manner that might influence the Participants’ free exercise of their voting rights. Proxy cards representing shares held by Participants must be returned to the tabulator by April 27, 2023 using the enclosed return envelope and should not be returned to NVR. If shares are owned through the Plans and the Participant does not submit voting instructions by April 27, 2023, the trustee of the Plans will vote such shares in the same proportion as the voting instructions received from other Participants. Participants who wish to revoke a proxy will need to contact the trustee and follow its instructions.

As of the Record Date, we had a total of 3,247,521 shares of Common Stock outstanding, each share of which is entitled to one vote. The presence, either in person or by proxy, of persons entitled to vote a majority of the outstanding Common Stock is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Under our Restated Articles of Incorporation and Bylaws, holders of Common Stock are not entitled to vote such shares on a cumulative basis, including with respect to the voting for directors.

Important Notice Regarding the Availability of Proxy Materials for the

Shareholder Meeting to Be Held on May 2, 2023:

This Proxy Statement and our Annual Report for the year ended December 31, 2022 are available at www.edocumentview.com/nvr.

Company Overview

Who We Are

We are one of the largest homebuilders in the United States. We operate in thirty-five metropolitan areas in fifteen states, and Washington, D.C. Our homebuilding operations include the construction and sale of single-family detached homes, townhomes and condominium buildings under three trade names: Ryan Homes, NVHomes and Heartland Homes. Our Ryan Homes product is marketed primarily to first-time and first-time move-up buyers. Our NVHomes and Heartland Homes products are marketed primarily to move-up and luxury buyers. In addition to selling and building homes, we provide a number of mortgage-related services through our wholly owned subsidiary, NVR Mortgage Finance, Inc. (“NVRM”). Through operations in each of our homebuilding markets, NVRM originates mortgage loans almost exclusively for our homebuyers.

2022 Corporate Sustainability Highlights

Our Board believes that corporate responsibility and business sustainability go hand in hand at NVR. The Nominating and Corporate Governance Committee (the “Nominating Committee”) is responsible for setting our Environmental, Social and Governance ("ESG") strategy and overseeing the mitigation of ESG risks as part of our strong governance framework. In 2022, the Nominating Committee received briefings on ESG matters from our management team in each of its four regularly scheduled meetings. Topics discussed during 2022 included shareholder feedback and priorities related to ESG matters, regulatory proposals, monitoring of ESG industry developments, and our Responsible Building Policy and Sustainability Accounting Standards Board ("SASB") Disclosures, which is available on our website.

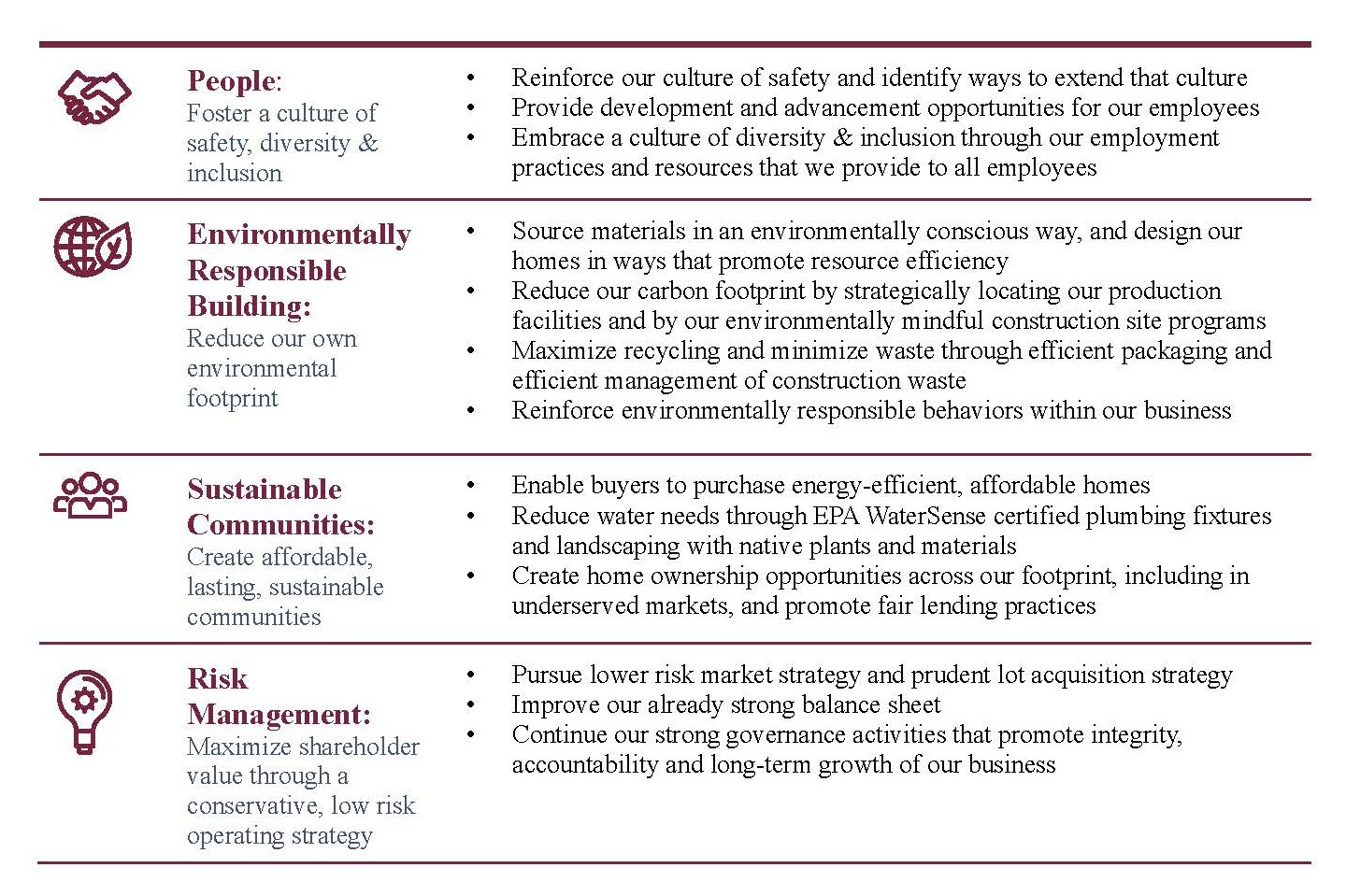

NVR has four sustainability priorities: continuing our strong commitment to our people, minimizing the impact of our operations on the environment, building sustainable communities and managing risk.

People

Safety: Our employees are our most important asset, and the safety of our employees is our first priority. Our concern for safety goes beyond our employees, extending to our customers and trade partners. Construction presents a demanding environment and we strive to ensure that all of our employees, customers and trade partners go home safely every single day.

We produce large portions of our houses in eight centralized production facilities, which promotes safety by decreasing exposure to lumber cuts and by consistently applying our safe work protocols. We provide ongoing training and employ strict safe building practices. All new hires undergo a two day safety orientation followed by additional training at 30, 60 and 90 days, along with ongoing regular safety meetings. Over the last ten years, our production facilities maintained a safety incident rate approximately 40% lower than the industry average.

We maintain robust safety and training programs to ensure that safety is an integral part of our onsite construction process. We perform frequent and regular construction site inspections to ensure our safety processes and procedures are being followed. We conduct semi-annual unannounced safety audits at all of our homebuilding divisions. The audits assess compliance with OSHA standards and company safety policies. The results of these audits are reviewed by our senior management team, and division management is responsible for updating safety processes and procedures as needed based on the results. We maintain a rigorous enforcement program to hold our management and trade partners accountable for non-compliant actions. We also engage directly with our trade partners to ensure they have input regarding the safety of their employees on our construction sites.

Development & Advancement: We provide advancement opportunities for our employees by offering training and development that aligns with each employee’s responsibilities and career path. Managers provide frequent performance coaching through a formal process to develop our employees and enhance our succession planning. The substantial majority of our leadership fulfillments are from within our workforce. We believe this focus provides both long-term success and continuity to our operations and growth for our employees. Our results in this area are demonstrated by the tenure of our executives and our regional and division leaders.

Diversity & Inclusion: Diversity and inclusion is an important part of our culture. We are committed to hiring and developing an inclusive workplace with a strong diversity of backgrounds and perspectives. Our culture is about creating opportunities for growth, a sense of belonging and operating with the highest level of integrity.

Environmentally Responsible Building

Sourcing & Design: Our centralized production facilities enable us to have significant control over the sourcing of raw materials. For example, lumber is one of our most important raw materials, and centralization allows us to purchase a significant amount of lumber from sustainable forests. Currently, approximately 80% of our lumber spending is from Forest Stewardship Council (FSC) or similar certified sustainable forests. When we source intermediate and finished goods for our homes, we also strive to source sustainably. For example, the cabinets we install in our homes are “Green-Approved” certified by the NAHB Research Center and certified by the Kitchen Cabinet Manufacturers Association under its Environmental Stewardship Program.

We also use materials in our homes that promote greater resource efficiency. For instance, the floor, wall and roof sheathing that we use is engineered lumber, not plywood, which allows us to use the entire tree. Much of the waste that we create from our raw lumber is recycled.

Production facilities: We produce large portions of our homes in our centralized production facilities, including wall panels, roof trusses and stairs, which allows us to reduce waste, effectively recycle materials, and improve accuracy and consistency in our construction. Our production processes use computer-driven saws that maximize the use of raw lumber to fabricate roof trusses and wall panels, resulting in an extremely low waste factor. We use advanced framing techniques recommended for Leadership in Energy and Environmental Design (LEED) green building certification and use highly-sophisticated material takeoff and sourcing techniques to reduce waste. Our framing waste factor is within the LEED-H & National Association of Homebuilders (NAHB) Green Guidelines.

We also strategically locate our production facilities in close proximity to our communities to reduce freight, road congestion and fuel consumption and minimize air pollution. We have eight such production facilities and are adding a ninth in Fayetteville, NC, which we believe is a clear indication of our commitment to environmentally friendly production. We continually update our production processes to enhance vertical integration, which results in significantly fewer shipments to our job sites and reduced fuel usage.

Recycling: We recycle materials in our production processes whenever possible. We recycle cardboard, metal and wooden pallets as part of our recycling program, which significantly reduces the amount of materials that end up going to landfills. We optimize our lumber cuts to minimize lumber scrap and work with lumber recyclers to repurpose our lumber scrap.

Responsibility: We are responsible stewards of our own land; no run-off or by-product discharge is created from our processes at our production facilities. We utilize an extensive storm water management system and have implemented erosion and sediment controls on all of our construction sites to manage storm water run-off. We also perform semi-annual unannounced environmental audits at construction sites in which we assess compliance with company policies and federal, state and local clean water standards. The results of the audits are reviewed by our senior management team and local management is responsible for updating environmental processes and procedures as needed based on the results. We maintain a rigorous enforcement program to hold our management and our trade partners accountable for non-compliant actions. We actively monitor the regulatory environment with respect to environmental and climate disclosures and have hired outside advisors to assist us in proactively preparing for compliance with emerging requirements.

Sustainable Communities

Energy Efficient & Affordable Homes: We design our homes under our BuiltSmart program, which has been designed to highlight the quality, livability and energy efficiency that go into our home designs. Our building practices and standards result in a lower long-term carbon footprint for our homes and communities. Our homes use resources as efficiently as possible while providing durable structures that will last for generations. We believe that building our homes to use less energy, water and other natural resources is an important way we can have a lasting sustainability impact.

According to the U.S. Energy Information Administration, more than half of all energy consumed in the types of homes we build is used to heat and cool. We reduce our homes’ energy demand through the use of air and moisture infiltration systems, high-efficiency windows, engineered air handling systems to minimize imbalance and loss, and the use of insulation that meets or exceeds local building requirements. We then deliver heating and cooling with high-efficiency heating and air conditioning systems and install programmable thermostats in each home to help homeowners reduce their energy usage.

We also install integrated LED light fixtures and bulbs to use 25-80% less energy than traditional lighting, and create less waste due to a lifespan that is 10-20 times longer than a traditional light bulb.

All of our homes are tested using the RESNET standard for energy efficiency by an independent third-party. For 2022, 100% of our homes built were more energy efficient than a standard new home (as defined by the Home Energy Rating System, or HERS), and were on average over 40% more efficient than the standard new home.

Reduce Water Needs: We use high-efficiency tankless water heaters to provide on-demand hot water, resulting in a significant energy use reduction for homeowners. We use faucets and shower heads that are certified to the EPA WaterSense program, reducing the consumption of water by up to 20%, and we install landscaping using native plants and materials to reduce the need for extra irrigation.

Home Ownership: Since 1948, our passion and purpose has been in building beautiful places people love to call home, and we have built more than 530,000 homes in that time. We bring the dream of affordable home ownership to first time buyers, move-up buyers, empty nesters and active adults, and are a leading builder in diverse areas in our footprint such as Washington D.C. and Baltimore, MD. We build homes in thirty-five metropolitan areas in fifteen states and included in those areas are a number of traditionally underserved markets. In addition, we actively support low and moderate income households through state and local affordable housing initiatives. Our mortgage banking operations lending practices are conducted in accordance with the Equal Credit Opportunity Act and Fair Housing Act, and approximately 52% of FHA loans closed in 2022 were made in underserved markets. We know that engaging and supporting our communities throughout the building process and beyond enhances the long term sustainability and value creation of our business.

As a result of our sustainability efforts, some of our homes have achieved a level of efficiency and sustainability that allows us to sell the mortgage loans we close on such homes to Fannie Mae for inclusion in their “green bond” mortgage backed securities. At present, we are one of seven builders whose mortgages are included in this Fannie Mae program. For more information on this program, visit the Fannie Mae website at https://www.fanniemae.com/about-us/esg/green-bonds.

Risk Management

Strategy: Two of the key differentiators that contribute to our success are our market concentration strategy and our lot acquisition strategy. We focus on obtaining and maintaining a leading market position in each market we serve. This strategy allows us to gain valuable efficiencies and competitive advantages in our markets, which we believe contributes to minimizing the adverse effects of regional economic cycles and provides growth opportunities within these markets.

With respect to our lot acquisition strategy, we generally do not engage in direct land ownership or land development. Instead, we typically acquire finished building lots from various third party land developers pursuant to fixed price finished lot purchase agreements (“LPAs”) that require deposits that may be forfeited if we fail to perform under the LPAs. The deposits required under the LPAs are in the form of cash or letters of credit in varying amounts and typically range up to 10% of the aggregate purchase price of the finished lots. We believe that our lot acquisition strategy avoids the financial requirements and risks associated with direct land ownership and land development. In this way, we operate in a much less capital intensive manner than most other homebuilders.

Capital Allocation: Our strategy described above is the key driver of our strong balance sheet that, over the long-term, maximizes shareholder value in a cyclical industry. We were the only publicly traded homebuilder that remained profitable through the 2006-2011 housing downturn, the most severe since the Great Depression of the 1930s. That outperformance in a recessionary period was a direct result of our strategy. In 2022, we continued our robust share repurchase program by repurchasing over $1.5 billion of outstanding stock, while maintaining a strong balance sheet with a net cash balance in excess of $1.6 billion at December 31, 2022. Our strong balance sheet enables us to weather future business disruptions and take advantage of opportunities that may arise from future economic and homebuilding market volatility.

Corporate Governance: We are committed to having sound corporate governance principles and practices. Having and acting on that commitment is essential to the long term sustainability of our business and to maintaining our integrity in the marketplace. During 2022, our Board was actively engaged in overseeing the rapidly shifting risk environment brought on by changes in interest rates and the continuing impacts of the COVID-19 pandemic. During the year, directors met formally five times, and worked closely with management to monitor the resilience of the business, supply chain issues and the welfare of our employees, customers and trade partners.

We have three female independent directors on our Board, and have a broad diversity of backgrounds and perspectives within our boardroom. Our Board and management regularly consider board refreshment and we have a robust board self-evaluation process. These practices ensure we strike the right balance between long-term understanding of our business, business experience, tenure and fresh external perspectives.

Sustainability is an Ongoing NVR Priority

We are committed to our priorities of people, environmentally responsible building, sustainable communities and risk management. The actions we have described here are a small part of what we do every day to fulfill our corporate responsibility and enhance our business sustainability. These important topics will continue to evolve, and so will our active approach to addressing these topics as part of our strong governance framework.

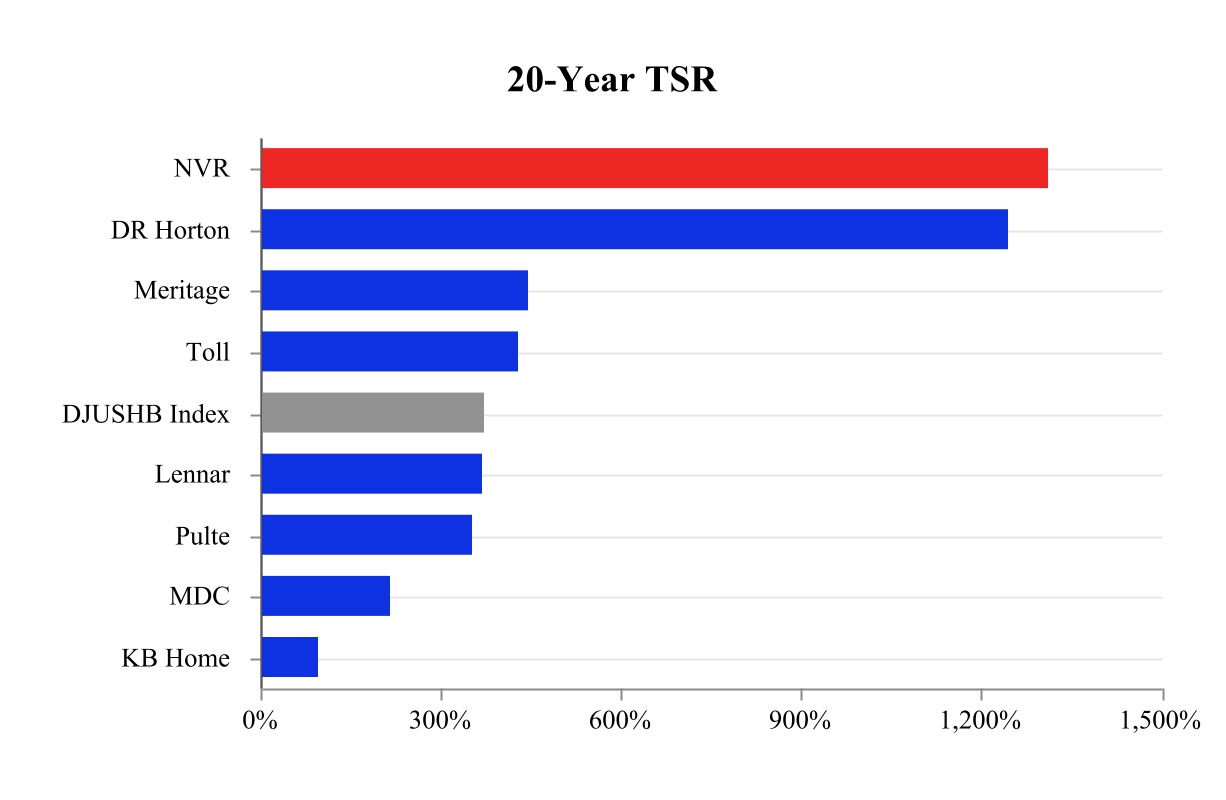

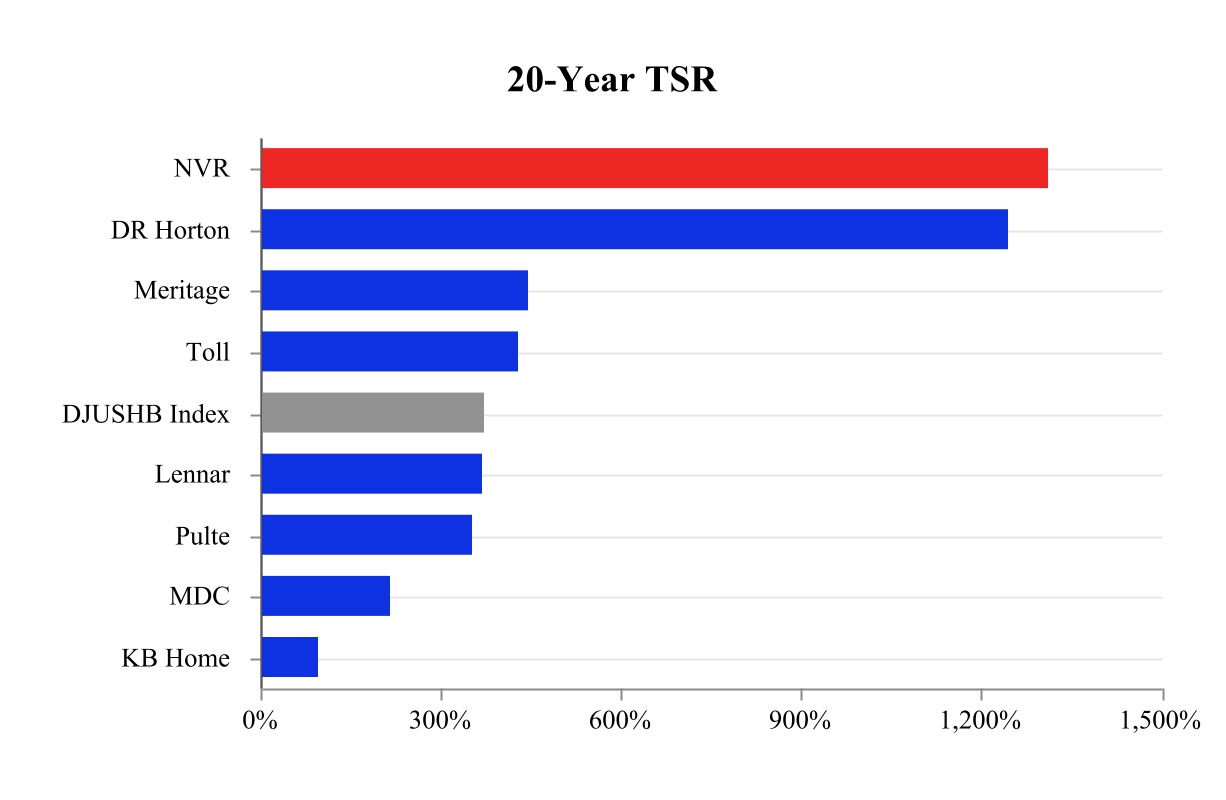

We believe profitability and sustainability go hand-in-hand; we are more profitable because we operate sustainably, and we are more sustainable because we operate profitably. While the examples we provide in this proxy are focused on current and recent practices, the fundamentals of our sustainable strategy have been the very underpinning of our business success. The 1,313% return our shareholders have enjoyed over the last 20 years is a testament to the success of our strategy.

Election of Directors

(Proposal No. 1)

Director Nominees

Our Restated Articles of Incorporation state that the number of directors on our Board will be no less than seven and no more than thirteen, as established from time to time by Board resolution. Our Board has set the size of the Board at ten members. We strive to strike the right balance on our Board between long-term understanding of our business, business experience and fresh external perspectives.

The following persons have been nominated by the Board to be elected to hold office for a one-year term ending at the 2024 Annual Meeting and until their successors are duly elected and qualified:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Year First

Elected or

Appointed | | Independent | | Other Public Company Boards |

| Paul C. Saville | | 67 | | 2022 | | No | | — |

| C. E. Andrews | | 71 | | 2008 | | Yes | | 1 |

| Sallie B. Bailey | | 63 | | 2020 | | Yes | | 2 |

| Thomas D. Eckert | | 75 | | 2011 | | Yes | | 1 |

| Alfred E. Festa | | 63 | | 2008 | | Yes | | 1 |

| Alexandra A. Jung | | 52 | | 2018 | | Yes | | — |

| Mel Martinez | | 76 | | 2012 | | Yes | | 1 |

| David A. Preiser | | 65 | | 1993 | | Yes | | 1 |

| W. Grady Rosier | | 74 | | 2008 | | Yes | | 1 |

| Susan Williamson Ross | | 61 | | 2016 | | Yes | | — |

All of the director nominees are current directors standing for re-election. Each nominee has consented to serve as one of our directors if elected. Our Board does not contemplate that any of its proposed nominees listed above will be unwilling to serve or become unavailable for any reason, but if any such circumstance should occur before the Annual Meeting, proxies may be voted for another nominee selected by the Board.

Biographical Information for Our Directors and Director Nominees

The biographies below describe the skills, attributes and experience of our directors and director nominees who were considered by the Board and Nominating Committee.

Paul C. Saville has been Executive Chairman of our Board since being elected to the Board by our shareholders at the 2022 Annual Meeting on May 4, 2022. Prior to that, Mr. Saville served as President and Chief Executive Officer of NVR from July 1, 2005 through May 3, 2022. Mr. Saville has been employed by NVR since 1981.

The Board believes that Mr. Saville is highly qualified to serve on the Board based on his lengthy NVR and homebuilding industry and real estate experience, his executive leadership experience, his brand marketing expertise, his financial expertise, his mergers and acquisitions experience and his turn-around/restructuring experience.

C. E. Andrews has been a director since May 6, 2008. Mr. Andrews served as Chief Executive Officer and a member of the board of directors of MorganFranklin Consulting, LLC from May 2013 through March 2017, and served on its Board of Directors from May 2013 through June 2019. From June 2009 until February 2012, Mr. Andrews was the president of RSM McGladrey Business Services, Inc. Prior to that, Mr. Andrews served as the president of SLM Corporation (“Sallie Mae”). He joined Sallie Mae in 2003 as the executive vice president of accounting and risk management, and held the title of chief financial officer from 2006 to 2007. Prior to joining Sallie Mae, Mr. Andrews spent approximately 30 years at Arthur Andersen. He served as managing partner for Arthur Andersen’s mid-Atlantic region, and was promoted to global managing partner for audit and advisory services in 2002. Mr. Andrews serves on the board of Marriott Vacations Worldwide Corporation.

The Board believes that Mr. Andrews is highly qualified to serve on our Board based on his executive leadership experience, his financial and accounting expertise, his restructuring experience and his public company board experience.

Sallie B. Bailey has been a director since February 21, 2020. Ms. Bailey was Executive Vice President and Chief Financial Officer of Louisiana-Pacific Corporation from December 2011 until July 2018. From January 2007 until July 2010, Ms. Bailey

was the Vice President and Chief Financial Officer of Ferro Corporation. From 1995 until 2006, Ms. Bailey served in various senior management roles at The Timken Company, lastly as Senior Vice President and Controller. Ms. Bailey serves on the boards of The Azek Company, Inc. and L3Harris Technologies, Inc.

The Board believes that Ms. Bailey is highly qualified to serve on our Board based on her executive leadership, her financial and accounting expertise and her public company board experience.

Thomas D. Eckert has been a director since December 1, 2011. Mr. Eckert was Chairman of Capital Automotive Real Estate Services, Inc. (“Capital Automotive”) until October 2014. He was one of the founders of Capital Automotive in October 1997 and led its initial public offering in 1998. Capital Automotive went private in 2005. Mr. Eckert serves on the board of Park Hotels & Resorts. Within the past five years, Mr. Eckert previously served on the boards of Chesapeake Lodging Trust and Gramercy Property Trust.

The Board believes that Mr. Eckert is highly qualified to serve on our Board based on his executive leadership experience, his homebuilding and real estate experience, his public company board experience, and his mergers and acquisitions experience.

Alfred E. Festa has been a director since December 1, 2008. Mr. Festa was Chairman of W. R. Grace & Co (“Grace”) from January 2008 through November 2019. He joined Grace as President and Chief Operating Officer in November 2003, and was Chief Executive Officer from June 2005 through November 2018. From November 2002 until November 2003, Mr. Festa was a partner in Morgenthaler Private Equity Partners, a venture/buyout firm focused on mid-market industrial build-ups. Mr. Festa serves on the board of Owens Corning, Inc. Within the past five years, Mr. Festa previously served on the board of Grace.

The Board believes that Mr. Festa is highly qualified to serve on our Board based on his executive leadership experience, his public company board experience, his financial expertise, his brand marketing expertise, his mergers and acquisitions experience, and his restructuring experience.

Alexandra A. Jung has been a director since December 3, 2018. Ms. Jung is a co-founder and Managing Partner of Amateras Capital, an investment firm focused on private credit and equity investments. She is also a Partner and Head of Private Debt at AEA Investors, L.P. From 2009 through April 2020, Ms. Jung was at Oak Hill Advisors ("Oak Hill"), a leading alternative investment firm with over $50 billion of assets under management. Ms. Jung was a partner at Oak Hill from 2012 through April 2019 when she became a senior advisor. Prior to joining Oak Hill, Ms. Jung was a Managing Director at Greywolf Capital Management, where she was responsible for investments in credit, private equity and special situations. Previously, she managed investments in credit, distressed debt and equity as part of Goldman Sachs’ European Special Situations Group.

The Board believes that Ms. Jung is highly qualified to serve on our Board based on her executive leadership experience, her financial expertise, her knowledge of capital markets, her mergers and acquisitions experience, and her restructuring experience.

Mel Martinez has been a director since December 1, 2012. Mr. Martinez was Chairman of the South East and Latin America for JPMorgan Chase & Co. ("JPMorgan") from August 2010 through March 1, 2023. Prior to joining JPMorgan, Mr. Martinez was a partner in the law firm DLA Piper from September 2009 to July 2010. Mr. Martinez served as a United States Senator from Florida from January 2005 to September 2009. Prior to his election, Mr. Martinez served as the Secretary of the United States Department of Housing and Urban Development from January 2001 to January 2004. Mr. Martinez serves on the board of Marriott Vacations Worldwide Corporation.

The Board believes that Mr. Martinez is highly qualified to serve on our Board based on his executive leadership experience, his housing industry experience, his government and housing regulatory expertise, and his public company board experience.

David A. Preiser has been a director since September 30, 1993. Mr. Preiser has been Co-President of the investment banking firm of Houlihan Lokey, Inc. since 2013 and a member of its board of directors since 2001. Since January 1, 2005, Mr. Preiser has served as Chairman of Houlihan Lokey– Europe, pursuant to which he leads Houlihan Lokey’s European investment banking activities, including Houlihan Lokey’s European restructuring business. Mr. Preiser is also active in Houlihan Lokey’s investment banking and restructuring activities in the United States. Since 1990, Mr. Preiser has been active in coordinating Houlihan Lokey's real estate and financial restructuring activities as a senior managing director.

The Board believes that Mr. Preiser is highly qualified to serve on our Board based on his executive leadership experience, his financial expertise, his knowledge of capital markets, his mergers and acquisitions experience, his public company board experience, and his turn-around/restructuring experience.

W. Grady Rosier has been a director since December 1, 2008. Mr. Rosier served as the President and CEO of McLane Company, Inc. (“McLane”), a supply chain services company, from 1995 through August 2020. Prior to 1995, Mr. Rosier held various senior management roles since joining McLane in 1984. Mr. Rosier serves on the board of NuStar Energy L.P.

The Board believes that Mr. Rosier is highly qualified to serve on our Board based on his executive leadership experience and his public company board experience.

Susan Williamson Ross has been a director since July 28, 2016. Ms. Ross has been the President of the privately-held majority investor in Clark Construction Group, Shirley Contracting and several other construction, development and real estate businesses since January 2016. She became the President and Chief Executive Officer in December 2020. She has been employed by Clark Construction Group since December 1986 in various positions, including Chief Administrative Officer from July 2004 to 2020 and Executive Vice President from January 2008 to the present.

The Board believes that Ms. Ross is highly qualified to serve on our Board based on her executive leadership experience, and her construction, development and real estate experience.

Majority Vote Standard

Pursuant to our Corporate Governance Guidelines, the Board expects a director to tender his or her resignation if he or she fails to receive the required number of votes for re-election. Under these guidelines, the Board shall nominate for re-election as a director only candidates who agree to tender their resignation if they fail to receive the required number of votes for re-election. In addition, the Board shall fill director vacancies and new directorships only with candidates who agree to tender their resignation if they fail to receive the required number of votes for re-election.

If a director fails to be re-elected by a majority of votes cast, the Nominating Committee shall promptly consider the resignation offer of any such director and recommend to the Board whether to accept the tendered resignation or reject it. The Board shall take action with respect to the Nominating Committee's recommendation no later than 90 days following the submission of any such resignation offer. Following the Board's action regarding the Nominating Committee's recommendation, we will promptly file a Current Report on Form 8-K with the Securities and Exchange Commission (the “SEC”) which shall detail the Board's decision regarding a tendered resignation. This report shall include an explanation of the process by which the Board's decision was reached and the reasons for the Board's decision.

To the extent that one or more directors’ resignations are accepted by the Board, the Nominating Committee will recommend to the Board whether to fill the vacancy or vacancies or to reduce the size of the Board.

The Board expects that any director who tenders his or her resignation pursuant to this policy will not participate in the Nominating Committee recommendation or Board action regarding whether to accept or reject the tendered resignation. If, however, a majority of the members of the Nominating Committee fails to receive the required number of votes for re-election in the election, the independent directors who did not fail to receive the required number of votes for re-election shall form a committee amongst themselves for the purposes of evaluating the tendered resignations and recommending to the Board whether to accept or reject them.

Required Vote

Each director shall be elected by a majority of the votes cast in the election at the Annual Meeting, assuming that a quorum is present. A majority of the votes cast means that the number of shares voted "for" a director must exceed the number of shares voted "against" that director. Unless marked otherwise, proxies received will be voted FOR the election of the ten nominees designated above. Shareholders may abstain from voting for any particular nominee by so indicating in the space provided on the accompanying proxy card. An abstention will not be counted as a vote cast “for” or “against” a director’s election.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS VOTING “FOR” ALL OF THE FOREGOING NOMINEES AS DIRECTORS OF NVR.

______________________________________________________________________________________________________

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS

We are committed to having sound corporate governance principles and practices. Having and acting on that commitment is essential to running our business efficiently and to maintaining our integrity in the marketplace. Our primary corporate governance documents, including our Corporate Governance Guidelines, Code of Ethics and all of our Board Committee Charters, are available to the public on our website at www.nvrinc.com.

The following are highlights of our Corporate Governance practices:

•Separate Chairman of the Board and Chief Executive Officer positions

•Annual elections for all directors

•Majority voting standard for uncontested elections

•Nine of the ten director nominees are independent

•Independent lead director

•Shareholder proxy access

•Annual Board and Committee evaluations

•Robust NVR stock ownership requirements for named executive officers and directors

•Robust pre-clearance process for trading NVR stock during open trading windows

•Prohibition against short sales, hedging or pledging of NVR stock by named executive officers and directors

•Prohibition against named executive officers and directors owning NVR debt

•No poison pill or other anti-takeover provisions

•Independent compensation consultant

Board Leadership Structure, Committee Composition and Role in Risk Oversight

Board Leadership Structure

Separate Chief Executive Officer (“CEO”) and Executive Chairman of the Board (“Chairman”)

We seek to maintain an appropriate balance between management and our Board. In 2005, we separated the roles of the Chairman and the CEO. Currently, Mr. Saville serves as Chairman, and Eugene J. Bredow serves as CEO. Our CEO is not a Board member. Our Board believes that this structure provides a bridge between management and the Board, as Mr. Saville is well-positioned to bring key business issues and stockholder interests to the Board's attention, given his in-depth understanding of our business. Mr. Saville continues to provide strategic direction in this role while Mr. Bredow provides operational direction. This structure also helps ensure accountability for the actions and strategic direction of NVR.

While the Board retains the discretion to combine the roles of Chairman and CEO, as from time to time it may be in our best interests, we expect that the roles of Chairman and CEO will remain separated for the foreseeable future. Our separate Chairman and CEO roles allow us to effectively manage the business and we believe the structure is a key driver in maintaining our sound corporate governance principles. All of our Board members other than our Chairman are independent.

Independent Lead Director

Our Board has an independent lead director who provides independent oversight of senior management and Board matters. We believe having an independent lead director is an important governance practice given that our Board’s Chairman, Mr. Saville, is not independent. The selection of an independent lead director is meant to facilitate, and not to inhibit, communication among the directors or between any of them, our Chairman and our CEO. Accordingly, directors are encouraged to continue to communicate among themselves and directly with the Chairman and the CEO. Our independent lead director position rotates annually among the chairs of the Audit, Compensation, and Nominating Committees. We believe rotating the role of independent lead director is beneficial to our Board and our stockholders because it provides a fresh perspective to the role on a rotating basis.

The independent lead director's role is critical to ensure the Board is able to carry out its responsibilities effectively and independently of management. The authority and responsibilities of the independent lead director include, but are not limited to, the following:

•Presides over meetings of our independent directors and provides feedback to the Chairman and the CEO, as needed, following such meetings;

•Presides over meetings of our Board if the Chairman is not present; and

•Communicates with shareholders where appropriate.

Mr. Andrews, the Chair of our Audit Committee, currently serves as our independent lead director and has extensive executive leadership experience. After the 2023 Annual Meeting, we expect to appoint the chair of the Compensation Committee as our independent lead director, to serve in such role until the 2024 Annual Meeting. The Board believes that this leadership structure optimizes the roles of Chairman, CEO and independent lead director and provides the Company with sound corporate governance in the management of its business.

Director Attendance at Meetings

Our Board holds regular meetings at least quarterly. During 2022, the Board met six times.

Our Board requires that our directors attend each Board and Committee meeting in person, unless personal circumstances affecting a director make such attendance impractical or inappropriate. Each of our current Board members attended 100% of the Board meetings and the meetings of Committees of which he or she was a member during 2022.

Our Board also requires that all current directors and all nominees for election to our Board attend in person our annual meetings of shareholders, unless personal circumstances affecting such director or director nominee make such attendance impractical or inappropriate. Each of our then-serving directors attended the 2022 Annual Meeting of Shareholders in person.

Executive Sessions of the Board

Our full Board met twice during 2022 in executive session. Dwight C. Schar (our Chairman of the Board through May 4, 2022) chaired the first executive session in February 2022. Following his appointment as Executive Chairman on May 4, 2022, Mr. Saville chaired the subsequent executive session.

Our independent directors met once during 2022 in executive session without the presence of the non-independent directors or management. Mr. Andrews, our independent lead director in 2022, chaired the executive session of the independent directors.

Our Audit Committee meets in executive sessions at each Audit Committee meeting, separately with (1) our external auditor, (2) the Vice President of Internal Audit and Corporate Governance and (3) the Chief Financial Officer and Chief Accounting Officer. The Chair of the Audit Committee chaired these executive sessions.

Board Role in Risk Oversight

Our Board as a whole oversees our business risks and operational performance through regularly scheduled Board and Committee meetings, as well as through frequent and informal communications between management and the Board. Our Board does not have a standing risk management committee, but directly oversees risk management, as well as through various standing committees that address risk inherent in their respective areas of oversight. In particular, a primary function of our Board as set forth in the Company’s corporate governance guidelines is to review assessments of, and management’s plans with respect to, significant risks facing the Company, and our Audit Committee monitors the Company’s policies with respect to risk assessment and risk management and discusses the same periodically with management.

Further, our Bylaws and each of the various Board Committee Charters provide additional detail regarding the areas, duties and functions for which the Board or a Board Committee provides specific oversight of specified areas of risk. That oversight includes a variety of operational and regulatory matters, including, among other things:

•Approval of the annual business plan and the periodic review of our actual performance in comparison to the approved plan;

•Review and analysis of our operational and financial performance compared to our competitors;

•Review of our five year business plan;

•Our land acquisition process;

•Approval of short-term and long-term management incentive compensation plans;

•Review of succession planning throughout our organization for key management positions;

•Oversight of our information security program, designed to enhance business continuity, protect confidential information and implement best practices to mitigate cybersecurity risks;

•Oversight of our ESG strategy;

•Review of our response to new laws, rules or regulations; and

•Direct oversight of our internal audit function and our whistleblower hotline.

Discussions in Board meetings are enhanced by direct lines of communication for Board members with members of the management team responsible for various compliance matters, risk mitigation and strategy. Among other roles, we have a Senior Vice President of Human Resources and Chief Ethics Officer, a Chief Financial Officer, a Vice President of Internal Audit and Corporate Governance, a Chief Accounting Officer, a Chief Information Officer, a Chief Information Security Officer and a General Counsel, each of whom directly communicate with the Board on various matters regarding risk management, when and where appropriate.

Specifically:

•Our Senior Vice President of Human Resources regularly communicates with the Chair of the Compensation Committee on compensation matters and succession planning;

•Our Chief Information Officer communicates directly with members of the Audit Committee and Board on cybersecurity matters;

•Our Chief Accounting Officer communicates directly with members of the Audit Committee on emerging accounting and disclosure topics and matters; and

•Our Vice President of Internal Audit and Corporate Governance communicates with members of our Audit Committee on internal control matters and with members of our Board on governance matters.

We believe regular communications with the Board outside of Board meetings is an important aspect of our compliance strategy and sound risk oversight practices. Below is a discussion of how the Board oversees certain of our more significant business risks.

Land Acquisition

We believe our continued success is contingent upon our ability to control an adequate supply of finished lots on which to build. With this as a critical aspect of our continued success, management and the Board believe the full Board should be closely involved in our land acquisition strategy. The full Board, therefore, has retained direct oversight responsibility for our land acquisition process, rather than such process being delegated to a Board committee. We expend substantial monetary resources to place deposits under lot purchase contracts, typically ranging up to 10% of the aggregate purchase price of the finished lots. Our lot acquisition policy is a Board-approved policy that requires Board approval of:

•Lot purchase contracts above certain parameters, measured by the aggregate size of the deposit or investment;

•Contracts to acquire raw land above certain parameters, measured by aggregate size of the investment;

•Joint venture investments above certain parameters, measured by aggregate size of the investment; and

•Related-party lot purchase contracts (see "Transactions with Related Persons" below).

Liquidity

In a cyclical industry, it is imperative that we focus on our liquidity needs throughout the various stages of the cycle, while maintaining a prudent and efficient capital structure. Accordingly, our full Board has retained the lead role in ensuring that management prudently manages our cash, through the following:

•A Board-approved investment policy that specifies the types of investments allowed for our excess cash;

•Pre-approval of stock repurchases and debt repurchases;

•Pre-approval of capital transactions for the issuance of long-term debt or equity; and

•A Board review of our short-term and long-term cash needs in connection with its reviews of our quarterly forecasts and our annual and five year business plans.

Financial Reporting, Internal Control and Regulatory Matters

Our Audit Committee takes a lead role in overseeing risks as enumerated within its Committee Charter, including the following:

•Our Internal Audit function performs a primary role in risk management. Our Vice President of Internal Audit and Corporate Governance reports directly to the Audit Committee, and the Audit Committee formally approves the annual internal audit budget and staffing.

•The Audit Committee approves the annual internal audit plan, which is prepared using a comprehensive risk-based approach. Each year, our Vice President of Internal Audit and Corporate Governance presents our risk assessment to the Audit Committee. The annual risk assessment includes detailed discussions with senior management focused on operational and internal control risks. As part of this process, management consults with outside advisors where appropriate to provide insights into evolving and emerging risks. We present to the Audit Committee the results of this risk assessment along with a detailed summary of our risk mitigation strategies for each risk.

•On a quarterly basis, our Vice President of Internal Audit and Corporate Governance reviews with the Audit Committee the results of all internal audits of controls over accounting, operations, information technology and cybersecurity.

•Our Audit Committee reviews our cybersecurity processes, including ongoing initiatives, current threats and our response readiness. In 2022, our Chief Information Officer and Chief Information Security Officer presented updates on our cybersecurity initiatives quarterly; three times to our Audit Committee and once to our full Board.

•On a quarterly basis, our Vice President of Internal Audit and Corporate Governance and our external auditor each have a private session with the Audit Committee without the presence of management.

•Management reports to the Audit Committee any governmental regulatory reviews or audits conducted on our operations, including mortgage regulatory matters and SEC comment letters. The Audit Committee also obtains a report from management at the conclusion of any such review.

•The Audit Committee monitors compliance with our Code of Ethics and Standards of Business Conduct.

ESG Matters

The Nominating Committee is responsible for setting our ESG strategy and overseeing the mitigation of ESG risks as part of our strong governance framework. In 2022, management briefed our Nominating Committee on ESG matters in each of the Committee's four regularly scheduled meetings, including a discussion of the following topics:

•NVR's Responsible Building Policy and Practices document, which describes our commitment to responsible building practices including sustainability and energy efficiency. This policy is available to the public on our website at www.nvrinc.com;

•Shareholder feedback and priorities related to ESG matters;

•Peer group ESG disclosures; and

•ESG reporting frameworks.

The Nominating Committee considers our shareholders’ views and perspectives as part of the decision-making process on key ESG issues, taking into account the feedback from our management’s active monitoring of the broader ESG environment.

Board Independence

Our Board has established director independence standards to assist us in determining director independence, which standards meet the independence requirements of the NYSE corporate governance listing standards. Our independence standards are included within our Corporate Governance Guidelines, which are available on our website at www.nvrinc.com. Our Board considers all relevant facts and circumstances in making an independence determination. As required by the rules of the NYSE, for a director to be considered "independent" under our independence standards, our Board must affirmatively determine that the director has no material relationship with us (other than as a director), directly or indirectly.

Our Board has affirmatively determined that our directors and director nominees, other than Mr. Saville, are independent pursuant to our independence standards. Mr. Saville, our Executive Chairman, has been determined by our Board not to be “independent".

When our Board analyzed the independence of its members, it considered relevant transactions, relationships and arrangements, including those specified in the NYSE listing standards and our independence guidelines. The Board considered that certain directors serve as directors or employees of other companies with which we engage in ordinary course of business transactions. In accordance with our independence standards, none of these relationships constitute material relationships that would impair the independence of these directors.

Board Committees

Our Board has a standing Audit Committee, Compensation Committee, Nominating Committee, and Executive Committee. The members of the Audit Committee, Compensation Committee and Nominating Committee are independent under the applicable rules of the NYSE and the SEC. Each Committee operates pursuant to a written Committee Charter adopted by our Board, which is available at www.nvrinc.com. Board members serving on our Committees are shown in the table below.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Audit Committee | | Compensation Committee | | Nominating Committee | | Executive Committee |

| Paul C. Saville | | | | | | | | Chair |

| C. E. Andrews (L) | | Chair | | | | | | Member |

| Sallie B. Bailey | | Member | | | | | | |

| Thomas D. Eckert | | | | Member | | | | |

| Alfred E. Festa | | Member | | | | Chair | | Member |

| Alexandra A. Jung | | Member | | | | | | |

| Mel Martinez | | | | | | Member | | |

| David A. Preiser | | | | Member | | Member | | Member |

| W. Grady Rosier | | | | Member | | | | Member |

| Susan Williamson Ross | | | | Chair | | Member | | |

| | | | | | | | | |

| Number of Meetings in 2022 | | 5 | | 5 | | 4 | | 0 |

| | | | | | | | |

| (L) - Independent lead director | | | | | | |

Audit Committee

All members of the Audit Committee are financially literate and are able to read and understand fundamental financial statements, including a balance sheet, income statement and cash flow statement. Our Board has determined that Mr. Andrews and Ms. Bailey qualify as audit committee financial experts as defined within Item 407(d)(5) of Regulation S-K under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). All members of the Audit Committee satisfy the independence standards specified in Rule 10A-3(b)(1) under the Exchange Act.

The Audit Committee assists our Board in oversight and monitoring of:

•The integrity of our accounting and financial reporting processes;

•Our compliance with legal and regulatory requirements;

•Our independent external auditor’s qualifications and independence;

•Oversight of our cybersecurity processes, including systems to collect and store confidential information;

•Our policies with respect to risk assessment and risk management; and

•The performance of our internal audit function and our independent external auditors.

The Audit Committee performs the following functions:

•Appoints, evaluates and determines the compensation of our independent external auditor, including annually considering rotation of our independent external auditor;

•Discusses the scope and results of the audit with our independent external auditor and reviews our interim and year end operating results with management and our independent external auditor;

•Oversees our internal audit department;

•Maintains written procedures for the receipt, retention and treatment of complaints on accounting, internal accounting controls or auditing matters, as well as for the confidential, anonymous submissions by our employees of concerns regarding questionable accounting or auditing matters;

•Reviews substantiated complaints received from internal and external sources regarding accounting, internal accounting controls or auditing matters;

•Reviews our cybersecurity processes, including ongoing initiatives, current threats and our response readiness;

•Reviews reports from management regarding significant accounting, internal accounting controls, auditing, legal, cybersecurity and regulatory matters;

•Functions as a qualified legal compliance committee under Part 205 of the rules of the SEC; and

•Prepares the Audit Committee Report for inclusion in our proxy statement.

The Audit Committee has the authority and available funding to engage any independent legal counsel and any accounting or other expert advisors, as our Audit Committee deems necessary to carry out its duties.

Compensation Committee

The Compensation Committee performs the following functions:

•Reviews and determines all compensation of our Executive Chairman and CEO and, based in part on the recommendation of the CEO, of our other executive officers;

•Obtains advice and assistance from compensation consultants that it determines to be necessary to carry out its duties;

•Periodically reviews and makes recommendations to the Board with respect to the compensation of our directors;

•Administers and interprets incentive compensation and equity plans for our employees (except as otherwise described below);

•Assists in preparing the Compensation Discussion and Analysis and prepares our Compensation Committee Report for inclusion in our annual meeting proxy statement in accordance with applicable rules and regulations of the SEC;

•Makes recommendations to our Board about succession planning for our CEO, and in conjunction with the CEO, is actively engaged in succession planning for other key positions; and

•Reviews and approves any employment agreements, or amendments thereto, with our Executive Chairman, CEO and CFO.

The Compensation Committee may delegate to a senior executive officer of NVR the authority to grant equity awards to employees other than executive officers, within limits prescribed by the full Board. The Compensation Committee, by resolution, delegated authority to our Executive Chairman or CEO, acting jointly with the Senior Vice President of Human Resources, to grant equity awards to new and existing employees (other than executive officers) during 2022. Management is required to report any equity awards granted pursuant to this delegated authority to the Compensation Committee at its next scheduled meeting after the delegated authority is exercised.

The Compensation Committee may delegate its authority to one or more members of the Compensation Committee. Any person to whom authority is delegated must report any actions taken by him or her to the full Compensation Committee at its next regularly scheduled meeting. During 2022, the Compensation Committee did not delegate any of its authority to any individual member.

The Compensation Committee has the authority and available funding to retain any compensation consultant, independent legal counsel or other expert adviser to assist in the evaluation of directors and executive officers' compensation, as our Compensation Committee deems necessary to carry out its duties.

Compensation Consultants

For a description of the role of the compensation consultant during 2022, see Compensation Discussion and Analysis - Compensation Determination Process below.

Compensation Committee Interlocks and Insider Participation

Ms. Ross and Messrs. Eckert, Preiser and Rosier were members of the Compensation Committee during 2022. During 2022, none of our executive officers served as a member of the board of directors or compensation committee of any entity that had one or more executive officers serving as a member of our Board or our Compensation Committee. Thus, there were no interlocks with other companies within the meaning of Item 407(e)(4) of SEC Regulation S-K during 2022.

Nominating Committee

The Nominating Committee performs the following functions:

•Identifies individuals qualified to become Board members, including diversity of our members;

•Recommends that our Board select the director nominees for the next annual meeting of shareholders;

•Recommends Board committee structure and makeup;

•Oversees and makes recommendations regarding corporate governance matters, including our Corporate Governance Guidelines;

•Sets our strategy with respect to ESG matters and recommends policies, practices and disclosures that conform to our strategy; and

•Manages the Board’s annual evaluation process.

The Nominating Committee also has the sole authority and available funding to obtain advice and assistance from executive search firms, and internal or outside legal, accounting or other expert advisors that it determines necessary to carry out its duties.

Criteria for Nomination to the Board of Directors

The Nominating Committee will consider shareholder nominees as described in our Policies and Procedures for the Consideration of Board of Director Candidates, which is available at www.nvrinc.com. These policies and procedures include minimum qualifications for director nominees and the process for identifying and evaluating director nominees, including nominees submitted by our security holders.

The Nominating Committee has a stated goal of selecting director nominees who have high personal and professional integrity, have demonstrated exceptional ability and judgment, and who will be effective in serving the long-term interests of NVR and our shareholders, and who otherwise meet the standards set forth in our Corporate Governance Guidelines. In selecting director nominees, the Committee will assess the nominee’s independence status relative to the Company, and will consider the nominee’s qualifications in the areas of skills, education, knowledge, perspective, broad business judgment and leadership, relevant industry or regulatory affairs knowledge, business creativity, strategy and vision, experience, age and diversity, all in the context of the perceived needs of the Board at that time.

Ideal candidates will encourage and challenge our management team to operate the business in a manner that maximizes shareholder value, and leads to high customer satisfaction, a diverse and inclusive workforce, a safe work environment for all employees, and sustainable communities, all of which lead to a sustainable business.

Attributes that the Nominating Committee seeks to have represented on the Board include, but are not limited to, executive leadership experience, financial expertise, homebuilding/construction/real estate experience, public board experience, cybersecurity expertise, brand marketing expertise, mergers and acquisitions expertise, turnaround/restructuring experience, and government/regulatory expertise.

Proxy Access

Our Bylaws allow eligible shareholders to propose director nominees for inclusion in the proxy statement in addition to the nominees proposed by the Board. The proxy access bylaw permits shareholders owning 3% or more of our common stock for at least three years, to nominate up to 20% of our Board. The number of shareholders who may aggregate their shares to meet the 3% ownership threshold is limited to 20. The shareholder(s) and nominees(s) must also satisfy the other requirements in our Bylaws.

Executive Committee

The Executive Committee was established pursuant to our Bylaws to have such powers, authority and responsibilities as may be determined by a majority of our Board. The Executive Committee has never met, nor has our Board ever delegated any powers, authority or responsibilities to the Executive Committee. Our Board intends to continue the practice of considering corporate matters outside the scope of our other existing Board committees at the full Board level.

Annual Board and Committee Evaluations

Annual Board Evaluations

The members of the Board conduct an annual evaluation to assess the Board's effectiveness and performance. The results are reviewed by the Board, which considers the results and any ways in which Board effectiveness may be enhanced.

Annual Committee Evaluations

The members of each committee conduct an annual evaluation to assess each committee's compliance with its charter, effectiveness and performance. The results are reviewed by the members of the applicable committee, which considers the results and any ways in which the committee's effectiveness may be enhanced.

Communications with the Board of Directors

Our Policies and Procedures Regarding Communications with the NVR, Inc. Board of Directors, the Independent Lead Director and the Non-Management Directors as a Group are available at www.nvrinc.com.

Shareholders and other interested parties may contact an individual director by mail at the following address: 11700 Plaza America Drive, Suite 500, Reston, VA 20190. All mail received will be opened and screened by our management. We generally will not forward to directors a shareholder or interested party communication that is unrelated to the duties of the Board, including junk mail, mass mailings, customer complaints, surveys and business solicitation.

Role of Shareholder Engagement in Corporate Governance

We have an extensive history of conducting shareholder outreach. During 2022, our engagement with shareholders encompassed a variety of topics including executive officer and director compensation, ESG disclosures, our CEO transition and director tenure.

We value feedback we receive from our shareholders and we consider such feedback in evaluating our corporate governance and compensation policies. In 2022, we implemented two substantive changes following our engagement with shareholders:

•Removal of director performance metric - We issued equity to our directors in 2022 with vesting subject only to continued service as a Director, and eliminated the NVR return on capital performance metric as a criterion for vesting.

•Director tenure - We reduced the average tenure of directors and the size of our Board through three director retirements, and nominating ten directors for election to our Board, down from twelve in the prior year.

We believe our proactive engagement with shareholders in 2022 and our responsiveness to feedback in these key areas demonstrate our strong desire to align our sound corporate governance principles with the best interests of our shareholders.

Review, Approval or Ratification of Related Person Transactions

We have a policy that requires that all related person (as defined by Item 404(a) of Regulation S-K) transactions be considered, reviewed and approved or ratified by the disinterested, independent members of our Board, regardless of the type of transaction or amount involved. Under this policy, the related person must notify the Chief Financial Officer (“CFO”) of any proposed transaction with a related person. The CFO must seek approval of the disinterested, independent members of the Board for any related person transaction. The disinterested, independent directors must review the material facts before determining whether to approve or ratify the transaction. This requirement is set forth in Section 7.05 of our Bylaws (available on our website at www.nvrinc.com), Sections 1 and 4 of our Code of Ethics (available on our website at www.nvrinc.com), and our Human Resources Policies and Procedures and Financial Policies and Procedures.

Transactions with Related Persons

During 2022, we purchased 642 developed lots for approximately $102,125,000 from Elm Street Development, Inc. (“Elm Street”) at market prices. Elm Street is controlled by William A. Moran, a former non-independent director who retired from our Board effective May 4, 2022. The 642 developed lots purchased from Elm Street are approximately 3% of the 20,867 lots we purchased during 2022. The independent members of our Board approved these transactions.

Security Ownership of Certain Beneficial Owners and Management

The following tables set forth certain information as to the beneficial ownership of Common Stock by each person known by us to be the beneficial owner of more than 5% of the outstanding Common Stock as of the dates indicated, and by each director, director nominee and named executive officer and by all directors and executive officers as a group as of March 1, 2023. Except as otherwise indicated, all shares are owned directly and the owner has sole voting and investment power with respect thereto.

Certain Beneficial Owners

| | | | | | | | | | | | | | | | | |

| Name and Address of Holder | | Number of

Shares | | | Percent of

Class |

| The Vanguard Group | | 344,319 | | (1) | | | 10.6 | % |

| 100 Vanguard Blvd. | | | | | |

| Malvern, PA 19355 | | | | | |

| | | | | |

| BlackRock, Inc. | | 230,029 | | (2) | | | 7.1 | % |

| 55 East 52nd Street | | | | | |

| New York, NY 10055 | | | | | |

| | | | | |

(1)As reported within a Schedule 13G filed February 9, 2023, the entity has shared power to vote or direct the vote for 4,414 shares, sole power to dispose or direct the disposition of 331,696 shares and shared power to dispose or direct the disposition of 12,623 shares.

(2)As reported within a Schedule 13G filed February 7, 2023, the entity has sole power to vote or direct the vote for 208,431 shares and the sole power to dispose or direct the disposition of 230,029 shares.

Directors and Management

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Number of Shares | | | | Vested Options Issued Under Equity Incentive Plans (1) | | Percent of

Class |

| Paul C. Saville | | 210,378 | | | (2) | | 95,800 | | | 6.3% |

| C. E. Andrews | | 1,660 | | | | | 750 | | | * |

| Sallie B. Bailey | | 304 | | | | | 204 | | | * |

| Thomas D. Eckert | | 3,150 | | | | | 2,050 | | | * |

| Alfred E. Festa | | 1,071 | | | | | 750 | | | * |

| Alexandra A. Jung | | 689 | | | | | 564 | | | * |

| Mel Martinez | | 941 | | | | | 750 | | | * |

| David A. Preiser | | 989 | | | | | 750 | | | * |

| W. Grady Rosier | | 3,159 | | | | | 750 | | | * |

| Susan Williamson Ross | | 2,888 | | | | | 2,483 | | | * |

| Eugene J. Bredow | | 20,211 | | | (3) | | 18,200 | | | * |

| Daniel D. Malzahn | | 43,880 | | | (4) | | 35,501 | | | 1.3% |

| Matthew B. Kelpy | | 3,202 | | | (5) | | 2,924 | | | * |