Exhibit 99.3

|

Table of Contents

|

||||

|

First Quarter 2013

|

||||

|

Section I - Financial Information

|

Section II - Core Portfolio Information

|

|||

|

Company Information

|

3

|

Core Properties

|

21

|

|

|

Total Market Capitalization

|

4

|

Core Portfolio by State

|

23

|

|

|

Operating Statements

|

Core Top Tenants

|

24

|

||

|

Pro-rata Consolidation

|

5

|

Core Lease Expirations

|

25

|

|

|

Opportunity Funds

|

6

|

Core New and Renewal Rent Spreads

|

26

|

|

|

Funds from Operations ("FFO"), Adjusted FFO ("AFFO")

|

Core Capital Expenditures

|

27

|

||

|

and Funds Available for Distribution ("FAD")

|

7

|

Portfolio Demographics

|

28

|

|

|

EBITDA

|

8

|

|||

|

Same Property Net Operating Income

|

9

|

|||

|

Fee Income

|

10

|

Section III - Opportunity Fund Information

|

||

|

Balance Sheet - Pro-rata Consolidation

|

11

|

|||

|

Notes Receivable

|

12

|

Opportunity Fund Overview

|

31

|

|

|

Other Information

|

Opportunity Fund Properties

|

32

|

||

|

2013 Guidance

|

13

|

Opportunity Fund Lease Expirations

|

33

|

|

|

Net Asset Valuation Information

|

14

|

Redevelopment Projects - Construction and Design

|

34

|

|

|

Selected Financial Ratios

|

15

|

RCP Venture Investments

|

35

|

|

|

Debt Analysis

|

||||

|

Summary

|

16

|

|||

|

Detail

|

17

|

|||

|

Maturities

|

20

|

Important Notes

|

36

|

Visit www.acadiarealty.com for additional investor and portfolio information

- 2 -

|

Company Information

|

|

Acadia Realty Trust, a fully-integrated equity real estate investment trust, is focused on the acquisition, ownership, management and redevelopment of high-quality retail properties and urban/infill mixed-use properties with a strong retail component located primarily in high-barrier-to-entry, densely-populated metropolitan areas along the East Coast and in Chicago. Acadia owns, or has an ownership interest in, these properties through its core portfolio and its opportunistic/value-add investment funds. Additional information may be found on the Company’s website at www.acadiarealty.com.

|

|

Contact Information

|

|||||

|

Corporate Headquarters

|

Investor Relations

|

New York Stock Exchange

|

|||

|

1311 Mamaroneck Avenue

|

Jon Grisham

|

Symbol AKR

|

|||

|

Suite 260

|

Senior Vice President,

|

||||

|

White Plains, NY 10605

|

Chief Financial Officer

|

||||

|

(914) 288-8142

|

|||||

|

jgrisham@acadiarealty.com

|

|||||

|

Analyst Coverage

|

|||||

|

Bank of America / Merrill Lynch

|

Cowen and Company

|

KeyBanc Capital Markets, Inc.

|

|||

|

Craig Schmidt - (646) 855-3640

|

Michael Gorman - (646) 562-1381

|

Todd Thomas - (917) 368-2286

|

|||

|

craig.schmidt@baml.com

|

michael.gorman@cowen.com

|

tthomas@keybanccm.com

|

|||

|

Bank of Montreal

|

Green Street Advisors

|

RBC Capital Markets

|

|||

|

Paul Adornato, CFA - (212) 885-4170

|

Cedrik LaChance - (949) 640-8780

|

Rich Moore, CFA - (440) 715-2646

|

|||

|

paul.adornato@bmo.com

|

clachance@greenst.com

|

rich.moore@rbccm.com

|

|||

|

Citigroup - Global Markets

|

J.P. Morgan Securities, Inc.

|

UBS

|

|||

|

Quentin Velleley, CFA - (212) 816-6981

|

Michael W. Mueller, CFA - (212) 622-6689

|

Christy McElroy - (203) 719-7831

|

|||

|

quentin.velleley@citi.com

|

michael.w.mueller@jpmorgan.com

|

christy.mcelroy@ubs.com

|

|||

- 3 -

|

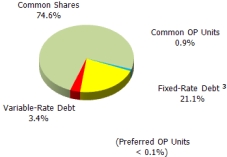

Total Market Capitalization

|

||||||||||||||

|

(including pro-rata share of Opportunity Fund debt, dollars in thousands)

|

||||||||||||||

|

Capitalization

|

||||||||||||||

|

Percent of

|

Total Market Capitalization

|

based on

|

||||||||||||

|

Total Equity

|

$ | % |

Net Debt1

|

Total Market Capitalization | ||||||||||

|

Equity Capitalization

|

||||||||||||||

|

Total Common Shares Outstanding

|

98.8% | 54,514 | ||||||||||||

|

Common Operating Partnership ("OP") Units

|

1.2% | 664 | ||||||||||||

|

Combined Common Shares and OP Units

|

55,178 |  |

||||||||||||

|

Share Price at March 31, 2013

|

$ | 27.77 | ||||||||||||

|

Equity Capitalization - Common Shares and OP Units

|

$ | 1,532,293 | ||||||||||||

|

Preferred OP Units

|

696 | 2 | ||||||||||||

|

Total Equity Capitalization

|

1,532,989 | 76% | 78% | |||||||||||

|

Debt Capitalization

|

||||||||||||||

|

Consolidated debt

|

934,980 | |||||||||||||

|

Adjustment to reflect pro-rata share of debt

|

(438,039 | ) | ||||||||||||

|

Total Debt Capitalization

|

496,941 | 24% | 22% | |||||||||||

|

Total Market Capitalization

|

$ | 2,029,930 | 100% | 100% | ||||||||||

|

Weighted Average Outstanding Common Shares and OP Units

|

||||||||||||||

|

(in thousands)

|

||||||||||||||

|

March 31, 2013

|

March 31, 2012

|

|||||||||||||

| Quarter |

Quarter

|

|||||||||||||

|

Weighted average Common Shares - Basic EPS

|

53,414 | 42,736 | ||||||||||||

|

Dilutive potential Common Shares

|

437 | 410 | ||||||||||||

|

Weighted average Common Shares - Diluted EPS

|

53,851 | 43,146 | ||||||||||||

|

OP Units

|

655 | 621 | ||||||||||||

|

Dilutive potential OP Units

|

25 | 25 | ||||||||||||

|

Weighted average Common Shares and OP Units - Diluted FFO

|

54,531 | 43,792 | ||||||||||||

|

Notes:

|

||||||||||

|

1 Reflects debt net of Core Portfolio and pro-rata share of Opportunity Funds cash balance ("Net Debt") totaling $52,700.

|

||||||||||

|

2 Represents 188 Series A Preferred OP Units convertible into 25,067 Common OP units multiplied by the Common Share price at quarter end.

|

||||||||||

|

3 Fixed-rate debt includes notional principal fixed through interest rate swap transactions.

|

||||||||||

- 4 -

|

Income Statements - Pro-rata Consolidation1

|

||||||||||||||||||||||||

|

(in thousands)

|

||||||||||||||||||||||||

| Three months ended March 31, 2013 | ||||||||||||||||||||||||

| Core Retail | Opportunity Funds |

Total

|

||||||||||||||||||||||

|

Total

|

||||||||||||||||||||||||

|

Wholly

|

Joint

|

Continuing

|

|

Continuing

|

Discontinued | |||||||||||||||||||

|

Owned

|

Ventures 2

|

Operations

|

Operations

|

Operations

|

||||||||||||||||||||

|

CORE PORTFOLIO AND OPPORTUNITY FUND INCOME

|

||||||||||||||||||||||||

|

PROPERTY REVENUES

|

||||||||||||||||||||||||

|

Minimum rents

|

$ | 16,745 | $ | 808 | $ | 17,553 | $ | 2,975 | $ | 204 | $ | 20,732 | ||||||||||||

|

Percentage rents

|

100 | - | 100 | 32 | - | 132 | ||||||||||||||||||

|

Expense reimbursements - CAM

|

1,892 | 94 | 1,986 | 422 | 7 | 2,415 | ||||||||||||||||||

|

Expense reimbursements - Taxes

|

2,511 | 210 | 2,721 | 398 | 7 | 3,126 | ||||||||||||||||||

|

Other property income

|

237 | 3 | 240 | 111 | 12 | 363 | ||||||||||||||||||

|

Total Property Revenues

|

21,485 | 1,115 | 22,600 | 3,938 | 230 | 26,768 | ||||||||||||||||||

|

PROPERTY EXPENSES

|

||||||||||||||||||||||||

|

Property operating - CAM

|

2,031 | 100 | 2,131 | 410 | 8 | 2,549 | ||||||||||||||||||

|

Other property operating (Non-CAM)

|

572 | 60 | 632 | 324 | 133 | 1,089 | ||||||||||||||||||

|

Real estate taxes

|

3,017 | 257 | 3,274 | 495 | 14 | 3,783 | ||||||||||||||||||

|

Total Property Expenses

|

5,620 | 417 | 6,037 | 1,229 | 155 | 7,421 | ||||||||||||||||||

|

NET OPERATING INCOME - PROPERTIES

|

15,865 | 698 | 16,563 | 2,709 | 75 | 19,347 | ||||||||||||||||||

|

OTHER INCOME (EXPENSE)

|

||||||||||||||||||||||||

|

Mezzanine interest income

|

2,367 | - | 2,367 | 106 | - | 2,473 | ||||||||||||||||||

|

Other interest income

|

23 | - | 23 | 4 | - | 27 | ||||||||||||||||||

|

Straight-line rent income

|

371 | (6 | ) | 365 | 302 | 3 | 670 | |||||||||||||||||

|

Straight-line ground rent

|

- | - | - | (21 | ) | - | (21 | ) | ||||||||||||||||

|

Above/below market rent

|

470 | - | 470 | 134 | - | 604 | ||||||||||||||||||

|

Interest expense

|

(4,332 | ) | (512 | ) | (4,844 | ) | (915 | ) | (17 | ) | (5,776 | ) | ||||||||||||

|

Amortization of finance costs

|

(186 | ) | - | (186 | ) | (113 | ) | - | (299 | ) | ||||||||||||||

|

Above/below market interest expense

|

442 | - | 442 | 34 | - | 476 | ||||||||||||||||||

|

Asset and property management expense

|

(25 | ) | (11 | ) | (36 | ) | (37 | ) | (12 | ) | (85 | ) | ||||||||||||

|

Other income

|

462 | - | 462 | 498 | 26 | 986 | ||||||||||||||||||

|

Acquisition costs

|

(703 | ) | - | (703 | ) | (187 | ) | - | (890 | ) | ||||||||||||||

|

CORE PORTFOLIO AND OPPORTUNITY FUND INCOME

|

14,754 | 169 | 14,923 | 2,514 | 75 | 17,512 | ||||||||||||||||||

|

FEE INCOME

|

||||||||||||||||||||||||

|

Asset and property management fees

|

4,303 | - | 4,303 | 58 | - | 4,361 | ||||||||||||||||||

|

Transactional fees3

|

1,252 | 1,252 | - | - | 1,252 | |||||||||||||||||||

|

Income tax benefit (provision)

|

91 | (1 | ) | 90 | 8 | (1 | ) | 97 | ||||||||||||||||

|

Total Fee Income

|

5,646 | (1 | ) | 5,645 | 66 | (1 | ) | 5,710 | ||||||||||||||||

|

PROMOTE, RCP AND OTHER INCOME

|

||||||||||||||||||||||||

|

Equity in earnings (losses) from RCP investments

|

- | - | - | (27 | ) | - | (27 | ) | ||||||||||||||||

|

Total Promote, RCP and Other Income

|

- | - | - | (27 | ) | - | (27 | ) | ||||||||||||||||

|

GENERAL AND ADMINISTRATIVE

|

(6,222 | ) | - | (6,222 | ) | 9 | - | (6,213 | ) | |||||||||||||||

|

Depreciation and amortization

|

(5,910 | ) | (194 | ) | (6,104 | ) | (1,126 | ) | - | (7,230 | ) | |||||||||||||

|

Income before noncontrolling interests

|

8,268 | (26 | ) | 8,242 | 1,436 | 74 | 9,752 | |||||||||||||||||

|

Noncontrolling interest - OP

|

(107 | ) | (2 | ) | (109 | ) | (20 | ) | - | (129 | ) | |||||||||||||

|

NET INCOME

|

$ | 8,161 | $ | (28 | ) | $ | 8,133 | $ | 1,416 | $ | 74 | $ | 9,623 | |||||||||||

|

Notes:

|

||||||||||||||||||||||||

|

1Quarterly results are unaudited, although they reflect all adjustments, which in the opinion of management, are necessary for a fair presentation of operating results for the interim periods.

|

||||||||||||||||||||||||

|

The Company's investments in consolidated and unconsolidated joint ventures are reflected separately for revenues and expenses by calculating its pro-rata share for each of the above line items.

|

||||||||||||||||||||||||

|

In total, net income agrees with net income as reported in the Company's Form 10Q's and 10K for the corresponding periods.

|

||||||||||||||||||||||||

|

2Represents the Company's pro-rata share unconsolidated investments which are detailed on pages 21 and 22.

|

||||||||||||||||||||||||

|

3Consists of development, construction, leasing and legal fees.

|

||||||||||||||||||||||||

- 5 -

|

Income Statements - Opportunity Funds1

|

|||||||||||||||||||||||||||||||||||||||||||

|

(in thousands)

|

|||||||||||||||||||||||||||||||||||||||||||

|

Three months ended March 31, 2013

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Continuing

|

Continuing

|

Discontinued

|

Continuing

|

Discontinued

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Operations

|

Operations

|

Operations

|

Operations

|

Operations

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Fund I

|

AKR Pro-

|

AKR Pro-

|

Fund II

|

Fund II

|

Fund II

|

AKR Pro-

|

AKR Pro-

|

AKR Pro-

|

Fund III

|

AKR Pro-

|

AKR Pro-

|

AKR Pro-

|

Total

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Continuing

|

rata share4

|

rata share4

|

Continuing

|

Discontinued

|

Consolidated

|

rata share

|

rata share

|

rata share

|

Continuing

|

rata share

|

rata share

|

rata share

|

AKR Pro-

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Operations

|

37.78% |

Mervyns I

|

37.78% |

Operations

|

Operations

|

Operations

|

20.00% | 20.00% |

Mervyns II

|

20.00% |

Operations 3

|

19.90% | 19.90% |

Fund IV 3

|

23.12% |

rata share

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

PROPERTY REVENUES

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Minimum rents

|

$ | 57 | $ | 22 | $ | - | $ | - | $ | 5,966 | $ | 1,022 | $ | 6,988 | $ | 1,193 | $ | 204 | $ | - | $ | - | $ | 7,080 | $ | 1,409 | $ | - | $ | 1,519 | $ | 351 | $ | 3,179 | ||||||||||||||||||||||||||||||||||

|

Percentage rents

|

- | - | - | - | - | - | - | - | - | - | - | 160 | 32 | - | - | - | 32 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Expense reimbursements - CAM

|

3 | 1 | - | - | 630 | 36 | 666 | 126 | 7 | - | - | 1,295 | 258 | - | 161 | 37 | 429 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Expense reimbursements - Taxes

|

- | - | - | - | 356 | 36 | 392 | 71 | 7 | - | - | 1,442 | 287 | - | 175 | 40 | 405 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Other property income

|

- | - | - | - | 91 | 62 | 153 | 18 | 12 | - | - | 456 | 91 | - | 7 | 2 | 123 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Total Property Revenues

|

60 | 23 | - | - | 7,043 | 1,156 | 8,199 | 1,408 | 230 | - | - | 10,433 | 2,077 | - | 1,862 | 430 | 4,168 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

PROPERTY EXPENSES

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Property operating - CAM

|

4 | 2 | - | - | 1,056 | 42 | 1,098 | 211 | 8 | - | - | 942 | 187 | - | 43 | 10 | 418 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Other property operating (Non-CAM)

|

43 | 16 | - | - | 719 | 678 | 1,397 | 144 | 133 | - | - | 781 | 155 | - | 37 | 9 | 457 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Real estate taxes

|

3 | 1 | - | - | 465 | 70 | 535 | 93 | 14 | - | - | 1,816 | 361 | - | 173 | 40 | 509 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Total Property Expenses

|

50 | 19 | - | - | 2,240 | 790 | 3,030 | 448 | 155 | - | - | 3,539 | 703 | - | 253 | 59 | 1,384 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

NET OPERATING INCOME - PROPERTIES

|

10 | 4 | - | - | 4,803 | 366 | 5,169 | 960 | 75 | - | - | 6,894 | 1,374 | - | 1,609 | 371 | 2,784 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

OTHER INCOME (EXPENSE)

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Mezzanine interest income

|

207 | 78 | - | - | - | - | - | - | - | - | - | 143 | 28 | - | - | - | 106 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Other interest income

|

- | - | - | - | 6 | - | 6 | 1 | - | - | - | 17 | 3 | - | 1 | - | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Straight-line rent income

|

- | - | - | - | 797 | 13 | 810 | 159 | 3 | - | - | 537 | 107 | - | 148 | 36 | 305 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Straight-line ground rent

|

- | - | - | - | (104 | ) | 2 | (102 | ) | (21 | ) | - | - | - | - | - | - | - | - | (21 | ) | |||||||||||||||||||||||||||||||||||||||||||||||

|

Above/below market rent

|

- | - | - | - | - | - | - | - | - | - | - | 675 | 134 | - | - | - | 134 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Interest expense

|

(1 | ) | - | - | - | (2,136 | ) | (85 | ) | (2,221 | ) | (427 | ) | (17 | ) | - | - | (1,897 | ) | (378 | ) | - | (475 | ) | (110 | ) | (932 | ) | ||||||||||||||||||||||||||||||||||||||||

|

Amortization of finance costs

|

- | - | - | - | (175 | ) | - | (175 | ) | (35 | ) | - | - | - | (225 | ) | (45 | ) | - | (142 | ) | (33 | ) | (113 | ) | |||||||||||||||||||||||||||||||||||||||||||

|

Above/below market interest

|

- | - | - | - | - | - | - | - | - | - | - | 170 | 34 | - | - | - | 34 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Asset and property management expense2

|

2 | 1 | - | - | 2 | (61 | ) | (59 | ) | - | (12 | ) | - | - | (114 | ) | (23 | ) | - | (63 | ) | (15 | ) | (49 | ) | |||||||||||||||||||||||||||||||||||||||||||

|

Promote expense2

|

(17 | ) | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||||||||||||||||||||||||||||

|

Other income

|

- | - | - | - | 1 | 131 | 132 | - | 26 | - | - | 2,501 | 498 | - | - | - | 524 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Acquisition costs

|

- | - | - | - | - | - | - | - | - | - | - | (800 | ) | (159 | ) | - | (123 | ) | (28 | ) | (187 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

|

OPPORTUNITY FUND INCOME

|

201 | 83 | - | - | 3,194 | 366 | 3,560 | 637 | 75 | - | - | 7,901 | 1,573 | - | 955 | 221 | 2,589 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

FEE INCOME

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Asset and property management fees

|

- | - | - | - | - | - | - | - | - | - | - | 291 | 58 | - | - | - | 58 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Income tax benefit (provision)

|

(4 | ) | (2 | ) | - | - | (10 | ) | (5 | ) | (15 | ) | (2 | ) | (1 | ) | - | - | 60 | 12 | - | - | - | 7 | ||||||||||||||||||||||||||||||||||||||||||||

|

Total Fee Income

|

(4 | ) | (2 | ) | - | - | (10 | ) | (5 | ) | (15 | ) | (2 | ) | (1 | ) | - | - | 351 | 70 | - | - | - | 65 | ||||||||||||||||||||||||||||||||||||||||||||

|

PROMOTE, RCP AND OTHER INCOME

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Equity in earnings (losses) from RCP investments

|

- | - | (44 | ) | (17 | ) | - | - | - | - | - | (52 | ) | (10 | ) | - | - | - | - | - | (27 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

|

Promote income - Fund capital transactions

|

- | - | 9 | - | - | - | - | - | - | - | - | - | - | - | - | - | - | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Total Promote, RCP and Other Income

|

- | - | (35 | ) | (17 | ) | - | - | - | - | - | (53 | ) | (10 | ) | - | - | - | - | - | (27 | ) | ||||||||||||||||||||||||||||||||||||||||||||||

|

GENERAL AND ADMINISTRATIVE

|

(17 | ) | (6 | ) | - | - | 60 | - | 60 | 12 | - | (6 | ) | (1 | ) | (16 | ) | (3 | ) | - | 32 | 7 | 9 | |||||||||||||||||||||||||||||||||||||||||||||

|

Depreciation and amortization

|

(1 | ) | - | - | - | (2,042 | ) | - | (2,042 | ) | (408 | ) | - | - | - | (2,813 | ) | (560 | ) | - | (684 | ) | (158 | ) | (1,126 | ) | ||||||||||||||||||||||||||||||||||||||||||

|

Income before noncontrolling interest

|

179 | 75 | (35 | ) | (17 | ) | 1,202 | 361 | 1,563 | 239 | 74 | (59 | ) | (11 | ) | 5,423 | 1,080 | - | 303 | 70 | 1,510 | |||||||||||||||||||||||||||||||||||||||||||||||

|

Noncontrolling interest - OP

|

(3 | ) | (1 | ) | - | - | (20 | ) | - | (20 | ) | (4 | ) | - | - | - | (70 | ) | (14 | ) | - | (4 | ) | (1 | ) | (20 | ) | |||||||||||||||||||||||||||||||||||||||||

|

NET INCOME

|

$ | 176 | $ | 74 | $ | (35 | ) | $ | (17 | ) | $ | 1,182 | $ | 361 | $ | 1,543 | $ | 235 | $ | 74 | $ | (59 | ) | $ | (11 | ) | $ | 5,353 | $ | 1,066 | $ | - | $ | 299 | $ | 69 | $ | 1,490 | ||||||||||||||||||||||||||||||

|

Notes:

|

|||||||||||||||||||||||||||||||||

|

1 Quarterly results are unaudited, although they reflect all adjustments, which in the opinion of management, are necessary for a fair presentation of operating results for the interim periods. The Company's investments in consolidated and unconsolidated joint ventures are reflected separately for revenues and expenses by calculating it's pro-rata share for each of the above line items. In total, net income agrees with net income as reported in the Company's Form 10Q's and 10K for the corresponding periods. The Company currently invests in Funds I, II, III & IV and Mervyn's which are consolidated with the Company's financial statements.

|

|||||||||||||||||||||||||||||||||

|

2 Funds I, II, III & IV and the Mervyn's entities pay various fees to and promotes the Company. As it is the recipient of such fees, the Company does not recognize its pro-rata share of these expenses.

|

|||||||||||||||||||||||||||||||||

|

3 Represents the Company's pro-rata share unconsolidated investments which are detailed on page 32.

|

|||||||||||||||||||||||||||||||||

|

4 Represents a 20% promote earned by Acadia in addition to our 22.22% pro-rata share of the remaining 80% after promote (20%+22.22%*80% = 37.78%)

|

|||||||||||||||||||||||||||||||||

- 6 -

|

Funds from Operations ("FFO") 1

|

||||||||

|

(in thousands)

|

||||||||

| 2013 | 2012 | |||||||

|

Current

|

Historic

|

|||||||

|

Quarter

|

Quarter

|

|||||||

|

3 months ended

|

3 months ended

|

|||||||

|

Funds from operations ("FFO"):

|

March 31, 2013

|

March 31, 2012

|

||||||

|

Net Income

|

$ | 9,623 | $ | 4,010 | ||||

|

Add back:

|

||||||||

|

Depreciation of real estate and amortization of leasing costs:

|

||||||||

|

(net of noncontrolling interest share)

|

||||||||

|

Consolidated affiliates

|

6,697 | 4,828 | ||||||

|

Unconsolidated affiliates

|

397 | 392 | ||||||

|

Income attributable to noncontrolling interests'

|

||||||||

|

share in Operating Partnership

|

124 | 63 | ||||||

|

Distributions on Preferred OP Units 2

|

5 | 5 | ||||||

|

FFO

|

$ | 16,846 | $ | 9,298 | ||||

|

Adjusted Funds from operations ("AFFO"):

|

||||||||

|

Diluted FFO

|

$ | 16,846 | $ | 9,298 | ||||

|

Straight line rent, net

|

(670 | ) | (628 | ) | ||||

|

Straight-line ground rent

|

21 | 22 | ||||||

|

Above/below market rent

|

(604 | ) | (162 | ) | ||||

|

Amortization of finance costs

|

299 | 207 | ||||||

|

Above/below market interest

|

(476 | ) | (21 | ) | ||||

|

Non real estate depreciation

|

102 | 118 | ||||||

|

Amortization of cost of management contracts

|

- | 20 | ||||||

|

Leasing commissions

|

(647 | ) | (306 | ) | ||||

|

Tenant improvements

|

(1,192 | ) | (1,583 | ) | ||||

|

Capital expenditures

|

(46 | ) | (64 | ) | ||||

|

AFFO

|

$ | 13,633 | $ | 6,901 | ||||

|

Funds Available for Distribution ("FAD")

|

||||||||

|

AFFO

|

$ | 13,633 | $ | 6,901 | ||||

|

Scheduled principal repayments

|

(814 | ) | (906 | ) | ||||

|

FAD

|

$ | 12,819 | $ | 5,995 | ||||

|

Total weighted average shares and OP Units:

|

||||||||

|

Basic

|

54,094 | 43,382 | ||||||

|

Diluted

|

54,531 | 43,792 | ||||||

|

FFO per share:

|

||||||||

|

FFO per share - Basic

|

$ | 0.31 | $ | 0.21 | ||||

|

FFO per share - Diluted

|

$ | 0.31 | $ | 0.21 | ||||

|

AFFO per share - Basic

|

$ | 0.25 | $ | 0.16 | ||||

|

AFFO per share - Diluted

|

$ | 0.25 | $ | 0.16 | ||||

|

FAD per share - Basic

|

$ | 0.24 | $ | 0.14 | ||||

|

FAD per share - Diluted

|

$ | 0.24 | $ | 0.14 | ||||

|

Notes:

|

||||

|

1 Quarterly results are unaudited, although they reflect all adjustments, which in the opinion of management are necessary for a fair presentation of operating results for the interim periods.

|

||||

|

2 Quarterly Preferred OP Unit distributions are added back for the purposes of calculating diluted FFO. Refer to "Market Capitalization" for weighted-average basic and diluted shares.

|

||||

- 7 -

|

EBITDA

|

||||||||||||||||||||||||

|

(in thousands)

|

||||||||||||||||||||||||

|

Current Quarter

|

||||||||||||||||||||||||

|

Three months ended March 31, 2013

|

||||||||||||||||||||||||

|

Core Retail

|

Opportunity Funds

|

|||||||||||||||||||||||

|

Total

|

||||||||||||||||||||||||

|

Wholly

|

Joint

|

Continuing

|

Continuing

|

Discontinued

|

||||||||||||||||||||

|

Owned

|

Ventures

|

Operations

|

Operations

|

Operations

|

TOTAL

|

|||||||||||||||||||

|

NET INCOME

|

$ | 8,161 | $ | (28 | ) | $ | 8,133 | $ | 1,416 | $ | 74 | $ | 9,623 | |||||||||||

|

Add back:

|

||||||||||||||||||||||||

|

Depreciation and amortization

|

5,910 | 194 | 6,104 | 1,126 | - | 7,230 | ||||||||||||||||||

|

Interest expense

|

4,332 | 512 | 4,844 | 915 | 17 | 5,776 | ||||||||||||||||||

|

Amortization of finance costs

|

186 | - | 186 | 113 | - | 299 | ||||||||||||||||||

|

Above/below market interest

|

(442 | ) | - | (442 | ) | (34 | ) | - | (476 | ) | ||||||||||||||

|

Provision for income taxes

|

(91 | ) | 1 | (90 | ) | (8 | ) | 1 | (97 | ) | ||||||||||||||

|

Noncontrolling interest - OP

|

107 | 2 | 109 | 20 | - | 129 | ||||||||||||||||||

|

EBITDA

|

$ | 18,163 | $ | 681 | $ | 18,844 | $ | 3,548 | $ | 92 | $ | 22,484 | ||||||||||||

- 8 -

|

Core Portfolio

|

||||||||||

|

Net Operating Income (NOI) - Same Property Performance 1

|

||||||||||

|

(in thousands)

|

||||||||||

|

Quarter

|

||||||||||

|

Growth in Same

|

||||||||||

|

Three months ended

|

Property NOI -

|

|||||||||

|

Continuing Operations

|

||||||||||

|

March 31, 2013

|

March 31, 2012

|

Favorable (unfavorable)

|

||||||||

|

Reconciliation of total NOI to same property NOI:

|

||||||||||

|

NOI - Core properties - Continuing Operations

|

$ | 16,563 | $ | 12,013 | ||||||

|

NOI - Properties acquired or in redevelopment

|

(4,472 | ) | (1,109 | ) | ||||||

|

Total

|

$ | 12,091 | $ | 10,904 | 10.9% | |||||

|

Same property NOI by revenues/expenses:

|

||||||||||

|

|

||||||||||

|

Revenues

|

$ | 16,655 | $ | 14,980 | 11.2% | |||||

|

Expenses

|

4,564 | 4,076 | -12.0% | |||||||

|

Total Core Portfolio

|

$ | 12,091 | $ | 10,904 | 10.9% | |||||

|

Notes:

|

||||||

|

1 The above amounts include the pro-rata activity related to the Company's Core consolidated and unconsolidated investments.

|

||||||

- 9 -

|

Fee income by Opportunity Fund

|

||||||||||||||||||||||||

|

(in thousands)

|

||||||||||||||||||||||||

|

Fund I

|

Fund II

|

Fund III

|

Fund IV

|

Other

|

Total

|

|||||||||||||||||||

|

Three months ended March 31, 2013

|

||||||||||||||||||||||||

|

Asset and property management fees

|

$ | 67 | $ | 1,090 | $ | 1,417 | $ | 1,587 | $ | 142 | $ | 4,303 | ||||||||||||

|

Transactional fees

|

3 | 638 | 528 | 18 | 65 | 1,252 | ||||||||||||||||||

|

Total management fees

|

$ | 70 | $ | 1,728 | $ | 1,945 | $ | 1,605 | $ | 207 | $ | 5,555 | ||||||||||||

- 10 -

|

Pro-Rata Consolidated Balance Sheet

|

||||||||||||||||||||||||

|

(in thousands)

|

||||||||||||||||||||||||

| Consolidated |

Noncontrolling

|

Company's

|

Pro-Rata

|

|||||||||||||||||||||

|

Balance

|

Interest in

|

Interest in

|

Consolidated | |||||||||||||||||||||

|

Sheet

|

Consolidated

|

Unconsolidated

|

Balance

|

|||||||||||||||||||||

| As Reported 1 |

Subsidiaries

|

Subsidiaries

|

Sheet 2

|

Notes

|

||||||||||||||||||||

|

ASSETS

|

||||||||||||||||||||||||

|

Real estate

|

1 The interim consolidated balance sheet is unaudited, although it | |||||||||||||||||||||||

|

Land

|

$ | 344,178 | $ | (119,893 | ) | $ | 18,518 | $ | 242,803 | reflects all adjustments, which in the opinion of management, | ||||||||||||||

|

Buildings and improvements

|

1,157,960 | (423,164 | ) | 75,496 | 810,292 | are necessary for the fair presentation of the consolidated | ||||||||||||||||||

|

Construction in progress

|

2,747 | (1,324 | ) | 1,363 | 2,786 |

balance sheet for the interim period.

|

||||||||||||||||||

| 1,504,885 | (544,381 | ) | 95,377 | 1,055,881 | ||||||||||||||||||||

|

Less: accumulated depreciation

|

(223,834 | ) | 63,256 | (7,540 | ) | (168,118 | ) | 2 The Company currently invests in Funds I, II, III & IV and Mervyns I & II | ||||||||||||||||

|

Net real estate

|

1,281,051 | (481,125 | ) | 87,837 | 887,763 | which are consolidated with the Company's financial statements. | ||||||||||||||||||

| To provide investors with supplemental information, the Company's | ||||||||||||||||||||||||

|

Net real estate under development

|

262,291 | 3 | (213,407 | ) | 99 | 48,983 | investments in these joint ventures are reflected above on a pro-rata | |||||||||||||||||

| basis by calculating its ownership percentage for each of the asset | ||||||||||||||||||||||||

|

Cash and cash equivalents

|

81,831 | (29,657 | ) | 526 | 52,700 | and liability line items. Similarly, the presentation also includes | ||||||||||||||||||

|

Cash in escrow

|

171,913 | (133,969 | ) | 955 | 38,899 | the Company's pro-rata share of assets and liabilities for | ||||||||||||||||||

|

Investments in and advances to unconsolidated affiliates

|

222,462 | (167,411 | ) | (51,592 | ) | 3,459 | unconsolidated investments which are accounted for under the equity | |||||||||||||||||

|

Rents receivable, net

|

5,048 | (2,013 | ) | 452 | 3,487 | method of accounting for the Company's financial statements |

.

|

|||||||||||||||||

|

Straight-line rents receivable, net

|

27,099 | (14,174 | ) | 996 | 13,921 | |||||||||||||||||||

|

Notes Receivable

|

105,367 | (7,593 | ) | 1,080 | 98,854 | 3 The components of Net real estate under development are as follows: | ||||||||||||||||||

|

Deferred charges, net

|

39,053 | (27,236 | ) | 1,401 | 13,218 |

Fund II

|

$ | 232,032 | ||||||||||||||||

|

Prepaid expenses and other assets

|

45,768 | 10,948 | 877 | 57,593 |

Fund III

|

28,599 | ||||||||||||||||||

|

Acquired lease intangibles

|

31,839 | (11,123 | ) | 1,135 | 21,851 |

Fund IV

|

3 | |||||||||||||||||

|

Accounts receivable from related parties

|

1,133 | - | - | 1,133 | ||||||||||||||||||||

|

Assets of discontinued operations

|

21,014 | (16,811 | ) | - | 4,203 |

Total Opportunity Funds

|

260,634 | |||||||||||||||||

|

Core Portfolio

|

1,657 | |||||||||||||||||||||||

|

Total Assets

|

$ | 2,295,869 | $ | (1,093,571 | ) | $ | 43,766 | $ | 1,246,064 |

Total

|

$ | 262,291 | ||||||||||||

|

LIABILITIES AND SHAREHOLDERS' EQUITY

|

4 The components of Prepaid expenses and other assets are as follows: | |||||||||||||||||||||||

|

Due from Fund Investors

|

$ | 38,957 | ||||||||||||||||||||||

|

Mortgage notes payable

|

$ | 1,100,249 | (656,681 | ) | $ | 52,443 | $ | 496,011 |

Prepaid expenses

|

7,939 | ||||||||||||||

|

Notes payable

|

930 | - | - | 930 |

Unsettled At-The-Market proceeds

|

4,983 | ||||||||||||||||||

|

Valuation of debt at acquisition, net of amortization

|

1,142 | (214 | ) | 97 | 1,025 |

Accrued interest on Notes Receivable

|

2,135 | |||||||||||||||||

|

Acquired lease intangibles

|

16,962 | (5,134 | ) | 1,565 | 13,393 |

Contract deposits

|

1,090 | |||||||||||||||||

|

Accounts payable and accrued expenses

|

31,074 | (13,350 | ) | 1,066 | 18,790 |

Other

|

2,489 | |||||||||||||||||

|

Dividends and distributions payable

|

11,764 | - | - | 11,764 |

Total

|

$ | 57,593 | |||||||||||||||||

|

Share of losses in excess of inv. in unconsolidated affiliates

|

12,488 | - | (12,488 | ) | - | |||||||||||||||||||

|

Accounts payable to related parties

|

- | - | - | - | ||||||||||||||||||||

|

Other liabilities

|

22,657 | (8,667 | ) | 1,083 | 15,073 | |||||||||||||||||||

|

Liabilities of discontinued operations

|

11,911 | (9,529 | ) | - | 2,382 | |||||||||||||||||||

|

Total liabilities

|

1,209,177 | (693,575 | ) | 43,766 | 559,368 | |||||||||||||||||||

|

Shareholders' equity:

|

||||||||||||||||||||||||

|

Common shares

|

54 | - | - | 54 | ||||||||||||||||||||

|

Additional paid-in capital

|

635,414 | - | - | 635,414 | ||||||||||||||||||||

|

Accumulated other comprehensive income

|

(4,932 | ) | - | - | (4,932 | ) | ||||||||||||||||||

|

Retained earnings

|

43,341 | - | - | 43,341 | ||||||||||||||||||||

|

Total controlling interest

|

673,877 | - | - | 673,877 | ||||||||||||||||||||

|

Non-controlling interest in subsidiary

|

412,815 | (399,996 | ) | - | 12,819 | |||||||||||||||||||

|

Total shareholders' equity

|

1,086,692 | (399,996 | ) | - | 686,696 | |||||||||||||||||||

|

Total Liabilities and Shareholders' Equity

|

$ | 2,295,869 | $ | (1,093,571 | ) | $ | 43,766 | $ | 1,246,064 | |||||||||||||||

- 11 -

|

Notes Receivable

|

||||||||||||||||||||||||||||||||

|

(in thousands)

|

||||||||||||||||||||||||||||||||

|

Balance at

|

Balance at

|

Underlying third-party

|

||||||||||||||||||||||||||||||

|

December 31, 2012

|

First

|

March 31, 2013

|

Stated

|

Effective

|

first mortgage

|

|||||||||||||||||||||||||||

|

Quarter

|

Accrued

|

Interest

|

Interest

|

Maturity

|

Extension

|

Maturity | ||||||||||||||||||||||||||

|

Investment

|

Principal

|

Activity

|

Principal2

|

Interest

|

Total

|

Rate

|

Rate 1

|

Dates

|

Options

|

Amount

|

Dates

|

|||||||||||||||||||||

|

First mortgage notes

|

$ | 48,919 | $ | (5,400 | ) | $ | 43,519 | $ | 369 | $ | 43,888 | 7.75% | 9.27% |

2013 to 2014

|

- | n/a | n/a | |||||||||||||||

|

Mezzanine notes

|

49,526 | 119 | 49,645 | 1,720 | 51,365 | 14.11% | 14.79% |

2013 to 2020

|

- | 302,923 |

2014 thru 2019

|

|||||||||||||||||||||

|

Total notes receivable

|

$ | 98,445 | $ | (5,281 | ) | $ | 93,164 | $ | 2,089 | $ | 95,253 | 11.14% | 12.21% | |||||||||||||||||||

|

Notes:

|

||||||||||||||||||||||||||||||||

|

1 Inclusive of points and exit fees.

|

||||||||||||||||||||||||||||||||

|

2 Reconciliation of Notes Receivable to the Consolidated Balance Sheet

|

|

|||||||||||||||||||||||||||||||

|

Total Notes Receivable per above

|

$ | 93,164 | ||||||||||||||||||||||||||||||

|

Fund I first mortgage loan - seller financing for Kroger/Safeway sale

|

12,203 | |||||||||||||||||||||||||||||||

|

Total Notes Receivable per Consolidated Balance Sheet

|

$ | 105,367 | ||||||||||||||||||||||||||||||

- 12 -

|

2013 Guidance

|

||||

|

(in millions except per share amounts, all per share amounts are fully diluted)

|

||||

|

2013 Guidance

|

2012 Actual

|

|||

|

Overall:

|

||||

|

Fully diluted Common Shares and OP Units

|

54,600 - 55,800

|

51,150

|

||

|

Full year Funds from Operations ("FFO") per share

|

$1.17 to $1.25

|

$1.04

|

||

|

Earnings per Share ("EPS")

|

$0.66 to $0.71

|

$0.85

|

||

|

FFO Components:

|

||||

|

Core and pro-rata share of opportunity Fund ("Fund") portfolio income

|

$66.5 to $70.5

|

$47.6

|

||

|

Asset and property management fee income, net of TRS taxes

|

$14.5 to $15.0

|

$16.3

|

||

|

Transactional fee income, net of TRS taxes

|

$6.5 to $7.0

|

$6.8

|

||

|

Promote, RCP and other income, net of TRS taxes

|

$1.0 to $1.5

|

$1.5

|

||

|

General and administrative expense

|

$(24.5) to $(24.0)

|

$(23.4)

|

||

|

Total

|

$64.0 to $70.0

|

$48.8

|

||

- 13 -

|

Net Asset Valuation Information

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

(in thousands)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

CORE

|

FUND I

|

FUND II

|

FUND III

|

FUND IV

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Fund Level

|

AKR pro-rata share

|

Fund Level

|

AKR Pro-rata Share

|

Fund Level

|

AKR pro-rata share

|

Fund Level

|

AKR pro-rata share

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Quarterly

|

Annualized (x4)

|

%

|

$ |

Quarterly

|

Annualized (x4)

|

%

|

$ |

Quarterly

|

Annualized (x4)

|

%

|

$ |

Quarterly

|

Annualized (x4)

|

%

|

$ | ||||||||||||||||||||||||||||||||||||||||||||||||

|

Current NOI

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Net Operating Income - Continuing Operations

|

$ | 16,563 | $ | 66,252 |

|

-- | $ | 4,803 | $ | 19,212 | 20.00 | % | $ | 3,842 | $ | 6,894 | $ | 27,576 | 19.90 | % | $ | 5,488 | $ | 1,609 | $ | 6,436 | 23.12 | % | $ | 1,488 | |||||||||||||||||||||||||||||||||

|

Less: Net Operating Income of pre-stabilized assets

|

- | - | - | (1,803 | ) | (7,212 | ) | (1,435 | ) | (1,381 | ) | (5,524 | ) | (1,277 | ) | ||||||||||||||||||||||||||||||||||||||||||||||||

|

Net Operating Income of stabilized assets

|

4,803 | 19,212 | 3,842 | 5,091 | 20,364 | 4,053 | 228 | 912 | 211 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Cost to Date

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Cost basis of pre-stabilized assets

|

$ | 200,800 | $ | 40,160 | $ | 96,066 | $ | 19,118 | $ | 147,050 | $ | 33,998 | |||||||||||||||||||||||||||||||||||||||||||||||||||

|

Discontinued operations, contract price, net of debt

|

$ | 23,139 | $ | 4,628 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Debt

|

$ | 356,299 | $ | - | $ | 395,230 | $ | 76,095 | $ | 237,068 | $ | 43,034 | $ | 93,050 | $ | 21,513 | |||||||||||||||||||||||||||||||||||||||||||||||

|

Gross asset value1

|

16,000 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Net Asset Value

|

$ | 16,000 | 37.78 | % | $ |

6,045

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Notes:

|

|||||||||||||||||||||||||

|

1Fund I value is based on property appraisals. Pro-rata share is 20% (AKR promote) + 22% x 80% (AKR remaining share after promote) = 37.78%.

|

|||||||||||||||||||||||||

- 14 -

|

Selected Financial Ratios

|

|||||||||||||||||||

|

(in thousands)

|

|||||||||||||||||||

|

Three months ended March 31,

|

Three months ended March 31,

|

Three months ended December 31,

|

|||||||||||||||||

|

2013

|

2012

|

2013

|

2012

|

||||||||||||||||

|

COVERAGE RATIOS1

|

LEVERAGE RATIOS

|

||||||||||||||||||

|

Fixed-Charge Coverage Ratios

|

Debt4

|

$ | 496,941 | $ | 445,582 | ||||||||||||||

|

Total Market Capitalization

|

2,029,930 | 1,773,821 | |||||||||||||||||

|

EBITDA2 divided by:

|

$ | 18,844 | $ | 12,357 |

Debt/Total Market Capitalization

|

24 | % | 25 | % | ||||||||||

|

Interest expense

|

4,844 | 4,333 | |||||||||||||||||

|

Principal Amortization

|

607 | 788 |

Debt4, 6

|

$ | 444,241 | $ | 382,653 | ||||||||||||

|

Preferred Dividends

|

5 | 5 |

Total Market Capitalization

|

1,977,230 | 1,710,892 | ||||||||||||||

|

Fixed-Charge Coverage Ratio - Core Portfolio

|

3.5 | x | 2.4 | x |

Net Debt/Total Market Capitalization

|

22 | % | 22 | % | ||||||||||

|

EBITDA divided by:

|

$ | 22,484 | $ | 15,558 |

Debt + Preferred Equity (Preferred O.P. Units)

|

$ | 497,637 | $ | 446,211 | ||||||||||

|

Interest expense

|

5,776 | 5,396 |

Total Market Capitalization

|

2,029,930 | 1,773,821 | ||||||||||||||

|

Principal Amortization

|

814 | 906 |

Debt+Preferred Equity/Total Market Capitalization

|

25 | % | 25 | % | ||||||||||||

|

Preferred Dividends

|

5 | 5 | |||||||||||||||||

|

Fixed-Charge Coverage Ratio - Core Portfolio

|

Debt

|

$ | 356,299 | $ | 341,044 | ||||||||||||||

|

and Opportunity Funds

|

3.4 | x | 2.5 | x |

EBITDA (Annualized)

|

75,376 | 71,764 | ||||||||||||

|

Debt/EBITDA - Core Portfolio

|

4.7 | x | 4.8 | x | |||||||||||||||

|

Payout Ratios

|

|||||||||||||||||||

|

Debt5

|

$ | 311,843 | $ | 287,139 | |||||||||||||||

|

Dividends (Shares) & Distributions (OP Units) paid

|

$ | 11,763 | $ | 7,914 |

EBITDA (Annualized)

|

75,376 | 71,764 | ||||||||||||

|

FFO

|

16,846 | 9,298 |

Net Debt/EBITDA - Core Portfolio

|

4.1 | x | 4.0 | x | ||||||||||||

|

FFO Payout Ratio

|

70 | % | 85 | % | |||||||||||||||

|

Debt

|

$ | 496,941 | $ | 445,582 | |||||||||||||||

|

Dividends (Shares) & Distributions (OP Units) paid

|

$ | 11,763 | $ | 7,914 |

EBITDA (Annualized)

|

89,568 | 82,676 | ||||||||||||

|

AFFO

|

13,633 | 6,901 |

Debt/EBITDA - Core Portfolio and Opportunity Funds

|

5.5 | x | 5.4 | x | ||||||||||||

|

AFFO Payout Ratio

|

86 | % | 115 | % | |||||||||||||||

|

Debt6

|

$ | 444,241 | $ | 382,653 | |||||||||||||||

|

Dividends (Shares) & Distributions (OP Units) paid

|

$ | 11,763 | $ | 7,914 |

EBITDA (Annualized)

|

89,568 | 82,676 | ||||||||||||

|

FAD

|

12,819 | 5,995 |

Net Debt/EBITDA - Core Portfolio and Opportunity Funds

|

5.0 | x | 4.6 | x | ||||||||||||

|

FAD Payout Ratio

|

92 | % | 132 | % | |||||||||||||||

|

NOI (Annualized)

|

$ | 66,252 | $ | 58,056 | |||||||||||||||

|

Debt

|

356,299 | 341,044 | |||||||||||||||||

|

Notes:

|

Debt Yield - Core Portfolio

|

19 | % | 17.0 | % | ||||||||||||||

| 1Quarterly results are unaudited, although they reflect all adjustments, which in the opinion of | |||||||||||||||||||

|

management, are necessary for a fair presentation of operating results for the interim periods.

|

NOI (Annualized)

|

$ | 66,252 | $ | 58,056 | ||||||||||||||

|

The coverage ratios include the Company's pro-rata share of FFO, AFFO, EBITDA, interest

|

Debt5

|

311,843 | 287,139 | ||||||||||||||||

|

expense and principal amortization related to both the Company's consolidated and

|

Net Debt Yield - Core Portfolio

|

21 | % | 20.2 | % | ||||||||||||||

|

unconsolidated investments in joint ventures.

|

|||||||||||||||||||

|

2See page 8 for a calculation of EBITDA.

|

NOI (Annualized)

|

$ | 77,088 | $ | 65,844 | ||||||||||||||

|

3Represents preferred distributions on Preferred Operating partnership Units.

|

Debt

|

496,941 | 445,582 | ||||||||||||||||

|

4Includes the Company's pro-rata share of consolidated and unconsolidated joint venture debt.

|

Debt Yield - Core Portfolio and Opportunity Funds

|

16 | % | 14.8 | % | ||||||||||||||

|

5Reflects debt net of the current Core Portfolio cash balance at end of period.

|

|||||||||||||||||||

|

6Reflects debt net of the current Core Portfolio and pro-rata share of the Opportunity Funds

|

NOI (Annualized)

|

$ | 77,088 | $ | 65,844 | ||||||||||||||

|

cash balance at end of period.

|

Debt6

|

444,241 | 382,653 | ||||||||||||||||

|

Net Debt Yield - Core Portfolio and Opportunity Funds

|

17 | % | 17.2 | % | |||||||||||||||

- 15 -

|

Portfolio Debt - Summary

|

||||||||||||||||||||||||||||||||||||||||

|

Reconciliation from Pro-Rata Share of Debt to GAAP Debt per Financial Statement

|

||||||||||||||||||||||||||||||||||||||||

|

(in thousands)

|

||||||||||||||||||||||||||||||||||||||||

|

Acadia Pro-Rata Share of Debt 2

|

Reconciliation to Consolidated Debt as Reported

|

|||||||||||||||||||||||||||||||||||||||

|

Add:

|

Less:

|

Acadia

|

||||||||||||||||||||||||||||||||||||||

|

Core Portfolio

|

Opportunity Funds

|

Total

|

Noncontrolling

|

Pro-rata Share of

|

Consolidated

|

|||||||||||||||||||||||||||||||||||

|

Principal

|

Interest

|

Principal

|

Interest

|

|

Principal

|

Interest

|

Fixed vs

|

Interest Share of

|

Unconsolidated

|

Debt

|

||||||||||||||||||||||||||||||

|

Mortgage Notes Payable

|

Balance

|

Rate

|

Balance

|

Rate

|

Balance

|

Rate

|

Variable

|

Consolidated Debt 3

|

Debt 4

|

As Reported

|

||||||||||||||||||||||||||||||

|

Fixed-Rate Debt 1

|

$ | 356,299 | 5.5 | % | $ | 71,791 | 4.5 | % | $ | 428,090 | 5.3 | % | 86 | % | $ | 396,501 | $ | (48,370 | ) | $ | 776,221 | |||||||||||||||||||

|

Variable-Rate Debt

|

- | N/A | 68,851 | 2.6 | % | 68,851 | 2.6 | % | 14 | % | 260,179 | (4,072 | ) | 324,958 | ||||||||||||||||||||||||||

|

Total

|

$ | 356,299 | 5.5 | % | $ | 140,642 | 3.6 | % | $ | 496,941 | 4.9 | % | 100 | % | $ | 656,680 | $ | (52,442 | ) | 1,101,179 | ||||||||||||||||||||

|

Unamortized premium

|

1,142 | |||||||||||||||||||||||||||||||||||||||

|

Total debt as reported

|

$ | 1,102,321 | ||||||||||||||||||||||||||||||||||||||

|

Notes:

|

||||||||||||||||||||||||||||||||||||||||

|

1 Fixed-rate debt includes notional principal fixed through swap transactions.

|

||||||||||||||||||||||||||||||||||||||||

|

2 Represents the Company's pro-rata share of debt based on its percent ownership.

|

||||||||||||||||||||||||||||||||||||||||

|

3 Represents the noncontrolling interest pro-rata share of consolidated partnership debt based on its percent ownership.

|

||||||||||||||||||||||||||||||||||||||||

|

4 Represents the Company's pro-rata share of unconsolidated partnership debt based on its percent ownership.

|

||||||||||||||||||||||||||||||||||||||||

- 16 -

|

Portfolio Debt - Detail

|

||||||||||||||||||

|

(in thousands)

|

||||||||||||||||||

|

Principal Balance at

|

Acadia's Pro-rata Share

|

Interest

|

Maturity

|

Extension

|

||||||||||||||

|

Property

|

Entity

|

March 31, 2013

|

Percent

|

Amount

|

Rate

|

Date

|

Options

|

|||||||||||

|

CORE PORTFOLIO

|

||||||||||||||||||

|

Fixed-Rate Debt

|

||||||||||||||||||

|

Clark Diversey

|

Acadia

|

$ | 4,308 | 100.0 | % | $ | 4,308 | 6.35 | % |

7/1/2014

|

None

|

|||||||

|

New Loudon Center

|

Acadia

|

13,566 | 100.0 | % | 13,566 | 5.64 | % |

9/6/2014

|

None

|

|||||||||

|

Crossroads Shopping Center

|

Crossroads JV

|

59,078 | 49.0 | % | 28,948 | 5.37 | % |

12/1/2014

|

None

|

|||||||||

|

Crescent Plaza

|

Acadia

|

16,954 | 100.0 | % | 16,954 | 4.98 | % |

9/6/2015

|

None

|

|||||||||

|

Pacesetter Park Shopping Center

|

Acadia

|

11,688 | 100.0 | % | 11,688 | 5.12 | % |

11/6/2015

|

None

|

|||||||||

|

Elmwood Park Shopping Center

|

Acadia

|

33,125 | 100.0 | % | 33,125 | 5.53 | % |

1/1/2016

|

None

|

|||||||||

|

Chicago Portfolio

|

Acadia

|

15,764 | 100.0 | % | 15,764 | 5.61 | % |

2/1/2016

|

None

|

|||||||||

|

The Gateway Shopping Center

|

Acadia

|

19,962 | 100.0 | % | 19,962 | 5.44 | % |

3/1/2016

|

None

|

|||||||||

|

Cambridge (Whole Foods)

|

Acadia

|

6,903 | 100.0 | % | 6,903 | 6.26 | % |

5/1/2016

|

None

|

|||||||||

|

Cambridge (Rite Aid)

|

Acadia

|

4,170 | 100.0 | % | 4,170 | 3.68 | % |

5/1/2016

|

1 x 60 mos.

|

|||||||||

|

Brandywine Town Center

|

Brandywine JV

|

166,200 | 22.2 | % | 36,933 | 5.99 | % |

7/1/2016

|

None

|

|||||||||

|

Walnut Hill Plaza

|

Acadia

|

23,120 | 100.0 | % | 23,120 | 6.06 | % |

10/1/2016

|

None

|

|||||||||

|

Rhode Island Place Shopping Center

|

Acadia

|

16,369 | 100.0 | % | 16,369 | 6.35 | % |

12/1/2016

|

None

|

|||||||||

|

Acadia Realty Trust (Convertible Notes)

|

Acadia

|

930 | 100.0 | % | 930 | 3.75 | % |

12/15/2016

|

None

|

|||||||||

|

239 Greenwich Avenue

|

Acadia

|

26,000 | 75.0 | % | 19,500 | 5.42 | % |

2/11/2017

|

None

|

|||||||||

|

639 West Diversey

|

Acadia

|

4,409 | 100.0 | % | 4,409 | 6.65 | % |

3/1/2017

|

None

|

|||||||||

|

Merrillville Plaza

|

Acadia

|

26,069 | 100.0 | % | 26,069 | 5.88 | % |

8/1/2017

|

None

|

|||||||||

|

A & P Shopping Plaza

|

Acadia

|

7,934 | 60.0 | % | 4,760 | 4.20 | % |

9/6/2022

|

None

|

|||||||||

|

Georgetown Portfolio

|

Acadia

|

18,406 | 50.0 | % | 9,203 | 4.72 | % |

11/10/2027

|

None

|

|||||||||

|

Interest rate swaps1

|

Acadia

|

59,618 | 100.0 | % | 59,618 | 4.76 | % |

Various

|

||||||||||

|

Sub-Total Fixed-Rate Debt

|

534,573 | 356,299 | 5.46 | % | ||||||||||||||

|

Variable-Rate Debt

|

||||||||||||||||||

|

Branch Plaza

|

Acadia

|

12,467 | 100.0 | % | 12,467 |

Libor + 225

|

9/30/2014

|

1 x 36 mos.

|

||||||||||

|

Unsecured Line of Credit2

|

Acadia

|

- | 100.0 | % | - |

Libor + 155

|

1/31/2016

|

1 x 12 mos.

|

||||||||||

|

Village Commons Shopping Center

|

Acadia

|

9,163 | 100.0 | % | 9,163 |

Libor + 140

|

6/30/2018

|

None

|

||||||||||

|

West Diversey

|

Acadia

|

15,172 | 100.0 | % | 15,172 |

Libor + 190

|

4/27/2019

|

None

|

||||||||||

|

4401 N White Plains Road

|

Acadia

|

6,353 | 100.0 | % | 6,353 |

Libor + 190

|

9/1/2022

|

None

|

||||||||||

|

28 Jericho Turnpike

|

Acadia

|

16,463 | 100.0 | % | 16,463 |

Libor + 190

|

1/23/2023

|

None

|

||||||||||

|

Interest rate swaps1

|

Acadia

|

(59,618 | ) | 100.0 | % | (59,618 | ) |

Libor + 190

|

||||||||||

|

Sub-Total Variable-Rate Debt

|

- | - |

Libor + 190

|

|||||||||||||||

|

Total Core Portfolio Debt

|

$ | 534,573 | $ | 356,299 | 5.46 | % | ||||||||||||

- 17 -

|

Portfolio Debt - Detail (continued)

|

|||||||||||||||||||||

|

(in thousands)

|

|||||||||||||||||||||

|

Principal Balance at

|

Acadia's Pro-rata Share

|

Interest

|

Maturity

|

Extension

|

|||||||||||||||||

|

Property

|

Entity

|

March 31, 2013

|

Percent

|

Amount

|

Rate

|

Date

|

Options

|

||||||||||||||

|

OPPORTUNITY FUNDS

|

|||||||||||||||||||||

|

Fixed-Rate Debt

|

|||||||||||||||||||||

|

Lincoln Park Centre

|

Fund III

|

$ | 19,364 | 19.9 | % | $ | 3,854 | 5.85 | % |

12/1/2013

|

None

|

||||||||||

|

Lincoln Road6

|

Fund III

|

19,764 | 18.9 | % | 3,737 | 6.14 | % |

8/11/2014

|

None

|

||||||||||||

|

CityPoint

|

Fund II

|

20,000 | 18.8 | % | 3,766 | 7.25 | % |

11/1/2014

|

None

|

||||||||||||

|

Arundel Plaza7

|

Fund III

|

9,136 | 17.9 | % | 1,637 | 5.60 | % |

4/1/2015

|

None

|

||||||||||||

|

216th Street3

|

Fund II

|

25,500 | 19.8 | % | 5,054 | 5.80 | % |

10/1/2017

|

None

|

||||||||||||

|

CityPoint

|

Fund II

|

160,000 | 18.8 | % | 30,126 | 4.75 | % | 20198 |

None

|

||||||||||||

|

CityPoint

|

Fund II

|

5,262 | 18.8 | % | 991 | 1.00 | % |

8/23/2019

|

None

|

||||||||||||

|

Interest rate swaps1

|

Funds II & III

|

117,979 | 19.2 | % | 22,626 | 2.96 | % |

Various

|

|||||||||||||

|

Sub-Total Fixed-Rate Debt

|

377,005 | 71,791 | 4.49 | % | |||||||||||||||||

|

Variable-Rate Debt

|

|||||||||||||||||||||

|

Pelham Manor Shopping Plaza3

|

Fund II

|

33,759 | 19.8 | % | 6,691 |

Libor + 275

|

12/1/2013

|

None

|

|||||||||||||

|

Parkway Crossing7

|

Fund III

|

13,654 | 17.9 | % | 2,446 |

Libor + 220

|

1/1/2015

|

2 x 12 mos.

|

|||||||||||||

|

640 Broadway

|

Fund III

|

22,750 | 10.0 | % | 2,264 |

Libor + 295

|

7/1/2015

|

1 x 12 mos.

|

|||||||||||||

|

Heritage Shops

|

Fund III

|

21,000 | 19.9 | % | 4,179 |

Libor + 225

|

8/10/2015

|

2 x 12 mos.

|

|||||||||||||

|

CityPoint

|

Fund II

|

20,650 | 18.8 | % | 3,888 |

Libor + 250

|

8/12/2015

|

None

|

|||||||||||||

|

CityPoint

|

Fund II

|

20,000 | 18.8 | % | 3,766 |

Libor + 500

|

8/23/2015

|

1 x 12 mos.

|

|||||||||||||

|

Fordham Place3

|

Fund II

|

80,559 | 19.8 | % | 15,966 |

Libor + 300

|

9/25/2015

|

2 x 12 mos.

|

|||||||||||||

|

Cortlandt Towne Center

|

Fund III

|

73,303 | 19.9 | % | 14,587 |

Libor + 190

|

10/26/2015

|

None

|

|||||||||||||

|

New Hyde Park Shopping Center

|

Fund III

|

6,437 | 19.9 | % | 1,281 |

Libor + 225

|

11/10/2015

|

2 x 12 mos.

|

|||||||||||||

|

Acadia Strategic Opportunity IV LLC4

|

Fund IV

|

93,050 | 23.1 | % | 21,513 |

Libor + 165

|

11/20/2015

|

1 x 12 mos.

|

|||||||||||||

|

Nostrand Avenue

|

Fund III

|

12,957 | 19.9 | % | 2,578 |

Libor + 265

|

2/1/2016

|

2 x 12 mos.

|

|||||||||||||

|

White City Shopping Center5

|

Fund III

|

38,703 | 16.7 | % | 6,471 |

Libor + 260

|

12/23/2017

|

1 x 36 mos.

|

|||||||||||||

|

161st Street3

|

Fund II

|

29,500 | 19.8 | % | 5,847 |

Libor + 250

|

4/1/2018

|

None

|

|||||||||||||

|

Interest rate swaps1

|

Funds II & III

|

(117,979 | ) | 19.2 | % | (22,626 | ) |

Libor + 232

|

|||||||||||||

|

Sub-Total Variable-Rate Debt

|

348,343 | 68,851 |

Libor + 244

|

||||||||||||||||||

|

Total Opportunity Funds Portfolio Debt

|

$ | 725,348 | $ | 140,642 | 3.59 | % | |||||||||||||||

- 18 -

|

Portfolio Debt - Notes

|

||||||||||||||||

|

(in thousands)

|

||||||||||||||||

|

1The Company has hedged a portion of its variable-rate debt with variable to fixed-rate swap agreements as follows:

|

||||||||||||||||

|

Notional

|

Pro-rata

|

Average

|

Maturity

|

|||||||||||||

|

principal

|

Share

|

Swap rate

|

All-in Rate

|

Date

|

||||||||||||

|

Core Portfolio

|

||||||||||||||||

| $ | 9,163 | $ | 9,163 | 2.90 | % | 4.80 | % |

7/2/2018

|

||||||||

| 15,172 | 15,172 | 1.57 | % | 3.47 | % |

5/1/2019

|

||||||||||

| 6,353 | 6,353 | 1.75 | % | 3.65 | % |

9/1/2022

|

||||||||||

| 12,467 | 12,467 | 3.77 | % | 5.67 | % |

12/1/2022

|

||||||||||

| 16,463 | 16,463 | 3.77 | % | 5.67 | % |

1/23/2023

|

||||||||||

| 59,618 | 59,618 | 2.86 | % | 4.76 | % | |||||||||||

|

Opportunity Funds

|

||||||||||||||||

| 35,418 | 7,084 | 0.70 | % | 2.95 | % |

5/1/2015

|

||||||||||

| 32,589 | 6,518 | 0.70 | % | 2.95 | % |

5/1/2015

|

||||||||||

| 21,000 | 4,179 | 0.52 | % | 2.77 | % |

8/10/2015

|

||||||||||

| 19,315 | 3,230 | 2.90 | % | 5.50 | % |

12/26/2017

|

||||||||||

| 9,657 | 1,615 | 3.02 | % | 5.62 | % |

12/26/2017

|

||||||||||

| 117,979 | 22,626 | 1.15 | % | 2.96 | % | |||||||||||

|

Total Core Portfolio and Opportunity Funds

|

$ | 177,597 | $ | 82,244 | 1.63 | % | 2.99 | % | ||||||||

|

2This is an unsecured revolving facility which has a current capacity up to $150,000 and can be increased to $300,000.

|

|||||

|

The interest rate will vary based on levels of leverage. As of March 31, 2013, the interest rate is LIBOR + 155 basis points.

|

|||||

|

3Fund II is a 99.1% joint venture partner on this investment. As such, Acadia's pro-rata share of the above debt is 99.1% x 20%, or 19.8%.

|

|||||

|

4Total current availability under this facility is $150,000. Fund IV also has the ability to increase the size of this facility to a total of $272,069.

|

|||||

|

5Fund III is an 84.0% joint venture partner on this investment. As such, Acadia's pro-rata share of the above debt is 84.0% x 19.9%, or 16.7%.

|

|||||

|

6Fund III is a 95.0% joint venture partner on this investment. As such, Acadia's pro-rata share of the above debt is 95.0% x 19.9%, or 18.9%.

|

|||||

|

7Fund III is a 90.0% joint venture partner on this investment. As such, Acadia's pro-rata share of the above debt is 90.0% x 19.9%, or 17.9%.

|

|||||

|

8The maturity date of this loan is five years after the final advancing of funds which is anticipated to occur during 2014.

|

|||||

- 19 -

|

Future Debt Maturities1

|

|||||||||||||||||||||||||||||||||

|

(in thousands)

|

|||||||||||||||||||||||||||||||||

|

Core Portfolio

|

|||||||||||||||||||||||||||||||||

|

Total Debt Maturities

|

Acadia's Pro-rata Share

|

Weighted Average Interest Rate of Maturing Debt

|

|||||||||||||||||||||||||||||||

|

Scheduled

|

Scheduled

|

||||||||||||||||||||||||||||||||

|

Year

|

Amortization

|

Maturities

|

Total

|

Amortization

|

Maturities

|

Total

|

Total Debt

|

Fixed-Rate Debt

|

Variable-Rate Debt

|

||||||||||||||||||||||||

|

2013

|

$ | 4,399 | $ | - | $ | 4,399 | $ | 3,838 | $ | - | $ | 3,838 | n/a | n/a | n/a | ||||||||||||||||||

|

2014

|

5,972 | 86,500 | 92,472 | 5,181 | 57,374 | 62,555 | 5.05 | % | 5.47 | % | 2.45 | % | |||||||||||||||||||||

|

2015

|

4,460 | 27,344 | 31,804 | 4,248 | 27,344 | 31,592 | 5.04 | % | 5.04 | % | n/a | ||||||||||||||||||||||

|

2016

|

2,857 | 280,509 | 283,366 | 2,637 | 151,242 | 153,879 | 5.88 | % | 5.88 | % | n/a | ||||||||||||||||||||||

|

2017

|

1,943 | 54,549 | 56,492 | 1,711 | 48,049 | 49,760 | 5.72 | % | 5.72 | % | n/a | ||||||||||||||||||||||

|

Thereafter

|

9,440 | 56,600 | 66,040 | 6,901 | 47,774 | 54,675 | 2.84 | % | 4.55 | % | 1.99 | % | |||||||||||||||||||||

|

Total

|

$ | 29,071 | $ | 505,502 | $ | 534,573 | $ | 24,516 | $ | 331,783 | $ | 356,299 | |||||||||||||||||||||

|

Opportunity Funds

|

|||||||||||||||||||||||||||||||||

|

Total Debt Maturities

|

Acadia's Pro-rata Share

|

Weighted Average Interest Rate of Maturing Debt

|

|||||||||||||||||||||||||||||||

|

Scheduled

|

Scheduled

|

||||||||||||||||||||||||||||||||

|

Year

|

Amortization

|

Maturities

|

Total

|

Amortization

|

Maturities

|

Total

|

Total Debt

|

Fixed-Rate Debt

|

Variable-Rate Debt

|

||||||||||||||||||||||||

|

2013

|

$ | 3,747 | $ | 52,549 | $ | 56,296 | $ | 719 | $ | 10,431 | $ | 11,150 | 4.00 | % | 5.85 | % | 2.95 | % | |||||||||||||||

|

2014

|

4,593 | 39,179 | 43,772 | 850 | 7,393 | 8,243 | 6.71 | % | 6.71 | % | n/a | ||||||||||||||||||||||

|

2015

|

3,595 | 352,780 | 356,375 | 650 | 70,083 | 70,733 | 2.68 | % | 5.60 | % | 2.61 | % | |||||||||||||||||||||

|

2016

|

707 | 11,397 | 12,104 | 120 | 2,269 | 2,389 | 2.85 | % | n/a | 2.85 | % | ||||||||||||||||||||||

|

2017

|

576 | 61,463 | 62,039 | 96 | 11,067 | 11,163 | 4.04 | % | 5.80 | % | 2.80 | % | |||||||||||||||||||||

|

Thereafter

|

- | 194,762 | 194,762 | - | 36,964 | 36,964 | 4.34 | % | 4.63 | % | 2.70 | % | |||||||||||||||||||||

|

Total

|

$ | 13,218 | $ | 712,130 | $ | 725,348 | $ | 2,435 | $ | 138,207 | $ | 140,642 | |||||||||||||||||||||

|

Note:

|

||||||||

|

1 Does not include any applicable extension options

|

||||||||

- 20 -

|

Core Portfolio Retail Properties - Detail

|

||||||||||||||||||||||||||||||||||||||||

|

Leased

|

||||||||||||||||||||||||||||||||||||||||

|

Year

|

Acadia's

|

Gross Leaseable Area

|

In Place Occupancy

|

Occupancy

|

Annualized Base Rent PSF | |||||||||||||||||||||||||||||||||||

|

Property

|

Anchors

|

Acquired

|

interest

|

Anchors

|

Shops

|

Total

|

Anchors

|

Shops

|

Total

|

Total

|

Anchors

|

Shops

|

Total

|

|||||||||||||||||||||||||||

|

NEW YORK

|

||||||||||||||||||||||||||||||||||||||||

|

Connecticut

|

||||||||||||||||||||||||||||||||||||||||

|

239 Greenwich Avenue

|

- | 1998 | 75.0 | % | - | 16,834 | 16,834 | - | 100.0 | % | 100.0 | % | 100.0 | % | $ | - | $ | 92.35 | $ | 92.35 | ||||||||||||||||||||

|

181 Main Street

|

- | 2012 | 100.0 | % | - | 11,350 | 11,350 | - | 100.0 | % | 100.0 | % | 100.0 | % | - | 74.48 | 74.48 | |||||||||||||||||||||||

| - | 28,184 | 28,184 | - | 100.0 | % | 100.0 | % | 100.0 | % | - | 85.15 | 85.15 | ||||||||||||||||||||||||||||

|

New Jersey

|

||||||||||||||||||||||||||||||||||||||||

|

Elmwood Park Shopping Center

|

Walgreens, Pathmark (A&P)

|

1998 | 100.0 | % | 62,610 | 86,652 | 149,262 | 100.0 | % | 94.6 | % | 96.9 | % | 96.9 | % | 25.26 | 25.05 | 25.14 | ||||||||||||||||||||||

|

A & P Shopping Plaza

|

A&P

|

2006 | 60.0 | % | 49,463 | 13,278 | 62,741 | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 19.21 | 29.71 | 21.43 | ||||||||||||||||||||||

|

60 Orange Street

|

Home Depot

|

2012 | 98.0 | % | 101,715 | - | 101,715 | 100.0 | % | - | 100.0 | % | 100.0 | % | 6.83 | - | 6.83 | |||||||||||||||||||||||

|

Total - New Jersey

|

213,788 | 99,930 | 313,718 | 100.0 | % | 95.3 | % | 98.5 | % | 98.5 | % | 15.09 | 25.70 | 18.36 | ||||||||||||||||||||||||||

|

New York

|

||||||||||||||||||||||||||||||||||||||||

|

Village Commons Shopping Center

|

- | 1998 | 100.0 | % | - | 87,330 | 87,330 | - | 95.4 | % | 95.4 | % | 95.4 | % | - | 30.67 | 30.67 | |||||||||||||||||||||||

|

Branch Plaza

|

LA Fitness, CVS

|

1998 | 100.0 | % | 74,050 | 52,223 | 126,273 | 75.7 | % | 90.0 | % | 81.6 | % | 81.6 | % | 21.35 | 29.44 | 25.04 | ||||||||||||||||||||||

|

Amboy Center

|

Stop & Shop (Ahold)

|

2005 | 100.0 | % | 37,266 | 26,024 | 63,290 | 100.0 | % | 100.0 | % | 100.0 | % | 100.0 | % | 20.00 | 43.90 | 29.83 | ||||||||||||||||||||||

|

Bartow Avenue

|

- | 2005 | 100.0 | % | - | 14,676 | 14,676 | - | 92.8 | % | 92.8 | % | 100.0 | % | - | 30.91 | 30.91 | |||||||||||||||||||||||

|

Pacesetter Park Shopping Center

|

Stop & Shop (Ahold)

|

1999 | 100.0 | % | 52,052 | 45,531 | 97,583 | 100.0 | % | 88.4 | % | 94.6 | % | 94.6 | % | 8.24 | 18.66 | 12.78 | ||||||||||||||||||||||

|

LA Fitness

|

LA Fitness

|

2007 | 100.0 | % | 55,000 | - | 55,000 | 100.0 | % | - | 100.0 | % | 100.0 | % | 25.30 | - | 25.30 | |||||||||||||||||||||||

|

East 17th Street

|

Barnes & Noble

|

2008 | 100.0 | % | 10,382 | - | 10,382 | 100.0 | % | - | 100.0 | % | 100.0 | % | 60.20 | - | 60.20 | |||||||||||||||||||||||

|

Crossroads Shopping Center1

|

Kmart, Home Goods, Modell's

|

1998 | 49.0 | % | 201,296 | 108,227 | 309,523 | 81.0 | % | 70.5 | % | 77.3 | % | 78.1 | % | 9.93 | 45.13 | 21.15 | ||||||||||||||||||||||

|

Third Avenue

|

Planet Fitness

|

2006 | 100.0 | % | 21,650 | 18,670 | 40,320 | 100.0 | % | 55.3 | % | 79.3 | % | 79.3 | % | 21.65 | 19.19 | 20.85 | ||||||||||||||||||||||

|

Mercer Street

|

- | 2011 | 100.0 | % | - | 3,375 | 3,375 | - | 100.0 | % | 100.0 | % | 100.0 | % | - | 116.93 | 116.93 | |||||||||||||||||||||||

|

28 Jericho Turnpike

|

Kohl's

|