UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a-12

Acadia Realty Trust

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 10, 2018

TO THE COMPANY'S SHAREHOLDERS:

Please take notice that the annual meeting of shareholders (the "Annual Meeting") of Acadia Realty Trust (the "Company", "we", "us" and "our") will be held on Thursday, May 10, 2018, at 1:00 p.m., EDT time. This year's Annual Meeting will be a completely "virtual meeting" of shareholders. You will be able to attend the Annual Meeting, vote and submit your questions during the Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/AKR18. Prior to the Annual Meeting, you will be able to vote at www.proxyvote.com for the purpose of considering and voting upon:

1. | The election of eight Trustees to hold office until the next Annual Meeting or until their successors are duly elected and qualified; |

2. | The ratification of the appointment of BDO USA, LLP as the independent registered public accounting firm for the Company for the fiscal year ending December 31, 2018; |

3. | The approval, on an advisory basis, of the compensation of Named Executive Officers as disclosed in the Company's 2018 Proxy Statement in accordance with compensation rules of the Securities and Exchange Commission; |

4. | Such other business as may properly come before the Annual Meeting. |

The Board of Trustees of the Company recommends a vote "FOR" proposals 1 through 3. You should carefully review the accompanying Proxy Statement which contains additional information.

The Board of Trustees has fixed the close of business on March 16, 2018 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof.

By order of the Board of Trustees

Jason Blacksberg, Secretary

March 27, 2018

SHAREHOLDERS, WHETHER OR NOT THEY EXPECT TO ATTEND THE VIRTUAL MEETING, ARE REQUESTED TO VOTE THEIR SHARES ELECTRONICALLY VIA THE INTERNET OR BY COMPLETING AND RETURNING THE PROXY CARD, IF YOU REQUESTED PAPER PROXY MATERIALS. VOTING INSTRUCTIONS ARE PROVIDED IN THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS, OR, IF YOU REQUESTED PRINTED MATERIALS, THE INSTRUCTIONS ARE PRINTED ON YOUR PROXY CARD AND INCLUDED IN THE ACCOMPANYING PROXY STATEMENT.

ANY PERSON GIVING A PROXY HAS THE POWER TO REVOKE IT AT ANY TIME PRIOR TO THE MEETING, AND SHAREHOLDERS WHO ATTEND THE MEETING MAY WITHDRAW THEIR PROXIES AND VOTE DURING THE MEETING. IT IS IMPORTANT THAT YOU VOTE YOUR COMMON SHARES. YOUR FAILURE TO PROMPTLY VOTE YOUR SHARES INCREASES THE OPERATING COSTS OF YOUR INVESTMENT.

YOU ARE CORDIALLY INVITED TO ATTEND THE VIRTUAL MEETING VIA LIVE WEBCAST BY VISITING WWW.VIRTUALSHAREHOLDERMEETING.COM/AKR18, BUT YOU SHOULD SUBMIT A PROXY BY INTERNET OR MAIL PRIOR TO THE MEETING, WHETHER OR NOT YOU PLAN TO ATTEND.

ACADIA REALTY TRUST

411 THEODORE FREMD AVENUE, SUITE 300, RYE, NEW YORK 10580

PROXY STATEMENT

FOR THE

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD

May 10, 2018

GENERAL INFORMATION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Trustees ("Board of Trustees," "Trustees" or "Board") of Acadia Realty Trust (the "Company") for use at the annual meeting of shareholders scheduled to be held on Thursday, May 10, 2018, at 1:00 p.m., EDT time, via live webcast at www.virtualshareholdermeeting.com/AKR18, or any postponement or adjournment thereof (the "Annual Meeting"). This Proxy Statement and accompanying form of proxy were first sent to shareholders on or about March 27, 2018.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on May 10, 2018. This Proxy Statement and the Company's 2017 Annual Report to shareholders are available at www.acadiarealty.com/proxy.

The Company will bear the costs of the solicitation of its proxies in connection with the Annual Meeting, including the costs of retaining a third party that will assist the Company in preparing, assembling and mailing proxy materials and the handling and tabulation of proxies received. In addition to solicitation of proxies by mail, the Company's Board of Trustees, officers and employees may solicit proxies in connection with the Annual Meeting by e-mail, telephone, personal interviews or otherwise. Trustees, officers and employees will not be paid any additional compensation for soliciting proxies. Arrangements have been made with brokerage firms, custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of common shares of beneficial interest, par value $.001, of the Company, (the "Common Shares") held of record by such persons or firms with their nominees, and in connection therewith, such firms will be reimbursed for their reasonable out-of-pocket expenses in forwarding such materials.

All properly executed and unrevoked proxies in the accompanying form that are received in time for the Annual Meeting will be voted at the Annual Meeting in accordance with the specification thereon. If no specification is made, signed proxies will be voted "FOR" each of proposals 1 through 3 set forth in the Notice of Annual Meeting.

You may revoke your proxy and reclaim your right to vote:

• | by submitting a later-dated proxy either by Internet or telephone by following the instructions on your proxy or voting card; |

• | electronically during the Annual Meeting at www.virtualshareholdermeeting.com/AKR18 when you enter your 16-Digit Control Number; |

• | by submitting a later-dated written proxy to the address shown on your proxy or voting card; or |

• | if you are a holder of record, by (i) delivering by mail to the Company's Corporate Secretary at or prior to the Annual Meeting an instrument revoking your proxy or (ii) delivering a subsequently dated proxy with respect to the same Common Shares to the Board at or prior to the Annual Meeting. |

Any written notice revoking a proxy should be delivered at or prior to the Annual Meeting to the attention of the Corporate Secretary, Acadia Realty Trust, 411 Theodore Fremd Avenue, Suite 300, Rye, NY 10580.

The Board of Trustees recommends a vote "FOR" proposals 1 through 3.

OUTSTANDING SHARES AND VOTING RIGHTS

The outstanding capital shares of beneficial interest of the Company ("Shares") as of March 16, 2018 consisted of 82,602,889 Common Shares. Holders of Common Shares are entitled to one vote for each Common Share registered in their names on the record date. The Board of Trustees has fixed the close of business on March 16, 2018 as the record date for determination of shareholders entitled to notice of, and to vote at, the Annual Meeting. The presence, in person or by proxy, of the holders of Common Shares entitled to cast a majority of all the votes entitled to be vast at the Annual Meeting on any matter will constitute a quorum at the Annual Meeting.

1

The affirmative vote of a majority of all the votes cast by holders of Common Shares in person or by proxy at the Annual Meeting at which a quorum is present is required for (i) the election of each Trustee, (ii) the ratification of the appointment of BDO USA, LLP as the independent registered public accounting firm for the year ending December 31, 2018, and (iii) the advisory (non-binding) resolution approving the Company's executive compensation program for Named Executive Officers. With respect to any of the foregoing, an “affirmative vote of a majority of all the votes cast” means that the number of shares voted for such Trustee-nominee or proposal must exceed the number of shares voted against such Trustee-nominee or proposal. There is no cumulative voting in the election of Trustees.

With respect to a particular Trustee-nominee or proposal, holders of Common Shares may vote for or against such Trustee-nominee or proposal by marking "FOR" or "AGAINST," respectively, on their proxy. Alternatively, holders of Common Shares may abstain from voting on a particular Trustee-nominee or proposal by marking "ABSTAIN" on their proxy. Proxies marked "ABSTAIN" (or for which no vote is indicated) are included in determining the presence of a quorum for the Annual Meeting. Except with respect to broker non-votes, proxies for which no vote is indicated are treated as votes cast and are voted in accordance with the recommendation of the Board of Trustees as set forth in this Proxy Statement. Proxies marked "ABSTAIN," on the other hand, are not treated as votes cast and thus are not the equivalent of votes for or against a Trustee-nominee or any of the proposals, as the case may be, and will not affect the vote with respect to these matters.

A "broker non-vote" occurs when a nominee holding Common Shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received instructions with respect to that proposal from the beneficial owner (despite voting on at least one other proposal for which it does have discretionary authority or for which it has received instructions). Broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum. Of the proposals to be voted upon at the Annual Meeting, the only vote that a nominee may cast without receiving instructions from the beneficial owner is the vote to ratify the appointment of the independent registered public accounting firm. Signed proxies returned without specific voting instructions will be voted "FOR" proposals 1-3.

MATTERS TO BE VOTED ON AT OUR 2018 ANNUAL MEETING

Proposal | Board Recommendation | Page |

Proposal No. 1: Election of Trustees | FOR each nominee | X |

Proposal No. 2: Ratification of Independent Registered Public Accounting Firm | FOR | X |

Proposal No. 3: Advisory Approval of the Company’s Executive Compensation | FOR | X |

PROPOSAL 1 - ELECTION OF TRUSTEES

There are eight nominees for election as Trustees for one-year terms, expiring in 2019 or until their respective successors are duly elected and qualified. Election of each Trustee requires the approval of all the majority of the votes cast by the holders of Common Shares in person or by proxy at the Annual Meeting.

The Company's Declaration of Trust provides that the Board of Trustees may be composed of up to a maximum of 15 members. Pursuant to a resolution of the Board, the Board of Trustees currently consists of eight Trustees, each of whom serves until the next annual meeting or until his or her successor is duly elected and qualified. As stated elsewhere herein, the enclosed proxy will be voted for the election as Trustee of each nominee whose name is set forth below unless a contrary instruction is given. All of the nominees currently serve as Trustees of the Company. Management believes that all of its nominees are willing and able to serve the Company as Trustees. If any nominee at the time of election is unable or unwilling to serve or is otherwise unavailable for election, and as a consequence thereof, other nominees are designated, the persons named in the enclosed proxy or their substitutes will have the discretion and authority to vote or refrain from voting for other nominees in accordance with their discretion. The Board of Trustees has a Nominating and Corporate Governance Committee.

Trustee Independence

With seven independent Trustees out of eight, the Board has satisfied its objective that a majority of the Board should consist of independent Trustees. The Board of Trustees has affirmatively determined that each of Messrs. Crocker, Kellar, Spitz, Wielansky and Zoba, and Mss. Luscombe and Thurber is independent under the rules of the New York Stock Exchange. In determining this, the Board of Trustees considered transactions and relationships between each Trustee or any member of his or her immediate family and the Company and its subsidiaries and affiliates. The Board of Trustees has determined that each member of the Audit, Compensation and Nominating and Corporate Governance Committees is independent under the criteria for independence set

2

forth in the listing standards of the New York Stock Exchange. Upon the election of all nominees, the Company will continue to meet the New York Stock Exchange requirement for a majority of independent Trustees serving on the Board of Trustees.

Nominees for Election as Trustees

The table below provides a summary of information about the nominees for election as Trustees of the Company:

Committee Memberships | |||||||

Name | Age | Director Since | Independent | Audit | Compensation | Nominating and Corporate Governance | Investment/Capital Markets |

Kenneth F. Bernstein | 56 | 1998 | No | X(2) | |||

Lee S. Wielansky | 66 | 2000 | Yes | X | |||

Douglas Crocker II | 77 | 2003 | Yes | X | X | X(1) | |

Lorrence T. Kellar | 80 | 2003 | Yes | X(1) | X | ||

Wendy Luscombe | 66 | 2004 | Yes | X | X(1) | ||

William T. Spitz | 66 | 2007 | Yes | X | X(1) | X | |

Lynn C. Thurber | 71 | 2016 | Yes | X | X | ||

C. David Zoba | 66 | 2015 | Yes | X | X | ||

Notes:

(1) Chairman of the committee.

(2) Ex-Officio member of the committee.

Kenneth F. Bernstein, age 56

Professional Experience: Mr. Bernstein has been Chief Executive Officer ("CEO") of the Company since January of 2001. He has been the President and a Trustee of the Company since August 1998, when the Company acquired substantially all of the assets of RD Capital, Inc. ("RDC") and affiliates. From 1990 to August 1998, Mr. Bernstein was the Chief Operating Officer of RDC. In such capacity, he was responsible for overseeing the day-to-day operations of RDC, its management companies, and its affiliated partnerships. Prior to joining RDC, Mr. Bernstein was an associate at the New York law firm of Battle Fowler, LLP. Mr. Bernstein received his Bachelor of Arts Degree from the University of Vermont and his Juris Doctorate from Boston University School of Law. Mr. Bernstein sits on the Board of Trustees of the International Council of Shopping Centers ("ICSC") and serves as its 2017/2018 Chairman. He has previously served as the co-chair of the Committee on Open-Air Centers, National Association of Real Estate Investment Trusts ("NAREIT"), Urban Land Institute ("ULI"), and the Real Estate Roundtable. He is a member of the World President’s Organization (YPO-WPO), where he was the founding chairman of the Real Estate Network and currently sits on the Board of Advisors. Mr. Bernstein is a member of the Board of Trustees of Golub Capital.

Trustee Qualifications: The Board believes Mr. Bernstein's qualifications to sit on the Board include his extensive real estate, management and board experience. Highlights of these qualifications include Mr. Bernstein's:

• | service as president and chief executive officer of the Company for the past 17 years; |

• | extensive network of contacts in the real estate industry and his leadership positions with various industry and business associations; |

• | five years of experience as a real estate attorney; |

• | eight years of experience as the Chief Operating Officer of a private real estate company; and |

• | three years of experience as the Chief Operating Officer of a public real estate company. |

3

Douglas Crocker II, age 77

Professional Experience: Mr. Crocker has been a Trustee of the Company since November 2003. Mr. Crocker has been the managing partner of DC Partners LLC since 2013. He was the Chief Executive Officer of Equity Residential, a multi-family residential real estate investment trust ("REIT"), from December 1992 until his retirement in December of 2002. During Mr. Crocker's tenure, Equity Residential grew from 21,000 apartments with a total market capitalization of $700 million to a $17 billion company with over 225,000 apartments. Mr. Crocker was also a former Managing Director of Prudential Securities, and from 1982 to 1992 served as Chief Executive Officer of McKinley Finance Group, a privately held company involved with real estate, banking and corporate finance. From 1979 to 1982, Mr. Crocker was President of American Invesco, the nation's largest condominium conversion company, and from 1969 to 1979 served as Vice President of Arlen Realty and Development Company. He currently sits on the boards of the real estate investment trusts Colony Northstar. In addition, Mr. Crocker serves as a trustee of Milton Academy. Mr. Crocker has been a five-time recipient of Commercial Property News' Multifamily Executive of the Year Award, a three-time winner of their REIT Executive of the Year Award, a three-time winner of Realty Stock Review's Outstanding CEO Award, and received NAREIT's 2010 Edward H. Linde Industry Leadership Award. Mr. Crocker is also a member of the NACD.

Trustee Qualifications: The Board believes Mr. Crocker's qualifications to sit on the Board include his extensive CEO, board, financial and real estate experience. Highlights of these qualifications include Mr. Crocker's:

• | service as CEO of Equity Residential, a publicly traded REIT, for ten years; |

• | current service on the boards of directors of other REITs; |

• | past service on the audit committees of the boards of directors of a number of publicly traded companies; and |

• | over 40 years of experience in the real estate industry. |

Lorrence T. Kellar, age 80

Professional Experience: Mr. Kellar has been a Trustee of the Company since November 2003 and is an "audit committee financial expert" as that term is defined by the U.S. Securities and Exchange Commission ("SEC"). Mr. Kellar was Vice President at Continental Properties, a retail and residential developer from November 2002 until his retirement in November 2009. He is a director of Spar Group, Inc. and the recently retired chairman of Multi-Color Corporation. Prior to joining Continental Properties in November of 2002, Mr. Kellar served as Vice President of Real Estate with Kmart Corporation from 1996 to 2002. From 1965 to 1996, Mr. Kellar served with The Kroger Co., the country's largest supermarket company, where his final position was Group Vice President of Finance and Real Estate. Mr. Kellar is also a member of the NACD.

Trustee Qualifications: The Board believes Mr. Kellar's qualifications to sit on the Board include his extensive real estate development, public company board, asset management and mergers and acquisitions experience, as well as financial expertise. Highlights of these qualifications include Mr. Kellar's:

• | over 40 years of real estate operating and development experience; |

• | extensive experience managing financial functions, including general accounting, audit, finance, and treasury; |

• | qualification as an "audit committee financial expert" as that term is defined by the SEC; |

• | service on the boards of directors of eight public companies, including his service as the chair on two of those boards; |

• | service as chair of both the City of Cincinnati and Kroger pension funds; |

• | past service as chair of the Bartlett Management Trust mutual fund group; and |

• | involvement in a number of mergers and acquisitions transactions while with Kroger, U.S. Shoe, BT Office Products International and Multi-Color Corporation. |

4

Wendy Luscombe, age 66

Professional Experience: Ms. Luscombe has been a Trustee of the Company since May 2004. Since 1994 Ms. Luscombe has worked independently including being master advisor to the Prudential, PLC of the U.K. on its US real estate strategy and also asset managing its retail properties. From 1989 to 1994, Ms. Luscombe was based in London and was Chief Executive Officer of Taylor Woodrow Construction's urban renewal subsidiary, responsible for its London Dockland developments. She also worked on the Russian and Australian projects of a private developer. Prior to that, from 1979 to 1989, Ms. Luscombe was Chief Executive Officer of Pan American Properties, Inc. a New York based public REIT sponsored by the British Coal Pension Funds. During the same period she was also Chief Executive Officer and Chief Investment Officer of Buckingham Holdings, Inc. the U.S. private equity investor of the British Coal Pension Funds. Ms. Luscombe was responsible for the acquisition, management and disposition of all the assets of these two entities, including the unsolicited takeover of two publicly traded REITs. Ms. Luscombe has sat on the boards of both public and private companies in both the U.S. and Europe, including the Zweig Fund and Zweig Total Return Fund where she was Co-Lead Director from 2005-2013 and Deutsche Bank's International Real Estate Opportunity Funds (1A and B) where she was Chair of the Management Oversight Committee until 2014. She sat on the board of PXRE/Argo Reinsurance Company where she served as Chair of the Investment Committee from 1994 to 2007. Ms. Luscombe is also a member of the NACD and served as a member of NACD's teaching faculty, a Fellow of the Royal Institution of Chartered Surveyors and a Member of the Chartered Institute of Arbitrators. Her government and not for profit board service includes the Board of Governors of NAREIT, the Real Estate Advisory Committee for the New York State Common Retirement Fund and the Commission for the New Towns, a U.K. Government entity. She received her degree in Estate Management from Oxford Brookes University.

Trustee Qualifications: The Board believes Ms. Luscombe's qualifications to sit on the Board include her extensive real estate operational background, CEO experience, asset management experience, extensive board service and strong corporate governance, information security and risk management background. Highlights of these qualifications include Ms. Luscombe's:

• | experience as the CEO of a public equity REIT; |

• | experience as the CEO of a UK urban renewal developer; |

• | experience as the chief investment officer in the United States for a foreign pension fund and a real estate advisor to a U.S. pension fund; |

• | experience in a variety of real estate asset types including, among others, regional malls, community shopping centers and mixed use; |

• | service as an independent director for over 30 years, including service on audit, compensation, investment and nominating and corporate governance committees. and service as a co-lead director and committee chairs; |

• | experience as one of the first governors of NAREIT; |

• | successful launch of two successful contested REIT takeovers; |

• | qualification as an "audit committee financial expert" as that term is defined by the SEC; and |

• | all pre certification training for the information systems security professional (CISSP) and CERT in Certificate of Cyber Security Oversight. |

William T. Spitz, age 66

Professional Experience: Mr. Spitz has been a Trustee of the Company since August 2007. Mr. Spitz has served as a Director of Diversified Trust Company, a private wealth management trust company, for 24 years and has served as a Director and Principal since March 2009. Previously, he was Vice Chancellor for Investments and Treasurer of Vanderbilt University, Nashville, Tennessee from 1985 to July 2007. As Vice Chancellor for Investments at Vanderbilt, Mr. Spitz was responsible for managing the University's $3.5 billion endowment. He was also a member of the Senior Management Group of the University, which is responsible for the day- to-day operations of the institution. During his tenure, the Vanderbilt endowment earned returns in the top 10% of a broad universe of endowments for multiple time frames. While at Vanderbilt, Mr. Spitz conducted asset allocation studies and implemented detailed investment objectives and guidelines, developed a comprehensive risk management plan, invested in approximately two hundred limited partnerships in five illiquid assets classes, selected new custodians for both the endowment fund and the University's charitable remainder trusts and implemented a more aggressive approach to working capital management which increased returns by 2% per annum. In addition, Mr. Spitz was also on the faculty of Vanderbilt University as Clinical Professor of Management- Owen Graduate School of Management. He has also held various high-level positions with successful asset management companies and has served on the board of several companies, including Cambium Global Timber Fund, The Common Fund, MassMutual Financial, and the Bradford Fund. He has also served on multiple advisory committees, including Acadia's Opportunity Fund Advisory Boards, on which he served from 2001 to July 2007. Mr. Spitz is a published author and frequent speaker at industry conferences and seminars.

5

Trustee Qualifications: The Board believes Mr. Spitz's qualifications to sit on the Board include his asset management experience as well as real estate development, board, fund, and REIT experience. Highlights of these qualifications include Mr. Spitz's:

• | former role as Vice Chancellor for Investments and Treasurer of Vanderbilt University for over 20 years; |

• | former responsibilities managing Vanderbilt University's multi-billion dollar endowment fund; |

• | high-level positions with successful asset management companies; |

• | service on the boards of directors of several companies; |

• | service on multiple fund advisory committees, including, previously, the Company's fund advisory boards; |

• | involvement in numerous real estate development projects; |

• | former position as director of a private REIT; |

• | past service on the audit committee of MassMutual; and |

• | qualification as chartered financial analyst. |

Lynn C. Thurber, 71

Professional Experience: Ms. Thurber has been a Trustee of the Company since March 2016. Ms. Thurber is past chairman (2007-2017) of LaSalle Investment Management, a global real estate money management firm with over $55 billion of assets under management, investing in private real estate as well as publicly-traded real estate companies on behalf of institutional and individual investors. Prior to becoming chairman of LaSalle Investment Management, Ms. Thurber was the chief executive officer of LaSalle Investment Management from March 2000 to December 2006 and co-president from December 1994 to March 2000. Prior to Alex Brown, Kleinwort Benson (“ABKB”) Realty Advisors’ merger with LaSalle Partners in 1994, Ms. Thurber was chief executive officer of that company. Before joining ABKB in 1992, she was a principal at Morgan Stanley & Co. Ms. Thurber is chairman of the board of Jones Lang LaSalle Income Property Trust, an SEC registered, non-traded REIT. Ms. Thurber earned an M.B.A. from Harvard Business School and an A.B. from Wellesley College. Ms. Thurber is a member of the board of Duke Realty Corporation. Ms. Thurber is a board member and the past global Chairman of ULI-Urban Land Institute. In addition, Ms. Thurber is currently a member of the Wellesley College Business Leadership Council and a member of the board of the Bitterroot Land Trust. Ms. Thurber was the 2013 recipient of the Landauer White award from the Counselors of Real Estate and the 2015 recipient of the Lifetime Achievement Award from the ULI District Council of Chicago.

Trustee Qualifications: The Board believes Ms. Thurber’s qualifications to sit on the Board include her extensive real estate investment, capital markets and Board experiences. Highlights of these qualifications include Ms. Thurber's:

• | experience as CEO, Co-president or Chairman of real estate investment management companies for over twenty-two years; |

• | extensive experience investing in and managing real estate properties including retail shopping centers, neighborhood and community centers and mixed-use properties; |

• | experience in investing and managing real estate in private fund entities on behalf of institutional investors for twenty-six years; |

• | current service on two other public REIT boards and past service on another public real estate company board and numerous private real estate fund and company boards; |

• | service on audit, finance, nominating and compensation committees of real estate company boards; and |

• | over 35 years’ experience in the real estate industry |

Lee S. Wielansky, age 66

Professional Experience: Mr. Wielansky has been a Trustee of the Company since May 2000 and the Lead Trustee since 2004. Mr. Wielansky has been Chairman and Chief Executive Officer of Midland Development Group, Inc., which focuses on the development of retail properties in the mid-west and southeast, since May 2003. From November 2000 to March 2003, Mr. Wielansky served as Chief Executive Officer and President of JDN Development Company, Inc. and a director of JDN Realty Corporation through its merger with Developers Diversified Realty Corporation in 2003. He was also a founding partner and Chief Executive Officer of Midland Development Group, Inc. from 1983 through 1998 when the company sold its assets to Regency Centers Corporation. Mr. Wielansky is also Chairman of the Board of Brookdale Senior Living and a member of the NACD.

6

Trustee Qualifications: The Board believes Mr. Wielansky's qualifications to sit on the Board include his real estate development, public company board, fund, asset management and CEO experience. Highlights of these qualifications include Mr. Wielansky's:

• | over 38 years of real estate development experience; |

• | his role in developing over 150 shopping centers; |

• | his service as Chairman and CEO of Midland Development Group, Inc., which focuses on the development of retail properties in the mid-west and southeast, since May 2003; |

• | service on the boards of directors of four public companies, including two current public company directorships; |

• | service on compensation, nominating and corporate governance, and audit committees; |

• | current service as the Lead Trustee of the Company, a position he has held since 2004; |

• | responsibility for the asset management of 100 properties, accounting for over 11 million square feet; |

• | former position as CEO of JDN Development Company; and |

• | former position as Senior Vice President and Director of Regency Centers. |

C. David Zoba, age 66

Professional Experience: Mr. Zoba has been a Trustee of the Company since August 2015. Mr. Zoba retired on January 31, 2016 from his position as Senior Real Estate Strategy advisor for Gap Inc. that he held since 2015, after having served, since 2009, as Senior Vice President of Global Real Estate and Store Development for Gap Inc., the $15 billion retailer operating as Gap, Banana Republic, Old Navy, Athleta, Intermix and Outlet Brands. Immediately prior to joining Gap, Inc., Mr. Zoba was Principal and Chief Operating Officer for Steiner +Associates, one of the country's most respected mixed-use retail developers. From November 2004 through April 2006, Mr. Zoba served as president and chief operating officer of Premier Properties, a real estate development company. From 2001 through late 2004, Mr. Zoba worked for Galyan's Trading Company, Inc., where, as EVP, he helped create and launch a specialty sporting goods retailer that later became part of Dick's Sporting Goods. In the mid-1990s, Mr. Zoba was with The Limited (now L Brands) and served as chief transaction attorney, and then expanded his responsibilities significantly to other areas during his seven years there. Mr. Zoba earned his undergraduate degree from Harvard University and attended the London School of Economics for graduate studies. Mr. Zoba has a Juris Doctorate from Case Western Reserve University Law School. Since July 2015, Mr. Zoba has been Chairman (Non-Executive), Global Retail Leasing Board, with Jones Lang LaSalle Incorporated. Mr. Zoba is also an Executive Board Member and Chair of the Compensation Committee, International Council of Shopping Centers and serves on the governing board for this 65,000+ member shopping center real estate trade association. He serves as a consultant for Crown Acquisitions, Inc., serving as a non-employee consultant in connection with urban retail real estate acquisitions and in support of retailer relationships. Mr. Zoba also serves on the Board of PF Baseline Fitness, a franchisee of Planet Fitness. Mr. Zoba is also a co-founder and principal of Direct Brands Group, which is a start-up company that serves as a platform for operating international retail brands in North America under its “HiO” brand.

Trustee Qualifications: The Board believes Mr. Zoba's qualifications to sit on the Board include his extensive retail, real estate and Board experiences. Highlights of these qualifications include Mr. Zoba's:

• | management of real estate transactions and professionals for Gap Inc.'s 3,300 retail stores operating in 10 countries; |

• | experience as a chief transaction attorney; |

• | experience in growing retail brands in both North America and globally; |

• | service on the boards of directors of several companies; and |

• | experience in supporting the strategy and growth of the retail leasing business for global real estate services and consulting businesses. |

Vote Required; Recommendation

The election to the Board of Trustees of each of the eight nominees will require the affirmative vote of a majority of all the votes cast by the holders of Common Shares in person or by proxy at the Annual Meeting.

7

The Board of Trustees unanimously recommends that the shareholders vote "FOR" the election of each of the eight nominees to the Board of Trustees.

Unless otherwise indicated by a shareholder on a proxy and except with respect to broker non-votes, shares will be voted "FOR" the election of each nominee.

Because the election of nominees to the Board of Trustees is a non-routine matter under the rules of the New York Stock Exchange, brokerage firms, banks and other nominees who hold shares on behalf of clients in "street name" are not permitted to vote the Common Shares if the client does not provide instructions.

For additional information regarding voting requirements, please refer to "Outstanding Shares and Voting Rights" above.

PROPOSAL 2 - RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Trustees has selected BDO USA, LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2018 and has directed that the selection of the independent registered public accounting firm be submitted for ratification by the shareholders at the Annual Meeting.

Shareholder ratification of the selection of BDO USA, LLP as the Company's independent registered public accounting firm is not required by the Company's Declaration of Trust, Bylaws or otherwise. However, the Audit Committee is submitting the selection of BDO USA, LLP to the shareholders for ratification as a matter of what it considers to be good corporate practice. Notwithstanding the ratification of, or failure to, ratify the selection, the Audit Committee of the Board of Trustees in its discretion may direct the appointment of a different independent accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and its subsidiaries.

Representatives of BDO USA, LLP, the Company's auditors for 2017, are expected to be present at the Annual Meeting and will have the opportunity to make a statement if such representatives desire to do so and will be available to respond to appropriate questions.

Vote Required; Recommendation

The affirmative vote of a majority of all the votes cast by holders of Common Shares in person or by proxy at the Annual Meeting is required to ratify the appointment of BDO USA, LLP as the independent registered public accounting firm for the fiscal year ending December 31, 2018.

The Board of Trustees unanimously recommends that the shareholders vote "FOR" the ratification of BDO USA, LLP as the independent registered public accounting firm for the fiscal year ending December 31, 2018.

Unless otherwise indicated by a shareholder on a proxy and except with respect to broker non-votes, shares will be voted "FOR" such ratification.

For additional information regarding voting requirements, please refer to "Outstanding Shares and Voting Rights" above.

PROPOSAL 3 - ADVISORY APPROVAL OF THE COMPANY'S EXECUTIVE COMPENSATION

As required under the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the "Dodd-Frank Act"), the Company is seeking a non-binding shareholder vote approving the compensation of Named Executive Officers as disclosed in this Proxy Statement in accordance with SEC rules and as discussed in "Compensation Discussion and Analysis," the compensation tables and any related material. This vote is not intended to address any specific item of compensation, but rather the overall compensation of the Company's Named Executive Officers and the policies and practices described in this Proxy Statement.

The Board and management have thoughtfully designed the Company's executive compensation philosophy, policies and programs tailored with the understanding of the Company's business and the strategic mission of the Company.

The Compensation Committee's executive compensation objectives are as follows:

1. | Motivating the Company's Named Executive Officers to create maximum shareholder value. |

2. | Providing incentives to the Company's Named Executive Officers that reward dedication, hard work and success. |

8

3. | Providing a compensation program that ensures "pay for performance." |

4. | Aligning the interests of the Company's Named Executive Officers and shareholders as closely as possible. |

5. | Aligning the interests of the Company's Named Executive Officers and the Company's external fund investors as closely as possible. |

6. | Creating the right mix of long-term incentives to motivate and to retain the Company's Named Executive Officers. |

7. | Creating an incentive compensation program that can go beyond the Company's Named Executive Officers and be utilized throughout the organization. |

Vote Required; Recommendation

The affirmative vote of a majority of all the votes cast by holders of Common Shares in person or by proxy at the Annual Meeting is required to approve the advisory (non-binding) resolution approving the Company's executive compensation program for Named Executive Officers as set forth in this Proxy Statement. Because the shareholder vote is advisory, the results will not be binding upon the Board. However, the Compensation Committee will take the outcome of the vote expressed by the shareholders into consideration for future executive compensation arrangements.

The Board of Trustees unanimously recommends that the shareholders vote "FOR" the approval, on an advisory basis, of the Company's executive compensation program for Named Executive Officers as set forth in this Proxy Statement.

Unless otherwise indicated by a shareholder on a proxy and except with respect to broker non-votes, shares will be voted "FOR" the approval of the executive compensation.

Because this proposal is a non-routine matter under the rules of the New York Stock Exchange, brokerage firms, banks and other nominees who hold Common Shares on behalf of clients in "street name" are not permitted to vote the Common Shares if the client does not provide instructions.

For additional information regarding voting requirements, please refer to "Outstanding Shares and Voting Rights" above.

BOARD OF TRUSTEES

Trustee Meetings and Attendance

During 2017, the Board of Trustees held four in-person meetings, the Audit Committee held five telephonic meetings, the Compensation Committee held four in-person meetings and had a number of telephonic discussions, the Nominating and Corporate Governance Committee held one in person meeting and two telephonic meetings and the Investment/Capital Markets Committee held numerous telephonic discussions to discuss potential transactions. The Board of Trustees believes consistent attendance with a minimum of missed meetings is important in carrying out the responsibilities of being a Trustee. The average attendance in the aggregate of the total number of Board of Trustees and committee meetings was 99%. No Trustee attended fewer than 91% of the aggregate of all meetings of the Board of Trustees and applicable committee meetings.

The Company does not have a formal policy requiring Trustees to be present at Annual Meetings, although the Company does encourage their attendance. All of the Company's Trustees attended the 2017 Annual Meeting.

9

Board Leadership Structure

The Board's Lead Trustee and the Company's Chief Executive Officer generally serve as the leadership of the Board. The Company does not have a chairperson of the Board. Mr. Wielansky, an independent Trustee who serves as a member of the Investment/Capital Markets Committee, has been selected by the Board to serve as the Lead Trustee. The duties of the Lead Trustee include, without limitation, the following:

• | to chair and facilitate discussions among the independent Trustees; |

• | to facilitate communication between the independent Trustees, the Chief Executive Officer and management; |

• | to assist in the planning and preparation of meetings of the independent Trustees and meetings of the Board of Trustees, including the preparation of the agendas for such meetings; |

• | to be available to participate in any and all committee meetings, as needed; and |

• | to act as the spokesperson of the independent Trustees in matters dealing with the press and public when called upon. |

The Lead Trustee has final say on the agenda for all Board meetings.

The Chief Executive Officer presides over the regular meetings of the Board of Trustees, calling each meeting to order and leading the Trustees through the agenda items. The Lead Trustee presides over all meetings of the non-management Trustees held in executive session. "Non-management" Trustees are all those who are not Company officers and include Trustees, if any, who are not "independent" by virtue of the existence of a material relationship with the Company (although all of the current non-management trustees are also independent). An executive session is held in conjunction with each regularly scheduled Board meeting and other executive sessions may be called by the Lead Trustee in his own discretion or at the request of the Board. The Lead Trustee's responsibilities are more fully described in the Company's Corporate Governance Guidelines, which are available on the Company's website at www.acadiarealty.com in the "Investors - Corporate Governance" section. Please note that the information on the Company's website is not incorporated by reference in this Proxy Statement.

Because the Chief Executive Officer is the Trustee most familiar with the Company's business and industry and is the most capable of effectively identifying strategic priorities and leading the discussion regarding the execution of the Company's strategy, discussion at Board meetings is usually led by the Chief Executive Officer. Independent Trustees and management have different perspectives and roles in strategy development. The Company's independent Trustees bring experience, oversight and expertise from outside the Company, while the Chief Executive Officer brings company-specific experience and expertise. The Board believes that its leadership structure is appropriate because it combines an appropriate balance between independent leadership through the use of a Lead Trustee and strategy development, which results from the Chief Executive Officer leading the discussions on most Board topics.

Committees of the Board of Trustees

The Board of Trustees has standing Audit, Compensation, Nominating and Corporate Governance and Investment/Capital Markets Committees. The functions of each committee are detailed in its respective committee charter, which are available on the Company's website at www.acadiarealty.com in the "Investors - Corporate Governance" section. Please note that the information on the Company's website is not incorporated by reference in this Proxy Statement.

Audit Committee

The Audit Committee is empowered to engage the Company's independent registered public accounting firm and review the scope and results of the audit. The Audit Committee examines the accounting practices and methods of control and the manner of reporting financial results. These reviews and examinations include meetings with independent auditors, staff accountants and representatives of management. The results of the Audit Committee's examinations and the choice of the Company's independent registered public accounting firm are reported to the full Board of Trustees. The Audit Committee includes no officers or employees of the Company or any of its subsidiaries.

The Audit Committee held five telephonic meetings during the last fiscal year.

The Audit Committee Charter requires that the Audit Committee be comprised of at least three members, each of whom is "independent," as defined by the listing standards of the New York Stock Exchange and at least one of whom is an "audit committee financial expert," as that term is defined by the SEC.

10

The following Trustees are members of the Audit Committee: Mr. Kellar (Chair), Ms. Luscombe, Mr. Spitz and Ms. Thurber. Mr. Kellar and Ms. Luscombe have served as members of the Audit Committee since the 2004 Annual Meeting, Mr. Spitz was appointed a member in February 2010 and Ms. Thurber has been on the Audit Committee since 2016. The Board has determined that each of these members meets the independence requirements for members of audit committees prescribed by the listing standards of the New York Stock Exchange. Mr. Kellar serves on the audit committee of one other public company. The Board has determined that the participation by Mr. Kellar on this other audit committee does not impair his ability to serve effectively on the Company's Audit Committee. The Board has determined that Mr. Kellar and Ms. Luscombe are each an "audit committee financial expert," as that term is defined by the SEC. See the biographical information in "PROPOSAL 1 - ELECTION OF TRUSTEES" for their relevant experience.

Compensation Committee

The Compensation Committee is responsible for administering the 2006 Plan and recommending to the full Board the compensation of the executive officers of the Company. With respect to the Chief Executive Officer, the Compensation Committee, either as a Committee or together with the other independent trustees (as directed by the Board), is responsible for determining and approving the Chief Executive Officer's compensation level. In addition, the Compensation Committee evaluates the Chief Executive Officer's performance, coordinates and reviews the Company's succession plans related to the Chief Executive Officer and other executive officers and reports the status of such plans to the Board annually.

The Compensation Committee held four in-person meetings and had a number of telephonic discussions during the last fiscal year.

The Compensation Committee Charter requires that the Compensation Committee be comprised of at least two members, with all committee members being "independent" as defined by the listing standards of the New York Stock Exchange.

The members of the Compensation Committee during the last fiscal year were Messrs. Spitz (Chair), Kellar and Crocker and Ms. Thurber. Mr. Spitz and Mr. Crocker have served as members since 2007, Mr. Kellar has served as a member since 2004 and Ms. Thurber has served as a member since 2016. The Board of Trustees has determined that each of these members is independent within the meaning of the listing standards of the New York Stock Exchange. See "Acadia Realty Trust Compensation Committee Report" below.

For information relating to the compensation consultant hired by the Compensation Committee, please refer to the discussions under the headings "Role of the Independent Compensation Consultant and Use of Peer Group Data" in "Compensation Discussion and Analysis" below.

Compensation Committee Interlocks and Insider Participation

During 2017, none of the Compensation Committee members (i) were officers or employees of the Company or any of its subsidiaries; (ii) are former officers of the Company or any of the Company's subsidiaries or (iii) had any relationship with the Company requiring disclosure under Item 404 of Regulation S-K. In addition, during the last completed fiscal year, none of the executive officers of the Company served as:

• | a member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, in an instance where one of such entities' executive officers served on the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire Board of Trustees) of the Company; |

• | a director of another entity, in an instance where one of such entities' executive officers served on the Compensation Committee of the Company; or |

• | a member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, in an instance where one of such entities' executive officers served as a Trustee of the Company. |

11

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for reviewing the qualifications and performance of the Board of Trustees and recommending nominees for Trustees and Board committees to the Board. The Nominating and Corporate Governance Committee is also responsible for recommending to the Board changes in the Company's Corporate Governance Guidelines. The Nominating and Corporate Governance Committee Charter requires the Nominating and Corporate Governance Committee to be comprised of at least two members, each of whom is "independent" as defined by the listing standards of the New York Stock Exchange.

The Nominating and Corporate Governance Committee held one in person meetings and two telephonic meetings during the last fiscal year.

Members of the Nominating and Corporate Governance Committee during the last fiscal year were Ms. Luscombe (Chair), who has served since 2005, Mr. Crocker, who has served since August 2005 and Mr. Zoba who has served since November 2015. The Board of Trustees has determined that these members are independent within the meaning of the listing standards of the New York Stock Exchange.

The Nominating and Corporate Governance Committee will consider all shareholder recommendations for candidates for the Board of Trustees. All shareholder recommendations should be sent to the Company's Corporate Secretary at Acadia Realty Trust, 411 Theodore Fremd Avenue, Suite 300, Rye, New York 10580, and should include all information relating to such person that is required to be disclosed in a proxy statement for the election of Trustees or is otherwise required pursuant to Regulation l4A under the Exchange Act. Shareholders must also include the nominee's written consent to being named in the proxy statement as a nominee and to serving as a Trustee if elected. Furthermore, the shareholder giving the notice and the beneficial owner, if any, on whose behalf the nomination is made must include their names and addresses as they appear on the Company's books, as well as the class and number of Common Shares of the Company that they beneficially own. The Nominating and Corporate Governance Committee may identify other candidates, if necessary, through recommendations from directors, management, employees or outside consultants. The Nominating and Corporate Governance Committee will review candidates in the same manner regardless of the source of the recommendation. The Committee received no shareholder recommendations for candidates for the Board of Trustees for this Annual Meeting. Under the Company's Bylaws, if a shareholder wishes to put forward a nominee for Trustee, it must deliver notice of such nominee to the Company's Corporate Secretary not less than 120 days and no more than 150 days prior to the first anniversary date of the proxy statement for the preceding year's annual meeting, provided, however, that in the event that the date of the annual meeting is advanced or delayed by more than 30 days from the anniversary date of the preceding year's annual meeting, notice by the shareholder must be so delivered not earlier than the 150th day prior to such annual meeting and not later than 5:00 p.m., Eastern Time, on the later of the 120th day prior to such annual meeting or the tenth day following the day on which public announcement of the date of such annual meeting is first made. See "Submission of Shareholder Proposals" below.

Trustee Qualifications and Review of Trustee Nominees

The Nominating and Corporate Governance Committee makes recommendations to the Board of Trustees regarding the size and composition of the Board. The Nominating and Corporate Governance Committee annually reviews the composition of the Board as a whole and recommends, if necessary, measures to be taken so that the Board reflects the appropriate balance of knowledge, experience, skills, expertise and diversity of backgrounds, experience and competencies required for the Board as a whole and contains at least the minimum number of independent Trustees required by applicable laws and regulations. The Nominating and Corporate Governance Committee is responsible for ensuring that the composition of the Board accurately reflects the needs of the Company to execute its strategic plan and achieve its objectives. In the event the Nominating and Corporate Governance Committee determines that additional expertise is needed on the Board, or if there is a vacancy, the Nominating and Corporate Governance Committee expects to use its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm.

The Company's strategic plan can be summarized in the following broad categories:

• | Maintain a strong balance sheet; |

• | Maintain a strong core portfolio; |

• | Enhance the Company's external growth platform; and |

• | Utilize its experienced management team. |

12

In evaluating a Trustee candidate, the Nominating and Corporate Governance Committee considers factors that are in the best interests of the Company and its shareholders, including the knowledge, experience, integrity and judgment of the candidate; the potential contribution of the candidate to the diversity of backgrounds, experience and competencies required by the Board; the candidate's ability to devote sufficient time and effort to his or her duties as a Trustee; independence and willingness to consider all strategic proposals and oversee the agreed-upon strategic direction of the Company; and any other criteria established by the Board, as well as other core competencies or technical expertise necessary to fill all of the committees of the Board.

Each nominee meets the foregoing criteria and also brings a strong and unique background and set of skills to the Board, giving the Board, as a whole, competence and experience in a wide variety of areas. The skills include:

• | General real estate experience; |

• | Real estate investment experience; |

• | Asset management experience; |

• | REIT experience; |

• | Financial expertise; |

• | Real estate development experience; |

• | Public company board service; |

• | Information systems security and cyber risk oversight; |

• | Corporate governance expertise; |

• | CEO experience; |

• | Experience in risk management; |

• | Experience in mergers and acquisitions; and |

• | Experience in supporting strategy and growth of the retail leasing business. |

Investment/Capital Markets Committee

The Investment/Capital Markets Committee (the "Investment Committee") has been established for the primary purpose of (i) screening all transactions that are within certain defined pre-approval limits to ensure such transactions are within such limits, (ii) acting as the pricing committee for all equity offerings and (iii) for other investments and capital market transactions, exercising such authority as is given to it from time to time by the Board of Trustees. The Investment Committee has the authority to obtain advice and assistance from outside legal, accounting or other advisors as deemed appropriate to perform its duties and responsibilities.

The Investment Committee held numerous informal telephonic discussions to discuss potential transactions during the last fiscal year.

The Investment Committee Charter requires that it be comprised of at least three members, each of whom is "independent" as defined by the listing standards of the New York Stock Exchange. The Company's Chief Executive Officer is an ex-officio member of the Investment Committee. Messrs. Crocker (Chair) and Wielansky have served as the members of the Investment Committee since the 2004 Annual Meeting, Mr. Spitz has served since 2007 and Mr. Zoba has served since November 2015. The Board of Trustees has determined that Messrs. Crocker, Wielansky, Spitz and Zoba are "independent" within the meaning of the listing standards of the New York Stock Exchange.

Communication with Trustees

You may communicate directly with the Board of Trustees by sending correspondence to the Company's Corporate Secretary at Acadia Realty Trust, 411 Theodore Fremd Avenue, Suite 300, Rye, New York 10580. The sender should indicate in the address whether it is intended for the entire Board, the independent Trustees as a group, or to an individual Trustee. Each communication intended for the Board, the independent Trustees or an individual Trustee received by the Corporate Secretary will be promptly forwarded to the intended recipients in accordance with the sender's instructions.

13

Other Corporate Governance Initiatives

The Company regularly monitors developments in the area of corporate governance and continues to enhance the Company's corporate governance structure based upon a review of new developments and recommended best practices.

On November 6, 2017, the Board of Trustees approved a resolution to opt out of Section 3-803 of Subtitle 8 of Title 3 of the Maryland General Corporation Law ("MGCL"), commonly referred to as the "Maryland Unsolicited Takeover Act" or "MUTA". MUTA contains statutory provisions that allow the Board, without shareholder approval, to elect to classify into three classes with staggered three-year terms. To effectuate the opt out, in accordance with Sections 3-802(c) and 3-802(d) of the MGCL, on November 9, 2017, the Company filed Articles Supplementary ("Articles Supplementary") with the State Department of Assessments and Taxation of Maryland. The Articles Supplementary prohibit the Company, without the affirmative vote of a majority of the votes cast on the matter by shareholders entitled to vote generally in the election of trustees, from classifying the Board.

The Company's corporate governance materials, including the Company's Corporate Governance Guidelines, Code of Business Conduct and Ethics, Whistle Blower Policy and standing committee charters may be found on the Company's website at www.acadiarealty.com in the "Investors - Corporate Governance" section. Please note that the information on the Company's website is not incorporated by reference in this Proxy Statement. Copies of these materials are also available to shareholders upon written request to the Company's Corporate Secretary, Acadia Realty Trust 411 Theodore Fremd Avenue, Suite 300, Rye, New York 10580.

Risk Oversight

The entire Board and each of its committees are involved in overseeing risk associated with the Company.

Financial and Accounting

The Board and the Audit Committee monitor the Company's financial and regulatory risk through regular reviews with management and internal and external auditors and other advisors. In its periodic meetings with the internal auditors and the independent registered public accounting firm, the Audit Committee discusses the scope and plan for the internal audit and the audit conducted by the independent registered accounting firm, and includes management in its review of accounting and financial controls and assessment of business risks.

Governance and Succession

The Board and the Nominating and Corporate Governance Committee monitor the Company's corporate governance policies and procedures by regular review with management and outside advisors. The Board and the Compensation Committee monitor CEO succession and the Company's compensation policies and related risks by regular reviews with management and the Committee's outside advisors.

Cyber Security

The Company is aware of the existence of threats to cyber security and issues related to cyber security form an integral part of the Board’s and the Audit Committee’s risk analysis and discussions with management. While the Company attempts to mitigate these risks by employing a number of measures, including a dedicated information technology team, employee training and background checks, comprehensive monitoring of the Company’s networks and systems and maintenance of backup systems and redundancy along with purchasing available insurance coverage, the Company’s systems, networks and services remain potentially vulnerable to advanced threats.

Compensation

As part of its oversight of the Company's executive compensation program, the Compensation Committee considers the impact of the Company's executive compensation program, and the incentives created by the compensation awards that it administers, on the Company's risk profile. In addition, the Company reviews all of its compensation policies and procedures, including the incentives that they create and factors that may reduce the likelihood of excessive risk taking, to determine whether they present a significant risk to the Company. Based on these reviews, the Company has concluded that its compensation policies and procedures are not reasonably likely to have a material adverse effect on the Company.

14

MANAGEMENT

Executive Officers

The executive officers of the Company as of the date of this Proxy Statement are as follows:

Name | Age | Office Held | Year First Became Officer/Trustee | Term Expires |

Kenneth F. Bernstein | 56 | Trustee, Chief Executive Officer and President | 1998 | 2018 |

John Gottfried | 46 | Senior Vice President and Chief Financial Officer | 2016 | - |

Joel Braun | 66 | Executive Vice President and Chief Investment Officer | 1998 | - |

Christopher Conlon | 58 | Executive Vice President and Chief Operating Officer | 2008 | - |

Joseph M. Napolitano | 53 | Senior Vice President and Chief Administrative Officer | 1998 | - |

Jason Blacksberg | 42 | Senior Vice President, General Counsel, Chief Compliance Officer and Secretary | 2014 | - |

Biographical information with respect to Mr. Bernstein is set forth under "PROPOSAL 1 - ELECTION OF TRUSTEES," above.

John Gottfried, age 46, joined the Company in June 2016 as Chief Financial Officer. Mr. Gottfried is responsible for all accounting, financial reporting, budgeting/forecasting, real estate finance, capital market activities, tax and treasury functions. Mr. Gottfried joined Acadia after 18 years at PwC, where he was a Partner and most recently served as the assurance leader of PwC’s New York City Real Estate practice. He earned a Bachelor of Science degree in Business Administration from the University of Dayton and is a Certified Public Accountant and a member of the American Institute of Certified Public Accountants.

Joel Braun, age 66, has been Chief Investment Officer of the Company since January 2007. Mr. Braun was a Senior Vice President of the Company from August 1998 until January 2007 when he was named Executive Vice President. Mr. Braun is responsible for all of the Company's merger and acquisition activities. Previously, Mr. Braun was Vice President of Acquisitions for RDC. Mr. Braun holds a Bachelor's Degree in Business Administration and Psychology from Boston University and a Master's Degree in Planning from The Johns Hopkins University.

Christopher Conlon, age 58, has been Executive Vice President/Chief Operating Officer of the Company since January 2012. From February 2008 through 2011, Mr. Conlon served as Senior Vice President - Leasing and Development. From 1992 to 2007, Mr. Conlon was a partner at Ripco Real Estate Corporation where he was responsible for the leasing and development/redevelopment of neighborhood shopping centers, vertical urban retail centers and mixed-use properties with retail components. Mr. Conlon received his Bachelor of Arts from the State University of New York at Stony Brook and his J.D. from St. John's University School of Law.

Joseph M. Napolitano, age 53, has been Senior Vice President and Chief Administrative Officer of the Company since April 2007. He is accountable for managing the Company’s property management, human resources, marketing and information technology disciplines. Mr. Napolitano has been with the Company since January 1995, and has 35 years of real estate experience. Mr. Napolitano has a bachelor’s degree in Business Administration from Adelphi University, is a Master Human Capital Strategist (MHCS) as certified by the Human Capital Institute, is a Certified Property Manager (CPM) by the Institute of Real Estate Management, and is a Real Property Administrator (RPA) certified by the Building Owners and Managers Institute International. Mr. Napolitano is also a board member for DDI (Developmental Disabilities Institute), a non-profit, multi-site agency serving the special needs of children with Autism and other developmental disabilities.

Jason Blacksberg, age 42, has been Senior Vice President and General Counsel for the Company since May 2014, as well as Chief Compliance Officer and Corporate Secretary since 2016. He is accountable for leading and executing Acadia’s legal strategy and affairs. Prior to joining the Company, Mr. Blacksberg was Senior Vice President of Investments & Assistant General Counsel at the Trump Organization. Prior to joining Trump, Mr. Blacksberg was an Associate at the law firm of Davis Polk & Wardwell. Mr. Blacksberg began his legal career as a law clerk to Chief Judge Marilyn Huff in the U.S. District Court, Southern District of CA. He received his law degree from Georgetown University Law Center and his bachelor's degree from the University of Pennsylvania.

15

COMPENSATION DISCUSSION AND ANALYSIS

The "Compensation Discussion and Analysis" section of this Proxy Statement presents the detailed compensation arrangements for the Company's Named Executive Officers ("NEOs") for fiscal year 2017, which were determined by the Compensation Committee. For the fiscal year ended December 31, 2017, the Company's NEOs and their titles were as follows:

•Kenneth F. Bernstein - President and Chief Executive Officer ("CEO")

•John Gottfried - Senior Vice President and Chief Financial Officer ("CFO")

•Joel Braun - Executive Vice President and Chief Investment Officer ("CIO")

•Christopher Conlon - Executive Vice President and Chief Operating Officer ("COO")

•Jason Blacksberg - Senior Vice President, Chief Compliance Officer, Corporate Secretary and General Counsel ("GC")

The Link Between The Company's Business Model and Compensation Program

The Company's business model is unique (as compared to many other publicly-traded REITs) in that it uses dual platforms comprised of its core portfolio and fund platform. The Company's long-term growth strategy is based on the following key principles:

Core Portfolio | Fund Platform | Balance Sheet |

Building a best-in-class core real estate portfolio with meaningful concentrations of assets in the nation’s most dynamic urban and street retail corridors | Making profitable opportunistic and value- add investments through the Company's series of discretionary institutional funds | Safeguarding the Company’s growth trajectory by maintaining appropriate leverage levels and interest rate protection |

The Company attributes its success to its unique business model and to its uncompromising commitment to three core attributes:

1. | Stay focused. The Company executes its strategy by focusing on four key business strengths: enhancing its core portfolio, maintaining a strong balance sheet, launching profitable external growth initiatives and energizing the Acadia Team. |

2. | Maintain discipline. The very nature of the Company's business is long-term, with horizons measured in years, not quarters. The Company waits patiently for the right opportunities to present themselves and makes strategic decisions that are driven by its commitment to sustain growth over the long term. |

3. | Provide value. The Company believes that the value it consistently creates and delivers is one of the attributes most admired by its varied constituency, consumers who shop in its centers, retailers who lease its properties, loyal shareholders who rely on its expertise, its business partners and the talented employees who are the face of Acadia. |

Business Highlights

During 2017, the executive officers led the Company to achieve strong operational and financial results, including the following:

• | Funds from Operations ("FFO") per share, excluding net promote income which is subject to significant variation year-to-year given the timing discrepancy of fund investment acquisitions and dispositions, increased to $1.49 in 2017 from $1.42 the prior year (5% growth). Including net promote income, FFO per share decreased by 3% due to the fact that net promote income decreased from $0.13 in 2016 to $0.01 in 2017; |

• | Same-property NOI was flat for the year, driven by the previously-reported recapture of occupancy during 2017 which impacted period-over-period comparability; |

• | 2017 Core occupancy of 95.3% as of December 31, 2017; |

• | Continued to strengthen our strong, low-leveraged balance sheet. The Company’s net debt to EBITDA ratio for the Core Portfolio was 4.5x; |

• | Received repayments of approximately $32 million of structured finance investments during 2017 and an additional $26 million in January 2018; |

• | Completed $203 million of fund acquisitions and currently have more than $1 billion of fund buying power; |

• | Completed $346 million of dispositions across Acadia Strategic Opportunity Fund II, LLC, Fund III (as defined below) and Fund IV (as defined below); |

• | Generated net promote income of approximately $1 million, or $0.01 per share, from its Fund III asset sales; and |

16

• | The Company's long-term total shareholder return ("TSR") performance has consistently performed at or above the median of its peers (detailed in the "Total Shareholder Return" section below). |

Total Shareholder Return

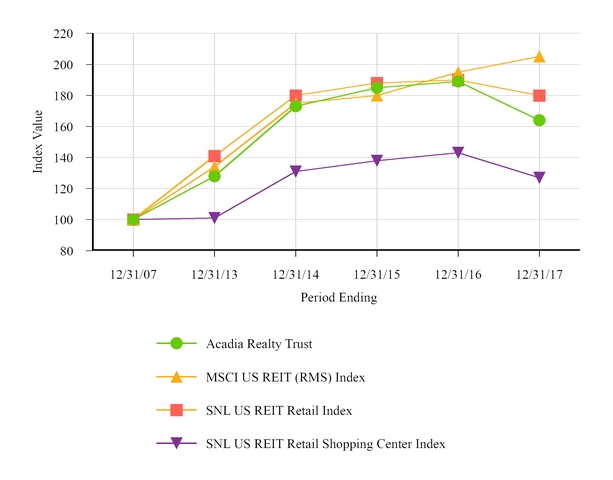

The Company believes that the true value creation of real estate should be assessed over the long-term horizon, thus its strategy has focused on long-term value creation. Over the ten-year period the Company has performed consistent with its executive compensation peer group (both retail peers and the larger real estate industry), while significantly outperforming the SNL US REIT Shopping Center Index.

1-Year | 3-Year | 5-Year | 10-Year | |||||

AKR | (13.15 | )% | (4.79 | )% | 31.10 | % | 64.30 | % |

Executive Compensation Peer Group Median | (11.61 | )% | (14.92 | )% | 28.86 | % | 28.84 | % |

MSCI US REIT (RMS) Index | 5.07 | % | 16.98 | % | 56.29 | % | 105.05 | % |

SNL US REIT Retail Index | (4.98 | )% | (0.06 | )% | 31.76 | % | 80.31 | % |

SNL US REIT Retail Shopping Center Index | (11.08 | )% | (3.06 | )% | 34.21 | % | 27.00 | % |

Source: SNL Financial LC

17

Executive Compensation Highlights

The Company's success depends on developing, motivating and retaining executives who have the skills and expertise to lead a REIT that uses both a traditional core portfolio and a fund platform. The Company seeks to design an executive compensation program that supports its business model and aligns management’s interests with its shareholders and fund investors. During 2017, the Board of Trustees, in consultation with our independent compensation consultant, conducted a comprehensive review of compensation structure in the real estate industry and, based on this assessment, certain components have been redesigned. The Board’s objectives in redesigning our executive compensation program were to:

• | Create a compensation program aligned with best market practices and ensure market competitiveness; |

• | Simplify the overall structure, providing additional transparency to shareholders with regard to the compensation decision-making process; |

• | Provide target total compensation with the ability to earn more or less commensurate with Company performance; |

• | Ensure the program has appropriate rigor and reflects an appropriate pay-for-performance structure; |

• | Reallocate compensation to be more heavily equity-based; and |

• | Redesign the Company’s performance-based equity to include more rigorous hurdles by eliminating the "either/or" concept of the prior grants |

Our focus is and continues to be to maintain a strong link between our NEO’s compensation and the Company’s performance. Highlights of our 2017 executive compensation program are outlined below and the key changes to our compensation structure summarized in the chart:

• | Pay-for-Performance Alignment - We maintain strong pay-for-performance alignment with more than 86% of our CEO’s 2017 approved compensation variable and subject to the Company’s performance. |

• | Formulaic Annual Cash Bonuses - 75% of our NEO’s annual cash bonuses are formulaic and based on the achievement of pre-established corporate performance goals, with the remaining 25% based on individual performance goals set forth at the beginning of the year. Our cash bonus program employs challenging hurdles and may result in significant fluctuations in payouts depending on our financial and operating success each year. |

• | Focus on Long-Term Performance and Alignment with Our Shareholders and Investors - For 2017 performance, approximately 55% of our CEO’s compensation was paid in the form of long-term incentive units ("LTIP Units") that are subject to additional service-based and performance-based vesting conditions, which reflected a meaningful shift from 29% paid in LTIP Units in 2016. Half of the LTIP Units are subject to a long-term vesting period of five-years and half are subject to the achievement of relative TSR goals over a three-year performance period (plus an additional two-year vesting period on any earned LTIP Units). Additionally, our NEO’s may receive fund-based compensation if a particular investment has achieved a preferred rate of return and requires a long-term commitment from our management team given that such payouts typically involve value creation over a seven- to ten- year period before payouts, if any, are realized. |

• | Commitment to Strong Compensation Governance - Our executive compensation program is designed to achieve an appropriate balance between risk and reward and employs good compensation governance and risk mitigation features, including: |

• | Share ownership requirements, including 10x base salary for our CEO |

• | Anti-hedging and anti-pledging policies |

• | Long-term vesting requirements on equity awards |

• | Caps on annual cash awards and equity award payouts |

• | Multiple performance factors |

• | Range of payouts (not all or nothing) |

18

Previous Compensation Program | New Program | |

Base Salaries | Fixed cash compensation set at a level that promotes executive retention and recruitment | No change 2017 base salaries were modestly increased by 2.5% 2018 base salaries remained flat |