false0000899715DEF 14A00008997152023-01-012023-12-31iso4217:USDiso4217:USDxbrli:shares00008997152022-01-012022-12-3100008997152021-01-012021-12-3100008997152020-01-012020-12-31000089971512023-01-012023-12-310000899715ecd:PeoMemberskt:StockAndOptionAwardValuesReportedForCoveredYearMember2023-01-012023-12-310000899715ecd:PeoMemberskt:StockAndOptionAwardValuesReportedForCoveredYearMember2022-01-012022-12-310000899715ecd:PeoMemberskt:StockAndOptionAwardValuesReportedForCoveredYearMember2021-01-012021-12-310000899715ecd:PeoMemberskt:StockAndOptionAwardValuesReportedForCoveredYearMember2020-01-012020-12-310000899715skt:FairValueForStockAndOptionAwardsGrantedInTheCoveredYearThatRemainUnvestedMemberecd:PeoMember2023-01-012023-12-310000899715skt:FairValueForStockAndOptionAwardsGrantedInTheCoveredYearThatRemainUnvestedMemberecd:PeoMember2022-01-012022-12-310000899715skt:FairValueForStockAndOptionAwardsGrantedInTheCoveredYearThatRemainUnvestedMemberecd:PeoMember2021-01-012021-12-310000899715skt:FairValueForStockAndOptionAwardsGrantedInTheCoveredYearThatRemainUnvestedMemberecd:PeoMember2020-01-012020-12-310000899715skt:ChangeInFairValueOfOutstandingUnvestedStockAndOptionsFromPriorYearsMemberecd:PeoMember2023-01-012023-12-310000899715skt:ChangeInFairValueOfOutstandingUnvestedStockAndOptionsFromPriorYearsMemberecd:PeoMember2022-01-012022-12-310000899715skt:ChangeInFairValueOfOutstandingUnvestedStockAndOptionsFromPriorYearsMemberecd:PeoMember2021-01-012021-12-310000899715skt:ChangeInFairValueOfOutstandingUnvestedStockAndOptionsFromPriorYearsMemberecd:PeoMember2020-01-012020-12-310000899715ecd:PeoMemberskt:ChangeInFairValueOfStockAndOptionAwardsFromPriorYearsThatVestedInTheCoveredYearMember2023-01-012023-12-310000899715ecd:PeoMemberskt:ChangeInFairValueOfStockAndOptionAwardsFromPriorYearsThatVestedInTheCoveredYearMember2022-01-012022-12-310000899715ecd:PeoMemberskt:ChangeInFairValueOfStockAndOptionAwardsFromPriorYearsThatVestedInTheCoveredYearMember2021-01-012021-12-310000899715ecd:PeoMemberskt:ChangeInFairValueOfStockAndOptionAwardsFromPriorYearsThatVestedInTheCoveredYearMember2020-01-012020-12-310000899715skt:StockAndOptionAwardValuesReportedForCoveredYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000899715skt:StockAndOptionAwardValuesReportedForCoveredYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000899715skt:StockAndOptionAwardValuesReportedForCoveredYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000899715skt:StockAndOptionAwardValuesReportedForCoveredYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000899715skt:FairValueForStockAndOptionAwardsGrantedInTheCoveredYearThatRemainUnvestedMemberecd:NonPeoNeoMember2023-01-012023-12-310000899715skt:FairValueForStockAndOptionAwardsGrantedInTheCoveredYearThatRemainUnvestedMemberecd:NonPeoNeoMember2022-01-012022-12-310000899715skt:FairValueForStockAndOptionAwardsGrantedInTheCoveredYearThatRemainUnvestedMemberecd:NonPeoNeoMember2021-01-012021-12-310000899715skt:FairValueForStockAndOptionAwardsGrantedInTheCoveredYearThatRemainUnvestedMemberecd:NonPeoNeoMember2020-01-012020-12-310000899715skt:ChangeInFairValueOfOutstandingUnvestedStockAndOptionsFromPriorYearsMemberecd:NonPeoNeoMember2023-01-012023-12-310000899715skt:ChangeInFairValueOfOutstandingUnvestedStockAndOptionsFromPriorYearsMemberecd:NonPeoNeoMember2022-01-012022-12-310000899715skt:ChangeInFairValueOfOutstandingUnvestedStockAndOptionsFromPriorYearsMemberecd:NonPeoNeoMember2021-01-012021-12-310000899715skt:ChangeInFairValueOfOutstandingUnvestedStockAndOptionsFromPriorYearsMemberecd:NonPeoNeoMember2020-01-012020-12-310000899715skt:ChangeInFairValueOfStockAndOptionAwardsFromPriorYearsThatVestedInTheCoveredYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000899715skt:ChangeInFairValueOfStockAndOptionAwardsFromPriorYearsThatVestedInTheCoveredYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000899715skt:ChangeInFairValueOfStockAndOptionAwardsFromPriorYearsThatVestedInTheCoveredYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000899715skt:ChangeInFairValueOfStockAndOptionAwardsFromPriorYearsThatVestedInTheCoveredYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000899715skt:FairValueOfStockAndOptionAwardsForfeitedInTheCoveredYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000899715skt:FairValueOfStockAndOptionAwardsForfeitedInTheCoveredYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000899715skt:FairValueOfStockAndOptionAwardsForfeitedInTheCoveredYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000899715skt:FairValueOfStockAndOptionAwardsForfeitedInTheCoveredYearMemberecd:NonPeoNeoMember2020-01-012020-12-31000089971522023-01-012023-12-31000089971532023-01-012023-12-31000089971542023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| | | | | | | | | | | |

| ☑ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| | | | | |

CHECK THE APPROPRIATE BOX: |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☑ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

Tanger Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

☑ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | |

Message from Our Lead Director |

| | | | | |

| “In 2023, Tanger once again significantly led the REIT industry in delivering total shareholder returns to investors – an outcome fueled by the shared commitment of the Board of Directors and the entire Tanger team to fulfill our mission of delivering the best value, experience, and opportunity for our communities, stakeholders and partners.” |

Dear Fellow Shareholders:

I am pleased to invite you to attend our 2024 Annual Meeting of Shareholders, which will be held virtually beginning at 10:00 am Eastern time on Friday, May 17, 2024.

As Lead Independent Director, it is my great privilege to work with Tanger’s talented and dedicated group of executives and directors. I am enormously proud of the results they have achieved on behalf of our shareholders.

Since Stephen Yalof assumed the role of Chief Executive Officer of Tanger in 2021, there has been tremendous and sustained growth, as evidenced by our leading 3-year and 1-year performance among REIT industry stocks. During that time, we have fully refreshed the balance of Tanger’s executive team with exceptional industry talent. Under their leadership, there has been a revitalization of our shopping centers and employee base, positioning the organization for ongoing value creation. This will further align the company to fulfill its vision of leveraging customer insights and experiences to inform the future of shopping. The Board is also pleased to have renewed Mr. Yalof’s employment agreement in 2023 for a three-year term.

On behalf of the Board of Directors, we thank you for your continued investment and confidence in Tanger and ask for your support on the matters described in this Proxy Statement, so that we can continue to produce positive results and increase long-term shareholder value.

Please review the Proxy Statement and our 2023 Annual Report carefully. They contain important information about the company’s results, details about the matters to be considered during the Annual Meeting, and instructions on how to vote your shares. Your vote is important to us, and we encourage you to vote as soon as possible.

BRIDGET M. RYAN-BERMAN

LEAD INDEPENDENT DIRECTOR

| | | | | |

Tanger Inc. | 2024 Proxy Statement | 1 |

| | |

Notice of Annual Meeting of Shareholders |

| | | | | | | | | | | | | | | | | |

| DATE AND TIME May 17, 2024 (Friday) 10:00 AM (Eastern Time) | | LOCATION The Annual Meeting will be held online at www.meetnow.global/MQTGCAN | | WHO CAN VOTE Shareholders as of March 22, 2024 are entitled to vote |

YOUR VOTE IS IMPORTANT TO US. Whether or not you plan to attend the 2024 annual meeting of the shareholders (the “Annual Meeting”) of Tanger Inc. (“Tanger”, the “Company”, “we” or “us”), we urge you to vote your shares as soon as possible. This will not prevent you from voting your shares during the Annual Meeting if you subsequently choose to attend the Annual Meeting online and wish to change your vote.

Voting Items

| | | | | | | | | | | | | | | | | |

|  See page 17 See page 17 | |  See page 77 See page 77 | |  See page 80 See page 80 |

| | |

To elect the nine director nominees named in the attached Proxy Statement for a term of office expiring at the 2025 Annual Meeting of Shareholders | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024 | To approve, on an advisory (non-binding) basis, named executive officer compensation |

| | |

| | |

We will also transact such other business as may properly come before the Annual Meeting or any postponement(s), continuation(s) or adjournment(s) thereof.

Only common shareholders of record at the close of business on March 22, 2024 will be entitled to vote at the Annual Meeting or any postponement(s), continuation(s) or adjournment(s) thereof. Information concerning the matters to be considered and voted upon at the Annual Meeting is set out in the attached Proxy Statement.

Sincerely,

STEPHEN J. YALOF

President &

Chief Executive Officer

April 4, 2024

| | | | | |

2 | Tanger Inc. | 2024 Proxy Statement |

Notice of Annual Meeting of Shareholders

| | | | | | | | | | | |

| How to Vote |

| | | |

ONLINE www.envisionreports.com/SKT | BY PHONE 1-800-652-VOTE (8683) | BY MAIL Fill out your proxy card and drop in the mail in the enclosed postage paid envelope | QR CODE Use your smartphone or tablet to scan the QR Code |

If your shares are held by a broker, bank or other nominee, please follow the instructions you receive from your broker, bank or other nominee to have your shares voted.

| | | | | |

| |

| IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL SHAREHOLDER MEETING TO BE HELD ON FRIDAY, MAY 17, 2024. This Proxy Statement and our Annual Report for the year ended December 31, 2023 (the “Annual Report”) to Shareholders are available at www.envisionreports.com/SKT. |

| |

Forward-Looking Statements

Certain statements in the Proxy Summary and the Proxy Statement contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and included this statement for purposes of complying with these safe harbor provisions. Forward-looking statements, which are based on certain assumptions and describe our future plans, strategies, beliefs and expectations, are generally identifiable by use of the words “anticipate,” “believe,” “can,” “continue,” “could,” “designed,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would,” or similar expressions. Such forward-looking statements include, but are not limited to, risks related to pandemics, supply chain and labor issues and rising interest rates on our business, financial results and financial condition; our ability to raise additional capital, including via future issuances of equity and debt, and the use of proceeds from such issuances; our results of operations and financial condition; capital expenditure and working capital needs and the funding thereof; the repurchase of the Company's common shares, including the potential use of a 10b5-1 plan to facilitate repurchases; future dividend payments; interest rates, the possibility of future asset impairments, development initiatives and strategic partnerships, the anticipated impact of the Company’s newly acquired assets in Huntsville and Asheville, as well as its newly opened Nashville development, compliance with debt covenants; renewal and re-lease of leased space; the outlook for the retail environment, potential bankruptcies, and other store closings; consumer shopping trends and preferences; the outcome of legal proceedings arising in the normal course of business; and real estate joint ventures. You should exercise caution in relying on forward-looking statements since they involve known and unknown risks, uncertainties and other important factors which are, in some cases, beyond our control and which could materially affect our actual results, performance or achievements. Please refer to the documents filed by us with the SEC, including specifically the “Risk Factors” sections of our Annual Report on Form 10-K for the year ended December 31, 2023, and our other filings with the SEC, which identify additional factors that could cause actual results to differ from those contained in forward-looking statements. Except as required by applicable law, we assume no, and expressly disclaim any, obligation to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

| | | | | |

Tanger Inc. | 2024 Proxy Statement | 3 |

| | | | | |

4 | Tanger Inc. | 2024 Proxy Statement |

2023 Business Recap

2023 was a transformative year for us, as we continued to grow our portfolio, leverage our platform capabilities to grow value for our stakeholders, and enhance the shopping experience for our customers by implementing placemaking strategies and elevating our retail offerings. Our 2023 financial results reflect our ability to:

•deliver organic growth driven by strategic leasing and proactive asset management,

•maximize traffic and shopper engagement through measurable and relevant digital communications and compelling offers in collaboration with our tenants,

•further intensify our real estate over time including outparcel activation and unlock additional revenue opportunities, and

•selectively pursue the acquisition and development of additional open-air centers.

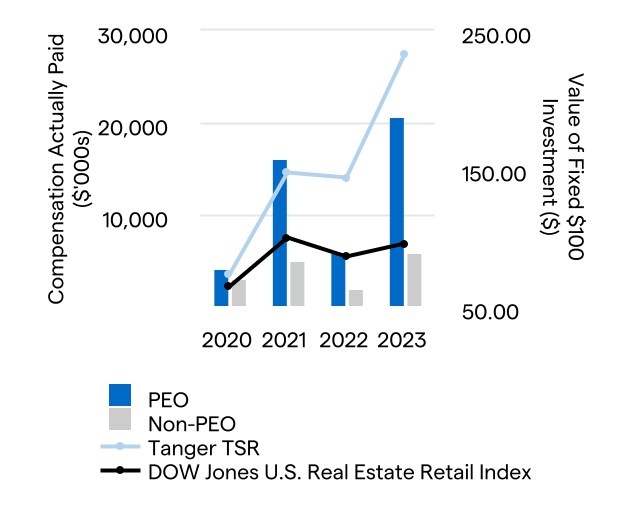

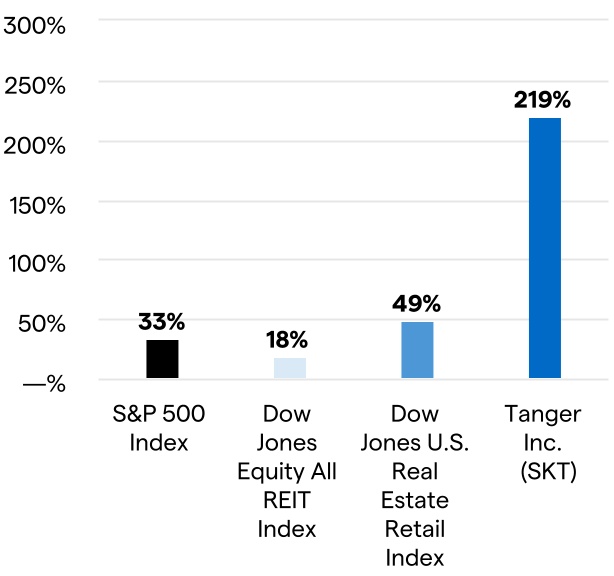

During 2023, we continued to demonstrate our ability to create value for our shareholders,through dividends totaling $0.97, which was a 21% increase over the total dividends paid in 2022, and share price appreciation that combined to result in TSR that significantly outpaced the retail real estate investment trust (“REIT”), total REIT and S&P 500 indices. In 2023 we added three new centers to our portfolio. Our ground up development, Tanger Outlets Nashville, which features a transformational design and dynamic retail mix, and two property acquisitions – Asheville Outlets, in Asheville, NC and Bridge Street Town Centre in Huntsville, AL, the first lifestyle center in our portfolio. All three new center additions are consistent with our long-term strategy of investing in dominant open-air retail centers in markets that benefit from outsized residential and tourism growth and that we believe can immediately benefit from the Tanger leasing, marketing and operations platforms.

Tanger Inc.

1-Year and 3-Year Total Shareholder Return - 2023

| | | | | | | | |

| | |

1-Year Total Shareholder Return | | 3-Year Total Shareholder Return |

| | | | | |

Tanger Inc. | 2024 Proxy Statement | 5 |

| | | | | |

| |

Net Income | Net income available to common shareholders was $0.92 per Common Share, or $98.0 million, for the year ended December 31, 2023 compared to net income available to common shareholders of $0.77 per Common Share, or $81.2 million, for the year ended December 31, 2022. |

| |

Core Funds from Operations (“Core FFO”)* | Core FFO available to common shareholders was $1.96 per Comon Share, or $217.6 million, for the year ended December 31, 2023 compared to $1.83 per Common Share, or $201.8 million, for the year ended December 31, 2022.* |

| |

Same Center Net Operating Income (“NOI”)* | Same Center NOI for the consolidated portfolio increased to $317.2 million for 2023 from $298.1 million for 2022 driven by growth in occupancy and rental rates during 2023. |

| |

Occupancy | 97.3% occupancy for the consolidated portfolio on December 31, 2023 (compared to 96.9% on December 31, 2022). On a same center basis, occupancy was 97.8% compared to 96.9% on December 31, 2022. |

| |

Quarterly Common Share Cash Dividends | Paid $0.97 per Common Share in dividends during 2023. We paid an all-cash dividend every year since becoming a public company in May 1993. |

| |

| |

Average Tenant Sales | Average tenant sales were $436 per square foot for the total portfolio for the year ended December 31, 2023, a decrease of 1.8% compared to the year ended December 31, 2022. |

| |

Net Debt to Adjusted EBITDA Ratio* | Net Debt to Adjusted EBITDA (calculated as Net Debt* divided by Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”))* for the consolidated portfolio was 5.7 times for the year ended December 31, 2023, compared to 4.9 times for the year ended December 31, 2022. On a pro forma basis assuming a full year of Adjusted EBITDA from properties acquired (Tanger Outlets Asheville and Bridge Street Town Centre) or opened (Tanger Outlets Nashville) during the fourth quarter of 2023, Net Debt to Adjusted EBITDA was in the range of 5.0 to 5.1 times for the year ended December 31, 2023.* |

| |

Interest Coverage Ratio* | Interest coverage ratio (calculated as Adjusted EBITDA* divided by interest expense) for the consolidated portfolio improved to 5.2 times for 2023 from 5.1 times for 2022. |

| |

| Debt Compliance | Remained in full compliance with all debt covenants as of December 31, 2023. |

| |

Occupancy Cost Ratio | Occupancy cost ratio (calculated as annualized occupancy costs as of the end of the reporting period as a percentage of tenant sales for the trailing twelve-month period) of 9.3% for the year ended December 31, 2023 compared to 8.6% for the year ended December 31, 2022. |

| |

*Core FFO, Same Center NOI, Net Debt, Adjusted EBITDA, Net Debt to Adjusted EBITDA ratio and interest coverage ratio are non-GAAP (as defined below) financial measures that the Company’s management believes to be important supplemental indicators of our operating performance and which are used by securities analysts, investors and other interested parties in the evaluation of REITs, but are not measures computed in accordance with generally accepted accounting principles in the United States (“GAAP”). Net debt to Adjusted EBITDA (pro forma) incorporates Adjusted EBITDA from properties acquired or opened during 2023, assuming a full year of Adjusted EBITDA for these. For a discussion of Core FFO, Same Center NOI, Net debt and Adjusted EBITDA including a reconciliation to their most directly comparable GAAP equivalent, please see Appendix A to this Proxy Statement.

During 2023, we further strengthened our balance sheet to position the Company with the liquidity and flexibility to invest in our growth. In May 2023, Fitch Ratings assigned a first-time ‘BBB’ long-term issuer default rating to the Company and the Operating Partnership, along with a Stable rating outlook. Fitch also assigned a ‘BBB’ rating to Operating Partnership’s senior unsecured debt, which includes our lines of credit, a term loan and senior notes. As a result, the applicable pricing margin on each of our unsecured lines of credit and our term loan was reduced by 25 basis points (including a 5 basis point reduction in the facility fee on the unsecured lines of credit). As of December 31, 2023, $300 million of the outstanding balance of the Company’s $325 million unsecured term loan, which matures in January 2027 plus a one-year extension, was fixed with interest rate swaps at a weighted average daily Secured Overnight Financing Rate (“Daily SOFR”) of 0.4%, which matured on February 1, 2024. The Company entered into $325 million of forward-starting swaps that commenced February 1, 2024 and have varying maturities through January 2027. Collectively, these swaps fix the Daily SOFR base rate at a weighted average of 3.9% as of February 1, 2024. During 2023, the Company sold 3.5 million shares at a weighted average price of $25.75 per share, generating gross proceeds of $90.0 million, and as of December 31, 2023, the Company has a remaining authorization of $220.1 million.

As of December 31, 2023, our consolidated outstanding debt aggregated approximately $1.4 billion with $89.7 million of floating rate debt, representing approximately 6% of total consolidated debt and 2% of total enterprise value. Approximately 94% of our total consolidated square footage was unencumbered by mortgages. As of December 31, 2023, our outstanding debt had a weighted average interest rate of 3.2% and a weighted average term to maturity, including extension options, of approximately 4.6 years. We have no significant debt maturities until September 2026, and we ended 2023 with $22 million of cash and cash equivalents and short-term investments, along with $507 million of capacity available under our $520 million unsecured lines of credit.

| | | | | |

6 | Tanger Inc. | 2024 Proxy Statement |

Our Mission, Vision and Core Values

| | | | | | | | | | | | | | | | | |

| | | | | |

Our Mission To deliver the best value, experience and opportunity for our communities, stakeholders and partners | Our Vision Using customer insights and experiences to inform the future of shopping | |

| | | | | |

| Consider Community First Our diverse communities are the heartbeat of our business. Our decision-making must reflect the varied perspectives that contribute to making Tanger a welcoming environment for all. Our philanthropic and sustainable commitments exist to better all the communities we serve. | | Act Fairly & With Integrity Our bond is strongest when we act with integrity and fairness in everything we do. Tanger’s commitment to ethics lives throughout every level, interaction, and function of the organization, and is what we are known for. | |

| Seek The Success Of Others We are all in this together, and we believe true success can only be achieved when it is experienced by our shoppers, retailers and team members alike. We strive to create a culture of inclusion, where we can all be better—together. | Make It Happen This is the Tanger state of mind, and it is deeply rooted in our heritage. We are empowered to take smart risks, innovate and to use our voices to advocate for our ideas and for others within our communities. | |

| | | | | |

| | | | | |

Tanger Inc. | 2024 Proxy Statement | 7 |

Our Environmental, Social and Governance Approach

At Tanger, we work to create long-term value for our stakeholders, retail partners, and employee team members while we build strong communities and consider the future of our planet. We strive to integrate environmental, social and governance (ESG) principles into our business practices and address the issues most important to Tanger stakeholders. Strong governance and our core values form the foundation of our approach.

Our goal is to utilize best practices in every aspect of our business, and we continue to enhance our ESG reporting practices through alignment with highly regarded disclosure frameworks. Our ESG reporting is guided by the standards of the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), now part of the International Sustainability Standards Board, and the Task Force on Climate-related Financial Disclosures (TCFD). We also disclose to the Global Real Estate Sustainability Benchmark (GRESB) and CDP (formerly the Carbon Disclosure Project).

A portion of our 2023 short-term incentive plan for our named executive officers was contingent on achieving goals related to emissions reductions and continued progress on sustainability initiatives related to our solar platform, electric vehicle charging network and waste diversion rate.

ESG Strategic Pillars and Priorities

Our strategic pillars are focused on our priority ESG issues, which are rooted in our business strategy and informed by our stakeholders. These four pillars guide our actions and support our ambition to create long-term sustainable value:

| | | | | | | | | | | |

| | | |

| | | |

Our

Governance Managing Our Business with Integrity We build trusting relationships and seek to create long-term value for our stakeholders with ethics as the foundation for our approach to ESG and our entire business | Our

People Creating a Positive Workplace We aim to create an engaging, equitable workplace where all people are welcomed, valued, and have opportunities to thrive | Our

Community Contributing to Strong, Vibrant Communities We actively serve our communities through partnerships with nonprofits, community leaders, and retailers | Our

Planet Minding Our Environmental Impact We are committed to taking steps to mitigate climate change through embedding energy efficiency and sustainability measures in center operations, new center development, and retailer partnerships |

| | | |

Our ESG materiality process drives strategy on environmental, social, economic and governance topics. We begin by identifying opportunities and risks, and leverage external frameworks and engage stakeholders, executives and our Board members to help identify key ESG issues. These key issues are translated into operational priorities and processes across the Company.

| | | | | | | | | | | | | | |

| | | | |

| DIVERSITY, EQUITY & INCLUSION | ENERGY USE & EFFICIENCY | COMMUNITY INVOLVEMENT | CLIMATE

CHANGE | TENANTS’ ENVIRONMENTAL & SOCIAL FOOTPRINT |

| | | | | |

8 | Tanger Inc. | 2024 Proxy Statement |

This summary highlights information contained elsewhere in this Proxy Statement and does not encompass all the information that you should consider. Please read the Proxy Statement in its entirety before voting. The Board of Directors of Tanger Inc. (NYSE:SKT) is soliciting your proxy for use at the Annual Meeting of Shareholders of the Company to be held on Friday, May 17, 2024. Unless the context indicates otherwise, the term “Company” refers to Tanger Inc. and the term “Operating Partnership” refers to Tanger Properties Limited Partnership. The terms “we,” “our” and “us” refer to the Company or the Company and the Operating Partnership together, as the context requires.

The Board of Directors of Tanger Inc. (NYSE:SKT) is soliciting your proxy for use at the Annual Meeting of Shareholders of the Company (the “Annual Meeting”) to be held on Friday, May 17, 2024. All holders of record of our common shares, par value $0.01 per share (referred to as “Common Shares”), as of the close of business on the record date, March 22, 2024, are entitled to attend and vote on all proposals at the Annual Meeting. We anticipate that our Proxy Statement and proxy card will be first sent or available to shareholders on or about April 4, 2024.

What is New in this Proxy Statement

•Changes in board committee composition and leadership

•Transition of our Executive Chair to Non-Executive Chair of the Board of Directors

•Adoption of a new Clawback Policy

•Cybersecurity Risk Management Oversight

•Enhanced disclosure regarding

–Board and Committee risk management oversight

–Shareholder engagement

General Information

| | | | | | | | | | | |

| Meeting: | Annual Meeting of Shareholders | Stock Symbol: | SKT |

| Date: | May 17, 2024 | Exchange: | New York Stock Exchange |

| Time: | 10:00 a.m., Eastern Time | Common Shares Outstanding: | 109,192,778 |

| Location: | www.meetnow.global/MQTGCAN | State of Incorporation: | North Carolina |

| Record Date: | March 22, 2024 | Public Company Since: | 1993 |

The Annual Meeting will be a virtual meeting, which will be conducted solely via remote participation by visiting www.meetnow.global/MQTGCAN. You will be able to attend the Annual Meeting online, vote your shares electronically and ask questions during the meeting. A virtual meeting enables increased shareholder attendance and participation because shareholders can participate from any location around the world. In addition, hosting a virtual meeting helps us to maintain a safe and healthy environment for our directors, members of management and shareholders who wish to attend the Annual Meeting. To participate in the Annual Meeting, you will need to review the information included on your Notice of Internet Availability of Proxy Materials, on your proxy card or on the instructions that accompanied your proxy materials.

Corporate Website: www.tanger.com

Investor Relations Website: investors.tanger.com

| | | | | | | | |

| |

| | IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON FRIDAY, May 17, 2024. This Proxy Statement and our Annual Report for the year ended December 31, 2023 (the “Annual Report”) to Shareholders are available at www.envisionreports.com/SKT. The information found on, or otherwise accessible through, our website is not incorporated by reference into, nor does it form a part of, this Proxy Statement. |

| | | | | |

Tanger Inc. | 2024 Proxy Statement | 9 |

| | | | | | | | | | | | | | |

| | | |

| | |

| | | | |

| Election of Directors | |

| | | | |

| | | | |

| The Board recommends a vote FOR each director nominee. |  See page 17 See page 17 |

| | | | |

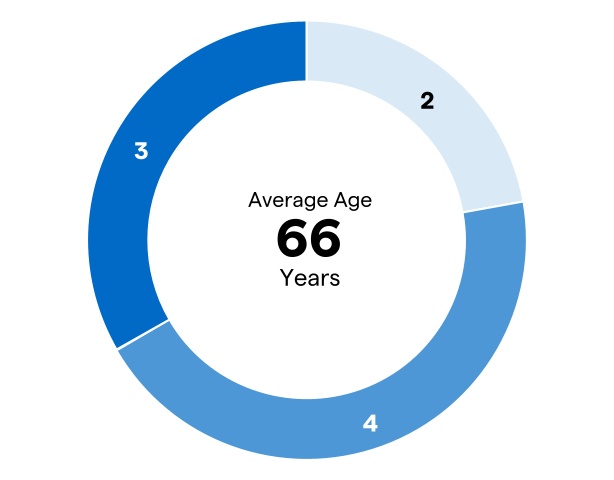

Directors

We believe that the composition of our Board of Directors (the “Board” or “the Board of Directors”) is balanced, that it reflects diversity in experience, professional background, gender, ethnicity, areas of expertise and perspectives, and that the range of tenures of our directors creates a synergy between institutional knowledge and new perspectives. As a corporate governance best practice, our Nominating and Corporate Governance Committee annually considers the composition of our Board and standing Board committees to ensure an appropriate balance and a diversity of perspectives.

The table below outlines the ages, tenures, independence and committee membership of our director nominees for the annual meeting to be held on May 17, 2024. For more information about our director nominees and their qualifications, please see “Proposal 1 - Election of Directors.”

| | | | | | | | | | | | | | | | | | | | |

| Age | Years on

Board | Independent | Audit

Committee | Compensation

and Human

Capital

Committee | Nominating and

Corporate

Governance

Committee |

| Jeffrey B. Citrin | 66 | 9 | | | | |

| David B. Henry | 75 | 8 | | | | |

| Sandeep L. Mathrani | 61 | 2 | | | | |

| Thomas J. Reddin | 63 | 13 | | | | |

Bridget M. Ryan-Berman* | 63 | 15 | | | | |

| Susan E. Skerritt | 69 | 5 | | | | |

| Steven B. Tanger** | 75 | 30 | | | | |

| Luis A. Ubiñas | 61 | 4 | | | | |

Stephen J. Yalof*** | 61 | 3 | | | | |

* Lead Independent Director

** Non-Executive Chair of the Board

*** Chief Executive Officer

| | | | | |

10 | Tanger Inc. | 2024 Proxy Statement |

| | | | | |

| n | Employee Directors |

| n | Independent Directors |

| | | | | |

| n | 3 years or less |

| n | 4-10 years |

| n | Greater than 10 years |

| | |

|

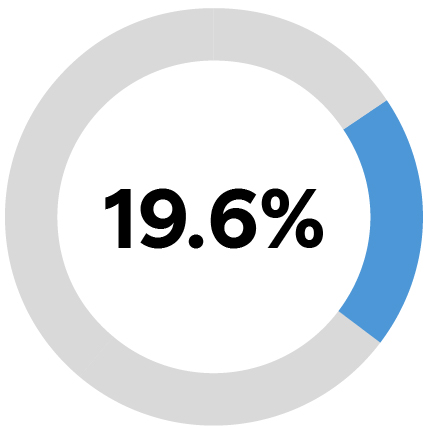

Gender and Racial/Ethnic Diversity* |

| | | | | |

| n | Racial/Ethnic Diversity |

| n | Gender Diversity (Female) |

| n | Not Diverse Based on Gender or Race/Ethnicity |

| | | | | |

| n | Not Independent |

| n | Independent |

* The four Board members identified as diverse do not overlap in either gender or racial/ethnic diversity.

| | | | | |

Tanger Inc. | 2024 Proxy Statement | 11 |

Governance Highlights

Strong Corporate Governance Practices

| | | | | | | | |

| | |

| | |

| INDEPENDENCE | BEST PRACTICES | |

•7 of 9 current directors are independent •Lead Independent Director of the Board •All Board committees composed entirely of independent directors •Regular executive sessions of non-management directors and independent directors •Board and committees may hire outside advisors independently of management | •Active shareholder engagement process •Diversity reflected in Board and Senior Management •Current Board includes 4 audit committee financial experts •Strategy and risk oversight by the Board and its Committees •Share ownership guidelines for named executive officers and non-employee directors •Complete annual Board evaluations •Annual election of Directors with majority voting in uncontested elections •No stockholder rights plan | |

| | |

| |

| | | | | | | | |

| | |

| | |

| RISK OVERSIGHT | Audit Committee •Enterprise Risk Management (including cybersecurity risks) •Internal controls over financial reporting •Interest rate risk and hedging strategies Compensation and Human Capital Committee •Human capital management, including, retention, succession, diversity, culture and engagement •Incentive and equity-based compensation plan design and levels for executive officers Nominating and Corporate Governance Committee •Corporate governance principals •Annual self-assessment process •Environmental and sustainability programs | |

The Board is responsible for overseeing our risk management process and each of our Committees has specific risk management responsibilities to assist the Board, as follows: | |

| | |

| |

| | | | | |

12 | Tanger Inc. | 2024 Proxy Statement |

Active Stakeholder Engagement

Why We Engage

We believe that hearing directly from our fellow shareholders, the investment community and key stakeholders informs and enables the Board and our management team to be a more effective steward of your capital and provides valuable insights into addressing the issues most important to our stakeholders. We are proud of our track record of being responsive to our shareholders, and during 2023, we elevated our efforts to engage with the investment community and other key stakeholders.

How We Engage

| | | | | | | | | | | |

| | | |

| Outreach | | 2023 Stakeholder Engagement Facts |

We engage with stakeholders through various in-person and virtual methods, including shareholder outreach efforts, quarterly earnings calls, the annual shareholder meeting, one-on-one meetings, investor conferences, property tours and non-deal roadshows. | | ~ 70% | The percentage of our total shareholder base that we engaged with during 2023 |

| | | |

| | | |

| Discussion | | | |

Active discussions involving management and independent directors are important to gaining insight and understanding of investor questions and concerns. | | 75% | The percentage of our top 20 shareholders that we directly engaged with during 2023 |

| | | |

| | | |

| Feedback | | | |

Key stakeholder feedback is shared with management and the Board of Directors, providing them with insight into stakeholder views of Tanger. | | > 30 | Number of investment community events participated in during 2023, including 12 property tours |

| | | |

| | | |

| Results | | | |

We are proud of our track record of being responsive to our shareholders. Based on the feedback we have received, we have made many positive changes, especially related to our executive compensation programs. As a result, 96% of the votes cast in 2023 approved, on an advisory (non-binding) basis, our executive compensation. | | > 500 | Number of investment community touchpoints during 2023 |

| | | |

Engagement Topics and Focus Areas

Key focus areas of stakeholder engagement include:

•Corporate governance

•Executive compensation

•Business strategy

•Business performance and expectations

•Industry trends

•Market conditions

•Corporate responsibility initiatives

We are committed to robust information sharing through:

•SEC filings, press releases & company websites

•ESG reports and disclosures

•Quarterly management presentations

Engaging with our Lenders, Noteholders and Ratings Agencies

We recognize the importance of cultivating strong relationships with our lenders, ratings agencies and the fixed income investment community in order to maintain a strong and flexible balance sheet. Our priorities include:

•Ensuring that we understand and consider the issues important to our lenders, ratings agencies, and debtholders

•Maintaining an open dialogue regarding our business performance, strategic goals and financing needs

•Partnering with our lenders to proactively address upcoming maturities

| | | | | |

Tanger Inc. | 2024 Proxy Statement | 13 |

| | | | | | | | | | | | | | |

| | | |

| | |

| | | | |

| Ratification of Appointment of Independent Registered Public Accounting Firm | |

| | | | |

| | | | |

| The Board recommends a vote FOR this proposal. |  See page 77 See page 77 |

| | | | |

| | | | | | | | | | | | | | |

| | | |

| | |

| | | | |

Approval, on an Advisory Basis, of Executive Compensation | |

| | | | |

| | | | |

| The Board recommends a vote FOR this proposal. |  See page 80 See page 80 |

| | | | |

We will also transact such other business as may properly come before the meeting or any postponement(s), continuation(s) or adjournment(s) thereof.

| | | | | |

14 | Tanger Inc. | 2024 Proxy Statement |

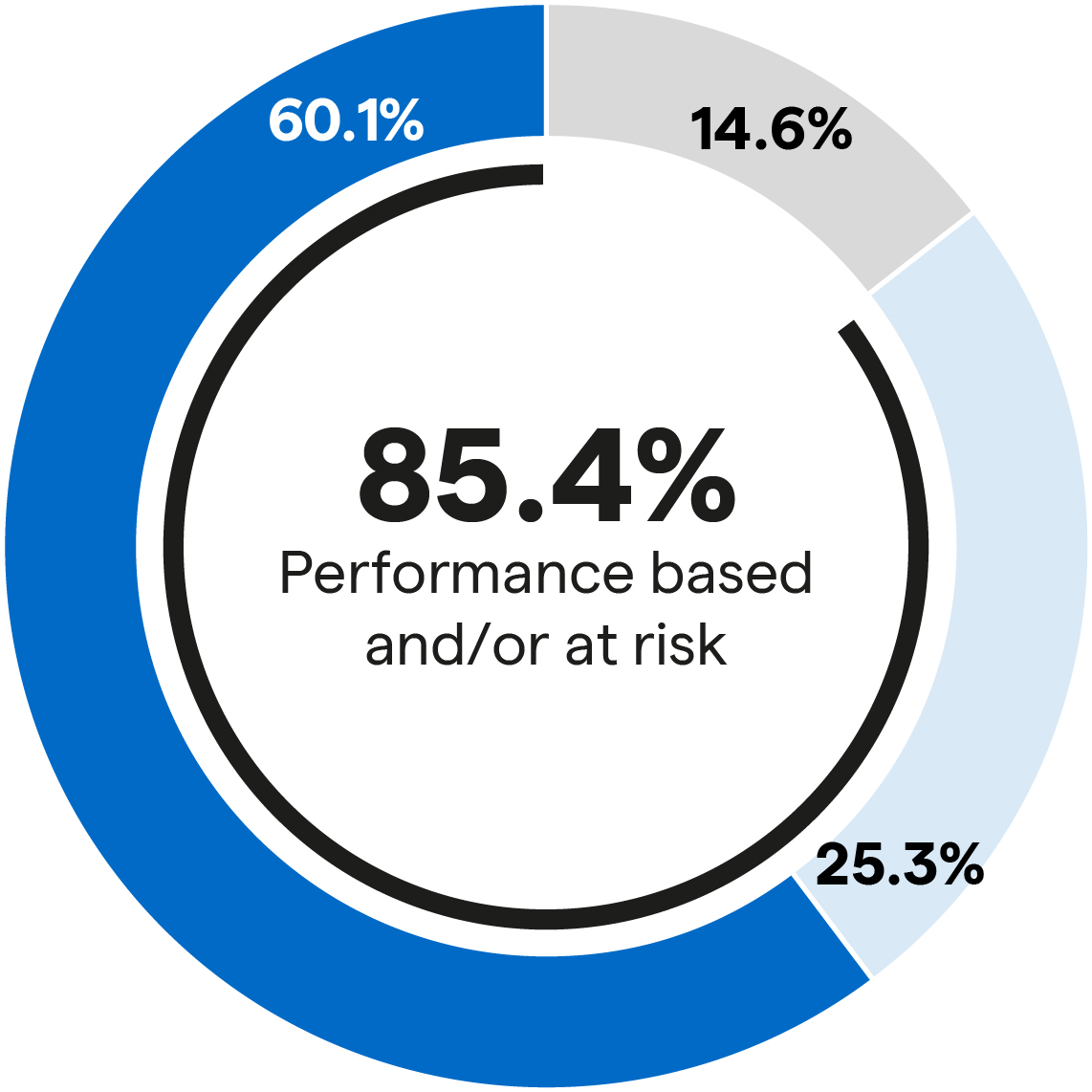

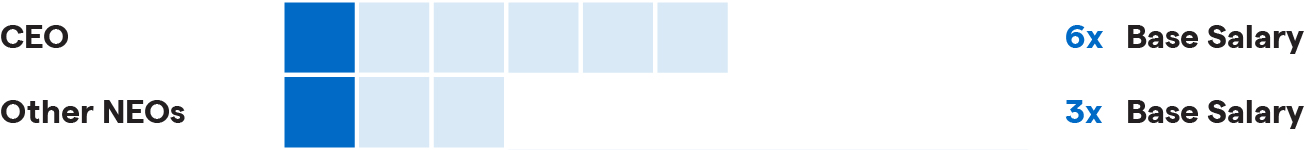

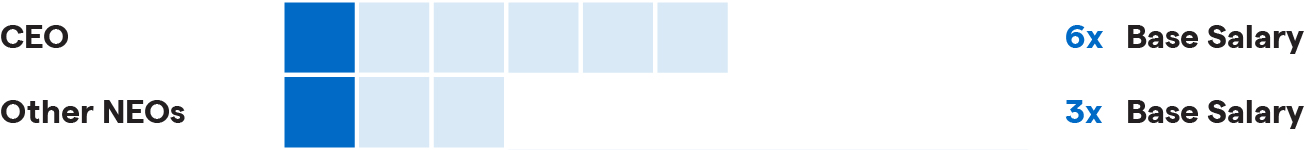

2023 Compensation

The Company’s primary components of compensation for its executive officers are base salary, annual incentive cash bonuses, and annual long-term equity-based incentive compensation subject to time-based or performance-based vesting conditions. There is no pre-established policy or target for the allocation between cash and non-cash incentive compensation or between short-term and long-term compensation, although the Company attempts to keep total cash compensation within the Company’s fiscal year budget while reinforcing its pay-for-performance philosophy and also considering annual accounting cost and the impact of share dilution. Within the framework of aligning total compensation with corporate and individual performance, the purpose of each of the primary components of compensation is as follows:

| | | | | | | | | | | | | | | | | |

| | | Pay Element | Objectives |

| | | CEO | Other NEOs |

| | | | | |

| | | Base Salary | Base Salary | To provide competitive fixed pay at a level consistent with the individual’s job responsibilities relative to such individual’s peers |

| | |

| | | | |

| | | | |

| | Annual Incentive

Cash Bonus | Annual Incentive

Cash Bonus | To incentivize management to achieve the Company’s strategic and financial goals for the fiscal year, generally using a formulaic calculation |

| | |

| | | |

| Annual Long-Term

Time-Based Equity Incentive | Annual Long-Term Time-Based

Equity Incentive | To reward prior year performance and support the retention of senior management, while exposing recipients to the same market fluctuations as shareholders and thereby motivating management to create long-term shareholder value |

| | |

| | | |

| Performance Share Plan | Performance Share Plan | To enhance the pay-for-performance structure and shareholder alignment, while motivating and rewarding senior management for total shareholder return (“TSR”) performance in excess of rigorous, predetermined absolute and relative hurdles |

| | |

| | | | | |

Tanger Inc. | 2024 Proxy Statement | 15 |

Executive Compensation Governance Highlights

Our executive compensation program is designed to attract, retain and motivate experienced and talented executives who can help the Company maximize shareholder value. We believe that we maintain a competitive compensation program that incorporates strong governance practices.

| | | | | |

16 | Tanger Inc. | 2024 Proxy Statement |

| | | | | | | | |

| Election of Directors |

| |

| The Board recommends that you vote FOR all of the director nominees set forth below. |

| |

Our By-Laws provide that directors be elected at each annual meeting of our shareholders. The Board has nominated nine director candidates for election to the Board at the Annual Meeting. Each of the nine nominees for director designated below is presently a director of the Company. It is expected that each of these nominees will be able to serve, but if any such nominee is unable to serve, or for good cause will not serve, the proxies reserve discretion to vote for a substitute nominee or nominees designated by the Board, or the Board may elect to reduce its size. The terms of all of our directors expire at the next annual meeting of our shareholders or when their successors are elected and qualified.

Director Resignation Policy

Our By-Laws provide that in uncontested elections, nominees will be elected if votes cast for each nominee’s election exceed the votes cast against such nominee’s election, provided that a quorum is present. Pursuant to our director resignation policy, the Board will nominate for re-election as directors only candidates who agree to tender their irrevocable resignation at or prior to their nomination. In addition, the Board will fill director vacancies and new directorships only with candidates who agree to tender, promptly following their appointment to the Board, the same form of resignation tendered by other directors in accordance with the director resignation policy. The resignations will only become effective upon the occurrence of both the failure to receive the required majority vote for election and Board acceptance of the resignations. If a director nominee does not receive the required vote, the Nominating and Corporate Governance Committee or another committee consisting solely of independent directors (excluding the director nominee in question) will consider and make a recommendation to the Board as to whether to accept or reject the director nominee’s previously tendered resignation. The Board (excluding the director nominee in question) will make a final determination as to whether to accept or reject the director nominee’s resignation within 90 days following the certification of the shareholder vote. The Nominating and Corporate Governance Committee and the Board may consider any factors they deem relevant in deciding whether to accept a director’s resignation. The Company will then promptly disclose the Board’s decision in a document furnished or filed with the SEC.

Board Diversity and Refreshment

The Board seeks a mix of backgrounds and experience among its members. We believe that decision-making is improved when various perspectives contribute to the discussion. In evaluating director candidates, the Nominating and Corporate Governance Committee uses its judgment to identify nominees whose viewpoints, backgrounds, experience, gender, race, ethnicity and other attributes, taken as a whole, contribute to the high standards of Board service at the Company. While the Board does not follow any ratio or formula to determine the appropriate mix, the Board is committed to increasing gender and racial diversity among directors over time and, as reflected in our Corporate Governance Guidelines, the Nominating and Corporate Governance Committee is committed to including highly qualified women and minority candidates in each search the Board undertakes. The Nominating and Corporate Governance Committee assesses its performance as to all aspects of the selection and nomination process for directors, including diversity, as part of its annual self-evaluation process.

Currently of the nine directors on the Board, two are women, one is Asian and one is Latino. In July 2023, Bridget Ryan-Berman, who had been a member of the Company's Board of directors since January 1, 2009, was appointed Lead Independent Director, a position previously held by Board member David B. Henry. At the May 13, 2022 Board meeting, Susan E. Skerritt was appointed to serve as Audit Committee Chair and Luis A. Ubiñas was appointed to serve as Nominating and Corporate Governance Committee Chair. These appointments reflect our thoughtful approach and commitment to ongoing Board and committee refreshment and diversification. These changes have further increased the diversity of our Board and committee leadership in terms of gender, ethnicity and career experience.

| | | | | |

Tanger Inc. | 2024 Proxy Statement | 17 |

Proposal 1 Election of Directors

Nominee Qualifications

The biographical description below for each nominee includes the specific experience, qualifications, attributes and skills that led to the conclusion by the Board that such person should serve as a director of the Company. Each of our director nominees has achieved an extremely high level of success in his or her career. In these positions, each has been directly involved in the challenges relating to setting the strategic direction of or managing and overseeing the financial performance, personnel and processes of complex, public and private companies. Each has had exposure to effective leaders, and as a result, we believe has developed the ability to judge leadership qualities. Each also has experience in serving as an executive or on the board of directors of at least one other major corporation, which we believe provides additional relevant experience on which each nominee can draw.

Information Regarding Nominees

| | | | | | | | |

| | |

| BACKGROUND | |

•Co-Founder and Executive Chairman of Temerity Strategic Partners. •Managing Principal of Hectad Strategic Partners, a private investment firm he founded in 2021. •Special Advisor of Square Mile Capital Management LLC, a private New York-based investment firm he founded focusing on real estate-related opportunities since January 2021, Vice President/Senior Advisor from 2017 to 2020, and Managing Principal of Square Mile from 2006 to 2017. •President of Blackacre Capital Management LLC (now known as Cerberus Institutional Real Estate), which he co-founded, from 1994 to 2005. •Managing Director of the Commercial Mortgage Investment Unit of Oppenheimer & Company, Inc. from 1993 to 1994. | •Vice President of the Distressed Real Estate Principal Group of Credit Suisse First Boston, Inc. from 1991 to 1993. •Vice President of the Real Estate Investment Banking Unit of Chemical Bank from 1986 to 1991. •Attorney in the real estate practices of Kelley Drye & Warren LLP and Proskauer Rose LLP from 1983 to 1986. •Previously served as an Independent Trustee of First Union Real Estate and Mortgage (now known as Winthrop Realty Trust) from 2001 to 2003. •Serves on the advisory boards of the Hospital for Special Surgery in New York and the Hood Museum of Art. |

Jeffrey B. Citrin Age 66 Director since July 28, 2014 Co-Founder and Executive Chairman of Temerity Strategic Partners Committees: Compensation & Human Capital |

|

|

QUALIFICATIONS FOR THE TANGER BOARD Mr. Citrin has over 34 years of experience in public company and private company real estate investment during which he has structured complex real estate and financial transactions. The Board benefits from this technical experience as well as from Mr. Citrin’s extensive executive, management and legal experience. OTHER CURRENT PUBLIC COMPANY BOARDS Trinity Place Holdings Inc. (NYSE: TPHS) |

| | |

| | | | | |

18 | Tanger Inc. | 2024 Proxy Statement |

Proposal 1 Election of Directors

| | | | | | | | |

| | |

| BACKGROUND | |

•Lead Independent Director of the Board from January 1, 2021 to June 30, 2023; Non-Executive Chair of the Board from May 17, 2019 to December 31, 2020. •Chief Executive Officer of Kimco Realty Corporation, a publicly-traded REIT, from December 2009 and Vice Chairman of the Board of Directors from April 2001 until his retirement from both positions in January 2016. •A 23-year career at G.E. Capital Real Estate, General Electric’s former real estate division, including serving as Senior Vice President and Chief Investment Officer, as well as Chairman of G.E. Capital Investment Advisors. •Co-founder and Chairman of Peaceable Street Capital, a preferred equity lender for income producing commercial real estate properties. •Previously served on the Board of Directors of VEREIT, Inc. from September 2015 to November 2021, and Columbia Property Trust, Inc. from January 2016 to December 2021. | •Director of Fairfield County Bank, a private Connecticut mutual savings bank. •Serves on the real estate advisory boards of New York University, Bucknell University, Baruch College, ALTO Real Estate Funds, Orangewood Partners and Pine Tree, LLC. •Former Trustee and 2011-2012 Chairman of the International Council of Shopping Centers. •Former Vice-Chairman of the Board of Governors of the National Association of Real Estate Investment Trusts. •Former member of the Executive Board of the Real Estate Roundtable. |

David B. Henry Age 75 Director since January 1, 2016 Retired Vice Chairman of the Board of Directors and Chief Executive Officer of Kimco Realty Corporation Committees: Audit & Nominating & Corporate Governance |

| |

QUALIFICATIONS FOR THE TANGER BOARD Mr. Henry has over 43 years of real estate industry experience with multinational, publicly traded companies. The Board benefits from his familiarity with the REIT industry, particularly the retail sector, as well as from his extensive executive, financial and management expertise. OTHER CURRENT PUBLIC COMPANY BOARDS Healthpeak Properties, Inc. (NYSE: DOC), not standing for re-election in 2024. Starwood Real Estate Income Trust, a non-traded REIT. |

| | |

| | | | | |

Tanger Inc. | 2024 Proxy Statement | 19 |

Proposal 1 Election of Directors

| | | | | | | | |

| | |

| BACKGROUND | |

•Director at Sycamore Partners since 2023 with responsibility for providing real estate strategy for the portfolio. •Chairman, Chief Executive Officer, and Director of WeWork Inc., a commercial real estate company, from 2020 to 2023. •Chief Executive Officer of Brookfield Properties’ retail group, a commercial real estate agency, and Vice Chairman of Brookfield Properties from 2018 to 2019. •Chief Executive Officer of GGP Inc. for eight years, during which he recapitalized the company from bankruptcy in 2010 and led eight successful years of growth prior to the successful $9.25 billion acquisition of GGP by Brookfield Property Partners in 2018. | •President of Retail at Vornado Realty Trust, a real estate investment trust company, from 2002 to 2010. •Executive Vice President at Forest City Ratner Companies, LLC from 1994 to 2002. •Former Chair and current Executive Board member of the National Association of Real Estate Investment Trusts, as well as a former Trustee of the International Council of Shopping Centers. |

Sandeep L. Mathrani Age 61 Director since June 3, 2021 Director at Sycamore Partners Committees: Audit & Compensation & Human Capital |

| |

QUALIFICATIONS FOR THE TANGER BOARD With more than three decades of professional experience and insight, as well as a proven record of success in the real estate industry, Mr. Mathrani brings dynamic value and further strengthens the talent represented on the Board. OTHER CURRENT PUBLIC COMPANY BOARDS Bowlero Corp. (NYSE: BOWL) Dick’s Sporting Goods, Inc. (NYSE: DKS) |

| | |

| | | | | |

20 | Tanger Inc. | 2024 Proxy Statement |

Proposal 1 Election of Directors

| | | | | | | | |

| | |

| BACKGROUND | |

•Non-Executive Chair of the Board from May 20, 2016 to May 17, 2019. •Managing Partner and Owner of Red Dog Ventures, LLC, a private equity and venture capital firm, since 2009. •Chief Executive Officer of Richard Petty Motorsports from 2008 to 2009. •Chief Executive Officer of LendingTree.com from 2005 to 2007; President and Chief Operating Officer from 2000 to 2005. | •Various senior leadership positions at The Coca-Cola Company from 1995 to 1999, including Vice President, Consumer Marketing of Coca-Cola USA, and at Kraft Foods, Inc. from 1982 to 1995. •Previously served on the Board of Directors of Premier Farnell plc from 2010 to 2016 and of Valassis Communications Inc. from 2010 to 2014 and R.H. Donnelley from 2007 to 2010. |

Thomas J. Reddin Age 63 Director since July 26, 2010 Managing Partner and Owner of Red Dog Ventures, LLC Committees: Compensation & Human Capital (Chair), Nominating & Corporate Governance |

| |

QUALIFICATIONS FOR THE TANGER BOARD Mr. Reddin has over 37 years of experience in general management and e-commerce, including managing some of the leading brands in their respective categories. His experience in growing and building digital businesses and developing and marketing leading consumer brands enables him to provide invaluable insights into helping the Company elevate its brand and advance its digital strategy. He is certified in Cyber Security Risk Oversight by the Software Engineering Institute at Carnegie Mellon University & NACD and has experience overseeing cyber security risk management as CEO of LendingTree.com. OTHER CURRENT PUBLIC COMPANY BOARDS Asbury Automotive Group (NYSE: ABG) Deluxe Corporation (NYSE: DLX) |

| | |

| | | | | |

Tanger Inc. | 2024 Proxy Statement | 21 |

Proposal 1 Election of Directors

| | | | | | | | |

| | |

| BACKGROUND | |

•Lead Independent Director since July 1, 2023. •Managing Partner at Ryan-Berman Advisory, LLC, a strategic advisory and consulting firm, since January 2018. •Chief Experience Officer of Enjoy Technology, Inc., a provider of setup and training services for tech products, from June 2016 to December 2017. •Independent consultant advising multi-channel brands and companies on business innovation and large-scale transformation designed around the customer experience from 2015 to 2016. •Chief Executive Officer of Victoria’s Secret Direct, LLC, an online and catalog division of Victoria’s Secret, a specialty retailer of women’s lingerie, beauty products, apparel and accessories from 2011 to 2015. •Independent consultant advising clients in the retail, wholesale and financial investment sectors providing strategic planning, business development and executive coaching services. •Chief Executive Officer of Giorgio Armani Corp., the wholly owned U.S. subsidiary of Giorgio Armani S.p.A., a provider of fashion and luxury goods products, from 2006 to 2007. •Vice President/Chief Operating Officer of Apple Computer Retail from 2004 to 2005. | •Various executive positions with Polo Ralph Lauren Corporation, including Group President of Polo Ralph Lauren Global Retail, from 1992 to 2004 and various capacities at May Department Stores, Federated Department Stores and Allied Stores Corp. from 1982 to 1992. •Serves on the Board of Directors of Tegra Global, a private apparel manufacturing and supply chain provider. •Previously served on the Board of Directors of J. Crew Group, Inc. and as Chair of the Board of Directors of BH Cosmetics. •Co-founder of Miraclefeet, a non-profit organization providing technical and financial support to children and families for the treatment of clubfoot in developing countries. •Former Chair of the Dean's Cabinet of the Advisory Council for Virginia Tech’s Pamplin College of Business. She serves on the University’s Alumni Association Board and was previously on the University's Foundation Board. She also serves on the Board of Trustees for Benedictine Schools of Richmond. |

Bridget M. Ryan-Berman Age 63 Director since January 1, 2009 Managing Partner of Ryan-Berman Advisory, LLC Committees: Compensation & Human Capital, Nominating & Corporate Governance |

| |

QUALIFICATIONS FOR THE TANGER BOARD For more than three decades, Bridget Ryan-Berman has been responsible for business development, consumer strategies and retail operations at leading global fashion and luxury goods companies. She serves as a strategic advisor and board director for multi-channel consumer companies focused on the acceleration of brand growth and business development, digital transformation and consumer engagement. Ms. Ryan-Berman’s extensive experience in apparel and retailing enables her to provide invaluable insight into the environment in which the Company operates. OTHER CURRENT PUBLIC COMPANY BOARDS Asbury Automotive Group (NYSE: ABG) Newell Brands Inc. (NASDAQ: NWL) |

| | |

| | | | | |

22 | Tanger Inc. | 2024 Proxy Statement |

Proposal 1 Election of Directors

| | | | | | | | |

| | |

| BACKGROUND | |

•Chief Executive Officer of West Walk Advisors, LLC, a private advisory firm she founded in 2018. •Former Senior Advisor to Boston Consulting Group, a global consulting firm, providing treasury management services to the group’s clients from 2019 to 2022. •Former Senior Advisor to Promontory Financial Group, a financial service company and an IBM company, guiding clients on regulatory and risk management measures, from 2018 to 2021. •Former Chairwoman, Chief Executive Officer and President of Deutsche Bank Trust Company Americas, Deutsche Bank’s U.S. commercial banking entity, from 2016 to 2018. Beginning in 2013, she led the transaction banking businesses in North and South America, and also led the global correspondent banking business. •A seven-year career at Bank of New York Mellon Trust Company, N.A., including serving as an Executive member of the Board of Directors and as an Executive Vice President, co-leading the acquisition and integration of the JPMorgan Corporate Trust business. | •Various leadership roles at companies including Morgan Stanley, Treasury Strategies, Inc., Ernst & Young and Manufacturers Hanover Trust Company. •Previously served on the Board of Directors of VEREIT, Inc. from February 2021 to November 2021. •Serves as a Director of the Falcon Group, a private inventory management solutions business. •Previously served as a Director of RBC U.S. Group Holdings LLC, the private intermediate holding company for Royal Bank of Canada’s U.S. operations. •Serves on the Board of Trustees of Hamilton College since 1994 and as an elected trustee of the Village of Saltaire in Fire Island, New York since 2022. •Previously served on the Board of Trustees of The Brooklyn Hospital Center from 2013 to 2022. |

Susan E. Skerritt Age 69 Director since July 30, 2018 Chief Executive Officer of West Walk Advisors, LLC Committees: Audit (Chair) |

| |

QUALIFICATIONS FOR THE TANGER BOARD With a 40-year financial career as a demonstrated leader with deep expertise in global financial markets, regulatory compliance, and risk management, Ms. Skerritt brings valuable perspective to the Board. Ms. Skerritt is also certified by the National Association of Corporate Directors (NACD) Cyber-Risk Oversight Program and is an NACD Board Leadership Fellow. OTHER CURRENT PUBLIC COMPANY BOARDS Community Bank System, Inc. (NYSE: CBU) IG Group Holdings plc (LSE: IGG) |

| | |

| | | | | |

Tanger Inc. | 2024 Proxy Statement | 23 |

Proposal 1 Election of Directors

| | | | | | | | |

| | |

| BACKGROUND | |

•Non-Executive Chair of the Board since January 1, 2024 and Executive Chair of the Board from January 1, 2021 to December 31, 2023. •Served as the Company’s Chief Executive Officer from May 2017 to December 2020; President and Chief Executive Officer from January 2009 to May 2017; President and Chief Operating Officer from January 1995 to December 2008; and Executive Vice President from 1986 to December 1994. | •Served on the Board of Directors of The Fresh Market, Inc. from June 2012 to April 2016. •Former Trustee of the International Council of Shopping Centers (ICSC), a member of the Real Estate Roundtable, and a Director and Member of the Executive Committee of the National Association of Real Estate Investment Trusts (NAREIT). |

Steven B. Tanger Age 75 Director since May 13, 1993 Former Executive Chair of the Board Committees: None |

| |

QUALIFICATIONS FOR THE TANGER BOARD Mr. Tanger joined the Company’s predecessor in 1986 and is the son of the Company’s founder, the late Stanley K. Tanger. Together with his father, Mr. Tanger helped develop the Company into a portfolio of 38 outlet shopping centers, one adjacent managed center and one open-air lifestyle center in 20 U.S. states and in Canada. Mr. Tanger provides an insider’s perspective in Board discussions and is experienced in all aspects of the Company’s business. OTHER CURRENT PUBLIC COMPANY BOARDS None |

| | |

| | | | | |

24 | Tanger Inc. | 2024 Proxy Statement |

Proposal 1 Election of Directors

| | | | | | | | |

| | |

| BACKGROUND | |

•Mr. Ubiñas is Chairman of the Statue of Liberty - Ellis Island Foundation (a nonprofit organization that works to preserve the Statue of Liberty and Ellis Island) and has served in this capacity since January 2021; he previously served as Vice Chair from 2018 until 2021 and has served as a member of its board of directors since 2014. •President of the Ford Foundation from 2008 to 2013, then the second-largest foundation in the United States, where he led a broad-based restructuring of the organization, including a strategic resetting of its programs, reinvestment of over 80% of the endowment, and a rebuilding of facilities and systems. •An 18-year career at McKinsey & Company where, as a Senior Partner, he led the firm’s media practice during the transition from analog to digital and omnichannel platforms. | •Previously served on the Board of Directors of Boston Private Financial Holdings from September 2017 to July 2021, Valassis Communications, Inc. from December 2012 to February 2014, and CommerceHub, Inc. from June 2016 to May 2018. •Serves on the Board of Trustees of Mercer Funds, a registered management investment company. •Member of the Advisory Board of the United Nations Fund of International Partnerships. He is also a member of the Executive Committee and Chairs the Finance Committee of the New York Public Library. |

Luis A. Ubiñas Age 61 Director since July 29, 2019 Former President, Ford Foundation Committees: Nominating & Corporate Governance (Chair) |

| |

QUALIFICATIONS FOR THE TANGER BOARD As a demonstrated leader with deep expertise in helping companies adopt successful strategies during periods of transformation, Mr. Ubiñas brings valuable perspective to the Board. OTHER CURRENT PUBLIC COMPANY BOARDS AT&T (NYSE: T) Electronic Arts Inc. (NASDAQ: EA) |

| | |

| | | | | |

Tanger Inc. | 2024 Proxy Statement | 25 |

Proposal 1 Election of Directors

| | | | | | | | |

| | |

| BACKGROUND | |

•President and Chief Executive Officer of the Company since January 2021. Mr. Yalof joined the Company in April 2020 as President and Chief Operating Officer. •Chief Executive Officer of Simon Premium Outlets of the Simon Property Group, Inc. from September 2014 to April 2020. •More than 21 years of experience in the retail industry, previously serving as Senior Vice President of Real Estate for Ralph Lauren Corporation and Senior Director of Real Estate for The Gap, Inc. | •Serves as a Trustee of the International Council of Shopping Centers, as well as on the advisory boards of HeadCount and the Center for Real Estate & Urban Analysis (CREUA) at George Washington University. |

Stephen J. Yalof Age 61 Director since July 20, 2020 President and Chief Executive Officer Committees: None |

| |

QUALIFICATIONS FOR THE TANGER BOARD Mr. Yalof provides insight into the Company's operations and strategy as well as extensive experience in the real estate and retail industries. OTHER CURRENT PUBLIC COMPANY BOARDS None |

| | |

Vote Required. The nominees will be elected if votes cast for each nominee’s election exceed the votes cast against such nominee’s election, provided that a quorum is present. Accordingly, abstentions, broker non-votes and Common Shares present at the meeting for any other purpose but which are not voted on this proposal will not affect the outcome of the vote on the nominees. The nine nominees who were approved by the Nominating and Corporate Governance Committee for inclusion on the proxy card are standing for re-election.

Director Independence

Our Corporate Governance Guidelines and the listing standards of the New York Stock Exchange (“NYSE”) require that a majority of our directors be “independent” and that every member of the Board’s Audit Committee, Compensation and Human Capital Committee, and Nominating and Corporate Governance Committee be “independent,” in each case as such term is defined by the NYSE listing requirements. Generally, independent directors are those directors who are not concurrently serving as officers of the Company and who have no material relationship with us. We presently have nine directors, including seven independent directors. Our Board has affirmatively determined that the following seven current directors are “independent,” as that term is defined under the listing standards of the NYSE: Jeffrey B. Citrin, David B. Henry, Sandeep L. Mathrani, Thomas J. Reddin, Bridget M. Ryan-Berman, Susan E. Skerritt and Luis A. Ubiñas. Steven B. Tanger is serving as our Non-Executive Chair of the Board as of January 1, 2024, and Stephen J. Yalof is our President and CEO, and therefore, are not independent.

In determining the independence of our directors, the Board considered that Ms. Ryan-Berman is a director of Newell Brands Inc., the owner of a portfolio of brands, including one of our tenants and that Mr. Mathrani is a director of Dick’s Sporting Goods, Inc., one of our tenants. The Board considered the nature of this relationship and the dollar value of the annual rental payments received from the respective tenant and determined that the relationship does not impair Ms. Ryan-Berman’s or Mr. Mathrani’s independence.

| | | | | |

26 | Tanger Inc. | 2024 Proxy Statement |

Proposal 1 Election of Directors

Board Leadership Structure

Pursuant to our By-Laws and our Corporate Governance Guidelines, our Board determines the appropriate board leadership structure for our Company from time to time. We recognize that different board leadership structures may be appropriate for companies in different situations and so as part of our annual Board self-evaluation process, we evaluate our leadership structure to ensure that the Board continues to believe that it provides the optimal structure for our Company and shareholders.

We presently operate with a non-executive Chair, a Chief Executive Officer and a Lead Independent Director. Mr. Tanger became our non-executive Chair on January 1, 2024, after having served as our Executive Chair since January 1, 2021 and prior to that as a director since May 1993. Mr. Yalof, our President and CEO, was appointed to the Board effective July 20, 2020 and became CEO on January 1, 2021. Ms. Bridget M. Ryan-Berman was appointed Lead Independent Director effective July 1, 2023.

We believe our current leadership structure is the optimal structure for us at this time, providing both strong oversight and operational insight. We believe the benefits of the arrangement include the following:

•Leverages the valuable expertise of Mr. Tanger, who has substantive knowledge of the outlet sector and significant industry relationships.

•Affords consistent and stable leadership in the board room, with Mr. Tanger facilitating board room discussion and presiding over Board meetings.

•Establishes clear leadership roles, with our Chair assuming principal responsibility for the functioning of our Board while our CEO assumes principal responsibility for the day to day operations of the Company.

•Provides valuable independent oversight of management from our Lead independent Director since our non-executive Chair does not meet our independence requirements.

•Creates an environment in which our President and CEO, Mr. Yalof, can effectively lead and engage our employees and work productively to create and execute the Company’s strategic vision.

•Ensures effective communication between the independent directors, the Chief Executive Officer and the non-executive Chair.

| | | | | |

| The Role of the Lead Independent Director |

| |

Bridget Ryan-Berman Lead Independent Director | Ms. Ryan-Berman has substantial experience with corporate governance and public company management, as well as deep knowledge of the Company and its governance practices. The Board believes Ms. Ryan-Berman’s tenure as a director enables her to provide a valuable perspective on Tanger’s business and risk framework and enhances her ability to challenge members of senior management. As our Lead Independent Director, Ms. Ryan-Berman has significant authority and responsibilities to provide for an effective and independent Board. In this role, she has the following responsibilities: |

| |

| |

EXECUTIVE SESSIONS & MEETING OF INDEPENDENT DIRECTORS | •Leads executive sessions (including of independent directors) and facilitates discussion of the Company’s strategy and key governance issues (including succession planning) •Serves as liaison between independent directors and the non-executive Chair and CEO |

| |

| |

| PERFORMANCE EVALUATIONS | •Focuses on Board effectiveness, performance and composition with input from the Nominating and Corporate Governance Committee •Oversees and reports on annual Board and Committee self-evaluations, in consultation with the Nominating and Corporate Governance Committee •Facilitates discussions regarding the performance of Tanger senior executives |

| |

| |

BOARD PROCESSES AND INFORMATION | •Develops and approves the agenda for Board meetings, in consultation with the non-executive Chair, CEO and Committee Chairs •Meets regularly between Board meetings with the non-executive Chair and CEO •Sits on and attends the meetings of each Board committee |

| |

| |

| SHAREHOLDER OUTREACH | •Responds to shareholder inquiries and leads shareholder outreach efforts, when appropriate |

| |

| | | | | |

Tanger Inc. | 2024 Proxy Statement | 27 |

Proposal 1 Election of Directors

Risk Oversight

| | | | | | | | | | | | | | | | | |

| | | | | |

| Board of Directors •The full Board is ultimately responsible for overseeing the Company’s risk management processes, and our committees assist the Board in fulfilling this responsibility. Our Board is involved in risk oversight through direct decision-making authority with respect to fundamental financial and business strategies and major corporate activities. In addition, our Board regularly receives reports by each committee chair after each meeting regarding the applicable committee’s considerations and actions with respect to certain risks. Finally, the Board, when appropriate, receives reports directly from officers and senior management responsible for oversight of particular risks within the Company. | |

| | | | | |

| | | | | |

| | |

| | | | | |

| | | | | |

| AUDIT COMMITTEE | | |

| •The Audit Committee is responsible for primary risk oversight related to our financial reporting, accounting and internal controls. •The Audit Committee receives reports from management at least quarterly regarding the Company’s assessment of risks. These risks relate to a range of issues including strategy, operations, legal/regulatory and cybersecurity, among others. •The Audit Committee focuses on the most significant risks facing the Company and the Company’s general risk management strategy, and also ensure that risks undertaken by us are consistent with the Board’s levels of risk tolerance. | |

| | | | | |

| COMPENSATION AND HUMAN CAPITAL COMMITTEE | | | |

| •The Compensation and Human Capital Committee is responsible for overseeing our Company’s assessment and management of risk related to our Company’s compensation plans, policies and overall philosophy as more fully described under our “Compensation Review Process.” •The Compensation and Human Capital Committee maintains primary responsibility for the oversight of and risks related to human capital management, including, but not limited to, retention, management succession, diversity, culture and engagement. |

| | | | | |

| NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | | | |

| •The Nominating and Corporate Governance Committee oversees risks related to corporate governance, including our overall governance framework and the development of our corporate governance principles. •The Nominating and Corporate Governance Committee oversees risks related to board and CEO succession. •The Nominating and Corporate Governance Committee maintains primary responsibility for the oversight of and risks related to the environment and sustainability, including the alignment of such programs with Company strategy. | |

| | | | | |

| | | | | |

| | |

| | | | | |

| | | | | |

| MANAGEMENT •While the Board oversees our overall risk management, our management is responsible for day-to-day risk management processes. | |

| | | | | |

| | | | | |

28 | Tanger Inc. | 2024 Proxy Statement |

Proposal 1 Election of Directors

Cybersecurity Risk Management Oversight

We recognize the critical importance of developing, implementing, and maintaining robust cybersecurity measures to safeguard our information systems and protect the confidentiality, integrity, and availability of our data. Our executive management team is regularly informed of all aspects related to cybersecurity risks and incidents and we have strategically integrated cybersecurity risk management into our broader risk management framework to promote a Company-wide culture of cybersecurity risk management. We believe that this integration ensures that cybersecurity considerations are an integral part of our decision-making processes at every level. Our technology department continuously identifies, evaluates and manages material risks from cybersecurity threats to our critical computer networks, third-party hosted services, communications systems, hardware and software, and our critical data, including intellectual property, confidential information that is proprietary, strategic or competitive in nature, and tenant data in alignment with our business objectives and operational needs. The Board is focused on the critical nature of managing risks associated with cybersecurity threats. The Board has delegated to its Audit Committee oversight of management's processes for identifying and mitigating risks, including cybersecurity-related risks, to help align our risk exposure with our strategic objectives. The Audit Committee engages in regular discussions with management regarding the Company’s significant financial risk exposures and the measures implemented to monitor and control these risks, including those that may result from material cybersecurity threats. These discussions include the Company’s risk assessment and risk management policies.

Assessing, identifying and managing cybersecurity related risks are integrated into our overall ERM process. Cybersecurity related risks are included in the population that the ERM function evaluates to assess the top risks to the enterprise on a quarterly basis. To the extent the ERM process identifies a heightened cybersecurity related risk, management develops risk mitigation plans to minimize the risk. The ERM annual risk assessment is presented to the Audit Committee. For a further description of the cybersecurity risk management policies and practices of the Board and management, see Item 1C of the Form 10-K included in the Company’s Annual Report.

| | | | | |

Tanger Inc. | 2024 Proxy Statement | 29 |

Proposal 1 Election of Directors

Attendance at Board and Committee Meetings

The Board held five meetings during 2023. Each of the incumbent directors in office during 2023 attended 100% of the Board meetings and meetings of committees on which the director served, during the period in which such person served as a director. We do not have a formal policy of attendance for directors at our annual meeting of shareholders. All of our incumbent directors who were serving at the time of the 2023 annual meeting of shareholders attended the meeting.

Pursuant to our Corporate Governance Guidelines, non-management directors are required to meet in executive sessions following each regularly scheduled quarterly Board meeting. The Lead Independent Director of the Board presides at all executive sessions at which he or she is in attendance. In addition, to the extent applicable, non-management directors who are not independent under the rules of the NYSE may participate in these executive sessions, but our independent directors meet in executive session at least once per year.

Anti-Hedging Policy