| Cheryl R. Blanchard, Ph.D. | ||

|

June 11, 2024

Dear Fellow Anika Stockholder,

2023 was an important year for Anika, as we achieved several key milestones across our highly differentiated product portfolio in early intervention orthopedic care. We conducted a strategic review of the business, and we took decisive action to reduce spending and focus our strategy on driving the products that optimize performance to |

provide the greatest opportunities for profitable growth. We expect these cost savings to enable Anika to deliver over 75% growth in adjusted EBITDA in 2024, accelerating our path to profitability.

Our leading hyaluronic acid, or HA, based Osteoarthritis, or OA, Pain Management business delivered record revenue in 2023, as we further grew our leading market share position in the U.S. with our single injection Monovisc and multi-injection Orthovisc products and continued to experience strong international growth driven by Monovisc and Cingal. With double digit growth in 2023, Cingal continued to excel as the next generation, non-opioid, OA pain product of choice in over 40 countries outside the U.S. We remain excited to bring this tremendously effective product to the U.S. market as we continue to regularly interact with the FDA on the non-clinical work proposed during the Type C meeting held in 2023. We believe that Cingal will provide meaningful relief to the more than 32.5 million people in the U.S. who suffer from osteoarthritis knee pain daily.

We also made strides within our HA Regenerative Solutions, Sports Medicine, and Arthrosurface Joint Solutions product families. Anika continues to innovate with our proprietary HA regenerative technologies and, in November of 2023, we initiated the limited market release of our Integrity Implant System, a regenerative HA-based implant system for tendon repairs. Following the successful completion of over 200 cases through the first quarter of 2024, Integrity is on track for a mid-year full market launch. In addition, in 2023 we fully enrolled the Phase III clinical trial for our single-stage cartilage repair scaffold, Hyalofast, which is expected to launch by 2026. Finally, our X-Twist Biocomposite Fixation System and RevoMotion Reverse Shoulder Arthroplasty System are both receiving very positive clinical feedback after their recent launches.

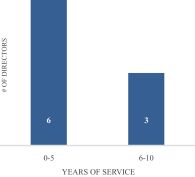

We have strong conviction in our strategy, which is supported by a healthy balance sheet, positive cash flow generation and no debt. We are also supported by an outstanding Board of Directors that comprises proven leaders with the expertise we need to usher in our next chapter of growth. We recently welcomed two new directors, Joseph Capper and William Jellison, each of whom brings extensive industry experience and an additive skillset. Our commitment to active Board refreshment has resulted in the appointment of six new directors in the last four years.

In addition, we would like to thank Jeffery S. Thompson, former Chair of Anika’s Board, for his 13 years of dedicated service as he prepares to retire. We are pleased to have appointed John B. Henneman, III, an independent director of the Company’s Board since 2020, as Chair of the Board this past February. As we move forward, our Board will remain nimble and continue to ensure we are well-positioned both operationally and financially.

Finally, I’d like to thank Mike Levitz, our former CFO, who decided to step down from his position this year. Over the last 4 years, Mike’s strategic and operational insights have helped Anika navigate this period of change while positioning Anika for an exciting future. We are glad to continue benefitting from his expertise through the end of the year and wish him the best. We are pleased that Steve Griffin, an accomplished public company leader whose ability to connect strategic, operational, and financial expertise will be a significant asset for Anika, has