SIF-2014.09.30-10K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

/X/ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended September 30, 2014

or

| |

/ / | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _________________ to _____________________ |

Commission file number 1-5978

SIFCO Industries, Inc.

(Exact name of registrant as specified in its charter) |

| | | | | | |

Ohio | | 34-0553950 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

970 East 64th Street, Cleveland Ohio | | 44103 |

(Address of principal executive offices) | | (Zip Code) |

| (216) 881-8600 | |

(Registrant’s telephone number, including area code) |

Securities Registered Pursuant to Section 12(b) of the Act: | |

Common Shares, $1 Par Value | | NYSE MKT |

(Title of each class) | | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Securities Exchange Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act).

large accelerated filer [ ] accelerated filer [X] non-accelerated filer [ ] smaller reporting company [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, as of the last business day of the registrant’s most recently completed second fiscal quarter is $81,031,322.

The number of the Registrant’s Common Shares outstanding at October 31, 2014 was 5,413,129.

Documents incorporated by reference: Portions of the definitive Proxy Statement for the Annual Meeting of Shareholders to be held on January 28, 2015 (Part III).

PART I

Item 1. Business

SIFCO Industries, Inc., an Ohio corporation, was incorporated in 1916. The executive offices of the Company are located at 970 East 64th Street, Cleveland, Ohio 44103, and its telephone number is (216) 881-8600.

SIFCO Industries, Inc. is engaged in the production of forgings and machined components primarily for the Aerospace and Energy ("A&E") markets. The processes and services include forging, heat-treating and machining. SIFCO Industries, Inc.'s operations are conducted in a single business segment (“SIFCO,” "Company," "we" or “our”), previously referenced as SIFCO Forged Components, during fiscal 2014. Information relating to the Company's financial results is set forth in the consolidated financial statements included in Item 8. In fiscal 2013, the Company had two additional segments: Turbine Component Services and Repair, which was discontinued in fiscal 2013, and Applied Surface Concepts, which was divested in fiscal 2013. Financial information relating to the Company’s divestiture and discontinued operations is referenced in Note 13 of the consolidated financial statements included in Item 8.

| |

B. | Principal Products and Services |

1. SIFCO

Operations

SIFCO is a manufacturer of forgings and machined components for the A&E markets that range in size from approximately 2 to 1,200 pounds (depending on configuration and alloy), primarily in steel, stainless steel, titanium and aluminum. SIFCO products include: original equipment manufacturer (“OEM”) and aftermarket components for aircraft and industrial gas turbine engines; structural airframe components; aircraft landing gear components; wheels and brakes; critical rotating components for helicopters; and commercial/industrial products. SIFCO also provides heat-treatment, surface-treatment, non-destructive testing and select machining of forged components.

SIFCO generally has multiple sources for its raw materials, which consist primarily of high quality metals essential to this business. Suppliers of such materials are located principally in North America, Taiwan and Europe. SIFCO generally does not depend on a single source for the supply of its materials. Due to the limited supply of certain raw materials, some material is provided by a small number of suppliers; however, SIFCO believes that its sources are adequate for its business. SIFCO's various operations are AS 9100C and/or ISO 9001:2000 certified.

Products

The Company’s strategic vision is to build a leading A&E company positioned for long-term, stable growth and profitability. In the past several years, SIFCO has actively diversified into the industrial gas turbine business, added more commercial aerospace business, reduced its dependence on the U.S. military business, and broadened the scope of its product and service offerings by adding machining and finishing to its forgings capabilities. The Company's success is not dependent on patents, trademarks, licenses or franchises.

SIFCO has multiple locations. SIFCO Forge ("Cleveland") is located in Cleveland, Ohio; T&W Forge (“Alliance”) is located in Alliance, Ohio; Quality Aluminum Forge (“Orange”) is located in Orange, California and Long Beach, California; and General Aluminum Forge (“Colorado Springs”) is located in Colorado Springs, Colorado. On July 23, 2013, the Company completed the purchase of the forging business and substantially all related operating assets from MW General, Inc. (DBA General Aluminium Forgings), which business is operated in General Aluminum Forge's Colorado Springs, Colorado facility. This portion of the Company’s business consists principally of the manufacture of aluminum forged components for applications primarily in the commercial aerospace market.

SIFCO’s continued migration toward more commercial business and decreased dependence on military business has further supported its strategic vision. In fiscal 2014, commercial and military revenues accounted for 55.9% and 44.1% of revenues, respectively, compared with 52.4% and 50.2% in commercial revenues and 47.6% and 49.8% military revenues in fiscal 2013 and 2012, respectively. The Company has expanded its capabilities to be a supplier of forged and machined components of aluminum, titanium, steel and other exotic metals.

Industry

The performance of the domestic and international air transport industry and the energy industry, as well as government defense spending, directly and significantly impact the performance of SIFCO.

| |

• | SIFCO supplies new and spare components for commercial aircraft, principally for large aircraft produced by Boeing and Airbus. A continued increase in passenger travel demand will drive backlog for new aircraft. Demand for more fuel-efficient aircraft, particularly the Boeing 737Max and 787 and the Airbus A320neo and A350, remains strong despite oil prices moderating recently. |

| |

• | SIFCO also supplies new and spare components to the U.S. military for aircraft, helicopters, vehicles, and ammunition. While the defense budget in the United States has shrunk due to the reduced armed conflict in Iraq and Afghanistan and concerns over product affordability, the demand for certain programs in which the Company participates has been more favorable. |

| |

• | SIFCO supplies new and spare components to the energy industry, particularly the industrial gas turbine market. The industrial gas turbine market is projecting flat near-term growth and stable long-term OEM growth. The demand in the maintenance, repair and overhaul market should remain strong. The shale gas boom continues, which should benefit the market for gas turbines through continued investment in natural gas plants for power generation. |

Competition

SIFCO competes with numerous companies, approximately fifteen of which are known by SIFCO, and some of which are non-U.S. based companies. Many of these companies focus within the A&E markets. While there has been some consolidation in the forging industry, SIFCO believes there is limited opportunity to increase prices, other than for the pass-through of raw material price increases and valued added services. SIFCO believes that it has an advantage in the primary markets it serves due to: (i) demonstrated A&E expertise; (ii) focus on quality and customer service; (iii) operating initiatives such as SMART (Streamlined Manufacturing Activities to Reduce Time/Cost) and Six Sigma; and (iv) offering a broad range of capabilities. SIFCO competes with both U.S. and non-U.S. suppliers of forgings, some of which are significantly larger than SIFCO. As customers establish new facilities throughout the world, SIFCO will continue to encounter non-U.S. competition. SIFCO believes it can expand its markets by (i) acquiring additional forging operations; (ii) broadening its product lines through investment in equipment that expands its manufacturing capabilities; and (iii) developing new customers in markets where the participants require similar technical competence and service as those in the A&E industries and who are willing to pay a premium for quality and service.

Customers

During fiscal 2014, SIFCO had three customers, consisting of various business units of United Technologies Corporation, General Electric Corporation, and Textron, Inc., which accounted for 24%, 15% and 11%, respectively, of consolidated net sales. The net sales to these three customers, and to their direct subcontractors, accounted for 50% of consolidated net sales in fiscal 2014. SIFCO believes that the loss of sales to such customers would result in a materially adverse impact on the business and its income. However, SIFCO has maintained a business relationship with many of these customers for several years and is currently conducting business with some of them under multi-year agreements. Although there is no assurance that this will continue, historically, as one or more major customers have reduced their purchases, SIFCO has generally been successful in replacing such reduced purchases, thereby avoiding a material adverse impact on SIFCO. SIFCO attempts to rely on its ability to adapt its services and operations to changing requirements of the market in general and its customers in particular. No material part of SIFCO’s business is seasonal. For additional financial information about geographic areas refer to Note 10 of the consolidated financial statements included in Item 8.

Backlog of Orders

SIFCO’s backlog as of September 30, 2014 decreased to $86.7 million, of which $71.7 million is scheduled for delivery during fiscal 2015, compared with $99.9 million as of September 30, 2013, of which $83.4 million was scheduled for delivery during fiscal 2014. Orders may be subject to modification or cancellation by the customer with limited charges. The decrease in the backlog as of September 30, 2014 compared to September 30, 2013 is primarily attributed to fewer orders from an energy components customer. The backlog amount may not necessarily be indicative of expected future sales.

2. Other

In fiscal 2013, the Company discontinued its Turbine Component Services and Repair ("Repair Group") operations. The Repair Group had a single operation in Minneapolis, Minnesota, and this segment of the Company’s business consisted of the repair and remanufacture of small turbine engine components principally for aerospace applications. As a part of the repair and remanufacture

process, the business performed precision component machining and applied high temperature-resistant coatings to turbine engine components. In fiscal 2013, the Company also divested its Applied Surface Concepts ("ASC") business. ASC previously provided surface enhancement technologies principally related to selective plating and anodizing. Principal product offerings included (i) the development, production and sale of metal plating solutions and equipment required for selective plating and (ii) providing selective plating contract services. See Note 13 to the consolidated financial statements included in Item 8 for more details on discontinued operations.

| |

C. | Environmental Regulations |

The Company is required to comply with various laws and regulations relating to the protection of the environment. The costs of such compliance have not had, and are not presently expected to have, a material effect on the capital expenditures, earnings or competitive position of the Company and its subsidiaries under existing regulations and interpretations.

The number of SIFCO employees decreased from approximately 538 at the beginning of fiscal 2014 to approximately 465 employees at the end of fiscal 2014. The Company is a party to collective bargaining agreements with certain employees located at the Cleveland (expires in May 2015) and Alliance (expires in July 2017) facilities.

As of September 30, 2014, essentially all of the Company’s cash and cash equivalents are in the possession of its non-operating Irish subsidiary and relate to undistributed earnings of the Irish subsidiary. Distributions from the Company’s non-operating Irish subsidiary to the Company may be subject to statutory restrictions, adverse tax consequences or other limitations.

The Company previously operated service and distribution facilities in the United Kingdom, France and Sweden prior to the divestiture of these operations from the sale of the Applied Surface Concepts segment in fiscal 2013. Further discussion about the divestiture is set forth in Note 13 to the consolidated financial statements included in Item 8.

F.Available Information

The Company files annual, quarterly, and current reports, proxy statements, and other documents with the SEC under the Securities Exchange Act of 1934. The public may read and copy any materials filed with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. Also, the SEC maintains an Internet website that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The public can obtain any documents that are filed by the Company at http://www.sec.gov.

In addition, our annual reports on Form 10-K, as well as our quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to all of the foregoing reports, are made available free of charge on or through the “Investor Relations” section of our website at www.sifco.com as soon as reasonably practicable after such reports are electronically filed with or furnished to the SEC.

Information relating to our corporate governance at SIFCO, including the Audit Committee, Corporate Governance and Nominating Committee and Compensation Committee Charters, as well as the Corporate Governance Guidelines and Policies and the Code of Conduct & Ethics adopted by our Board of Directors, is available free of charge on or through the “Investor Relations” section of our website at www.sifco.com. References to our website or the SEC’s website do not constitute incorporation by reference of the information contained on such websites, and such information is not part of this Form 10-K.

Item 1A. Risk Factors

This Form 10-K, including Item 1A ("Risk Factors"), may contain various forward-looking statements and includes assumptions concerning the Company’s operations, future results and prospects. These forward-looking statements are based on current expectations and are subject to risk and uncertainties. In connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, the Company provides this cautionary statement identifying important economic, political and technological factors, among others, the absence or effect of which could cause the actual results or events to differ materially from those set forth in or implied by the forward-looking statements and related assumptions. Such factors include the following: (1) the impact on business conditions in general, and on the demand for product in the A&E industries in particular, of the global economic outlook, including the continuation of military spending at or near current levels and the availability of capital and

liquidity from banks and other providers of credit; (2) the future business environment, including capital and consumer spending; (3) competitive factors, including the ability to replace business that may be lost; (4) metals and commodities price increases and the Company’s ability to recover such price increases; (5) successful development and market introduction of new products and services; (6) continued reliance on consumer acceptance of regional and business aircraft powered by more fuel efficient turboprop engines; (7) continued reliance on military spending, in general, and/or several major customers, in particular, for revenues; (8) the impact on future contributions to the Company’s defined benefit pension plans due to changes in actuarial assumptions, government regulations and the market value of plan assets; (9) stable governments, business conditions, laws, regulations and taxes in economies where business is conducted; and (10) the ability to successfully integrate businesses that may be acquired into the Company’s operations.

In addition to the other information in this Form 10-K and our other filings with the SEC, the following risk factors should be carefully considered in evaluating us and our business before investing in our common stock. The risks and uncertainties described below are not the only ones facing us and are not listed in any order of magnitude or likelihood of occurrence. Additional risks and uncertainties, not presently known to us or otherwise, may also impair our business. If any of the risks actually occur, our business, financial condition or results of operations could be materially and adversely affected. In that case, the trading price of our common stock could decline, and investors may lose all or part of their investment. All written and verbal descriptions of our business, operations and assets and all forward-looking statements attributable to the Company or any person acting on the Company’s behalf are expressly qualified in their entirety by the risks, uncertainties, and cautionary statements contained herein.

Global economic conditions may adversely impact our business, operating results or financial condition.

Disruption and volatility in global financial markets may lead to increased rates of default and bankruptcy and may negatively impact consumer spending levels. These macroeconomic developments could adversely affect our business, operating results or financial condition. Current or potential customers may delay or decrease spending on our products and services as their business and/or budgets are impacted by economic conditions. The inability of current and potential customers to pay SIFCO for its products and services may adversely affect its earnings and cash flows.

Government spending priorities and terms may change in a manner adverse to our business.

At times, our military business has been adversely affected by significant changes in U.S. defense and national security budgets. Budget changes that result in a decline in overall spending, program delays, program cancellations or a slowing of new program starts on programs in which we participate could materially adversely affect our business, prospects, financial condition or results of operations. Future levels of expenditures and authorizations for defense-related programs by the U.S. government may decrease, remain constant or shift to programs in areas where we do not currently provide products, thereby reducing the chances that we will be awarded new contracts.

SIFCO has contracts for programs where the period of performance may exceed one year. Congress and certain foreign governments must usually approve funds for a given program each fiscal year and may significantly reduce funding of a program in a particular year. Significant reductions in these appropriations or the amount of new defense contracts awarded may affect our ability to complete contracts, obtain new work and grow our business. Congress does not always enact spending bills by the beginning of the new fiscal year. Such delays leave the affected agencies under-funded, which delay their ability to contract. Future delays and uncertainties in funding could impose additional business risks on us.

A deadlock in the U.S. Congress over budgets and spending could cause another partial shutdown of the U.S. government, which could result in a termination or suspension of some or all of our contracts with suppliers to the U.S. government.

Congress may fail to pass a budget or continuing resolution, which would result in a partial shutdown of the U.S. government and cause the termination or suspension of our contracts with suppliers to the U.S. government. SIFCO would be required to furlough affected employees for an indefinite time. It is uncertain in such a circumstance if we would be compensated or reimbursed for any loss of revenue during such a shutdown. If we were not compensated or reimbursed, it could result in significant adverse effects on our revenues, operating costs and cash flows.

Further consolidation in the aerospace industry could adversely affect our business and financial results.

The aerospace and defense industry is experiencing significant consolidation, including among its customers, competitors and suppliers. Consolidation among our customers in the industry may result in delays in the award of new contracts and losses of existing business for SIFCO. Consolidation among our competitors may result in larger competitors with greater resources and market share, which could adversely affect our ability to compete successfully. Consolidation among our suppliers may result in fewer sources of supply and increased cost to SIFCO.

Changes in future business or other market conditions could cause business investments and/or recorded goodwill or other long- term assets to become impaired, resulting in substantial losses and write-downs that would reduce our results of operations.

As part of our strategy, we will, from time to time, acquire a business. These investments are made upon careful analysis and due diligence procedures designed to achieve a desired return or strategic objective. These procedures often involve certain assumptions and judgment in determining acquisition price. After acquisition, unforeseen issues could arise that adversely affect the anticipated returns, or which are otherwise not recoverable as an adjustment to the purchase price. Even after diligent integration efforts, actual operating results may vary significantly from initial estimates. We evaluate the recorded goodwill balances for potential impairment annually as of July 31, or when circumstances indicate that the carrying value may not be recoverable. The goodwill impairment test is performed by comparing the fair value of each reporting unit to its carrying value, including recorded goodwill. Any future impairment could result in substantial losses and write-downs that would reduce our results of operations.

We are subject to the cyclical nature of the aerospace and energy industries and any future downturn in these industries could adversely impact the demand for our products.

Our business may be affected by certain characteristics and trends of the A&E market that affect its customers, such as fluctuations in the aerospace industry’s business cycle, varying fuel and labor costs, intense price competition and regulatory scrutiny, a possible decrease in aviation activity, a decrease in outsourcing by aircraft manufacturers or the failure of projected market growth to materialize or continue. In the event that these characteristics and trends adversely affect customers in the aerospace industry, they may reduce the overall demand for our products.

Failure to retain existing contracts or win new contracts under competitive bidding processes may adversely affect our sales.

SIFCO obtains most of its contracts through a competitive bidding process, and substantially all of the business that we expect to seek in the foreseeable future likely will be subject to a competitive bidding process. Competitive bidding presents a number of risks, including:

| |

• | the need to compete against companies or teams of companies with more financial and marketing resources and more experience in bidding on and performing major contracts than we have; |

| |

• | the need to compete against companies or teams of companies that may be long-term, entrenched incumbents for a particular contract for which we are competing and that have, as a result, greater domain expertise and better customer relations; |

| |

• | the need to compete to retain existing contracts that have in the past been awarded to us on a sole-source basis or that have been incumbent for a long time; |

| |

• | the award of contracts to providers offering solutions at the “lowest price technically acceptable,” which may lower the profit we may generate under a contract awarded using this pricing method or prevent us from submitting a bid for such work due to us deeming such work to be unprofitable; |

| |

• | the reduction of margins achievable under any contracts awarded to us; |

| |

• | the need to bid on some programs in advance of the completion of their specifications, which may result in unforeseen technological difficulties or increased costs that lower our profitability; |

| |

• | the substantial cost and managerial time and effort, including design, development and marketing activities, necessary to prepare bids and proposals for contracts that may not be awarded to us; |

| |

• | the need to develop, introduce and implement new and enhanced solutions to our customers’ needs; |

| |

• | the need to locate and contract with teaming partners and subcontractors; and |

| |

• | the need to accurately estimate the resources and cost structure that will be required to perform any contract that we are awarded. |

If SIFCO wins a contract, and upon expiration, the customer requires further services of the type provided by the contract, there is frequently a competitive rebidding process. There can be no assurance that we will win any particular bid, that we will win the contract at the same profit margin, or that we will be able to replace business lost upon expiration or completion of a contract.

If SIFCO is unable to consistently retain existing contracts or win new contract awards, our business, prospects, financial condition and results of operations may be adversely affected.

We may not receive the full amounts estimated under the contracts in our total backlog, which could reduce our sales in future periods below the levels anticipated, and which makes backlog an uncertain indicator of future operating results.

As of September 30, 2014, the total backlog was $86.7 million. Orders may be canceled and scope adjustments may occur, and we may not realize the full amounts of sales that we may anticipate in our backlog numbers. Additionally, the timing of receipt

of sales, if any, on contracts included in our backlog could change. The failure to realize amounts reflected in our backlog could materially adversely affect our business, financial condition and results of operations in future periods.

Our failure to identify, attract and retain qualified personnel could adversely affect our existing business, financial condition and results of operations.

SIFCO may not be able to identify, attract or retain qualified technical personnel, sales and customer service personnel, employees with expertise in forging, or management personnel to supervise such activities. We may also not attract and retain employees who share the Company's core values, can maintain and grow our existing business, and are suited to work in a public company environment, which could adversely affect our financial condition and results of operations.

Our business could be negatively affected by cyber or other security threats or other disruptions.

SIFCO faces cyber threats, threats to the physical security of our facilities and employees, including senior executives, and terrorist acts, as well as the potential for business disruptions associated with information technology failures, damaging weather or other acts of nature, and pandemics or other public health crises, which may adversely affect our business.

SIFCO experiences cyber security threats, threats to our information technology infrastructure and attempts to gain access to the Company's sensitive information, as do our customers, suppliers and subcontractors. SIFCO may experience similar security threats at customer sites that we operate and manage as a contractual requirement.

Prior cyber-attacks directed at us have not had a material impact on our financial results, and we believe our threat detection and mitigation processes and procedures are robust. Due to the evolving nature of these security threats, however, the impact of any future incident cannot be predicted.

Although SIFCO works cooperatively with our customers and our suppliers and subcontractors to seek to minimize the impacts of cyber threats, other security threats or business disruptions, in addition to our internal processes, procedures and systems, it must also rely on the safeguards put in place by those entities.

The costs related to cyber or other security threats or disruptions may not be fully mitigated by insurance or other means. The occurrence of any of these events could adversely affect our internal operations, the services we provide to customers, our competitive advantages, our future financial results, our reputation, our stock price, and lead to early obsolescence of our products and services. The occurrence of any of these events could also result in civil and/or criminal liabilities.

We rely on our suppliers to meet the quality or delivery expectations of our customers.

The ability to deliver SIFCO's products and services on schedule is dependent upon a variety of factors, including execution of internal performance plans, availability of raw materials, internal and supplier produced parts and structures, conversion of raw materials into parts and assemblies, and performance of suppliers and others. We rely on numerous third-party suppliers for raw materials and a large proportion of the components used in our production process. Certain of these raw materials and components are available only from single sources or a limited number of suppliers, or similarly, customers’ specifications may require SIFCO to obtain raw materials and/or components from a single source or certain suppliers. Many of our suppliers are small companies with limited financial resources and manufacturing capabilities. We do not currently have the ability to manufacture these components ourselves. Consequently, we risk disruptions in our supply of key products and components if our suppliers fail or are unable to perform because of shortages in raw materials, operational problems, strikes, natural disasters, financial condition or other factors. We may have disputes with our vendors arising from, among other things, the quality of products and services or customer concerns about the vendor. If any of our vendors fail to timely meet their contractual obligations or have regulatory compliance or other problems, our ability to fulfill our obligations may be jeopardized. Economic downturns can adversely affect a vendor’s ability to manufacture or deliver products. Further, vendors may also be enjoined from manufacturing and distributing products to us as a result of litigation filed by third parties, including intellectual property litigation. If SIFCO were to experience difficulty in obtaining certain products, there could be an adverse effect on its results of operations and on its customer relationships and our reputation. Additionally, our key vendors could also increase pricing of their products, which could negatively affect our ability to win contracts by offering competitive prices.

Any material supply disruptions could adversely affect our ability to perform our obligations under our contracts and could result in cancellation of contracts or purchase orders, penalties, delays in realizing revenues, and payment delays, as well as adversely affect our ongoing product cost structure.

Failure to perform by our subcontractors could materially and adversely affect our contract performance and our ability to obtain future business.

Our performance of contracts often involves subcontractors, upon which we rely to complete delivery of products to our customers. SIFCO may have disputes with subcontractors. A failure by a subcontractor to satisfactorily deliver products can adversely affect our ability to perform our obligations as a prime contractor. Any subcontractor performance deficiencies could result in the customer terminating our contract for default, which could expose us to liability for excess costs of re-procurement by the customer and have a material adverse effect on our ability to compete for other contracts.

Our future success will depend on our ability to meet the needs of our customer requirements in a timely manner.

We believe that the commercial A&E markets in which we operate are changing toward more sophisticated manufacturing and system-integration techniques and capabilities using composite and metallic materials. Our future success depends to a significant extent on our ability to acquire and/or develop and execute such sophisticated techniques and capabilities to meet the needs of our customers and to bring those products to market quickly and at cost-effective prices. Accordingly, our performance depends on a number of factors, including our ability to:

| |

• | identify emerging trends in our current and target markets; |

| |

• | develop and maintain competitive products and capabilities that meet our customers' requirements; and |

| |

• | develop, manufacture and bring to market cost-effective offerings in the most efficient manner. |

If we are unable to acquire and/or develop and execute such techniques and capabilities, we may experience an adverse effect to our business, financial condition or results of operation.

The terms of our financing arrangements may restrict our financial and operational flexibility, including our ability to invest in new business opportunities.

The Company currently has a $30.0 million secured revolving credit agreement that expires in October 2016.

We also have a $10.0 million term loan, secured by substantially all the assets of the Company and its U.S. subsidiaries and a pledge of 65% of the stock of our non-U.S. subsidiary. The term loan is repayable in quarterly installments of $0.5 million, which began December 2011. As of September 30, 2014, the loan balance was $4.0 million.

The loans are subject to certain customary financial covenants, including, without limitation, covenants that require us to not exceed a maximum leverage ratio and to maintain a minimum fixed charge coverage ratio. In the event of a default, we would not be able to access our revolver, which could impact the ability to fund working capital needs, capital expenditures and invest in new business opportunities.

We face certain significant risk exposures and potential liabilities that may not be covered adequately by insurance or indemnity.

We are exposed to liabilities that are unique to the products we provide. While we maintain insurance for certain risks, the amount of insurance or indemnity may not be adequate to cover all claims or liabilities, and we may be forced to bear substantial costs from an accident or incident. It also is not possible for SIFCO to obtain insurance to protect against all operational risks and liabilities. Substantial claims resulting from an incident in excess of the indemnification we receive and our insurance coverage would harm our financial condition, results of operations and cash flows. Moreover, any accident or incident for which we are liable, even if fully insured, could negatively affect our standing with our customers and the public, thereby making it more difficult for us to compete effectively, and could significantly impact the cost and availability of adequate insurance in the future.

We may acquire other companies, which could increase our levels of debt, increase costs or liabilities, require alternative forms of capital, increase competition, or be disruptive to our business.

Part of our strategy involves the acquisition of other companies. For example, in July 2013, we completed the purchase of the forging business and substantially all related operating assets from MW General, Inc. We cannot ensure that we will be able to integrate acquired companies successfully without substantial expense, delay or operational or financial problems. Such expenses, delays or operational or financial problems may include the following:

| |

• | we may need to divert management resources to integration, which may adversely affect our ability to pursue other more profitable activities; |

| |

• | integration may be difficult as a result of the necessity of coordinating geographically separated organizations, |

integrating personnel with disparate business backgrounds and combining different corporate cultures;

| |

• | we may not be able to eliminate redundant costs anticipated at the time we select acquisition candidates; and |

| |

• | one or more of our acquisition candidates may have unexpected liabilities, fraud risk, or adverse operating issues that we fail to discover through our due diligence procedures prior to the acquisition. |

As a result, the integration of acquired businesses may be costly and may adversely impact our results of operations and financial condition.

The funding and costs associated with our pension plans and significant changes in key estimates and assumptions, such as discount rates and assumed long-term returns on assets, actual investment returns on our pension plan assets, and legislative and regulatory actions could affect our earnings, equity and contributions to our pension plans in future periods.

Certain of our employees are covered by its noncontributory defined benefit pension plans ("Plans"). The impact of these Plans on our GAAP earnings may be volatile in that the amount of expense we record for our pension plans may materially change from year to year because those calculations are sensitive to changes in several key economic assumptions, including discount rates, inflation, salary growth, expected return on plan assets, retirement rates and mortality rates. These pension costs are dependent on significant judgment in the use of various estimates and assumptions, particularly with respect to the discount rate and expected long-term rates of return on plan assets. Changes to these estimates and assumptions could have a material adverse effect on our financial position, results of operations or cash flows. Differences between actual investment returns and our assumed long-term returns on assets will result in changes in future pension expense and the funded status of our Plans, and could increase future funding of the Plans. Changes in these factors affect our plan funding, cash flows, earnings, and shareholders’ equity.

The price of our common stock may fluctuate significantly.

An active, liquid and orderly market for our common stock may not be sustained, which could depress the trading price of our common stock.

Volatility in the market price of our common stock may prevent you from being able to sell your shares at or above the price you paid for your shares or at all. The market price of our common stock could fluctuate significantly for various reasons, which include:

| |

• | our quarterly or annual earnings or those of our competitors; |

| |

• | the public’s reaction to our press releases, our other public announcements and our filings with the Securities and Exchange Commission; |

| |

• | changes in earnings estimates or recommendations by research analysts who track the stocks of our competitors; |

| |

• | new laws or regulations or new interpretations of laws or regulations applicable to our business; |

| |

• | changes in accounting standards, policies, guidance, interpretations or principles; |

| |

• | changes in general conditions in the domestic and global economies or financial markets, including those resulting from war, incidents of terrorism or responses to such events; |

| |

• | litigation involving our company or investigations or audits by regulators into the operations of our company or our competitors; |

| |

• | strategic action by our competitors; and |

| |

• | sales of common stock by our directors, executive officers and significant shareholders. |

In addition, the stock market in general has experienced extreme price and volume fluctuations that have often been unrelated or disproportionate to the operating performance of those companies. Broad market and industry factors may seriously affect the market price of our common stock, regardless of actual operating performance. In addition, in the past, following periods of volatility in the overall market and the market price of a particular company’s securities, securities class action litigation has often been instituted against these companies. If litigation is instituted against us, it could result in substantial costs and a diversion of our management’s attention and resources.

If we are unable to pay annual dividends at the targeted level, our reputation and stock price may be harmed.

The dividend program requires the use of a portion of our cash flows. Our ability to continue to pay annual dividends will depend in large part on our ability to generate sufficient cash flows from operations in the future. This ability may be subject to certain economic, financial, competitive and other factors that are beyond our control. The board of directors may, at its discretion, decrease the targeted annual dividend amount or entirely discontinue the payment of dividends at any time. Any failure to pay dividends after we have announced the intention to do so may adversely affect our reputation and investor confidence in SIFCO and negatively impact our stock price.

If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results. As a result, current and potential shareholders could lose confidence in our financial reporting, which would harm our business and the trading price of our common stock.

In connection with our assessment of the effectiveness of our internal control over financial reporting as of September 30, 2014, we concluded there were two material weaknesses in internal controls over financial reporting related to identified control deficiencies with respect to the precision and sufficiency of reviews performed on reconciliations and calculations around inventory related items and certain segregation of duties issues surrounding information technology at one facility. Under standards established by the Public Company Accounting Oversight Board, a material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected or corrected on a timely basis.

We have taken steps and plan to take additional measures to remediate the underlying causes of the material weaknesses, primarily through the continued development and implementation of formal policies, improved processes and documented procedures, as well as changes in our software. The actions that we are taking are subject to ongoing senior management review, as well as audit committee oversight. Although we plan to complete this remediation as quickly as possible, we cannot at this time estimate how long it will take, and our initiatives may not prove to be successful in remediating this material weakness. As with any material weakness, our remedial measures are insufficient to address the material weaknesses, or if additional material weaknesses or significant deficiencies in our internal control over financial reporting are discovered or occur in the future, our consolidated financial statements may contain material misstatements and we could be required to restate our financial results.

Increased competition from low-cost providers and customer pricing pressures could reduce the demand and/or price for our products and services.

The aerospace and non-aerospace end-use markets SIFCO serves are highly competitive and price sensitive. In both of these markets, we compete worldwide with a number of domestic and international companies that have substantially greater manufacturing, purchasing, marketing and financial resources than we do. Many of SIFCO's customers have the in-house capability to fulfill their manufacturing requirements. SIFCO's larger competitors may be able to vie more effectively for very large-scale contracts than we can by providing different or greater capabilities or benefits such as technical qualifications, past performance on large-scale contracts, geographic presence, price and availability of key professional personnel. If SIFCO is unable to successfully compete for new business, our net sales growth and operating margins may decline. Several of SIFCO's major customers have completed extensive cost containment efforts and SIFCO expects continued pricing pressures in 2015 and beyond. Competitive pricing pressures may have an adverse effect on our financial condition and operating results. Further, there can be no assurance that competition from existing or potential competitors will not have a material adverse effect on our financial results. If SIFCO does not continue to compete effectively and win contracts, our future business, financial condition, results of operations and our ability to meet its financial obligations may be materially compromised.

The occurrence of litigation where we could be named as a defendant is unpredictable.

From time to time, we are involved in various legal and other proceedings that are incidental to the conduct of our business. While we believe no current proceedings, if adversely determined, could have a material adverse effect on our financial results, no assurances can be given. Any such claims may divert financial and management resources that would otherwise be used to benefit our operations and could have a material adverse effect on our financial results.

Damage or destruction of our facilities caused by storms, earthquakes or other causes could adversely affect our financial results and financial condition.

We have operations located in regions of the U.S. that may be exposed to damaging storms, earthquakes and other natural disasters. Although we maintain standard property casualty insurance covering our properties and may be able to recover costs associated with certain natural disasters through insurance, we do not carry any earthquake insurance based on our assessment of the potential risk to our equipment and facilities. Two of our properties are located in Southern California, an area subject to earthquake activity. Even if covered by insurance, any significant damage or destruction of our facilities due to storms, earthquakes or other natural disasters could result in its inability to meet customer delivery schedules and may result in the loss of customers and significant additional costs to SIFCO. Thus, any significant damage or destruction of our properties could have a material adverse effect on our business, financial condition or results of operations.

Labor disruptions by our employees could adversely affect our business.

As of September 30, 2014, we employed approximately 465 people. Two of our operating locations are parties to collective bargaining agreements, covering 115 full time hourly employees and 36 full time hourly employees, and will expire May 2015 and July 2017, respectively. Although we have not experienced any material labor-related work stoppage and consider our relations with our employees to be good, labor stoppages may occur in the future. If the unionized workers were to engage in a strike or other work stoppage, if SIFCO is unable to negotiate acceptable collective bargaining agreements with the unions or if other employees were to become unionized, we could experience a significant disruption of our operations, higher ongoing labor costs and possible loss of customer contracts, which could have an adverse effect on our business and results of operations.

Market volatility and adverse capital or credit market conditions may affect our ability to access cost-effective sources of funding and may expose SIFCO to risks associated with the financial viability of suppliers.

The financial markets can experience high levels of volatility and disruption, reducing the availability of credit for certain issuers. We sometimes access these markets to support certain business activities, including acquisitions and capital expansion projects, obtaining credit support for our workers' compensation self-insurance program and refinancing existing indebtedness. Depending on the condition of the capital or credit markets existing at the time, we may be unable in the future to obtain capital market financing or bank financing on favorable terms, or at all, which could have a material adverse effect on our financial position, results of operations or cash flows.

Tightening credit markets could also adversely affect our suppliers' ability to obtain financing. Delays in suppliers' ability to obtain financing, or the unavailability of financing, could negatively affect their ability to perform their contracts with SIFCO and cause our inability to meet our contract obligations. The inability of our suppliers to obtain financing could also result in the need for us to transition to alternate suppliers, which could result in significant incremental costs and delays.

Unanticipated changes in our tax provisions or exposure to additional income tax liabilities could affect our profitability and cash flow.

We are subject to income taxes in the United States. Significant judgment is required in determining our provision for income taxes. In the ordinary course of business, there are many transactions and calculations where the ultimate tax determination is uncertain. Changes in applicable income tax laws and regulations, or their interpretation, could result in higher or lower income tax rates or changes in the taxability of certain sales or the deductibility of certain expenses, thereby affecting our income tax expense and profitability. In addition, the final results of any tax audits or related litigation could be materially different from our related historical income tax provisions and accruals. Additionally, changes in our tax rate as a result of changes in our overall profitability, changes in tax legislation, changes in the valuation of deferred tax assets and liabilities, changes in differences between financial reporting income and taxable income, the examination of previously filed tax returns by taxing authorities and continuing assessments of our tax exposures can also impact our tax liabilities and affect our income tax expense, profitability and cash flow.

We use estimates when pricing contracts and any changes in such estimates could have an adverse effect on our profitability and our overall financial performance.

When agreeing to contractual terms, we make assumptions and projections about future conditions and events, many of which extend over long periods. These projections assess the productivity and availability of labor, complexity of the work to be performed, cost and availability of materials, impact of delayed performance and timing of product deliveries. Contract pricing requires judgment relative to assessing risks, estimating contract revenues and costs, and making assumptions for schedule and technical issues. Due to the size and nature of many of our contracts, the estimation of total revenues and costs at completion is complicated and subject to many variables. For example, assumptions are made regarding the length of time to complete a contract since costs also include expected increases in wages, prices for materials and allocated fixed costs. Similarly, assumptions are made regarding the future impact of our efficiency initiatives and cost reduction efforts. Incentives, awards or penalties related to performance on contracts are considered in estimating revenue and profit rates and are recorded when there is sufficient information to assess anticipated performance. Suppliers' assertions are also assessed and considered in estimating costs and profit rates.

Because of the significance of the judgment and estimation processes described above, it is possible that materially different amounts could be obtained if different assumptions were used or if the underlying circumstances were to change. Changes in underlying assumptions, circumstances or estimates may have a material adverse effect upon the profitability of one or more of the affected contracts, future period financial reporting and performance.

Our technologies could become obsolete, reducing our revenues and profitability.

The future of our business will depend in large part upon the continuing relevance of our forging capabilities. SIFCO could encounter competition from new or revised technologies that render its technologies and equipment less profitable or obsolete in our chosen markets and our operating results may suffer.

Item 1B. Unresolved Staff Comments

The Company has no unresolved comments.

Item 2. Properties

The Company’s property, plant and equipment include the facilities described below and a substantial quantity of machinery and equipment, most of which consists of industry specific machinery and equipment using special dies, jigs, tools and fixtures and in many instances having automatic control features and special adaptations. In general, the Company’s property, plant and equipment are in good operating condition, are well maintained, and substantially all of its facilities are in regular use. The Company considers its investment in property, plant and equipment as of September 30, 2014 suitable and adequate given the current product offerings for the respective business segments’ operations in the current business environment. The square footage numbers set forth in the following paragraphs are approximations:

| |

• | SIFCO operates in multiple facilities—(i) an owned 240,000 square foot facility located in Cleveland, Ohio, which is also the site of the Company’s corporate headquarters, (ii) a leased 450,000 square foot facility located in Alliance, Ohio, (iii) leased facilities aggregating approximately 67,000 square feet located in Orange and Long Beach, California, and (iv) leased facilities aggregating approximately 18,000 square feet located in Colorado Springs, Colorado. |

| |

• | The Company owns a building located in Cork, Ireland (59,000 square feet) that is subject to a long-term lease arrangement with the acquirer of the Repair Group’s industrial turbine engine component repair business that was sold in June 2007. |

| |

• | The Repair Group owns a building located in Minneapolis, Minnesota with a total of 59,000 square feet that is currently for sale as the Company discontinued the operations at this facility during fiscal 2013. |

Item 3. Legal Proceedings

In the normal course of business, the Company may be involved in ordinary, routine legal actions. The Company cannot reasonably estimate future costs, if any, related to these matters and does not believe any such matters are material to its financial condition or results of operations. The Company maintains various liability insurance coverages to protect its assets from losses arising out of or involving activities associated with ongoing and normal business operations; however, it is possible that the Company’s future operating results could be affected by future costs of litigation.

Executive Officers of the Registrant

Set forth below is certain information concerning the executive officers of SIFCO as of September 30, 2014. The executive officers are appointed annually by the Board of Directors.

|

| | | | |

Name | | Age | | Title and Business Experience |

Michael S. Lipscomb | | 68 | | President and Chief Executive officer since August 2009 and a director of the Company since April 2010. Mr. Lipscomb previously served as a director of the Company from 2002 to 2006. Mr. Lipscomb is also currently the Chief Executive Officer of Aviation Component Solutions, a supplier of FAA-approved, second source replacement parts for commercial aircraft and engine components. Prior to joining the Company, Mr. Lipscomb was Chairman, President and Chief Executive Officer of Argo-Tech Corporation, which was acquired by Eaton Corporation in 2006, and was a leading maker of high-performance aerospace engine fuel pumps and systems, airframe fuel pumps and systems, and ground fueling for commercial and military aerospace markets, from 1994 to 2007, President from 1990 to 1994, Executive V.P. and Chief Operating Officer from 1988 to 1990, and Vice President of Operations from 1986, when Argo-Tech was formed, to 1988. In 1981, Mr. Lipscomb joined the corporate staff of TRW, a conglomerate manufacturer of industrial bearings in aerospace, automotive, energy and general industrial markets, currently a part of Northrop Grumman Corp., and was appointed Director of Operations for the Power Accessories Division of TRW in 1985. Mr. Lipscomb previously served as a director of Argo-Tech and AT Holdings Corporation from 1990 to 2007. He serves on the boards of Ruhlin Construction Company and Altra Holdings, Inc. He is a former board member of the Aerospace Industries Association and General Aviation Manufacturers Association, an organization that represents the U.S. aerospace and defense industry. |

James P. Woidke | | 51 | | Executive Vice-President and Chief Operating Officer since March 2010. Prior to the assumption of his current role, Mr. Woidke served as General Manager of SIFCO’s Forged Components Group since March, 2006. Prior to joining the Company, Mr. Woidke was the Director of Engineering and Quality as well as Business Unit Manager for Anchor Manufacturing Group, an automotive stamping and assembly manufacturer, from 2003 to 2006. From 1993 to 2003, Mr. Woidke held a number of different positions with Lake Erie Screw Corporation, a manufacturer of specialty fasteners, last serving as Director of Manufacturing Operations. |

Catherine M. Kramer | | 40 | | Vice President, Finance and Chief Financial Officer since January 2013. Prior to the assumption of her current role, Ms. Kramer served as Director of Financial Planning & Analysis of the Company. Prior to joining the Company, Ms. Kramer was Managing Director at Greenstar Capital, LLC, a private equity firm that invests in lower-middle market companies and provides management consulting services, from 2009 to 2012 and Vice President of Strategic Planning from 2007 to 2009. Ms. Kramer was Vice President of Corporate Strategic Planning from 2005 to 2007 and Manager of Finance from 2001 to 2005 at Argo-Tech Corporation, which was acquired by Eaton Corporation in 2006, and was a leading maker of high-performance aerospace engine fuel pumps and systems, airframe fuel pumps and systems, and ground fueling for commercial and military aerospace markets. |

Item 4. Mine Safety Disclosures

Not Applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

The Company’s Common Shares are traded on the NYSE MKT exchange under the symbol “SIF”. The following table sets forth, for the periods indicated, the high and low closing sales price for the Company’s Common Shares.

|

| | | | | | | | | | | | | | | |

| Years Ended September 30, |

| 2014 | | 2013 |

| High | | Low | | High | | Low |

First Quarter | $ | 27.91 |

| | $ | 18.08 |

| | $ | 17.17 |

| | $ | 14.15 |

|

Second Quarter | 35.26 |

| | 25.87 |

| | 19.20 |

| | 14.47 |

|

Third Quarter | 35.61 |

| | 30.22 |

| | 18.25 |

| | 15.16 |

|

Fourth Quarter | 32.13 |

| | 26.28 |

| | 20.00 |

| | 16.08 |

|

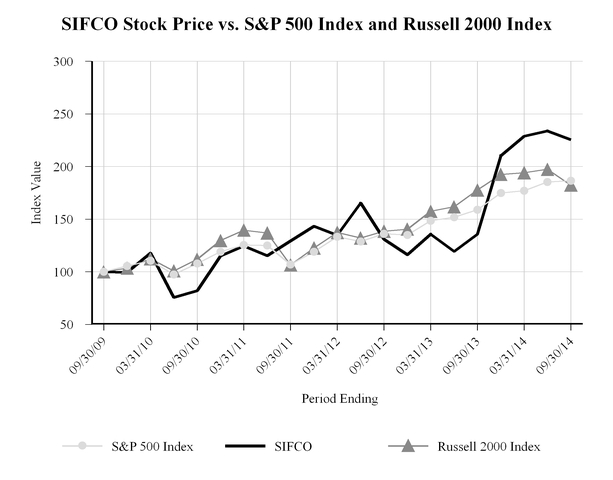

Performance Graph

The following graph compares the cumulative 5-Year total return to shareholders of the Company's Common Shares to the cumulative total returns to shareholders of the S&P Composite - 500 Stock Index and the Russell 2000 Index. The graph assumes that the value of the investment in the Common Shares and in each of the indexes (including the reinvestment of dividends) was $100 on September 30, 2009 and tracks it through September 30, 2014.

Dividends and Shares Outstanding

The Company declared a cash dividend of $0.20 per Common Share in both fiscal 2014 and fiscal 2013. The Company will continue to evaluate the payment of such dividends annually based on its relative profitability and available resources. The Company currently intends to retain a significant majority of its earnings for the operation and growth of its businesses. The Company’s ability to declare or pay cash dividends is limited by its credit agreement covenants and the fact that essentially all of the Company's cash and cash equivalents are in the possession of its non-operating Irish subsidiary and distribution of cash from such subsidiary to the Company may be subject to statutory restrictions, adverse consequences or other limitations. At October 31, 2014, there were approximately 520 shareholders of record of the Company’s Common Shares, as reported by Computershare, Inc., the Company’s Transfer Agent and Registrar, which maintains its U.S. corporate offices at 250 Royall Street, Canton, MA 02021.

Reference Part III, Item 12. “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters” for information related to the Company’s equity compensation plans.

Item 6. Selected Financial Data

The following table sets forth selected consolidated financial data of the Company. The data presented below should be read in conjunction with the audited Consolidated Financial Statements and Notes to the Consolidated Financial Statements included in Item 8.

|

| | | | | | | | | | | | | | | | | | | | |

| | For the Years Ended September 30, |

| | 2014 | | 2013 (a) | | 2012 (b) | | 2011 (c) | | 2010 |

| | (Amounts in thousands, except per share data) |

Statement of Operations Data: | | | | | | | | | | |

Net sales | | $ | 119,654 |

| | $ | 116,001 |

| | $ | 102,900 |

| | $ | 107,357 |

| | $ | 83,270 |

|

Income from continuing operations | | 5,603 |

| | 9,758 |

| | 6,307 |

| | 7,449 |

| | 5,362 |

|

| | | | | | | | | | |

Per Share Data: | | | | | | | | | | |

Income per share from continuing operations - basic | | $ | 1.04 |

| | $ | 1.82 |

| | $ | 1.19 |

| | $ | 1.41 |

| | $ | 1.01 |

|

Income per share from continuing operations - diluted | | $ | 1.03 |

| | $ | 1.81 |

| | $ | 1.18 |

| | $ | 1.40 |

| | $ | 1.00 |

|

Cash dividends per share | | $ | 0.20 |

| | $ | 0.20 |

| | $ | 0.20 |

| | $ | 0.20 |

| | $ | 0.15 |

|

| | | | | | | | | | |

Balance Sheet Data: | | | | | | | | | | |

Total assets | | $ | 109,697 |

| | $ | 105,765 |

| | $ | 106,545 |

| | $ | 80,011 |

| | $ | 69,650 |

|

Long term debt, net of current maturities | | 8,429 |

| | 7,381 |

| | 19,683 |

| | 1,186 |

| | 35 |

|

| |

a. | In the fourth quarter of fiscal 2013, the Company decided to exit the Turbine Component Service and Repair business. On July 23, 2013, the Company completed the purchase of the forging business and substantially all related operating assets from MW General, Inc. On December 10, 2012, the Company completed the divestiture of its Applied Surface Concepts business. |

| |

b. | On October 28, 2011, the Company completed the purchase of the forging business and substantially all related operating assets from GEL Industries, Inc. |

| |

c. | On December 10, 2010, the Company completed the purchase of the forging business and substantially all related operating assets from T&W Forge, Inc. |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

SIFCO is engaged in the production of forgings and machined components primarily for the aerospace and energy markets. The processes and services include forging, heat-treating and machining. As of the end of fiscal 2014, the Company operates under one business segment: SIFCO.

The Company endeavors to plan and evaluate its business operations while taking into consideration certain factors including the following: (i) the projected build rate for commercial, business and military aircraft, as well as the engines that power such aircraft; (ii) the projected build rate for industrial gas turbine engines; and (iii) the projected maintenance, repair and overhaul schedules for commercial, business and military aircraft, as well as the engines that power such aircraft.

The Company operates within a cost structure that includes a significant fixed component. Therefore, higher net sales volumes are expected to result in greater operating income because such higher volumes allow the business operations to better leverage the fixed component of their respective cost structures. Conversely, the opposite effect is expected to occur at lower net sales and related production volumes.

A. Results of Operations

Non-GAAP Financial Measures

Presented below is certain financial information based on our EBITDA and Adjusted EBITDA. References to “EBITDA” mean earnings from continuing operations before interest, taxes, depreciation and amortization, and references to “Adjusted EBITDA” mean EBITDA plus, as applicable for each relevant period, certain adjustments as set forth in the reconciliations of net income to EBITDA and Adjusted EBITDA.

Neither EBITDA nor Adjusted EBITDA is a measurement of financial performance under generally accepted accounting principles in the United States of America (“GAAP”). The Company presents EBITDA and Adjusted EBITDA because it believes that they are useful indicators for evaluating operating performance and liquidity, including the Company’s ability to incur and service debt and it uses EBITDA to evaluate prospective acquisitions. Although the Company uses EBITDA and Adjusted EBITDA for the reasons noted above, the use of these non-GAAP financial measures as analytical tools has limitations. Therefore, reviewers of the Company’s financial information should not consider them in isolation, or as a substitute for analysis of the Company's results of operations as reported in accordance with GAAP. Some of these limitations include:

| |

• | Neither EBITDA nor Adjusted EBITDA reflects the interest expense, or the cash requirements necessary to service interest payments, on indebtedness; |

| |

• | Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and neither EBITDA nor Adjusted EBITDA reflects any cash requirements for such replacements; |

| |

• | The omission of the substantial amortization expense associated with the Company’s intangible assets further limits the usefulness of EBITDA and Adjusted EBITDA; and |

| |

• | Neither EBITDA nor Adjusted EBITDA includes the payment of taxes, which is a necessary element of operations. |

Because of these limitations, EBITDA and Adjusted EBITDA should not be considered as measures of discretionary cash available to the Company to invest in the growth of its businesses. Management compensates for these limitations by not viewing EBITDA or Adjusted EBITDA in isolation and specifically by using other GAAP measures, such as net income, net sales, and operating profit, to measure operating performance. The Company’s calculation of EBITDA and Adjusted EBITDA may not be comparable to the calculation of similarly titled measures reported by other companies.

The following table sets forth a reconciliation of net income to EBITDA and Adjusted EBITDA:

|

| | | | | | | | | | | |

(Dollars in thousands) | |

| Years Ended September 30, |

| 2014 | | 2013 | | 2012 |

Net income | $ | 5,023 |

| | $ | 10,234 |

| | $ | 6,548 |

|

Less: Income (loss) from discontinued operations, net of tax | (580 | ) | | 476 |

| | 241 |

|

Income from continuing operations | 5,603 |

| | 9,758 |

| | 6,307 |

|

Adjustments: | | | | | |

Depreciation and amortization expense | 6,896 |

| | 5,725 |

| | 6,032 |

|

Interest expense, net | 184 |

| | 318 |

| | 444 |

|

Income tax provision | 2,753 |

| | 4,088 |

| | 2,861 |

|

EBITDA | 15,436 |

| | 19,889 |

| | 15,644 |

|

Adjustments: | | | | | |

Foreign currency exchange (gain) loss, net (1) | (20 | ) | | 23 |

| | (16 | ) |

Other income, net (2) | (433 | ) | | (421 | ) | | (575 | ) |

Loss (gain) on disposal of operating assets (3) | (3 | ) | | (89 | ) | | — |

|

Inventory purchase accounting adjustments (4) | — |

| | 286 |

| | 437 |

|

Non-recurring severance expense (5) | — |

| | 813 |

| | — |

|

Equity compensation expense (6) | 1,572 |

| | 126 |

| | 892 |

|

Pension settlement expense (7) | — |

| | 248 |

| | 513 |

|

Acquisition transaction-related expenses (8) | 920 |

| | 197 |

| | 407 |

|

LIFO impact (9) | 140 |

| | (1,560 | ) | | 1,563 |

|

Adjusted EBITDA | $ | 17,612 |

| | $ | 19,512 |

| | $ | 18,865 |

|

| |

(1) | Represents the gain or loss from changes in the exchange rates between the functional currency and the foreign currency in which the transaction is denominated. |

| |

(2) | Represents miscellaneous non-operating income or expense, primarily rental income from our Irish subsidiary. |

| |

(3) | Represents the difference between the proceeds from the sale of operating equipment and the carrying value shown on the Company’s books. |

| |

(4) | Represents accounting adjustments to value inventory at fair market value associated with the acquisition of a business that was charged to cost of goods sold when the inventory was sold. |

| |

(5) | Represents severance expense related to the departure of an executive officer. Included in the $813 is $155 of equity-based compensation expense recognized by the Company under its 2007 Long-term Incentive Plan. |

| |

(6) | Represents the equity-based compensation expense recognized by the Company under its 2007 Long-term Incentive Plan. |

| |

(7) | Represents expense incurred by a defined benefit pension plan related to settlement of pension obligations. |

| |

(8) | Represents transaction-related costs such as legal, financial, tax due diligence expenses, valuation services, costs, and executive travel that are required to be expenses as incurred. |

| |

(9) | Represents the increase (decrease) in the reserve for inventories for which cost is determined using the last in, first out ("LIFO") method. Included in the $140 for fiscal 2014 is an increase in the E&O reserve related to LIFO of $238, partially offset by a decrease in the LIFO inventory reserve of $98. |

Overview

During fiscal 2014, SIFCO continued its strategic path to build a leading A&E company focused on long-term, stable growth and profitability. Since 2010, the Company has broadened its footprint in the industrial gas turbine industry, added more commercial aerospace business and expanded its product offerings through the acquisition of three businesses. Additionally, SIFCO discontinued its Repair Group business and divested its ASC business.

During 2014, SIFCO was added to the Russell Global Index, a reflection of the progress the Company has made. Setting a platform for further growth, the Company chose and is in process of implementing an Enterprise Resource Planning ("ERP") system at its Cleveland plant and Corporate headquarters and invested in cost saving infrastructure in Cleveland.

The Company is in the process of integrating and expanding its Western U.S. facilities to achieve synergies in its aluminum forging business and position itself to support its customers and its growth strategy.

Fiscal Year 2014 Compared with Fiscal Year 2013

Net Sales

The Company's results for fiscal 2014 include the results of Colorado Springs for the entire period versus from the date of its acquisition during fiscal 2013. Net sales in fiscal 2014 increased 3.2% to $119.7 million, compared with $116.0 million in fiscal 2013. The Company produces forged components for (i) turbine engines that power commercial, business and regional aircraft as well as military aircraft and armored military vehicles; (ii) airframe applications for a variety of aircraft; (iii) industrial gas turbine engines for power generation units; and (iv) other commercial applications. Net sales comparative information for fiscal 2014 and 2013, respectively, is as follows:

|

| | | | | | | | | | | |

(Dollars in millions) | Years Ended September 30, | | Increase (Decrease) |

Net Sales | 2014 | | 2013 | |

Aerospace components for: | | | | | |

Fixed wing aircraft | $ | 61.2 |

| | $ | 57.7 |

| | $ | 3.5 |

|

Rotorcraft | 31.9 |

| | 32.5 |

| | (0.6 | ) |

Energy components for power generation units | 18.6 |

| | 19.4 |

| | (0.8 | ) |

Commercial product and other revenue | 8.0 |

| | 6.4 |

| | 1.6 |

|

Total | $ | 119.7 |

| | $ | 116.0 |

| | $ | 3.7 |

|

Overall, net sales for the Company increased $3.7 million in fiscal 2014 compared with fiscal 2013. The increase in fixed wing aircraft sales, due primarily to the acquisition of Colorado Springs, was partially offset by lower rotorcraft sales, resulting from decreased demand in the Black Hawk and V-22 military rotorcraft programs. The Company's lower energy components sales were due to a major customer announcing the closing of a facility, which resulted in decreased demand. The Company's higher commercial products and other revenue sales were due to sales related to a new ordnance program.

Commercial net sales were 55.9% of total net sales and military net sales were 44.1% of total net sales in fiscal 2014, compared with 52.4% and 47.6%, respectively, in the comparable period in fiscal 2013. Although commercial net sales increased in fiscal 2014, it was partially offset by lower sales of the Company's energy components. Military net sales decreased $2.5 million to $52.8 million in fiscal 2014, compared to $55.2 million in fiscal 2013. This was primarily due to the decline in military rotorcraft sales, which was partially offset by an increase in sales due to the new ordnance program. The Company's aerospace components have both military and commercial applications.

Cost of Goods Sold

Cost of goods sold increased by $5.7 million, or 6.5%, to $93.7 million during fiscal 2014, compared to $88.0 million in the comparable period of fiscal 2013, primarily due to the additional business as a result of the acquisition of Colorado Springs and higher employee benefits expense.

Gross Profit

Gross profit decreased by $2.1 million, or 7.5%, to $25.9 million during fiscal 2014, compared with $28.0 million in fiscal 2013. Gross margin as a percentage of sales was 21.7% during fiscal 2014, compared with 24.2% in fiscal 2013. The decrease in gross margin as a percentage of sales in fiscal 2014 compared to fiscal 2013 was primarily due to a change in mix within the Company's energy components sales.

Selling, General and Administrative Expenses