| |

SUMMARY | |

RRBGX | |

May 1, 2013 | |

T. Rowe Price Blue Chip Growth Fund—R Class | |

A fund seeking long-term capital growth through investments in stocks of well-established large- and mid-cap companies. This class of shares is sold only through financial intermediaries. | |

Before

you invest, you may want to review the fund’s prospectus, which contains more information about

the fund and its risks. You can find the fund’s prospectus and other information about the fund

online at troweprice.com/prospectus.

You can also get this information at no cost by calling The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense. | |

| |

Summary | 1 |

Investment Objective

The fund seeks to provide long-term capital growth. Income is a secondary objective.

Fees and Expenses

This table describes the fees and expenses that you may pay if you buy and hold shares of the fund.

Fees and Expenses of the Fund’s R Class

Annual

fund operating expenses | |

Management fees | 0.60% |

Distribution and service (12b-1) fees | 0.50%a |

Other expenses | 0.20% |

Total annual fund operating expenses | 1.30% |

a Restated to show maximum 12b-1 fee rate of 0.50%. Actual rate for the prior fiscal year was 0.47%.

Example This example is intended to help you compare the cost of investing in the fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

1 year | 3 years | 5 years | 10 years |

$132 | $412 | $713 | $1,568 |

Portfolio Turnover The fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the fund’s performance. During the most recent fiscal year, the fund’s portfolio turnover rate was 24.5% of the average value of its portfolio.

Investments, Risks, and Performance

Principal Investment Strategies The fund will normally invest at least 80% of its net assets (including any borrowings for investment purposes) in the common stocks of large and medium-sized blue chip growth companies. These are firms that, in our view, are well established in their industries and have the potential for above-average earnings growth. We focus on companies with leading market position, seasoned management, and strong financial fundamentals. Our investment approach reflects our belief that solid company fundamentals (with emphasis on strong growth in

T. Rowe Price | 2 |

earnings per share or operating cash flow) combined with a positive industry outlook will ultimately reward investors with strong investment performance. Some of the companies we target for the fund should have good prospects for dividend growth, and the fund may at times invest significantly in stocks of technology companies.

In pursuing its investment objective, the fund has the discretion to deviate from its normal investment criteria, as previously described, and purchase securities that the fund’s management believes will provide an opportunity for substantial appreciation. These situations might arise when the fund’s management believes a security could increase in value for a variety of reasons, including an extraordinary corporate event, a new product introduction or innovation, a favorable competitive development, or a change in management.

While most assets will typically be invested in U.S. common stocks, the fund may invest in foreign stocks in keeping with the fund’s objectives.

The fund may sell securities for a variety of reasons, such as to secure gains, limit losses, or redeploy assets into more promising opportunities.

Principal Risks As with any mutual fund, there is no guarantee that the fund will achieve its objective. The fund’s share price fluctuates, which means you could lose money by investing in the fund. The principal risks of investing in this fund are summarized as follows:

Active management risk The fund is subject to the risk that the investment adviser’s judgments about the attractiveness, value, or potential appreciation of the fund’s investments may prove to be incorrect. If the securities selected and strategies employed by the fund fail to produce the intended results, the fund could underperform other funds with similar objectives and investment strategies.

Risks of stock investing Stocks generally fluctuate in value more than bonds and may decline significantly over short time periods. There is a chance that stock prices overall will decline because stock markets tend to move in cycles, with periods of rising prices and falling prices. The value of a stock in which the fund invests may decline due to general weakness in the stock market or because of factors that affect a company or a particular industry.

Investment style risk Different investment styles tend to shift in and out of favor, depending on market conditions and investor sentiment. The fund’s growth approach to investing could cause it to underperform other stock funds that employ a different investment style. Growth stocks tend to be more volatile than certain other types of stocks and their prices usually fluctuate more dramatically than the overall stock market. A stock with growth characteristics can have sharp price declines due to decreases in current or expected earnings and may lack dividends that can help cushion its share price in a declining market.

Industry risk To the extent the fund invests in technology companies, the fund may perform poorly during a downturn in one or more of the industries that heavily

Summary | 3 |

impact technology companies. Technology companies can be adversely affected by, among other things, intense competition, earnings disappointments, and rapid obsolescence of products and services due to technological innovations or changing consumer preferences.

Foreign investing risk This is the risk that the fund’s investments in foreign securities may be adversely affected by political and economic conditions overseas, reduced liquidity, or decreases in foreign currency values relative to the U.S. dollar.

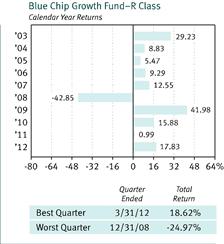

Performance The bar chart showing calendar year returns and the average annual total returns table indicate risk by illustrating how much returns can differ from one year to the next and how fund performance compares with that of a comparable market index. The fund’s past performance (before and after taxes) is not necessarily an indication of future performance.

The fund can also experience short-term performance swings, as shown by the best and worst calendar quarter returns during the years depicted.

In addition, the average annual total returns table shows hypothetical after-tax returns to suggest how taxes paid by a shareholder may influence returns. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements, such as a 401(k) account or individual retirement account.

T. Rowe Price | 4 |

Average Annual Total Returns | ||||||||||||

|

|

| Periods ended |

| ||||||||

| December 31, 2012 |

| ||||||||||

| 1 Year | 5 Years | 10 Years |

| ||||||||

| Blue Chip Growth Fund-R Class |

| ||||||||||

| Returns before taxes | 17.83 | % |

| 2.27 | % |

| 7.40 | % |

|

| |

| Returns after taxes on distributions | 17.83 |

|

| 2.27 |

|

| 7.39 |

|

|

| |

| Returns after taxes on distributions |

|

|

|

|

|

|

|

|

|

| |

| and sale of fund shares | 11.59 |

|

| 1.94 |

|

| 6.54 |

|

|

| |

| S&P 500 Index (reflects no deduction for fees, expenses, or taxes) | 16.00 |

|

| 1.66 |

|

| 7.10 |

|

|

| |

| Lipper Large-Cap Growth Funds Index | 15.92 |

|

| 1.01 |

|

| 6.39 |

|

|

| |

Updated performance information is available through troweprice.com or may be obtained by calling 1-800-638-8790.

Management

Investment Adviser T. Rowe Price Associates, Inc. (T. Rowe Price)

Portfolio Manager | Title | Managed Fund Since | Joined Investment |

Larry J. Puglia | Chairman of Investment Advisory Committee | 1993 | 1990 |

Purchase and Sale of Fund Shares

For retirement plan accounts and Uniform Gifts to Minors Act or Uniform Transfers to Minors Act accounts, generally the fund’s minimum initial investment requirement is $1,000 and, for all other accounts, generally the fund’s minimum initial investment requirement is $2,500. The fund’s minimum subsequent investment requirement is $100. Your financial intermediary may impose different investment minimums.

You may purchase, redeem, or exchange shares of the fund on any day the New York Stock Exchange is open for business. You must purchase, redeem, and exchange shares through your financial intermediary.

Tax Information

Any dividends or capital gains are declared and paid annually, usually in December. Distributions by the fund, whether or not you reinvest these amounts in additional fund shares, may be taxed as ordinary income or capital gains unless you invest through a tax-deferred account. A redemption or exchange of fund shares may be taxable.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the fund through a broker-dealer or other financial intermediary (such as a bank), the fund and its related companies may pay the

Summary | 5 |

intermediary for the sale of fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

T. Rowe Price

Associates, Inc. | E493-045 5/1/13 |