|

Class

|

Inst.

|

R-1

|

R-3

|

R-4

|

R-5

|

R-6

|

|

Ticker Symbol(s)

|

PINIX

|

PPISX

|

PRPPX

|

PUPPX

|

PTPPX

|

PIIDX

|

|

Shareholder Fees (fees paid directly from your investment):

|

None

|

(expenses that you pay each year as a percentage of the value of your investment)

|

|

Share Class

|

|||||

|

|

Inst.

|

R-1

|

R-3

|

R-4

|

R-5

|

R-6

|

|

Management Fees

|

0.65%

|

0.65%

|

0.65%

|

0.65%

|

0.65%

|

0.65%

|

|

Distribution and/or Service (12b-1) Fees

|

N/A

|

0.35%

|

0.25%

|

0.10%

|

N/A

|

N/A

|

|

Other Expenses

|

0.18%

|

0.57%

|

0.36%

|

0.32%

|

0.30%

|

0.05%

|

|

Total Annual Fund Operating Expenses

|

0.83%

|

1.57%

|

1.26%

|

1.07%

|

0.95%

|

0.70%

|

|

Expense Reimbursement(1)

|

(0.04)%

|

N/A

|

N/A

|

N/A

|

N/A

|

(0.01)%

|

|

Total Annual Fund Operating Expenses after Expense

Reimbursement

|

0.79%

|

1.57%

|

1.26%

|

1.07%

|

0.95%

|

0.69%

|

|

|

1 year

|

3 years

|

5 years

|

10 years

|

|

Institutional Class

|

$81

|

$261

|

$457

|

$1,022

|

|

Class R-1

|

160

|

496

|

855

|

1,867

|

|

Class R-3

|

128

|

400

|

692

|

1,523

|

|

Class R-4

|

109

|

340

|

590

|

1,306

|

|

Class R-5

|

97

|

303

|

525

|

1,166

|

|

Class R-6

|

70

|

223

|

389

|

870

|

|

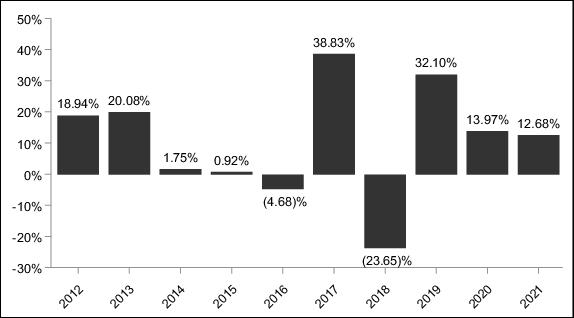

Highest return for a quarter during the period of the bar chart above:

|

Q2 2020

|

22.05%

|

|

Lowest return for a quarter during the period of the bar chart above:

|

Q1 2020

|

(22.85)%

|

For the periods ended December 31, 2021

|

|

1 Year

|

5 Years

|

10 Years

|

|

Institutional Class Return Before Taxes

|

12.68%

|

12.45%

|

9.66%

|

|

Institutional Class Return After Taxes on Distributions

|

9.26%

|

11.00%

|

8.78%

|

|

Institutional Class Return After Taxes on Distributions and Sale of Fund Shares

|

9.99%

|

9.94%

|

7.91%

|

|

Class R-1 Return Before Taxes

|

11.75%

|

11.56%

|

8.75%

|

|

Class R-3 Return Before Taxes

|

12.09%

|

11.91%

|

9.10%

|

|

Class R-4 Return Before Taxes

|

12.33%

|

12.12%

|

9.30%

|

|

Class R-5 Return Before Taxes

|

12.42%

|

12.25%

|

9.42%

|

|

Class R-6 Return Before Taxes

|

12.78%

|

12.55%

|

9.66%

|

|

MSCI ACWI Ex USA Index NTR (reflects withholding taxes on foreign dividends, but no

deduction for fees, expenses, or other taxes)

|

7.83%

|

9.61%

|

7.28%

|