Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-07704

Schwab Capital Trust – Schwab Fundamental Global Real Estate Index Fund

(Exact name of registrant as specified in charter)

| 211 Main Street, San Francisco, California | 94105 | |

| (Address of principal executive offices) | (Zip code) |

Marie Chandoha

Schwab Capital Trust

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415) 636-7000

Date of fiscal year end: February 28

Date of reporting period: February 29, 2016

Table of Contents

Item 1: Report(s) to Shareholders.

Table of Contents

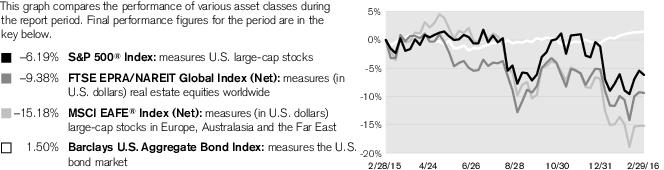

| Total Returns for the 12 Months Ended February 29, 2016 | |

| Schwab Fundamental Global Real Estate Index Fund (Ticker Symbol: SFREX) | -8.92% 1 |

| Russell Fundamental Global Select Real Estate Index (Net)2 | -9.20% |

| Fund Category: Morningstar Global Real Estate | -9.81% |

| Performance Details | pages 6-7 |

| Minimum Initial Investment3 | $100 |

| 1 | Total return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the net asset value (NAV) at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual and semi-annual reports. |

| 2 | The total return cited for the index is calculated net of foreign withholding taxes. |

| 3 | Please see the fund's prospectus for further detail and eligibility requirements. |

|

Agnes Hong, CFA, Vice President and Head of Passive Equity Strategies, leads the portfolio management teams of Schwab's passive equity funds and ETFs, which comprise the Schwab Equity Index Funds, the Schwab Fundamental Index Funds, and the Schwab Equity ETFs. She also has overall responsibility for all aspects of the management of the fund. Prior to joining CSIM in 2009, Ms. Hong spent five years as a portfolio manager at Barclays Global Investors (subsequently acquired by BlackRock), where she managed institutional index funds and quantitative active funds. Prior to that, Ms. Hong worked in management consulting and product management, servicing global financial services clients. |

|

Ferian Juwono, CFA, Managing Director and Senior Portfolio Manager, is responsible for the day-to-day co-management of the fund. Prior to joining CSIM in 2010, Mr. Juwono worked at BlackRock (formerly Barclays Global Investors), where he spent more than three years as a portfolio manager, managing equity index funds for institutional clients, and nearly two years as a senior business analyst. Prior to that, Mr. Juwono worked for over four years as a senior financial analyst with Union Bank of California. |

| 1 | The total return cited for the index is calculated net of foreign withholding taxes. |

| 2 | This list is not a recommendation of any security by the investment adviser. |

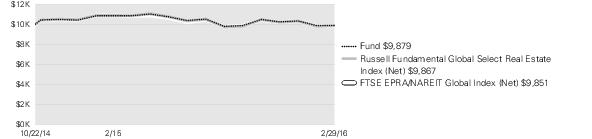

Performance of Hypothetical

$10,000 Investment1

| Fund and Inception Date | 1 Year | Since Inception |

| Fund: Schwab Fundamental Global Real Estate Index Fund (10/22/14) | -8.92% 3 | -0.89% |

| Russell Fundamental Global Select Real Estate Index (Net)4 | -9.20% | -0.98% |

| FTSE EPRA/NAREIT Global Index (Net)4 | -9.38% | -1.09% |

| Fund Category: Morningstar Global Real Estate | -9.81% | -1.65% |

| 1 | Fund expenses may have been partially absorbed by the investment adviser and its affiliates. Without these reductions, the fund’s returns may have been lower. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. |

| 2 | Source for category information: Morningstar, Inc. |

| 3 | Total return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the net asset value (NAV) at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual and semi-annual reports. |

| 4 | The total return cited for the index is calculated net of foreign withholding taxes. |

| 5 | As stated in the fund's prospectus. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as CSIM serves as adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual ratios during the reporting period, refer to the Financial Highlights section of the financial statements. |

| Expense

Ratio1 (Annualized) |

Beginning

Account Value at 9/1/15 |

Ending

Account Value (Net of Expenses) at 2/29/16 |

Expenses

Paid During Period2 9/1/15–2/29/16 | |

| Schwab Fundamental Global Real Estate Index Fund | ||||

| Actual Return | 0.49% | $1,000.00 | $1,011.30 | $ 2.45 |

| Hypothetical 5% Return | 0.49% | $1,000.00 | $1,022.46 | $2.46 |

| 1 | Based on the most recent six-month expense ratio; may differ from the expense ratio provided in the Financial Highlights which covers a 12-month period. |

| 2 | Expenses for the fund are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by the 182 days of the period, and divided by the 366 days of the fiscal year. |

| 3/1/15–

2/29/16 |

10/22/14

1– 2/28/15 |

|||||

| Per-Share Data | ||||||

| Net asset value at beginning of period | $10.74 | $10.00 | ||||

| Income (loss) from investment operations: | ||||||

| Net investment income (loss)2 | 0.27 | 0.10 | ||||

| Net realized and unrealized gains (losses) | (1.21) | 0.75 | ||||

| Total from investment operations | (0.94) | 0.85 | ||||

| Less distributions: | ||||||

| Distributions from net investment income | (0.27) | (0.11) | ||||

| Distributions from net realized gains | — | (0.00) 3 | ||||

| Total distributions | (0.27) | (0.11) | ||||

| Net asset value at end of period | $9.53 | $10.74 | ||||

| Total return | (8.91%) | 8.57% 4 | ||||

| Ratios/Supplemental Data | ||||||

| Ratios to average net assets: | ||||||

| Net operating expenses | 0.50% 5 | 0.13% 6,7 | ||||

| Gross operating expenses | 0.89% | 2.58% 6 | ||||

| Net investment income (loss) | 2.65% | 2.62% 6 | ||||

| Portfolio turnover rate | 26% | 4% 4 | ||||

| Net assets, end of period (x 1,000,000) | $84 | $105 | ||||

| Description | Quoted

Prices in Active Markets for Identical Assets (Level 1) |

Other

Significant Observable Inputs (Level 2) |

Significant

Unobservable Inputs (Level 3) |

Total | |||||

| Common Stock1 | $— | $37,891,778 | $— | $37,891,778 | |||||

| Brazil 1 | 628,306 | — | — | 628,306 | |||||

| Canada 1 | 1,677,688 | — | — | 1,677,688 | |||||

| China | |||||||||

| Real Estate | 108,557 | 5,853,771 | — | 5,962,328 | |||||

| Switzerland | |||||||||

| Real Estate | 134,633 | 219,369 | — | 354,002 | |||||

| United States1 | 36,994,184 | — | — | 36,994,184 | |||||

| Other Investment Company | 269,340 | — | — | 269,340 | |||||

| Short-Term Investments1 | — | 171,620 | — | 171,620 | |||||

| Total | $39,812,708 | $44,136,538 | $— | $83,949,246 |

| 1 | As categorized in Portfolio Holdings. |

| Assets | ||

| Investments, at value (cost $89,872,224) | $83,949,246 | |

| Foreign currency, at value (cost $10,806) | 10,904 | |

| Receivables: | ||

| Investments sold | 18 | |

| Dividends | 96,282 | |

| Fund shares sold | 22,525 | |

| Foreign tax reclaims | 8,248 | |

| Prepaid expenses | + | 10,665 |

| Total assets | 84,097,888 | |

| Liabilities | ||

| Payables: | ||

| Investment adviser and administrator fees | 1,111 | |

| Shareholder service fees | 1,647 | |

| Independent trustees' fees | 535 | |

| Fund shares redeemed | 113,935 | |

| Accrued expenses | + | 91,681 |

| Total liabilities | 208,909 | |

| Net Assets | ||

| Total assets | 84,097,888 | |

| Total liabilities | – | 208,909 |

| Net assets | $83,888,979 | |

| Net Assets by Source | ||

| Capital received from investors | 90,528,396 | |

| Distributions in excess of net investment income | (28,957) | |

| Net realized capital losses | (688,117) | |

| Net unrealized capital depreciation | (5,922,343) | |

| Net Asset Value (NAV) | ||||

| Net Assets | ÷ | Shares

Outstanding |

= | NAV |

| $83,888,979 | 8,804,846 | $9.53 | ||

| Investment Income | ||

| Dividends (net of foreign withholding tax of $172,400) | $3,043,133 | |

| Interest | + | 177 |

| Total investment income | 3,043,310 | |

| Expenses | ||

| Investment adviser and administrator fees | 386,745 | |

| Shareholder service fees | 96,494 | |

| Index fees | 82,908 | |

| Offering costs | 65,847 | |

| Professional fees | 57,727 | |

| Portfolio accounting fees | 48,645 | |

| Custodian fees | 31,223 | |

| Shareholder reports | 24,781 | |

| Transfer agent fees | 22,357 | |

| Registration fees | 13,196 | |

| Independent trustees' fees | 8,372 | |

| Proxy fees | 6,573 | |

| Interest expense | 73 | |

| Other expenses | + | 12,376 |

| Total expenses | 857,317 | |

| Expense reduction by CSIM and its affiliates | – | 376,908 |

| Net expenses | – | 480,409 |

| Net investment income | 2,562,901 | |

| Realized and Unrealized Gains (Losses) | ||

| Net realized losses on investments (net of foreign capital gain tax paid of $60) | (546,420) | |

| Net realized losses on futures contracts | (12,098) | |

| Net realized losses on foreign currency transactions | + | (10,799) |

| Net realized losses | (569,317) | |

| Net change in unrealized appreciation (depreciation) on investments | (11,237,270) | |

| Net change in unrealized appreciation (depreciation) on futures contracts | 1,334 | |

| Net change in unrealized appreciation (depreciation) on foreign currency translations | + | (984) |

| Net change in unrealized appreciation (depreciation) | + | (11,236,920) |

| Net realized and unrealized losses | (11,806,237) | |

| Decrease in net assets resulting from operations | ($9,243,336) | |

| Operations | |||

| 3/1/15-2/29/16 | 10/22/14*-2/28/15 | ||

| Net investment income | $2,562,901 | $802,053 | |

| Net realized gains (losses) | (569,317) | 62,109 | |

| Net change in unrealized appreciation (depreciation) | + | (11,236,920) | 5,314,577 |

| Increase (decrease) in net assets from operations | (9,243,336) | 6,178,739 | |

| Distributions to Shareholders | |||

| Distributions from net investment income | (2,655,237) | (916,331) | |

| Distributions from net realized gains | + | — | (3,252) |

| Total distributions | ($2,655,237) | ($919,583) | |

| Transactions in Fund Shares | |||||

| 3/1/15-2/29/16 | 10/22/14*-2/28/15 | ||||

| SHARES | VALUE | SHARES | VALUE | ||

| Shares sold | 1,918,394 | $19,727,219 | 10,123,658 | $103,354,738 | |

| Shares reinvested | 200,489 | 2,071,587 | 69,163 | 719,990 | |

| Shares redeemed | + | (3,121,007) | (31,289,328) | (385,851) | (4,055,810) |

| Net transactions in fund shares | (1,002,124) | ($9,490,522) | 9,806,970 | $100,018,918 | |

| Shares Outstanding and Net Assets | |||||

| 3/1/15-2/29/16 | 10/22/14*-2/28/15 | ||||

| SHARES | NET ASSETS | SHARES | NET ASSETS | ||

| Beginning of period | 9,806,970 | $105,278,074 | — | $— | |

| Total increase or decrease | + | (1,002,124) | (21,389,095) | 9,806,970 | 105,278,074 |

| End of period | 8,804,846 | $83,888,979 | 9,806,970 | $105,278,074 | |

| Distributions in excess of net investment income/Net investment income not yet distributed | ($28,957) | $17,433 | |||

| * | Commencement of operations. |

| Schwab Capital Trust (organized May 7, 1993) | Schwab Large-Cap Growth Fund™ |

| Schwab Fundamental Global Real Estate Index Fund | Schwab Small-Cap Equity Fund™ |

| Schwab Fundamental US Large Company Index Fund | Schwab Hedged Equity Fund™ |

| Schwab Fundamental US Small Company Index Fund | Schwab Financial Services Fund™ |

| Schwab Fundamental International Large Company Index Fund | Schwab Health Care Fund™ |

| Schwab Fundamental International Small Company Index Fund | Schwab ® International Core Equity Fund |

| Schwab Fundamental Emerging Markets Large Company Index Fund | Schwab Target 2010 Fund |

| Schwab ® S&P 500 Index Fund | Schwab Target 2015 Fund |

| Schwab Small-Cap Index Fund® | Schwab Target 2020 Fund |

| Schwab Total Stock Market Index Fund® | Schwab Target 2025 Fund |

| Schwab International Index Fund® | Schwab Target 2030 Fund |

| Schwab MarketTrack All Equity Portfolio™ | Schwab Target 2035 Fund |

| Schwab MarketTrack Growth Portfolio™ | Schwab Target 2040 Fund |

| Schwab MarketTrack Balanced Portfolio™ | Schwab Target 2045 Fund |

| Schwab MarketTrack Conservative Portfolio™ | Schwab Target 2050 Fund |

| Laudus Small-Cap MarketMasters Fund™ | Schwab Target 2055 Fund |

| Laudus International MarketMasters Fund™ | Schwab ® Monthly Income Fund — Moderate Payout |

| Schwab Balanced Fund™ | Schwab ® Monthly Income Fund — Enhanced Payout |

| Schwab Core Equity Fund™ | Schwab ® Monthly Income Fund — Maximum Payout |

| Schwab Dividend Equity Fund™ |

| % of Average Daily Net Assets | |

| First $500 million | 0.40% |

| $500 million to $5 billion | 0.38% |

| $5 billion to $10 billion | 0.36% |

| Over $10 billion | 0.34% |

| Purchases of Securities | Sales/Maturities of Securities | |

| $25,138,299 | $33,570,126 |

| Current

Period (3/1/15-2/29/16) |

Prior

Period (10/22/14*-2/28/15) | |

| $2,652 | $5,119 |

| * | Commencement of operations. |

| Undistributed ordinary income | $691,342 |

| Undistributed long-term capital gains | — |

| Unrealized appreciation on investments | 4,037,301 |

| Unrealized depreciation on investments | (11,096,513) |

| Other unrealized appreciation (depreciation) | 635 |

| Net unrealized appreciation (depreciation) | ($7,058,577) |

| * | As a result of the passage of the Regulated Investment Company Modernization Act of 2010, capital losses incurred after December 31, 2010 may now be carried forward indefinitely, but must retain the character of the original loss. |

| Current period distributions | |

| Ordinary income | $2,655,237 |

| Long-term capital gains | — |

| Return of capital | — |

| Prior period distributions | |

| Ordinary income | $915,589 |

| Long-term capital gains | 3,994 |

| Return of capital | — |

| Capital shares | $— |

| Undistributed net investment income | 45,946 |

| Net realized capital gains (losses) | (45,946) |

Schwab Fundamental Global Real Estate Index Fund

San Francisco, California

April 15, 2016

| Proposal

– To elect each of the following individuals as trustees of the Trust: |

For | Withheld | ||

| Walter W. Bettinger II | 1,781,628,338.445 | 341,201,457.803 | ||

| Marie A. Chandoha | 2,069,741,484.184 | 53,088,312.064 | ||

| Joseph R. Martinetto | 2,070,394,888.403 | 52,434,907.845 | ||

| Robert W. Burns | 2,070,083,106.758 | 52,746,689.490 | ||

| John F. Cogan | 1,909,915,620.213 | 212,914,176.035 | ||

| Stephen T. Kochis | 2,067,778,859.342 | 55,050,936.906 | ||

| David L. Mahoney | 2,068,011,019.030 | 54,818,777.218 | ||

| Kiran M. Patel | 2,066,263,491.520 | 56,566,304.728 | ||

| Kimberly S. Patmore | 2,069,034,220.641 | 53,795,575.607 | ||

| Charles A. Ruffel | 2,070,448,922.775 | 52,380,873.473 | ||

| Gerald B. Smith | 2,069,060,923.296 | 53,768,872.952 | ||

| Joseph H. Wender | 2,065,502,834.216 | 57,326,962.032 |

| Independent Trustees | |||

| Name,

Year of Birth, and Position(s) with the trust (Terms of office, and length of Time Served1) |

Principal

Occupations During the Past Five Years |

Number

of Portfolios in Fund Complex Overseen by the Trustee |

Other Directorships |

| Robert

W. Burns 1959 Trustee (Trustee of Schwab Strategic Trust since 2009; The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2016) |

Retired/Private Investor (Jan. 2009 – present). Formerly, Managing Director, Pacific Investment Management Company, LLC (PIMCO) and President, PIMCO Funds. | 96 | Director, PS Business Parks, Inc. (2005 – 2012). |

| John

F. Cogan 1947 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust and Schwab Annuity Portfolios since 2008; Laudus Trust and Laudus Institutional Trust since 2010; Schwab Strategic Trust since 2016) |

Senior Fellow, The Hoover Institution at Stanford University (Oct. 1979 – present); Senior Fellow, Stanford Institute for Economic Policy Research (2000 – present); Professor of Public Policy, Stanford University (1994 – 2015). | 96 | Director,

Gilead Sciences, Inc. (2005 – present) |

| Stephen

Timothy Kochis 1946 Trustee (Trustee of Schwab Strategic Trust since 2012; The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2016) |

CEO and Owner, Kochis Global (wealth management consulting) (May 2012 – present); Chairman and CEO, Aspiriant, LLC (wealth management) (Jan. 2008 – Apr. 2012). | 96 | None |

| David

L. Mahoney 1954 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Laudus Trust and Laudus Institutional Trust since 2011; Schwab Strategic Trust since 2016) |

Private Investor. | 96 | Director,

Symantec Corporation (2003 – present) Director, Corcept Therapeutics Incorporated (2004 – present) Director, Adamas Pharmaceuticals, Inc. (2009 – present) |

| Kiran

M. Patel 1948 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Laudus Trust and Laudus Institutional Trust since 2011; Schwab Strategic Trust since 2016) |

Retired. Executive Vice President and General Manager of Small Business Group, Intuit, Inc. (financial software and services firm for consumers and small businesses) (Dec. 2008 – Sept. 2013). | 96 | Director, KLA-Tencor Corporation (2008 – present) |

| Independent Trustees (continued) | |||

| Name,

Year of Birth, and Position(s) with the trust (Terms of office, and length of Time Served1) |

Principal

Occupations During the Past Five Years |

Number

of Portfolios in Fund Complex Overseen by the Trustee |

Other Directorships |

| Kimberly

S. Patmore 1956 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust, and Laudus Trust since 2016) |

Consultant, Patmore Management Consulting (management consulting) (2008 – present). | 96 | None |

| Charles

A. Ruffel 1956 Trustee (Trustee of Schwab Strategic Trust since 2009; The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Laudus Trust and Laudus Institutional Trust since 2015) |

Co-Chief Executive Officer, Kudu Investment Management, LLC (financial services) (Jan. 2015 – present); Partner, Kudu Advisors, LLC (financial services) (June 2008 – Jan. 2015); Advisor, Asset International, Inc. (publisher of financial services information) (Aug. 2008 – Jan. 2015). | 96 | None |

| Gerald

B. Smith 1950 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust and Schwab Annuity Portfolios since 2000; Laudus Trust and Laudus Institutional Trust since 2010; Schwab Strategic Trust since 2016) |

Chairman, Chief Executive Officer and Founder of Smith Graham & Co. (investment advisors) (Mar. 1990 – present). | 96 | Director,

Eaton (2012 – present) Director and Chairman of the Audit Committee, Oneok Partners LP (2003 – 2013) Director, Oneok, Inc. (2009 – 2013) Lead Independent Director, Board of Cooper Industries (2002 – 2012) |

| Joseph

H. Wender 1944 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust and Schwab Annuity Portfolios since 2008; Laudus Trust and Laudus Institutional Trust since 2010; Schwab Strategic Trust since 2016) |

Senior Consultant, Goldman Sachs & Co., Inc. (investment banking and securities firm) (Jan. 2008 – present); Partner, Colgin Partners, LLC (vineyards) (Feb. 1998 – present). | 96 | Board

Member and Chairman of the Audit Committee, Isis Pharmaceuticals (1994 – present) Lead Independent Director and Chair of Audit Committee, OUTFRONT Media Inc. (2014 – present) |

| Interested Trustees | |||

| Name,

Year of Birth, and Position(s) with the trust (Terms of office, and length of Time Served1) |

Principal

Occupations During the Past Five Years |

Number

of Portfolios in Fund Complex Overseen by the Trustee |

Other Directorships |

| Walter

W. Bettinger II2 1960 Chairman and Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust and Schwab Annuity Portfolios since 2008; Schwab Strategic Trust since 2009; Laudus Trust and Laudus Institutional Trust since 2010) |

Director, President and Chief Executive Officer, The Charles Schwab Corporation (Oct. 2008 – present); President and Chief Executive Officer (Oct. 2008 – present), Director (May 2008 – present), Charles Schwab & Co., Inc.; Director, Charles Schwab Bank (Apr. 2006 – present); and Director, Schwab Holdings, Inc. (May 2008 – present). | 96 | Director, The Charles Schwab Corporation (2008 – present) |

| Interested Trustees (continued) | |||

| Name,

Year of Birth, and Position(s) with the trust (Terms of office, and length of Time Served1) |

Principal

Occupations During the Past Five Years |

Number

of Portfolios in Fund Complex Overseen by the Trustee |

Other Directorships |

| Marie

A. Chandoha2 1961 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust, and Laudus Trust since 2016) |

Director, President and Chief Executive Officer (Dec. 2010 – present), Chief Investment Officer (Sept. 2010 – Oct. 2011), Charles Schwab Investment Management, Inc.; Trustee (Jan. 2016 – present), President, Chief Executive Officer (Dec. 2010 – present), and Chief Investment Officer (Sept. 2010 – Oct. 2011), Schwab Funds, Laudus Funds and Schwab ETFs; Director, Charles Schwab Worldwide Funds plc and Charles Schwab Asset Management (Ireland) Limited (Jan. 2011 – present); Global Head of Fixed Income Business Division, BlackRock, Inc. (formerly Barclays Global Investors) (Mar. 2007 – Aug. 2010). | 96 | None |

| Joseph

R. Martinetto2 1962 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust, and Laudus Trust since 2016) |

Senior Executive Vice President and Chief Financial Officer, The Charles Schwab Corporation and Charles Schwab & Co., Inc. (July 2015 – present); Executive Vice President and Chief Financial Officer of The Charles Schwab Corporation and Charles Schwab & Co., Inc. (May 2007 – July 2015); Director, Charles Schwab & Co., Inc. (May 2007 – present); Director (Apr. 2010 – present) and Chief Executive Officer (July 2013 – Apr. 2015), Charles Schwab Bank; Director, Executive Vice President and Chief Financial Officer, Schwab Holdings, Inc. (May 2007 – present). | 96 | None |

| Officers of the Trust | |

| Name,

Year of Birth, and Position(s) with the trust (Terms of office, and length of Time Served3) |

Principal Occupations During the Past Five Years |

| Marie

A. Chandoha 1961 President and Chief Executive Officer (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust, Laudus Trust and Laudus Institutional Trust since 2010) |

Director, President and Chief Executive Officer (Dec. 2010 – present), Chief Investment Officer (Sept. 2010 – Oct. 2011), Charles Schwab Investment Management, Inc.; Trustee (Jan. 2016 – present), President, Chief Executive Officer (Dec. 2010 – present), and Chief Investment Officer (Sept. 2010 – Oct. 2011), Schwab Funds, Laudus Funds and Schwab ETFs; Director, Charles Schwab Worldwide Funds plc and Charles Schwab Asset Management (Ireland) Limited (Jan. 2011 – present); Global Head of Fixed Income Business Division, BlackRock, Inc. (formerly Barclays Global Investors) (Mar. 2007 – Aug. 2010). |

| Mark

Fischer 1970 Treasurer and Chief Financial Officer (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust, Laudus Trust and Laudus Institutional Trust since 2013) |

Treasurer and Chief Financial Officer, Schwab Funds, Laudus Funds and Schwab ETFs (Jan. 2016 – present); Assistant Treasurer, Schwab Funds and Laudus Funds (Dec. 2013 – Dec. 2015), Schwab ETFs (Nov. 2013 – Dec. 2015); Vice President, Charles Schwab Investment Management, Inc. (Oct. 2013 – present); Executive Director, J.P. Morgan Investor Services (Apr. 2011 – Sept. 2013); Assistant Treasurer, Massachusetts Financial Service Investment Management (May 2005 – Mar. 2011). |

| Officers of the Trust (continued) | |

| Name,

Year of Birth, and Position(s) with the trust (Terms of office, and length of Time Served3) |

Principal Occupations During the Past Five Years |

| George

Pereira 1964 Senior Vice President and Chief Operating Officer (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust and Schwab Annuity Portfolios since 2004; Laudus Trust and Laudus Institutional Trust since 2006; Schwab Strategic Trust since 2009) |

Senior Vice President and Chief Financial Officer (Nov. 2004 – present), Chief Operating Officer (Jan. 2011 – present), Charles Schwab Investment Management, Inc.; Senior Vice President and Chief Operating Officer (Jan. 2016 – present), Treasurer and Chief Financial Officer, Laudus Funds (June 2006 – Dec. 2015); Treasurer and Principal Financial Officer, Schwab Funds (Nov. 2004 – Dec. 2015) and Schwab ETFs (Oct. 2009 – Dec. 2015); Director, Charles Schwab Worldwide Funds plc and Charles Schwab Asset Management (Ireland) Limited (Apr. 2005 – present). |

| Omar

Aguilar 1970 Senior Vice President and Chief Investment Officer – Equities (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust, Laudus Trust and Laudus Institutional Trust since 2011) |

Senior Vice President and Chief Investment Officer – Equities, Charles Schwab Investment Management, Inc. (Apr. 2011 – present); Senior Vice President and Chief Investment Officer – Equities, Schwab Funds, Laudus Funds and Schwab ETFs (June 2011 – present); Head of the Portfolio Management Group and Vice President of Portfolio Management, Financial Engines, Inc. (May 2009 – Apr. 2011); Head of Quantitative Equity, ING Investment Management (July 2004 – Jan. 2009). |

| Brett

Wander 1961 Senior Vice President and Chief Investment Officer – Fixed Income (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust, Laudus Trust and Laudus Institutional Trust since 2011) |

Senior Vice President and Chief Investment Officer – Fixed Income, Charles Schwab Investment Management, Inc. (Apr. 2011 – present); Senior Vice President and Chief Investment Officer – Fixed Income, Schwab Funds, Laudus Funds and Schwab ETFs (June 2011 – present); Senior Managing Director, Global Head of Active Fixed-Income Strategies, State Street Global Advisors (Jan. 2008 – Oct. 2010); Director of Alpha Strategies Loomis, Sayles & Company (Apr. 2006 – Jan. 2008). |

| David

Lekich 1964 Chief Legal Officer and Secretary, Schwab Funds and Schwab ETFs Vice President and Assistant Clerk, Laudus Funds (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust, Laudus Trust and Laudus Institutional Trust since 2011) |

Senior Vice President (Sept. 2011 – present), Vice President (Mar. 2004 – Sept. 2011), Charles Schwab & Co., Inc.; Senior Vice President and Chief Counsel (Sept. 2011 – present), Vice President (Jan. 2011 – Sept. 2011), Charles Schwab Investment Management, Inc.; Secretary (Apr. 2011 – present) and Chief Legal Officer (Dec. 2011 – present), Schwab Funds; Vice President and Assistant Clerk, Laudus Funds (Apr. 2011 – present); Secretary (May 2011 – present) and Chief Legal Officer (Nov. 2011 – present), Schwab ETFs. |

| Catherine

MacGregor 1964 Vice President and Assistant Secretary, Schwab Funds and Schwab ETFs Chief Legal Officer, Vice President and Clerk, Laudus Funds (Officer of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Laudus Trust and Laudus Institutional Trust since 2005; Schwab Strategic Trust since 2009) |

Vice President, Charles Schwab & Co., Inc., Charles Schwab Investment Management, Inc. (July 2005 – present); Vice President (Dec. 2005 – present), Chief Legal Officer and Clerk (Mar. 2007 – present), Laudus Funds; Vice President (Nov. 2005 – present) and Assistant Secretary (June 2007 – present), Schwab Funds; Vice President and Assistant Secretary, Schwab ETFs (Oct. 2009 – present). |

| 1 | Each Trustee shall hold office until the election and qualification of his or her successor, or until he or she dies, resigns or is removed. The retirement policy requires that each independent trustee retire by December 31 of the year in which the Trustee turns 74 or the Trustee’s twentieth year of service as an independent trustee on any trust in the Fund Complex, whichever occurs first. |

| 2 | Mr. Bettinger, Ms. Chandoha, and Mr. Martinetto are Interested Trustees because they own stock of The Charles Schwab Corporation, the parent company of the investment adviser. |

| 3 | The President, Treasurer and Secretary/Clerk hold office until their respective successors are chosen and qualified or until he or she sooner dies, resigns, is removed or becomes disqualified. Each of the other officers serves at the pleasure of the Board. |

211 Main Street, San Francisco, CA 94105

1-800-435-4000

© 2016 Charles Schwab & Co., Inc. All rights reserved.

Member SIPC®

Printed on recycled paper.

00162649

Table of Contents

Item 2: Code of Ethics.

| (a) | Registrant has adopted a code of ethics that applies to its principal executive officer, principal financial officer, and any other persons who perform a similar function, regardless of whether these individuals are employed by Registrant or a third party. |

| (c) | During the period covered by the report, no amendments were made to the provisions of this code of ethics. |

| (d) | During the period covered by the report, Registrant did not grant any waivers, including implicit waivers, from the provisions of this code of ethics. |

| (f)(1) | Registrant has filed this code of ethics as an exhibit pursuant to Item 12(a)(1) of Form N-CSR. |

Item 3: Audit Committee Financial Expert.

Registrant’s Board of Trustees has determined that Kiran M. Patel, Robert W. Burns and Kimberly S. Patmore, each currently serving on its audit committee, are each an “audit committee financial expert,” as such term is defined in Item 3 of Form N-CSR. Each member of Registrant’s audit committee is “independent” under the standards set forth in Item 3 of Form N-CSR.

The designation of each of Mr. Patel, Mr. Burns and Ms. Patmore as an “audit committee financial expert” pursuant to Item 3 of Form N-CSR does not (i) impose upon such individual any duties, obligations, or liability that are greater than the duties, obligations and liability imposed upon such individual as a member of Registrant’s audit committee or Board of Trustees in the absence of such designation; and (ii) affect the duties, obligations or liability of any other member of Registrant’s audit committee or Board of Trustees.

Item 4: Principal Accountant Fees and Services.

Registrant is composed of thirty-eight series. One series has a fiscal year-end of February 28, whose annual financial statements are reported in Item 1, thirty-four series have a fiscal year-end of October 31, and three series have a fiscal year-end of December 31. Principal accountant fees disclosed in Items 4(a)-(d) and 4(g) include fees billed for services rendered to the thirty-eight series live during 2016 and 2015, based on their respective 2015/2016 and 2014/2015 fiscal years, as applicable.

The following table presents fees billed by the principal accountant in each of the last two fiscal years for the services rendered to the Funds:

| (a) Audit Fees | (b) Audit-Related Fees1 | (c) Tax Fees2 | (d) All Other Fees3 | |||||||||||||||||||||||||||

| Fiscal Year 2015/2016 |

Fiscal Year 2014/2015 |

Fiscal Year 2015/2016 |

Fiscal Year 2014/2015 |

Fiscal Year 2015/2016 |

Fiscal Year 2014/2015 |

Fiscal Year 2015/2016 |

Fiscal Year 2014/2015 |

|||||||||||||||||||||||

| $ | 1,275,248 | $ | 1,419,234 | $ | 0 | $ | 0 | $ | 129,645 | $ | 101,456 | $ | 12,838 | $ | 19,357 | |||||||||||||||

Table of Contents

| 1 | The nature of the services includes assurance and related services reasonably related to the performance of the audit of financial statements not included in Audit Fees. |

| 2 | The nature of the services includes tax compliance, tax advice and tax planning. |

| 3 | The nature of the services include agreed upon procedures relating to Charles Schwab Investment Management., Inc.’s, (“CSIM”) expenses for purposes of Section 15(c) of the Investment Company Act of 1940. |

| (e) | (1) | Registrant’s audit committee does not have pre-approval policies and procedures as described in paragraph (c)(7) of Rule 2-01 of Regulation S-X. | ||

| (2) | There were no services described in each of paragraphs (b) through (d) above (including services required to be approved by Registrant’s audit committee pursuant to paragraph (c)(7)(ii) of Rule 2-01 of Regulation S-X) that were approved by Registrant’s audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. | |||

(f) Not applicable.

(g) Below are the aggregate non-audit fees billed in each of the last two fiscal years by Registrant’s principal accountant for services rendered to Registrant, to Registrant’s investment adviser, and to any entity controlling, controlled by, or under common control with Registrant’s investment adviser that provides ongoing services to Registrant.

| 2015/2016: $142,483 | 2014/2015: $120,813 |

Although not required to be included in the amounts disclosed under this paragraph (g) or any other paragraph of this Item 4, below are the aggregate fees billed in each of the last two fiscal years by Registrant’s principal accountant for tax compliance services rendered to U.S. Trust, an entity under common control with Registrant’s investment adviser that does not provide services to Registrant.

| (h) | During the past fiscal year, all non-audit services provided by Registrant’s principal accountant to either Registrant’s investment adviser or to any entity controlling, controlled by, or under common control with Registrant’s investment adviser that provides ongoing services to Registrant were pre-approved. Included in the audit committee’s pre-approval was the review and consideration as to whether the provision of these non-audit services is compatible with maintaining the principal accountant’s independence. |

Item 5: Audit Committee of Listed Registrants.

Not applicable.

Item 6: Schedule of Investments.

The schedules of investments are included as part of the report to shareholders filed under Item 1 of this Form.

Table of Contents

Item 7: Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8: Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

| Item 9: | Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers. |

Not applicable.

Item 10: Submission of Matters to a Vote of Security Holders.

Not applicable.

Item 11: Controls and Procedures.

| (a) | Based on their evaluation of Registrant’s disclosure controls and procedures, as of a date within 90 days of the filing date, Registrant’s Chief Executive Officer, Marie Chandoha and Registrant’s Principal Financial Officer, Mark Fischer, have concluded that Registrant’s disclosure controls and procedures are: (i) reasonably designed to ensure that information required to be disclosed in this report is appropriately communicated to Registrant’s officers to allow timely decisions regarding disclosures required in this report; (ii) reasonably designed to ensure that information required to be disclosed in this report is recorded, processed, summarized and reported in a timely manner; and (iii) are effective in achieving the goals described in (i) and (ii) above. |

| (b) | During the second fiscal quarter of the period covered by this report, there have been no changes in Registrant’s internal control over financial reporting that the above officers believe to have materially affected, or to be reasonably likely to materially affect, Registrant’s internal control over financial reporting. |

Item 12: Exhibits.

| (a) | (1) | Registrant’s code of ethics (that is the subject of the disclosure required by Item 2(a)) is attached. | ||

| (2) | Separate certifications for Registrant’s principal executive officer and principal financial officer, as required by Rule 30a-2(a) under the 1940 Act, are attached. | |||

| (3) | Not applicable. | |||

| (b) | A certification for Registrant’s principal executive officer and principal financial officer, as required by Rule 30a-2(b) under the 1940 Act, is attached. This certification is being | |||

Table of Contents

| furnished to the Securities and Exchange Commission solely pursuant to 18 U.S.C. section 1350 and is not being filed as part of the Form N-CSR with the Commission. | ||||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) Schwab Capital Trust | ||

| By: | /s/ Marie Chandoha | |

| Marie Chandoha | ||

| Chief Executive Officer | ||

| Date: | 4/12/16 | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By: | /s/ Marie Chandoha | |

| Marie Chandoha | ||

| Chief Executive Officer | ||

| Date: | 4/12/16 | |

| By: | /s/ Mark Fischer | |

| Mark Fischer | ||

| Chief Financial Officer | ||

| Date: | 4/5/16 | |