form10kfyjune302012.htm

UNITED STATES SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

|

X ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended June 30, 2012

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

For the transition period from to .

|

Commission File Number: 001-34269

SHARPS COMPLIANCE CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

|

74-2657168

|

|

(State or other jurisdiction of

|

(I.R.S. Employer Identification No.)

|

|

incorporation or organization)

|

|

|

9220 Kirby Drive, Suite 500, Houston, Texas

|

77054

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code (713) 432-0300

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange on Which Registered

|

|

Common Shares, $0.01 Par Value

|

The NASDAQ Capital Market

|

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes o No o

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yeso No o

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer o

|

Smaller reporting company o

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No o

As of December 31, 2011, the aggregate market value of the Registrant’s Common Stock held by non-affiliates was approximately $52.1 million (based on the closing price of $4.11 on December 30, 2011 as reported by The NASDAQ Capital Market).

The number of common shares outstanding of the Registrant was 15,206,127 as of August 27, 2012.

DOCUMENTS INCORPORATED BY REFERENCE:

|

(1)

|

Portions of the Registrant’s Proxy Statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A for the Annual Meeting of Shareholders to be held on November 15, 2012 are incorporated by reference into Part III.

|

|

PART I

|

|

Item 1

|

|

2

|

|

Item 1A

|

|

12

|

|

Item 1B

|

|

15

|

|

Item 2

|

|

15

|

|

Item 3

|

|

15

|

|

Item 4

|

|

15 |

|

PART II

|

|

Item 5

|

|

16

|

|

Item 6

|

|

18

|

|

Item 7

|

|

19

|

|

Item 7A

|

|

30

|

|

Item 8

|

|

30

|

|

Item 9

|

|

30

|

|

Item 9A

|

|

30

|

|

Item 9B

|

|

31

|

|

PART III

|

|

Item 10

|

|

32

|

|

Item 11

|

|

32

|

|

Item 12

|

|

32

|

|

Item 13

|

|

33

|

|

Item 14

|

|

33

|

|

PART IV

|

|

Item 15

|

|

33

|

| |

|

37

|

| |

|

|

| |

*This Table of Contents is inserted for convenience of reference only and is not a part of this Report as filed.

|

|

| |

|

|

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K contains certain forward-looking statements and information relating to the Company and its subsidiaries that are based on the beliefs of the Company’s management as well as assumptions made by and information currently available to the Company’s management. When used in this report, the words “anticipate”, “believe”, “expect”, “estimate”, “project” and “intend” and words or phrases of similar import, as they relate to the Company or its subsidiaries or Company management, are intended to identify forward-looking statements. Such statements reflect the current risks, uncertainties and assumptions related to certain factors, including without limitations, competitive factors, general economic conditions, customer relations, relationships with vendors, governmental regulation and supervision, seasonality, distribution networks, product introductions and acceptance, technological change, changes in industry practices, onetime events and other factors described herein. Based upon changing conditions, should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein as anticipated, believed, estimated, expected or intended. The Company does not intend to update these forward-looking statements.

PART I

Sharps Compliance Corp. was formed in November 1992 as a Delaware corporation. The information presented herein is for Sharps Compliance Corp. and its wholly owned subsidiaries, Sharps Compliance, Inc. of Texas (dba Sharps Compliance, Inc.), Sharps e-Tools.com, Inc. (“Sharps e-Tools”), Sharps Manufacturing, Inc., Sharps Environmental Services, Inc. (dba Sharps Environmental Services of Texas, Inc.) and Sharps Safety, Inc. (collectively, “Sharps” or the “Company”). Unless the context otherwise requires, “Company”, “we”, “us”, and “our” refer to Sharps Compliance Corp. and its subsidiaries.

The Company provides access to all of its filings with the Securities and Exchange Commission (“SEC”) through its website www.sharpsinc.com, as soon as reasonably practicable after the reports are filed with the SEC. The filings are also available via the SEC’s website at www.sec.gov/edgar/searchedgar/companysearch.html.

COMPANY OVERVIEW

Sharps Compliance Corp. is a leading full-service provider of cost-effective management solutions for medical waste, used health care materials and unused dispensed medications. Our solutions facilitate the proper treatment of numerous types of items, including hypodermic needles, lancets and other devices or objects used to puncture or lacerate the skin, or sharps, and unused consumer dispensed prescription and over-the-counter drugs and medications. We serve customers in multiple markets such as home health care, retail clinics and immunizing pharmacies, pharmaceutical manufacturers, professional offices (physicians, dentists and veterinarians), hospitality (including assisted living facilities, hotels, motels and restaurants), government (federal, state and local), consumers, commercial, industrial and agriculture, and distributors to many of the aforementioned markets. We assist our customers in determining which of our distinct solution offerings best fit their needs for the collection, storage, return transportation and treatment of their or their patients’ medical waste, used healthcare materials and unused dispensed medications. Our differentiated approach provides our customers the flexibility to return and properly treat their or their patients’ medical waste, used healthcare materials or unused dispensed medications through a variety of solutions and products transported primarily through the United States Postal Service (“USPS”). Furthermore, we provide comprehensive tracking and reporting tools that enable our customers to meet complex medical waste disposal and unused dispensed patient medication compliance requirements. We believe the fully-integrated nature of our operations is a key factor leading to our success and continued recurring revenue growth.

The Company continues to take advantage of the many opportunities in the markets served as professional offices, retail pharmacies, communities, consumers, pharmaceutical manufacturers, government agencies, health care facilities, individual self-injectors and commercial organizations become more aware of the need for the proper treatment of medical sharps waste, used healthcare materials and unused dispensed medications as well as alternatives to traditional methods of disposal.

Recent data from the Human Capital Management Services Group indicates that the number of used needles

improperly disposed of outside the large healthcare setting and into the solid waste system has tripled over the past ten years to 7.8 billion each year and the number of self-injectors in the country has increased to 13.5 million over the same period. The Company estimates that it would require over 80 million Sharps Recovery System™ (formerly Sharps Disposal by Mail System®) products to properly dispose of all such syringes, which would equate to a market opportunity of over $2 billion.

There are an estimated 800,000 doctors, dentists, veterinarians, clinics, tattoo parlors and other businesses in the country that generate smaller quantities of medical waste, including used syringes. These offices and facilities, which must demonstrate proper management of their medical waste, comprise a market opportunity of approximately $600 million, based on estimates of using our solution offerings rather than the traditional pick-up service in what we characterize as a regulated market.

Additionally, an estimated 40% of the four billion dispensed medication prescriptions go unused every year in the United States generating an estimated 200 million pounds of unused medication waste. The Company estimated the market opportunity for the proper recovery and management of the unused medications to be at least $1 billion per year.

We believe that demand for our cost-effective medical waste management solutions has been increasing due to several factors. First, communities, consumers, government and health care and commercial organizations are increasingly becoming aware of the need to properly treat medical waste and unused dispensed medication as federal and state regulatory bodies continue to provide guidance and enact legislation which mandate the proper disposal of medical waste outside the hospital setting to protect the general public and workers from potential exposure to contagious diseases and health and safety risks. Second, there is heightened public awareness and growing demand for influenza vaccines that are driving demand for our solutions both in the short-term to address the immediate flu shot needs and in the long-term as the public increasingly obtains its immunizations from retail locations and clinics. Third, there continues to be an increase for the Complete Needle™ which is focused on the traditional under-served home self-injector required to regularly use needles or syringes for their health and well-being. Fourth, there is growing demand for Sharps TakeAway Environmental Recovery System™ solutions for unused, non-controlled prescriptions and over-the-counter medications. Additionally, there is increased competition by pharmaceutical manufacturers to differentiate themselves by offering products such as our Sharps Recovery System® to their participants, which allows for proper containment, return and treatment of the needles or injection devices utilized in therapy. Our proprietary SharpsTracer™ system tracks the return of the Sharps Recovery System® by the patient to the treatment facility, where the package is scanned and weighed prior to treatment. This data is electronically available to the pharmaceutical manufacturer which assists them in monitoring medication discipline and provides them with a touch point for individual patient follow-up for improved outcomes. Finally, we believe that customers in many of the sectors we serve, such as physicians, dentists, veterinarians, clinics and assisted living facilities, are becoming aware of alternatives to the traditional medical waste pick-up service and the lower cost (estimated average savings of up to 50%) and convenience associated with the Sharps Recovery System™ (formerly Sharps Disposal By Mail System®).

In February 2009, the Company launched Sharps®MWMS™, a Medical Waste Management System (“MWMS”), which is a comprehensive medical waste and dispensed medication solution which includes an array of products and services necessary to effectively collect, store and treat medical waste and unused dispensed medication outside of the hospital or large health care facility setting. In connection with the launch in 2009, the Company signed a five year contract (one year, plus four option years) with a major U.S. government agency for a $40 million program to provide our comprehensive Medical Waste Management System™, or Sharps®MWMS™, which is a rapid-deployment solution offering designed to provide medical waste collection, storage and treatment in the event of natural disasters, pandemics, man-made disasters, or other national emergencies. Sharps®MWMS™ is unique in that the solution also offers warehousing, inventory management, training, data and other services necessary to provide a comprehensive solution. We received a purchase order for $28.5 million ($6.0 million of which was recognized in fiscal year 2009, and $22.5 million was recognized in the first half of fiscal year 2010). In January 2010, we were awarded the first option year (ending January 31, 2011) valued at approximately $1.6 million which was recognized from February 1, 2010 through January 31, 2011. In January 2011, we were awarded the second option year (ending January 31, 2012) valued at approximately $3.0 million and was recognized from February 1, 2011 through January 31, 2012. The Company was notified by an agency of the U. S. Government, acting on behalf of the Division of Strategic National Stockpile (“DSNS”) that the maintenance contract would not be renewed for the third option year (beginning February 1, 2012) and that the contract would be terminated effective January 31, 2012. This non-renewal was preceded by a letter dated December 2, 2011 advising the Company of the U.S. Government’s intent to exercise the third option year. Although not stated in the notice provided by the U.S.

Government, the Company believes the action is part of a budget reduction program being implemented by the DSNS.

Our principal executive offices are located at 9220 Kirby Drive, Suite 500, Houston, Texas. Our telephone number at that location is (713) 432-0300. We currently have 55 full-time employees and 1 part-time employee. We have manufacturing, assembly, distribution and warehousing operations located on Reed Road in Houston, Texas, and our corporate offices located on Kirby Drive in Houston, Texas. We have a facility in Atlanta, Georgia. As a result of the termination of the U.S. Government contract, the Company is attempting to buy-out or sublease the Atlanta facility lease obligation. In August 2012, the Company agreed in principle to a deal with the Atlanta facility landlord reducing its obligation under the lease for the 51,000 square foot facility by approximately 20,000 square feet effective September 1, 2012. We own and operate a fully-permitted treatment facility in Carthage, Texas that incorporates our processing and treatment operations. Approximately three years ago we supplemented the treatment facility’s existing incineration process with an autoclave system, which is a cost-effective alternative to traditional incineration that treats medical waste with steam at high temperature and pressure to kill pathogens. The autoclave system is utilized alongside the incinerator for day-to-day operations. We believe that our facility is one of only ten permitted commercial facilities in the United States capable of treating all types of medical waste, used healthcare materials and unused or expired dispensed medications (i.e., both incineration and autoclave capabilities).

SOLUTIONS OVERVIEW

We offer a broad line of product and service solutions to manage the medical waste and unused dispensed medications generated by our customers. Our primary solutions include the following:

Sharps Recovery System™ (formerly Sharps Disposal by Mail System®): a comprehensive solution for the containment, transportation, treatment and tracking of medical waste and used health care materials generated outside the hospital and large health care facility setting. The Sharps Recovery System™ includes a securely sealed, leak and puncture resistant sharps container in several sizes ranging from one quart to eighteen gallons; USPS approved shipping carton with pre-paid priority mail postage; absorbent material inside the container that can safely hold up to 150 milliliters of fluids; a red bag for additional containment; and complete documentation and tracking manifest. The Sharps Recovery System™ is transported to our facility for treatment. Upon treatment or conversion of the waste, we provide electronic proof of receipt and treatment documentation to the customer through our proprietary SharpsTracer® system.

TakeAway Environmental Return System™: a comprehensive solution that facilitates the proper disposal or treatment of unused dispensed medications and includes the TakeAway Environmental Return System and the RxTakeAway Recovery and Reporting System. The solution provides a means for individual consumers, retail or mail-order pharmacies, communities and facilities including assisted living, long-term care and correction operations to facilitate the proper disposal of unused dispensed medications (other than controlled substances) and consists of customized containment, transportation, destruction or conversion and tracking services. Our proprietary tracking system, MedsTracerTM, is designed for tracking unused dispensed medications, which assists pharmaceutical manufacturers in monitoring drug usage and provides critical data for patient management and compliance. Our proprietary tracking system is a highly value-added component of our solution as it enhances pharmaceutical manufacturers’ ability to monitor patient drug usage.

Complete Needle™ Collection and Disposal System: a safe, easy-to-use and cost-effective solution designed for self-injecting consumers and includes the Company’s containment, packaging, return shipping via the U.S. Postal Service, tracking and treatment. The Complete Needle™ Collection and Disposal System is actually two offerings in one. First, the product provides the individual self-injector with a reasonably priced containment solution designed to protect self-injectors and their family members. Second, the product includes an optional disposal feature utilizing the USPS designed to protect the individual’s community, solid waste workers and the environment. Our solution offers significant convenience as it utilizes the same delivery channel, the retail pharmacy, that the self-injector typically uses to obtain medications, for example insulin, and needles or syringes. Our solution is also designed to enhance the interactions between the pharmacist and the individual thereby creating counseling opportunities and possibly better treatment outcomes.

ComplianceTRACSM: a more advanced web-based version of the Company’s compliance and training program. ComplianceTRACSM is designed to improve worker safety while satisfying applicable Occupational Safety and Health Administration (“OSHA”) and other requirements for the end-user.

SharpsTracer®: a comprehensive solution that provides customers with an electronic record of receipt and treatment of their waste to meet regulatory requirements. SharpsTracer® eliminates the need for traditional paper-based methods of tracking and is designed to enhance customer efficiencies with an automatic evidence of proof of receipt and treatment and market data capabilities. This cost-effective and regulatory compliant tracking and documentation system is an important part of our full-service and comprehensive suite of solutions.

Other Solutions: a wide variety of other solutions including Pitch-It IV™ Poles, Trip LesSystem®, Sharps® Pump and Asset Return System, Sharps Secure® Needle Collection and Containment System, Sharps® MWMS™, and Spill Kit TakeAway Recovery System™.

MARKET OVERVIEW

The Company continues to take advantage of the many opportunities in the markets served as professional offices, retail pharmacies, communities, consumers, pharmaceutical manufacturers, government agencies, health care facilities, individual self-injectors and commercial organizations become more aware of the need for the proper treatment of medical sharps waste, used healthcare materials and unused dispensed medications as well as alternatives to traditional methods of disposal.

Recent data from the Human Capital Management Services Group indicates that the number of used needles improperly disposed of outside the large healthcare setting and into the solid waste system has tripled over the past ten years to 7.8 billion each year and the number of self-injectors in the country has increased to 13.5 million over the same period. The Company estimates that it would require over 80 million Sharps Recovery System™ (formerly Sharps Disposal by Mail System®) products to properly dispose of all such syringes, which would equate to a market opportunity of over $2 billion.

There are an estimated 800,000 doctors, dentists, veterinarians, clinics, tattoo parlors and other businesses in the country that generate smaller quantities of medical waste, including used syringes. These offices and facilities, which must demonstrate proper management of their medical waste, comprise a market opportunity of approximately $600 million, based on estimates of using our solution offerings rather than the traditional pick-up service in what we characterize as a regulated market.

Additionally, an estimated 40% of the four billion dispensed medication prescriptions go unused every year in the United States generating an estimated 200 million pounds of unused medication waste. Most unused dispensed medications are either (i) disposed of untreated in the garbage or flushed down the toilet, ending up in landfills and polluting rivers and water supply systems, lakes and streams with trace amounts of unused dispensed medications or (ii) stored in medicine cabinets that are accessible to children and teenagers. Improperly disposed of or diverted unused dispensed medications have been shown to increase the risk of accidental poisoning of citizens, including children and teenagers. The Company has estimated that the market for the proper disposal of unused dispensed medications outside the hospital setting is over $1 billion per year.

The Company believes the pace of regulation of sharps and unused dispensed medications disposal is gaining momentum at both the state and federal level. The following regulatory related events contribute to increasing awareness:

|

·

|

In December 2004, the EPA issued its new guidelines for the proper disposal of medical sharps, revising the previous guidance that advised patients to dispose of used syringes in the trash;

|

|

·

|

In 2009 and 2010, the states of Iowa and North Dakota introduced state funded programs to properly dispose of unused medications. In 2010, Minnesota enacted legislation that allows individuals to transfer their unused dispensed medications directly or through a caregiver to an organization authorized by the state to manage and/or ultimately destroy the medication. In 2012, the state of Nebraska introduced a state funded program to provide residents with options to dispose of unwanted and unused medications to participating pharmacies;

|

|

·

|

In October 2010, the Secure and Responsible Drug Disposal Act was enacted which addresses the proper handling of unused controlled medications;

|

|

·

|

In April 2011, the United States Senate re-introduced a bill (S.725) which, if enacted, would provide for Medicare reimbursement, under part D, for the safe and effective disposal of used needles and syringes;

|

|

·

|

In July 2012, Alameda County in California enacted an ordinance requiring manufacturers of drugs sold or distributed in the county to pay for the safe collection and disposal of unused medications. Pharmaceutical manufacturers are required to submit their compliance plans to the county for approval by July 1, 2013; and

|

|

·

|

As of June 30, 2012 approximately 46 percent of US citizens live in states that have enacted legislation or strict guidelines mandating the proper disposal of used syringes while 67 percent live in states that have enacted or proposed legislation mandating the proper disposal of dispensed unused medications.

|

COMPETITIVE STRENGTHS

We believe our competitive strengths include the following:

Leading comprehensive provider of cost-effective medical waste management solutions.

We offer a broad line of solutions designed to address the proper management of medical waste, used healthcare materials and patient dispensed unused or expired medications. The Company is able to offer mail or ship-back based services at a significantly lower cost as compared to the traditional model of pick-up services since the Company utilizes the existing infrastructure of USPS or in some cases United Parcel Service (“UPS”) for return transportation. In contrast to traditional pick-up service providers which generally make periodic pick-ups, our mail or ship-back based solution offerings are less costly and more convenient for small quantity generators. Our proprietary SharpsTracer® tracking and documentation systems provide customers a comprehensive electronic record of receipt and treatment of their waste to meet regulatory requirements. While competitors may attempt to replicate our solution offerings, we believe the ability to offer such a comprehensive, value-added turnkey solution is a significant competitive advantage.

Vertically integrated full-service operations.

Our operations are fully integrated including manufacturing, assembly, distribution, treatment, online tracking and customer reporting. We have manufacturing, assembly, distribution and warehousing operations in Houston, Texas. We own and operate a fully-permitted treatment facility in Carthage, Texas, that incorporates our processing and treatment operations. Approximately three years ago we supplemented the treatment facility’s existing incineration process with an autoclave system, which is a cost-effective alternative to traditional incineration that treats medical waste with steam at high temperature and pressure to kill pathogens. The autoclave system is utilized alongside the incinerator for day-to-day operations. We believe that our facility is one of only ten permitted commercial facilities in the United States capable of treating all types of medical waste, used healthcare materials and unused or expired dispensed medications (i.e., both incineration and autoclave capabilities). We track the movement of each shipment from outbound shipping to ultimate treatment and provide confirmation to the customer for their records using our proprietary SharpsTracer® tracking and documentation system. We also provide customized reporting and comprehensive regulatory support for many of our customers. By controlling all aspects of the process internally, the Company is able to provide a one-stop solution and simplify the tracking and record-keeping processes to meet regulatory requirements for our customers. We believe the fully-integrated nature of our operations is seen by current and prospective customers as a key factor and differentiator leading to our success and leadership position in our industry.

Diverse product markets.

Sharps offers services and products to a wide variety of end markets. The Company’s growth strategies are focused on retail pharmacies and clinics, pharmaceutical manufacturers, professional physician, dental and veterinary clinics and the U.S. Government contract, federal, state and local government agencies. We also serve home health care companies, retirement and assisted living facilities and hospitality and other which includes hotel, commercial, industrial and agriculture.

Our billings by market for the years ended June 30, 2012, 2011 and 2010 are below (as expressed in percentages of revenues):

| |

|

Year Ended June 30,

|

|

| |

|

2012

|

|

|

2011

|

|

|

2010

|

|

| |

|

|

|

|

|

|

|

|

|

|

BILLINGS BY MARKET:

|

|

|

|

|

|

|

|

|

|

|

Home Health Care

|

|

|

31 |

% |

|

|

35 |

% |

|

|

17 |

% |

|

Retail

|

|

|

24 |

% |

|

|

24 |

% |

|

|

11 |

% |

|

Professional

|

|

|

14 |

% |

|

|

10 |

% |

|

|

4 |

% |

|

Pharmaceutical

|

|

|

10 |

% |

|

|

2 |

% |

|

|

2 |

% |

|

U.S. Government contract

|

|

|

8 |

% |

|

|

11 |

% |

|

|

59 |

% |

|

Core Government

|

|

|

2 |

% |

|

|

4 |

% |

|

|

2 |

% |

|

Assisted Living/ Hospitality

|

|

|

6 |

% |

|

|

6 |

% |

|

|

3 |

% |

|

Other

|

|

|

5 |

% |

|

|

8 |

% |

|

|

2 |

% |

| |

|

|

100 |

% |

|

|

100 |

% |

|

|

100 |

% |

Highly scalable business model.

Because of our proven business model, we can add new business while leveraging our existing infrastructure. Our facilities are able to accommodate significant additional volume, incurring only variable costs of transportation and processing. Once we gain a new customer, our profitability typically increases as our customer base grows without additional overhead expense due to the embedded nature of our products and the ease with which we can accommodate additional volume.

Increased state and federal regulatory attention.

To protect citizens and waste workers from needle stick injuries, nine states have passed legislation or regulations making it illegal to discard used sharps into household trash. Another nine states and the District of Columbia have strict guidelines regarding home sharps disposal. Passed or strict guidelines related to home sharps disposal covers 46% of the U.S. population.

In order to reduce accidental poisonings and pollution of our water and municipal water systems, twenty-two states and the District of Columbia have introduced legislation over the last few years intended to manage the disposal of consumer unused medications. Seven states and the District of Columbia have successfully passed such legislation. Passed or pending legislation related to disposal of consumer medications covers 67% of the U.S. population. As state and federal enforcement of these statutes increases, more companies could turn to solutions such as ours to help manage their medical waste and regulatory compliance. We believe we are well positioned to benefit given our strict adherence to established standards and extensive documentation and records.

Environmentally-conscious solution provider.

In addition to providing cost-effective solutions for our customers, the Company is committed to mitigating the effects of medical waste and dispensed patient medications on the environment. Today, most used syringes and needles as well as unused or expired dispensed medications are disposed of untreated in the garbage, ending up in landfills and polluting rivers, lakes and streams with trace amounts of pharmaceuticals. Our products and services provide an environmentally cleaner alternative process for treatment. Our GREEN Waste Conversion Process™ eliminates medical waste processed for the Company’s customers from going into landfills. The process transforms treated medical waste into PELLA-DRX™ - a clean, raw material used in the manufacture of various industrial resources. The use of recycled paper and plastic materials for many of our products further demonstrates our total commitment to environmentally sound business practices. As an organization, the Company is a leading proponent for the development of solutions for the safe disposal of sharps and unused dispensed medications in the community and continually works to raise public awareness of the issue.

Experienced and accomplished management team.

Our senior management team has extensive industry experience, and is committed to the continued growth and

success of our company. Mr. David P. Tusa, CEO and President, in addition to his nine plus years with the Company has 20 years of financial, accounting, business and public company experience in multiple industries and in companies with revenues up to $500 million. Mr. Claude Dance, Executive Vice President of Sales and Marketing, has broad health care and reverse logistics industry experience at a variety of firms including Pharmerica, Cardinal Health and Wyeth Pharmaceuticals. Ms. Diana Diaz, CPA, MBA, Vice President and Chief Financial Officer, has over 25 years of finance, accounting, health care and public company industry experience. Mr. Gregory C. Davis, Vice President of Operations, has over 18 years of information technology and operations-related experience. Mr. Khairan Aladwani, Vice President of Assurance/Quality Control, has over 25 years of quality assurance and operations experience, including medical devices, at a variety of companies both private and public.

The Company’s Board of Directors oversees CEO and senior management succession planning. The process focuses on

building management depth, considers continuity and stability within the Company, and responds to Sharps’ evolving needs and changing circumstances.

GROWTH STRATEGIES

We plan to grow our business by employing the following primary growth strategies:

Further penetrate existing customers and markets.

Many of our customers who currently use the Sharps Recovery System™ (formerly Sharps Disposal by Mail System®) could also benefit from the TakeAway Environmental Return System™ products, the Complete Needle™ Collection and Disposal System or other specialized products. Although currently focused primarily on the proper management of used syringes and needles as well as dispensed expired or unused medication, pharmacies (including chains and mail order), assisted living facilities and other related organizations will develop needs for our other product lines as they expand their patient service offerings. As an entrenched and value-added supplier of treatment solutions, we believe the Company is well-positioned to capture incremental business from our existing customers.

In the fiscal year ended June 30, 2012, the Company experienced growth of over 600% or $1.8 million in the pharmaceutical market. We have seen a recent surge of interest in our patient support program solution offering among pharmaceutical manufacturers as it relates to self-injectable medications. We believe manufacturers are now, more than ever, focused on (i) product differentiation, (ii) improved interaction with patients and (iii) creating a touch point for individual patient follow-up that could lead to improved therapy outcomes. In fiscal year 2012, we launched three new patient support programs announced in August and October 2011. The patient support programs include the direct fulfillment of the Sharps Recovery System® to the pharmaceutical manufacturers’ program participants which provides the proper containment, return and treatment of the needles or injection devices utilized in therapy. Sharps’ proprietary SharpsTracer™ system tracks the return of the Sharps Recovery System® by the patient to the treatment facility, and then makes available to the pharmaceutical manufacturer electronic data which assists them in monitoring medication discipline and provides them with a touch point for individual patient follow-up which potentially could lead to better outcomes. We believe the Company is the leader in providing solutions of this type to this market.

In August 2011, the Company introduced the Complete Needle™ Collection and Disposal System which is focused on the traditional under-served home self-injector required to regularly use needles or syringes for their health and well-being, such as people with diabetes. The Complete Needle™ Collection and Disposal System is actually two offerings in one. First, the product provides the individual self-injector with a reasonably priced containment solution designed to protect self-injectors and their family members. Second, the product includes an optional disposal feature utilizing the USPS designed to protect the individual’s community, solid waste workers and the environment. The solution offers significant convenience as it utilizes the same delivery channel, the retail pharmacy that the self-injector typically uses to obtain medications, for example, insulin, and needles or syringes. The solution is also designed to enhance the interaction between the pharmacist and the individual thereby creating counseling opportunities and possibly better treatment outcomes.

In October 2011, the Company announced the promotional program being offered for the Complete Needle™ Collection & Disposal System in support of National Diabetes Month sponsored by a leading global insulin manufacturer and the nation’s largest drugstore chain. Within this promotion program, the pharmaceutical manufacturer and the retail pharmacy in effect purchased the solutions from the Company and provided it at no cost to the user through rebates and redemption codes printed at the register. The Company believes this could serve as a model program for the country and that larger participation and sponsorship of the offering by other retail channels as well as additional drug and ancillary product manufacturers could follow. The Company also believes that similar

sponsorship could be available for its TakeAway line of products for unused medications.

In May 2012, the Company announced a joint marketing alliance with Daniels Sharpsmart (“JMA”) to serve the entire U.S. medical waste market, offering clients a blended product portfolio to effectively target health care customers with multi-site and multi-sized locations. The alliance also enables a team effort for cross selling each company’s capabilities where best suited. The Company believes the JMA will assist the Company in landing larger opportunities whereby the customer has both large and small quantity facilities generating medical waste and used healthcare materials.

Enhance sales and marketing efforts.

Through targeted telemarketing initiatives, e-commerce driven website and web-based promotional activities, we believe we can drive significant additional growth by increasing awareness of the Company’s solution offerings.

Improve product and service awareness to attract new customers.

As we grow, we continue to focus additional marketing and sales efforts designed to educate home health care providers, physician and dental clinics, pharmaceutical manufacturers, consumers, communities and government agencies of the benefits of our solution offerings and the need for safe, cost-effective and environmentally-friendly methods of medical waste treatment. We believe that the full-service nature of our solution offerings, ease of our mail and ship-back based delivery system and convenience will attract new customers who are not yet aware of the services we provide. In addition to providing a convenient, cost-effective solution to waste and used healthcare materials treatment, we believe future growth will be driven by the need for our customers to properly document and track the disposal of their hazardous waste to maintain compliance with new and existing legislation. We believe our understanding of the legislative process and focus on accurate and thorough electronic tracking of waste disposal or treatment will provide substantial benefits to new customers looking to comply with new standards and promote environmentally cleaner business practices.

Develop new products and services.

We continue to develop new solution offerings including the Complete Needle™ Collection and Disposal System (designed for the traditional under-served home self-injector), the TakeAway line of products for unused medications (including TakeAway Environmental Return System™), the Medical/Professional TakeAway Recovery System™, the Sharps®MWMS™ and ComplianceTRACSM. These innovative product and service offerings allow us to gain further sales from existing customers as well as gain new customers who have a need for more comprehensive products. We will continue our efforts to develop new solution offerings designed to facilitate the proper and cost effective solutions for management of medical waste, used healthcare materials and unused dispensed medications to better serve our customers and the environment. Additionally, we will continue to seek out and identify prospective new customers and markets for new solutions designed to meet the needs of these new customer segments. Research and development expenses were $1 thousand, $131 thousand and $41 thousand for the fiscal years ended June 30, 2012, 2011 and 2010, respectively.

Increase adoption of our product lines among federal, state and local government agencies.

In January 2010, we launched a pilot program with the United States Department of Veterans Affairs (“VA”) within the VA Capitol Health Care Network (“Veterans Integrated Service Network” or “VISN”). The VISN is part of the Veterans Health

Administration which encompasses the largest integrated health care system in the United States, consisting of 153 medical centers, in addition to numerous community based outpatient clinics, community living centers and Vet Centers. Together these health care facilities provide comprehensive care to over 5.5 million Veterans each year. The pilot allowed each of the participating medical centers within the VISN, both inpatient and outpatient, to provide the Sharps Recovery System™ (formerly known as the Sharps Disposal By Mail System®) and the TakeAway Environmental Return System solutions to their patients. Since its original launch, the pilot program expanded to include eight VISNs. The VA Pilot was completed as of June 30, 2012 and generated revenue of approximately $0.4 million.

In February 2009, we signed a five year contract (one year, plus four option years) with a major U.S. government agency for a $40 million program to provide our comprehensive Medical Waste Management System™, or Sharps®MWMSTM, which is a rapid-deployment solution offering designed to provide medical waste collection, storage and treatment in the event of natural disasters, pandemics, man-made disasters, or other national emergencies. Sharps®MWMSTM is unique in that the solution also offers warehousing, inventory management, training, data and other services necessary to provide a comprehensive solution. The contract was terminated

effective January 31, 2012. This non-renewal was preceded by a letter dated December 2, 2011 advising the Company of the U.S. Government’s intent to exercise the third option year. Although not stated in the notice provided by the U.S. Government, the Company believes the action is part of a budget reduction program being implemented by the DSNS.

CONCENTRATION OF CREDIT AND SUPPLIERS

There is a concentration of credit risk associated with accounts receivable arising from sales to our major customers. For the fiscal year ended June 30, 2012, two customers represented approximately 30% of revenues. One of these customers represented approximately 26%, or $623 thousand, of the total accounts receivable balance at June 30, 2012. The other customer, which had no accounts receivable balance at June 30, 2012, was a major U.S. government agency which terminated January 31, 2012. For the fiscal year ended June 30, 2011, two customers represented approximately 33% of revenues. Those same two customers represented approximately 22% or $660 thousand, of the total accounts receivable balance at June 30, 2011. For the fiscal year ended June 30, 2010, two customers represented approximately 68% of revenues. We may be adversely affected by our dependence on a limited number of high volume customers. Management believes that the risks are mitigated by, (i) the contractual relationships with key customers, (ii) the high quality and reputation of the Company and its solution offerings and (iii) the continued diversification of our solution offerings into additional markets outside of its traditional customer base.

We currently transport (from the patient or user to the Company’s facility) the majority of our solution offerings using USPS; therefore, any long-term interruption in USPS delivery services would disrupt the return transportation and treatment element of our business. Postal delivery interruptions are rare. Additionally, since USPS employees are federal employees, such employees may be prohibited from engaging in or continuing a postal work stoppage, although there can be no assurance that such work stoppage can be avoided. As noted above, we entered into an arrangement with UPS whereby UPS transports our TakeAway Recovery System™ line of solution offerings. The ability to ship items, whether through the USPS or UPS, is regulated by the government and related agencies. Any change in regulation restricting the shipping of medical waste, used healthcare materials or unused or expired dispensed pharmaceuticals through these channels would be detrimental to our ability to conduct operations.

We maintain relationships with multiple raw materials suppliers and vendors in order to meet customer demands and assure availability of our products and solutions. With respect to the Sharps Recovery System™ (formerly Sharps Disposal by Mail System®) solutions, we own all proprietary molds and dies and utilize three contract manufacturers for the production of the primary raw materials. We believe that alternative suitable contract manufacturers are readily available to meet the production specifications of our products and solutions. We utilize national suppliers such as Southern Container and R & D Molders for the majority of the raw materials used in our other products and solutions and international suppliers such as Ashoka Company for Pitch-It™ IV Poles.

INTELLECTUAL PROPERTY

We have a portfolio of trademarks and patents, both granted and pending. We consider our trademarks important in the marketing of our products and services, including Sharps Disposal by Mail System®, TakeAway Environmental Return System™, Complete Needle™ Collection and Disposal System, ComplianceTRACSM, Sharps®MWMS™, Pitch-It IV™ Poles, Trip LesSystem®, GREEN Waste Conversion Process™, and PELLA-DRX™ among others. With respect to our registered marks, we continue using such marks and will file all necessary documentation to maintain their registrations for the foreseeable future. We have a number of patents issued, including those applicable to our PELLA-DRX waste conversion process (patent numbers US 8,163,045 and US 8,100,989) and our Sharps Secure® Needle Collection and Containment System™ (patent numbers US 8,162,139 and US 8,235,883). We have patents pending on our Complete Needle™ Collection & Disposal System and our Medical Waste Management System (Sharps MWMS™ rapid deployment system).

COMPETITION

There are several competitors who offer similar or identical products and services that facilitate the disposal of smaller quantities of medical waste. There are also a number of companies that focus specifically on the marketing of products and services which facilitate disposal through transport by the USPS (similar to the Company’s products). These companies include (i) smaller private companies or (ii) divisions of larger companies. Additionally, we compete, in certain markets, with Stericycle, the largest medical waste company in the country, which focuses primarily on a pick-up service business model. As Sharps continues to grow and increase awareness

of the proper disposal of syringes and unused medications it could face additional and possibly significant competition. We believe our comprehensive line of proven solution offerings first mover advantages, excellent industry reputation, significant history of market and customer success, quality solutions and products, as well as our capabilities as a vertically integrated producer of products and services, provides significant differentiation in the current competitive market.

GOVERNMENT REGULATION

Sharps is subject to extensive federal, state, and/or local laws, rules and regulations. We are required to obtain permits, authorizations, approvals, certificates and other types of governmental permission from the EPA, the State of Texas and the local governments in Carthage, Texas with respect to our facilities. Such laws, rules and regulations have been established to promote occupational safety and health standards and certain standards have been established in connection with the handling, transportation and disposal of certain types of medical and solid wastes, including transported medical waste. Our estimated annual costs of complying with these laws, regulations and guidelines is currently less than $100,000 per year. In the event additional laws, rules or regulations are adopted which affect our business, additional expenditures may be required in order for Sharps to be in compliance with such changing laws, rules and regulations.

COMPLIANCE WITH ENVIRONMENTAL LAWS

In November 2005 and September 2009, the EPA and the Texas Commission on Environmental Quality promulgated new regulations under the Clean Air Act and associated state statutes which affect the incineration portion of our operation of the treatment facility located in Carthage, Texas. These regulations modify the emission limits and monitoring procedures required to operate an incineration facility. These new regulations and the recent receipt of a Title V permit require additional emissions-related monitoring equipment and compliance by the end of calendar year 2012. Such changes require us to incur capital expenditures in order to meet the requirements of the new regulations. We believe the capital expenditures will be in the range of $300,000 to $400,000 and we expect to incur the costs during the first and second quarters of fiscal year 2013.

We may be unable to manage our growth effectively.

We experienced core revenue growth for fiscal year 2012, as we saw the benefits of our marketing activities in our target markets, Pharmaceutical, Professional and Retail. Core revenue increased more than 16% to $20.1 million for the fiscal year ended June 30, 2012 as we launched three patient support programs in the pharmaceutical market, almost doubled sales through our inside and online sales efforts and served the retail market’s growing immunization business and launch of new consumer products like Complete Needle™ Collection & Disposal System and TakeAway Environmental System™. The increase in revenue as well as an expanded presence into retail markets has placed and will continue to place significant demands on our financial, operational and management resources. In order to continue our growth, we may need, at some point, to add operations, administrative and other personnel, and may need to make additional investments in the infrastructure and systems. There can be no assurance that we will be able to find and train qualified personnel, do so on a timely basis, or expand our operations and systems to the extent, and in the time, required.

The loss of the Company’s senior executives could affect the Company’s ability to manage the business profitability.

Our growth and development to date has been largely dependent on the active participation and leadership of its senior management team consisting of the Company’s CEO and President, Executive Vice President of Sales, Vice President and CFO, Vice President of Operations and Vice President of Quality Assurance. We believe that the continued success of the business is largely dependent upon the continued employment of the senior management team and has, therefore, (i) entered into individual employment arrangements with key personnel and (ii) approved the Executive Officer Incentive Compensation Plan for participation by certain senior management members in order to provide an incentive for their continued employment with the Company. The unplanned loss of one or more members of the senior management team and our inability to hire key employees could disrupt and adversely impact the Company’s ability to execute its business plan.

The Board of Directors oversees CEO and senior management succession planning. The process focuses on building management depth, considers continuity and stability within the Company, and responds to Sharps’ evolving needs and changing circumstances. The Board approves continuity plans for the CEO and senior management succession planning to enable the Board to respond to planned or unexpected vacancies in key positions. The Board considers optimizing the ongoing safe and sound operation of the Company and minimizing any potential disruption or loss of continuity to our business and operations as it evaluates the plan.

Our business is dependent on a small number of customers. To the extent we are not successful in winning additional business mandates from our government and commercial customers or attracting new customers, our results of operations and financial condition would be adversely affected.

We are dependent on a small group of customers. In addition, there is a concentration of credit risk associated with accounts receivable arising from sales to our major customers. For the fiscal year ended June 30, 2012, two customers represented approximately 30% of revenues. One of these customers represented approximately 26%, or $623 thousand, of the total accounts receivable balance at June 30, 2012. The other customer, which had no accounts receivable balance at June 30, 2012, was a major U.S. government agency which terminated January 31, 2012. To the extent these significant customers are delinquent or delayed in paying or we are not successful in obtaining consistent and additional business from our existing and new customers, our results of operations and financial condition would be adversely affected.

Aggressive pricing by existing competitors and the entrance of new competitors could drive down the Company’s profits and slow its growth.

There are several competitors who offer similar or identical products and services that facilitate the disposal of smaller quantities of medical waste. There are also a number of companies that focus specifically on the marketing of products and services which facilitate disposal through transport by the USPS (similar to the Company’s products). These companies include (i) smaller private companies or (ii) divisions of larger companies. Additionally, we do compete, in certain markets, with Stericycle, the largest medical waste company in the country, which focuses primarily on a pick-up service business model. As Sharps continues to grow and increase awareness of the proper disposal of syringes and unused medications it could face additional and possibly significant competition. As a result, we could experience increased pricing pressures that could reduce our margins. In addition, as we expand our business into other markets, the number, type and size of our competitors may expand. Many of these potential competitors may have greater financial and operational resources, flexibility to reduce prices and other competitive advantages that could adversely impact our current competitive position.

The lack of customer long-term volume commitments could adversely affect the Company’s profits and future growth.

Although we enter into exclusive contracts with the majority of our enterprise customers, these contracts do not have provisions for firm long-term volume commitments. In general, customer purchase orders may be canceled and order volume levels can be changed or delayed with limited or no penalties. Canceled, delayed or reduced purchase orders could significantly affect our financial performance.

The Company is subject to extensive and costly federal, state and local laws and existing or future regulations may restrict the Company’s operations, increase our costs of operations and subject us to additional liability.

We are subject to extensive federal, state, and/or local laws, rules and regulations. We are required to obtain permits, authorizations, approvals, certificates and other types of governmental permission from the EPA, Texas and the local governments in Carthage, Texas with respect to our facilities. Such laws, rules and regulations have been established to promote occupational safety and health standards and certain standards have been established in connection with the handling, transportation and disposal of certain types of medical and solid wastes, including transported medical waste. We believe that we are currently in compliance in all material respects with all applicable laws and regulations governing our business, including the permits and authorizations for our incinerator facility. Our estimated annual costs of complying with these laws, regulations and guidelines is currently less than $100,000 per year. In the event additional laws, rules or regulations are adopted which affect our business, additional expenditures may be required in order for us to be in compliance with such changing laws, rules and regulations. Furthermore, any material relaxation of any existing regulatory requirements governing the transportation and disposal of medical waste could result in a reduced demand for our products and services and could have a material adverse effect on our revenues and financial condition. The scope and duration of existing and future regulations affecting the medical and solid waste disposal industry cannot be anticipated and are subject to change.

In November 2005 and September 2009, the EPA and the Texas Commission on Environmental Quality promulgated new regulations under the Clean Air Act and associated state statutes which affect the incineration portion of our operation of the treatment facility located in Carthage, Texas. These regulations modify the emission limits and monitoring procedures required to operate an incineration facility. These new regulations and the recent receipt of a Title V permit require additional emissions-related monitoring and compliance by the end of calendar year 2012. Such changes require us to incur capital expenditures in order to meet the requirements of the new regulations. We believe the capital expenditures will be in the range of $300,000 to $400,000 and we expect to incur the costs during the first and second quarters of fiscal year 2013. There can be no assurance that once we incur the capital expenditures and install the related equipment that the facility will comply with the new regulations. An inability to comply with the regulations could disrupt incinerator operations at the treatment facility and could have a material adverse effect on our future operations.

The inability of the Company to operate its treatment facility would adversely affect its operations.

Our business utilizes a treatment facility for the proper disposal or treatment of medical waste, used health care materials and unused pharmaceuticals. Our owned facility has both incineration and autoclave technologies in Carthage, Texas (Panola County). Prior to the purchase of the facility in January 2008, we operated the facility since 1999 under a lease arrangement. Sharps’ believes it operates and maintains the facility in compliance in all material respects with all federal, state and local laws and/or any other regulatory agency requirements involving treatment and disposal and the operation of the incinerator and autoclave facility. The failure to maintain the permits for the treatment facility or unfavorable conditions contained in the permits or new regulations could substantially impair our operations and reduce our revenues. During fiscal year 2013, the Company, under an agreement with Daniels Sharpsmart, is scheduled to begin utilizing four Daniels Sharpsmart treatment facilities located across the country for the proper treatment of medical waste and used healthcare materials generated by our customers. This will not only reduce the Company’s return transportation costs but also provide back-up treatment facility capabilities in the event of disruption at the Company’s treatment facility in Carthage, Texas. Any disruption in the availability of a disposal or treatment facility, whether as a result of action taken by governmental authorities, natural disasters or

otherwise, would have an adverse effect on our operations and results of operations.

The handling and disposal or treatment of regulated waste carries with it the risk of personal injury to employees and others.

Our business requires us to handle materials that may be infectious or hazardous to life and property in other ways. Although our products and procedures are designed to minimize exposure to these materials, the possibility of accidents, leaks, spills, and acts of God always exists. Human beings, animals or property could be injured, sickened or damaged by exposure to regulated waste. This in turn could result in lawsuits in which we are found liable for such injuries, and substantial damages could be awarded against us. While we carry liability insurance intended to cover these contingencies, particular instances may occur that are not insured against or that are inadequately insured against. An uninsured or underinsured loss could be substantial and could impair our profitability and reduce our liquidity.

An inability to win additional government contracts could have a material adverse effect on our operations and adversely affect our future revenue.

A material amount of our revenues were generated through a contract with a major U.S. government agency for the period from March 2009 through the contract’s termination in January 2012 totaling $33 million. Subsequent to the contract’s termination, our Company-wide revenues have experienced a decrease compared to prior periods. Although the Company is attempting to secure large additional U.S. Government contracts, including programs with the Veterans Administration, there can be no assurances that such efforts will be successful. All contracts with, or subcontracts involving, the federal government are terminable, or subject to renegotiation, by the applicable governmental agency on 30 days’ notice, at the option of the governmental agency. If a material contract is terminated or renegotiated in a manner that is materially adverse to us, our revenues and future operations could be materially adversely affected.

As a government contractor, we are subject to extensive government regulation, and our failure to comply with applicable regulations could subject us to penalties that may restrict our ability to conduct our business.

Governmental contracts or subcontracts involving governmental facilities are often subject to specific procurement regulations, contract provisions and a variety of other requirements relating to the formation, administration, performance and accounting of these contracts. Many of these contracts include express or implied certifications of compliance with applicable regulations and contractual provisions. If we fail to comply with any regulations, requirements or statutes, our existing governmental contracts or subcontracts involving governmental facilities could be terminated or we could be suspended from government contracting or subcontracting. If one or more of our governmental contracts or subcontracts are terminated for any reason, or if we are suspended or debarred from government work, we could suffer a significant reduction in expected revenues and profits. Furthermore, as a result of our governmental contracts or subcontracts involving governmental facilities, claims for civil or criminal fraud may be brought by the government for violations of these regulations, requirements or statutes.

The possibility of postal work interruptions and restrictions on shipping through the mail would adversely affect the disposal or treatment element of the Company’s business and have an adverse effect on our operations, results of operations and financial condition.

We currently transport (from the patient or user to the Company’s facility) the majority of our solution offerings using USPS; therefore, any long-term interruption in USPS delivery services would disrupt the return transportation and treatment element of our business. Postal delivery interruptions are rare. Additionally, since USPS employees are federal employees, such employees may be prohibited from engaging in or continuing a postal work stoppage, although there can be no assurance that such work stoppage can be avoided. As noted above, we entered into an arrangement with UPS whereby UPS transports our TakeAway Recovery System™ line of solution offerings. The ability to ship items, whether through the USPS or UPS, is regulated by the government and related agencies. Any change in regulation restricting the shipping of medical waste, used healthcare materials or unused or expired dispensed pharmaceuticals through these channels would be detrimental to our ability to conduct operations. Notwithstanding the foregoing, any disruption in the transportation of products would have an adverse effect on our operations, results of operations and financial condition.

The Company’s stock has experienced, and may continue to experience, low trading volume and price volatility.

Our common stock has been listed on the NASDAQ Capital Market (“NASDAQ”) under the symbol “SMED” since

May 6, 2009. The daily trading volumes for our common stock are, and may continue to be, relatively small compared to many other publicly traded securities. Since trading on the NASDAQ, our average daily trading volume has been approximately 80,000 shares. It may be difficult for you to sell your shares in the public market at any given time at prevailing prices, and the price of our common stock may, therefore, be volatile.

As of the date of this report, we do not have any unresolved staff comments.

Sharps leases 190,489 square feet of space in Houston, Texas and Atlanta, Georgia. Sharps has manufacturing, assembly, distribution and warehousing operations on Reed Road in Houston, Texas, and corporate offices on Kirby Drive in Houston, Texas. In August 2012, the Company agreed in principle to a deal with the Atlanta facility landlord reducing its obligation under the 51,000 square foot facility in Atlanta by approximately 20,000 square feet effective September 1, 2012. The Company is currently attempting to sublease the remaining approximately 31,000 square feet of space at the Atlanta facility. The Company’s leases expire from April 2014 to April 2015 with options to renew the leases for warehouses for 5 years and for office space for 10 years.

We own and operate a facility in Carthage, Texas that houses our processing and treatment operations in an estimated 12,000 square foot building on 4.5 acres of land. The facility is permitted to process 40 tons per day of municipal solid waste. The incinerator at the facility is currently permitted to treat 10.9 tons per day of municipal solid waste with 10% of this amount identified as applicable to healthcare facility generated medical waste while the autoclave is capable of treating up to seven tons per day of medical waste.

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

Market Information: Beginning May 6, 2009, the Company’s common stock has been quoted on the NASDAQ under the symbol “SMED”. Previously, the Company’s common stock was quoted on the over-the-counter (“OTC”) Bulletin Board under the symbol “SCOM”. Since trading on the NASDAQ, the Company’s common stock had an average trading volume of approximately 1,740,297 shares traded per month. The table below sets forth the high and low closing prices of the Company’s common stock on the NASDAQ (July 1, 2010 through August 27, 2012) for each quarter within the last two fiscal years.

| |

|

Common Stock

|

|

| |

|

High

|

|

|

Low

|

|

|

Fiscal Year Ended June 30, 2011

|

|

|

|

|

|

|

|

First Quarter

|

|

$ |

5.40 |

|

|

$ |

4.00 |

|

|

Second Quarter

|

|

$ |

5.87 |

|

|

$ |

3.98 |

|

|

Third Quarter

|

|

$ |

5.75 |

|

|

$ |

3.74 |

|

|

Fourth Quarter

|

|

$ |

5.35 |

|

|

$ |

3.58 |

|

| |

|

|

|

|

|

|

|

|

|

Fiscal Year Ended June 30, 2012

|

|

|

|

|

|

|

|

|

|

First Quarter

|

|

$ |

4.55 |

|

|

$ |

2.98 |

|

|

Second Quarter

|

|

$ |

4.83 |

|

|

$ |

3.88 |

|

|

Third Quarter

|

|

$ |

4.25 |

|

|

$ |

3.47 |

|

|

Fourth Quarter

|

|

$ |

4.14 |

|

|

$ |

2.97 |

|

|

Fiscal Year Ending June 30, 2013

|

|

|

|

|

|

|

|

First Quarter (August 27, 2012)

|

|

$ |

3.74 |

|

|

$ |

2.52 |

|

Stockholders: At August 27, 2012, there were 15,206,127 shares of common stock held by approximately 173 holders of record. The last reported sale of the common stock on August 27, 2012 was $2.91 per share.

Dividend Policy: The Company has never declared nor paid any cash dividends on its common stock. The Company currently intends to retain its cash generated from operations for working capital purposes and to fund the continued expansion of its business and does not anticipate paying any dividends on our common stock in the foreseeable future.

Issuer Purchases of Equity Securities: The Company has no reportable purchases of equity securities.

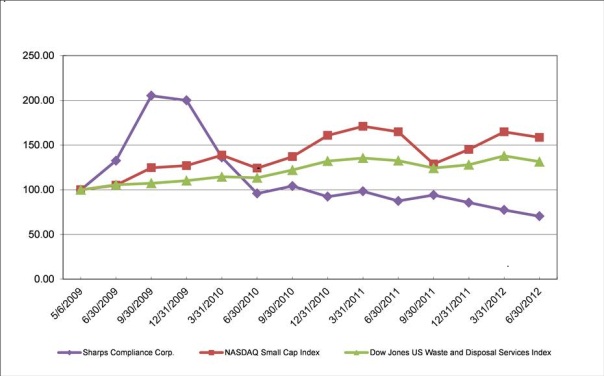

Corporate Performance Graph*: The graph compares the cumulative total return (i.e., stock price appreciation) on the Company’s common stock from the first day it began trading on the NASDAQ and each quarter thereafter with the cumulative total return for the same period on the NASDAQ Small Cap Index and the Dow Jones US Waste and Disposal Services Index. The graph assumes that $100 was invested on May 6, 2009 in our common stock and in the stock represented by each of the two indices.

*The Corporate Performance Graph and related information shall not be deemed "soliciting material" or to be "filed" with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act or the Exchange Act, except to the extent that we specifically incorporate it by reference into such filing.

Securities Authorized for Issuance under Equity Compensation Plans:

The following equity compensation plan information is provided as of June 30, 2012:

|

Plan Category

|

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

|

|

|

Weighted average exercise price of outstanding options, warrants and rights

|

|

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)

|

|

| |

|

(a)

|

|

|

(b)

|

|

|

(c)

|

|

| |

|

|

|

|

|

|

|

|

|

|

2010 Stock Plan as approved by shareholders (1) (3) (4)

|

|

|

494,748 |

|

|

$ |

4.02 |

|

|

|

372,384 |

|

|

1993 Stock Plan as approved by shareholders (2)

|

|

|

600,683 |

|

|

$ |

4.95 |

|

|

|

144,173 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

1,095,431 |

|

|

$ |

4.53 |

|

|

|

516,557 |

|

Notes:

|

(1) Represents stock options issued under the 2010 Sharps Compliance Corp. Stock Plan.

|

|

(2) Represents stock options issued under the 1993 Sharps Compliance Corp. Stock Plan.

|

|

(3) The 2010 Stock Plan replaced the 1993 Stock Plan in November 2010.

|

|

(4) Number of securities to be issued and weighted average exercise price include the effect of 17,248 shares of restricted stock issued to the Board of Directors.

|

| |

The following selected historical financial data has been derived from our audited financial statements and should be read in conjunction with the historical Consolidated Financial Statements and related notes (in thousands except earnings per share data):

| |

|

For the Year Ended June 30,

|

|

| |

|

2012

|

|

|

2011

|

|

|

2010

|

|

|

2009

|

|

|

2008

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$ |

21,787 |

|

|

$ |

19,395 |

|

|

$ |

39,156 |

|

|

$ |

20,297 |

|

|

$ |

12,841 |

|

|

Operating Income (Loss)

|

|

$ |

(2,521 |

) |

|

$ |

(4,536 |

) |

|

$ |

14,398 |

|

|

$ |

3,464 |

|

|

$ |

(1 |

) |

|

Net Income (Loss)

|

|

$ |

(3,621 |

) |

|

$ |

(2,975 |

) |

|

$ |

9,356 |

|

|

$ |

4,197 |

|

|

$ |

82 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

(0.24 |

) |

|

$ |

(0.20 |

) |

|

$ |

0.66 |

|

|

$ |

0.33 |

|

|

$ |

0.01 |

|

|

Diluted

|

|

$ |

(0.24 |

) |

|

$ |

(0.20 |

) |

|

$ |

0.63 |

|

|

$ |

0.30 |

|

|

$ |

0.01 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

$ |

27,638 |

|

|

$ |

30,598 |

|

|

$ |

31,632 |

|

|

$ |

15,188 |

|

|

$ |

5,676 |

|

|

Total Debt

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

Cash and Cash Equivalents

|

|

$ |