|

|

|

Registration Nos. 033-49581/811-7059

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-1A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 /X/

Post-Effective Amendment No. 46 /X/

and/or

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 /X/

Amendment No. 47 /X/

Exact Name of Registrant as Specified in Charter

100 East Pratt Street, Baltimore, Maryland 21202

Address of

Principal Executive Offices

410-345-2000

Registrant’s Telephone Number, Including Area Code

David Oestreicher

100

East Pratt Street, Baltimore, Maryland 21202

Name and Address of Agent for Service

It is proposed that this filing will become effective (check appropriate box):

/X/ Immediately upon filing pursuant to paragraph (b)

// On (date) pursuant to paragraph (b)

// 60 days after filing pursuant to paragraph (a)(1)

// On (date) pursuant to paragraph (a)(1)

// 75 days after filing pursuant to paragraph (a)(2)

// On (date) pursuant to paragraph (a)(2) of Rule 485

Page 2

If appropriate, check the following box:

// This post-effective amendment designates a new effective date for a previously filed post-effective amendment.

Page 3

EXHIBITS

|

Exhibit |

Exhibit No. |

|

XBRL Instance Document |

EX-101.INS |

|

XBRL Taxonomy Extension Schema Document |

EX-101.SCH |

|

XBRL Taxonomy Extension Calculation Linkbase Document |

EX-101.CAL |

|

XBRL Taxonomy Extension Definition Linkbase Document |

EX-101.DEF |

|

XBRL Taxonomy Extension Labels Linkbase Document |

EX-101.LAB |

|

XBRL Taxonomy Extension Presentation Linkbase Document |

EX-101.PRE |

Page 4

Signatures

Pursuant to the requirements of the Securities Act of 1933, as amended, and the Investment Company Act of 1940, as amended, the Registrant certifies that it meets all of the requirements for effectiveness of this Registration Statement pursuant to Rule 485(b) under the Securities Act of 1933 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, duly authorized, in the City of Baltimore, State of Maryland, this December 15, 2020.

T. ROWE PRICE BLUE CHIP GROWTH FUND, INC.

/s/David Oestreicher

By: David Oestreicher

Director and Executive Vice President

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed below by the following persons in the capacities and on the dates indicated:

|

Signature |

Title |

Date |

|

/s/David Oestreicher |

Director (Principal Executive Officer) |

December 15, 2020 |

|

David Oestreicher |

and Executive Vice President |

|

|

/s/Alan S. Dupski |

Treasurer and Vice President |

December 15, 2020 |

|

Alan S. Dupski |

(Principal Financial Officer |

|

|

and Principal Accounting Officer) |

||

|

* |

||

|

Teresa Bryce Bazemore |

Director |

December 15, 2020 |

|

* |

||

|

Ronald J. Daniels |

Director |

December 15, 2020 |

|

* |

||

|

Bruce W. Duncan |

Director |

December 15, 2020 |

|

* |

||

|

Robert J. Gerrard, Jr. |

Chairman of the Board |

December 15, 2020 |

|

and Director |

||

|

* |

||

|

Paul F. McBride |

Director |

December 15, 2020 |

|

* |

||

|

Cecilia E. Rouse |

Director |

December 15, 2020 |

|

* |

||

|

John G. Schreiber |

Director |

December 15, 2020 |

Page 5

|

/s/Robert W. Sharps |

Director and Vice President |

December 15, 2020 |

|

Robert W. Sharps |

||

|

*/s/David Oestreicher |

Attorney-In-Fact |

December 15, 2020 |

|

David Oestreicher |

Page 6

T. ROWE PRICE BALANCED FUND, INC.

T. ROWE PRICE BLUE CHIP GROWTH FUND, INC.

T. ROWE PRICE CAPITAL APPRECIATION FUND, INC.

T. ROWE PRICE CAPITAL OPPORTUNITY FUND, INC.

T. ROWE PRICE COMMUNICATIONS & TECHNOLOGY FUND, INC.

T. ROWE PRICE CORPORATE INCOME FUND, INC.

T. ROWE PRICE CREDIT OPPORTUNITIES FUND, INC.

T. ROWE PRICE DIVERSIFIED MID-CAP GROWTH FUND, INC.

T. ROWE PRICE DIVIDEND GROWTH FUND, INC.

T. ROWE PRICE EQUITY INCOME FUND, INC.

T. ROWE PRICE EQUITY SERIES, INC.

T. ROWE PRICE FINANCIAL SERVICES FUND, INC.

T. ROWE PRICE FIXED INCOME SERIES, INC.

T. ROWE PRICE FLOATING RATE FUND, INC.

T. ROWE PRICE GLOBAL ALLOCATION FUND, INC.

T. ROWE PRICE GLOBAL MULTI-SECTOR BOND FUND, INC.

T. ROWE PRICE GLOBAL REAL ESTATE FUND, INC.

T. ROWE PRICE GLOBAL TECHNOLOGY FUND, INC.

T. ROWE PRICE GNMA FUND, INC.

T. ROWE PRICE GOVERNMENT MONEY FUND, INC.

T. ROWE PRICE GROWTH & INCOME FUND, INC.

T. ROWE PRICE GROWTH STOCK FUND, INC.

T. ROWE PRICE HEALTH SCIENCES FUND, INC.

T. ROWE PRICE HIGH YIELD FUND, INC.

T. ROWE PRICE INDEX TRUST, INC.

T. ROWE PRICE INFLATION PROTECTED BOND FUND, INC.

T. ROWE PRICE INSTITUTIONAL EQUITY FUNDS, INC.

T. ROWE PRICE INSTITUTIONAL INCOME FUNDS, INC.

T. ROWE PRICE INSTITUTIONAL INTERNATIONAL FUNDS, INC.

T. ROWE PRICE INTERMEDIATE TAX-FREE HIGH YIELD FUND, INC.

T. ROWE PRICE INTERNATIONAL FUNDS, INC.

T. ROWE PRICE INTERNATIONAL INDEX FUND, INC.

T. ROWE PRICE INTERNATIONAL SERIES, INC.

T. ROWE PRICE LIMITED DURATION INFLATION FOCUSED BOND FUND, INC.

T. ROWE PRICE MID-CAP GROWTH FUND, INC.

T. ROWE PRICE MID-CAP VALUE FUND, INC.

T. ROWE PRICE MULTI-SECTOR ACCOUNT PORTFOLIOS, INC.

T. ROWE PRICE MULTI-STRATEGY TOTAL RETURN FUND, INC.

T. ROWE PRICE NEW AMERICA

GROWTH FUND, INC.

T. ROWE PRICE NEW ERA FUND, INC.

T. ROWE PRICE NEW HORIZONS FUND, INC.

T. ROWE PRICE NEW INCOME FUND, INC.

T. ROWE PRICE PERSONAL STRATEGY FUNDS, INC.

T. ROWE PRICE QUANTITATIVE MANAGEMENT FUNDS, INC.

T. ROWE PRICE REAL ASSETS FUND, INC.

T. ROWE PRICE REAL ESTATE FUND, INC.

T. ROWE PRICE RESERVE INVESTMENT FUNDS, INC.

T. ROWE PRICE RETIREMENT FUNDS, INC.

T. ROWE PRICE SCIENCE & TECHNOLOGY FUND, INC.

T. ROWE PRICE SHORT-TERM BOND FUND, INC.

Page 7

T. ROWE PRICE SMALL-CAP STOCK FUND, INC.

T. ROWE PRICE SMALL-CAP VALUE FUND, INC.

T. ROWE PRICE SPECTRUM FUND, INC.

T. ROWE PRICE STATE TAX-FREE FUNDS, INC.

T. ROWE PRICE SUMMIT FUNDS, INC.

T. ROWE PRICE SUMMIT MUNICIPAL FUNDS, INC.

T. ROWE PRICE TAX-EFFICIENT FUNDS, INC.

T. ROWE PRICE TAX-EXEMPT MONEY FUND, INC.

T. ROWE PRICE TAX-FREE HIGH YIELD FUND, INC.

T. ROWE PRICE TAX-FREE INCOME FUND, INC.

T. ROWE PRICE TAX-FREE SHORT-INTERMEDIATE FUND, INC.

T. ROWE PRICE TOTAL RETURN FUND, INC.

T. ROWE PRICE U.S. BOND ENHANCED INDEX FUND, INC.

T. ROWE PRICE U.S. LARGE-CAP CORE FUND, INC.

T. ROWE PRICE U.S. TREASURY FUNDS, INC.

T. ROWE PRICE VALUE FUND, INC.

POWER OF ATTORNEY

RESOLVED, that the Corporation does hereby constitute and authorize Darrell N. Braman, Catherine D. Mathews, Margery K. Neale, and David Oestreicher, and each of them individually, their true and lawful attorneys and agents to take any and all action and execute any and all instruments which said attorneys and agents may deem necessary or advisable to enable the Corporation to comply with the Securities Act of 1933, as amended, and the Investment Company Act of 1940, as amended, and any rules, regulations, orders or other requirements of the United States Securities and Exchange Commission thereunder, in connection with the registration under the Securities Act of 1933, as amended, of shares of the Corporation, to be offered by the Corporation, and the registration of the Corporation under the Investment Company Act of 1940, as amended, including specifically, but without limitation of the foregoing, power and authority to sign the name of the Corporation on its behalf, and to sign the names of each of such directors and officers on his or her behalf as such director or officer to any (i) Registration Statement on Form N-1A or N-14 of the Corporation filed with the Securities and Exchange Commission under the Securities Act of 1933, as amended; (ii) Registration Statement on Form N-1A or N-14 of the Corporation under the Investment Company Act of 1940, as amended; (iii) amendment or supplement (including, but not limited to, Post-Effective Amendments adding additional series or classes of the Corporation) to said Registration Statement; and (iv) instruments or documents filed or to be filed as a part of or in connection with such Registration Statement, including Articles Supplementary, Articles of Amendment, and other instruments with respect to the Articles of Incorporation of the Corporation.

IN WITNESS WHEREOF, the above named Corporations have caused these presents to be signed and the same attested by its Assistant Secretary, each thereunto duly authorized by its Board of Directors, and each of the undersigned has hereunto set his or her hand and seal as of the day set opposite his or her name.

Page 8

|

/s/David Oestreicher |

||

|

David Oestreicher /s/Catherine D. Mathews |

Executive Vice President (Principal Executive Officer) Director |

April 29, 2019 |

|

Catherine D. Mathews /s/Teresa Bryce Bazemore |

Treasurer (Principal Financial Officer) Vice President |

April 29, 2019 |

|

Teresa Bryce Bazemore /s/Ronald J. Daniels |

Director |

April 29, 2019 |

|

Ronald J. Daniels /s/Bruce W. Duncan |

Director |

April 29, 2019 |

|

Bruce W. Duncan /s/Robert J. Gerrard, Jr. |

Director |

April 29, 2019 |

|

Robert J. Gerrard, Jr. /s/Paul F. McBride |

Director |

April 29, 2019 |

|

Paul F. McBride /s/Cecilia E. Rouse |

Director |

April 29, 2019 |

|

Cecilia E. Rouse /s/John G. Schreiber |

Director |

April 29, 2019 |

|

John G. Schreiber /s/Robert W. Sharps |

Director |

April 29, 2019 |

|

Robert W. Sharps |

Director |

April 29, 2019 |

(Signatures Continued)

Page 9

ATTEST:

/s/Shannon Hofher Rauser

|

Shannon Hofher Rauser, Assistant Secretary |

|

|

|

|||

|

PROSPECTUS

|

||||

|

T. ROWE PRICE |

||||

|

Blue Chip Growth Fund |

||||

|

TRBCX TBCIX PABGX RRBGX TRZBX |

Investor Class I Class Advisor Class R Class Z Class |

|||

|

The Securities and Exchange Commission (SEC) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense. Beginning on January 1, 2021, as permitted by SEC regulations, paper copies of the T. Rowe Price funds’ annual and semiannual shareholder reports will no longer be mailed, unless you specifically request them. Instead, shareholder reports will be made available on the funds’ website (troweprice.com/prospectus), and you will be notified by mail with a website link to access the reports each time a report is posted to the site. If you already elected to receive reports electronically, you will not be affected by this change and need not take any action. At any time, shareholders who invest directly in T. Rowe Price funds may generally elect to receive reports or other communications electronically by enrolling at troweprice.com/paperless or, if you are a retirement plan sponsor or invest in the funds through a financial intermediary (such as an investment advisor, broker-dealer, insurance company, or bank), by contacting your representative or your financial intermediary. You may elect to continue receiving paper copies of future shareholder reports free of charge. To do so, if you invest directly with T. Rowe Price, please call T. Rowe Price as follows: IRA, nonretirement account holders, and institutional investors, 1-800-225-5132; small business retirement accounts, 1-800-492-7670. If you are a retirement plan sponsor or invest in the T. Rowe Price funds through a financial intermediary, please contact your representative or financial intermediary, or follow additional instructions if included with this document. Your election to receive paper copies of reports will apply to all funds held in your account with your financial intermediary or, if you invest directly in the T. Rowe Price funds, with T. Rowe Price. Your election can be changed at any time in the future. |

||||

|

|

||||

Table of Contents

|

1 |

SUMMARY |

||

|

2 |

MORE ABOUT THE FUND |

||

|

More Information About the Fund’s

|

|||

|

3 |

INFORMATION ABOUT ACCOUNTS |

||

|

Investing with T. Rowe Price 27

Distribution and Shareholder

Policies for Opening an Account 32 Pricing of Shares and Transactions 33 Investing Directly with T. Rowe Price 35

Investing Through a Financial

General Policies Relating to Transactions 43 |

|

SUMMARY |

1 |

|

The fund seeks to provide long-term capital growth. Income is a secondary objective.

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the fund. The fees and expenses set forth below are annualized based on the fees and expenses for the six-month period ended June 30, 2020. You may also incur brokerage commissions and other charges when buying or selling shares of the Investor Class or I Class, which are not reflected in the table.

Fees and Expenses of the Fund

|

Investor |

I |

Advisor |

R |

Z |

||||||

|

Shareholder fees (fees paid directly from your investment) |

||||||||||

|

Maximum account fee |

$ |

a |

|

|

|

|

||||

|

|

||||||||||

|

Management fees |

|

% |

|

% |

|

% |

|

% |

|

% |

|

Distribution and service (12b-1) fees |

|

|

|

|

|

|||||

|

Other expenses |

|

|

|

|

|

|||||

|

Total annual fund |

|

|

|

|

|

|||||

|

Fee waiver/expense reimbursement |

|

|

|

|

( |

) b |

||||

|

Total annual fund operating expenses after fee waiver/expense reimbursement |

|

|

|

|

|

b |

||||

a

b

T. ROWE PRICE 2 adjusted

to reflect fee waivers or expense reimbursements only in the periods for which the expense limitation

arrangement is expected to continue. Although your actual costs may be higher or lower, based on these

assumptions your costs would be:

|

1 year |

3 years |

5 years |

10 years |

|

|

Investor Class |

$ |

$ |

$ |

$ |

|

I Class |

|

|

|

|

|

Advisor Class |

|

|

|

|

|

R Class |

|

|

|

|

|

Z Class |

|

|

|

|

Investments, Risks, and Performance

In pursuing its investment objective(s), the fund has the discretion to deviate from its normal investment criteria. These situations might arise when the adviser believes a security could increase in value for a variety of reasons, including an extraordinary corporate event, a new product introduction or innovation, a favorable competitive development, or a change in management.

While most assets will typically be invested in U.S. common stocks, the fund may invest in foreign stocks in keeping with its objective(s).

The fund may sell securities for a variety of reasons, including to realize gains, limit losses, or redeploy assets into more promising opportunities.

|

SUMMARY |

3 |

As with any fund, there is no guarantee that the fund will achieve

its objective(s).

Stock investing Stocks generally fluctuate in value more than bonds and may decline significantly over short time periods. There is a chance that stock prices overall will decline because stock markets tend to move in cycles, with periods of rising and falling prices. The value of stocks held by the fund may decline due to general weakness or volatility in the stock markets in which the fund invests or because of factors that affect a particular company or industry.

Market conditions The value of the fund’s investments may decrease, sometimes rapidly or unexpectedly, due to factors affecting an issuer held by the fund, particular industries, or the overall securities markets. A variety of factors can increase the volatility of the fund’s holdings and markets generally, including political or regulatory developments, recessions, inflation, rapid interest rate changes, war or acts of terrorism, natural disasters, and outbreaks of infectious illnesses or other widespread public health issues such as the coronavirus pandemic and related governmental and public responses. Certain events may cause instability across global markets, including reduced liquidity and disruptions in trading markets, while some events may affect certain geographic regions, countries, sectors, and industries more significantly than others. Government intervention in markets may impact interest rates, market volatility, and security pricing. These adverse developments may cause broad declines in market value due to short-term market movements or for significantly longer periods during more prolonged market downturns.

Growth investing The fund’s growth approach to investing could cause it to underperform other stock funds that employ a different investment style. Growth stocks tend to be more volatile than certain other types of stocks, and their prices may fluctuate more dramatically than the overall stock market. A stock with growth characteristics can have sharp price declines due to decreases in current or expected earnings and may lack dividends that can help cushion its share price in a declining market.

Large- and mid-cap stocks Securities issued by large-cap and mid-cap companies tend to be less volatile than securities issued by smaller companies. However, larger companies may not be able to attain the high growth rates of successful smaller companies, especially during strong economic periods, and may be unable to respond as quickly to competitive challenges. The fund’s share price could fluctuate more than the share price of a fund that invests only in large companies as stocks of mid-cap companies entail greater risk and are usually more volatile than stocks of large-cap companies.

Dividend-paying stocks The fund’s emphasis on dividend-paying stocks could cause the fund to underperform similar funds that invest without consideration of a company’s track record of paying dividends. Stocks of companies with a history of paying dividends may not

|

T. ROWE PRICE |

4 |

participate in a broad market advance to the same degree as most other stocks, and a sharp rise in interest rates or economic downturn could cause a company to unexpectedly reduce or eliminate its dividend.

Sector exposure At times, the fund may have a significant portion of its assets invested in securities of issuers conducting business in a broadly related group of industries within the same economic sector. Issuers in the same economic sector may be similarly affected by economic or market events, making the fund more vulnerable to unfavorable developments in that economic sector than funds that invest more broadly. Investments in the technology sector are susceptible to intense competition, government regulation, changing consumer preferences, and dependency on patent protection.

Foreign investing Investments in the securities of non-U.S. issuers may be adversely affected by local, political, social, and economic conditions overseas, greater volatility, reduced liquidity, or decreases in foreign currency values relative to the U.S. dollar. The risks of investing outside the U.S. are heightened for any investments in emerging markets, which are susceptible to greater volatility than investments in developed markets.

Active management The fund’s overall investment program and holdings selected by the fund’s investment adviser may underperform the broad markets, relevant indices, or other funds with similar objectives and investment strategies.

Cybersecurity breaches The fund could be harmed by intentional cyber-attacks and other cybersecurity breaches, including unauthorized access to the fund’s assets, customer data and confidential shareholder information, or other proprietary information. In addition, a cybersecurity breach could cause one of the fund’s service providers or financial intermediaries to suffer unauthorized data access, data corruption, or loss of operational functionality.

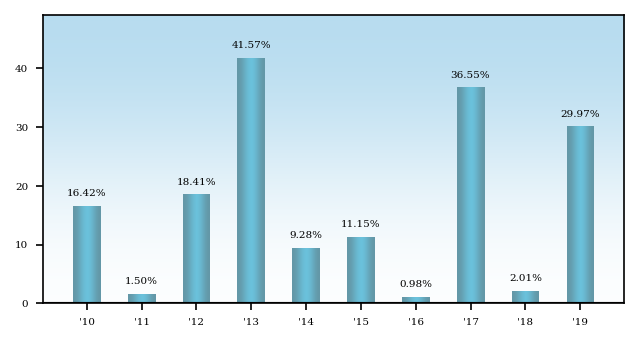

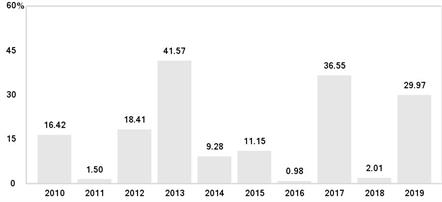

The following bar chart illustrates how much returns can differ from year to year by showing calendar year returns and the best and worst calendar quarter returns during those years for the fund’s Investor Class. Returns for other share classes vary since they have different expenses.

|

SUMMARY |

5 |

|

BLUE CHIP GROWTH FUND |

|

Quarter Ended |

Total Return |

Quarter Ended |

Total Return |

|||||

|

|

|

|

|

|

- |

was

The following table shows the average annual total returns for each class of the fund that has been in operation for at least one full calendar year, and also compares the returns with the returns of a relevant broad-based market index, as well as with the returns of one or more comparative indexes that have investment characteristics similar to those of the fund, if applicable.

In addition, the table shows hypothetical after-tax returns to demonstrate how taxes paid by a shareholder may influence returns.

|

T. ROWE PRICE |

6 |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

Periods ended |

|

||||||||||||

|

|

|

|

December 31, 2019 |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Since |

Inception |

|

||

|

|

|

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

|

inception |

date |

|

||

|

|

Investor Class |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Returns before taxes |

|

% |

|

|

% |

|

|

% |

|

|

% |

|

|

|

|

|

|

Returns after taxes on distributions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Returns after taxes on distributions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and sale of fund shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I Class |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Returns before taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Advisor Class |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Returns before taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R Class |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Returns before taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Z Class |

|

|

||||||||||||||

|

|

|

Returns before taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

a |

|

|

|

|

a

tr.

Management

Investment Adviser T. Rowe Price Associates, Inc. (T. Rowe Price or Price Associates)

|

Portfolio Manager |

Title |

Managed |

Joined |

|

Larry J. Puglia |

Chair of Investment Advisory Committee |

1993 |

1990 |

Purchase and Sale of Fund Shares

The Investor Class, Advisor Class, and R Class generally require a $2,500 minimum initial investment ($1,000 minimum initial investment if opening an IRA, a custodial account for a minor, or a small business retirement plan account). Additional purchases generally require a $100 minimum. These investment minimums generally are waived for financial intermediaries and certain employer-sponsored retirement plans submitting orders on behalf of their customers. Advisor Class and R Class shares may generally only be purchased through a financial intermediary or retirement plan.

|

SUMMARY |

7 |

The I Class requires a $1 million minimum initial investment and there is no minimum for additional purchases, although the initial investment minimum generally is waived for financial intermediaries, retirement plans, and certain client accounts for which T. Rowe Price or its affiliate has discretionary investment authority.

The Z Class is only available to funds managed by T. Rowe Price and other advisory clients of T. Rowe Price or its affiliates that are subject to a contractual fee for investment management services. There is no minimum initial investment and no minimum for additional purchases.

For investors holding shares of the fund directly with T. Rowe Price, you may purchase, redeem, or exchange fund shares by mail; by telephone (1-800-225-5132 for IRAs and nonretirement accounts; 1-800-492-7670 for small business retirement plans; and 1-800-638-8790 for institutional investors and financial intermediaries); or, for certain accounts, by accessing your account online through troweprice.com.

If you hold shares through a financial intermediary or retirement plan, you must purchase, redeem, and exchange shares of the fund through your intermediary or retirement plan. You should check with your intermediary or retirement plan to determine the investment minimums that apply to your account.

Tax Information

Any dividends or capital gains are declared and paid annually, usually in December. Redemptions or exchanges of fund shares and distributions by the fund, whether or not you reinvest these amounts in additional fund shares, generally may be taxed as ordinary income or capital gains unless you invest through a tax-deferred account (in which case you will be taxed upon withdrawal from such account).

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as a bank), the fund and its related companies may pay the intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

|

MORE ABOUT THE FUND |

2 |

|

Investment Adviser(s)

T. Rowe Price is the fund’s investment adviser and oversees the selection of the fund’s investments and management of the fund’s portfolio pursuant to an investment management agreement between the investment adviser and the fund. T. Rowe Price is the investment adviser for all mutual funds sponsored and managed by T. Rowe Price (T. Rowe Price Funds); is an SEC-registered investment adviser that provides investment management services to individual and institutional investors and sponsors; and serves as adviser and subadviser to registered investment companies, institutional separate accounts, and common trust funds. The address for T. Rowe Price is 100 East Pratt Street, Baltimore, Maryland 21202. As of September 30, 2020, T. Rowe Price and its affiliates (Firm) had approximately $1.31 trillion in assets under management and provided investment management services for more than 6.6 million individual and institutional investor accounts.

Portfolio Management

T. Rowe Price has established an Investment Advisory Committee with respect to the fund. The committee chair is ultimately responsible for the day-to-day management of the fund’s portfolio and works with the committee in developing and executing the fund’s investment program. The members of the committee are as follows: Larry J. Puglia, Chair, Jason R. Adams, Ziad Bakri, Peter J. Bates, Eric L. DeVilbiss, Greg Dunham, Paul D. Greene II, Ryan S. Hedrick, Thomas J. Huber, David L. Rowlett, Emily C. Scudder, Robert W. Sharps, Weijie Si, Taymour R. Tamaddon, Alan Tu, Justin P. White, and Rouven J. Wool-Lewis. The following information provides the year that the chair (portfolio manager) first joined the Firm and the chair’s specific business experience during the past five years (although the chair may have had portfolio management responsibilities for a longer period). Mr. Puglia has been chair of the committee since 1996 but has been involved in managing the fund since the fund’s inception in 1993. He joined the Firm in 1990 and his investment experience dates from 1989. He has served as a portfolio manager with the Firm throughout the past five years. The Statement of Additional Information provides additional information about the portfolio manager’s compensation, other accounts managed by the portfolio manager, and the portfolio manager’s ownership of the fund’s shares.

The Management Fee

The management fee consists of two components—an “individual fund fee,” which reflects the fund’s particular characteristics, and a “group fee.” The group fee, which is designed to reflect the benefits of the shared resources of the Firm, is calculated daily based on the combined net assets of all T. Rowe Price Funds (except the funds-of-funds, TRP Reserve Funds, Multi-Sector Account Portfolios, and any index or private-label mutual funds). The group fee schedule (in

|

MORE ABOUT THE FUND |

9 |

the following table) is graduated, declining as the combined assets of the T. Rowe Price Funds rise, so shareholders benefit from the overall growth in mutual fund assets.

Group Fee Schedule

|

0.334%* |

First $50 billion |

|

0.305% |

Next $30 billion |

|

0.300% |

Next $40 billion |

|

0.295% |

Next $40 billion |

|

0.290% |

Next $60 billion |

|

0.285% |

Next $80 billion |

|

0.280% |

Next $100 billion |

|

0.275% |

Next $100 billion |

|

0.270% |

Next $150 billion |

|

0.265% |

Next $195 billion |

|

0.260% |

Thereafter |

* Represents a blended group fee rate containing various breakpoints.

The fund’s group fee is determined by applying the group fee rate to the fund’s average daily net assets. On December 31, 2019, the effective annual group fee rate was 0.29%. The individual fund fee, also applied to the fund’s average daily net assets, is 0.30% on assets up to $15 billion and 0.255% on assets above $15 billion.

With respect to the I Class, T. Rowe Price has contractually agreed (through April 30, 2022) to pay the operating expenses of the fund’s I Class excluding management fees; interest; expenses related to borrowings, taxes, and brokerage; nonrecurring, extraordinary expenses; and acquired fund fees and expenses (“I Class Operating Expenses”), to the extent the I Class Operating Expenses exceed 0.05% of the class’ average daily net assets. The agreement may only be terminated at any time after April 30, 2022, with approval by the fund’s Board of Directors. Any expenses paid under this agreement (and a previous limitation of 0.05%) are subject to reimbursement to T. Rowe Price by the fund whenever the fund’s I Class Operating Expenses are below 0.05%. However, no reimbursement will be made more than three years from the date such amounts were initially waived or reimbursed. The fund may only make repayments to T. Rowe Price if such repayment does not cause the I Class Operating Expenses (after the repayment is taken into account) to exceed the lesser of: (1) the limitation on I Class Operating Expenses in place at the time such amounts were waived; or (2) the current expense limitation on I Class Operating Expenses.

A discussion about the factors considered by the fund’s Board of Directors (Board) and its conclusions in approving the fund’s investment management agreement (and any subadvisory agreement, if applicable) appear in the fund’s semiannual report to shareholders for the period ended June 30.

|

T. ROWE PRICE |

10 |

Investment Objective(s)

The fund seeks to provide long-term capital growth. Income is a secondary objective.

Principal Investment Strategies

The fund will normally invest at least 80% of its net assets (including any borrowings for investment purposes) in the common stocks of large and medium-sized blue-chip growth companies. Shareholders will receive at least 60 days’ prior notice of a change in the fund’s policy requiring it to normally invest at least 80% of its net assets (including any borrowings for investment purposes) in the common stocks of large and medium-sized blue chip growth companies.

These are firms that, in the investment adviser’s view, are well established in their industries and have the potential for above-average earnings growth. The fund focuses on companies with leading market positions, seasoned management, and strong financial fundamentals. The fund’s investment approach reflects the adviser’s belief that solid company fundamentals (with an emphasis on the potential for strong growth in earnings per share or operating cash flow) combined with a positive outlook for a company’s industry will ultimately reward investors with strong investment performance. Some of the companies the adviser targets for the fund should have good prospects for dividend growth, and the fund may at times invest significantly in stocks of information technology companies.

Equity investors should have a long-term investment horizon and be willing to wait out bear markets.

The market may reward growth stocks with price increases when earnings expectations are met or exceeded. A successful implementation of our strategy could lead to long-term growth of capital. By investing in companies with proven track records, the fund should be less risky than one focusing on newer or smaller companies while still offering significant appreciation potential.

A “blue chip” investment approach seeks to identify blue chip growth companies—those with strong market franchises in industries that appear to be strategically poised for long-term growth. Our strategy reflects T. Rowe Price’s belief that the combination of solid company fundamentals (with emphasis on the potential for above-average growth) and a positive outlook for the overall industry will ultimately result in a higher stock price. While the primary emphasis is on a company’s prospects for future growth, the fund will not purchase securities that, in T. Rowe Price’s opinion, are overvalued considering the underlying business fundamentals. In the search for substantial capital appreciation, the fund looks for stocks attractively priced relative to their anticipated long-term value.

|

MORE ABOUT THE FUND |

11 |

The fund will generally take the following into consideration:

Market positions Blue chip companies often have leading market positions that are expected to be maintained or enhanced over time. Strong positions, particularly in growing industries, can give a company pricing flexibility as well as the potential for good unit sales. These factors, in turn, can lead to higher earnings growth and greater share price appreciation.

Management Seasoned management teams with a track record of providing superior financial results are important for a company’s long-term growth prospects. Our analysts will evaluate the depth and breadth of a company’s management experience.

Financial fundamentals Companies should demonstrate faster earnings growth than their competitors and the market in general; high profit margins relative to competitors; strong cash flow; a healthy balance sheet with relatively low debt; and a high return on equity with a comparatively low dividend payout ratio.

The Firm integrates pecuniary environmental, social, and governance (ESG) factors into its investment research process. We focus on the ESG factors we consider most likely to have a material impact on the performance of the holdings in the fund’s portfolio.

The fund’s investments may be subject to further restrictions and risks described in the Statement of Additional Information.

Common and Preferred Stocks

Stocks represent shares of ownership in a company. Generally, preferred stocks have a specified dividend rate and rank after bonds and before common stocks in their claim on income for dividend payments and on assets should the company be liquidated. After other claims are satisfied, common stockholders participate in company profits on a pro-rata basis and profits may be paid out in dividends or reinvested in the company to help it grow. Increases and decreases in earnings are usually reflected in a company’s stock price, so common stocks generally have the greatest appreciation and depreciation potential of all corporate securities. Unlike common stock, preferred stock does not ordinarily carry voting rights. While most preferred stocks pay a dividend, the fund may decide to purchase preferred stock where the issuer has suspended, or is in danger of suspending, payment of its dividend.

Foreign Securities

Investments in foreign securities could include non-U.S. dollar-denominated securities traded outside the U.S. and U.S. dollar-denominated securities of foreign issuers traded in the U.S. The fund may purchase American Depositary Receipts and Global Depositary Receipts, which are certificates evidencing ownership of shares of a foreign issuer. American Depositary Receipts and Global Depositary Receipts trade on established markets and are alternatives to directly purchasing the underlying foreign securities in their local markets and currencies. Such investments are subject to many of the same risks associated with investing directly in foreign securities.

|

T. ROWE PRICE |

12 |

Principal Risks

Some of the principal tools the adviser uses to try to reduce overall risk include intensive research when evaluating a company’s prospects and limiting exposure to certain industries, asset classes, or investment styles when appropriate.

The principal risks associated with the fund’s principal investment strategies include the following:

Stock investing The fund’s share price can fall because of weakness in the overall stock markets, a particular industry, or specific holdings. Stock markets as a whole can be volatile and decline for many reasons, such as adverse local, political, regulatory, or economic developments; changes in investor psychology; or heavy institutional selling at the same time by major institutional investors in the market, such as mutual funds, pension funds, and banks. The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, the adviser’s assessment of companies whose stocks are held by the fund may prove incorrect, resulting in losses or poor performance, even in rising markets. In the event an issuer is liquidated or declares bankruptcy, the claims of owners of the issuer’s bonds and preferred stock take precedence over the claims of those who own common stock.

Market conditions The value of investments held by the fund may decline, sometimes rapidly or unpredictably, due to factors affecting certain issuers, particular industries or sectors, or the overall markets. Rapid or unexpected changes in market conditions could cause the fund to liquidate its holdings at inopportune times or at a loss or depressed value. The value of a particular holding may decrease due to developments related to that issuer, but also due to general market conditions, including real or perceived economic developments such as changes in interest rates, credit quality, inflation, or currency rates, or generally adverse investor sentiment. The value of a holding may also decline due to factors that negatively affect a particular industry or sector, such as labor shortages, increased production costs, or competitive conditions. In addition, local, regional, or global events such as war, acts of terrorism, political and social unrest, regulatory changes, recessions, shifts in monetary or trade policies, natural or environmental disasters, and the spread of infectious diseases or other public health issues could have a significant negative impact on securities markets and the fund’s investments. Unpredictable events such as natural disasters, pandemics, and widespread health crises, including the coronavirus pandemic and related governmental and public responses, may lead to unexpected suspensions or closures of securities exchanges, travel restrictions or quarantines, business disruptions and closures, inability to obtain raw materials, supplies and component parts, reduced or disrupted operations for the fund’s service providers or issuers in which the fund invests, and an extended adverse impact on global market conditions. Government intervention in markets may impact interest rates, market volatility, and security pricing. The occurrence, reoccurrence, and uncertainty of widespread diseases and health crises could adversely affect the economies (including through changes in business activity and increased unemployment) and financial markets of specific countries or worldwide.

|

MORE ABOUT THE FUND |

13 |

Growth investing Different investment styles tend to shift into and out of favor depending on market conditions and investor sentiment. Growth stocks can be more volatile than other types of stocks, and their prices tend to fluctuate more dramatically than the overall stock markets. Growth stocks are typically priced higher than other stocks because investors believe they have more growth potential, which may or may not be realized. Since these companies usually invest a high portion of earnings in their businesses, they may lack the dividends that can cushion stock prices in a falling market. In addition, earnings disappointments often lead to sharply falling prices for growth stocks.

Large- and mid-cap stocks Although stocks issued by large-cap and mid-cap companies tend to have less overall volatility than stocks issued by smaller companies, larger companies may not be able to attain the high growth rates of successful smaller companies, especially during strong economic periods. In addition, larger companies may be less capable of responding quickly to competitive challenges and industry changes, and may suffer sharper price declines as a result of earnings disappointments. Mid-cap companies typically have less experienced management, narrower product lines, and more limited financial resources than large-cap companies. However, by being more focused in their business activities, mid-cap companies may be more responsive and better able to adapt to the changing needs of their markets than large-cap companies during certain market conditions.

Dividend-paying stocks The fund’s emphasis on dividend-paying stocks could cause the fund to underperform similar funds that invest without consideration of a company’s track record of paying dividends. There is no guarantee that the issuers of the stocks held by the fund will declare dividends in the future or that, if dividends are declared, they will remain at their current levels or increase over time. For example, a sharp rise in interest rates or economic downturn could cause a company to unexpectedly reduce or eliminate its dividend. In addition, stocks of companies with a history of paying dividends may not benefit from a broad market advance to the same degree as the overall stock market.

Sector exposure At times, the fund may have a significant portion of its assets invested in securities of issuers conducting business in a related group of industries within the same economic sector. Issuers within the same economic sector may be similarly affected by specific market events impacting that sector. As a result, the fund is more susceptible to adverse developments affecting an economic sector in which the fund has significant investments and may perform poorly during a downturn in one or more of the industries within that economic sector. To the extent the fund has significant investments in the technology sector, it is more susceptible to adverse developments affecting technology and information technology companies, which could include, among other things, intense competition, government regulation, earnings disappointments, dependency on patent protection, and rapid obsolescence of products and services due to technological innovations or changing consumer preferences.

Foreign investing The fund’s investments outside the U.S. are subject to special risks, whether the securities (including depositary receipts and other instruments that represent interests in a non-U.S. issuer) are denominated in U.S. dollars or foreign currencies. These risks include

|

T. ROWE PRICE |

14 |

potentially adverse local, political, social, and economic conditions overseas, greater volatility, lower liquidity, and the possibility that settlement practices and regulatory and accounting standards will differ from those of U.S. issuers. Foreign currencies could decline against the U.S. dollar, lowering the value of securities denominated in those currencies and possibly the fund’s share price. These risks are heightened for any investments in emerging markets, which are more susceptible to governmental interference, less efficient trading markets, and the imposition of local taxes or restrictions on gaining access to sales proceeds for foreign investors.

Active management The investment adviser’s judgments about the attractiveness, value, or potential appreciation of the fund’s investments may prove to be incorrect. The fund could underperform other funds with a similar benchmark or similar investment program if the fund’s investment selections or overall strategies fail to produce the intended results. Regulatory, tax, or other developments may affect the investment strategies available to a portfolio manager, which could adversely affect the ability to implement the fund’s overall investment program and achieve the fund’s investment objective(s).

Cybersecurity breaches The fund may be subject to operational and information security risks resulting from breaches in cybersecurity. Cybersecurity breaches may involve deliberate attacks and unauthorized access to the digital information systems (for example, through “hacking” or malicious software coding) used by the fund or its third-party service providers but may also result from outside attacks such as denial-of-service attacks, which are efforts to make network services unavailable to intended users. These breaches may, among other things, result in financial losses to the fund and its shareholders, cause the fund to lose proprietary information, disrupt business operations, or result in the unauthorized release of confidential information. Further, cybersecurity breaches involving the fund’s third-party service providers, financial intermediaries, trading counterparties, or issuers in which the fund invests could subject the fund to many of the same risks associated with direct breaches.

Additional Strategies, Risks, and Investment Management Practices

In addition to the principal investment strategies and principal risks previously described, the fund may employ other investment strategies and may be subject to other risks, which include the following:

Derivatives

The fund may invest in securities other than common stocks and use derivatives that are consistent with its investment program. For instance, the fund may invest, to a limited extent, in futures contracts. Any investments in futures would typically serve as an efficient means of gaining exposure to certain markets, or as a tool to manage cash flows into and out of the fund and maintain liquidity while being invested in the market. To the extent the fund invests in futures, it could be exposed to potential volatility and losses greater than direct investments in the contract’s underlying assets.

Futures Futures are often used to establish exposures, or manage or hedge risk, because they enable the investor to buy or sell an asset in the future at an agreed-upon price. Futures

|

MORE ABOUT THE FUND |

15 |

contracts may be bought or sold for any number of reasons, including to manage exposure to changes in interest rates, securities prices and indexes, currency exchange rates, and credit quality; as an efficient means of increasing or decreasing the fund’s exposure to certain markets; in an effort to enhance income; to improve risk-adjusted returns; to protect the value of portfolio securities; and to serve as a cash management tool. The fund may choose to continue a futures contract by “rolling over” an expiring futures contract into an identical contract with a later maturity date. This could increase the fund’s transaction costs and portfolio turnover rate. Futures contracts may not be successful investments or hedges, their prices can be highly volatile and their use could lower the fund’s total return, and the potential loss from the use of futures can exceed the fund’s initial investment in such contracts.

Derivatives typically involve risks different from, and possibly greater than, the risks associated with investing directly in the assets on which the derivative is based. Certain derivatives can be highly volatile, lack liquidity, and be difficult to value. Changes in the value of a derivative may not properly correlate with changes in the value of the underlying asset, reference rate, or index. The fund could be exposed to significant losses if it is unable to close a derivative position due to the lack of a liquid trading market. Derivatives involve the risk that a counterparty to the derivatives agreement will fail to make required payments or comply with the terms of the agreement. There is also the possibility that limitations or trading restrictions may be imposed by an exchange or government regulation, which could adversely impact the value and liquidity of a derivatives contract subject to such regulation. Recent regulations have changed the requirements related to the use of certain derivatives. Some of these new regulations have limited the availability of certain derivatives and made their use by funds more costly. It is expected that additional changes to the regulatory framework will occur, but the extent and impact of additional new regulations are not certain at this time.

Convertible Securities and Warrants

The fund may invest in debt instruments or preferred equity securities that are convertible into, or exchangeable for, equity securities at specified times in the future and according to a certain exchange ratio. Convertible bonds are typically callable by the issuer, which could in effect force conversion before the holder would otherwise choose. Traditionally, convertible securities have paid dividends or interest at rates higher than common stocks but lower than nonconvertible securities. They generally participate in the appreciation or depreciation of the underlying stock into which they are convertible, but to a lesser degree than common stock. Some convertible securities combine higher or lower current income with options and other features. Warrants are options to buy, directly from the issuer, a stated number of shares of common stock at a specified price anytime during the life of the warrants (generally, two or more years). Warrants have no voting rights, pay no dividends, and can be highly volatile. In some cases, the redemption value of a warrant could be zero.

Debt Instruments

The fund may invest in bonds and debt instruments of any type, including municipal securities, without restrictions on quality or rating. Investments in a company also may be made through a privately negotiated note or loan, including loan participations and

|

T. ROWE PRICE |

16 |

assignments. These investments will be made in companies, municipalities, or entities that meet the fund’s investment criteria. Such investments may have a fixed, variable, or floating interest rate. The price of a bond or fixed rate debt instrument usually fluctuates with changes in interest rates, generally rising when interest rates fall and falling when interest rates rise. Investments involving below investment-grade issuers or borrowers can be more volatile and have greater risk of default than investment-grade bonds. Certain of these investments may be illiquid and holding a loan could expose the fund to the risks of being a direct lender.

Investments in Other Investment Companies

The fund may invest in other investment companies, including open-end funds, closed-end funds, and exchange-traded funds.

The fund may purchase the securities of another investment company to temporarily gain exposure to a portion of the market while awaiting the purchase of securities or as an efficient means of gaining exposure to a particular asset class. The fund might also purchase shares of another investment company, including shares of other T. Rowe Price Funds, to gain exposure to the securities in the investment company’s portfolio at times when the fund may not be able to buy those securities directly, or as a means of gaining efficient and cost-effective exposure to certain asset classes. Any investment in another investment company would be consistent with the fund’s objective(s) and investment program.

The risks of owning another investment company are generally similar to the risks of investing directly in the securities in which that investment company invests. However, an investment company may not achieve its investment objective or execute its investment strategy effectively, which may adversely affect the fund’s performance. In addition, because closed-end funds and exchange-traded funds trade on a secondary market, their shares may trade at a premium or discount to the actual net asset value of their portfolio securities, and their shares may have greater volatility if an active trading market does not exist.

As a shareholder of another investment company, the fund must pay its pro-rata share of that investment company’s fees and expenses. The fund’s investments in non-T. Rowe Price investment companies are subject to the limits that apply to investments in other funds under the Investment Company Act of 1940 or under any applicable exemptive order.

Investments in other investment companies could allow the fund to obtain the benefits of a more diversified portfolio than might otherwise be available through direct investments in a particular asset class, and will subject the fund to the risks associated with the particular asset class or asset classes in which an underlying fund invests. Examples of asset classes in which other mutual funds (including T. Rowe Price Funds) focus their investments include high yield bonds, inflation-linked securities, floating rate loans, international bonds, emerging market bonds, stocks of companies involved in activities related to real assets, stocks of companies that focus on a particular industry or sector, and emerging market stocks. If the fund invests in another T. Rowe Price Fund, the management fee paid by the fund will be reduced to ensure that the fund does not incur duplicate management fees as a result of its investment.

|

MORE ABOUT THE FUND |

17 |

Illiquid Investments

Some of the fund’s holdings may be considered illiquid because they are subject to legal or contractual restrictions on resale or because they cannot reasonably be expected to be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment. The determination of liquidity involves a variety of factors. Illiquid investments may include private placements that are sold directly to a small number of investors, usually institutions. Unlike public offerings, such securities are not registered with the SEC. Although certain of these securities may be readily sold (for example, pursuant to Rule 144A under the Securities Act of 1933) and therefore deemed liquid, others may have resale restrictions and be considered illiquid. The sale of illiquid investments may involve substantial delays and additional costs, and the fund may only be able to sell such investments at prices substantially lower than what it believes they are worth. In addition, the fund’s investments in illiquid investments may reduce the returns of the fund because it may be unable to sell such investments at an advantageous time, which could prevent the fund from taking advantage of other investment opportunities.

Reserve Position

A certain portion of the fund’s assets may be held in reserves. The fund’s reserve positions will primarily consist of: (1) shares of a T. Rowe Price internal money market fund or short-term bond fund (which do not charge any management fees and are not available for public purchase); (2) short-term, high-quality U.S. and non-U.S. dollar-denominated money market securities, including repurchase agreements; and (3) U.S. dollar or non-U.S. dollar currencies. In order to respond to adverse market, economic, or political conditions, or to provide flexibility in meeting redemptions, paying expenses, managing cash flows into the fund, and responding to periods of unusual market volatility, the fund may assume a temporary defensive position that is inconsistent with its principal investment objective(s) and/or strategies and may invest, without limitation, in reserves. If the fund has significant holdings in reserves, it could compromise its ability to achieve its objective(s). Non-U.S. dollar reserves are subject to currency risk.

Borrowing Money and Transferring Assets

The fund may borrow from banks, other persons, and other T. Rowe Price Funds for temporary or emergency purposes, to facilitate redemption requests, or for other purposes consistent with the fund’s policies as set forth in this prospectus and the Statement of Additional Information. Such borrowings may be collateralized with the fund’s assets, subject to certain restrictions.

Borrowings may not exceed 331/3% of the fund’s total assets. This limitation includes any borrowings for temporary or emergency purposes, applies at the time of the transaction, and continues to the extent required by the Investment Company Act of 1940.

Meeting Redemption Requests

We expect that the fund will hold cash or cash equivalents to meet redemption requests. The fund may also use the proceeds from the sale of portfolio securities to meet redemption requests if consistent with the management of the fund. These redemption methods will be

|

T. ROWE PRICE |

18 |

used regularly and may also be used in deteriorating or stressed market conditions. The fund reserves the right to pay redemption proceeds with securities from the fund’s portfolio rather than in cash (redemptions in-kind), as described under “Large Redemptions.” Redemptions in-kind are typically used to meet redemption requests that represent a large percentage of the fund’s net assets in order to minimize the effect of large redemptions on the fund and its remaining shareholders. In general, any redemptions in-kind will represent a pro-rata distribution of the fund’s securities, subject to certain limited exceptions. Redemptions in-kind may be used regularly in circumstances as described above (generally if the shareholder is able to accept securities in-kind) and may also be used in stressed market conditions.

The fund, along with other T. Rowe Price Funds, is a party to an interfund lending exemptive order received from the SEC that permits the T. Rowe Price Funds to borrow money from and/or lend money to other T. Rowe Price Funds to help the funds meet short-term redemptions and liquidity needs.

During periods of deteriorating or stressed market conditions, when an increased portion of the fund’s portfolio may be composed of holdings with reduced liquidity or lengthy settlement periods, or during extraordinary or emergency circumstances, the fund may be more likely to pay redemption proceeds with cash obtained through interfund lending or short-term borrowing arrangements (if available) or by redeeming a large redemption request in-kind.

Lending of Portfolio Securities

The fund may lend its securities to broker-dealers, other institutions, or other persons to earn additional income. Risks include the potential insolvency of the broker-dealer or other borrower that could result in delays in recovering securities and capital losses. Additionally, losses could result from the reinvestment of collateral received on loaned securities in investments that decline in value, default, or do not perform as well as expected. Cash collateral from securities lending is invested in the T. Rowe Price Short-Term Fund.

The Statement of Additional Information contains more detailed information about the fund and its investments, operations, and expenses.

Turnover is an indication of frequency of trading. Each time the fund purchases or sells a security, it incurs a cost. This cost is reflected in the fund’s net asset value but not in its operating expenses. The higher the turnover rate, the higher the transaction costs and the greater the impact on the fund’s total return. Higher turnover can also increase the possibility of taxable capital gain distributions. The fund’s portfolio turnover rates are shown in the Financial Highlights tables.

|

MORE ABOUT THE FUND |

19 |

The Financial Highlights tables, which provide information about each class’ financial history for each class that was in operation at the end of the prior fiscal year, are based on a single share outstanding throughout the periods shown. The tables are part of the fund’s financial statements, which are included in its semi-annual report and are incorporated by reference into the Statement of Additional Information (available upon request). The financial statements included in the semi-annual report, including the financial highlights, were unaudited. The financial statements in the annual report were audited by the fund’s independent registered public accounting firm, PricewaterhouseCoopers LLP.

|

FINANCIAL HIGHLIGHTS |

For a share outstanding throughout each period |

|

Investor Class |

||||||||||||||||||||||||

|

|

|

6 Months |

|

|

Year |

|

12/31/18 |

|

12/31/17 |

|

12/31/16 |

|

12/31/15 |

|||||||||||

|

NET ASSET VALUE |

|

|

|

|

|

|

||||||||||||||||||

|

Beginning of period |

$ |

124.35 |

$ |

96.03 |

$ |

96.31 |

$ |

72.61 |

$ |

72.38 |

$ |

67.27 |

||||||||||||

|

|

||||||||||||||||||||||||

|

Investment activities |

||||||||||||||||||||||||

|

Net investment |

(0.10 |

) |

0.08 |

0.09 |

0.08 |

0.08 |

0.01 |

|||||||||||||||||

|

Net realized and unrealized gain/loss |

13.78 |

28.69 |

1.97 |

26.45 |

0.64 |

7.46 |

||||||||||||||||||

|

Total from investment |

13.68 |

28.77 |

2.06 |

26.53 |

0.72 |

7.47 |

||||||||||||||||||

|

|

||||||||||||||||||||||||

|

Distributions |

||||||||||||||||||||||||

|

Net investment income |

– |

(0.11 |

) |

– |

(0.06 |

) |

(0.05 |

) |

– |

|||||||||||||||

|

Net realized gain |

– |

(0.34 |

) |

(2.34 |

) |

(2.77 |

) |

(0.44 |

) |

(2.36 |

) |

|||||||||||||

|

Total distributions |

– |

(0.45 |

) |

(2.34 |

) |

(2.83 |

) |

(0.49 |

) |

(2.36 |

) |

|||||||||||||

|

|

||||||||||||||||||||||||

|

NET ASSET VALUE

|

$ |

138.03 |

$ |

124.35 |

$ |

96.03 |

$ |

96.31 |

$ |

72.61 |

$ |

72.38 |

||||||||||||

|

T. ROWE PRICE |

20 |

|

FINANCIAL HIGHLIGHTS |

For a share outstanding throughout each period |

|

Investor Class |

||||||||||||||||||||||||

|

|

|

6 Months |

|

|

Year |

|

12/31/18 |

|

12/31/17 |

|

12/31/16 |

|

12/31/15 |

|||||||||||

|

Ratios/Supplemental Data |

||||||||||||||||||||||||

|

Total return(2)(3) |

11.00 |

% |

29.97 |

% |

2.01 |

% |

36.55 |

% |

0.98 |

% |

11.15 |

% |

||||||||||||

|

Ratios

to average net |

||||||||||||||||||||||||

|

Gross expenses before |

0.69 |

%(4) |

0.69 |

% |

0.70 |

% |

0.70 |

% |

0.72 |

% |

0.71 |

% |

||||||||||||

|

Net expenses after |

0.69 |

%(4) |

0.69 |

% |

0.70 |

% |

0.70 |

% |

0.72 |

% |

0.71 |

% |

||||||||||||

|

Net investment |

(0.17 |

)%(4) |

0.07 |

% |

0.09 |

% |

0.09 |

% |

0.11 |

% |

0.01 |

% |

||||||||||||

|

Portfolio turnover rate |

13.3 |

% |

31.5 |

% |

27.2 |

% |

34.5 |

% |

32.4 |

% |

33.1 |

% |

||||||||||||

|

Net

assets, end of period |

$ |

48,852 |

$ |

44,552 |

$ |

34,938 |

$ |

33,347 |

$ |

25,640 |

$ |

27,812 |

||||||||||||

(1) Per share amounts calculated using average shares outstanding method.

(2) Includes the impact of expense-related arrangements with Price Associates.

(3) Total return reflects the rate that an investor would have earned on an investment in the fund during each period, assuming reinvestment of all distributions, and payment of no redemption or account fees, if applicable. Total return is not annualized for periods less than one year.

(4) Annualized

|

MORE ABOUT THE FUND |

21 |

|

FINANCIAL HIGHLIGHTS |

For a share outstanding throughout each period |

|

I Class |

||||||||||||||||||||||||

|

|

|

6 Months |

|

|

Year |

|

12/31/18 |

|

12/31/17 |

|

12/31/16 |

|

12/17/15(1) |

|||||||||||

|

NET ASSET VALUE |

|

|

|

|

|

|

||||||||||||||||||

|

Beginning of period |

$ |

124.47 |

$ |

96.12 |

$ |

96.33 |

$ |

72.62 |

$ |

72.38 |

$ |

72.41 |

||||||||||||

|

|

||||||||||||||||||||||||

|

Investment activities |

||||||||||||||||||||||||

|

Net investment |

(0.02 |

) |

0.22 |

0.24 |

0.19 |

0.22 |

– |

(3) |

||||||||||||||||

|

Net realized and unrealized gain/loss |

13.80 |

28.73 |

1.95 |

26.46 |

0.61 |

(0.03 |

) |

|||||||||||||||||

|

Total from investment |

13.78 |

28.95 |

2.19 |

26.65 |

0.83 |

(0.03 |

) |

|||||||||||||||||

|

|

||||||||||||||||||||||||

|

Distributions |

||||||||||||||||||||||||

|

Net investment income |

– |

(0.26 |

) |

(0.06 |

) |

(0.17 |

) |

(0.15 |

) |

– |

||||||||||||||

|

Net realized gain |

– |

(0.34 |

) |

(2.34 |

) |

(2.77 |

) |

(0.44 |

) |

– |

||||||||||||||

|

Total distributions |

– |

(0.60 |

) |

(2.40 |

) |

(2.94 |

) |

(0.59 |

) |

– |

||||||||||||||

|

|

||||||||||||||||||||||||

|

NET ASSET VALUE

|

$ |

138.25 |

$ |

124.47 |

$ |

96.12 |

$ |

96.33 |

$ |

72.62 |

$ |

72.38 |

||||||||||||

|

T. ROWE PRICE |

22 |

|

FINANCIAL HIGHLIGHTS |

For a share outstanding throughout each period |

|

I Class |

||||||||||||||||||||||||

|

|

|

6 Months |

|

|

Year |

|

12/31/18 |

|

12/31/17 |

|

12/31/16 |

|

12/17/15(1) |

|||||||||||

|

Ratios/Supplemental Data |

||||||||||||||||||||||||

|

Total return(4)(5) |

11.07 |

% |

30.13 |

% |

2.14 |

% |

36.71 |

% |

1.13 |

% |

(0.04 |

)% |

||||||||||||

|

Ratios

to average net |

||||||||||||||||||||||||

|

Gross expenses before waivers/ |

0.56 |

%(6) |

0.56 |

% |

0.57 |

% |

0.57 |

% |

0.58 |

% |

0.63 |

%(6) |

||||||||||||

|

Net expenses

after |

0.56 |

%(6) |

0.56 |

% |

0.57 |

% |

0.57 |

% |

0.58 |

% |

0.62 |

%(6) |

||||||||||||

|

Net investment income (loss) |

(0.04 |

)%(6) |

0.20 |

% |

0.22 |

% |

0.22 |

% |

0.31 |

% |

0.88 |

%(6) |

||||||||||||

|

Portfolio turnover rate |

13.3 |

% |

31.5 |

% |

27.2 |

% |

34.5 |

% |

32.4 |

% |

33.1 |

% |

||||||||||||

|

Net assets, end of period (in millions) |

$ |

25,652 |

$ |

20,898 |

$ |

11,719 |

$ |

8,058 |

$ |

3,669 |

$ |

11 |

||||||||||||

(1) Inception date

(2) Per share amounts calculated using average shares outstanding method.

(3) Amounts round to less than $0.01 per share.

(4) Includes the impact of expense-related arrangements with Price Associates.

(5) Total return reflects the rate that an investor would have earned on an investment in the fund during each period, assuming reinvestment of all distributions, and payment of no redemption or account fees, if applicable. Total return is not annualized for periods less than one year.

(6) Annualized

|

MORE ABOUT THE FUND |

23 |

|

FINANCIAL HIGHLIGHTS |

For a share outstanding throughout each period |

|

Advisor Class |

||||||||||||||||||||||||

|

|

|

6 Months |

|

|

Year |

|

12/31/18 |

|

12/31/17 |

|

12/31/16 |

|

12/31/15 |

|||||||||||

|

NET ASSET VALUE |

|

|

|

|

|

|

||||||||||||||||||

|

Beginning of period |

$ |

122.08 |

$ |

94.45 |

$ |

95.02 |

$ |

71.69 |

$ |

71.61 |

$ |

66.75 |

||||||||||||

|

|

||||||||||||||||||||||||

|

Investment activities |

||||||||||||||||||||||||

|

Net investment |

(0.27 |

) |

(0.23 |

) |

(0.21 |

) |

(0.15 |

) |

(0.10 |

) |

(0.18 |

) |

||||||||||||

|

Net realized and unrealized gain/loss |

13.52 |

28.20 |

1.98 |

26.07 |

0.62 |

7.40 |

||||||||||||||||||

|

Total from investment |

13.25 |

27.97 |

1.77 |

25.92 |

0.52 |

7.22 |

||||||||||||||||||

|

|

||||||||||||||||||||||||

|

Distributions |

||||||||||||||||||||||||

|

Net realized gain |

– |

(0.34 |

) |

(2.34 |

) |

(2.59 |

) |

(0.44 |

) |

(2.36 |

) |

|||||||||||||

|

|

||||||||||||||||||||||||

|

NET ASSET VALUE

|

$ |

135.33 |

$ |

122.08 |

$ |

94.45 |

$ |

95.02 |

$ |

71.69 |

$ |

71.61 |

||||||||||||

|

T. ROWE PRICE |

24 |

|

FINANCIAL HIGHLIGHTS |

For a share outstanding throughout each period |

|

Advisor Class |

||||||||||||||||||||||||

|

|

|

6 Months |

|

|

Year |

|

12/31/18 |

|

12/31/17 |

|

12/31/16 |

|

12/31/15 |

|||||||||||

|

Ratios/Supplemental Data |

||||||||||||||||||||||||

|

Total return(2)(3) |

10.85 |

% |

29.62 |

% |

1.73 |

% |

36.17 |

% |

0.72 |

% |

10.86 |

% |

||||||||||||

|

Ratios

to average net |

||||||||||||||||||||||||

|

Gross expenses before |

0.96 |

%(4) |

0.96 |

% |

0.97 |

% |

0.97 |

% |

0.98 |

% |

0.99 |

% |

||||||||||||

|

Net expenses after |

0.96 |

%(4) |

0.96 |

% |

0.97 |

% |

0.97 |

% |

0.98 |

% |

0.99 |

% |

||||||||||||

|

Net investment loss |

(0.44 |

)%(4) |

(0.21 |

)% |

(0.20 |

)% |

(0.18 |

)% |

(0.15 |

)% |

(0.26 |

)% |

||||||||||||

|

Portfolio turnover rate |

13.3 |

% |

31.5 |

% |

27.2 |

% |

34.5 |

% |

32.4 |

% |

33.1 |

% |

||||||||||||

|

Net

assets, end of period |

$ |

3,395 |

$ |

3,480 |

$ |

3,035 |

$ |

3,648 |

$ |

2,894 |

$ |

2,936 |

||||||||||||

(1) Per share amounts calculated using average shares outstanding method.

(2) Includes the impact of expense-related arrangements with Price Associates.

(3) Total return reflects the rate that an investor would have earned on an investment in the fund during each period, assuming reinvestment of all distributions, and payment of no redemption or account fees, if applicable. Total return is not annualized for periods less than one year.

(4) Annualized

|

MORE ABOUT THE FUND |

25 |

|

FINANCIAL HIGHLIGHTS |

For a share outstanding throughout each period |

|

R Class |

||||||||||||||||||||||||

|

|

|

6 Months |

|

|