Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14A-101)

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No.___ )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Section 240.14a-12

SIFCO Industries, Inc.

(NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

_______________________________________________________________

(NAME OF PERSON(S) FILING PROXY STATEMENT, IF OTHER THAN THE REGISTRANT)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| |

1. | Title of each class of securities to which transaction applies: ___________ |

| |

2. | Aggregate number of securities to which transaction applies: __________ |

| |

3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): _______________________ |

| |

4. | Proposed maximum aggregate value of transaction: __________________ |

| |

5. | Total fee paid: _______________________________________________ |

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| |

1. | Amount Previously Paid: _________________________________________ |

| |

2. | Form, Schedule or Registration Statement No.: ________________________ |

| |

3. | Filing Party: ____________________________________________________ |

| |

4. | Date Filed: __________________________________________ |

SIFCO Industries, Inc.

970 East 64th Street, Cleveland, Ohio 44103

NOTICE OF 2017 ANNUAL MEETING OF SHAREHOLDERS

The 2016 Annual Meeting of Shareholders of SIFCO Industries, Inc. (the "Company" or "SIFCO") will be held on January 25, 2017 at 9:30 a.m. local time at the Great Lakes Room, 200 Public Square – 3rd Floor, Cleveland, Ohio, 44114, to consider and vote upon proposals to:

| |

1. | Elect seven (7) directors, each to serve a one-year term until the 2018 Annual Meeting of Shareholders and/or their successors are duly elected; |

| |

2. | Ratify the selection of Grant Thornton LLP as the independent registered public accounting firm of the Company; |

| |

3. | Adopt an Amendment and Restatement of the SIFCO Industries, Inc. 2007 Long-term Incentive Plan ("2016 Amended and Restated LTIP"); and |

| |

4. | Consider and take action upon such other matters as may properly come before the meeting or any adjournment thereof. |

The holders of record of Common Shares at the close of business on December 5, 2016 will be entitled to receive notice of and vote at the meeting.

The SIFCO Industries, Inc. Annual Report for the fiscal year ended September 30, 2016 is included with this Notice.

By order of the Board of Directors.

|

| | | | |

| | SIFCO Industries, Inc. | |

| | | | |

December 6, 2016 | | Megan L. Mehalko, Corporate Secretary |

Kindly fill in, date and sign the enclosed proxy card and promptly return it in the enclosed addressed envelope, which requires no postage if mailed in the United States. If you are present and vote in person at the meeting, your proxy will not be used.

SIFCO Industries, Inc.

970 East 64th Street, Cleveland, Ohio 44103

PROXY STATEMENT

Notice of Internet Availability mailed on or about December 16, 2016

General Information

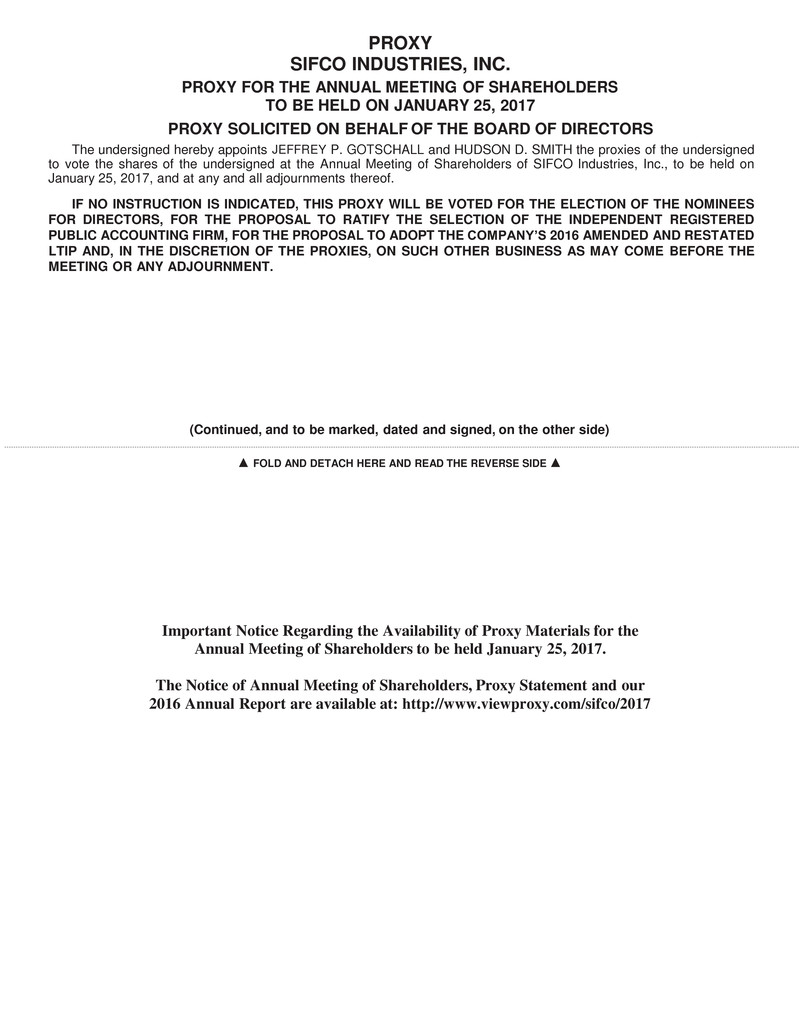

The proxy that accompanies this statement is solicited by the Board of Directors of SIFCO Industries, Inc. (the "Company" or "SIFCO") for use at the 2017 Annual Meeting of the Shareholders of the Company to be held January 25, 2017, or at any adjournment thereof.

As permitted by the Securities and Exchange Commission (the "SEC"), the Company is sending a Notice of Internet Availability of Proxy Material (the "Notice") to all shareholders. All shareholders will have the ability to access this Proxy Statement and the Company's Annual Report on Form 10-K for the fiscal year ended September 30, 2016 as filed with the SEC on December 6, 2016 on a website referred to in the Notice or to request a printed set of these materials at no charge. Instructions on how to access these materials over the Internet or to request a printed copy may be found in the Notice.

In addition, any shareholder may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. The cost of solicitation of proxies in the form accompanying this statement will be borne by the Company. Choosing to receive future proxy materials by email will save the Company the cost of printing and mailing documents to shareholders and will reduce the impact of annual meetings on the environment. A shareholder's election to receive proxy materials by email will remain in effect until the shareholder terminates it.

Any shareholder giving a proxy for the meeting may revoke it before it is exercised by giving a later dated proxy or by giving notice of revocation to the Company in writing before or at the 2017 Annual Meeting. However, the mere presence at the 2017 Annual Meeting of the shareholder granting a proxy will not revoke the proxy. Unless revoked by notice as above stated, shares represented by valid proxies will be voted on all matters to be acted upon at the 2017 Annual Meeting. On any matter or matters with respect to which the proxy contains instructions for voting, such shares will be voted in accordance with such instructions. Abstentions and broker non-votes will be deemed to be present for the purpose of determining a quorum for the 2017 Annual Meeting. Abstentions will not affect the vote on Proposal No. 1, but will be counted as “votes against” with respect to proposal No. 2 and 3. Brokers who have not received voting instructions from beneficial owners generally may vote in their discretion with respect to the ratification of the selection of the independent registered public accounting firm, but will not be able to vote with respect to Proposal No. 1 and 3. Broker non-votes will not affect the outcome of any proposals brought before the 2017 Annual Meeting.

OUTSTANDING SHARES AND VOTING RIGHTS

The record date for determining shareholders entitled to vote at the 2017 Annual Meeting is December 5, 2016. As of October 31, 2016, the outstanding voting securities of the Company consisted of 5,525,256 common shares, $1.00 par value per share (“Common Shares”). Each Common Share, exclusive of treasury shares, has one

vote. The Company held no Common Shares in its treasury on October 31, 2016. The holders of a majority of the Common Shares of the Company issued and outstanding, present in person or by proxy, shall constitute a quorum for the purposes of the 2017 Annual Meeting.

STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The table below shows the number of shares of our common stock beneficially owned as of October 31, 2016 (unless otherwise indicated) by each person who, to our knowledge, beneficially owns more than 5% of our common stock.

|

| | |

| | |

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class |

| | |

Ms. Janice Carlson and Mr. Charles H. Smith, III, | 1,994,674 (1) | 36.10% (1) |

Trustees, Voting Trust Agreement | | |

c/o SIFCO Industries, Inc. | | |

970 E. 64th Street | | |

Cleveland, OH 44103 | | |

| | |

M. and S. Silk Revocable Trust | 707,737 (2) | 12.81% (2) |

4946 Azusa Canyon Road | | |

Irwindale, CA 91706 | | |

| | |

Thomson Horstmann & Bryant, Inc. | 634,606 (3) | 11.49% (3) |

501 Merritt 7 | | |

Norwalk, CT 06851 | | |

| | |

| |

(1) | Based on a Schedule 13D/A filed with the Securities and Exchange Commission (“SEC”), as of January 26, 2015, Janice Carlson and Charles H. Smith, III beneficially owned, as Trustees (the "Trustees"), 1,994,674 Common Shares of the Company and such Common Shares have been deposited with them or their predecessors, as Trustees, under a Voting Trust Agreement entered into as of January 31, 2013 (the "Voting Trust Agreement") and extended by an amendment entered into on January 15, 2015 (the "Voting Trust Agreement Extension"). The Voting Trust Agreement Extension is for a two-year term ending January 31, 2017. The Trustees under the Voting Trust Agreement share voting control with respect to all such Common Shares. Although the Trustees do not have the power to dispose of the shares subject to the Voting Trust Agreement, they share the power to terminate the voting trust or to return shares subject to the Voting Trust Agreement to holders of voting trust certificates. |

(2) Based on a Schedule 13D/A filed with the SEC on May 21, 2009, M. and S. Silk Revocable Trust, Mark J. Silk and Sarah C. Silk, Co-Trustees, share both voting and dispositive power over 700,600 Common Shares of the Company as of May 21, 2009. During fiscal 2011 and fiscal 2015, Mr. Silk was awarded 1,780 and 1,476 restricted shares, respectively as a director of the Company. In fiscal 2016, Mr. Silk was issued 3,881 restricted shares in his capacity as a director of the Company.

| |

(3) | Based on a Schedule 13G/A filed with the SEC on January 21, 2016, Thomson Horstmann & Bryant, Inc., an investment adviser registered under section 203 of the Investment Advisers Act of 1940, held shared voting and sole dispositive power over 356,887 and 634,606 Common Shares, respectively, of the Company. |

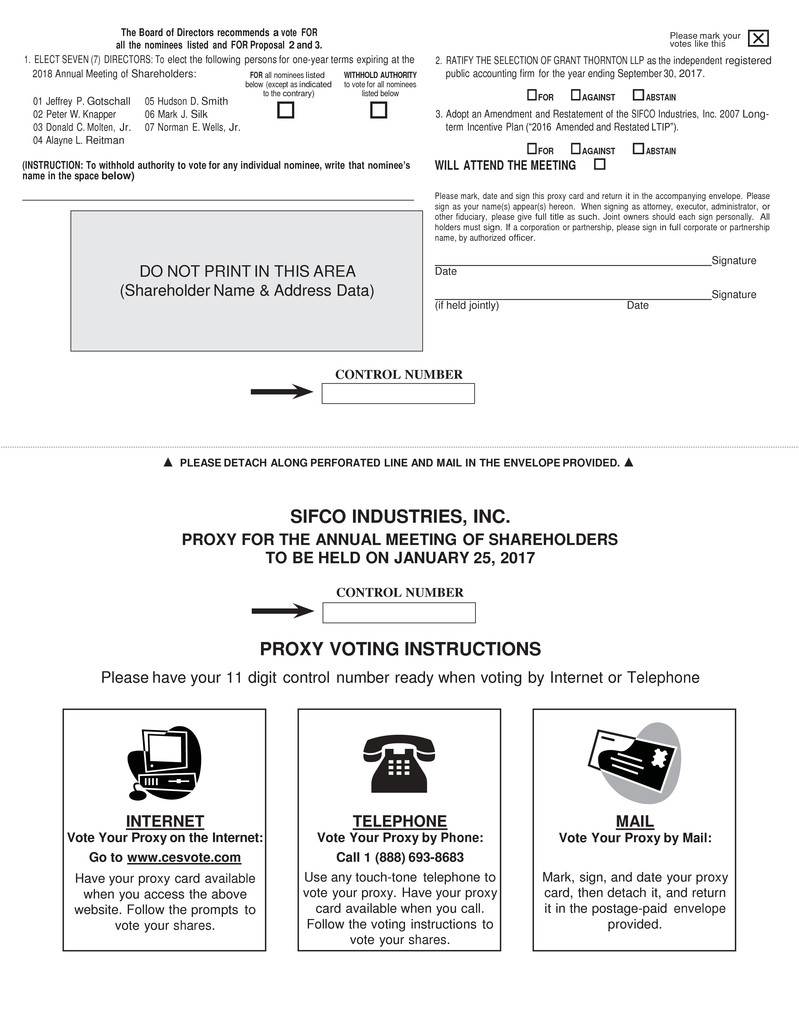

PROPOSAL 1 - TO ELECT SEVEN (7) DIRECTORS

Seven (7) directors are to be elected at the 2017 Annual Meeting to hold office until the next annual meeting of shareholders and/or until their respective successors are elected and qualified. Shares represented by validly given proxies will be voted in favor of the following persons to serve as directors unless the shareholder indicates to the contrary on the proxy. The seven (7) nominees receiving the most votes will be elected as directors at the 2017 Annual Meeting. Proxies cannot be voted for a greater number of nominees than the number named in this Proxy Statement.

The Board has determined it is in the best interest for the Company to reduce the size of the board from nine (9) directors to seven (7) directors, primarily due to the nature and size of the Company and to reduce cost. As such, Mr. John G. Chapman and Mr. Michael S. Lipscomb will not seek renomination. Messrs. Chapman's and Lipscomb's decisions not to stand for re-election are not the result of any disagreement with the Company. The Company deeply appreciates and thanks Messrs. Chapman and Lipscomb for their years of service.

As a result of Messrs. Chapman's and Lipscomb's decisions not to stand for re-election, the Board has determined that, effective with the Annual Meeting of Shareholders, the size of the Board will be reduced from nine (9) to seven (7) directors.

Each of the below nominees has consented (i) to serve as a nominee, (ii) to being named as a nominee in this Proxy Statement and (iii) to serve as a director, if elected. Although the Company does not contemplate that any of the nominees will be unavailable for election, if a vacancy in the slate of nominees is occasioned by death or other unexpected occurrence, it is currently intended that the remaining directors will, by the vote of a majority of their number, designate a different nominee for election to the Board at the 2017 Annual Meeting.

Board Recommendation - The Board of Directors recommends that you vote FOR the election of all nominees. Unless you instruct otherwise on your proxy card or in person, your proxy will be voted in accordance with the Board’s recommendation.

Nominees for election to the Board of Directors

Set forth below for each nominee for election as a director is a brief statement, including the age, principal occupation and business experience, and any directorships held. The members of the Nominating and Governance Committee have recommended the persons listed below as nominees for the Board of Directors, all of whom presently are directors of the Company.

The Nominating and Governance Committee reviews and evaluates individuals for nomination, to stand for election as a director, who are recommended to the Nominating and Governance Committee in writing by any of our shareholders pursuant to the procedure outlined below in the section titled “Process for Selecting and Nominating Directors” on the same basis as candidates who are suggested by our current or past directors, executive officers, or other sources. In considering individuals for nomination to stand for election, the Nominating and Governance Committee will consider: (1) the current composition of directors and how they function as a group; (2) the skills, experiences or background, and the personalities, strengths, and weaknesses of current directors; (3) the value of contributions made by individual directors; (4) the need for a person with specific skills, experiences or background to be added to the Board; (5) any anticipated vacancies due to retirement or other reasons; and (6) other factors that may enter into the nomination decision. The Nominating and Governance Committee endeavors to select nominees that contribute requisite skills and professional experiences in order to advance the performance of the Board of Directors and establish a well rounded Board with diverse views that reflect the interests of our shareholders. The

Nominating and Governance Committee considers diversity as one of a number of factors in identifying nominees for directors, however, there is no formal policy in this regard. The Nominating and Governance Committee views diversity broadly to include diversity of experience, skills and viewpoint, in addition to traditional concepts of diversity, such as race and gender.

When considering an individual candidate’s suitability for the Board, the Nominating and Governance Committee does not prescribe minimum qualifications or standards for directors, however, the Nominating and Governance Committee looks for directors who have personal characteristics, educational backgrounds and relevant experience that would be expected to help further the goals of both the Board and the Company. The Nominating and Governance Committee will review the extent of the candidate’s demonstrated success in his or her chosen business, profession, or other career and the skills that the candidate would be expected to add to the Board. The Nominating and Governance Committee may, in certain cases, conduct interviews with the candidate and/or contact references, business associates, other members of boards on which the candidate serves or other appropriate persons to obtain additional information. The Nominating and Governance Committee will make its determinations on whether to nominate an individual candidate based on the Board’s then-current needs, the merits of that candidate and the qualifications of other available candidates. The types of key attributes and/or experience that the Nominating and Governance Committee believes the composite board membership needs to possess to ensure the existence of a functionally effective board are: (i) proven leadership capabilities; (ii) familiarity with the organizational and operational requirements of medium and large-sized manufacturing organizations; (iii) strategic planning; (iv) experience in mergers and acquisitions and an understanding of financial markets; (v) experience in finance and accounting; (vi) familiarity with the aerospace, defense, energy and related industries and markets, (vii) experience with public company compensation matters and structure; and (viii) prior service on the boards of directors of other companies – both public and private. The Nominating and Governance Committee believes that each of the nominees possesses certain of the key attributes that such Committee believes to be important for an effective board.

Jeffrey P. Gotschall, 68, director of the Company since 1986, Chairman of the Board from 2001 to 2015 and Chairman Emeritus since 2015. Mr. Gotschall previously served the Company as Chief Executive Officer from 1990 until his retirement in 2009 and served from 1989 to 2002 as President, from 1986 to 1990 as Chief Operating Officer, from 1986 through 1989 as Executive Vice President and from 1985 through 1989 as President of SIFCO Turbine Component Services, a former operating subsidiary of the Company. Mr. Gotschall’s long history with the Company, coupled with his management expertise, enables him to bring valuable perspective to the Board and its discussion of industry issues.

Peter W. Knapper, 55, is the Company’s President and Chief Executive Officer. Mr. Knapper succeeded Mr. Lipscomb to this position on June 29, 2016. Prior to his appointment, Mr. Knapper worked for the TECT Corporation from 2007 to 2016, and was the Director of Strategy and Site Development. TECT offers the aerospace, power-generation, transportation, marine, and medical industries a combination of capabilities unique among metal component manufacturers. Prior to this role, Mr. Knapper, served as President of TECT Aerospace and Vice President of Operations of TECT Power. In addition, Mr. Knapper spent five years at Rolls Royce Energy Systems, Inc., a subsidiary of Roll-Royce Holdings plc, as the Director of Component Manufacturing and Assembly. Mr. Knapper brings his strategic and industry experience to his role in management and to the Board of the Company.

Donald C. Molten, Jr., 59, director of the Company since 2010. In June 2016, Mr. Molten retired as the Associate Headmaster at University School, a K-12 boys' college preparatory school in Hunting Valley, Ohio. Prior to joining University School in 2004, Mr. Molten was a Managing Director and Partner of Linsalata Capital Partners, a private equity firm that specializes in acquiring middle market companies. Mr. Molten is the former chairman

and director of the Tranzonic Companies, Inc. and a former director of U-Line Corporation, Inc. Mr. Molten also continues to serve on the board for First Choice Packaging, and Wellborn Forest Company. Mr. Molten formerly served as director of America’s Body Company, CMS / Hartzell, Neff Motivation, Transpac, Teleco and Degree Communications. Prior to joining Linsalata Capital Partners, Mr. Molten was a vice president of Key Equity Capital and its predecessor, Society Venture Capital, entities that made equity investments in closely held businesses. His experience in equity and debt transactions and leveraged buyouts also includes seven years with The Northwestern Mutual Life Insurance Company. Mr. Molten provides significant experience in implementation of growth strategies, execution of strategic acquisitions and divestitures and meaningfully contributes to the Board’s discussion of strategic considerations.

Alayne L. Reitman, 52, director of the Company since 2002. Ms. Reitman currently serves as a Trustee of The Cleveland Museum of Natural History and is a member of the Audit Committee of Hawken School. Ms. Reitman serves on the board of Embedded Planet LLC, a high-tech start-up company, where she previously served from 1999 to 2001 as President. Ms. Reitman previously served from 1993 to 1998 as Vice President and Chief Financial Officer of the Tranzonic Companies, Inc., a manufacturer and distributor of a variety of cleaning, maintenance and personal protection products, and from 1991 to 1993 as Senior Financial Analyst for American Airlines. Ms. Reitman's leadership skills and her financial acumen and management experience allow her to be a significant resource to the Board.

Mark J. Silk, 50, director of the Company since 2014. Mr. Silk was previously involved with the Company as both a customer and former director. Mr. Silk is President and CEO of ThinKom Solutions, Inc., a designer and manufacturer of high performance antenna systems for the aeronautical and ground mobile satellite communications industry. Mr. Silk is also a partner in Blue Sea Capital, a middle-market private equity firm focused on investments in Aerospace and Defense, Healthcare and Industrial Growth. Mr. Silk is also the owner and Chairman of Arrow Engineering, Inc., which manufactures machined parts for the military and commercial aerospace industry. Mr. Silk was previously the President and CEO and a shareholder of Integrated Aerospace, Inc., a supplier of landing gear and external fuel tanks to the military and commercial aerospace industry and of Tri-Star Electronics International, Inc., a manufacturer of high reliability electrical contacts and specialty connectors for the military and commercial aerospace industry. Mr. Silk’s broad industry knowledge and diverse investment expertise provides the Board with an expanded view of opportunities to grow the existing business and factors for consideration regarding acquisition opportunities.

Hudson D. Smith, 65, director of the Company since 1988. Mr. Smith is currently the President of Forged Aerospace Sales, LLC. Mr. Smith previously served the Company as Executive Vice President from 2003 through 2005; as Treasurer from 1983 through 2005; as President of SIFCO Forge Group, the Company's Cleveland forging operation from 1998 through 2003; as Vice President and General Manager of SIFCO Forge Group, from 1995 through 1997; as General Manager of SIFCO Forge Group from 1989 through 1995; and as General Sales Manager of SIFCO Forge Group from 1985 through 1989. Mr. Smith served as a board member of the Forging Industry Association from 2004 through 2008. Refer to “Director Compensation” below for a discussion of certain transactions between Mr. Smith and the Company. Mr. Smith’s historic and current involvement in the industry make him an invaluable contributor to considerations of industry trends and major customer matters.

Norman E. Wells, Jr., 68, director of the Company since 2013, succeeded Mr. Lipscomb as Chairman of the Board effective July 1, 2016. Mr. Wells served as a Partner and Operating Executive of SFW Capital Partners, LLC (“SFW”), a specialized private equity firm that exclusively invests in Analytical Tools and Related Services businesses from 2005 to 2015. He continues to serve on the board of Spectro, Inc., an SFW portfolio investment. Mr. Wells was also the Chairman of the Board of the Summa Health System, a not-for-profit health care provider,

from 2012 to 2015. Mr. Wells previously served as Chairman and CEO of Sovereign Specialty Chemicals, Inc., a manufacturer of specialty chemical products from 2002 to 2005; as CEO of Easco Aluminum, Inc. from 1996 until 1999; and as CEO of CasTech Aluminum Group Inc. from 1991 to 1996. Mr. Wells also served on the boards of Dal-Tile International and Manchester Tank & Equipment Co. Mr. Wells’ experience in managerial positions and with boards of directors of other businesses provides valuable business acumen and strategic insight to the Board.

Each of the foregoing nominees is recommended by the Nominating and Governance Committee. There are, and during the past ten years there have been, no legal proceedings material to an evaluation of the ability of any director or executive officer of the Company to act in such capacity or concerning his or her integrity. There are no family relationships among any of the directors and executive officers except that Mr. Gotschall and Mr. Smith are cousins.

STOCK OWNERSHIP OF EXECUTIVE OFFICERS, DIRECTORS AND NOMINEES

The following table sets forth, as of October 31, 2016, the number of Common Shares of the Company beneficially owned by each director, nominee for director and named executive officer and all directors and executive officers as a group, according to information furnished to the Company by such persons:

|

| | | | | | | |

| | Amount and Nature of | | |

Name of Beneficial Owner | | Beneficial Ownership | | Percent of Class |

| | | | | | |

Mark J. Silk | | | 707,737 |

| | | 12.81% |

Hudson D. Smith (2)(3)(5) | | | 266,802 |

| | | 4.83% |

Michael S. Lipscomb (3) | | | 176,230 |

| | | 3.19% |

Jeffrey P. Gotschall (2)(3)(5) | | | 164,701 |

| | | 2.98% |

Donald C. Molten, Jr. | | | 33,621 |

| | | * |

Peter W. Knapper | | | 30,000 |

| | | * |

John G. Chapman, Sr. | | | 20,333 |

| | | * |

Alayne L. Reitman | | | 16,211 |

| | | * |

Norman E. Wells, Jr. | | | 11,515 |

| | | * |

Salvatore Incanno (4) | | | 3,571 |

| | | * |

| | | | | | |

All Directors and Executive Officers as a Group (1) | | 1,430,721 |

| | | 25.89% |

*Common Shares owned are less than one percent of class.

| |

(1) | Unless otherwise stated below, the named person owns all of such shares of record and has sole voting and investment power as to those shares. |

| |

(2) | In the cases of Mr. Gotschall and Mr. Smith, includes 400 shares and 8,655 shares, respectively, owned by their spouses and any children or in trust for them, their spouses and their lineal descendants. |

| |

(3) | Includes Voting Trust Certificates issued by the aforementioned (see page 3) Voting Trust representing an equivalent number of Common Shares held by such Trust as follows: Mr. Gotschall – 152,629, Mr. Smith – 251,821 and Mr. Lipscomb - 150,000. |

| |

(4) | The total number of shares: 3,571 for Mr. Incanno represents shares granted in June 2016 as part of a retention agreement which are expected to vest as of November 30, 2016. |

| |

(5) | Mr. Gotschall and Mr. Smith are cousins. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 (“Exchange Act”) requires the Company’s officers and directors, and persons who own more than ten percent (10%) of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the U.S. Securities and Exchange Commission (“SEC”). Officers, directors and greater than ten percent (10%) shareholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file.

Based solely upon a review of Forms 3, 4 and 5 furnished to the Company during, or with respect to, the fiscal year ended September 30, 2016, the Company believes that no director, officer, beneficial owner of more than ten percent (10%) of its outstanding Common Shares or any other person subject to Section 16(a) of the Exchange Act failed to file on a timely basis during fiscal 2016 any reports required by 16(a) of the Exchange Act.

CORPORATE GOVERNANCE AND BOARD OF DIRECTORS MATTERS

Board of Directors - The Company's Board of Directors held seventeen (17) scheduled meetings during fiscal 2016. The Board of Directors' standing committees are the Audit, Compensation, Nominating and Governance Committees. From time-to-time, the Board may determine that it is appropriate to form a special committee of its independent directors to address a particular matter(s) not specific to one of its standing committees. Directors are expected to attend Board meetings, the annual shareholders’ meeting, and meetings of the committees on which he or she serves. During fiscal 2016, each director attended at least 75% of the total number of meetings of the Board and the committees on which he or she served. SIFCO’s independent directors meet in executive session at each regularly scheduled Board meeting. All the directors attended (in person or telephonically) the Company’s 2016 Annual Meeting of Shareholders.

Director Independence - The members of the Board of Directors' standing committees are all independent directors as defined in Section 803 of the NYSE MKT Company Guide. The Board has affirmatively determined that Mr. Gotschall, Mr. Molten, Jr., Ms. Reitman, Mr. Chapman, Sr., Mr. Wells, Jr. and Mr. Silk meet these standards of independence. There are no undisclosed transactions, relationships, or arrangements between the Company and any of such directors. The Board has affirmatively determined that Mr. Knapper, current employee of the Company, Mr. Lipscomb, due to his employment with the Company within the past 3 years, and Mr. Smith, due to his relationship as described in the Director Compensation section included herein, do not meet these standards of independence, are therefore not independent and, accordingly, are not members of any of the Board’s standing committees.

Board Committees

Audit Committee - The functions of the Audit Committee are to select, subject to shareholder ratification, the Company’s independent registered public accounting firm; to approve all non-audit related services performed by the Company’s independent registered public accounting firm; to determine the scope of the audit; to discuss any special problems that may arise during the course of the audit; and to review the audit and its findings for the purpose of reporting to the Board of Directors. Further, the Audit Committee receives a written statement delineating the relationship between the independent registered public accounting firm and the Company. None of the members of the Audit Committee participated in the preparation of the Company’s financial statements at any time during the past three (3) years. The members of the Audit Committee are all independent directors as defined in Section 803 of the NYSE MKT Company Guide and SEC Rule 10A-3. Each member of the Audit Committee is financially literate and Ms. Reitman is designated as the Audit Committee financial expert. None of the Audit Committee members serve on more than one (1) other public company audit committee. The Audit Committee, currently composed of Ms.

Reitman (Chairperson), Mr. Molten, Jr., Mr. Wells, Jr., Mr. Silk and Mr. Chapman, Sr., held ten (10) meetings during fiscal 2016. Mr. Chapman has determined not to stand for re-election and, accordingly, will no longer be a member of the Audit Committee following the Annual Meeting of Shareholders. The Audit Committee operates under a written charter that is available on the Company’s website at www.sifco.com.

Compensation Committee - The functions of the Compensation Committee are to review and make recommendations to the Board to ensure that our executive compensation and benefit programs are consistent with our compensation philosophy and corporate governance guidelines and, subject to the approval of the Board, to establish the executive compensation packages offered to directors and officers. Officers’ base salary, target annual incentive compensation awards and granting of long-term equity-based incentive compensation, and the number of shares that should be subject to each equity instrument so granted, are set at competitive levels with the opportunity to earn competitive pay for targeted performance as measured against a peer group of companies. The Compensation Committee is appointed by the Board, and consists entirely of directors who are independent directors as defined in Section 803 of the NYSE MKT Company Guide. Our Compensation Committee, currently composed of Mr. Wells, Jr. (Chairperson), Ms. Reitman, Mr. Molten, Jr., Mr. Silk and Mr. Chapman, Sr., held four (4) meetings during fiscal 2016 and conducted other committee discussions as a part of a regular board meeting, some of which discussions were conducted without the CEO present. Mr. Chapman has determined not to stand for re-election and, accordingly, will no longer be a member of the Compensation Committee following the Annual Meeting of Shareholders. The Compensation Committee operates under a written charter that is available on the Company’s website at www.sifco.com.

Nominating and Governance Committee - The functions of the Nominating and Governance Committee are to recommend candidates for the Board of Directors and address issues relating to (i) senior management performance and Board succession and (ii) the composition and procedures of the Board. The Nominating and Governance Committee is currently composed of Mr. Chapman, Sr. (Chairperson), Ms. Reitman, Mr. Wells, Jr., Mr. Silk and Mr. Molten, Jr. Mr. Chapman has determined not to stand for re-election and, accordingly, will no longer be a member of the Nominating and Governance Committee following the Annual Meeting of Shareholders. The members of the Nominating and Governance Committee are all independent directors as defined in Section 803 of the NYSE MKT Company Guide. The Nominating and Governance Committee held two (2) meeting during fiscal 2016. Other functions of the Nominating and Governance Committee were fulfilled during sessions of the full Board of Directors. The Nominating and Governance Committee operates under a written charter that is available on the Company’s website at www.sifco.com.

Board Role in Risk Oversight - The Board reviews the Company’s annual plan and strategic plan, which address, among other things, the risks and opportunities facing the Company. The Board also has overall responsibility for executive officer succession planning, and discusses and reviews succession planning on a regular basis. Certain areas of oversight may be delegated to the relevant committees of the Board and the committees report back on their deliberations. This oversight is enabled by reporting processes that are designed to provide visibility to the Board about the identification, assessment, monitoring and management of enterprise-wide risks. Management incorporates enterprise-wide risk assessment of the Company as part of its annual planning process, including each of its business segments, and presents it to the Board for review as part of senior management’s annual planning process. The principal areas of this risk assessment include a review of strategic business, financial, operational, compliance and technology objectives and the potential risk for the Company. In addition, on an ongoing basis: (a) the Audit Committee maintains primary responsibility for oversight of risks and exposures pertaining to the accounting, auditing and financial reporting processes of the Company; (b) the Compensation Committee maintains primary responsibility for risks and exposures associated with oversight of the administration and implementation of our compensation policies; and

(c) the Nominating and Governance Committee maintains primary responsibility for risks and exposures associated with corporate governance and succession planning.

Separation of Role of Chairman of the Board and CEO - Mr. Wells serves as Chairman of the Board, a position he has held since July 1, 2016 (following the retirement of Mr. Lipscomb on June 30, 2016). Prior to that, Mr. Lipscomb had acted as Chairman of the Board and Mr. Wells was Lead Independent Director, a position he had held since November 2015. The Company has determined its current structure to be most effective as the Chairman serves as a liaison between its directors and management and helps to maintain communication and discussion among the Board and management. The Chairman serves in a presiding capacity at meetings and has such other duties as are determined by the Board from time to time.

Process for Selecting and Nominating Directors - In its role as the nominating body for the Board, the Nominating and Governance Committee reviews the credentials of potential director candidates (including any potential candidates recommended by shareholders), conducts interviews and makes formal recommendations to the Board for the annual and any interim election of directors. The Nominating and Governance Committee will consider shareholder nominations for directors at any time. Any shareholder desiring to have a nominee considered by the Nominating and Governance Committee should submit such recommendation in writing to a member of the Nominating and Governance Committee or the Corporate Secretary of the Company, c/o SIFCO Industries, Inc., 970 East 64th Street, Cleveland, Ohio 44103. The recommendation letter should include the shareholder’s own name, address and the number of shares owned and the candidate’s name, age, business address, residence address, and principal occupation, as well as the number of shares the candidate owns. The letter should provide all the information that would need to be disclosed in the solicitation of proxies for the election of directors under federal securities laws. Finally, the shareholder should also submit the recommended candidate’s written consent to be elected and commitment to serve if elected. The Company may also require a candidate to furnish additional information regarding his or her eligibility and qualifications.

Communications with the Board of Directors – Shareholders may communicate their concerns directly to the entire Board of Directors or specifically to non-management directors of the Board. Such communication can be confidential or anonymous, if so designated, and may be submitted in writing to the following address: Board of Directors, SIFCO Industries, Inc., c/o Ms. Megan L. Mehalko, Corporate Secretary, 970 E. 64th Street, Cleveland, Ohio 44103, who will forward the communication to the specified director(s) as necessary.

Code of Ethics – The Company’s Code of Ethics applies to all of its Directors and its employees, including its Chief Executive Officer and its Chief Financial Officer. The Code of Ethics and all committee charters are posted in the Investor Relations portion of the Company website at www.sifco.com.

Certain Relationships and Related Transactions - There were no transactions between the Company and its officers, directors or any person related to its officers or directors, or with any holder of more than 5% of the Company’s Common Shares, either during fiscal 2016 or up to the date of this proxy statement, except for the sales representative agreement in place between the Company and Mr. Smith that is discussed below under the heading “Director Compensation.”

The Company reviews all transactions between the Company and any of its officers and directors. The Company’s Code of Ethics, which applies to all employees, emphasizes the importance of avoiding situations or transactions in which personal interests may interfere with the best interests of the Company or its shareholders. In addition, the Company’s general corporate governance practice includes board-level discussion and assessment of procedures for discussing and assessing relationships, including business, financial, familial and nonprofit, among

the Company and its officers and directors, to the extent that they may arise. The Board reviews any transaction with an officer or director to determine, on a case-by-case basis, whether a conflict of interest exists. The Board ensures that all directors voting on such a matter have no interest in the matter and discusses the transaction with counsel as the Board deems necessary. The Board will generally delegate the task of discussing, reviewing and approving transactions between the Company and any of its related persons to the Audit Committee.

EXECUTIVE COMPENSATION

The Company is a “smaller reporting company” under the rules promulgated by the SEC and complies with the disclosure requirements specifically applicable to smaller reporting companies. This section and summary compensation table are not intended to meet the “Compensation Disclosure and Analysis” disclosure that is required to be made by larger reporting companies.

Executive Summary:

This section contains information about the compensation paid to our Named Executive Officers ("NEOs") during its fiscal years ended September 30, 2016 and 2015. The following should be read in conjunction with the information presented in the compensation tables, the footnotes to those tables and the related disclosures appearing later in this section. The tables and related disclosures contain specific information about the compensation earned or paid during the fiscal years ending September 30, 2016 and 2015 to the following individuals, who were determined to be the Company's NEOs.

| |

• | Peter W. Knapper, President and Chief Executive Officer (effective June 29, 2016) |

| |

• | Michael S. Lipscomb, Chairman and Chief Executive Officer (through June 28, 2016) |

| |

• | Salvatore Incanno, Vice President of Finance and Chief Financial Officer |

Pay Philosophy and Practices

Role of Compensation Committee:

Five independent directors comprise our Compensation Committee, which is responsible for establishing and administering our compensation policies, programs and procedures. In performing its duties, the Compensation Committee may request information from senior management regarding the Company’s performance, pay and programs to assist it in its actions. Moreover, the Compensation Committee has the authority to retain outside advisors as needed to assist it in reviewing the Company’s programs, revising them and providing analysis regarding competitive pay information. The Compensation Committee annually reviews and establishes the goals used for our incentive plans. In addition, it annually assesses the performance of the Company and the Chief Executive Officer. Based on this evaluation, the Compensation Committee then recommends the Chief Executive Officer’s compensation for the next year to the Board for its consideration and approval. In addition, the Compensation Committee reviews the Chief Executive Officer’s compensation recommendations for the remaining NEOs, providing appropriate input and approving final awards. Finally, the Compensation Committee provides approval for the Chief Executive Officer's recommendations of the compensation of other key executives.

Role of Senior Management:

The Company’s management serves in an advisory or support capacity as the Compensation Committee carries out its charter. Typically, the Company’s Chief Executive Officer participates in meetings of the Compensation

Committee. The Company’s other NEOs and senior management may participate as necessary or at the Compensation Committee’s request. The NEOs and senior management normally provide the Compensation Committee with information regarding the Company’s performance, as well as information regarding executives who participate in the Company’s various plans. Such data is usually focused on the executives’ historical pay and benefit levels, plan costs, context for how programs have changed over time and input regarding particular management issues that need to be addressed. In addition, management normally furnishes similar information to the Compensation Committee’s independent compensation advisor. Management provides input regarding the recommendations made by outside advisors or the Compensation Committee. Management implements, communicates and administers the programs approved by the Compensation Committee. The Chief Executive Officer annually evaluates the performance of the Company and its other NEOs. Based on his evaluation, he provides the Compensation Committee with his recommendations regarding the pay for the other NEOs for its consideration, input and approval. The Compensation Committee, in turn, authorizes the Chief Executive Officer to establish the pay for the Company’s other executives based on terms consistent with those used to establish the pay of the NEOs. Members of management present at meetings when pay is discussed are recused from such discussions when the Compensation Committee focuses on their individual pay.

Role of Independent Compensation Advisor:

The fiscal 2016 pay program utilized compensation data from a market pay study conducted by Pay Governance (“Pay Governance”). This study was originally commissioned by the Compensation Committee in fiscal 2013 in order to achieve a comprehensive, independent review of the Company’s executive compensation program. Compensation data for the CEO position was provided by Pay Governance at the end of fiscal 2015. The Pay Governance studies provided compensation information from a peer group of companies in technology-oriented metals manufacturing companies whose median revenues and assets are comparable to ours, as well as data from compensation surveys that included hundreds of companies in a broader range of industries with revenues that are comparable to ours. We continued to reference this data when making our fiscal 2016 pay decisions, applying an aging factor to bring the 2013 data current to fiscal 2016.

Summary Compensation Table for Fiscal 2016

The following table sets forth information regarding the compensation of the Company’s President and Chief Executive Officer, Retired Chairman and Chief Executive Officer and current Vice President and Chief Financial Officer, who are the only named executive officers of the Company, for the fiscal years ended September 30, 2016, and 2015:

|

| | | | | | | | | | | | | | | | | | | | | | | | | |

Summary Compensation Table |

Name and Principal Position (1) | Year | Salary ($) | Bonus ($) (6) | Stock Awards ($) (2) | Option Awards ($) | Non- Equity Incentive Plan Compensation ($) (3) | Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($) (4)(5) | Total ($) |

Peter W. Knapper | 2016 | $ | 90,417 |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 11,806 |

| $ | 102,223 |

|

President and CEO | 2015 | $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

|

Michael S. Lipscomb | 2016 | $ | 270,750 |

| $ | — |

| $ | 45,969 |

| $ | — |

| $ | — |

| $ | — |

| $ | 5,218 |

| $ | 321,937 |

|

Retired Chairman & CEO | 2015 | $ | 356,688 |

| $ | — |

| $ | 729,095 |

| $ | — |

| $ | — |

| $ | — |

| $ | 19,687 |

| $ | 1,105,470 |

|

Salvatore Incanno | 2016 | $ | 276,075 |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 10,429 |

| $ | 286,504 |

|

Vice President & CFO | 2015 | $ | 106,875 |

| $ | 57,500 |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 62,826 |

| $ | 227,201 |

|

| |

(1) | The following executives did not serve as NEOs the entirety of fiscal 2016 and fiscal 2015: |

• Peter W. Knapper - President and CEO starting on June 29, 2016.

• Michael S. Lipscomb - Chairman and CEO through June 28, 2016.

• Salvatore Incanno - CFO starting on May 11, 2015 through present.

| |

(2) | Amounts shown do not reflect compensation actually received by the executive officer. The awards for which amounts are shown in this column include the stock awards granted under the Company's 2007 Long-Term Incentive Plan. The above amounts represent the grant date fair values of the stock awards granted in fiscal 2016 and 2015, as measured in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 718, Compensation – Stock Compensation. Such fair value is based on the target number of restricted and performance-based stock awards granted in each of the two fiscal years noted multiplied by the closing market price of the Company’s Common Shares on the NYSE MKT Exchange on the date of grant. |

| |

(3) | Reflects the value of annual incentive compensation earnings for named executive officers. For fiscal 2016, actual Adjusted EBITDA results were below target and actual working capital was above the target range, resulting in no payout of any compensation pursuant to the Annual Incentive Plan. |

| |

(4) | All other compensation for Messrs. Knapper, Lipscomb, and Incanno consists of amounts contributed by the Company as matching contributions pursuant to the SIFCO Industries, Inc. Employees' 401(k) Plan, a defined contribution plan. |

| |

(5) | All other compensation for Messrs. Knapper and Incanno consists of relocation benefits paid by the Company in fiscal 2016 and fiscal 2015, respectively. |

| |

(6) | Reflects the amount of Mr. Incanno's hiring signing bonus, paid in fiscal 2015. |

Outstanding Equity Awards

For each individual named in the Summary Compensation Table, set forth below is information relating to such person’s ownership of unearned restricted shares and performance-based shares at September 30, 2016. There were no outstanding stock options at September 30, 2016.

|

| | | | | | | | | | | | | | | | | | |

| | Outstanding Equity Awards at Fiscal Year-End |

| | Name | Option Awards | Stock Awards |

| | Number of Securities Underlying Unexercised Options (#) Exercisable | Number of Securities Underlying Unexercised Options (#) Unexercisable | Option Exercises Price ($) | Option Expiration Date | Number of Shares or Units of Stock That Have Not Vested (#) | Market Value of Shares or Units of Stock That Have Not Vested ($) (2) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) (1) | Equity Incentive Plan Award: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($) (2) |

| |

| | Peter W. Knapper (3) | | | | | | | | |

| | Restricted Shares | — |

| — |

| — |

| N/A | 30,000 |

| $ | 297,300 |

| — |

| $ | — |

|

| | Michael S. Lipscomb | | | | | | | | |

| | Performance Shares | — |

| — |

| — |

| N/A | — |

| — |

| 22,641 |

| 224,372 |

|

| | Salvatore Incanno (4) | | | | | | | | |

| | Performance Shares | — |

| — |

| — |

| N/A | 7,143 |

| 70,787 |

| 10,300 |

| 102,073 |

|

| |

(1) | Based on the actual number of restricted stock awards and the target number of performance-based stock awards. Mr. Lipscomb's number of shares is based on a pro-rated target number of shares due to his retirement on June 30, 2016. |

| |

(2) | Based upon the closing market price of the Company’s Common Shares on the NYSE MKT Exchange on September 30, 2016, which was $9.91. |

| |

(3) | Mr. Knapper received a grant of 30,000 restricted shares upon his hire. |

| |

(4) | Mr. Incanno received an equity retention agreement in June 2016. |

Defined Benefit Pension Plan

None of the NEOs participate in the Company's defined benefit pension plan for salaried employees, which was frozen to new entrants and ceased future benefit accruals as of March 1, 2003.

Supplemental Executive Retirement Plan

None of the NEOs participate in the Company's non-qualified Supplemental Executive Retirement Plan ("SERP"), which was frozen to new entrants and ceased future benefit accruals as of March 1, 2003.

Potential Payments Upon Termination or Change-in-Control

The Company has entered into a Change in Control and Severance Agreement with Mr. Knapper, which provides severance benefits in the event of his involuntary termination with or without a change in control. The Company has entered a Change in Control Agreement with Mr. Incanno, which provides severance benefits in the event of his involuntary termination as a result of a change in control. The purpose of these agreements is to reinforce and encourage the continued attention and dedication of these executives to their assigned duties without distraction in the face of (i) solicitations by other employers and (ii) the potentially disturbing circumstances arising from the possibility of a change in control of the Company. These agreements provide the following benefits:

•In the case of Mr. Knapper, if Mr. Knapper is terminated involuntarily without a change in control within the first three (3) years of his employment, or if Mr. Knapper is terminated other than for cause or if he terminates for good reason within the two year period following a change in control, the Change in Control and Severance Agreement provides for a lump sum severance payment equal to 200% of his annual base salary in effect at the time of termination, continuation of health and welfare insurance coverage for up to 24 months following termination, and pro-rata vesting of any outstanding awards under the Company's 2007 Long Term Incentive Plan.

•In the case of Mr. Incanno, if, within the two year period following a change of control, Mr. Incanno is terminated other than for cause or if he terminates for good reason, the Change in Control Agreement provides for a lump sum severance payment equal to 150% of his annual base salary in effect at the time of termination and continuation of health and welfare insurance coverage for up to 24 months following termination. The terms of the long term equity incentive award granted in fiscal 2016 provide for accelerated full vesting upon a termination within 12 months following a change in control.

The following table describes the potential payments upon termination of employment of Mr. Knapper and Mr. Incanno. The table assumes the executive's employment was terminated on September 30, 2016, the last business day of the Company’s 2016 fiscal year.

|

| | | |

Potential Payments Upon Termination of Employment |

Name and Principal Position |

Voluntary Termination | Involuntary Not For Cause (or For Good Reason) Termination – without a Change in Control ($) | Involuntary Not For Cause (or For Good Reason) Termination – with a Change in Control ($) (1) |

Peter W. Knapper Severance Accelerated Vested Restricted Stock awards Health & Welfare Insurance |

-0- -0- -0- |

$700,000 $24,775 $46,049 |

$700,000 $297,300 $46,049 |

Salvatore Incanno Severance Accelerated Vested Performance Stock awards Health & Welfare Insurance |

-0- -0- -0- |

-0- -0- -0- |

$405,000 $172,860 $ 46,049 |

| |

(1) | The value of the accelerated vested restricted stock and performance stock awards is determined based on the closing price of the Company's stock as of 9/30/2016. |

DIRECTOR COMPENSATION

Chairman of the Board compensation was evaluated following Mr. Lipscomb's retirement as Chairman and CEO effective June 30, 2016 and Mr. Wells' appointment as Chairman effective July 1, 2016. The annual cash retainer for the Chairman of the Board remained at $30,000. The annual cash retainer for the Chairman Emeritus of the Board was $40,000. The annual cash retainer for all other non-employee directors is $30,000. In addition, Committee members receive a $4,000 cash retainer per year. The Chair of the Audit Committee receives an additional $13,000 cash retainer per year; the Chair of the Compensation Committee receives an additional $8,000 cash retainer per year; and the Chairs of the Governance Committee and any Special Committee receive an additional $6,000 cash retainer per year. Directors who are employees of the Company do not receive the annual retainer.

Under our Director Compensation Policy, except for the Chairman of the Board, each non-employee director who holds such position on the date of the annual meeting of the shareholders will be awarded shares of our Common Stock equal to a grant date value of $46,000. Prior to becoming Chairman of the Board effective July 1, 2016, Mr. Wells was Lead Director and received shares of our Common Stock equal to a grant value of $70,000 in fiscal 2016. As Chairman of the Board, Mr. Wells will receive shares of our Common Stock equal to a grant value of $85,000 beginning in fiscal 2017.

Our Amended and Restated Code of Regulations provides that we will indemnify any of our directors or former directors who was or is a party or is threatened to be made a party to any matter, whether civil, criminal, administrative or investigative, by reason of the fact that the individual is or was a director of the Company. We also currently have in effect director and officer insurance coverage.

The following table shows the compensation paid to each of the non-employee directors during fiscal 2016. Mr. Lipscomb, who was our Chief Executive Officer (through June 28, 2016) and Mr. Knapper (effective June 29, 2016), did not receive any additional compensation for services as a director.

|

| | | | | | | | | | | | | | | | | | | | | |

Director Compensation Table |

Director Compensation for Fiscal 2016 |

Name |

Fees Earned or Paid in Cash ($) |

Stock Awards ($) (1) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings |

All Other Compensation ($) (2) | Total ($) |

John G. Chapman, Sr. | $ | 40,000 |

| $ | 36,675 |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 76,675 |

|

Jeffrey P. Gotschall | $ | 40,000 |

| $ | 36,675 |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 76,675 |

|

Donald C. Molten, Jr. | $ | 40,000 |

| $ | 36,675 |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 76,675 |

|

Michael S. Lipscomb | $ | 7,500 |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 7,500 |

|

Alayne L. Reitman | $ | 47,000 |

| $ | 36,675 |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 83,675 |

|

Mark J. Silk | $ | 34,000 |

| $ | 36,675 |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 70,675 |

|

Hudson D. Smith | $ | 30,000 |

| $ | 36,675 |

| $ | — |

| $ | — |

| $ | — |

| $ | 111,757 |

| $ | 178,432 |

|

Norman E. Wells, Jr. (3) | $ | 45,750 |

| $ | 55,821 |

| $ | — |

| $ | — |

| $ | — |

| $ | — |

| $ | 101,571 |

|

| |

(1) | Each non-employee Director except Mr. Wells was awarded 3,881 restricted shares of the Company’s common stock. Mr. Wells, as Lead Director, was awarded 5,907 restricted shares of the Company's common stock. Mr. Lipscomb was an employee Director at the time of the grant and therefore did not receive restricted shares. Fair value is based on (i) the number of restricted stock awards granted in fiscal 2016 multiplied by (ii) the closing market price of the Company’s Common Shares on the NYSE MKT Exchange on the date of grant, which was $9.45. |

| |

(2) | With respect to Mr. Smith, all other compensation consists of payments made to Forged Aerospace Sales, LLC, an entity affiliated to Mr. Smith, during fiscal 2016 under the Sales Representative Agreement, further described below, for services other than as director. |

| |

(3) | Mr. Wells received a one-time cash payment of $3,750 upon his appointment as Chairman of the Board. |

Mr. Smith previously held several executive level positions with the Company and, in connection with his resignation from the Company, Mr. Smith, through his affiliated entity, Forged Aerospace Sales, LLC, entered a Sales Representative Agreement with the Company, the terms of which are substantially the same as the terms of other agreements the Company maintains with its third-party sales representatives. Compensation under the Sales Representative Agreement, which resulted in payments of $111,757 in fiscal 2016, is based strictly upon earned sales commissions with no guaranteed minimum obligation to Mr. Smith and/or to Forged Aerospace Sales, LLC.

PRINCIPAL ACCOUNTING FEES AND SERVICES

Audit Fees

Fees paid or payable to Grant Thornton LLP for the audits of the annual financial statements included in the Company’s Form 10-K and for the reviews of the interim financial statements included in the Company’s Forms 10-Q for the years ended September 30, 2016 and 2015 were $610,097 and $1,089,025, respectively. The Audit Committee has sole responsibility for determining whether and under what circumstances an independent registered public

accounting firm may be engaged to perform audit-related services and must pre-approve any non-audit related service performed by such firm. In fiscal 2016, audit and non-audit related fees, to the extent they were incurred, were pre-approved by the Audit Committee.

Audit Related Fees

Fees paid or payable to Grant Thornton LLP for audit-related services for the years ended September 30, 2016 and 2015 were $0 and $65,187, respectively.

Tax Fees

There were no fees paid or payable during fiscal 2016 or 2015 to Grant Thornton LLP for tax compliance or consulting services.

All Other Fees

There were no fees paid or payable during fiscal 2016 or 2015 to Grant Thornton LLP for products or services other than the professional services described above.

AUDIT COMMITTEE REPORT

The Audit Committee reviewed and discussed the audited financial statements of the Company for the fiscal year ended September 30, 2016, with the Company's management and with the Company's independent registered public accounting firm, Grant Thornton LLP. The Audit Committee also has (i) discussed with Grant Thornton LLP the matters required to be discussed by the Statement of Auditing Standards No. 61, as amended (Communication with Audit Committees), (ii) received the written communications from Grant Thornton LLP pursuant to the applicable requirements of the Public Company Accounting Oversight Board certifying the firm’s independence and (iii) the Audit Committee discussed the independence of Grant Thornton LLP with that firm. Grant Thornton LLP has confirmed to the Company that it is in compliance with all rules, standards and policies of the Independence Standards board and the SEC governing auditor independence.

The Audit Committee operates under a written charter as last amended in May 2013.

Based upon the Audit Committee's review and discussions noted above, the Audit Committee recommended to the Board of Directors that the Company's audited financial statements be included in the Company's Annual Report on Form 10-K for the fiscal year ended September 30, 2016 to be filed with the SEC.

|

| |

Audit Committee |

Alayne L. Reitman; Chairperson |

John G. Chapman, Sr. |

Donald C. Molten, Jr. |

Mark J. Silk |

Norman E. Wells, Jr. |

PROPOSAL 2 – TO RATIFY THE SELECTION OF AUDITORS

The firm of Grant Thornton LLP has been the Company's independent registered public accounting firm since 2002. The Board of Directors has chosen that firm to audit the accounts of the Company and its consolidated subsidiaries for the fiscal year ending September 30, 2017, subject to the ratification of the shareholders for which the affirmative vote of a majority of the Common Shares present and voting at the 2017 Annual Meeting (in person or by proxy) is required. Proposal No. 2 is a non-binding proposal. Although shareholder ratification is not required under the laws of the State of Ohio, the appointment of Grant Thornton LLP is being submitted to the Company’s shareholders for ratification at the 2017 Annual Meeting in order to provide a means by which our shareholders may communicate their opinion to the Audit Committee. If our shareholders do not ratify the appointment of Grant Thornton LLP, the Audit Committee will reconsider the appointment, but is not obligated to change the appointment, and may for other reasons be unable to make another appointment. Grant Thornton LLP has advised the Company that neither the firm nor any of its members or associates has any direct or indirect financial interest in the Company or any of its affiliates other than as auditors.

Board Recommendation - the Board of Directors recommends that you vote FOR the ratification of the selection of Grant Thornton LLP as the independent registered public accounting firm of the Company for the year ending September 30, 2017. Unless you instruct otherwise on your proxy card or in person, your proxy will be voted in accordance with the Board’s recommendation.

Representatives of Grant Thornton LLP are expected to be present at the 2017 Annual Meeting with the opportunity to make a statement if they desire to do so and to be available to respond to appropriate questions.

PROPOSAL 3 – TO ADOPT AN AMENDMENT AND RESTATEMENT OF THE SIFCO INDUSTRIES, INC. 2007 LONG-TERM INCENTIVE PLAN

On November 16, 2016, the Board of Directors approved an Amendment and Restatement of the SIFCO Industries, Inc. 2007 Long-Term Incentive Plan (“2016 Amended and Restated LTIP”), subject to approval by the Company’s shareholders at the 2017 Annual Meeting. A copy of the 2016 Amended and Restated LTIP is attached to this proxy statement as Exhibit A. A summary of the material provisions of the 2016 Amended and Restated LTIP is provided below; and this summary is qualified by reference to the full and complete text of the 2016 Amended and Restated LTIP (any inconsistencies between this summary and the text of the 2016 Amended and Restated LTIP will be governed by such text).

Purpose of Amended and Restatement. The 2016 Amended and Restated LTIP incorporated the following material changes to the plan:

1) Extended the term of the LTIP through 2026 (or ten years from the effective date of the amendment and restatement);

2) Increased the number of shares available for award by 247,931, for a total of 646,401; and

3) Included a clawback provision that clarifies that awards subject to recovery under law, regulation, stock exchange listing requirement or the Company’s policies will be subject to clawback as required under such laws, regulations, requirements or policies.

In addition, the changes set forth in Amendment No. 1 to the plan adopted in 2010 were incorporated into the 2016 Amended and Restated LTIP, along with certain other administrative changes.

Purpose of Plan. The purpose of the 2016 Amended and Restated LTIP is to enhance the Company’s ability to attract and retain highly qualified employees, consultants, and Board members, to motivate those persons by means of an opportunity to acquire or increase their interest in the Company’s operations and to align the interests of participants and shareholders through the ownership of common shares and the performance of the Company.

Administration. The 2016 Amended and Restated LTIP will continue to be administered by the Board or a committee appointed by the Board (the “Administrator”), which has broad power and authority, including conclusive authority to construe and interpret the Plan and any related award agreement, authority to designate grantees and determine types and terms of awards.

Eligibility. Those persons eligible to participate in the 2016 Amended and Restated LTIP are Company employees, employees of its affiliates who the Administrator determines and designates to be able to receive awards under the 2016 Amended and Restated LTIP, key consultants of the Company or its affiliates, and the Company’s directors. The Company estimates that approximately fifteen (15) employees, one (1) consultant, and nine (9) directors (or seven (7) directors following the election of directors at the Annual Meeting) would currently be eligible to be selected by the Administrator for participation in the 2016 Amended and Restated LTIP.

Shares Subject to the 2016 Amended and Restated LTIP and Award Limitations. The total number of Common Shares of the Company available for awards under the 2016 Amended and Restated LTIP is 646,401, of which approximately 146,401 shares of common stock are currently subject to awards and 500,000 shares of common stock remain available for issuance as future awards.

The Board is seeking to increase the number of shares available under the plan to ensure that a sufficient number of shares will be available to fund the Company’s compensation programs. If the amendment is approved by our shareholders, we plan to register the offer and sale of the 247,931 additional shares of common stock on a registration statement on Form S-8. We anticipate we would have enough shares, after approval by our shareholders, to provide annual market equity grants for approximately three years, in a manner consistent with prior practices. If shares of our common stock are changed into or exchanged for a different kind or number of shares, for example, in the event of a stock split, stock dividend or other recapitalization, then the number and kind of shares which may be issued under the plan, the limitations on the number of shares which may be made subject to awards and the terms and provisions of outstanding awards may be appropriately adjusted to reflect such change in the common stock.

The closing price of the Company’s shares was $10.30 per share on October 31, 2016.

Types of Awards. The Administrator shall determine, as it deems appropriate, the type(s) of award(s) to be made to each eligible participant and shall set forth, in a related award agreement between the Company and the eligible participant, the terms, conditions, restrictions or limitations of each award. Awards granted under the 2016 Amended and Restated LTIP may take the following forms: (i) Stock Options; (ii) Stock Appreciation Rights; (iii) Restricted Stock and Restricted Stock Units; (iv) Unrestricted Stock or (v) Performance Shares, Performance Units, Performance Awards and Annual Incentive Awards.

Term. Awards may be granted under the 2016 Amended and Restated LTIP for a period of ten (10) years from the date of adoption of the 2016 Amended and Restated LTIP, at which date the 2016 Amended and Restated LTIP will expire without affecting any awards that are then outstanding.

Amendment. The Board of Directors may amend, suspend or terminate the 2016 Amended and Restated LTIP at any time, subject to applicable shareholder approval requirements, including as set forth in the 2016 Amended and Restated LTIP. No amendment, suspension or termination of the 2016 Amended and Restated LTIP may impair rights or obligations under any outstanding 2016 Amended and Restated LTIP award without the participant’s consent. The Administrator may amend, modify or supplement the terms of any award, but may not impair the rights of the holder of an award without the holder’s consent.

Plan Benefits. Because awards under the 2016 Amended and Restated LTIP are determined by the Administrator in its sole discretion, the benefits or amounts that may be received or allocated in the future to the Company’s directors or key consultants under the 2016 Amended and Restated LTIP have not yet been determined. Benefits under the plan were awarded to named executive officers in fiscal 2016 as disclosed in the Summary Compensation Table on page 13.

This summary is qualified in its entirety by reference to the full and complete text of the 2016 Amended and Restated LTIP, a copy of which is attached hereto as Exhibit A.

Vote Required - Approval of the 2016 Amended and Restated LTIP requires the affirmative vote of the holders of a majority of the Common Shares present in person or by proxy and entitled to vote at the 2017 Annual Meeting.

Board Recommendation - The Board of Directors of the Company unanimously recommends a vote FOR the adoption of the 2016 Amended and Restated LTIP.

SHAREHOLDER PROPOSALS FOR THE 2018 ANNUAL MEETING OF SHAREHOLDERS

A shareholder who intends to present a proposal at the 2018 Annual Meeting, and who wishes to have the proposal included in the Company's proxy statement and form of proxy for that meeting, must deliver the proposal to the Company no later than October 1, 2017. Any shareholder proposal submitted other than for inclusion in the Company's proxy materials for the 2018 Annual Meeting must be delivered to the Company no later than October 30, 2017 or such proposal will be considered untimely. If a shareholder proposal is received after October 30, 2017, the Company may vote, in its discretion as to the proposal, all of the Common Shares for which it has received proxies for the 2018 Annual Meeting.

OTHER MATTERS

The Company does not know of any other matters that will come before the meeting. In case any other matter should properly come before the 2017 Annual Meeting, it is the intention of the persons named in the enclosed proxy or their substitutions to vote in accordance with their best judgment in accordance with the recommendation of the Board of Directors or, in the absence of such a recommendation, in accordance with their judgment pursuant to the discretionary authority conferred by the enclosed proxy.

NO INCORPORATION BY REFERENCE

The Audit Committee Report (including reference to the independence of the Audit Committee members) is not deemed filed with the SEC or subject to the liabilities of Section 18 of the Securities Act of 1933, as amended ("Securities Act"), and shall not be deemed incorporated by reference into any prior or future filings made by us under the Securities Act, or the Exchange Act, except to the extent that we specifically incorporate such information by reference. The section of this Proxy Statement entitled "Proposal to Elect Seven (7) Directors," "Section 16(a)

Beneficial Ownership Reporting Compliance," "Corporate Governance and Board of Director Matters," "Executive Compensation," "Director Compensation," and "Principal Accounting Fees and Services" are specifically incorporated by reference in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2016.

NOTICE REGARDING DELIVERY OF SECURITY HOLDER DOCUMENTS

The SEC now permits companies to send a single set of annual disclosure documents to any household at which two or more stockholders reside, unless contrary instructions have been received, but only if the Company provides advance notice and follows certain procedures. In such cases, such stockholders continue to receive a separate notice of the meeting and proxy card. This “householding” process reduces the volume of duplicate information and reduces printing and mailing expenses. The Company has not instituted householding for shareholders of record; however, a number of brokerage firms may have instituted householding for beneficial owners of the Company’s Common Shares held through such brokerage firms. If your family has multiple accounts holding shares of Common Shares of the Company, you already may have received householding notification from your broker. Please contact your broker directly if you have any questions or require additional copies of the annual disclosure documents. The broker will arrange for delivery of a separate copy of this Proxy Statement or our Annual Report promptly upon your written or oral request. You may decide at any time to revoke your decision to household, and thereby receive multiple copies.

EXECUTIVE OFFICERS OF THE COMPANY

Disclosure regarding the executive officers of the Company is set forth in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2016 filed with the SEC under the heading “Directors, Executive Officers and Corporate Governance”, which is incorporated into this Proxy Statement by reference. This Annual Report will be delivered to our shareholders with the Proxy Statement. Copies of the Company’s filings with the SEC, including the Annual Report, are available to any shareholder through the SEC’s internet website at http://www.sec.gov or in person at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580, Washington, DC 20549. Information regarding operations of the Public Reference Room may also be obtained by calling the SEC at 1-800-SEC-0330. Shareholders may also access our SEC filings free of charge on the Company’s own internet website at http://www.sifco.com/proxy_materials. The content of the Company’s website is available for informational purposes only, and is not incorporated by reference into this Proxy Statement.

|

| | |

| | |

By order of the Board of Directors. | | SIFCO Industries, Inc. |

| | |

| | |

December 6, 2016 | | Megan L. Mehalko, Corporate Secretary |

| | |

| | |

| | |

| | |

| | |

Exhibit A

SIFCO INDUSTRIES, INC. 2007 LONG-TERM INCENTIVE PLAN.

(Amended and Restated as of November 16, 2016)

SIFCO Industries, Inc., an Ohio corporation (the “Company”), sets forth herein the terms of the SIFCO Industries, Inc. 2007 Long-Term Incentive Plan (the “Plan”), as follows:

The Plan is intended to enhance the Company’s and its Affiliates’ (as defined herein) ability to attract and retain highly qualified employees, consultants and Board members, and to motivate such persons to serve the Company and its Affiliates and to expend maximum effort to improve the business results and earnings of the Company, by providing to such persons an opportunity to acquire or increase a direct proprietary interest in the operations and future success of the Company, and furthering the identity of interests of employees and shareholders of the Company. Therefore, the Plan provides for the grant of stock options, stock appreciation rights, restricted stock, restricted stock units, unrestricted stock, performance shares, performance units, and annual and long-term performance awards. Any of these awards may, but need not, be made as performance incentives to reward attainment of annual or long-term performance goals in accordance with the terms hereof. Stock options granted under the Plan may be nonqualified stock options or incentive stock options, as provided herein.

For purposes of interpreting the Plan and related documents (including Award Agreements), the following definitions shall apply:

| |

2.1 | “Administrator” means the Board or, where pursuant to Section 3.2 the Board has delegated its authority to the Committee or one or more directors of the Company, the Committee or such director or directors. |

| |