Filed by 3TEC Energy Corporation Pursuant to Rule 425 of the Securities

Act of 1933 and deemed filed pursuant to Rule 14a-12 of the

Securities Exchange Act of 1934

Subject Company: 3TEC Energy Corporation

Registration Statement No.: 333-103149

PXP

Plains Exploration & Production Company

Investor Presentations

Boston, MA & New York, NY

May 19-21, 2003

Forward Looking Statements and Additional Information

Except for the historical information contained herein, the matters discussed in this presentation are forward-looking statements that involve certain risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties include, among other things, economic conditions, oil and gas price volatility, the success of risk management activities, uncertainties inherent in the the exploration for and development and production of oil and gas and in estimating reserves, regulatory changes and other factors discussed in PXP’s filings with the Securities and Exchange Commission.

Investors and security holders are urged to read the proxy statement/prospectus that will be included in the Registration Statement on Form S-4 to be filed with the SEC in connection with the proposed merger. PXP and 3TEC will file the proxy statement/prospectus with the SEC. Investors and security holders may obtain a free copy of the proxy statement/prospectus (when available) and other documents filed by PXP and 3TEC with the SEC at the SEC’s web site at www.sec.gov. The proxy statement/prospectus and such other documents (relating to PXP) may also be obtained for free from PXP by directing such request to: Plains Exploration & Production Company, 500 Dallas, Suite 700 Houston, TX 77002, Attention: Joanna Pankey; telephone: (713) 739-6700; e-mail: jpankey@plainsxp.com. The proxy statement/prospectus and such other documents (relating to 3TEC) may also be obtained for free from 3TEC by directing such request to: 3TEC Energy Corporation, 700 Milam, Suite 1100, Houston, Texas 77002.

PXP, its directors, executive officers and certain members of management and employees may be considered “participants in the solicitation” of proxies from PXP’s stockholders in connection with the merger. Information regarding such persons and a description of their interests in the merger will be contained in the Registration Statement on Form S-4 when it is filed.

3TEC, its directors, executive officers and certain members of management and employees may be considered “participants in the solicitation” in connection with the merger. Information regarding such persons and a description of their interests in the merger will be contained in the Registration Statement on Form S-4 when it is filed.

| PXP |

2 | |

Participants

Jim Flores

Chairman & CEO

John Raymond

President & COO

Stephen Thorington

Executive Vice President & CFO

Winston Talbert

Vice President – Finance & Investor Relations

| PXP |

3 | |

3Tec Transaction Overview

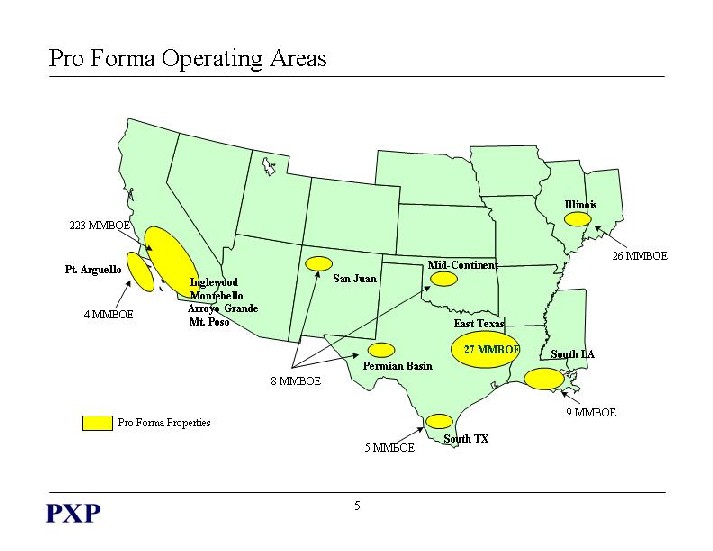

Pro Forma Operating Areas

[GRAPHIC]

| PXP |

5 | |

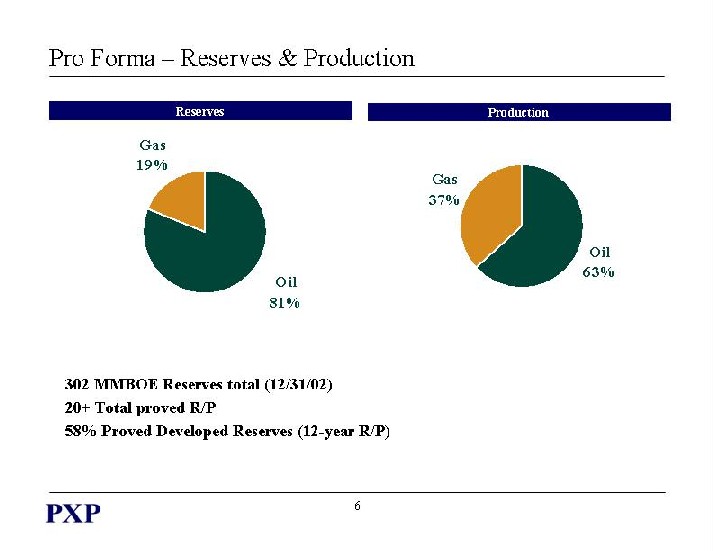

Pro Forma – Reserves & Production

| Reserves |

Production | |

| Gas 19% |

Gas 37% | |

| Oil 81% |

Oil 63% |

302 MMBOE Reserves total (12/31/02)

20+ Total proved R/P

58% Proved Developed Reserves (12-year R/P)

| PXP |

6 | |

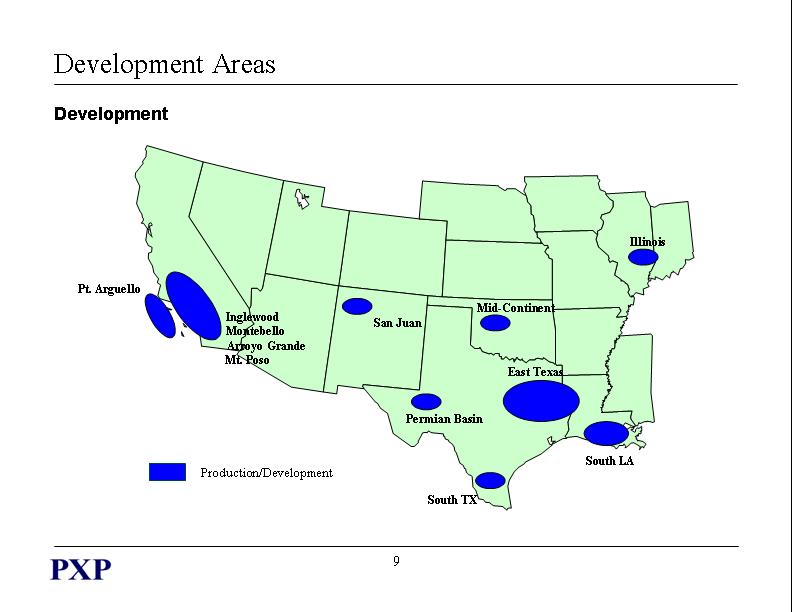

PXP Pro Forma Operational Strategy

| Target % of Budget | ||||

| ¨ Development: East Texas Gas & California Onshore Oil |

50% | |||

| ¨ Exploitation: South Louisiana Gas & Inglewood Deep Oil |

35% | |||

| ¨ Exploration: South Louisiana Gas & Rocky Point Oil |

15% | |||

| PXP |

7 | |

Operational Strategy Detail

| PXP |

8 | |

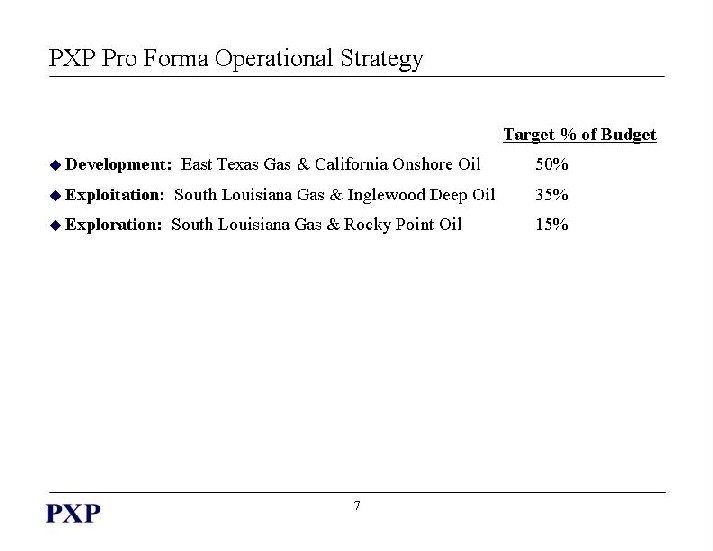

Development Areas

Development

[GRAPHIC]

| PXP |

9 | |

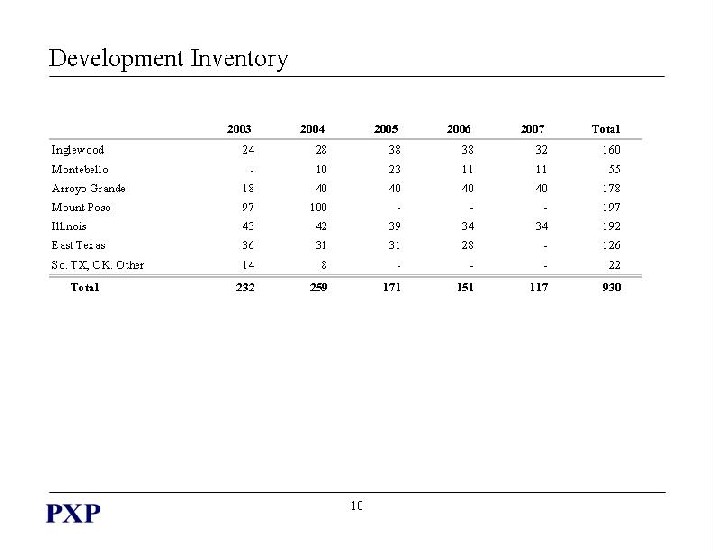

Development Inventory

| 2003 |

2004 |

2005 |

2006 |

2007 |

Total | |||||||

| Inglewood |

24 |

28 |

38 |

38 |

32 |

160 | ||||||

| Montebello |

— |

10 |

23 |

11 |

11 |

55 | ||||||

| Arroyo Grande |

18 |

40 |

40 |

40 |

40 |

178 | ||||||

| Mount Poso |

97 |

100 |

— |

— |

— |

197 | ||||||

| Illinois |

43 |

42 |

39 |

34 |

34 |

192 | ||||||

| East Texas |

36 |

31 |

31 |

28 |

— |

126 | ||||||

| So. TX, OK. Other |

14 |

8 |

— |

— |

— |

22 | ||||||

| Total |

232 |

259 |

171 |

151 |

117 |

930 |

| PXP |

10 | |

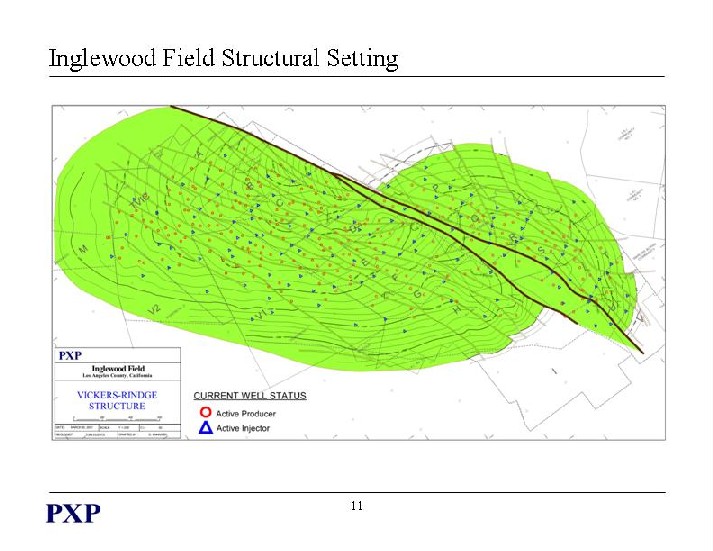

Inglewood Field Structural Setting

[GRAPHIC]

| PXP |

11 | |

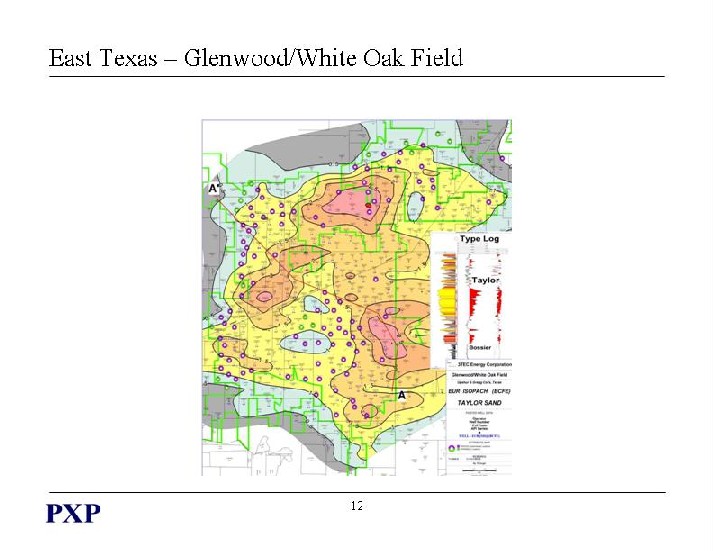

East Texas – Glenwood/White Oak Field

[GRAPHIC]

| PXP |

12 | |

Pro Forma Activity Areas

Exploitation

[GRAPHIC]

| PXP |

13 | |

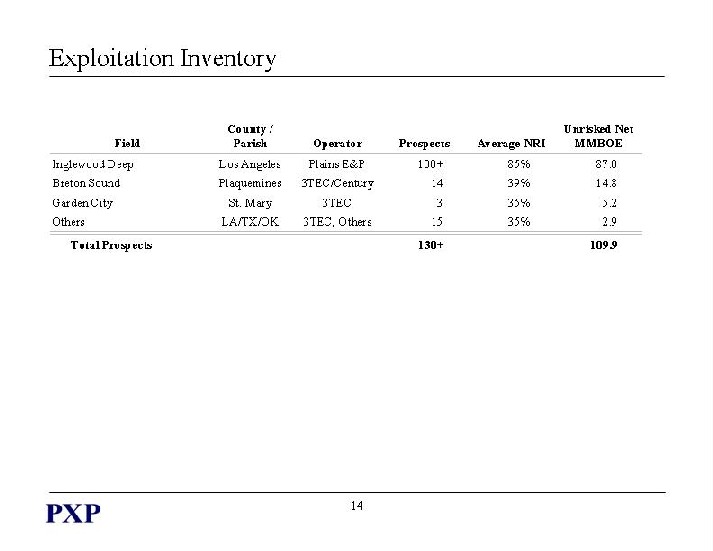

Exploitation Inventory

| Field |

County / Parish |

Operator |

Prospects |

Average NRI |

Unrisked Net MMBOE | ||||||

| Inglewood Deep |

Los Angeles |

Plains E&P |

100+ |

85 |

% |

87.0 | |||||

| Breton Sound |

Plaquemines |

3TEC/Century |

14 |

39 |

% |

14.8 | |||||

| Garden City |

St. Mary |

3TEC |

3 |

35 |

% |

5.2 | |||||

| Others |

LA/TX/OK |

3TEC, Others |

15 |

35 |

% |

2.9 | |||||

| Total Prospects |

130+ |

109.9 |

| PXP |

14 | |

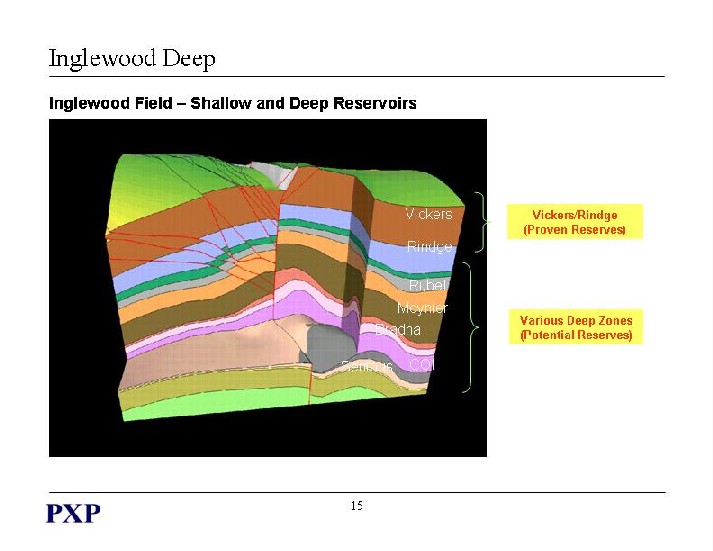

Inglewood Deep

Inglewood Field – Shallow and Deep Reservoirs

| Vickers/Rindge (Proven Reserves) | ||

| [GRAPHICS] |

||

| Various Deep Zones (Potential Reserves) |

| PXP |

15 | |

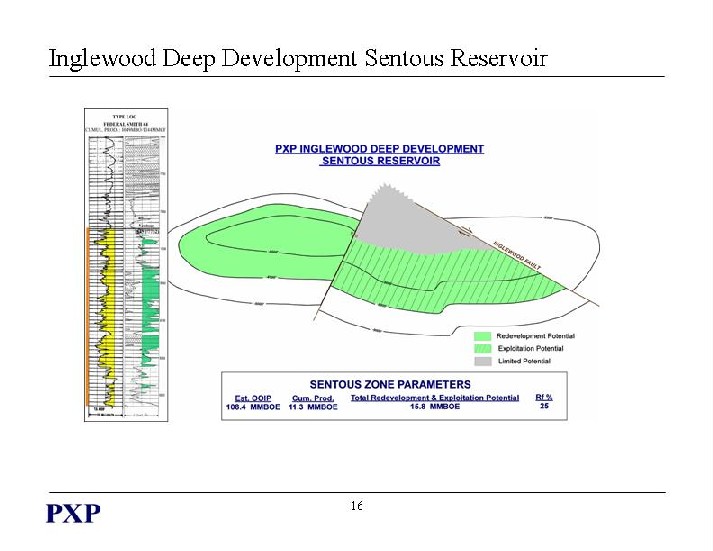

Inglewood Deep Development Sentous Reservoir

[GRAPHIC]

| PXP |

16 | |

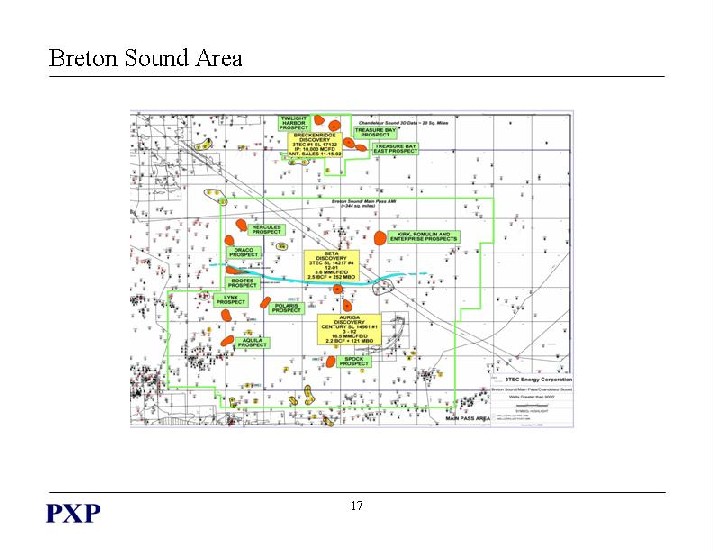

Breton Sound Area

[GRAPHIC]

| PXP |

17 | |

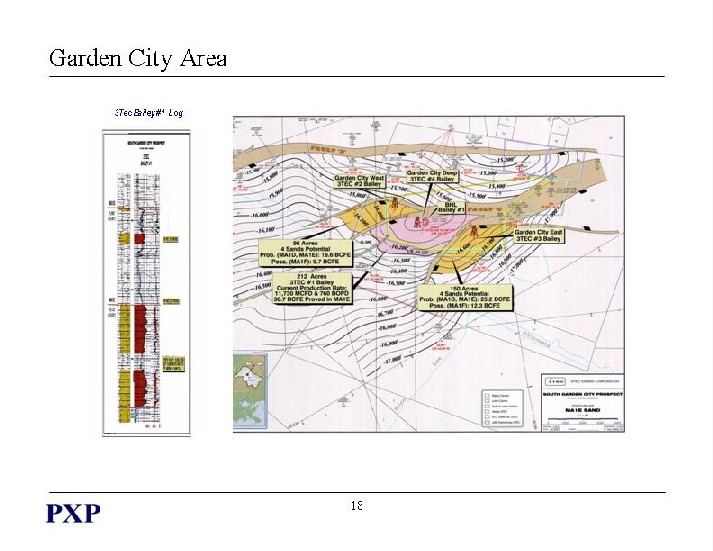

Garden City Area

[GRAPHIC]

| PXP |

18 | |

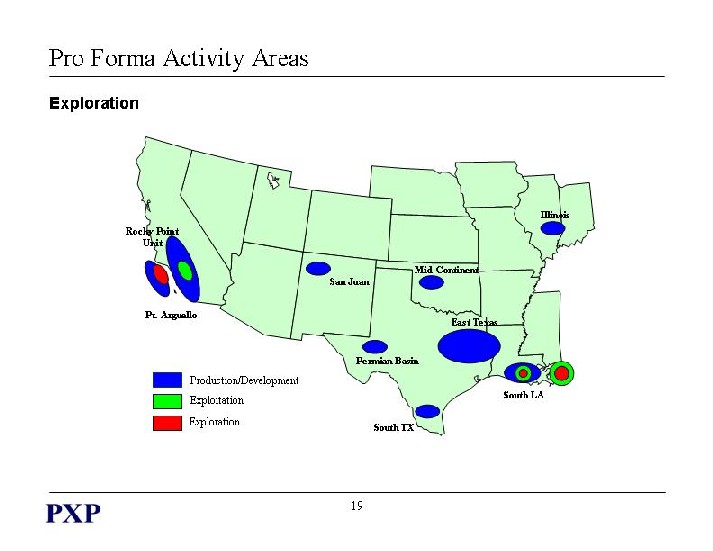

Pro Forma Activity Areas

Exploration

[GRAPHIC]

| Production/Development |

||

| Exploitation |

||

| Exploration |

| PXP |

19 | |

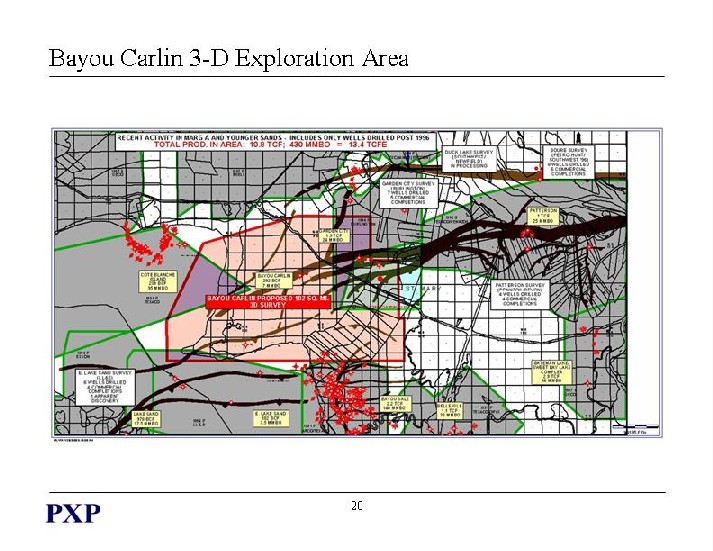

Bayou Carlin 3-D Exploration Area

[GRAPHIC]

| PXP |

20 | |

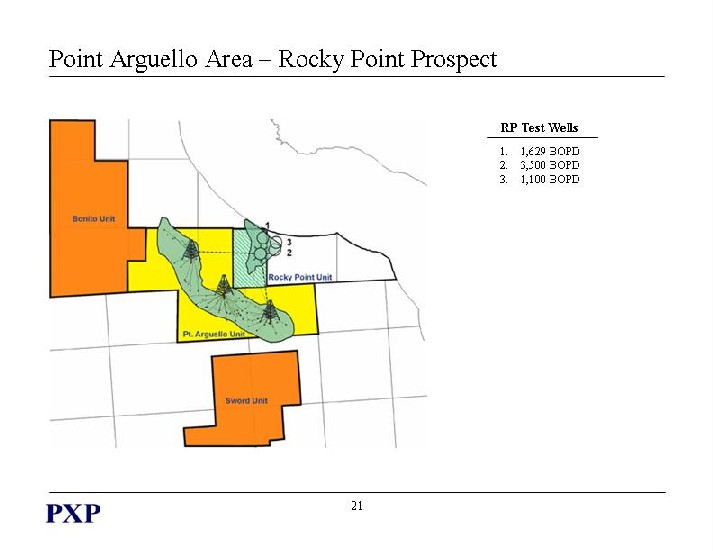

Point Arguello Area – Rocky Point Prospect

| RP Test Wells | ||

| 1. 1,629 BOPD | ||

| [GRAPHIC] |

2. 3,500 BOPD | |

| 3. 1,100 BOPD |

| PXP |

21 | |

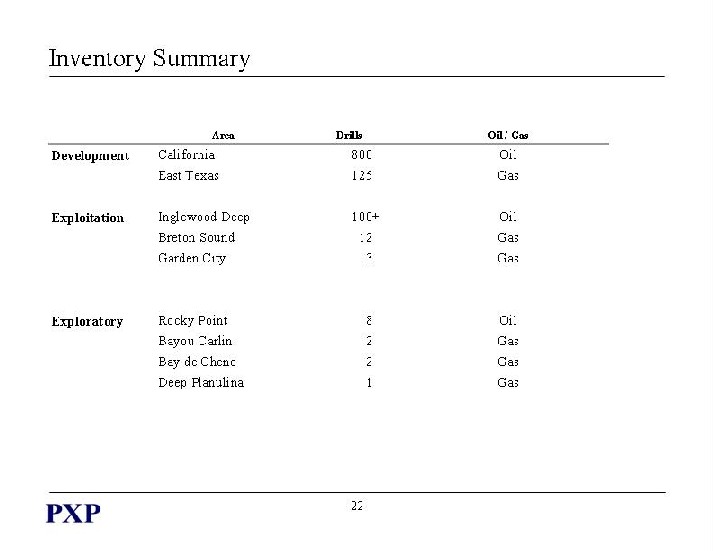

Inventory Summary

| Area |

Drills |

Oil / Gas | |||||

| Development |

California |

800 |

|

Oil | |||

| East Texas |

125 |

|

Gas | ||||

| Exploitation |

Inglewood Deep |

100 |

+ |

Oil | |||

| Breton Sound |

12 |

|

Gas | ||||

| Garden City |

3 |

|

Gas | ||||

| Exploratory |

Rocky Point |

8 |

|

Oil | |||

| Bayou Carlin |

2 |

|

Gas | ||||

| Bay de Chene |

2 |

|

Gas | ||||

| Deep Planulina |

1 |

|

Gas |

| PXP |

22 | |

PXP Financial Overview

Financing Strategy

| ¨ | Maintain well-capitalized, liquid balance sheet |

| – | BB-/Ba3 stable outlook senior implied rating; B2/B stable outlook senior subordinated rating |

| – | Improving coverage ratios |

| ¨ | Apply free cash flow to reduce bank debt |

| ¨ | 2004 target mid 40% debt/total capital ratio |

| ¨ | Continue hedging program to manage commodity risk |

| PXP |

24 | |

Pro Forma Capitalization

| As of 3/31/03 | |||||||||

| PXP Actual |

Adjustments |

Pro Forma | |||||||

| ($ in millions) |

|||||||||

| Cash and cash equivalents |

$ |

1.0 |

$ |

1.8 |

$ |

2.8 | |||

| Total Debt (Including Current Maturities): |

|||||||||

| Bank Debt / Credit Facility |

$ |

32.5 |

$ |

218.8 |

$ |

251.3 | |||

| 8.75% Senior Subordinated Notes |

|

200.0 |

|

75.0 |

|

275.0 | |||

| Other |

|

1.0 |

|

— |

|

1.0 | |||

| TOTAL DEBT |

$ |

233.5 |

$ |

293.8 |

$ |

527.3 | |||

| Common Shareholders’ Equity |

|

192.9 |

|

150.9 |

|

343.8 | |||

| TOTAL BOOK CAPITALIZATION |

$ |

426.4 |

$ |

444.7 |

$ |

871.1 | |||

| PXP |

25 | |

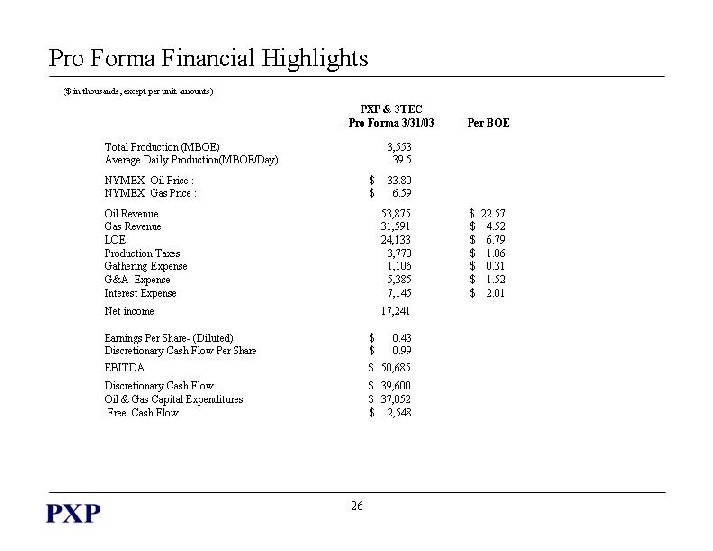

Pro Forma Financial Highlights

| ($ in thousands, except per unit amounts) |

||||||

| PXP & 3TEC Pro Forma 3/31/03 |

Per BOE | |||||

| Total Production (MBOE) |

|

3,553 |

||||

| Average Daily Production (MBOE/Day) |

|

39.5 |

||||

| NYMEX Oil Price: |

$ |

33.80 |

||||

| NYMEX Gas Price: |

$ |

6.59 |

||||

| Oil Revenue |

|

53,875 |

$ |

22.57 | ||

| Gas Revenue |

|

31,591 |

$ |

4.52 | ||

| LOE |

|

24,133 |

$ |

6.79 | ||

| Production Taxes |

|

3,770 |

$ |

1.06 | ||

| Gathering Expense |

|

1,106 |

$ |

0.31 | ||

| G&A Expense |

|

5,385 |

$ |

1.52 | ||

| Interest Expense |

|

7,145 |

$ |

2.01 | ||

| Net income |

|

17,241 |

||||

| Earnings Per Share- (Diluted) |

$ |

0.43 |

||||

| Discretionary Cash Flow Per Share |

$ |

0.99 |

||||

| EBITDA |

$ |

50,685 |

||||

| Discretionary Cash Flow |

$ |

39,600 |

||||

| Oil & Gas Capital Expenditures |

$ |

37,052 |

||||

| Free Cash Flow |

$ |

2,548 |

||||

| PXP |

26 | |

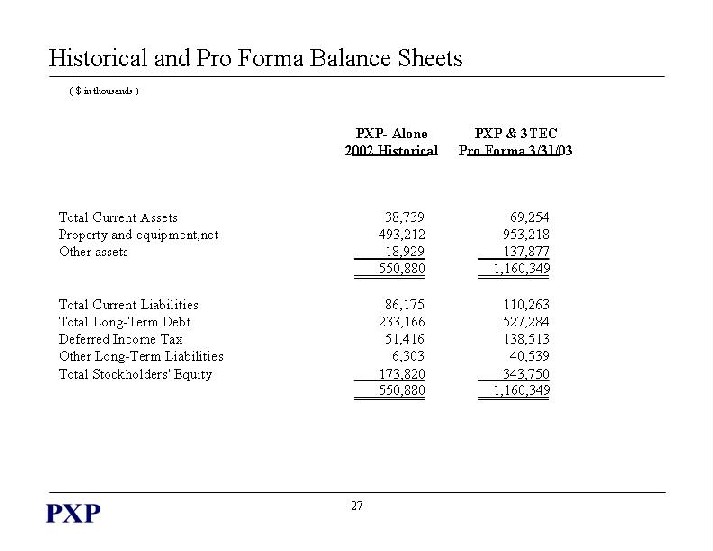

Historical and Pro Forma Balance Sheets

| ( $ in thousands ) |

||||

| PXP-Alone 2002 Historical |

PXP & 3TEC Pro Forma 3/31/03 | |||

| Total Current Assets |

38,739 |

69,254 | ||

| Property and equipment, net |

493,212 |

953,218 | ||

| Other assets |

18,929 |

137,877 | ||

| 550,880 |

1,160,349 | |||

| Total Current Liabilities |

86,175 |

110,263 | ||

| Total Long-Term Debt |

233,166 |

527,284 | ||

| Deferred Income Tax |

51,416 |

138,513 | ||

| Other Long-Term Liabilities |

6,303 |

40,539 | ||

| Total Stockholders’ Equity |

173,820 |

343,750 | ||

| 550,880 |

1,160,349 | |||

| PXP |

27 | |

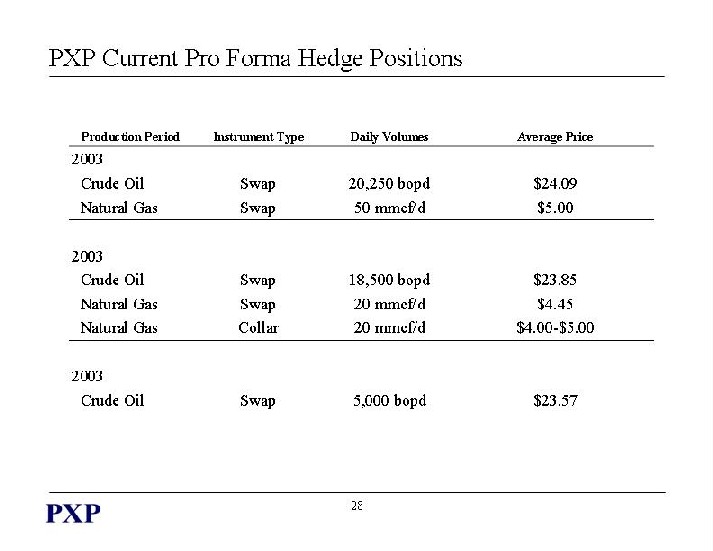

PXP Current Pro Forma Hedge Positions

| Production Period |

Instrument Type |

Daily Volumes |

Average Price | |||

| 2003 |

||||||

| Crude Oil |

Swap |

20,250 bopd |

$24.09 | |||

| Natural Gas |

Swap |

50 mmcf/d |

$5.00 | |||

| 2003 |

||||||

| Crude Oil |

Swap |

18,500 bopd |

$23.85 | |||

| Natural Gas |

Swap |

20 mmcf/d |

$4.45 | |||

| Natural Gas |

Collar |

20 mmcf/d |

$4.00-$5.00 | |||

| 2003 |

||||||

| Crude Oil |

Swap |

5,000 bopd |

$23.57 |

| PXP |

28 | |

2003 Outlook

| Pro Forma Combined Full Year 2003 |

|||

| Production: |

|||

| MBOE per day |

39.4-41.0 |

| |

| % Oil |

67 |

% | |

| % Gas |

33 |

% | |

| Differential to NYMEX (pre-hedge) Oil ($ per bbl) |

$4.00-$ 4.35 |

| |

| Operating Cost per BOE: |

|||

| Production Expense |

$6.85-$ 7.00 |

| |

| Production and ad valorem taxes |

$1.15-$ 1.20 |

| |

| General & Administrative |

$1.40-$ 1.50 |

| |

| Expected Capital Expenditure (millions) |

$ 115-$ 135 |

|

| PXP |

29 | |

PXP Summary

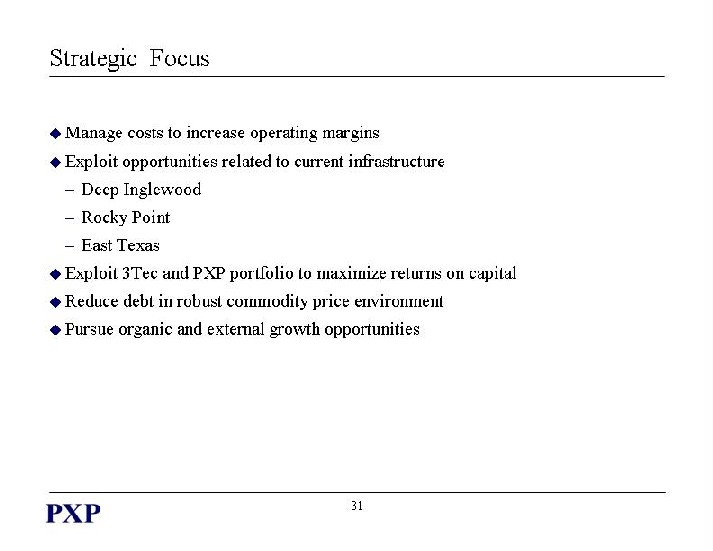

Strategic Focus

| ¨ | Manage costs to increase operating margins |

| ¨ | Exploit opportunities related to current infrastructure |

| – | Deep Inglewood |

| – | Rocky Point |

| – | East Texas |

| ¨ | Exploit 3Tec and PXP portfolio to maximize returns on capital |

| ¨ | Reduce debt in robust commodity price environment |

| ¨ | Pursue organic and external growth opportunities |

| PXP |

31 | |

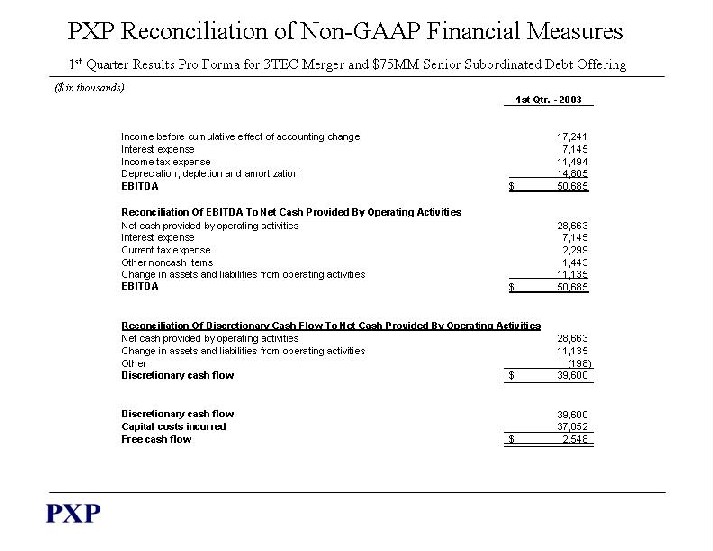

PXP Reconciliation of Non-GAAP Financial Measures

1st Quarter Results Pro Forma for 3TEC Merger and $75MM Senior Subordinated Debt Offering

| ($ in thousands) |

||||

| 1st Qtr.—2003 |

||||

| Income before cumulative effect of accounting change |

|

17,241 |

| |

| Interest expense |

|

7,145 |

| |

| Income tax expense |

|

11,494 |

| |

| Depreciation, depletion and amortization |

|

14,805 |

| |

| EBITDA |

$ |

50,685 |

| |

| Reconciliation Of EBITDA To Net Cash Provided By Operating Activities |

||||

| Net cash provided by operating activities |

|

28,663 |

| |

| Interest expense |

|

7,145 |

| |

| Current tax expense |

|

2,299 |

| |

| Other noncash items |

|

1,443 |

| |

| Change in assets and liabilities from operating activities |

|

11,135 |

| |

| EBITDA |

$ |

50,685 |

| |

| Reconciliation Of Discretionary Cash Flow To Net Cash Provided By Operating Activities |

||||

| Net cash provided by operating activities |

|

28,663 |

| |

| Change in assets and liabilities from operating activities |

|

11,135 |

| |

| Other |

|

(198 |

) | |

| Discretionary cash flow |

$ |

39,600 |

| |

| Discretionary cash flow |

|

39,600 |

| |

| Capital costs incurred |

|

37,052 |

| |

| Free cash flow |

$ |

2,548 |

| |

| PXP |

32 | |

PXP

Plains Exploration & Production Company

Investor Presentations

Boston, MA & New York, NY

May 19-21, 2003

33

On February 12, 2003, PXP and 3TEC filed a joint proxy statement/prospectus with the Securities and Exchange Commission. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS BECAUSE IT CONTAINS IMPORTANT INFORMATION ABOUT PXP AND 3TEC AND THE PROPOSED TRANSACTION. The proxy statement/prospectus was sent to security holders of PXP and 3TEC on May 5, 2003. Investors and security holders may obtain a free copy of the proxy statement/prospectus and other documents filed by PXP and 3TEC with the SEC at the SEC’s web site at www.sec.gov. The proxy statement/prospectus and such other documents (relating to PXP) may also be obtained for free from PXP by directing such request to: Plains Exploration & Production Company, 500 Dallas, Suite 700 Houston, Tx 77002, Attention: Joanna Pankey; telephone: (713) 739-6700; e-mail: jpankey@plainsxp.com. The proxy statement/prospectus and such other documents (relating to 3TEC) may also be obtained for free from 3TEC by directing such request to: 3TEC Energy Corporation, 700 Milam, Suite 1100, Houston, Texas 77002, Attention: Investor Relations; telephone: (713) 821-7100.

PXP and 3TEC and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of PXP and 3TEC in connection with the merger. Information regarding the persons who may, under SEC rules, be considered to be participants in the solicitation of PXP’s and 3TEC’s stockholders is set forth in the joint proxy statement / prospectus that forms a part of the Registration Statement on Form S-4, as amended, that PXP filed on May 1, 2003.

34