UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07704

Schwab Capital Trust

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Jonathan de St. Paer

Schwab Capital Trust

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2020

Item 1: Report(s) to Shareholders.

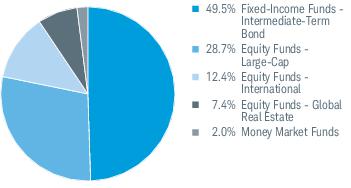

Moderate Payout

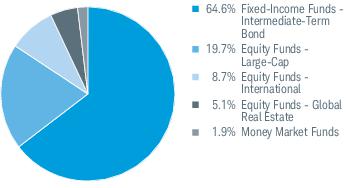

Enhanced Payout

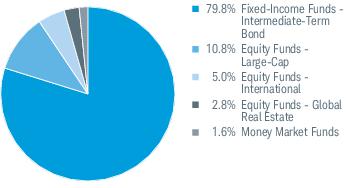

Maximum Payout

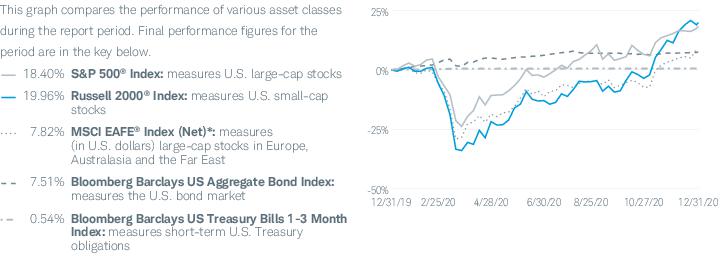

| Total Returns for the 12 Months Ended December 31, 2020 | |

| Schwab Monthly Income Fund – Moderate Payout (Ticker Symbol: SWJRX) | 5.32% |

| Moderate Payout Composite Index | 9.94% |

| Fund Category: Morningstar Allocation - 30% to 50% Equity1 | 8.86% |

| Performance Details | pages 7-9 |

| Schwab Monthly Income Fund – Enhanced Payout (Ticker Symbol: SWKRX) | 6.11% |

| Enhanced Payout Composite Index | 9.28% |

| Fund Category: Morningstar Allocation - 30% to 50% Equity1 | 8.86% |

| Performance Details | pages 10-12 |

| Schwab Monthly Income Fund – Maximum Payout (Ticker Symbol: SWLRX) | 6.93% |

| Maximum Payout Composite Index | 8.48% |

| Fund Category: Morningstar Allocation - 15% to 30% Equity1 | 7.29% |

| Performance Details | pages 13-15 |

| 1 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| * | The net version of the index reflects reinvested dividends net of withholding taxes, but reflects no deductions for expenses or other taxes. |

|

Zifan Tang, Ph.D., CFA, Senior Portfolio Manager, is responsible for the co-management of the funds. Prior to joining CSIM in January 2012, Ms. Tang was a product manager at Thomson Reuters and from 1997 to 2009 worked as a portfolio manager at Barclays Global Investors (now known as BlackRock). |

|

Patrick Kwok, CFA, Portfolio Manager, is responsible for the co-management of the funds. Previously, Mr. Kwok served as an associate portfolio manager with CSIM from 2012 to 2016. Prior to that, he worked as a fund administration manager for CSIM, where he was responsible for oversight of sub-advisers, trading, cash management, and fund administration for the Charles Schwab Trust Bank Collective Investment Trusts and Schwab’s multi-asset mutual funds. Prior to joining CSIM in 2008, Mr. Kwok spent two years as an asset operations specialist at Charles Schwab Trust Company. He also worked for one year at State Street Bank & Trust as a portfolio accountant and pricing specialist. |

| 1 | For more information about payouts, please see the fund’s prospectus. |

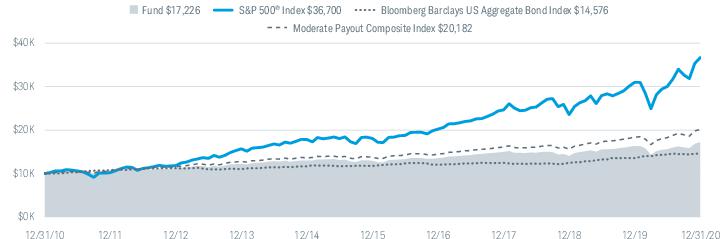

| Fund and Inception Date | 1 Year | 5 Years | 10 Years |

| Fund: Schwab Monthly Income Fund – Moderate Payout (3/28/08) | 5.32% | 5.89% | 5.59% |

| S&P 500® Index | 18.40% | 15.22% | 13.88% |

| Bloomberg Barclays US Aggregate Bond Index | 7.51% | 4.44% | 3.84% |

| Moderate Payout Composite Index | 9.94% | 7.98% | 7.27% |

| Fund Category: Morningstar Allocation – 30% to 50% Equity2 | 8.86% | 6.89% | 5.97% |

| Fund Expense Ratios3: Net 0.51%; Gross 0.75% | |||

| 1 | The fund’s routine expenses have been absorbed by CSIM and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 3 | As stated in the prospectus. Includes 0.51% of acquired fund fees and expenses (AFFE), which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as CSIM serves as adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual expense ratios during the period, not including AFFE, refer to the financial highlights section of the financial statements. |

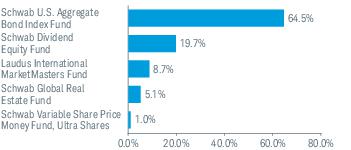

| 1 | Calculation reflects the fund’s monthly ordinary income distributions for the last 12 months divided by the fund’s Net Asset Value as of the end of the reporting period. Distribution yield does not include capital gains distributions. Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the total return/yield may have been lower. |

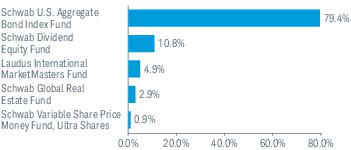

| 2 | The fund intends to invest in a combination of the underlying funds; however, the fund may also invest directly in equity and fixed income securities, exchange-traded funds, nonproprietary mutual funds, and cash and cash equivalents, including money market securities. |

| 3 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 4 | This list is not a recommendation of any security by the investment adviser. |

| 5 | The holdings listed exclude any temporary liquidity investments. |

| 1 | For more information about payouts, please see the fund’s prospectus. |

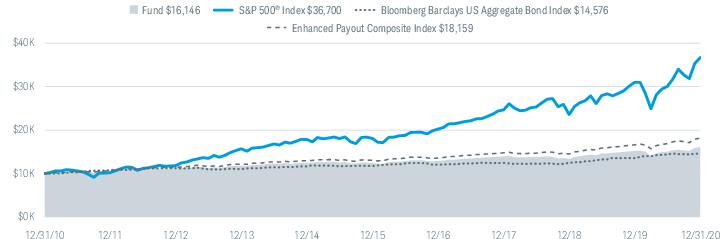

| Fund and Inception Date | 1 Year | 5 Years | 10 Years |

| Fund: Schwab Monthly Income Fund – Enhanced Payout (3/28/08) | 6.11% | 5.35% | 4.91% |

| S&P 500® Index | 18.40% | 15.22% | 13.88% |

| Bloomberg Barclays US Aggregate Bond Index | 7.51% | 4.44% | 3.84% |

| Enhanced Payout Composite Index | 9.28% | 6.86% | 6.15% |

| Fund Category: Morningstar Allocation – 30% to 50% Equity2 | 8.86% | 6.89% | 5.97% |

| Fund Expense Ratios3: Net 0.37%; Gross 0.51% | |||

| 1 | The fund’s routine expenses have been absorbed by CSIM and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 3 | As stated in the prospectus. Includes 0.37% of acquired fund fees and expenses (AFFE), which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver for so long as CSIM serves as the adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual expense ratios during the period, not including AFFE, refer to the financial highlights section in the financial statements. |

| 1 | Calculation reflects the fund’s monthly ordinary income distributions for the last 12 months divided by the fund’s Net Asset Value as of the end of the reporting period. Distribution yield does not include capital gains distributions. Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the total return/yield may have been lower. |

| 2 | The fund intends to invest in a combination of the underlying funds; however, the fund may also invest directly in equity and fixed income securities, exchange-traded funds, nonproprietary mutual funds, and cash and cash equivalents, including money market securities. |

| 3 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 4 | This list is not a recommendation of any security by the investment adviser. |

| 5 | The holdings listed exclude any temporary liquidity investments. |

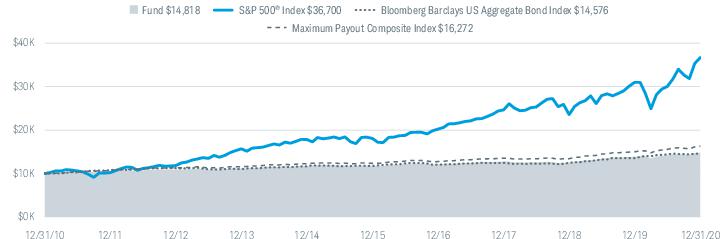

| 1 | For more information about payouts, please see the fund’s prospectus. |

| Fund and Inception Date | 1 Year | 5 Years | 10 Years |

| Fund: Schwab Monthly Income Fund – Maximum Payout (3/28/08) | 6.93% | 4.79% | 4.01% |

| S&P 500® Index | 18.40% | 15.22% | 13.88% |

| Bloomberg Barclays US Aggregate Bond Index | 7.51% | 4.44% | 3.84% |

| Maximum Payout Composite Index | 8.48% | 5.69% | 4.99% |

| Fund Category: Morningstar Allocation – 15% to 30% Equity2 | 7.29% | 5.55% | 4.82% |

| Fund Expense Ratios3: Net 0.22%; Gross 0.45% | |||

| 1 | The fund’s routine expenses have been absorbed by CSIM and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 3 | As stated in the prospectus. Includes 0.22% of acquired fund fees and expenses (AFFE), which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver for so long as CSIM serves as the adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual expense ratios during the period, not including AFFE, refer to the financial highlights section in the financial statements. |

| 1 | Calculation reflects the fund’s monthly ordinary income distributions for the last 12 months divided by the fund’s Net Asset Value as of the end of the reporting period. Distribution yield does not include capital gains distributions. Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the total return/yield may have been lower. |

| 2 | The fund intends to invest in a combination of the underlying funds; however, the fund may also invest directly in equity and fixed income securities, exchange-traded funds, nonproprietary mutual funds, and cash and cash equivalents, including money market securities. |

| 3 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 4 | This list is not a recommendation of any security by the investment adviser. |

| 5 | The holdings listed exclude any temporary liquidity investments. |

| Expense

Ratio (Annualized)1,2 |

Effective

Expense Ratio (Annualized)3,4 |

Beginning

Account Value at 7/1/20 |

Ending

Account Value (Net of Expenses) at 12/31/202 |

Expenses

Paid During Period 7/1/20-12/31/202,5 |

Effective

Expenses Paid During Period 7/1/20-12/31/204,5 | |

| Schwab Monthly Income Fund - Moderate Payout | ||||||

| Actual Return | 0.00% | 0.51% | $1,000.00 | $1,104.00 | $0.00 | $2.70 |

| Hypothetical 5% Return | 0.00% | 0.51% | $1,000.00 | $1,025.10 | $0.00 | $2.59 |

| Schwab Monthly Income Fund - Enhanced Payout | ||||||

| Actual Return | 0.00% | 0.37% | $1,000.00 | $1,074.70 | $0.00 | $1.93 |

| Hypothetical 5% Return | 0.00% | 0.37% | $1,000.00 | $1,025.10 | $0.00 | $1.88 |

| Schwab Monthly Income Fund - Maximum Payout | ||||||

| Actual Return | 0.00% | 0.22% | $1,000.00 | $1,045.80 | $0.00 | $1.13 |

| Hypothetical 5% Return | 0.00% | 0.22% | $1,000.00 | $1,025.10 | $0.00 | $1.12 |

| 1 | Based on the most recent six-month expense ratio. |

| 2 | Excludes acquired fund fees and expenses, which are indirect expenses incurred by the fund through its investments in underlying funds. |

| 3 | Based on the most recent six-month acquired fund fees and expense ratio; may differ from the acquired fund fees and expenses ratios in the prospectus. |

| 4 | Includes acquired fund fees and expenses, which are indirect expenses incurred by the fund through its investments in underlying funds. |

| 5 | Expenses for each fund are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by the 184 days of the period, and divided by the 366 days of the fiscal year. |

| 1/1/20–

12/31/20 |

1/1/19–

12/31/19 |

1/1/18–

12/31/18 |

1/1/17–

12/31/17 |

1/1/16–

12/31/16 |

||

| Per-Share Data | ||||||

| Net asset value at beginning of period | $11.09 | $10.05 | $11.09 | $10.31 | $10.46 | |

| Income (loss) from investment operations: | ||||||

| Net investment income (loss)1 | 0.21 | 0.29 | 0.23 | 0.23 | 0.21 | |

| Net realized and unrealized gains (losses) | 0.36 | 1.34 | (0.92) | 0.87 | 0.26 | |

| Total from investment operations | 0.57 | 1.63 | (0.69) | 1.10 | 0.47 | |

| Less distributions: | ||||||

| Distributions from net investment income | (0.21) | (0.29) | (0.24) | (0.32) | (0.22) | |

| Distributions from net realized gains | (0.07) | (0.30) | (0.11) | — | (0.40) | |

| Total distributions | (0.28) | (0.59) | (0.35) | (0.32) | (0.62) | |

| Net asset value at end of period | $11.38 | $11.09 | $10.05 | $11.09 | $10.31 | |

| Total return | 5.32% | 16.41% | (6.31%) | 10.80% | 4.58% | |

| Ratios/Supplemental Data | ||||||

| Ratios to average net assets: | ||||||

| Net operating expenses2 | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | |

| Gross operating expenses2 | 0.21% | 0.24% | 0.19% | 0.20% | 0.18% | |

| Net investment income (loss) | 1.93% | 2.68% | 2.17% | 2.11% | 1.99% | |

| Portfolio turnover rate | 30% | 30% | 20% | 41% 3 | 9% | |

| Net assets, end of period (x 1,000,000) | $45 | $47 | $41 | $49 | $45 | |

| Affiliated Underlying Funds |

Value at 12/31/19 |

Gross

Purchases |

Gross

Sales |

Realized

Gains (Losses) |

Net

Change in Unrealized Appreciation (depreciation) |

Value at 12/31/20 |

Balance

of Shares Held at 12/31/20 |

Distributions

Received* |

| Laudus International MarketMasters Fund | $5,643,347 | $1,544,922 | ($2,596,000) | $191,636 | $757,209 | $5,541,114 | 198,535 | $340,923 |

| Schwab Dividend Equity Fund | 13,450,958 | 3,815,982 | (3,615,000) | (804,300) | (25,829) | 12,821,811 | 914,537 | 287,981 |

| Schwab Global Real Estate Fund | 3,333,687 | 1,017,822 | (603,000) | (96,921) | (354,957) | 3,296,631 | 474,335 | 95,822 |

| Schwab U.S. Aggregate Bond Index Fund | 23,173,073 | 6,445,324 | (8,540,028) | 141,700 | 909,654 | 22,129,723 | 2,047,153 | 553,632 |

| Schwab Variable Share Price Money Fund, Ultra Shares | 572,650 | 452,709 | (600,000) | 107 | (259) | 425,207 | 425,080 | 2,631 |

| Total | $46,173,715 | $13,276,759 | ($15,954,028) | ($567,778) | $1,285,818 | $44,214,486 | $1,280,989 |

| * | Distributions received include distributions from net investment income and capital gains, if any, from the underlying funds. |

| Assets | ||

| Investments in affiliated underlying funds, at value (cost $39,128,213) | $44,214,486 | |

| Investments in unaffiliated underlying funds, at value (cost $461,444) | 461,444 | |

| Receivables: | ||

| Fund shares sold | 45,722 | |

| Dividends | 42,875 | |

| Due from investment adviser | 6,936 | |

| Prepaid expenses | + | 6,074 |

| Total assets | 44,777,537 | |

| Liabilities | ||

| Payables: | ||

| Investments bought | 42,696 | |

| Independent trustees’ fees | 72 | |

| Fund shares redeemed | 32,962 | |

| Accrued expenses | + | 38,930 |

| Total liabilities | 114,660 | |

| Net Assets | ||

| Total assets | 44,777,537 | |

| Total liabilities | – | 114,660 |

| Net assets | $44,662,877 | |

| Net Assets by Source | ||

| Capital received from investors | 40,520,427 | |

| Total distributable earnings | 4,142,450 | |

| Net Asset Value (NAV) | ||||

| Net Assets | ÷ | Shares

Outstanding |

= | NAV |

| $44,662,877 | 3,923,170 | $11.38 | ||

| Investment Income | ||

| Dividends received from affiliated underlying funds | $856,886 | |

| Dividends received from unaffiliated underlying funds | + | 771 |

| Total investment income | 857,657 | |

| Expenses | ||

| Professional fees | 26,409 | |

| Registration fees | 21,905 | |

| Portfolio accounting fees | 18,344 | |

| Shareholder reports | 12,925 | |

| Independent trustees’ fees | 8,028 | |

| Transfer agent fees | 1,774 | |

| Custodian fees | 1,483 | |

| Other expenses | + | 3,708 |

| Total expenses | 94,576 | |

| Expense reduction by CSIM and its affiliates | – | 94,576 |

| Net expenses | – | — |

| Net investment income | 857,657 | |

| Realized and Unrealized Gains (Losses) | ||

| Realized capital gain distributions received from affiliated underlying funds | 424,103 | |

| Net realized losses on sales of affiliated underlying funds | + | (567,778) |

| Net realized losses | (143,675) | |

| Net change in unrealized appreciation (depreciation) on affiliated underlying funds | + | 1,285,818 |

| Net realized and unrealized gains | 1,142,143 | |

| Increase in net assets resulting from operations | $1,999,800 | |

| Operations | ||||

| 1/1/20-12/31/20 | 1/1/19-12/31/19 | |||

| Net investment income | $857,657 | $1,169,886 | ||

| Net realized gains (losses) | (143,675) | 164,097 | ||

| Net change in unrealized appreciation (depreciation) | + | 1,285,818 | 5,224,936 | |

| Increase in net assets from operations | 1,999,800 | 6,558,919 | ||

| Distributions to Shareholders | ||||

| Total distributions | ($1,160,837) | ($2,415,500) | ||

| Transactions in Fund Shares | ||||||||

| 1/1/20-12/31/20 | 1/1/19-12/31/19 | |||||||

| SHARES | VALUE | SHARES | VALUE | |||||

| Shares sold | 1,473,250 | $15,784,151 | 835,441 | $9,132,983 | ||||

| Shares reinvested | 62,524 | 679,897 | 137,230 | 1,510,728 | ||||

| Shares redeemed | + | (1,816,959) | (19,246,565) | (881,615) | (9,538,580) | |||

| Net transactions in fund shares | (281,185) | ($2,782,517) | 91,056 | $1,105,131 | ||||

| Shares Outstanding and Net Assets | ||||||||

| 1/1/20-12/31/20 | 1/1/19-12/31/19 | |||||||

| SHARES | NET ASSETS | SHARES | NET ASSETS | |||||

| Beginning of period | 4,204,355 | $46,606,431 | 4,113,299 | $41,357,881 | ||||

| Total increase or decrease | + | (281,185) | (1,943,554) | 91,056 | 5,248,550 | |||

| End of period | 3,923,170 | $44,662,877 | 4,204,355 | $46,606,431 | ||||

| 1/1/20–

12/31/20 |

1/1/19–

12/31/19 |

1/1/18–

12/31/18 |

1/1/17–

12/31/17 |

1/1/16–

12/31/16 |

||

| Per-Share Data | ||||||

| Net asset value at beginning of period | $11.49 | $10.58 | $11.38 | $10.81 | $10.92 | |

| Income (loss) from investment operations: | ||||||

| Net investment income (loss)1 | 0.23 | 0.31 | 0.25 | 0.24 | 0.22 | |

| Net realized and unrealized gains (losses) | 0.45 | 1.13 | (0.72) | 0.64 | 0.18 | |

| Total from investment operations | 0.68 | 1.44 | (0.47) | 0.88 | 0.40 | |

| Less distributions: | ||||||

| Distributions from net investment income | (0.23) | (0.31) | (0.26) | (0.31) | (0.24) | |

| Distributions from net realized gains | (0.12) | (0.22) | (0.07) | — | (0.27) | |

| Total distributions | (0.35) | (0.53) | (0.33) | (0.31) | (0.51) | |

| Net asset value at end of period | $11.82 | $11.49 | $10.58 | $11.38 | $10.81 | |

| Total return | 6.11% | 13.79% | (4.20%) | 8.19% | 3.69% | |

| Ratios/Supplemental Data | ||||||

| Ratios to average net assets: | ||||||

| Net operating expenses2 | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | |

| Gross operating expenses2 | 0.12% | 0.14% | 0.12% | 0.11% | 0.10% | |

| Net investment income (loss) | 2.06% | 2.75% | 2.28% | 2.14% | 2.01% | |

| Portfolio turnover rate | 28% | 31% | 9% | 50% 3 | 6% | |

| Net assets, end of period (x 1,000,000) | $90 | $86 | $77 | $95 | $94 | |

| Affiliated Underlying Funds |

Value at 12/31/19 |

Gross

Purchases |

Gross

Sales |

Realized

Gains (Losses) |

Net

Change in Unrealized Appreciation (depreciation) |

Value at 12/31/20 |

Balance

of Shares Held at 12/31/20 |

Distributions

Received* |

| Laudus International MarketMasters Fund | $7,206,709 | $1,607,796 | ($2,389,000) | $208,525 | $1,144,347 | $7,778,377 | 278,695 | $476,796 |

| Schwab Dividend Equity Fund | 16,998,813 | 5,860,960 | (4,340,000) | (810,894) | (26,478) | 17,682,401 | 1,261,227 | 380,960 |

| Schwab Global Real Estate Fund | 4,186,346 | 1,167,146 | (264,000) | (45,258) | (474,533) | 4,569,701 | 657,511 | 131,146 |

| Schwab U.S. Aggregate Bond Index Fund | 55,399,302 | 14,571,838 | (14,635,584) | 343,198 | 2,206,583 | 57,885,337 | 5,354,795 | 1,369,324 |

| Schwab Variable Share Price Money Fund, Ultra Shares | 1,072,482 | 1,805,201 | (1,950,000) | 212 | (285) | 927,610 | 927,332 | 5,053 |

| Total | $84,863,652 | $25,012,941 | ($23,578,584) | ($304,217) | $2,849,634 | $88,843,426 | $2,363,279 |

| * | Distributions received include distributions from net investment income and capital gains, if any, from the underlying funds. |

| Assets | ||

| Investments in affiliated underlying funds, at value (cost $78,313,055) | $88,843,426 | |

| Investments in unaffiliated underlying funds, at value (cost $801,702) | 801,702 | |

| Receivables: | ||

| Fund shares sold | 165,925 | |

| Dividends | 112,293 | |

| Due from investment adviser | 7,936 | |

| Prepaid expenses | + | 7,161 |

| Total assets | 89,938,443 | |

| Liabilities | ||

| Payables: | ||

| Investments bought | 111,822 | |

| Independent trustees’ fees | 73 | |

| Fund shares redeemed | 94,722 | |

| Distributions to shareholders | 356 | |

| Accrued expenses | + | 40,193 |

| Total liabilities | 247,166 | |

| Net Assets | ||

| Total assets | 89,938,443 | |

| Total liabilities | – | 247,166 |

| Net assets | $89,691,277 | |

| Net Assets by Source | ||

| Capital received from investors | 79,496,940 | |

| Total distributable earnings | 10,194,337 | |

| Net Asset Value (NAV) | ||||

| Net Assets | ÷ | Shares

Outstanding |

= | NAV |

| $89,691,277 | 7,585,498 | $11.82 | ||

| Investment Income | ||

| Dividends received from affiliated underlying funds | $1,741,565 | |

| Dividends received from unaffiliated underlying funds | + | 2,096 |

| Total investment income | 1,743,661 | |

| Expenses | ||

| Professional fees | 30,465 | |

| Registration fees | 25,281 | |

| Portfolio accounting fees | 18,726 | |

| Shareholder reports | 16,542 | |

| Independent trustees’ fees | 8,200 | |

| Transfer agent fees | 2,489 | |

| Custodian fees | 129 | |

| Other expenses | + | 4,081 |

| Total expenses | 105,913 | |

| Expense reduction by CSIM and its affiliates | – | 105,913 |

| Net expenses | – | — |

| Net investment income | 1,743,661 | |

| Realized and Unrealized Gains (Losses) | ||

| Realized capital gain distributions received from affiliated underlying funds | 621,714 | |

| Net realized losses on sales of affiliated underlying funds | + | (304,217) |

| Net realized gains | 317,497 | |

| Net change in unrealized appreciation (depreciation) on affiliated underlying funds | + | 2,849,634 |

| Net realized and unrealized gains | 3,167,131 | |

| Increase in net assets resulting from operations | $4,910,792 | |

| Operations | ||||

| 1/1/20-12/31/20 | 1/1/19-12/31/19 | |||

| Net investment income | $1,743,661 | $2,220,089 | ||

| Net realized gains | 317,497 | 551,484 | ||

| Net change in unrealized appreciation (depreciation) | + | 2,849,634 | 7,536,050 | |

| Increase in net assets from operations | 4,910,792 | 10,307,623 | ||

| Distributions to Shareholders | ||||

| Total distributions | ($2,674,802) | ($3,866,624) | ||

| Transactions in Fund Shares | ||||||||

| 1/1/20-12/31/20 | 1/1/19-12/31/19 | |||||||

| SHARES | VALUE | SHARES | VALUE | |||||

| Shares sold | 2,448,176 | $27,839,048 | 1,442,946 | $16,376,802 | ||||

| Shares reinvested | 147,131 | 1,693,229 | 219,480 | 2,502,629 | ||||

| Shares redeemed | + | (2,461,385) | (27,672,110) | (1,446,268) | (16,277,099) | |||

| Net transactions in fund shares | 133,922 | $1,860,167 | 216,158 | $2,602,332 | ||||

| Shares Outstanding and Net Assets | ||||||||

| 1/1/20-12/31/20 | 1/1/19-12/31/19 | |||||||

| SHARES | NET ASSETS | SHARES | NET ASSETS | |||||

| Beginning of period | 7,451,576 | $85,595,120 | 7,235,418 | $76,551,789 | ||||

| Total increase | + | 133,922 | 4,096,157 | 216,158 | 9,043,331 | |||

| End of period | 7,585,498 | $89,691,277 | 7,451,576 | $85,595,120 | ||||

| 1/1/20–

12/31/20 |

1/1/19–

12/31/19 |

1/1/18–

12/31/18 |

1/1/17–

12/31/17 |

1/1/16–

12/31/16 |

||

| Per-Share Data | ||||||

| Net asset value at beginning of period | $10.33 | $9.60 | $10.15 | $9.85 | $9.95 | |

| Income (loss) from investment operations: | ||||||

| Net investment income (loss)1 | 0.23 | 0.29 | 0.24 | 0.22 | 0.20 | |

| Net realized and unrealized gains (losses) | 0.47 | 0.77 | (0.48) | 0.33 | 0.09 | |

| Total from investment operations | 0.70 | 1.06 | (0.24) | 0.55 | 0.29 | |

| Less distributions: | ||||||

| Distributions from net investment income | (0.22) | (0.28) | (0.24) | (0.25) | (0.22) | |

| Distributions from net realized gains | (0.01) | (0.05) | (0.07) | — | (0.17) | |

| Total distributions | (0.23) | (0.33) | (0.31) | (0.25) | (0.39) | |

| Net asset value at end of period | $10.80 | $10.33 | $9.60 | $10.15 | $9.85 | |

| Total return | 6.93% | 11.18% | (2.31%) | 5.64% | 2.97% | |

| Ratios/Supplemental Data | ||||||

| Ratios to average net assets: | ||||||

| Net operating expenses2 | 0.00% | 0.00% | 0.00% | 0.00% 3,4 | 0.00% | |

| Gross operating expenses2 | 0.14% | 0.23% | 0.20% | 0.20% | 0.18% | |

| Net investment income (loss) | 2.17% | 2.85% | 2.42% | 2.17% | 2.02% | |

| Portfolio turnover rate | 23% | 31% | 11% | 63% 5 | 9% | |

| Net assets, end of period (x 1,000,000) | $112 | $63 | $40 | $48 | $47 | |

| Affiliated Underlying Funds |

Value at 12/31/19 |

Gross

Purchases |

Gross

Sales |

Realized

Gains (Losses) |

Net

Change in Unrealized Appreciation (depreciation) |

Value at 12/31/20 |

Balance

of Shares Held at 12/31/20 |

Distributions

Received* |

| Laudus International MarketMasters Fund | $2,900,535 | $2,836,616 | ($1,033,000) | ($67,270) | $905,167 | $5,542,048 | 198,569 | $330,616 |

| Schwab Dividend Equity Fund | 6,789,111 | 6,850,617 | (1,610,000) | (235,803) | 259,899 | 12,053,824 | 859,759 | 200,617 |

| Schwab Global Real Estate Fund | 1,655,362 | 1,686,655 | — | — | (150,581) | 3,191,436 | 459,199 | 81,655 |

| Schwab U.S. Aggregate Bond Index Fund | 49,732,452 | 52,355,016 | (15,209,990) | 17,017 | 2,114,334 | 89,008,829 | 8,233,934 | 1,550,938 |

| Schwab Variable Share Price Money Fund, Ultra Shares | 671,900 | 603,808 | (300,000) | (80) | (107) | 975,521 | 975,228 | 3,717 |

| Total | $61,749,360 | $64,332,712 | ($18,152,990) | ($286,136) | $3,128,712 | $110,771,658 | $2,167,543 |

| * | Distributions received include distributions from net investment income and capital gains, if any, from the underlying funds. |

| Assets | ||

| Investments in affiliated underlying funds, at value (cost $104,551,450) | $110,771,658 | |

| Investments in unaffiliated underlying funds, at value (cost $782,622) | 782,622 | |

| Receivables: | ||

| Fund shares sold | 865,510 | |

| Dividends | 167,547 | |

| Due from investment adviser | 10,737 | |

| Prepaid expenses | + | 13,748 |

| Total assets | 112,611,822 | |

| Liabilities | ||

| Payables: | ||

| Investments bought | 418,912 | |

| Independent trustees’ fees | 73 | |

| Fund shares redeemed | 109,971 | |

| Distributions to shareholders | 64 | |

| Accrued expenses | + | 40,100 |

| Total liabilities | 569,120 | |

| Net Assets | ||

| Total assets | 112,611,822 | |

| Total liabilities | – | 569,120 |

| Net assets | $112,042,702 | |

| Net Assets by Source | ||

| Capital received from investors | 105,891,269 | |

| Total distributable earnings | 6,151,433 | |

| Net Asset Value (NAV) | ||||

| Net Assets | ÷ | Shares

Outstanding |

= | NAV |

| $112,042,702 | 10,369,672 | $10.80 | ||

| Investment Income | ||

| Dividends received from affiliated underlying funds | $1,688,586 | |

| Dividends received from unaffiliated underlying funds | + | 981 |

| Total investment income | 1,689,567 | |

| Expenses | ||

| Registration fees | 31,410 | |

| Professional fees | 28,330 | |

| Portfolio accounting fees | 18,531 | |

| Shareholder reports | 15,729 | |

| Independent trustees’ fees | 8,122 | |

| Transfer agent fees | 2,346 | |

| Custodian fees | 1,576 | |

| Other expenses | + | 3,883 |

| Total expenses | 109,927 | |

| Expense reduction by CSIM and its affiliates | – | 109,927 |

| Net expenses | – | — |

| Net investment income | 1,689,567 | |

| Realized and Unrealized Gains (Losses) | ||

| Realized capital gain distributions received from affiliated underlying funds | 478,957 | |

| Net realized losses on sales of affiliated underlying funds | + | (286,136) |

| Net realized gains | 192,821 | |

| Net change in unrealized appreciation (depreciation) on affiliated underlying funds | + | 3,128,712 |

| Net realized and unrealized gains | 3,321,533 | |

| Increase in net assets resulting from operations | $5,011,100 | |

| Operations | ||||

| 1/1/20-12/31/20 | 1/1/19-12/31/19 | |||

| Net investment income | $1,689,567 | $1,354,894 | ||

| Net realized gains | 192,821 | 97,164 | ||

| Net change in unrealized appreciation (depreciation) | + | 3,128,712 | 3,376,911 | |

| Increase in net assets from operations | 5,011,100 | 4,828,969 | ||

| Distributions to Shareholders | ||||

| Total distributions | ($1,822,117) | ($1,671,665) | ||

| Transactions in Fund Shares | ||||||||

| 1/1/20-12/31/20 | 1/1/19-12/31/19 | |||||||

| SHARES | VALUE | SHARES | VALUE | |||||

| Shares sold | 8,675,410 | $91,217,898 | 3,258,193 | $33,223,959 | ||||

| Shares reinvested | 105,564 | 1,111,251 | 101,722 | 1,036,494 | ||||

| Shares redeemed | + | (4,462,298) | (46,001,366) | (1,496,811) | (15,105,259) | |||

| Net transactions in fund shares | 4,318,676 | $46,327,783 | 1,863,104 | $19,155,194 | ||||

| Shares Outstanding and Net Assets | ||||||||

| 1/1/20-12/31/20 | 1/1/19-12/31/19 | |||||||

| SHARES | NET ASSETS | SHARES | NET ASSETS | |||||

| Beginning of period | 6,050,996 | $62,525,936 | 4,187,892 | $40,213,438 | ||||

| Total increase | + | 4,318,676 | 49,516,766 | 1,863,104 | 22,312,498 | |||

| End of period | 10,369,672 | $112,042,702 | 6,050,996 | $62,525,936 | ||||

| SCHWAB CAPITAL TRUST (ORGANIZED MAY 7, 1993) | |

| Schwab Monthly Income Fund - Moderate Payout | Schwab Balanced Fund |

| Schwab Monthly Income Fund - Enhanced Payout | Schwab Core Equity Fund |

| Schwab Monthly Income Fund - Maximum Payout | Schwab Dividend Equity Fund |

| Schwab Target 2010 Fund | Schwab Large-Cap Growth Fund |

| Schwab Target 2015 Fund | Schwab Small-Cap Equity Fund |

| Schwab Target 2020 Fund | Schwab Hedged Equity Fund |

| Schwab Target 2025 Fund | Schwab Health Care Fund |

| Schwab Target 2030 Fund | Schwab International Core Equity Fund |

| Schwab Target 2035 Fund | Schwab Fundamental US Large Company Index Fund |

| Schwab Target 2040 Fund | Schwab Fundamental US Small Company Index Fund |

| Schwab Target 2045 Fund | Schwab Fundamental International Large Company Index Fund |

| Schwab Target 2050 Fund | Schwab Fundamental International Small Company Index Fund |

| Schwab Target 2055 Fund | Schwab Fundamental Emerging Markets Large Company Index Fund |

| Schwab Target 2060 Fund | Schwab Fundamental Global Real Estate Index Fund |

| Schwab S&P 500 Index Fund | Schwab Target 2010 Index Fund |

| Schwab Small-Cap Index Fund® | Schwab Target 2015 Index Fund |

| Schwab Total Stock Market Index Fund® | Schwab Target 2020 Index Fund |

| Schwab U.S. Large-Cap Growth Index Fund | Schwab Target 2025 Index Fund |

| Schwab U.S. Large-Cap Value Index Fund | Schwab Target 2030 Index Fund |

| Schwab U.S. Mid-Cap Index Fund | Schwab Target 2035 Index Fund |

| Schwab International Index Fund® | Schwab Target 2040 Index Fund |

| Schwab MarketTrack All Equity Portfolio™ | Schwab Target 2045 Index Fund |

| Schwab MarketTrack Growth Portfolio™ | Schwab Target 2050 Index Fund |

| Schwab MarketTrack Balanced Portfolio™ | Schwab Target 2055 Index Fund |

| Schwab MarketTrack Conservative Portfolio™ | Schwab Target 2060 Index Fund |

| Laudus International MarketMasters Fund™ | |

2. Significant Accounting Policies:

3. Risk Factors:

| Underlying Funds | Schwab

Monthly Income Fund - Moderate Payout |

Schwab

Monthly Income Fund - Enhanced Payout |

Schwab

Monthly Income Fund - Maximum Payout |

| Laudus International MarketMasters Fund | 0.4% | 0.5% | 0.4% |

| Schwab Dividend Equity Fund | 2.0% | 2.8% | 1.9% |

| Schwab Global Real Estate Fund | 1.2% | 1.6% | 1.1% |

| Schwab U.S. Aggregate Bond Index Fund | 0.4% | 1.1% | 1.7% |

| Schwab Variable Share Price Money Fund, Ultra Shares | 0.0%* | 0.0%* | 0.0%* |

| * | Less than 0.05% |

5. Board of Trustees:

7. Purchases and Sales of Investment Securities:

| Purchases

of Securities |

Sales

of Securities | |

| Schwab Monthly Income Fund - Moderate Payout | $13,276,759 | $15,954,028 |

| Schwab Monthly Income Fund - Enhanced Payout | 25,012,941 | 23,578,584 |

| Schwab Monthly Income Fund - Maximum Payout | 64,332,712 | 18,152,990 |

8. Federal Income Taxes:

| Schwab

Monthly Income Fund - Moderate Payout |

Schwab

Monthly Income Fund - Enhanced Payout |

Schwab

Monthly Income Fund - Maximum Payout | |||

| Tax cost | $40,835,140 | $80,157,585 | $105,919,975 | ||

| Gross unrealized appreciation | $5,086,430 | $10,530,460 | $6,220,208 | ||

| Gross unrealized depreciation | (1,245,640) | (1,042,917) | (585,903) | ||

| Net unrealized appreciation (depreciation) | $3,840,790 | $9,487,543 | $5,634,305 |

| Schwab

Monthly Income Fund - Moderate Payout |

Schwab

Monthly Income Fund - Enhanced Payout |

Schwab

Monthly Income Fund - Maximum Payout | |||

| Undistributed ordinary income | $3,679 | $22,622 | $27,494 | ||

| Undistributed long-term capital gains | 297,981 | 684,172 | 489,634 | ||

| Net unrealized appreciation (depreciation) on investments | 3,840,790 | 9,487,543 | 5,634,305 | ||

| Total | $4,142,450 | $10,194,337 | $6,151,433 |

| Schwab

Monthly Income Fund - Moderate Payout |

Schwab

Monthly Income Fund - Enhanced Payout |

Schwab

Monthly Income Fund - Maximum Payout | |

| Current fiscal year end distributions | |||

| Ordinary income | $868,732 | $1,819,998 | $1,763,366 |

| Long-term capital gains | 292,105 | 854,804 | 58,751 |

| Prior fiscal year end distributions | |||

| Ordinary income | $1,174,740 | $2,225,772 | $1,355,845 |

| Long-term capital gains | 1,240,760 | 1,640,852 | 315,820 |

9. Independent Registered Public Accounting Firm:

10. Subsequent Events:

Denver, Colorado

February 17, 2021

| Foreign Tax Credit | Foreign Source Income | |

| Schwab Monthly Income Fund — Moderate Payout | $10,560 | $23,573 |

| Schwab Monthly Income Fund — Enhanced Payout | 14,705 | 31,787 |

| Schwab Monthly Income Fund — Maximum Payout | 10,043 | 17,943 |

| Percentage | |

| Schwab Monthly Income Fund — Moderate Payout | 33.15 |

| Schwab Monthly Income Fund — Enhanced Payout | 20.93 |

| Schwab Monthly Income Fund — Maximum Payout | 11.38 |

| Schwab Monthly Income Fund — Moderate Payout | $287,981 |

| Schwab Monthly Income Fund — Enhanced Payout | 380,960 |

| Schwab Monthly Income Fund — Maximum Payout | 200,617 |

| Schwab Monthly Income Fund — Moderate Payout | $292,105 |

| Schwab Monthly Income Fund — Enhanced Payout | 854,804 |

| Schwab Monthly Income Fund — Maximum Payout | 58,751 |

| Independent Trustees | |||

| Name,

Year of Birth, and Position(s) with the trust (Terms of office, and length of Time Served1) |

Principal

Occupations During the Past Five Years |

Number

of Portfolios in Fund Complex Overseen by the Trustee |

Other Directorships |

| Robert

W. Burns 1959 Trustee (Trustee of Schwab Strategic Trust since 2009; The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2016) |

Retired/Private Investor (Jan. 2009 – present). Formerly, Managing Director, Pacific Investment Management Company, LLC (PIMCO) (investment management firm) and President, PIMCO Funds. | 102 | None |

| John

F. Cogan 1947 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust and Schwab Annuity Portfolios since 2008; Laudus Trust since 2010; Schwab Strategic Trust since 2016) |

Senior Fellow (Oct. 1979 – present), The Hoover Institution at Stanford University (public policy think tank); Senior Fellow (2000 – present), Stanford Institute for Economic Policy Research; Professor of Public Policy (1994 – 2015), Stanford University. | 102 | Director (2005 – 2020), Gilead Sciences, Inc. |

| Nancy

F. Heller 1956 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2018) |

Retired. President and Chairman (2014 – 2016), TIAA Charitable (financial services); Senior Managing Director (2003 – 2016), TIAA (financial services). | 102 | None |

| David

L. Mahoney 1954 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2011; Schwab Strategic Trust since 2016) |

Private Investor. | 102 | Director

(2004 – present), Corcept Therapeutics Incorporated Director (2009 – present), Adamas Pharmaceuticals, Inc. Director (2003 – 2019), Symantec Corporation |

| Jane

P. Moncreiff 1961 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2019) |

Consultant (2018 – present), Fulham Advisers LLC (management consulting); Chief Investment Officer (2009 – 2017), CareGroup Healthcare System, Inc. (healthcare). | 102 | None |

| Independent Trustees (continued) | |||

| Name,

Year of Birth, and Position(s) with the trust (Terms of office, and length of Time Served1) |

Principal

Occupations During the Past Five Years |

Number

of Portfolios in Fund Complex Overseen by the Trustee |

Other Directorships |

| Kiran

M. Patel 1948 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2011; Schwab Strategic Trust since 2016) |

Retired. Executive Vice President and General Manager of Small Business Group (Dec. 2008 – Sept. 2013), Intuit, Inc. (financial software and services firm for consumers and small businesses). | 102 | Director (2008 – present), KLA-Tencor Corporation |

| Kimberly

S. Patmore 1956 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2016) |

Consultant (2008 – present), Patmore Management Consulting (management consulting). | 102 | None |

| Interested Trustees | |||

| Name,

Year of Birth, and Position(s) with the trust (Terms of office, and length of Time Served1) |

Principal

Occupations During the Past Five Years |

Number

of Portfolios in Fund Complex Overseen by the Trustee |

Other Directorships |

| Walter

W. Bettinger II2 1960 Chairman and Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust and Schwab Annuity Portfolios since 2008; Schwab Strategic Trust since 2009; Laudus Trust since 2010) |

Director, President and Chief Executive Officer (Oct. 2008 – present), The Charles Schwab Corporation; President and Chief Executive Officer (Oct. 2008 – present) and Director (May 2008 – present), Charles Schwab & Co., Inc.; Director (Apr. 2006 – present), Charles Schwab Bank, SSB; Director (Nov. 2017 – present), Charles Schwab Premier Bank, SSB; Director (July 2019 – present), Charles Schwab Trust Bank; Director (May 2008 – present) and President and Chief Executive Officer (Aug. 2017 – present), Schwab Holdings, Inc.; Director (Oct. 2020 – present), TD Ameritrade Holding Corporation; Director (July 2016 – present), Charles Schwab Investment Management, Inc. | 102 | Director (2008 – present), The Charles Schwab Corporation |

| Joseph

R. Martinetto2 1962 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2016) |

Chief Operating Officer (Feb. 2018 – present) and Senior Executive Vice President (July 2015 – Feb. 2018), The Charles Schwab Corporation; Senior Executive Vice President (July 2015 – present), Charles Schwab & Co., Inc.; Chief Financial Officer (July 2015 – Aug. 2017) and Executive Vice President and Chief Financial Officer (May 2007 – July 2015), The Charles Schwab Corporation and Charles Schwab & Co., Inc.; Director (May 2007 – present), Charles Schwab & Co., Inc.; Director (Apr. 2010 – present) and Chief Executive Officer (July 2013 – Apr. 2015), Charles Schwab Bank, SSB; Director (Nov. 2017 – present), Charles Schwab Premier Bank, SSB; Director (May 2007 – present), Chief Financial Officer (May 2007 – Aug. 2017), Senior Executive Vice President (Feb. 2016 – present), and Executive Vice President (May 2007 – Feb. 2016), Schwab Holdings, Inc.; Director (Oct. 2020 – present), TD Ameritrade Holding Corporation. | 102 | None |

| Officers of the Trust | |

| Name,

Year of Birth, and Position(s) with the trust (Terms of office, and length of Time Served3) |

Principal Occupations During the Past Five Years |

| Jonathan

de St. Paer 1973 President and Chief Executive Officer (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2018) |

Director (Apr. 2019 – present), President (Oct. 2018 – present), Chief Operating Officer (Jan. 2020 – present), and Chief Executive Officer (Apr. 2019 – Nov. 2019), Charles Schwab Investment Management, Inc.; Senior Vice President (June 2020 – present) and Chief Operating Officer (Jan. 2020 – present), Charles Schwab Investment Advisory, Inc.; Chief Executive Officer (Apr. 2019 – present), President (Nov. 2018 – present) and Trustee (Apr. 2019 – Dec. 2020), Schwab Funds, Laudus Funds and Schwab ETFs; Director (Apr. 2019 – present), Charles Schwab Worldwide Funds plc and Charles Schwab Asset Management (Ireland) Limited; Senior Vice President (Apr. 2019 – present), Senior Vice President – Strategy and Product Development (CSIM) (Jan. 2014 – Mar. 2019), and Vice President (Jan. 2009 – Dec. 2013), Charles Schwab & Co., Inc. |

| Mark

Fischer 1970 Treasurer, Chief Financial Officer and Chief Operating Officer (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2013) |

Treasurer and Chief Financial Officer (Jan. 2016 – present) and Chief Operating Officer (Dec. 2020 – present), Schwab Funds, Laudus Funds and Schwab ETFs; Assistant Treasurer (Dec. 2013 – Dec. 2015), Schwab Funds and Laudus Funds; Assistant Treasurer (Nov. 2013 – Dec. 2015), Schwab ETFs; Chief Financial Officer (Mar. 2020 – present) and Vice President (Oct. 2013 – present), Charles Schwab Investment Management, Inc.; Executive Director (Apr. 2011 – Sept. 2013), J.P. Morgan Investor Services; Assistant Treasurer (May 2005 – Mar. 2011), Massachusetts Financial Service Investment Management. |

| Omar

Aguilar 1970 Senior Vice President and Chief Investment Officer – Equities and Multi-Asset Strategies (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2011) |

Senior Vice President and Chief Investment Officer (Apr. 2011 – present), Charles Schwab Investment Management, Inc.; Senior Vice President and Chief Investment Officer – Equities and Multi-Asset Strategies (June 2011 – present), Schwab Funds, Laudus Funds and Schwab ETFs; Head of the Portfolio Management Group and Vice President of Portfolio Management (May 2009 – Apr. 2011), Financial Engines, Inc. (investment management firm); Head of Quantitative Equity (July 2004 – Jan. 2009), ING Investment Management. |

| Brett

Wander 1961 Senior Vice President and Chief Investment Officer – Fixed Income (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2011) |

Senior Vice President and Chief Investment Officer (Apr. 2011 – present), Charles Schwab Investment Management, Inc.; Senior Vice President and Chief Investment Officer – Fixed Income (June 2011 – present), Schwab Funds, Laudus Funds and Schwab ETFs; Senior Managing Director and Global Head of Active Fixed-Income Strategies (Jan. 2008 – Oct. 2010), State Street Global Advisors; Director of Alpha Strategies (Apr. 2006 – Jan. 2008), Loomis, Sayles & Company (investment management firm). |

| David

Lekich 1964 Chief Legal Officer and Secretary, Schwab Funds and Schwab ETFs Vice President and Assistant Clerk, Laudus Funds (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2011) |

Senior Vice President (Sept. 2011 – present) and Vice President (Mar. 2004 – Sept. 2011), Charles Schwab & Co., Inc.; Senior Vice President and Chief Counsel (Sept. 2011 – present) and Vice President (Jan. 2011 – Sept. 2011), Charles Schwab Investment Management, Inc.; Secretary (Apr. 2011 – present) and Chief Legal Officer (Dec. 2011 – present), Schwab Funds; Vice President and Assistant Clerk (Apr. 2011 – present), Laudus Funds; Secretary (May 2011 – present) and Chief Legal Officer (Nov. 2011 – present), Schwab ETFs. |

| Catherine

MacGregor 1964 Vice President and Assistant Secretary, Schwab Funds and Schwab ETFs Chief Legal Officer, Vice President and Clerk, Laudus Funds (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2005; Schwab Strategic Trust since 2009) |

Vice President (July 2005 – present), Charles Schwab & Co., Inc.; Vice President (Sept. 2005 – present), Charles Schwab Investment Management, Inc.; Vice President (Dec. 2005 – present) and Chief Legal Officer and Clerk (Mar. 2007 – present), Laudus Funds; Vice President (Nov. 2005 – present) and Assistant Secretary (June 2007 – present), Schwab Funds; Vice President and Assistant Secretary (Oct. 2009 – present), Schwab ETFs. |

| 1 | Each Trustee shall hold office until the election and qualification of his or her successor, or until he or she dies, resigns or is removed. The retirement policy requires that each independent trustee retire by December 31 of the year in which the Trustee turns 74 or the Trustee’s twentieth year of service as an independent trustee on any trust in the Fund Complex, whichever occurs first. |

| 2 | Mr. Bettinger and Mr. Martinetto are Interested Trustees. Mr. Bettinger is an Interested Trustee because he owns stock of The Charles Schwab Corporation (CSC), the parent company of Charles Schwab Investment Management, Inc. (CSIM), the investment adviser for the trusts in the Fund Complex, is an employee and director of Charles Schwab & Co., Inc. (CS&Co), the principal underwriter for The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust, and is a director of CSIM. Mr. Martinetto is an Interested Trustee because he owns stock of CSC and is an employee and director of CS&Co. |

| 3 | The President, Treasurer and Secretary/Clerk hold office until their respective successors are chosen and qualified or until he or she sooner dies, resigns, is removed or becomes disqualified. Each of the other officers serves at the pleasure of the Board. |

Schwab Funds

| ¹ | State, local, and the Federal Alternative Minimum Tax may apply. Capital gains are not exempt from Federal Taxation. |

| ² | You could lose money by investing in the Schwab Money Funds. All Schwab Money Funds with the exception of Schwab Variable Share Price Money Fund seek to preserve the value of your investment at $1.00 per share, but cannot guarantee they will do so. Because the share price of Schwab Variable Share Price Money Fund will fluctuate, when you sell your shares they may be worth more or less than what you originally paid for them. All Schwab Money Funds with the exception of Schwab Government Money Fund, Schwab Retirement Government Money Fund, Schwab U.S. Treasury Money Fund, Schwab Treasury Obligations Money Fund and Schwab Government Money Market Portfolio may impose a fee upon the sale of your shares or may temporarily suspend your ability to sell shares if the Fund’s liquidity falls below required minimums because of market conditions or other factors. An investment in the Schwab Money Funds is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The Schwab Money Funds’ sponsor has no legal obligation to provide financial support to the Funds, and you should not expect that the sponsor will provide financial support to the Funds at any time. |

Item 2: Code of Ethics.

| (a) | Registrant has adopted a code of ethics that applies to its principal executive officer, principal financial officer, and any other persons who perform a similar function, regardless of whether these individuals are employed by Registrant or a third party. |

| (c) | During the period covered by the report, no amendments were made to the provisions of this code of ethics. |

| (d) | During the period covered by the report, Registrant did not grant any waivers, including implicit waivers, from the provisions of this code of ethics. |

| (f)(1) | Registrant has filed this code of ethics as an exhibit pursuant to Item 13(a)(1) of Form N-CSR. |

Item 3: Audit Committee Financial Expert.

Registrant’s Board of Trustees has determined that Kiran M. Patel and Kimberly S. Patmore, each currently serving on its audit, compliance and valuation committee, are each an “audit committee financial expert,” as such term is defined in Item 3 of Form N-CSR. Each member of Registrant’s audit, compliance and valuation committee is “independent” under the standards set forth in Item 3 of Form N-CSR.

The designation of each of Mr. Patel and Ms. Patmore as an “audit committee financial expert” pursuant to Item 3 of Form N-CSR does not (i) impose upon such individual any duties, obligations, or liability that are greater than the duties, obligations and liability imposed upon such individual as a member of Registrant’s audit, compliance and valuation committee or Board of Trustees in the absence of such designation; and (ii) affect the duties, obligations or liability of any other member of Registrant’s audit, compliance and valuation committee or Board of Trustees.

Item 4: Principal Accountant Fees and Services.

Registrant is composed of fifty-one operational series. Three series have a fiscal year-end of December 31, whose annual financial statements are reported in Item 1, one series has a fiscal year-end of the last day of February, eleven series have a fiscal year-end of March 31, and thirty-six series have a fiscal year-end of October 31. Principal accountant fees disclosed in Items 4(a)-(d) and 4(g) include fees billed for services rendered to the fifty-one operational series during 2020/2021 and 2019/2020, based on their respective 2020/2021 and 2019/2020 fiscal years, as applicable.

The following table presents fees billed by the principal accountant in each of the last two fiscal years for the services rendered to the funds:

| (a) Audit Fees |

(b) Audit-Related Fees1 | (c) Tax Fees2 | (d) All Other Fees | |||||||||||

| Fiscal Year |

Fiscal Year 2019/2020 |

Fiscal Year 2020/2021 |

Fiscal Year 2019/2020 |

Fiscal Year 2020/2021 |

Fiscal Year 2019/2020 |

Fiscal Year 2020/2021 |

Fiscal Year 2019/2020 | |||||||

| $1,203,450 |

$1,517,001 | $90,000 | $87,870 | $158,100 | $177,307 | $0 | $0 | |||||||

| 1 | The nature of the services includes assurance and related services reasonably related to the performance of the audit of financial statements not included in Audit Fees. |

| 2 | The nature of the services includes tax compliance, tax advice and tax planning. |

| (e) (1) | Registrant’s audit, compliance and valuation committee does not have pre-approval policies and procedures as described in paragraph (c)(7) of Rule 2-01 of Regulation S-X. |

| (2) | There were no services described in each of paragraphs (b) through (d) above (including services required to be approved by Registrant’s audit, compliance and valuation committee pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X) that were approved by Registrant’s audit, compliance and valuation committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (f) | Not applicable. |

| (g) | Below are the aggregate non-audit fees billed in each of the last two fiscal years by Registrant’s principal accountant for services rendered to Registrant, to Registrant’s investment adviser, and to any entity controlling, controlled by, or under common control with Registrant’s investment adviser that provides ongoing services to Registrant. |

| 2020/2021: $3,577,864 |

2019/2020: $265,177 |

| (h) | During the past fiscal year, all non-audit services provided by Registrant’s principal accountant to either Registrant’s investment adviser or to any entity controlling, controlled by, or under common control with Registrant’s investment adviser that provides ongoing services to Registrant were pre-approved. Included in the audit, compliance and valuation committee’s pre-approval was the review and consideration as to whether the provision of these non-audit services is compatible with maintaining the principal accountant’s independence. |

Item 5: Audit Committee of Listed Registrants.

Not applicable.

Item 6: Schedule of Investments.

The schedules of investments are included as part of the report to shareholders filed under Item 1 of this Form.

Item 7: Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8: Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9: Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10: Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11: Controls and Procedures.

| (a) | Based on their evaluation of Registrant’s disclosure controls and procedures, as of a date within 90 days of the filing date, Registrant’s Chief Executive Officer, Jonathan de St. Paer and Registrant’s Chief Financial Officer, Mark Fischer, have concluded that Registrant’s disclosure controls and procedures are: (i) reasonably designed to ensure that information required to be disclosed in this report is appropriately communicated to Registrant’s officers to allow timely decisions regarding disclosures required in this report; (ii) reasonably designed to ensure that information required to be disclosed in this report is recorded, processed, summarized and reported in a timely manner; and (iii) are effective in achieving the goals described in (i) and (ii) above. |

| (b) | During the period covered by this report, there have been no changes in Registrant’s internal control over financial reporting that the above officers believe to have materially affected, or to be reasonably likely to materially affect, Registrant’s internal control over financial reporting. |

Item 12: Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable.

Item 13: Exhibits.

| (a) (1) |

| (2) |

| (3) | Not applicable. |

| (b) |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Schwab Capital Trust

| By: | /s/ Jonathan de St. Paer | |

| Jonathan de St. Paer | ||

| Chief Executive Officer | ||

| Date: | February 17, 2021 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ Jonathan de St. Paer | |

| Jonathan de St. Paer | ||

| Chief Executive Officer | ||

| Date: | February 17, 2021 | |

| By: | /s/ Mark Fischer | |

| Mark Fischer | ||

| Chief Financial Officer | ||

| Date: | February 17, 2021 | |