|

JULY 31, 2022 |

2022 Annual Report | ||

Not FDIC Insured • May Lose Value • No Bank Guarantee |

Total Returns as of July 31, 2022 | ||||

6-Month |

12-Month | |||

| U.S. large cap equities (S&P 500 ® Index) |

(7.81)% | (4.64)% | ||

| U.S. small cap equities (Russell 2000 ® Index) |

(6.42) | (14.29) | ||

| International equities (MSCI Europe, Australasia, Far East Index) |

(11.27) | (14.32) | ||

| Emerging market equities (MSCI Emerging Markets Index) |

(16.24) | (20.09) | ||

| 3-month Treasury bills (ICE BofA 3-Month U.S. Treasury Bill Index) |

0.21 | 0.22 | ||

| U.S. Treasury securities (ICE BofA 10-Year U.S. Treasury Index) |

(6.38) | (10.00) | ||

| U.S. investment grade bonds (Bloomberg U.S. Aggregate Bond Index) |

(6.14) | (9.12) | ||

| Tax-exempt municipal bonds (Bloomberg Municipal Bond Index) |

(3.95) | (6.93) | ||

| U.S. high yield bonds (Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index) |

(6.58) | (8.03) | ||

| Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | ||||

2 |

T H I S P A G E I S N O T P A R T O F Y O U R F U N D R E P O R T |

| Page |

||||

| 2 | ||||

| Annual Report: |

||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| Financial Statements: |

||||

| 21 | ||||

| 76 | ||||

| 78 | ||||

| 81 | ||||

| 84 | ||||

| 90 | ||||

| 95 | ||||

| 109 | ||||

| 110 | ||||

| 111 | ||||

| 115 | ||||

| 125 | ||||

| 127 | ||||

| 128 | ||||

| 131 | ||||

| 134 | ||||

| 3 |

| During the 12 months ended July 31, 2022, municipal bond funds experienced net outflows totaling $65 billion (based on data from the Investment Company Institute). The post-pandemic inflow cycle, which spanned 92-weeks and garnered $149 billion, ended abruptly in early-2022 as performance turned starkly negative. As a result, elevated bid-wanted activity weighed on the market as investors raised cash to meet redemptions. At the same time, the market absorbed $421 billion in issuance, below the $471 billion issued during the prior 12-months. New issue oversubscriptions waned late in the period as sentiment turned less constructive. |

Bloomberg Municipal Bond Index Total Returns as of July 31, 2022 6 months: (3.95)% 12 months: (6.93)% | |||

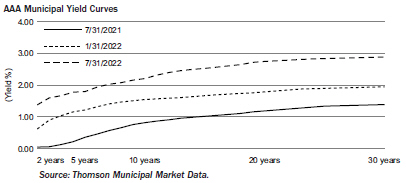

A Closer Look at Yields |

||||

|

|

From July 31, 2021 to July 31, 2022, yields on AAA-rated 30-year municipal bonds increased by 150 basis points (“bps”) from 1.39% to 2.89%, while ten-year rates increased by 139 bps from 0.82% to 2.21% and five-year rates increased by 144 bps from 0.36% to 1.80% (as measured by Thomson Municipal Market Data). As a result, the municipal yield curve flattened over the 12-month period with the spread between two- and 30-year maturities flattening by 4bps, lagging the 158 bps of flattening experienced in the U.S. Treasury curve.After maintaining historically tight valuations early in the period, the selloff experienced in early-2022 restored value to the asset class. Municipal-to-Treasury 5-year averages in the long-end of the curve, while municipals out yield both the S&P 500 and investment-grade corporates on an after-tax basis. |

4 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| T H E B E N E F I T S A N D R I S K S O F L E V E R A G I N G / D E R I V A T I V E F I N A N C I A L I N S T R U M E N T S |

5 |

Fund Summary as of July 31, 2022 |

BlackRock Long-Term Municipal Advantage Trust (BTA) |

| Symbol on New York Stock Exchange |

BTA | |

| Initial Offering Date |

February 28, 2006 | |

| Yield on Closing Market Price as of July 31, 2022 ($12.10) (a) |

5.40% | |

| Tax Equivalent Yield (b) |

9.12% | |

| Current Monthly Distribution per Common Share (c) |

$0.0545 | |

| Current Annualized Distribution per Common Share (c) |

$0.6540 | |

| Leverage as of July 31, 2022 (d) |

42% |

(a) |

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

(b) |

Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

(c) |

The distribution rate is not constant and is subject to change. |

(d) |

Represents VRDP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VRDP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

07/31/22 |

07/31/21 |

Change |

High |

Low |

||||||||||||||||

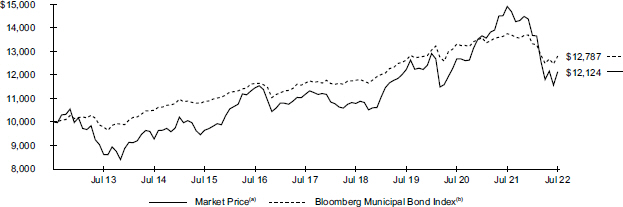

| Closing Market Price |

$ | 12.10 | $ | 13.65 | (11.36 | )% | $ | 15.18 | $ | 10.10 | ||||||||||

| Net Asset Value |

11.17 | 13.74 | (18.70 | ) | 13.74 | 10.32 | ||||||||||||||

(a) |

Represents the Fund’s closing market price on the NYSE and reflects the reinvestment of dividends and/or distributions at actual reinvestment prices. |

(b) |

An unmanaged index that tracks the U.S. long term tax-exempt bond market, including state and local general obligation bonds, revenue bonds, pre-refunded bonds, and insured bonds. |

6 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Fund Summary as of July 31, 2022 (continued) |

BlackRock Long-Term Municipal Advantage Trust (BTA) |

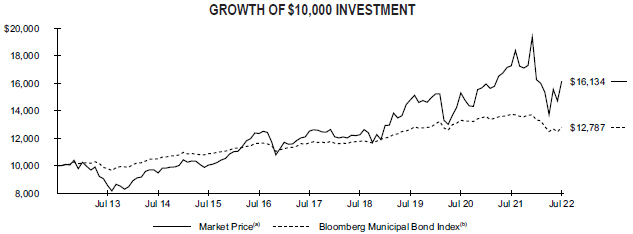

| Average Annual Total Returns | ||||||||||||

1 Year |

5 Years |

10 Years |

||||||||||

| Fund at NAV (a)(b) |

(14.27 | )% | 2.93 | % | 4.50 | % | ||||||

| Fund at Market Price (a)(b) |

(6.52 | ) | 5.22 | 4.90 | ||||||||

| Customized Reference Benchmark (c) |

(7.23 | ) | 2.49 | N/A | ||||||||

| Bloomberg Municipal Bond Index |

(6.93 | ) | 1.88 | 2.49 | ||||||||

(a) |

All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Fund’s use of leverage. |

(b) |

The Fund moved from a discount to NAV to a premium during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

(c) |

The Customized Reference Benchmark is comprised of the Bloomberg Municipal Bond Index Total Return Index Value Unhedged (75%) and the Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (25%). The Customized Reference Benchmark commenced on September 30, 2016. |

| F U N D S U M M A R Y |

7 |

Fund Summary as of July 31, 2022 (continued) |

BlackRock Long-Term Municipal Advantage Trust (BTA) |

Sector (a)(b) |

07/31/22 |

|||

| County/City/Special District/School District |

17.1 | % | ||

| Health |

14.6 | |||

| Education |

13.1 | |||

| Transportation |

12.8 | |||

| Utilities |

10.5 | |||

| Corporate |

9.6 | |||

| Tobacco |

9.3 | |||

| State |

7.8 | |||

| Housing |

5.2 | |||

Credit Rating (a)(d) |

07/31/22 |

|||

| AAA/Aaa |

2.8 | % | ||

| AA/Aa |

19.6 | |||

| A |

23.4 | |||

| BBB/Baa |

9.9 | |||

| BB/Ba |

11.1 | |||

| B |

2.9 | |||

| N/R (e) |

30.3 | |||

Calendar Year Ended December 31, (a)(c) |

Percentage |

|||

2022 |

5.7 | % | ||

2023 |

8.5 | |||

2024 |

7.1 | |||

2025 |

5.6 | |||

2026 |

8.5 | |||

(a) |

Excludes short-term securities. |

(b) |

For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

(c) |

Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

(d) |

For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

(e) |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of July 31, 2022, the market value of unrated securities deemed by the investment adviser to be investment grade represents 2.2% of the Fund’s total investments. |

8 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Fund Summary as of July 31, 2022 |

BlackRock MuniAssets Fund, Inc. (MUA) |

Symbol on New York Stock Exchange |

MUA | |

Initial Offering Date |

June 25, 1993 | |

Yield on Closing Market Price as of July 31, 2022 ($12.55) (a) |

4.35% | |

Tax Equivalent Yield (b) |

7.35% | |

Current Monthly Distribution per Common Share (c) |

$0.0455 | |

Current Annualized Distribution per Common Share (c) |

$0.5460 | |

Leverage as of July 31, 2022 (d) |

31% |

(a) |

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

(b) |

Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

(c) |

The distribution rate is not constant and is subject to change. |

(d) |

Represents VRDP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VRDP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

07/31/22 |

07/31/21 |

Change |

High |

Low |

||||||||||||||||

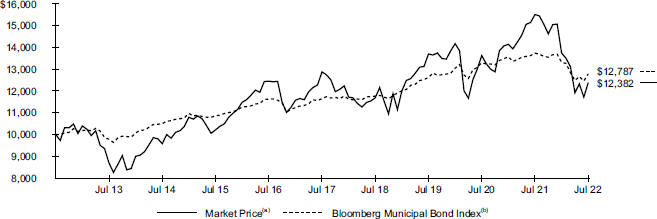

Closing Market Price |

$ | 12.55 | $ | 16.20 | (22.53 | )% | $ | 16.77 | $ | 10.83 | ||||||||||

Net Asset Value |

12.53 | 15.23 | (17.73 | ) | 15.23 | 11.65 | ||||||||||||||

(a) |

Represents the Fund’s closing market price on the NYSE and reflects the reinvestment of dividends and/or distributions at actual reinvestment prices. |

(b) |

An index designed to measure the performance of U.S. dollar-denominated high-yield municipal bonds issued by U.S. states, the District of Columbia, U.S. territories and local governments or agencies. |

F U N D S U M M A R Y |

9 |

Fund Summary as of July 31, 2022 (continued) |

BlackRock MuniAssets Fund, Inc. (MUA) |

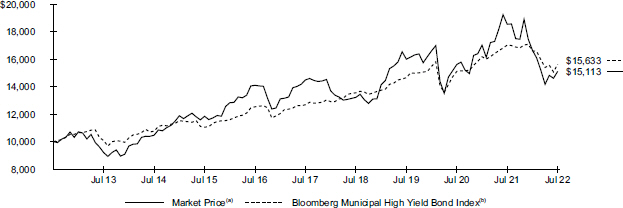

| Average Annual Total Returns | ||||||||||||

1 Year |

5 Years |

10 Years |

||||||||||

Fund at NAV (a)(b) |

(13.43 | )% | 2.24 | % | 4.11 | % | ||||||

Fund at Market Price (a)(b) |

(18.49 | ) | 0.84 | 4.22 | ||||||||

High Yield Customized Reference Benchmark (c) |

(7.98 | ) | 3.52 | N/A | ||||||||

Bloomberg Municipal High Yield Bond Index |

(8.16 | ) | 4.26 | 4.57 | ||||||||

(a) |

All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Fund’s use of leverage. |

(b) |

The Fund’s premium to NAV narrowed during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

(c) |

The High Yield Customized Reference Benchmark is comprised of the Bloomberg Municipal Bond Rated Baa Index (20%), the Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (60%) and the Bloomberg Municipal Investment Grade ex BBB Index (20%). The High Yield Customized Reference Benchmark commenced on September 30, 2016. |

10 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Fund Summary as of July 31, 2022 (continued) |

BlackRock MuniAssets Fund, Inc. (MUA) |

Sector (a)(b) |

07/31/22 |

|||

Education |

15.4 | % | ||

County/City/Special District/School District |

13.9 | |||

State |

13.0 | |||

Transportation |

12.7 | |||

Health |

10.4 | |||

Corporate |

9.3 | |||

Tobacco |

8.7 | |||

Housing |

8.6 | |||

Utilities |

8.0 | |||

Credit Rating (a)(d) |

07/31/22 |

|||

AAA/Aaa |

0.7 | % | ||

AA/Aa |

14.1 | |||

A |

13.9 | |||

BBB/Baa |

7.9 | |||

BB/Ba |

11.7 | |||

B |

3.3 | |||

CCC/Caa |

0.2 | |||

N/R (e) |

48.2 | |||

Calendar Year Ended December 31, (a)(c) |

Percentage |

|||

2022 |

8.3 | % | ||

2023 |

10.3 | |||

2024 |

5.8 | |||

2025 |

4.7 | |||

2026 |

7.1 | |||

(a) |

Excludes short-term securities. |

(b) |

For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

(c) |

Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

(d) |

For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

(e) |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of July 31, 2022, the market value of unrated securities deemed by the investment adviser to be investment grade represents 2.3% of the Fund’s total investments. |

F U N D S U M M A R Y |

11 |

Fund Summary as of July 31, 2022 |

BlackRock Municipal Income Fund, Inc. (MUI) |

Symbol on New York Stock Exchange |

MUI | |

Initial Offering Date |

August 1, 2003 | |

Yield on Closing Market Price as of July 31, 2022 ($12.44) (a) |

5.21% | |

Tax Equivalent Yield (b) |

8.80% | |

Current Monthly Distribution per Common Share (c) |

$0.0540 | |

Current Annualized Distribution per Common Share (c) |

$0.6480 | |

Leverage as of July 31, 2022 (d) |

42% |

(a) |

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

(b) |

Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

(c) |

The distribution rate is not constant and is subject to change. |

(d) |

Represents VRDP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VRDP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

07/31/22 |

07/31/21 |

Change |

High |

Low |

||||||||||||||||

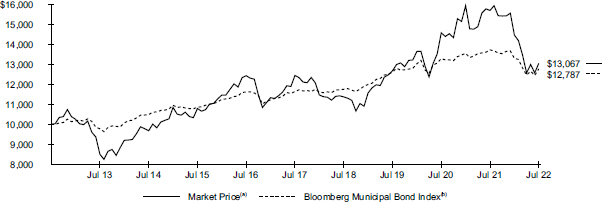

Closing Market Price |

$ | 12.44 | $ | 16.01 | (22.30 | )% | $ | 16.03 | $ | 11.49 | ||||||||||

Net Asset Value |

13.64 | 16.25 | (16.06 | ) | 16.27 | 12.72 | ||||||||||||||

(a) |

Represents the Fund’s closing market price on the NYSE and reflects the reinvestment of dividends and/or distributions at actual reinvestment prices. |

(b) |

An unmanaged index that tracks the U.S. long term tax-exempt bond market, including state and local general obligation bonds, revenue bonds, pre-refunded bonds, and insured bonds. |

12 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Fund Summary as of July 31, 2022 (continued) |

BlackRock Municipal Income Fund, Inc. (MUI) |

| Average Annual Total Returns | ||||||||||||||||

1 Year |

5 Years |

10 Years |

||||||||||||||

Fund at NAV (a)(b) |

(12.08 | )% | 1.80 | % | 3.20 | % | ||||||||||

Fund at Market Price (a)(b) |

(18.62 | ) | 1.65 | 1.95 | ||||||||||||

National Customized Reference Benchmark (c) |

(7.05 | ) | 2.13 | N/A | ||||||||||||

Bloomberg Municipal Bond Index |

(6.93 | ) | 1.88 | 2.49 | ||||||||||||

(a) |

All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Fund’s use of leverage. |

(b) |

The Fund’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

(c) |

The National Customized Reference Benchmark is comprised of the Bloomberg Municipal Bond Index Total Return Index Value Unhedged (90%) and the Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (10%). The National Customized Reference Benchmark commenced on September 30, 2016. |

F U N D S U M M A R Y |

13 |

Fund Summary as of July 31, 2022 (continued) |

BlackRock Municipal Income Fund, Inc. (MUI) |

Sector (a)(b) |

07/31/22 |

|||

Transportation |

31.5 | % | ||

State |

17.2 | |||

Health |

13.9 | |||

County/City/Special District/School District |

10.7 | |||

Utilities |

8.6 | |||

Education |

7.1 | |||

Corporate |

5.1 | |||

Tobacco |

3.4 | |||

Housing |

2.5 | |||

Calendar Year Ended December 31, (a)(c) |

Percentage |

|||

2022 |

1.3 | % | ||

2023 |

11.0 | |||

2024 |

5.3 | |||

2025 |

5.7 | |||

2026 |

12.2 | |||

Credit Rating (a)(d) |

07/31/22 |

|||

| AAA/Aaa |

7.2 | % | ||

| AA/Aa |

40.9 | |||

| A |

32.9 | |||

| BBB/Baa |

7.1 | |||

| BB/Ba |

3.9 | |||

| B |

0.1 | |||

| N/R (e) |

7.9 | |||

(a) |

Excludes short-term securities. |

(b) |

For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

(c) |

Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

(d) |

For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

(e) |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of July 31, 2022, the market value of unrated securities deemed by the investment adviser to be investment grade represents less than 1.0% of the Fund’s total investments. |

14 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Fund Summary as of July 31, 2022 |

BlackRock MuniYield Fund, Inc. (MYD) |

| Symbol on New York Stock Exchange |

MYD | |

| Initial Offering Date |

November 29, 1991 | |

| Yield on Closing Market Price as of July 31, 2022 ($11.72) (a) |

5.27% | |

| Tax Equivalent Yield (b) |

8.90% | |

| Current Monthly Distribution per Common Share (c) |

$0.0515 | |

| Current Annualized Distribution per Common Share (c) |

$0.6180 | |

| Leverage as of July 31, 2022 (d) |

38% |

(a) |

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

(b) |

Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

(c) |

The distribution rate is not constant and is subject to change. |

(d) |

Represents VRDP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VRDP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

07/31/22 |

07/31/21 |

Change |

High |

Low |

||||||||||||||||

| Closing Market Price |

$ | 11.72 | $ | 15.41 | (23.95 | )% | $ | 15.48 | $ | 10.55 | ||||||||||

| Net Asset Value |

12.73 | 15.61 | (18.45 | ) | 15.62 | 11.83 | ||||||||||||||

(a) |

Represents the Fund’s closing market price on the NYSE and reflects the reinvestment of dividends and/or distributions at actual reinvestment prices. |

(b) |

An unmanaged index that tracks the U.S. long term tax-exempt bond market, including state and local general obligation bonds, revenue bonds, pre-refunded bonds, and insured bonds. |

| F U N D S U M M A R Y |

15 |

Fund Summary as of July 31, 2022 (continued) |

BlackRock MuniYield Fund, Inc. (MYD) |

| Average Annual Total Returns | ||||||||||||||||

| |

|

|||||||||||||||

1 Year |

5 Years |

10 Years |

||||||||||||||

| Fund at NAV (a)(b) |

(14.41 | )% | 1.85 | % | 3.59 | % | ||||||||||

| Fund at Market Price (a)(b) |

(20.18 | ) | (0.78 | ) | 2.16 | |||||||||||

| National Customized Reference Benchmark (c) |

(7.05 | ) | 2.13 | N/A | ||||||||||||

| Bloomberg Municipal Bond Index |

(6.93 | ) | 1.88 | 2.49 | ||||||||||||

(a) |

All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Fund’s use of leverage. |

(b) |

The Fund’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

(c) |

The National Customized Reference Benchmark is comprised of the Bloomberg Municipal Bond Index Total Return Index Value Unhedged (90%) and the Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (10%). The National Customized Reference Benchmark commenced on September 30, 2016. |

16 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Fund Summary as of July 31, 2022 (continued) |

BlackRock MuniYield Fund, Inc. (MYD) |

Sector (a)(b) |

07/31/22 |

|||

| Transportation |

21.9 | % | ||

| Health |

16.7 | |||

| State |

15.0 | |||

| County/City/Special District/School District |

9.6 | |||

| Utilities |

8.9 | |||

| Housing |

7.4 | |||

| Education |

7.1 | |||

| Corporate |

6.8 | |||

| Tobacco |

6.6 | |||

Credit Rating (a)(d) |

07/31/22 |

|||

| AAA/Aaa |

5.5 | % | ||

| AA/Aa |

40.1 | |||

| A |

29.7 | |||

| BBB/Baa |

8.1 | |||

| BB/Ba |

5.4 | |||

| B |

1.7 | |||

| N/R (e) |

9.5 | |||

Calendar Year Ended December 31, (a)(c) |

Percentage |

|||

| 2022 |

6.9 | % | ||

| 2023 |

6.7 | |||

| 2024 |

7.4 | |||

| 2025 |

8.3 | |||

| 2026 |

3.3 | |||

(a) |

Excludes short-term securities. |

(b) |

For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

(c) |

Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

(d) |

For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

(e) |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of July 31, 2022, the market value of unrated securities deemed by the investment adviser to be investment grade represents 2.4% of the Fund’s total investments. |

| F U N D S U M M A R Y |

17 |

Fund Summary as of July 31, 2022 |

BlackRock MuniYield Quality Fund, Inc. (MQY) |

| Symbol on New York Stock Exchange |

MQY | |

| Initial Offering Date |

June 26, 1992 | |

| Yield on Closing Market Price as of July 31, 2022 ($13.12) (a) |

5.12% | |

| Tax Equivalent Yield (b) |

8.65% | |

| Current Monthly Distribution per Common Share (c) |

$0.0560 | |

| Current Annualized Distribution per Common Share (c) |

$0.6720 | |

| Leverage as of July 31, 2022 (d) |

39% |

(a) |

Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

(b) |

Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

(c) |

The distribution rate is not constant and is subject to change. |

(d) |

Represents VRDP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Fund, including any assets attributable to VRDP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Fund, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

07/31/22 |

07/31/21 |

Change |

High |

Low |

||||||||||||||||

| Closing Market Price |

$ | 13.12 | $ | 16.60 | (20.96 | )% | $ | 16.99 | $ | 11.75 | ||||||||||

| Net Asset Value |

13.89 | 16.81 | (17.37 | ) | 16.82 | 12.98 | ||||||||||||||

(a) |

Represents the Fund’s closing market price on the NYSE and reflects the reinvestment of dividends and/or distributions at actual reinvestment prices. |

(b) |

An unmanaged index that tracks the U.S. long term tax-exempt bond market, including state and local general obligation bonds, revenue bonds, pre-refunded bonds, and insured bonds. |

18 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

Fund Summary as of July 31, 2022 (continued) |

BlackRock MuniYield Quality Fund, Inc. (MQY) |

| Average Annual Total Returns | ||||||||||||||||

1 Year |

5 Years |

10 Years |

||||||||||||||

| Fund at NAV (a)(b) |

(13.07 | )% | 2.28 | % | 3.69 | % | ||||||||||

| Fund at Market Price (a)(b) |

(16.86 | ) | 0.96 | 2.71 | ||||||||||||

| National Customized Reference Benchmark (c) |

(7.05 | ) | 2.13 | N/A | ||||||||||||

| Bloomberg Municipal Bond Index |

(6.93 | ) | 1.88 | 2.49 | ||||||||||||

(a) |

All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Fund’s use of leverage. |

(b) |

The Fund’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

(c) |

The National Customized Reference Benchmark is comprised of the Bloomberg Municipal Bond Index Total Return Index Value Unhedged (90%) and the Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (10%). The National Customized Reference Benchmark commenced on September 30, 2016. |

| F U N D S U M M A R Y |

19 |

Fund Summary as of July 31, 2022 (continued) |

BlackRock MuniYield Quality Fund, Inc. (MQY) |

Sector (a)(b) |

07/31/22 |

|||

| Transportation |

25.8 | % | ||

| County/City/Special District/School District |

16.6 | |||

| Health |

13.9 | |||

| State |

13.1 | |||

| Housing |

8.2 | |||

| Utilities |

7.8 | |||

| Education |

7.2 | |||

| Corporate |

4.1 | |||

| Tobacco |

3.3 | |||

Credit Rating (a)(d) |

07/31/22 |

|||

| AAA/Aaa |

4.5 | % | ||

| AA/Aa |

40.8 | |||

| A |

33.5 | |||

| BBB/Baa |

7.7 | |||

| BB/Ba |

3.3 | |||

| B |

0.4 | |||

| CCC/Caa |

— | (e) | ||

| N/R (f) |

9.8 | |||

Calendar Year Ended December 31, (a)(c) |

Percentage |

|||

| 2022 |

5.1 | % | ||

| 2023 |

8.4 | |||

| 2024 |

8.9 | |||

| 2025 |

7.5 | |||

| 2026 |

8.9 | |||

(a) |

Excludes short-term securities. |

(b) |

For Fund compliance purposes, the Fund’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

(c) |

Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

(d) |

For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

(e) |

Rounds to less than 0.1% of total investments. |

(f) |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of July 31, 2022, the market value of unrated securities deemed by the investment adviser to be investment grade represents 1.5% of the Fund’s total investments. |

20 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Schedule of Investments July 31, 2022 |

BlackRock Long-Term Municipal Advantage Trust (BTA) (Percentages shown are based on Net Assets) |

Security |

Par (000) |

Value |

||||||

| Municipal Bonds |

||||||||

| Alabama — 3.5% |

||||||||

| County of Jefferson Alabama Sewer Revenue, Refunding RB, Series D, Sub Lien, 6.00%, 10/01/42 |

$ | 1,655 | $ | 1,801,045 | ||||

| Hoover Industrial Development Board, RB, AMT, 6.38%, 11/01/50 (a) |

1,040 | 1,183,223 | ||||||

| Southeast Energy Authority A Cooperative District, RB, Series B-1, 5.00%, 05/01/53(a) |

1,300 | 1,395,426 | ||||||

| Sumter County Industrial Development Authority, RB, AMT, 6.00%, 07/15/52 (a) |

645 | 652,382 | ||||||

| Tuscaloosa County Industrial Development Authority, Refunding RB, Series A, 4.50%, 05/01/32 (b) |

154 | 142,897 | ||||||

| |

|

|||||||

| 5,174,973 | ||||||||

Arizona — 5.1% |

||||||||

| Arizona Industrial Development Authority, Refunding RB (b) |

||||||||

| Series A, 5.13%, 07/01/37 |

360 | 367,930 | ||||||

| Series A, 5.38%, 07/01/50 |

925 | 943,035 | ||||||

| Series A, 5.50%, 07/01/52 |

855 | 874,424 | ||||||

| Series G, 5.00%, 07/01/47 |

135 | 136,375 | ||||||

| Industrial Development Authority of the City of Phoenix, RB |

||||||||

| Series A, 5.00%, 07/01/33 |

870 | 870,280 | ||||||

| Series A, 5.00%, 07/01/46 (b) |

1,255 | 1,266,473 | ||||||

| Industrial Development Authority of the City of Phoenix, Refunding RB, Series A, 5.00%, 07/01/35 (b) |

125 | 126,971 | ||||||

| Industrial Development Authority of the County of Pima, Refunding RB (b) |

||||||||

| 4.00%, 06/15/51 |

540 | 454,826 | ||||||

| 5.00%, 07/01/56 |

235 | 233,616 | ||||||

| 4.00%, 06/15/57 |

415 | 341,966 | ||||||

| Maricopa County Industrial Development Authority, RB, AMT, 4.00%, 10/15/47 (b) |

835 | 770,029 | ||||||

| Maricopa County Industrial Development Authority, Refunding RB, Series A, 4.13%, 09/01/38 |

375 | 382,460 | ||||||

| Salt Verde Financial Corp., RB, 5.00%, 12/01/37 |

725 | 803,819 | ||||||

| Tempe Industrial Development Authority, Refunding RB, Series A, 4.00%, 12/01/46 |

140 | 112,857 | ||||||

| |

|

|||||||

| 7,685,061 | ||||||||

Arkansas (b) — 3.0% |

||||||||

| Arkansas Development Finance Authority, RB |

||||||||

| Series A, AMT, 4.50%, 09/01/49 |

925 | 897,695 | ||||||

| Series A, AMT, 4.75%, 09/01/49 |

3,570 | 3,579,867 | ||||||

| |

|

|||||||

| 4,477,562 | ||||||||

California — 9.7% |

||||||||

| California County Tobacco Securitization Agency, Refunding RB, Series A, 5.00%, 06/01/47 |

140 | 140,004 | ||||||

| California Housing Finance Agency, RB, M/F Housing, Class A, 3.25%, 08/20/36 |

643 | 608,744 | ||||||

| California Municipal Finance Authority, RB, S/F Housing |

||||||||

| Series A, 5.25%, 08/15/39 |

70 | 71,853 | ||||||

| Series A, 5.25%, 08/15/49 |

175 | 179,394 | ||||||

| California Public Finance Authority, RB, Series A, 6.25%, 07/01/54 (b) |

850 | 935,978 | ||||||

| California State Public Works Board, RB, Series I, 5.00%, 11/01/38 |

355 | 365,991 | ||||||

| CMFA Special Finance Agency VIII, RB, M/F Housing, Series A-1, 3.00%, 08/01/56(b) |

460 | 344,332 | ||||||

Security |

Par (000) |

Value |

||||||

| California (continued) |

||||||||

| CSCDA Community Improvement Authority, RB, M/F Housing (b) |

||||||||

| 4.00%, 12/01/56 |

$ | 1,265 | $ | 1,014,530 | ||||

| 4.00%, 03/01/57 |

330 | 262,917 | ||||||

| Series A, 3.00%, 09/01/56 |

725 | 555,074 | ||||||

| Series A2, 3.25%, 07/01/56 |

155 | 114,600 | ||||||

| Series B, 4.00%, 07/01/58 |

200 | 151,364 | ||||||

| Series B, 4.00%, 12/01/59 |

835 | 606,402 | ||||||

| Series A, Class 2, Senior Lien, 4.00%, 12/01/58 |

2,545 | 2,078,748 | ||||||

| Series B, Sub Lien, 4.00%, 12/01/59 |

285 | 210,612 | ||||||

| Golden State Tobacco Securitization Corp., Refunding RB, CAB, Series B, Subordinate, 0.00%, 06/01/66 (c) |

10,530 | 1,337,605 | ||||||

| Hastings Campus Housing Finance Authority, RB, CAB, Sub-Series A, 6.75%, 07/01/35(b)(d) |

830 | 394,613 | ||||||

| Indio Finance Authority, Refunding RB, Series A, 4.50%, 11/01/52 (e) |

595 | 612,276 | ||||||

| Regents of the University of California Medical Center Pooled Revenue, RB, Series P, 4.00%, 05/15/53 |

935 | 942,572 | ||||||

| Riverside County Transportation Commission, Refunding RB |

||||||||

| 2nd Lien, 4.00%, 06/01/47 |

180 | 174,242 | ||||||

| Senior Lien, 3.00%, 06/01/49 |

120 | 98,584 | ||||||

| San Diego County Regional Airport Authority, ARB, Series B, AMT, Subordinate, 4.00%, 07/01/56 |

355 | 344,235 | ||||||

| San Francisco City & County Redevelopment Agency Successor Agency, TA, CAB, Series D, 0.00%, 08/01/31 (b)(c) |

1,265 | 821,626 | ||||||

| San Marcos Unified School District, GO, CAB, Series B, Election 2010, 0.00%, 08/01/38 (c) |

3,725 | 2,066,332 | ||||||

| Stockton Public Financing Authority, RB, Series A, 6.25%, 10/01/23 (f) |

165 | 173,768 | ||||||

| |

|

|||||||

| 14,606,396 | ||||||||

Colorado — 3.7% |

||||||||

| Centerra Metropolitan District No.1, TA, 5.00%, 12/01/47 (b) |

275 | 262,589 | ||||||

| City & County of Denver Colorado Airport System Revenue, Refunding ARB |

||||||||

| Series A, AMT, 4.13%, 11/15/53 |

320 | 321,632 | ||||||

| Series A, AMT, 5.50%, 11/15/53 |

340 | 386,646 | ||||||

| Colorado Health Facilities Authority, RB |

||||||||

| Series A, 5.00%, 05/15/35 |

140 | 135,671 | ||||||

| Series A, 5.00%, 05/15/44 |

180 | 164,119 | ||||||

| Series A, 5.00%, 05/15/49 |

120 | 106,229 | ||||||

| Series A, 5.00%, 05/15/58 |

250 | 213,604 | ||||||

| Constitution Heights Metropolitan District, Refunding GO, 5.00%, 12/01/49 |

500 | 469,667 | ||||||

| Denver Convention Center Hotel Authority, Refunding RB, 5.00%, 12/01/40 |

1,550 | 1,601,762 | ||||||

| Fitzsimons Village Metropolitan District No.3, Refunding GO, Series A-1, 4.00%, 12/01/31 |

500 | 456,773 | ||||||

| Loretto Heights Community Authority, RB, 4.88%, 12/01/51 |

500 | 423,667 | ||||||

| Pueblo Urban Renewal Authority, TA, 4.75%, 12/01/45 (b) |

650 | 639,365 | ||||||

| Waters’ Edge Metropolitan District No.2, GO, 5.00%, 12/01/51 |

500 | 437,188 | ||||||

| |

|

|||||||

| 5,618,912 | ||||||||

Connecticut (b) — 0.9% |

||||||||

| Connecticut State Health & Educational Facilities Authority, RB |

||||||||

| Series A, 5.00%, 01/01/45 |

160 | 163,899 | ||||||

| S C H E D U L E O F I N V E S T M E N T S |

21 |

| Schedule of Investments (continued) July 31, 2022 |

BlackRock Long-Term Municipal Advantage Trust (BTA) (Percentages shown are based on Net Assets) |

Security |

Par (000) |

Value |

||||||

| Connecticut (continued) |

||||||||

| Connecticut State Health & Educational Facilities Authority, RB (continued) |

||||||||

| Series A, 5.00%, 01/01/55 |

$ | 210 | $ | 212,798 | ||||

| Mohegan Tribe of Indians of Connecticut, Refunding RB, Series C, 6.25%, 02/01/30 |

860 | 916,659 | ||||||

| |

|

|||||||

| 1,293,356 | ||||||||

Delaware — 0.3% |

||||||||

| Affordable Housing Opportunities Trust, RB, Series AH-01, Class B, 6.88%, 05/01/39(b)(g) |

450 | 450,000 | ||||||

| |

|

|||||||

District of Columbia — 1.2% |

||||||||

| District of Columbia, Refunding RB, Series A, 6.00%, 07/01/43 (f) |

260 | 270,440 | ||||||

| District of Columbia, TA, 5.13%, 06/01/41 |

750 | 751,814 | ||||||

| Metropolitan Washington Airports Authority Dulles Toll Road Revenue, Refunding RB, Series B, Subordinate, 4.00%, 10/01/49 |

870 | 818,352 | ||||||

| |

|

|||||||

| 1,840,606 | ||||||||

Florida — 8.9% |

||||||||

| Brevard County Health Facilities Authority, Refunding RB (b) |

||||||||

| 4.00%, 11/15/23 |

100 | 100,690 | ||||||

| 4.00%, 11/15/29 |

100 | 99,468 | ||||||

| 4.00%, 11/15/33 |

625 | 608,266 | ||||||

| Buckhead Trails Community Development District, SAB, Series 2022, 5.75%, 05/01/52 |

145 | 146,162 | ||||||

| Capital Region Community Development District, Refunding SAB |

||||||||

| Series A-1, 5.13%, 05/01/39 |

210 | 215,895 | ||||||

| Series A-2, 4.60%, 05/01/31 |

515 | 524,629 | ||||||

| Capital Trust Agency, Inc., RB |

||||||||

| Series A, 5.75%, 06/01/54 (b) |

450 | 433,940 | ||||||

| Series B, 0.00%, 01/01/60 (c) |

3,000 | 236,361 | ||||||

| Capital Trust Agency, Inc., RB, CAB (b)(c) |

||||||||

| 0.00%, 07/01/61 |

25,215 | 1,531,241 | ||||||

| Subordinate, 0.00%, 01/01/61 |

5,865 | 415,741 | ||||||

| Charlotte County Industrial Development Authority, RB (b) |

||||||||

| AMT, 5.00%, 10/01/34 |

120 | 123,450 | ||||||

| AMT, 5.00%, 10/01/49 |

560 | 548,353 | ||||||

| County of Osceola Florida Transportation Revenue, Refunding RB, CAB (c) |

||||||||

| Series A-2, 0.00%, 10/01/46 |

775 | 222,919 | ||||||

| Series A-2, 0.00%, 10/01/47 |

745 | 202,428 | ||||||

| Series A-2, 0.00%, 10/01/48 |

525 | 134,514 | ||||||

| Series A-2, 0.00%, 10/01/49 |

435 | 105,402 | ||||||

| Florida Development Finance Corp., RB (b) |

||||||||

| 5.25%, 06/01/55 |

525 | 483,724 | ||||||

| 5.00%, 06/15/56 |

550 | 523,502 | ||||||

| Series B, 4.50%, 12/15/56 |

705 | 558,617 | ||||||

| Series C, 5.75%, 12/15/56 |

250 | 204,869 | ||||||

| Florida Development Finance Corp., Refunding RB |

||||||||

| 5.00%, 06/01/51 |

165 | 145,976 | ||||||

| 6.50%, 06/30/57 (b) |

250 | 255,390 | ||||||

| Lakes of Sarasota Community Development District, SAB |

||||||||

| Series A-1, 2.75%, 05/01/26 |

100 | 96,959 | ||||||

| Series A-1, 3.90%, 05/01/41 |

285 | 251,326 | ||||||

| Series B-1, 3.00%, 05/01/26 |

100 | 96,968 | ||||||

| Series B-1, 4.13%, 05/01/41 |

200 | 176,238 | ||||||

| Series B-1, 4.30%, 05/01/51 |

100 | 84,791 | ||||||

| Lakewood Ranch Stewardship District, SAB |

||||||||

| 4.25%, 05/01/26 |

100 | 100,167 | ||||||

| 5.13%, 05/01/46 |

355 | 356,373 | ||||||

Security |

Par (000) |

Value |

||||||

| Florida (continued) |

||||||||

| Lakewood Ranch Stewardship District, SAB (continued) |

||||||||

| Series 1B, 4.75%, 05/01/29 |

$ | 270 | $ | 279,742 | ||||

| Series 1B, 5.30%, 05/01/39 |

310 | 327,789 | ||||||

| Series 1B, 5.45%, 05/01/48 |

550 | 578,619 | ||||||

| Miami Beach Health Facilities Authority, RB, 3.00%, 11/15/51 |

130 | 99,696 | ||||||

| Palm Beach County Health Facilities Authority, RB |

||||||||

| Series A, 5.00%, 11/01/47 |

110 | 114,026 | ||||||

| Series A, 5.00%, 11/01/52 |

150 | 155,293 | ||||||

| Sawyers Landing Community Development District, SAB, 4.25%, 05/01/53 |

535 | 463,930 | ||||||

| Tolomato Community Development District, Refunding SAB, Series 2015-2, 6.61%, 11/01/24(a)(d) |

310 | 234,361 | ||||||

| Tolomato Community Development District, SAB, Series 2015-3, 6.61%,05/01/40 (a)(h)(i) |

340 | 3 | ||||||

| Trout Creek Community Development District, SAB |

||||||||

| 5.00%, 05/01/28 |

160 | 163,164 | ||||||

| 5.50%, 05/01/49 |

570 | 579,675 | ||||||

| Village Community Development District No.14, SA |

||||||||

| 5.38%, 05/01/42 |

415 | 432,039 | ||||||

| 5.50%, 05/01/53 |

310 | 322,163 | ||||||

| West Villages Improvement District, SAB |

||||||||

| 4.75%, 05/01/39 |

220 | 218,733 | ||||||

| 5.00%, 05/01/50 |

450 | 444,658 | ||||||

| |

|

|||||||

| 13,398,250 | ||||||||

Georgia — 5.5% |

||||||||

| Atlanta Urban Redevelopment Agency, RB, 3.88%, 07/01/51 (b) |

355 | 314,230 | ||||||

| East Point Business & Industrial Development Authority, RB, Series A, 5.25%, 06/15/62 (b) |

110 | 112,376 | ||||||

| Gainesville & Hall County Hospital Authority, Refunding RB, Series A, (GTD), 5.50%, 08/15/54 (f) |

240 | 262,373 | ||||||

| Main Street Natural Gas, Inc., RB |

||||||||

| Series A, 5.00%, 05/15/49 |

1,770 | 1,926,944 | ||||||

| Series B, 5.00%, 12/01/52 (a)(e) |

2,230 | 2,390,228 | ||||||

| Municipal Electric Authority of Georgia, RB |

||||||||

| 4.00%, 01/01/49 |

865 | 833,688 | ||||||

| 4.00%, 01/01/59 |

1,640 | 1,561,144 | ||||||

| Series A, 5.00%, 07/01/52 |

460 | 486,444 | ||||||

| Municipal Electric Authority of Georgia, Refunding RB, Sub-Series A, 4.00%, 01/01/49 |

320 | 311,043 | ||||||

| |

|

|||||||

| 8,198,470 | ||||||||

Idaho — 0.4% |

||||||||

| Idaho Health Facilities Authority, Refunding RB, 3.00%, 03/01/51 |

700 | 549,347 | ||||||

| |

|

|||||||

Illinois — 7.7% |

||||||||

| Chicago Board of Education, GO |

||||||||

| Series C, 5.25%, 12/01/35 |

795 | 815,200 | ||||||

| Series D, 5.00%, 12/01/46 |

1,035 | 1,052,884 | ||||||

| Series H, 5.00%, 12/01/36 |

935 | 971,748 | ||||||

| Chicago Board of Education, Refunding GO |

||||||||

| Series C, 5.00%, 12/01/25 |

350 | 370,113 | ||||||

| Series C, 5.00%, 12/01/27 |

415 | 451,412 | ||||||

| Series C, 5.00%, 12/01/34 |

940 | 985,006 | ||||||

| Chicago Transit Authority Sales Tax Receipts Fund, Refunding RB, Series A, 2nd Lien, 4.00%, 12/01/49 |

640 | 625,077 | ||||||

| City of Chicago Illinois, Refunding GO, Series A, 6.00%, 01/01/38 |

595 | 656,465 | ||||||

| Cook County Community College District No.508, GO, 5.50%, 12/01/38 |

350 | 362,273 | ||||||

22 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Schedule of Investments (continued) July 31, 2022 |

BlackRock Long-Term Municipal Advantage Trust (BTA) (Percentages shown are based on Net Assets) |

Security |

Par (000) |

Value |

||||||

| Illinois (continued) |

||||||||

| Illinois Finance Authority, Refunding RB, Series C, 5.00%, 02/15/41 |

$ | 1,500 | $ | 1,598,488 | ||||

| Metropolitan Pier & Exposition Authority, RB |

||||||||

| Series A, 5.50%, 06/15/53 |

200 | 208,302 | ||||||

| Series A, 5.00%, 06/15/57 |

555 | 573,410 | ||||||

| Metropolitan Pier & Exposition Authority, Refunding RB |

||||||||

| 4.00%, 06/15/50 |

410 | 386,389 | ||||||

| Series B, 5.00%, 06/15/52 |

225 | 230,396 | ||||||

| Metropolitan Pier & Exposition Authority, Refunding RB, CAB, Series B, 0.00%, 12/15/54 (c) |

500 | 103,972 | ||||||

| State of Illinois, GO |

||||||||

| 5.00%, 05/01/27 |

500 | 521,915 | ||||||

| 5.00%, 01/01/28 |

1,005 | 1,078,954 | ||||||

| University of Illinois, RB, Series A, 5.00%, 04/01/44 |

475 | 486,486 | ||||||

| |

|

|||||||

| 11,478,490 | ||||||||

Indiana — 3.4% |

||||||||

| City of Valparaiso Indiana, RB |

||||||||

| AMT, 6.75%, 01/01/34 |

365 | 387,409 | ||||||

| AMT, 7.00%, 01/01/44 |

885 | 936,126 | ||||||

| City of Vincennes Indiana, Refunding RB, 6.25%, 01/01/29 (b) |

810 | 810,539 | ||||||

| Indiana Finance Authority, RB |

||||||||

| Series A, AMT, 5.00%, 07/01/23 (f) |

160 | 163,972 | ||||||

| Series A, AMT, 5.25%, 07/01/23 (f) |

1,190 | 1,223,196 | ||||||

| Series A, AMT, 6.75%, 05/01/39 |

515 | 590,665 | ||||||

| Indiana Housing & Community Development Authority, RB, 5.38%, 10/01/40 (b) |

595 | 538,671 | ||||||

| Indianapolis Local Public Improvement Bond Bank, RB, Series A, 5.00%, 01/15/40 |

445 | 450,782 | ||||||

| |

|

|||||||

| 5,101,360 | ||||||||

Iowa — 0.1% |

||||||||

| Iowa Student Loan Liquidity Corp., Refunding RB, Series B, AMT, 3.00%, 12/01/39 |

195 | 171,582 | ||||||

| |

|

|||||||

Kentucky — 0.4% |

||||||||

| Kentucky Public Transportation Infrastructure Authority, RB, CAB, Series C, Convertible, 6.75%, 07/01/43 (a)(d) |

565 | 617,464 | ||||||

| |

|

|||||||

Louisiana — 1.2% |

||||||||

| Louisiana Local Government Environmental Facilities & Community Development Authority, RB, 5.00%, 07/01/54 (b) |

445 | 417,297 | ||||||

| Louisiana Public Facilities Authority, RB, Series A, 6.50%, 06/01/62 (b) |

105 | 107,067 | ||||||

| Tobacco Settlement Financing Corp., Refunding RB |

||||||||

| Series A, 5.25%, 05/15/33 |

360 | 366,229 | ||||||

| Series A, 5.25%, 05/15/35 |

945 | 969,597 | ||||||

| |

|

|||||||

| 1,860,190 | ||||||||

Maine — 0.2% |

||||||||

| Finance Authority of Maine, RB, AMT, 8.00%, 12/01/51 (b) |

380 | 333,017 | ||||||

| |

|

|||||||

Maryland — 2.0% |

||||||||

| County of Frederick Maryland, Refunding TA, 4.63%, 07/01/43 (b) |

925 | 998,909 | ||||||

Security |

Par (000) |

Value |

||||||

| Maryland (continued) |

||||||||

| Maryland Economic Development Corp., RB, Class B, AMT, 5.25%, 06/30/47 |

$ | 380 | $ | 415,291 | ||||

| Maryland Health & Higher Educational Facilities Authority, RB, Series A, 7.00%, 03/01/55 (b) |

1,480 | 1,592,277 | ||||||

| |

|

|||||||

| 3,006,477 | ||||||||

Massachusetts — 1.8% |

||||||||

| Massachusetts Development Finance Agency, RB |

||||||||

| Series A, 6.50%, 11/15/43 (b)(f) |

1,000 | 1,061,468 | ||||||

| Series A, 5.00%, 01/01/47 |

860 | 889,736 | ||||||

| Massachusetts Development Finance Agency, Refunding RB |

||||||||

| 4.00%, 07/01/45 |

100 | 88,632 | ||||||

| 4.00%, 07/01/50 |

150 | 127,243 | ||||||

| Massachusetts Housing Finance Agency, Refunding RB, Series A, AMT, 4.45%, 12/01/42 |

545 | 546,183 | ||||||

| |

|

|||||||

| 2,713,262 | ||||||||

Michigan — 1.0% |

||||||||

| City of Detroit Michigan, GO |

||||||||

| 5.00%, 04/01/34 |

140 | 147,101 | ||||||

| 5.00%, 04/01/35 |

140 | 146,779 | ||||||

| 5.00%, 04/01/36 |

95 | 99,374 | ||||||

| 5.00%, 04/01/37 |

155 | 161,778 | ||||||

| 5.00%, 04/01/38 |

70 | 72,889 | ||||||

| Michigan State Housing Development Authority, RB, M/F Housing, Series A, 2.70%, 10/01/56 |

460 | 335,510 | ||||||

| Michigan Strategic Fund, RB, AMT, 5.00%, 06/30/48 |

500 | 504,178 | ||||||

| |

|

|||||||

| 1,467,609 | ||||||||

Minnesota — 1.7% |

||||||||

| Duluth Economic Development Authority, Refunding RB |

||||||||

| Series A, 4.25%, 02/15/48 |

1,940 | 1,900,901 | ||||||

| Series A, 5.25%, 02/15/58 |

655 | 690,975 | ||||||

| |

|

|||||||

| 2,591,876 | ||||||||

Missouri — 1.7% |

||||||||

| Health & Educational Facilities Authority of the State of Missouri, Refunding RB, 5.50%, 05/01/43 |

115 | 117,974 | ||||||

| Industrial Development Authority of the City of St. Louis Missouri, Refunding RB |

||||||||

| Series A, 4.38%, 11/15/35 |

330 | 298,344 | ||||||

| Series A, 4.75%, 11/15/47 |

365 | 308,694 | ||||||

| Kansas City Industrial Development Authority, ARB |

||||||||

| AMT, (AGM), 4.00%, 03/01/57 |

975 | 951,134 | ||||||

| Class B, AMT, 5.00%, 03/01/54 |

850 | 888,106 | ||||||

| |

|

|||||||

| 2,564,252 | ||||||||

Nebraska — 0.2% |

||||||||

| Central Plains Energy Project, Refunding RB, 5.25%, 09/01/37 |

285 | 285,763 | ||||||

| |

|

|||||||

New Hampshire — 1.0% |

||||||||

| New Hampshire Business Finance Authority, RB |

||||||||

| Series A, 4.13%, 08/15/40 |

260 | 236,500 | ||||||

| Series A, 4.25%, 08/15/46 |

290 | 256,222 | ||||||

| Series A, 4.50%, 08/15/55 |

600 | 525,636 | ||||||

| S C H E D U L E O F I N V E S T M E N T S |

23 |

| Schedule of Investments (continued) July 31, 2022 |

BlackRock Long-Term Municipal Advantage Trust (BTA) (Percentages shown are based on Net Assets) |

Security |

Par (000) |

Value |

||||||

New Hampshire (continued) |

||||||||

| New Hampshire Business Finance Authority, Refunding RB (a)(b) |

||||||||

| Series A, 3.63%, 07/01/43 |

$ | 130 | $ | 113,167 | ||||

| Series B, AMT, 3.75%, 07/01/45 |

375 | 327,258 | ||||||

| |

|

|||||||

| 1,458,783 | ||||||||

New Jersey — 11.1% |

||||||||

| Casino Reinvestment Development Authority, Inc., Refunding RB |

||||||||

| 5.25%, 11/01/39 |

475 | 492,369 | ||||||

| 5.25%, 11/01/44 |

1,160 | 1,193,508 | ||||||

| New Jersey Economic Development Authority, ARB, AMT, 5.13%, 09/15/23 |

750 | 758,152 | ||||||

| New Jersey Economic Development Authority, RB, Series EEE, 5.00%, 06/15/43 |

195 | 206,484 | ||||||

| New Jersey Economic Development Authority, Refunding RB, Series BBB, 5.50%, 06/15/31 (f) |

1,225 | 1,415,050 | ||||||

| New Jersey Economic Development Authority, Refunding SAB, 5.75%, 04/01/31 |

785 | 762,534 | ||||||

| New Jersey Health Care Facilities Financing Authority, RB, 3.00%, 07/01/51 |

1,230 | 1,004,770 | ||||||

| New Jersey Higher Education Student Assistance Authority, Refunding RB |

||||||||

| Sub-Series C, AMT, 3.63%, 12/01/49 |

645 | 564,565 | ||||||

| Series C, AMT, Subordinate, 4.25%, 12/01/50 |

1,340 | 1,245,746 | ||||||

| New Jersey Transportation Trust Fund Authority, RB |

||||||||

| Series AA, 5.00%, 06/15/45 |

585 | 601,273 | ||||||

| Series S, 5.25%, 06/15/43 |

2,535 | 2,735,260 | ||||||

| New Jersey Turnpike Authority, RB, Series A, 4.00%, 01/01/48 |

245 | 247,248 | ||||||

| Tobacco Settlement Financing Corp., Refunding RB |

||||||||

| Series A, 5.00%, 06/01/35 |

730 | 787,424 | ||||||

| Series A, 5.25%, 06/01/46 |

1,700 | 1,791,839 | ||||||

| Sub-Series B, 5.00%, 06/01/46 |

2,825 | 2,885,947 | ||||||

| |

|

|||||||

| 16,692,169 | ||||||||

New York — 16.7% |

||||||||

| Erie Tobacco Asset Securitization Corp., Refunding RB, |

||||||||

| Series A, 5.00%, 06/01/45 |

910 | 909,912 | ||||||

| Metropolitan Transportation Authority, RB |

||||||||

| Series B, 5.25%, 11/15/38 |

1,125 | 1,166,443 | ||||||

| Series B, 5.25%, 11/15/39 |

400 | 413,402 | ||||||

| Metropolitan Transportation Authority, Refunding RB, |

||||||||

| Series C-1, 4.75%, 11/15/45 |

985 | 1,020,888 | ||||||

| New York City Industrial Development Agency, Refunding RB, (AGM), 3.00%, 03/01/49 |

465 | 369,363 | ||||||

| New York City Transitional Finance Authority Future Tax Secured Revenue, RB |

||||||||

| Sub-Series B-1, 4.00%, 11/01/45 |

5,000 | 5,016,660 | ||||||

| Subordinate, 3.00%, 05/01/46 |

1,180 | 1,031,849 | ||||||

| Series A-1, Subordinate, 4.00%, 08/01/48(e) |

555 | 552,784 | ||||||

| Series F-1, Subordinate, 4.00%, 02/01/51 |

190 | 190,282 | ||||||

| Series F-1, Subordinate, 5.00%, 02/01/51 |

270 | 301,187 | ||||||

| New York Counties Tobacco Trust IV, Refunding RB |

||||||||

| Series A, 6.25%, 06/01/41 (b) |

900 | 903,788 | ||||||

| Series A, 5.00%, 06/01/42 |

1,505 | 1,495,809 | ||||||

| Series A, 5.00%, 06/01/45 |

555 | 547,454 | ||||||

| New York Counties Tobacco Trust VI, Refunding RB, |

||||||||

| Series A-2-B, |

1,000 | 1,006,360 | ||||||

| New York Liberty Development Corp., Refunding RB |

||||||||

| Series 1, Class 1, 5.00%, 11/15/44 (b) |

2,355 | 2,362,322 | ||||||

Security |

Par (000) |

Value |

||||||

New York (continued) |

||||||||

| New York Liberty Development Corp., Refunding RB (continued) |

||||||||

| Series 2, Class 2, 5.15%, 11/15/34 (b) |

$ | 160 | $ | 162,584 | ||||

| Series 2, Class 2, 5.38%, 11/15/40 (b) |

395 | 402,771 | ||||||

| Series A, 2.88%, 11/15/46 |

1,290 | 1,019,711 | ||||||

| New York Power Authority, Refunding RB, Series A, 4.00%, 11/15/60 |

565 | 562,711 | ||||||

| New York State Dormitory Authority, Refunding RB, 5.00%, 12/01/33 (b) |

410 | 438,234 | ||||||

| New York Transportation Development Corp., ARB AMT, 5.00%, 12/01/39 |

555 | 592,559 | ||||||

| Series A, AMT, 5.25%, 01/01/50 |

1,000 | 1,016,129 | ||||||

| New York Transportation Development Corp., RB |

||||||||

| AMT, 5.00%, 10/01/35 |

190 | 197,338 | ||||||

| AMT, 5.00%, 10/01/40 |

535 | 550,088 | ||||||

| New York Transportation Development Corp., Refunding ARB, AMT, 5.38%, 08/01/36 |

730 | 788,824 | ||||||

| Westchester County Local Development Corp., Refunding RB, 5.00%, 07/01/46 (b) |

755 | 667,363 | ||||||

| Westchester Tobacco Asset Securitization Corp., Refunding RB, Sub-Series C, 4.00%, 06/01/42 |

1,295 | 1,319,757 | ||||||

| |

|

|||||||

| 25,006,572 | ||||||||

Ohio — 4.6% |

||||||||

| Buckeye Tobacco Settlement Financing Authority, Refunding RB, Series B-2, Class 2, 5.00%, 06/01/55 |

3,400 | 3,387,760 | ||||||

| Cleveland-Cuyahoga County Port Authority, Refunding TA (b) |

||||||||

| 4.00%, 12/01/55 |

120 | 100,519 | ||||||

| 4.50%, 12/01/55 |

100 | 82,378 | ||||||

| County of Hamilton Ohio, Refunding RB, 4.00%, 08/15/50 |

800 | 797,845 | ||||||

| Ohio Air Quality Development Authority, RB, AMT, 5.00%, 07/01/49 (b) |

400 | 394,160 | ||||||

| Port of Greater Cincinnati Development Authority, RB, 4.25%, 12/01/50 (b) |

185 | 157,900 | ||||||

| Southern Ohio Port Authority, RB, Series A, AMT, 7.00%, 12/01/42 (b) |

805 | 711,666 | ||||||

| State of Ohio, RB, AMT, 5.00%, 06/30/53 |

1,220 | 1,242,269 | ||||||

| |

|

|||||||

| 6,874,497 | ||||||||

Oklahoma — 4.0% |

||||||||

| Oklahoma Development Finance Authority, RB 7.25%, 09/01/51 (b) |

2,205 | 2,285,734 | ||||||

| Series B, 5.00%, 08/15/38 |

1,450 | 1,392,244 | ||||||

| Series B, 5.25%, 08/15/43 |

1,305 | 1,246,101 | ||||||

| Tulsa Authority for Economic Opportunity, TA, 4.38%, 12/01/41 (b) |

155 | 133,592 | ||||||

| Tulsa County Industrial Authority, Refunding RB, 5.25%, 11/15/45 |

925 | 939,870 | ||||||

| |

|

|||||||

| 5,997,541 | ||||||||

Oregon — 0.4% |

||||||||

| Clackamas County School District No.12 North Clackamas, GO, CAB, Series A, (GTD), 0.00%, 06/15/38 (c) |

625 | 323,538 | ||||||

| Oregon State Facilities Authority, Refunding RB, Series A, 4.13%, 06/01/52 |

235 | 229,303 | ||||||

| |

|

|||||||

| 552,841 | ||||||||

Pennsylvania — 3.0% |

||||||||

| Allentown Neighborhood Improvement Zone Development Authority, RB, 5.00%, 05/01/42 (b) |

470 | 481,884 | ||||||

| Bucks County Industrial Development Authority, RB 4.00%, 07/01/46 |

100 | 81,006 | ||||||

24 |

2 0 2 2 B L A C K R O C K A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Schedule of Investments (continued) July 31, 2022 |

BlackRock Long-Term Municipal Advantage Trust (BTA) (Percentages shown are based on Net Assets) |

Security |

Par (000) |

Value |

||||||

Pennsylvania (continued) |

||||||||

| Bucks County Industrial Development Authority, RB (continued) |

||||||||

| 4.00%, 07/01/51 |

$ | 100 | $ | 79,305 | ||||

| Montgomery County Higher Education and Health Authority, Refunding RB, 4.00%, 09/01/51 |

1,240 | 1,233,130 | ||||||

| Pennsylvania Economic Development Financing Authority, RB, AMT, 5.00%, 12/31/38 |

465 | 481,655 | ||||||

| Pennsylvania Economic Development Financing Authority, Refunding RB, AMT, 5.50%, 11/01/44 |

720 | 735,571 | ||||||

| Pennsylvania Higher Educational Facilities Authority, RB, 4.00%, 08/15/44 |

805 | 810,447 | ||||||

| Pennsylvania Turnpike Commission, RB, Series A, 5.00%, 12/01/44 |

520 | 542,555 | ||||||

| |

|

|||||||

| 4,445,553 | ||||||||

Puerto Rico — 5.8% |

||||||||

| Children’s Trust Fund, RB, Series A, 0.00%, 05/15/57 (c) |

9,585 | 693,034 | ||||||

| Children’s Trust Fund, Refunding RB, 5.63%, 05/15/43 |

820 | 833,368 | ||||||

| Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, RB |

||||||||

| Series A-2, Convertiable, Restructured, 4.33%, 07/01/40 |

72 | 70,082 | ||||||

| Series A-1, Restructured, 4.75%, 07/01/53 |

1,529 | 1,523,283 | ||||||

| Series A-1, Restructured, 5.00%, 07/01/58 |

3,066 | 3,088,023 | ||||||

| Series A-2, Restructured, 4.33%, 07/01/40 |

851 | 842,460 | ||||||

| Series A-2, Restructured, 4.78%, 07/01/58 |

1,038 | 1,035,125 | ||||||

| Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, RB, CAB, Series A-1, Restructured,0.00%, 07/01/46 (c) |

1,914 | 553,113 | ||||||

| |

|

|||||||

| 8,638,488 | ||||||||

Rhode Island — 2.5% |

||||||||

| Rhode Island Student Loan Authority, RB, Series A, AMT, 3.63%, 12/01/37 |

410 | 366,736 | ||||||

| Tobacco Settlement Financing Corp., Refunding RB |

||||||||

| Series A, 5.00%, 06/01/40 |

420 | 429,276 | ||||||

| Series B, 4.50%, 06/01/45 |

1,630 | 1,631,946 | ||||||

| Series B, 5.00%, 06/01/50 |

1,360 | 1,388,809 | ||||||

| |

|

|||||||

| 3,816,767 | ||||||||

South Carolina — 3.6% |

||||||||

| South Carolina Jobs-Economic Development Authority, RB, |

||||||||

| Series A, 5.00%, 11/15/54 |

165 | 156,104 | ||||||

| South Carolina Jobs-Economic Development Authority, Refunding RB, Series A, 5.00%, 05/01/43 |

1,110 | 1,180,416 | ||||||

| South Carolina Public Service Authority, RB |

||||||||

| Series A, 5.50%, 12/01/54 |

1,840 | 1,905,763 | ||||||

| Series E, 5.00%, 12/01/48 |

420 | 431,277 | ||||||

| Series E, 5.50%, 12/01/53 |

750 | 771,419 | ||||||

| South Carolina Public Service Authority, Refunding RB |

||||||||

| Series A, 4.00%, 12/01/33 |

550 | 568,573 | ||||||

| Series E, 5.25%, 12/01/55 |

430 | 448,744 | ||||||

| |

|

|||||||

| 5,462,296 | ||||||||

Tennessee — 1.6% |

||||||||

| Memphis-Shelby County Industrial Development Board, Refunding TA, Series A, 5.63%, 01/01/46 |

570 | 430,058 | ||||||

Security |

Par (000) |

Value |

||||||

Tennessee (continued) |

||||||||

| Metropolitan Government Nashville & Davidson County Health & Educational Facilities Board, Refunding RB |

||||||||

| Series A, 4.00%, 10/01/49 |

$ | 290 | $ | 270,135 | ||||

| Series A, 5.25%, 10/01/58 |

1,430 | 1,522,062 | ||||||

| Metropolitan Government Nashville & Davidson County Industrial Development Board, SAB, CAB, 0.00%, 06/01/43 (b)(c) |

450 | 156,758 | ||||||

| |

|

|||||||

| 2,379,013 | ||||||||

Texas — 8.7% |

||||||||

| Angelina & Neches River Authority, RB, Series A, AMT, 7.50%, 12/01/45 (b) |

335 | 268,682 | ||||||

| Arlington Higher Education Finance Corp., RB, Series A, 5.75%, 08/15/62 |

500 | 501,009 | ||||||

| Arlington Higher Education Finance Corp., Refunding RB, Series S, 5.00%, 08/15/41 |

180 | 176,720 | ||||||

| Brazoria County Industrial Development Corp., RB, AMT, 7.00%, 03/01/39 |

325 | 340,304 | ||||||

| Brazos Higher Education Authority, Inc., RB, Series 1B, AMT, Subordinate, 3.00%, 04/01/40 |

285 | 225,144 | ||||||

| City of Houston Texas Airport System Revenue, ARB, AMT, 4.00%, 07/15/41 |

100 | 89,864 | ||||||

| City of Houston Texas Airport System Revenue, Refunding ARB, AMT, 5.00%, 07/15/27 |

125 | 128,588 | ||||||

| City of Houston Texas Airport System Revenue, Refunding RB, Series C, AMT, 5.00%, 07/15/27 |

800 | 820,213 | ||||||

| Harris County Cultural Education Facilities Finance Corp., RB, Series B, 7.00%, 01/01/43 (f) |

210 | 214,949 | ||||||

| Harris County-Houston Sports Authority, Refunding RB, CAB, Series A, Senior Lien, (AGM, NPFGC), 0.00%, 11/15/34 (c) |

3,000 | 1,704,300 | ||||||

| Midland County Fresh Water Supply District No.1, RB, CAB, Series A, 0.00%, 09/15/37 (c) |

5,200 | 2,638,033 | ||||||

| Mission Economic Development Corp., Refunding RB, AMT, Senior Lien, 4.63%, 10/01/31 (b) |

430 | 439,579 | ||||||

| New Hope Cultural Education Facilities Finance Corp., Refunding RB, Series A, 6.75%, 10/01/52 (e) |

600 | 611,993 | ||||||

| Newark Higher Education Finance Corp., RB (b) |

||||||||

| Series A, 5.50%, 08/15/35 |

135 | 141,756 | ||||||

| Series A, 5.75%, 08/15/45 |

275 | 284,832 | ||||||

| North Texas Tollway Authority, Refunding RB, 4.25%, 01/01/49 |

1,890 | 1,920,537 | ||||||

| Port Beaumont Navigation District, RB, AMT, 2.75%, 01/01/36 (b) |

710 | 571,214 | ||||||

| San Antonio Education Facilities Corp., RB |

||||||||

| Series A, 5.00%, 10/01/41 |

85 | 79,612 | ||||||

| Series A, 5.00%, 10/01/51 |

115 | 100,753 | ||||||

| Texas Private Activity Bond Surface Transportation Corp., RB, AMT, Senior Lien, 5.00%, 12/31/55 |

1,025 | 1,034,828 | ||||||

| Texas Transportation Commission, RB, CAB, 0.00%, 08/01/43 (c) |

2,205 | 792,911 | ||||||

| |

|

|||||||

| 13,085,821 | ||||||||

Utah (b) — 0.1% |

||||||||

| Utah Charter School Finance Authority, RB |

||||||||

| Series A, 5.00%, 06/15/41 |

100 | 98,673 | ||||||

| Series A, 5.00%, 06/15/52 |

125 | 120,359 | ||||||

| |

|

|||||||

| 219,032 | ||||||||

| S C H E D U L E O F I N V E S T M E N T S |

25 |

| Schedule of Investments (continued) July 31, 2022 |

BlackRock Long-Term Municipal Advantage Trust (BTA) (Percentages shown are based on Net Assets) |

Security |

Par (000) |

Value |

||||||

| Vermont — 0.3% |

||||||||

| Vermont Student Assistance Corp., RB, Series A, AMT, 3.38%, 06/15/36 |

$ | 455 | $ | 449,998 | ||||

| |

|

|||||||

Virginia — 1.6% |

||||||||

| Ballston Quarter Community Development Authority, TA |

||||||||

| Series A, 5.00%, 03/01/26 |

235 | 227,126 | ||||||

| Series A, 5.13%, 03/01/31 |

510 | 444,687 | ||||||

| Norfolk Redevelopment & Housing Authority, RB |

||||||||

| Series A, 5.00%, 01/01/34 |

235 | 241,497 | ||||||

| Series A, 5.00%, 01/01/49 |

455 | 454,985 | ||||||

| Tobacco Settlement Financing Corp., Refunding RB, Series B-1, 5.00%, 06/01/47 |

1,025 | 1,006,930 | ||||||

| |

|

|||||||

| 2,375,225 | ||||||||

Washington — 0.7% |

||||||||

| Port of Seattle Washington, ARB, Series C, AMT, 5.00%, 04/01/40 |

350 | 363,510 | ||||||

| Washington State Convention Center Public Facilities District, RB, Series B, 3.00%, 07/01/58 |

425 | 279,901 | ||||||

| Washington State Housing Finance Commission, RB, M/F Housing, Series A-1, 3.50%, 12/20/35 |

472 | 454,879 | ||||||

| |

|

|||||||

| 1,098,290 | ||||||||

Wisconsin — 6.2% |

||||||||

| Public Finance Authority, ARB, AMT, 4.25%, 07/01/54 |

750 | 575,129 | ||||||

| Public Finance Authority, RB |

||||||||

| 5.00%, 06/15/41 (b) |

165 | 154,170 | ||||||

| 5.00%, 01/01/42 (b) |

290 | 292,458 | ||||||

| 5.00%, 06/15/55 (b) |

440 | 385,642 | ||||||

| 5.00%, 01/01/56 (b) |

710 | 692,532 | ||||||

| 5.00%, 06/15/56 (b) |

230 | 196,078 | ||||||

| Series A, 6.25%, 10/01/31 (b) |

290 | 287,762 | ||||||

| Series A, 5.00%, 11/15/41 |

95 | 102,006 | ||||||

| Series A, 7.00%, 10/01/47 (b) |

290 | 277,672 | ||||||

| Series A, 5.00%, 10/15/50 (b) |

530 | 496,708 | ||||||

| Series A, 4.75%, 06/15/56 (b) |

735 | 588,237 | ||||||

| Series A-1, 4.50%, 01/01/35 (b) |

600 | 588,937 | ||||||

| Series A-1, 5.50%, 12/01/48 (b)(h)(i) |

10 | 3,163 | ||||||

| Series A-1, 5.00%, 01/01/55 (b) |

1,290 | 1,212,084 | ||||||

| Series B, 0.00%, 01/01/35 (b)(c) |

1,055 | 484,689 | ||||||

| Series B, 0.00%, 01/01/60 (b)(c) |

16,025 | 1,262,530 | ||||||

| AMT, 4.00%, 03/31/56 |

930 | 784,465 | ||||||

| Public Finance Authority, RB, CAB, Series B, 0.00%, 01/01/61 (b)(c) |

6,685 | 520,735 | ||||||

| Public Finance Authority, Refunding RB, 4.00%, 04/01/52 (b) |

255 | 220,417 | ||||||

| Wisconsin Health & Educational Facilities Authority, Refunding RB, 5.00%, 11/01/46 |

230 | 227,685 | ||||||

| |

|

|||||||

| 9,353,099 | ||||||||

| |

|

|||||||

| Total Municipal Bonds — 135.5% (Cost: $206,216,940) |

203,390,260 | |||||||

| |

|

|||||||

Security |

Par (000) |

Value |

||||||

| Municipal Bonds Transferred to Tender Option Bond Trusts (j) |

| |||||||

| California — 2.2% |

||||||||

| City of Los Angeles Department of Airports, ARB, Series B, AMT, 5.00%, 05/15/46 |

$ | 2,700 | $ | 2,822,477 | ||||

| Sacramento Area Flood Control Agency, Refunding SAB, 5.00%, 10/01/47 |

495 | 533,747 | ||||||

| |

|

|||||||

| 3,356,224 | ||||||||

Colorado — 1.2% |

||||||||

| Colorado Health Facilities Authority, Refunding RB, Series A, 4.00%, 08/01/49 (k) |

1,810 | 1,752,847 | ||||||

| |

|

|||||||

Florida — 1.5% |

||||||||

| Escambia County Health Facilities Authority, Refunding RB, 4.00%, 08/15/45 (k) |

2,321 | 2,216,424 | ||||||

| |

|

|||||||

Georgia — 0.7% |

||||||||

| Dalton Whitfield County Joint Development Authority, RB, 4.00%, 08/15/48 |

1,025 | 1,004,421 | ||||||

| |

|

|||||||

Idaho — 1.5% |

||||||||

| Idaho State Building Authority, RB, Series A, 4.00%, 09/01/27 (f) |

2,120 | 2,325,486 | ||||||

| |

|

|||||||

Illinois — 1.1% |

||||||||

| Illinois State Toll Highway Authority, RB, Series C, 5.00%, 01/01/38 |

1,498 | 1,581,905 | ||||||

| |

|

|||||||

Iowa — 1.2% |

||||||||

| Iowa Finance Authority, Refunding RB, Series E, 4.00%, 08/15/46 |

1,815 | 1,757,638 | ||||||

| |

|

|||||||

Massachusetts — 1.2% |

||||||||

| Massachusetts Housing Finance Agency, Refunding RB, Series A, AMT, 4.50%, 12/01/47 |

1,796 | 1,810,005 | ||||||

| |

|

|||||||

Michigan — 1.3% |

||||||||

| Michigan Finance Authority, RB, 4.00%, 02/15/47 |

2,000 | 1,980,608 | ||||||

| |

|

|||||||

Nebraska — 3.4% |

||||||||

| Central Plains Energy Project, RB, Series 1, 5.00%, 05/01/53 |

4,771 | 5,139,434 | ||||||

| |

|

|||||||

New York — 3.5% |

||||||||

| New York City Housing Development Corp., Refunding RB, Series A, 4.15%, 11/01/38 |

2,339 | 2,364,103 | ||||||

| Port Authority of New York & New Jersey, Refunding ARB 194th Series, 5.25%, 10/15/55 |

1,215 | 1,278,681 | ||||||

| Series 221, AMT, 4.00%, 07/15/55 |

1,720 | 1,657,022 | ||||||

| |

|

|||||||

| 5,299,806 | ||||||||

North Carolina — 1.0% |

||||||||

| North Carolina Capital Facilities Finance Agency, Refunding RB, Series B, 5.00%, 10/01/25 (f) |

1,180 | 1,293,963 | ||||||