10-Q

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended SEPTEMBER 30, 2015

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 1-12252 (Equity Residential)

Commission File Number: 0-24920 (ERP Operating Limited Partnership)

EQUITY RESIDENTIAL

ERP OPERATING LIMITED PARTNERSHIP

(Exact name of registrant as specified in its charter)

|

| |

Maryland (Equity Residential) | 13-3675988 (Equity Residential) |

Illinois (ERP Operating Limited Partnership) | 36-3894853 (ERP Operating Limited Partnership) |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

Two North Riverside Plaza, Chicago, Illinois 60606 | (312) 474-1300 |

(Address of principal executive offices) (Zip Code) | (Registrant's telephone number, including area code) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

| |

Equity Residential Yes x No ¨ | ERP Operating Limited Partnership Yes x No o |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

| |

Equity Residential Yes x No ¨ | ERP Operating Limited Partnership Yes x No o |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| |

Equity Residential: | |

Large accelerated filer x | Accelerated filer ¨ |

Non-accelerated filer ¨ (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

|

| |

ERP Operating Limited Partnership: | |

Large accelerated filer ¨ | Accelerated filer ¨ |

Non-accelerated filer x (Do not check if a smaller reporting company) | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

| |

Equity Residential Yes ¨ No x | ERP Operating Limited Partnership Yes ¨ No x |

The number of EQR Common Shares of Beneficial Interest, $0.01 par value, outstanding on October 30, 2015 was 364,261,854.

EXPLANATORY NOTE

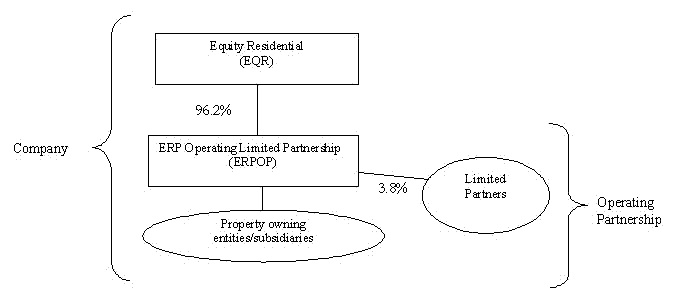

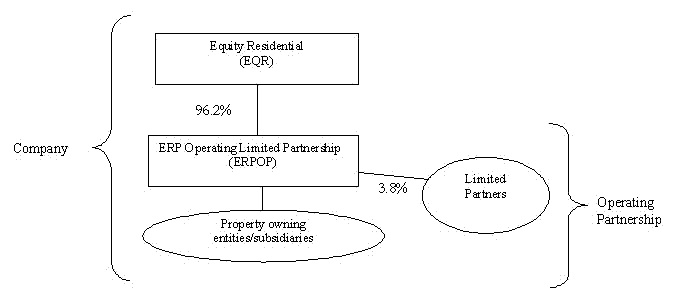

This report combines the reports on Form 10-Q for the quarterly period ended September 30, 2015 of Equity Residential and ERP Operating Limited Partnership. Unless stated otherwise or the context otherwise requires, references to “EQR” mean Equity Residential, a Maryland real estate investment trust (“REIT”), and references to “ERPOP” mean ERP Operating Limited Partnership, an Illinois limited partnership. References to the “Company,” “we,” “us” or “our” mean collectively EQR, ERPOP and those entities/subsidiaries owned or controlled by EQR and/or ERPOP. References to the “Operating Partnership” mean collectively ERPOP and those entities/subsidiaries owned or controlled by ERPOP. The following chart illustrates the Company's and the Operating Partnership's corporate structure:

EQR is the general partner of, and as of September 30, 2015 owned an approximate 96.2% ownership interest in, ERPOP. The remaining 3.8% interest is owned by limited partners. As the sole general partner of ERPOP, EQR has exclusive control of ERPOP's day-to-day management.

The Company is structured as an umbrella partnership REIT (“UPREIT”) and EQR contributes all net proceeds from its various equity offerings to ERPOP. In return for those contributions, EQR receives a number of OP Units (see definition below) in ERPOP equal to the number of Common Shares it has issued in the equity offering. Contributions of properties to the Company can be structured as tax-deferred transactions through the issuance of OP Units in ERPOP, which is one of the reasons why the Company is structured in the manner shown above. Based on the terms of ERPOP's partnership agreement, OP Units can be exchanged with Common Shares on a one-for-one basis. The Company maintains a one-for-one relationship between the OP Units of ERPOP issued to EQR and the Common Shares.

The Company believes that combining the reports on Form 10-Q of EQR and ERPOP into this single report provides the following benefits:

| |

• | enhances investors' understanding of the Company and the Operating Partnership by enabling investors to view the business as a whole in the same manner as management views and operates the business; |

| |

• | eliminates duplicative disclosure and provides a more streamlined and readable presentation since a substantial portion of the disclosure applies to both the Company and the Operating Partnership; and |

| |

• | creates time and cost efficiencies through the preparation of one combined report instead of two separate reports. |

Management operates the Company and the Operating Partnership as one business. The management of EQR consists of the same members as the management of ERPOP.

The Company believes it is important to understand the few differences between EQR and ERPOP in the context of how EQR and ERPOP operate as a consolidated company. All of the Company's property ownership, development and related business operations are conducted through the Operating Partnership and EQR has no material assets or liabilities other than its investment in ERPOP. EQR's primary function is acting as the general partner of ERPOP. EQR also issues equity from time to time and guarantees certain debt of ERPOP, as disclosed in this report. EQR does not have any indebtedness as all debt is incurred by the Operating Partnership. The Operating Partnership holds substantially all of the assets of the Company, including the Company's ownership interests in its joint ventures. The Operating Partnership conducts the operations of the business and is structured as a partnership with no publicly traded equity. Except for the net proceeds from equity offerings by EQR, which are contributed to

the capital of ERPOP in exchange for additional limited partnership interests in ERPOP (“OP Units”) (on a one-for-one Common Share per OP Unit basis), the Operating Partnership generates all remaining capital required by the Company's business. These sources include the Operating Partnership's working capital, net cash provided by operating activities, borrowings under its revolving credit facility and/or commercial paper program, the issuance of secured and unsecured debt and equity securities and proceeds received from disposition of certain properties and joint ventures.

Shareholders' equity, partners' capital and noncontrolling interests are the main areas of difference between the consolidated financial statements of the Company and those of the Operating Partnership. The limited partners of the Operating Partnership are accounted for as partners' capital in the Operating Partnership's financial statements and as noncontrolling interests in the Company's financial statements. The noncontrolling interests in the Operating Partnership's financial statements include the interests of unaffiliated partners in various consolidated partnerships and development joint venture partners. The noncontrolling interests in the Company's financial statements include the same noncontrolling interests at the Operating Partnership level and limited partner OP Unit holders of the Operating Partnership. The differences between shareholders' equity and partners' capital result from differences in the equity issued at the Company and Operating Partnership levels.

To help investors understand the differences between the Company and the Operating Partnership, this report provides separate consolidated financial statements for the Company and the Operating Partnership; a single set of consolidated notes to such financial statements that includes separate discussions of each entity's debt, noncontrolling interests and shareholders' equity or partners' capital, as applicable; and a combined Management's Discussion and Analysis of Financial Condition and Results of Operations section that includes discrete information related to each entity.

This report also includes separate Part I, Item 4. Controls and Procedures sections and separate Exhibits 31 and 32 certifications for each of the Company and the Operating Partnership in order to establish that the requisite certifications have been made and that the Company and the Operating Partnership are compliant with Rule 13a-15 or Rule 15d-15 of the Securities Exchange Act of 1934 and 18 U.S.C. §1350.

In order to highlight the differences between the Company and the Operating Partnership, the separate sections in this report for the Company and the Operating Partnership specifically refer to the Company and the Operating Partnership. In the sections that combine disclosure of the Company and the Operating Partnership, this report refers to actions or holdings as being actions or holdings of the Company. Although the Operating Partnership is generally the entity that directly or indirectly enters into contracts and joint ventures and holds assets and debt, reference to the Company is appropriate because the Company is one business and the Company operates that business through the Operating Partnership.

As general partner with control of ERPOP, EQR consolidates ERPOP for financial reporting purposes, and EQR essentially has no assets or liabilities other than its investment in ERPOP. Therefore, the assets and liabilities of the Company and the Operating Partnership are the same on their respective financial statements. The separate discussions of the Company and the Operating Partnership in this report should be read in conjunction with each other to understand the results of the Company on a consolidated basis and how management operates the Company.

TABLE OF CONTENTS

EQUITY RESIDENTIAL

CONSOLIDATED BALANCE SHEETS

(Amounts in thousands except for share amounts)

(Unaudited) |

| | | | | | | | |

| | September 30,

2015 | | December 31,

2014 |

ASSETS | | | | |

Investment in real estate | | | | |

Land | | $ | 6,424,887 |

| | $ | 6,295,404 |

|

Depreciable property | | 20,540,247 |

| | 19,851,504 |

|

Projects under development | | 1,039,657 |

| | 1,343,919 |

|

Land held for development | | 154,690 |

| | 184,556 |

|

Investment in real estate | | 28,159,481 |

| | 27,675,383 |

|

Accumulated depreciation | | (5,914,695 | ) | | (5,432,805 | ) |

Investment in real estate, net | | 22,244,786 |

| | 22,242,578 |

|

Cash and cash equivalents | | 37,366 |

| | 40,080 |

|

Investments in unconsolidated entities | | 74,108 |

| | 105,434 |

|

Deposits – restricted | | 135,674 |

| | 72,303 |

|

Escrow deposits – mortgage | | 54,071 |

| | 48,085 |

|

Deferred financing costs, net | | 57,001 |

| | 58,380 |

|

Other assets | | 405,798 |

| | 383,754 |

|

Total assets | | $ | 23,008,804 |

| | $ | 22,950,614 |

|

| | | | |

LIABILITIES AND EQUITY | | | | |

Liabilities: | | | | |

Mortgage notes payable | | $ | 4,891,529 |

| | $ | 5,086,515 |

|

Notes, net | | 5,881,794 |

| | 5,425,346 |

|

Line of credit and commercial paper | | 29,996 |

| | 333,000 |

|

Accounts payable and accrued expenses | | 253,027 |

| | 153,590 |

|

Accrued interest payable | | 86,083 |

| | 89,540 |

|

Other liabilities | | 353,106 |

| | 389,915 |

|

Security deposits | | 76,934 |

| | 75,633 |

|

Distributions payable | | 209,086 |

| | 188,566 |

|

Total liabilities | | 11,781,555 |

| | 11,742,105 |

|

| | | | |

Commitments and contingencies | | | | |

| | | | |

Redeemable Noncontrolling Interests – Operating Partnership | | 522,585 |

| | 500,733 |

|

Equity: | | | | |

Shareholders’ equity: | | | | |

Preferred Shares of beneficial interest, $0.01 par value;

100,000,000 shares authorized; 803,600 shares issued and

outstanding as of September 30, 2015 and 1,000,000 shares

issued and outstanding as of December 31, 2014 | | 40,180 |

| | 50,000 |

|

Common Shares of beneficial interest, $0.01 par value;

1,000,000,000 shares authorized; 364,140,040 shares issued

and outstanding as of September 30, 2015 and 362,855,454

shares issued and outstanding as of December 31, 2014 | | 3,641 |

| | 3,629 |

|

Paid in capital | | 8,584,143 |

| | 8,536,340 |

|

Retained earnings | | 2,007,590 |

| | 1,950,639 |

|

Accumulated other comprehensive (loss) | | (157,020 | ) | | (172,152 | ) |

Total shareholders’ equity | | 10,478,534 |

| | 10,368,456 |

|

Noncontrolling Interests: | | | | |

Operating Partnership | | 221,487 |

| | 214,411 |

|

Partially Owned Properties | | 4,643 |

| | 124,909 |

|

Total Noncontrolling Interests | | 226,130 |

| | 339,320 |

|

Total equity | | 10,704,664 |

| | 10,707,776 |

|

Total liabilities and equity | | $ | 23,008,804 |

| | $ | 22,950,614 |

|

EQUITY RESIDENTIAL

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(Amounts in thousands except per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, | | Quarter Ended September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

REVENUES | | | | | | | | |

Rental income | | $ | 2,035,359 |

| | $ | 1,942,492 |

| | $ | 694,245 |

| | $ | 662,001 |

|

Fee and asset management | | 6,413 |

| | 7,596 |

| | 2,044 |

| | 2,077 |

|

Total revenues | | 2,041,772 |

| | 1,950,088 |

| | 696,289 |

| | 664,078 |

|

| | | | | | | | |

EXPENSES | | | | | | | | |

Property and maintenance | | 364,948 |

| | 361,087 |

| | 122,383 |

| | 120,139 |

|

Real estate taxes and insurance | | 254,513 |

| | 245,717 |

| | 84,962 |

| | 80,568 |

|

Property management | | 60,887 |

| | 61,080 |

| | 18,925 |

| | 18,407 |

|

Fee and asset management | | 3,764 |

| | 4,293 |

| | 1,169 |

| | 1,253 |

|

Depreciation | | 584,862 |

| | 565,772 |

| | 196,059 |

| | 190,469 |

|

General and administrative | | 50,942 |

| | 41,296 |

| | 15,290 |

| | 9,968 |

|

Total expenses | | 1,319,916 |

| | 1,279,245 |

| | 438,788 |

| | 420,804 |

|

| | | | | | | | |

Operating income | | 721,856 |

| | 670,843 |

| | 257,501 |

| | 243,274 |

|

| | | | | | | | |

Interest and other income | | 6,906 |

| | 3,213 |

| | 256 |

| | 576 |

|

Other expenses | | (2,839 | ) | | (7,179 | ) | | (1,139 | ) | | (4,976 | ) |

Interest: | | | | | | | | |

Expense incurred, net | | (333,622 | ) | | (347,224 | ) | | (114,205 | ) | | (118,251 | ) |

Amortization of deferred financing costs | | (7,734 | ) | | (8,554 | ) | | (2,607 | ) | | (2,628 | ) |

Income before income and other taxes, income (loss) from investments

in unconsolidated entities, net gain (loss) on sales of real estate

properties and land parcels and discontinued operations | | 384,567 |

| | 311,099 |

| | 139,806 |

| | 117,995 |

|

Income and other tax (expense) benefit | | (698 | ) | | (1,146 | ) | | (329 | ) | | (260 | ) |

Income (loss) from investments in unconsolidated entities | | 14,388 |

| | (10,201 | ) | | (1,041 | ) | | (1,176 | ) |

Net gain on sales of real estate properties | | 295,692 |

| | 128,544 |

| | 66,939 |

| | 113,641 |

|

Net (loss) gain on sales of land parcels | | (1 | ) | | 1,846 |

| | — |

| | 1,052 |

|

Income from continuing operations | | 693,948 |

| | 430,142 |

| | 205,375 |

| | 231,252 |

|

Discontinued operations, net | | 350 |

| | 1,500 |

| | 81 |

| | (62 | ) |

Net income | | 694,298 |

| | 431,642 |

| | 205,456 |

| | 231,190 |

|

Net (income) attributable to Noncontrolling Interests: | | | | | | | | |

Operating Partnership | | (26,191 | ) | | (16,273 | ) | | (7,778 | ) | | (8,738 | ) |

Partially Owned Properties | | (2,473 | ) | | (1,800 | ) | | (986 | ) | | (708 | ) |

Net income attributable to controlling interests | | 665,634 |

| | 413,569 |

| | 196,692 |

| | 221,744 |

|

Preferred distributions | | (2,557 | ) | | (3,109 | ) | | (833 | ) | | (1,037 | ) |

Premium on redemption of Preferred Shares | | (2,789 | ) |

| — |

| | — |

| | — |

|

Net income available to Common Shares | | $ | 660,288 |

| | $ | 410,460 |

| | $ | 195,859 |

| | $ | 220,707 |

|

| | | | | | | | |

Earnings per share – basic: | | | | | | | | |

Income from continuing operations available to Common Shares | | $ | 1.82 |

| | $ | 1.13 |

| | $ | 0.54 |

| | $ | 0.61 |

|

Net income available to Common Shares | | $ | 1.82 |

| | $ | 1.14 |

| | $ | 0.54 |

| | $ | 0.61 |

|

Weighted average Common Shares outstanding | | 363,386 |

| | 360,900 |

| | 363,579 |

| | 361,409 |

|

| | | | | | | | |

Earnings per share – diluted: | | | | | | | | |

Income from continuing operations available to Common Shares | | $ | 1.80 |

| | $ | 1.13 |

| | $ | 0.53 |

| | $ | 0.61 |

|

Net income available to Common Shares | | $ | 1.80 |

| | $ | 1.13 |

| | $ | 0.53 |

| | $ | 0.61 |

|

Weighted average Common Shares outstanding | | 380,423 |

| | 377,228 |

| | 380,663 |

| | 377,954 |

|

| | | | | | | | |

Distributions declared per Common Share outstanding | | $ | 1.6575 |

| | $ | 1.50 |

| | $ | 0.5525 |

| | $ | 0.50 |

|

EQUITY RESIDENTIAL

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (Continued)

(Amounts in thousands except per share data)

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, | | Quarter Ended September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Comprehensive income: | | | | | | | | |

Net income | | $ | 694,298 |

| | $ | 431,642 |

| | $ | 205,456 |

| | $ | 231,190 |

|

Other comprehensive income (loss): | | | | | | | | |

Other comprehensive income (loss) – derivative instruments: | | | | | | | | |

Unrealized holding gains (losses) arising during the period | | 1,796 |

| | (21,784 | ) | | 1,908 |

| | 97 |

|

Losses reclassified into earnings from other comprehensive income | | 13,647 |

| | 12,606 |

| | 4,736 |

| | 4,271 |

|

Other comprehensive (loss) income – foreign currency: | | | | | | | | |

Currency translation adjustments arising during the period | | (311 | ) | | (466 | ) | | 191 |

| | (2,184 | ) |

Other comprehensive income (loss) | | 15,132 |

| | (9,644 | ) | | 6,835 |

| | 2,184 |

|

Comprehensive income | | 709,430 |

| | 421,998 |

| | 212,291 |

| | 233,374 |

|

Comprehensive (income) attributable to Noncontrolling Interests | | (29,244 | ) | | (17,705 | ) | | (9,025 | ) | | (9,530 | ) |

Comprehensive income attributable to controlling interests | | $ | 680,186 |

| | $ | 404,293 |

| | $ | 203,266 |

| | $ | 223,844 |

|

EQUITY RESIDENTIAL

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

(Unaudited)

|

| | | | | | | | |

| | Nine Months Ended September 30, |

| | 2015 | | 2014 |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

Net income | | $ | 694,298 |

| | $ | 431,642 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

Depreciation | | 584,862 |

| | 565,772 |

|

Amortization of deferred financing costs | | 7,734 |

| | 8,554 |

|

Amortization of above/below market leases | | 2,534 |

| | 2,376 |

|

Amortization of discounts and premiums on debt | | (7,718 | ) | | (8,750 | ) |

Amortization of deferred settlements on derivative instruments | | 13,483 |

| | 12,205 |

|

Write-off of pursuit costs | | 2,322 |

| | 2,067 |

|

(Income) loss from investments in unconsolidated entities | | (14,388 | ) | | 10,201 |

|

Distributions from unconsolidated entities – return on capital | | 3,564 |

| | 4,557 |

|

Net (gain) on sale of investment securities | | (387 | ) | | (57 | ) |

Net (gain) on sales of real estate properties | | (295,692 | ) | | (128,544 | ) |

Net loss (gain) on sales of land parcels | | 1 |

| | (1,846 | ) |

Net (gain) on sales of discontinued operations | | — |

| | (223 | ) |

Realized/unrealized loss (gain) on derivative instruments | | 3,055 |

| | (66 | ) |

Compensation paid with Company Common Shares | | 29,269 |

| | 24,647 |

|

Changes in assets and liabilities: | | | | |

(Increase) in deposits – restricted | | (1,268 | ) | | (2,223 | ) |

Decrease in mortgage deposits | | 756 |

| | 1,638 |

|

(Increase) decrease in other assets | | (25,428 | ) | | 3,854 |

|

Increase in accounts payable and accrued expenses | | 63,385 |

| | 76,331 |

|

(Decrease) increase in accrued interest payable | | (3,457 | ) | | 8,163 |

|

Increase (decrease) in other liabilities | | 5,120 |

| | (173 | ) |

Increase in security deposits | | 1,301 |

| | 4,146 |

|

Net cash provided by operating activities | | 1,063,346 |

| | 1,014,271 |

|

| | | | |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | | |

Investment in real estate – acquisitions | | (159,575 | ) | | (404,658 | ) |

Investment in real estate – development/other | | (485,758 | ) | | (380,691 | ) |

Capital expenditures to real estate | | (134,438 | ) | | (133,181 | ) |

Non-real estate capital additions | | (2,384 | ) | | (2,446 | ) |

Interest capitalized for real estate and unconsolidated entities under development | | (45,850 | ) | | (38,140 | ) |

Proceeds from disposition of real estate, net | | 457,499 |

| | 224,538 |

|

Investments in unconsolidated entities | | (22,998 | ) | | (14,568 | ) |

Distributions from unconsolidated entities – return of capital | | 45,245 |

| | 77,042 |

|

Proceeds from sale of investment securities | | 387 |

| | 57 |

|

(Increase) decrease in deposits on real estate acquisitions and investments, net | | (62,433 | ) | | 20,845 |

|

(Increase) decrease in mortgage deposits | | (407 | ) | | 560 |

|

Net cash (used for) investing activities | | (410,712 | ) | | (650,642 | ) |

EQUITY RESIDENTIAL

CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued)

(Amounts in thousands)

(Unaudited)

|

| | | | | | | | |

| | Nine Months Ended September 30, |

| | 2015 | | 2014 |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

Debt financing costs | | $ | (6,355 | ) | | $ | (10,598 | ) |

Mortgage deposits | | (6,335 | ) | | (5,557 | ) |

Mortgage notes payable: | | | | |

Lump sum payoffs | | (177,564 | ) | | (63,772 | ) |

Scheduled principal repayments | | (7,161 | ) | | (8,919 | ) |

Notes, net: | | | | |

Proceeds | | 746,391 |

| | 1,194,278 |

|

Lump sum payoffs | | (300,000 | ) | | (1,250,000 | ) |

Line of credit and commercial paper: | | | | |

Line of credit proceeds | | 3,569,000 |

| | 5,324,000 |

|

Line of credit repayments | | (3,902,000 | ) | | (4,993,000 | ) |

Commercial paper proceeds | | 2,491,848 |

| | — |

|

Commercial paper repayments | | (2,462,500 | ) | | — |

|

(Payments on) settlement of derivative instruments | | (13,938 | ) | | (758 | ) |

Proceeds from Employee Share Purchase Plan (ESPP) | | 3,376 |

| | 2,728 |

|

Proceeds from exercise of options | | 37,047 |

| | 56,554 |

|

Common Shares repurchased and retired | | — |

| | (1,777 | ) |

Redemption of Preferred Shares | | (9,820 | ) | | — |

|

Premium on redemption of Preferred Shares | | (2,789 | ) | | — |

|

Payment of offering costs | | (69 | ) | | — |

|

Other financing activities, net | | (33 | ) | | (33 | ) |

Acquisition of Noncontrolling Interests – Partially Owned Properties | | — |

| | (5,501 | ) |

Contributions – Noncontrolling Interests – Partially Owned Properties | | — |

| | 5,684 |

|

Contributions – Noncontrolling Interests – Operating Partnership | | 3 |

| | 3 |

|

Distributions: | | | | |

Common Shares | | (583,568 | ) | | (595,564 | ) |

Preferred Shares | | (2,557 | ) | | (3,109 | ) |

Noncontrolling Interests – Operating Partnership | | (22,968 | ) | | (23,582 | ) |

Noncontrolling Interests – Partially Owned Properties | | (5,356 | ) | | (6,762 | ) |

Net cash (used for) financing activities | | (655,348 | ) | | (385,685 | ) |

Net (decrease) in cash and cash equivalents | | (2,714 | ) | | (22,056 | ) |

Cash and cash equivalents, beginning of period | | 40,080 |

| | 53,534 |

|

Cash and cash equivalents, end of period | | $ | 37,366 |

| | $ | 31,478 |

|

EQUITY RESIDENTIAL

CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued)

(Amounts in thousands)

(Unaudited) |

| | | | | | | | |

| | Nine Months Ended September 30, |

| | 2015 | | 2014 |

SUPPLEMENTAL INFORMATION: | | | | |

Cash paid for interest, net of amounts capitalized | | $ | 328,400 |

| | $ | 335,646 |

|

Net cash paid for income and other taxes | | $ | 1,052 |

| | $ | 866 |

|

Amortization of discounts and premiums on debt: | | | | |

Mortgage notes payable | | $ | (10,261 | ) | | $ | (10,515 | ) |

Notes, net | | $ | 1,895 |

| | $ | 1,765 |

|

Line of credit and commercial paper | | $ | 648 |

| | $ | — |

|

Amortization of deferred settlements on derivative instruments: | | | | |

Other liabilities | | $ | (164 | ) | | $ | (401 | ) |

Accumulated other comprehensive income | | $ | 13,647 |

| | $ | 12,606 |

|

Write-off of pursuit costs: | | | | |

Investment in real estate, net | | $ | 1,929 |

| | $ | 1,965 |

|

Deposits – restricted | | $ | 330 |

| | $ | — |

|

Other assets | | $ | 63 |

| | $ | 102 |

|

(Income) loss from investments in unconsolidated entities: | | | | |

Investments in unconsolidated entities | | $ | (16,309 | ) | | $ | 7,684 |

|

Other liabilities | | $ | 1,921 |

| | $ | 2,517 |

|

Distributions from unconsolidated entities – return on capital: | | | | |

Investments in unconsolidated entities | | $ | 3,462 |

| | $ | 4,399 |

|

Other liabilities | | $ | 102 |

| | $ | 158 |

|

Realized/unrealized loss (gain) on derivative instruments: | | | | |

Other assets | | $ | (9,677 | ) | | $ | 11,409 |

|

Notes, net | | $ | 8,162 |

| | $ | (2,485 | ) |

Other liabilities | | $ | 2,774 |

| | $ | 12,794 |

|

Accumulated other comprehensive income | | $ | 1,796 |

| | $ | (21,784 | ) |

Interest capitalized for real estate and unconsolidated entities under development: | | | | |

Investment in real estate, net | | $ | (45,850 | ) | | $ | (38,086 | ) |

Investments in unconsolidated entities | | $ | — |

| | $ | (54 | ) |

Investments in unconsolidated entities: | | | | |

Investments in unconsolidated entities | | $ | (1,383 | ) | | $ | (5,118 | ) |

Other liabilities | | $ | (21,615 | ) | | $ | (9,450 | ) |

Other: | | | | |

Foreign currency translation adjustments | | $ | 311 |

| | $ | 466 |

|

EQUITY RESIDENTIAL

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(Amounts in thousands)

(Unaudited)

|

| | | | |

| | Nine Months Ended |

| | September 30, 2015 |

SHAREHOLDERS’ EQUITY | | |

| | |

PREFERRED SHARES | | |

Balance, beginning of year | | $ | 50,000 |

|

Partial redemption of 8.29% Series K Cumulative Redeemable | | (9,820 | ) |

Balance, end of period | | $ | 40,180 |

|

| | |

COMMON SHARES, $0.01 PAR VALUE | | |

Balance, beginning of year | | $ | 3,629 |

|

Conversion of OP Units into Common Shares | | 2 |

|

Exercise of share options | | 8 |

|

Share-based employee compensation expense: | | |

Restricted shares | | 2 |

|

Balance, end of period | | $ | 3,641 |

|

| | |

PAID IN CAPITAL | | |

Balance, beginning of year | | $ | 8,536,340 |

|

Common Share Issuance: | | |

Conversion of OP Units into Common Shares | | 4,376 |

|

Exercise of share options | | 37,039 |

|

Employee Share Purchase Plan (ESPP) | | 3,376 |

|

Conversion of restricted shares to restricted units | | (70 | ) |

Share-based employee compensation expense: | | |

Restricted shares | | 12,689 |

|

Share options | | 2,887 |

|

ESPP discount | | 692 |

|

Offering costs | | (69 | ) |

Supplemental Executive Retirement Plan (SERP) | | (1,325 | ) |

Change in market value of Redeemable Noncontrolling Interests – Operating Partnership | | (20,262 | ) |

Adjustment for Noncontrolling Interests ownership in Operating Partnership | | 8,470 |

|

Balance, end of period | | $ | 8,584,143 |

|

| | |

RETAINED EARNINGS | | |

Balance, beginning of year | | $ | 1,950,639 |

|

Net income attributable to controlling interests | | 665,634 |

|

Common Share distributions | | (603,337 | ) |

Preferred Share distributions | | (2,557 | ) |

Premium on redemption of Preferred Shares – cash charge | | (2,789 | ) |

Balance, end of period | | $ | 2,007,590 |

|

EQUITY RESIDENTIAL

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (Continued)

(Amounts in thousands)

(Unaudited)

|

| | | | |

| | Nine Months Ended |

| | September 30, 2015 |

SHAREHOLDERS’ EQUITY (continued) | | |

ACCUMULATED OTHER COMPREHENSIVE (LOSS) | | |

Balance, beginning of year | | $ | (172,152 | ) |

Accumulated other comprehensive income – derivative instruments: | | |

Unrealized holding gains arising during the period | | 1,796 |

|

Losses reclassified into earnings from other comprehensive income | | 13,647 |

|

Accumulated other comprehensive (loss) – foreign currency: | | |

Currency translation adjustments arising during the period | | (311 | ) |

Balance, end of period | | $ | (157,020 | ) |

| | |

NONCONTROLLING INTERESTS | | |

| | |

OPERATING PARTNERSHIP | | |

Balance, beginning of year | | $ | 214,411 |

|

Issuance of restricted units to Noncontrolling Interests | | 3 |

|

Conversion of OP Units held by Noncontrolling Interests into OP Units held by General Partner | | (4,378 | ) |

Conversion of restricted shares to restricted units | | 70 |

|

Equity compensation associated with Noncontrolling Interests | | 18,969 |

|

Net income attributable to Noncontrolling Interests | | 26,191 |

|

Distributions to Noncontrolling Interests | | (23,719 | ) |

Change in carrying value of Redeemable Noncontrolling Interests – Operating Partnership | | (1,590 | ) |

Adjustment for Noncontrolling Interests ownership in Operating Partnership | | (8,470 | ) |

Balance, end of period | | $ | 221,487 |

|

| | |

PARTIALLY OWNED PROPERTIES | | |

Balance, beginning of year | | $ | 124,909 |

|

Net income attributable to Noncontrolling Interests | | 2,473 |

|

Distributions to Noncontrolling Interests | | (5,389 | ) |

Deconsolidation of previously consolidated Noncontrolling Interests | | (117,350 | ) |

Balance, end of period | | $ | 4,643 |

|

ERP OPERATING LIMITED PARTNERSHIP

CONSOLIDATED BALANCE SHEETS

(Amounts in thousands)

(Unaudited)

|

| | | | | | | | |

| | September 30,

2015 | | December 31,

2014 |

ASSETS | | | | |

Investment in real estate | | | | |

Land | | $ | 6,424,887 |

| | $ | 6,295,404 |

|

Depreciable property | | 20,540,247 |

| | 19,851,504 |

|

Projects under development | | 1,039,657 |

| | 1,343,919 |

|

Land held for development | | 154,690 |

| | 184,556 |

|

Investment in real estate | | 28,159,481 |

| | 27,675,383 |

|

Accumulated depreciation | | (5,914,695 | ) | | (5,432,805 | ) |

Investment in real estate, net | | 22,244,786 |

| | 22,242,578 |

|

Cash and cash equivalents | | 37,366 |

| | 40,080 |

|

Investments in unconsolidated entities | | 74,108 |

| | 105,434 |

|

Deposits – restricted | | 135,674 |

| | 72,303 |

|

Escrow deposits – mortgage | | 54,071 |

| | 48,085 |

|

Deferred financing costs, net | | 57,001 |

| | 58,380 |

|

Other assets | | 405,798 |

| | 383,754 |

|

Total assets | | $ | 23,008,804 |

| | $ | 22,950,614 |

|

| | | | |

LIABILITIES AND CAPITAL | | | | |

Liabilities: | | | | |

Mortgage notes payable | | $ | 4,891,529 |

| | $ | 5,086,515 |

|

Notes, net | | 5,881,794 |

| | 5,425,346 |

|

Line of credit and commercial paper | | 29,996 |

| | 333,000 |

|

Accounts payable and accrued expenses | | 253,027 |

| | 153,590 |

|

Accrued interest payable | | 86,083 |

| | 89,540 |

|

Other liabilities | | 353,106 |

| | 389,915 |

|

Security deposits | | 76,934 |

| | 75,633 |

|

Distributions payable | | 209,086 |

| | 188,566 |

|

Total liabilities | | 11,781,555 |

| | 11,742,105 |

|

| | | | |

Commitments and contingencies | |

| |

|

| | | | |

Redeemable Limited Partners | | 522,585 |

| | 500,733 |

|

Capital: | | | | |

Partners' Capital: | | | | |

Preference Units | | 40,180 |

| | 50,000 |

|

General Partner | | 10,595,374 |

| | 10,490,608 |

|

Limited Partners | | 221,487 |

| | 214,411 |

|

Accumulated other comprehensive (loss) | | (157,020 | ) | | (172,152 | ) |

Total partners' capital | | 10,700,021 |

| | 10,582,867 |

|

Noncontrolling Interests – Partially Owned Properties | | 4,643 |

| | 124,909 |

|

Total capital | | 10,704,664 |

| | 10,707,776 |

|

Total liabilities and capital | | $ | 23,008,804 |

| | $ | 22,950,614 |

|

ERP OPERATING LIMITED PARTNERSHIP

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(Amounts in thousands except per Unit data)

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, | | Quarter Ended September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

REVENUES | | | | | | | | |

Rental income | | $ | 2,035,359 |

| | $ | 1,942,492 |

| | $ | 694,245 |

| | $ | 662,001 |

|

Fee and asset management | | 6,413 |

| | 7,596 |

| | 2,044 |

| | 2,077 |

|

Total revenues | | 2,041,772 |

| | 1,950,088 |

| | 696,289 |

| | 664,078 |

|

| | | | | | | | |

EXPENSES | | | | | | | | |

Property and maintenance | | 364,948 |

| | 361,087 |

| | 122,383 |

| | 120,139 |

|

Real estate taxes and insurance | | 254,513 |

| | 245,717 |

| | 84,962 |

| | 80,568 |

|

Property management | | 60,887 |

| | 61,080 |

| | 18,925 |

| | 18,407 |

|

Fee and asset management | | 3,764 |

| | 4,293 |

| | 1,169 |

| | 1,253 |

|

Depreciation | | 584,862 |

| | 565,772 |

| | 196,059 |

| | 190,469 |

|

General and administrative | | 50,942 |

| | 41,296 |

| | 15,290 |

| | 9,968 |

|

Total expenses | | 1,319,916 |

| | 1,279,245 |

| | 438,788 |

| | 420,804 |

|

| | | | | | | | |

Operating income | | 721,856 |

| | 670,843 |

| | 257,501 |

| | 243,274 |

|

| | | | | | | | |

Interest and other income | | 6,906 |

| | 3,213 |

| | 256 |

| | 576 |

|

Other expenses | | (2,839 | ) | | (7,179 | ) | | (1,139 | ) | | (4,976 | ) |

Interest: | | | | | | | | |

Expense incurred, net | | (333,622 | ) | | (347,224 | ) | | (114,205 | ) | | (118,251 | ) |

Amortization of deferred financing costs | | (7,734 | ) | | (8,554 | ) | | (2,607 | ) | | (2,628 | ) |

Income before income and other taxes, income (loss) from investments

in unconsolidated entities, net gain (loss) on sales of real estate

properties and land parcels and discontinued operations | | 384,567 |

| | 311,099 |

| | 139,806 |

| | 117,995 |

|

Income and other tax (expense) benefit | | (698 | ) | | (1,146 | ) | | (329 | ) | | (260 | ) |

Income (loss) from investments in unconsolidated entities | | 14,388 |

| | (10,201 | ) | | (1,041 | ) | | (1,176 | ) |

Net gain on sales of real estate properties | | 295,692 |

| | 128,544 |

| | 66,939 |

| | 113,641 |

|

Net (loss) gain on sales of land parcels | | (1 | ) | | 1,846 |

| | — |

| | 1,052 |

|

Income from continuing operations | | 693,948 |

| | 430,142 |

| | 205,375 |

| | 231,252 |

|

Discontinued operations, net | | 350 |

| | 1,500 |

| | 81 |

| | (62 | ) |

Net income | | 694,298 |

| | 431,642 |

| | 205,456 |

| | 231,190 |

|

Net (income) attributable to Noncontrolling Interests – Partially

Owned Properties | | (2,473 | ) | | (1,800 | ) | | (986 | ) | | (708 | ) |

Net income attributable to controlling interests | | $ | 691,825 |

| | $ | 429,842 |

| | $ | 204,470 |

| | $ | 230,482 |

|

| | | | | | | | |

ALLOCATION OF NET INCOME: | | | | | | | | |

Preference Units | | $ | 2,557 |

| | $ | 3,109 |

| | $ | 833 |

| | $ | 1,037 |

|

Premium on redemption of Preference Units | | $ | 2,789 |

| | $ | — |

| | $ | — |

| | $ | — |

|

| | | | | | | | |

General Partner | | $ | 660,288 |

| | $ | 410,460 |

| | $ | 195,859 |

| | $ | 220,707 |

|

Limited Partners | | 26,191 |

| | 16,273 |

| | 7,778 |

| | 8,738 |

|

Net income available to Units | | $ | 686,479 |

| | $ | 426,733 |

| | $ | 203,637 |

| | $ | 229,445 |

|

| | | | | | | | |

Earnings per Unit – basic: | | | | | | | | |

Income from continuing operations available to Units | | $ | 1.82 |

| | $ | 1.13 |

| | $ | 0.54 |

| | $ | 0.61 |

|

Net income available to Units | | $ | 1.82 |

| | $ | 1.14 |

| | $ | 0.54 |

| | $ | 0.61 |

|

Weighted average Units outstanding | | 376,970 |

| | 374,626 |

| | 377,147 |

| | 375,116 |

|

| | | | | | | | |

Earnings per Unit – diluted: | | | | | | | | |

Income from continuing operations available to Units | | $ | 1.80 |

| | $ | 1.13 |

| | $ | 0.53 |

| | $ | 0.61 |

|

Net income available to Units | | $ | 1.80 |

| | $ | 1.13 |

| | $ | 0.53 |

| | $ | 0.61 |

|

Weighted average Units outstanding | | 380,423 |

| | 377,228 |

| | 380,663 |

| | 377,954 |

|

| | | | | | | | |

Distributions declared per Unit outstanding | | $ | 1.6575 |

| | $ | 1.50 |

| | $ | 0.5525 |

| | $ | 0.50 |

|

ERP OPERATING LIMITED PARTNERSHIP

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (Continued)

(Amounts in thousands except per Unit data)

(Unaudited)

|

| | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, | | Quarter Ended September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

Comprehensive income: | | | | | | | | |

Net income | | $ | 694,298 |

| | $ | 431,642 |

| | $ | 205,456 |

| | $ | 231,190 |

|

Other comprehensive income (loss): | | | | | | | | |

Other comprehensive income (loss) – derivative instruments: | | | | | | | | |

Unrealized holding gains (losses) arising during the period | | 1,796 |

| | (21,784 | ) | | 1,908 |

| | 97 |

|

Losses reclassified into earnings from other comprehensive income | | 13,647 |

| | 12,606 |

| | 4,736 |

| | 4,271 |

|

Other comprehensive (loss) income – foreign currency: | | | | | | | | |

Currency translation adjustments arising during the period | | (311 | ) | | (466 | ) | | 191 |

| | (2,184 | ) |

Other comprehensive income (loss) | | 15,132 |

| | (9,644 | ) | | 6,835 |

| | 2,184 |

|

Comprehensive income | | 709,430 |

| | 421,998 |

| | 212,291 |

| | 233,374 |

|

Comprehensive (income) attributable to Noncontrolling Interests –

Partially Owned Properties | | (2,473 | ) | | (1,800 | ) | | (986 | ) | | (708 | ) |

Comprehensive income attributable to controlling interests | | $ | 706,957 |

| | $ | 420,198 |

| | $ | 211,305 |

| | $ | 232,666 |

|

ERP OPERATING LIMITED PARTNERSHIP

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

(Unaudited) |

| | | | | | | | |

| | Nine Months Ended September 30, |

| | 2015 | | 2014 |

CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

Net income | | $ | 694,298 |

| | $ | 431,642 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

Depreciation | | 584,862 |

| | 565,772 |

|

Amortization of deferred financing costs | | 7,734 |

| | 8,554 |

|

Amortization of above/below market leases | | 2,534 |

| | 2,376 |

|

Amortization of discounts and premiums on debt | | (7,718 | ) | | (8,750 | ) |

Amortization of deferred settlements on derivative instruments | | 13,483 |

| | 12,205 |

|

Write-off of pursuit costs | | 2,322 |

| | 2,067 |

|

(Income) loss from investments in unconsolidated entities | | (14,388 | ) | | 10,201 |

|

Distributions from unconsolidated entities – return on capital | | 3,564 |

| | 4,557 |

|

Net (gain) on sale of investment securities | | (387 | ) | | (57 | ) |

Net (gain) on sales of real estate properties | | (295,692 | ) | | (128,544 | ) |

Net loss (gain) on sales of land parcels | | 1 |

| | (1,846 | ) |

Net (gain) on sales of discontinued operations | | — |

| | (223 | ) |

Realized/unrealized loss (gain) on derivative instruments | | 3,055 |

| | (66 | ) |

Compensation paid with Company Common Shares | | 29,269 |

| | 24,647 |

|

Changes in assets and liabilities: | | | | |

(Increase) in deposits – restricted | | (1,268 | ) | | (2,223 | ) |

Decrease in mortgage deposits | | 756 |

| | 1,638 |

|

(Increase) decrease in other assets | | (25,428 | ) | | 3,854 |

|

Increase in accounts payable and accrued expenses | | 63,385 |

| | 76,331 |

|

(Decrease) increase in accrued interest payable | | (3,457 | ) | | 8,163 |

|

Increase (decrease) in other liabilities | | 5,120 |

| | (173 | ) |

Increase in security deposits | | 1,301 |

| | 4,146 |

|

Net cash provided by operating activities | | 1,063,346 |

| | 1,014,271 |

|

| | | | |

CASH FLOWS FROM INVESTING ACTIVITIES: | | | | |

Investment in real estate – acquisitions | | (159,575 | ) | | (404,658 | ) |

Investment in real estate – development/other | | (485,758 | ) | | (380,691 | ) |

Capital expenditures to real estate | | (134,438 | ) | | (133,181 | ) |

Non-real estate capital additions | | (2,384 | ) | | (2,446 | ) |

Interest capitalized for real estate and unconsolidated entities under development | | (45,850 | ) | | (38,140 | ) |

Proceeds from disposition of real estate, net | | 457,499 |

| | 224,538 |

|

Investments in unconsolidated entities | | (22,998 | ) | | (14,568 | ) |

Distributions from unconsolidated entities – return of capital | | 45,245 |

| | 77,042 |

|

Proceeds from sale of investment securities | | 387 |

| | 57 |

|

(Increase) decrease in deposits on real estate acquisitions and investments, net | | (62,433 | ) | | 20,845 |

|

(Increase) decrease in mortgage deposits | | (407 | ) | | 560 |

|

Net cash (used for) investing activities | | (410,712 | ) | | (650,642 | ) |

ERP OPERATING LIMITED PARTNERSHIP

CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued)

(Amounts in thousands)

(Unaudited)

|

| | | | | | | | |

| | Nine Months Ended September 30, |

| | 2015 | | 2014 |

CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

Debt financing costs | | $ | (6,355 | ) | | $ | (10,598 | ) |

Mortgage deposits | | (6,335 | ) | | (5,557 | ) |

Mortgage notes payable: | | | | |

Lump sum payoffs | | (177,564 | ) | | (63,772 | ) |

Scheduled principal repayments | | (7,161 | ) | | (8,919 | ) |

Notes, net: | | | | |

Proceeds | | 746,391 |

| | 1,194,278 |

|

Lump sum payoffs | | (300,000 | ) | | (1,250,000 | ) |

Line of credit and commercial paper: | | | | |

Line of credit proceeds | | 3,569,000 |

| | 5,324,000 |

|

Line of credit repayments | | (3,902,000 | ) | | (4,993,000 | ) |

Commercial paper proceeds | | 2,491,848 |

| | — |

|

Commercial paper repayments | | (2,462,500 | ) | | — |

|

(Payments on) settlement of derivative instruments | | (13,938 | ) | | (758 | ) |

Proceeds from EQR's Employee Share Purchase Plan (ESPP) | | 3,376 |

| | 2,728 |

|

Proceeds from exercise of EQR options | | 37,047 |

| | 56,554 |

|

OP Units repurchased and retired | | — |

| | (1,777 | ) |

Redemption of Preference Units | | (9,820 | ) | | — |

|

Premium on redemption of Preference Units | | (2,789 | ) | | — |

|

Payment of offering costs | | (69 | ) | | — |

|

Other financing activities, net | | (33 | ) | | (33 | ) |

Acquisition of Noncontrolling Interests – Partially Owned Properties | | — |

| | (5,501 | ) |

Contributions – Noncontrolling Interests – Partially Owned Properties | | — |

| | 5,684 |

|

Contributions – Limited Partners | | 3 |

| | 3 |

|

Distributions: | | | | |

OP Units – General Partner | | (583,568 | ) | | (595,564 | ) |

Preference Units | | (2,557 | ) | | (3,109 | ) |

OP Units – Limited Partners | | (22,968 | ) | | (23,582 | ) |

Noncontrolling Interests – Partially Owned Properties | | (5,356 | ) | | (6,762 | ) |

Net cash (used for) financing activities | | (655,348 | ) | | (385,685 | ) |

Net (decrease) in cash and cash equivalents | | (2,714 | ) | | (22,056 | ) |

Cash and cash equivalents, beginning of period | | 40,080 |

| | 53,534 |

|

Cash and cash equivalents, end of period | | $ | 37,366 |

| | $ | 31,478 |

|

ERP OPERATING LIMITED PARTNERSHIP

CONSOLIDATED STATEMENTS OF CASH FLOWS (Continued)

(Amounts in thousands)

(Unaudited)

|

| | | | | | | | |

| | Nine Months Ended September 30, |

| | 2015 | | 2014 |

SUPPLEMENTAL INFORMATION: | | | | |

Cash paid for interest, net of amounts capitalized | | $ | 328,400 |

| | $ | 335,646 |

|

Net cash paid for income and other taxes | | $ | 1,052 |

| | $ | 866 |

|

Amortization of discounts and premiums on debt: | | | | |

Mortgage notes payable | | $ | (10,261 | ) | | $ | (10,515 | ) |

Notes, net | | $ | 1,895 |

| | $ | 1,765 |

|

Line of credit and commercial paper | | $ | 648 |

| | $ | — |

|

Amortization of deferred settlements on derivative instruments: | | | | |

Other liabilities | | $ | (164 | ) | | $ | (401 | ) |

Accumulated other comprehensive income | | $ | 13,647 |

| | $ | 12,606 |

|

Write-off of pursuit costs: | | | | |

Investment in real estate, net | | $ | 1,929 |

| | $ | 1,965 |

|

Deposits – restricted | | $ | 330 |

| | $ | — |

|

Other assets | | $ | 63 |

| | $ | 102 |

|

(Income) loss from investments in unconsolidated entities: | | | | |

Investments in unconsolidated entities | | $ | (16,309 | ) | | $ | 7,684 |

|

Other liabilities | | $ | 1,921 |

| | $ | 2,517 |

|

Distributions from unconsolidated entities – return on capital: | | | | |

Investments in unconsolidated entities | | $ | 3,462 |

| | $ | 4,399 |

|

Other liabilities | | $ | 102 |

| | $ | 158 |

|

Realized/unrealized loss (gain) on derivative instruments: | | | | |

Other assets | | $ | (9,677 | ) | | $ | 11,409 |

|

Notes, net | | $ | 8,162 |

| | $ | (2,485 | ) |

Other liabilities | | $ | 2,774 |

| | $ | 12,794 |

|

Accumulated other comprehensive income | | $ | 1,796 |

| | $ | (21,784 | ) |

Interest capitalized for real estate and unconsolidated entities under development: | | | | |

Investment in real estate, net | | $ | (45,850 | ) | | $ | (38,086 | ) |

Investments in unconsolidated entities | | $ | — |

| | $ | (54 | ) |

Investments in unconsolidated entities: | | | | |

Investments in unconsolidated entities | | $ | (1,383 | ) | | $ | (5,118 | ) |

Other liabilities | | $ | (21,615 | ) | | $ | (9,450 | ) |

Other: | | | | |

Foreign currency translation adjustments | | $ | 311 |

| | $ | 466 |

|

ERP OPERATING LIMITED PARTNERSHIP

CONSOLIDATED STATEMENT OF CHANGES IN CAPITAL

(Amounts in thousands)

(Unaudited)

|

| | | | |

| | Nine Months Ended |

| | September 30, 2015 |

PARTNERS' CAPITAL | | |

| | |

PREFERENCE UNITS | | |

Balance, beginning of year | | $ | 50,000 |

|

Partial redemption of 8.29% Series K Cumulative Redeemable | | (9,820 | ) |

Balance, end of period | | $ | 40,180 |

|

| | |

GENERAL PARTNER | | |

Balance, beginning of year | | $ | 10,490,608 |

|

OP Unit Issuance: | | |

Conversion of OP Units held by Limited Partners into OP Units held by General Partner | | 4,378 |

|

Exercise of EQR share options | | 37,047 |

|

EQR's Employee Share Purchase Plan (ESPP) | | 3,376 |

|

Conversion of EQR restricted shares to restricted units | | (70 | ) |

Share-based employee compensation expense: | | |

EQR restricted shares | | 12,691 |

|

EQR share options | | 2,887 |

|

EQR ESPP discount | | 692 |

|

Net income available to Units – General Partner | | 660,288 |

|

OP Units – General Partner distributions | | (603,337 | ) |

Offering costs | | (69 | ) |

Supplemental Executive Retirement Plan (SERP) | | (1,325 | ) |

Change in market value of Redeemable Limited Partners | | (20,262 | ) |

Adjustment for Limited Partners ownership in Operating Partnership | | 8,470 |

|

Balance, end of period | | $ | 10,595,374 |

|

| | |

LIMITED PARTNERS | | |

Balance, beginning of year | | $ | 214,411 |

|

Issuance of restricted units to Limited Partners | | 3 |

|

Conversion of OP Units held by Limited Partners into OP Units held by General Partner | | (4,378 | ) |

Conversion of EQR restricted shares to restricted units | | 70 |

|

Equity compensation associated with Units – Limited Partners | | 18,969 |

|

Net income available to Units – Limited Partners | | 26,191 |

|

Units – Limited Partners distributions | | (23,719 | ) |

Change in carrying value of Redeemable Limited Partners | | (1,590 | ) |

Adjustment for Limited Partners ownership in Operating Partnership | | (8,470 | ) |

Balance, end of period | | $ | 221,487 |

|

| | |

ACCUMULATED OTHER COMPREHENSIVE (LOSS) | | |

Balance, beginning of year | | $ | (172,152 | ) |

Accumulated other comprehensive income – derivative instruments: | | |

Unrealized holding gains arising during the period | | 1,796 |

|

Losses reclassified into earnings from other comprehensive income | | 13,647 |

|

Accumulated other comprehensive (loss) – foreign currency: | | |

Currency translation adjustments arising during the period | | (311 | ) |

Balance, end of period | | $ | (157,020 | ) |

ERP OPERATING LIMITED PARTNERSHIP

CONSOLIDATED STATEMENT OF CHANGES IN CAPITAL (Continued)

(Amounts in thousands)

(Unaudited)

|

| | | | |

| | Nine Months Ended |

| | September 30, 2015 |

NONCONTROLLING INTERESTS | | |

| | |

NONCONTROLLING INTERESTS – PARTIALLY OWNED PROPERTIES | | |

Balance, beginning of year | | $ | 124,909 |

|

Net income attributable to Noncontrolling Interests | | 2,473 |

|

Distributions to Noncontrolling Interests | | (5,389 | ) |

Deconsolidation of previously consolidated Noncontrolling Interests | | (117,350 | ) |

Balance, end of period | | $ | 4,643 |

|

EQUITY RESIDENTIAL

ERP OPERATING LIMITED PARTNERSHIP

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Equity Residential (“EQR”), a Maryland real estate investment trust (“REIT”) formed in March 1993, is an S&P 500 company focused on the acquisition, development and management of high quality apartment properties in top United States growth markets. ERP Operating Limited Partnership ("ERPOP"), an Illinois limited partnership, was formed in May 1993 to conduct the multifamily residential property business of Equity Residential. EQR has elected to be taxed as a REIT. References to the "Company," "we," "us" or "our" mean collectively EQR, ERPOP and those entities/subsidiaries owned or controlled by EQR and/or ERPOP. References to the "Operating Partnership" mean collectively ERPOP and those entities/subsidiaries owned or controlled by ERPOP. Unless otherwise indicated, the notes to consolidated financial statements apply to both the Company and the Operating Partnership.

EQR is the general partner of, and as of September 30, 2015 owned an approximate 96.2% ownership interest in, ERPOP. All of the Company’s property ownership, development and related business operations are conducted through the Operating Partnership and EQR has no material assets or liabilities other than its investment in ERPOP. EQR issues public equity from time to time but does not have any indebtedness as all debt is incurred by the Operating Partnership. The Operating Partnership holds substantially all of the assets of the Company, including the Company’s ownership interests in its joint ventures. The Operating Partnership conducts the operations of the business and is structured as a partnership with no publicly traded equity.

As of September 30, 2015, the Company, directly or indirectly through investments in title holding entities, owned all or a portion of 392 properties located in 12 states and the District of Columbia consisting of 109,347 apartment units. The ownership breakdown includes (table does not include various uncompleted development properties):

|

| | | | | | |

| | Properties | | Apartment

Units |

Wholly Owned Properties | | 365 |

| | 98,331 |

|

Master-Leased Properties – Consolidated | | 3 |

| | 853 |

|

Partially Owned Properties – Consolidated | | 19 |

| | 3,771 |

|

Partially Owned Properties – Unconsolidated | | 3 |

| | 1,281 |

|

Military Housing | | 2 |

| | 5,111 |

|

| | 392 |

| | 109,347 |

|

| |

2. | Summary of Significant Accounting Policies |

Basis of Presentation

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by accounting principles generally accepted in the United States for complete financial statements. In the opinion of management, all adjustments (consisting of normal recurring accruals) and certain reclassifications considered necessary for a fair presentation have been included. Certain reclassifications have been made to the prior period financial statements in order to conform to the current year presentation. These reclassifications did not have an impact on net income previously reported. Operating results for the nine months ended September 30, 2015 are not necessarily indicative of the results that may be expected for the year ending December 31, 2015.

In preparation of the Company’s financial statements in conformity with accounting principles generally accepted in the United States, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements as well as the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates.

The balance sheets at December 31, 2014 have been derived from the audited financial statements at that date but do not include all of the information and footnotes required by accounting principles generally accepted in the United States for complete financial statements.

For further information, including definitions of capitalized terms not defined herein, refer to the consolidated financial statements and footnotes thereto included in the Company’s and the Operating Partnership's annual report on Form 10-K for the year ended December 31, 2014.

Income and Other Taxes

Due to the structure of EQR as a REIT and the nature of the operations of its operating properties, no provision for federal income taxes has been made at the EQR level. In addition, ERPOP generally is not liable for federal income taxes as the partners recognize their proportionate share of income or loss in their tax returns; therefore no provision for federal income taxes has been made at the ERPOP level. Historically, the Company has generally only incurred certain state and local income, excise and franchise taxes. The Company has elected Taxable REIT Subsidiary (“TRS”) status for certain of its corporate subsidiaries and as a result, these entities will incur both federal and state income taxes on any taxable income of such entities after consideration of any net operating losses.

Deferred tax assets and liabilities applicable to the TRS are recognized for future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. These assets and liabilities are measured using enacted tax rates for which the temporary differences are expected to be recovered or settled. The effects of changes in tax rates on deferred tax assets and liabilities are recognized in earnings in the period enacted. The Company’s deferred tax assets are generally the result of tax affected suspended interest deductions, net operating losses, differing depreciable lives on capitalized assets and the timing of expense recognition for certain accrued liabilities. As of September 30, 2015, the Company has recorded a deferred tax asset, which is fully offset by a valuation allowance due to the uncertainty in forecasting future TRS taxable income.

Recent Accounting Pronouncements

In April 2014, the Financial Accounting Standards Board (the "FASB") issued new guidance for reporting discontinued operations. Only disposals representing a strategic shift in operations that has a major effect on a company’s operations and financial results will be presented as discontinued operations. Companies are required to expand their disclosures about discontinued operations to provide more information on the assets, liabilities, income and expenses of the discontinued operations. Companies are also required to disclose the pre-tax income attributable to a disposal of a significant part of a company that does not qualify for discontinued operations reporting. Application of this guidance is prospective from the date of adoption and early adoption was permitted, but only for disposals (or classifications as held for sale) that had not been reported in financial statements previously issued. The new standard was effective January 1, 2015, but the Company early adopted it as allowed effective January 1, 2014. Adoption of this standard resulted in and will likely continue to result in substantially fewer of the Company's dispositions meeting the discontinued operations qualifications. See Note 11 for further discussion.

In May 2014, the FASB issued a comprehensive new revenue recognition standard entitled Revenue from Contracts with Customers that will supersede nearly all existing revenue recognition guidance. The new standard specifically excludes lease contracts. The new standard’s core principle is that a company will recognize revenue when it transfers promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services. Companies will likely need to use more judgment and make more estimates than under current revenue recognition guidance. These may include identifying performance obligations in the contract, estimating the amount of variable consideration, if any, to include in the transaction price and allocating the transaction price to each separate performance obligation. The new standard will be effective for the Company beginning on January 1, 2018 and early adoption will be permitted beginning on January 1, 2017. The new standard may be applied retrospectively to each prior period presented or retrospectively with the cumulative effect recognized as of the date of adoption. The Company has not yet selected a transition method and is currently evaluating the impact of adopting the new standard on its consolidated results of operations and financial position.

In August 2014, the FASB issued a new standard that will explicitly require management to assess an entity's ability to continue as a going concern and to provide related footnote disclosures in certain circumstances. In connection with each annual and interim period, management will assess whether there is substantial doubt about an entity's ability to continue as a going concern within one year after the issuance date. Disclosures will be required if conditions give rise to substantial doubt. However, to determine the specific disclosures, management will need to assess whether its plans will alleviate substantial doubt. The new standard is effective for the annual period ending after December 15, 2016 and for interim periods thereafter. The Company does not expect that this will have a material effect on its consolidated results of operations or financial position.

In February 2015, the FASB issued new consolidation guidance which makes changes to both the variable interest model and the voting model. Among other changes, the new standard specifically eliminates the presumption in the current voting model

that a general partner controls a limited partnership or similar entity unless that presumption can be overcome. Generally, only a single limited partner that is able to exercise substantive kick-out rights will consolidate. The new standard will be effective for the Company beginning on January 1, 2016 and early adoption is permitted, including adoption in an interim period. The new standard must be applied using a modified retrospective approach by recording a cumulative-effect adjustment to equity/capital as of the beginning of the period of adoption or retrospectively to each period presented. The Company has not yet selected a transition method and is currently evaluating the impact of adopting the new standard on its consolidated results of operations and financial position.

In April 2015, the FASB issued a new standard which requires companies to present debt financing costs as a direct deduction from the carrying amount of the associated debt liability rather than as an asset, consistent with the presentation of debt discounts on the consolidated balance sheets. The new standard will be effective for the Company beginning on January 1, 2016 and early adoption is permitted. The new standard must be applied retrospectively to all prior periods presented in the consolidated financial statements. The Company does not expect that this will have a material effect on its consolidated results of operations or financial position.

Other

The Company is the controlling partner in various consolidated partnerships owning 19 properties and 3,771 apartment units having a noncontrolling interest book value of $4.6 million at September 30, 2015. The Company is required to make certain disclosures regarding noncontrolling interests in consolidated limited-life subsidiaries. Of the consolidated entities described above, the Company is the controlling partner in limited-life partnerships owning six properties having a noncontrolling interest deficit balance of $11.0 million. These six partnership agreements contain provisions that require the partnerships to be liquidated through the sale of their assets upon reaching a date specified in each respective partnership agreement. The Company, as controlling partner, has an obligation to cause the property owning partnerships to distribute the proceeds of liquidation to the Noncontrolling Interests in these Partially Owned Properties only to the extent that the net proceeds received by the partnerships from the sale of their assets warrant a distribution based on the partnership agreements. As of September 30, 2015, the Company estimates the value of Noncontrolling Interest distributions for these six properties would have been approximately $71.8 million (“Settlement Value”) had the partnerships been liquidated. This Settlement Value is based on estimated third party consideration realized by the partnerships upon disposition of the six Partially Owned Properties and is net of all other assets and liabilities, including yield maintenance on the mortgages encumbering the properties, that would have been due on September 30, 2015 had those mortgages been prepaid. Due to, among other things, the inherent uncertainty in the sale of real estate assets, the amount of any potential distribution to the Noncontrolling Interests in the Company's Partially Owned Properties is subject to change. To the extent that the partnerships' underlying assets are worth less than the underlying liabilities, the Company has no obligation to remit any consideration to the Noncontrolling Interests in these Partially Owned Properties.

| |

3. | Equity, Capital and Other Interests |

Equity and Redeemable Noncontrolling Interests of Equity Residential

The following tables present the changes in the Company’s issued and outstanding Common Shares and “Units” (which includes OP Units and restricted units (formerly known as Long-Term Incentive Plan (“LTIP”) Units)) for the nine months ended September 30, 2015:

|

| | | |

| | 2015 |

Common Shares | | |

Common Shares outstanding at January 1, | | 362,855,454 |

|

Common Shares Issued: | | |

Conversion of OP Units | | 181,753 |

|

Exercise of share options | | 882,764 |

|

Employee Share Purchase Plan (ESPP) | | 52,869 |

|

Restricted share grants, net | | 168,484 |

|

Common Shares Other: | | |

Conversion of restricted shares to restricted units | | (1,284 | ) |

Common Shares outstanding at September 30, | | 364,140,040 |

|

Units | | |

Units outstanding at January 1, | | 14,298,691 |

|

Restricted units, net | | 337,505 |

|

Conversion of restricted shares to restricted units | | 1,284 |

|

Conversion of OP Units to Common Shares | | (181,753 | ) |

Units outstanding at September 30, | | 14,455,727 |

|

Total Common Shares and Units outstanding at September 30, | | 378,595,767 |

|

Units Ownership Interest in Operating Partnership | | 3.8 | % |

The equity positions of various individuals and entities that contributed their properties to the Operating Partnership in exchange for OP Units, as well as the equity positions of the holders of restricted units, are collectively referred to as the “Noncontrolling Interests – Operating Partnership”. Subject to certain exceptions (including the “book-up” requirements of restricted units), the Noncontrolling Interests – Operating Partnership may exchange their Units with EQR for Common Shares on a one-for-one basis. The carrying value of the Noncontrolling Interests – Operating Partnership (including redeemable interests) is allocated based on the number of Noncontrolling Interests – Operating Partnership Units in total in proportion to the number of Noncontrolling Interests – Operating Partnership Units in total plus the number of Common Shares. Net income is allocated to the Noncontrolling Interests – Operating Partnership based on the weighted average ownership percentage during the period.

The Operating Partnership has the right but not the obligation to make a cash payment instead of issuing Common Shares to any and all holders of Noncontrolling Interests – Operating Partnership Units requesting an exchange of their OP Units with EQR. Once the Operating Partnership elects not to redeem the Noncontrolling Interests – Operating Partnership Units for cash, EQR is obligated to deliver Common Shares to the exchanging holder of the Noncontrolling Interests – Operating Partnership Units.

The Noncontrolling Interests – Operating Partnership Units are classified as either mezzanine equity or permanent equity. If EQR is required, either by contract or securities law, to deliver registered Common Shares, such Noncontrolling Interests – Operating Partnership are differentiated and referred to as “Redeemable Noncontrolling Interests – Operating Partnership”. Instruments that require settlement in registered shares can not be classified in permanent equity as it is not always completely within an issuer’s control to deliver registered shares. Therefore, settlement in cash is assumed and that responsibility for settlement in cash is deemed to fall to the Operating Partnership as the primary source of cash for EQR, resulting in presentation in the mezzanine section of the balance sheet. The Redeemable Noncontrolling Interests – Operating Partnership are adjusted to the greater of carrying value or fair market value based on the Common Share price of EQR at the end of each respective reporting period. EQR has the ability to deliver unregistered Common Shares for the remaining portion of the Noncontrolling Interests – Operating Partnership Units that are classified in permanent equity at September 30, 2015 and December 31, 2014.

The carrying value of the Redeemable Noncontrolling Interests – Operating Partnership is allocated based on the number of Redeemable Noncontrolling Interests – Operating Partnership Units in proportion to the number of Noncontrolling Interests – Operating Partnership Units in total. Such percentage of the total carrying value of Units which is ascribed to the Redeemable Noncontrolling Interests – Operating Partnership is then adjusted to the greater of carrying value or fair market value as described above. As of September 30, 2015, the Redeemable Noncontrolling Interests – Operating Partnership have a redemption value of approximately $522.6 million, which represents the value of Common Shares that would be issued in exchange with the Redeemable Noncontrolling Interests – Operating Partnership Units.

The following table presents the changes in the redemption value of the Redeemable Noncontrolling Interests – Operating Partnership for the nine months ended September 30, 2015 (amounts in thousands):

|

| | | | |

| | 2015 |

Balance at January 1, | | $ | 500,733 |

|

Change in market value | | 20,262 |

|

Change in carrying value | | 1,590 |

|

Balance at September 30, | | $ | 522,585 |

|

Net proceeds from EQR Common Share and Preferred Share (see definition below) offerings are contributed by EQR to ERPOP. In return for those contributions, EQR receives a number of OP Units in ERPOP equal to the number of Common Shares it has issued in the equity offering (or in the case of a preferred equity offering, a number of preference units in ERPOP equal in number and having the same terms as the Preferred Shares issued in the equity offering). As a result, the net offering proceeds from Common Shares and Preferred Shares are allocated between shareholders’ equity and Noncontrolling Interests – Operating Partnership to account for the change in their respective percentage ownership of the underlying equity of ERPOP.

The Company’s declaration of trust authorizes it to issue up to 100,000,000 preferred shares of beneficial interest, $0.01 par value per share (the “Preferred Shares”), with specific rights, preferences and other attributes as the Board of Trustees may determine, which may include preferences, powers and rights that are senior to the rights of holders of the Company’s Common Shares.

The following table presents the Company’s issued and outstanding Preferred Shares as of September 30, 2015 and December 31, 2014:

|

| | | | | | | | | | | | | | |

| | | | | | Amounts in thousands |

| | Redemption

Date (1) | | Annual

Dividend per

Share (2) | | September 30,

2015 | | December 31,

2014 |

Preferred Shares of beneficial interest, $0.01 par value;

100,000,000 shares authorized: | | | | | | | | |

8.29% Series K Cumulative Redeemable Preferred; liquidation

value $50 per share; 803,600 shares issued and outstanding

at September 30, 2015 and 1,000,000 shares issued and

outstanding at December 31, 2014 (3) | | 12/10/26 | |

| $4.145 |

| | $ | 40,180 |

| | $ | 50,000 |

|

| | | | | | $ | 40,180 |

| | $ | 50,000 |

|

| |

(1) | On or after the redemption date, redeemable preferred shares may be redeemed for cash at the option of the Company, in whole or |

in part, at a redemption price equal to the liquidation price per share, plus accrued and unpaid distributions, if any.

| |

(2) | Dividends on Preferred Shares are payable quarterly. |

| |

(3) | Effective January 26, 2015, the Company repurchased and retired 196,400 Series K Preferred Shares with a par value of $9.82 million for total cash consideration of approximately $12.7 million. As a result of this partial redemption, the Company incurred a cash charge of approximately $2.8 million which was recorded as a premium on the redemption of Preferred Shares. |

Capital and Redeemable Limited Partners of ERP Operating Limited Partnership

The following tables present the changes in the Operating Partnership’s issued and outstanding Units and in the limited partners’ Units for the nine months ended September 30, 2015:

|

| | | |

| | |

| | 2015 |

General and Limited Partner Units | | |

General and Limited Partner Units outstanding at January 1, | | 377,154,145 |

|