UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF

REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-07059

| T. Rowe Price Blue Chip Growth Fund, Inc. |

|

|

| (Exact name of registrant as specified in charter) |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

|

| (Address of principal executive offices) |

| David Oestreicher |

| 100 East Pratt Street, Baltimore, MD 21202 |

|

|

| (Name and address of agent for service) |

Registrant’s telephone number, including area

code: (410) 345-2000

Date of fiscal year end: December

31

Date of reporting period: March 31, 2015

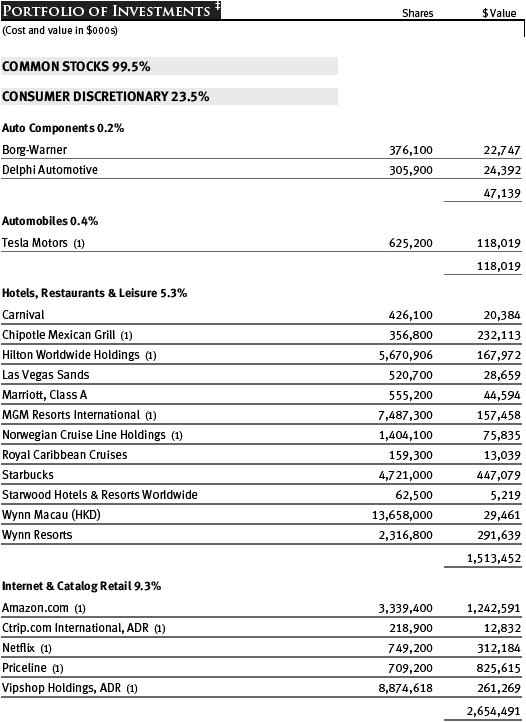

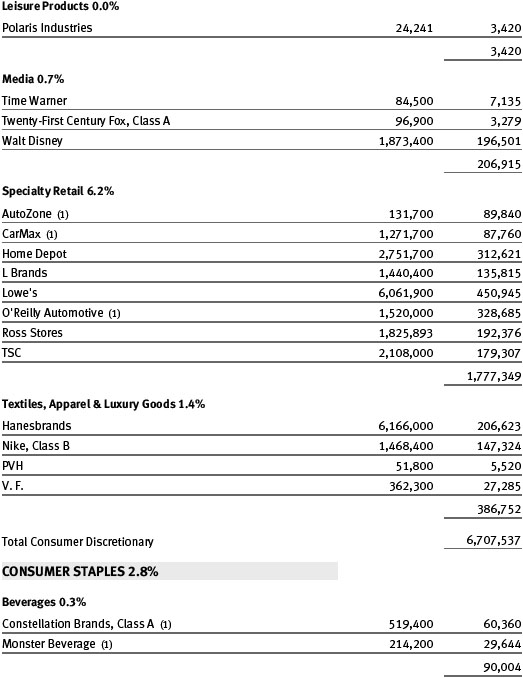

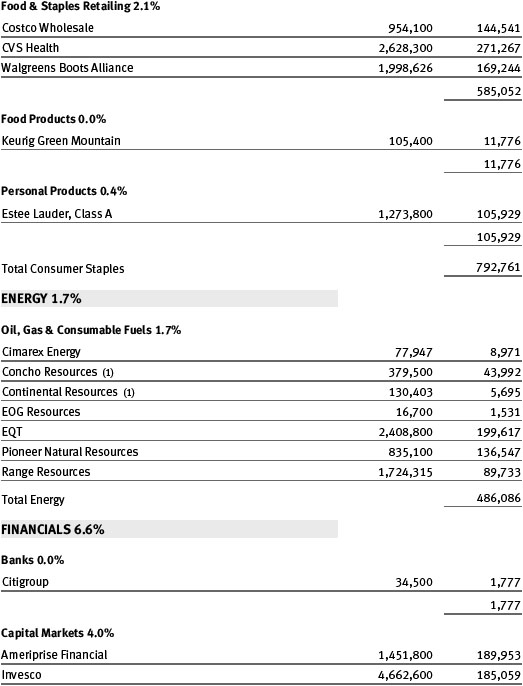

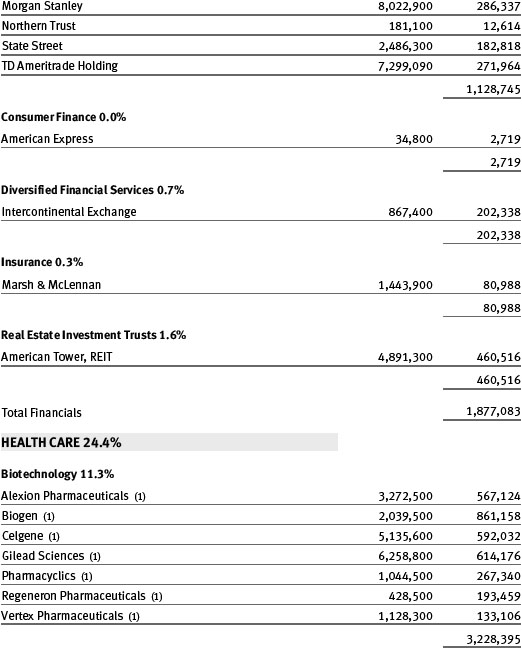

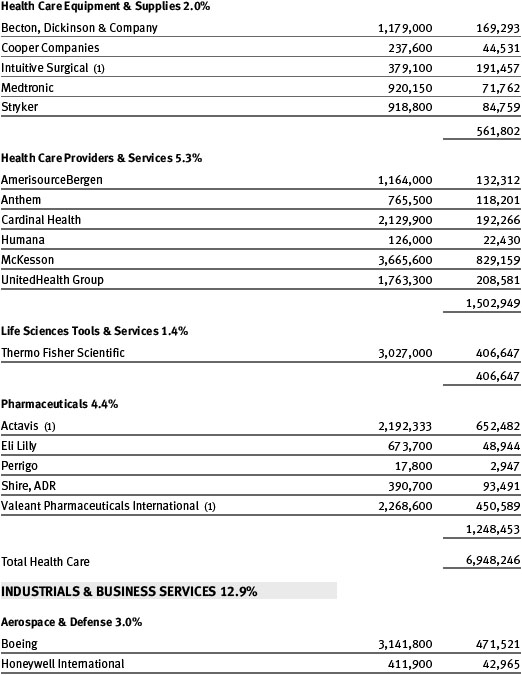

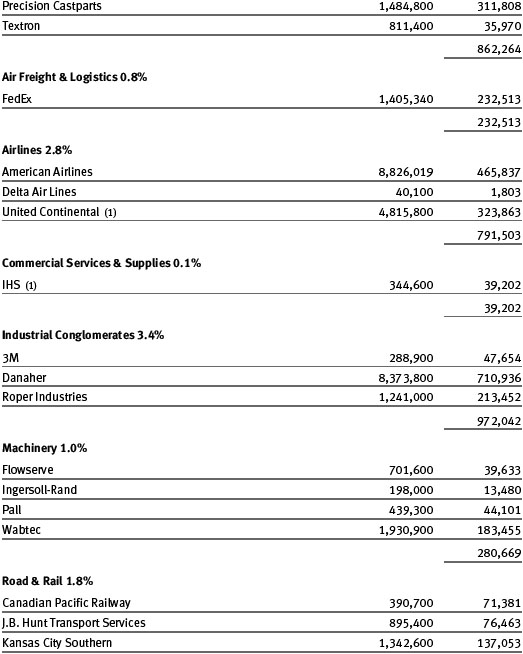

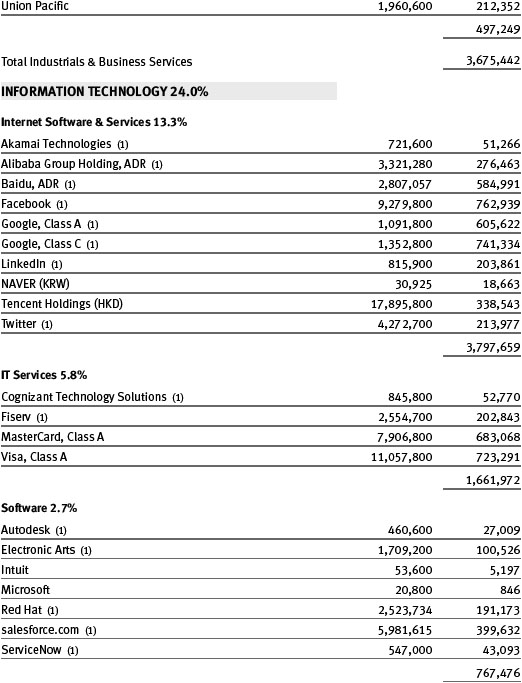

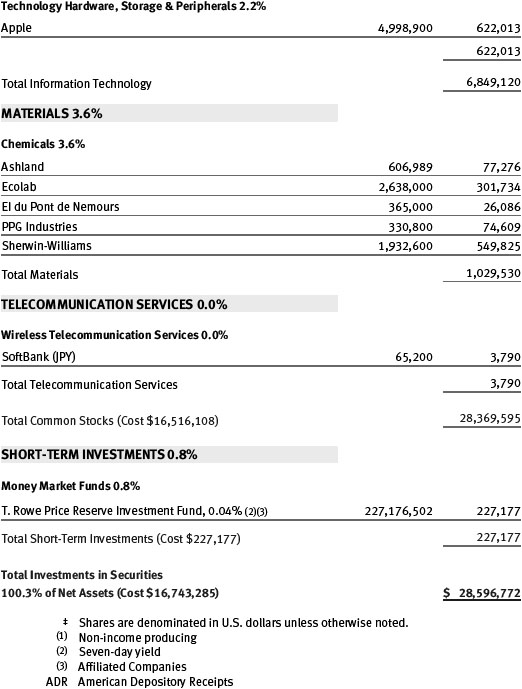

Item 1. Schedule of Investments

|

|

Blue Chip

Growth Fund |

March 31,

2015 |

| T. Rowe Price Blue Chip Growth Fund |

|

|

Unaudited

The accompanying notes are an integral part of this Portfolio of Investments.

T. Rowe Price Blue Chip Growth

Fund

Unaudited

Notes to Portfolio of Investments

T. Rowe Price Blue Chip Growth Fund, Inc. (the fund), is registered under the Investment Company Act of 1940 (the 1940 Act) as a diversified, open-end management investment company. The fund commenced operations on June 30, 1993. The fund seeks to provide long-term capital growth. Income is a secondary objective.

NOTE 1 - SIGNIFICANT ACCOUNTING POLICIES

Basis of

Preparation

The fund is an investment

company and follows accounting and reporting guidance in the Financial

Accounting Standards Board (FASB) Accounting

Standards Codification Topic 946 (ASC 946).

The accompanying Portfolio of Investments was prepared in accordance with

accounting principles generally accepted in the United States of America (GAAP),

including but not limited to ASC 946. GAAP requires the use of estimates made by

management. Management believes that estimates and valuations are appropriate;

however, actual results may differ from those estimates, and the valuations

reflected in the Portfolio of Investments may differ from the values ultimately

realized upon sale or maturity.

Investment

Transactions

Investment transactions are

accounted for on the trade date.

Currency

Translation

Assets, including investments,

and liabilities denominated in foreign currencies are translated into U.S.

dollar values each day at the prevailing exchange rate, using the mean of the

bid and asked prices of such currencies against U.S. dollars as quoted by a

major bank. Purchases and sales of securities are translated into U.S. dollars

at the prevailing exchange rate on the date of the transaction.

New Accounting Guidance

In June 2014, FASB issued Accounting

Standards Update (ASU) No. 2014-11, Transfers

and Servicing (Topic 860), Repurchase-to-Maturity Transactions, Repurchase

Financings, and Disclosures. The ASU changes

the accounting for certain repurchase agreements and expands disclosure

requirements related to repurchase agreements, securities lending,

repurchase-to-maturity and similar transactions. The ASU is effective for

interim and annual reporting periods beginning after December 15, 2014. Adoption

will have no effect on the fund’s net assets or results of operations.

NOTE 2 – VALUATION

The fund’s financial instruments are valued and each class’s net asset value (NAV) per share is computed at the close of the New York Stock Exchange (NYSE), normally 4 p.m. ET, each day the NYSE is open for business.

Fair Value

The fund’s financial instruments are reported at fair value,

which GAAP defines as the price that would be received to sell an asset or paid

to transfer a liability in an orderly transaction between market participants at

the measurement date. The T. Rowe Price Valuation Committee (the Valuation

Committee) has been established by the fund’s Board of Directors (the Board) to

ensure that financial instruments are appropriately priced at fair value in

accordance with GAAP and the 1940 Act. Subject to oversight by the Board, the

Valuation Committee develops and oversees pricing-related policies and

procedures and approves all fair value determinations. Specifically, the

Valuation Committee establishes procedures to value securities; determines

pricing techniques, sources, and persons eligible to effect fair value pricing

actions; oversees the selection, services, and performance of pricing vendors;

oversees valuation-related business continuity practices; and provides guidance on internal controls and

valuation-related matters. The Valuation Committee reports to the Board; is

chaired by the fund’s treasurer; and has representation from legal, portfolio

management and trading, operations, and risk management.

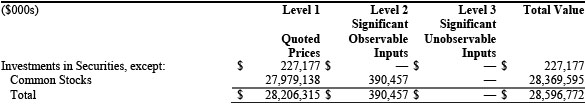

Various valuation techniques and inputs are used to determine the fair value of financial instruments. GAAP establishes the following fair value hierarchy that categorizes the inputs used to measure fair value:

Level 1 – quoted prices (unadjusted) in active markets for identical financial instruments that the fund can access at the reporting date

Level 2 – inputs other than Level 1 quoted prices that are observable, either directly or indirectly (including, but not limited to, quoted prices for similar financial instruments in active markets, quoted prices for identical or similar financial instruments in inactive markets, interest rates and yield curves, implied volatilities, and credit spreads)

Level 3 – unobservable inputs

Observable inputs are developed using market data, such as publicly available information about actual events or transactions, and reflect the assumptions that market participants would use to price the financial instrument. Unobservable inputs are those for which market data are not available and are developed using the best information available about the assumptions that market participants would use to price the financial instrument. GAAP requires valuation techniques to maximize the use of relevant observable inputs and minimize the use of unobservable inputs. When multiple inputs are used to derive fair value, the financial instrument is assigned to the level within the fair value hierarchy based on the lowest-level input that is significant to the fair value of the financial instrument. Input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level but rather the degree of judgment used in determining those values.

Valuation Techniques

Equity securities listed or regularly

traded on a securities exchange or in the over-the-counter (OTC) market are

valued at the last quoted sale price or, for certain markets, the official

closing price at the time the valuations are made. OTC Bulletin Board securities

are valued at the mean of the closing bid and asked prices. A security that is

listed or traded on more than one exchange is valued at the quotation on the

exchange determined to be the primary market for such security. Listed

securities not traded on a particular day are valued at the mean of the closing

bid and asked prices for domestic securities and the last quoted sale or closing

price for international securities.

For valuation purposes, the last quoted prices of non-U.S. equity securities may be adjusted to reflect the fair value of such securities at the close of the NYSE. If the fund determines that developments between the close of a foreign market and the close of the NYSE will, in its judgment, materially affect the value of some or all of its portfolio securities, the fund will adjust the previous quoted prices to reflect what it believes to be the fair value of the securities as of the close of the NYSE. In deciding whether it is necessary to adjust quoted prices to reflect fair value, the fund reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. The fund may also fair value securities in other situations, such as when a particular foreign market is closed but the fund is open. The fund uses outside pricing services to provide it with quoted prices and information to evaluate or adjust those prices. The fund cannot predict how often it will use quoted prices and how often it will determine it necessary to adjust those prices to reflect fair value. As a means of evaluating its security valuation process, the fund routinely compares quoted prices, the next day’s opening prices in the same markets, and adjusted prices.

Actively traded domestic equity securities generally are categorized in Level 1 of the fair value hierarchy. Non-U.S. equity securities generally are categorized in Level 2 of the fair value hierarchy despite the availability of quoted prices because, as described above, the fund evaluates and determines whether those quoted prices reflect fair value at the close of the NYSE or require adjustment. OTC Bulletin Board securities, certain preferred securities, and equity securities traded in inactive markets generally are categorized in Level 2 of the fair value hierarchy.

Investments in mutual funds are valued at the mutual fund’s closing NAV per share on the day of valuation and are categorized in Level 1 of the fair value hierarchy.

Thinly traded financial instruments and those for which the above valuation procedures are inappropriate or are deemed not to reflect fair value are stated at fair value as determined in good faith by the Valuation Committee. The objective of any fair value pricing determination is to arrive at a price that could reasonably be expected from a current sale. Financial instruments fair valued by the Valuation Committee are primarily private placements, restricted securities, warrants, rights, and other securities that are not publicly traded.

Subject to oversight by the Board, the Valuation Committee regularly makes good faith judgments to establish and adjust the fair valuations of certain securities as events occur and circumstances warrant. For instance, in determining the fair value of an equity investment with limited market activity, such as a private placement or a thinly traded public company stock, the Valuation Committee considers a variety of factors, which may include, but are not limited to, the issuer’s business prospects, its financial standing and performance, recent investment transactions in the issuer, new rounds of financing, negotiated transactions of significant size between other investors in the company, relevant market valuations of peer companies, strategic events affecting the company, market liquidity for the issuer, and general economic conditions and events. In consultation with the investment and pricing teams, the Valuation Committee will determine an appropriate valuation technique based on available information, which may include both observable and unobservable inputs. The Valuation Committee typically will afford greatest weight to actual prices in arm’s length transactions, to the extent they represent orderly transactions between market participants; transaction information can be reliably obtained; and prices are deemed representative of fair value. However, the Valuation Committee may also consider other valuation methods such as market-based valuation multiples; a discount or premium from market value of a similar, freely traded security of the same issuer; or some combination. Fair value determinations are reviewed on a regular basis and updated as information becomes available, including actual purchase and sale transactions of the issue. Because any fair value determination involves a significant amount of judgment, there is a degree of subjectivity inherent in such pricing decisions, and fair value prices determined by the Valuation Committee could differ from those of other market participants. Depending on the relative significance of unobservable inputs, including the valuation technique(s) used, fair valued securities may be categorized in Level 2 or 3 of the fair value hierarchy.

Valuation Inputs

The following table summarizes the fund’s financial

instruments, based on the inputs used to determine their fair values on March

31, 2015:

There were no material transfers between Levels 1 and 2 during the period ended March 31, 2015.

NOTE 3 - FEDERAL INCOME TAXES

At March 31, 2015, the cost of investments for federal income tax purposes was $16,743,285,000. Net unrealized gain aggregated $11,853,483,000 at period-end, of which $12,064,640,000 related to appreciated investments and $211,157,000 related to depreciated investments.

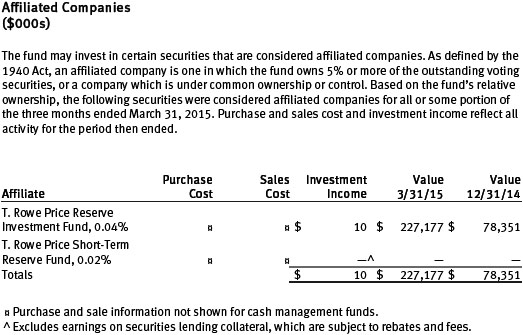

NOTE 4 - RELATED PARTY TRANSACTIONS

The fund may invest in the T. Rowe Price Reserve Investment Fund, the T. Rowe Price Government Reserve Investment Fund, or the T. Rowe Price Short-Term Reserve Fund (collectively, the Price Reserve Investment Funds), open-end management investment companies managed by T. Rowe Price Associates, Inc. (Price Associates) and considered affiliates of the fund. The Price Reserve Investment Funds are offered as short-term investment options to mutual funds, trusts, and other accounts managed by Price Associates or its affiliates and are not available for direct purchase by members of the public. The Price Reserve Investment Funds pay no investment management fees.

Item 2. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have evaluated the registrant’s disclosure controls and procedures within 90 days of this filing and have concluded that the registrant’s disclosure controls and procedures were effective, as of that date, in ensuring that information required to be disclosed by the registrant in this Form N-Q was recorded, processed, summarized, and reported timely.

(b) The registrant’s principal executive officer and principal financial officer are aware of no change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 3. Exhibits.

Separate certifications by the registrant's principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 and required by Rule 30a-2(a) under the Investment Company Act of 1940, are attached.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

T. Rowe Price Blue Chip Growth Fund,

Inc.

| By | /s/ Edward C. Bernard | |

| Edward C. Bernard | ||

| Principal Executive Officer | ||

| Date May 26, 2015 | ||

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By | /s/ Edward C. Bernard | |

| Edward C. Bernard | ||

| Principal Executive Officer | ||

| Date May 26, 2015 | ||

| By | /s/ Gregory K. Hinkle | |

| Gregory K. Hinkle | ||

| Principal Financial Officer | ||

| Date May 26, 2015 | ||